Organizational Challenges: An Analysis of ANZ Bank's Management

VerifiedAdded on 2021/04/17

|20

|4541

|151

Report

AI Summary

This report offers an in-depth analysis of the management challenges confronting ANZ Bank. It begins with an executive summary highlighting the importance of practical management knowledge in the business context and identifies the strengths and weaknesses within ANZ Bank's management approaches. The report employs SWOT and PESTEL analyses to evaluate the bank's macro and micro environments, emphasizing its strong financial position as a source of resilience. It then delves into various challenges, including those related to business and technology, and assesses key performance indicators (KPIs) of agile management. The report concludes by summarizing the challenges and providing recommendations for improvement. The report includes an introduction to the organization, SWOT and PESTEL analyses, Force Field Analysis, specific ANZ management challenges, challenges of focusing on business and technology, KPIs of Agile Management and a conclusion.

Running head: ORGANIZATIONAL CHALLENGES

ORGANIZATIONAL CHALLENGES

Name of the Student:

Name of the University:

Authors Note:

ORGANIZATIONAL CHALLENGES

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ORGANIZATIONAL CHALLENGES

Executive Summary

The report showcase the importance on the practical knowledge of management in

business scenario. The report throws light on the given company, ANZ bank and identifies the

strength and weaknesses of the management approaches. There are various challenges in the

businesses that is a combination of internal and external factors. Through the SWOT and

PESTLE the macro and micro environment is analyzed. Strong financial position furthermore

provides resilience to various market developments. Moreover the various factors and challenges

is evaluated for the ANZ bank. Various challenges that leads to focus on business and

technology is also ascertained.

Executive Summary

The report showcase the importance on the practical knowledge of management in

business scenario. The report throws light on the given company, ANZ bank and identifies the

strength and weaknesses of the management approaches. There are various challenges in the

businesses that is a combination of internal and external factors. Through the SWOT and

PESTLE the macro and micro environment is analyzed. Strong financial position furthermore

provides resilience to various market developments. Moreover the various factors and challenges

is evaluated for the ANZ bank. Various challenges that leads to focus on business and

technology is also ascertained.

2ORGANIZATIONAL CHALLENGES

Table of Contents

Introduction:....................................................................................................................................3

About the Organization:..................................................................................................................3

SWOT Analysis of the Organization:..............................................................................................4

PESTEL Analysis:...........................................................................................................................7

Force Field Analysis:.....................................................................................................................11

ANZ Management Challenges:.....................................................................................................13

Challenges of Focusing on Business and Technology..................................................................13

KPI of Agile Management.............................................................................................................14

Conclusion.....................................................................................................................................15

References:....................................................................................................................................16

Table of Contents

Introduction:....................................................................................................................................3

About the Organization:..................................................................................................................3

SWOT Analysis of the Organization:..............................................................................................4

PESTEL Analysis:...........................................................................................................................7

Force Field Analysis:.....................................................................................................................11

ANZ Management Challenges:.....................................................................................................13

Challenges of Focusing on Business and Technology..................................................................13

KPI of Agile Management.............................................................................................................14

Conclusion.....................................................................................................................................15

References:....................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ORGANIZATIONAL CHALLENGES

Introduction:

In the recent times, organization faces variety of problem or challenges that becomes a

great hurdle for their growth. The most common business challenges or issues can be different

for various industry, service or business. The report highlights the major challenges faced by the

management of ANZ Bank. There several external and internal factors faced by the firms. This

factor provides potential threats and opportunities for all short-term and long-term growth of the

firm in the business environment (Ferraro, Etzion and Gehman 2015).

With the help of external and internal analysis of the business, the challenges faced by the

organization can be evaluated. Through SWOT and PESTEL analysis, both the micro and macro

environment can be analyzed. After analyzing the organizational management practices of the

company all the opportunities and strengths can be easily evaluated. The organization can easily

ascertain the area where management strengths can be easily aligned with the organizational

goals.

About the Organization:

The Australia and New Zealand Banking Group Limited (ANZ Bank) was initially

opened as the Bank of Australia. In the year 1835, the bank opened their first office in Sydney

(Anz.com. 2018). Later, in the year 1938 the bank’s office was established in Melbourne, where

the current headquarter of the bank is located. ANZ bank operates in more than 33 markets that

is global representation in New Zealand, Australia, Pacific, and Europe and all over the Middle

East. ANZ bank is the third largest bank all over Australia and is the largest banking group in

Pacific and New Zealand among the leading banks in the world. The bank facilitates in providing

Introduction:

In the recent times, organization faces variety of problem or challenges that becomes a

great hurdle for their growth. The most common business challenges or issues can be different

for various industry, service or business. The report highlights the major challenges faced by the

management of ANZ Bank. There several external and internal factors faced by the firms. This

factor provides potential threats and opportunities for all short-term and long-term growth of the

firm in the business environment (Ferraro, Etzion and Gehman 2015).

With the help of external and internal analysis of the business, the challenges faced by the

organization can be evaluated. Through SWOT and PESTEL analysis, both the micro and macro

environment can be analyzed. After analyzing the organizational management practices of the

company all the opportunities and strengths can be easily evaluated. The organization can easily

ascertain the area where management strengths can be easily aligned with the organizational

goals.

About the Organization:

The Australia and New Zealand Banking Group Limited (ANZ Bank) was initially

opened as the Bank of Australia. In the year 1835, the bank opened their first office in Sydney

(Anz.com. 2018). Later, in the year 1938 the bank’s office was established in Melbourne, where

the current headquarter of the bank is located. ANZ bank operates in more than 33 markets that

is global representation in New Zealand, Australia, Pacific, and Europe and all over the Middle

East. ANZ bank is the third largest bank all over Australia and is the largest banking group in

Pacific and New Zealand among the leading banks in the world. The bank facilitates in providing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ORGANIZATIONAL CHALLENGES

range of financial and banking products and services to more than millions of customers. The

bank also provides employment to more than 50,000 people all over the world.

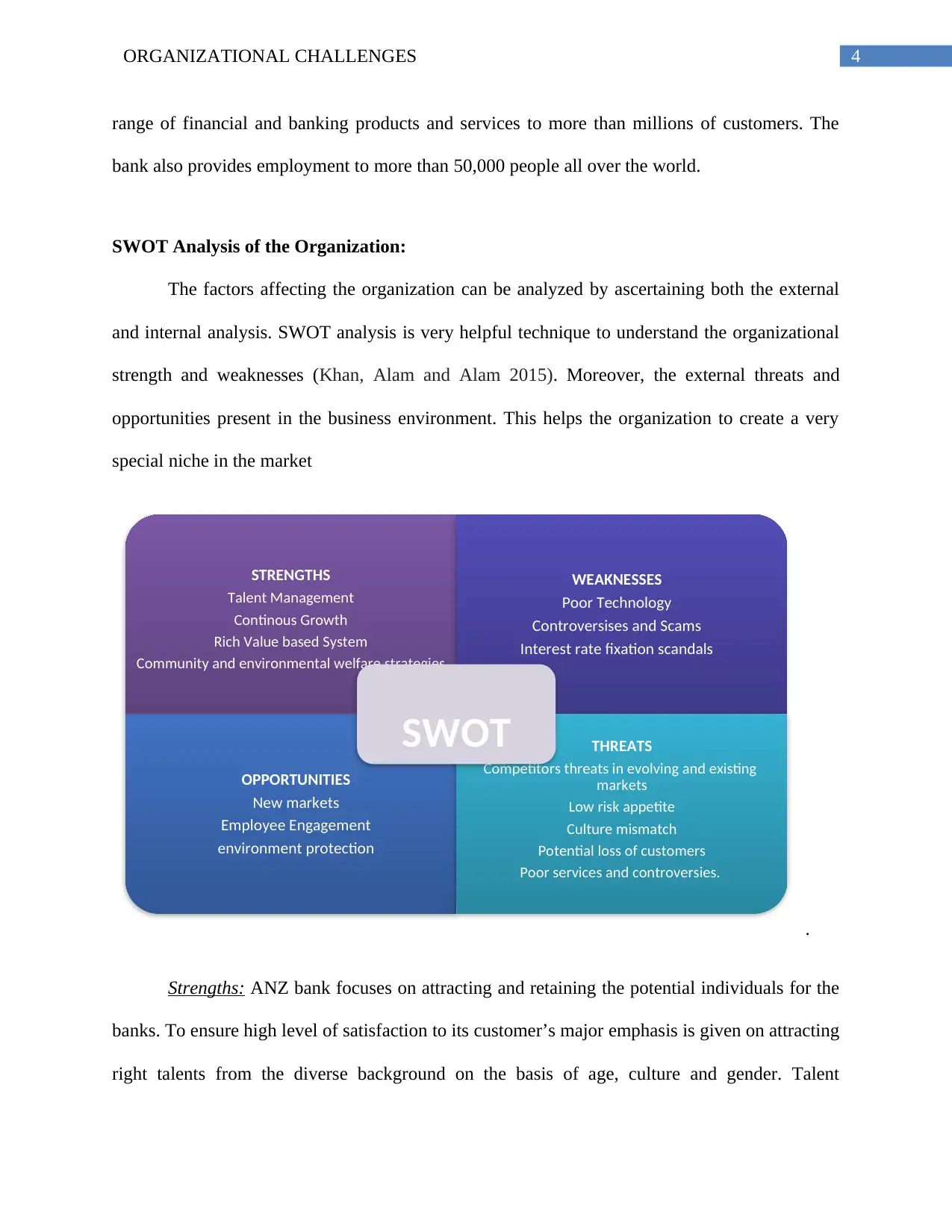

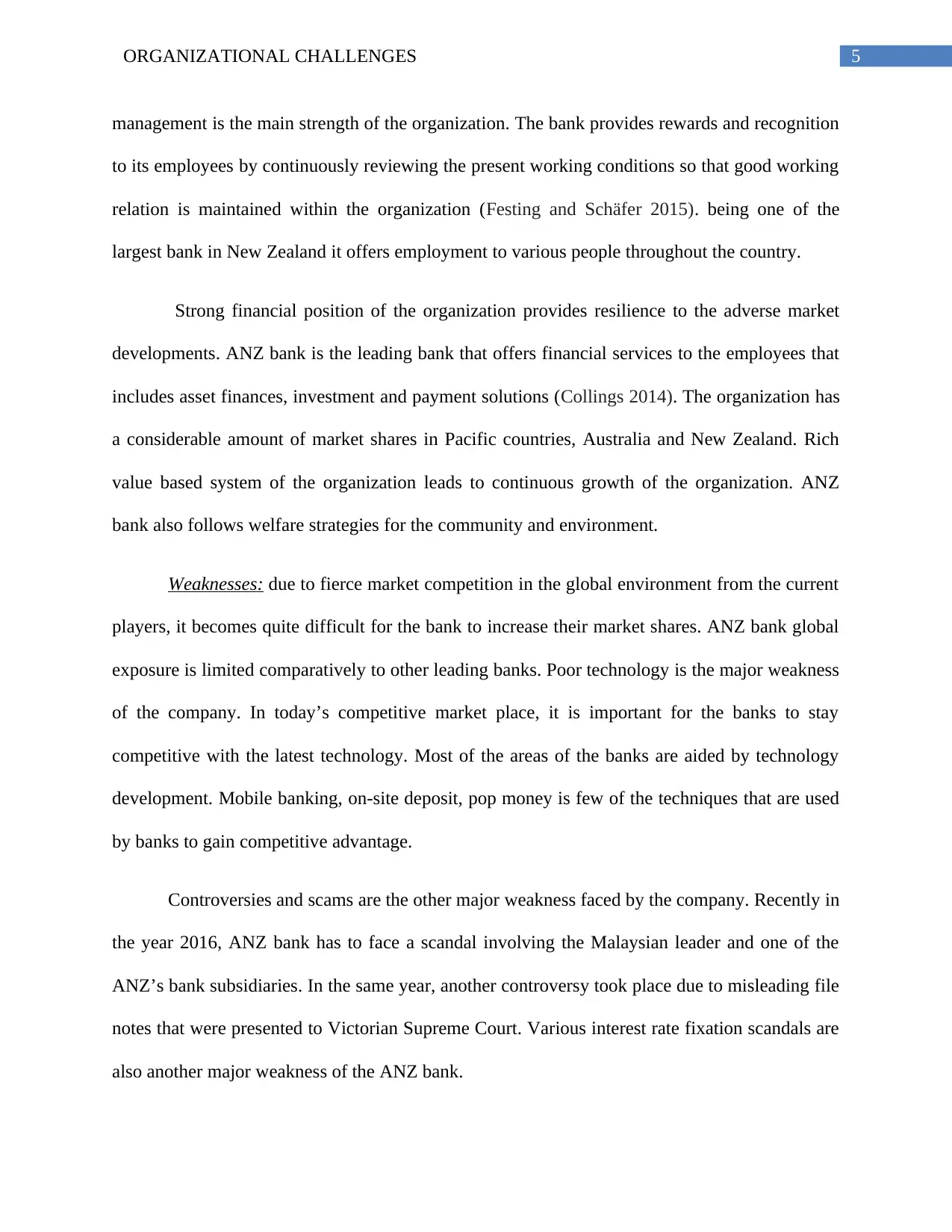

SWOT Analysis of the Organization:

The factors affecting the organization can be analyzed by ascertaining both the external

and internal analysis. SWOT analysis is very helpful technique to understand the organizational

strength and weaknesses (Khan, Alam and Alam 2015). Moreover, the external threats and

opportunities present in the business environment. This helps the organization to create a very

special niche in the market

.

Strengths: ANZ bank focuses on attracting and retaining the potential individuals for the

banks. To ensure high level of satisfaction to its customer’s major emphasis is given on attracting

right talents from the diverse background on the basis of age, culture and gender. Talent

STRENGTHS

Talent Management

Continous Growth

Rich Value based System

Community and environmental welfare strategies

WEAKNESSES

Poor Technology

Controversises and Scams

Interest rate fixation scandals

OPPORTUNITIES

New markets

Employee Engagement

environment protection

THREATS

Competitors threats in evolving and existing

markets

Low risk appetite

Culture mismatch

Potential loss of customers

Poor services and controversies.

SWOT

range of financial and banking products and services to more than millions of customers. The

bank also provides employment to more than 50,000 people all over the world.

SWOT Analysis of the Organization:

The factors affecting the organization can be analyzed by ascertaining both the external

and internal analysis. SWOT analysis is very helpful technique to understand the organizational

strength and weaknesses (Khan, Alam and Alam 2015). Moreover, the external threats and

opportunities present in the business environment. This helps the organization to create a very

special niche in the market

.

Strengths: ANZ bank focuses on attracting and retaining the potential individuals for the

banks. To ensure high level of satisfaction to its customer’s major emphasis is given on attracting

right talents from the diverse background on the basis of age, culture and gender. Talent

STRENGTHS

Talent Management

Continous Growth

Rich Value based System

Community and environmental welfare strategies

WEAKNESSES

Poor Technology

Controversises and Scams

Interest rate fixation scandals

OPPORTUNITIES

New markets

Employee Engagement

environment protection

THREATS

Competitors threats in evolving and existing

markets

Low risk appetite

Culture mismatch

Potential loss of customers

Poor services and controversies.

SWOT

5ORGANIZATIONAL CHALLENGES

management is the main strength of the organization. The bank provides rewards and recognition

to its employees by continuously reviewing the present working conditions so that good working

relation is maintained within the organization (Festing and Schäfer 2015). being one of the

largest bank in New Zealand it offers employment to various people throughout the country.

Strong financial position of the organization provides resilience to the adverse market

developments. ANZ bank is the leading bank that offers financial services to the employees that

includes asset finances, investment and payment solutions (Collings 2014). The organization has

a considerable amount of market shares in Pacific countries, Australia and New Zealand. Rich

value based system of the organization leads to continuous growth of the organization. ANZ

bank also follows welfare strategies for the community and environment.

Weaknesses: due to fierce market competition in the global environment from the current

players, it becomes quite difficult for the bank to increase their market shares. ANZ bank global

exposure is limited comparatively to other leading banks. Poor technology is the major weakness

of the company. In today’s competitive market place, it is important for the banks to stay

competitive with the latest technology. Most of the areas of the banks are aided by technology

development. Mobile banking, on-site deposit, pop money is few of the techniques that are used

by banks to gain competitive advantage.

Controversies and scams are the other major weakness faced by the company. Recently in

the year 2016, ANZ bank has to face a scandal involving the Malaysian leader and one of the

ANZ’s bank subsidiaries. In the same year, another controversy took place due to misleading file

notes that were presented to Victorian Supreme Court. Various interest rate fixation scandals are

also another major weakness of the ANZ bank.

management is the main strength of the organization. The bank provides rewards and recognition

to its employees by continuously reviewing the present working conditions so that good working

relation is maintained within the organization (Festing and Schäfer 2015). being one of the

largest bank in New Zealand it offers employment to various people throughout the country.

Strong financial position of the organization provides resilience to the adverse market

developments. ANZ bank is the leading bank that offers financial services to the employees that

includes asset finances, investment and payment solutions (Collings 2014). The organization has

a considerable amount of market shares in Pacific countries, Australia and New Zealand. Rich

value based system of the organization leads to continuous growth of the organization. ANZ

bank also follows welfare strategies for the community and environment.

Weaknesses: due to fierce market competition in the global environment from the current

players, it becomes quite difficult for the bank to increase their market shares. ANZ bank global

exposure is limited comparatively to other leading banks. Poor technology is the major weakness

of the company. In today’s competitive market place, it is important for the banks to stay

competitive with the latest technology. Most of the areas of the banks are aided by technology

development. Mobile banking, on-site deposit, pop money is few of the techniques that are used

by banks to gain competitive advantage.

Controversies and scams are the other major weakness faced by the company. Recently in

the year 2016, ANZ bank has to face a scandal involving the Malaysian leader and one of the

ANZ’s bank subsidiaries. In the same year, another controversy took place due to misleading file

notes that were presented to Victorian Supreme Court. Various interest rate fixation scandals are

also another major weakness of the ANZ bank.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ORGANIZATIONAL CHALLENGES

Opportunities: ANZ bank is the first Australian bank to receive license from the

government. The bank can easily conduct retail business in Yuan region of China. This also

provides for the bank an immense opportunity to tap the business in Chinese market. The bank

also provides high opportunities to grow in the Thailand market after receiving license from the

government. Moreover, ANZ bank also has a high opportunity to expand its business in the

Asian markets like India and China.

In addition to this, employee engagement is another great factor that ANZ bank can enjoy

in the rapidly growing economy of Australia and New Zealand. Most of the employees in

Australia are highly enthusiastic, committed and involved to their workplace (Gerow, Thatcher

and Grover 2015). High retention and low turnover rate is a great opportunity for the growth and

development of the bank. The major advantage of investing in employee engagement is that it

will lead to give higher productivity and profitability.

Threats: the economic condition of New Zealand and Australia is deteriorating at a rapid

rate. Drastic changes and fluctuations have been occurring in the banking system of Australia.

There is also fierce competition from all the global banks present in Pacific regions and

Australia, which is increasing at a rapid rate. Competitor’s threats are very high in the existing

and evolving markets. Furthermore, several kinds of controversies that affect the business

processes create a negative impact on the goodwill of the bank. This further leads to potential

loss of target customers. The risk tolerance and appetite level is also quiet low and therefore is

unable to meet the organization’s strategic objective. Culture mismatch also poses a major threat

to the ANZ bank growth and development.

Opportunities: ANZ bank is the first Australian bank to receive license from the

government. The bank can easily conduct retail business in Yuan region of China. This also

provides for the bank an immense opportunity to tap the business in Chinese market. The bank

also provides high opportunities to grow in the Thailand market after receiving license from the

government. Moreover, ANZ bank also has a high opportunity to expand its business in the

Asian markets like India and China.

In addition to this, employee engagement is another great factor that ANZ bank can enjoy

in the rapidly growing economy of Australia and New Zealand. Most of the employees in

Australia are highly enthusiastic, committed and involved to their workplace (Gerow, Thatcher

and Grover 2015). High retention and low turnover rate is a great opportunity for the growth and

development of the bank. The major advantage of investing in employee engagement is that it

will lead to give higher productivity and profitability.

Threats: the economic condition of New Zealand and Australia is deteriorating at a rapid

rate. Drastic changes and fluctuations have been occurring in the banking system of Australia.

There is also fierce competition from all the global banks present in Pacific regions and

Australia, which is increasing at a rapid rate. Competitor’s threats are very high in the existing

and evolving markets. Furthermore, several kinds of controversies that affect the business

processes create a negative impact on the goodwill of the bank. This further leads to potential

loss of target customers. The risk tolerance and appetite level is also quiet low and therefore is

unable to meet the organization’s strategic objective. Culture mismatch also poses a major threat

to the ANZ bank growth and development.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ORGANIZATIONAL CHALLENGES

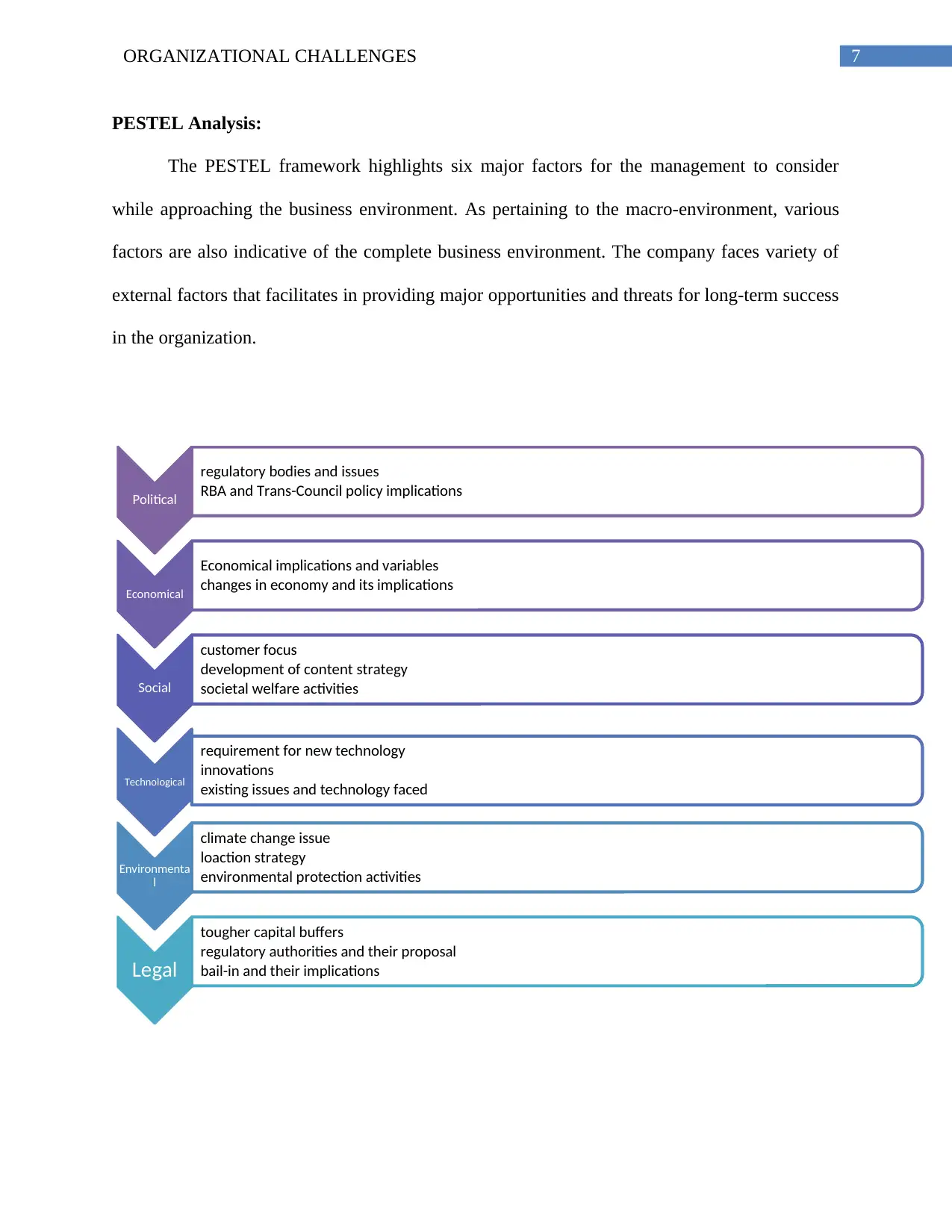

PESTEL Analysis:

The PESTEL framework highlights six major factors for the management to consider

while approaching the business environment. As pertaining to the macro-environment, various

factors are also indicative of the complete business environment. The company faces variety of

external factors that facilitates in providing major opportunities and threats for long-term success

in the organization.

Political

regulatory bodies and issues

RBA and Trans-Council policy implications

Economical

Economical implications and variables

changes in economy and its implications

Social

customer focus

development of content strategy

societal welfare activities

Technological

requirement for new technology

innovations

existing issues and technology faced

Environmenta

l

climate change issue

loaction strategy

environmental protection activities

Legal

tougher capital buffers

regulatory authorities and their proposal

bail-in and their implications

PESTEL Analysis:

The PESTEL framework highlights six major factors for the management to consider

while approaching the business environment. As pertaining to the macro-environment, various

factors are also indicative of the complete business environment. The company faces variety of

external factors that facilitates in providing major opportunities and threats for long-term success

in the organization.

Political

regulatory bodies and issues

RBA and Trans-Council policy implications

Economical

Economical implications and variables

changes in economy and its implications

Social

customer focus

development of content strategy

societal welfare activities

Technological

requirement for new technology

innovations

existing issues and technology faced

Environmenta

l

climate change issue

loaction strategy

environmental protection activities

Legal

tougher capital buffers

regulatory authorities and their proposal

bail-in and their implications

8ORGANIZATIONAL CHALLENGES

Political: politics plays a major role in the businesses as there is a balance between

systems of control and free markets. The regulatory bodies and issues affect the business that

mostly revolve around taxes, potential subsidies, import and export tariffs. The Australian

regulatory bodies and issues affect the business of the ANZ bank. The global economics now

supersede the economics of banking businesses.

ANZ bank also considers various opportunities and threats while identifying maximum

areas for production, corporate or sales headquarter and expending into new regions. This also

affects the trans-council and RBA implications of the ANZ bank. Generally there are low

barriers of market entry in this developed economy. For instance, the political strife in pacific

regions of Solomon Island, Fiji and Tonga creates an adverse impact on the environment. The

growth rate and credit worthiness for all the business prospects and investment levels within the

banks also face major consequences.

Economic: The economic factors are the major metrics that assesses and measure the

health of the economy. The main factors include gross domestic product (GDP), interest rates,

consumer purchasing indices, inflation and various other indicators. The economy of a country

and banking industry is interrelated to each other. The economic factors affecting ANZ bank is

highly critical in nature. Change in economy whether, inflation or recession severely impacts the

banking habits of the organization. The exchange rates also affect the ANZ bank at a global

level. Stable currencies such as dollars affect the spending habits and currencies of people.

The economic environment for ANZ has been fairly positive and in the near future it is

expected it to be the same. Since the last year, the world economy has been expanded by 5.4%.

The Australian economy, especially the region where ANZ bank is headquartered is in its growth

Political: politics plays a major role in the businesses as there is a balance between

systems of control and free markets. The regulatory bodies and issues affect the business that

mostly revolve around taxes, potential subsidies, import and export tariffs. The Australian

regulatory bodies and issues affect the business of the ANZ bank. The global economics now

supersede the economics of banking businesses.

ANZ bank also considers various opportunities and threats while identifying maximum

areas for production, corporate or sales headquarter and expending into new regions. This also

affects the trans-council and RBA implications of the ANZ bank. Generally there are low

barriers of market entry in this developed economy. For instance, the political strife in pacific

regions of Solomon Island, Fiji and Tonga creates an adverse impact on the environment. The

growth rate and credit worthiness for all the business prospects and investment levels within the

banks also face major consequences.

Economic: The economic factors are the major metrics that assesses and measure the

health of the economy. The main factors include gross domestic product (GDP), interest rates,

consumer purchasing indices, inflation and various other indicators. The economy of a country

and banking industry is interrelated to each other. The economic factors affecting ANZ bank is

highly critical in nature. Change in economy whether, inflation or recession severely impacts the

banking habits of the organization. The exchange rates also affect the ANZ bank at a global

level. Stable currencies such as dollars affect the spending habits and currencies of people.

The economic environment for ANZ has been fairly positive and in the near future it is

expected it to be the same. Since the last year, the world economy has been expanded by 5.4%.

The Australian economy, especially the region where ANZ bank is headquartered is in its growth

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9ORGANIZATIONAL CHALLENGES

phase and is continued towards expansion (Kader Ali, Wilson and Mohammad 2014). On the

other hand, the growth rate of New Zealand is not that high and the expansion level is expected

to be the same in the near future. However, the overall economic environment is highly positive

for ANZ bank. This therefore indicates various business opportunities for the banks in the next

few years.

Social: social factors include the demographic analysis, where specific groups showcase

tendencies or preferences that can threaten a given incumbent or can be leveraged. The culture of

the individual affects the necessities and buying behavior and their application of banking

options. Social factors often lead to various kinds of risks and challenges to financial institutions,

mostly in its lending activities.

ANZ bank also has to overcome this major challenge with effective implementation of

decisions. The potential customers are always in the search of comfort and ease and as

technology has developed, as the people accept major seamless banking experiences. Customer

focused is the vital factor in the developed economy of Australia and New Zealand. ANZ bank

applies client screening tool that helps in the credit approval process. This approach also

identifies any high risk or low risk borrowers as per their social standings.

Technological: technology plays a major role in the business that will continue to drive

new innovation through research and development. Recognizing the potential technology is a

great asset for the management that optimizes the internal efficiency of the firm. In the recent

times, as technology is changing the techniques how a customer handle their funds and their

banking habits is also improving. ANZ bank offers several mobile apps to transfer funds, mobile

apps and customers can easily pay their bills through their smart phones. Smartphone can easily

phase and is continued towards expansion (Kader Ali, Wilson and Mohammad 2014). On the

other hand, the growth rate of New Zealand is not that high and the expansion level is expected

to be the same in the near future. However, the overall economic environment is highly positive

for ANZ bank. This therefore indicates various business opportunities for the banks in the next

few years.

Social: social factors include the demographic analysis, where specific groups showcase

tendencies or preferences that can threaten a given incumbent or can be leveraged. The culture of

the individual affects the necessities and buying behavior and their application of banking

options. Social factors often lead to various kinds of risks and challenges to financial institutions,

mostly in its lending activities.

ANZ bank also has to overcome this major challenge with effective implementation of

decisions. The potential customers are always in the search of comfort and ease and as

technology has developed, as the people accept major seamless banking experiences. Customer

focused is the vital factor in the developed economy of Australia and New Zealand. ANZ bank

applies client screening tool that helps in the credit approval process. This approach also

identifies any high risk or low risk borrowers as per their social standings.

Technological: technology plays a major role in the business that will continue to drive

new innovation through research and development. Recognizing the potential technology is a

great asset for the management that optimizes the internal efficiency of the firm. In the recent

times, as technology is changing the techniques how a customer handle their funds and their

banking habits is also improving. ANZ bank offers several mobile apps to transfer funds, mobile

apps and customers can easily pay their bills through their smart phones. Smartphone can easily

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10ORGANIZATIONAL CHALLENGES

scan cheques and process the banking transaction from one location to other very easily. ANZ

bank has launched full digital certificate technology that offers more secure banking and online

environment for their customers. This has also helped ANZ to complements its security

initiatives and trust level. Therefore, sustaining its position as a leader in the banking and

financial industry at a global level.

Environmental: in the recent times, the impact of the business on the environment is a

major concern for the organization. Both the government and customers penalizes the

companies, which adversely affects the environment (Reamer 2015). ANZ bank has developed a

Social and Environmental policy so that it can monitor and ascertain any potential risks in the

credit approval processes.

ANZ bank has implemented significant principles that are applied for the investments and

lending decisions in all of the developing countries. Due to the use of latest technology and with

the help of mobile banking apps, the use of paper has tremendously reduced. Most of the issues

are handled through online services, therefore reducing the adverse impact on environmental

condition. These steps taken by the bank leads to minimize the negative impacts of its

operational activities in the light of social environment (Tshelane and Mahlomaholo 2015). The

company is also involved in corporate social responsibility and various kinds of environmental

protection acts.

Legal: adequate understanding of the legal scenario is vital for the businesses to avoid the

legal pitfalls so that it could confine with the established regulations (Peltoniemi 2015). Banks

are required to comply with the rules and regulations established by law. This rule is also

applicable for the ANZ bank as they have to ensure compliance with all the operational business

scan cheques and process the banking transaction from one location to other very easily. ANZ

bank has launched full digital certificate technology that offers more secure banking and online

environment for their customers. This has also helped ANZ to complements its security

initiatives and trust level. Therefore, sustaining its position as a leader in the banking and

financial industry at a global level.

Environmental: in the recent times, the impact of the business on the environment is a

major concern for the organization. Both the government and customers penalizes the

companies, which adversely affects the environment (Reamer 2015). ANZ bank has developed a

Social and Environmental policy so that it can monitor and ascertain any potential risks in the

credit approval processes.

ANZ bank has implemented significant principles that are applied for the investments and

lending decisions in all of the developing countries. Due to the use of latest technology and with

the help of mobile banking apps, the use of paper has tremendously reduced. Most of the issues

are handled through online services, therefore reducing the adverse impact on environmental

condition. These steps taken by the bank leads to minimize the negative impacts of its

operational activities in the light of social environment (Tshelane and Mahlomaholo 2015). The

company is also involved in corporate social responsibility and various kinds of environmental

protection acts.

Legal: adequate understanding of the legal scenario is vital for the businesses to avoid the

legal pitfalls so that it could confine with the established regulations (Peltoniemi 2015). Banks

are required to comply with the rules and regulations established by law. This rule is also

applicable for the ANZ bank as they have to ensure compliance with all the operational business

11ORGANIZATIONAL CHALLENGES

requirements. ANZ bank has its operation in various countries therefore the bank is bond to get

affected by all the jurisdiction and law in which it operates. In Australia, it is mandatory for all

the banks to operate as per the requirements of Banking Act, 1959. Therefore, ANZ bank has to

take active part in the advisory bodies of government so that they can engage with the

government officials and regulators on a continuous basis.

Force Field Analysis:

Kurt Lewin’s Force Field Analysis

Source: (Festing and Schäfer 2014)

Any issues that is held in between interaction of two opposing set of forces seeks to

promote major changes and therefore attempting it to maintain status quo is analyzed through

force field analysis. While analyzing the force of changes, two major forces are taken into action

requirements. ANZ bank has its operation in various countries therefore the bank is bond to get

affected by all the jurisdiction and law in which it operates. In Australia, it is mandatory for all

the banks to operate as per the requirements of Banking Act, 1959. Therefore, ANZ bank has to

take active part in the advisory bodies of government so that they can engage with the

government officials and regulators on a continuous basis.

Force Field Analysis:

Kurt Lewin’s Force Field Analysis

Source: (Festing and Schäfer 2014)

Any issues that is held in between interaction of two opposing set of forces seeks to

promote major changes and therefore attempting it to maintain status quo is analyzed through

force field analysis. While analyzing the force of changes, two major forces are taken into action

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.