Microeconomics Assignment: Market Structures, Elasticity, and Welfare

VerifiedAdded on 2022/09/26

|20

|1691

|26

Homework Assignment

AI Summary

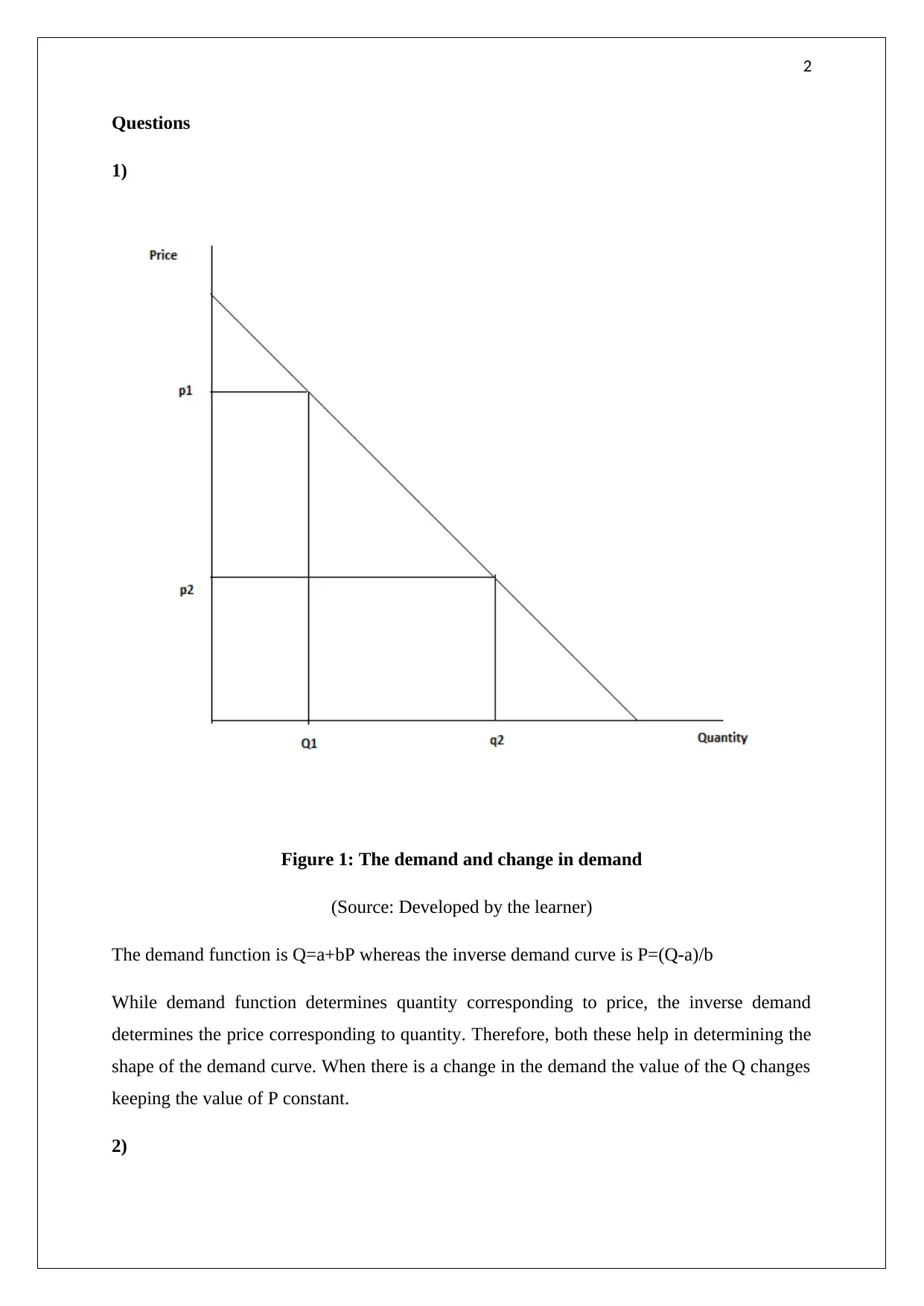

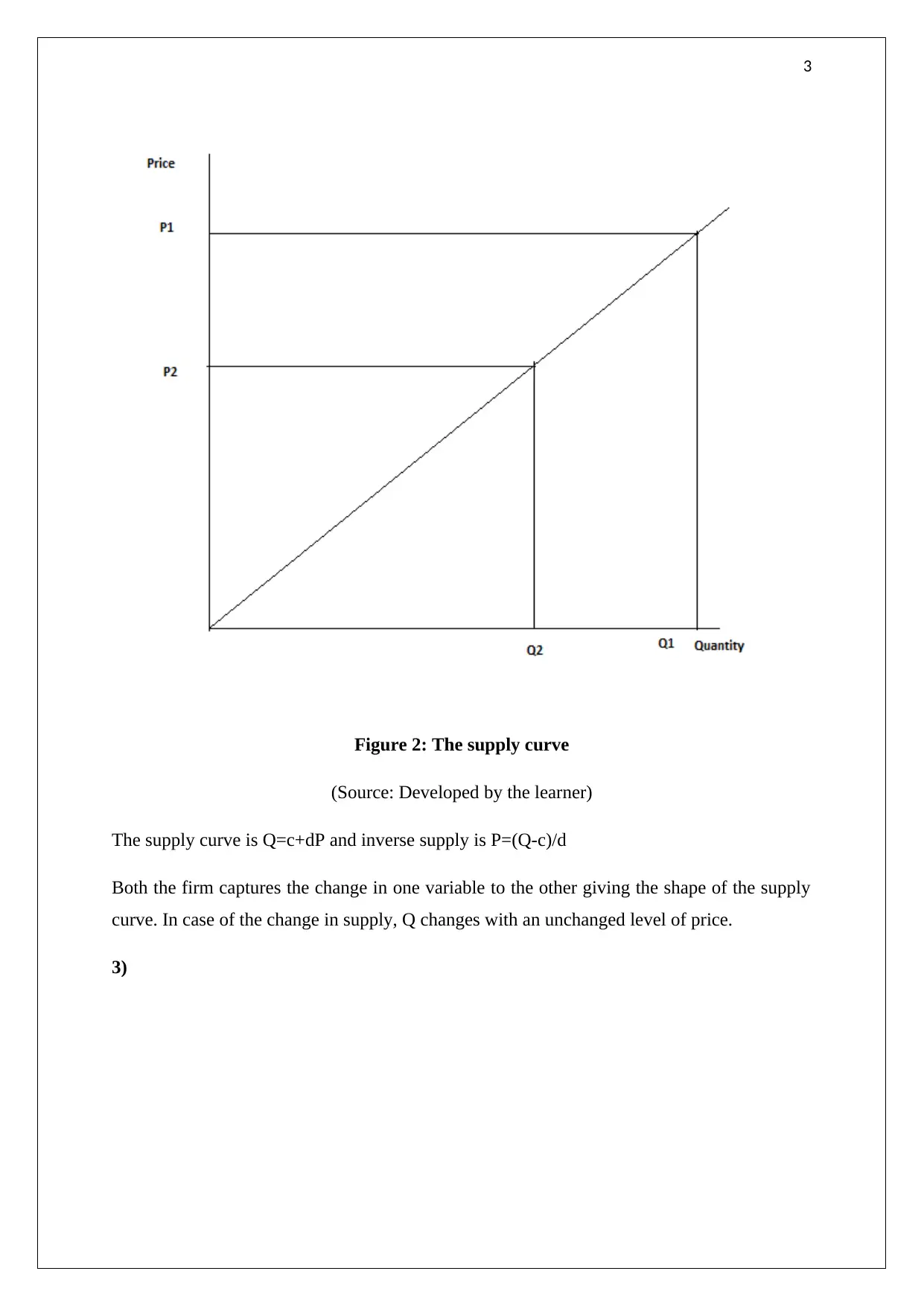

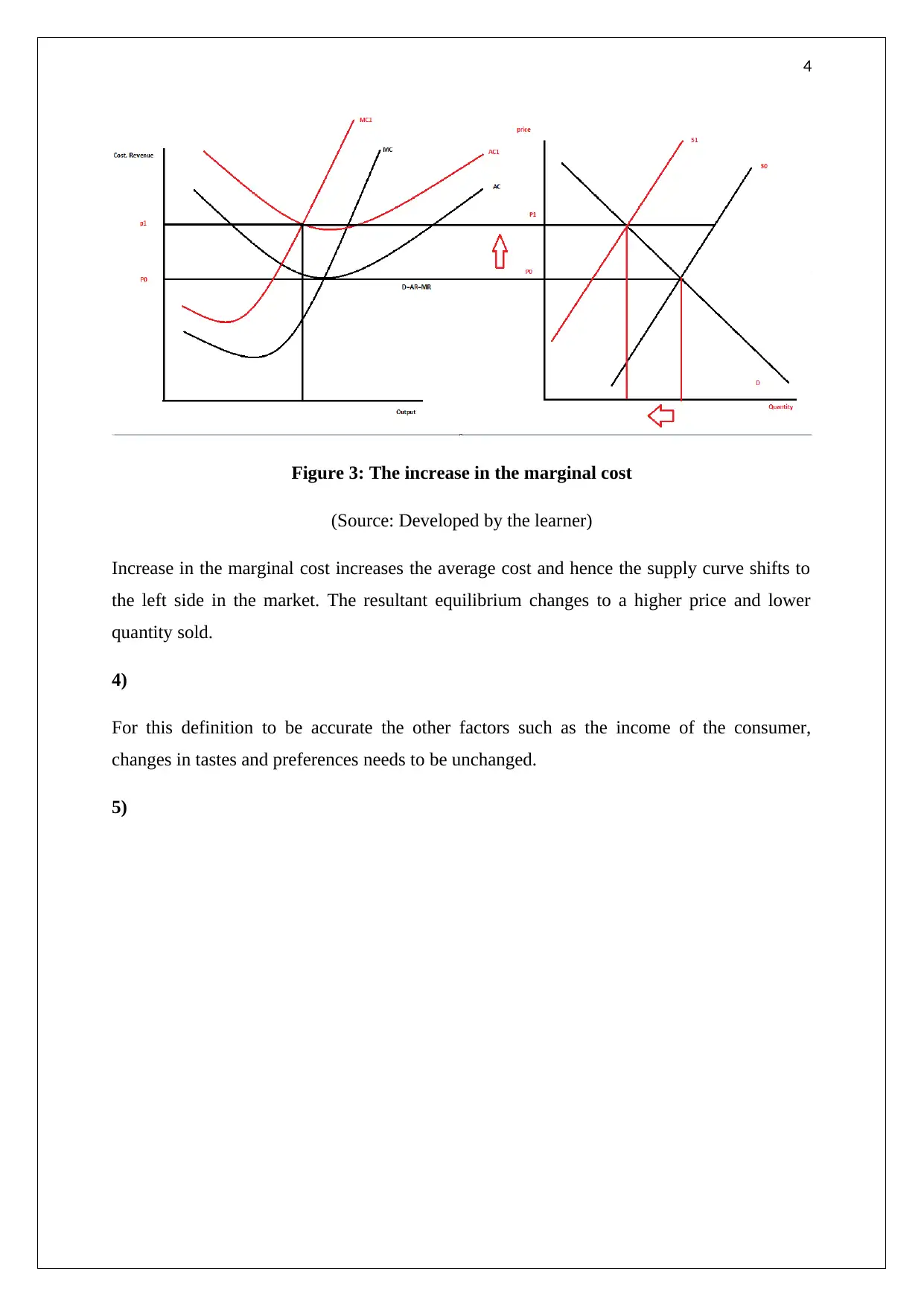

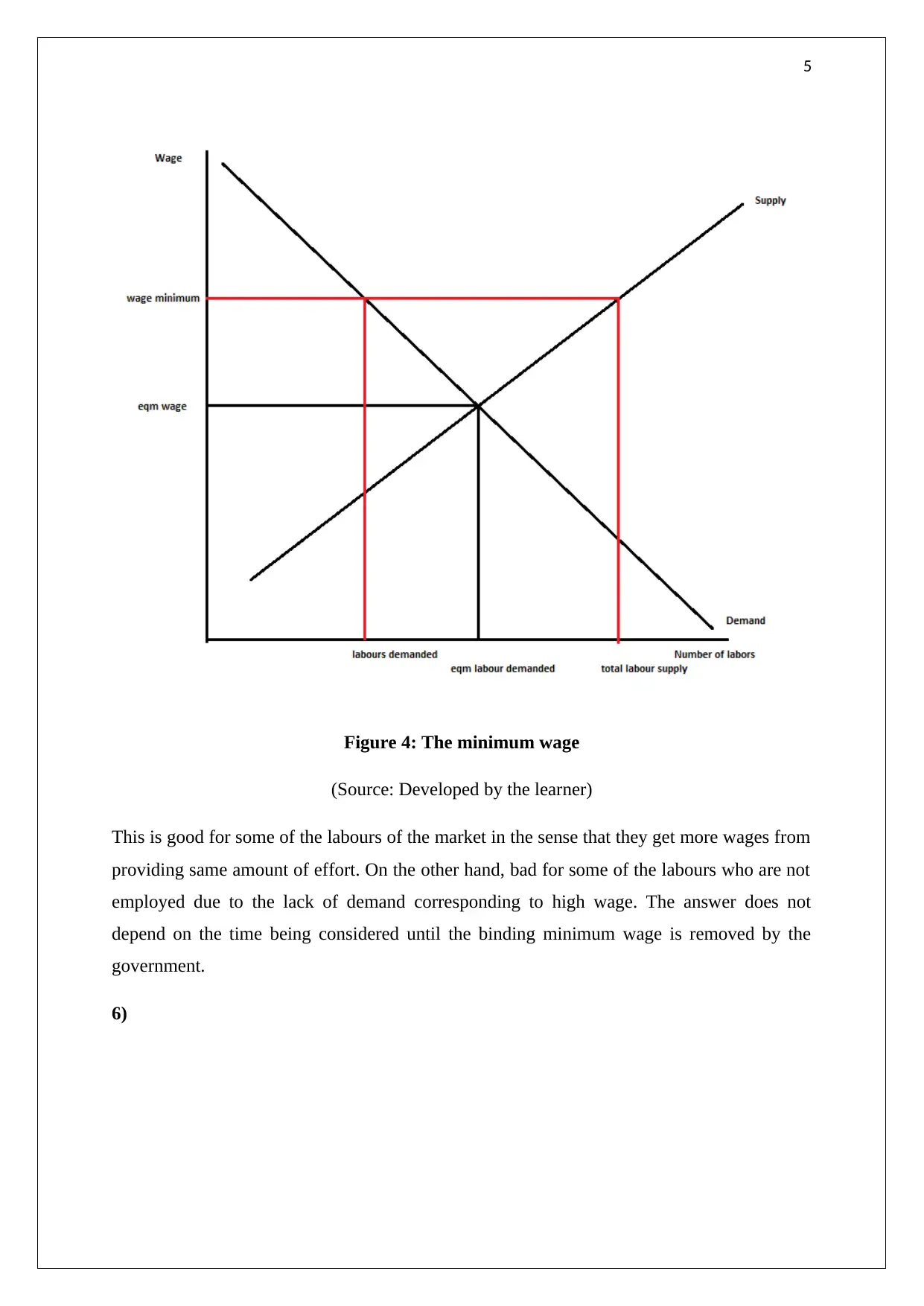

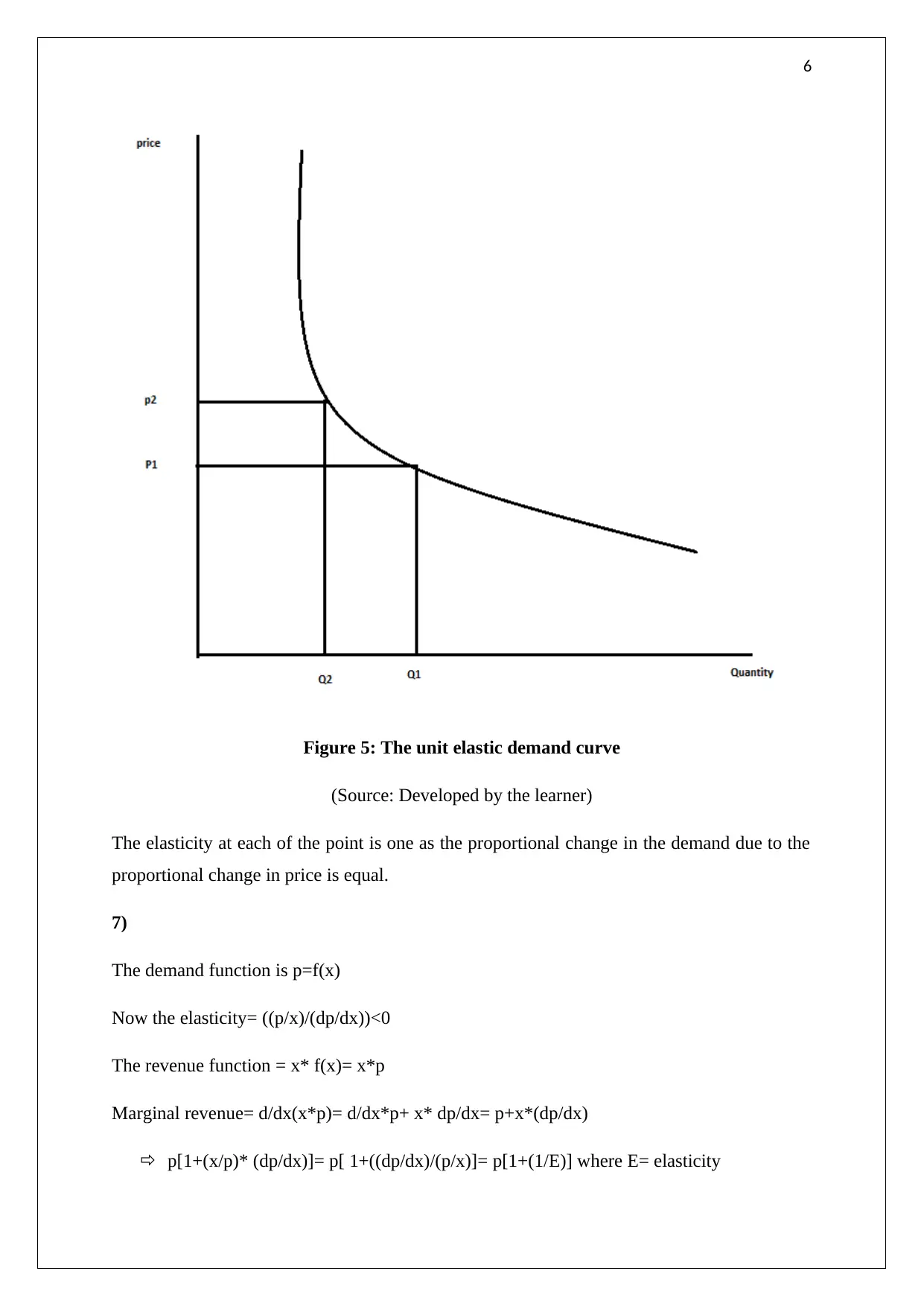

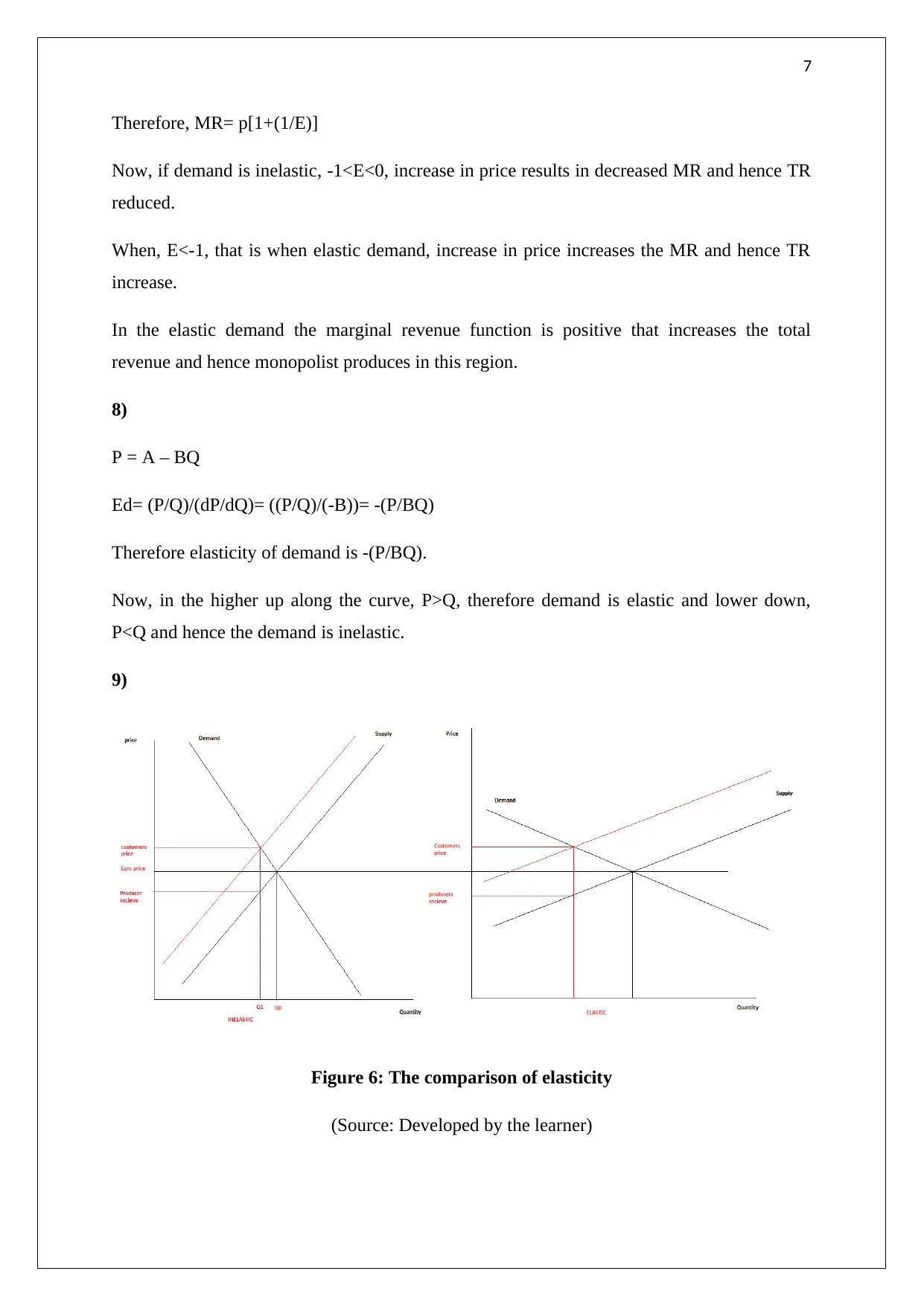

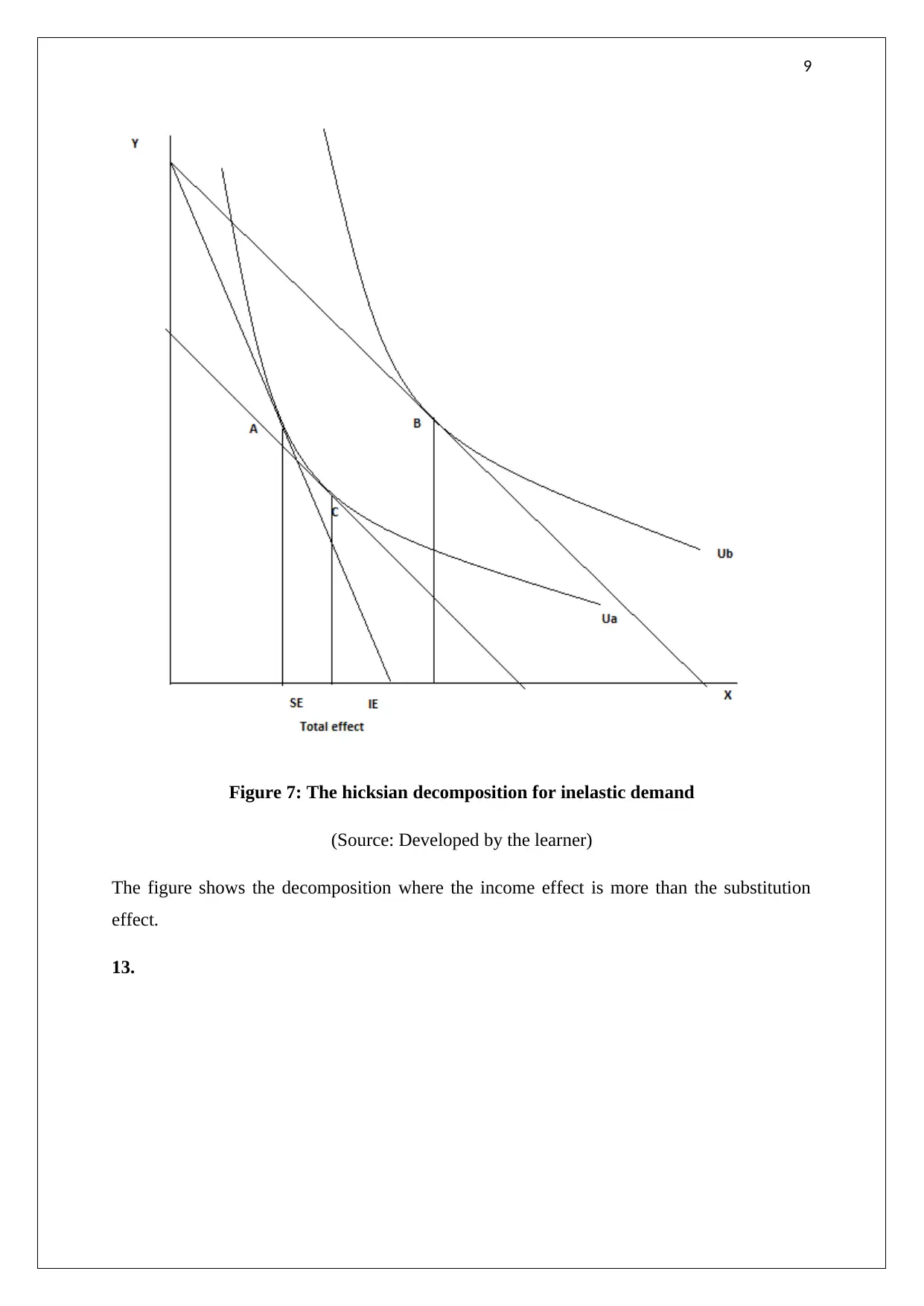

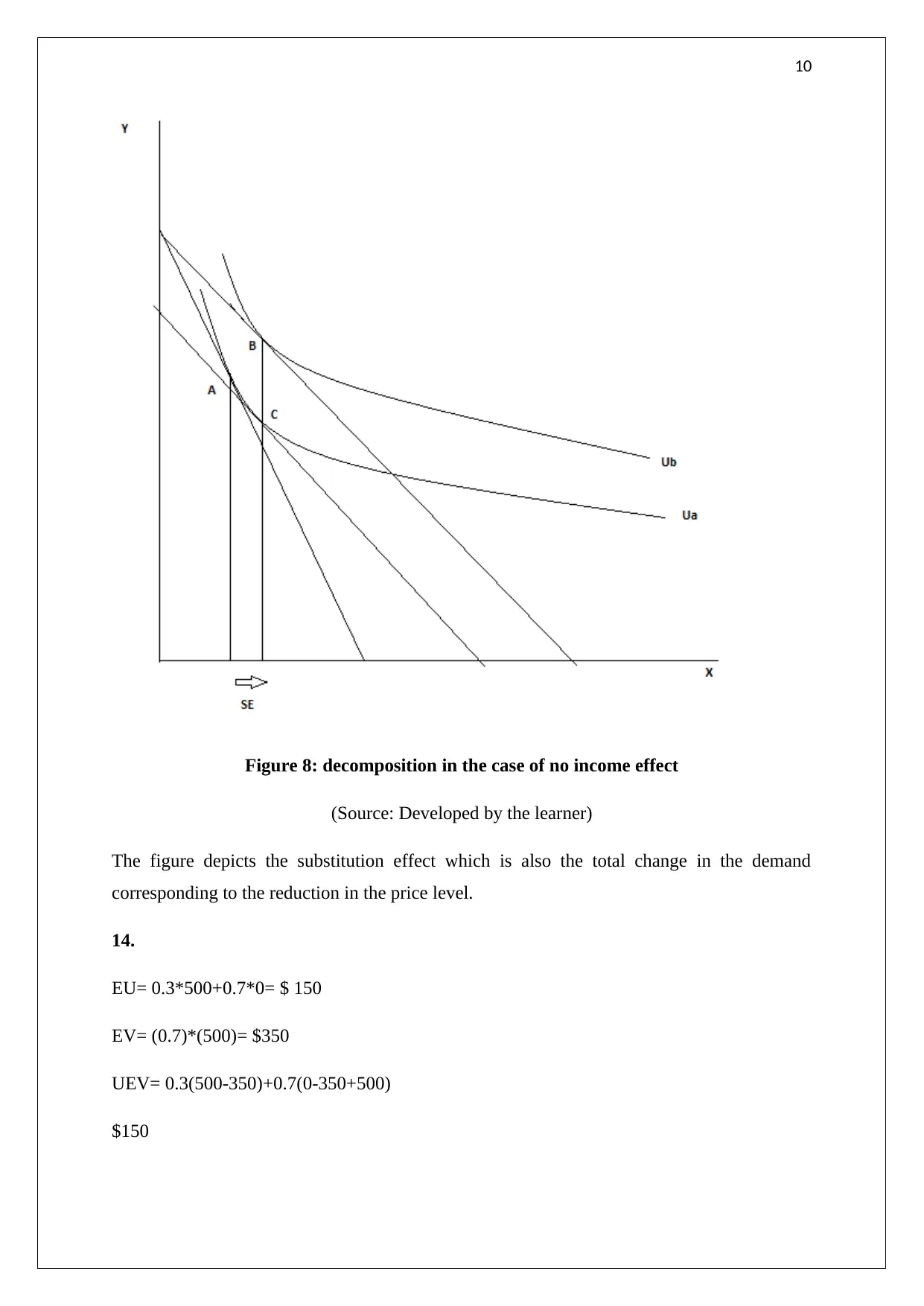

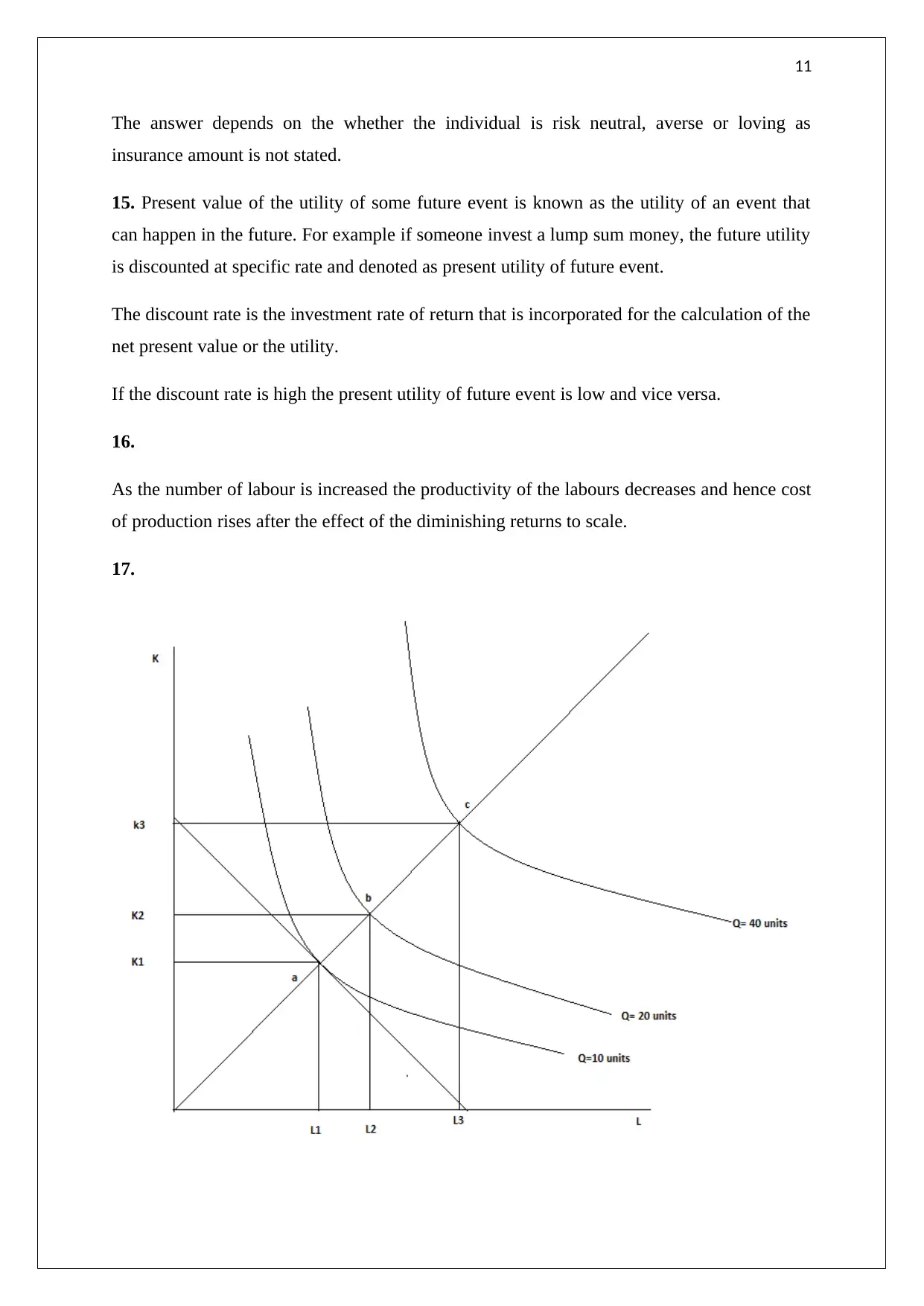

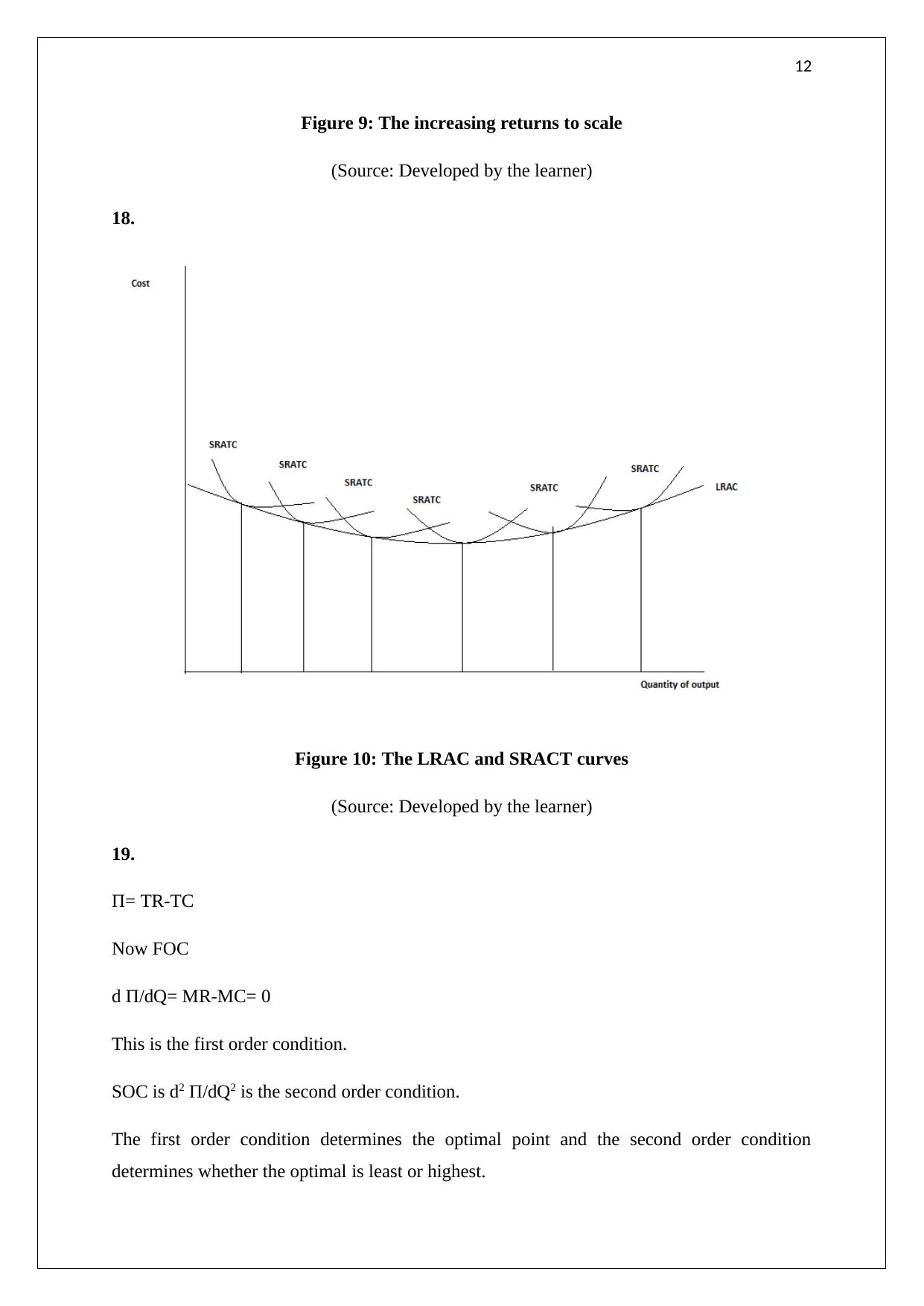

This microeconomics assignment solution covers a wide range of topics, including demand and supply functions, inverse demand and supply curves, and the impact of changes in marginal costs on market equilibrium. It explores the concept of complements, minimum wage effects, and the unit elastic demand curve. The assignment delves into elasticity, marginal revenue, and total revenue relationships, along with graphical representations. It also includes indifference curves, Hicksian decomposition, and the concept of present value of utility. The assignment explores production costs, returns to scale, and the relationship between long-run and short-run average cost curves. Furthermore, it examines profit maximization under perfect competition and monopoly, market structures, Herfindahl-Hirschman Index, Cournot Nash equilibrium, monopolistic competition, consumer and producer surplus, welfare loss, and the provision of public goods. The solution provides detailed explanations and graphical analyses for each question.

1 out of 20

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)