Strategy in Practice: An Analysis of Maruti Suzuki

VerifiedAdded on 2022/12/30

|25

|6578

|46

Report

AI Summary

This report provides a comprehensive strategic analysis of Maruti Suzuki, a leading automobile manufacturer. It begins with an introduction to strategy and its application within the automotive industry. Task 1 explores the growth opportunities and emerging threats within the global automobile industry using PESTLE analysis, followed by an assessment of the sector's attractiveness using Porter's Five Forces model. Task 2 focuses on Maruti Suzuki's internal capabilities, identifying its unique resources and applying value chain analysis to understand its activities. The VRIO framework is then used to evaluate these resources for competitive advantage. Finally, Task 3 proposes and evaluates new strategic options for Maruti Suzuki, considering factors such as the current market trends, competitive landscape and the firm's internal strengths and weaknesses using the SAFE criteria. The report concludes with a list of references to support the findings.

STRATEGY IN PRACTICE

1

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

A) Growth chances and emerging threats in automobile industry environment...................3

B) Automobile sector attractiveness......................................................................................5

TASK 2............................................................................................................................................7

A) Identification of unique resources for Maruti Suzuki .....................................................7

B) value chain analysis applies to identify organization’s activities.....................................8

C) Application of VRIO framework....................................................................................10

TASK 3..........................................................................................................................................11

A) Suggestions in form of set of new strategic options.......................................................11

B) Evaluation of chosen strategic option by using SAFE criteria.......................................13

REFERENCES .............................................................................................................................14

Appendix........................................................................................................................................15

2

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

A) Growth chances and emerging threats in automobile industry environment...................3

B) Automobile sector attractiveness......................................................................................5

TASK 2............................................................................................................................................7

A) Identification of unique resources for Maruti Suzuki .....................................................7

B) value chain analysis applies to identify organization’s activities.....................................8

C) Application of VRIO framework....................................................................................10

TASK 3..........................................................................................................................................11

A) Suggestions in form of set of new strategic options.......................................................11

B) Evaluation of chosen strategic option by using SAFE criteria.......................................13

REFERENCES .............................................................................................................................14

Appendix........................................................................................................................................15

2

INTRODUCTION

Strategy refers to an activity taken by manager to gain one of more benefits and achieve

set goals and objectives. It includes setting priorities and aims, mobilizing key resource and

identifying actions to achieve an aim to execute plan or tactic. Strategy development for a

venture means to develop a procedure which guide companies in recent time to successful

further. The current assignment will be based on Maruti Suzuki, which falls under category of

leading auto mobile manufacturers in the world. It is a subsidiary of Suzuki Motor Company

establish in Japan. Brand is known as the biggest passenger car firm which account for over 50%

of domestic car market. It has operated its venture within auto mobile industry where number of

skilled workers and engineers are working and performing daily task or act together in order to

serve its best and excellent products or services to wide consumer base.

This study will be divided into three tasks. Task one will explains progress opportunities and

current emerging trends in chosen sector environment. It will define industry attractiveness and

justify unique resources for company. Furthermore, this report will clarify usage of value chain

and CRIO concept. It will explain possible suggestions in context of new strategic options for

chosen company and justification in regard to specific one.

TASK 1

A) Growth chances and emerging threats in global automobile industry environment

The Global automotive sector encompasses a wider range of organizations and businesses

included in development, design, manufacturing, advertising and selling of motor vehicles. It

begins in 1860s with a hundred of producers that pioneered horseless carriage. There are a lot of

barriers occurred in growth and success of chosen sector, which may define by using specific

models. The scope of this analysis is to determine threats and opportunities in the context of

global automobile industry.

PESTLE analysis-

Political factor-

In case of global automotive sector, increase taxes or tax rate, is one of the biggest

emerging threats for chosen industry (Pandit and et.al., 2018). As it put negative impact on

supply chain and production operation of firms in term of increasing products price and cost of

manufacture procedure (Kumar and et.al., 2020). Because of this element all the organizations

that have been operated under this sector may experience a lot of negative things in form of

3

Strategy refers to an activity taken by manager to gain one of more benefits and achieve

set goals and objectives. It includes setting priorities and aims, mobilizing key resource and

identifying actions to achieve an aim to execute plan or tactic. Strategy development for a

venture means to develop a procedure which guide companies in recent time to successful

further. The current assignment will be based on Maruti Suzuki, which falls under category of

leading auto mobile manufacturers in the world. It is a subsidiary of Suzuki Motor Company

establish in Japan. Brand is known as the biggest passenger car firm which account for over 50%

of domestic car market. It has operated its venture within auto mobile industry where number of

skilled workers and engineers are working and performing daily task or act together in order to

serve its best and excellent products or services to wide consumer base.

This study will be divided into three tasks. Task one will explains progress opportunities and

current emerging trends in chosen sector environment. It will define industry attractiveness and

justify unique resources for company. Furthermore, this report will clarify usage of value chain

and CRIO concept. It will explain possible suggestions in context of new strategic options for

chosen company and justification in regard to specific one.

TASK 1

A) Growth chances and emerging threats in global automobile industry environment

The Global automotive sector encompasses a wider range of organizations and businesses

included in development, design, manufacturing, advertising and selling of motor vehicles. It

begins in 1860s with a hundred of producers that pioneered horseless carriage. There are a lot of

barriers occurred in growth and success of chosen sector, which may define by using specific

models. The scope of this analysis is to determine threats and opportunities in the context of

global automobile industry.

PESTLE analysis-

Political factor-

In case of global automotive sector, increase taxes or tax rate, is one of the biggest

emerging threats for chosen industry (Pandit and et.al., 2018). As it put negative impact on

supply chain and production operation of firms in term of increasing products price and cost of

manufacture procedure (Kumar and et.al., 2020). Because of this element all the organizations

that have been operated under this sector may experience a lot of negative things in form of

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

maximizing pressure for manufacturing vehicles under budget without comprise in quality. The

tax has increased recently in smaller level due to (Vital, Essential and desirable) VED rates being

linked to inflation via RPI (Mattioli, Wadud and Lucas, 2018). As it possess as threat, that

impact negatively upon financial performance of sector. When government increase charges or

tax rate, it directly impacts trading and outsourcing process of companies in term of increasing

cost of product purchase and production management. When tax rates increased in the context of

global automotive sector, they may pay extra charges on trading process which may decrease

profitability and bring challenge to manage everything accordingly.

Economic factor-

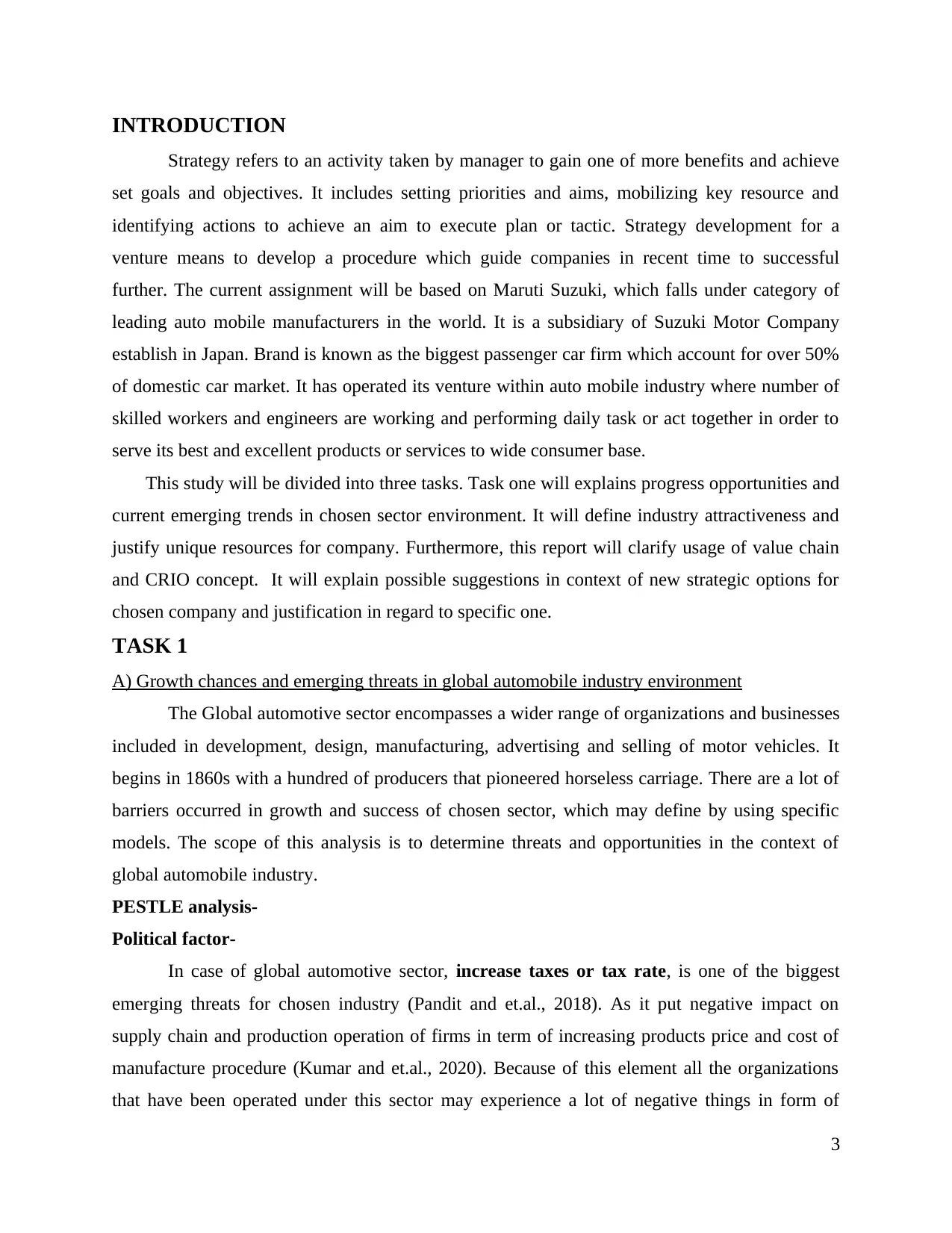

Due to COVID- many people losses their jobs which made them unable to manage their

living standards. It increase unemployment rate more than last certain years. In term of

opportunity, this issue give chance to global automotive sector to hire new people in cheaper rate

from talent pool. Unemployment rate within UK and other countries has getting higher because

of COVID (Bell and Blanchflower, 2020). Global automotive sector have chance to hire those

applicants who are ready to work within profitable sector by following terms and conditions.

Due to increasing competition within job market, unemployment rate within UK may affected in

form of acceleratory number of unemployed people.

4

tax has increased recently in smaller level due to (Vital, Essential and desirable) VED rates being

linked to inflation via RPI (Mattioli, Wadud and Lucas, 2018). As it possess as threat, that

impact negatively upon financial performance of sector. When government increase charges or

tax rate, it directly impacts trading and outsourcing process of companies in term of increasing

cost of product purchase and production management. When tax rates increased in the context of

global automotive sector, they may pay extra charges on trading process which may decrease

profitability and bring challenge to manage everything accordingly.

Economic factor-

Due to COVID- many people losses their jobs which made them unable to manage their

living standards. It increase unemployment rate more than last certain years. In term of

opportunity, this issue give chance to global automotive sector to hire new people in cheaper rate

from talent pool. Unemployment rate within UK and other countries has getting higher because

of COVID (Bell and Blanchflower, 2020). Global automotive sector have chance to hire those

applicants who are ready to work within profitable sector by following terms and conditions.

Due to increasing competition within job market, unemployment rate within UK may affected in

form of acceleratory number of unemployed people.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It may give the best chance to strengthen workforce by hiring and selecting experienced

new candidate. This factor make hiring cheaper, which is quite beneficial for sector as it may

save money. This issue may consider as opportunity because it provide chance to recruit skilled

people who are not working in any brand or company.

Social factor-

In recent time, people need and demands relate to cars and other vehicles are changes as

they want to buy cars which provide safety while driving and offer entertainment sources. It can

put negative impact on overall sector because it manufactures products by considering needs of

its target market, which get changed due to safety purpose and other reasons. It may occur in

form of threat that put negative affect upon automotive sector. Furthermore, it can be said that

global automotive sector is influenced by changing people preferences and socio cultural trends

(Lin and et.al., 2019). Fluctuation in social factors like these two may possess threat for entire

industry, which is not beneficial for it. In recent time, people demand and decision related to

vehicle purchase is changing, as they consider and follow varied market trends. It is fact that

restrictions affect people who love driving as it discourages them and impact in negative manner.

Technology factor-

Technology advancement is an external factor which provides the best opportunity to

global automotive sector. Industry may grab this chance by using advanced technologies in the

context of manufacturing or offering self-drive facilities to buyers, which is quite beneficial and

essential as well in term of increasing sales and productivity levels. Self-drive is one of the

emerging and most trending technology that many companies while operating under automotive

sector has been used to provide excellent experience to customers (Green, 2020). It allows

industry to add value for buyers by adding innovation in form of self-driven facility. Global

automotive sector in recent time has manufactures the best quality vehicles by self-driving

vehicle technology. It is one of the best opportunities, which sector has grab and implement in

term of manufacturing a self-driven cars that had capability to ride without input from a human

operator. This opportunity brings a lot of benefits to sector in term of increasing customer base,

profitability and productivity as well as sales.

Legal factor-

Change in government regulations and rules govern for automotive sector could impact in

positive manner because overall industry and its companies has followed excellent standards of

5

new candidate. This factor make hiring cheaper, which is quite beneficial for sector as it may

save money. This issue may consider as opportunity because it provide chance to recruit skilled

people who are not working in any brand or company.

Social factor-

In recent time, people need and demands relate to cars and other vehicles are changes as

they want to buy cars which provide safety while driving and offer entertainment sources. It can

put negative impact on overall sector because it manufactures products by considering needs of

its target market, which get changed due to safety purpose and other reasons. It may occur in

form of threat that put negative affect upon automotive sector. Furthermore, it can be said that

global automotive sector is influenced by changing people preferences and socio cultural trends

(Lin and et.al., 2019). Fluctuation in social factors like these two may possess threat for entire

industry, which is not beneficial for it. In recent time, people demand and decision related to

vehicle purchase is changing, as they consider and follow varied market trends. It is fact that

restrictions affect people who love driving as it discourages them and impact in negative manner.

Technology factor-

Technology advancement is an external factor which provides the best opportunity to

global automotive sector. Industry may grab this chance by using advanced technologies in the

context of manufacturing or offering self-drive facilities to buyers, which is quite beneficial and

essential as well in term of increasing sales and productivity levels. Self-drive is one of the

emerging and most trending technology that many companies while operating under automotive

sector has been used to provide excellent experience to customers (Green, 2020). It allows

industry to add value for buyers by adding innovation in form of self-driven facility. Global

automotive sector in recent time has manufactures the best quality vehicles by self-driving

vehicle technology. It is one of the best opportunities, which sector has grab and implement in

term of manufacturing a self-driven cars that had capability to ride without input from a human

operator. This opportunity brings a lot of benefits to sector in term of increasing customer base,

profitability and productivity as well as sales.

Legal factor-

Change in government regulations and rules govern for automotive sector could impact in

positive manner because overall industry and its companies has followed excellent standards of

5

business governance, they follow legal laws and policies in concern of consumers’ safety and

well fare. It is one of those issues that sector solve and grow even better. It can be said that

fluctuation in regulations and policies may emerge as an issue which is not good for global

sector.

Furthermore, global auto-motive sector also complies its own practices according to

equality act 2010 terms and conditions in order provide the best facilities to staff at workplace

which in return boost productivity and profitability even better. This factor also considers as

growth opportunity which give from power to take effective action. Changes in Equality act

2010 impacting sector in positive manner, bring create growth and success opportunity as it

boost the productivity even better than last years.

Environmental factor-

Consumer and government are concern for environmental safety and nature protection

and because of that they put pressure on global automotive sector for reducing carbon foot,

which really very essential. It can consider as current emerge opportunity for industry which

impact existing business plans and strategies in positive manner. Global automotive sector gets

affected positively due to this factor because it has introduced and manufactured number of

vehicles that protect environment (Settey, Gnap and Beňová, 2019). This issue may consider as

emission level. In London, it has introduced ULEZ zone and will charge drivers driving non

ULEZ cars in UK (Morganti and Browne, 2018). By grabbing this opportunity sector may grow

even better and get unexpected success.

B) Automobile sector attractiveness

Industry attractiveness can define as further growth and profitable potential of a market,

which can determine by using specific concept or model that is mention below-

Porter’s five forces model-

Bargaining power of buyers -

Degree of this force is high because dealers are more aware about advanced features and

valuable services offer by automobile sector that has been demanding by many customers

(Lapko and Trucco, 2018). With great awareness, they conduct bargaining activity that may put

negative impact on those who are not adopting and improving quality of vehicles by adding

excellent features as it decreases sales and profitability and also leads to minimize operational

efficiency of firms, which is not suitable for current business performances. There are several

6

well fare. It is one of those issues that sector solve and grow even better. It can be said that

fluctuation in regulations and policies may emerge as an issue which is not good for global

sector.

Furthermore, global auto-motive sector also complies its own practices according to

equality act 2010 terms and conditions in order provide the best facilities to staff at workplace

which in return boost productivity and profitability even better. This factor also considers as

growth opportunity which give from power to take effective action. Changes in Equality act

2010 impacting sector in positive manner, bring create growth and success opportunity as it

boost the productivity even better than last years.

Environmental factor-

Consumer and government are concern for environmental safety and nature protection

and because of that they put pressure on global automotive sector for reducing carbon foot,

which really very essential. It can consider as current emerge opportunity for industry which

impact existing business plans and strategies in positive manner. Global automotive sector gets

affected positively due to this factor because it has introduced and manufactured number of

vehicles that protect environment (Settey, Gnap and Beňová, 2019). This issue may consider as

emission level. In London, it has introduced ULEZ zone and will charge drivers driving non

ULEZ cars in UK (Morganti and Browne, 2018). By grabbing this opportunity sector may grow

even better and get unexpected success.

B) Automobile sector attractiveness

Industry attractiveness can define as further growth and profitable potential of a market,

which can determine by using specific concept or model that is mention below-

Porter’s five forces model-

Bargaining power of buyers -

Degree of this force is high because dealers are more aware about advanced features and

valuable services offer by automobile sector that has been demanding by many customers

(Lapko and Trucco, 2018). With great awareness, they conduct bargaining activity that may put

negative impact on those who are not adopting and improving quality of vehicles by adding

excellent features as it decreases sales and profitability and also leads to minimize operational

efficiency of firms, which is not suitable for current business performances. There are several

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

organizations accessible in automobile sector that satisfy its customers by providing satisfactory

product and services to them as it gives change to target market for bargain. High bargaining

power of dealers affecting the way firm offer its services as they may improve operational

efficiencies to manufacture the best and most attractive cars, which help to gain attention of

consumers towards purchase (Chesula and Kiriiny, 2018). Furthermore, high bargaining power

allows each buyer to put pressure on sector and its companies in context of setting prices. A

dealer holds strong power, which they may use to decrease price tag and to make changes in

existing practices of those sectors with which they make a business contract.

Bargaining power of suppliers-

Extent of this force is low because accessibility of suppliers within global automobile

industry is wider. It gives organizations chance to build strong relationship with its supplier

which is quite beneficial in term of producing and selling quality products. Accessibility of this

force cater global automotive sector opportunity to retain existing suppliers who could not be

able to increase cost of supply chain activity and impact in negative manner. Suppliers are the

main stakeholder of company who could influence existing pricing structure of brand. Sector has

number of suppliers. In form of opportunity, companies within chosen industry conduct

collaborative practice with other stakeholders as well as it strengthens and enlarge distribution

network and allow firm to operate its venture all over the world.

Threat of new entrances-

Degree of this force is low because while entering into automotive sector a huge

investment is required which is not possible for each brand. Because of this element global

automotive sector may sustain for longer period of time without facing any issues in form of

competition by new entrances. It gives organization power to retain and attract new buyers who

are able to pay in exchange for quality products or vehicles. Due to this force, company could

develop plan for gaining further business opportunities. Most of the companies due to demand

relate to huge investment in context of business establishment within new sector or market, take

step back, which is quite common thing.

Threat of substitute products and services-

Extent of this factor is medium because there are many substitute items or services like

bikes, cycles and scooters available in the world that put negative impact on sales and

profitability global automotive sector. Innovation of E-Bike can consider as emerging threat for

7

product and services to them as it gives change to target market for bargain. High bargaining

power of dealers affecting the way firm offer its services as they may improve operational

efficiencies to manufacture the best and most attractive cars, which help to gain attention of

consumers towards purchase (Chesula and Kiriiny, 2018). Furthermore, high bargaining power

allows each buyer to put pressure on sector and its companies in context of setting prices. A

dealer holds strong power, which they may use to decrease price tag and to make changes in

existing practices of those sectors with which they make a business contract.

Bargaining power of suppliers-

Extent of this force is low because accessibility of suppliers within global automobile

industry is wider. It gives organizations chance to build strong relationship with its supplier

which is quite beneficial in term of producing and selling quality products. Accessibility of this

force cater global automotive sector opportunity to retain existing suppliers who could not be

able to increase cost of supply chain activity and impact in negative manner. Suppliers are the

main stakeholder of company who could influence existing pricing structure of brand. Sector has

number of suppliers. In form of opportunity, companies within chosen industry conduct

collaborative practice with other stakeholders as well as it strengthens and enlarge distribution

network and allow firm to operate its venture all over the world.

Threat of new entrances-

Degree of this force is low because while entering into automotive sector a huge

investment is required which is not possible for each brand. Because of this element global

automotive sector may sustain for longer period of time without facing any issues in form of

competition by new entrances. It gives organization power to retain and attract new buyers who

are able to pay in exchange for quality products or vehicles. Due to this force, company could

develop plan for gaining further business opportunities. Most of the companies due to demand

relate to huge investment in context of business establishment within new sector or market, take

step back, which is quite common thing.

Threat of substitute products and services-

Extent of this factor is medium because there are many substitute items or services like

bikes, cycles and scooters available in the world that put negative impact on sales and

profitability global automotive sector. Innovation of E-Bike can consider as emerging threat for

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

chosen automotive brand which affect negatively upon its customer base and financial

performance. It can lead to decrease chance for reaching at global level and building

international presences. Threat of substitute is one of the porter’s five forces that drive attention

of potential buyers towards other innovative goods. The main reason behind moderate degree of

this force is average accessibility of luxury and conformable transportation services.

Competitive rivals between existing companies-

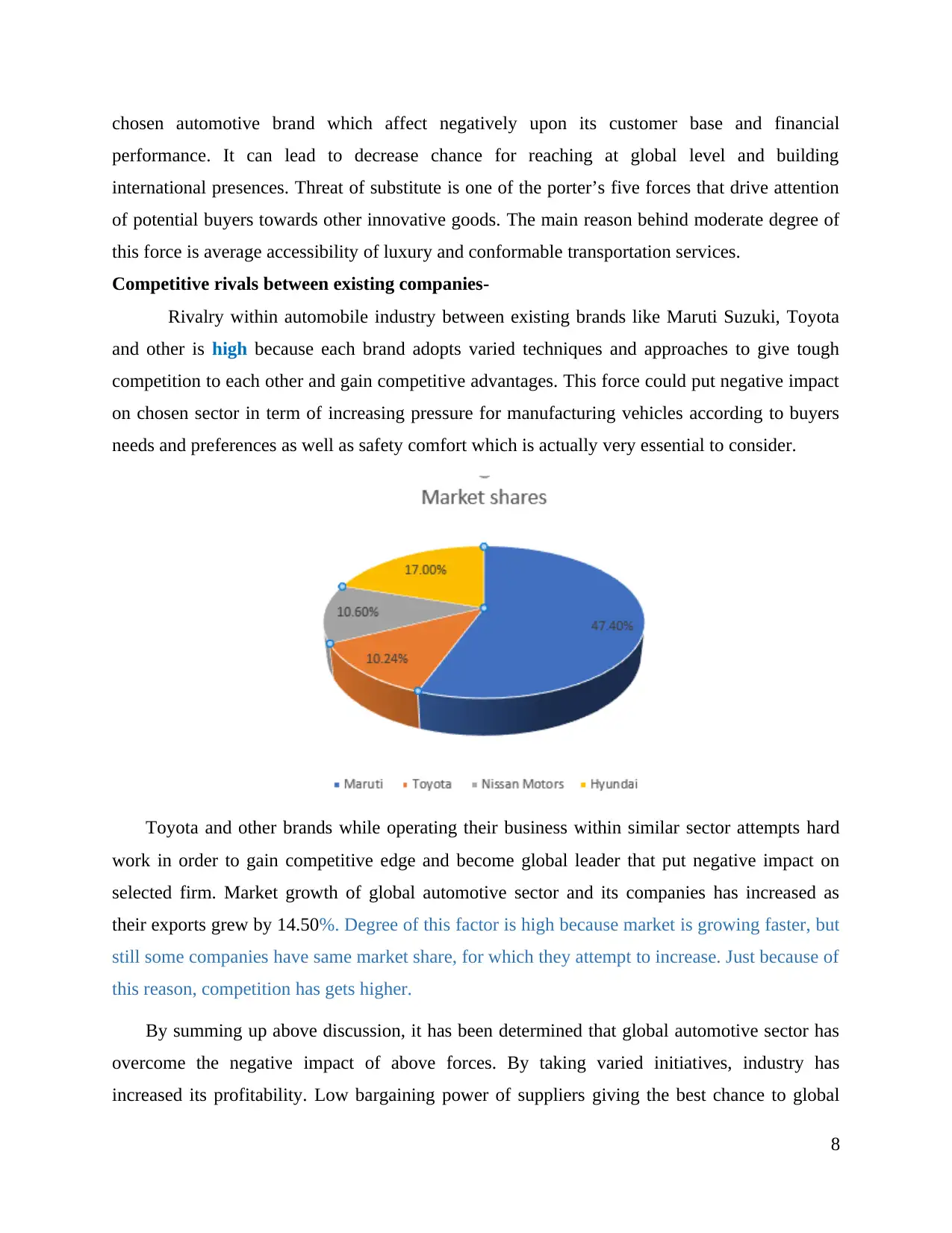

Rivalry within automobile industry between existing brands like Maruti Suzuki, Toyota

and other is high because each brand adopts varied techniques and approaches to give tough

competition to each other and gain competitive advantages. This force could put negative impact

on chosen sector in term of increasing pressure for manufacturing vehicles according to buyers

needs and preferences as well as safety comfort which is actually very essential to consider.

Toyota and other brands while operating their business within similar sector attempts hard

work in order to gain competitive edge and become global leader that put negative impact on

selected firm. Market growth of global automotive sector and its companies has increased as

their exports grew by 14.50%. Degree of this factor is high because market is growing faster, but

still some companies have same market share, for which they attempt to increase. Just because of

this reason, competition has gets higher.

By summing up above discussion, it has been determined that global automotive sector has

overcome the negative impact of above forces. By taking varied initiatives, industry has

increased its profitability. Low bargaining power of suppliers giving the best chance to global

8

performance. It can lead to decrease chance for reaching at global level and building

international presences. Threat of substitute is one of the porter’s five forces that drive attention

of potential buyers towards other innovative goods. The main reason behind moderate degree of

this force is average accessibility of luxury and conformable transportation services.

Competitive rivals between existing companies-

Rivalry within automobile industry between existing brands like Maruti Suzuki, Toyota

and other is high because each brand adopts varied techniques and approaches to give tough

competition to each other and gain competitive advantages. This force could put negative impact

on chosen sector in term of increasing pressure for manufacturing vehicles according to buyers

needs and preferences as well as safety comfort which is actually very essential to consider.

Toyota and other brands while operating their business within similar sector attempts hard

work in order to gain competitive edge and become global leader that put negative impact on

selected firm. Market growth of global automotive sector and its companies has increased as

their exports grew by 14.50%. Degree of this factor is high because market is growing faster, but

still some companies have same market share, for which they attempt to increase. Just because of

this reason, competition has gets higher.

By summing up above discussion, it has been determined that global automotive sector has

overcome the negative impact of above forces. By taking varied initiatives, industry has

increased its profitability. Low bargaining power of suppliers giving the best chance to global

8

automotive industry as it helps to retain potential suppliers who are loyal and trustable. Global

automotive industry is attractive, because it has less substituted items or services, which drives

the sales of section higher.

TASK 2

A) Identification of unique resources for Maruti Suzuki

Experienced workers (strength)

In context of selected company, human resource or experienced workers are the key

resource, because they all are capable and able to support firm while competing with existing and

new rivals (Ariffin and Sahid, 2018). Organization has 40,000 number of employees who all are

talented, skilled and knowledgeable and able to manufacture cars or other vehicles according to

exact needs and demands of their consumer which is really a very influencing act. With this

resource company is capable to do a lot of attempts especially for satisfying its potential buyers

and gaining attention of new.

Other key asset that boost productivity and profitability of Maruti Suzuki even better than

its competitors is its financial performance. Organization increase 6% of its sales by selling

vehicles to consumers. Current resource rose 56 and stood at 124 Billion, while actual assets rose

10 percent and stand at 170 billion in FY19. It can analyse that sum liabilities and assets stood at

640 billion as opposite to 602 billion which can witness progress of above discussion percentage.

Financial resources is a concept that covers all financial funds or profits of companies,

like Maruti Suzuki. It includes specific amount of money, which enable company to gain

competitive edge by increasing productivity. Financial resources may included in category of

unique resources that firm need to get success and grow venture. In form of money, organization

may collect financial resource for business growth purpose from varied sources such as bank

loan, Angel investors etc. Firm may obtain benefit from its financial resource by making

investment within profitable projects and product manufacture operation which in return enable

firm to produce car that people like the most and seek to purchase for longer period of time.

Ratio Analysis

ROCE

Particulars Formula 2018 2019

Profitability Ratios

9

automotive industry is attractive, because it has less substituted items or services, which drives

the sales of section higher.

TASK 2

A) Identification of unique resources for Maruti Suzuki

Experienced workers (strength)

In context of selected company, human resource or experienced workers are the key

resource, because they all are capable and able to support firm while competing with existing and

new rivals (Ariffin and Sahid, 2018). Organization has 40,000 number of employees who all are

talented, skilled and knowledgeable and able to manufacture cars or other vehicles according to

exact needs and demands of their consumer which is really a very influencing act. With this

resource company is capable to do a lot of attempts especially for satisfying its potential buyers

and gaining attention of new.

Other key asset that boost productivity and profitability of Maruti Suzuki even better than

its competitors is its financial performance. Organization increase 6% of its sales by selling

vehicles to consumers. Current resource rose 56 and stood at 124 Billion, while actual assets rose

10 percent and stand at 170 billion in FY19. It can analyse that sum liabilities and assets stood at

640 billion as opposite to 602 billion which can witness progress of above discussion percentage.

Financial resources is a concept that covers all financial funds or profits of companies,

like Maruti Suzuki. It includes specific amount of money, which enable company to gain

competitive edge by increasing productivity. Financial resources may included in category of

unique resources that firm need to get success and grow venture. In form of money, organization

may collect financial resource for business growth purpose from varied sources such as bank

loan, Angel investors etc. Firm may obtain benefit from its financial resource by making

investment within profitable projects and product manufacture operation which in return enable

firm to produce car that people like the most and seek to purchase for longer period of time.

Ratio Analysis

ROCE

Particulars Formula 2018 2019

Profitability Ratios

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

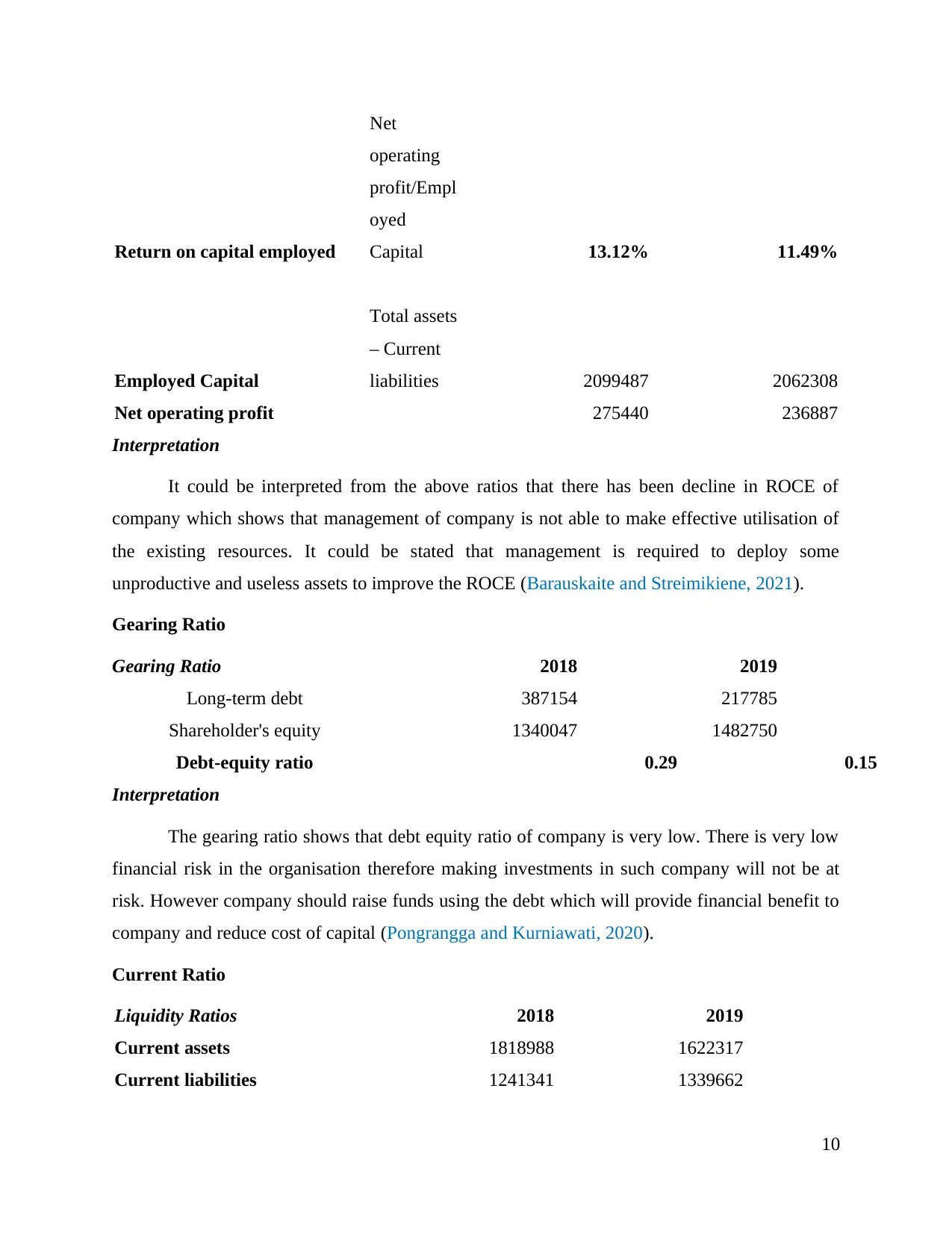

Return on capital employed

Net

operating

profit/Empl

oyed

Capital 13.12% 11.49%

Employed Capital

Total assets

– Current

liabilities 2099487 2062308

Net operating profit 275440 236887

Interpretation

It could be interpreted from the above ratios that there has been decline in ROCE of

company which shows that management of company is not able to make effective utilisation of

the existing resources. It could be stated that management is required to deploy some

unproductive and useless assets to improve the ROCE (Barauskaite and Streimikiene, 2021).

Gearing Ratio

Gearing Ratio 2018 2019

Long-term debt 387154 217785

Shareholder's equity 1340047 1482750

Debt-equity ratio 0.29 0.15

Interpretation

The gearing ratio shows that debt equity ratio of company is very low. There is very low

financial risk in the organisation therefore making investments in such company will not be at

risk. However company should raise funds using the debt which will provide financial benefit to

company and reduce cost of capital (Pongrangga and Kurniawati, 2020).

Current Ratio

Liquidity Ratios 2018 2019

Current assets 1818988 1622317

Current liabilities 1241341 1339662

10

Net

operating

profit/Empl

oyed

Capital 13.12% 11.49%

Employed Capital

Total assets

– Current

liabilities 2099487 2062308

Net operating profit 275440 236887

Interpretation

It could be interpreted from the above ratios that there has been decline in ROCE of

company which shows that management of company is not able to make effective utilisation of

the existing resources. It could be stated that management is required to deploy some

unproductive and useless assets to improve the ROCE (Barauskaite and Streimikiene, 2021).

Gearing Ratio

Gearing Ratio 2018 2019

Long-term debt 387154 217785

Shareholder's equity 1340047 1482750

Debt-equity ratio 0.29 0.15

Interpretation

The gearing ratio shows that debt equity ratio of company is very low. There is very low

financial risk in the organisation therefore making investments in such company will not be at

risk. However company should raise funds using the debt which will provide financial benefit to

company and reduce cost of capital (Pongrangga and Kurniawati, 2020).

Current Ratio

Liquidity Ratios 2018 2019

Current assets 1818988 1622317

Current liabilities 1241341 1339662

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

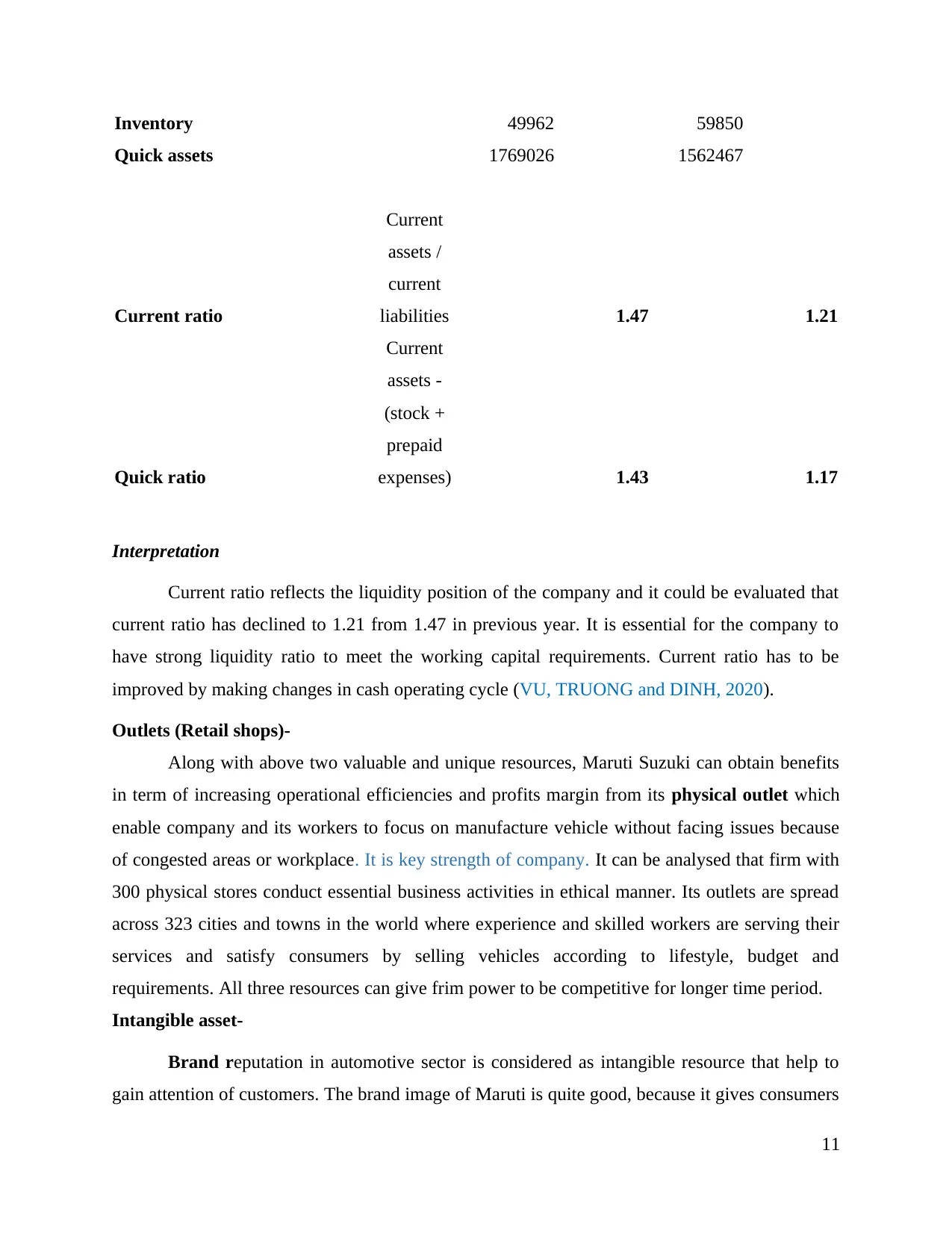

Inventory 49962 59850

Quick assets 1769026 1562467

Current ratio

Current

assets /

current

liabilities 1.47 1.21

Quick ratio

Current

assets -

(stock +

prepaid

expenses) 1.43 1.17

Interpretation

Current ratio reflects the liquidity position of the company and it could be evaluated that

current ratio has declined to 1.21 from 1.47 in previous year. It is essential for the company to

have strong liquidity ratio to meet the working capital requirements. Current ratio has to be

improved by making changes in cash operating cycle (VU, TRUONG and DINH, 2020).

Outlets (Retail shops)-

Along with above two valuable and unique resources, Maruti Suzuki can obtain benefits

in term of increasing operational efficiencies and profits margin from its physical outlet which

enable company and its workers to focus on manufacture vehicle without facing issues because

of congested areas or workplace. It is key strength of company. It can be analysed that firm with

300 physical stores conduct essential business activities in ethical manner. Its outlets are spread

across 323 cities and towns in the world where experience and skilled workers are serving their

services and satisfy consumers by selling vehicles according to lifestyle, budget and

requirements. All three resources can give frim power to be competitive for longer time period.

Intangible asset-

Brand reputation in automotive sector is considered as intangible resource that help to

gain attention of customers. The brand image of Maruti is quite good, because it gives consumers

11

Quick assets 1769026 1562467

Current ratio

Current

assets /

current

liabilities 1.47 1.21

Quick ratio

Current

assets -

(stock +

prepaid

expenses) 1.43 1.17

Interpretation

Current ratio reflects the liquidity position of the company and it could be evaluated that

current ratio has declined to 1.21 from 1.47 in previous year. It is essential for the company to

have strong liquidity ratio to meet the working capital requirements. Current ratio has to be

improved by making changes in cash operating cycle (VU, TRUONG and DINH, 2020).

Outlets (Retail shops)-

Along with above two valuable and unique resources, Maruti Suzuki can obtain benefits

in term of increasing operational efficiencies and profits margin from its physical outlet which

enable company and its workers to focus on manufacture vehicle without facing issues because

of congested areas or workplace. It is key strength of company. It can be analysed that firm with

300 physical stores conduct essential business activities in ethical manner. Its outlets are spread

across 323 cities and towns in the world where experience and skilled workers are serving their

services and satisfy consumers by selling vehicles according to lifestyle, budget and

requirements. All three resources can give frim power to be competitive for longer time period.

Intangible asset-

Brand reputation in automotive sector is considered as intangible resource that help to

gain attention of customers. The brand image of Maruti is quite good, because it gives consumers

11

the best and unexpected driving experiences which also gives value for money. It is one of the

most popular automotive companies the world that has gained the trust of each customer. It is

popular because of offering range of vehicles.

It has been identified that by manufacturing each vehicle according to needs and

expectations as well as preferences of buyers, company has gained better success and built its

strong brand image in market.

B) value chain analysis applies to identify organization’s activities

Maruti Suzuki Company and its management conduct a lot of practices, actions and

activities in order to sustain business in automotive sector, retain customers, increase sales and

build top position in market. With all these acts, firm conduct more that can identify by using

particular model which is value chain.

Infrastructure Manageable

infrastructure

Legal

department

Classified

departments

HRM Manage staff

performance

Hire new

workers

Training and

development

Solve

workers

problems

Use

motivational

techniques

R&D Use market

analysis tools

Gather

information

about key

market trends

Collect data

about current

market

situation

Use

advanced

technologies

Conduct

effective

market

research

Procurement Used

advanced

technologies

Build

connection

with trustable

suppliers

Design

vehicles

Analyse key

customers

trends

Manage

supply chain

Primary

activities ->

Inbound

logistics

Conduct

Operations

Six Sigma

Outbound

logistics

Supply

Marketing

and sales

Use social

Services

Insurance

distribution

12

most popular automotive companies the world that has gained the trust of each customer. It is

popular because of offering range of vehicles.

It has been identified that by manufacturing each vehicle according to needs and

expectations as well as preferences of buyers, company has gained better success and built its

strong brand image in market.

B) value chain analysis applies to identify organization’s activities

Maruti Suzuki Company and its management conduct a lot of practices, actions and

activities in order to sustain business in automotive sector, retain customers, increase sales and

build top position in market. With all these acts, firm conduct more that can identify by using

particular model which is value chain.

Infrastructure Manageable

infrastructure

Legal

department

Classified

departments

HRM Manage staff

performance

Hire new

workers

Training and

development

Solve

workers

problems

Use

motivational

techniques

R&D Use market

analysis tools

Gather

information

about key

market trends

Collect data

about current

market

situation

Use

advanced

technologies

Conduct

effective

market

research

Procurement Used

advanced

technologies

Build

connection

with trustable

suppliers

Design

vehicles

Analyse key

customers

trends

Manage

supply chain

Primary

activities ->

Inbound

logistics

Conduct

Operations

Six Sigma

Outbound

logistics

Supply

Marketing

and sales

Use social

Services

Insurance

distribution

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 25

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.