International Financial Strategy Report: Marks and Spencer's Expansion

VerifiedAdded on 2021/02/19

|15

|3291

|256

Report

AI Summary

This report provides a comprehensive analysis of Marks and Spencer's international financial strategy. It begins with an evaluation of the Capital Asset Pricing Model (CAPM) and the Dividend Valuation Model (DVM), including their assumptions, limitations, and estimation of price, alongside the estimation of Beta and comments on the differences between the models. The report then examines Marks & Spencer's strategy for investing in China, considering correlation and co-efficient between China and the UK, potential challenges for managers, and risk diversification. The analysis includes various entry modes into the Chinese market, pricing strategies, and the importance of market analysis, providing insights into the company's approach to international expansion and financial decision-making. The report concludes with a summary of the key findings and recommendations for Marks and Spencer's international financial strategy.

International financial

Strategy

1

Strategy

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

PART 1............................................................................................................................................3

Evaluation of CAPM along with its assumptions and limitations and Estimation of price using

CAPM..........................................................................................................................................3

Estimation of Beta and comments...............................................................................................4

Evaluation of DVM along with its assumptions and limitations and Estimation of price using

DVM............................................................................................................................................6

Reasons for differences and comments........................................................................................8

PART 2............................................................................................................................................8

Evaluation of company’s strategy to invest in China in same sector and correlation and co-

efficient between China and the UK............................................................................................8

Potential challenges for managers when investing in China.....................................................10

Consideration of risk diversification..........................................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

2

INTRODUCTION...........................................................................................................................3

PART 1............................................................................................................................................3

Evaluation of CAPM along with its assumptions and limitations and Estimation of price using

CAPM..........................................................................................................................................3

Estimation of Beta and comments...............................................................................................4

Evaluation of DVM along with its assumptions and limitations and Estimation of price using

DVM............................................................................................................................................6

Reasons for differences and comments........................................................................................8

PART 2............................................................................................................................................8

Evaluation of company’s strategy to invest in China in same sector and correlation and co-

efficient between China and the UK............................................................................................8

Potential challenges for managers when investing in China.....................................................10

Consideration of risk diversification..........................................................................................12

CONCLUSION..............................................................................................................................12

REFERENCES..............................................................................................................................13

2

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

International financial strategy can be defined as the decisions that are formulated by such

companies that are executing their business at international level and willing to acquire higher

profits in future. With the help of it all of them try to find such ways in which business can attain

growth and get developed in future. It is mainly used by such companies to plan commercial

transactions that are taking place between organisations executing business in different countries

(Blecker, 2016). Main goal of it is to increase profits so that monetary resources to run business

can be enhanced. It guides managers to take appropriate decisions for business so that

profitability can be maximised and business can be developed. Organisation which is selected for

this project is Marks and Spencer. It is one of the largest retailers in United Kingdom. It was

founded in year 1884 by Thomas Spencer and Michael Marks. It is mainly established in UK and

operating its business all around the world. This report covers various topics such as evaluation,

limitation, assumptions, calculation and estimation of CAPM and DVM. Along with this,

evaluation of company’s strategy, potential challenges for managers, risk diversification etc. are

also covered under this project.

PART 1

Evaluation of CAPM along with its assumptions and limitations and Estimation of price using

CAPM

CAPM (Capital Asset Pricing Model): It is a financial model which is used by managers

in business entities for the purpose of determining the required rate of return of a financial asset

so that decision regarding adding that asset to portfolio can be formulated. With the help of it

managers in Marks and Spencer can analyse relation between expected return and systematic risk

of a particular asset (Annual Report of M&S, 2018). Formula of it is as follows:

Formula : ERi = Rf + Bi (ERm - Rf)

ERi = Expected Return of investment

Rf = Risk free rate

Bi = Beta of the investment

ERm =Expected Return of Market

ERm - Rf = Market risk premium

ERi = Rf + Bi (ERm – Rf)

4

International financial strategy can be defined as the decisions that are formulated by such

companies that are executing their business at international level and willing to acquire higher

profits in future. With the help of it all of them try to find such ways in which business can attain

growth and get developed in future. It is mainly used by such companies to plan commercial

transactions that are taking place between organisations executing business in different countries

(Blecker, 2016). Main goal of it is to increase profits so that monetary resources to run business

can be enhanced. It guides managers to take appropriate decisions for business so that

profitability can be maximised and business can be developed. Organisation which is selected for

this project is Marks and Spencer. It is one of the largest retailers in United Kingdom. It was

founded in year 1884 by Thomas Spencer and Michael Marks. It is mainly established in UK and

operating its business all around the world. This report covers various topics such as evaluation,

limitation, assumptions, calculation and estimation of CAPM and DVM. Along with this,

evaluation of company’s strategy, potential challenges for managers, risk diversification etc. are

also covered under this project.

PART 1

Evaluation of CAPM along with its assumptions and limitations and Estimation of price using

CAPM

CAPM (Capital Asset Pricing Model): It is a financial model which is used by managers

in business entities for the purpose of determining the required rate of return of a financial asset

so that decision regarding adding that asset to portfolio can be formulated. With the help of it

managers in Marks and Spencer can analyse relation between expected return and systematic risk

of a particular asset (Annual Report of M&S, 2018). Formula of it is as follows:

Formula : ERi = Rf + Bi (ERm - Rf)

ERi = Expected Return of investment

Rf = Risk free rate

Bi = Beta of the investment

ERm =Expected Return of Market

ERm - Rf = Market risk premium

ERi = Rf + Bi (ERm – Rf)

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

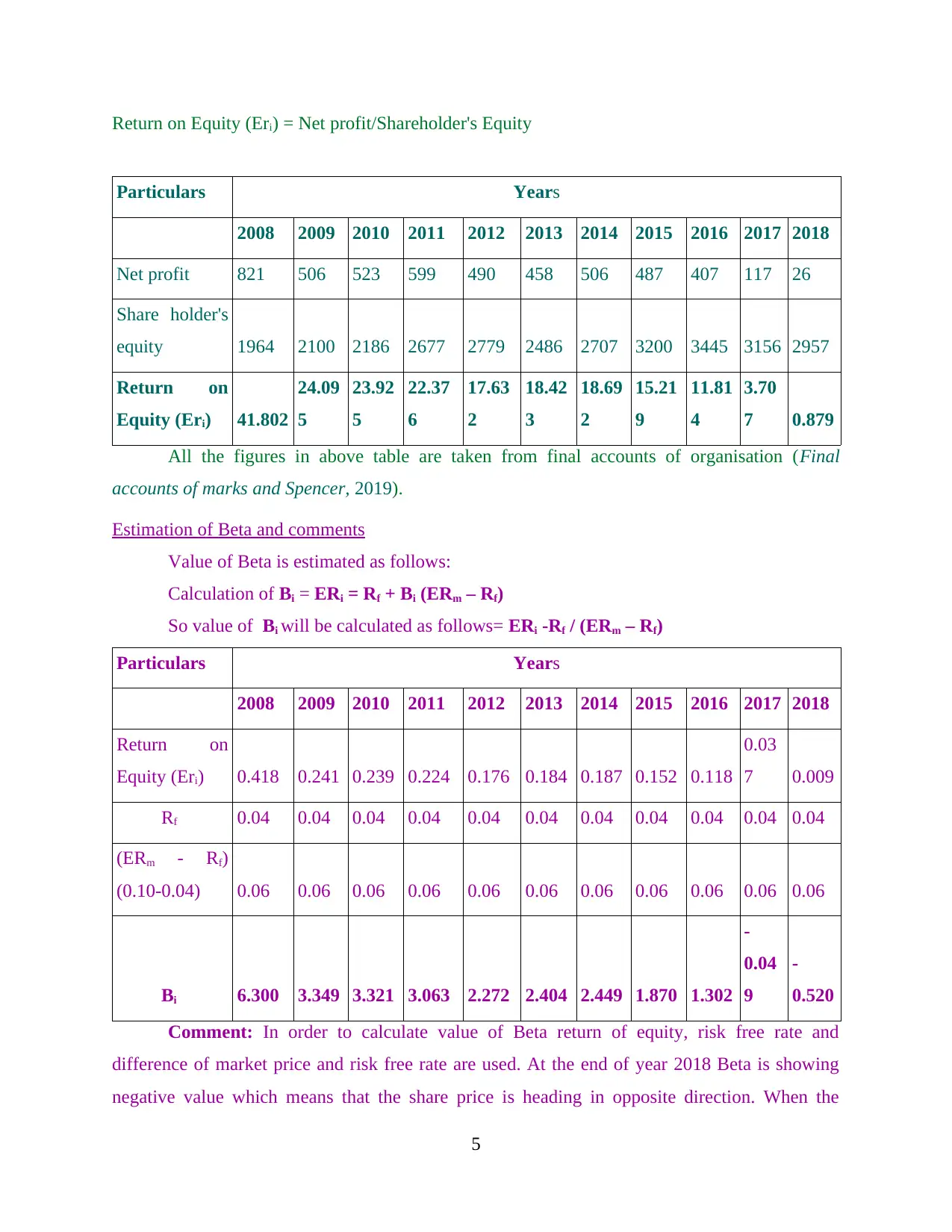

Return on Equity (Eri) = Net profit/Shareholder's Equity

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Net profit 821 506 523 599 490 458 506 487 407 117 26

Share holder's

equity 1964 2100 2186 2677 2779 2486 2707 3200 3445 3156 2957

Return on

Equity (Eri) 41.802

24.09

5

23.92

5

22.37

6

17.63

2

18.42

3

18.69

2

15.21

9

11.81

4

3.70

7 0.879

All the figures in above table are taken from final accounts of organisation (Final

accounts of marks and Spencer, 2019).

Estimation of Beta and comments

Value of Beta is estimated as follows:

Calculation of Bi = ERi = Rf + Bi (ERm – Rf)

So value of Bi will be calculated as follows= ERi -Rf / (ERm – Rf)

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Return on

Equity (Eri) 0.418 0.241 0.239 0.224 0.176 0.184 0.187 0.152 0.118

0.03

7 0.009

Rf 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04

(ERm - Rf)

(0.10-0.04) 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06

Bi 6.300 3.349 3.321 3.063 2.272 2.404 2.449 1.870 1.302

-

0.04

9

-

0.520

Comment: In order to calculate value of Beta return of equity, risk free rate and

difference of market price and risk free rate are used. At the end of year 2018 Beta is showing

negative value which means that the share price is heading in opposite direction. When the

5

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Net profit 821 506 523 599 490 458 506 487 407 117 26

Share holder's

equity 1964 2100 2186 2677 2779 2486 2707 3200 3445 3156 2957

Return on

Equity (Eri) 41.802

24.09

5

23.92

5

22.37

6

17.63

2

18.42

3

18.69

2

15.21

9

11.81

4

3.70

7 0.879

All the figures in above table are taken from final accounts of organisation (Final

accounts of marks and Spencer, 2019).

Estimation of Beta and comments

Value of Beta is estimated as follows:

Calculation of Bi = ERi = Rf + Bi (ERm – Rf)

So value of Bi will be calculated as follows= ERi -Rf / (ERm – Rf)

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Return on

Equity (Eri) 0.418 0.241 0.239 0.224 0.176 0.184 0.187 0.152 0.118

0.03

7 0.009

Rf 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04

(ERm - Rf)

(0.10-0.04) 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06

Bi 6.300 3.349 3.321 3.063 2.272 2.404 2.449 1.870 1.302

-

0.04

9

-

0.520

Comment: In order to calculate value of Beta return of equity, risk free rate and

difference of market price and risk free rate are used. At the end of year 2018 Beta is showing

negative value which means that the share price is heading in opposite direction. When the

5

market goes up then the investment goes down. This does not mean that negative beta shows

inherent risk for the investment.

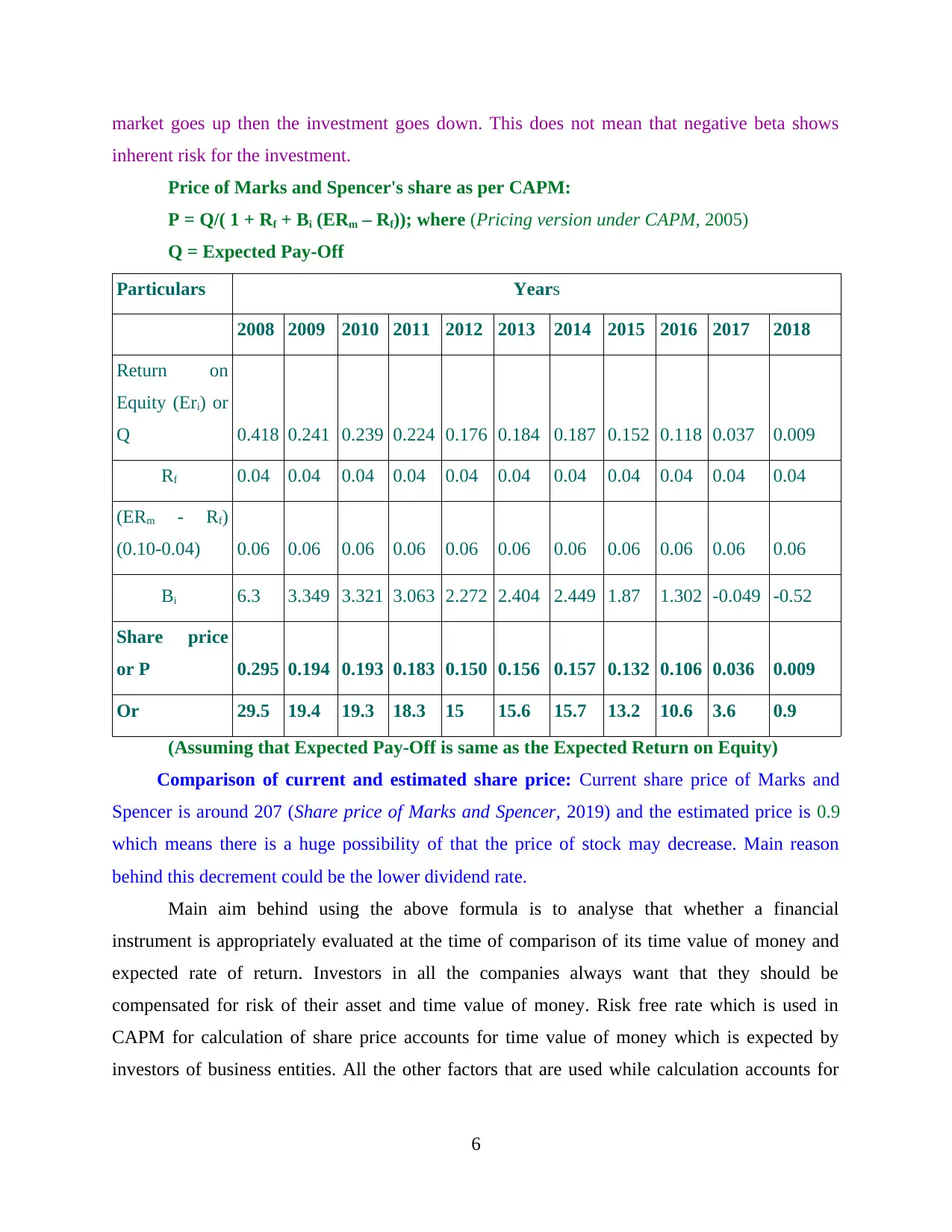

Price of Marks and Spencer's share as per CAPM:

P = Q/( 1 + Rf + Bi (ERm – Rf)); where (Pricing version under CAPM, 2005)

Q = Expected Pay-Off

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Return on

Equity (Eri) or

Q 0.418 0.241 0.239 0.224 0.176 0.184 0.187 0.152 0.118 0.037 0.009

Rf 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04

(ERm - Rf)

(0.10-0.04) 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06

Bi 6.3 3.349 3.321 3.063 2.272 2.404 2.449 1.87 1.302 -0.049 -0.52

Share price

or P 0.295 0.194 0.193 0.183 0.150 0.156 0.157 0.132 0.106 0.036 0.009

Or 29.5 19.4 19.3 18.3 15 15.6 15.7 13.2 10.6 3.6 0.9

(Assuming that Expected Pay-Off is same as the Expected Return on Equity)

Comparison of current and estimated share price: Current share price of Marks and

Spencer is around 207 (Share price of Marks and Spencer, 2019) and the estimated price is 0.9

which means there is a huge possibility of that the price of stock may decrease. Main reason

behind this decrement could be the lower dividend rate.

Main aim behind using the above formula is to analyse that whether a financial

instrument is appropriately evaluated at the time of comparison of its time value of money and

expected rate of return. Investors in all the companies always want that they should be

compensated for risk of their asset and time value of money. Risk free rate which is used in

CAPM for calculation of share price accounts for time value of money which is expected by

investors of business entities. All the other factors that are used while calculation accounts for

6

inherent risk for the investment.

Price of Marks and Spencer's share as per CAPM:

P = Q/( 1 + Rf + Bi (ERm – Rf)); where (Pricing version under CAPM, 2005)

Q = Expected Pay-Off

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Return on

Equity (Eri) or

Q 0.418 0.241 0.239 0.224 0.176 0.184 0.187 0.152 0.118 0.037 0.009

Rf 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04 0.04

(ERm - Rf)

(0.10-0.04) 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06 0.06

Bi 6.3 3.349 3.321 3.063 2.272 2.404 2.449 1.87 1.302 -0.049 -0.52

Share price

or P 0.295 0.194 0.193 0.183 0.150 0.156 0.157 0.132 0.106 0.036 0.009

Or 29.5 19.4 19.3 18.3 15 15.6 15.7 13.2 10.6 3.6 0.9

(Assuming that Expected Pay-Off is same as the Expected Return on Equity)

Comparison of current and estimated share price: Current share price of Marks and

Spencer is around 207 (Share price of Marks and Spencer, 2019) and the estimated price is 0.9

which means there is a huge possibility of that the price of stock may decrease. Main reason

behind this decrement could be the lower dividend rate.

Main aim behind using the above formula is to analyse that whether a financial

instrument is appropriately evaluated at the time of comparison of its time value of money and

expected rate of return. Investors in all the companies always want that they should be

compensated for risk of their asset and time value of money. Risk free rate which is used in

CAPM for calculation of share price accounts for time value of money which is expected by

investors of business entities. All the other factors that are used while calculation accounts for

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

additional risk taken by the person who invested money within the organisation (Bussin and Van

Rooy, 2014).

There are various assumptions in CAPM model which are as follows:

One of the assumptions is that it should not be hold in reality but still it is used widely

due to its simplicity in calculation and also helps to make comparison of alternatives to

invest money in different options.

With the help of this formula assumes that risk involved in an investment could be

measured with the help of volatility of price. Movement of price in both the directions do

not carry equal risk factor.

This method also assumes that the rate for risk free factor will always remain constant for

the whole discounting period of time.

The portfolio which is used to analyse market risk premium is only a value which is

based upon theory and it is not a stock which could be bought.

The most contradictory assumption regarding CAPM model is that with the help of it

future cash flows could be forecasted with the help of discounting process. If the future

rate of return of a financial instrument could be estimated by an investor then CAPM is

not necessary for same purpose.

Limitations of Capital Asset Pricing Model:

There is no transaction cost in CAPM method because individuals are required to pay

trading fee and bid aske spread.

There are borrowing limitations for investor so they cannot borrow or lend unlimited

amount.

In CAPM model all the assets are divisible because of it is extended to include real estate

and other large assets then it is not a sensible decision.

In CAPM model investors have homogeneous expectations because they always try to

select overpriced or under-priced stock (Cohen, Naoum and Vlismas, 2014).

In this model investors are utility maximisers so they have right to make changes in their

investments.

Large traders can change prices for illiquid assets whenever they want as they are treated

as price takers in CAPM method.

7

Rooy, 2014).

There are various assumptions in CAPM model which are as follows:

One of the assumptions is that it should not be hold in reality but still it is used widely

due to its simplicity in calculation and also helps to make comparison of alternatives to

invest money in different options.

With the help of this formula assumes that risk involved in an investment could be

measured with the help of volatility of price. Movement of price in both the directions do

not carry equal risk factor.

This method also assumes that the rate for risk free factor will always remain constant for

the whole discounting period of time.

The portfolio which is used to analyse market risk premium is only a value which is

based upon theory and it is not a stock which could be bought.

The most contradictory assumption regarding CAPM model is that with the help of it

future cash flows could be forecasted with the help of discounting process. If the future

rate of return of a financial instrument could be estimated by an investor then CAPM is

not necessary for same purpose.

Limitations of Capital Asset Pricing Model:

There is no transaction cost in CAPM method because individuals are required to pay

trading fee and bid aske spread.

There are borrowing limitations for investor so they cannot borrow or lend unlimited

amount.

In CAPM model all the assets are divisible because of it is extended to include real estate

and other large assets then it is not a sensible decision.

In CAPM model investors have homogeneous expectations because they always try to

select overpriced or under-priced stock (Cohen, Naoum and Vlismas, 2014).

In this model investors are utility maximisers so they have right to make changes in their

investments.

Large traders can change prices for illiquid assets whenever they want as they are treated

as price takers in CAPM method.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

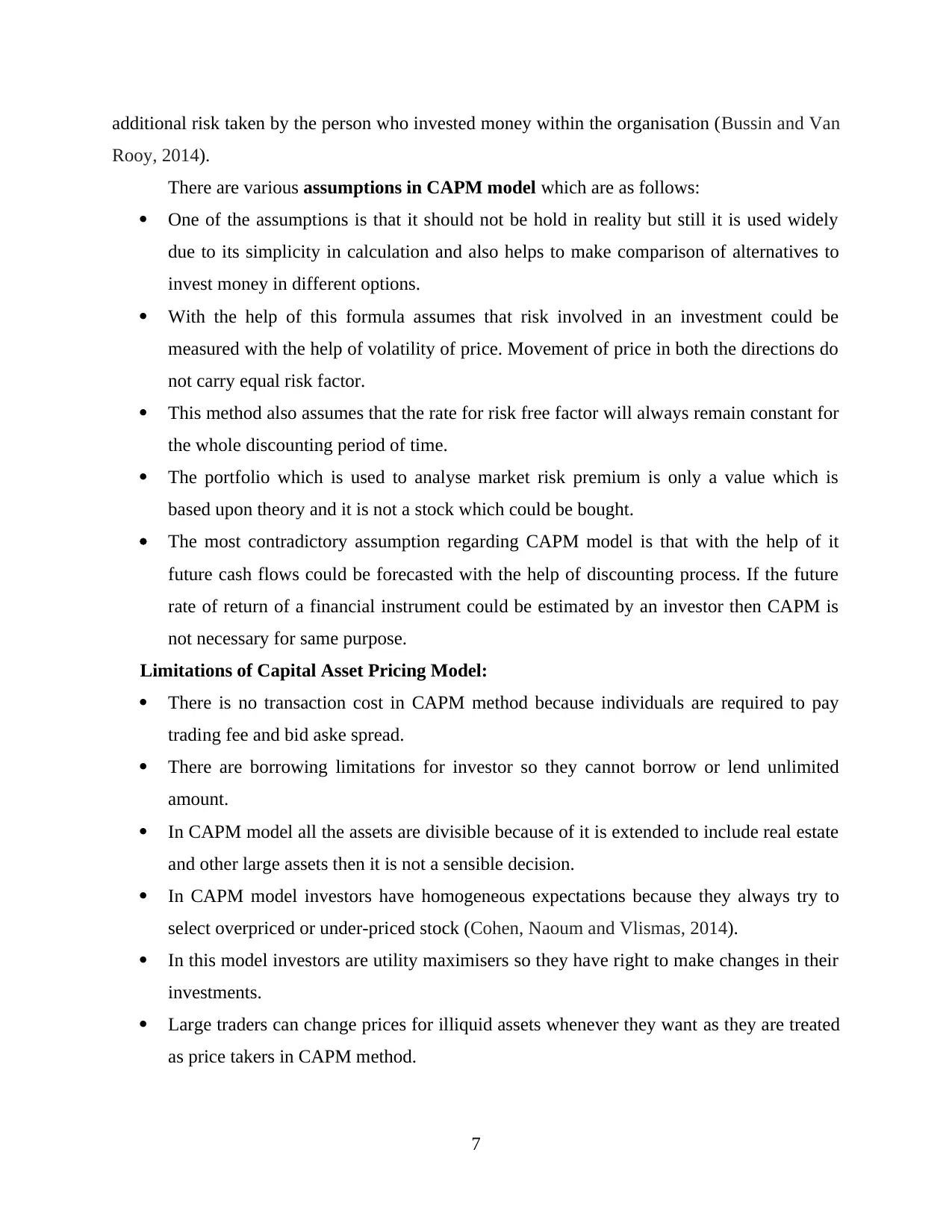

Evaluation of DVM along with its assumptions and limitations and Estimation of price using

DVM

DVM (Dividend Valuation Method): In this method current share price of the company

is determined with the help of future dividends and discounted at the required rate of return of

investor (Dividend of Marks and Spencer, 2018).

Formula : P0 = d / ke

P0 = The ex dividend market price of shares bought by investor.

d = Constant dividend of share

ke = cost of equity

In order to calculate cost of equity the formula can be arranged as follows:

ke = d / P0

This method is mainly used to calculate cost of equity.

P0 = d / ke

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Dividend 22.5 17.8 15 17 17 17 17 18 23.3 18.7 18.7

Cost of equity 0.071

-

0.161

-

0.113 0.179 0.045 0.037 0.031 0.103 0.364

-

0.12

8 0.066

DVM

316.90

1

-

110.5

59

-

132.7

43

94.97

2

377.7

78

459.4

59

548.3

87

174.7

57

64.01

1

-

146.

094

283.3

33

Calculation of cost of equity: DPS/ MPS +r (Growth rate)

Year

Dividend

per share

Dividend growth rate

(r) MPS Cost of equity

2008 22.5 0 316 0.071

2009 17.8 -0.2088888889 372 -0.161

2010 15 -0.1573033708 339 -0.113

8

DVM

DVM (Dividend Valuation Method): In this method current share price of the company

is determined with the help of future dividends and discounted at the required rate of return of

investor (Dividend of Marks and Spencer, 2018).

Formula : P0 = d / ke

P0 = The ex dividend market price of shares bought by investor.

d = Constant dividend of share

ke = cost of equity

In order to calculate cost of equity the formula can be arranged as follows:

ke = d / P0

This method is mainly used to calculate cost of equity.

P0 = d / ke

Particulars Years

2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Dividend 22.5 17.8 15 17 17 17 17 18 23.3 18.7 18.7

Cost of equity 0.071

-

0.161

-

0.113 0.179 0.045 0.037 0.031 0.103 0.364

-

0.12

8 0.066

DVM

316.90

1

-

110.5

59

-

132.7

43

94.97

2

377.7

78

459.4

59

548.3

87

174.7

57

64.01

1

-

146.

094

283.3

33

Calculation of cost of equity: DPS/ MPS +r (Growth rate)

Year

Dividend

per share

Dividend growth rate

(r) MPS Cost of equity

2008 22.5 0 316 0.071

2009 17.8 -0.2088888889 372 -0.161

2010 15 -0.1573033708 339 -0.113

8

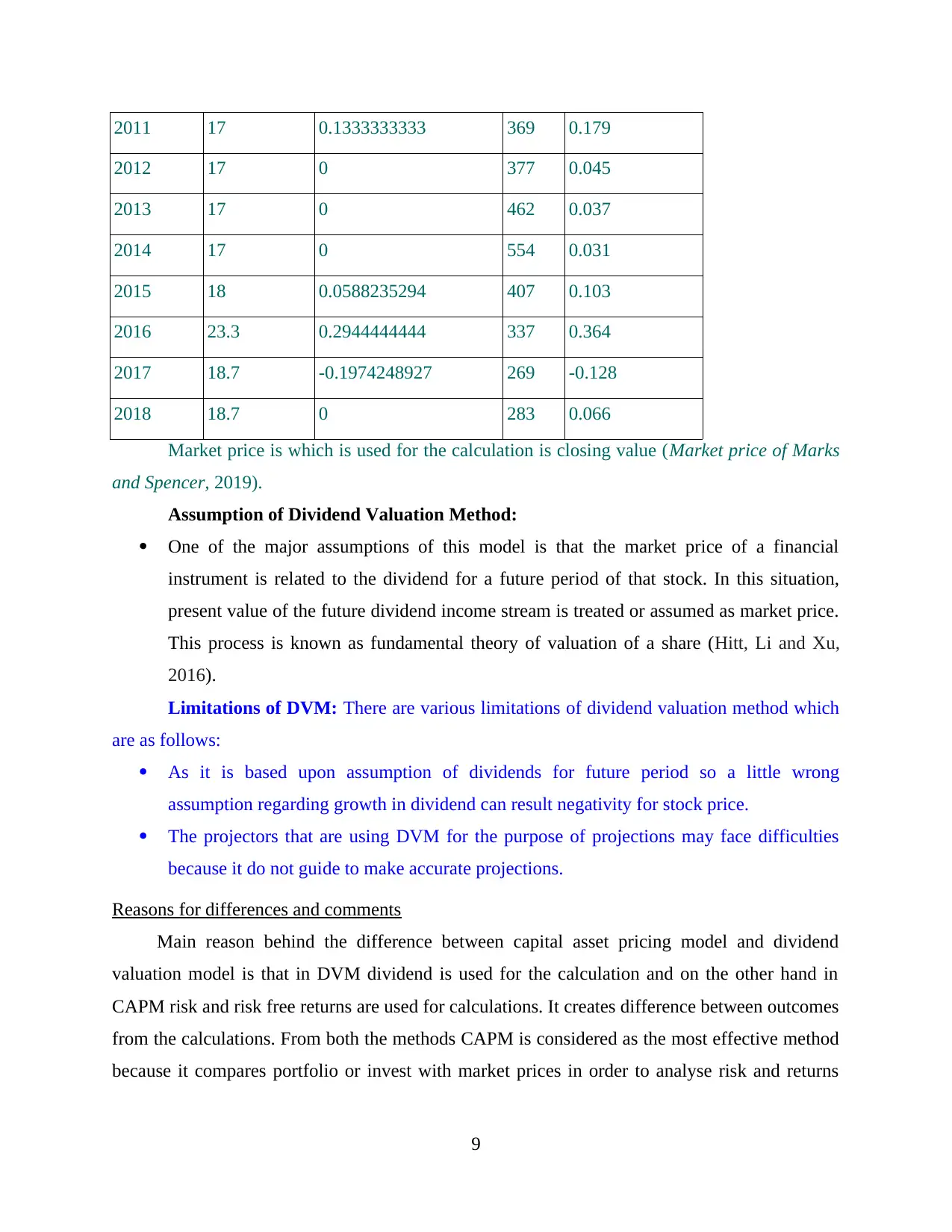

2011 17 0.1333333333 369 0.179

2012 17 0 377 0.045

2013 17 0 462 0.037

2014 17 0 554 0.031

2015 18 0.0588235294 407 0.103

2016 23.3 0.2944444444 337 0.364

2017 18.7 -0.1974248927 269 -0.128

2018 18.7 0 283 0.066

Market price is which is used for the calculation is closing value (Market price of Marks

and Spencer, 2019).

Assumption of Dividend Valuation Method:

One of the major assumptions of this model is that the market price of a financial

instrument is related to the dividend for a future period of that stock. In this situation,

present value of the future dividend income stream is treated or assumed as market price.

This process is known as fundamental theory of valuation of a share (Hitt, Li and Xu,

2016).

Limitations of DVM: There are various limitations of dividend valuation method which

are as follows:

As it is based upon assumption of dividends for future period so a little wrong

assumption regarding growth in dividend can result negativity for stock price.

The projectors that are using DVM for the purpose of projections may face difficulties

because it do not guide to make accurate projections.

Reasons for differences and comments

Main reason behind the difference between capital asset pricing model and dividend

valuation model is that in DVM dividend is used for the calculation and on the other hand in

CAPM risk and risk free returns are used for calculations. It creates difference between outcomes

from the calculations. From both the methods CAPM is considered as the most effective method

because it compares portfolio or invest with market prices in order to analyse risk and returns

9

2012 17 0 377 0.045

2013 17 0 462 0.037

2014 17 0 554 0.031

2015 18 0.0588235294 407 0.103

2016 23.3 0.2944444444 337 0.364

2017 18.7 -0.1974248927 269 -0.128

2018 18.7 0 283 0.066

Market price is which is used for the calculation is closing value (Market price of Marks

and Spencer, 2019).

Assumption of Dividend Valuation Method:

One of the major assumptions of this model is that the market price of a financial

instrument is related to the dividend for a future period of that stock. In this situation,

present value of the future dividend income stream is treated or assumed as market price.

This process is known as fundamental theory of valuation of a share (Hitt, Li and Xu,

2016).

Limitations of DVM: There are various limitations of dividend valuation method which

are as follows:

As it is based upon assumption of dividends for future period so a little wrong

assumption regarding growth in dividend can result negativity for stock price.

The projectors that are using DVM for the purpose of projections may face difficulties

because it do not guide to make accurate projections.

Reasons for differences and comments

Main reason behind the difference between capital asset pricing model and dividend

valuation model is that in DVM dividend is used for the calculation and on the other hand in

CAPM risk and risk free returns are used for calculations. It creates difference between outcomes

from the calculations. From both the methods CAPM is considered as the most effective method

because it compares portfolio or invest with market prices in order to analyse risk and returns

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

from the same. On the other hand, DVM method is considered as less effective method for

calculation of share price because it takes dividend in to consideration (Lake, 2018).

PART 2

Evaluation of company’s strategy to invest in China in same sector and correlation and co-

efficient between China and the UK

Marks and Spencer is a retail sector company which is planning to expand its business in

China in retail sector for the purpose of capturing large market share. While expansion it is very

important for managers of organisation are required to formulate strategy so that monetary

resources can be invested appropriately. For this purpose various factors are required to be

focused which includes modes to enter in Chinese market, pricing strategies of products, market

analysis etc. Correlation coefficient between china and UK is 0.962.

There are various options are available to enter in Chinese market all of them are as

follows:

Exporting: It is considered as the easiest mode of making investment in a new country or

expanding the business. Most of the business entities use this option to enter in a new market. It

is the process of selling products and services in foreign market which are sourced from the hoe

country. Marks and Spencer can use this technique to enter in Chinese market or make

investment in it. In this option company can export its products and services in China and

generate high revenues and profits. Main advantage of exporting is that the enterprise is do not

required to face the cost of establishing business in a new nation. With the help of it Marks and

Spencer can get a market to sale its products in China.

Licensing and franchising: It is another option which can help Marks and Spencer to

make investment in China. In this type of business expansion model an organisation gives

license or franchise to another organisation to execute operational activities by taking its name.

With the help of it Marks and Spencer can enter to the Chinese market easily and generate higher

profits. In franchising and licensing companies are not required to bear the cost of market

research, establishment, hiring new employees etc. It could be selected by the enterprise to invest

money in China for the purpose of generating higher returns (Linnerooth-Bayer and Mechler,

2015).

10

calculation of share price because it takes dividend in to consideration (Lake, 2018).

PART 2

Evaluation of company’s strategy to invest in China in same sector and correlation and co-

efficient between China and the UK

Marks and Spencer is a retail sector company which is planning to expand its business in

China in retail sector for the purpose of capturing large market share. While expansion it is very

important for managers of organisation are required to formulate strategy so that monetary

resources can be invested appropriately. For this purpose various factors are required to be

focused which includes modes to enter in Chinese market, pricing strategies of products, market

analysis etc. Correlation coefficient between china and UK is 0.962.

There are various options are available to enter in Chinese market all of them are as

follows:

Exporting: It is considered as the easiest mode of making investment in a new country or

expanding the business. Most of the business entities use this option to enter in a new market. It

is the process of selling products and services in foreign market which are sourced from the hoe

country. Marks and Spencer can use this technique to enter in Chinese market or make

investment in it. In this option company can export its products and services in China and

generate high revenues and profits. Main advantage of exporting is that the enterprise is do not

required to face the cost of establishing business in a new nation. With the help of it Marks and

Spencer can get a market to sale its products in China.

Licensing and franchising: It is another option which can help Marks and Spencer to

make investment in China. In this type of business expansion model an organisation gives

license or franchise to another organisation to execute operational activities by taking its name.

With the help of it Marks and Spencer can enter to the Chinese market easily and generate higher

profits. In franchising and licensing companies are not required to bear the cost of market

research, establishment, hiring new employees etc. It could be selected by the enterprise to invest

money in China for the purpose of generating higher returns (Linnerooth-Bayer and Mechler,

2015).

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Partnership and strategic alliance: One of the major options to invest in an international

market in which one organisation signs an agreement with another and both of them agree to

execute business together. It could be selected by Marks and Spencer to expand its business in

China and generate higher returns. In Chinese market the organisation can sign an agreement

with a well-established company which can help it to establish the business successfully in

China.

Acquisition: It is a method of business expansion in which one business entity buy

another one in order to establish its business in a new location. Marks and Spencer can use this

option to make investment in Chinese market for the purpose of acquiring higher returns.

From all the above described modes of entry Marks and Spencer should use acquisition

option as it can help the organisation to make investment in China and generate higher returns on

its monetary resources.

Different pricing strategies which could be selected by Marks and Spencer are as follows:

Penetration pricing: In this type of pricing strategy business entities set low prices for

all their products at initial level in order to attract large number of customers. When the company

attain success while establishing the business then prices of products is increased by

organisation. This option could be selected by Marks and Spencer to make investment in China

as it can help to attract large number of clients towards the enterprise (Martínez‐Ferrero and

Frías‐Aceituno, 2015).

Premium pricing: In this pricing strategy business entities set high prices for the

products due to very good quality of the same. It helps to deal with competition in the market

and attain higher level of competitive advantage. Marks and Spencer can use this strategy to

make investment in Chinese Market by setting high rates for all its products and grab attention

for all the customers.

Economic pricing: While using this pricing strategy organisations set low prices for all

their products so that business could be established in market appropriately. In order to make

investment in Chinese market Marks and Spencer can use economic pricing strategy by setting

very low prices for its products so that the business can be established in China successfully.

From all the above described pricing strategies Marks and Spencer should use penetration

pricing strategy because it can help it to establish its business in China by attracting large number

11

market in which one organisation signs an agreement with another and both of them agree to

execute business together. It could be selected by Marks and Spencer to expand its business in

China and generate higher returns. In Chinese market the organisation can sign an agreement

with a well-established company which can help it to establish the business successfully in

China.

Acquisition: It is a method of business expansion in which one business entity buy

another one in order to establish its business in a new location. Marks and Spencer can use this

option to make investment in Chinese market for the purpose of acquiring higher returns.

From all the above described modes of entry Marks and Spencer should use acquisition

option as it can help the organisation to make investment in China and generate higher returns on

its monetary resources.

Different pricing strategies which could be selected by Marks and Spencer are as follows:

Penetration pricing: In this type of pricing strategy business entities set low prices for

all their products at initial level in order to attract large number of customers. When the company

attain success while establishing the business then prices of products is increased by

organisation. This option could be selected by Marks and Spencer to make investment in China

as it can help to attract large number of clients towards the enterprise (Martínez‐Ferrero and

Frías‐Aceituno, 2015).

Premium pricing: In this pricing strategy business entities set high prices for the

products due to very good quality of the same. It helps to deal with competition in the market

and attain higher level of competitive advantage. Marks and Spencer can use this strategy to

make investment in Chinese Market by setting high rates for all its products and grab attention

for all the customers.

Economic pricing: While using this pricing strategy organisations set low prices for all

their products so that business could be established in market appropriately. In order to make

investment in Chinese market Marks and Spencer can use economic pricing strategy by setting

very low prices for its products so that the business can be established in China successfully.

From all the above described pricing strategies Marks and Spencer should use penetration

pricing strategy because it can help it to establish its business in China by attracting large number

11

of customers. It can help to acquire higher returns on the investments that are going to be made

by the company in China (Morris and Tronnes, 2018).

Market analysis: In order to make investment in Chinese market it is very important for

Marks and Spencer to conduct a market analysis so that preferences, tastes, requirements and

demand of customers can be analysed. With the help of it Marks and Spencer can meet the

expectations of customers appropriately. It can guide managers to set that prices for its products

that clients are willing buy.

Potential challenges for managers when investing in China

There are various challenges which could be faced by managers of Marks and Spencer

while expanding business in China. All these challenges are discussed below in detail:

Cultural: While making investment in China Marks and Spencer may have to face

challenges regarding cultural because there is a huge difference between culture of UK and

China. In order to attain success in Chinese market it is very important for the organisation to

gather information regarding culture of the new location where business is going to be expanded.

It can help to meet expectations of customers and attract them to buy products.

Environmental: While making investment in China managers of Marks and Spencer are

required to analyse environmental factors and required to make sure that its business operations

are not affecting society or environment of China. It can help to reduce possibility of

governmental interferences in business activities. If operational activities of the company are

affecting the environment of the new location then it can affect the business expansion.

Legal: All the countries are having their own rules and regulations for different business

entities. All of them are required to follow them in order to run the operational as well as

executional activities appropriately. Marks and Spencer is also have to comply with all the

governmental policies of China while expanding business there it can help to acquire higher

returns on all the investments that are made by the company.

Standard: For all the organisations it is very important to comply with standards that are

established by legal authorities for financial reporting. This could be one of the major challenge

for Marks and Spencer while making investment in Chinese market because managers are

required to learn about standards of new country. It can take time and affect the goal of

organisation to generate high returns on its funds (Patel and Chrisman, 2014).

12

by the company in China (Morris and Tronnes, 2018).

Market analysis: In order to make investment in Chinese market it is very important for

Marks and Spencer to conduct a market analysis so that preferences, tastes, requirements and

demand of customers can be analysed. With the help of it Marks and Spencer can meet the

expectations of customers appropriately. It can guide managers to set that prices for its products

that clients are willing buy.

Potential challenges for managers when investing in China

There are various challenges which could be faced by managers of Marks and Spencer

while expanding business in China. All these challenges are discussed below in detail:

Cultural: While making investment in China Marks and Spencer may have to face

challenges regarding cultural because there is a huge difference between culture of UK and

China. In order to attain success in Chinese market it is very important for the organisation to

gather information regarding culture of the new location where business is going to be expanded.

It can help to meet expectations of customers and attract them to buy products.

Environmental: While making investment in China managers of Marks and Spencer are

required to analyse environmental factors and required to make sure that its business operations

are not affecting society or environment of China. It can help to reduce possibility of

governmental interferences in business activities. If operational activities of the company are

affecting the environment of the new location then it can affect the business expansion.

Legal: All the countries are having their own rules and regulations for different business

entities. All of them are required to follow them in order to run the operational as well as

executional activities appropriately. Marks and Spencer is also have to comply with all the

governmental policies of China while expanding business there it can help to acquire higher

returns on all the investments that are made by the company.

Standard: For all the organisations it is very important to comply with standards that are

established by legal authorities for financial reporting. This could be one of the major challenge

for Marks and Spencer while making investment in Chinese market because managers are

required to learn about standards of new country. It can take time and affect the goal of

organisation to generate high returns on its funds (Patel and Chrisman, 2014).

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.