Market Overview: Middle East Dental Market

VerifiedAdded on 2019/10/01

|17

|3307

|163

Report

AI Summary

This report provides a comprehensive overview of the dental market in the Middle East in 2018. It analyzes market drivers (increased awareness of oral hygiene, increased purchasing power, use of approved ingredients), restraints (market dominance by large players), opportunities (untapped market segments, demand for electric toothbrushes, growth of modern retail), and challenges (promoting oral healthcare). The report includes demographic insights on the number of dentists and dental clinics in various Middle Eastern countries (Saudi Arabia, Israel, Iran, UAE, Iraq), the number of pharmacies, and dental schools. A product-wise analysis of the oral care market (toothbrushes, toothpaste, mouthwash) is presented, along with an overview of the top five players. The report concludes with a market strategy based on SWOT and Porter's Five Forces analyses, offering recommendations for new brands entering the market, such as focusing on advanced products, utilizing dentist dispensaries, targeting the Saudi market, and collaborating with oral hygienists in Iran.

Running Head: Market Overview

DENTAL MARKET

OVERVIEW IN MIDDLE

EAST

DENTAL MARKET

OVERVIEW IN MIDDLE

EAST

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Market Overview

Table of Contents

1. Dental Market Overview Middle East, 2018...............................................................................4

1.1 Drivers...................................................................................................................................4

1.2 Restraints...............................................................................................................................4

1.3 Opportunities.........................................................................................................................4

1.4 Challenges..............................................................................................................................5

2. Demographic Insights (2018)......................................................................................................5

2.1 Number of Dentists................................................................................................................5

2.1.1 Dentistry in Saudi Arabia...............................................................................................5

2.1.2 Dentistry in Israel...........................................................................................................8

2.1.3 Dentistry in Iran..............................................................................................................8

2.1.4 Dentistry in UAE............................................................................................................8

2.1.5 Dentistry in Iraq..............................................................................................................8

2.2 Number of Dental Clinics..........................................................................................................8

2.2.1 Saudi Arabia.......................................................................................................................9

2.2.2 Iran................................................................................................................................10

2.3 Number of Pharmacies............................................................................................................10

2.4 Number of dental Schools & Universities...............................................................................11

3. Middle East Oral Care Market (Byproduct)..............................................................................12

3.1 Toothbrush...........................................................................................................................13

3.2 Toothpaste............................................................................................................................13

3.3 Mouthwash..........................................................................................................................13

3.4 Top Big 5 Players at the Market and forecast to 2022........................................................13

4. Market Strategy.........................................................................................................................14

4.1 S.W.O.T Analysis................................................................................................................14

Table of Contents

1. Dental Market Overview Middle East, 2018...............................................................................4

1.1 Drivers...................................................................................................................................4

1.2 Restraints...............................................................................................................................4

1.3 Opportunities.........................................................................................................................4

1.4 Challenges..............................................................................................................................5

2. Demographic Insights (2018)......................................................................................................5

2.1 Number of Dentists................................................................................................................5

2.1.1 Dentistry in Saudi Arabia...............................................................................................5

2.1.2 Dentistry in Israel...........................................................................................................8

2.1.3 Dentistry in Iran..............................................................................................................8

2.1.4 Dentistry in UAE............................................................................................................8

2.1.5 Dentistry in Iraq..............................................................................................................8

2.2 Number of Dental Clinics..........................................................................................................8

2.2.1 Saudi Arabia.......................................................................................................................9

2.2.2 Iran................................................................................................................................10

2.3 Number of Pharmacies............................................................................................................10

2.4 Number of dental Schools & Universities...............................................................................11

3. Middle East Oral Care Market (Byproduct)..............................................................................12

3.1 Toothbrush...........................................................................................................................13

3.2 Toothpaste............................................................................................................................13

3.3 Mouthwash..........................................................................................................................13

3.4 Top Big 5 Players at the Market and forecast to 2022........................................................13

4. Market Strategy.........................................................................................................................14

4.1 S.W.O.T Analysis................................................................................................................14

Market Overview

4.2 Porter 5 Forces.....................................................................................................................14

4.3 Conclusion & Recommendation..............................................................................................15

References:....................................................................................................................................17

List of Tables

Table 1: Distribution of dentistry professionals in Saudi Arabia....................................................5

Table 2: Dental Care in Iran..........................................................................................................10

Table 3: Number of dental schools in the Middle East.................................................................11

Table 4: SWOT analysis................................................................................................................14

Table 5: Porter's five forces analysis.............................................................................................15

List of Figures

Figure 1: Different dentistry specialists in Saudi Arabia.................................................................7

Figure 2: Year of establishment wise distribution of private dental clinics in Riyadh....................9

Figure 3: Category-wise distribution of pharmacist......................................................................11

Figure 4: Product-wise distribution of Middle-East and Africa Oral care market........................12

4.2 Porter 5 Forces.....................................................................................................................14

4.3 Conclusion & Recommendation..............................................................................................15

References:....................................................................................................................................17

List of Tables

Table 1: Distribution of dentistry professionals in Saudi Arabia....................................................5

Table 2: Dental Care in Iran..........................................................................................................10

Table 3: Number of dental schools in the Middle East.................................................................11

Table 4: SWOT analysis................................................................................................................14

Table 5: Porter's five forces analysis.............................................................................................15

List of Figures

Figure 1: Different dentistry specialists in Saudi Arabia.................................................................7

Figure 2: Year of establishment wise distribution of private dental clinics in Riyadh....................9

Figure 3: Category-wise distribution of pharmacist......................................................................11

Figure 4: Product-wise distribution of Middle-East and Africa Oral care market........................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Market Overview

1. Dental Market Overview Middle East, 2018

1.1 Drivers

The key drivers of oral care market growth in the Middle East are—

Increased awareness on Oral hygiene-- The routine of brushing teeth twice is being

prevalent in the Middle East countries. As an impact, the use of oral care products such as

toothpaste, toothbrush and mouthwash is increasing. Increased purchasing power-- The purchasing power of the people in the Middle East is

increasing. As a result, the spending onthe oral care products is also increasing.

Use of approved ingredients in oral care products-- Use of natural ingredients in the

toothpaste comply with the religious belief of consumers in Middle-East. Use of natural

ingredients facilitate the consumers to use such products any time even during fast also.

The alternative ingredients also increased the use of oral care items.

1.2 Restraints

The Middle- East Oral care market is already dominated by big players of the industry

(Chidzonga et al., 2015). So, acquiring customers can be difficult for new brands.

1.3 Opportunities

The Middle East oral care market is still growing. The new brands can focus on the

untapped portion of the market.

The tendency of purchasing manual toothbrush is high among the Middle East

consumers. Launching of modern electric toothbrushes can create new opportunities for

new brands.

The modern retail supermarkets are increasing in the Middle East. The new brands can

reach customers through these supermarkets. Reaching the customers through online

shops can create new opportunities for the new brands.

The number of dentists is increasing in the Middle-East countries. So, use of the

medicated products can also increase accordingly.

1. Dental Market Overview Middle East, 2018

1.1 Drivers

The key drivers of oral care market growth in the Middle East are—

Increased awareness on Oral hygiene-- The routine of brushing teeth twice is being

prevalent in the Middle East countries. As an impact, the use of oral care products such as

toothpaste, toothbrush and mouthwash is increasing. Increased purchasing power-- The purchasing power of the people in the Middle East is

increasing. As a result, the spending onthe oral care products is also increasing.

Use of approved ingredients in oral care products-- Use of natural ingredients in the

toothpaste comply with the religious belief of consumers in Middle-East. Use of natural

ingredients facilitate the consumers to use such products any time even during fast also.

The alternative ingredients also increased the use of oral care items.

1.2 Restraints

The Middle- East Oral care market is already dominated by big players of the industry

(Chidzonga et al., 2015). So, acquiring customers can be difficult for new brands.

1.3 Opportunities

The Middle East oral care market is still growing. The new brands can focus on the

untapped portion of the market.

The tendency of purchasing manual toothbrush is high among the Middle East

consumers. Launching of modern electric toothbrushes can create new opportunities for

new brands.

The modern retail supermarkets are increasing in the Middle East. The new brands can

reach customers through these supermarkets. Reaching the customers through online

shops can create new opportunities for the new brands.

The number of dentists is increasing in the Middle-East countries. So, use of the

medicated products can also increase accordingly.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Market Overview

1.4 Challenges

The oral care practices are being popular among the consumers although the practices are not

widely accepted among all of the users. Promoting the importance of oral healthcare can be

challenging forthe new brands.

2. Demographic Insights (2018)

2.1 Number of Dentists

The number of dentists in a country can be considered as an indicator of the current status of the

dental health services in the nation. In this section, the information on a number of dentists in

different countries of the Middle East is discussed.

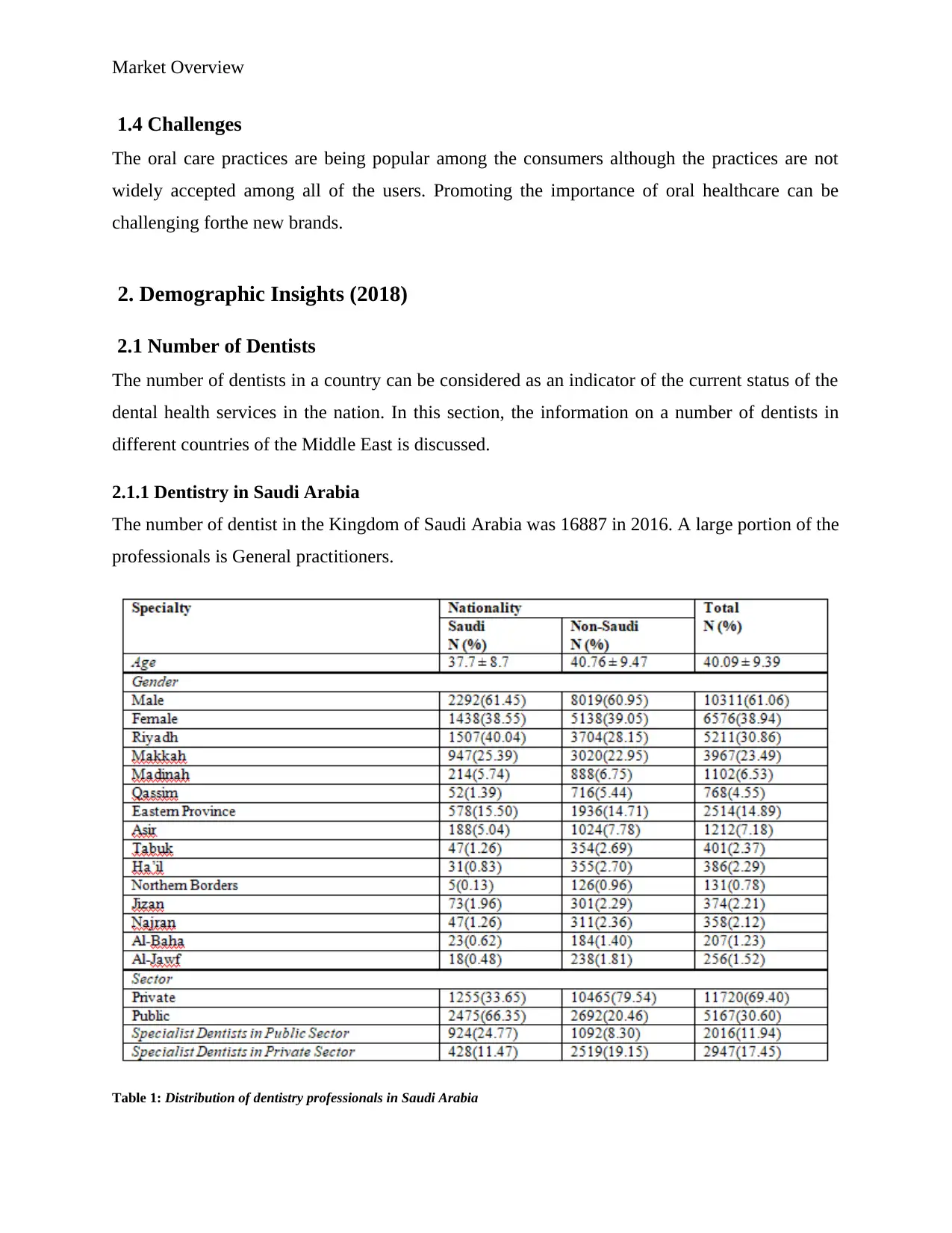

2.1.1 Dentistry in Saudi Arabia

The number of dentist in the Kingdom of Saudi Arabia was 16887 in 2016. A large portion of the

professionals is General practitioners.

Table 1: Distribution of dentistry professionals in Saudi Arabia

1.4 Challenges

The oral care practices are being popular among the consumers although the practices are not

widely accepted among all of the users. Promoting the importance of oral healthcare can be

challenging forthe new brands.

2. Demographic Insights (2018)

2.1 Number of Dentists

The number of dentists in a country can be considered as an indicator of the current status of the

dental health services in the nation. In this section, the information on a number of dentists in

different countries of the Middle East is discussed.

2.1.1 Dentistry in Saudi Arabia

The number of dentist in the Kingdom of Saudi Arabia was 16887 in 2016. A large portion of the

professionals is General practitioners.

Table 1: Distribution of dentistry professionals in Saudi Arabia

Market Overview

Source: (Source: AlBaker et al., 2017)

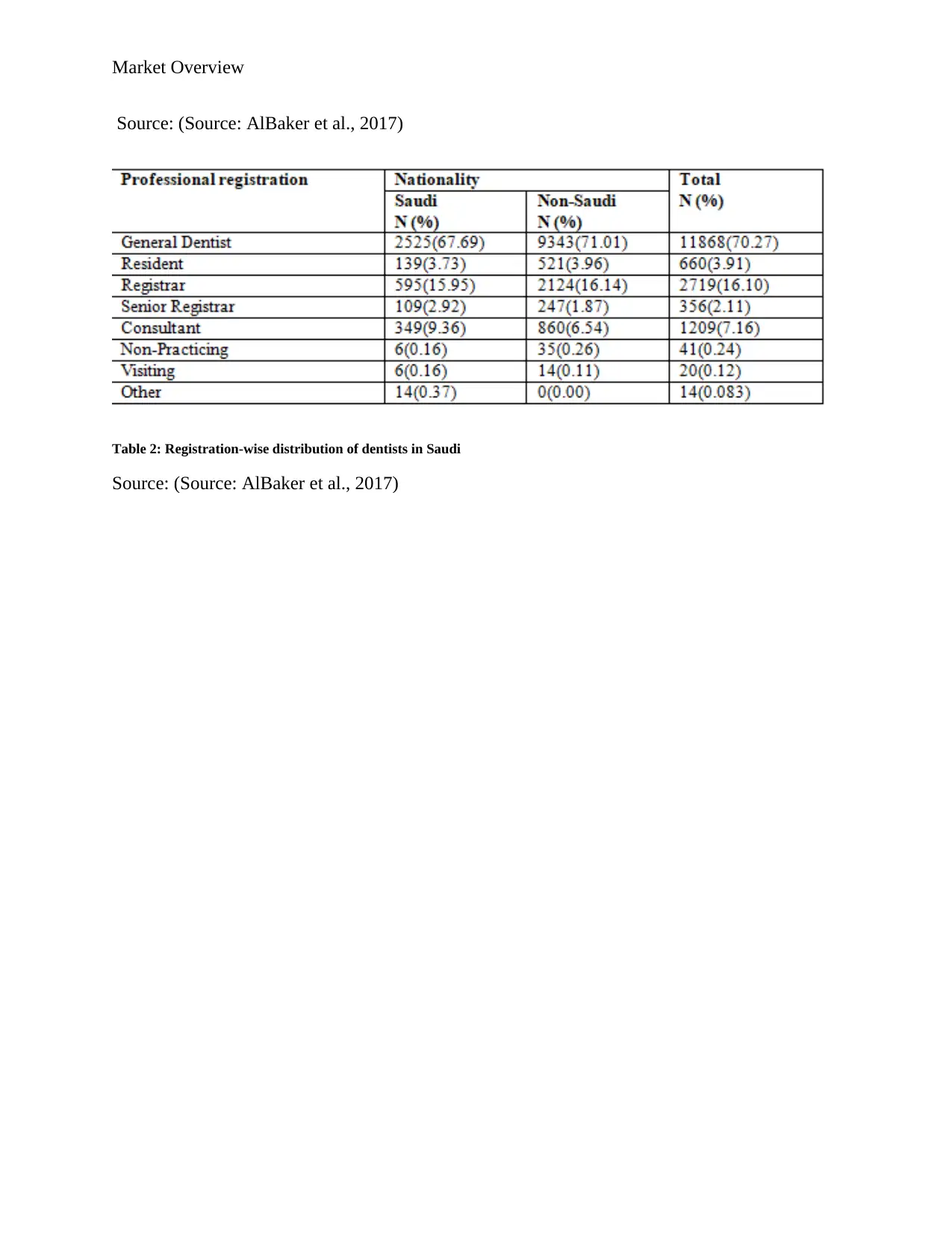

Table 2: Registration-wise distribution of dentists in Saudi

Source: (Source: AlBaker et al., 2017)

Source: (Source: AlBaker et al., 2017)

Table 2: Registration-wise distribution of dentists in Saudi

Source: (Source: AlBaker et al., 2017)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Market Overview

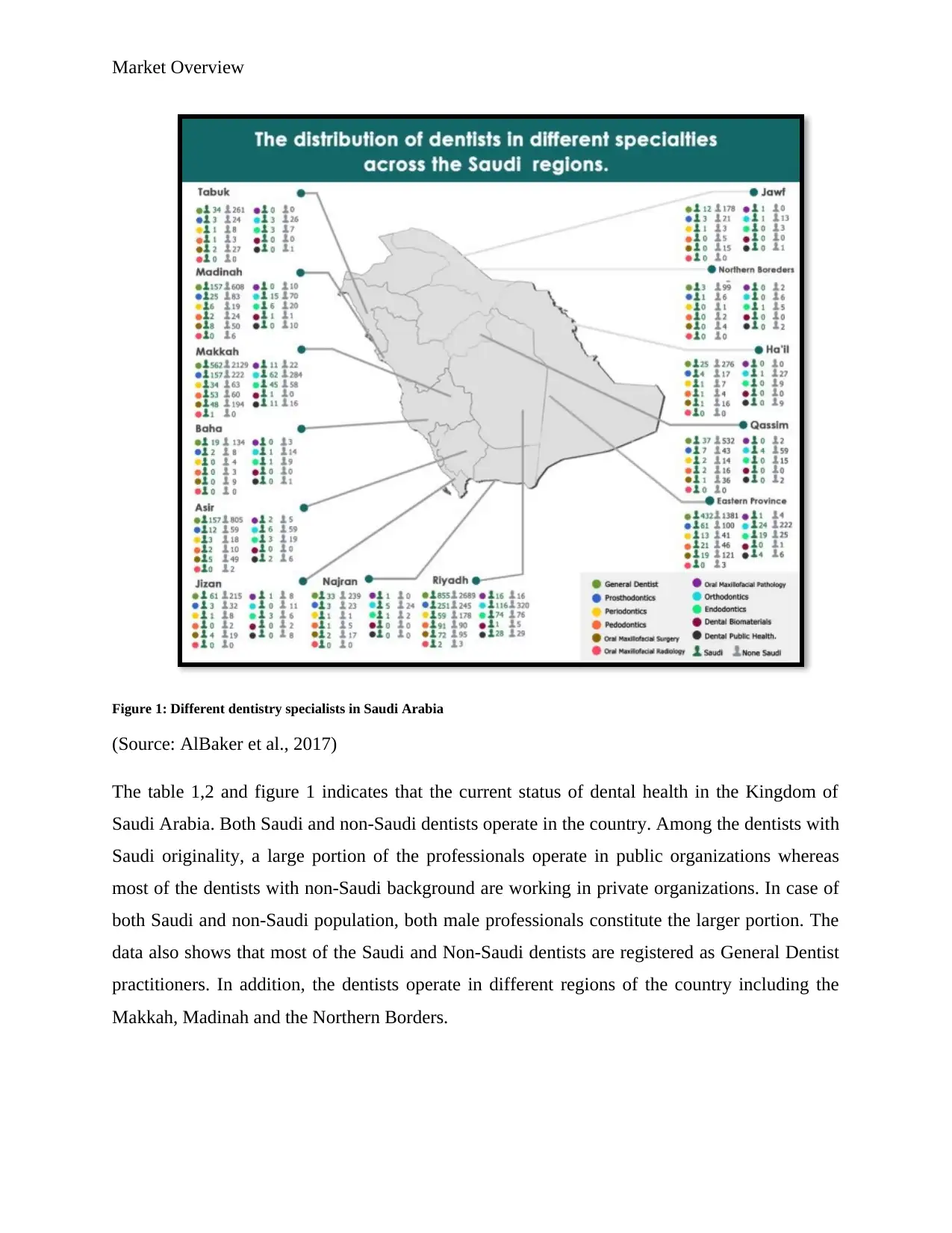

Figure 1: Different dentistry specialists in Saudi Arabia

(Source: AlBaker et al., 2017)

The table 1,2 and figure 1 indicates that the current status of dental health in the Kingdom of

Saudi Arabia. Both Saudi and non-Saudi dentists operate in the country. Among the dentists with

Saudi originality, a large portion of the professionals operate in public organizations whereas

most of the dentists with non-Saudi background are working in private organizations. In case of

both Saudi and non-Saudi population, both male professionals constitute the larger portion. The

data also shows that most of the Saudi and Non-Saudi dentists are registered as General Dentist

practitioners. In addition, the dentists operate in different regions of the country including the

Makkah, Madinah and the Northern Borders.

Figure 1: Different dentistry specialists in Saudi Arabia

(Source: AlBaker et al., 2017)

The table 1,2 and figure 1 indicates that the current status of dental health in the Kingdom of

Saudi Arabia. Both Saudi and non-Saudi dentists operate in the country. Among the dentists with

Saudi originality, a large portion of the professionals operate in public organizations whereas

most of the dentists with non-Saudi background are working in private organizations. In case of

both Saudi and non-Saudi population, both male professionals constitute the larger portion. The

data also shows that most of the Saudi and Non-Saudi dentists are registered as General Dentist

practitioners. In addition, the dentists operate in different regions of the country including the

Makkah, Madinah and the Northern Borders.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Market Overview

2.1.2 Dentistry in Israel

In 2017, the predicted number of dentists in Israel was 6090 (Vered et al., 2010). It included both

the Israeli and immigrants. It was also assumed that a negligible number of professionals is

leaving the country.

2.1.3 Dentistry in Iran

In 2017, approximately 25000 dentists were practising in different parts of Iran (Iran-daily.com,

2018). The country has a comparatively higher proportion of dentists than other nations of the

Middle East. Due to the presence of higher number of dentists, Iran has better opportunities to

boost dental tourism.

2.1.4 Dentistry in UAE

In UAE, the number of dentists in 2007 was 566 (Data.bayanat.ae.,2018). In 2015, the number

of dentists increased to 4205 (Data.bayanat.ae.,2018). It indicates that the number of dentists in

UAE is increasing gradually.

2.1.5 Dentistry in Iraq

The Oral Health services have been developed significantly in Iraq after 2003. In 2003, the total

number of dentists registered to Iraqi Dental Association (IDA) was 3000. In 2010, the number

of dentists increased to 4863 which indicates 1.7 dentists were available per 10000 people. In

2015, the number further increased to7277 and in 2017, about 8500 dentists were practising in

the country.

The analysis of the data available on a number of dentists in different countries of middle-east

indicates that most of the nations do not have an adequate number of professionals. However, in

some countries such as Saudi Arabia and Iran, the availability of dentists is comparatively

higher. On the contrary, nations like UAE and Israel have a lower number of dentists.

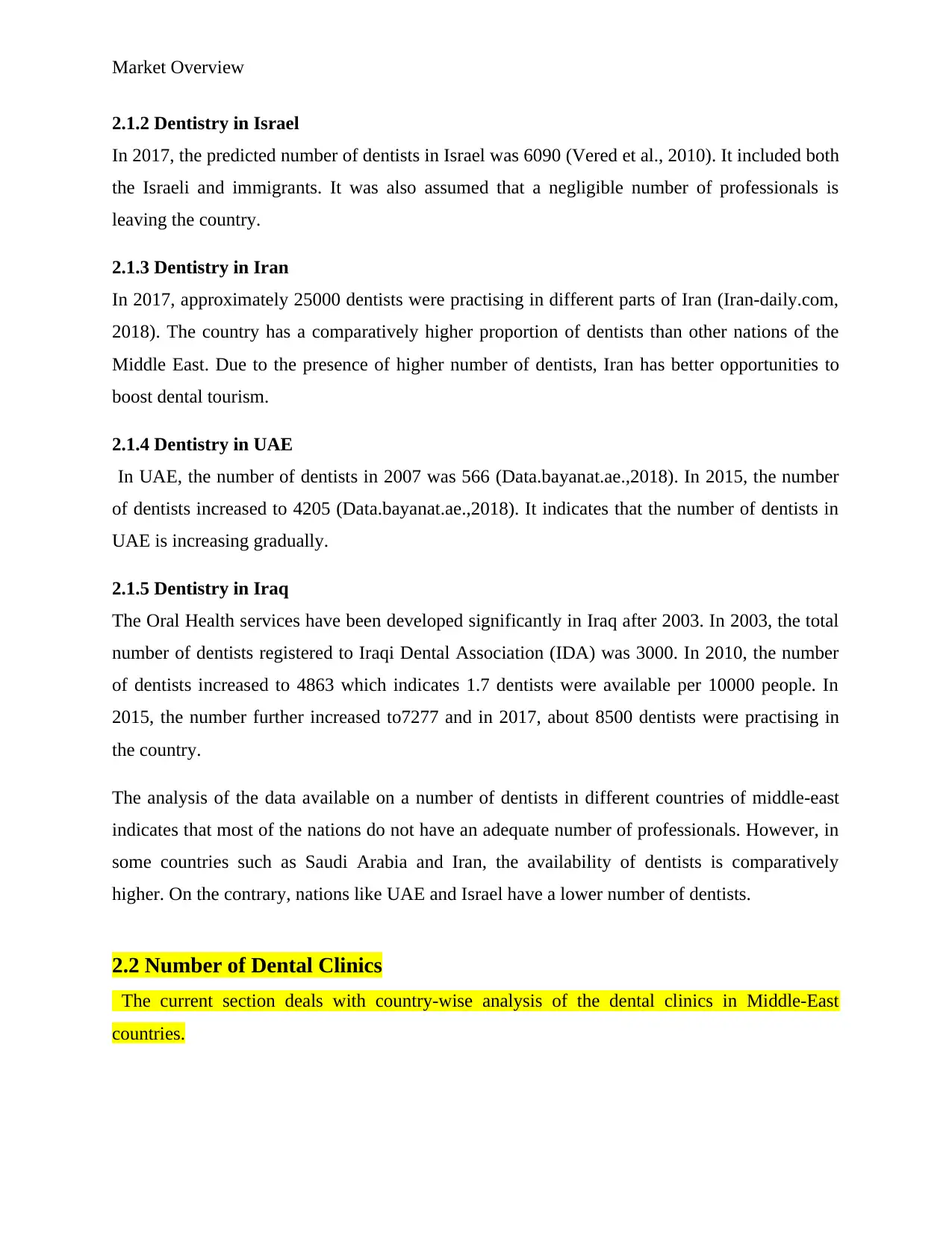

2.2 Number of Dental Clinics

The current section deals with country-wise analysis of the dental clinics in Middle-East

countries.

2.1.2 Dentistry in Israel

In 2017, the predicted number of dentists in Israel was 6090 (Vered et al., 2010). It included both

the Israeli and immigrants. It was also assumed that a negligible number of professionals is

leaving the country.

2.1.3 Dentistry in Iran

In 2017, approximately 25000 dentists were practising in different parts of Iran (Iran-daily.com,

2018). The country has a comparatively higher proportion of dentists than other nations of the

Middle East. Due to the presence of higher number of dentists, Iran has better opportunities to

boost dental tourism.

2.1.4 Dentistry in UAE

In UAE, the number of dentists in 2007 was 566 (Data.bayanat.ae.,2018). In 2015, the number

of dentists increased to 4205 (Data.bayanat.ae.,2018). It indicates that the number of dentists in

UAE is increasing gradually.

2.1.5 Dentistry in Iraq

The Oral Health services have been developed significantly in Iraq after 2003. In 2003, the total

number of dentists registered to Iraqi Dental Association (IDA) was 3000. In 2010, the number

of dentists increased to 4863 which indicates 1.7 dentists were available per 10000 people. In

2015, the number further increased to7277 and in 2017, about 8500 dentists were practising in

the country.

The analysis of the data available on a number of dentists in different countries of middle-east

indicates that most of the nations do not have an adequate number of professionals. However, in

some countries such as Saudi Arabia and Iran, the availability of dentists is comparatively

higher. On the contrary, nations like UAE and Israel have a lower number of dentists.

2.2 Number of Dental Clinics

The current section deals with country-wise analysis of the dental clinics in Middle-East

countries.

Market Overview

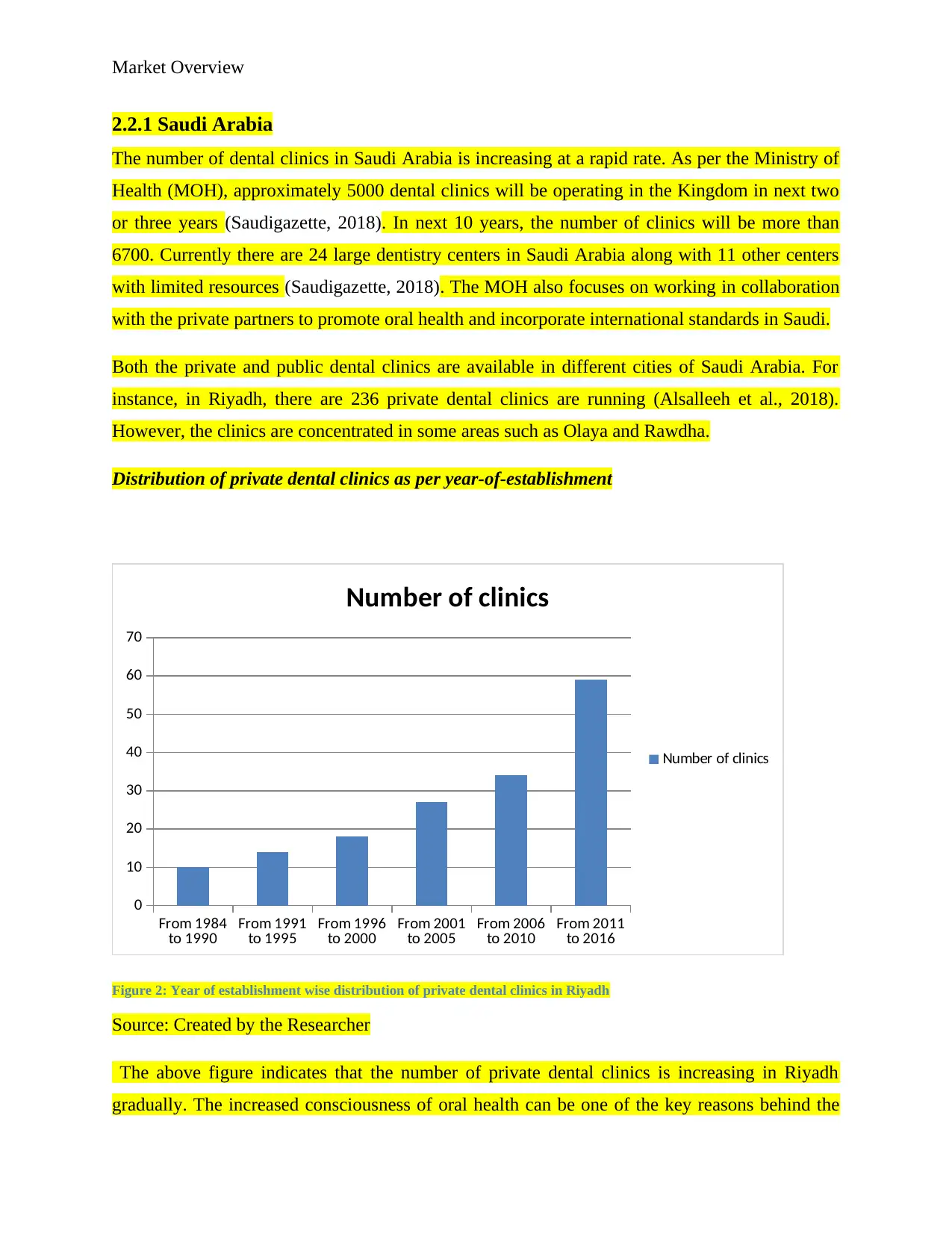

2.2.1 Saudi Arabia

The number of dental clinics in Saudi Arabia is increasing at a rapid rate. As per the Ministry of

Health (MOH), approximately 5000 dental clinics will be operating in the Kingdom in next two

or three years (Saudigazette, 2018). In next 10 years, the number of clinics will be more than

6700. Currently there are 24 large dentistry centers in Saudi Arabia along with 11 other centers

with limited resources (Saudigazette, 2018). The MOH also focuses on working in collaboration

with the private partners to promote oral health and incorporate international standards in Saudi.

Both the private and public dental clinics are available in different cities of Saudi Arabia. For

instance, in Riyadh, there are 236 private dental clinics are running (Alsalleeh et al., 2018).

However, the clinics are concentrated in some areas such as Olaya and Rawdha.

Distribution of private dental clinics as per year-of-establishment

From 1984

to 1990 From 1991

to 1995 From 1996

to 2000 From 2001

to 2005 From 2006

to 2010 From 2011

to 2016

0

10

20

30

40

50

60

70

Number of clinics

Number of clinics

Figure 2: Year of establishment wise distribution of private dental clinics in Riyadh

Source: Created by the Researcher

The above figure indicates that the number of private dental clinics is increasing in Riyadh

gradually. The increased consciousness of oral health can be one of the key reasons behind the

2.2.1 Saudi Arabia

The number of dental clinics in Saudi Arabia is increasing at a rapid rate. As per the Ministry of

Health (MOH), approximately 5000 dental clinics will be operating in the Kingdom in next two

or three years (Saudigazette, 2018). In next 10 years, the number of clinics will be more than

6700. Currently there are 24 large dentistry centers in Saudi Arabia along with 11 other centers

with limited resources (Saudigazette, 2018). The MOH also focuses on working in collaboration

with the private partners to promote oral health and incorporate international standards in Saudi.

Both the private and public dental clinics are available in different cities of Saudi Arabia. For

instance, in Riyadh, there are 236 private dental clinics are running (Alsalleeh et al., 2018).

However, the clinics are concentrated in some areas such as Olaya and Rawdha.

Distribution of private dental clinics as per year-of-establishment

From 1984

to 1990 From 1991

to 1995 From 1996

to 2000 From 2001

to 2005 From 2006

to 2010 From 2011

to 2016

0

10

20

30

40

50

60

70

Number of clinics

Number of clinics

Figure 2: Year of establishment wise distribution of private dental clinics in Riyadh

Source: Created by the Researcher

The above figure indicates that the number of private dental clinics is increasing in Riyadh

gradually. The increased consciousness of oral health can be one of the key reasons behind the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Market Overview

boost in number of private dental clinics. However, the growth of private dental clinics indicates

that the demand of medicated oral healthcare products can increase in Saudi.

2.2.2 Iran

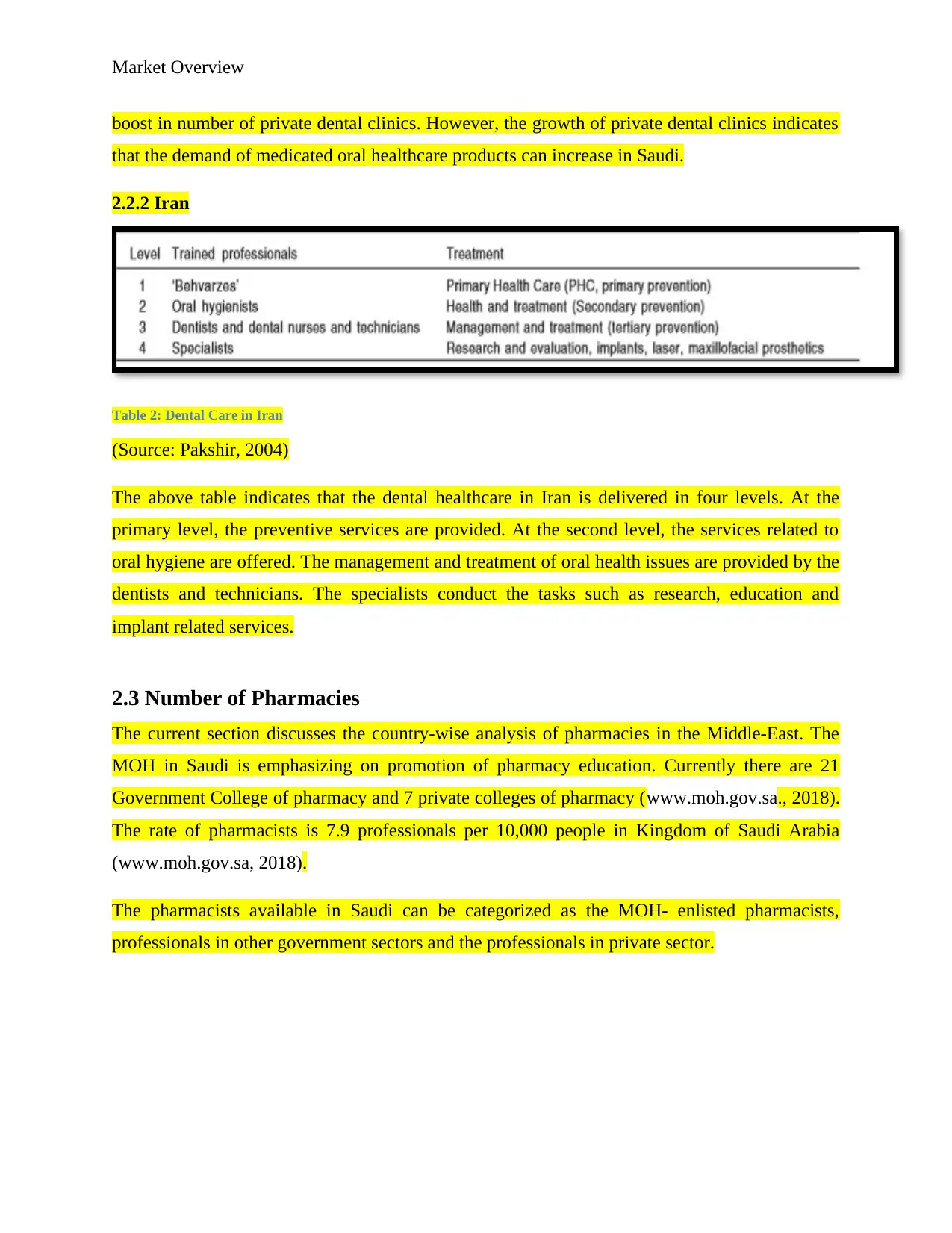

Table 2: Dental Care in Iran

(Source: Pakshir, 2004)

The above table indicates that the dental healthcare in Iran is delivered in four levels. At the

primary level, the preventive services are provided. At the second level, the services related to

oral hygiene are offered. The management and treatment of oral health issues are provided by the

dentists and technicians. The specialists conduct the tasks such as research, education and

implant related services.

2.3 Number of Pharmacies

The current section discusses the country-wise analysis of pharmacies in the Middle-East. The

MOH in Saudi is emphasizing on promotion of pharmacy education. Currently there are 21

Government College of pharmacy and 7 private colleges of pharmacy (www.moh.gov.sa., 2018).

The rate of pharmacists is 7.9 professionals per 10,000 people in Kingdom of Saudi Arabia

(www.moh.gov.sa, 2018).

The pharmacists available in Saudi can be categorized as the MOH- enlisted pharmacists,

professionals in other government sectors and the professionals in private sector.

boost in number of private dental clinics. However, the growth of private dental clinics indicates

that the demand of medicated oral healthcare products can increase in Saudi.

2.2.2 Iran

Table 2: Dental Care in Iran

(Source: Pakshir, 2004)

The above table indicates that the dental healthcare in Iran is delivered in four levels. At the

primary level, the preventive services are provided. At the second level, the services related to

oral hygiene are offered. The management and treatment of oral health issues are provided by the

dentists and technicians. The specialists conduct the tasks such as research, education and

implant related services.

2.3 Number of Pharmacies

The current section discusses the country-wise analysis of pharmacies in the Middle-East. The

MOH in Saudi is emphasizing on promotion of pharmacy education. Currently there are 21

Government College of pharmacy and 7 private colleges of pharmacy (www.moh.gov.sa., 2018).

The rate of pharmacists is 7.9 professionals per 10,000 people in Kingdom of Saudi Arabia

(www.moh.gov.sa, 2018).

The pharmacists available in Saudi can be categorized as the MOH- enlisted pharmacists,

professionals in other government sectors and the professionals in private sector.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Market Overview

MOH-registered

professionals Government sector

professionals Private sector

professionals

0

5000

10000

15000

20000

25000

Categorization of Saudi Pharmacists

Categorization of Saudi

Pharmacists

Figure 3: Category-wise distribution of pharmacist

(Source: www.moh.gov.sa, 2018)

The above figure indicates that most of pharmacists in Saudi work in the private sector. The

increased focus of MOH on development of pharmacists can be favorable for growth of oral

healthcare market in Saudi.

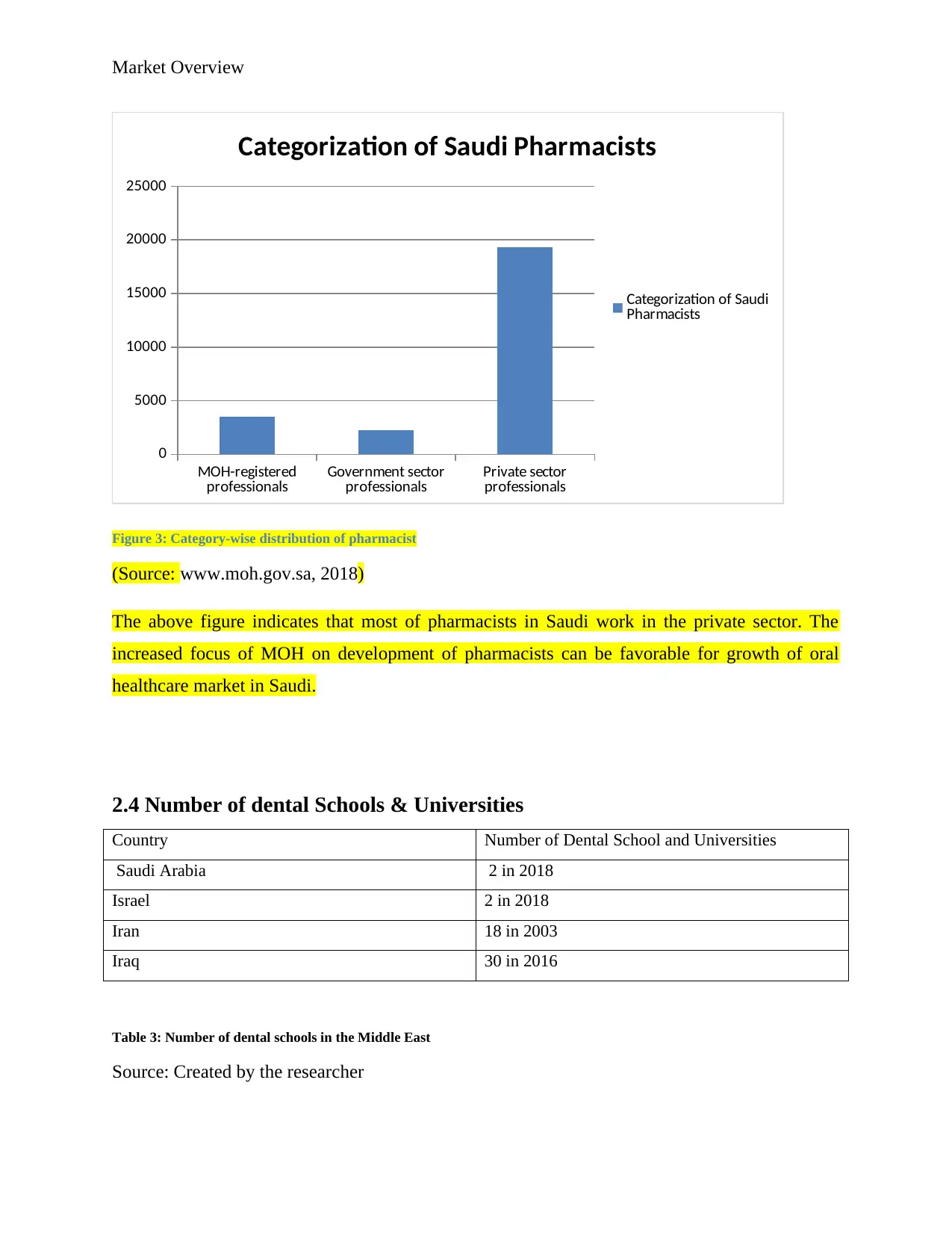

2.4 Number of dental Schools & Universities

Country Number of Dental School and Universities

Saudi Arabia 2 in 2018

Israel 2 in 2018

Iran 18 in 2003

Iraq 30 in 2016

Table 3: Number of dental schools in the Middle East

Source: Created by the researcher

MOH-registered

professionals Government sector

professionals Private sector

professionals

0

5000

10000

15000

20000

25000

Categorization of Saudi Pharmacists

Categorization of Saudi

Pharmacists

Figure 3: Category-wise distribution of pharmacist

(Source: www.moh.gov.sa, 2018)

The above figure indicates that most of pharmacists in Saudi work in the private sector. The

increased focus of MOH on development of pharmacists can be favorable for growth of oral

healthcare market in Saudi.

2.4 Number of dental Schools & Universities

Country Number of Dental School and Universities

Saudi Arabia 2 in 2018

Israel 2 in 2018

Iran 18 in 2003

Iraq 30 in 2016

Table 3: Number of dental schools in the Middle East

Source: Created by the researcher

Market Overview

In Saudi Arabia, the total number of graduating students from dental colleges is 1500 (Al-

Shalan, 2018). Iran has made significant progress in the field of dentistry education. Before

1979, only 5 undergraduate dentistry schools were present in Iran (HR, 2003). In 2003, there

were 18 dental schools and the postgraduate programs started being offered. By 2003, the

number of dentists increased to approximately 11,000 (HR, 2003). Currently, there are 25000

dentists practising in Iran (HR, 2003). Similarly in Iraq also, significant progress has been made

in dentistry education. In 2003, there were only 4 colleges in Iran and in 2016, the number of

colleges increased to 30 (Ammar NH ALBUJEER, 2018). It, in turn, results in, a significant

increase in the number of dentists in Iraq.

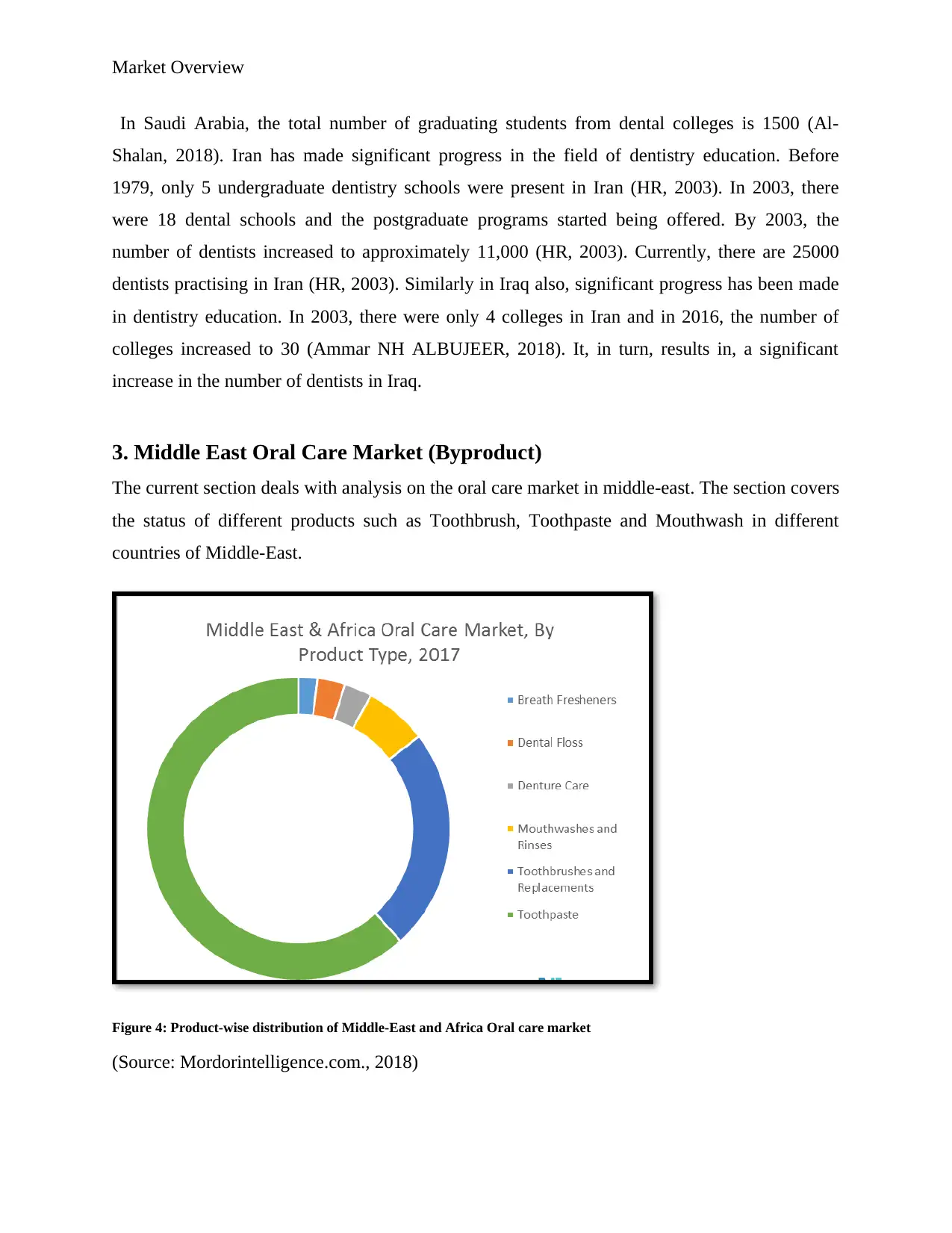

3. Middle East Oral Care Market (Byproduct)

The current section deals with analysis on the oral care market in middle-east. The section covers

the status of different products such as Toothbrush, Toothpaste and Mouthwash in different

countries of Middle-East.

Figure 4: Product-wise distribution of Middle-East and Africa Oral care market

(Source: Mordorintelligence.com., 2018)

In Saudi Arabia, the total number of graduating students from dental colleges is 1500 (Al-

Shalan, 2018). Iran has made significant progress in the field of dentistry education. Before

1979, only 5 undergraduate dentistry schools were present in Iran (HR, 2003). In 2003, there

were 18 dental schools and the postgraduate programs started being offered. By 2003, the

number of dentists increased to approximately 11,000 (HR, 2003). Currently, there are 25000

dentists practising in Iran (HR, 2003). Similarly in Iraq also, significant progress has been made

in dentistry education. In 2003, there were only 4 colleges in Iran and in 2016, the number of

colleges increased to 30 (Ammar NH ALBUJEER, 2018). It, in turn, results in, a significant

increase in the number of dentists in Iraq.

3. Middle East Oral Care Market (Byproduct)

The current section deals with analysis on the oral care market in middle-east. The section covers

the status of different products such as Toothbrush, Toothpaste and Mouthwash in different

countries of Middle-East.

Figure 4: Product-wise distribution of Middle-East and Africa Oral care market

(Source: Mordorintelligence.com., 2018)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.