Certificate IV in Mortgage Broker and Finance Assignment Solution

VerifiedAdded on 2023/06/03

|16

|1396

|147

Homework Assignment

AI Summary

This document presents a comprehensive solution for a Certificate IV in Mortgage Broker and Finance assignment. It covers various aspects of mortgage broking, including assumptions made due to missing information, calculations of Net Disposable Income (NDI) and borrowing capacity, and the use of a credit guide. The assignment includes detailed loan application forms, asset and liability assessments, future monthly repayment projections, and a sample approval letter. The document also addresses topics like offset accounts and provides references to relevant financial literature. It provides a structured approach to the assignment, breaking down the requirements and providing the necessary calculations and documentation to complete the assignment. The solution is designed to help students understand the concepts and apply them in a practical context.

Running head: CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

Certificate IV in Mortgage Broker and Finance

Name of the Student:

Name of the University:

Authors Note:

Certificate IV in Mortgage Broker and Finance

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

Contents

Assumptions:...................................................................................................................................2

Assessment three:............................................................................................................................2

Assessment Five:.............................................................................................................................3

Sample Approval Letter:................................................................................................................10

References:....................................................................................................................................14

Contents

Assumptions:...................................................................................................................................2

Assessment three:............................................................................................................................2

Assessment Five:.............................................................................................................................3

Sample Approval Letter:................................................................................................................10

References:....................................................................................................................................14

2CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

Assumptions:

In this document the information has been provided to fill Certificate IV for Mortgage

Loan. Due to lack of information number of fields have been left vacant. It is important to note

that the monthly food and other expenses have been assumed to complete the document (Reed,

2016). In respect of various fees where no particular information has been given it has been

assumed no such fees are required to be paid for the mortgage loan.

Assessment three:

Exercise: Glenworth Net Disposable Income ratio (NDI) for the applicant is 0.61 (as can be seen

in the calculation

Step 2:

Maximum borrowing capacity for these applicants is $500,000.

Q4.10:

Credit guide is to be used to obtain borrowers instructions.

Q5.17:

In Property Registration office in NSW titles interests are registered. Option (b) is the correct

option.

Upfront after settlement:

Upfront after settlement of 0.715% is to be paid which will be (450000 x 0.715%) = $3,217.50

(Mailer, 2015).

Assumptions:

In this document the information has been provided to fill Certificate IV for Mortgage

Loan. Due to lack of information number of fields have been left vacant. It is important to note

that the monthly food and other expenses have been assumed to complete the document (Reed,

2016). In respect of various fees where no particular information has been given it has been

assumed no such fees are required to be paid for the mortgage loan.

Assessment three:

Exercise: Glenworth Net Disposable Income ratio (NDI) for the applicant is 0.61 (as can be seen

in the calculation

Step 2:

Maximum borrowing capacity for these applicants is $500,000.

Q4.10:

Credit guide is to be used to obtain borrowers instructions.

Q5.17:

In Property Registration office in NSW titles interests are registered. Option (b) is the correct

option.

Upfront after settlement:

Upfront after settlement of 0.715% is to be paid which will be (450000 x 0.715%) = $3,217.50

(Mailer, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

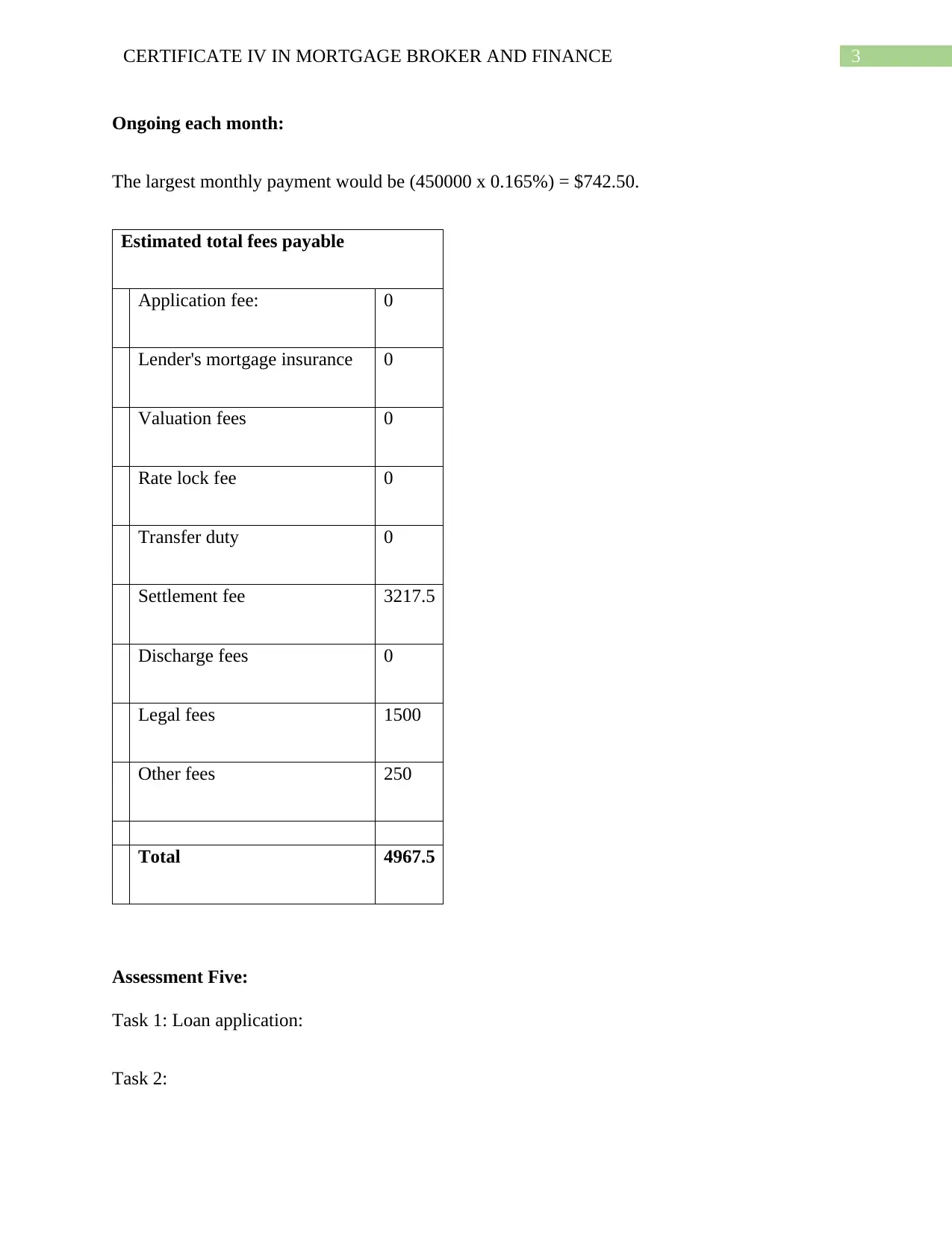

Ongoing each month:

The largest monthly payment would be (450000 x 0.165%) = $742.50.

Estimated total fees payable

Application fee: 0

Lender's mortgage insurance 0

Valuation fees 0

Rate lock fee 0

Transfer duty 0

Settlement fee 3217.5

Discharge fees 0

Legal fees 1500

Other fees 250

Total 4967.5

Assessment Five:

Task 1: Loan application:

Task 2:

Ongoing each month:

The largest monthly payment would be (450000 x 0.165%) = $742.50.

Estimated total fees payable

Application fee: 0

Lender's mortgage insurance 0

Valuation fees 0

Rate lock fee 0

Transfer duty 0

Settlement fee 3217.5

Discharge fees 0

Legal fees 1500

Other fees 250

Total 4967.5

Assessment Five:

Task 1: Loan application:

Task 2:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

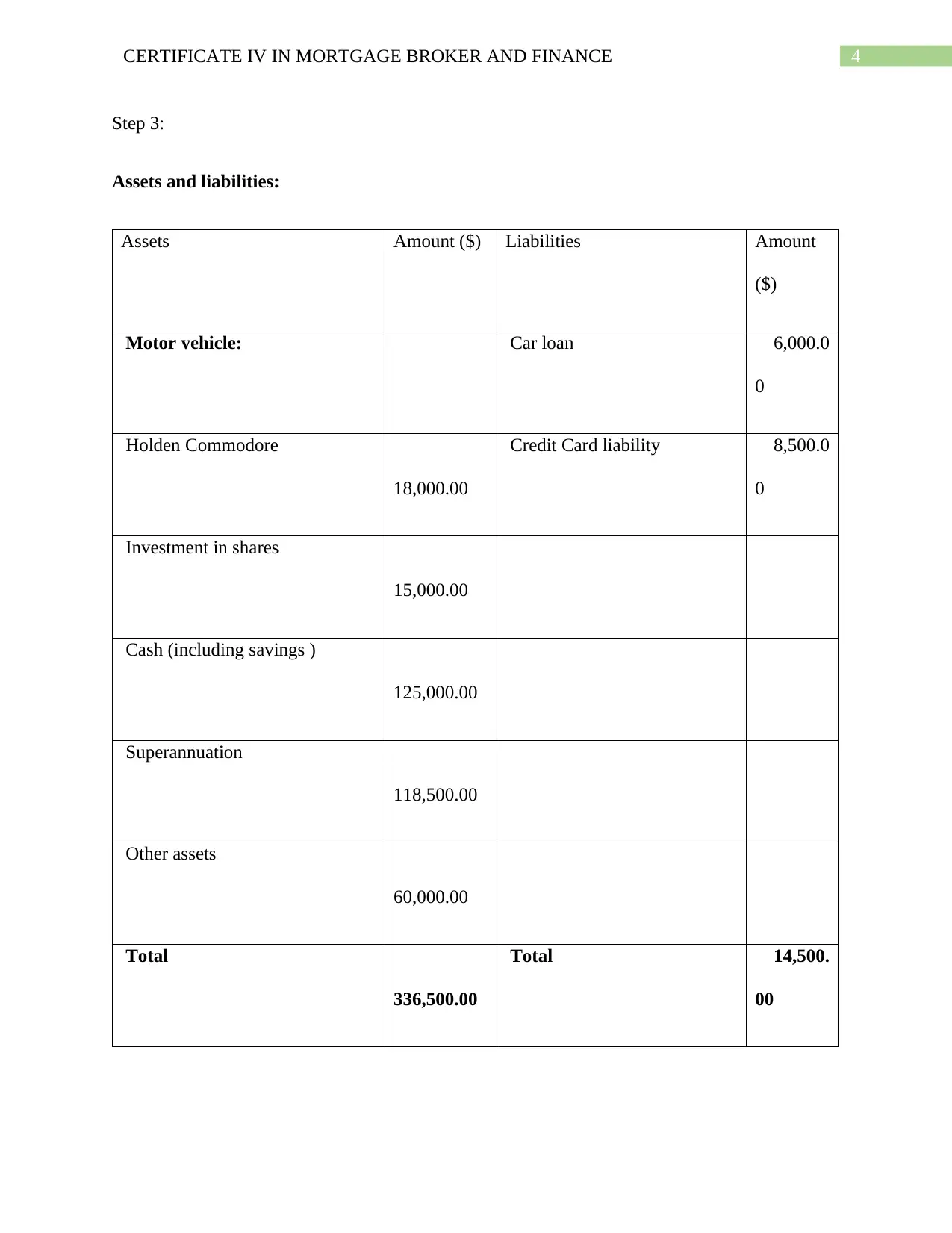

Step 3:

Assets and liabilities:

Assets Amount ($) Liabilities Amount

($)

Motor vehicle: Car loan 6,000.0

0

Holden Commodore

18,000.00

Credit Card liability 8,500.0

0

Investment in shares

15,000.00

Cash (including savings )

125,000.00

Superannuation

118,500.00

Other assets

60,000.00

Total

336,500.00

Total 14,500.

00

Step 3:

Assets and liabilities:

Assets Amount ($) Liabilities Amount

($)

Motor vehicle: Car loan 6,000.0

0

Holden Commodore

18,000.00

Credit Card liability 8,500.0

0

Investment in shares

15,000.00

Cash (including savings )

125,000.00

Superannuation

118,500.00

Other assets

60,000.00

Total

336,500.00

Total 14,500.

00

5CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

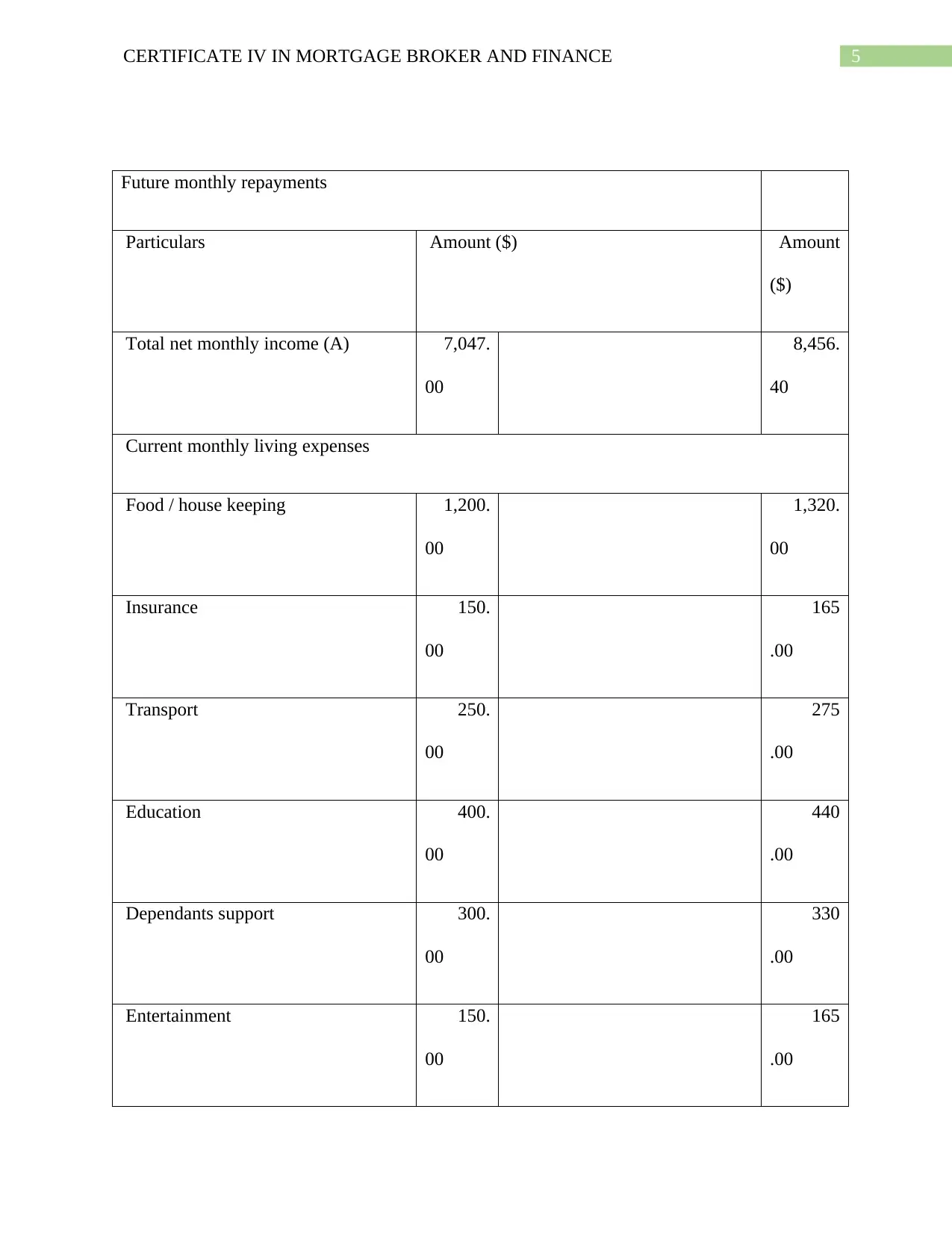

Future monthly repayments

Particulars Amount ($) Amount

($)

Total net monthly income (A) 7,047.

00

8,456.

40

Current monthly living expenses

Food / house keeping 1,200.

00

1,320.

00

Insurance 150.

00

165

.00

Transport 250.

00

275

.00

Education 400.

00

440

.00

Dependants support 300.

00

330

.00

Entertainment 150.

00

165

.00

Future monthly repayments

Particulars Amount ($) Amount

($)

Total net monthly income (A) 7,047.

00

8,456.

40

Current monthly living expenses

Food / house keeping 1,200.

00

1,320.

00

Insurance 150.

00

165

.00

Transport 250.

00

275

.00

Education 400.

00

440

.00

Dependants support 300.

00

330

.00

Entertainment 150.

00

165

.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

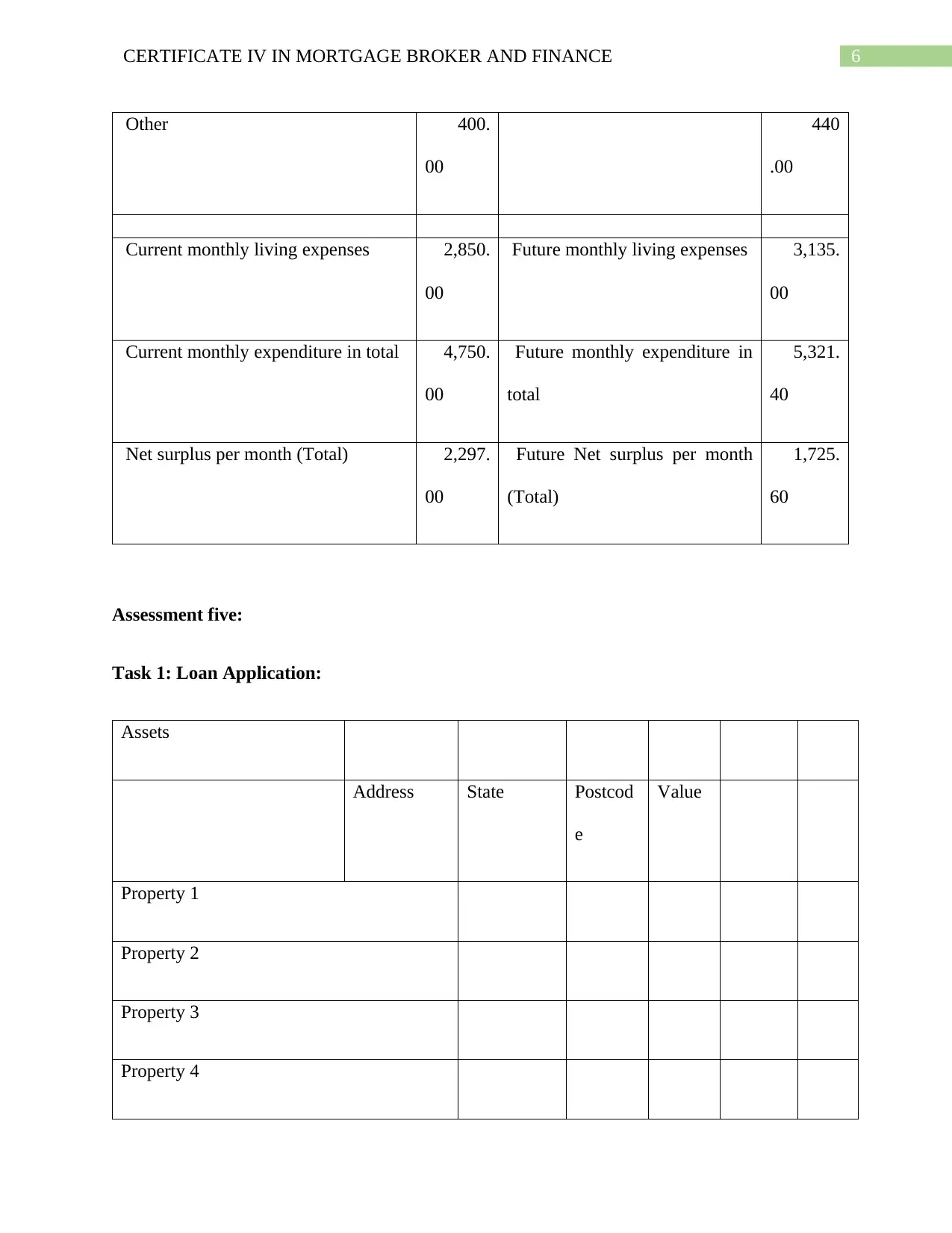

Other 400.

00

440

.00

Current monthly living expenses 2,850.

00

Future monthly living expenses 3,135.

00

Current monthly expenditure in total 4,750.

00

Future monthly expenditure in

total

5,321.

40

Net surplus per month (Total) 2,297.

00

Future Net surplus per month

(Total)

1,725.

60

Assessment five:

Task 1: Loan Application:

Assets

Address State Postcod

e

Value

Property 1

Property 2

Property 3

Property 4

Other 400.

00

440

.00

Current monthly living expenses 2,850.

00

Future monthly living expenses 3,135.

00

Current monthly expenditure in total 4,750.

00

Future monthly expenditure in

total

5,321.

40

Net surplus per month (Total) 2,297.

00

Future Net surplus per month

(Total)

1,725.

60

Assessment five:

Task 1: Loan Application:

Assets

Address State Postcod

e

Value

Property 1

Property 2

Property 3

Property 4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

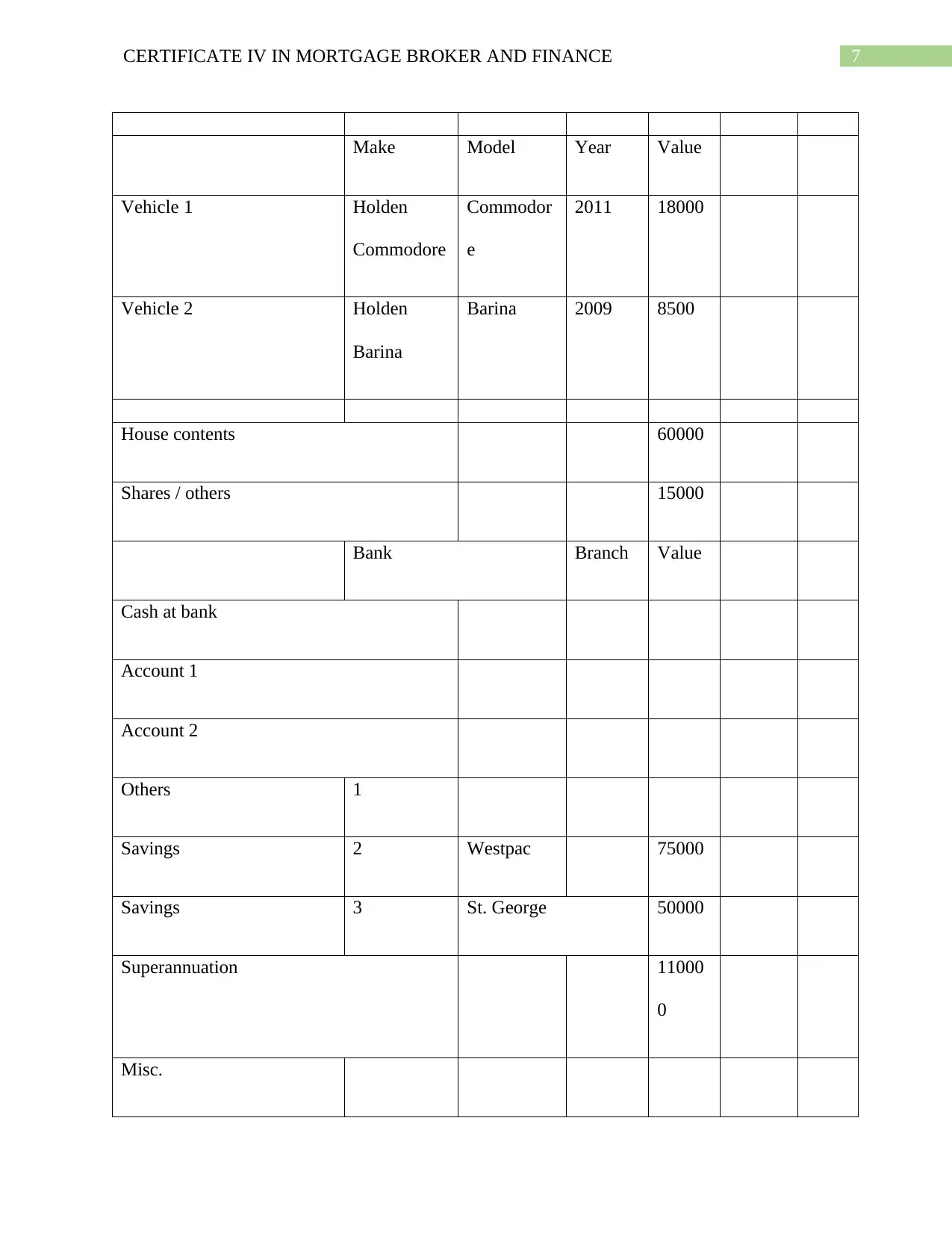

7CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

Make Model Year Value

Vehicle 1 Holden

Commodore

Commodor

e

2011 18000

Vehicle 2 Holden

Barina

Barina 2009 8500

House contents 60000

Shares / others 15000

Bank Branch Value

Cash at bank

Account 1

Account 2

Others 1

Savings 2 Westpac 75000

Savings 3 St. George 50000

Superannuation 11000

0

Misc.

Make Model Year Value

Vehicle 1 Holden

Commodore

Commodor

e

2011 18000

Vehicle 2 Holden

Barina

Barina 2009 8500

House contents 60000

Shares / others 15000

Bank Branch Value

Cash at bank

Account 1

Account 2

Others 1

Savings 2 Westpac 75000

Savings 3 St. George 50000

Superannuation 11000

0

Misc.

8CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

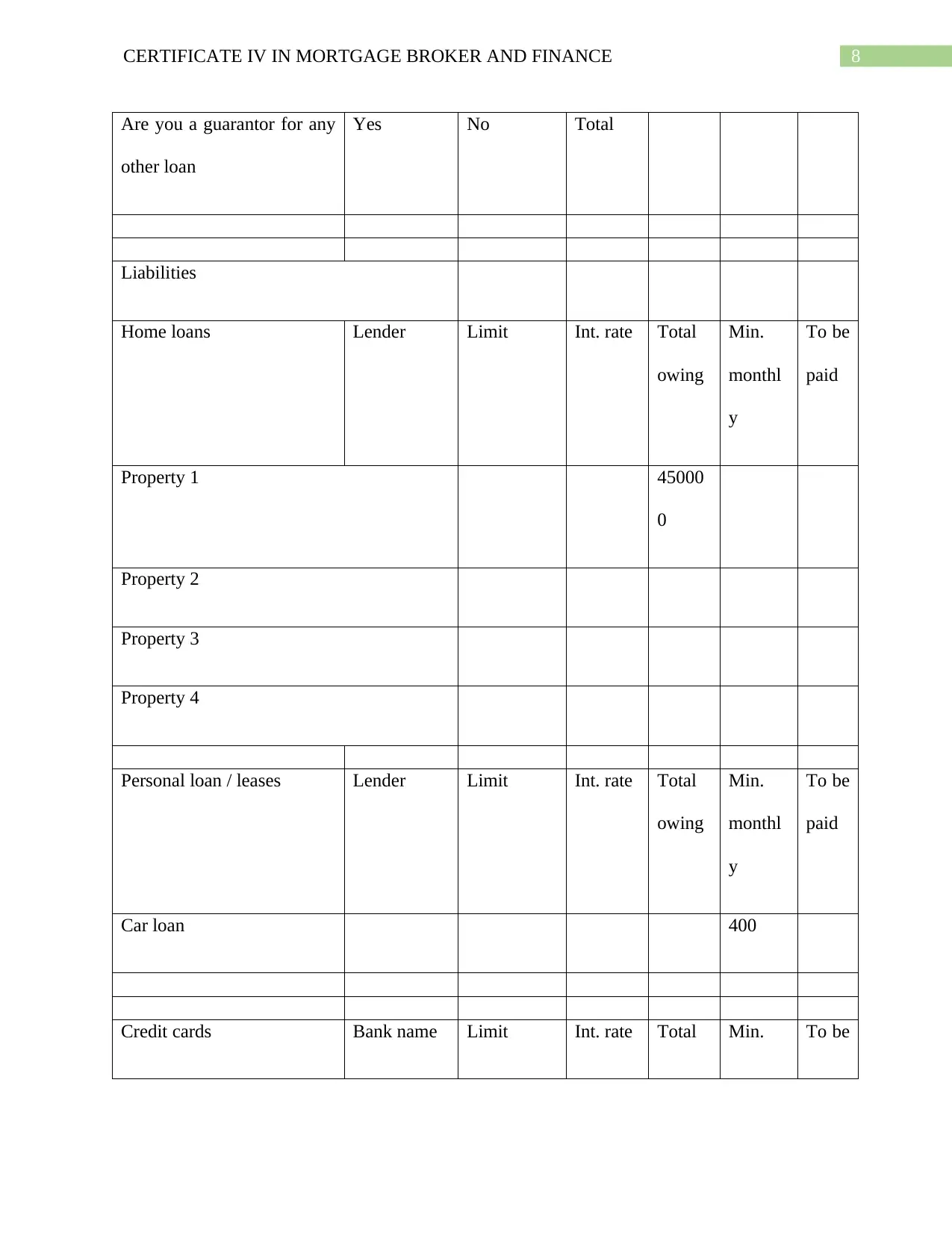

Are you a guarantor for any

other loan

Yes No Total

Liabilities

Home loans Lender Limit Int. rate Total

owing

Min.

monthl

y

To be

paid

Property 1 45000

0

Property 2

Property 3

Property 4

Personal loan / leases Lender Limit Int. rate Total

owing

Min.

monthl

y

To be

paid

Car loan 400

Credit cards Bank name Limit Int. rate Total Min. To be

Are you a guarantor for any

other loan

Yes No Total

Liabilities

Home loans Lender Limit Int. rate Total

owing

Min.

monthl

y

To be

paid

Property 1 45000

0

Property 2

Property 3

Property 4

Personal loan / leases Lender Limit Int. rate Total

owing

Min.

monthl

y

To be

paid

Car loan 400

Credit cards Bank name Limit Int. rate Total Min. To be

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

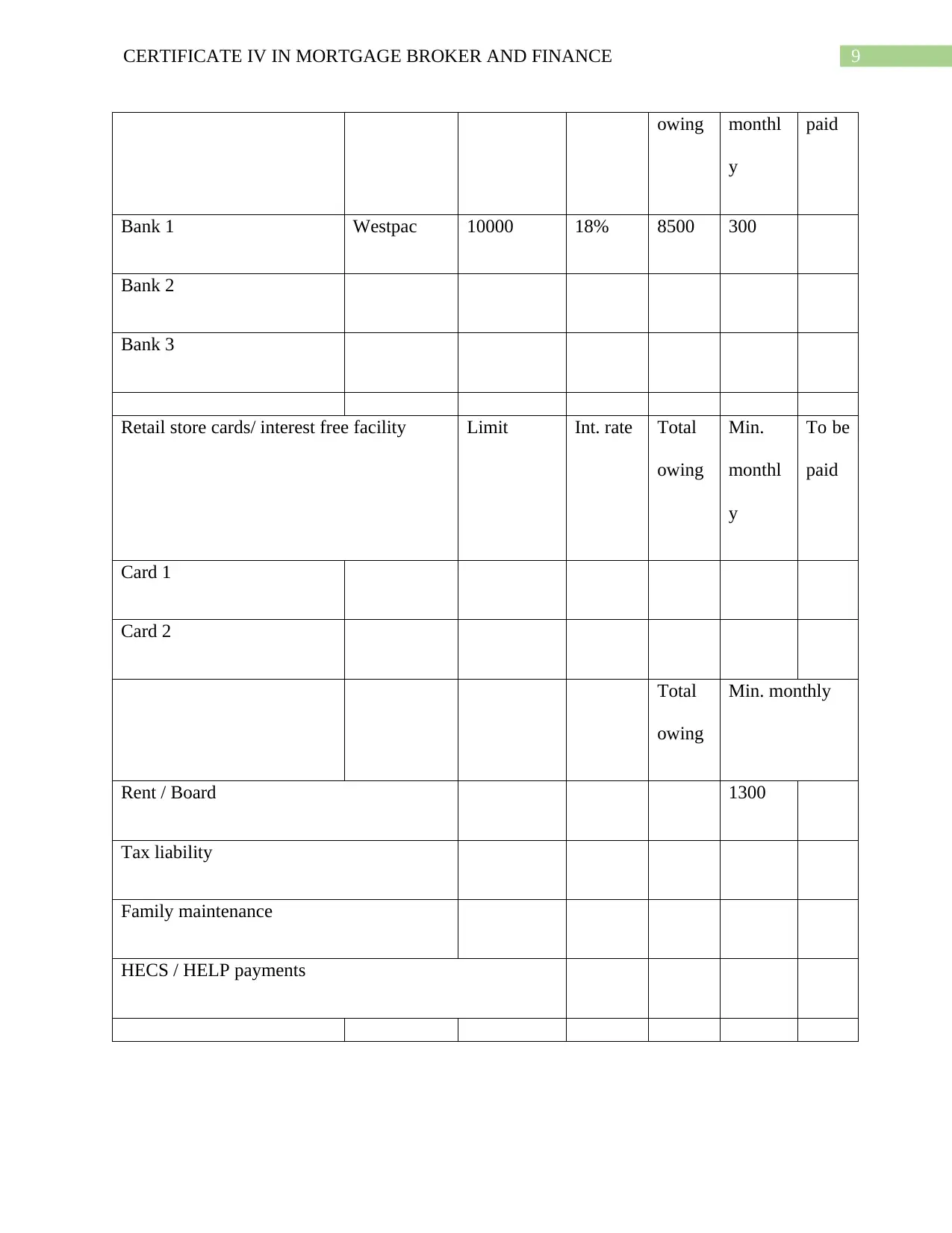

9CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

owing monthl

y

paid

Bank 1 Westpac 10000 18% 8500 300

Bank 2

Bank 3

Retail store cards/ interest free facility Limit Int. rate Total

owing

Min.

monthl

y

To be

paid

Card 1

Card 2

Total

owing

Min. monthly

Rent / Board 1300

Tax liability

Family maintenance

HECS / HELP payments

owing monthl

y

paid

Bank 1 Westpac 10000 18% 8500 300

Bank 2

Bank 3

Retail store cards/ interest free facility Limit Int. rate Total

owing

Min.

monthl

y

To be

paid

Card 1

Card 2

Total

owing

Min. monthly

Rent / Board 1300

Tax liability

Family maintenance

HECS / HELP payments

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

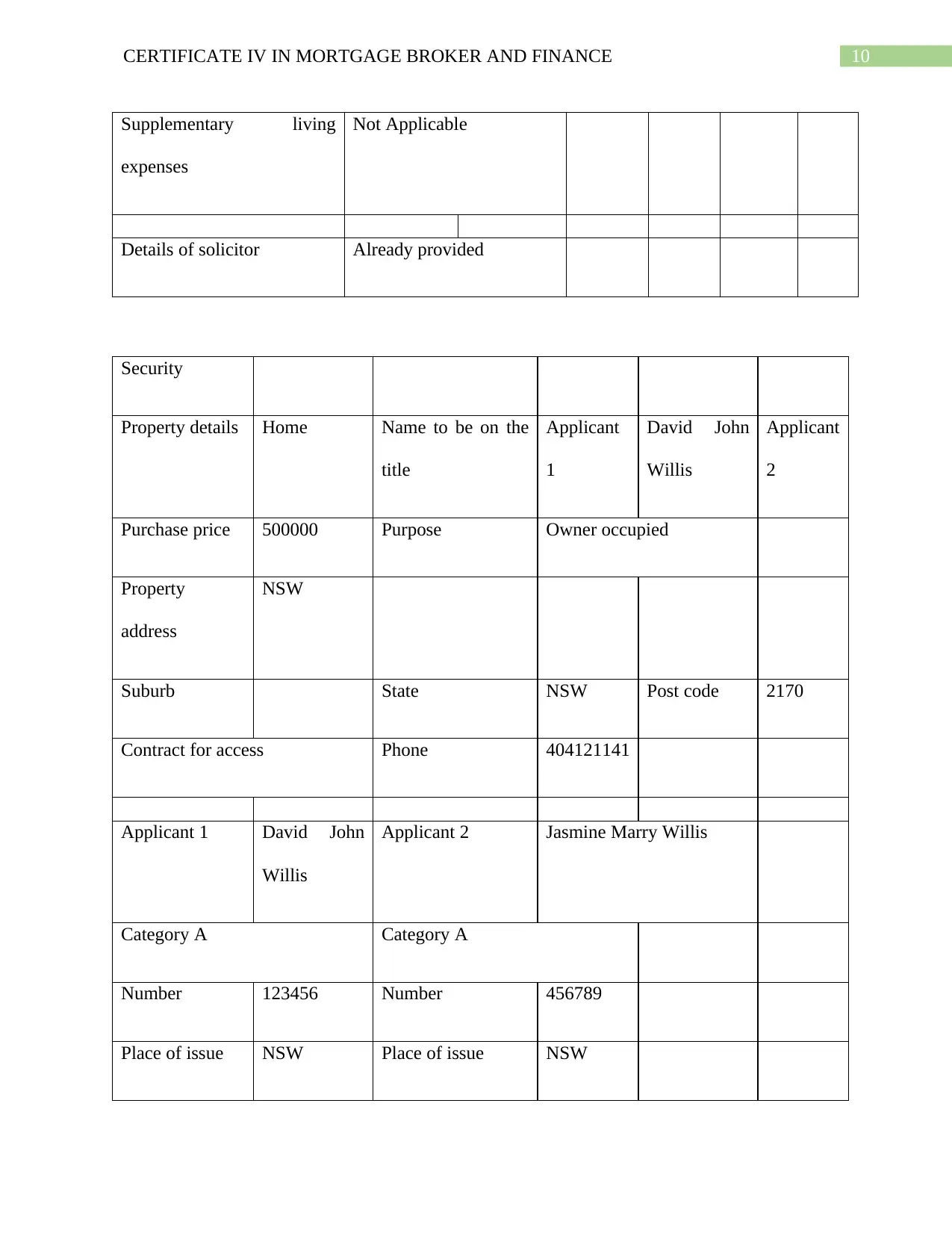

10CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

Supplementary living

expenses

Not Applicable

Details of solicitor Already provided

Security

Property details Home Name to be on the

title

Applicant

1

David John

Willis

Applicant

2

Purchase price 500000 Purpose Owner occupied

Property

address

NSW

Suburb State NSW Post code 2170

Contract for access Phone 404121141

Applicant 1 David John

Willis

Applicant 2 Jasmine Marry Willis

Category A Category A

Number 123456 Number 456789

Place of issue NSW Place of issue NSW

Supplementary living

expenses

Not Applicable

Details of solicitor Already provided

Security

Property details Home Name to be on the

title

Applicant

1

David John

Willis

Applicant

2

Purchase price 500000 Purpose Owner occupied

Property

address

NSW

Suburb State NSW Post code 2170

Contract for access Phone 404121141

Applicant 1 David John

Willis

Applicant 2 Jasmine Marry Willis

Category A Category A

Number 123456 Number 456789

Place of issue NSW Place of issue NSW

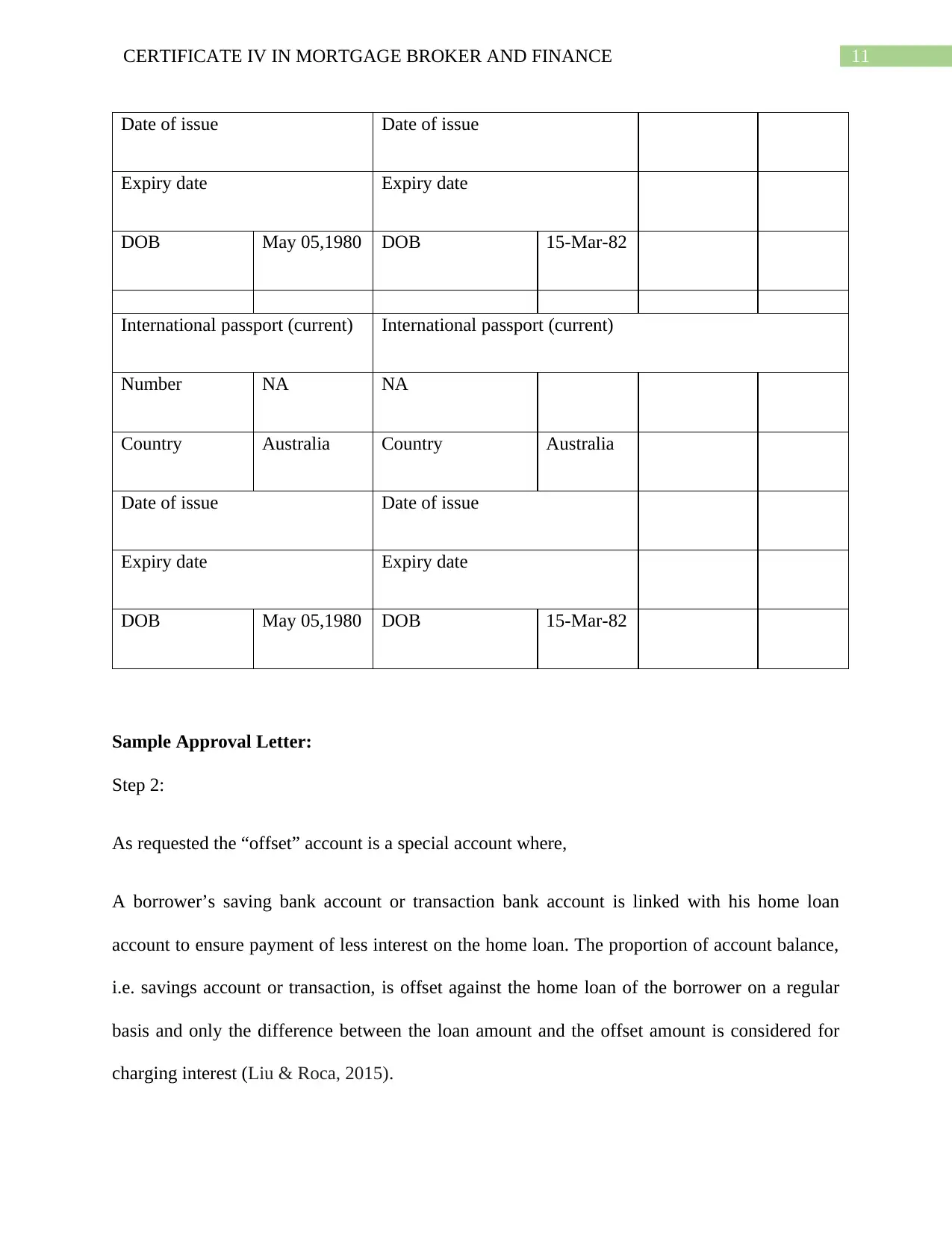

11CERTIFICATE IV IN MORTGAGE BROKER AND FINANCE

Date of issue Date of issue

Expiry date Expiry date

DOB May 05,1980 DOB 15-Mar-82

International passport (current) International passport (current)

Number NA NA

Country Australia Country Australia

Date of issue Date of issue

Expiry date Expiry date

DOB May 05,1980 DOB 15-Mar-82

Sample Approval Letter:

Step 2:

As requested the “offset” account is a special account where,

A borrower’s saving bank account or transaction bank account is linked with his home loan

account to ensure payment of less interest on the home loan. The proportion of account balance,

i.e. savings account or transaction, is offset against the home loan of the borrower on a regular

basis and only the difference between the loan amount and the offset amount is considered for

charging interest (Liu & Roca, 2015).

Date of issue Date of issue

Expiry date Expiry date

DOB May 05,1980 DOB 15-Mar-82

International passport (current) International passport (current)

Number NA NA

Country Australia Country Australia

Date of issue Date of issue

Expiry date Expiry date

DOB May 05,1980 DOB 15-Mar-82

Sample Approval Letter:

Step 2:

As requested the “offset” account is a special account where,

A borrower’s saving bank account or transaction bank account is linked with his home loan

account to ensure payment of less interest on the home loan. The proportion of account balance,

i.e. savings account or transaction, is offset against the home loan of the borrower on a regular

basis and only the difference between the loan amount and the offset amount is considered for

charging interest (Liu & Roca, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.