Case Analysis: Nursing Service Plan, Budget, Staffing, and Expenditure

VerifiedAdded on 2021/04/24

|16

|3541

|50

Report

AI Summary

This case analysis examines the development of a business plan for a new 12-bed short-stay surgical ward within a 32-bed general surgical ward. The report outlines the steps required to create a nursing service business plan, including business case formulation, setting aims and objectives, establishing patient criteria, and considering publicity and location. It also delves into the data and documents necessary for analysis, such as patient and staff records, and explores the use of nurse-to-patient staffing ratios. Furthermore, the analysis highlights the benefits of involving the nurse manager in cost centre budget development, advocating for the use of zero-based budgeting. The report identifies the main areas of expenditure – fixed, variable, and semi-variable costs – and discusses related issues. Finally, the analysis addresses the creation of a salaries and wages budget for the combined service, offering insights into effective healthcare management and financial planning.

Running head: CASE ANALYSIS

Case Analysis

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Case Analysis

Name of the Student:

Name of the University:

Author’s Note:

Course ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CASE ANALYSIS

Introduction:

The current assignment aims to formulate a business plan for adding a new 12-bed short

stay surgical ward in the 32 bed general surgical ward. The first section of the assignment would

focus on discussing steps required to develop a nursing service business plan, type of workload

methodology needed to ascertain nurse supply and staff education issues for the new service. The

second part would concentrate on identifying the benefits of including the nurse manager in

developing cost centre budget and the appropriate budgeting method to be used. In addition, the

three main areas of expenditure taken into account for the expenditure budget and issues related

to the expenditures have been identified as well. Finally, the assignment would shed light on

developing salaries and wages budget for the new combined service.

Question 1:

Question 1.1:

The steps required to form a nursing service business plan and their significance are

demonstrated briefly as follows:

Business case:

In this phase, planning needs to be made about the way of combining short stay surgical

ward in the 32-bed general surgical ward. Such planning would focus on the financial aspect of

the combined service, rational for using resources and the facility of the designed service

(Alviniussen and Jankensgard 2015). This would help in providing a clear depiction to all those

likely to be affected by the project.

Aims and objectives:

Introduction:

The current assignment aims to formulate a business plan for adding a new 12-bed short

stay surgical ward in the 32 bed general surgical ward. The first section of the assignment would

focus on discussing steps required to develop a nursing service business plan, type of workload

methodology needed to ascertain nurse supply and staff education issues for the new service. The

second part would concentrate on identifying the benefits of including the nurse manager in

developing cost centre budget and the appropriate budgeting method to be used. In addition, the

three main areas of expenditure taken into account for the expenditure budget and issues related

to the expenditures have been identified as well. Finally, the assignment would shed light on

developing salaries and wages budget for the new combined service.

Question 1:

Question 1.1:

The steps required to form a nursing service business plan and their significance are

demonstrated briefly as follows:

Business case:

In this phase, planning needs to be made about the way of combining short stay surgical

ward in the 32-bed general surgical ward. Such planning would focus on the financial aspect of

the combined service, rational for using resources and the facility of the designed service

(Alviniussen and Jankensgard 2015). This would help in providing a clear depiction to all those

likely to be affected by the project.

Aims and objectives:

2CASE ANALYSIS

In this step, the hospital needs to be clear regarding its aims and objectives of the project.

This would help in clarifying the services to be provided to the patients and other healthcare

professionals referring to the service (Anessi-Pessina et al. 2016). In addition, a clear approach at

this stage would enable in demonstrating the areas to be audited and evaluated in future.

Patient criteria:

This step requires setting up criteria required to meet for accessing the nurse-led clinic.

For instance, the clinic could provide leaflets to the patients regarding the services to be

provided.

Publicity:

It would not be possible for the clinic to succeed, if the patients and referrers do not know

its existence and the services offered. Public needs to be initiated at the planning phase, since it

might prompt discussion leading to adjustment of the designed service (Arnaboldi, Lapsley and

Steccolini 2015). Leaflets, posters, group discussions, web information and visits to those

probable to use it could depict the nature of service, its initiation and explaining the ways and

time of accessing the same.

Location:

This step needs determining the area where the proposed service would be provided. In

this case, the short stay surgical ward would be merged with the 32-bed general surgical ward for

developing a new 12-bed service.

Multidisciplinary support:

In this step, the hospital needs to be clear regarding its aims and objectives of the project.

This would help in clarifying the services to be provided to the patients and other healthcare

professionals referring to the service (Anessi-Pessina et al. 2016). In addition, a clear approach at

this stage would enable in demonstrating the areas to be audited and evaluated in future.

Patient criteria:

This step requires setting up criteria required to meet for accessing the nurse-led clinic.

For instance, the clinic could provide leaflets to the patients regarding the services to be

provided.

Publicity:

It would not be possible for the clinic to succeed, if the patients and referrers do not know

its existence and the services offered. Public needs to be initiated at the planning phase, since it

might prompt discussion leading to adjustment of the designed service (Arnaboldi, Lapsley and

Steccolini 2015). Leaflets, posters, group discussions, web information and visits to those

probable to use it could depict the nature of service, its initiation and explaining the ways and

time of accessing the same.

Location:

This step needs determining the area where the proposed service would be provided. In

this case, the short stay surgical ward would be merged with the 32-bed general surgical ward for

developing a new 12-bed service.

Multidisciplinary support:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CASE ANALYSIS

Before initiating the service, it is necessary for the healthcare professionals to refer to the

services obtaining the referrals along with suggesting for offering education, support and advice.

It requires taking into account the suggestions for adjustments or adaptation or it is not felt that

the service is warranted at this phase (Baal, Meltzer and Brouwer 2016). Hence, the value of the

business case is immense here in order to make clear argument about the service need and

viability.

Professional development:

This is a significant element of a nurse-led clinic, since it underpins competent service. It

is significant to place structures in place enhancing the ability to view deficits in knowledge base

along with the ability for rectifying them.

Managing medicines:

Medicines could be managed in a variety of ways from supplying them via patient group

directions to independent and supplementary prescribing. In case, the route taken is nurse

prescribing, the clinic needs to consider the way of maintaining professional development in this

area.

Audit and evaluation:

Ongoing audit and evaluation is crucial in order to meet the requirements of the patients.

This implies that the services offered make variation to the service users (Cherry and Jacob

2016). Hence, the service needs to be designed in such a manner that it satisfies the requirements

of all the users.

Closing the loop:

Before initiating the service, it is necessary for the healthcare professionals to refer to the

services obtaining the referrals along with suggesting for offering education, support and advice.

It requires taking into account the suggestions for adjustments or adaptation or it is not felt that

the service is warranted at this phase (Baal, Meltzer and Brouwer 2016). Hence, the value of the

business case is immense here in order to make clear argument about the service need and

viability.

Professional development:

This is a significant element of a nurse-led clinic, since it underpins competent service. It

is significant to place structures in place enhancing the ability to view deficits in knowledge base

along with the ability for rectifying them.

Managing medicines:

Medicines could be managed in a variety of ways from supplying them via patient group

directions to independent and supplementary prescribing. In case, the route taken is nurse

prescribing, the clinic needs to consider the way of maintaining professional development in this

area.

Audit and evaluation:

Ongoing audit and evaluation is crucial in order to meet the requirements of the patients.

This implies that the services offered make variation to the service users (Cherry and Jacob

2016). Hence, the service needs to be designed in such a manner that it satisfies the requirements

of all the users.

Closing the loop:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CASE ANALYSIS

The last step denotes the requirement to be kept in mind is that the clinic is a growing

service. In addition, it is necessary for the clinic in order to assure paperwork like publicity and

job descriptions, which would help in keeping pace with the variations in relation to the offered

service.

Question 1.2:

The data and documents that the hospital needs to collect and analyse for including

additional beds in the ward comprise of the following:

Patients’ clinical records:

These records denote the knowledge of events related to illness of the patients, their

recovery and kind of care that the hospital authority provides (Finkler, Calabrese and Ward

2018). This would help in providing legal protection to the hospital nurses and doctors along

with avoiding work duplication.

Individual staff records:

For the new group of staffs to be recruited, there would be a separate group of record

providing details regarding their sicknesses, career and development activities along with a

personnel note.

Ward records:

Ward records are those records, which are prepared for a specific ward (Greene et al.

2016). Such records would be in the form of round book, duty roaster, ward indent book and

staff-patient assignment record.

Administrative records:

The last step denotes the requirement to be kept in mind is that the clinic is a growing

service. In addition, it is necessary for the clinic in order to assure paperwork like publicity and

job descriptions, which would help in keeping pace with the variations in relation to the offered

service.

Question 1.2:

The data and documents that the hospital needs to collect and analyse for including

additional beds in the ward comprise of the following:

Patients’ clinical records:

These records denote the knowledge of events related to illness of the patients, their

recovery and kind of care that the hospital authority provides (Finkler, Calabrese and Ward

2018). This would help in providing legal protection to the hospital nurses and doctors along

with avoiding work duplication.

Individual staff records:

For the new group of staffs to be recruited, there would be a separate group of record

providing details regarding their sicknesses, career and development activities along with a

personnel note.

Ward records:

Ward records are those records, which are prepared for a specific ward (Greene et al.

2016). Such records would be in the form of round book, duty roaster, ward indent book and

staff-patient assignment record.

Administrative records:

5CASE ANALYSIS

For the new staffs to be appointed, they need to be provided with the organisational chart,

job description and procedure manual. In addition, there needs to be maintenance of treatment

register, personnel performance register along with administration and discharge register.

Question 1.3:

The hospital would use the compulsory hospital nurse to patient staffing ratios for

supplying the excess new nurses to achieve the new service demand. The expansion of the ward

because of the inclusion of additional surgical beds implies that there would be increase in the

number of patients (Dudin et al. 2015). With the help of nurse to patient staffing ratio, it would

be beneficial for the clinic to ascertain the number of nurses to be included. This would help in

assuring that the hospital would not encounter a challenge related to insufficient staffs for

providing health services to the patients.

Question 1.4:

The management of personnel in healthcare setting comprises of blending the staffs of

various professional backgrounds, skills and qualifications with the aim to maximise patient care

(Eldenburg, Krishnan and Krishnan 2017). Even though this staffing method tends to work

effectively, it would result in increased utilisation of less qualified staffs leading to insufficient

service delivery. The clinic, therefore, needs to take into account the issue of employing

numerous less qualified staffs through recruiting employees with the right qualifications.

Question 2:

Question 2.1:

The following are the major benefits of having the nurse manager in developing cost

centre budget:

For the new staffs to be appointed, they need to be provided with the organisational chart,

job description and procedure manual. In addition, there needs to be maintenance of treatment

register, personnel performance register along with administration and discharge register.

Question 1.3:

The hospital would use the compulsory hospital nurse to patient staffing ratios for

supplying the excess new nurses to achieve the new service demand. The expansion of the ward

because of the inclusion of additional surgical beds implies that there would be increase in the

number of patients (Dudin et al. 2015). With the help of nurse to patient staffing ratio, it would

be beneficial for the clinic to ascertain the number of nurses to be included. This would help in

assuring that the hospital would not encounter a challenge related to insufficient staffs for

providing health services to the patients.

Question 1.4:

The management of personnel in healthcare setting comprises of blending the staffs of

various professional backgrounds, skills and qualifications with the aim to maximise patient care

(Eldenburg, Krishnan and Krishnan 2017). Even though this staffing method tends to work

effectively, it would result in increased utilisation of less qualified staffs leading to insufficient

service delivery. The clinic, therefore, needs to take into account the issue of employing

numerous less qualified staffs through recruiting employees with the right qualifications.

Question 2:

Question 2.1:

The following are the major benefits of having the nurse manager in developing cost

centre budget:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CASE ANALYSIS

Function-specific cost:

This enables in keeping track of the expenses related to a specific function. By treating all

the cost centres in the form of a separate unit, the organisation could gauge the amount of money

it utilises every year for supporting a specific service (Jakobsen and Pallesen 2017). In case, the

nurse manager could not establish a cost centre, it would become complex for gauging the cost

of service supply. Hence, with the help of cost centre, the nurse manager could plan, gauge and

control costs for all the particular functions in the hospital.

Resource allocation:

As the cost centre budget enables the nurse manager to detect each function cost, it helps

in allocating the scarce resources in an effective manner (Kuo and Cheng 2018). For example, if

the nurse manager gains an understanding of the actual cost to manage a call centre in the

hospital, it would be helpful in computing the expenditure with the profit estimated from a new

service. This would result in directing new resources to the most valuable business activity

(Webb 2016).

Question 2.2:

Flexible budgeting:

Flexible budget is a budget, which realises the behavioural variation between variable

costs and fixed costs in terms of fluctuations in output, turnover or other variable factors. With

the help of flexible budgeting, the hospital could estimate the performance and income levels at a

provided range of activity levels for this particular service. In addition, it would help in

providing correct evaluation of organisational and managerial performance (Langabeer and

Helton 2015). For applying flexible budgeting, the hospital could carry out the following steps:

Function-specific cost:

This enables in keeping track of the expenses related to a specific function. By treating all

the cost centres in the form of a separate unit, the organisation could gauge the amount of money

it utilises every year for supporting a specific service (Jakobsen and Pallesen 2017). In case, the

nurse manager could not establish a cost centre, it would become complex for gauging the cost

of service supply. Hence, with the help of cost centre, the nurse manager could plan, gauge and

control costs for all the particular functions in the hospital.

Resource allocation:

As the cost centre budget enables the nurse manager to detect each function cost, it helps

in allocating the scarce resources in an effective manner (Kuo and Cheng 2018). For example, if

the nurse manager gains an understanding of the actual cost to manage a call centre in the

hospital, it would be helpful in computing the expenditure with the profit estimated from a new

service. This would result in directing new resources to the most valuable business activity

(Webb 2016).

Question 2.2:

Flexible budgeting:

Flexible budget is a budget, which realises the behavioural variation between variable

costs and fixed costs in terms of fluctuations in output, turnover or other variable factors. With

the help of flexible budgeting, the hospital could estimate the performance and income levels at a

provided range of activity levels for this particular service. In addition, it would help in

providing correct evaluation of organisational and managerial performance (Langabeer and

Helton 2015). For applying flexible budgeting, the hospital could carry out the following steps:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CASE ANALYSIS

Step 1: Specifying the used timeframe

Step 2: Categorising each cost into variable, fixed and semi-variable costs

Step 3: Ascertaining the kinds of standards to be used

Step 4: Evaluating the patterns of cost behaviour in relation to the previous activity levels

Step 5: Developing pertinent flexible budget for particular activity levels

However, flexible budgeting assumes that the costs are linear and it does not consider the

discounts for bulk material purchases. In addition, the method of ascertaining the variable and

fixed components of costs is arbitrary and there is little resemblance of the accurate budgeted

cost for the fixed activity level.

Zero-based budgeting:

It is a budgeting method, which is involved in apportioning funding depending on

program efficiency and necessity. In contrast to traditional budgeting, no previous items are

taken into account while preparing the next budget (Marlowe et al. 2018). The major advantage

of zero-based budgeting is that the resulting budget is justified effectively and it is aligned to

strategy. In addition, it helps in catalysing wider collaboration across the organisation. Finally,

the hospital could minimise costs by avoiding increases in automatic budget and hence, it would

increase its overall savings.

However, this type of budgeting system suffers from certain drawbacks. One of them is

time consuming and costly nature, since budget is developed from scratch annually. Another

drawback is that it might be cost-prohibitive for the hospitals having restricted budget. Finally,

Step 1: Specifying the used timeframe

Step 2: Categorising each cost into variable, fixed and semi-variable costs

Step 3: Ascertaining the kinds of standards to be used

Step 4: Evaluating the patterns of cost behaviour in relation to the previous activity levels

Step 5: Developing pertinent flexible budget for particular activity levels

However, flexible budgeting assumes that the costs are linear and it does not consider the

discounts for bulk material purchases. In addition, the method of ascertaining the variable and

fixed components of costs is arbitrary and there is little resemblance of the accurate budgeted

cost for the fixed activity level.

Zero-based budgeting:

It is a budgeting method, which is involved in apportioning funding depending on

program efficiency and necessity. In contrast to traditional budgeting, no previous items are

taken into account while preparing the next budget (Marlowe et al. 2018). The major advantage

of zero-based budgeting is that the resulting budget is justified effectively and it is aligned to

strategy. In addition, it helps in catalysing wider collaboration across the organisation. Finally,

the hospital could minimise costs by avoiding increases in automatic budget and hence, it would

increase its overall savings.

However, this type of budgeting system suffers from certain drawbacks. One of them is

time consuming and costly nature, since budget is developed from scratch annually. Another

drawback is that it might be cost-prohibitive for the hospitals having restricted budget. Finally,

8CASE ANALYSIS

this budgeting system could be risky, if there is uncertainty regarding potential savings

(McConnell 2018).

Output-based budgeting:

In the words of Menifield (2017), output-based budgeting is the method of formulating

budgets depending on the association between funding and estimated outcomes. One of the

major benefits of this budgeting system is that it increases transparency and involvement in the

budgeting process. The stakeholders could be able to draw linkages between allocated funds and

proposed results. However, this budgeting system might be costly and the government-identified

results might be complicated.

Based on the evaluation of the above three budgeting procedures, zero-based budgeting is

considered as the most appropriate. This is because it forms a practical way for the hospital to

redesign its cost structures. This is because it would be able to cut down 25% of expense on

support and overhead functions along with boosting and competitiveness of the new service.

Question 2.3:

The three main areas of expenditure, which could be taken into account for the

expenditure budget of the proposed service, include the following:

Fixed cost:

The fixed cost of the hospital includes overhead expenditure, staff salaries and bonuses

along with building utilities and maintenance. These costs do not change over a short-term in the

hospital (Mukherjee, Al Rahahleh and Lane 2016).

Variable cost:

this budgeting system could be risky, if there is uncertainty regarding potential savings

(McConnell 2018).

Output-based budgeting:

In the words of Menifield (2017), output-based budgeting is the method of formulating

budgets depending on the association between funding and estimated outcomes. One of the

major benefits of this budgeting system is that it increases transparency and involvement in the

budgeting process. The stakeholders could be able to draw linkages between allocated funds and

proposed results. However, this budgeting system might be costly and the government-identified

results might be complicated.

Based on the evaluation of the above three budgeting procedures, zero-based budgeting is

considered as the most appropriate. This is because it forms a practical way for the hospital to

redesign its cost structures. This is because it would be able to cut down 25% of expense on

support and overhead functions along with boosting and competitiveness of the new service.

Question 2.3:

The three main areas of expenditure, which could be taken into account for the

expenditure budget of the proposed service, include the following:

Fixed cost:

The fixed cost of the hospital includes overhead expenditure, staff salaries and bonuses

along with building utilities and maintenance. These costs do not change over a short-term in the

hospital (Mukherjee, Al Rahahleh and Lane 2016).

Variable cost:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CASE ANALYSIS

The variable cost of the hospital constitutes of staff supplies, patient care supplies,

medications along with diagnostic and therapeutic supplies. These costs tend to vary in the

hospital for a shorter timeframe.

Semi-variable cost:

The semi-variable costs are those costs, a part of which remain fixed and part of which

tend to vary over the short-term. Examples of semi-variable expenses in the hospital include

electricity, telephone bills and others.

Issues in the area of expenditure:

It is assumed that the hospital has yearly costs of $200 million with 15,000 patients each

year. The average payment that the patients have made is $13,500 each year, which has lead to

revenue of $202.5 million. 2/3rd of the costs have been fixed, while 1/3rd of the costs have been

variable and semi-variable. Hence, if the community enhances primary care for minimising 10%

people attaining hospital care. In this case, the variable cost of the hospital would decrease by

10% to $60 million, while the fixed costs remain at $133 million (Paulsson 2017). Even though

the overall expense would decline to $193 million, the revenue would fall to $182 million with

10% lower patients resulting in a loss of $11 million.

Question 2.4:

The cost centre that would be generated within the hospital constitute of general services,

ancillary services, in-patient services, outpatient services and other cost centres. The in-patient

services take into account the direct costs of hospital-affiliated nursing facilities along with other

long-term care units (Shanks 2016). The other cost centres comprise of a group of non-

reimbursable cost centres like gift shops and offices of the physicians.

The variable cost of the hospital constitutes of staff supplies, patient care supplies,

medications along with diagnostic and therapeutic supplies. These costs tend to vary in the

hospital for a shorter timeframe.

Semi-variable cost:

The semi-variable costs are those costs, a part of which remain fixed and part of which

tend to vary over the short-term. Examples of semi-variable expenses in the hospital include

electricity, telephone bills and others.

Issues in the area of expenditure:

It is assumed that the hospital has yearly costs of $200 million with 15,000 patients each

year. The average payment that the patients have made is $13,500 each year, which has lead to

revenue of $202.5 million. 2/3rd of the costs have been fixed, while 1/3rd of the costs have been

variable and semi-variable. Hence, if the community enhances primary care for minimising 10%

people attaining hospital care. In this case, the variable cost of the hospital would decrease by

10% to $60 million, while the fixed costs remain at $133 million (Paulsson 2017). Even though

the overall expense would decline to $193 million, the revenue would fall to $182 million with

10% lower patients resulting in a loss of $11 million.

Question 2.4:

The cost centre that would be generated within the hospital constitute of general services,

ancillary services, in-patient services, outpatient services and other cost centres. The in-patient

services take into account the direct costs of hospital-affiliated nursing facilities along with other

long-term care units (Shanks 2016). The other cost centres comprise of a group of non-

reimbursable cost centres like gift shops and offices of the physicians.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CASE ANALYSIS

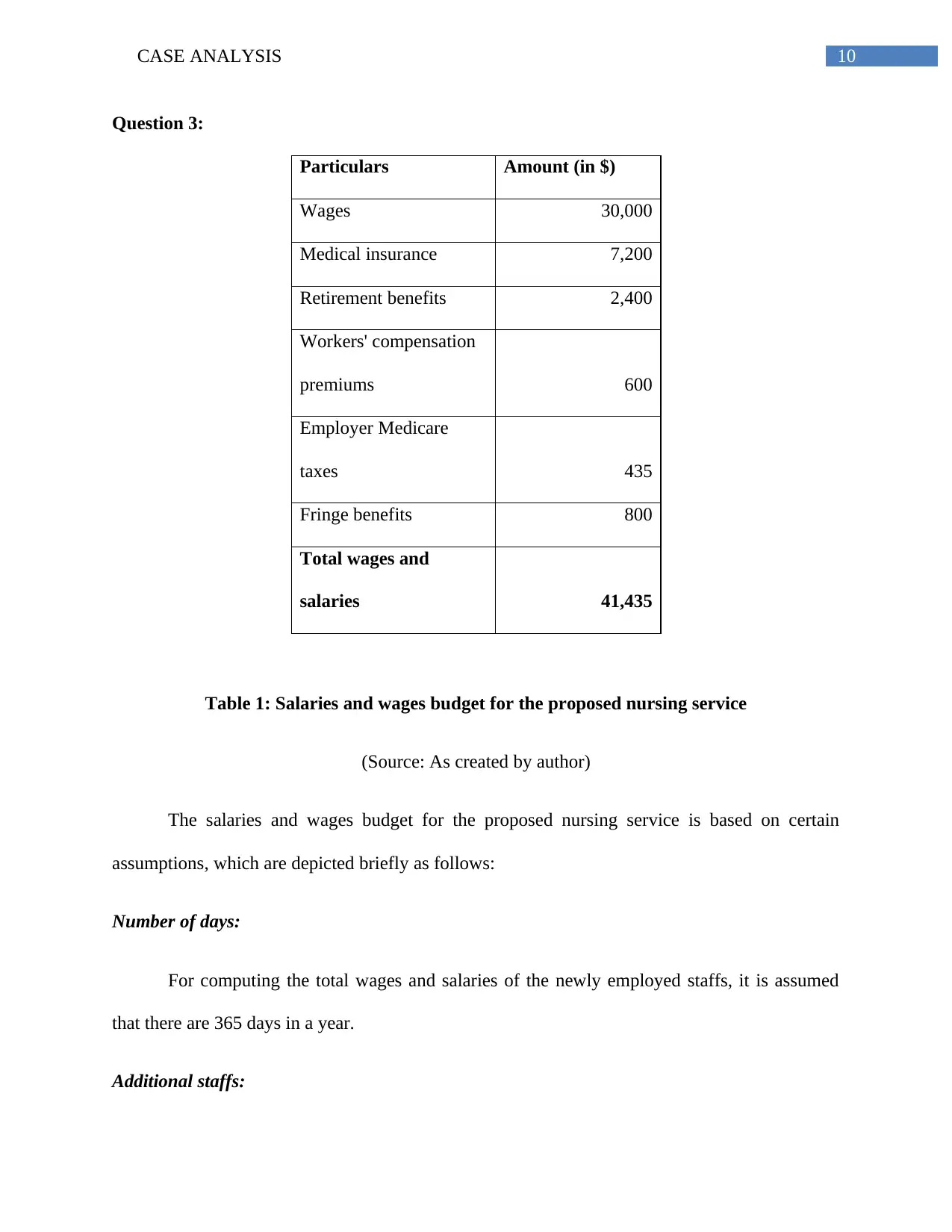

Question 3:

Particulars Amount (in $)

Wages 30,000

Medical insurance 7,200

Retirement benefits 2,400

Workers' compensation

premiums 600

Employer Medicare

taxes 435

Fringe benefits 800

Total wages and

salaries 41,435

Table 1: Salaries and wages budget for the proposed nursing service

(Source: As created by author)

The salaries and wages budget for the proposed nursing service is based on certain

assumptions, which are depicted briefly as follows:

Number of days:

For computing the total wages and salaries of the newly employed staffs, it is assumed

that there are 365 days in a year.

Additional staffs:

Question 3:

Particulars Amount (in $)

Wages 30,000

Medical insurance 7,200

Retirement benefits 2,400

Workers' compensation

premiums 600

Employer Medicare

taxes 435

Fringe benefits 800

Total wages and

salaries 41,435

Table 1: Salaries and wages budget for the proposed nursing service

(Source: As created by author)

The salaries and wages budget for the proposed nursing service is based on certain

assumptions, which are depicted briefly as follows:

Number of days:

For computing the total wages and salaries of the newly employed staffs, it is assumed

that there are 365 days in a year.

Additional staffs:

11CASE ANALYSIS

The total number of additional staffs to be appointed for initiating this service is 5.

Rotational shifts:

The rotational shifts in 104 weekend days are taken into consideration for arriving at the

total wages and salaries of the department.

Additional leave:

The staffs are allowed an additional leave of 14 vacation days.

Sick leave:

The staffs could avail obtain sick leave of additional 10 days in a year.

Personal holidays:

The staffs are also allowed to obtain 8 personal holiday days in a year

Number of staffs:

The total number of working days for the staffs about to be working in the department is

229 days.

Number of working hours:

Finally, the total number of working hours for each staff is 1,832.

The overall direct cost of payroll could be divided by the overall number of working hours

to obtain hourly rate. In this case, the hourly rate would be $22.62 ($41,435/1,832). This rate

would help the hospital to charge for accruals related to payroll and it has the amount of money

The total number of additional staffs to be appointed for initiating this service is 5.

Rotational shifts:

The rotational shifts in 104 weekend days are taken into consideration for arriving at the

total wages and salaries of the department.

Additional leave:

The staffs are allowed an additional leave of 14 vacation days.

Sick leave:

The staffs could avail obtain sick leave of additional 10 days in a year.

Personal holidays:

The staffs are also allowed to obtain 8 personal holiday days in a year

Number of staffs:

The total number of working days for the staffs about to be working in the department is

229 days.

Number of working hours:

Finally, the total number of working hours for each staff is 1,832.

The overall direct cost of payroll could be divided by the overall number of working hours

to obtain hourly rate. In this case, the hourly rate would be $22.62 ($41,435/1,832). This rate

would help the hospital to charge for accruals related to payroll and it has the amount of money

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.