Accounting and Finance Assignment: EMI, Annuity, and NPV Analysis

VerifiedAdded on 2023/01/19

|5

|658

|75

Homework Assignment

AI Summary

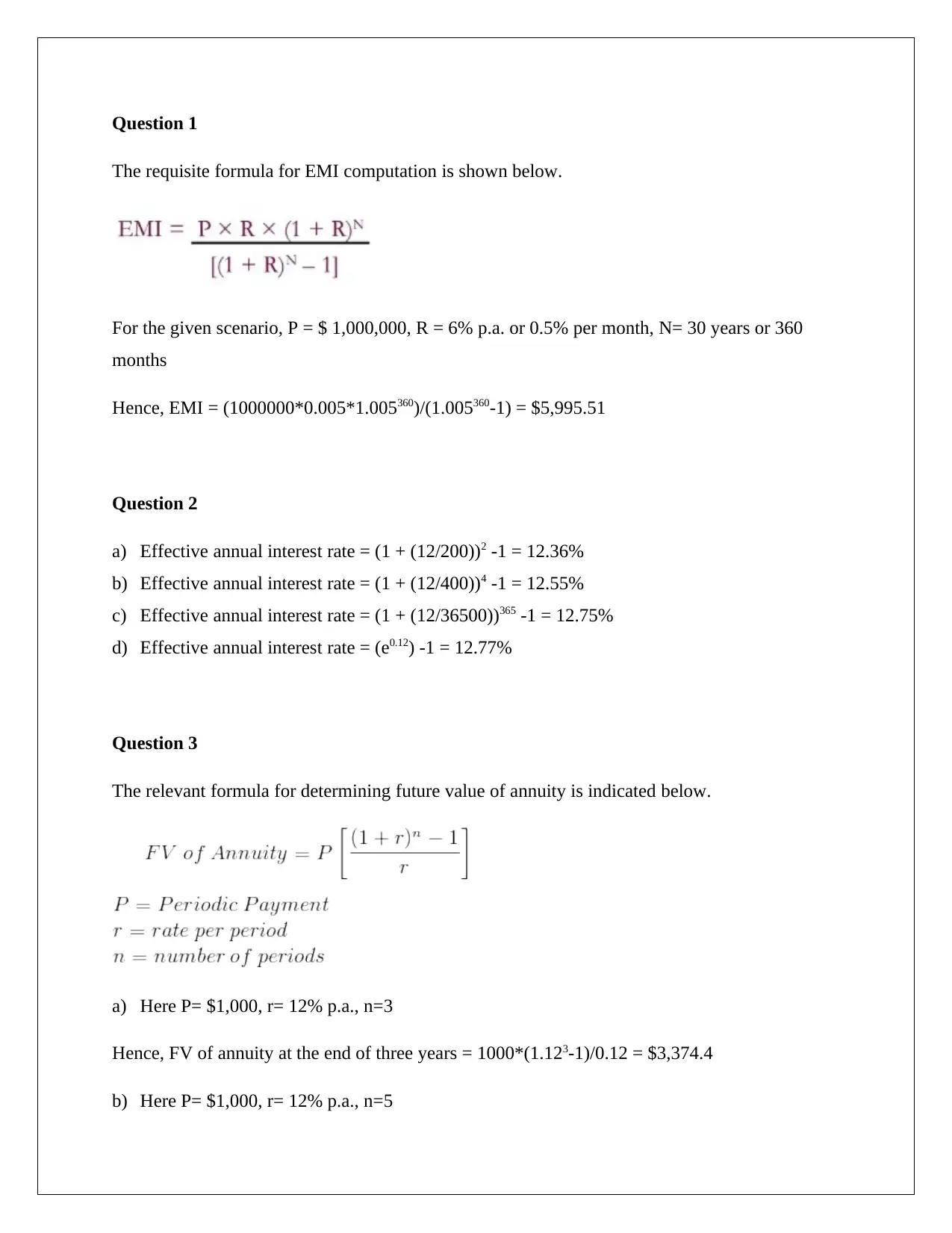

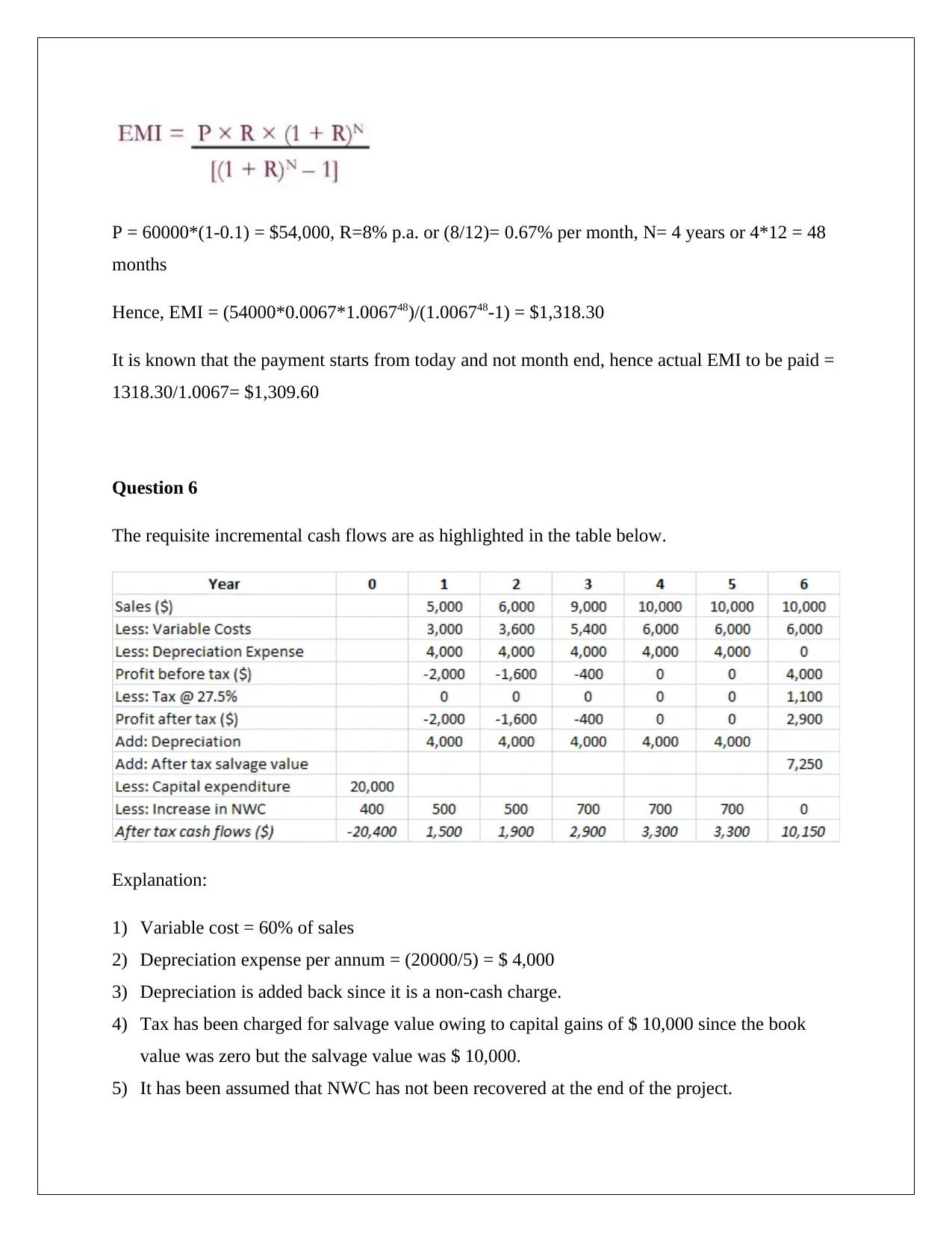

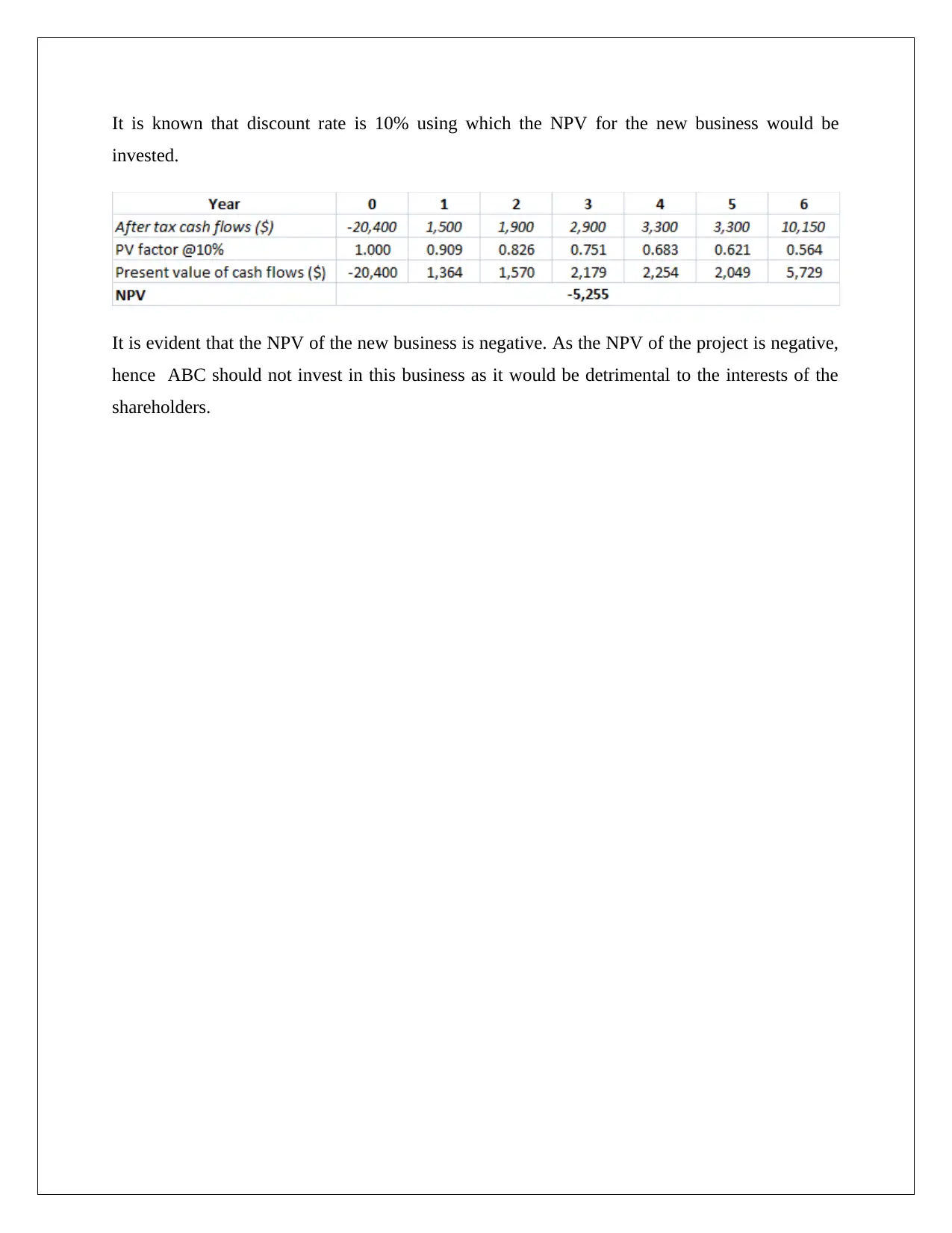

This document provides a comprehensive solution to a Master of Accounting statistics assignment. The assignment covers core financial concepts, including the calculation of EMI (Equated Monthly Installment) using the provided formula and real-world scenarios with different loan amounts, interest rates, and loan terms. It then delves into the calculation of effective annual interest rates under different compounding frequencies. The assignment proceeds to explore the future value of annuities, calculating the future value of a series of payments over several years, with variations in payment periods. Furthermore, the assignment addresses the present value of annuities, specifically calculating the present value of a lottery payout structured as two separate income streams over different time periods, and uses these calculations to determine the value of the lottery proceeds. Finally, the assignment tackles an incremental cash flow analysis, using the provided formulas and assumptions to determine the Net Present Value (NPV) of a new business venture, and concludes by providing a recommendation based on the NPV result.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)