University Economics Assignment: Micro and Macroeconomic Concepts

VerifiedAdded on 2022/12/28

|14

|2742

|27

Homework Assignment

AI Summary

This economics assignment delves into both microeconomic and macroeconomic concepts. In microeconomics, it examines consumer behavior, comparing the ordinal and cardinal approaches to consumer equilibrium. The assignment explains how consumers make choices to maximize satisfaction given budget constraints, detailing the conditions for consumer balance in both models. It also discusses the concept of elasticity of demand and its importance in price setting, production planning, and public policy. The macroeconomics section focuses on inflation, defining it as the decrease in the purchasing power of money and analyzing its various costs, including reduced trade, economic instability, and redistribution of income. The assignment provides a comprehensive overview of these key economic principles, offering insights into how consumers and economies function.

Economics

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Microeconomics..............................................................................................................................3

Question 1....................................................................................................................................3

a) Equilibrium position of the ordinalist and the cardinalist approaches in the theory of

consumer behavior...................................................................................................................3

b) Usefulness of the concept of elasticity’s.............................................................................4

Macroeconomics..............................................................................................................................8

Question 3:...................................................................................................................................8

a) Inflation...............................................................................................................................8

b) Costs of inflation.................................................................................................................8

References......................................................................................................................................14

Microeconomics..............................................................................................................................3

Question 1....................................................................................................................................3

a) Equilibrium position of the ordinalist and the cardinalist approaches in the theory of

consumer behavior...................................................................................................................3

b) Usefulness of the concept of elasticity’s.............................................................................4

Macroeconomics..............................................................................................................................8

Question 3:...................................................................................................................................8

a) Inflation...............................................................................................................................8

b) Costs of inflation.................................................................................................................8

References......................................................................................................................................14

Microeconomics

Question 1

a) Equilibrium position of the ordinalist and the cardinalist

approaches in the theory of consumer behavior

Ordinal Approach to Consumer Equilibrium

The systematic approach to consumer equity shows that harmonization has been achieved when

customers increase the overall need (performance) undetermined payment rate and current cost

of goods and campaigns. Procedure identifies two conditions for customer balance: the required

condition or position for the main application and an additional condition or condition for the

next application.

Ways to achieve balance:

Individual openings: Individual openings present another combination of two options (elements)

that offer the customer the same level of performance (benefit). Therefore, clients cannot use two

things with a strong connection.

Small scale of substitution (MRS): The margin transfer rate determines how quickly an item is

exchanged for another object with the aim of keeping the overall gain (behavior) as before

(Banwari, 2020).

Cardinal Approach to Consumer Equilibrium

The cardinal approach to consumer equity is to achieve equity when customers get maximum

satisfaction from specific assets (money) and different conditions. Buyers should be happy about

the cost allocation, so the ongoing unit spent on everything offers the same level of usage.

Question 1

a) Equilibrium position of the ordinalist and the cardinalist

approaches in the theory of consumer behavior

Ordinal Approach to Consumer Equilibrium

The systematic approach to consumer equity shows that harmonization has been achieved when

customers increase the overall need (performance) undetermined payment rate and current cost

of goods and campaigns. Procedure identifies two conditions for customer balance: the required

condition or position for the main application and an additional condition or condition for the

next application.

Ways to achieve balance:

Individual openings: Individual openings present another combination of two options (elements)

that offer the customer the same level of performance (benefit). Therefore, clients cannot use two

things with a strong connection.

Small scale of substitution (MRS): The margin transfer rate determines how quickly an item is

exchanged for another object with the aim of keeping the overall gain (behavior) as before

(Banwari, 2020).

Cardinal Approach to Consumer Equilibrium

The cardinal approach to consumer equity is to achieve equity when customers get maximum

satisfaction from specific assets (money) and different conditions. Buyers should be happy about

the cost allocation, so the ongoing unit spent on everything offers the same level of usage.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is softer to understand the concept of how customers are transformed as a one-size-fits-all and

a multi-subject model. In an article model, consumer attire is specified when one item is fired,

although, in a multivariate model, a customer balance is specified when at least two articles are

consumed (Barnett, 2003).

1. Buyer balance - Product model: The item could be used by a buyer with a share of assets

(money) (such as an X). For the buyer, payment has equal benefits and item X can be exchanged

in an appropriate or large X structure. In case the negligible profit (MUx) of item X outweighs

net income (X) of cash, the expanding supply benefits of a buyer are in cash to pay for products .

2. Customer Balance - Multipurpose Model: The single item model relies on the irrational

assumption that the buyer is using the item. In any case, consumers eat a ton of goods and

campaigns. This model clarifies how customers who use multiple items reach their balance.

Clients are believed to have limited cash payments, and items received from a variety of items

are subject to limited income (Barnett, 2003).

b) Usefulness of the concept of elasticity’s

Elasticity is an essential cash sign, especially for product or management providers, as it reflects

what a product or administrator uses when costs fluctuate. In the phase where an object is

polymorphic, the value changes rapidly to the desired level. At a time when an item is volatile,

the amount shown may not change whether or not the cost of the item fluctuates. Switching to

flexible products means that demand increases as costs decrease and demand decreases as costs

increase.

Organizations operating in very poor operations offer changeable articles and administrations as

they typically set costs or comply with all-inclusive assessments. As the cost of an item or

administration reaches a level of flexibility, buyers and sellers quickly change their interest in

that item or handling. The other side of flexibility is uncertain. At a time when an item or

administration is unstable, sellers and buyers are less likely to change their interest in an item or

handling due to cost fluctuations.

The importance of application elasticity is as follows:

a multi-subject model. In an article model, consumer attire is specified when one item is fired,

although, in a multivariate model, a customer balance is specified when at least two articles are

consumed (Barnett, 2003).

1. Buyer balance - Product model: The item could be used by a buyer with a share of assets

(money) (such as an X). For the buyer, payment has equal benefits and item X can be exchanged

in an appropriate or large X structure. In case the negligible profit (MUx) of item X outweighs

net income (X) of cash, the expanding supply benefits of a buyer are in cash to pay for products .

2. Customer Balance - Multipurpose Model: The single item model relies on the irrational

assumption that the buyer is using the item. In any case, consumers eat a ton of goods and

campaigns. This model clarifies how customers who use multiple items reach their balance.

Clients are believed to have limited cash payments, and items received from a variety of items

are subject to limited income (Barnett, 2003).

b) Usefulness of the concept of elasticity’s

Elasticity is an essential cash sign, especially for product or management providers, as it reflects

what a product or administrator uses when costs fluctuate. In the phase where an object is

polymorphic, the value changes rapidly to the desired level. At a time when an item is volatile,

the amount shown may not change whether or not the cost of the item fluctuates. Switching to

flexible products means that demand increases as costs decrease and demand decreases as costs

increase.

Organizations operating in very poor operations offer changeable articles and administrations as

they typically set costs or comply with all-inclusive assessments. As the cost of an item or

administration reaches a level of flexibility, buyers and sellers quickly change their interest in

that item or handling. The other side of flexibility is uncertain. At a time when an item or

administration is unstable, sellers and buyers are less likely to change their interest in an item or

handling due to cost fluctuations.

The importance of application elasticity is as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. When setting the first level:

To ensure production profits, it is important to quantify the quantities of goods and services

based on the demand for these products. Since changes in demand are caused by changes in

prices, information on the elasticity of demand is needed to determine production levels.

2. Price setting:

The elasticity of demand for products is the basis of the price. The higher the price, the lower the

demand for the product and vice versa, with the knowledge of the demand, you can find the

coefficient by which the demand for the product decreases. If the demand for a product is

volatile, the manufacturer may charge a high price when setting a low price for a product with

elastic demand. Therefore, knowledge of the elasticity of demand is essential for regulation to

increase profits.

3. Regarding price discrimination against monopoly:

When it comes to the difference of monopoly, the question of the prices of the same product in

two different markets depends on the demands of each market. In markets with elastic demand

for products, several monopolists set low prices, and in markets with less elastic demand, they

set high prices.

4. When determining the entry price:

The concept of elasticity of demand is very important in determining the prices of various factors

of production. Production factors are paid according to demand. That is, if the demand for a

factor is unstable, the price is high and if the demand is elastic, the price is lower.

5. Preview of application:

Demand sustainability is a key factor in forecasting demand. Information on revenue elasticity is

needed to predict future demand for manufactured goods. Long-term product planning and

management relies more on revenue elasticity as managers can experience the impact of changes

in revenue levels on demand for products.

To ensure production profits, it is important to quantify the quantities of goods and services

based on the demand for these products. Since changes in demand are caused by changes in

prices, information on the elasticity of demand is needed to determine production levels.

2. Price setting:

The elasticity of demand for products is the basis of the price. The higher the price, the lower the

demand for the product and vice versa, with the knowledge of the demand, you can find the

coefficient by which the demand for the product decreases. If the demand for a product is

volatile, the manufacturer may charge a high price when setting a low price for a product with

elastic demand. Therefore, knowledge of the elasticity of demand is essential for regulation to

increase profits.

3. Regarding price discrimination against monopoly:

When it comes to the difference of monopoly, the question of the prices of the same product in

two different markets depends on the demands of each market. In markets with elastic demand

for products, several monopolists set low prices, and in markets with less elastic demand, they

set high prices.

4. When determining the entry price:

The concept of elasticity of demand is very important in determining the prices of various factors

of production. Production factors are paid according to demand. That is, if the demand for a

factor is unstable, the price is high and if the demand is elastic, the price is lower.

5. Preview of application:

Demand sustainability is a key factor in forecasting demand. Information on revenue elasticity is

needed to predict future demand for manufactured goods. Long-term product planning and

management relies more on revenue elasticity as managers can experience the impact of changes

in revenue levels on demand for products.

6. In Dumping:

The company enters the foreign market to release its products due to its strong foreign

competition.

7. When setting prices for generic products:

The concept of elasticity of application is very useful when setting prices for by-products such as

wool and lamb, wheat and straw, cotton and cotton seeds, etc. In this case, the individual cost of

producing each product is unknown. Hence, all prices are set according to level of market

demand. That is why products such as wool, wheat and cotton, which are very unstable, are very

expensive compared to by-products such as lamb, straw and cotton seeds which are in high

demand.

8. Definition of public policy:

Knowledge of the need for resilience will also help governments make policy decisions. Before

introducing legal price controls for a product, governments must consider the elasticity of

demand for that product. The government's decision to clarify the interests of the sector where

production is volatile and under the threat of monopoly control of profits depends on the demand

for production.

9. Support for the adoption of protection policies:

The government is evaluating the elasticity of demand for products in companies seeking

subsidies or protections. Grants or protections are provided only to businesses with elastic

demand for their assets. Consequently, they cannot resist foreign competition unless they reduce

their prices through subsidies or raise their import prices with high taxes.

10. In determining international trade income:

The benefits of international trade depend, among other things, on demand. Exporting goods

with low elasticity of demand and importing goods on demand, the country will benefit from

international trade. In the first case, you can charge a higher price for the product, and in the

second case, you can pay less for the product received from another country. So you can make

money both ways and increase your exports and imports.

The company enters the foreign market to release its products due to its strong foreign

competition.

7. When setting prices for generic products:

The concept of elasticity of application is very useful when setting prices for by-products such as

wool and lamb, wheat and straw, cotton and cotton seeds, etc. In this case, the individual cost of

producing each product is unknown. Hence, all prices are set according to level of market

demand. That is why products such as wool, wheat and cotton, which are very unstable, are very

expensive compared to by-products such as lamb, straw and cotton seeds which are in high

demand.

8. Definition of public policy:

Knowledge of the need for resilience will also help governments make policy decisions. Before

introducing legal price controls for a product, governments must consider the elasticity of

demand for that product. The government's decision to clarify the interests of the sector where

production is volatile and under the threat of monopoly control of profits depends on the demand

for production.

9. Support for the adoption of protection policies:

The government is evaluating the elasticity of demand for products in companies seeking

subsidies or protections. Grants or protections are provided only to businesses with elastic

demand for their assets. Consequently, they cannot resist foreign competition unless they reduce

their prices through subsidies or raise their import prices with high taxes.

10. In determining international trade income:

The benefits of international trade depend, among other things, on demand. Exporting goods

with low elasticity of demand and importing goods on demand, the country will benefit from

international trade. In the first case, you can charge a higher price for the product, and in the

second case, you can pay less for the product received from another country. So you can make

money both ways and increase your exports and imports.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Macroeconomics

Question 3:

a) Inflation

Inflation is the decrease in the purchasing power of money after some time. A quantitative

assessment of the reduction in purchasing power can be reflected in the increase in the level of

average value for individual vessels of products and companies in the economy over a given

period of time. An increase in normal costs such as rates usually means fewer purchases per unit

of money than in the past. As estimates fall, so do costs and so do goods and businesses. This

shortage of purchasing power affects the average total cost of the basics of the population and

ultimately hinders financial development. Industry analysts agree that a steady increase occurs

when a country’s liquidity supply falls faster than money development (Forbes, 2019).

The extension refers to rising costs for most products and businesses consumed on a day-to-day

basis or in total, such as food, clothing, housing, leisure, transportation, and basic goods. The

bulge estimates the typical long-term change in production vessel and industry costs. The reverse

and just used from time to time in the table of value of this conventional current is classified as

"rot". The expansion is in the face of declining purchasing power of public funds. It is proven as

a standard (Ha, Kose and Ohnsorge, 2019).

The bulge is a proportion of the normal changes in the normal cost of administration and goods.

This shows that as the cost of goods and business enterprises goes up, the purchasing power of

unit’s decreases in public money. The bloat is significantly different between the total interest

rate and the total investment of goods and enterprises. At the point when complete interest

surpasses the current stock of crude materials at the current value, the value level ascents

(Coibion, Gorodnichenko and Weber, 2019).

Question 3:

a) Inflation

Inflation is the decrease in the purchasing power of money after some time. A quantitative

assessment of the reduction in purchasing power can be reflected in the increase in the level of

average value for individual vessels of products and companies in the economy over a given

period of time. An increase in normal costs such as rates usually means fewer purchases per unit

of money than in the past. As estimates fall, so do costs and so do goods and businesses. This

shortage of purchasing power affects the average total cost of the basics of the population and

ultimately hinders financial development. Industry analysts agree that a steady increase occurs

when a country’s liquidity supply falls faster than money development (Forbes, 2019).

The extension refers to rising costs for most products and businesses consumed on a day-to-day

basis or in total, such as food, clothing, housing, leisure, transportation, and basic goods. The

bulge estimates the typical long-term change in production vessel and industry costs. The reverse

and just used from time to time in the table of value of this conventional current is classified as

"rot". The expansion is in the face of declining purchasing power of public funds. It is proven as

a standard (Ha, Kose and Ohnsorge, 2019).

The bulge is a proportion of the normal changes in the normal cost of administration and goods.

This shows that as the cost of goods and business enterprises goes up, the purchasing power of

unit’s decreases in public money. The bloat is significantly different between the total interest

rate and the total investment of goods and enterprises. At the point when complete interest

surpasses the current stock of crude materials at the current value, the value level ascents

(Coibion, Gorodnichenko and Weber, 2019).

b) Costs of inflation

If a country's expansion is higher than its exchange rate, the intensity of the tariffs is low,

causing a drop in trade and a drop in the UK's current account. This is particularly difficult in

countries where exchange rates are fixed. For example, euro area countries such as Greece,

Ireland and Spain, for example, have expanded more than the northern euro area, resulting in a

normal deficit (over 10% of GDP in 2007). Instability has also encouraged financial

development).

• However, as the size of a nation's trade changes, a sharp increase can be offset by changes in

production rates. However, there are still financial costs as this is compounded by foreign

currency and more expensive imports.

2. Disorder and vulnerability

When the swelling is high, people don't know how much their money will cost. When the bulge

is high, organizations are generally less willing to contribute because they are skeptical of future

costs, benefits and expenses. This fragility and disorder can drive financial development. This is

probably the most troubling topic associated with high inflammation. Countries with low

expansion and security of monetary development are generally superior to countries with high

inflation.

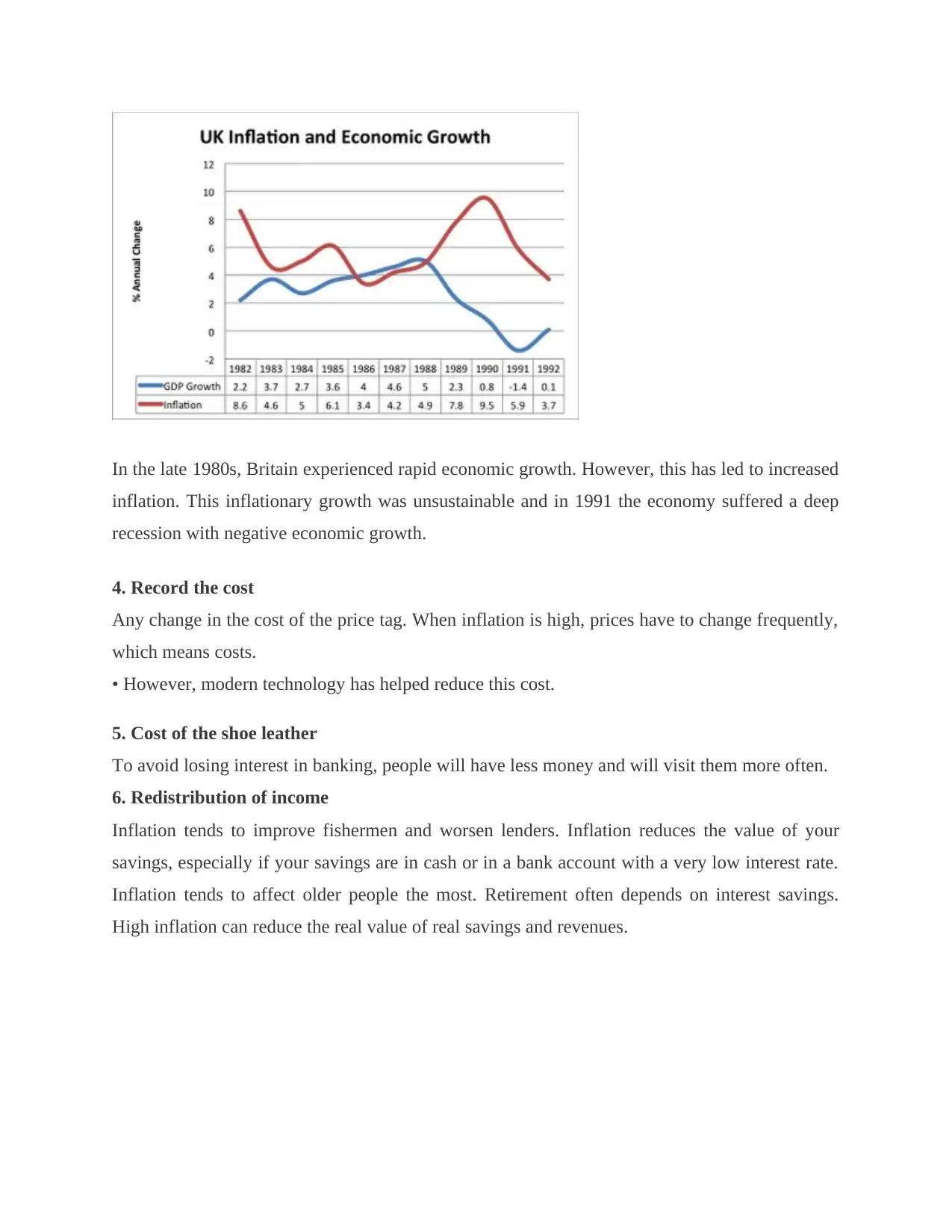

3. The financial model of performance and disappointment

High inflationary growth is impossible and usually causes decay. Keeping expansion low will

ensure long-term financial improvement. For example, in the UK somewhere between 1992 and

2007, low pressure has contributed to the development of more sustainable money than ever

before.

If a country's expansion is higher than its exchange rate, the intensity of the tariffs is low,

causing a drop in trade and a drop in the UK's current account. This is particularly difficult in

countries where exchange rates are fixed. For example, euro area countries such as Greece,

Ireland and Spain, for example, have expanded more than the northern euro area, resulting in a

normal deficit (over 10% of GDP in 2007). Instability has also encouraged financial

development).

• However, as the size of a nation's trade changes, a sharp increase can be offset by changes in

production rates. However, there are still financial costs as this is compounded by foreign

currency and more expensive imports.

2. Disorder and vulnerability

When the swelling is high, people don't know how much their money will cost. When the bulge

is high, organizations are generally less willing to contribute because they are skeptical of future

costs, benefits and expenses. This fragility and disorder can drive financial development. This is

probably the most troubling topic associated with high inflammation. Countries with low

expansion and security of monetary development are generally superior to countries with high

inflation.

3. The financial model of performance and disappointment

High inflationary growth is impossible and usually causes decay. Keeping expansion low will

ensure long-term financial improvement. For example, in the UK somewhere between 1992 and

2007, low pressure has contributed to the development of more sustainable money than ever

before.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

In the late 1980s, Britain experienced rapid economic growth. However, this has led to increased

inflation. This inflationary growth was unsustainable and in 1991 the economy suffered a deep

recession with negative economic growth.

4. Record the cost

Any change in the cost of the price tag. When inflation is high, prices have to change frequently,

which means costs.

• However, modern technology has helped reduce this cost.

5. Cost of the shoe leather

To avoid losing interest in banking, people will have less money and will visit them more often.

6. Redistribution of income

Inflation tends to improve fishermen and worsen lenders. Inflation reduces the value of your

savings, especially if your savings are in cash or in a bank account with a very low interest rate.

Inflation tends to affect older people the most. Retirement often depends on interest savings.

High inflation can reduce the real value of real savings and revenues.

inflation. This inflationary growth was unsustainable and in 1991 the economy suffered a deep

recession with negative economic growth.

4. Record the cost

Any change in the cost of the price tag. When inflation is high, prices have to change frequently,

which means costs.

• However, modern technology has helped reduce this cost.

5. Cost of the shoe leather

To avoid losing interest in banking, people will have less money and will visit them more often.

6. Redistribution of income

Inflation tends to improve fishermen and worsen lenders. Inflation reduces the value of your

savings, especially if your savings are in cash or in a bank account with a very low interest rate.

Inflation tends to affect older people the most. Retirement often depends on interest savings.

High inflation can reduce the real value of real savings and revenues.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

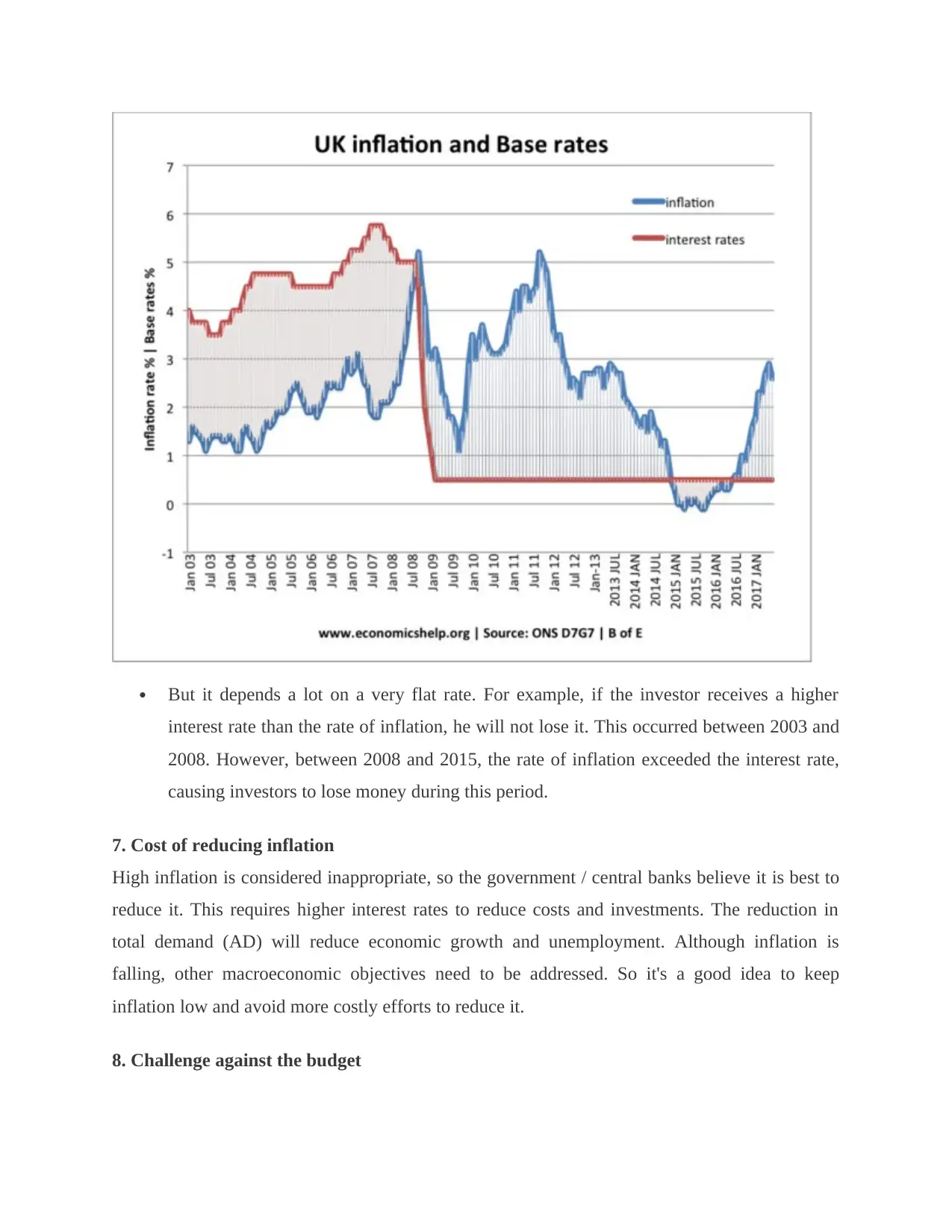

But it depends a lot on a very flat rate. For example, if the investor receives a higher

interest rate than the rate of inflation, he will not lose it. This occurred between 2003 and

2008. However, between 2008 and 2015, the rate of inflation exceeded the interest rate,

causing investors to lose money during this period.

7. Cost of reducing inflation

High inflation is considered inappropriate, so the government / central banks believe it is best to

reduce it. This requires higher interest rates to reduce costs and investments. The reduction in

total demand (AD) will reduce economic growth and unemployment. Although inflation is

falling, other macroeconomic objectives need to be addressed. So it's a good idea to keep

inflation low and avoid more costly efforts to reduce it.

8. Challenge against the budget

interest rate than the rate of inflation, he will not lose it. This occurred between 2003 and

2008. However, between 2008 and 2015, the rate of inflation exceeded the interest rate,

causing investors to lose money during this period.

7. Cost of reducing inflation

High inflation is considered inappropriate, so the government / central banks believe it is best to

reduce it. This requires higher interest rates to reduce costs and investments. The reduction in

total demand (AD) will reduce economic growth and unemployment. Although inflation is

falling, other macroeconomic objectives need to be addressed. So it's a good idea to keep

inflation low and avoid more costly efforts to reduce it.

8. Challenge against the budget

When inflation occurs, the taxes we pay go up. This is because as wages rise, more and more

people fall into sectors with higher income taxes.

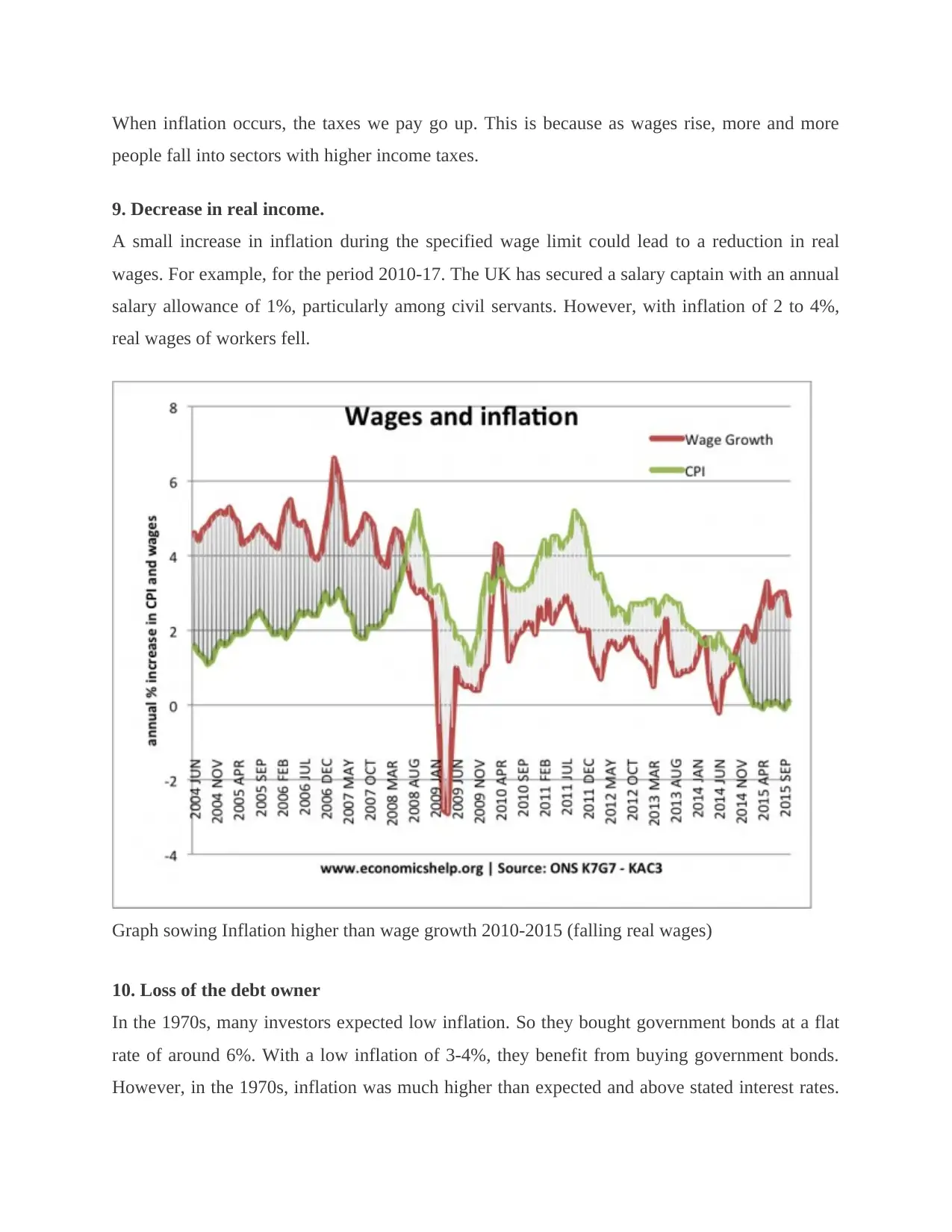

9. Decrease in real income.

A small increase in inflation during the specified wage limit could lead to a reduction in real

wages. For example, for the period 2010-17. The UK has secured a salary captain with an annual

salary allowance of 1%, particularly among civil servants. However, with inflation of 2 to 4%,

real wages of workers fell.

Graph sowing Inflation higher than wage growth 2010-2015 (falling real wages)

10. Loss of the debt owner

In the 1970s, many investors expected low inflation. So they bought government bonds at a flat

rate of around 6%. With a low inflation of 3-4%, they benefit from buying government bonds.

However, in the 1970s, inflation was much higher than expected and above stated interest rates.

people fall into sectors with higher income taxes.

9. Decrease in real income.

A small increase in inflation during the specified wage limit could lead to a reduction in real

wages. For example, for the period 2010-17. The UK has secured a salary captain with an annual

salary allowance of 1%, particularly among civil servants. However, with inflation of 2 to 4%,

real wages of workers fell.

Graph sowing Inflation higher than wage growth 2010-2015 (falling real wages)

10. Loss of the debt owner

In the 1970s, many investors expected low inflation. So they bought government bonds at a flat

rate of around 6%. With a low inflation of 3-4%, they benefit from buying government bonds.

However, in the 1970s, inflation was much higher than expected and above stated interest rates.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 14

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.