Decision Modelling for Business Analytics Assignment - Finance Project

VerifiedAdded on 2022/09/17

|4

|1128

|18

Project

AI Summary

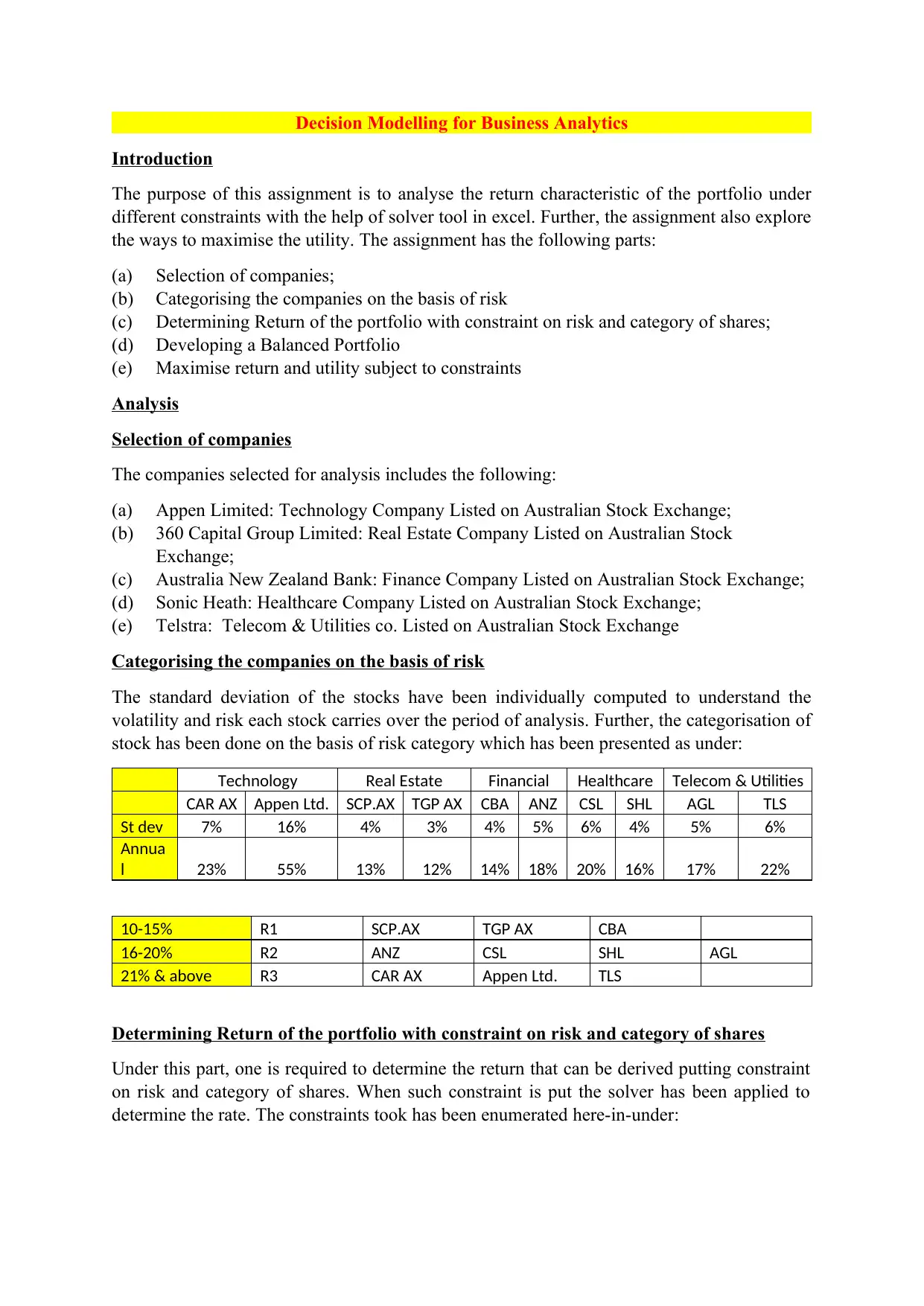

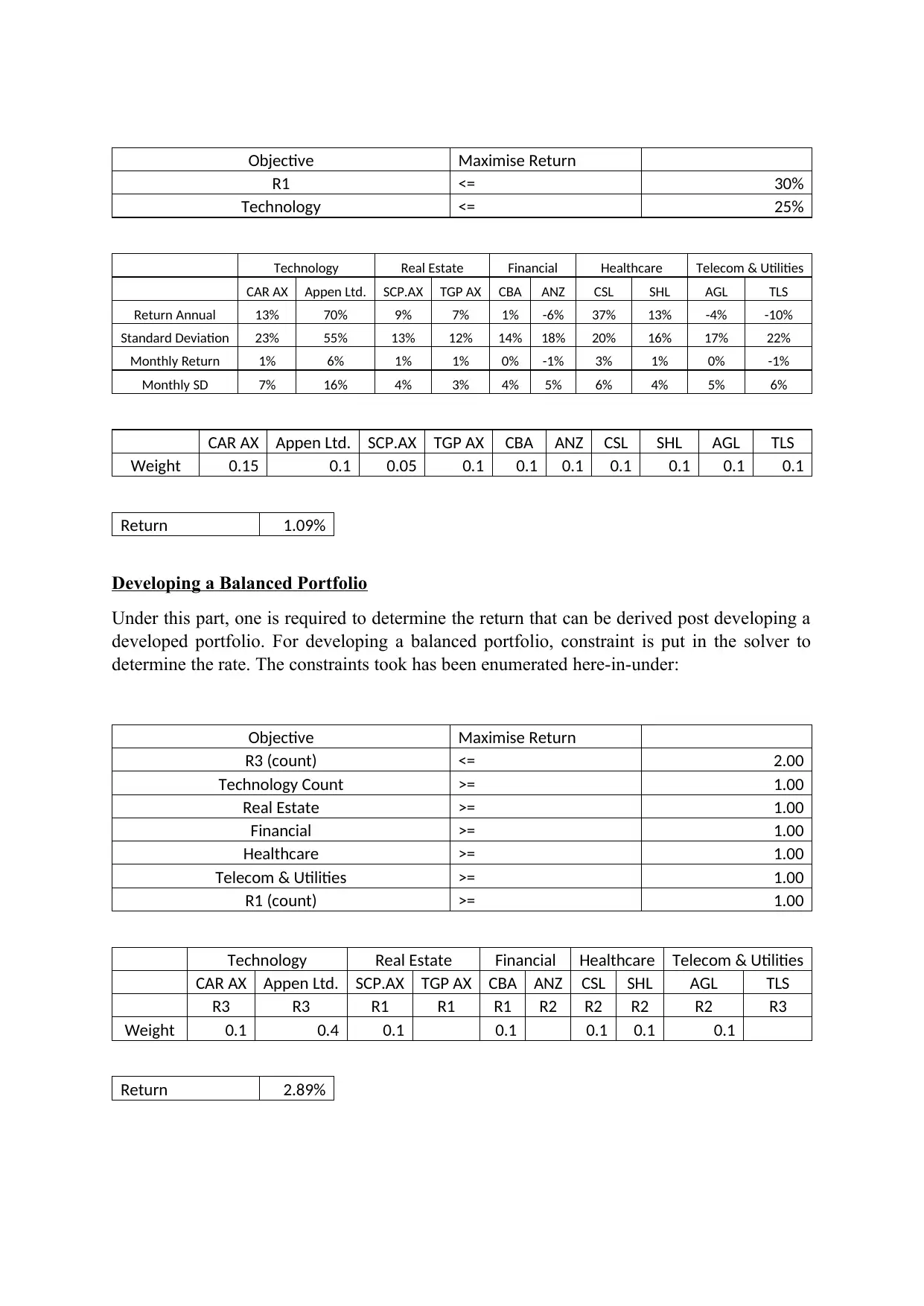

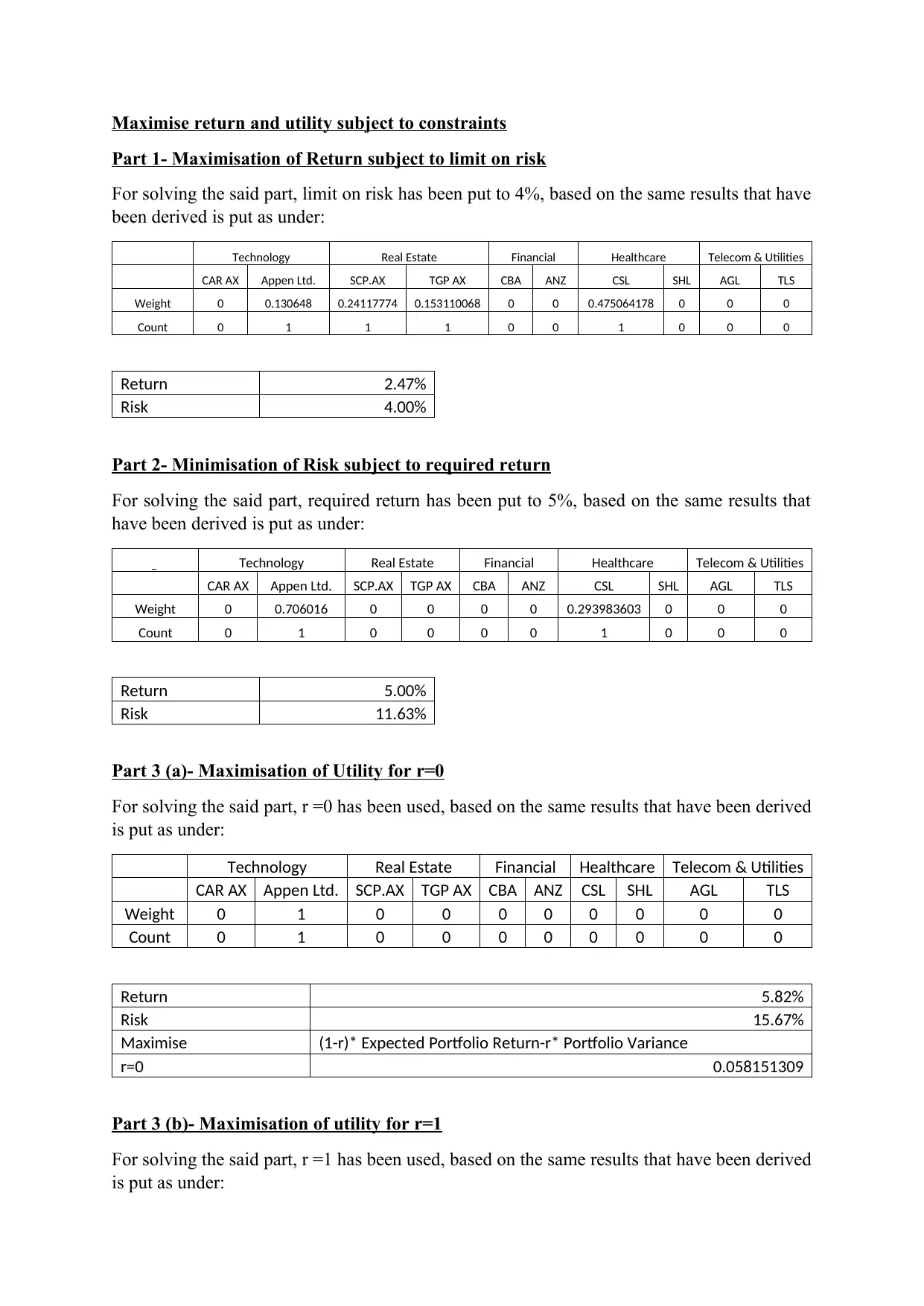

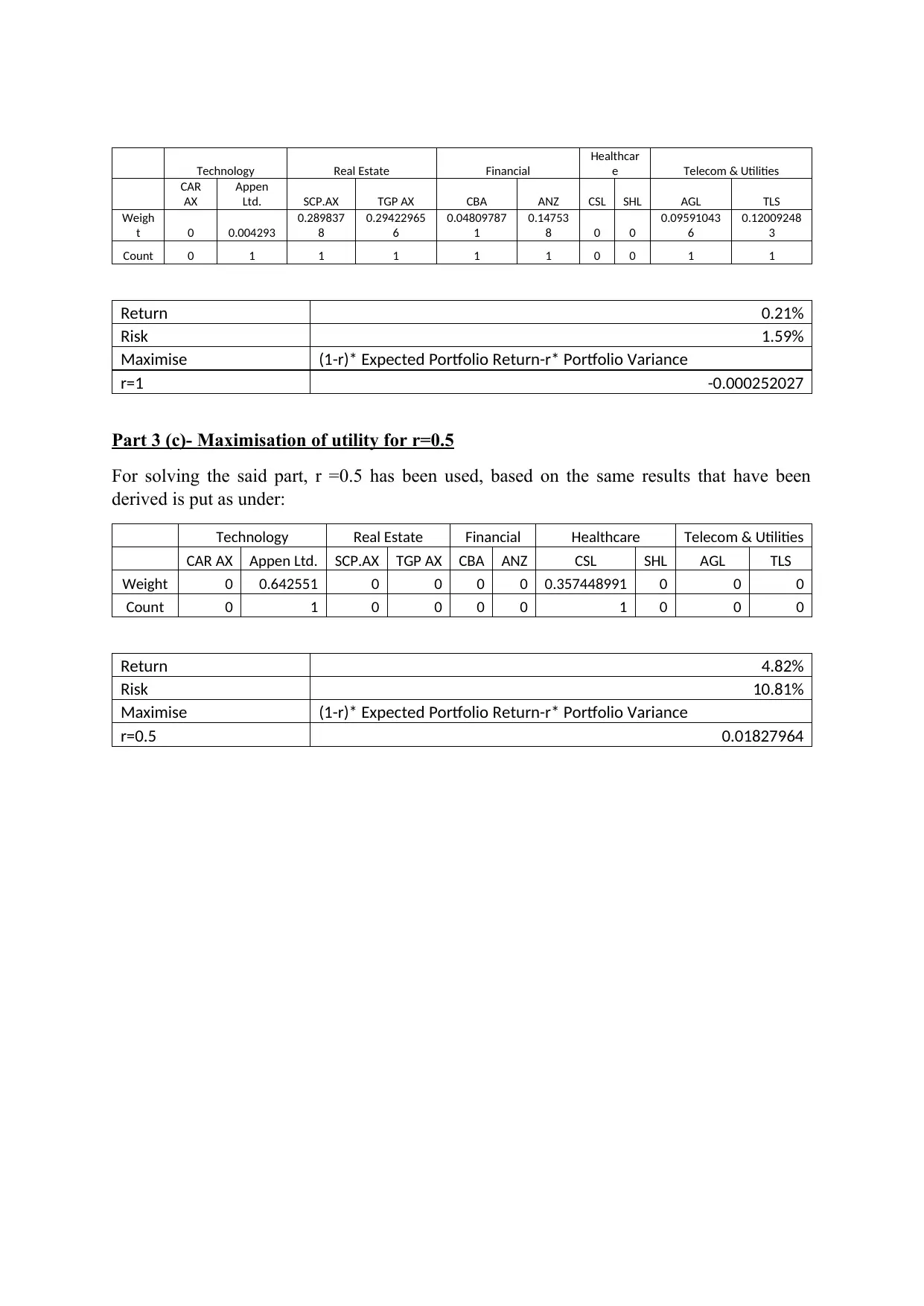

This assignment focuses on decision modelling for business analytics, specifically analyzing the return characteristics of a portfolio under various constraints using Excel's Solver tool. The analysis involves selecting companies from the Australian Stock Exchange, categorizing them based on risk, and determining portfolio returns under different constraints on risk and share categories. The project explores developing a balanced portfolio and maximizing return and utility, subject to specified constraints. It includes detailed calculations, risk assessments, and the application of optimization techniques to achieve the best possible financial outcomes. The assignment covers maximizing returns subject to risk limits, minimizing risk for required returns, and maximizing utility with different risk aversion levels, providing a comprehensive understanding of portfolio management and financial modeling.

1 out of 4

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)