Accrual-Based Accounting: MicroSystems Financial Statements, July 2021

VerifiedAdded on 2023/06/10

|6

|691

|313

Homework Assignment

AI Summary

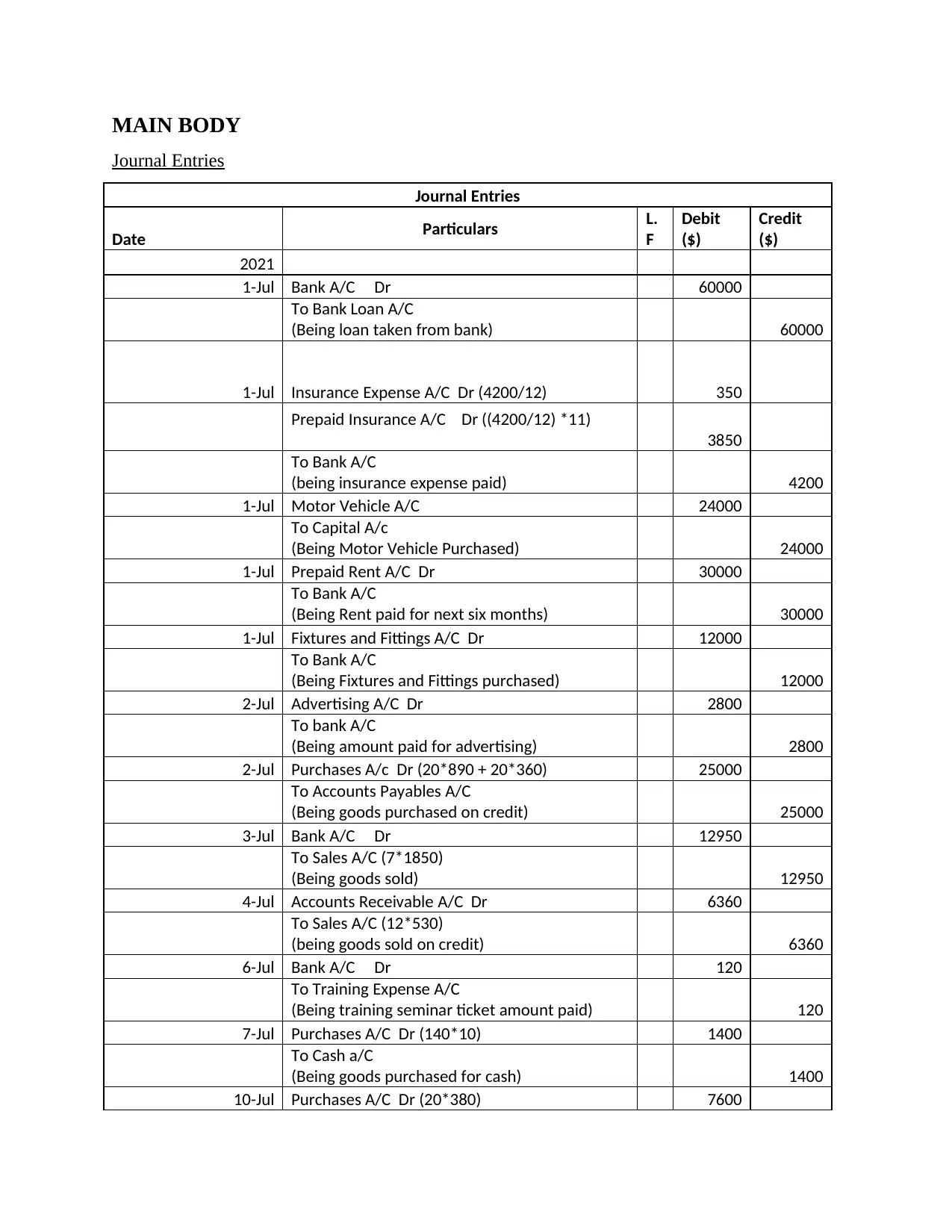

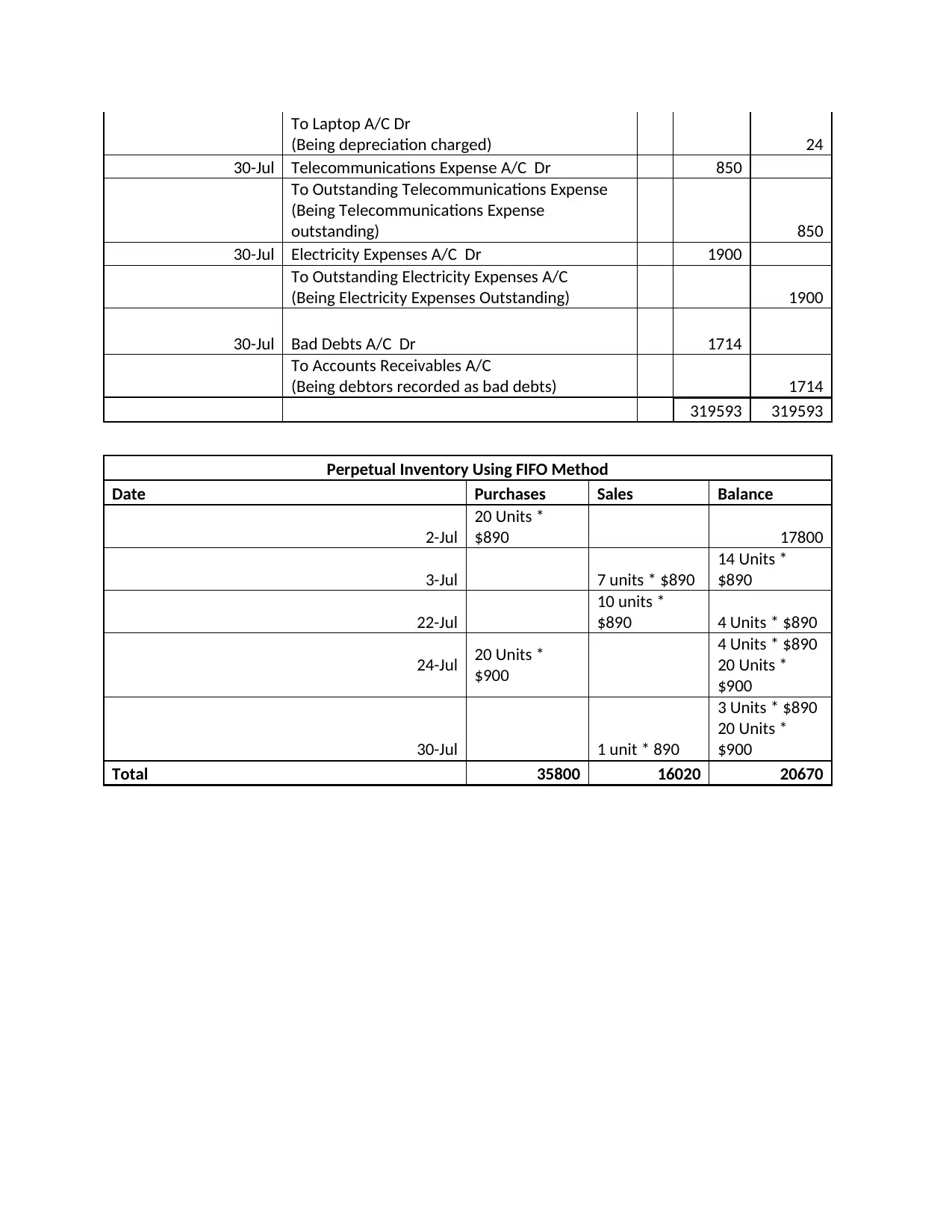

This assignment focuses on preparing financial statements for MicroSystems, a retailer of electronics, for the month of July 2021. The task involves recording various transactions using journal entries, applying accrual-based accounting principles as opposed to cash-based, and utilizing the FIFO (First-In, First-Out) method for inventory valuation. Key transactions include bank loans, insurance expenses, motor vehicle purchase, rent payments, purchases on credit and cash, sales, wages, and other operational expenses. The assignment also addresses depreciation, bad debts, and outstanding expenses like telecommunications and electricity. The final output includes a perpetual inventory analysis using the FIFO method, providing a detailed overview of MicroSystems' financial activities during its first month of operation. This document is available on Desklib, a platform offering a wealth of academic resources.

1 out of 6

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)