Oak Cash & Carry: Strategies for Growth and Funding in the UK Market

VerifiedAdded on 2023/01/10

|18

|5318

|76

Report

AI Summary

This report analyzes growth strategies and funding options for small and medium enterprises (SMEs), using Oak Cash & Carry, a UK-based company, as a case study. It explores growth opportunities through frameworks like the Boston Consulting Group matrix, GE/McKinsey matrix, and Ansoff's growth matrix, examining market penetration, product development, and diversification strategies. The report also identifies various sources of funding available to SMEs, including angel investors, bank loans, and crowdfunding, providing a comprehensive overview for business expansion and financial planning. The report includes an overview of the company, an evaluation of growth opportunities, and a discussion of funding sources. The report concludes with a discussion of business planning and succession/exit strategies for small businesses.

Planning for Growth

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................3

PART 1............................................................................................................................................3

Evaluation of growth opportunities.............................................................................................3

Sources of funding.......................................................................................................................8

CONCLUSION................................................................................................................................9

PART 2............................................................................................................................................9

Introduction..................................................................................................................................9

Business plan...............................................................................................................................9

Succession or Exit Options for Small Business Organisation with Their Advantages and

Disadvantages............................................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION...........................................................................................................................3

PART 1............................................................................................................................................3

Evaluation of growth opportunities.............................................................................................3

Sources of funding.......................................................................................................................8

CONCLUSION................................................................................................................................9

PART 2............................................................................................................................................9

Introduction..................................................................................................................................9

Business plan...............................................................................................................................9

Succession or Exit Options for Small Business Organisation with Their Advantages and

Disadvantages............................................................................................................................15

CONCLUSION..............................................................................................................................16

REFERENCES..............................................................................................................................17

INTRODUCTION

Growth refers as a process of improving the capabilities of the company in term of

accomplishing profitability and effective outcomes of the corporation operations. To gain high

growth in the business requires well-organized planning. The brief study is completely based on

the small and medium size corporation or enterprise which operates in London, UK Oak Cash &

Carry Pvt. Ltd. It is UK-based company which operates it’s business operations in retail sector.

It is a fastest growing small and medium enterprise which has established in UK. In this report

will discuss about different growth opportunities for SME which are available in the business

market.

PART 1

Overview of Company

Oak Cash & Carry is a UK-based small-medium enterprise which is engaged in non-

specialized wholesale products like food, beverage and tobacco and other retail services. in

addition it has wide range of products which offers in bulk for retailer, caterers and other

domestic businesses. it is among the one of the top emerging small-scale business which is

established in UK. It has own website such as www.oakcashandcarry.co.uk.

Evaluation of growth opportunities

There are various growth opportunities that are framed to improve business outcomes of

the company. Management of the Oak Cash & Carry analyses it’s growth approaches based on

the different frameworks like Boston consultancy group matrix, Mckensey matrix/GE. Ansoff

Matrix also apply to raise different growth opportunities for the Oak Cash & Carry.

Boston consultancy group matrix

It is a strategic tool that emphasize on strategic positioning of the company. With the

model Oak Cash & Carry enable to create positioning of the brand in the market. this framework

categorized business portfolio into four parts based on the firm attractiveness and competitive

positioning of the organization in it’s sector. The four quadrants projected are isolated in term of

dogs, cash cows, stars and question mark (Kazmi and Shin, 2017).

Growth refers as a process of improving the capabilities of the company in term of

accomplishing profitability and effective outcomes of the corporation operations. To gain high

growth in the business requires well-organized planning. The brief study is completely based on

the small and medium size corporation or enterprise which operates in London, UK Oak Cash &

Carry Pvt. Ltd. It is UK-based company which operates it’s business operations in retail sector.

It is a fastest growing small and medium enterprise which has established in UK. In this report

will discuss about different growth opportunities for SME which are available in the business

market.

PART 1

Overview of Company

Oak Cash & Carry is a UK-based small-medium enterprise which is engaged in non-

specialized wholesale products like food, beverage and tobacco and other retail services. in

addition it has wide range of products which offers in bulk for retailer, caterers and other

domestic businesses. it is among the one of the top emerging small-scale business which is

established in UK. It has own website such as www.oakcashandcarry.co.uk.

Evaluation of growth opportunities

There are various growth opportunities that are framed to improve business outcomes of

the company. Management of the Oak Cash & Carry analyses it’s growth approaches based on

the different frameworks like Boston consultancy group matrix, Mckensey matrix/GE. Ansoff

Matrix also apply to raise different growth opportunities for the Oak Cash & Carry.

Boston consultancy group matrix

It is a strategic tool that emphasize on strategic positioning of the company. With the

model Oak Cash & Carry enable to create positioning of the brand in the market. this framework

categorized business portfolio into four parts based on the firm attractiveness and competitive

positioning of the organization in it’s sector. The four quadrants projected are isolated in term of

dogs, cash cows, stars and question mark (Kazmi and Shin, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Dogs:

Dogs symbol denotes that such kind brands that has slow growth in it’s market as well as market

share which is quite low than it’s competitors. The market presence of the brand which is

covered in dog category is not effective in business nature and investors also avoids to invest

their funds for such type brand which does not have any profitability in the market. thus, such

kind brands posses’ low growth capability in the business market. Oak Cash & Carry do not fit to

this category as corporation poses’ highly demanding products and services which can lead high

growth in the market.

Cash cows:

All such brands that operates in potential business outcomes are covered into this

quadrant. But these brands unable to attract potential or heavy investments due to ineffective

business growth. In that state those brands affiliated with cash cow category can formulate

complete planning for growth to reach the stare category in the model. Boston consultancy group

matrix is framed those brands which are part of cash cow category can get good investment that

helps them to sustain in the business market (Han and Lin, 2017). However Oak Cash & Carry

has effective and profitable growth rate that prevent corporation to be part of this quadrant.

Stars

Stars category is generally operated in high growth industries. According to this category the

brands operates in this quadrant that posses’ effective growth opportunities due to high market

demands. The brands consider in star category enables to attract potential investors to invest high

funds in the organization to expand growth of brand in the business market. This category intel

inks to the Oak Cash & Carry because it is an emerging abruptly in the wholesale sector and

posses’ effective requirements in it’s market.

Question mark

Question mark brands contains very low market share and entertains loss in it’s market.

However these brands or corporations needs effective business practices to lead profitability in

their business. Oak Cash & Carry do not belong to this category because growth rate of the

business is quite high as well as demands of product in the business market.

Dogs symbol denotes that such kind brands that has slow growth in it’s market as well as market

share which is quite low than it’s competitors. The market presence of the brand which is

covered in dog category is not effective in business nature and investors also avoids to invest

their funds for such type brand which does not have any profitability in the market. thus, such

kind brands posses’ low growth capability in the business market. Oak Cash & Carry do not fit to

this category as corporation poses’ highly demanding products and services which can lead high

growth in the market.

Cash cows:

All such brands that operates in potential business outcomes are covered into this

quadrant. But these brands unable to attract potential or heavy investments due to ineffective

business growth. In that state those brands affiliated with cash cow category can formulate

complete planning for growth to reach the stare category in the model. Boston consultancy group

matrix is framed those brands which are part of cash cow category can get good investment that

helps them to sustain in the business market (Han and Lin, 2017). However Oak Cash & Carry

has effective and profitable growth rate that prevent corporation to be part of this quadrant.

Stars

Stars category is generally operated in high growth industries. According to this category the

brands operates in this quadrant that posses’ effective growth opportunities due to high market

demands. The brands consider in star category enables to attract potential investors to invest high

funds in the organization to expand growth of brand in the business market. This category intel

inks to the Oak Cash & Carry because it is an emerging abruptly in the wholesale sector and

posses’ effective requirements in it’s market.

Question mark

Question mark brands contains very low market share and entertains loss in it’s market.

However these brands or corporations needs effective business practices to lead profitability in

their business. Oak Cash & Carry do not belong to this category because growth rate of the

business is quite high as well as demands of product in the business market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Oak Cash & Carry operates in retail sector whereas it holds huge dominance in the form

of market share and demands. Retail sector is the fastest growing market sector among all sectors

which are affiliated with business environment. Oak Cash & Carry is a part of star category has

effective profitability and good market presence . So it has attractive market share rather than

other SME in the business market.

GE/McKensey matrix

It is an effective approach that influences multiple corporations in the business industry.

The framework is mainly focused on the investment decision-making process and it’s profit

revenue. It evaluates the investment decision based on competitive strength of business unit and

industry attractiveness.

Industry attractiveness

Industry attractiveness comprises numerous factors that enough to attract investors

towards company. These factors give huge contribution to make decision of all the investors

regarding investment of financial resources within organization. Factors are industry size,

profitability of the industry, infrastructure of industry, changes in demands, highly availability of

labour and market segmentation and others are major factors that helps organization to long run

and assists investors to take fund investment decision in the industry (Zihare and Blumberga,

2017). Overall factors of market attractiveness promote enterprises business activities and it’s

profitability in the business market (Tomlins and et.al., 2020). Oak Cash & Carry operates into

retail sector and has wide range of products which has high demand in the business market.

Small scale corporation enables to attract potential investors through heavy demand of the

products and high growth potential as well.

Competitive strength of business unit:

It is also an effective tool that promote decision-making process of investors. it contains

different factors that’s affiliated with the corporation in which sector it operates. Investors takes

decision of investment in a specific organization based on it’s profitability, customer loyalty,

brand positioning, value chain analysis, Vrio analysis, production flexibility and other factors

that improves market presence of the brand. Oak Cash & Carry Pvt. Ltd. offers it’s product at

of market share and demands. Retail sector is the fastest growing market sector among all sectors

which are affiliated with business environment. Oak Cash & Carry is a part of star category has

effective profitability and good market presence . So it has attractive market share rather than

other SME in the business market.

GE/McKensey matrix

It is an effective approach that influences multiple corporations in the business industry.

The framework is mainly focused on the investment decision-making process and it’s profit

revenue. It evaluates the investment decision based on competitive strength of business unit and

industry attractiveness.

Industry attractiveness

Industry attractiveness comprises numerous factors that enough to attract investors

towards company. These factors give huge contribution to make decision of all the investors

regarding investment of financial resources within organization. Factors are industry size,

profitability of the industry, infrastructure of industry, changes in demands, highly availability of

labour and market segmentation and others are major factors that helps organization to long run

and assists investors to take fund investment decision in the industry (Zihare and Blumberga,

2017). Overall factors of market attractiveness promote enterprises business activities and it’s

profitability in the business market (Tomlins and et.al., 2020). Oak Cash & Carry operates into

retail sector and has wide range of products which has high demand in the business market.

Small scale corporation enables to attract potential investors through heavy demand of the

products and high growth potential as well.

Competitive strength of business unit:

It is also an effective tool that promote decision-making process of investors. it contains

different factors that’s affiliated with the corporation in which sector it operates. Investors takes

decision of investment in a specific organization based on it’s profitability, customer loyalty,

brand positioning, value chain analysis, Vrio analysis, production flexibility and other factors

that improves market presence of the brand. Oak Cash & Carry Pvt. Ltd. offers it’s product at

affordable prices. It also focuses on customer satisfaction that supports to take competitive

advantage in the business market.

Oak Cash & Carry operates it’s business in retail sector and it is considered as fastest growing

coming among all small scale companies in UK which assists to generate high profit by

improving level of satisfaction in customer for the product. So, investors can easily take decision

to invest in Oak Cash & Carry (Valler and Phelps, 2016).

Ansoff’s growth matrix

Ansoff’s growth matrix is a framework that is designed to give different growth

opportunities which can lead success in the business. there are various strategic options that can

apply by organization to influence growth and market share in the business market.

Market penetration

It is a growth option that uses by organization to influence brand image in exiting market.

it is mainly focused on exiting products with exiting market and helps company to capture large

market share on it’s certain products. With this strategy organization can offer highly discounted

products to the user or customers and key value-added services that can influence customer to

buy products from it’s firm. For example, Oak Cash & Carry offers effective discounted products

in respect of selling old products to the customer. This strategy contains all exiting or old

products that have very less requirement in the market.

Product development

It is another effective growth option that is available for the organization. it is mainly

focused on new products in exiting market. With this approach organization allows to introduce

new product for influencing the growth potential and market share within exiting market. For

example, Oak Cash & Carry primarily conduct deep research of market so that enables to

understand needs and expectation of the customer for the products then launch new product in

the UK market. This approach supports organization to lead high satisfaction in customer for the

product and it’s services (Yin, 2016). It also assists to attract all new customers in the exiting

market.

advantage in the business market.

Oak Cash & Carry operates it’s business in retail sector and it is considered as fastest growing

coming among all small scale companies in UK which assists to generate high profit by

improving level of satisfaction in customer for the product. So, investors can easily take decision

to invest in Oak Cash & Carry (Valler and Phelps, 2016).

Ansoff’s growth matrix

Ansoff’s growth matrix is a framework that is designed to give different growth

opportunities which can lead success in the business. there are various strategic options that can

apply by organization to influence growth and market share in the business market.

Market penetration

It is a growth option that uses by organization to influence brand image in exiting market.

it is mainly focused on exiting products with exiting market and helps company to capture large

market share on it’s certain products. With this strategy organization can offer highly discounted

products to the user or customers and key value-added services that can influence customer to

buy products from it’s firm. For example, Oak Cash & Carry offers effective discounted products

in respect of selling old products to the customer. This strategy contains all exiting or old

products that have very less requirement in the market.

Product development

It is another effective growth option that is available for the organization. it is mainly

focused on new products in exiting market. With this approach organization allows to introduce

new product for influencing the growth potential and market share within exiting market. For

example, Oak Cash & Carry primarily conduct deep research of market so that enables to

understand needs and expectation of the customer for the products then launch new product in

the UK market. This approach supports organization to lead high satisfaction in customer for the

product and it’s services (Yin, 2016). It also assists to attract all new customers in the exiting

market.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Market development

It is another option, available for the organization that lead growth in the market. With

this strategy organization enters in new market with it’s exiting products so that can establish

good brand image in new market. This strategy mainly focuses on expanding business into

multiple country with it’s available products instead of new products. With this strategy

organization does not have to invest in increasing quality and profitability of exiting products

(Loredana, 2016). For example, Oak Cash & Carry can use this strategy to enter into new market

without investing high funds.

Diversification

This strategy focuses on new market along with new products. it is an effective approach

that can be prove profitable for the Oak Cash & Carry company. With this strategy organization

can expand it’s business by opening it’s new stores and can attract new customer with their new

launched products.

Oak Cash & Carry is one of the fastest growing company among small scale industry in

UK. Organization can use market penetration strategy for promoting the sales revenue of it’s

exiting products. Even it can use product development strategy as well whereas it can launch

new products in existing market which attracts customers to buy this new product.

Differences between Boston consultancy group (BCG) matrix and GE/McKinsey matrix

BCG measures brand based on it’s performance in the business market and also business sector

in which company runs it’s business operations. It includes two factors growth market rate of the

organization and it’s industry which is subcategorized into four quadrants based on the market

presence.

McKinsey/GE matrix: It posses’ different factors that permits organization to achieve

competitive advantage in the business market. it is used to frame different factors or elements

that assists company to achieve larger growth potential in the business market.

It is another option, available for the organization that lead growth in the market. With

this strategy organization enters in new market with it’s exiting products so that can establish

good brand image in new market. This strategy mainly focuses on expanding business into

multiple country with it’s available products instead of new products. With this strategy

organization does not have to invest in increasing quality and profitability of exiting products

(Loredana, 2016). For example, Oak Cash & Carry can use this strategy to enter into new market

without investing high funds.

Diversification

This strategy focuses on new market along with new products. it is an effective approach

that can be prove profitable for the Oak Cash & Carry company. With this strategy organization

can expand it’s business by opening it’s new stores and can attract new customer with their new

launched products.

Oak Cash & Carry is one of the fastest growing company among small scale industry in

UK. Organization can use market penetration strategy for promoting the sales revenue of it’s

exiting products. Even it can use product development strategy as well whereas it can launch

new products in existing market which attracts customers to buy this new product.

Differences between Boston consultancy group (BCG) matrix and GE/McKinsey matrix

BCG measures brand based on it’s performance in the business market and also business sector

in which company runs it’s business operations. It includes two factors growth market rate of the

organization and it’s industry which is subcategorized into four quadrants based on the market

presence.

McKinsey/GE matrix: It posses’ different factors that permits organization to achieve

competitive advantage in the business market. it is used to frame different factors or elements

that assists company to achieve larger growth potential in the business market.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sources of funding

The term of sources of funding denotes as the bases for the funding for new start-up

business and it’s operation as well as creates potential business infrastructure for the wide scale

operations. To understand objective of the source of funding will be use various paradigms

associated with this term for achieving strong business expansion and functional energy from

higher capital development. Oak Cash & Carry needs to build strong capital infrastructure for

introducing new products while capital funding supports to gain effective performance

parameters.

There are various sources of funding available for new start-ups business who has desires

to invest in expansion procedures. Oak Cash & Carry company seeks for effective sources of

funding so that it can introduce new product or services which meets customer’s satisfaction

level and in return generate high revenue as well as market share.

Angle Investors

There are potential business investors who seeks for investing their funds into new

businesses which are highly involved into large innovation operations and also has good brand

strength in the business market. The major advantage of the angle investors is that they are more

intelligent and talented and monitors business operations effectively. The major drawback is this

high involvement in business activities can impact business’s decision-making process and can

ignore functional strengths (Tsakalerou, 2018).

Bank loans

It is a legal financial operations supports and assists to promote new business effectively

in the business market by offering financial services as per demands. Oak Cash & Carry can use

this funding source to create strong profitability with strong capital in the business market. Bank

loans enables organization to develop strong working capital requirements so that it can put more

funds in running new innovation factors and new working operations as well.

Crowd funding

It is another source of funding whereas customers invest their money to buy market

shares to keep hope that they will get more funds in returns. It can be done through social media

The term of sources of funding denotes as the bases for the funding for new start-up

business and it’s operation as well as creates potential business infrastructure for the wide scale

operations. To understand objective of the source of funding will be use various paradigms

associated with this term for achieving strong business expansion and functional energy from

higher capital development. Oak Cash & Carry needs to build strong capital infrastructure for

introducing new products while capital funding supports to gain effective performance

parameters.

There are various sources of funding available for new start-ups business who has desires

to invest in expansion procedures. Oak Cash & Carry company seeks for effective sources of

funding so that it can introduce new product or services which meets customer’s satisfaction

level and in return generate high revenue as well as market share.

Angle Investors

There are potential business investors who seeks for investing their funds into new

businesses which are highly involved into large innovation operations and also has good brand

strength in the business market. The major advantage of the angle investors is that they are more

intelligent and talented and monitors business operations effectively. The major drawback is this

high involvement in business activities can impact business’s decision-making process and can

ignore functional strengths (Tsakalerou, 2018).

Bank loans

It is a legal financial operations supports and assists to promote new business effectively

in the business market by offering financial services as per demands. Oak Cash & Carry can use

this funding source to create strong profitability with strong capital in the business market. Bank

loans enables organization to develop strong working capital requirements so that it can put more

funds in running new innovation factors and new working operations as well.

Crowd funding

It is another source of funding whereas customers invest their money to buy market

shares to keep hope that they will get more funds in returns. It can be done through social media

operations and invests for leading new promotional factors parameters among people. Oak Cash

& Carry enable to attract large scale crowd to invest their funds into business by influencing

business expansion strategies among people.

Angle investors method of funding source is the best source for the Oak Cash & Carry because it

helps gain stronger business functioning as well as can gain super expertise on various business

operation from the angle investors (Mohajan, 2017). With this source organization enables

expand it’s business in other location except UK and can attain longer business goodwill in the

business market.

CONCLUSION

Oak Cash & Carry is affiliated with retail sector in which it ins considered one of the

major rapid growing sector among other small scale business due to heavy demands of products

in the market. Due to heavy demand and effective growth is categorized into star quadrant.

Organization has used product development strategy for improving it’s market share. Angle

investors, crowd funding and others funding sources can support to fulfil the financial

requirement of the busines.

PART 2

Introduction

Business plan is crucial for organization in retail sector as the demands so that enables to

improve demand of products in it’s market. It supports to improve the performance of Oak Cash

& Carry to achieve higher profit margins (Keelson, 2017). In the growth plan project will discuss

about exit strategies for Oak Cash & Carry to compete within market and declines risk.

& Carry enable to attract large scale crowd to invest their funds into business by influencing

business expansion strategies among people.

Angle investors method of funding source is the best source for the Oak Cash & Carry because it

helps gain stronger business functioning as well as can gain super expertise on various business

operation from the angle investors (Mohajan, 2017). With this source organization enables

expand it’s business in other location except UK and can attain longer business goodwill in the

business market.

CONCLUSION

Oak Cash & Carry is affiliated with retail sector in which it ins considered one of the

major rapid growing sector among other small scale business due to heavy demands of products

in the market. Due to heavy demand and effective growth is categorized into star quadrant.

Organization has used product development strategy for improving it’s market share. Angle

investors, crowd funding and others funding sources can support to fulfil the financial

requirement of the busines.

PART 2

Introduction

Business plan is crucial for organization in retail sector as the demands so that enables to

improve demand of products in it’s market. It supports to improve the performance of Oak Cash

& Carry to achieve higher profit margins (Keelson, 2017). In the growth plan project will discuss

about exit strategies for Oak Cash & Carry to compete within market and declines risk.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Business plan

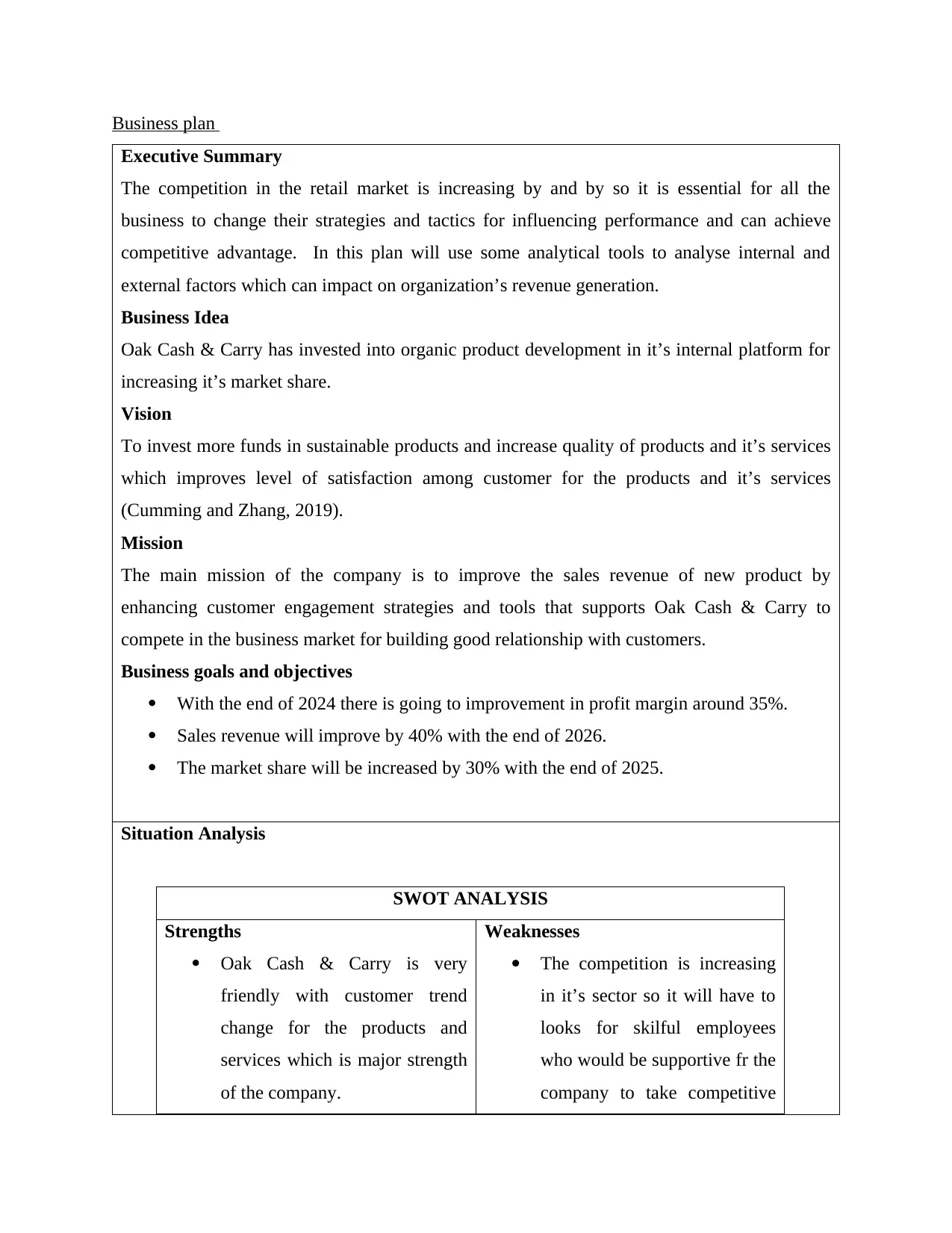

Executive Summary

The competition in the retail market is increasing by and by so it is essential for all the

business to change their strategies and tactics for influencing performance and can achieve

competitive advantage. In this plan will use some analytical tools to analyse internal and

external factors which can impact on organization’s revenue generation.

Business Idea

Oak Cash & Carry has invested into organic product development in it’s internal platform for

increasing it’s market share.

Vision

To invest more funds in sustainable products and increase quality of products and it’s services

which improves level of satisfaction among customer for the products and it’s services

(Cumming and Zhang, 2019).

Mission

The main mission of the company is to improve the sales revenue of new product by

enhancing customer engagement strategies and tools that supports Oak Cash & Carry to

compete in the business market for building good relationship with customers.

Business goals and objectives

With the end of 2024 there is going to improvement in profit margin around 35%.

Sales revenue will improve by 40% with the end of 2026.

The market share will be increased by 30% with the end of 2025.

Situation Analysis

SWOT ANALYSIS

Strengths

Oak Cash & Carry is very

friendly with customer trend

change for the products and

services which is major strength

of the company.

Weaknesses

The competition is increasing

in it’s sector so it will have to

looks for skilful employees

who would be supportive fr the

company to take competitive

Executive Summary

The competition in the retail market is increasing by and by so it is essential for all the

business to change their strategies and tactics for influencing performance and can achieve

competitive advantage. In this plan will use some analytical tools to analyse internal and

external factors which can impact on organization’s revenue generation.

Business Idea

Oak Cash & Carry has invested into organic product development in it’s internal platform for

increasing it’s market share.

Vision

To invest more funds in sustainable products and increase quality of products and it’s services

which improves level of satisfaction among customer for the products and it’s services

(Cumming and Zhang, 2019).

Mission

The main mission of the company is to improve the sales revenue of new product by

enhancing customer engagement strategies and tools that supports Oak Cash & Carry to

compete in the business market for building good relationship with customers.

Business goals and objectives

With the end of 2024 there is going to improvement in profit margin around 35%.

Sales revenue will improve by 40% with the end of 2026.

The market share will be increased by 30% with the end of 2025.

Situation Analysis

SWOT ANALYSIS

Strengths

Oak Cash & Carry is very

friendly with customer trend

change for the products and

services which is major strength

of the company.

Weaknesses

The competition is increasing

in it’s sector so it will have to

looks for skilful employees

who would be supportive fr the

company to take competitive

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

It uses angle investors funding

source which helps to handle it’s

funds well and investment

makes company worth it

(Ponticelli and Alencar, 2016).

advantage in the business

market.

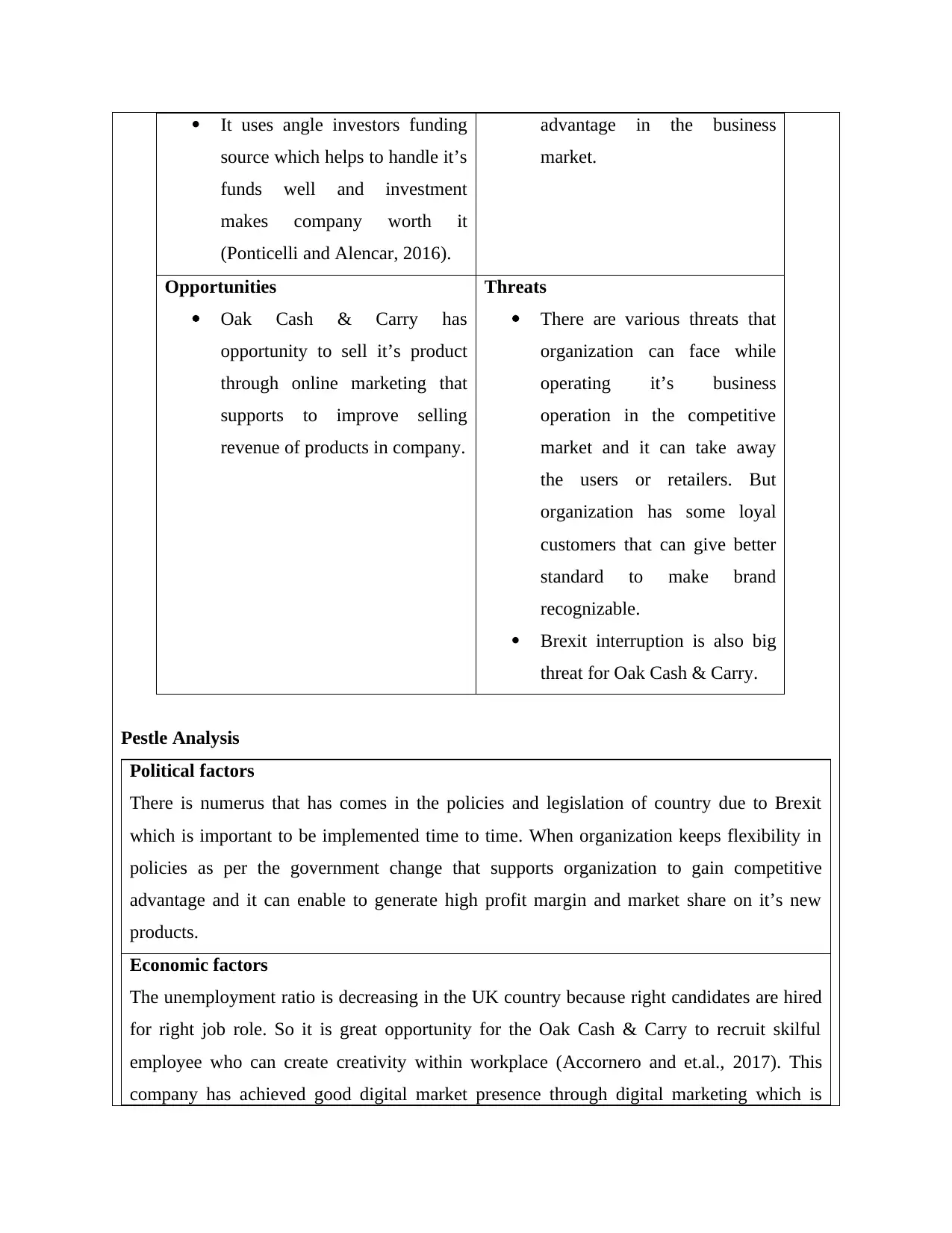

Opportunities

Oak Cash & Carry has

opportunity to sell it’s product

through online marketing that

supports to improve selling

revenue of products in company.

Threats

There are various threats that

organization can face while

operating it’s business

operation in the competitive

market and it can take away

the users or retailers. But

organization has some loyal

customers that can give better

standard to make brand

recognizable.

Brexit interruption is also big

threat for Oak Cash & Carry.

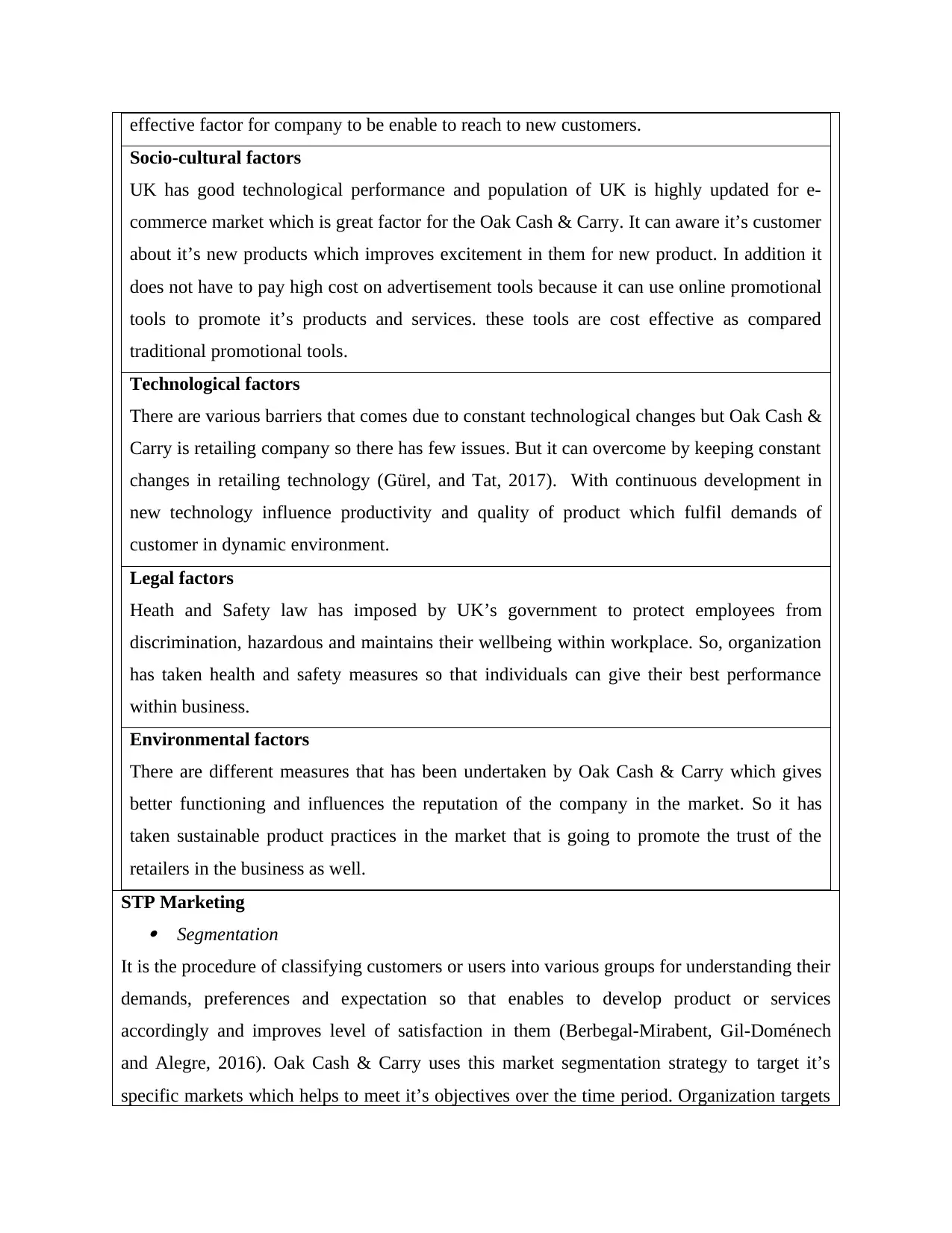

Pestle Analysis

Political factors

There is numerus that has comes in the policies and legislation of country due to Brexit

which is important to be implemented time to time. When organization keeps flexibility in

policies as per the government change that supports organization to gain competitive

advantage and it can enable to generate high profit margin and market share on it’s new

products.

Economic factors

The unemployment ratio is decreasing in the UK country because right candidates are hired

for right job role. So it is great opportunity for the Oak Cash & Carry to recruit skilful

employee who can create creativity within workplace (Accornero and et.al., 2017). This

company has achieved good digital market presence through digital marketing which is

source which helps to handle it’s

funds well and investment

makes company worth it

(Ponticelli and Alencar, 2016).

advantage in the business

market.

Opportunities

Oak Cash & Carry has

opportunity to sell it’s product

through online marketing that

supports to improve selling

revenue of products in company.

Threats

There are various threats that

organization can face while

operating it’s business

operation in the competitive

market and it can take away

the users or retailers. But

organization has some loyal

customers that can give better

standard to make brand

recognizable.

Brexit interruption is also big

threat for Oak Cash & Carry.

Pestle Analysis

Political factors

There is numerus that has comes in the policies and legislation of country due to Brexit

which is important to be implemented time to time. When organization keeps flexibility in

policies as per the government change that supports organization to gain competitive

advantage and it can enable to generate high profit margin and market share on it’s new

products.

Economic factors

The unemployment ratio is decreasing in the UK country because right candidates are hired

for right job role. So it is great opportunity for the Oak Cash & Carry to recruit skilful

employee who can create creativity within workplace (Accornero and et.al., 2017). This

company has achieved good digital market presence through digital marketing which is

effective factor for company to be enable to reach to new customers.

Socio-cultural factors

UK has good technological performance and population of UK is highly updated for e-

commerce market which is great factor for the Oak Cash & Carry. It can aware it’s customer

about it’s new products which improves excitement in them for new product. In addition it

does not have to pay high cost on advertisement tools because it can use online promotional

tools to promote it’s products and services. these tools are cost effective as compared

traditional promotional tools.

Technological factors

There are various barriers that comes due to constant technological changes but Oak Cash &

Carry is retailing company so there has few issues. But it can overcome by keeping constant

changes in retailing technology (Gürel, and Tat, 2017). With continuous development in

new technology influence productivity and quality of product which fulfil demands of

customer in dynamic environment.

Legal factors

Heath and Safety law has imposed by UK’s government to protect employees from

discrimination, hazardous and maintains their wellbeing within workplace. So, organization

has taken health and safety measures so that individuals can give their best performance

within business.

Environmental factors

There are different measures that has been undertaken by Oak Cash & Carry which gives

better functioning and influences the reputation of the company in the market. So it has

taken sustainable product practices in the market that is going to promote the trust of the

retailers in the business as well.

STP Marketing Segmentation

It is the procedure of classifying customers or users into various groups for understanding their

demands, preferences and expectation so that enables to develop product or services

accordingly and improves level of satisfaction in them (Berbegal-Mirabent, Gil-Doménech

and Alegre, 2016). Oak Cash & Carry uses this market segmentation strategy to target it’s

specific markets which helps to meet it’s objectives over the time period. Organization targets

Socio-cultural factors

UK has good technological performance and population of UK is highly updated for e-

commerce market which is great factor for the Oak Cash & Carry. It can aware it’s customer

about it’s new products which improves excitement in them for new product. In addition it

does not have to pay high cost on advertisement tools because it can use online promotional

tools to promote it’s products and services. these tools are cost effective as compared

traditional promotional tools.

Technological factors

There are various barriers that comes due to constant technological changes but Oak Cash &

Carry is retailing company so there has few issues. But it can overcome by keeping constant

changes in retailing technology (Gürel, and Tat, 2017). With continuous development in

new technology influence productivity and quality of product which fulfil demands of

customer in dynamic environment.

Legal factors

Heath and Safety law has imposed by UK’s government to protect employees from

discrimination, hazardous and maintains their wellbeing within workplace. So, organization

has taken health and safety measures so that individuals can give their best performance

within business.

Environmental factors

There are different measures that has been undertaken by Oak Cash & Carry which gives

better functioning and influences the reputation of the company in the market. So it has

taken sustainable product practices in the market that is going to promote the trust of the

retailers in the business as well.

STP Marketing Segmentation

It is the procedure of classifying customers or users into various groups for understanding their

demands, preferences and expectation so that enables to develop product or services

accordingly and improves level of satisfaction in them (Berbegal-Mirabent, Gil-Doménech

and Alegre, 2016). Oak Cash & Carry uses this market segmentation strategy to target it’s

specific markets which helps to meet it’s objectives over the time period. Organization targets

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.