Financial Analysis: Management Accounting Report for Meggit PLC

VerifiedAdded on 2021/02/19

|20

|5420

|71

Report

AI Summary

This report provides a detailed analysis of management accounting practices at Meggit PLC, a UK-based engineering organization. It covers various aspects of management accounting, including different types of managerial accounting systems like price optimizing, cost accounting, and inventory management systems, along with their essential requirements. The report also explores different methods utilized for management accounting reporting, such as budget reports, account receivable ageing reports, job cost reports, performance reports, and order information reports. Furthermore, it defines the advantages of management accounting systems, including job costing, price optimizing, and cost accounting systems, along with their applications within the organizational context. The report also delves into cost calculation and measurement using different cost analysis techniques to formulate effective income statements, and it discusses various planning tools used in budgetary control, along with their merits and demerits. Finally, the report examines how companies are adapting management accounting systems to resolve financial problems, emphasizing the role of planning tools in addressing financial issues and achieving sustainable success.

MANAGEMENT

ACCOUNTING

ACCOUNTING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirement for different type of management

accounting systems......................................................................................................................1

P2 Mention various methods utilised for management accounting reporting ............................2

M1 Define the advantages of management accounting systems along with their applications in

organisational context.................................................................................................................4

D1 Critical evaluation of management accounting systems and reporting are integrated with

process of company.....................................................................................................................5

TASK 2............................................................................................................................................5

P3 Calculate and measure costs by using different techniques of cost analysis to formulate

effective income statement..........................................................................................................5

M2 Apply different management accounting techniques and formulate financial reporting

documents...................................................................................................................................8

D2 Prepare a financial report which properly apply and interpret data for different business

activities......................................................................................................................................8

TASK 3............................................................................................................................................9

P4 Analyse the merits and demerits of various kinds of planning tools used in budgetary

control ........................................................................................................................................9

M3 Evaluate the use of various planning tools along with their application of forecasting and

preparing budgets......................................................................................................................10

TASK 4..........................................................................................................................................11

P5 Describe by comparison how companies are adapting the management accounting system

to resolve financial problems....................................................................................................11

M4 Management accounting system can lead to the sustainable success in relation to solving

the financial issues....................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

P1 Management accounting and essential requirement for different type of management

accounting systems......................................................................................................................1

P2 Mention various methods utilised for management accounting reporting ............................2

M1 Define the advantages of management accounting systems along with their applications in

organisational context.................................................................................................................4

D1 Critical evaluation of management accounting systems and reporting are integrated with

process of company.....................................................................................................................5

TASK 2............................................................................................................................................5

P3 Calculate and measure costs by using different techniques of cost analysis to formulate

effective income statement..........................................................................................................5

M2 Apply different management accounting techniques and formulate financial reporting

documents...................................................................................................................................8

D2 Prepare a financial report which properly apply and interpret data for different business

activities......................................................................................................................................8

TASK 3............................................................................................................................................9

P4 Analyse the merits and demerits of various kinds of planning tools used in budgetary

control ........................................................................................................................................9

M3 Evaluate the use of various planning tools along with their application of forecasting and

preparing budgets......................................................................................................................10

TASK 4..........................................................................................................................................11

P5 Describe by comparison how companies are adapting the management accounting system

to resolve financial problems....................................................................................................11

M4 Management accounting system can lead to the sustainable success in relation to solving

the financial issues....................................................................................................................14

D3 Planning tools for accounting respond accurately to solve the financial issues that leads to

the sustainable success..............................................................................................................14

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

.......................................................................................................................................................15

the sustainable success..............................................................................................................14

CONCLUSION .............................................................................................................................14

REFERENCES..............................................................................................................................15

.......................................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Management accounting is defined as the procedure of preparing accounts and

management reports which offers timely and accurate financial data needed by the managers of a

firm to make short term and daily basis decisions. With the help of management accounting,

weekly and monthly reports for internal audience of a business firm is prepared. By using these

reports, sales revenue, available cash flows, amount of orders can be acknowledge in a proper

manner. This assignment is based on Meggit PLC which is a Britain based Engineering

organisation which specially deals in Aerospace equipment. Organisation is headquartered at

Bournemouth Airport, UK. This engineering company was established in 1974 and employees

more than 11,700 employees as per the latest report (Cheng, 2012). This assignment is going to

include about management accounting and the needs of different kind of managerial accounting

systems within an organisation. Different tactics and methods which are used for management

accounting reporting are discussed. Beside this, cost and expenses are calculated by using

different cost analysis techniques so that an accurate income statement can be prepared. Various

kind of planning tools for budget control and mentioned along with their merits and demerits. At

last, use of management accounting to solve financial problems is carried out.

TASK 1

P1 Management accounting and essential requirement for different type of management

accounting systems

Management accounting is the process of identifying about the business costs and

operational cost for preparing financial reports and accounts which helps managers' in decision

making. The main motive of management accounting system is to take a better and accurate

decisions by controlling on the organisation performance, operational activities and development

process. This accounting system is only used by the organisation for maintaining a better

environment in the internal team. In context of Meggit PLC, management accounting help them

to take effective decision to order to accomplish their organisational goals and objectives. There

are various systems of management accounting which are discussed with their essential

requirement as below:-

Price Optimising system: This system is used by the organisations for deciding the

prices of their multiple products and services. It helps various organisations to know that

1

Management accounting is defined as the procedure of preparing accounts and

management reports which offers timely and accurate financial data needed by the managers of a

firm to make short term and daily basis decisions. With the help of management accounting,

weekly and monthly reports for internal audience of a business firm is prepared. By using these

reports, sales revenue, available cash flows, amount of orders can be acknowledge in a proper

manner. This assignment is based on Meggit PLC which is a Britain based Engineering

organisation which specially deals in Aerospace equipment. Organisation is headquartered at

Bournemouth Airport, UK. This engineering company was established in 1974 and employees

more than 11,700 employees as per the latest report (Cheng, 2012). This assignment is going to

include about management accounting and the needs of different kind of managerial accounting

systems within an organisation. Different tactics and methods which are used for management

accounting reporting are discussed. Beside this, cost and expenses are calculated by using

different cost analysis techniques so that an accurate income statement can be prepared. Various

kind of planning tools for budget control and mentioned along with their merits and demerits. At

last, use of management accounting to solve financial problems is carried out.

TASK 1

P1 Management accounting and essential requirement for different type of management

accounting systems

Management accounting is the process of identifying about the business costs and

operational cost for preparing financial reports and accounts which helps managers' in decision

making. The main motive of management accounting system is to take a better and accurate

decisions by controlling on the organisation performance, operational activities and development

process. This accounting system is only used by the organisation for maintaining a better

environment in the internal team. In context of Meggit PLC, management accounting help them

to take effective decision to order to accomplish their organisational goals and objectives. There

are various systems of management accounting which are discussed with their essential

requirement as below:-

Price Optimising system: This system is used by the organisations for deciding the

prices of their multiple products and services. It helps various organisations to know that

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

how the demand will vacillate with the changes in the prices of the products and services.

The Meggit PLC use this system for manage their products prices according to the

market segments. Moreover, it also help them in determining pricing structure for initial

pricing, discount pricing, and promotional pricing (Christ and Burritt, 2013). Cost accounting system: This system helps the organisation to recognise the cost of

products and services and help them to maintain the organisational profitability. By using

their system they can decide an effective price of their products and services so they able

to attract a large number of customers with their effective prices. These cost data will

help the organisation to compare between the estimated cost and actual cost which

enables to the management to decide the reasons behind this difference so they take

effective decisions. There are two types of cost accounting system which are as follow:-

Job order costing: This costing method is perfect for those who are indulge in the

production of unique and special products as it help them to identifying their manufacturing costs

of every activity. This method is also used by the industries to check the cost of production if

their prices are increased by their estimated data then they able to control on this by adopting this

method and can maintain their profitability.

Process costing: This system is perfect for those whose production is a process involving

in different departments. It will help them to know about the manufacturing cost of their each

production process.

Inventory management system: This system is help the organisations to maintain their

inventory according to the demand. The reason behind using this system is to maintain

the effective flow of goods and services so they able to meet from the expectation of the

customers. This system is beneficial for the Meggit PLC as it helps them to track the

records of their inventory which make easy for them to track the supply and demand of

the inventories in the market. It also helps them to advance management of inventories

and also help them to make a plan regarding to the inventory required in the the company.

Furthermore, it assist them to how they can reduce their cost and maintain their appropriate

inventory in the organisation (Garrison and et. al., 2010).

P2 Mention various methods utilised for management accounting reporting

There are different kind of managerial accounting reports which benefits the management

of an organisation is preparing proper account statements so that strategically advantageous

2

The Meggit PLC use this system for manage their products prices according to the

market segments. Moreover, it also help them in determining pricing structure for initial

pricing, discount pricing, and promotional pricing (Christ and Burritt, 2013). Cost accounting system: This system helps the organisation to recognise the cost of

products and services and help them to maintain the organisational profitability. By using

their system they can decide an effective price of their products and services so they able

to attract a large number of customers with their effective prices. These cost data will

help the organisation to compare between the estimated cost and actual cost which

enables to the management to decide the reasons behind this difference so they take

effective decisions. There are two types of cost accounting system which are as follow:-

Job order costing: This costing method is perfect for those who are indulge in the

production of unique and special products as it help them to identifying their manufacturing costs

of every activity. This method is also used by the industries to check the cost of production if

their prices are increased by their estimated data then they able to control on this by adopting this

method and can maintain their profitability.

Process costing: This system is perfect for those whose production is a process involving

in different departments. It will help them to know about the manufacturing cost of their each

production process.

Inventory management system: This system is help the organisations to maintain their

inventory according to the demand. The reason behind using this system is to maintain

the effective flow of goods and services so they able to meet from the expectation of the

customers. This system is beneficial for the Meggit PLC as it helps them to track the

records of their inventory which make easy for them to track the supply and demand of

the inventories in the market. It also helps them to advance management of inventories

and also help them to make a plan regarding to the inventory required in the the company.

Furthermore, it assist them to how they can reduce their cost and maintain their appropriate

inventory in the organisation (Garrison and et. al., 2010).

P2 Mention various methods utilised for management accounting reporting

There are different kind of managerial accounting reports which benefits the management

of an organisation is preparing proper account statements so that strategically advantageous

2

decisions can be taken. These report helps the manager of an organisation in attaining reliable

and accurate financial or statistical information. There are different kind of management reports

which can be prepared by the manager in Maggit Plc so that all accounts and transactions can be

mentioned in a proper manner. In this context, some reports are mentioned below:

Budget reports: A budget report is defined as an internal report which is used by

management of a company to compare estimated projections of budget with actual

performance within a specific period. In context with Maggit Plc, a budget report is

prepared to compare the difference in estimated and actual performance of company

within a financial year. Budget report of a company follow same format as income

statement. Manager in Maggit Plc can use budget report to give incentives to workers so

that they can feel motivated to deliver their best performance. Future budgets are also

forecasted in accordance with these reports so that overall objectives of company can be

formulated in a proper manner (Kober, Subraamanniam and Watson, 2012).

Account receivable ageing report: It is a report which lists the unused credit memos

and unpaid consumer invoices with the ranges of date. It is a primary tool which can be

used by collection personnels in Meggit Plc to identify those invoices which are overdue

for payment. This kind of managerial accounting report is related with the management

of accounting receivables for those business organisations that engaged in increasing

credits to the clients. This report will helps the concerned company on analysing about

the credit policies so that old and bad debts can be reduced and liquidity of company can

be maintained in a proper manner.

Job cost reports: These managerial accounting report is related with the identification of

profitability, expenses, costs of a particular job. This report is considered as the starting

place for data that is contained in other reports. With the help of this report, each job can

be listed on which work is performed so that total incurred cost can be acknowledged.

This report will benefits Meggit Plc in evaluating the costs even if the project is in

progress. This will assists in eliminating those aspects which are not adding any value to

the company. By this, projects handled by Meggit Plc can be make workable and

profitable.

Performance report: It is a report which is prepared by business organisations so that

performance of a particular activity or entire project can be acknowledged in a proper

3

and accurate financial or statistical information. There are different kind of management reports

which can be prepared by the manager in Maggit Plc so that all accounts and transactions can be

mentioned in a proper manner. In this context, some reports are mentioned below:

Budget reports: A budget report is defined as an internal report which is used by

management of a company to compare estimated projections of budget with actual

performance within a specific period. In context with Maggit Plc, a budget report is

prepared to compare the difference in estimated and actual performance of company

within a financial year. Budget report of a company follow same format as income

statement. Manager in Maggit Plc can use budget report to give incentives to workers so

that they can feel motivated to deliver their best performance. Future budgets are also

forecasted in accordance with these reports so that overall objectives of company can be

formulated in a proper manner (Kober, Subraamanniam and Watson, 2012).

Account receivable ageing report: It is a report which lists the unused credit memos

and unpaid consumer invoices with the ranges of date. It is a primary tool which can be

used by collection personnels in Meggit Plc to identify those invoices which are overdue

for payment. This kind of managerial accounting report is related with the management

of accounting receivables for those business organisations that engaged in increasing

credits to the clients. This report will helps the concerned company on analysing about

the credit policies so that old and bad debts can be reduced and liquidity of company can

be maintained in a proper manner.

Job cost reports: These managerial accounting report is related with the identification of

profitability, expenses, costs of a particular job. This report is considered as the starting

place for data that is contained in other reports. With the help of this report, each job can

be listed on which work is performed so that total incurred cost can be acknowledged.

This report will benefits Meggit Plc in evaluating the costs even if the project is in

progress. This will assists in eliminating those aspects which are not adding any value to

the company. By this, projects handled by Meggit Plc can be make workable and

profitable.

Performance report: It is a report which is prepared by business organisations so that

performance of a particular activity or entire project can be acknowledged in a proper

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

manner. In context with Meggit Plc, an annual performance report can be prepared for

every employee which is working in organisation to acknowledge their contribution in

the success of company. Other than this, performance report can be used by concerned

company to access the success rate of a product or project along with mentioning of the

measures to adhere budgetary constraints. In general, these reports are prepared on yearly

basis but an organisation can create them on quarterly and monthly basis too (Lukka and

Vinnari, 2014).

Order information report: This type of report assist a business organisation in

managing the trends of business in an effective and ineffective manner. There are

different kind of reports which can be prepared under such management accounting so

that while placing different orders, low cost can be achieved. Due to this, expenses of

revenues will be less and high amount of revenues can be utilised.

M1 Define the advantages of management accounting systems along with their applications in

organisational context

There are various merits of different accounting systems in relation with Meggit Plc.

Some of the benefits and applications in context with concerned company is discussed below:

Job costing system: This system benefits an organisation in predicting different kinds of

costs and expenses during the production or manufacturing processes. This will allow the

manager and workers in Maggit Plc to prevent from duplications of efforts and energy as

if work is performed once it will be reflected again when required. Beside this, job

costing system will helps the company in evaluating the quality of work which is done.

Price optimising system: With the help of this accounting system, attitude and

perception of consumers towards different prices of services or products of company can

be acknowledged. This system will benefit Maggit Plc in maximising their operating

profits with best prices. Beside this, it will helps in segmenting customers in a systematic

manner (Qian, Burritt and Monroe, 2011).

Cost accounting system: By taking help of this system, an organisation can measure the

effectiveness of processes and carry out needed modifications as per requirements. This

system will allow Maggit Plc in reducing and fixing prices as per requirement. Beside it,

this system will offer important information which is required for planning.

4

every employee which is working in organisation to acknowledge their contribution in

the success of company. Other than this, performance report can be used by concerned

company to access the success rate of a product or project along with mentioning of the

measures to adhere budgetary constraints. In general, these reports are prepared on yearly

basis but an organisation can create them on quarterly and monthly basis too (Lukka and

Vinnari, 2014).

Order information report: This type of report assist a business organisation in

managing the trends of business in an effective and ineffective manner. There are

different kind of reports which can be prepared under such management accounting so

that while placing different orders, low cost can be achieved. Due to this, expenses of

revenues will be less and high amount of revenues can be utilised.

M1 Define the advantages of management accounting systems along with their applications in

organisational context

There are various merits of different accounting systems in relation with Meggit Plc.

Some of the benefits and applications in context with concerned company is discussed below:

Job costing system: This system benefits an organisation in predicting different kinds of

costs and expenses during the production or manufacturing processes. This will allow the

manager and workers in Maggit Plc to prevent from duplications of efforts and energy as

if work is performed once it will be reflected again when required. Beside this, job

costing system will helps the company in evaluating the quality of work which is done.

Price optimising system: With the help of this accounting system, attitude and

perception of consumers towards different prices of services or products of company can

be acknowledged. This system will benefit Maggit Plc in maximising their operating

profits with best prices. Beside this, it will helps in segmenting customers in a systematic

manner (Qian, Burritt and Monroe, 2011).

Cost accounting system: By taking help of this system, an organisation can measure the

effectiveness of processes and carry out needed modifications as per requirements. This

system will allow Maggit Plc in reducing and fixing prices as per requirement. Beside it,

this system will offer important information which is required for planning.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

D1 Critical evaluation of management accounting systems and reporting are integrated with

process of company

In order to gain high benefits, it is essential for Meggit Plc to have an appropriate

integration between management accounting reporting and systems as these aspects will benefits

the company in making accurate decisions and procedures. Due to this organisational objectives

& goals can be attained in a desired manner. Properly maintaining transactional records in

management accounting reports is not possible without any accounting system like price

optimisation, inventory management or job cost system etc. for example, inventory management

system will help the manager in Maggit Plc in providing required information about present level

of inventory so that inventory management report can be prepared in a proper manner (Renz,

2016).

TASK 2

P3 Calculate and measure costs by using different techniques of cost analysis to formulate

effective income statement

In context with business organisations, cost is referred to the amount of capital or money

which is spent on producing a particular service or good. It is a monetary value which defines

expenditures associated with raw material, supplies, products, equipments, labour etc. There are

different kinds of cost related with budget and accounts of company. In context with Maggit Plc,

some type of costs are discussed below:

Absorption costing: It is referred as a technique that is used for calculating costs which

is invested for the purpose of producing or manufacturing products and services. It

involves both fixed and variable costs. This is the reason, it is also acknowledged as full

costing method.

Marginal costing: It is a method which is also used to calculate net profitability of

company including only variable cost. It is most adopted method especially by small and

medium large organisation as using such costing method shows more profitability in

financial statement of an organisation (Shah, Malik and Malik, 2011).

Maggit Plc can use both type of costs to achieve their objectives in a proper manner along

with formation of an appropriate income statement. In relation with concerned company, income

statements are mentioned below:

5

process of company

In order to gain high benefits, it is essential for Meggit Plc to have an appropriate

integration between management accounting reporting and systems as these aspects will benefits

the company in making accurate decisions and procedures. Due to this organisational objectives

& goals can be attained in a desired manner. Properly maintaining transactional records in

management accounting reports is not possible without any accounting system like price

optimisation, inventory management or job cost system etc. for example, inventory management

system will help the manager in Maggit Plc in providing required information about present level

of inventory so that inventory management report can be prepared in a proper manner (Renz,

2016).

TASK 2

P3 Calculate and measure costs by using different techniques of cost analysis to formulate

effective income statement

In context with business organisations, cost is referred to the amount of capital or money

which is spent on producing a particular service or good. It is a monetary value which defines

expenditures associated with raw material, supplies, products, equipments, labour etc. There are

different kinds of cost related with budget and accounts of company. In context with Maggit Plc,

some type of costs are discussed below:

Absorption costing: It is referred as a technique that is used for calculating costs which

is invested for the purpose of producing or manufacturing products and services. It

involves both fixed and variable costs. This is the reason, it is also acknowledged as full

costing method.

Marginal costing: It is a method which is also used to calculate net profitability of

company including only variable cost. It is most adopted method especially by small and

medium large organisation as using such costing method shows more profitability in

financial statement of an organisation (Shah, Malik and Malik, 2011).

Maggit Plc can use both type of costs to achieve their objectives in a proper manner along

with formation of an appropriate income statement. In relation with concerned company, income

statements are mentioned below:

5

Annex (A)

Budget 2019 2020 2021

Cost

Centre

Budgeted

production

overhead

costs in £)

Basis of

production

(overhead

absorption)

Cost

per

Hour Hours Cost Hours Cost Hours Cost

A 66000 22000 3 24200 72600 26620 79860 27500 82500

B 75000 15000 5 16500 82500 18150 90750 19500 97500

C 83600 41800 2 45980 91960 50578

10115

6 51500

10300

0

Annex (B)

(a) Labour hour: -

Product X = £6000*1 = £6000

Product Y = £8000*2 = £16000

Labour hour = £2,64,000

------------

22,000

= £12 per hour.

Overhead absorption on labour hour: -

X Y

Overhead absorption = 1*12 = 2*12

= 12 = 24

Total Overheads = £6000*12 = £8000*24

= £72,000 = £192,000

(b) Using ABC approach: -

Machine hour per period:

Product X = £6000*4 = £24,000

Product Y = £8000*2 = £16,000

Cost driven rate: -

6

Budget 2019 2020 2021

Cost

Centre

Budgeted

production

overhead

costs in £)

Basis of

production

(overhead

absorption)

Cost

per

Hour Hours Cost Hours Cost Hours Cost

A 66000 22000 3 24200 72600 26620 79860 27500 82500

B 75000 15000 5 16500 82500 18150 90750 19500 97500

C 83600 41800 2 45980 91960 50578

10115

6 51500

10300

0

Annex (B)

(a) Labour hour: -

Product X = £6000*1 = £6000

Product Y = £8000*2 = £16000

Labour hour = £2,64,000

------------

22,000

= £12 per hour.

Overhead absorption on labour hour: -

X Y

Overhead absorption = 1*12 = 2*12

= 12 = 24

Total Overheads = £6000*12 = £8000*24

= £72,000 = £192,000

(b) Using ABC approach: -

Machine hour per period:

Product X = £6000*4 = £24,000

Product Y = £8000*2 = £16,000

Cost driven rate: -

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Production set up = £179,000 = 2893 per set up.

60

Order handling = £30,000 = 416.666 = 417 per order

72

Machine cost = £55,000 = 1.375 per order

40,000

Overhead using ABC approach: -

X

Set up = 15*2983 = 44,745

Order = 12*417 = 5004

Machine cost = 24000*1.375 = 33,000

Total 82749

Y

Set up = 45*2983 = 134,235

Order = 60*417 = 25,020

Machine cost = 16000*1.375 = 22,000

Total 181,255

Annex (c)

Year X PV@ 12%

Dis Cash

Flow Y PV@ 12%

Dis Cash

Flow

0 -5000 -8000

1 2500 0.893 2232.143 1500 0.893 1339.286

2 1000 0.797 797.194 2000 0.797 1594.388

3 1000 0.712 711.780 2500 0.712 1779.451

4 500 0.636 317.759 1000 0.636 635.518

5 1500 0.567 851.140 1000 0.567 567.427

6 1000 0.507 506.631 2500 0.507 1266.578

Total 5416.647 7182.647

7

60

Order handling = £30,000 = 416.666 = 417 per order

72

Machine cost = £55,000 = 1.375 per order

40,000

Overhead using ABC approach: -

X

Set up = 15*2983 = 44,745

Order = 12*417 = 5004

Machine cost = 24000*1.375 = 33,000

Total 82749

Y

Set up = 45*2983 = 134,235

Order = 60*417 = 25,020

Machine cost = 16000*1.375 = 22,000

Total 181,255

Annex (c)

Year X PV@ 12%

Dis Cash

Flow Y PV@ 12%

Dis Cash

Flow

0 -5000 -8000

1 2500 0.893 2232.143 1500 0.893 1339.286

2 1000 0.797 797.194 2000 0.797 1594.388

3 1000 0.712 711.780 2500 0.712 1779.451

4 500 0.636 317.759 1000 0.636 635.518

5 1500 0.567 851.140 1000 0.567 567.427

6 1000 0.507 506.631 2500 0.507 1266.578

Total 5416.647 7182.647

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

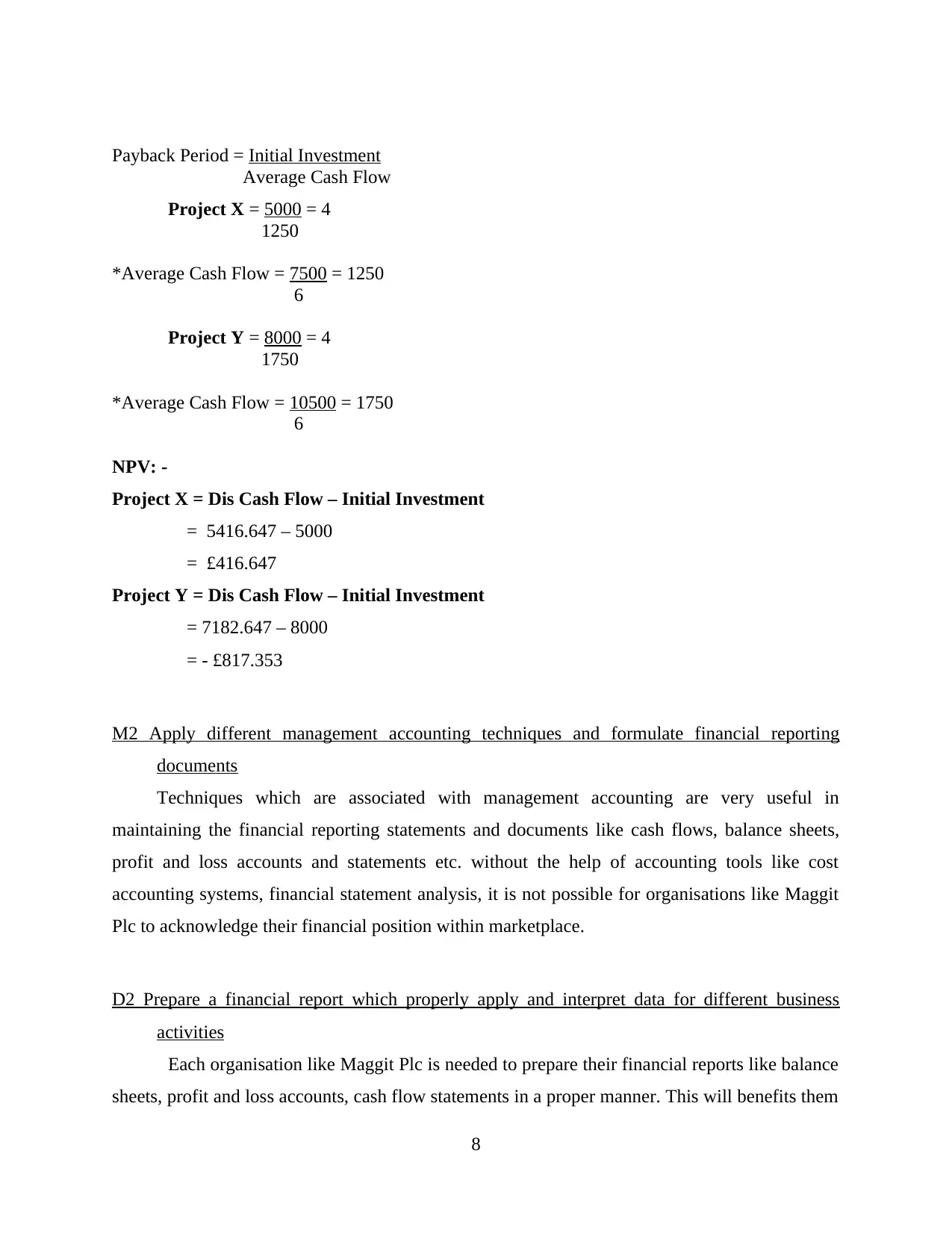

Payback Period = Initial Investment

Average Cash Flow

Project X = 5000 = 4

1250

*Average Cash Flow = 7500 = 1250

6

Project Y = 8000 = 4

1750

*Average Cash Flow = 10500 = 1750

6

NPV: -

Project X = Dis Cash Flow – Initial Investment

= 5416.647 – 5000

= £416.647

Project Y = Dis Cash Flow – Initial Investment

= 7182.647 – 8000

= - £817.353

M2 Apply different management accounting techniques and formulate financial reporting

documents

Techniques which are associated with management accounting are very useful in

maintaining the financial reporting statements and documents like cash flows, balance sheets,

profit and loss accounts and statements etc. without the help of accounting tools like cost

accounting systems, financial statement analysis, it is not possible for organisations like Maggit

Plc to acknowledge their financial position within marketplace.

D2 Prepare a financial report which properly apply and interpret data for different business

activities

Each organisation like Maggit Plc is needed to prepare their financial reports like balance

sheets, profit and loss accounts, cash flow statements in a proper manner. This will benefits them

8

Average Cash Flow

Project X = 5000 = 4

1250

*Average Cash Flow = 7500 = 1250

6

Project Y = 8000 = 4

1750

*Average Cash Flow = 10500 = 1750

6

NPV: -

Project X = Dis Cash Flow – Initial Investment

= 5416.647 – 5000

= £416.647

Project Y = Dis Cash Flow – Initial Investment

= 7182.647 – 8000

= - £817.353

M2 Apply different management accounting techniques and formulate financial reporting

documents

Techniques which are associated with management accounting are very useful in

maintaining the financial reporting statements and documents like cash flows, balance sheets,

profit and loss accounts and statements etc. without the help of accounting tools like cost

accounting systems, financial statement analysis, it is not possible for organisations like Maggit

Plc to acknowledge their financial position within marketplace.

D2 Prepare a financial report which properly apply and interpret data for different business

activities

Each organisation like Maggit Plc is needed to prepare their financial reports like balance

sheets, profit and loss accounts, cash flow statements in a proper manner. This will benefits them

8

in acknowledging their actual financial position within marketplace. In this context, the company

is required to interpret their different tractions which takes place while perusing different

business activities. This will helps in acknowledging the actual capital which is invested in a

specific business operation or activity (Suomala and Lyly-Yrjänäinen, 2012).

TASK 3

P4 Analyse the merits and demerits of various kinds of planning tools used in budgetary control

Budgetary control is referred to a tool which is used by business firms so that

organisational goals and targets can be achieved by using budget in a proper manner. In order to

control and monitor financial operations, each company used budgetary control. These tool give

overall estimation of funds so that future expenses of Maggit Plc related with labour, material,

overhead, manufacturing can be acknowledged. Some of the planning tools associated with

budgetary control are mentioned below:

Contingency planning: This plan is formulated by an organisation so that future

problems or situations can be overcomed in a proper manner. It is also called as Plan B which

implies that if any misshapenness will take place suddenly and company is not prepared for it

then this plan B will helps the Maggit Plc in dealing with uncertainties by appropriate means.

This plan is mainly used to resolve problems within workplace (Ward, 2012).

Advantages of contingency planning

This tool will allow the concerned company in overcoming the problems of workplace in

a systematic manner.

Organisations can use this planning tool as a strategy to eliminate potential risks which

can hinder the growth of company.

With the help of this plan, employees are able to share their plans and ideas due to which

their knowledge will increase (Nitzl, 2016).

Disadvantage of contingency planning

This type of planning tool can create problems between employees and managers due to

ideological differences.

Implementing this plan is time consuming as strategy formulation takes time.

9

is required to interpret their different tractions which takes place while perusing different

business activities. This will helps in acknowledging the actual capital which is invested in a

specific business operation or activity (Suomala and Lyly-Yrjänäinen, 2012).

TASK 3

P4 Analyse the merits and demerits of various kinds of planning tools used in budgetary control

Budgetary control is referred to a tool which is used by business firms so that

organisational goals and targets can be achieved by using budget in a proper manner. In order to

control and monitor financial operations, each company used budgetary control. These tool give

overall estimation of funds so that future expenses of Maggit Plc related with labour, material,

overhead, manufacturing can be acknowledged. Some of the planning tools associated with

budgetary control are mentioned below:

Contingency planning: This plan is formulated by an organisation so that future

problems or situations can be overcomed in a proper manner. It is also called as Plan B which

implies that if any misshapenness will take place suddenly and company is not prepared for it

then this plan B will helps the Maggit Plc in dealing with uncertainties by appropriate means.

This plan is mainly used to resolve problems within workplace (Ward, 2012).

Advantages of contingency planning

This tool will allow the concerned company in overcoming the problems of workplace in

a systematic manner.

Organisations can use this planning tool as a strategy to eliminate potential risks which

can hinder the growth of company.

With the help of this plan, employees are able to share their plans and ideas due to which

their knowledge will increase (Nitzl, 2016).

Disadvantage of contingency planning

This type of planning tool can create problems between employees and managers due to

ideological differences.

Implementing this plan is time consuming as strategy formulation takes time.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.