OCBC Bank Credit Card Customer Loyalty Improvement: Case Analysis

VerifiedAdded on 2023/06/06

|18

|5070

|469

Case Study

AI Summary

This integrated case study analysis focuses on the challenges faced by OCBC Bank in maintaining customer loyalty within its credit card business, particularly in light of poor rankings in customer satisfaction surveys. The report identifies several key problems, including less motivated employees, cultural barriers, inadequate team management, low customer satisfaction, and competitive pressures. It employs various analytical frameworks such as SWOT analysis, Porter's 5 Forces, Herzberg's motivation-hygiene theory, Hofstede's cultural dimensions theory, and the SOSTAC model to dissect these issues. Proposed solutions range from improving employee motivation and addressing cultural differences to enhancing marketing strategies and leveraging merchant tie-ups. The analysis culminates in a recommended action plan designed to improve OCBC Bank's market position and customer relationships. Desklib provides access to this and other solved assignments for students.

Integrated Case

Study Analysis

Study Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

OCBC bank is located in the Singapore which is dealing in varieties of financial services in

this industry. Currently, bank manager has planned that merchant tie ups could be a great action

to attain the success in the market. The bank has decided this because of the poor ranking which

is conducted by CSISG. Several issues have been faced by OCBC banks in last few years which

has created chaotic situation in the internal management too. This research report is describing

the different issues which are occurred in the OCBC bank and the potential reason for the same.

It has also mentioned some solutions for each of the problem which OCBC bank has faced in the

banking industry. This research has also explained the perfect solution through which company

can preserve it value in the global market. A suitable plan of action has been stated which should

be followed by the management.

OCBC bank is located in the Singapore which is dealing in varieties of financial services in

this industry. Currently, bank manager has planned that merchant tie ups could be a great action

to attain the success in the market. The bank has decided this because of the poor ranking which

is conducted by CSISG. Several issues have been faced by OCBC banks in last few years which

has created chaotic situation in the internal management too. This research report is describing

the different issues which are occurred in the OCBC bank and the potential reason for the same.

It has also mentioned some solutions for each of the problem which OCBC bank has faced in the

banking industry. This research has also explained the perfect solution through which company

can preserve it value in the global market. A suitable plan of action has been stated which should

be followed by the management.

Table of Contents

Executive Summary.........................................................................................................................2

Chapter 1: Introduction to the case study........................................................................................5

Statement of the problems........................................................................................................5

Research Aims............................................................................................................................5

Research Objectives...................................................................................................................6

Research Questions....................................................................................................................6

Report Structure........................................................................................................................6

Chapter 2: Case Brief.......................................................................................................................6

SWOT Analysis..........................................................................................................................6

Porter's 5 forces.........................................................................................................................7

Chapter 3: Problems Statements and Plan of Analysis....................................................................8

Problem 1....................................................................................................................................8

Problem 2....................................................................................................................................8

Problem 3....................................................................................................................................9

Problem 4....................................................................................................................................9

Problem 5....................................................................................................................................9

Problem 6....................................................................................................................................9

Problem 7..................................................................................................................................10

Problem 8..................................................................................................................................10

Problem 9..................................................................................................................................10

Chapter 4: Analysis and Findings..................................................................................................12

Analysis-1..................................................................................................................................12

Analysis-2..................................................................................................................................12

Analysis-3..................................................................................................................................12

Analysis-4..................................................................................................................................12

Analysis-5..................................................................................................................................13

Analysis-6..................................................................................................................................13

Analysis-7..................................................................................................................................13

Analysis-8..................................................................................................................................13

Executive Summary.........................................................................................................................2

Chapter 1: Introduction to the case study........................................................................................5

Statement of the problems........................................................................................................5

Research Aims............................................................................................................................5

Research Objectives...................................................................................................................6

Research Questions....................................................................................................................6

Report Structure........................................................................................................................6

Chapter 2: Case Brief.......................................................................................................................6

SWOT Analysis..........................................................................................................................6

Porter's 5 forces.........................................................................................................................7

Chapter 3: Problems Statements and Plan of Analysis....................................................................8

Problem 1....................................................................................................................................8

Problem 2....................................................................................................................................8

Problem 3....................................................................................................................................9

Problem 4....................................................................................................................................9

Problem 5....................................................................................................................................9

Problem 6....................................................................................................................................9

Problem 7..................................................................................................................................10

Problem 8..................................................................................................................................10

Problem 9..................................................................................................................................10

Chapter 4: Analysis and Findings..................................................................................................12

Analysis-1..................................................................................................................................12

Analysis-2..................................................................................................................................12

Analysis-3..................................................................................................................................12

Analysis-4..................................................................................................................................12

Analysis-5..................................................................................................................................13

Analysis-6..................................................................................................................................13

Analysis-7..................................................................................................................................13

Analysis-8..................................................................................................................................13

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Analysis-9..................................................................................................................................13

Chapter 5: Proposed Solutions to Problems..................................................................................14

Solution-1..................................................................................................................................14

Solution-2..................................................................................................................................14

Solution-3..................................................................................................................................14

Solution-4..................................................................................................................................14

Solution-5..................................................................................................................................14

Solution-6..................................................................................................................................14

Solution-7..................................................................................................................................15

Solution-8..................................................................................................................................15

Solution-9..................................................................................................................................15

Best Fit solution........................................................................................................................15

Recommendations....................................................................................................................15

Action Plan...............................................................................................................................16

Limitations................................................................................................................................16

Scope for Research..................................................................................................................16

References......................................................................................................................................17

Chapter 5: Proposed Solutions to Problems..................................................................................14

Solution-1..................................................................................................................................14

Solution-2..................................................................................................................................14

Solution-3..................................................................................................................................14

Solution-4..................................................................................................................................14

Solution-5..................................................................................................................................14

Solution-6..................................................................................................................................14

Solution-7..................................................................................................................................15

Solution-8..................................................................................................................................15

Solution-9..................................................................................................................................15

Best Fit solution........................................................................................................................15

Recommendations....................................................................................................................15

Action Plan...............................................................................................................................16

Limitations................................................................................................................................16

Scope for Research..................................................................................................................16

References......................................................................................................................................17

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Chapter 1: Introduction to the case study

Statement of the problems

This case study is about the several problems which are occurring in OCBC Bank which

has resulted in last rank of the institution as per the study. This banking institution wants to

establish the merchant tie ups, in order to solve the complexities which are facing by the

management (ANG, CHEN, and DARENDELI, 2022). Moreover company is working in the

direction to stimulate the quality of experience for their existing customers and works in

increasing the satisfaction with the credit card services.

Less motivated employees

Cultural barriers

Inadequate team management

Low level of customer satisfaction and loyalty.

Inability to maintain the good position in the market.

Excess competition

Inefficiency in presenting the product to the customer

Difficulty in dealing with the dynamic business environment.

Planning of merchant tie ups

Research Aims

The aim of this research is to identify the reasons due to which company is lacking in

providing the better card facilities to its consumers and not able to handle the competition in the

credit card market (Awadh, 2022)(Bataev, Koroleva, and Gorovoy, 2019). It will also include

the idea of merchant tie ups and different ways in which it can support the growth of OCBC

Bank and helps the customer to get embrace the good experience.

Statement of the problems

This case study is about the several problems which are occurring in OCBC Bank which

has resulted in last rank of the institution as per the study. This banking institution wants to

establish the merchant tie ups, in order to solve the complexities which are facing by the

management (ANG, CHEN, and DARENDELI, 2022). Moreover company is working in the

direction to stimulate the quality of experience for their existing customers and works in

increasing the satisfaction with the credit card services.

Less motivated employees

Cultural barriers

Inadequate team management

Low level of customer satisfaction and loyalty.

Inability to maintain the good position in the market.

Excess competition

Inefficiency in presenting the product to the customer

Difficulty in dealing with the dynamic business environment.

Planning of merchant tie ups

Research Aims

The aim of this research is to identify the reasons due to which company is lacking in

providing the better card facilities to its consumers and not able to handle the competition in the

credit card market (Awadh, 2022)(Bataev, Koroleva, and Gorovoy, 2019). It will also include

the idea of merchant tie ups and different ways in which it can support the growth of OCBC

Bank and helps the customer to get embrace the good experience.

Research Objectives

The aim of this research is to perform the better evaluation regarding the problems which

has been discussed above and identify the ways through which OCBC bank can modify its

banking functions so that it can achieve the desired goals and can hold their customers for the

longer period of time (Ziegler, 2021).

Research Questions

Following are the questions which has arose after reading this case study-

What could be the reasons due to which company has ranked last in the credit card

market?

How merchant tie ups will help the company?

What will be the different ways through which company can secure its position and

provide optimum satisfaction to the customers.

Report Structure

This given report is following the framework which has been started with an introduction

which is followed by a brief elaboration of the case study with the help of SWOT analysis and

Porter's 5 forces (Chen, Azmi, and Rahman, 2022). In addition to this, it has explained the

specific problems which along with its plan of analysis that will help in discovering the solution

for all the problems of OCBC Bank. In last it has a recommendation for the smooth functioning

of the financial institution.

Chapter 2: Case Brief

OCBC bank is working in very mass network, almost 570 branches of this institution has

been established in more than 18 countries (Wu, 2020). It gives a sufficient chance to the bank

by which management can achieve the prosperity in the market place. Along with the

functioning of the bank is associated with many big corporations with which company is

promoting the message of sustainability among their customer group. The biggest drawback of

OCBC bank is that it is not able to serve the customers as the one of the most famous bank.

Organisation is lacking behind in maintaining the enough cash flow inside the management

which is making it tough to cover some future planning.

The aim of this research is to perform the better evaluation regarding the problems which

has been discussed above and identify the ways through which OCBC bank can modify its

banking functions so that it can achieve the desired goals and can hold their customers for the

longer period of time (Ziegler, 2021).

Research Questions

Following are the questions which has arose after reading this case study-

What could be the reasons due to which company has ranked last in the credit card

market?

How merchant tie ups will help the company?

What will be the different ways through which company can secure its position and

provide optimum satisfaction to the customers.

Report Structure

This given report is following the framework which has been started with an introduction

which is followed by a brief elaboration of the case study with the help of SWOT analysis and

Porter's 5 forces (Chen, Azmi, and Rahman, 2022). In addition to this, it has explained the

specific problems which along with its plan of analysis that will help in discovering the solution

for all the problems of OCBC Bank. In last it has a recommendation for the smooth functioning

of the financial institution.

Chapter 2: Case Brief

OCBC bank is working in very mass network, almost 570 branches of this institution has

been established in more than 18 countries (Wu, 2020). It gives a sufficient chance to the bank

by which management can achieve the prosperity in the market place. Along with the

functioning of the bank is associated with many big corporations with which company is

promoting the message of sustainability among their customer group. The biggest drawback of

OCBC bank is that it is not able to serve the customers as the one of the most famous bank.

Organisation is lacking behind in maintaining the enough cash flow inside the management

which is making it tough to cover some future planning.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

By having the medium level of growth possibilities, OCBC bank can focus on its working

and service structure to present the product for the customers in the market. Furthermore,

management must focus on spreading the working of the business to the international market to

increase the global presence. This banking firm can work in utilizing the new technology, so that

there will be least cost and complexities in performing the task (Guild, 2020). Presence of global

rivalry which is continuously challenging the business strategy of the OCBC bank. And the

presence of the bank in different countries may lead to the severe financial issue due to the

inflexible rates of currencies.

Porter's 5 forces

Threat of new entrants- In the banking sector, the entry chances of new institution is

very less, because of the difficulty in attaining the competitive advantage. Also the

investment which is require in this industry to start the business is high which reduces the

power of new emerging financial institution in the market (Wong, 2019).

Bargaining power of the suppliers- OCBC bank has large quantity of suppliers in this

industry, so if management is finding it difficult to deal in the market then they can

switch to another one. If any supplier wants to earn the minimal amount of profit in the

market then it is important to go along with the demand of the buyer i.e., OCBC bank. In

this way the controlling power of supplier in this industry is low.

Bargaining power of buyers- The negotiation power of the buyer in this industry is

quite less as consumers in this market make regular purchase, so they can not

compromise with the quality. Product differentiation is another important aspect of this

industry as it reduces the possibilities for the consumer to find out the particular product.

Threat of substitute services- The availability of the customers in the banking sector is

low. And if there is any substitute present for the product which is offered by OCBC

bank then that will not be in the set budget of the customers. So, this elements of the

model is not much effective in the banking industry.

Threat of competitors- OCBC has few rivals in this industry but they have tremendous

market share, and this enough to affect the success of the bank. Company must be aware

and service structure to present the product for the customers in the market. Furthermore,

management must focus on spreading the working of the business to the international market to

increase the global presence. This banking firm can work in utilizing the new technology, so that

there will be least cost and complexities in performing the task (Guild, 2020). Presence of global

rivalry which is continuously challenging the business strategy of the OCBC bank. And the

presence of the bank in different countries may lead to the severe financial issue due to the

inflexible rates of currencies.

Porter's 5 forces

Threat of new entrants- In the banking sector, the entry chances of new institution is

very less, because of the difficulty in attaining the competitive advantage. Also the

investment which is require in this industry to start the business is high which reduces the

power of new emerging financial institution in the market (Wong, 2019).

Bargaining power of the suppliers- OCBC bank has large quantity of suppliers in this

industry, so if management is finding it difficult to deal in the market then they can

switch to another one. If any supplier wants to earn the minimal amount of profit in the

market then it is important to go along with the demand of the buyer i.e., OCBC bank. In

this way the controlling power of supplier in this industry is low.

Bargaining power of buyers- The negotiation power of the buyer in this industry is

quite less as consumers in this market make regular purchase, so they can not

compromise with the quality. Product differentiation is another important aspect of this

industry as it reduces the possibilities for the consumer to find out the particular product.

Threat of substitute services- The availability of the customers in the banking sector is

low. And if there is any substitute present for the product which is offered by OCBC

bank then that will not be in the set budget of the customers. So, this elements of the

model is not much effective in the banking industry.

Threat of competitors- OCBC has few rivals in this industry but they have tremendous

market share, and this enough to affect the success of the bank. Company must be aware

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

about the practising of these competitors and start concentrating on building some

efficient service structure for the customers (Gupta, and Xia, 2018).

Chapter 3: Problems Statements and Plan of Analysis

Problem 1

Herzberg motivation hygiene theory states that there are numbers of elements which are

present at work place and these are responsible for providing both satisfaction and dissatisfaction

to the employees who are working within the firm. These components may relate with the type

of job role which is assigned to an individual. In OCBC bank, this theory helps in solving the

problem of diminished motivation level among the employees which could result in low

performance of the organisation as well. In this situation employees are able to give their best by

involving some creativity and innovation in completion of the task which is being allotted to

them by the management of the banking institution.

Problem 2

Hofstede’s cultural dimensions’ theory describe the complex areas of the business which

shows the distinct features of cultural values followed by all the nations. This model includes 6

different factors which depicts the how one nations can vary from other one in various aspects or

attributes (Warrier, and Prasad, 2018). In the light of this model, OCBC bank is able to tackle the

cultural issues prevailing in the organisation. Due to this bank may face the conflicts among the

employees, which could result in lack of understanding and least productivity of the

organisation.

Problem 3

The model of HR value chain shows the positive side of human resource manager

activities which he has performed to attain the desirable organisational goal. It explains the

connection of between the functions which are performed by the human resource manager in the

firm to ensure the efficiency in all the departments. Team management is one of the major

concern of the OCBC bank and this problem could be arise because of the improper contribution

of workforce manager to handle the departments of the company. Poor working of the manager

towards the upliftment of the functional area is the main reason OCBC banks inefficient

working.

efficient service structure for the customers (Gupta, and Xia, 2018).

Chapter 3: Problems Statements and Plan of Analysis

Problem 1

Herzberg motivation hygiene theory states that there are numbers of elements which are

present at work place and these are responsible for providing both satisfaction and dissatisfaction

to the employees who are working within the firm. These components may relate with the type

of job role which is assigned to an individual. In OCBC bank, this theory helps in solving the

problem of diminished motivation level among the employees which could result in low

performance of the organisation as well. In this situation employees are able to give their best by

involving some creativity and innovation in completion of the task which is being allotted to

them by the management of the banking institution.

Problem 2

Hofstede’s cultural dimensions’ theory describe the complex areas of the business which

shows the distinct features of cultural values followed by all the nations. This model includes 6

different factors which depicts the how one nations can vary from other one in various aspects or

attributes (Warrier, and Prasad, 2018). In the light of this model, OCBC bank is able to tackle the

cultural issues prevailing in the organisation. Due to this bank may face the conflicts among the

employees, which could result in lack of understanding and least productivity of the

organisation.

Problem 3

The model of HR value chain shows the positive side of human resource manager

activities which he has performed to attain the desirable organisational goal. It explains the

connection of between the functions which are performed by the human resource manager in the

firm to ensure the efficiency in all the departments. Team management is one of the major

concern of the OCBC bank and this problem could be arise because of the improper contribution

of workforce manager to handle the departments of the company. Poor working of the manager

towards the upliftment of the functional area is the main reason OCBC banks inefficient

working.

Problem 4

The CAGE distance framework helps in discovering the several crucial distinct factors of

the countries which is being considered by the firm while making some relevant plan of action. It

includes factors like cultural, administrative, geographical and economical which is necessary to

formulate the better marketing strategy (Halim, 2019). This model will help OCBC bank in

constructing such policies for their functioning which will suits all the demands and

requirements of the people who are living in the different countries. Banks will identify the

trends in the banking sector of the various nations and formulate the plans accordingly.

Problem 5

The marketing mix communication is the combination of different marketing tools which

could be used in the organisation to ensure the better marketing of the product. It helps in

reaching the mass audience, in order to inform them about the offerings of the business in the

best possible way. OCBC bank should consider this model in its operation as it will allow in

creating the awareness among the customers in respect to new services which is being

introduced. It will also support in maintaining the proper balance among the various factors of

the marketing mix of the OCBC bank (Sugawara, and Nishimura, 2020).

Problem 6

When an employee or worker of the firm gets the proper recognition and

acknowledgement for the task which he has performed in the firm. He feels encouraged and

motivated for his future working, this situation is being explained by the expectancy theory. In

order to present the efficient marketing in OCBC bank, it is necessary to give appraisal to the

employees as this will support in improving their working capability and they will become more

open towards their duties which have been assigned to them by the higher authority. OCBC

banks should encourage its workforce as they are are only source through which company can

achieve the success and preserve its competitiveness in the market.

Problem 7

In order to upgrade the effectiveness of market planning and its uses in the company,

utilisation SOSTAC model is very important (SAPUTRA, 2022). It works with the help of six

precise phase- situation analysis, objectives, strategy, tactics, actions and control. This model

The CAGE distance framework helps in discovering the several crucial distinct factors of

the countries which is being considered by the firm while making some relevant plan of action. It

includes factors like cultural, administrative, geographical and economical which is necessary to

formulate the better marketing strategy (Halim, 2019). This model will help OCBC bank in

constructing such policies for their functioning which will suits all the demands and

requirements of the people who are living in the different countries. Banks will identify the

trends in the banking sector of the various nations and formulate the plans accordingly.

Problem 5

The marketing mix communication is the combination of different marketing tools which

could be used in the organisation to ensure the better marketing of the product. It helps in

reaching the mass audience, in order to inform them about the offerings of the business in the

best possible way. OCBC bank should consider this model in its operation as it will allow in

creating the awareness among the customers in respect to new services which is being

introduced. It will also support in maintaining the proper balance among the various factors of

the marketing mix of the OCBC bank (Sugawara, and Nishimura, 2020).

Problem 6

When an employee or worker of the firm gets the proper recognition and

acknowledgement for the task which he has performed in the firm. He feels encouraged and

motivated for his future working, this situation is being explained by the expectancy theory. In

order to present the efficient marketing in OCBC bank, it is necessary to give appraisal to the

employees as this will support in improving their working capability and they will become more

open towards their duties which have been assigned to them by the higher authority. OCBC

banks should encourage its workforce as they are are only source through which company can

achieve the success and preserve its competitiveness in the market.

Problem 7

In order to upgrade the effectiveness of market planning and its uses in the company,

utilisation SOSTAC model is very important (SAPUTRA, 2022). It works with the help of six

precise phase- situation analysis, objectives, strategy, tactics, actions and control. This model

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

basically promotes the inclusion of digital marketing in any kind of business industry. If OCBC

fails to develop good marketing plan, then it will result in low growth of the company's services

among the customers. It will also reduce the reputable image of the company due to failure of

OCBC bank in handling its offered services.

Problem 8

The complexity theory concentrates on finding it some loops and elements which may

affect the working of the business. It supports in identifying the reviews of the customers and

conduct some changes in the working of the business. OCBC bank's inability to deal will the

outside environment has making it difficult to do the changes in the management. OCBC must

focus on reviewing these external factors which could impact the working of the firm in

numerous ways (Hardiansyah, Rony, and Soehardi, 2019). By considering this model OCBC

bank is able to highlight the areas that may requires some changes to assure the better activity of

the company.

Problem 9

The porter's generic strategy is related to those elements with which company is able to

get the competitive advantage by performing some modification in the the strategic approach of

the business. By involving this model in the management company is able to discover the

establish the various methods through which it will become easy to make the innovation in the

service offerings of the OCBC bank. It assist in association of the business operation with some

new beneficial techniques. Through this financial institution can experience the growth in the

working of the business.

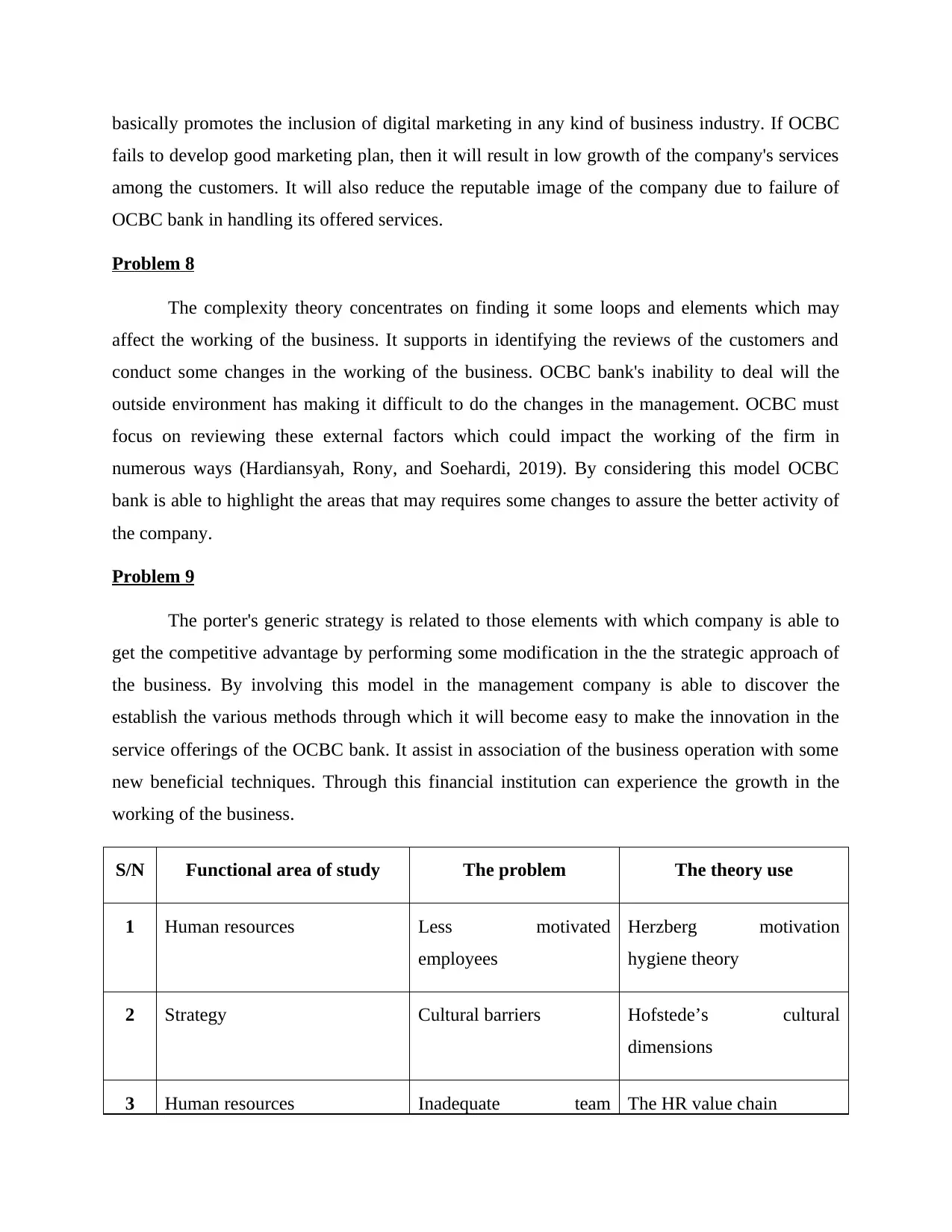

S/N Functional area of study The problem The theory use

1 Human resources Less motivated

employees

Herzberg motivation

hygiene theory

2 Strategy Cultural barriers Hofstede’s cultural

dimensions

3 Human resources Inadequate team The HR value chain

fails to develop good marketing plan, then it will result in low growth of the company's services

among the customers. It will also reduce the reputable image of the company due to failure of

OCBC bank in handling its offered services.

Problem 8

The complexity theory concentrates on finding it some loops and elements which may

affect the working of the business. It supports in identifying the reviews of the customers and

conduct some changes in the working of the business. OCBC bank's inability to deal will the

outside environment has making it difficult to do the changes in the management. OCBC must

focus on reviewing these external factors which could impact the working of the firm in

numerous ways (Hardiansyah, Rony, and Soehardi, 2019). By considering this model OCBC

bank is able to highlight the areas that may requires some changes to assure the better activity of

the company.

Problem 9

The porter's generic strategy is related to those elements with which company is able to

get the competitive advantage by performing some modification in the the strategic approach of

the business. By involving this model in the management company is able to discover the

establish the various methods through which it will become easy to make the innovation in the

service offerings of the OCBC bank. It assist in association of the business operation with some

new beneficial techniques. Through this financial institution can experience the growth in the

working of the business.

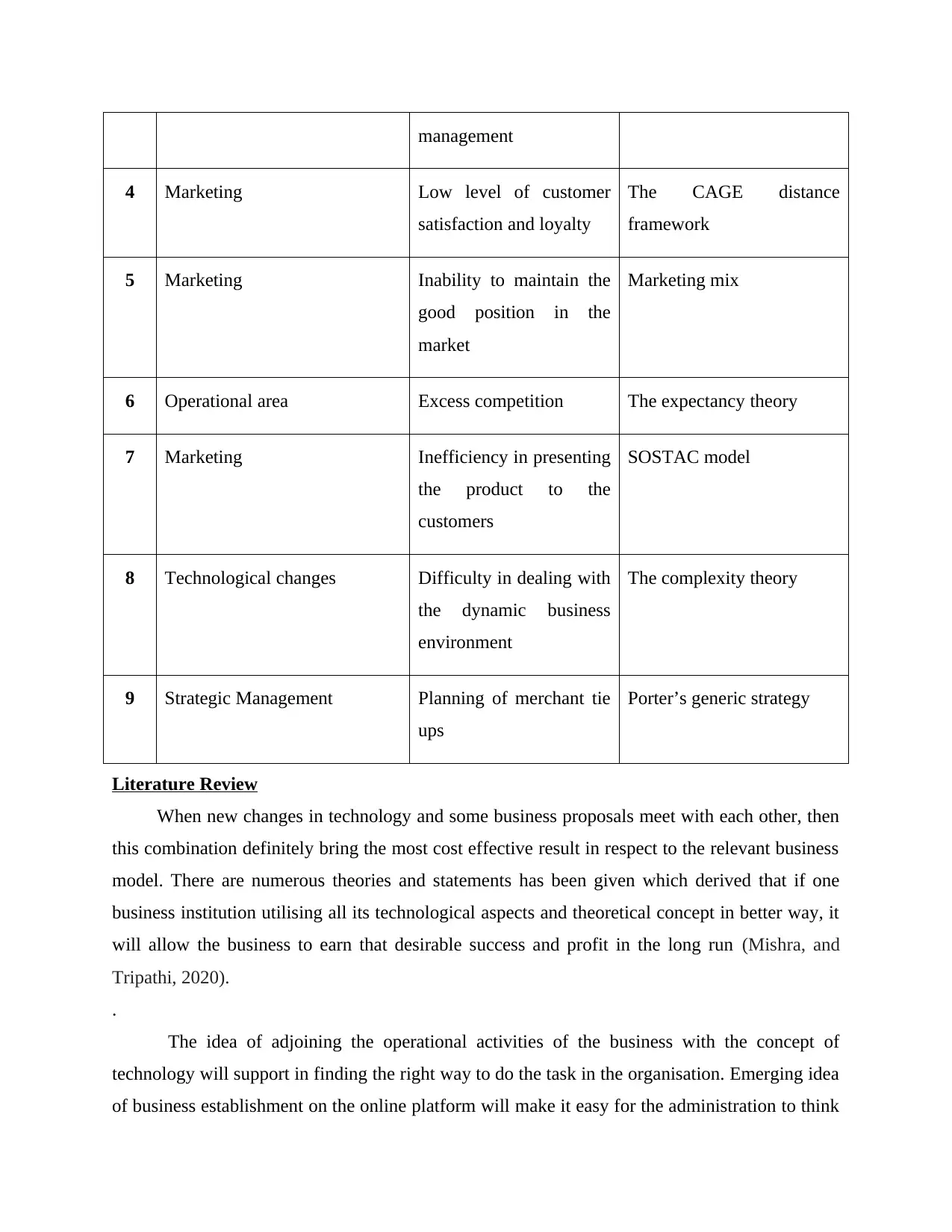

S/N Functional area of study The problem The theory use

1 Human resources Less motivated

employees

Herzberg motivation

hygiene theory

2 Strategy Cultural barriers Hofstede’s cultural

dimensions

3 Human resources Inadequate team The HR value chain

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

management

4 Marketing Low level of customer

satisfaction and loyalty

The CAGE distance

framework

5 Marketing Inability to maintain the

good position in the

market

Marketing mix

6 Operational area Excess competition The expectancy theory

7 Marketing Inefficiency in presenting

the product to the

customers

SOSTAC model

8 Technological changes Difficulty in dealing with

the dynamic business

environment

The complexity theory

9 Strategic Management Planning of merchant tie

ups

Porter’s generic strategy

Literature Review

When new changes in technology and some business proposals meet with each other, then

this combination definitely bring the most cost effective result in respect to the relevant business

model. There are numerous theories and statements has been given which derived that if one

business institution utilising all its technological aspects and theoretical concept in better way, it

will allow the business to earn that desirable success and profit in the long run (Mishra, and

Tripathi, 2020).

.

The idea of adjoining the operational activities of the business with the concept of

technology will support in finding the right way to do the task in the organisation. Emerging idea

of business establishment on the online platform will make it easy for the administration to think

4 Marketing Low level of customer

satisfaction and loyalty

The CAGE distance

framework

5 Marketing Inability to maintain the

good position in the

market

Marketing mix

6 Operational area Excess competition The expectancy theory

7 Marketing Inefficiency in presenting

the product to the

customers

SOSTAC model

8 Technological changes Difficulty in dealing with

the dynamic business

environment

The complexity theory

9 Strategic Management Planning of merchant tie

ups

Porter’s generic strategy

Literature Review

When new changes in technology and some business proposals meet with each other, then

this combination definitely bring the most cost effective result in respect to the relevant business

model. There are numerous theories and statements has been given which derived that if one

business institution utilising all its technological aspects and theoretical concept in better way, it

will allow the business to earn that desirable success and profit in the long run (Mishra, and

Tripathi, 2020).

.

The idea of adjoining the operational activities of the business with the concept of

technology will support in finding the right way to do the task in the organisation. Emerging idea

of business establishment on the online platform will make it easy for the administration to think

about their policies and offering with the perspective of consumer and supplier as well. This will

result in identification of loop holes in the functioning of the business organisation (Wahyono,

2018).

Chapter 4: Analysis and Findings

Analysis-1

The first problem of OCBC which is related to the demotivated employee is highly found

in the sales department, the reason could be less remuneration or compensation due to which

employees are not making much efforts to complete the task on the given deadline. This can

create the low revenue structure of the company as the department is unable to accomplish the

set goals of the sales.

Analysis-2

The second problem of OCBC bank is about the lack of cultural values and respective

behaviour of the employees in almost every other section. This may lead to the poor

communication and disinterest of the colleagues in supporting each other. The reason of this

condition in the OCBC bank could be manager’s avoidance in acknowledging the importance of

each cultural beliefs and making policies in this regard (Howe, 2019).

Analysis-3

The third problem of the banking firm is about the lack of team spirit among the

employees which is continuously creating the chaotic environment and confusion to understand

the things which has been explained by the manager. The reason behind this situation is the

unhealthy competition which is influencing the working environment of OCBC bank. For this

company emphasis the more group task where each and every individual of the team is allow to

explain his or her thoughts on the given project.

Analysis-4

The fourth issue of OCBC bank is about the customer satisfaction or their loyalty towards

the services which organisation is offering to their customer base. This due to the improper

marketing in the company which is creating lots of issues for OCBC bank in informing

consumers about the card facilities (Prabhakar, 2019). People who belong from distinct cultural

result in identification of loop holes in the functioning of the business organisation (Wahyono,

2018).

Chapter 4: Analysis and Findings

Analysis-1

The first problem of OCBC which is related to the demotivated employee is highly found

in the sales department, the reason could be less remuneration or compensation due to which

employees are not making much efforts to complete the task on the given deadline. This can

create the low revenue structure of the company as the department is unable to accomplish the

set goals of the sales.

Analysis-2

The second problem of OCBC bank is about the lack of cultural values and respective

behaviour of the employees in almost every other section. This may lead to the poor

communication and disinterest of the colleagues in supporting each other. The reason of this

condition in the OCBC bank could be manager’s avoidance in acknowledging the importance of

each cultural beliefs and making policies in this regard (Howe, 2019).

Analysis-3

The third problem of the banking firm is about the lack of team spirit among the

employees which is continuously creating the chaotic environment and confusion to understand

the things which has been explained by the manager. The reason behind this situation is the

unhealthy competition which is influencing the working environment of OCBC bank. For this

company emphasis the more group task where each and every individual of the team is allow to

explain his or her thoughts on the given project.

Analysis-4

The fourth issue of OCBC bank is about the customer satisfaction or their loyalty towards

the services which organisation is offering to their customer base. This due to the improper

marketing in the company which is creating lots of issues for OCBC bank in informing

consumers about the card facilities (Prabhakar, 2019). People who belong from distinct cultural

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.