University Tax Assignment: ACC400 Advanced Taxation Analysis

VerifiedAdded on 2022/09/14

|13

|1222

|10

Homework Assignment

AI Summary

This document presents a detailed solution to an advanced taxation assignment, addressing both personal and business tax scenarios. The solution meticulously calculates Manuel Liriano's employment income, total income, net income, taxable income, non-refundable tax credits, federal tax liability, and federal tax payable for the year 2019. It incorporates various income components, deductions, and tax credits based on the provided information. The assignment also includes an analysis of Olin's business income, determining deductible business expenses, and calculating the final business income. The solution addresses the deductibility of home office expenses, including depreciation and proportionate costs. Furthermore, the solution details the tax implications of various employment benefits, investment income, and business expenditures, providing a comprehensive understanding of the tax calculations involved. The solution adheres to the assignment brief, providing a clear and organized breakdown of the calculations and analysis required for the assignment.

Running head: ADVANCED TAXATION

Advanced Taxation

Name of the Student:

Name of the University:

Authors Note:

Advanced Taxation

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

ADVANCED TAXATION

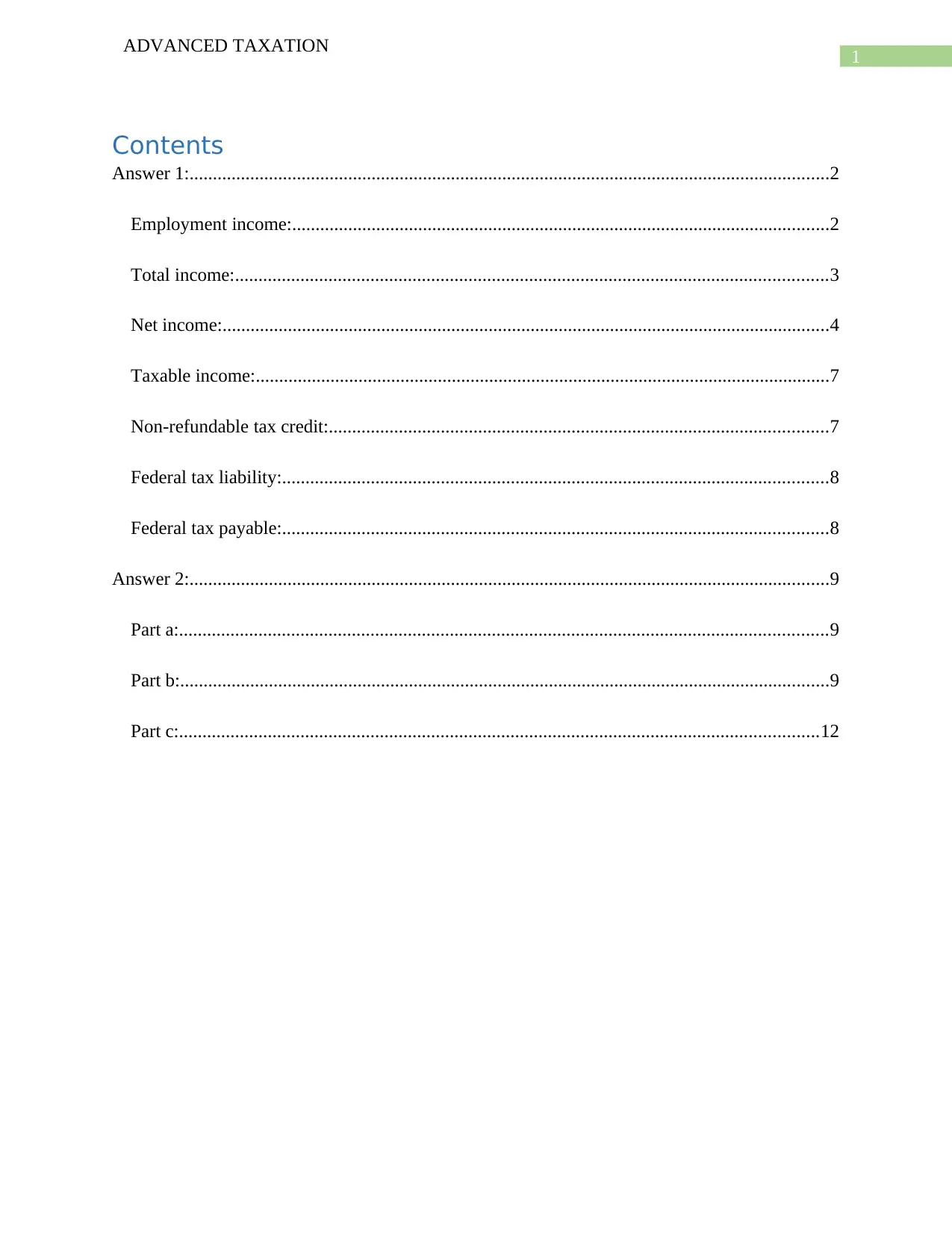

Contents

Answer 1:.........................................................................................................................................2

Employment income:...................................................................................................................2

Total income:...............................................................................................................................3

Net income:..................................................................................................................................4

Taxable income:...........................................................................................................................7

Non-refundable tax credit:...........................................................................................................7

Federal tax liability:.....................................................................................................................8

Federal tax payable:.....................................................................................................................8

Answer 2:.........................................................................................................................................9

Part a:...........................................................................................................................................9

Part b:...........................................................................................................................................9

Part c:.........................................................................................................................................12

ADVANCED TAXATION

Contents

Answer 1:.........................................................................................................................................2

Employment income:...................................................................................................................2

Total income:...............................................................................................................................3

Net income:..................................................................................................................................4

Taxable income:...........................................................................................................................7

Non-refundable tax credit:...........................................................................................................7

Federal tax liability:.....................................................................................................................8

Federal tax payable:.....................................................................................................................8

Answer 2:.........................................................................................................................................9

Part a:...........................................................................................................................................9

Part b:...........................................................................................................................................9

Part c:.........................................................................................................................................12

2

ADVANCED TAXATION

Answer 1:

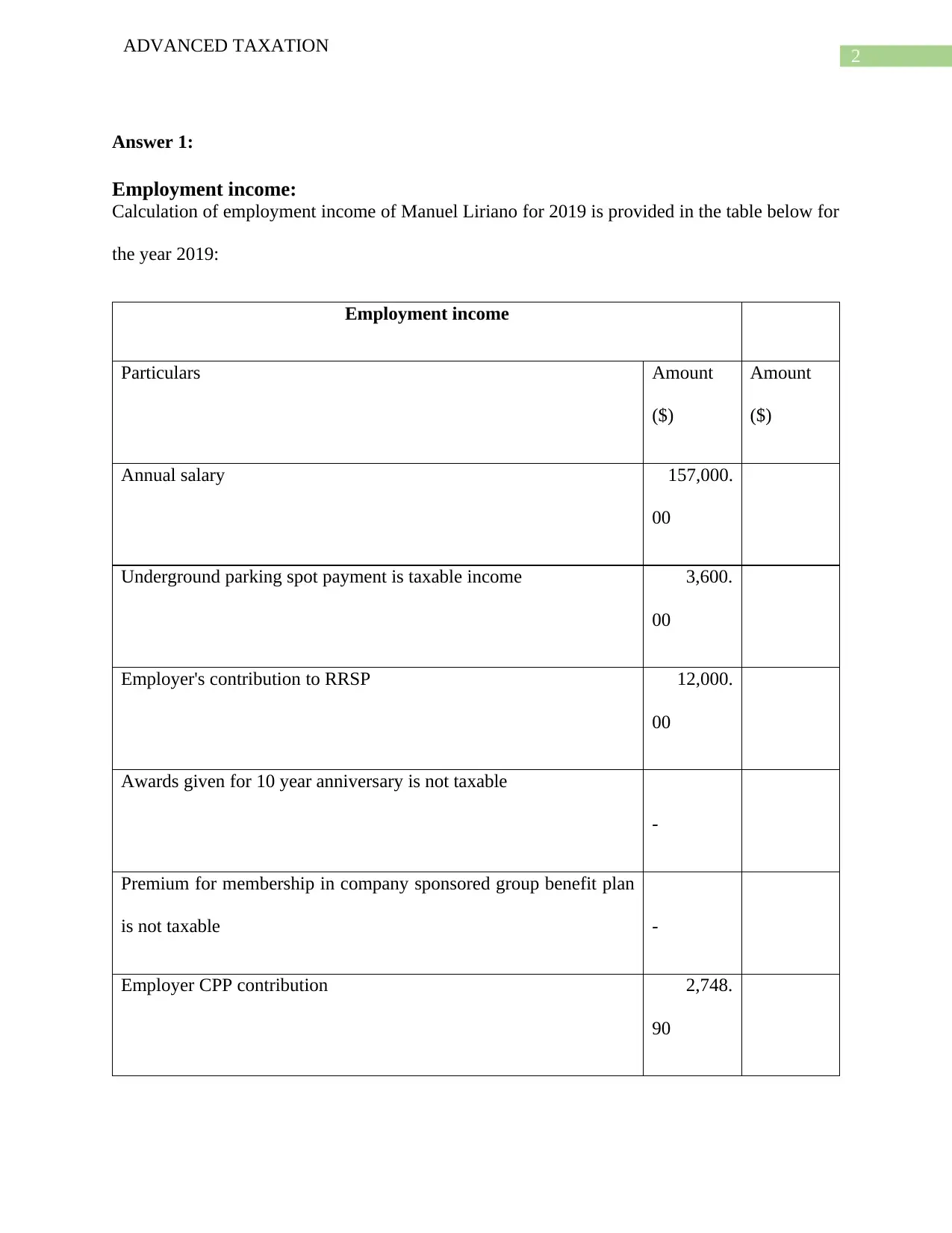

Employment income:

Calculation of employment income of Manuel Liriano for 2019 is provided in the table below for

the year 2019:

Employment income

Particulars Amount

($)

Amount

($)

Annual salary 157,000.

00

Underground parking spot payment is taxable income 3,600.

00

Employer's contribution to RRSP 12,000.

00

Awards given for 10 year anniversary is not taxable

-

Premium for membership in company sponsored group benefit plan

is not taxable -

Employer CPP contribution 2,748.

90

ADVANCED TAXATION

Answer 1:

Employment income:

Calculation of employment income of Manuel Liriano for 2019 is provided in the table below for

the year 2019:

Employment income

Particulars Amount

($)

Amount

($)

Annual salary 157,000.

00

Underground parking spot payment is taxable income 3,600.

00

Employer's contribution to RRSP 12,000.

00

Awards given for 10 year anniversary is not taxable

-

Premium for membership in company sponsored group benefit plan

is not taxable -

Employer CPP contribution 2,748.

90

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

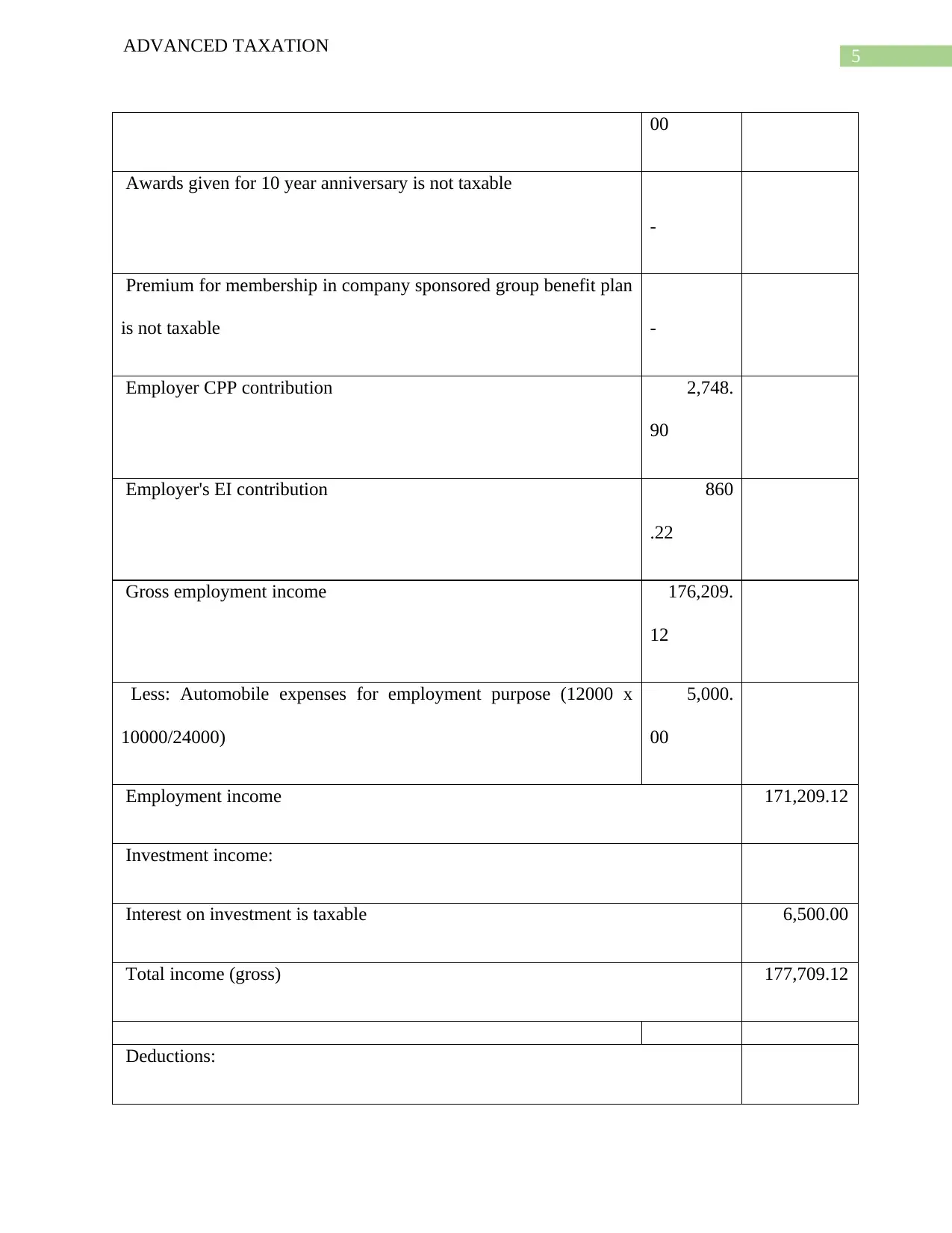

ADVANCED TAXATION

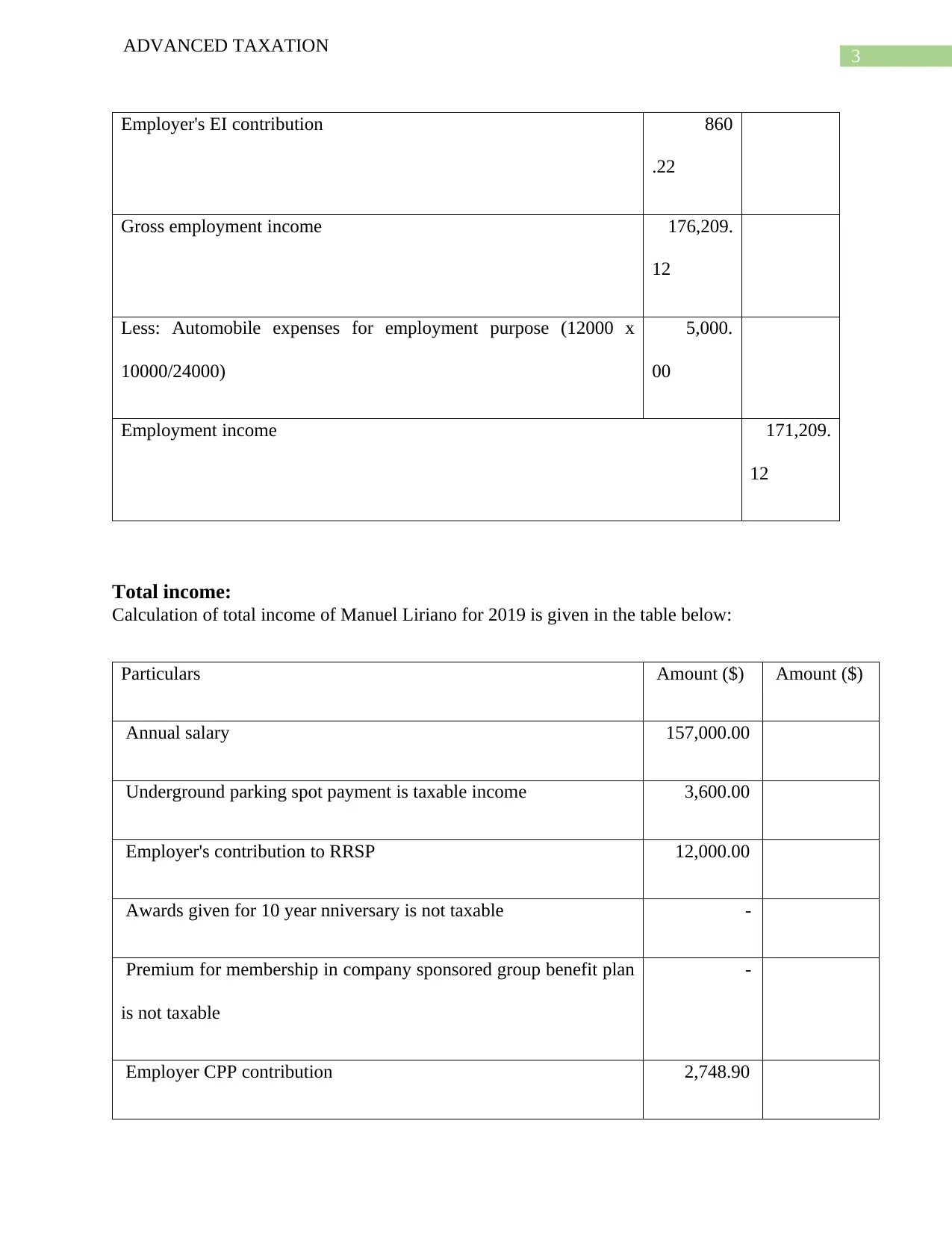

Employer's EI contribution 860

.22

Gross employment income 176,209.

12

Less: Automobile expenses for employment purpose (12000 x

10000/24000)

5,000.

00

Employment income 171,209.

12

Total income:

Calculation of total income of Manuel Liriano for 2019 is given in the table below:

Particulars Amount ($) Amount ($)

Annual salary 157,000.00

Underground parking spot payment is taxable income 3,600.00

Employer's contribution to RRSP 12,000.00

Awards given for 10 year nniversary is not taxable -

Premium for membership in company sponsored group benefit plan

is not taxable

-

Employer CPP contribution 2,748.90

ADVANCED TAXATION

Employer's EI contribution 860

.22

Gross employment income 176,209.

12

Less: Automobile expenses for employment purpose (12000 x

10000/24000)

5,000.

00

Employment income 171,209.

12

Total income:

Calculation of total income of Manuel Liriano for 2019 is given in the table below:

Particulars Amount ($) Amount ($)

Annual salary 157,000.00

Underground parking spot payment is taxable income 3,600.00

Employer's contribution to RRSP 12,000.00

Awards given for 10 year nniversary is not taxable -

Premium for membership in company sponsored group benefit plan

is not taxable

-

Employer CPP contribution 2,748.90

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

ADVANCED TAXATION

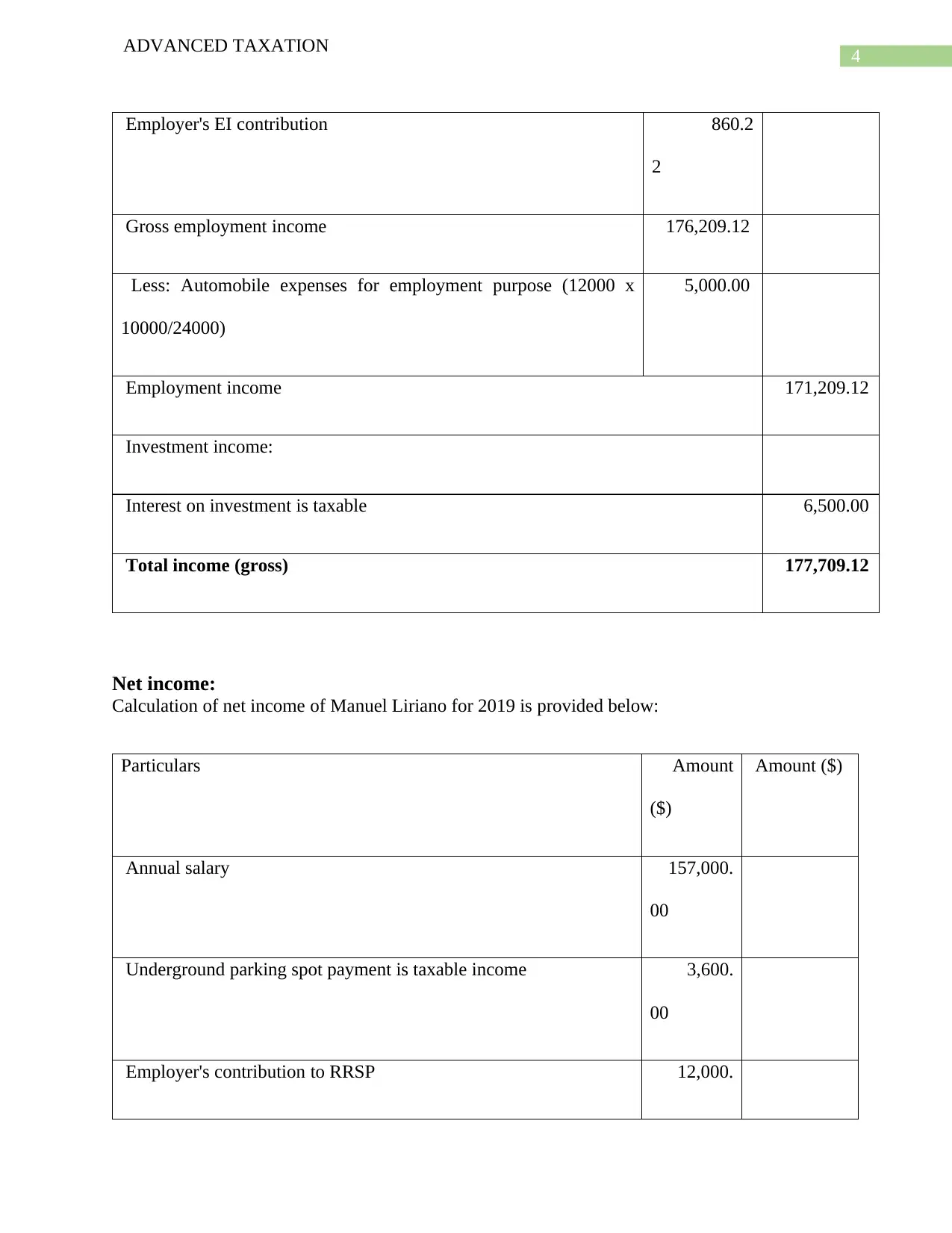

Employer's EI contribution 860.2

2

Gross employment income 176,209.12

Less: Automobile expenses for employment purpose (12000 x

10000/24000)

5,000.00

Employment income 171,209.12

Investment income:

Interest on investment is taxable 6,500.00

Total income (gross) 177,709.12

Net income:

Calculation of net income of Manuel Liriano for 2019 is provided below:

Particulars Amount

($)

Amount ($)

Annual salary 157,000.

00

Underground parking spot payment is taxable income 3,600.

00

Employer's contribution to RRSP 12,000.

ADVANCED TAXATION

Employer's EI contribution 860.2

2

Gross employment income 176,209.12

Less: Automobile expenses for employment purpose (12000 x

10000/24000)

5,000.00

Employment income 171,209.12

Investment income:

Interest on investment is taxable 6,500.00

Total income (gross) 177,709.12

Net income:

Calculation of net income of Manuel Liriano for 2019 is provided below:

Particulars Amount

($)

Amount ($)

Annual salary 157,000.

00

Underground parking spot payment is taxable income 3,600.

00

Employer's contribution to RRSP 12,000.

5

ADVANCED TAXATION

00

Awards given for 10 year anniversary is not taxable

-

Premium for membership in company sponsored group benefit plan

is not taxable -

Employer CPP contribution 2,748.

90

Employer's EI contribution 860

.22

Gross employment income 176,209.

12

Less: Automobile expenses for employment purpose (12000 x

10000/24000)

5,000.

00

Employment income 171,209.12

Investment income:

Interest on investment is taxable 6,500.00

Total income (gross) 177,709.12

Deductions:

ADVANCED TAXATION

00

Awards given for 10 year anniversary is not taxable

-

Premium for membership in company sponsored group benefit plan

is not taxable -

Employer CPP contribution 2,748.

90

Employer's EI contribution 860

.22

Gross employment income 176,209.

12

Less: Automobile expenses for employment purpose (12000 x

10000/24000)

5,000.

00

Employment income 171,209.12

Investment income:

Interest on investment is taxable 6,500.00

Total income (gross) 177,709.12

Deductions:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

ADVANCED TAXATION

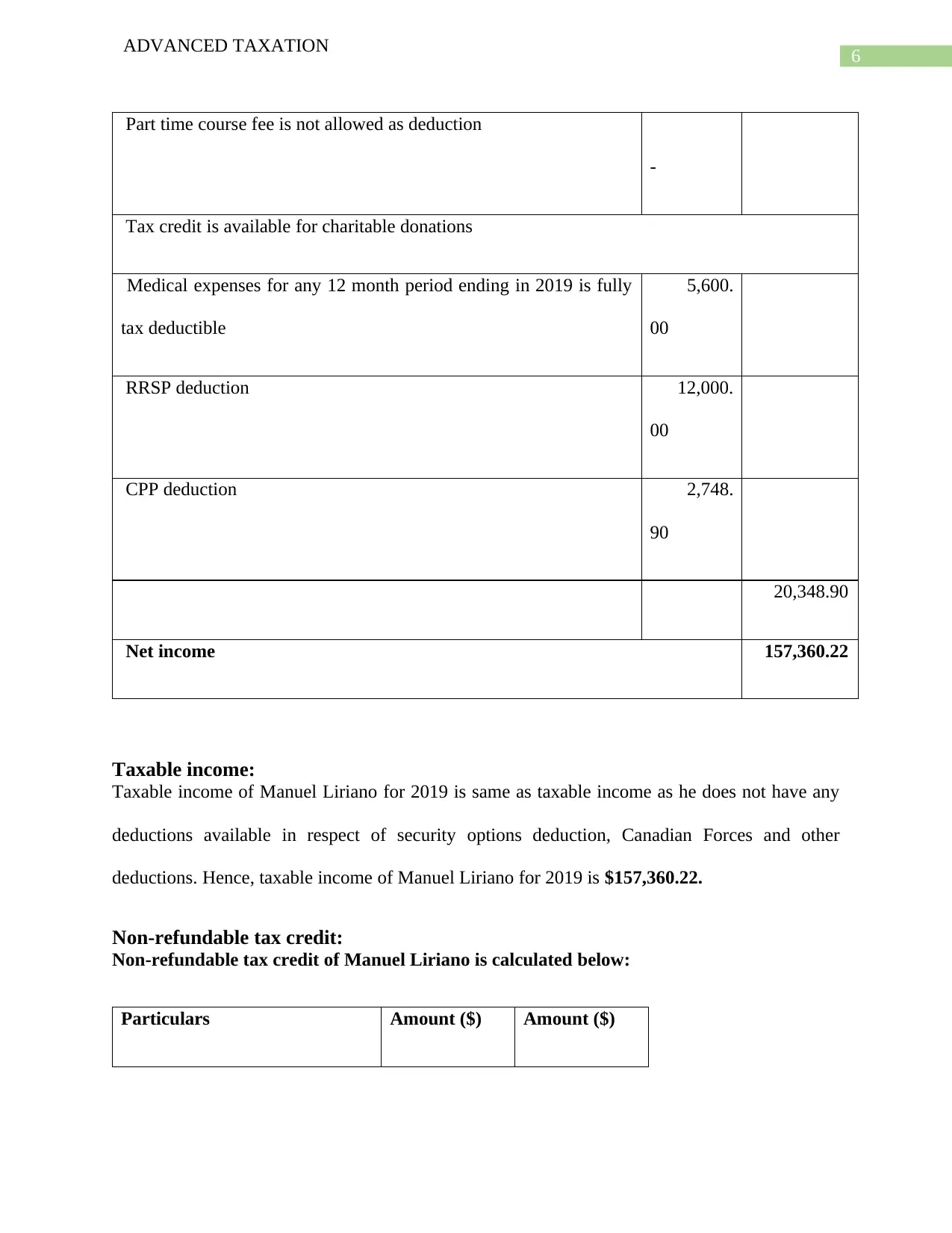

Part time course fee is not allowed as deduction

-

Tax credit is available for charitable donations

Medical expenses for any 12 month period ending in 2019 is fully

tax deductible

5,600.

00

RRSP deduction 12,000.

00

CPP deduction 2,748.

90

20,348.90

Net income 157,360.22

Taxable income:

Taxable income of Manuel Liriano for 2019 is same as taxable income as he does not have any

deductions available in respect of security options deduction, Canadian Forces and other

deductions. Hence, taxable income of Manuel Liriano for 2019 is $157,360.22.

Non-refundable tax credit:

Non-refundable tax credit of Manuel Liriano is calculated below:

Particulars Amount ($) Amount ($)

ADVANCED TAXATION

Part time course fee is not allowed as deduction

-

Tax credit is available for charitable donations

Medical expenses for any 12 month period ending in 2019 is fully

tax deductible

5,600.

00

RRSP deduction 12,000.

00

CPP deduction 2,748.

90

20,348.90

Net income 157,360.22

Taxable income:

Taxable income of Manuel Liriano for 2019 is same as taxable income as he does not have any

deductions available in respect of security options deduction, Canadian Forces and other

deductions. Hence, taxable income of Manuel Liriano for 2019 is $157,360.22.

Non-refundable tax credit:

Non-refundable tax credit of Manuel Liriano is calculated below:

Particulars Amount ($) Amount ($)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

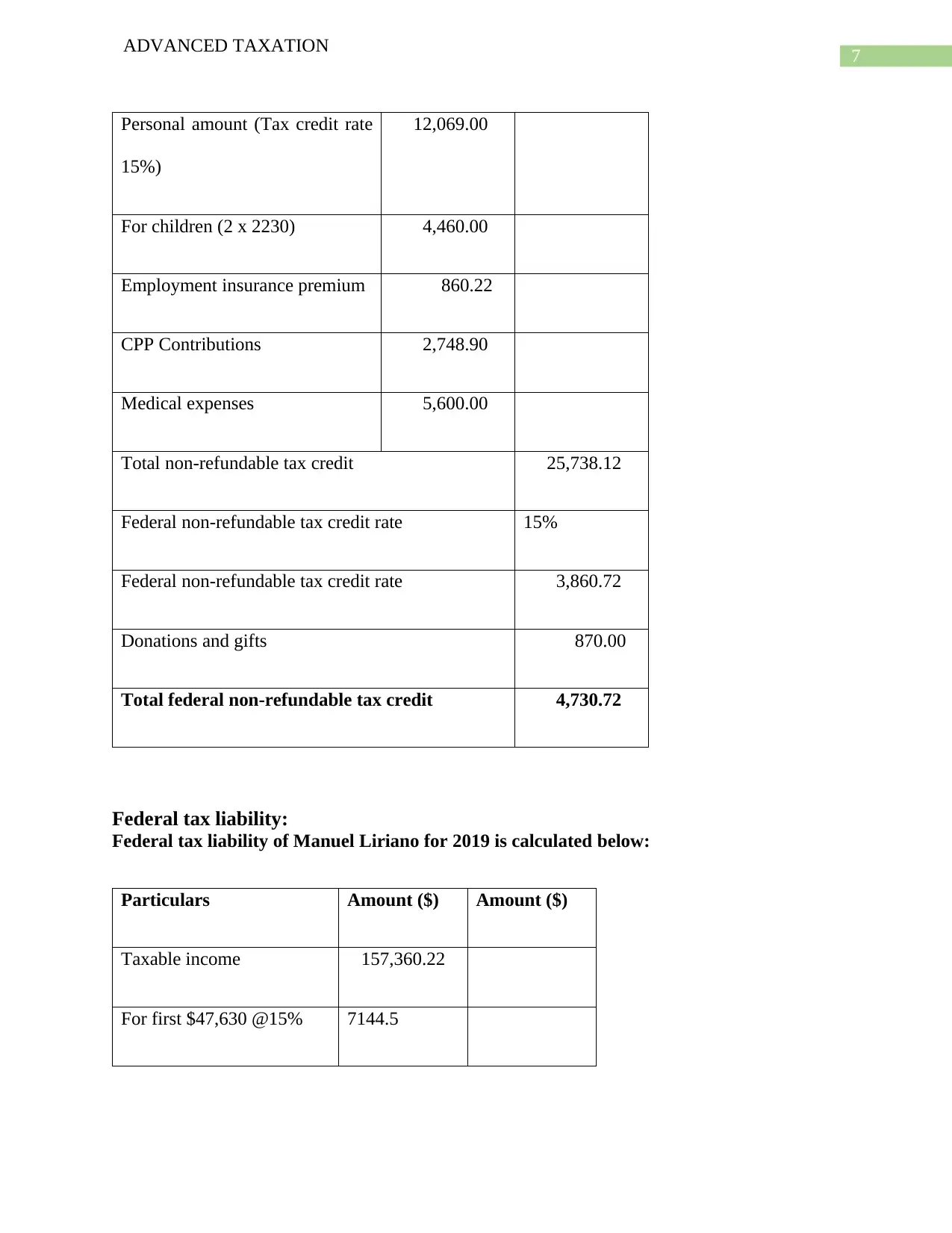

ADVANCED TAXATION

Personal amount (Tax credit rate

15%)

12,069.00

For children (2 x 2230) 4,460.00

Employment insurance premium 860.22

CPP Contributions 2,748.90

Medical expenses 5,600.00

Total non-refundable tax credit 25,738.12

Federal non-refundable tax credit rate 15%

Federal non-refundable tax credit rate 3,860.72

Donations and gifts 870.00

Total federal non-refundable tax credit 4,730.72

Federal tax liability:

Federal tax liability of Manuel Liriano for 2019 is calculated below:

Particulars Amount ($) Amount ($)

Taxable income 157,360.22

For first $47,630 @15% 7144.5

ADVANCED TAXATION

Personal amount (Tax credit rate

15%)

12,069.00

For children (2 x 2230) 4,460.00

Employment insurance premium 860.22

CPP Contributions 2,748.90

Medical expenses 5,600.00

Total non-refundable tax credit 25,738.12

Federal non-refundable tax credit rate 15%

Federal non-refundable tax credit rate 3,860.72

Donations and gifts 870.00

Total federal non-refundable tax credit 4,730.72

Federal tax liability:

Federal tax liability of Manuel Liriano for 2019 is calculated below:

Particulars Amount ($) Amount ($)

Taxable income 157,360.22

For first $47,630 @15% 7144.5

8

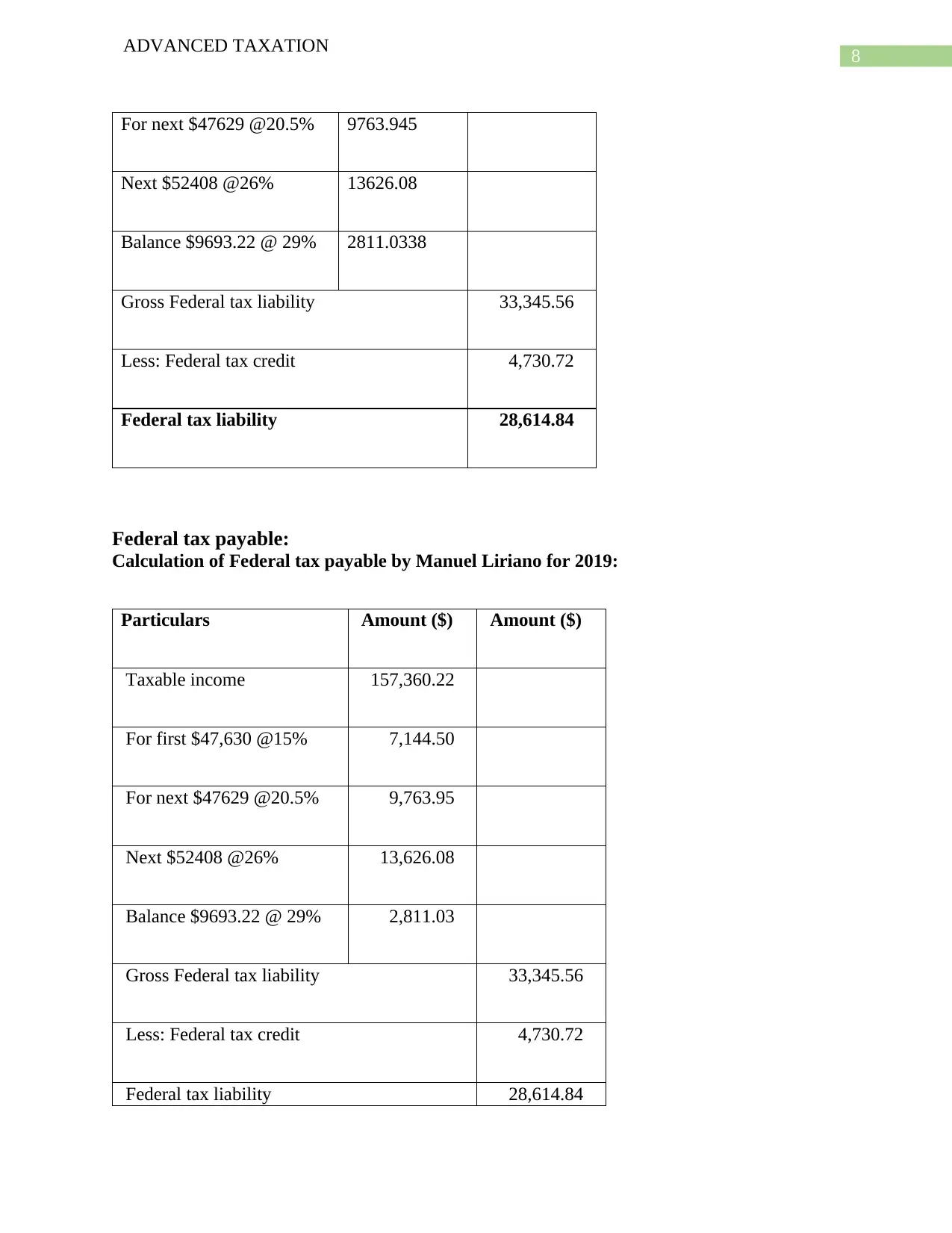

ADVANCED TAXATION

For next $47629 @20.5% 9763.945

Next $52408 @26% 13626.08

Balance $9693.22 @ 29% 2811.0338

Gross Federal tax liability 33,345.56

Less: Federal tax credit 4,730.72

Federal tax liability 28,614.84

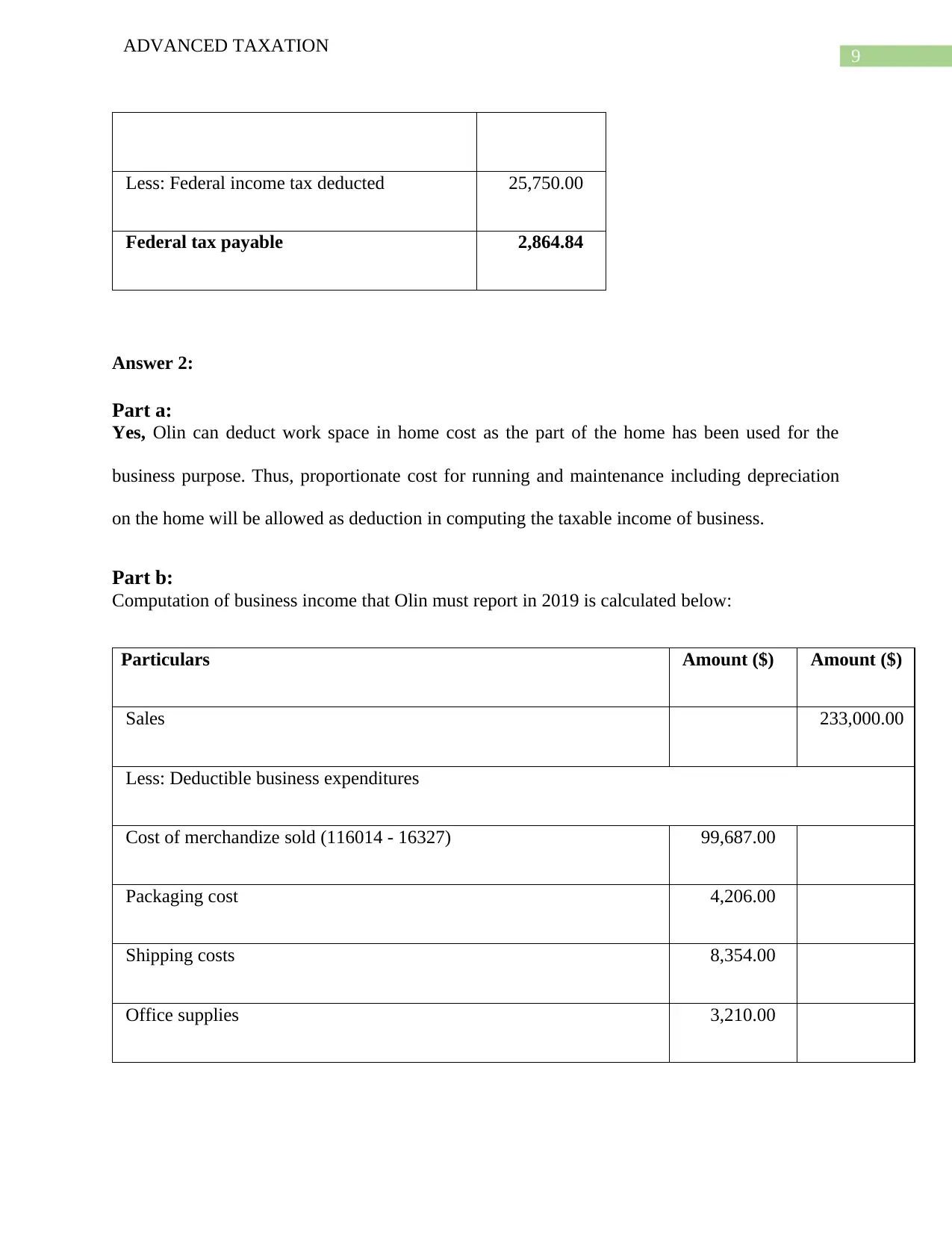

Federal tax payable:

Calculation of Federal tax payable by Manuel Liriano for 2019:

Particulars Amount ($) Amount ($)

Taxable income 157,360.22

For first $47,630 @15% 7,144.50

For next $47629 @20.5% 9,763.95

Next $52408 @26% 13,626.08

Balance $9693.22 @ 29% 2,811.03

Gross Federal tax liability 33,345.56

Less: Federal tax credit 4,730.72

Federal tax liability 28,614.84

ADVANCED TAXATION

For next $47629 @20.5% 9763.945

Next $52408 @26% 13626.08

Balance $9693.22 @ 29% 2811.0338

Gross Federal tax liability 33,345.56

Less: Federal tax credit 4,730.72

Federal tax liability 28,614.84

Federal tax payable:

Calculation of Federal tax payable by Manuel Liriano for 2019:

Particulars Amount ($) Amount ($)

Taxable income 157,360.22

For first $47,630 @15% 7,144.50

For next $47629 @20.5% 9,763.95

Next $52408 @26% 13,626.08

Balance $9693.22 @ 29% 2,811.03

Gross Federal tax liability 33,345.56

Less: Federal tax credit 4,730.72

Federal tax liability 28,614.84

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

ADVANCED TAXATION

Less: Federal income tax deducted 25,750.00

Federal tax payable 2,864.84

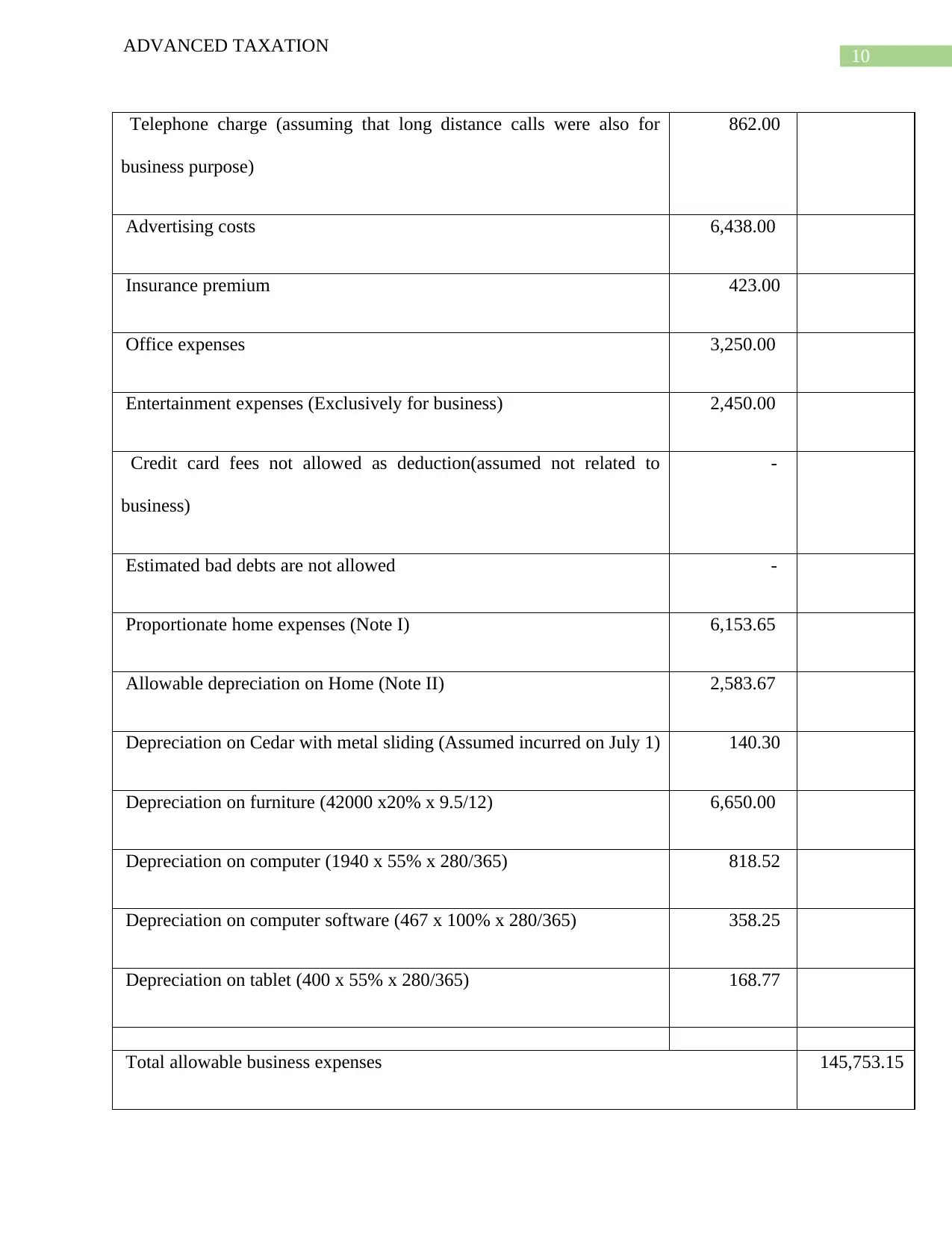

Answer 2:

Part a:

Yes, Olin can deduct work space in home cost as the part of the home has been used for the

business purpose. Thus, proportionate cost for running and maintenance including depreciation

on the home will be allowed as deduction in computing the taxable income of business.

Part b:

Computation of business income that Olin must report in 2019 is calculated below:

Particulars Amount ($) Amount ($)

Sales 233,000.00

Less: Deductible business expenditures

Cost of merchandize sold (116014 - 16327) 99,687.00

Packaging cost 4,206.00

Shipping costs 8,354.00

Office supplies 3,210.00

ADVANCED TAXATION

Less: Federal income tax deducted 25,750.00

Federal tax payable 2,864.84

Answer 2:

Part a:

Yes, Olin can deduct work space in home cost as the part of the home has been used for the

business purpose. Thus, proportionate cost for running and maintenance including depreciation

on the home will be allowed as deduction in computing the taxable income of business.

Part b:

Computation of business income that Olin must report in 2019 is calculated below:

Particulars Amount ($) Amount ($)

Sales 233,000.00

Less: Deductible business expenditures

Cost of merchandize sold (116014 - 16327) 99,687.00

Packaging cost 4,206.00

Shipping costs 8,354.00

Office supplies 3,210.00

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

ADVANCED TAXATION

Telephone charge (assuming that long distance calls were also for

business purpose)

862.00

Advertising costs 6,438.00

Insurance premium 423.00

Office expenses 3,250.00

Entertainment expenses (Exclusively for business) 2,450.00

Credit card fees not allowed as deduction(assumed not related to

business)

-

Estimated bad debts are not allowed -

Proportionate home expenses (Note I) 6,153.65

Allowable depreciation on Home (Note II) 2,583.67

Depreciation on Cedar with metal sliding (Assumed incurred on July 1) 140.30

Depreciation on furniture (42000 x20% x 9.5/12) 6,650.00

Depreciation on computer (1940 x 55% x 280/365) 818.52

Depreciation on computer software (467 x 100% x 280/365) 358.25

Depreciation on tablet (400 x 55% x 280/365) 168.77

Total allowable business expenses 145,753.15

ADVANCED TAXATION

Telephone charge (assuming that long distance calls were also for

business purpose)

862.00

Advertising costs 6,438.00

Insurance premium 423.00

Office expenses 3,250.00

Entertainment expenses (Exclusively for business) 2,450.00

Credit card fees not allowed as deduction(assumed not related to

business)

-

Estimated bad debts are not allowed -

Proportionate home expenses (Note I) 6,153.65

Allowable depreciation on Home (Note II) 2,583.67

Depreciation on Cedar with metal sliding (Assumed incurred on July 1) 140.30

Depreciation on furniture (42000 x20% x 9.5/12) 6,650.00

Depreciation on computer (1940 x 55% x 280/365) 818.52

Depreciation on computer software (467 x 100% x 280/365) 358.25

Depreciation on tablet (400 x 55% x 280/365) 168.77

Total allowable business expenses 145,753.15

11

ADVANCED TAXATION

Business income 87,246.85

Thus, the minimum business income that Olin must report in 2019 is $87,246.85 without taking

into consideration any specific deductions available for startup business in the country.

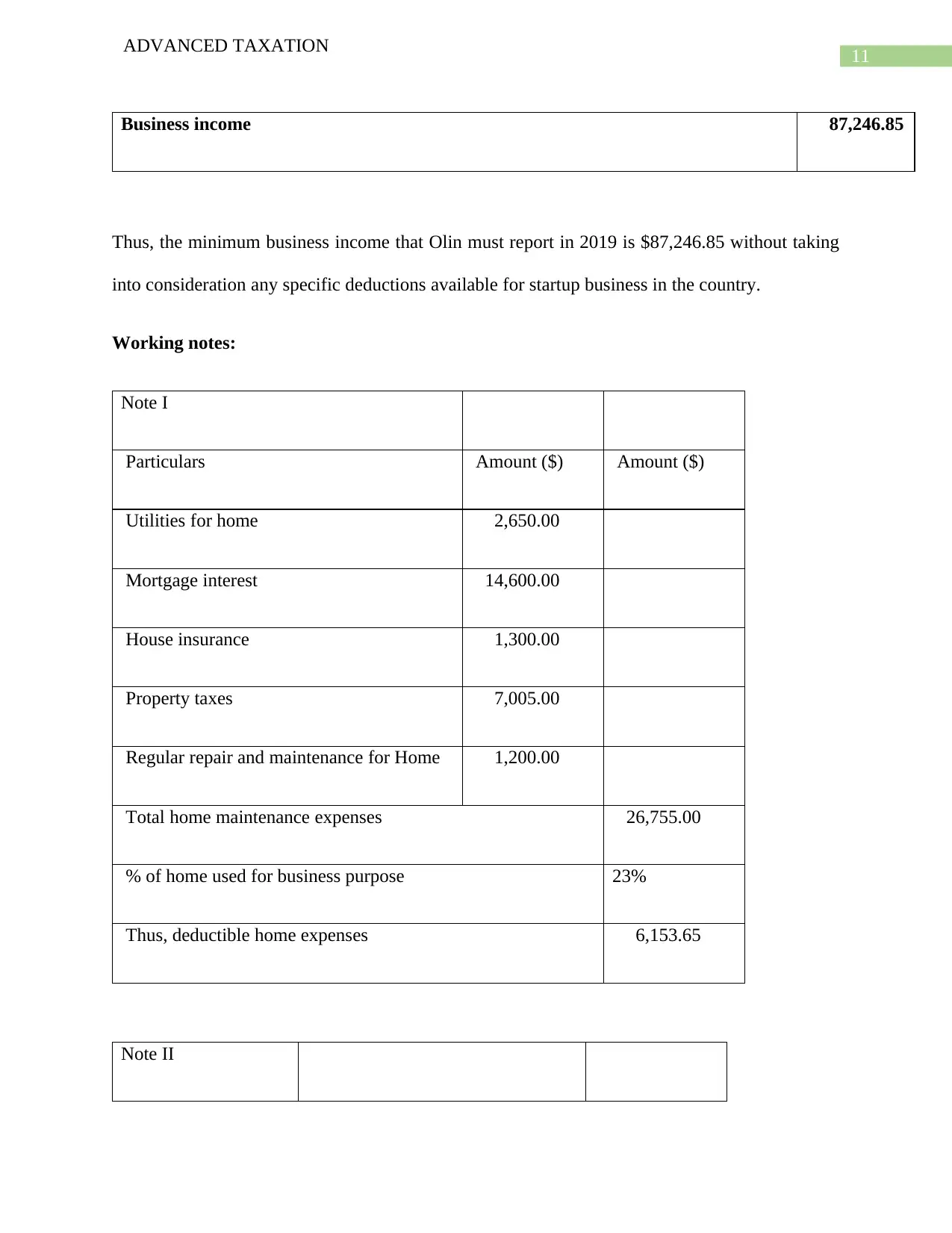

Working notes:

Note I

Particulars Amount ($) Amount ($)

Utilities for home 2,650.00

Mortgage interest 14,600.00

House insurance 1,300.00

Property taxes 7,005.00

Regular repair and maintenance for Home 1,200.00

Total home maintenance expenses 26,755.00

% of home used for business purpose 23%

Thus, deductible home expenses 6,153.65

Note II

ADVANCED TAXATION

Business income 87,246.85

Thus, the minimum business income that Olin must report in 2019 is $87,246.85 without taking

into consideration any specific deductions available for startup business in the country.

Working notes:

Note I

Particulars Amount ($) Amount ($)

Utilities for home 2,650.00

Mortgage interest 14,600.00

House insurance 1,300.00

Property taxes 7,005.00

Regular repair and maintenance for Home 1,200.00

Total home maintenance expenses 26,755.00

% of home used for business purpose 23%

Thus, deductible home expenses 6,153.65

Note II

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.