Auditing Report: Audit Plan for Murray River Organics Group Limited

VerifiedAdded on 2020/12/18

|12

|3763

|300

Report

AI Summary

This report provides an in-depth analysis of the auditing process for Murray River Organics Group Limited, a company involved in manufacturing and distributing organic food products. It begins with an executive summary and introduction outlining the importance of auditing in ensuring the accuracy and reliability of financial statements. The main body of the report delves into providing an understanding of the client, including its legal, ethical, and professional aspects relevant to the audit process. It identifies significant accounts at risk of material misstatement, such as expenditure, budgets, equity, remuneration, and inventory accounts, and discusses the auditing principles and practices used to gather evidence. Furthermore, the report covers the planning materiality level, including choosing appropriate benchmarks and considering various factors to set a tolerable misstatement level. Overall, the report aims to develop an audit plan, assess audit risk, and provide insights into the auditing of financial reports, ensuring stakeholder trust and regulatory compliance for the selected company.

Auditing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................3

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

a. Providing an understanding about the client...........................................................................1

b. Significant accounts which are at risk of being material misstated........................................3

c. Planning materiality level........................................................................................................4

d. Audit risk assessment..............................................................................................................6

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................2

EXECUTIVE SUMMARY.............................................................................................................3

INTRODUCTION...........................................................................................................................1

MAIN BODY...................................................................................................................................1

a. Providing an understanding about the client...........................................................................1

b. Significant accounts which are at risk of being material misstated........................................3

c. Planning materiality level........................................................................................................4

d. Audit risk assessment..............................................................................................................6

CONCLUSION................................................................................................................................1

REFERENCES................................................................................................................................2

EXECUTIVE SUMMARY

This project report is summarises as Auditing is a process of investigation and checking

the accuracy and reliability of financial statements of an organisation. In this project report,

Murray River Organics Group Limited is selected to develop an understanding about the concept

of auditing. In this project report, overview of the company is discussed. Numerous significant

accounts which are at risk are discussed along with ascertainment of materiality level. Various

issues regarding material misstatement are also discussed.

This project report is summarises as Auditing is a process of investigation and checking

the accuracy and reliability of financial statements of an organisation. In this project report,

Murray River Organics Group Limited is selected to develop an understanding about the concept

of auditing. In this project report, overview of the company is discussed. Numerous significant

accounts which are at risk are discussed along with ascertainment of materiality level. Various

issues regarding material misstatement are also discussed.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Auditing is a process of investigation and checking the accuracy and reliability of

financial statements of an organisation. The concept of auditing is discussed by selecting an

organisation named as Murray River Organics Group Limited. Main aim of this project report is

to develop an understanding about audit plan for the conduct and scope of audit. In this project

report, various accounts at risk are mentioned which are typically misstated. Audit risk

assessment is conducted for accounts which are misstated in order to set a planning materiality

level. Basic concepts and principle are used to ascertain audit opinion of an organisation which

can help in develop judgements about financial reports. Several audit tools are used in this

project to collect evidence about the chosen company which is operating in organic products

distribution is also covered in this report. (Alles and et. al., 2018).

MAIN BODY

a. Providing an understanding about the client

Murray River Organics Group Limited is a manufacturing and distributing company

which sells organic and natural food products mainly in Australia. This company gains

competitive advantage in food industry as they deals in manufacturing and sells organic food

products. This company is a large scale organisation which is listed on Australian stock

exchange. In order to gain trust of their stakeholders and fulfil compliance of authorities,

management of this company conducts and external audit of their annual financial statements. As

an auditor of this company, audit fee of 170000 dollars are to be received. To develop an audit

plan for this company various audit standards are considered and some of them are quality

control for financial report, audit documentation, materiality and many more (Arens, 2012).

Auditing and assurance services are the independent investigation typically conducted by

external auditors in order to not only check the accuracy of financial statements but to also to

improve information so that decision makers can be more informed. The main reason for the

existence of societal demand of auditing is to protect the interest of investors and other

stakeholders. This reason also applies on the selected company. In order to better understand

auditing of Murray River Organics Group Limited, it is important to review their current

environmental aspects in which auditors of this company operate. Some of these aspects along

with their understandings are discussed below:

1

Auditing is a process of investigation and checking the accuracy and reliability of

financial statements of an organisation. The concept of auditing is discussed by selecting an

organisation named as Murray River Organics Group Limited. Main aim of this project report is

to develop an understanding about audit plan for the conduct and scope of audit. In this project

report, various accounts at risk are mentioned which are typically misstated. Audit risk

assessment is conducted for accounts which are misstated in order to set a planning materiality

level. Basic concepts and principle are used to ascertain audit opinion of an organisation which

can help in develop judgements about financial reports. Several audit tools are used in this

project to collect evidence about the chosen company which is operating in organic products

distribution is also covered in this report. (Alles and et. al., 2018).

MAIN BODY

a. Providing an understanding about the client

Murray River Organics Group Limited is a manufacturing and distributing company

which sells organic and natural food products mainly in Australia. This company gains

competitive advantage in food industry as they deals in manufacturing and sells organic food

products. This company is a large scale organisation which is listed on Australian stock

exchange. In order to gain trust of their stakeholders and fulfil compliance of authorities,

management of this company conducts and external audit of their annual financial statements. As

an auditor of this company, audit fee of 170000 dollars are to be received. To develop an audit

plan for this company various audit standards are considered and some of them are quality

control for financial report, audit documentation, materiality and many more (Arens, 2012).

Auditing and assurance services are the independent investigation typically conducted by

external auditors in order to not only check the accuracy of financial statements but to also to

improve information so that decision makers can be more informed. The main reason for the

existence of societal demand of auditing is to protect the interest of investors and other

stakeholders. This reason also applies on the selected company. In order to better understand

auditing of Murray River Organics Group Limited, it is important to review their current

environmental aspects in which auditors of this company operate. Some of these aspects along

with their understandings are discussed below:

1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Legal aspect - Murray River Organics Group Limited is a large scale company which

has fulfil compulsory external auditing. For the year 2017, auditor group of this company is

Deloitte Limited which is a large network of professional services. Legal aspects of current

environment which has to face by auditors are financial market development, corporate

ownership structure and corporate policies. Deloitte Limited has to follow all legal requirements

of independent auditors mentioned by the government of Australia in statute of Auditor General

Act 1997. Rules and regulations of this act has to follow by all auditors which directly influences

working of Murray River Organics Group Limited.

Ethical aspect – Auditors are the independent party which has various ethics to be

followed so that issue of corruption and misstatement can be evaded. These ethical aspects are

referred as code of ethics which are stated by Institute of Internal auditors Australia. Some of

these ethics can include integrity, professional care and in-dependency. Code of ethics is

necessary and appropriate for the profession of internal and external auditing, as it is founded on

the trust placed in its objective assurance. Ethics which limits external auditors are described as

rules of conduct. Basic and most important principles of these ethical environment which has to

follow by Deloitte are integrity, objectivity, confidentiality and competency (Furnham, 2015).

Professional aspect – This aspect deals with code of professionalism which has to

followed by all the auditors of Australia. While conducting audit of Murray River Organics

Group Limited, it is important for auditors to follow all their duties mentioned in code of

professionalism. The main aim of this aspect is to maintain a uniformity in the process of

auditing.

Murray River Organics Group Limited is large scale company, which has to conduct

audit. This company is considered as a client and an audit plan is required to be developed. In

order to conduct audit of any company, it is important to understand functions and operations of

a company identified above along with current environment for auditors. The concept of audit is

important to society as it helps to build trust of stakeholders on a company. From the above

information about the client it can be said that this is a public limited company which has to

conduct a external auditor which is independent. This company deals in various products and

earns reasonable amount of profit which is needed to be audited using all standards and

principles of auditing. While conducting audit of this organisation, all above aspects of auditor's

environment should be consider. Auditing is not only a process of investigating but it also

2

has fulfil compulsory external auditing. For the year 2017, auditor group of this company is

Deloitte Limited which is a large network of professional services. Legal aspects of current

environment which has to face by auditors are financial market development, corporate

ownership structure and corporate policies. Deloitte Limited has to follow all legal requirements

of independent auditors mentioned by the government of Australia in statute of Auditor General

Act 1997. Rules and regulations of this act has to follow by all auditors which directly influences

working of Murray River Organics Group Limited.

Ethical aspect – Auditors are the independent party which has various ethics to be

followed so that issue of corruption and misstatement can be evaded. These ethical aspects are

referred as code of ethics which are stated by Institute of Internal auditors Australia. Some of

these ethics can include integrity, professional care and in-dependency. Code of ethics is

necessary and appropriate for the profession of internal and external auditing, as it is founded on

the trust placed in its objective assurance. Ethics which limits external auditors are described as

rules of conduct. Basic and most important principles of these ethical environment which has to

follow by Deloitte are integrity, objectivity, confidentiality and competency (Furnham, 2015).

Professional aspect – This aspect deals with code of professionalism which has to

followed by all the auditors of Australia. While conducting audit of Murray River Organics

Group Limited, it is important for auditors to follow all their duties mentioned in code of

professionalism. The main aim of this aspect is to maintain a uniformity in the process of

auditing.

Murray River Organics Group Limited is large scale company, which has to conduct

audit. This company is considered as a client and an audit plan is required to be developed. In

order to conduct audit of any company, it is important to understand functions and operations of

a company identified above along with current environment for auditors. The concept of audit is

important to society as it helps to build trust of stakeholders on a company. From the above

information about the client it can be said that this is a public limited company which has to

conduct a external auditor which is independent. This company deals in various products and

earns reasonable amount of profit which is needed to be audited using all standards and

principles of auditing. While conducting audit of this organisation, all above aspects of auditor's

environment should be consider. Auditing is not only a process of investigating but it also

2

ensures to find out what are the major problems in the financial reports and statements of a

company (He, 2018).

b. Significant accounts which are at risk of being material misstated

Audit is a process in which independent auditors investigate and check the accuracy of

financial statements. The main aim of this process is to identify any account of the organisational

statements which are materially misstated. Material misstatement is a state where any account or

report of the company is misstated due to some reasons. These reasons can include mistakes,

omission or frauds. Risk of material misstatement is the risk that the financial statements of a

company is misstated to the material extend. This risk can be identified even before

commencement of the process of audit. There are two levels which can help in assessing the risk

of material misstatement. First is assertion level where nature of the risk is identified that is

inherent risk or control risk. Second is financial statement level where risk related to frauds are

identified by determining the possibility of fraud.

It is easy to collect evidence about material misstatement when risk is high. An auditor

like auditor of Murray River Organics Group Limited uses and follows various key auditing

principles, concepts and practices in order to gather evidence of material misstatement (Hope,

2012).

There are few accounts or reports or books which are at high risk of material

misstatement due to the nature of accounts, organisation or situations. Some of the accounts

which are observed to be at high risk of misstated are mentioned below along with their auditing

principles and practices which helps in gathering evidence of material mistreatment are:

Expenditure account – For a company which deals in various products and services it is

crucial to prepare an accurate and reliable expenditure account as all products requires different

expenditures and raw material due to which classifying expenses is hard to do. This account is

observed to be material misstated in the case of Murray River Organics Group Limited. As

auditor report of this company has raised issue which states that it is hard to ascertain from

income statements to identify which expenses are capitalised. In order to gather evidence about

this information, auditor decided to use audit practice. According to this particular audit practice,

auditor obtains understanding about key controls and processes that management use. This

account deals with all the expenditures which are incurred by the organisation in an accounting

year (Knechel, 2016).

3

company (He, 2018).

b. Significant accounts which are at risk of being material misstated

Audit is a process in which independent auditors investigate and check the accuracy of

financial statements. The main aim of this process is to identify any account of the organisational

statements which are materially misstated. Material misstatement is a state where any account or

report of the company is misstated due to some reasons. These reasons can include mistakes,

omission or frauds. Risk of material misstatement is the risk that the financial statements of a

company is misstated to the material extend. This risk can be identified even before

commencement of the process of audit. There are two levels which can help in assessing the risk

of material misstatement. First is assertion level where nature of the risk is identified that is

inherent risk or control risk. Second is financial statement level where risk related to frauds are

identified by determining the possibility of fraud.

It is easy to collect evidence about material misstatement when risk is high. An auditor

like auditor of Murray River Organics Group Limited uses and follows various key auditing

principles, concepts and practices in order to gather evidence of material misstatement (Hope,

2012).

There are few accounts or reports or books which are at high risk of material

misstatement due to the nature of accounts, organisation or situations. Some of the accounts

which are observed to be at high risk of misstated are mentioned below along with their auditing

principles and practices which helps in gathering evidence of material mistreatment are:

Expenditure account – For a company which deals in various products and services it is

crucial to prepare an accurate and reliable expenditure account as all products requires different

expenditures and raw material due to which classifying expenses is hard to do. This account is

observed to be material misstated in the case of Murray River Organics Group Limited. As

auditor report of this company has raised issue which states that it is hard to ascertain from

income statements to identify which expenses are capitalised. In order to gather evidence about

this information, auditor decided to use audit practice. According to this particular audit practice,

auditor obtains understanding about key controls and processes that management use. This

account deals with all the expenditures which are incurred by the organisation in an accounting

year (Knechel, 2016).

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Budgets - Another account which is considered to be at high risk from material

misstatement is budgets. Budgets are the accounts which are prepared in order to forecast future

events. The reason behind the risk of material misstatement in case of budgets are uncertain

future. These budgets are prepared by using predictions and estimations due to which it has

highest chances that these accounts can be material misstated. From the annual reports of Murray

River Organics Group Limited, it has been observed that there is misstatement in the case of

forecasted sales and estimated yield. In order to collect information regarding this misstatement,

as an auditor management's methodology is evaluated and their model of forecasting is

ascertained.

Equity – This account deals with all the items of equity such as shareholder's fund,

issued capital and others. This account is at high risk of material misstatement as changes in

equity is directly proportional to issuance of new shares. According to the auditor's report of

Murray River Organics Group Limited, it has been ascertained that this account is misstated due

to pre IPO recognition. To handle this misstatement, auditor should obtain an understanding

about the structure of the group and their recognition patterns of equity.

Remuneration report – Another account is which is at high risk of material

misstatement is remuneration account or report as this account deals with human resource

department. All the salary or remuneration paid to employees are recorded in this report and due

to ample number of employees there are high chances of material misstatement. Auditor of this

company should follow principle of fair presentation in this case (Liu, 2014).

Inventory account – This account deals with stock related with raw material, work in

process or even warehoused goods. Murray River Organics Group Limited is a large scale

company which has several inventories and due to this chaos, inventory account is at risk of

material misstatement.

The above significant accounts which are at risk of material misstatement are related with

the selected company that is Murray River Organics Group Limited. As an auditor various

principles and procedures which should be followed are also discussed above along with

accounts (Louwers, 2015).

c. Planning materiality level

Materiality level is the maximum amount by which an auditor believe that financial

statement could be misstated. Setting a materiality level is often referred as materiality level

4

misstatement is budgets. Budgets are the accounts which are prepared in order to forecast future

events. The reason behind the risk of material misstatement in case of budgets are uncertain

future. These budgets are prepared by using predictions and estimations due to which it has

highest chances that these accounts can be material misstated. From the annual reports of Murray

River Organics Group Limited, it has been observed that there is misstatement in the case of

forecasted sales and estimated yield. In order to collect information regarding this misstatement,

as an auditor management's methodology is evaluated and their model of forecasting is

ascertained.

Equity – This account deals with all the items of equity such as shareholder's fund,

issued capital and others. This account is at high risk of material misstatement as changes in

equity is directly proportional to issuance of new shares. According to the auditor's report of

Murray River Organics Group Limited, it has been ascertained that this account is misstated due

to pre IPO recognition. To handle this misstatement, auditor should obtain an understanding

about the structure of the group and their recognition patterns of equity.

Remuneration report – Another account is which is at high risk of material

misstatement is remuneration account or report as this account deals with human resource

department. All the salary or remuneration paid to employees are recorded in this report and due

to ample number of employees there are high chances of material misstatement. Auditor of this

company should follow principle of fair presentation in this case (Liu, 2014).

Inventory account – This account deals with stock related with raw material, work in

process or even warehoused goods. Murray River Organics Group Limited is a large scale

company which has several inventories and due to this chaos, inventory account is at risk of

material misstatement.

The above significant accounts which are at risk of material misstatement are related with

the selected company that is Murray River Organics Group Limited. As an auditor various

principles and procedures which should be followed are also discussed above along with

accounts (Louwers, 2015).

c. Planning materiality level

Materiality level is the maximum amount by which an auditor believe that financial

statement could be misstated. Setting a materiality level is often referred as materiality level

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

planning. This misstatement can be a result of mistake, an unknown error, omission and fraud. In

order to set this materiality level it is important to consider various auditing standards and

principles so that auditor's can make informative decisions. This level can be ascertained by

choosing a single base like total revenues which are taken as a whole. After fixing the base,

amount of that base is multiplied by percentage factor which is usually determined as volume of

the base (Nigrini, 2012).

From the auditing standards it has been observed that, a general range of planning

materiality is between 50 to 70 percentage which is considered as tolerable misstatement. When

risk is high at the financial statement level a lower level of tolerable mistreatment will normally

result by using factor percent. There are various factors which should be considered by the

auditor while setting a materiality level and some of them are discussed below which will help in

setting planning materiality level of this company:

Choosing a benchmark – In order to ascertain the materiality level, it is important to

choose a benchmark which is also referred as base. Under the process of choosing a benchmark,

it is important to consider various factors such as nature of entity and the industry. These base

are chosen with the reference to the most concerned element of financial statements.

Appropriate benchmark – Base which is chosen to calculate materiality level should be

appropriate as it influences quality of audit. Examples of appropriate benchmarks which should

be used in the case of Murray River Organics Group Limited are profit before tax, total expenses,

gross profit, total equity and net assets. Auditors are required to use their professional judgement

to determine the appropriateness of the benchmark.

Use of multiple benchmarks – In order to ascertain materiality level of the organisations

it is important to determine accurate level. In order to achieve that two or more benchmarks are

use and than averages are taken. This methodology is used when there is an understanding or

predicting of high materiality misstatement (Vasarhelyi, 2012).

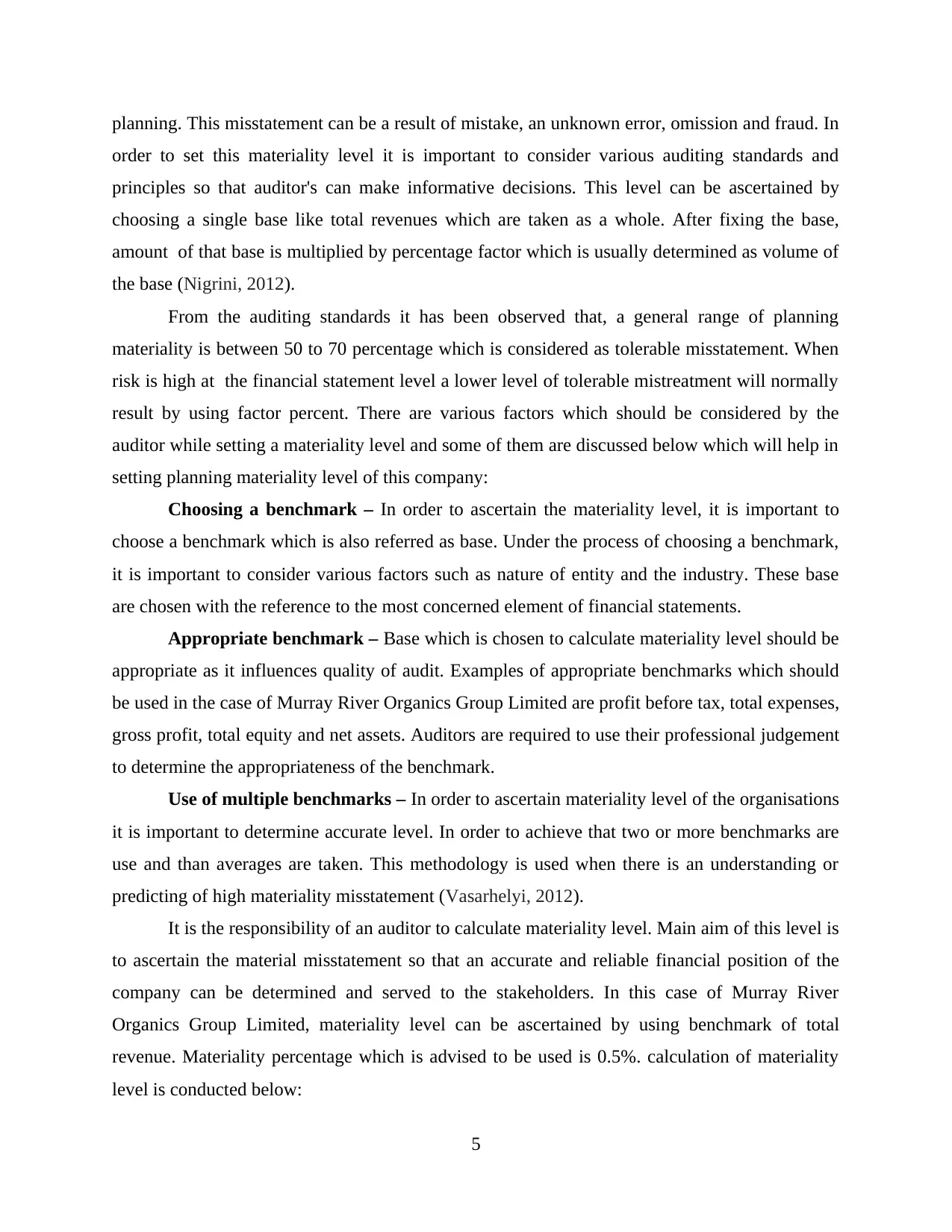

It is the responsibility of an auditor to calculate materiality level. Main aim of this level is

to ascertain the material misstatement so that an accurate and reliable financial position of the

company can be determined and served to the stakeholders. In this case of Murray River

Organics Group Limited, materiality level can be ascertained by using benchmark of total

revenue. Materiality percentage which is advised to be used is 0.5%. calculation of materiality

level is conducted below:

5

order to set this materiality level it is important to consider various auditing standards and

principles so that auditor's can make informative decisions. This level can be ascertained by

choosing a single base like total revenues which are taken as a whole. After fixing the base,

amount of that base is multiplied by percentage factor which is usually determined as volume of

the base (Nigrini, 2012).

From the auditing standards it has been observed that, a general range of planning

materiality is between 50 to 70 percentage which is considered as tolerable misstatement. When

risk is high at the financial statement level a lower level of tolerable mistreatment will normally

result by using factor percent. There are various factors which should be considered by the

auditor while setting a materiality level and some of them are discussed below which will help in

setting planning materiality level of this company:

Choosing a benchmark – In order to ascertain the materiality level, it is important to

choose a benchmark which is also referred as base. Under the process of choosing a benchmark,

it is important to consider various factors such as nature of entity and the industry. These base

are chosen with the reference to the most concerned element of financial statements.

Appropriate benchmark – Base which is chosen to calculate materiality level should be

appropriate as it influences quality of audit. Examples of appropriate benchmarks which should

be used in the case of Murray River Organics Group Limited are profit before tax, total expenses,

gross profit, total equity and net assets. Auditors are required to use their professional judgement

to determine the appropriateness of the benchmark.

Use of multiple benchmarks – In order to ascertain materiality level of the organisations

it is important to determine accurate level. In order to achieve that two or more benchmarks are

use and than averages are taken. This methodology is used when there is an understanding or

predicting of high materiality misstatement (Vasarhelyi, 2012).

It is the responsibility of an auditor to calculate materiality level. Main aim of this level is

to ascertain the material misstatement so that an accurate and reliable financial position of the

company can be determined and served to the stakeholders. In this case of Murray River

Organics Group Limited, materiality level can be ascertained by using benchmark of total

revenue. Materiality percentage which is advised to be used is 0.5%. calculation of materiality

level is conducted below:

5

Benchmark Total revenue

Significant percentage 0.50% 0.50%

Materiality level Total revenue*Significant

percentage

48,521,720*0.5% = 242608.6

From the above calculation of materiality level it has been observed that there is material

misstatement of 242608 dollars. This misstatement is significantly low and can be ignored as this

company is a large scale business organisation which deals in several products in several

locations. In the process of set planning materiality level it is important to ascertain significant

percentage of material misstatement which auditor expects that in this company can be

incorporated. In the case of this company, material misstatement is tolerable. According to this

case determining the lower limit for individually significant items in the financial statements

taken as a whole ranging from ten percentage to hundred percent. Auditing standards clearly

indicate that tolerable misstatement is affected by risk which usually different for each financial

statement classification.

While setting a materiality level it is important to consider various points which are

discussed above that is benchmark of materiality percentage. In the case of this company, total

revenue are considered as a base or benchmark as this is a manufacturing and distribution

company which is mainly concerned with amount of sales which is earned by the business

operations. After analysis the materiality level, it can be planned that materiality level will be set

as 0.5% from which material misstatement is determined as 242608.

d. Audit risk assessment

Audit risk assessment is a process in which audit investigates the level of risk which is

involved in the accounts and reports which are prepared by the company known as financial

statements. The major objective of this process is to identify and appropriately assess the risks of

material misstatement in order to design and implement responses to the risks of material

misstatement. Procedure of risk assessment procedure involves reason of material mistatemen

whether due to error or fraud. Risk of material misstatement can arise from various sources such

as external factors. These external factors can include company specific factors and control over

financial reporting. There can be various problems when it comes to accounts which are material

misstated. Some of the issues of accounts mentioned above are:

6

Significant percentage 0.50% 0.50%

Materiality level Total revenue*Significant

percentage

48,521,720*0.5% = 242608.6

From the above calculation of materiality level it has been observed that there is material

misstatement of 242608 dollars. This misstatement is significantly low and can be ignored as this

company is a large scale business organisation which deals in several products in several

locations. In the process of set planning materiality level it is important to ascertain significant

percentage of material misstatement which auditor expects that in this company can be

incorporated. In the case of this company, material misstatement is tolerable. According to this

case determining the lower limit for individually significant items in the financial statements

taken as a whole ranging from ten percentage to hundred percent. Auditing standards clearly

indicate that tolerable misstatement is affected by risk which usually different for each financial

statement classification.

While setting a materiality level it is important to consider various points which are

discussed above that is benchmark of materiality percentage. In the case of this company, total

revenue are considered as a base or benchmark as this is a manufacturing and distribution

company which is mainly concerned with amount of sales which is earned by the business

operations. After analysis the materiality level, it can be planned that materiality level will be set

as 0.5% from which material misstatement is determined as 242608.

d. Audit risk assessment

Audit risk assessment is a process in which audit investigates the level of risk which is

involved in the accounts and reports which are prepared by the company known as financial

statements. The major objective of this process is to identify and appropriately assess the risks of

material misstatement in order to design and implement responses to the risks of material

misstatement. Procedure of risk assessment procedure involves reason of material mistatemen

whether due to error or fraud. Risk of material misstatement can arise from various sources such

as external factors. These external factors can include company specific factors and control over

financial reporting. There can be various problems when it comes to accounts which are material

misstated. Some of the issues of accounts mentioned above are:

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Over capitalisation – The first most issue that can be faced by the company due to

material misstatement is over capitalisation. While preparing expenditure account, it is important

to classify nature of expense. In this account, if the accountant failed to determine nature of

account than account can be misstated. Expenses are of two types first is capitalisation and

second is work in progress. Both types of expenses are differently stated but in the case where

some expenditures are not stated as there nature than there is a huge possibility of material

misstatement (Wang, 2014).

Forecasting – In the account of budgeting, forecasting is the major issue. Budgeting is a

process which is based on prediction and forecasting. In the process of budgeting, future events

are ascertained in order to identify what are the possibility of earning profit and expenses. Future

is uncertain and so its planning, forecasting is a process which can help in determining future

expenses and revenues. This forecasting can be result in material misstatement.

Recognition – This type of material misstatement is the result of equity account. Equity

account is the statement which includes various types of equities such as issued capital,

shareholder's equity and other. In the case of this company, an initial public offering is executed

which is material misstatement. Due to various issues in the equity, account of ipo can be

material misstatement. the demand exceeds the remaining inventory, the unmet demand is lost

and unobserved. This problem in general has a non linear state evolution, and we use moralized

probability to linearise the system.

Overlapping – This type of material misstatement is occurred due to inventory account.

According to this account, all the stock involved in the company is recorded. This tock can

include warehoused stock, stock in work in progress an draw material. As this company is large

scale organisation, there are numerous amount of inventory present.

Above are some possibilities are stated which can go wrong while conducting a audit risk

assessment. This is a process of determining what are the risk involvement in the accounts of a

company. Accounts which are mentioned above that is equity, expenditure and budgetary

accounts there are numerous possibilities of material misstatement. These issues can be tackled

by auditing principles and procedures such as integrity, objectivity and many more. While

identifying all the risk which are involved in audit risk can be analysed and then handled by

above principles. The main of this identification is to serve a reliable auditing report (Zadek,

Evans and Pruzan, 2013).

7

material misstatement is over capitalisation. While preparing expenditure account, it is important

to classify nature of expense. In this account, if the accountant failed to determine nature of

account than account can be misstated. Expenses are of two types first is capitalisation and

second is work in progress. Both types of expenses are differently stated but in the case where

some expenditures are not stated as there nature than there is a huge possibility of material

misstatement (Wang, 2014).

Forecasting – In the account of budgeting, forecasting is the major issue. Budgeting is a

process which is based on prediction and forecasting. In the process of budgeting, future events

are ascertained in order to identify what are the possibility of earning profit and expenses. Future

is uncertain and so its planning, forecasting is a process which can help in determining future

expenses and revenues. This forecasting can be result in material misstatement.

Recognition – This type of material misstatement is the result of equity account. Equity

account is the statement which includes various types of equities such as issued capital,

shareholder's equity and other. In the case of this company, an initial public offering is executed

which is material misstatement. Due to various issues in the equity, account of ipo can be

material misstatement. the demand exceeds the remaining inventory, the unmet demand is lost

and unobserved. This problem in general has a non linear state evolution, and we use moralized

probability to linearise the system.

Overlapping – This type of material misstatement is occurred due to inventory account.

According to this account, all the stock involved in the company is recorded. This tock can

include warehoused stock, stock in work in progress an draw material. As this company is large

scale organisation, there are numerous amount of inventory present.

Above are some possibilities are stated which can go wrong while conducting a audit risk

assessment. This is a process of determining what are the risk involvement in the accounts of a

company. Accounts which are mentioned above that is equity, expenditure and budgetary

accounts there are numerous possibilities of material misstatement. These issues can be tackled

by auditing principles and procedures such as integrity, objectivity and many more. While

identifying all the risk which are involved in audit risk can be analysed and then handled by

above principles. The main of this identification is to serve a reliable auditing report (Zadek,

Evans and Pruzan, 2013).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

From the above project reports it has been summarised that auditing is a process of

analysing, examining and assessing financial statements of an organisation and it is done by the

auditor who is hired by the directors of the business enterprise. There are three different aspects

that may effect the auditor these aspects are legal, ethical and professional. Some accounts like

budget, expenditure, equity, inventory etc. can be materially misstated by the company. Planning

materiality level for the organisation was $242608. The reasons for materiality misstatements are

recognition, forecasting, over capitalisation and over lapping of work. The auditor of the

organisation is mainly concerned with the identification of misstatements of different

information in the annual report of an organisation.

From the above project reports it has been summarised that auditing is a process of

analysing, examining and assessing financial statements of an organisation and it is done by the

auditor who is hired by the directors of the business enterprise. There are three different aspects

that may effect the auditor these aspects are legal, ethical and professional. Some accounts like

budget, expenditure, equity, inventory etc. can be materially misstated by the company. Planning

materiality level for the organisation was $242608. The reasons for materiality misstatements are

recognition, forecasting, over capitalisation and over lapping of work. The auditor of the

organisation is mainly concerned with the identification of misstatements of different

information in the annual report of an organisation.

REFERENCES

Books and Journals:

Alles, M. and et. al., 2018. Continuous monitoring of business process controls: A pilot

implementation of a continuous auditing system at Siemens. In Continuous Auditing:

Theory and Application (pp. 219-246). Emerald Publishing Limited.

Arens, A. A., Elder, R. J. and Mark, B., 2012. Auditing and assurance services: an integrated

approach. Boston: Prentice Hall.

Furnham, A. and Gunter, B., 2015. Corporate Assessment (Routledge Revivals): Auditing a

Company's Personality. Routledge.

He, D., Zeadally, S. and Wu, L., 2018. Certificateless public auditing scheme for cloud-assisted

wireless body area networks. IEEE Systems Journal. 12(1). pp.64-73.

Hope, O. K., Langli, J. C. and Thomas, W. B., 2012. Agency conflicts and auditing in private

firms. Accounting, Organizations and Society. 37(7). pp.500-517.

Knechel, W. R. and Salterio, S. E., 2016. Auditing: Assurance and risk. Routledge.

Liu, C. and et. al., 2014. Authorized public auditing of dynamic big data storage on cloud with

efficient verifiable fine-grained updates. IEEE Transactions on Parallel and Distributed

Systems. 25(9). pp.2234-2244.

Louwers, T. J. And et. al., 2015. Auditing & assurance services. McGraw-Hill Education.

Nigrini, M., 2012. Benford's Law: Applications for forensic accounting, auditing, and fraud

detection (Vol. 586). John Wiley & Sons.

Vasarhelyi, M. A. and et. al., 2012. The acceptance and adoption of continuous auditing by

internal auditors: A micro analysis. International Journal of Accounting Information

Systems. 13(3). pp.267-281.

Wang, B., Li, B. and Li, H., 2014. Oruta: Privacy-preserving public auditing for shared data in

the cloud. IEEE transactions on cloud computing. 2(1). pp.43-56.

Zadek, S., Evans, R. and Pruzan, P., 2013. Building corporate accountability: Emerging practice

in social and ethical accounting and auditing. Routledge.

2

Books and Journals:

Alles, M. and et. al., 2018. Continuous monitoring of business process controls: A pilot

implementation of a continuous auditing system at Siemens. In Continuous Auditing:

Theory and Application (pp. 219-246). Emerald Publishing Limited.

Arens, A. A., Elder, R. J. and Mark, B., 2012. Auditing and assurance services: an integrated

approach. Boston: Prentice Hall.

Furnham, A. and Gunter, B., 2015. Corporate Assessment (Routledge Revivals): Auditing a

Company's Personality. Routledge.

He, D., Zeadally, S. and Wu, L., 2018. Certificateless public auditing scheme for cloud-assisted

wireless body area networks. IEEE Systems Journal. 12(1). pp.64-73.

Hope, O. K., Langli, J. C. and Thomas, W. B., 2012. Agency conflicts and auditing in private

firms. Accounting, Organizations and Society. 37(7). pp.500-517.

Knechel, W. R. and Salterio, S. E., 2016. Auditing: Assurance and risk. Routledge.

Liu, C. and et. al., 2014. Authorized public auditing of dynamic big data storage on cloud with

efficient verifiable fine-grained updates. IEEE Transactions on Parallel and Distributed

Systems. 25(9). pp.2234-2244.

Louwers, T. J. And et. al., 2015. Auditing & assurance services. McGraw-Hill Education.

Nigrini, M., 2012. Benford's Law: Applications for forensic accounting, auditing, and fraud

detection (Vol. 586). John Wiley & Sons.

Vasarhelyi, M. A. and et. al., 2012. The acceptance and adoption of continuous auditing by

internal auditors: A micro analysis. International Journal of Accounting Information

Systems. 13(3). pp.267-281.

Wang, B., Li, B. and Li, H., 2014. Oruta: Privacy-preserving public auditing for shared data in

the cloud. IEEE transactions on cloud computing. 2(1). pp.43-56.

Zadek, S., Evans, R. and Pruzan, P., 2013. Building corporate accountability: Emerging practice

in social and ethical accounting and auditing. Routledge.

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.