Moneykart Internship Report: Activities, Analysis, and Recommendations

VerifiedAdded on 2022/10/04

|21

|1818

|23

Report

AI Summary

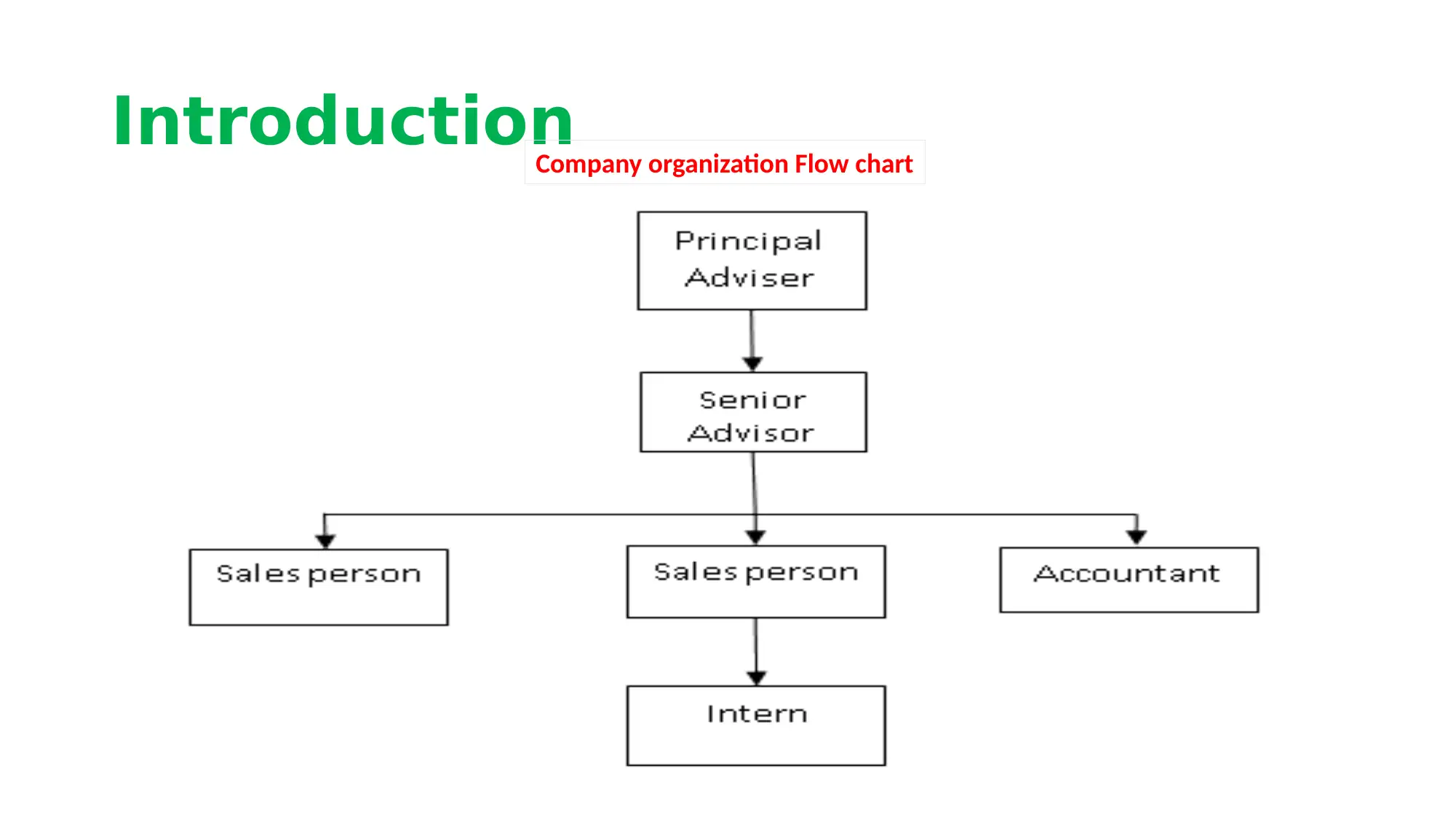

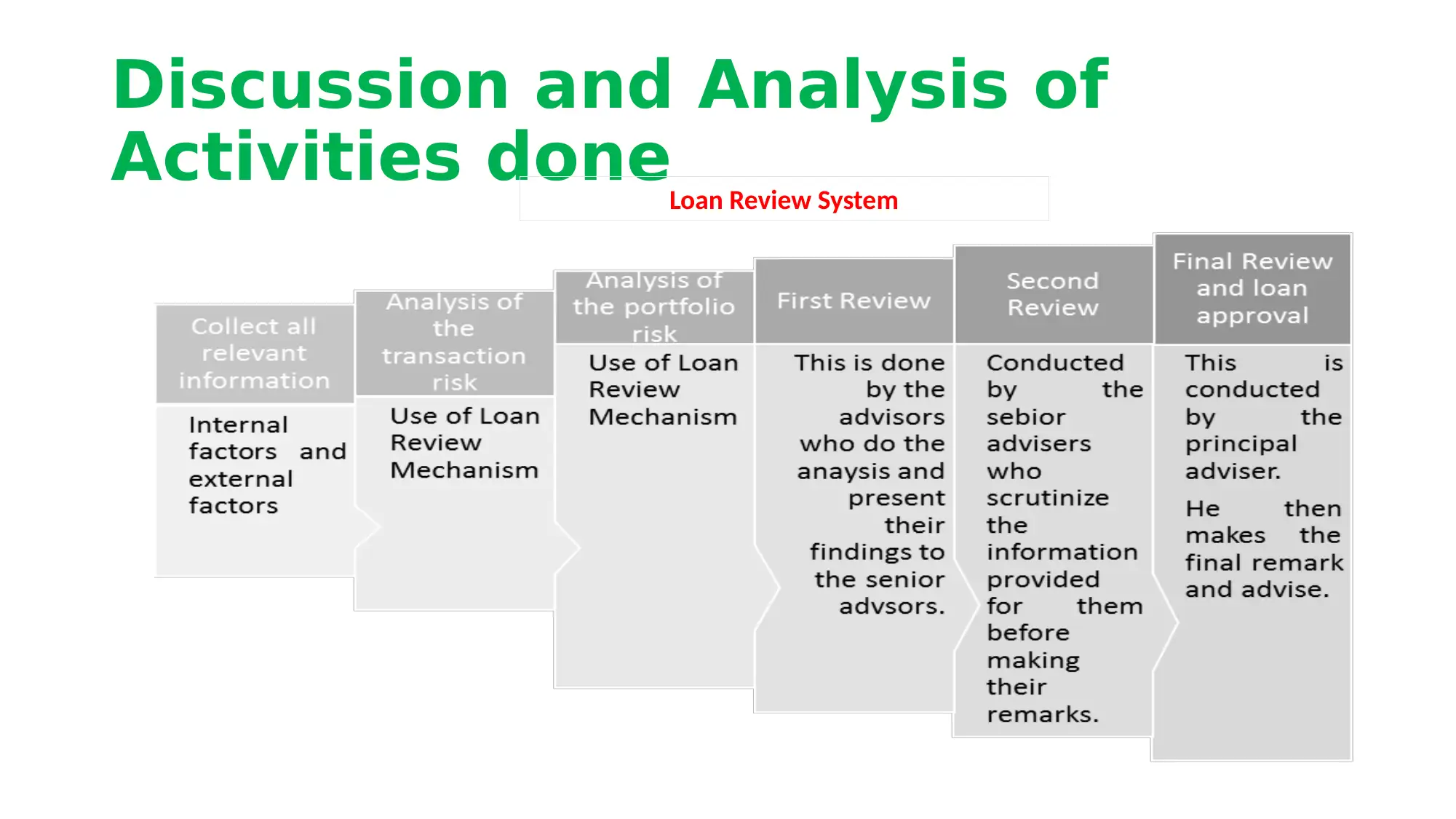

This report details an internship experience at Moneykart, a financial services firm in New Zealand. The report begins with an introduction to Moneykart, outlining its mission, vision, core values, and the services it offers, including mortgages, insurance, and financial advisory. It then moves on to an analysis of the activities undertaken during the internship, such as understanding lending operations, studying financial regulations, and reviewing loan applications. The report also includes a case study of a laundry business seeking a commercial loan, highlighting the financial analysis and decision-making processes involved. The report discusses the application of digital marketing and quality assurance. The report connects the internship experiences with the student's MBA modules, including Financial and Management Accounting, Quality Management, and others, demonstrating the practical application of theoretical knowledge. The report concludes with recommendations for both the student's personal development and areas for improvement within the company, offering insights into the benefits of the internship and suggestions for future enhancements. References are provided to support the information presented.

1 out of 21

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)