Project Analysis: Financial & Risk Assessment for Myer Holding

VerifiedAdded on 2023/06/11

|16

|2714

|419

Case Study

AI Summary

This case study analyzes a construction project's financial viability for Myer Holding, examining aspects such as project selection, cost management, funding, and potential winding up scenarios. It evaluates the company's equity capital, free cash flow, and Net Present Value (NPV) under varying exchange rate conditions between the Australian and Canadian dollar. The analysis considers the impact of a depreciating Canadian dollar on the project's NPV and offers advice to the Myer board regarding the project's feasibility, emphasizing the importance of financial tools like capital budgeting and cost accounting for effective project evaluation and strategic planning. The document concludes with recommendations for improved cost management and resource allocation to ensure project success. Desklib provides this document and many other study resources to help students excel.

Project analysis

Construction project analysis

Financial and risk analysis of the project

Name of the Author

Construction project analysis

Financial and risk analysis of the project

Name of the Author

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

Part-A..........................................................................................................................................................1

Executive Summary.................................................................................................................................1

Project selection......................................................................................................................................1

Cost management-...................................................................................................................................1

Funding...................................................................................................................................................2

Implementation and winding up..............................................................................................................3

Recommendation.....................................................................................................................................3

Part-B..........................................................................................................................................................4

Introduction.................................................................................................................................................4

Answer to question no-1..........................................................................................................................4

Why companies raises equity capital...................................................................................................4

Dropped in Equity capital of Myer Holding..........................................................................................4

Reason of reduction in the overall total equity capital of Myer Holding.............................................5

Answer to question no-2..........................................................................................................................5

Computation of the free cash flow of the undertaken project............................................................5

Computation of NPV in Australian Dollars (AUD)................................................................................7

Canadian dollar depreciates..............................................................................................................10

Changes in NPV due to the changes in Canadian dollar to AUD........................................................13

Effect on the decision making............................................................................................................13

Based on the analysis you did in questions i-iv what would your advice be to the Myer board about

this project? Why?.............................................................................................................................13

Conclusion.................................................................................................................................................13

References.................................................................................................................................................14

1

Part-A..........................................................................................................................................................1

Executive Summary.................................................................................................................................1

Project selection......................................................................................................................................1

Cost management-...................................................................................................................................1

Funding...................................................................................................................................................2

Implementation and winding up..............................................................................................................3

Recommendation.....................................................................................................................................3

Part-B..........................................................................................................................................................4

Introduction.................................................................................................................................................4

Answer to question no-1..........................................................................................................................4

Why companies raises equity capital...................................................................................................4

Dropped in Equity capital of Myer Holding..........................................................................................4

Reason of reduction in the overall total equity capital of Myer Holding.............................................5

Answer to question no-2..........................................................................................................................5

Computation of the free cash flow of the undertaken project............................................................5

Computation of NPV in Australian Dollars (AUD)................................................................................7

Canadian dollar depreciates..............................................................................................................10

Changes in NPV due to the changes in Canadian dollar to AUD........................................................13

Effect on the decision making............................................................................................................13

Based on the analysis you did in questions i-iv what would your advice be to the Myer board about

this project? Why?.............................................................................................................................13

Conclusion.................................................................................................................................................13

References.................................................................................................................................................14

1

Part-A

Executive Summary

With the ramified economic changes, each and every company wants to expand their

business on international level. It is observed that while selecting the project, every company

needs to analysis the available measures and resources, financial planning and operation

planning which need to be undertaken to implement the selected project. In this report, case

study analysis of the project of construction of the mall in Australia by the Fletcher Building

construction will be selected to determine whether it will be profitable for the company or not.

This report emphasis upon the case study analysis of the project section of construction of

the mall in Australia by the Fletcher Building construction in context with the cost management,

funding requirement and possible winding up situation that may lead to closure of the undertaken

project.

Project selection

With the ramified needs of the expansion of Fletcher Building construction, it needs to

undertake only those projects which has high viability of value creation in the invested amount

and could add value to organization. by using the capital budgeting tool, DU Pont analysis and

long term strategic planning, Fletcher Building construction could assess whether to select

particular project or not. The selection of the construction project is based on possible future

benefits and viability of the invested capital in the construction field. By using the construction

project, Fletcher could easily use its old assets and plants in the construction of the malls in

Australia. It could also easily export some of the imperative material for the constructions work

in Australia from its origin country (Fletcher Building Construction, 2016). However, joint

venture and strategic alliance would made to further expand the business in Australia (Alles,

Kogan, and Vasarhelyi, 2018).

Cost management-

Fletcher Building construction needs to use proper cost management which could be done

by installing the ABC model framework or life cycle costing method. The main role of cost

2

Executive Summary

With the ramified economic changes, each and every company wants to expand their

business on international level. It is observed that while selecting the project, every company

needs to analysis the available measures and resources, financial planning and operation

planning which need to be undertaken to implement the selected project. In this report, case

study analysis of the project of construction of the mall in Australia by the Fletcher Building

construction will be selected to determine whether it will be profitable for the company or not.

This report emphasis upon the case study analysis of the project section of construction of

the mall in Australia by the Fletcher Building construction in context with the cost management,

funding requirement and possible winding up situation that may lead to closure of the undertaken

project.

Project selection

With the ramified needs of the expansion of Fletcher Building construction, it needs to

undertake only those projects which has high viability of value creation in the invested amount

and could add value to organization. by using the capital budgeting tool, DU Pont analysis and

long term strategic planning, Fletcher Building construction could assess whether to select

particular project or not. The selection of the construction project is based on possible future

benefits and viability of the invested capital in the construction field. By using the construction

project, Fletcher could easily use its old assets and plants in the construction of the malls in

Australia. It could also easily export some of the imperative material for the constructions work

in Australia from its origin country (Fletcher Building Construction, 2016). However, joint

venture and strategic alliance would made to further expand the business in Australia (Alles,

Kogan, and Vasarhelyi, 2018).

Cost management-

Fletcher Building construction needs to use proper cost management which could be done

by installing the ABC model framework or life cycle costing method. The main role of cost

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

management is to avoid the unnecessary expenses and increased the overall return on capital

employed of the project undertaken by company. Fletcher Building construction should use the

proper costing method such as using ABC costing, Life cycle costing method and proper

recording of the data in the books of account are the some of the major tools. This cost

management is the most important tool which put control over the expenses and cash outflow in

the undertaken project. Company had to face the increased business cost due to the less effective

cost management tool. As per the work structure and undertaken project, Fletcher should have

undertaken the ABC costing model. This costing model assist in proper bifurcation of the cost in

the different work department of the organization which eventually reduces the overall costing

(Arens, Elder, and Mark, 2012).

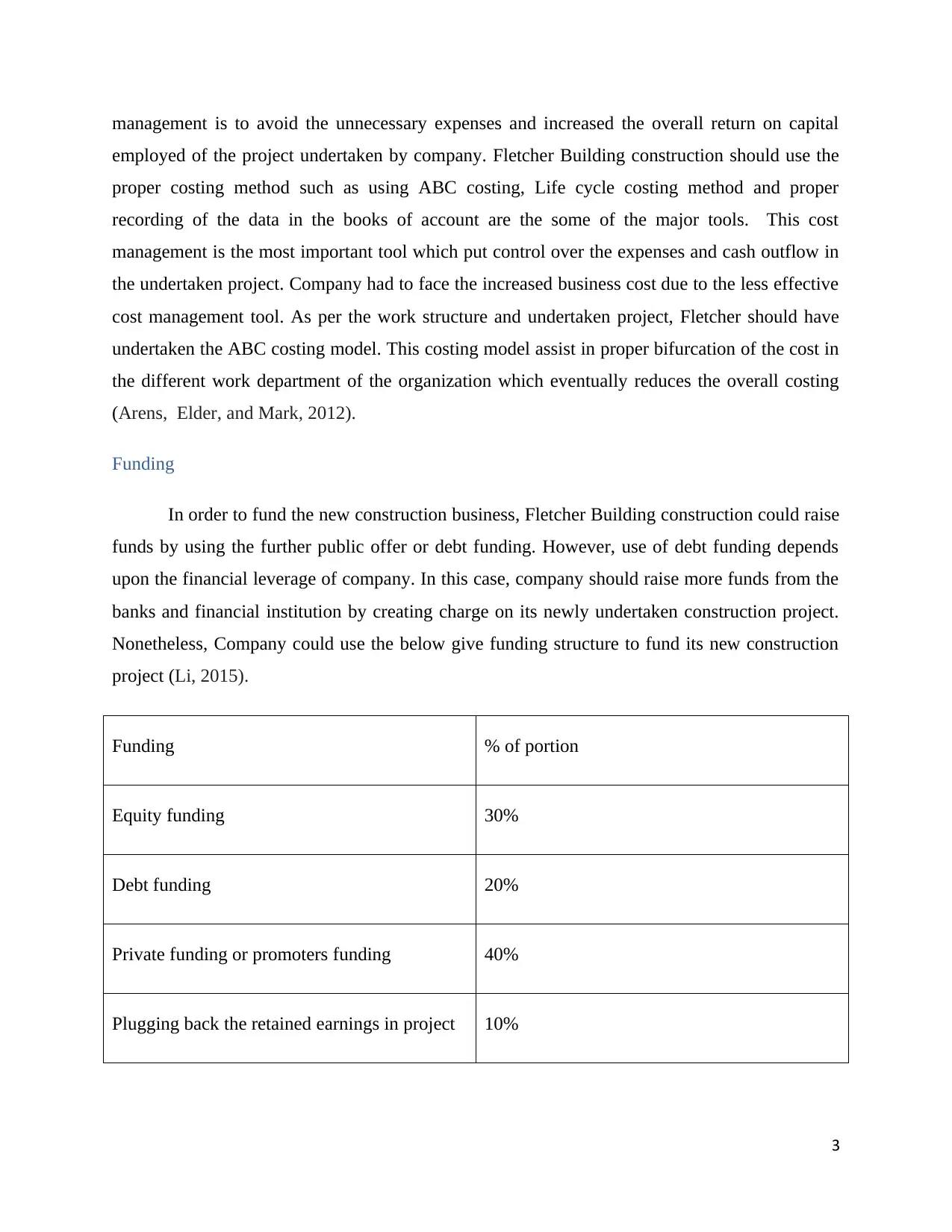

Funding

In order to fund the new construction business, Fletcher Building construction could raise

funds by using the further public offer or debt funding. However, use of debt funding depends

upon the financial leverage of company. In this case, company should raise more funds from the

banks and financial institution by creating charge on its newly undertaken construction project.

Nonetheless, Company could use the below give funding structure to fund its new construction

project (Li, 2015).

Funding % of portion

Equity funding 30%

Debt funding 20%

Private funding or promoters funding 40%

Plugging back the retained earnings in project 10%

3

employed of the project undertaken by company. Fletcher Building construction should use the

proper costing method such as using ABC costing, Life cycle costing method and proper

recording of the data in the books of account are the some of the major tools. This cost

management is the most important tool which put control over the expenses and cash outflow in

the undertaken project. Company had to face the increased business cost due to the less effective

cost management tool. As per the work structure and undertaken project, Fletcher should have

undertaken the ABC costing model. This costing model assist in proper bifurcation of the cost in

the different work department of the organization which eventually reduces the overall costing

(Arens, Elder, and Mark, 2012).

Funding

In order to fund the new construction business, Fletcher Building construction could raise

funds by using the further public offer or debt funding. However, use of debt funding depends

upon the financial leverage of company. In this case, company should raise more funds from the

banks and financial institution by creating charge on its newly undertaken construction project.

Nonetheless, Company could use the below give funding structure to fund its new construction

project (Li, 2015).

Funding % of portion

Equity funding 30%

Debt funding 20%

Private funding or promoters funding 40%

Plugging back the retained earnings in project 10%

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Implementation and winding up

The winding up is ideally the end steps when company finds difficulty to continue with

the undertaken project. The main issue associated with the commencing of the construction

project was related to the employees staff arrangement (Labour availability), lack of control of

management due to the non-effective strategic planning and proper deployment of funds. These

all these are very important to manage as these are the core aspects for the successful completion

of the project. The lack of r finance destructed the undertaken projects. On the other hand, due

to the lack of the human power, it was hard for company to efficiently working and create

synergy in its process work system. These all the factors resulted to the high cost of construction

and due to the high cash outflow as compared to the budgeted plan, company had to wind up its

construction project (Fletcher Building Construction, 2016). The project was ended due to the

lack of efficient working or strategic planning of the company. There were no environmental

issue which affected the project. However, company would have face the environmental issue if

it had gone through its internal work issues due the consistent changes in climate in Australia

(Warren, Reeve, and Duchac, 2013).

Recommendation

Company should use proper financial tools such as capital budgeting, cost accounting, ratio

analysis to evaluate the viability of the project.

There should be proper cost management tool such as ABC costing model, life cycle costing

model which could be used to reduce the overall costing of the business.

Proper strategic planning and availability of the resources is must for the effective operation of

the undertaken project (Fletcher Building Construction, 2016).

4

The winding up is ideally the end steps when company finds difficulty to continue with

the undertaken project. The main issue associated with the commencing of the construction

project was related to the employees staff arrangement (Labour availability), lack of control of

management due to the non-effective strategic planning and proper deployment of funds. These

all these are very important to manage as these are the core aspects for the successful completion

of the project. The lack of r finance destructed the undertaken projects. On the other hand, due

to the lack of the human power, it was hard for company to efficiently working and create

synergy in its process work system. These all the factors resulted to the high cost of construction

and due to the high cash outflow as compared to the budgeted plan, company had to wind up its

construction project (Fletcher Building Construction, 2016). The project was ended due to the

lack of efficient working or strategic planning of the company. There were no environmental

issue which affected the project. However, company would have face the environmental issue if

it had gone through its internal work issues due the consistent changes in climate in Australia

(Warren, Reeve, and Duchac, 2013).

Recommendation

Company should use proper financial tools such as capital budgeting, cost accounting, ratio

analysis to evaluate the viability of the project.

There should be proper cost management tool such as ABC costing model, life cycle costing

model which could be used to reduce the overall costing of the business.

Proper strategic planning and availability of the resources is must for the effective operation of

the undertaken project (Fletcher Building Construction, 2016).

4

Part-B

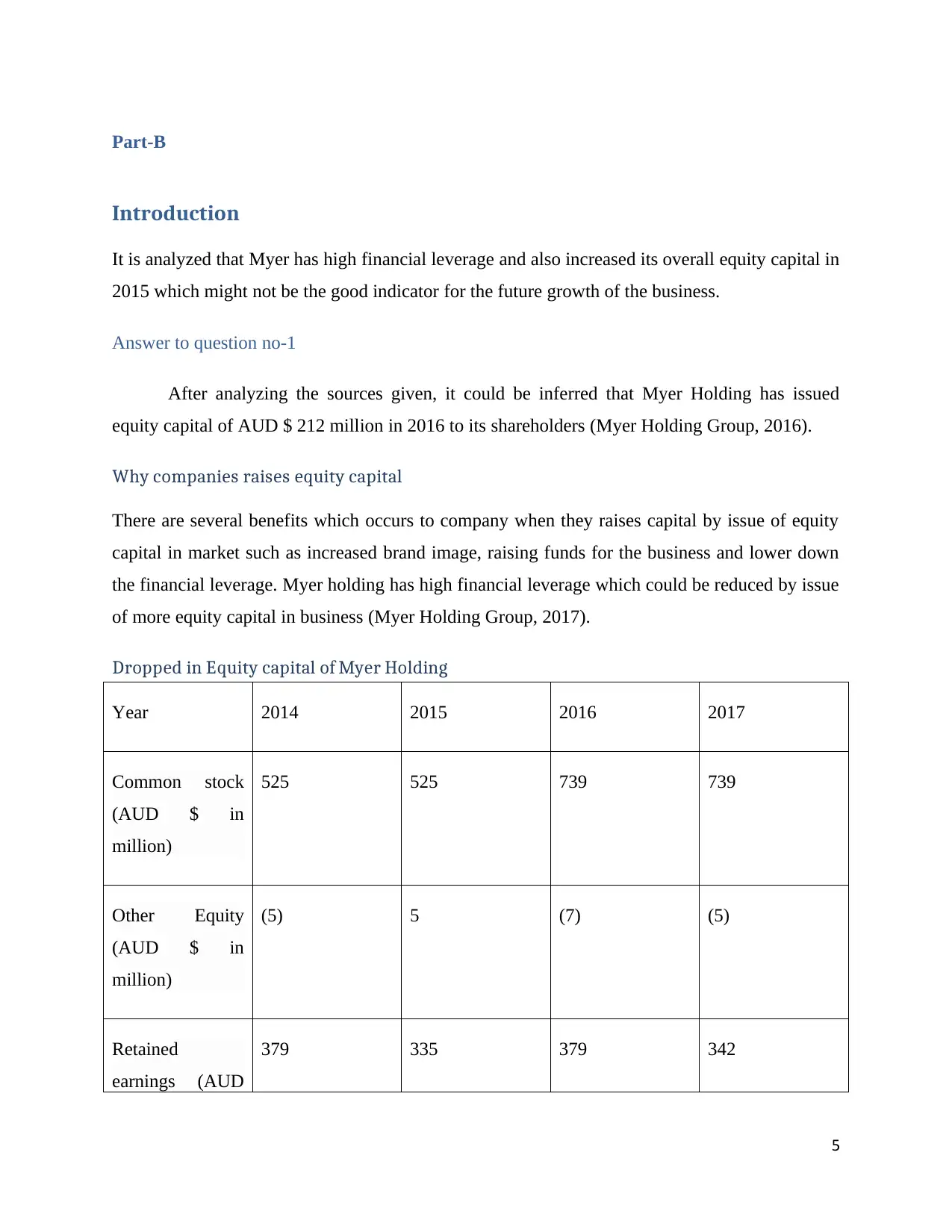

Introduction

It is analyzed that Myer has high financial leverage and also increased its overall equity capital in

2015 which might not be the good indicator for the future growth of the business.

Answer to question no-1

After analyzing the sources given, it could be inferred that Myer Holding has issued

equity capital of AUD $ 212 million in 2016 to its shareholders (Myer Holding Group, 2016).

Why companies raises equity capital

There are several benefits which occurs to company when they raises capital by issue of equity

capital in market such as increased brand image, raising funds for the business and lower down

the financial leverage. Myer holding has high financial leverage which could be reduced by issue

of more equity capital in business (Myer Holding Group, 2017).

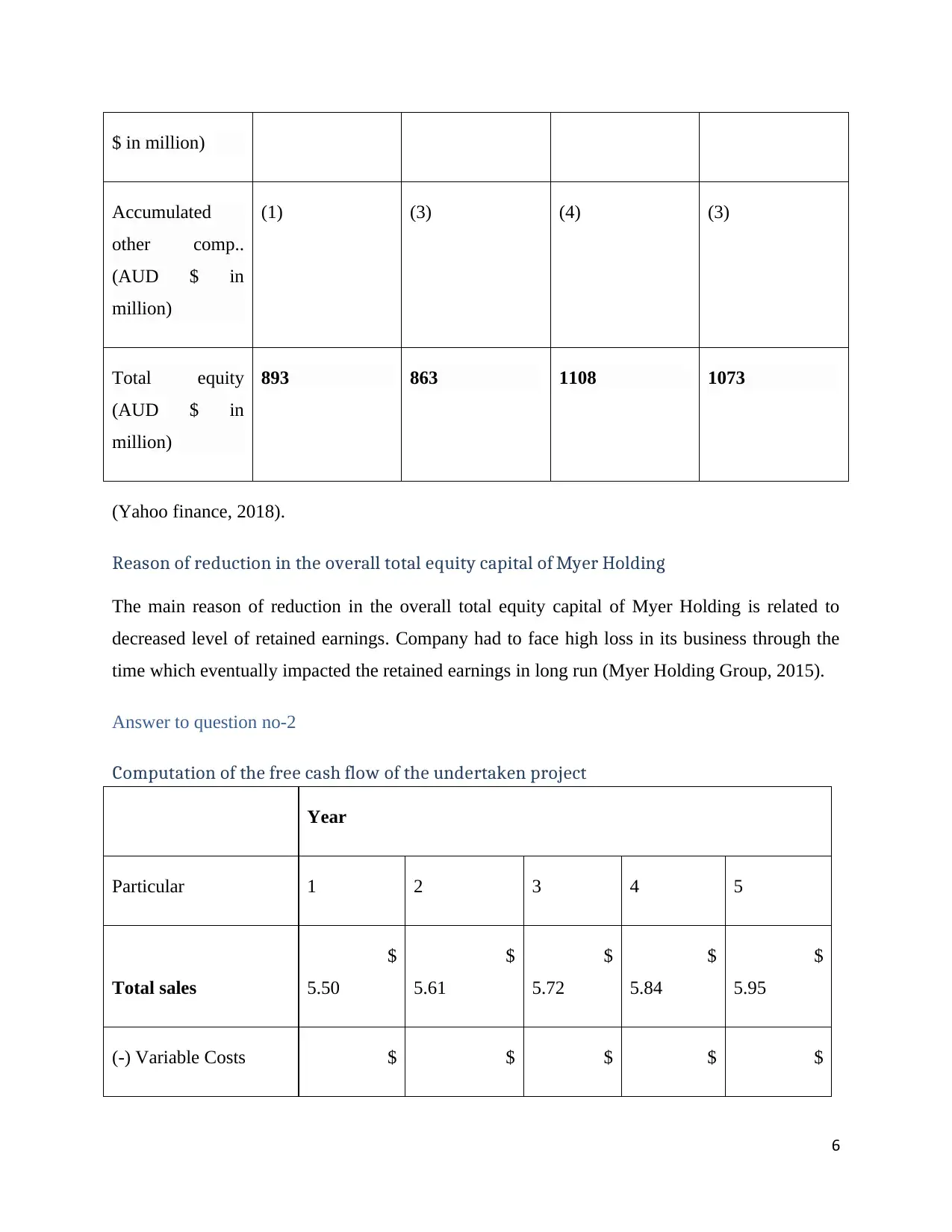

Dropped in Equity capital of Myer Holding

Year 2014 2015 2016 2017

Common stock

(AUD $ in

million)

525 525 739 739

Other Equity

(AUD $ in

million)

(5) 5 (7) (5)

Retained

earnings (AUD

379 335 379 342

5

Introduction

It is analyzed that Myer has high financial leverage and also increased its overall equity capital in

2015 which might not be the good indicator for the future growth of the business.

Answer to question no-1

After analyzing the sources given, it could be inferred that Myer Holding has issued

equity capital of AUD $ 212 million in 2016 to its shareholders (Myer Holding Group, 2016).

Why companies raises equity capital

There are several benefits which occurs to company when they raises capital by issue of equity

capital in market such as increased brand image, raising funds for the business and lower down

the financial leverage. Myer holding has high financial leverage which could be reduced by issue

of more equity capital in business (Myer Holding Group, 2017).

Dropped in Equity capital of Myer Holding

Year 2014 2015 2016 2017

Common stock

(AUD $ in

million)

525 525 739 739

Other Equity

(AUD $ in

million)

(5) 5 (7) (5)

Retained

earnings (AUD

379 335 379 342

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

$ in million)

Accumulated

other comp..

(AUD $ in

million)

(1) (3) (4) (3)

Total equity

(AUD $ in

million)

893 863 1108 1073

(Yahoo finance, 2018).

Reason of reduction in the overall total equity capital of Myer Holding

The main reason of reduction in the overall total equity capital of Myer Holding is related to

decreased level of retained earnings. Company had to face high loss in its business through the

time which eventually impacted the retained earnings in long run (Myer Holding Group, 2015).

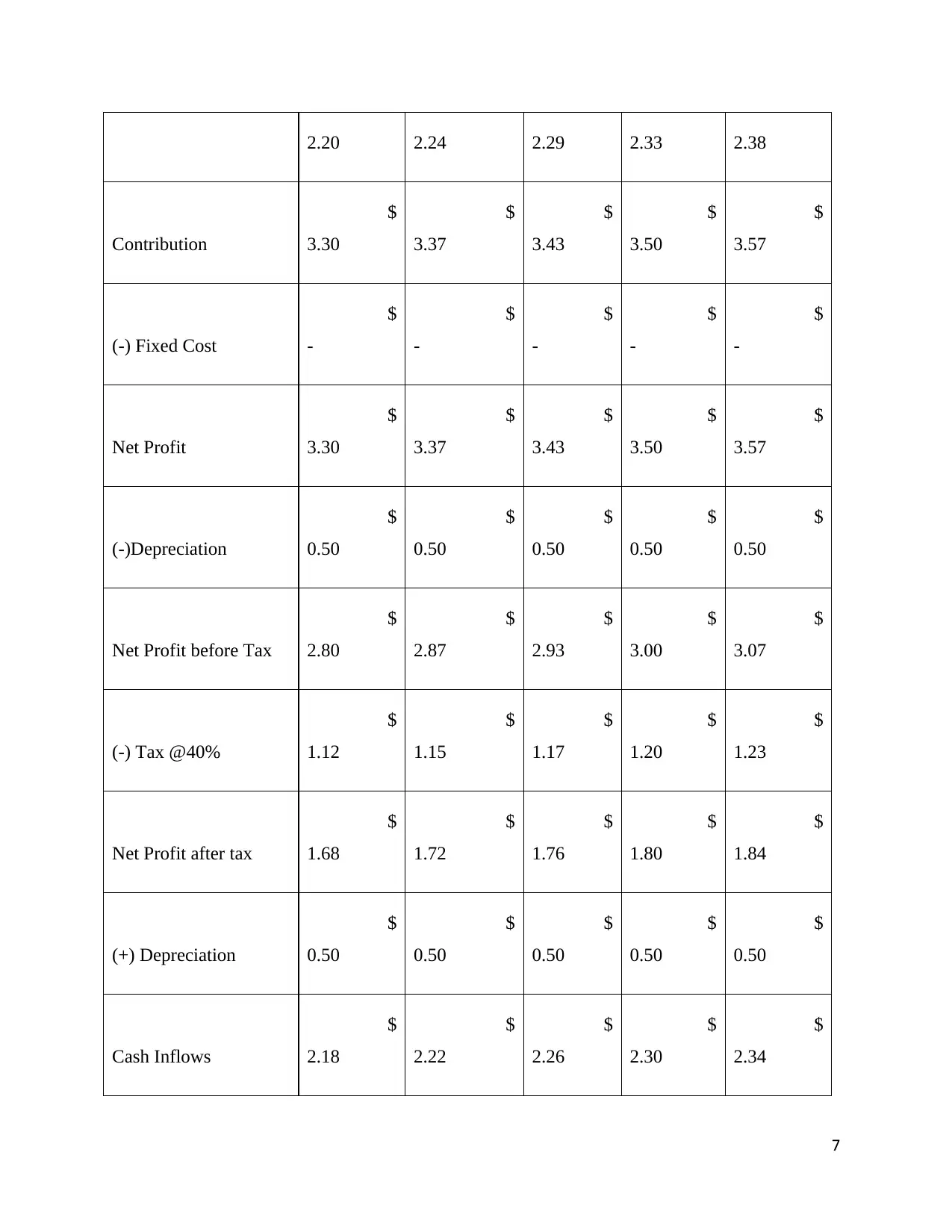

Answer to question no-2

Computation of the free cash flow of the undertaken project

Year

Particular 1 2 3 4 5

Total sales

$

5.50

$

5.61

$

5.72

$

5.84

$

5.95

(-) Variable Costs $ $ $ $ $

6

Accumulated

other comp..

(AUD $ in

million)

(1) (3) (4) (3)

Total equity

(AUD $ in

million)

893 863 1108 1073

(Yahoo finance, 2018).

Reason of reduction in the overall total equity capital of Myer Holding

The main reason of reduction in the overall total equity capital of Myer Holding is related to

decreased level of retained earnings. Company had to face high loss in its business through the

time which eventually impacted the retained earnings in long run (Myer Holding Group, 2015).

Answer to question no-2

Computation of the free cash flow of the undertaken project

Year

Particular 1 2 3 4 5

Total sales

$

5.50

$

5.61

$

5.72

$

5.84

$

5.95

(-) Variable Costs $ $ $ $ $

6

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2.20 2.24 2.29 2.33 2.38

Contribution

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-) Fixed Cost

$

-

$

-

$

-

$

-

$

-

Net Profit

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-)Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Net Profit before Tax

$

2.80

$

2.87

$

2.93

$

3.00

$

3.07

(-) Tax @40%

$

1.12

$

1.15

$

1.17

$

1.20

$

1.23

Net Profit after tax

$

1.68

$

1.72

$

1.76

$

1.80

$

1.84

(+) Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Cash Inflows

$

2.18

$

2.22

$

2.26

$

2.30

$

2.34

7

Contribution

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-) Fixed Cost

$

-

$

-

$

-

$

-

$

-

Net Profit

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-)Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Net Profit before Tax

$

2.80

$

2.87

$

2.93

$

3.00

$

3.07

(-) Tax @40%

$

1.12

$

1.15

$

1.17

$

1.20

$

1.23

Net Profit after tax

$

1.68

$

1.72

$

1.76

$

1.80

$

1.84

(+) Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Cash Inflows

$

2.18

$

2.22

$

2.26

$

2.30

$

2.34

7

(+) Salvage Value 9

Working Capital 2

Free Cash Flows in

Australian Dollars 2.18 2.22 2.26 2.30 13.34

The total free cash flow which Company would have would be $ 13.34 in all five years.

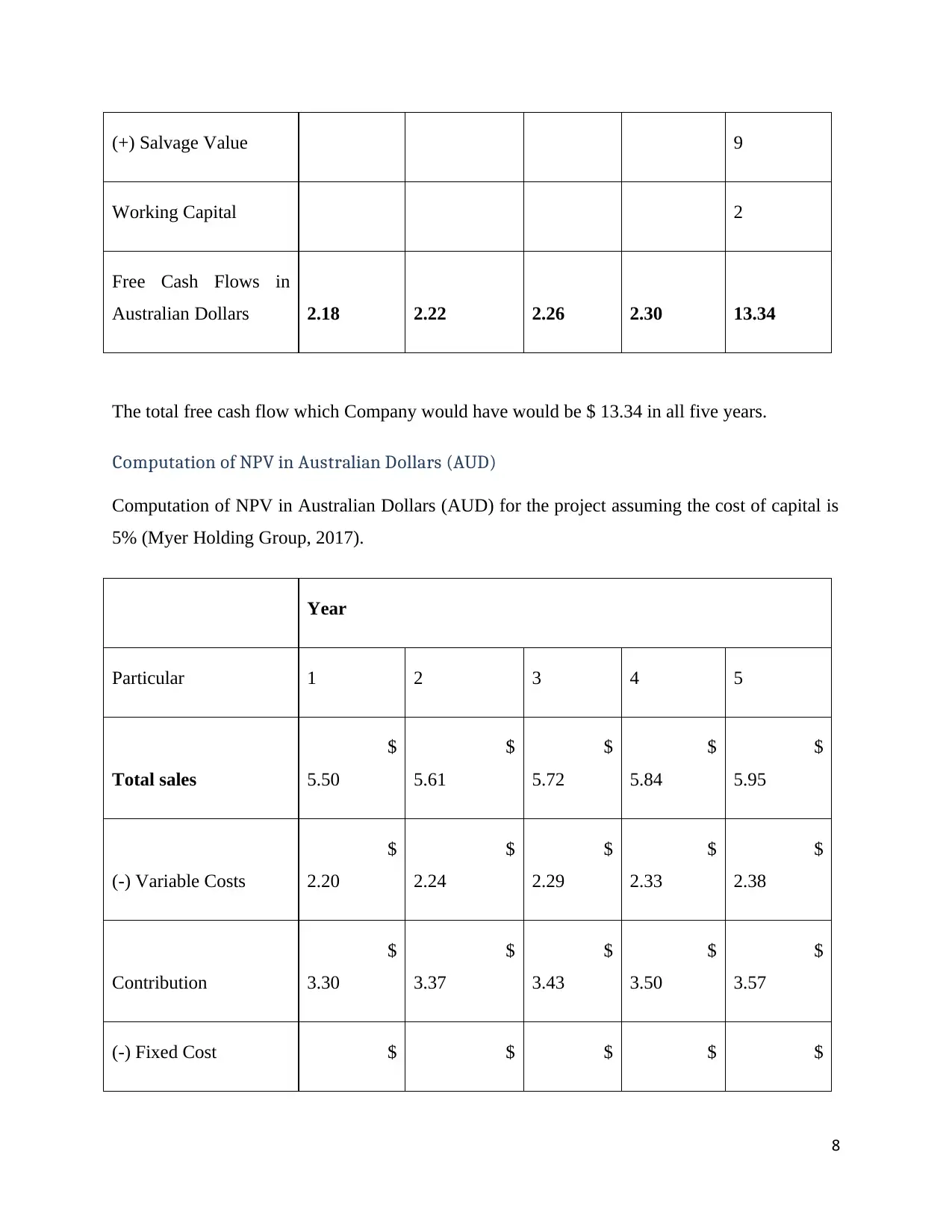

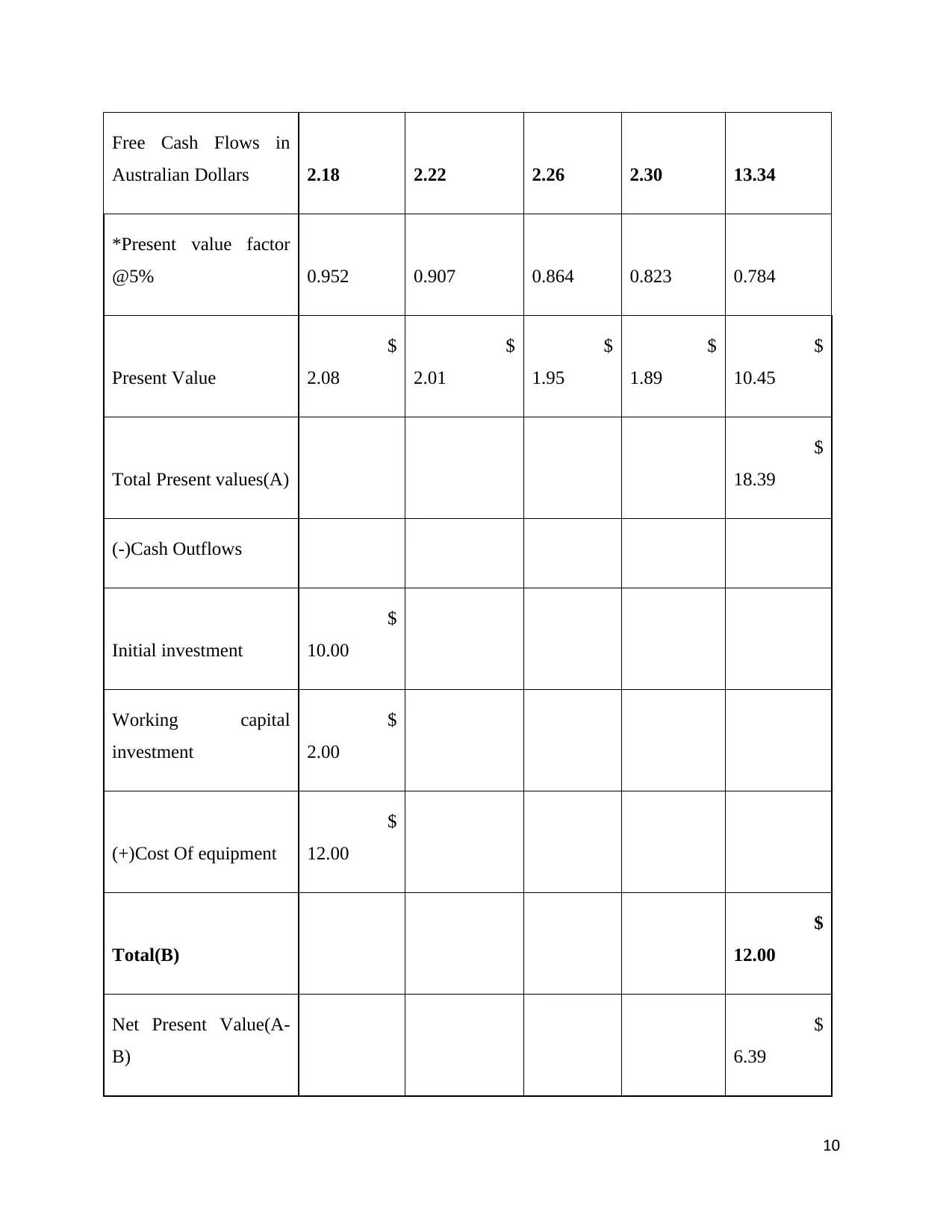

Computation of NPV in Australian Dollars (AUD)

Computation of NPV in Australian Dollars (AUD) for the project assuming the cost of capital is

5% (Myer Holding Group, 2017).

Year

Particular 1 2 3 4 5

Total sales

$

5.50

$

5.61

$

5.72

$

5.84

$

5.95

(-) Variable Costs

$

2.20

$

2.24

$

2.29

$

2.33

$

2.38

Contribution

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-) Fixed Cost $ $ $ $ $

8

Working Capital 2

Free Cash Flows in

Australian Dollars 2.18 2.22 2.26 2.30 13.34

The total free cash flow which Company would have would be $ 13.34 in all five years.

Computation of NPV in Australian Dollars (AUD)

Computation of NPV in Australian Dollars (AUD) for the project assuming the cost of capital is

5% (Myer Holding Group, 2017).

Year

Particular 1 2 3 4 5

Total sales

$

5.50

$

5.61

$

5.72

$

5.84

$

5.95

(-) Variable Costs

$

2.20

$

2.24

$

2.29

$

2.33

$

2.38

Contribution

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-) Fixed Cost $ $ $ $ $

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

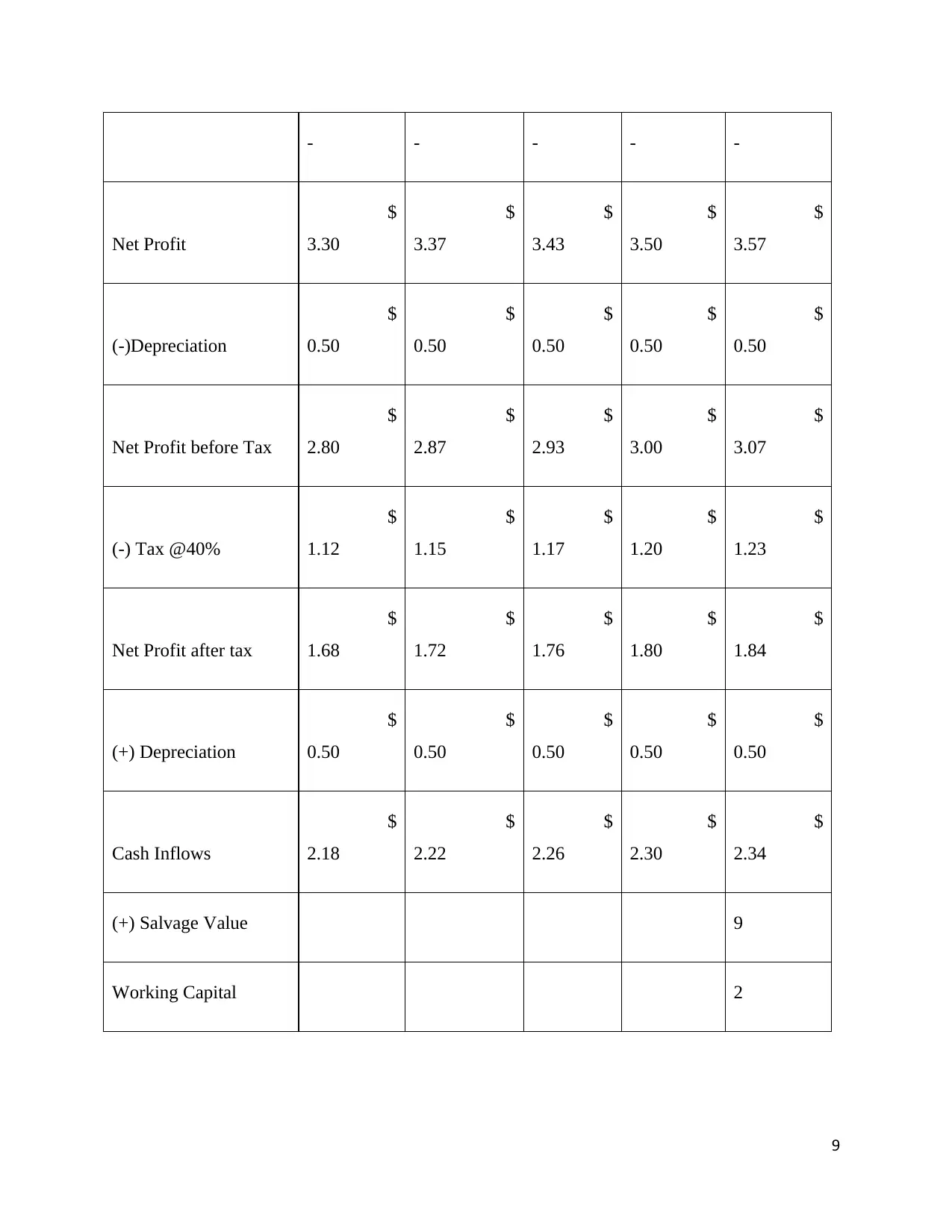

- - - - -

Net Profit

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-)Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Net Profit before Tax

$

2.80

$

2.87

$

2.93

$

3.00

$

3.07

(-) Tax @40%

$

1.12

$

1.15

$

1.17

$

1.20

$

1.23

Net Profit after tax

$

1.68

$

1.72

$

1.76

$

1.80

$

1.84

(+) Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Cash Inflows

$

2.18

$

2.22

$

2.26

$

2.30

$

2.34

(+) Salvage Value 9

Working Capital 2

9

Net Profit

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-)Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Net Profit before Tax

$

2.80

$

2.87

$

2.93

$

3.00

$

3.07

(-) Tax @40%

$

1.12

$

1.15

$

1.17

$

1.20

$

1.23

Net Profit after tax

$

1.68

$

1.72

$

1.76

$

1.80

$

1.84

(+) Depreciation

$

0.50

$

0.50

$

0.50

$

0.50

$

0.50

Cash Inflows

$

2.18

$

2.22

$

2.26

$

2.30

$

2.34

(+) Salvage Value 9

Working Capital 2

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Free Cash Flows in

Australian Dollars 2.18 2.22 2.26 2.30 13.34

*Present value factor

@5% 0.952 0.907 0.864 0.823 0.784

Present Value

$

2.08

$

2.01

$

1.95

$

1.89

$

10.45

Total Present values(A)

$

18.39

(-)Cash Outflows

Initial investment

$

10.00

Working capital

investment

$

2.00

(+)Cost Of equipment

$

12.00

Total(B)

$

12.00

Net Present Value(A-

B)

$

6.39

10

Australian Dollars 2.18 2.22 2.26 2.30 13.34

*Present value factor

@5% 0.952 0.907 0.864 0.823 0.784

Present Value

$

2.08

$

2.01

$

1.95

$

1.89

$

10.45

Total Present values(A)

$

18.39

(-)Cash Outflows

Initial investment

$

10.00

Working capital

investment

$

2.00

(+)Cost Of equipment

$

12.00

Total(B)

$

12.00

Net Present Value(A-

B)

$

6.39

10

Source: (Yahoo finance, 2018).

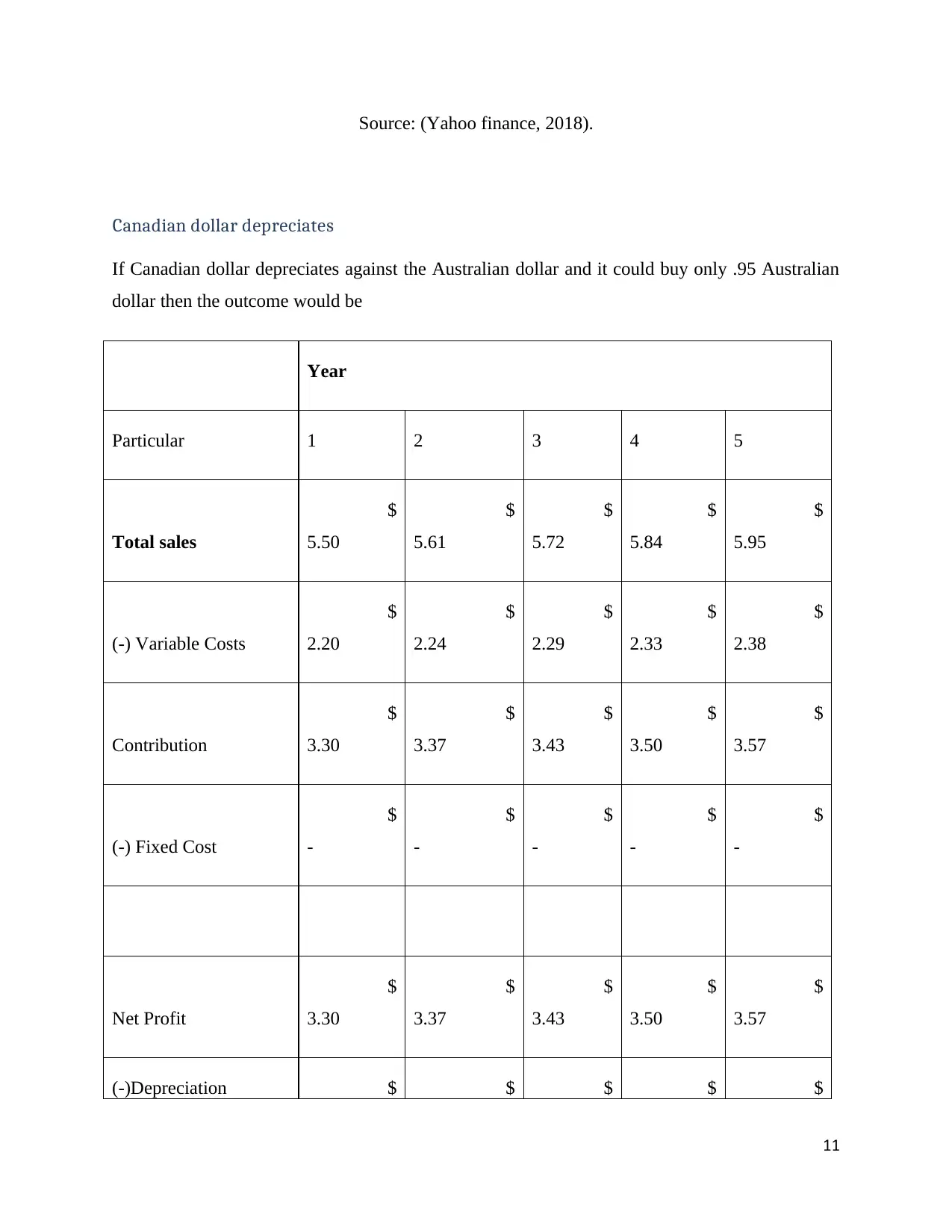

Canadian dollar depreciates

If Canadian dollar depreciates against the Australian dollar and it could buy only .95 Australian

dollar then the outcome would be

Year

Particular 1 2 3 4 5

Total sales

$

5.50

$

5.61

$

5.72

$

5.84

$

5.95

(-) Variable Costs

$

2.20

$

2.24

$

2.29

$

2.33

$

2.38

Contribution

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-) Fixed Cost

$

-

$

-

$

-

$

-

$

-

Net Profit

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-)Depreciation $ $ $ $ $

11

Canadian dollar depreciates

If Canadian dollar depreciates against the Australian dollar and it could buy only .95 Australian

dollar then the outcome would be

Year

Particular 1 2 3 4 5

Total sales

$

5.50

$

5.61

$

5.72

$

5.84

$

5.95

(-) Variable Costs

$

2.20

$

2.24

$

2.29

$

2.33

$

2.38

Contribution

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-) Fixed Cost

$

-

$

-

$

-

$

-

$

-

Net Profit

$

3.30

$

3.37

$

3.43

$

3.50

$

3.57

(-)Depreciation $ $ $ $ $

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.