Nanosonics Limited Report: Contemporary Accounting Theory, ACCT20074

VerifiedAdded on 2022/10/01

|18

|4632

|25

Report

AI Summary

This report delves into the critical role of sustainability and corporate social responsibility (CSR) in enhancing a company's financial performance. It begins with a theoretical overview, presenting a literature review that underscores the importance of CSR for organizations. The report then compares sustainability reporting with other reporting concepts and explores two key theories: stakeholder theory and agency theory, to provide a deeper understanding of sustainability reporting. The second part of the report provides a practical analysis by examining Nanosonics Limited, an ASX-listed company, including its history, ownership, governance, and financial performance. It evaluates the company's sustainability reporting using a scoring index based on Global Reporting Initiative (GRI) guidelines, analyzing the extent and quality of its CSR initiatives. The report concludes with a summary of findings and insights.

Running head: CONTEMPORARY ACCOUNTING THEORY

Contemporary Accounting Theory

Name of the Student

Student ID

Name of the University

Author’s note

Contemporary Accounting Theory

Name of the Student

Student ID

Name of the University

Author’s note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CONTEMPORARY ACCOUNTING THEORY

Table of Contents

Executive Summary...................................................................................................................1

Introduction................................................................................................................................1

Discussion..................................................................................................................................2

PART - A...................................................................................................................................2

Literature review showing the importance of corporate social responsibility for firms

operating with financial objectives............................................................................................2

Comparison of Sustainability reporting with other reporting concepts.....................................3

Two theories that explain the essence of sustainability reporting..............................................4

PART – B...................................................................................................................................5

Introduction of the company with an overview of its history, ownership, governance and

financial performance.................................................................................................................5

Sustainability reporting scoring index according to the Global Reporting Initiative (GRI)

guidelines...................................................................................................................................7

Extent and quality of sustainability reporting of the selected Australian company against

sustainability reporting scoring index........................................................................................8

Social responsibility of the company against the prepared index............................................10

Conclusion................................................................................................................................12

References................................................................................................................................13

Table of Contents

Executive Summary...................................................................................................................1

Introduction................................................................................................................................1

Discussion..................................................................................................................................2

PART - A...................................................................................................................................2

Literature review showing the importance of corporate social responsibility for firms

operating with financial objectives............................................................................................2

Comparison of Sustainability reporting with other reporting concepts.....................................3

Two theories that explain the essence of sustainability reporting..............................................4

PART – B...................................................................................................................................5

Introduction of the company with an overview of its history, ownership, governance and

financial performance.................................................................................................................5

Sustainability reporting scoring index according to the Global Reporting Initiative (GRI)

guidelines...................................................................................................................................7

Extent and quality of sustainability reporting of the selected Australian company against

sustainability reporting scoring index........................................................................................8

Social responsibility of the company against the prepared index............................................10

Conclusion................................................................................................................................12

References................................................................................................................................13

2CONTEMPORARY ACCOUNTING THEORY

Executive Summary

The report talks about the different benefits of corporate social responsibility and

sustainability in a theoretical as well as in a practical phenomenon. Considering the

theoretical perspective of the topic, a literature review stating the importance of corporate

social responsibility in achieving the financial objectives of an organisation. The organisation

chosen for this report is Nanosonics Limited which is an ASX listed company. A brief

overview of the company is provided stating its history, ownership, governance as well as

financial performance. The annual report of the company is thoroughly analysed for

determining the extent up to which the company follows sustainability and corporate social

responsibility in meeting its financial objectives. A sustainability reporting scoring index is

prepared according to the guidelines of Global Reporting Initiative (GRI). The social

responsibility that is shown in the annual report of the company, is rated according to the

prepared index and comments are provided accordingly.

Introduction

The primary objective of the report is to analyse and elaborate the growing

importance of sustainability and corporate social responsibility in achieving the financial

performance of a company. A theoretical perspective of corporate social responsibility is

provided through a literature review. A comparative study of the corporate social

responsibility is made with other relevant reporting concepts. Two other theories are then

explained which provides better essence of sustainability reporting. In the second part of the

report, the practical application of corporate social responsibility and sustainability is

examined through an organisation. The organisation that is chosen for this purpose is

Nanosonics Limited. An overview of the organisation is provided focussing on its history,

ownership, governance and financial performance. Further the report deals with a

sustainability reporting scoring index that is being prepared in accordance with the guidelines

Executive Summary

The report talks about the different benefits of corporate social responsibility and

sustainability in a theoretical as well as in a practical phenomenon. Considering the

theoretical perspective of the topic, a literature review stating the importance of corporate

social responsibility in achieving the financial objectives of an organisation. The organisation

chosen for this report is Nanosonics Limited which is an ASX listed company. A brief

overview of the company is provided stating its history, ownership, governance as well as

financial performance. The annual report of the company is thoroughly analysed for

determining the extent up to which the company follows sustainability and corporate social

responsibility in meeting its financial objectives. A sustainability reporting scoring index is

prepared according to the guidelines of Global Reporting Initiative (GRI). The social

responsibility that is shown in the annual report of the company, is rated according to the

prepared index and comments are provided accordingly.

Introduction

The primary objective of the report is to analyse and elaborate the growing

importance of sustainability and corporate social responsibility in achieving the financial

performance of a company. A theoretical perspective of corporate social responsibility is

provided through a literature review. A comparative study of the corporate social

responsibility is made with other relevant reporting concepts. Two other theories are then

explained which provides better essence of sustainability reporting. In the second part of the

report, the practical application of corporate social responsibility and sustainability is

examined through an organisation. The organisation that is chosen for this purpose is

Nanosonics Limited. An overview of the organisation is provided focussing on its history,

ownership, governance and financial performance. Further the report deals with a

sustainability reporting scoring index that is being prepared in accordance with the guidelines

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CONTEMPORARY ACCOUNTING THEORY

provided by Global Reporting Initiative (GRI). At the last section the sustainability reporting

of the company is compared with the standard provided by GRI and suitable analysis are

commentaries are provided. For the purpose of elaborating this section, the social

responsibility statement of the company has been used which is extracted from the annual

report of the company.

Discussion

PART - A

Literature review showing the importance of corporate social responsibility for firms

operating with financial objectives

Corporate social responsibility can be defined as a silent obligation of managers to

protect the interests of the groups belonging to the organisation. This obligation is implied

and enforced to the managers. In recent days, corporate social responsibility has been

considered as an important issue in the business operations.

A paper has been chosen to stress upon the importance and relevance of corporate

social responsibility in the business operations of today’s generation. In this context, it has

been observed that the different stakeholders of the company are becoming more aware of the

roles of the corporates in achieving its responsibilities towards the society (Strouhal et al.,

2015). The stakeholders have also demanded the involvements of the companies in the daily

running of the affairs of the society. Due to this reason, the corporates have realised that their

sole objective cannot be profit maximisation or growth (Strouhal et al., 2015). Along with

achieving its financial objectives, the corporates have thought of catering to the needs of its

interest groups and the host communities. In this process they have thought of linking their

financial objectives with their social interests.

provided by Global Reporting Initiative (GRI). At the last section the sustainability reporting

of the company is compared with the standard provided by GRI and suitable analysis are

commentaries are provided. For the purpose of elaborating this section, the social

responsibility statement of the company has been used which is extracted from the annual

report of the company.

Discussion

PART - A

Literature review showing the importance of corporate social responsibility for firms

operating with financial objectives

Corporate social responsibility can be defined as a silent obligation of managers to

protect the interests of the groups belonging to the organisation. This obligation is implied

and enforced to the managers. In recent days, corporate social responsibility has been

considered as an important issue in the business operations.

A paper has been chosen to stress upon the importance and relevance of corporate

social responsibility in the business operations of today’s generation. In this context, it has

been observed that the different stakeholders of the company are becoming more aware of the

roles of the corporates in achieving its responsibilities towards the society (Strouhal et al.,

2015). The stakeholders have also demanded the involvements of the companies in the daily

running of the affairs of the society. Due to this reason, the corporates have realised that their

sole objective cannot be profit maximisation or growth (Strouhal et al., 2015). Along with

achieving its financial objectives, the corporates have thought of catering to the needs of its

interest groups and the host communities. In this process they have thought of linking their

financial objectives with their social interests.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CONTEMPORARY ACCOUNTING THEORY

Another paper that has guided to suitable findings of this report has discussed about the

engagement of the management in achieving corporate social responsibility within the

organisation (Lim & Greenwood, 2017). It has been observed that the companies which

integrate social responsibility with their financial performance show all the aspects of social

development. Such companies have taken the initiative of making their products and services

more attractive to the customers (Lim & Greenwood, 2017). This in-turn generates more

profit for the company. Though the companies would incur additional costs for the

implementation of corporate social responsibility activity, still the benefits are likely to

outweigh the increased costs of the companies.

Comparison of Sustainability reporting with other reporting concepts

Sustainability reporting has been an emerging concept in today’s changing global

business environment. The companies have started to look beyond their financial

performances in order to incorporate sustainability in their accounting and reporting methods.

Sustainability accounting focuses on the disclosure of the non-financial information of the

companies to the external environment that comprises of the investors, creditors, government

and other kinds of authorities (Boiral & Henri, 2017). Sustainability reporting is a sub-

division of sustainability accounting that deals with the preparation of a sustainability report

for defining the goals, visions and missions of the organisations towards the society. The

sustainability report gives an idea regarding the commitment of the organisation towards the

development of the economy, society and the surrounding environment (Boiral & Henri,

2017). The major guidelines for the preparation of the sustainability report is provided by

Global Reporting Initiative (GRI). The companies are required to disclose their sustainability

performance properly and effectively in their sustainability reports.

Sustainability reporting can be explained in the light of corporate social responsibility

and the benefits of sustainability reporting over other reporting concepts can also be

Another paper that has guided to suitable findings of this report has discussed about the

engagement of the management in achieving corporate social responsibility within the

organisation (Lim & Greenwood, 2017). It has been observed that the companies which

integrate social responsibility with their financial performance show all the aspects of social

development. Such companies have taken the initiative of making their products and services

more attractive to the customers (Lim & Greenwood, 2017). This in-turn generates more

profit for the company. Though the companies would incur additional costs for the

implementation of corporate social responsibility activity, still the benefits are likely to

outweigh the increased costs of the companies.

Comparison of Sustainability reporting with other reporting concepts

Sustainability reporting has been an emerging concept in today’s changing global

business environment. The companies have started to look beyond their financial

performances in order to incorporate sustainability in their accounting and reporting methods.

Sustainability accounting focuses on the disclosure of the non-financial information of the

companies to the external environment that comprises of the investors, creditors, government

and other kinds of authorities (Boiral & Henri, 2017). Sustainability reporting is a sub-

division of sustainability accounting that deals with the preparation of a sustainability report

for defining the goals, visions and missions of the organisations towards the society. The

sustainability report gives an idea regarding the commitment of the organisation towards the

development of the economy, society and the surrounding environment (Boiral & Henri,

2017). The major guidelines for the preparation of the sustainability report is provided by

Global Reporting Initiative (GRI). The companies are required to disclose their sustainability

performance properly and effectively in their sustainability reports.

Sustainability reporting can be explained in the light of corporate social responsibility

and the benefits of sustainability reporting over other reporting concepts can also be

5CONTEMPORARY ACCOUNTING THEORY

highlighted. Sustainability reporting enhances the brand image of the company and also

increases its brand loyalty in the market (Maas, Schaltegger & Crutzen, 2016). This is

because the company has undertaken measures for addressing the issues of society and has

directly attracted more customers. The negative publicity of the company also gets eliminated

up to a greater extent.

Sustainability reporting also helps in attracting and retaining employees as the

company takes necessary steps in looking after the benefits of them through Corporate social

responsibility (Maas, Schaltegger & Crutzen, 2016). Sustainability reporting enables the

external stakeholders to possess an accurate picture regarding the value of the company and

also about its tangible and intangible assets.

The process helps the companies to incorporate their vision of sustainability into their

business as a corporate strategy. This would ultimately help the management in achieving

their overall goals and objectives that have been formulated regarding the development of

sustainability in the organisations.

Global studies have revealed that the companies who follow sustainability in their

accounting methods, have successfully earned greater revenues. The companies incur costs

by integrating sustainability into their reporting and accounting methods (Ehnert et al., 2016).

However, the revenues they generate through this, are large enough to supersede their cost

figures. This in-turn helps in the improvement of the efficiencies of the organisations.

Two theories that explain the essence of sustainability reporting

Two important theories that provides a deeper insight of sustainability accounting as

well as sustainability reporting are stakeholder theory and agency theory. Stakeholder theory

is regarded as the one of the major approaches to the management research consisting of

social, environmental and sustainability factors. In defining the stakeholder theory, it is

highlighted. Sustainability reporting enhances the brand image of the company and also

increases its brand loyalty in the market (Maas, Schaltegger & Crutzen, 2016). This is

because the company has undertaken measures for addressing the issues of society and has

directly attracted more customers. The negative publicity of the company also gets eliminated

up to a greater extent.

Sustainability reporting also helps in attracting and retaining employees as the

company takes necessary steps in looking after the benefits of them through Corporate social

responsibility (Maas, Schaltegger & Crutzen, 2016). Sustainability reporting enables the

external stakeholders to possess an accurate picture regarding the value of the company and

also about its tangible and intangible assets.

The process helps the companies to incorporate their vision of sustainability into their

business as a corporate strategy. This would ultimately help the management in achieving

their overall goals and objectives that have been formulated regarding the development of

sustainability in the organisations.

Global studies have revealed that the companies who follow sustainability in their

accounting methods, have successfully earned greater revenues. The companies incur costs

by integrating sustainability into their reporting and accounting methods (Ehnert et al., 2016).

However, the revenues they generate through this, are large enough to supersede their cost

figures. This in-turn helps in the improvement of the efficiencies of the organisations.

Two theories that explain the essence of sustainability reporting

Two important theories that provides a deeper insight of sustainability accounting as

well as sustainability reporting are stakeholder theory and agency theory. Stakeholder theory

is regarded as the one of the major approaches to the management research consisting of

social, environmental and sustainability factors. In defining the stakeholder theory, it is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CONTEMPORARY ACCOUNTING THEORY

extremely essential to define the term “stakeholder” (Jones, Harrison & Felps, 2018).

Stakeholders can be defined as those individuals or groups who are easily influenced by the

operations of the organisations. The process of value creation and trade affects the

stakeholders. In this respect, stakeholder theory can be defined as the way through which the

companies try to identify and manage the relevant stakeholders of the business and their

expectations in relation to sustainability (Jones, Harrison & Felps, 2018). Therefore, the

theory highlights the management of stakeholders by the different companies which can be

considered to be a crucial element of sustainability.

Another important theory that conspicuously defines sustainability is agency theory.

The theory broadly defines the relationship between the executive or the management of a

company and the shareholders (Shogren, Wehmeyer & Palmer, 2017). The shareholder is

treated as the principal while the executive is treated as an agent. Agency theory sorts to

resolve the issues that might arise between the principal and the agent. Through this method,

sustainability can be achieved inside the organisations.

PART – B

Introduction of the company with an overview of its history, ownership, governance and

financial performance

The company that has been chosen for this report is Nanosonics Limited. Nanosonics

is engaged in building up an effective technology that is automated to prevent infection of the

patients, clinics and the different staff personnel of the clinics. This technology has been

considered to be the first major innovation that leads to a high level disinfection (HLD) for

the ultrasound probes (Nanosonics.com.au, 2019). Through this technology the company

addresses the issues of infection with extreme safety and care. The company also tries to

extremely essential to define the term “stakeholder” (Jones, Harrison & Felps, 2018).

Stakeholders can be defined as those individuals or groups who are easily influenced by the

operations of the organisations. The process of value creation and trade affects the

stakeholders. In this respect, stakeholder theory can be defined as the way through which the

companies try to identify and manage the relevant stakeholders of the business and their

expectations in relation to sustainability (Jones, Harrison & Felps, 2018). Therefore, the

theory highlights the management of stakeholders by the different companies which can be

considered to be a crucial element of sustainability.

Another important theory that conspicuously defines sustainability is agency theory.

The theory broadly defines the relationship between the executive or the management of a

company and the shareholders (Shogren, Wehmeyer & Palmer, 2017). The shareholder is

treated as the principal while the executive is treated as an agent. Agency theory sorts to

resolve the issues that might arise between the principal and the agent. Through this method,

sustainability can be achieved inside the organisations.

PART – B

Introduction of the company with an overview of its history, ownership, governance and

financial performance

The company that has been chosen for this report is Nanosonics Limited. Nanosonics

is engaged in building up an effective technology that is automated to prevent infection of the

patients, clinics and the different staff personnel of the clinics. This technology has been

considered to be the first major innovation that leads to a high level disinfection (HLD) for

the ultrasound probes (Nanosonics.com.au, 2019). Through this technology the company

addresses the issues of infection with extreme safety and care. The company also tries to

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CONTEMPORARY ACCOUNTING THEORY

invest in its research and developmental areas for addressing the unmet needs for preventing

infection.

The company was first established in the year 2001 when it was head-quartered in

Sydney, Australia. The company got listed as NAN in the Australian Securities Exchange

(NAN) in the year 2007 (Nanosonics.com.au, 2019). As the years passed by, the company

launched many automated technologies for preventing infection in clinics. These

technologies gradually became very popular among the users and the company became an

eminent name in its respective industry.

The board of Nanosonics is jointly formed by two non-executive directors and the

CEO, who is also the president and the managing director of the company (Williamson,

2017). Next in the hierarchy is the non-executive chairman followed by two of the non-

executive directors (Tricker & Tricker, 2015). Another authority who is in-charge of the

board of the company is the deputy chairman. The board also consists of the chief technology

officer and the chief operations manager.

The board of directors of the company is committed towards achieving high standards

of corporate governance within the company. The board ensures the commitment of the

company towards corporate governance (Williamson, 2017). This is done by constant update

of the policies and the practices of the company. The company introduced Anti-Bribery and

Anti-Corruption Policies along with a revised Whistle-blower Policy. Nanosonics ensures its

compliancy with the listing rules that are stated by Australian Securities Exchange Board.

The company also abides by the corporate governance principles and recommendations that

are formulated by the same board (Tricker & Tricker, 2015). The different policies of

corporate governance as formulated by the company include code of conduct and ethics,

policies regarding trading of securities, Claw-back policy, Environmental policy, privacy and

invest in its research and developmental areas for addressing the unmet needs for preventing

infection.

The company was first established in the year 2001 when it was head-quartered in

Sydney, Australia. The company got listed as NAN in the Australian Securities Exchange

(NAN) in the year 2007 (Nanosonics.com.au, 2019). As the years passed by, the company

launched many automated technologies for preventing infection in clinics. These

technologies gradually became very popular among the users and the company became an

eminent name in its respective industry.

The board of Nanosonics is jointly formed by two non-executive directors and the

CEO, who is also the president and the managing director of the company (Williamson,

2017). Next in the hierarchy is the non-executive chairman followed by two of the non-

executive directors (Tricker & Tricker, 2015). Another authority who is in-charge of the

board of the company is the deputy chairman. The board also consists of the chief technology

officer and the chief operations manager.

The board of directors of the company is committed towards achieving high standards

of corporate governance within the company. The board ensures the commitment of the

company towards corporate governance (Williamson, 2017). This is done by constant update

of the policies and the practices of the company. The company introduced Anti-Bribery and

Anti-Corruption Policies along with a revised Whistle-blower Policy. Nanosonics ensures its

compliancy with the listing rules that are stated by Australian Securities Exchange Board.

The company also abides by the corporate governance principles and recommendations that

are formulated by the same board (Tricker & Tricker, 2015). The different policies of

corporate governance as formulated by the company include code of conduct and ethics,

policies regarding trading of securities, Claw-back policy, Environmental policy, privacy and

8CONTEMPORARY ACCOUNTING THEORY

diversity policy, policies for continuous disclosure of the financial information and policy for

owning shares.

The financial performance of Nanosonics Limited has been not very impressive in the

financial year ending at 2018. The sales revenue of the company has decreased from

$67,50,7000 to $60,69,8000 from years 2017 to 2018 (Nanosonics.com.au, 2019). In

comparing the profit before tax figure, the company has shown a sharp decline from 2017 to

2018 from $13,85,2000 to $5,58,3000. Similarly the net profit after tax figure has also shown

a sharp decline from $26,15,000 to $5,75,1000 (Nanosonics.com.au, 2019). The pre-tax

basic earnings per share of the company has decreased from 4.66 cents to 1.87 cents and

consequently the basic earnings per share has also decreased from 8.79 cents to 1.92 cents.

The share price of the company has remained on an average from $0.6 to $3.16. The highest

price has been observed in the year of 2018, that is, $3.16 (Nanosonics.com.au, 2019). As per

the report presented by the external auditors of the company, it has been stated that the

company has presented a true and a fair value of its financial position in its financial

statements. The company is also said to have complied with the Australian Accounting

Standard and also with the Corporations Regulations 2001.

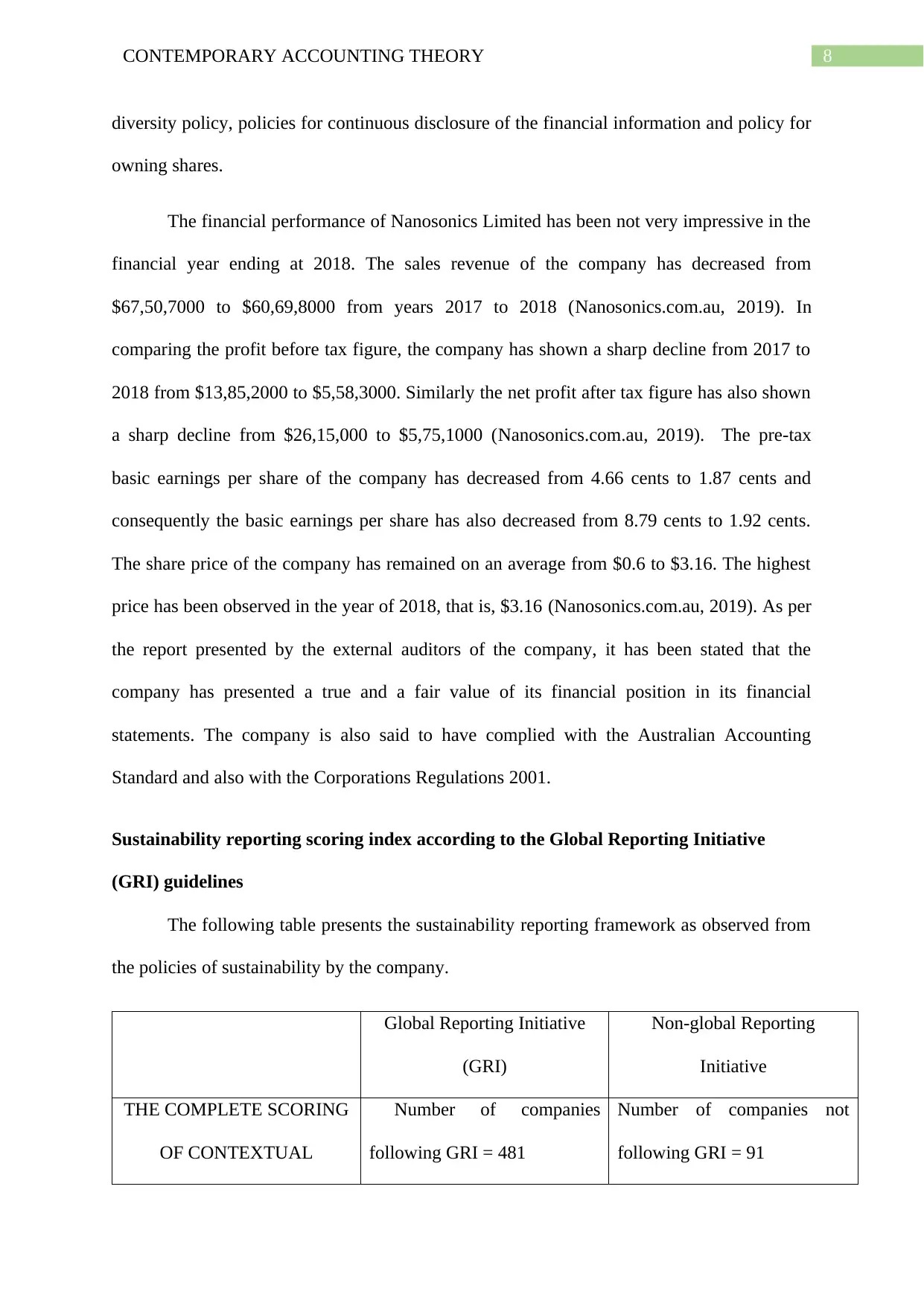

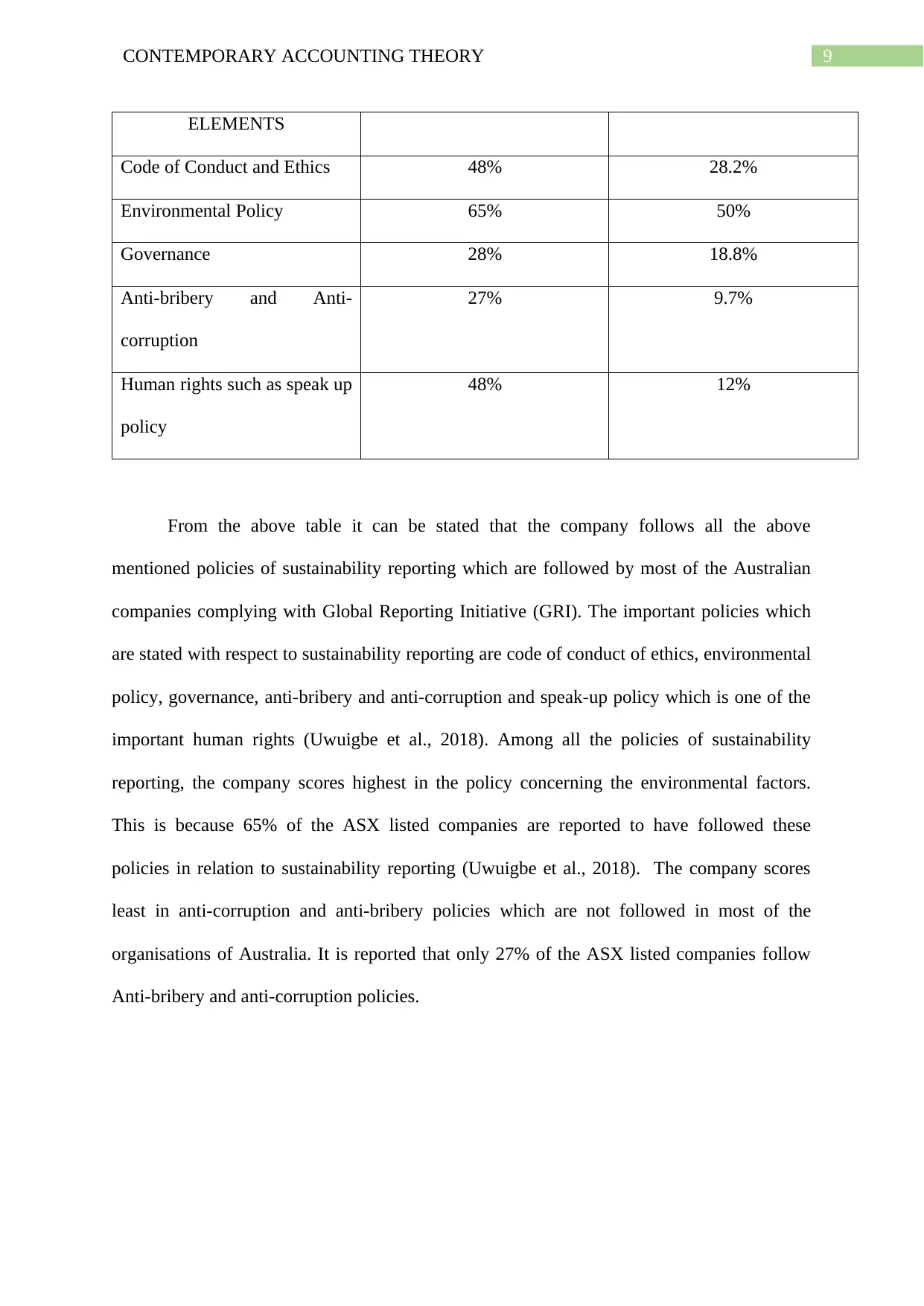

Sustainability reporting scoring index according to the Global Reporting Initiative

(GRI) guidelines

The following table presents the sustainability reporting framework as observed from

the policies of sustainability by the company.

Global Reporting Initiative

(GRI)

Non-global Reporting

Initiative

THE COMPLETE SCORING

OF CONTEXTUAL

Number of companies

following GRI = 481

Number of companies not

following GRI = 91

diversity policy, policies for continuous disclosure of the financial information and policy for

owning shares.

The financial performance of Nanosonics Limited has been not very impressive in the

financial year ending at 2018. The sales revenue of the company has decreased from

$67,50,7000 to $60,69,8000 from years 2017 to 2018 (Nanosonics.com.au, 2019). In

comparing the profit before tax figure, the company has shown a sharp decline from 2017 to

2018 from $13,85,2000 to $5,58,3000. Similarly the net profit after tax figure has also shown

a sharp decline from $26,15,000 to $5,75,1000 (Nanosonics.com.au, 2019). The pre-tax

basic earnings per share of the company has decreased from 4.66 cents to 1.87 cents and

consequently the basic earnings per share has also decreased from 8.79 cents to 1.92 cents.

The share price of the company has remained on an average from $0.6 to $3.16. The highest

price has been observed in the year of 2018, that is, $3.16 (Nanosonics.com.au, 2019). As per

the report presented by the external auditors of the company, it has been stated that the

company has presented a true and a fair value of its financial position in its financial

statements. The company is also said to have complied with the Australian Accounting

Standard and also with the Corporations Regulations 2001.

Sustainability reporting scoring index according to the Global Reporting Initiative

(GRI) guidelines

The following table presents the sustainability reporting framework as observed from

the policies of sustainability by the company.

Global Reporting Initiative

(GRI)

Non-global Reporting

Initiative

THE COMPLETE SCORING

OF CONTEXTUAL

Number of companies

following GRI = 481

Number of companies not

following GRI = 91

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CONTEMPORARY ACCOUNTING THEORY

ELEMENTS

Code of Conduct and Ethics 48% 28.2%

Environmental Policy 65% 50%

Governance 28% 18.8%

Anti-bribery and Anti-

corruption

27% 9.7%

Human rights such as speak up

policy

48% 12%

From the above table it can be stated that the company follows all the above

mentioned policies of sustainability reporting which are followed by most of the Australian

companies complying with Global Reporting Initiative (GRI). The important policies which

are stated with respect to sustainability reporting are code of conduct of ethics, environmental

policy, governance, anti-bribery and anti-corruption and speak-up policy which is one of the

important human rights (Uwuigbe et al., 2018). Among all the policies of sustainability

reporting, the company scores highest in the policy concerning the environmental factors.

This is because 65% of the ASX listed companies are reported to have followed these

policies in relation to sustainability reporting (Uwuigbe et al., 2018). The company scores

least in anti-corruption and anti-bribery policies which are not followed in most of the

organisations of Australia. It is reported that only 27% of the ASX listed companies follow

Anti-bribery and anti-corruption policies.

ELEMENTS

Code of Conduct and Ethics 48% 28.2%

Environmental Policy 65% 50%

Governance 28% 18.8%

Anti-bribery and Anti-

corruption

27% 9.7%

Human rights such as speak up

policy

48% 12%

From the above table it can be stated that the company follows all the above

mentioned policies of sustainability reporting which are followed by most of the Australian

companies complying with Global Reporting Initiative (GRI). The important policies which

are stated with respect to sustainability reporting are code of conduct of ethics, environmental

policy, governance, anti-bribery and anti-corruption and speak-up policy which is one of the

important human rights (Uwuigbe et al., 2018). Among all the policies of sustainability

reporting, the company scores highest in the policy concerning the environmental factors.

This is because 65% of the ASX listed companies are reported to have followed these

policies in relation to sustainability reporting (Uwuigbe et al., 2018). The company scores

least in anti-corruption and anti-bribery policies which are not followed in most of the

organisations of Australia. It is reported that only 27% of the ASX listed companies follow

Anti-bribery and anti-corruption policies.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CONTEMPORARY ACCOUNTING THEORY

Extent and quality of sustainability reporting of the selected Australian company

against sustainability reporting scoring index

The different codes of sustainability reporting as stated by Nanosonics Limited company

can be stated as below and the extent of their applicability is also analysed according to the

reporting index.

1) Code of conduct and ethics – The company has scored high in this category as

48% of the other Australian companies have immensely followed this code.

Nanosonics has set up this code so that there is an ethical and a legal framework

for the conduction of the business (Moraga et al., 2017). All the internal people

belonging to the company are required to act with honesty and integrity and

should not disclose price-sensitive information in the process of sustainability

reporting. Privacy and confidentiality is required to be maintained through this

code.

2) Environmental policy – The company has scored highest in this policy.

Approximately 65% of the ASX listed companies have followed this policy in

their sustainability reporting process (Durant, Fiorino & O'Leary, 2017). The

different activities that are taken into consideration by Nanosonics with respect to

this policy are waste management, paper reduction targets, compliance with legal

and other requirements, green initiatives and awareness of the company and

proper training methods.

3) Governance – The company scores moderate in this element of sustainability

reporting. The company recognises that in order to achieve its goals it is required

to understand and minimise the environmental impacts (Petschow, Rosenau &

Weizsäcker, 2017). The company has undertaken an ESG governance that relates

Extent and quality of sustainability reporting of the selected Australian company

against sustainability reporting scoring index

The different codes of sustainability reporting as stated by Nanosonics Limited company

can be stated as below and the extent of their applicability is also analysed according to the

reporting index.

1) Code of conduct and ethics – The company has scored high in this category as

48% of the other Australian companies have immensely followed this code.

Nanosonics has set up this code so that there is an ethical and a legal framework

for the conduction of the business (Moraga et al., 2017). All the internal people

belonging to the company are required to act with honesty and integrity and

should not disclose price-sensitive information in the process of sustainability

reporting. Privacy and confidentiality is required to be maintained through this

code.

2) Environmental policy – The company has scored highest in this policy.

Approximately 65% of the ASX listed companies have followed this policy in

their sustainability reporting process (Durant, Fiorino & O'Leary, 2017). The

different activities that are taken into consideration by Nanosonics with respect to

this policy are waste management, paper reduction targets, compliance with legal

and other requirements, green initiatives and awareness of the company and

proper training methods.

3) Governance – The company scores moderate in this element of sustainability

reporting. The company recognises that in order to achieve its goals it is required

to understand and minimise the environmental impacts (Petschow, Rosenau &

Weizsäcker, 2017). The company has undertaken an ESG governance that relates

11CONTEMPORARY ACCOUNTING THEORY

to the environmental, social factors that affect the business. Accordingly the

company has built up and updates its governance policies each year.

4) Anti-bribery and anti-corruption – The company scores least in this policy. The

anti-bribery and anti-corruption policy that has been vividly set up by the

company ensures that the sustainability reporting process does not get influenced

through the usage of these fraudulent activities (Borgonovi & Esposito, 2017). In

relation to this, the company sets out guidelines for its internal people for

appropriate recognition and dealing with the bribery as well as corruption issues.

5) Human rights – The company has been denoted as the highest scorer in this

policy. Through this policy, the company sets up ethical standards and ethical

conduct in its activities (Mani et al., 2016). The company fosters a culture of

openness, honesty, integrity as well as continuous improvement in this field. The

company also provides guidance about raising concerns and the process of

investigating these concerns.

Social responsibility of the company against the prepared index

The social initiatives that have been taken by the company with respect to sustainability

reporting can be stated as follows.

1) Healthy working environment – The company follows a positive and a supportive

working culture (Setó-Pamies & Papaoikonomou, 2016). The company has

successfully conducted a survey that aims to track the engagement of the company

with its internal people. This survey can be thought as a part of encouraging

expression as a part of communication within the environment of the organisation.

2) Diversity – In the field of social diversity, the company encourages gender

equality where females represent 29% among the 35% permanent full-time

workforce (Rao & Tilt, 2016).

to the environmental, social factors that affect the business. Accordingly the

company has built up and updates its governance policies each year.

4) Anti-bribery and anti-corruption – The company scores least in this policy. The

anti-bribery and anti-corruption policy that has been vividly set up by the

company ensures that the sustainability reporting process does not get influenced

through the usage of these fraudulent activities (Borgonovi & Esposito, 2017). In

relation to this, the company sets out guidelines for its internal people for

appropriate recognition and dealing with the bribery as well as corruption issues.

5) Human rights – The company has been denoted as the highest scorer in this

policy. Through this policy, the company sets up ethical standards and ethical

conduct in its activities (Mani et al., 2016). The company fosters a culture of

openness, honesty, integrity as well as continuous improvement in this field. The

company also provides guidance about raising concerns and the process of

investigating these concerns.

Social responsibility of the company against the prepared index

The social initiatives that have been taken by the company with respect to sustainability

reporting can be stated as follows.

1) Healthy working environment – The company follows a positive and a supportive

working culture (Setó-Pamies & Papaoikonomou, 2016). The company has

successfully conducted a survey that aims to track the engagement of the company

with its internal people. This survey can be thought as a part of encouraging

expression as a part of communication within the environment of the organisation.

2) Diversity – In the field of social diversity, the company encourages gender

equality where females represent 29% among the 35% permanent full-time

workforce (Rao & Tilt, 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.