New Zealand Economic Environment Analysis Report: MGMT.5920/5520

VerifiedAdded on 2023/03/21

|16

|2854

|20

Report

AI Summary

This report provides a comprehensive analysis of the economic environment of New Zealand, addressing key aspects such as supply and demand dynamics in the dairy industry, the impact of droughts and Chinese demand on milk prices, and the effects of reduced cow populations. The report further examines New Zealand's trade competitiveness by analyzing the Trade Weighted Index (TWI) and exchange rates, assessing the causes of current account deficits, and evaluating the impact of economic fluctuations in China. Additionally, the report explores the circular flow model in a multi-sector economy, identifying leakages and injections, and analyzes the Consumer Price Index (CPI) to calculate the inflation rate, providing a detailed overview of the economic factors influencing New Zealand's economy.

Running head: ECONOMIC ENVIRONMENT

Economic Environment

Name of the Student

Name of the University

Author Note

Economic Environment

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ECONOMIES OF NEW ZEALAND

Table of Contents

Part 1..........................................................................................................................................2

Answer to Question 1.............................................................................................................2

Answer to Question 2.............................................................................................................2

Answer 2.1.........................................................................................................................2

Answer 2.2.........................................................................................................................4

Answer to Question 3.............................................................................................................5

Answer 3.1.........................................................................................................................5

Answer 3.2.........................................................................................................................5

Answer to question 4..............................................................................................................6

Answer to 4.1.....................................................................................................................6

Answer to 4.2.....................................................................................................................7

Part 2..........................................................................................................................................7

Answer to Question 1.............................................................................................................7

Answer to a........................................................................................................................7

Answer to b........................................................................................................................7

Answer to c........................................................................................................................7

Answer to d........................................................................................................................8

Answer to question 2..............................................................................................................8

Answer to a........................................................................................................................8

Answer to b........................................................................................................................8

Answer to c........................................................................................................................9

Answer to question 3..............................................................................................................9

Answer to a........................................................................................................................9

Answer to b........................................................................................................................9

Answer to c........................................................................................................................9

Answer to d......................................................................................................................10

Answer to question 4............................................................................................................11

Answer to a......................................................................................................................11

Answer to b......................................................................................................................12

References................................................................................................................................13

Table of Contents

Part 1..........................................................................................................................................2

Answer to Question 1.............................................................................................................2

Answer to Question 2.............................................................................................................2

Answer 2.1.........................................................................................................................2

Answer 2.2.........................................................................................................................4

Answer to Question 3.............................................................................................................5

Answer 3.1.........................................................................................................................5

Answer 3.2.........................................................................................................................5

Answer to question 4..............................................................................................................6

Answer to 4.1.....................................................................................................................6

Answer to 4.2.....................................................................................................................7

Part 2..........................................................................................................................................7

Answer to Question 1.............................................................................................................7

Answer to a........................................................................................................................7

Answer to b........................................................................................................................7

Answer to c........................................................................................................................7

Answer to d........................................................................................................................8

Answer to question 2..............................................................................................................8

Answer to a........................................................................................................................8

Answer to b........................................................................................................................8

Answer to c........................................................................................................................9

Answer to question 3..............................................................................................................9

Answer to a........................................................................................................................9

Answer to b........................................................................................................................9

Answer to c........................................................................................................................9

Answer to d......................................................................................................................10

Answer to question 4............................................................................................................11

Answer to a......................................................................................................................11

Answer to b......................................................................................................................12

References................................................................................................................................13

2ECONOMIES OF NEW ZEALAND

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ECONOMIES OF NEW ZEALAND

Part 1

Answer to Question 1

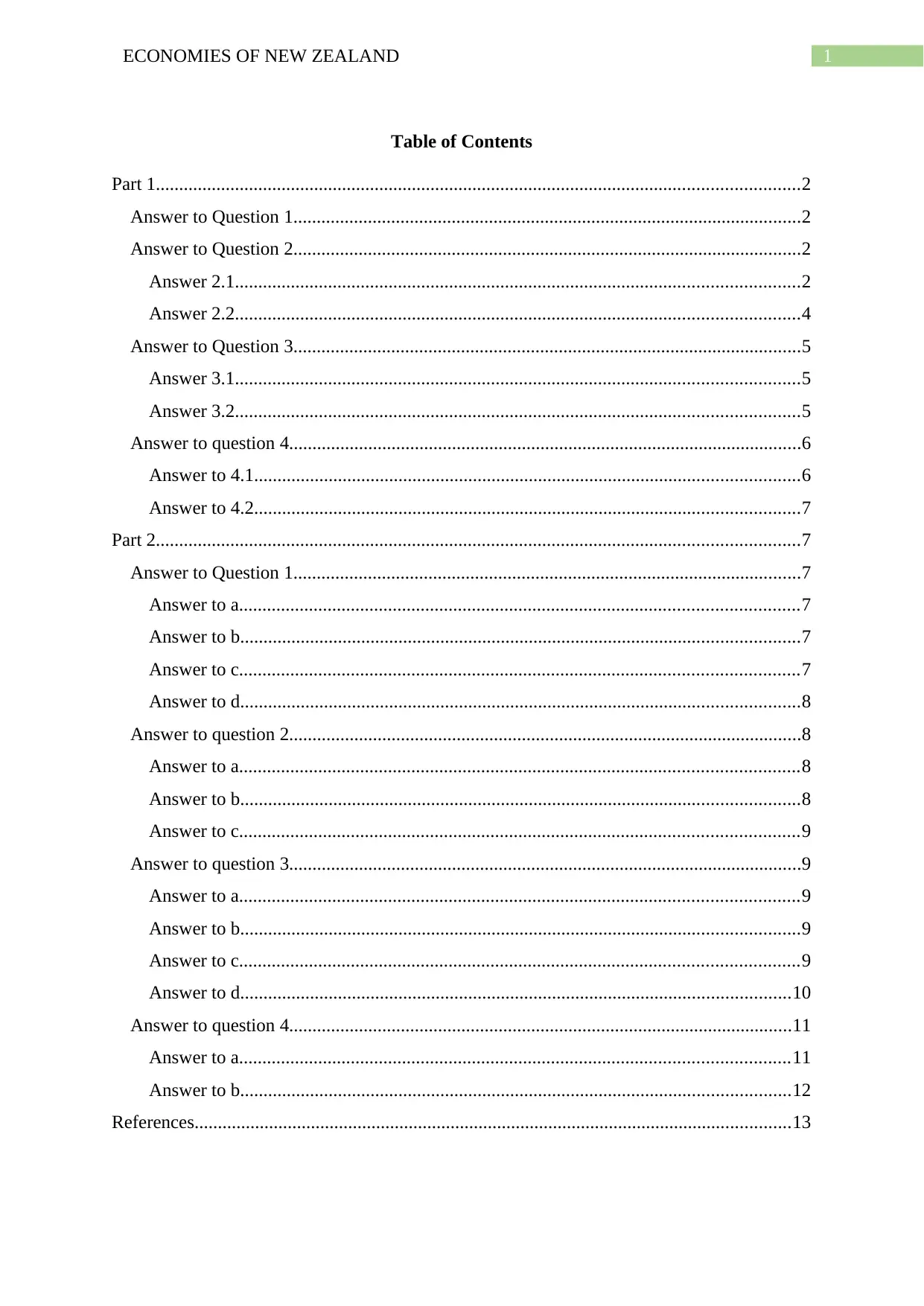

The price (P) of the dairy products in New Zealand increased in the first half of 2013

because of fall in supply caused due to drought. In the latter half of the year supply rose but

price did not fall due to rise is Chinese demand. The effect can be seen in the figure below.

Figure 1: Effect of drought and Chinese demand

Source: (Created by the Author)

In Figure 1, during drought supply of milk fell from Q1 to Q2 given same demand at

D1, thus price rose from P1 to P2 (Kamber, McDonald & Price, 2013). As the industry

rebound and production recovered, supply curve shifted back to S1form S2. However, it is

seen that price is at P3, which is close to previous high price P2. The reason behind this high

price is due increased Chinese demand that pushes demand curve rightward from D1 to D2.

Q3

P3

S2

S1

D1

D2

P2

Q2 Q1

P1

Price

Quantity of milkO

Part 1

Answer to Question 1

The price (P) of the dairy products in New Zealand increased in the first half of 2013

because of fall in supply caused due to drought. In the latter half of the year supply rose but

price did not fall due to rise is Chinese demand. The effect can be seen in the figure below.

Figure 1: Effect of drought and Chinese demand

Source: (Created by the Author)

In Figure 1, during drought supply of milk fell from Q1 to Q2 given same demand at

D1, thus price rose from P1 to P2 (Kamber, McDonald & Price, 2013). As the industry

rebound and production recovered, supply curve shifted back to S1form S2. However, it is

seen that price is at P3, which is close to previous high price P2. The reason behind this high

price is due increased Chinese demand that pushes demand curve rightward from D1 to D2.

Q3

P3

S2

S1

D1

D2

P2

Q2 Q1

P1

Price

Quantity of milkO

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ECONOMIES OF NEW ZEALAND

Answer to Question 2

Answer 2.1

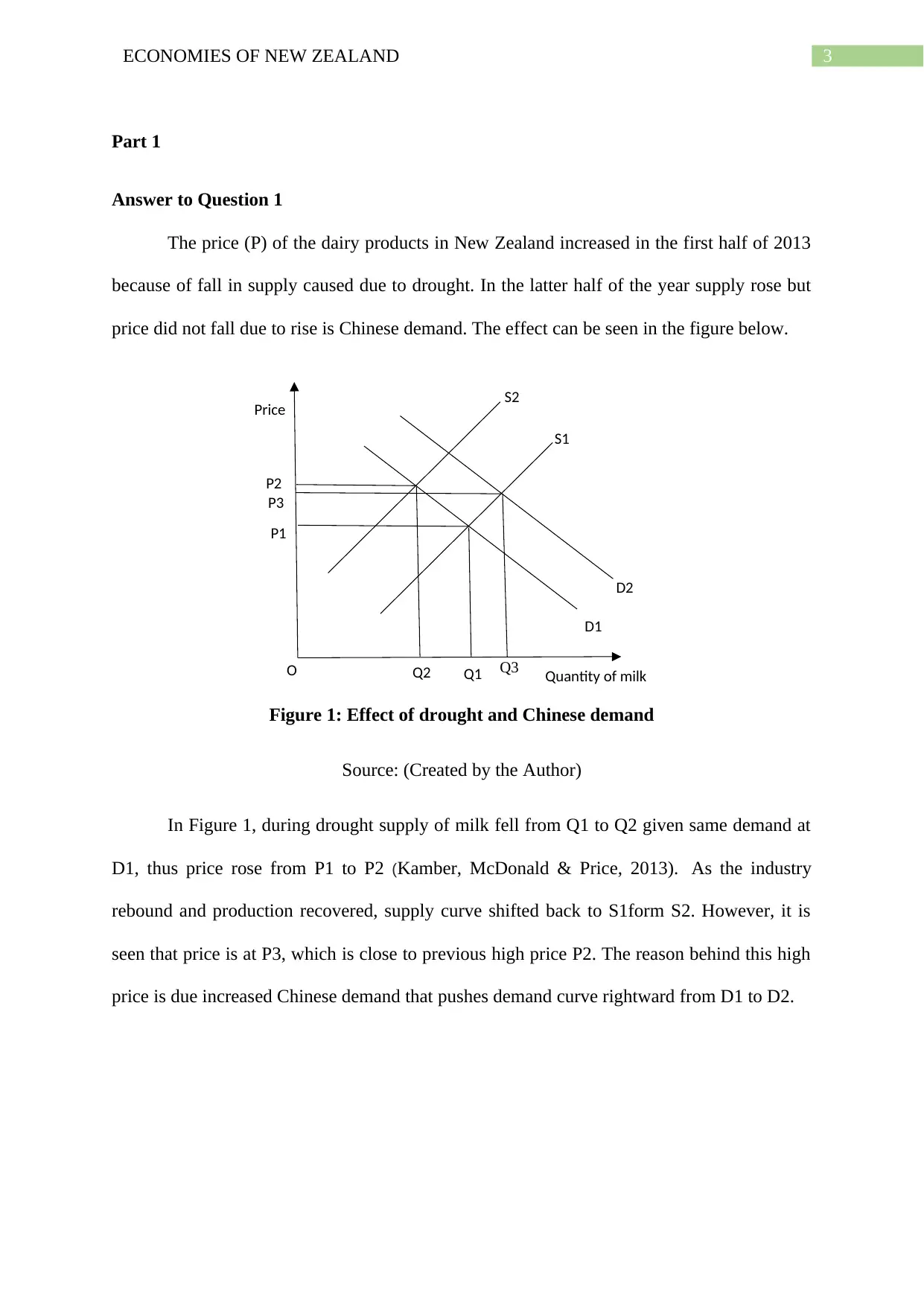

Young cows are going to meat works because of their low productivity, that does not

generating enough revenue in milk industry. The farms are of the plan that reducing cows’

numbers would reduce their cost of cow rearing; hence, the unproductive cows are going to

meat works (Morris & Kenyon 2014). The effect of reduced cow in the milk industry would

be minimal as the decrease in supply of milk will be less because unproductive cows are

going to meat works only. The effect of reduction in cows can be seen in Figure 2 given

below.

Figure 2: Effect of cows going to meat works

Source: (Created by the Author)

Hence, due to unproductive cows going to meat works supply curve shifts from S1

to S2. As a result, equilibrium quantity falls to Q2 and equilibrium price increases to P2.

S2 S1

D1

P2

P1

Q2 Q1

Price

Quantity of milkO

Answer to Question 2

Answer 2.1

Young cows are going to meat works because of their low productivity, that does not

generating enough revenue in milk industry. The farms are of the plan that reducing cows’

numbers would reduce their cost of cow rearing; hence, the unproductive cows are going to

meat works (Morris & Kenyon 2014). The effect of reduced cow in the milk industry would

be minimal as the decrease in supply of milk will be less because unproductive cows are

going to meat works only. The effect of reduction in cows can be seen in Figure 2 given

below.

Figure 2: Effect of cows going to meat works

Source: (Created by the Author)

Hence, due to unproductive cows going to meat works supply curve shifts from S1

to S2. As a result, equilibrium quantity falls to Q2 and equilibrium price increases to P2.

S2 S1

D1

P2

P1

Q2 Q1

Price

Quantity of milkO

5ECONOMIES OF NEW ZEALAND

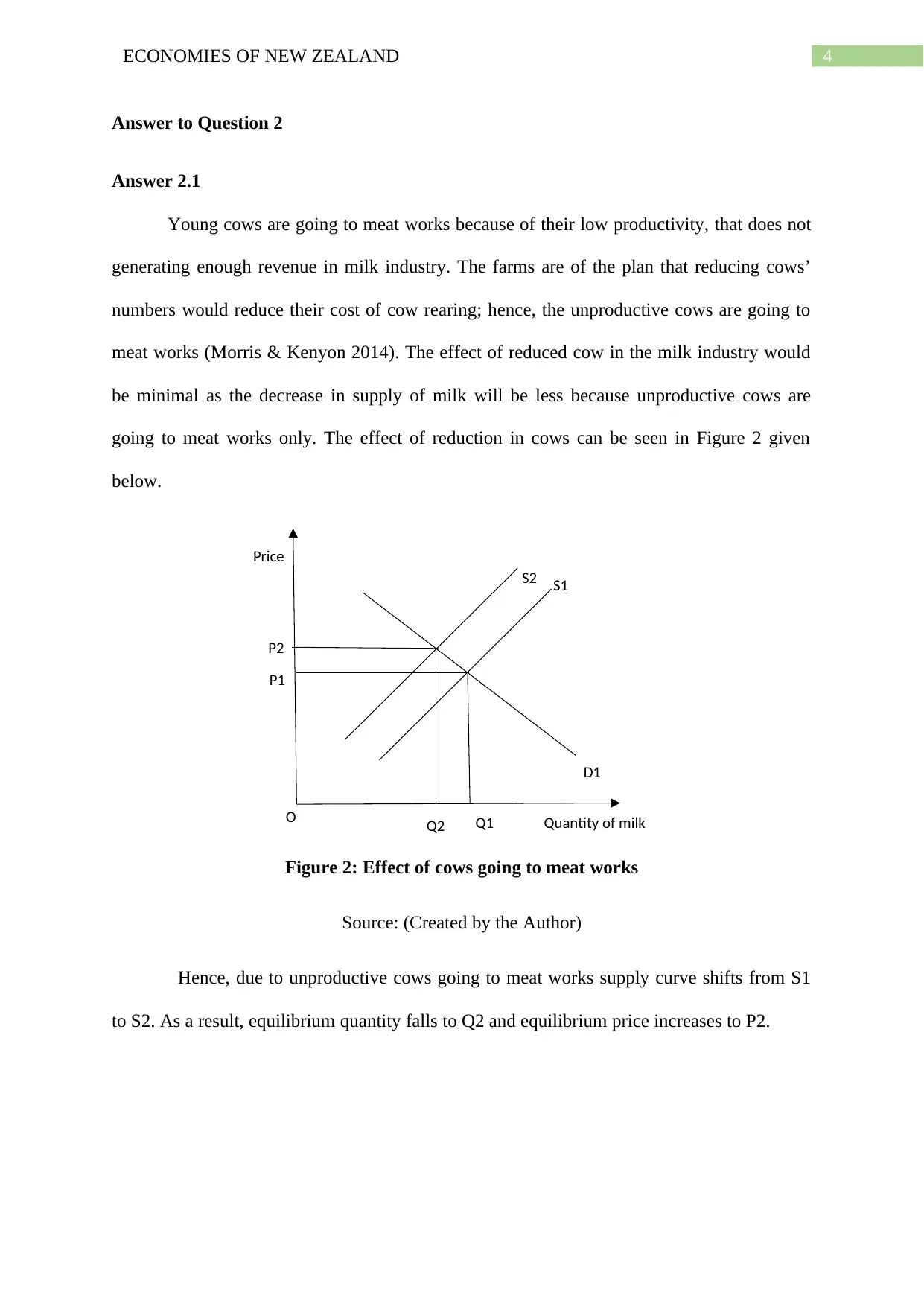

Answer 2.2

As cows going to meat works demand for crops will fall significantly, hence crop

price falls and farmers will face decrease amount of revenue (Bayoumi et al., 2013).

Figure 3: Effect of cows going to meat work on crop prices

Source: (Created by the Author)

In Figure 3, the fall in demand for crops shifted the demand curve inward from D1 to

D2 Consequently, equilibrium price in the crop market falls to P1 and equilibrium quantity in

the crop market declines to Q1.

S1

D1

P1

P*

Q*

Price

Quantity of cropsO

D2

Q1

Answer 2.2

As cows going to meat works demand for crops will fall significantly, hence crop

price falls and farmers will face decrease amount of revenue (Bayoumi et al., 2013).

Figure 3: Effect of cows going to meat work on crop prices

Source: (Created by the Author)

In Figure 3, the fall in demand for crops shifted the demand curve inward from D1 to

D2 Consequently, equilibrium price in the crop market falls to P1 and equilibrium quantity in

the crop market declines to Q1.

S1

D1

P1

P*

Q*

Price

Quantity of cropsO

D2

Q1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ECONOMIES OF NEW ZEALAND

Answer to Question 3

Answer 3.1

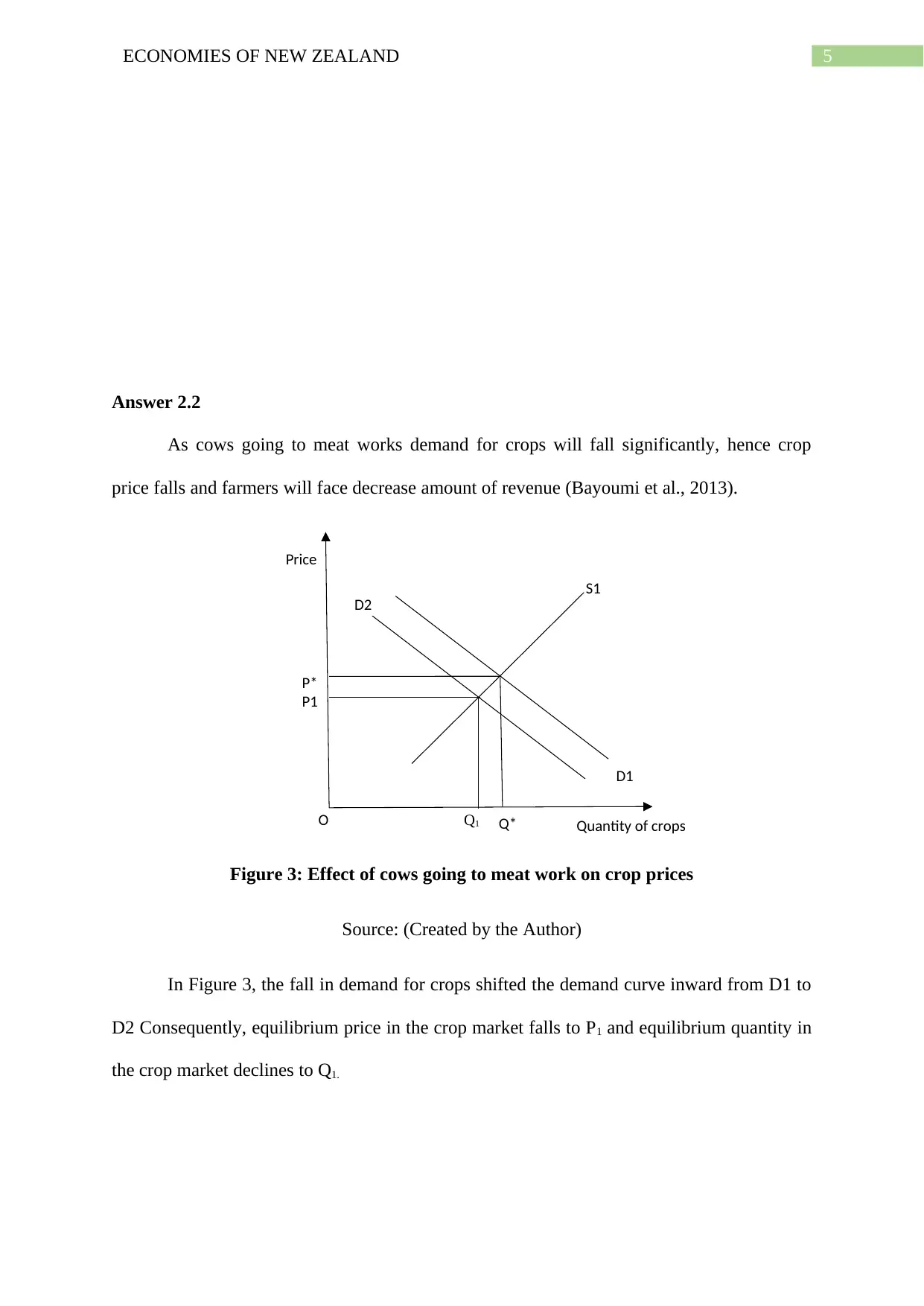

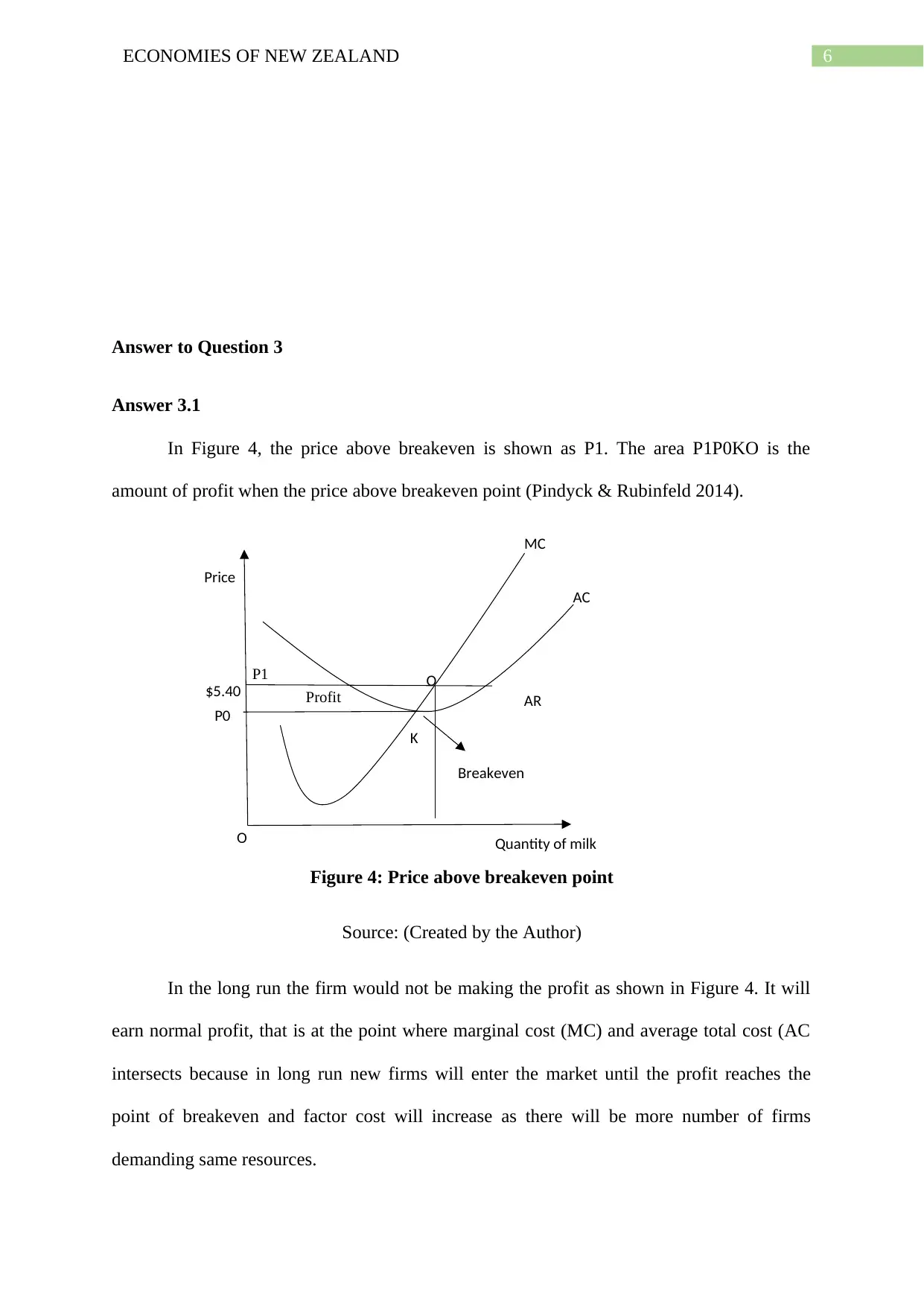

In Figure 4, the price above breakeven is shown as P1. The area P1P0KO is the

amount of profit when the price above breakeven point (Pindyck & Rubinfeld 2014).

Figure 4: Price above breakeven point

Source: (Created by the Author)

In the long run the firm would not be making the profit as shown in Figure 4. It will

earn normal profit, that is at the point where marginal cost (MC) and average total cost (AC

intersects because in long run new firms will enter the market until the profit reaches the

point of breakeven and factor cost will increase as there will be more number of firms

demanding same resources.

K

O

P0

MC

AC

$5.40

Price

Quantity of milkO

Breakeven

ARProfit

P1

Answer to Question 3

Answer 3.1

In Figure 4, the price above breakeven is shown as P1. The area P1P0KO is the

amount of profit when the price above breakeven point (Pindyck & Rubinfeld 2014).

Figure 4: Price above breakeven point

Source: (Created by the Author)

In the long run the firm would not be making the profit as shown in Figure 4. It will

earn normal profit, that is at the point where marginal cost (MC) and average total cost (AC

intersects because in long run new firms will enter the market until the profit reaches the

point of breakeven and factor cost will increase as there will be more number of firms

demanding same resources.

K

O

P0

MC

AC

$5.40

Price

Quantity of milkO

Breakeven

ARProfit

P1

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ECONOMIES OF NEW ZEALAND

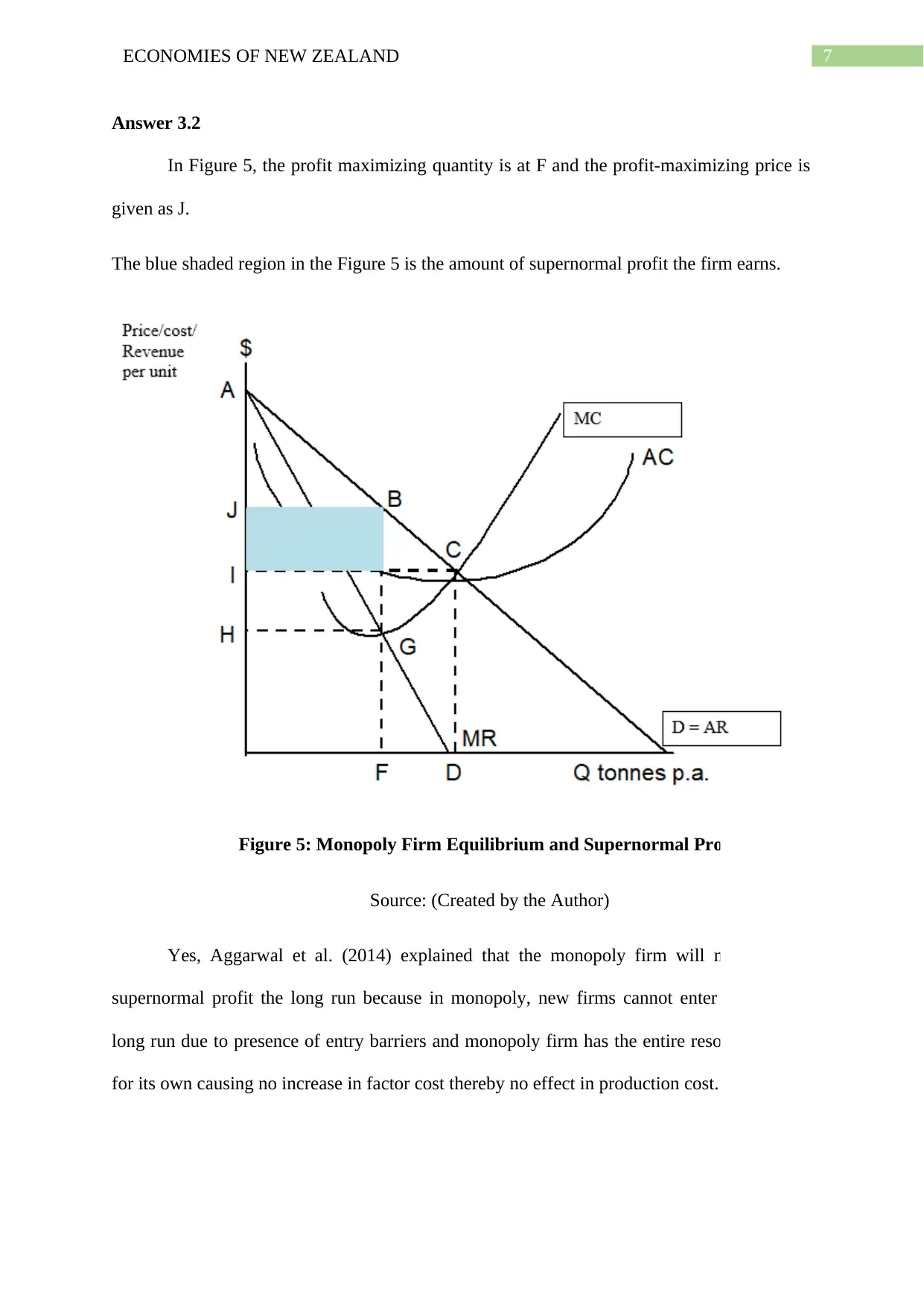

Answer 3.2

In Figure 5, the profit maximizing quantity is at F and the profit-maximizing price is

given as J.

The blue shaded region in the Figure 5 is the amount of supernormal profit the firm earns.

Figure 5: Monopoly Firm Equilibrium and Supernormal Profit

Source: (Created by the Author)

Yes, Aggarwal et al. (2014) explained that the monopoly firm will maintain the

supernormal profit the long run because in monopoly, new firms cannot enter even in the

long run due to presence of entry barriers and monopoly firm has the entire resource factors

for its own causing no increase in factor cost thereby no effect in production cost.

Answer 3.2

In Figure 5, the profit maximizing quantity is at F and the profit-maximizing price is

given as J.

The blue shaded region in the Figure 5 is the amount of supernormal profit the firm earns.

Figure 5: Monopoly Firm Equilibrium and Supernormal Profit

Source: (Created by the Author)

Yes, Aggarwal et al. (2014) explained that the monopoly firm will maintain the

supernormal profit the long run because in monopoly, new firms cannot enter even in the

long run due to presence of entry barriers and monopoly firm has the entire resource factors

for its own causing no increase in factor cost thereby no effect in production cost.

8ECONOMIES OF NEW ZEALAND

Answer to question 4

Answer to 4.1

The cost or benefit of any consumption or production incurred by an individual or a

group of people for which they are not responsible in anyway is considered as externalities to

them (Emas, 2015). There are two types of externalities one is positive and the other is

negative. The externalities associated with dairy farming are water pollution and degradation

of land quality. Both the externalities are negative externalities.

Answer to 4.2

Forestry absorbs carbon dioxide from the atmosphere and transforms them into wood

and soil. Therefore, improves the environment for all (Apsalyamova et al., 2015). Hence, the

externalities associated with forestry are positive one.

Part 2

Answer to Question 1

Answer to a

Trade Weighted Index (TWI) measures the effective exchange rate of a currency of a

country in comparison with one of the important trading partners. In other words, TWI

measures the strength of a country’s currency.

Answer to b

In 2014, NZD/USD exchange rate is high whereas TWI is low, that means, high value

of NZD is due to the weakness of USD. However, in 2015, TWI is more than the normal

exchange rate between NZD and USD; this indicates that though the exchange rate has fallen

the strength of NZD has increased (Jääskelä & Smith, 2013). In 2016, the gap between TWI

Answer to question 4

Answer to 4.1

The cost or benefit of any consumption or production incurred by an individual or a

group of people for which they are not responsible in anyway is considered as externalities to

them (Emas, 2015). There are two types of externalities one is positive and the other is

negative. The externalities associated with dairy farming are water pollution and degradation

of land quality. Both the externalities are negative externalities.

Answer to 4.2

Forestry absorbs carbon dioxide from the atmosphere and transforms them into wood

and soil. Therefore, improves the environment for all (Apsalyamova et al., 2015). Hence, the

externalities associated with forestry are positive one.

Part 2

Answer to Question 1

Answer to a

Trade Weighted Index (TWI) measures the effective exchange rate of a currency of a

country in comparison with one of the important trading partners. In other words, TWI

measures the strength of a country’s currency.

Answer to b

In 2014, NZD/USD exchange rate is high whereas TWI is low, that means, high value

of NZD is due to the weakness of USD. However, in 2015, TWI is more than the normal

exchange rate between NZD and USD; this indicates that though the exchange rate has fallen

the strength of NZD has increased (Jääskelä & Smith, 2013). In 2016, the gap between TWI

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ECONOMIES OF NEW ZEALAND

and exchange rate has decreased in comparison to 2015, but it is still stronger for NZD. Thus,

the trend shows from 2014 to 2016 the trading position of New Zealand has improved.

Answer to c

In 2009, NZD/USD exchange rate was low and TWI was much lower that means

during this period trading competitiveness of New Zealand was poor. However, in 2014 the

NZD/USD exchange rate grew significantly, same is the case with TWI, and the gap between

NZD/USD exchange rate and TWI is much less in comparison to 2009. Hence, the trading

competitiveness has improved from 2009 to 2014.

Answer to d

Current account deficit can cause due to overvaluation of domestic currency that rises

the value of import than export and leads to current account deficit (Coudert, Couharde &

Mignon, 2013). On the other hand, current account deficit can also occur due to

uncompetitive export products that cause decline in total exports and thereby give rise to

current account deficit.

Answer to question 2

Answer to a

The fall in household income of China would reduce the consumption of people. As a

result, the demand for products will decrease including imported products. Hence, the exports

of dairy and meat to China will reduce resulting less export for New Zealand and thereby

current account balance will decrease.

and exchange rate has decreased in comparison to 2015, but it is still stronger for NZD. Thus,

the trend shows from 2014 to 2016 the trading position of New Zealand has improved.

Answer to c

In 2009, NZD/USD exchange rate was low and TWI was much lower that means

during this period trading competitiveness of New Zealand was poor. However, in 2014 the

NZD/USD exchange rate grew significantly, same is the case with TWI, and the gap between

NZD/USD exchange rate and TWI is much less in comparison to 2009. Hence, the trading

competitiveness has improved from 2009 to 2014.

Answer to d

Current account deficit can cause due to overvaluation of domestic currency that rises

the value of import than export and leads to current account deficit (Coudert, Couharde &

Mignon, 2013). On the other hand, current account deficit can also occur due to

uncompetitive export products that cause decline in total exports and thereby give rise to

current account deficit.

Answer to question 2

Answer to a

The fall in household income of China would reduce the consumption of people. As a

result, the demand for products will decrease including imported products. Hence, the exports

of dairy and meat to China will reduce resulting less export for New Zealand and thereby

current account balance will decrease.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ECONOMIES OF NEW ZEALAND

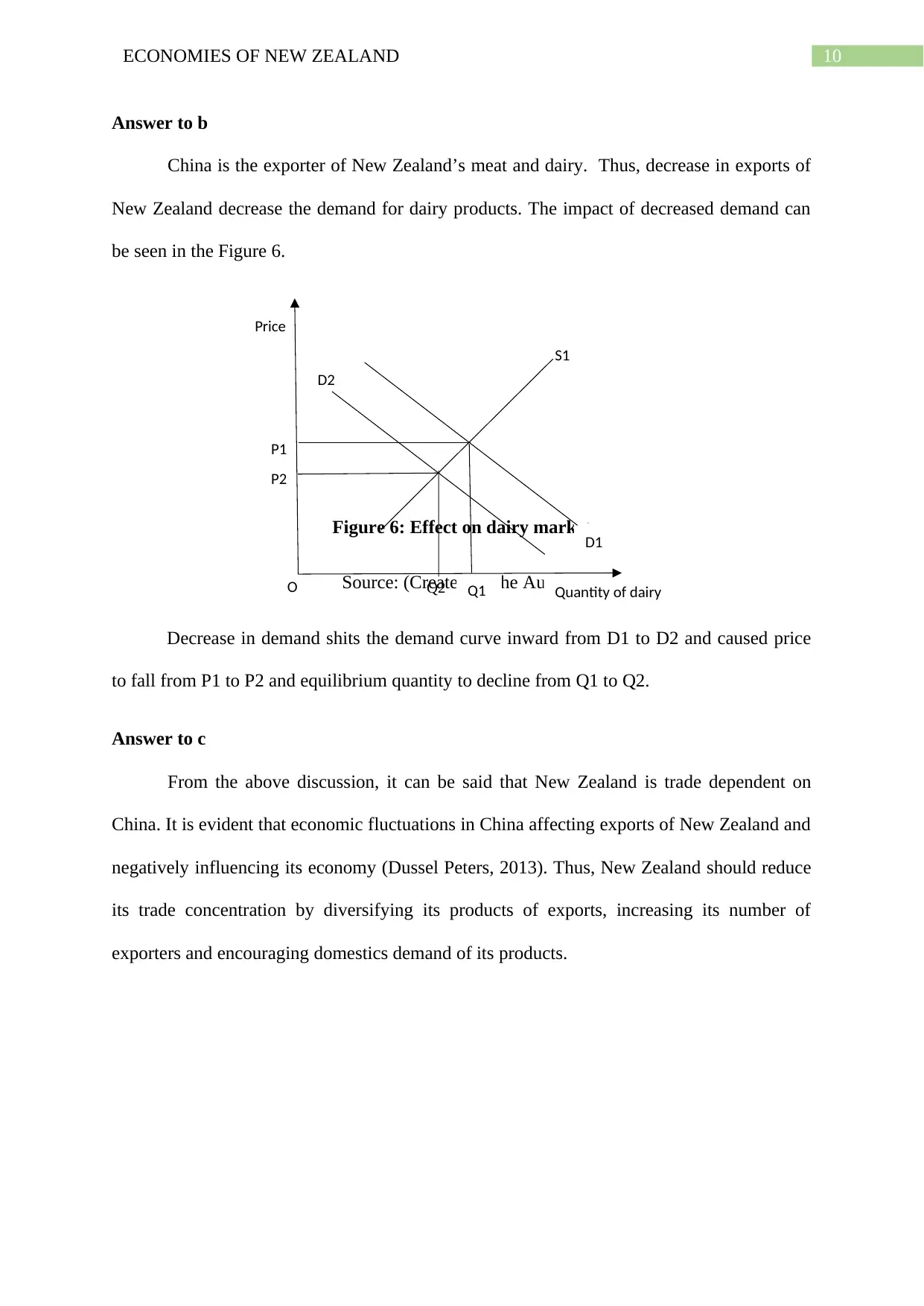

Answer to b

China is the exporter of New Zealand’s meat and dairy. Thus, decrease in exports of

New Zealand decrease the demand for dairy products. The impact of decreased demand can

be seen in the Figure 6.

Figure 6: Effect on dairy market

Source: (Created by the Author)

Decrease in demand shits the demand curve inward from D1 to D2 and caused price

to fall from P1 to P2 and equilibrium quantity to decline from Q1 to Q2.

Answer to c

From the above discussion, it can be said that New Zealand is trade dependent on

China. It is evident that economic fluctuations in China affecting exports of New Zealand and

negatively influencing its economy (Dussel Peters, 2013). Thus, New Zealand should reduce

its trade concentration by diversifying its products of exports, increasing its number of

exporters and encouraging domestics demand of its products.

S1

D1

P2

P1

Q1

Price

Quantity of dairyO

D2

Q2

Answer to b

China is the exporter of New Zealand’s meat and dairy. Thus, decrease in exports of

New Zealand decrease the demand for dairy products. The impact of decreased demand can

be seen in the Figure 6.

Figure 6: Effect on dairy market

Source: (Created by the Author)

Decrease in demand shits the demand curve inward from D1 to D2 and caused price

to fall from P1 to P2 and equilibrium quantity to decline from Q1 to Q2.

Answer to c

From the above discussion, it can be said that New Zealand is trade dependent on

China. It is evident that economic fluctuations in China affecting exports of New Zealand and

negatively influencing its economy (Dussel Peters, 2013). Thus, New Zealand should reduce

its trade concentration by diversifying its products of exports, increasing its number of

exporters and encouraging domestics demand of its products.

S1

D1

P2

P1

Q1

Price

Quantity of dairyO

D2

Q2

11ECONOMIES OF NEW ZEALAND

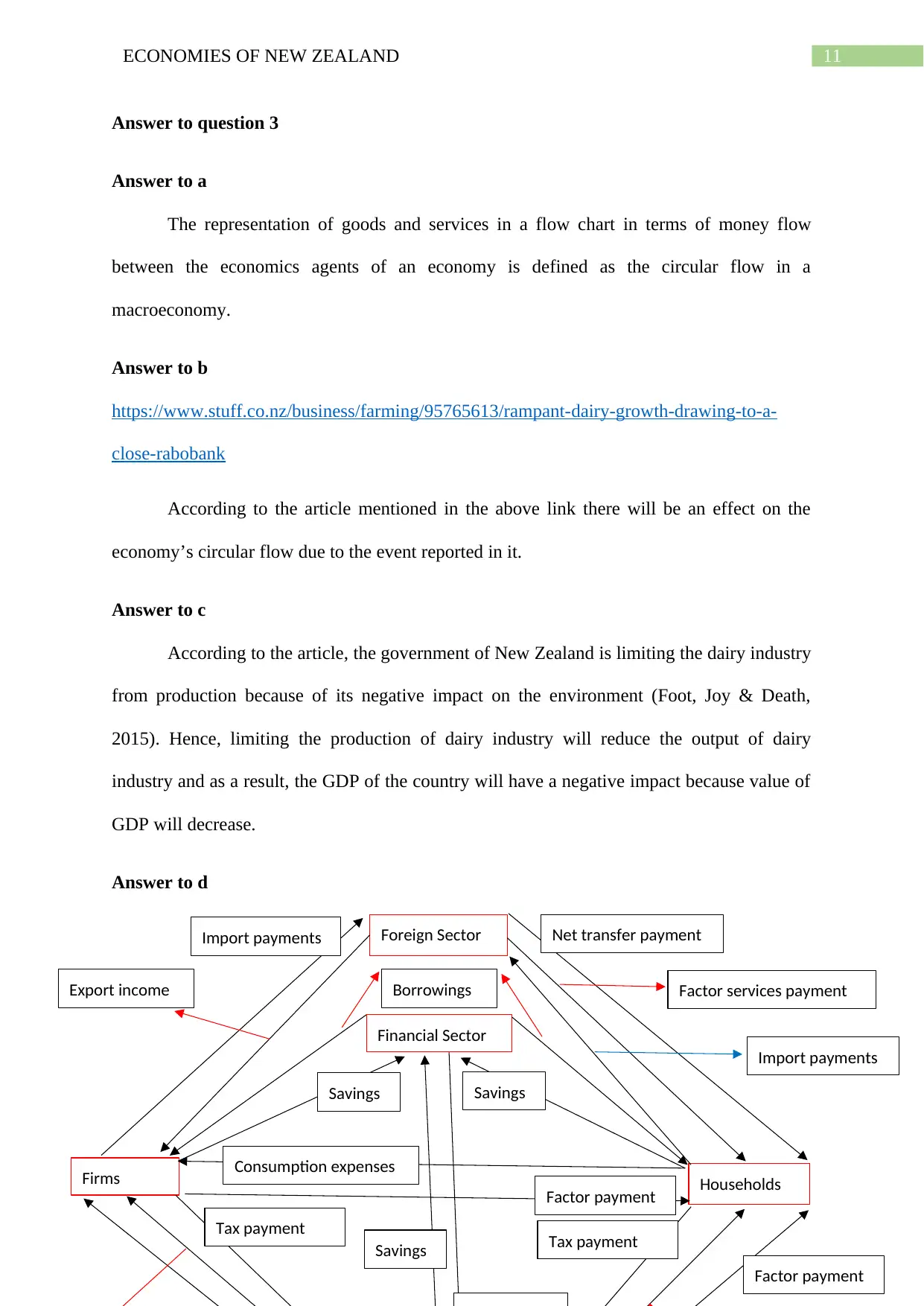

Answer to question 3

Answer to a

The representation of goods and services in a flow chart in terms of money flow

between the economics agents of an economy is defined as the circular flow in a

macroeconomy.

Answer to b

https://www.stuff.co.nz/business/farming/95765613/rampant-dairy-growth-drawing-to-a-

close-rabobank

According to the article mentioned in the above link there will be an effect on the

economy’s circular flow due to the event reported in it.

Answer to c

According to the article, the government of New Zealand is limiting the dairy industry

from production because of its negative impact on the environment (Foot, Joy & Death,

2015). Hence, limiting the production of dairy industry will reduce the output of dairy

industry and as a result, the GDP of the country will have a negative impact because value of

GDP will decrease.

Answer to d

HouseholdsFirms

Foreign Sector

Financial Sector

Factor payment

Tax payment

Consumption expenses

Factor payment

Tax payment

Net transfer payment

Factor services payment

Import payments

Savings

Savings Savings

Import payments

Export income Borrowings

Answer to question 3

Answer to a

The representation of goods and services in a flow chart in terms of money flow

between the economics agents of an economy is defined as the circular flow in a

macroeconomy.

Answer to b

https://www.stuff.co.nz/business/farming/95765613/rampant-dairy-growth-drawing-to-a-

close-rabobank

According to the article mentioned in the above link there will be an effect on the

economy’s circular flow due to the event reported in it.

Answer to c

According to the article, the government of New Zealand is limiting the dairy industry

from production because of its negative impact on the environment (Foot, Joy & Death,

2015). Hence, limiting the production of dairy industry will reduce the output of dairy

industry and as a result, the GDP of the country will have a negative impact because value of

GDP will decrease.

Answer to d

HouseholdsFirms

Foreign Sector

Financial Sector

Factor payment

Tax payment

Consumption expenses

Factor payment

Tax payment

Net transfer payment

Factor services payment

Import payments

Savings

Savings Savings

Import payments

Export income Borrowings

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.