FDMT4027 Financial Decision Making for Travel and Tourism: P&O Cruises

VerifiedAdded on 2021/06/17

|12

|2889

|24

Report

AI Summary

This report, prepared for the FDMT4027 Financial Decision Making for Travel and Tourism course, analyzes the financial strategies for P&O Cruises' expansion into premium travel packages. It begins with an introduction to the decision-making process and its importance in business, specifically focusing on P&O Cruises' diversification plan. The report then presents a draft report for the Board of Directors, recommending sources of finance, including bank loans, equity financing, and international assistance agencies, with a debt-equity ratio recommendation based on the company's profitability ratios. Furthermore, it explores cost behavior, differentiating between fixed, variable, and mixed costs, and emphasizes the significance of Cost Volume and Profit (CVP) analysis in price determination, cost control, and budget preparation. Finally, the report recommends appropriate pricing strategies, including markup and markdown pricing, and discusses the importance of rack rates. This comprehensive analysis provides valuable insights into financial decision-making for the travel and tourism industry, offering practical recommendations for P&O Cruises' expansion strategy.

FDMT4027 Financial Decision Making

for Travel and Tourism Spring 2018

for Travel and Tourism Spring 2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction................................................................................................................................3

Draft report to be presented to the Board of Directors...............................................................3

Recommendation of relevant sources of finance in context of the expansion plan...............3

Source of finance................................................................................................................3

Recommendations..............................................................................................................4

An explanation of behaviour of costs and the importance of Cost Volume and Profit (CVP)

analysis...................................................................................................................................5

Explanation of behaviour of costs......................................................................................5

Importance of Cost Volume and Profit (CVP) analysis.....................................................7

Recommendation of appropriate pricing strategies................................................................7

Pricing strategies................................................................................................................7

Recommendations..............................................................................................................8

Conclusion..................................................................................................................................9

References................................................................................................................................10

Introduction................................................................................................................................3

Draft report to be presented to the Board of Directors...............................................................3

Recommendation of relevant sources of finance in context of the expansion plan...............3

Source of finance................................................................................................................3

Recommendations..............................................................................................................4

An explanation of behaviour of costs and the importance of Cost Volume and Profit (CVP)

analysis...................................................................................................................................5

Explanation of behaviour of costs......................................................................................5

Importance of Cost Volume and Profit (CVP) analysis.....................................................7

Recommendation of appropriate pricing strategies................................................................7

Pricing strategies................................................................................................................7

Recommendations..............................................................................................................8

Conclusion..................................................................................................................................9

References................................................................................................................................10

LIST OF FIGURES

Figure 1: Profitability ratios of P&O Cruises (Carnival Corp CCL).........................................6

Figure 2: Graph of fixed cost.....................................................................................................7

Figure 3: Graph of variable cost.................................................................................................7

Figure 1: Profitability ratios of P&O Cruises (Carnival Corp CCL).........................................6

Figure 2: Graph of fixed cost.....................................................................................................7

Figure 3: Graph of variable cost.................................................................................................7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Decision-making process is a crucial process for all business irrespective of their scale of

operations. Managerial authorities aim to make rationale decision by making use of suitable

tools and techniques in order to make optimum use of available financial as wells non-

financial resources. The present study is based on developing expansion strategy for P&O

Cruises for their new project of diversification by adding premium travel packages in their

service portfolio. P&O Cruises is a cruise line; it is an American British travel line based at

the Carnival House located in Southampton, England functioned by the Carnival United

Kingdom with Carnival Corporation & plc ownership (P & O Cruises, 2018). It is said to be

the sister company of together with it holds significant connections with P&O Cruises

Australia. The present study will include a description of the range of sources of finance in

the context of the expansion plan. Further, it will include an explanation of the behaviour of

costs and the importance of Cost Volume and Profit (CVP) analysis. At last, it will include

recommendations for pricing strategies.

DRAFT REPORT TO BE PRESENTED TO THE BOARD OF

DIRECTORS

Recommendation of relevant sources of finance in the context of the expansion plan

Source of finance

Bank Loan

Banks and credits provide loans to big, small and medium businesses. When a loan is taken

out from a bank by the company, they have the accessibility to set an extent of money, which

are obliged to the repayments terms and rate of interest of the bank. Interest is said to be the

fees charged by the bank on the borrowed money, which is based on the usage of the loan and

the time business takes to pay the due amount. Applying for a bank loan, the owners of the

business are required to offer a proposal to financial institution stating the rationale for

borrowing lean, and the evidence whereby the business will be successful (Wild, J., 2015).

On the other hand, assurance is not given while the business loans are offered to applicants.

The commercial banking sector has not placed special provisions for travel and tourism

Decision-making process is a crucial process for all business irrespective of their scale of

operations. Managerial authorities aim to make rationale decision by making use of suitable

tools and techniques in order to make optimum use of available financial as wells non-

financial resources. The present study is based on developing expansion strategy for P&O

Cruises for their new project of diversification by adding premium travel packages in their

service portfolio. P&O Cruises is a cruise line; it is an American British travel line based at

the Carnival House located in Southampton, England functioned by the Carnival United

Kingdom with Carnival Corporation & plc ownership (P & O Cruises, 2018). It is said to be

the sister company of together with it holds significant connections with P&O Cruises

Australia. The present study will include a description of the range of sources of finance in

the context of the expansion plan. Further, it will include an explanation of the behaviour of

costs and the importance of Cost Volume and Profit (CVP) analysis. At last, it will include

recommendations for pricing strategies.

DRAFT REPORT TO BE PRESENTED TO THE BOARD OF

DIRECTORS

Recommendation of relevant sources of finance in the context of the expansion plan

Source of finance

Bank Loan

Banks and credits provide loans to big, small and medium businesses. When a loan is taken

out from a bank by the company, they have the accessibility to set an extent of money, which

are obliged to the repayments terms and rate of interest of the bank. Interest is said to be the

fees charged by the bank on the borrowed money, which is based on the usage of the loan and

the time business takes to pay the due amount. Applying for a bank loan, the owners of the

business are required to offer a proposal to financial institution stating the rationale for

borrowing lean, and the evidence whereby the business will be successful (Wild, J., 2015).

On the other hand, assurance is not given while the business loans are offered to applicants.

The commercial banking sector has not placed special provisions for travel and tourism

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

projects. All loan requests are considered as per the financial credibility. Banks and financial

agencies demand collateral as well as owner equity. The charges of interest are based on

existing rates, which differs from 8 to 16.5% per year (Cerqueiro, Ongena and Roszbach,

2016). In debt source, profits are not required to be distributed, but finance cost is to be paid

even if there are losses. It increases financial obligation of business. Further, it requires

deposition of an asset for the purpose of security.

Equity financing

Equity financing is the procedure to raise capital by selling shares in an entity. It means the

ownership sales in order to raise capital for the purpose of business. This financing source is

engaged not only the common equity sales but also other equity sales or quasi-equity tools

like preferred stock, equity units; convertible preferred that inclusive of shares as well as

warrants. These are also called Initial Public Offering (IPO), on the edge of the stock market

that engages offerings made by the public to raise funds. This is a costly yet complex choice

which also comes up with risk to raise funds because of weak market conditions (De

Visscher, 2016). In equity source of finance, the company will not be required to repay the

principal and further financial cost is to be paid if profits are generated by the business.

However, it dilutes the controlling power of business.

International Assistance Agencies

Not in the presence of national government subsidies, these global assistance agencies offer

financial as well as technical help to meet a broad variety of needs, which are supported by

initiatives made by research to conduct feasibility studies and help with the infrastructural

provision like interpretation and trials. Many international agencies provide help in terms of

grants from donor agencies (Dixit and Mathews, 2017) . These agencies have been charitable,

United States Agency for International Development, the OAS, CIDA, the Food and

Agricultural Organization (FAO) of the United Nations (UN), the European Economic

Community (EEC) and British Development Division in the Caribbean (BDDC). This funds

is free of cost and does not require repayment of the provided amount. However, this source

of finance is difficult to obtain due to several restrictions.

agencies demand collateral as well as owner equity. The charges of interest are based on

existing rates, which differs from 8 to 16.5% per year (Cerqueiro, Ongena and Roszbach,

2016). In debt source, profits are not required to be distributed, but finance cost is to be paid

even if there are losses. It increases financial obligation of business. Further, it requires

deposition of an asset for the purpose of security.

Equity financing

Equity financing is the procedure to raise capital by selling shares in an entity. It means the

ownership sales in order to raise capital for the purpose of business. This financing source is

engaged not only the common equity sales but also other equity sales or quasi-equity tools

like preferred stock, equity units; convertible preferred that inclusive of shares as well as

warrants. These are also called Initial Public Offering (IPO), on the edge of the stock market

that engages offerings made by the public to raise funds. This is a costly yet complex choice

which also comes up with risk to raise funds because of weak market conditions (De

Visscher, 2016). In equity source of finance, the company will not be required to repay the

principal and further financial cost is to be paid if profits are generated by the business.

However, it dilutes the controlling power of business.

International Assistance Agencies

Not in the presence of national government subsidies, these global assistance agencies offer

financial as well as technical help to meet a broad variety of needs, which are supported by

initiatives made by research to conduct feasibility studies and help with the infrastructural

provision like interpretation and trials. Many international agencies provide help in terms of

grants from donor agencies (Dixit and Mathews, 2017) . These agencies have been charitable,

United States Agency for International Development, the OAS, CIDA, the Food and

Agricultural Organization (FAO) of the United Nations (UN), the European Economic

Community (EEC) and British Development Division in the Caribbean (BDDC). This funds

is free of cost and does not require repayment of the provided amount. However, this source

of finance is difficult to obtain due to several restrictions.

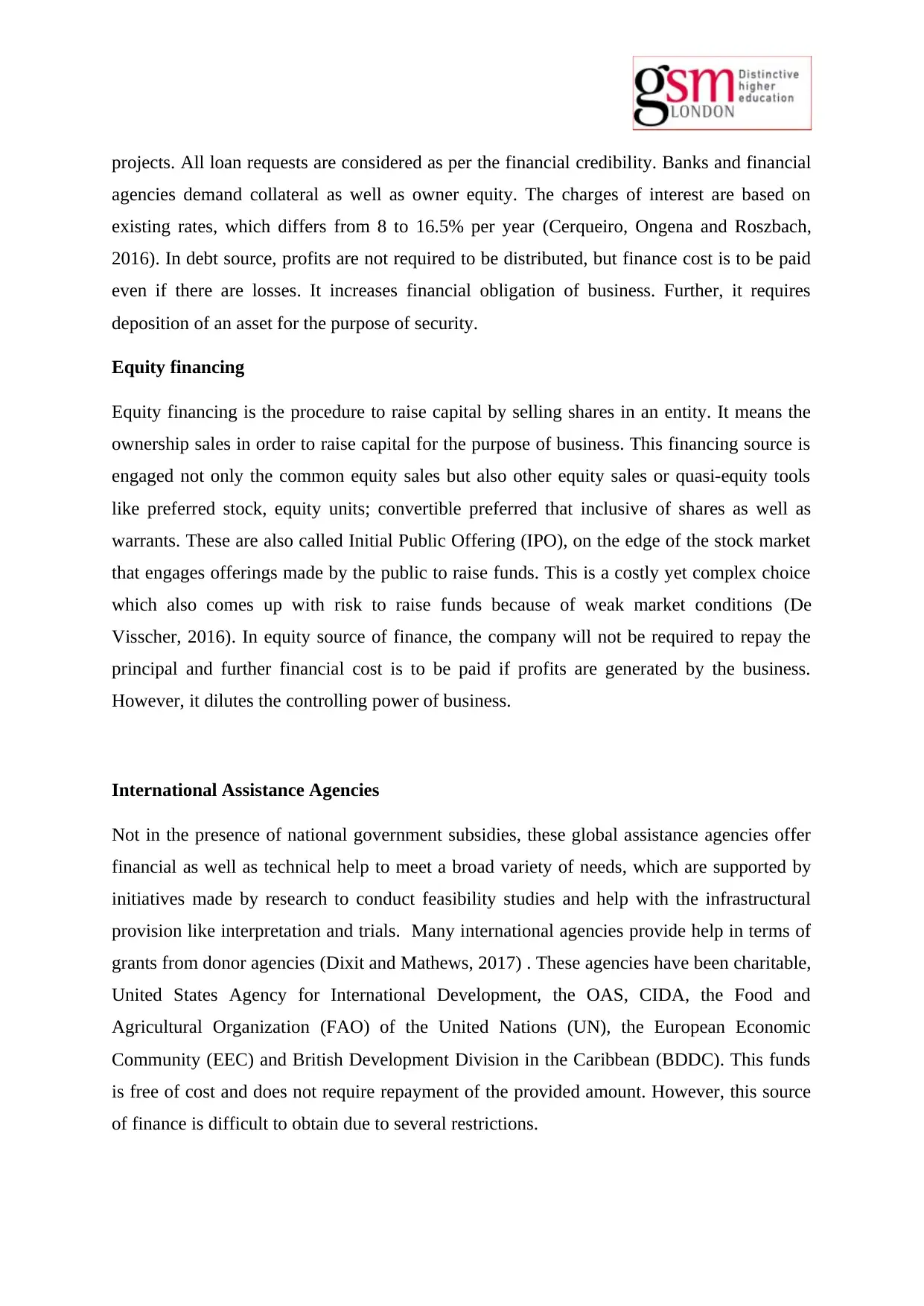

Recommendations

The company is adding premium travel services to the portfolio thus they will not be entitled

to any kind of grant of subsidy. Thus company is required to generate sources of finance from

debt and equity in accordance with their leverage and current profitability. By considering

current profits of the company return on equity is 11% approx. while the interest rate is 16%,

thus ratio debt-equity ratio for fund generation should be 60% and 40%.

Figure 1: Profitability ratios of P&O Cruises (Carnival Corp CCL)

(Source: Morningstar Carnival Corp CCL, 2018)

An explanation of the behaviour of costs and the importance of Cost Volume and Profit

(CVP) analysis

Explanation of behaviour of costs

Behaviour of costs is related to understanding the changes in costs when a change is observed

in an organizational activity level. The costs which differ in a proportioned manner with the

changes in the activity level are said as variable costs (Horner and Swarbrooke, 2016).

Further, the costs are not impacted by changes in the activity level are categorized as fixed

costs.

Behaviour of costs is not needed for exterior reporting as per the accounting standards. On

the other hand, the interpretation of cost behaviour is essential for efforts of management to

do the planning and controlling the organizational costs. Variance reports and budgets are

efficient while showcasing patterns of cost behaviour (Derudder and Witlox, 2016). The

The company is adding premium travel services to the portfolio thus they will not be entitled

to any kind of grant of subsidy. Thus company is required to generate sources of finance from

debt and equity in accordance with their leverage and current profitability. By considering

current profits of the company return on equity is 11% approx. while the interest rate is 16%,

thus ratio debt-equity ratio for fund generation should be 60% and 40%.

Figure 1: Profitability ratios of P&O Cruises (Carnival Corp CCL)

(Source: Morningstar Carnival Corp CCL, 2018)

An explanation of the behaviour of costs and the importance of Cost Volume and Profit

(CVP) analysis

Explanation of behaviour of costs

Behaviour of costs is related to understanding the changes in costs when a change is observed

in an organizational activity level. The costs which differ in a proportioned manner with the

changes in the activity level are said as variable costs (Horner and Swarbrooke, 2016).

Further, the costs are not impacted by changes in the activity level are categorized as fixed

costs.

Behaviour of costs is not needed for exterior reporting as per the accounting standards. On

the other hand, the interpretation of cost behaviour is essential for efforts of management to

do the planning and controlling the organizational costs. Variance reports and budgets are

efficient while showcasing patterns of cost behaviour (Derudder and Witlox, 2016). The

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

interpretation of cost behaviour is also essential for computing a break-even point of the

company or other factors related to costs analysis.

There are three key kinds of costs under cost behaviour:

Fixed Costs: Fixed costs are those costs which are all time stable with the level of activity in

the reliable range (Boardman and et al., 2017). These costs are also incurred when there is no

production of units, for instance, rental expenditure or depreciation expense based on the

straight line.

Figure 2: Graph of fixed cost

Variable Costs: Variable costs are not stable and keep on changing with direct proportion to

production level. The total variable costs rise when there is the production of more units, and

it falls when there is the production of fewer units. However, total variable costs are stable

per unit. Example of such kind of cost values like heat and electricity, and these are

considered as variable expenses.

company or other factors related to costs analysis.

There are three key kinds of costs under cost behaviour:

Fixed Costs: Fixed costs are those costs which are all time stable with the level of activity in

the reliable range (Boardman and et al., 2017). These costs are also incurred when there is no

production of units, for instance, rental expenditure or depreciation expense based on the

straight line.

Figure 2: Graph of fixed cost

Variable Costs: Variable costs are not stable and keep on changing with direct proportion to

production level. The total variable costs rise when there is the production of more units, and

it falls when there is the production of fewer units. However, total variable costs are stable

per unit. Example of such kind of cost values like heat and electricity, and these are

considered as variable expenses.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 3: Graph of variable cost

Mixed Costs: Mixed costs also known as semi-variable costs have elements of fixed as well

as variable costs because of the existence of the same traits in them. The best example for

mixed cost is expenditure held on telephone due to it includes a fixed element like line rent,

charges on fixed subscription and charging of variable costs each minute. On other instance

for mixed costs can be delivery costs which have fixed element of costs of depreciation of

trucks and variable elements of fuel expenditure (Becker, 2016). AS the mixed cost utilities

are not said as useful in the form of a ray, thereby they are distributed into a variable and

fixed elements by making use of behaviour analysis tools like Regression Analysis, High-

Low Method and Scatter Diagram Method.

Importance of Cost Volume and Profit (CVP) analysis

CVP analysis assists managers in interpreting the relationship of profits, costs and volumes,

thereby it an essential aspect of the process of decision making within an organization.

Further, CVP analysis impacts the managerial decisions while talking about a matter like

selecting the most suitable distribution channel, marketing strategies, pricing policy, best

production method, make or buy decisions and product selection mix (Said, 2016).

Price Determination

CVP caters as a fundamental pillar for price determination for instance, in a business where

the price is set by competitor for their service package at £350, and there is inability of

business to go under £500, it is the high time to overview the availability of other choices,

The business scan make reduction in the fixed and variable costs in order to set price of the

Mixed Costs: Mixed costs also known as semi-variable costs have elements of fixed as well

as variable costs because of the existence of the same traits in them. The best example for

mixed cost is expenditure held on telephone due to it includes a fixed element like line rent,

charges on fixed subscription and charging of variable costs each minute. On other instance

for mixed costs can be delivery costs which have fixed element of costs of depreciation of

trucks and variable elements of fuel expenditure (Becker, 2016). AS the mixed cost utilities

are not said as useful in the form of a ray, thereby they are distributed into a variable and

fixed elements by making use of behaviour analysis tools like Regression Analysis, High-

Low Method and Scatter Diagram Method.

Importance of Cost Volume and Profit (CVP) analysis

CVP analysis assists managers in interpreting the relationship of profits, costs and volumes,

thereby it an essential aspect of the process of decision making within an organization.

Further, CVP analysis impacts the managerial decisions while talking about a matter like

selecting the most suitable distribution channel, marketing strategies, pricing policy, best

production method, make or buy decisions and product selection mix (Said, 2016).

Price Determination

CVP caters as a fundamental pillar for price determination for instance, in a business where

the price is set by competitor for their service package at £350, and there is inability of

business to go under £500, it is the high time to overview the availability of other choices,

The business scan make reduction in the fixed and variable costs in order to set price of the

services package at £350 or end the same (da Silva Etges and et al., 2016). Furthermore, CVP

is said to be intensely useful to determine the prices by which a business can create the price

sensitivity to the volume of sales.

Cost Control

The CVP model assists in measuring the impacts held from costs changes in the volume for

the target of overviewing profits gained and costs held. For instance, P & O Cruises may

want to add new services in accordance with taste and preferences of targeted customers.

These modern services might make increment in fixed references. In this situation, to look for

the figure in which the variable costs has to be decreased to manage the same level of profit,

for this aspect company makes use of CVP analysis.

Preparation of Budgets

P & O Cruises tends to identify the sales level to satisfy its targets and meet the desired

profits, and then they make use of CVP analysis. For accomplishing this, they do preparation

of flexible budgets which informs about the costs and anticipated costs at different production

stages (Vogel, 2016). They are also capable of interpreting the concept of break-even

concept, and thereby creating strategic budgets while preventing losses when required.

Recommendation of appropriate pricing strategies

Pricing strategies

Mark up a pricing strategy

A markup strategy is engaged with the setting prices for tours and travelling activities to

make sure that company generates profit at every sale. For determining the tour prices while

establishing a markup strategy, the company is required to determine all related costs to run a

tour. This is inclusive of time consumed to develop a tour, and the resources utilized to

provide each tour, and the entire cost of operating business.

Markdown pricing strategy

A market down pricing strategy needs providers of tour and travel activities mark down their

charges to attain a competitive edge and to motivate the customer to make bookings due to

desirable prices. Further, mark-down pricing is best at the time of the low season, when the

company is not able to fill every tour that it is operating. If the general costs for the tour are

is said to be intensely useful to determine the prices by which a business can create the price

sensitivity to the volume of sales.

Cost Control

The CVP model assists in measuring the impacts held from costs changes in the volume for

the target of overviewing profits gained and costs held. For instance, P & O Cruises may

want to add new services in accordance with taste and preferences of targeted customers.

These modern services might make increment in fixed references. In this situation, to look for

the figure in which the variable costs has to be decreased to manage the same level of profit,

for this aspect company makes use of CVP analysis.

Preparation of Budgets

P & O Cruises tends to identify the sales level to satisfy its targets and meet the desired

profits, and then they make use of CVP analysis. For accomplishing this, they do preparation

of flexible budgets which informs about the costs and anticipated costs at different production

stages (Vogel, 2016). They are also capable of interpreting the concept of break-even

concept, and thereby creating strategic budgets while preventing losses when required.

Recommendation of appropriate pricing strategies

Pricing strategies

Mark up a pricing strategy

A markup strategy is engaged with the setting prices for tours and travelling activities to

make sure that company generates profit at every sale. For determining the tour prices while

establishing a markup strategy, the company is required to determine all related costs to run a

tour. This is inclusive of time consumed to develop a tour, and the resources utilized to

provide each tour, and the entire cost of operating business.

Markdown pricing strategy

A market down pricing strategy needs providers of tour and travel activities mark down their

charges to attain a competitive edge and to motivate the customer to make bookings due to

desirable prices. Further, mark-down pricing is best at the time of the low season, when the

company is not able to fill every tour that it is operating. If the general costs for the tour are

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

£200 per individual, then they many do mark-down pricing to £150 each individual. This will

still enable the company to generate profits on every booking they make while staying

competitive in the market and doing better than other wine tour companies. Moreover, a

markdown strategy might enable the company to have more bookings as compared to

promotional bookings, in the end, the company can enjoy more income.

Recommendations

Pricing strategy is formed by these following elements:

Rack Rates

All travel and tourism businesses must possess a rack rate by which their “full rate” is

applicable prior to any discounts and the same is offered to wholesales and are published on

brochures at the time of the season. For the operations and activity to attract clients, it tends

to be charged every time with no daily discounting, on the other hand, accommodation

operators, especially those in the centre of the market are not consistent pricing roughly for

the time period of 1 or 2 months to full up these gaps.

Seasonal Pricing

Making use of a mixture of pricing across the year to conceal low, peak and medium seasons

in a general way for travel and tourism businesses to serve for varying demand levels because

of the time of year. In general, these are considered as the similar date period every year but

also might be applicable for holidays for regional events wherein the dates differ every year.

Last Minute Pricing

A general means for accommodation supplies to satisfy the gaps of last minute in the

availability of booking, the prices based on last-minute which means discounting day-today

prices under ahead booking and supported on the websites of last minute.

By considering above described P & O Cruises is required to make use of Markup pricing

strategy as it will assure covering entire prices along with getting desired returns. Mark down

strategy is not suitable because expansion is for premium class customers however factor of

discount is essential to consider in offseason.

still enable the company to generate profits on every booking they make while staying

competitive in the market and doing better than other wine tour companies. Moreover, a

markdown strategy might enable the company to have more bookings as compared to

promotional bookings, in the end, the company can enjoy more income.

Recommendations

Pricing strategy is formed by these following elements:

Rack Rates

All travel and tourism businesses must possess a rack rate by which their “full rate” is

applicable prior to any discounts and the same is offered to wholesales and are published on

brochures at the time of the season. For the operations and activity to attract clients, it tends

to be charged every time with no daily discounting, on the other hand, accommodation

operators, especially those in the centre of the market are not consistent pricing roughly for

the time period of 1 or 2 months to full up these gaps.

Seasonal Pricing

Making use of a mixture of pricing across the year to conceal low, peak and medium seasons

in a general way for travel and tourism businesses to serve for varying demand levels because

of the time of year. In general, these are considered as the similar date period every year but

also might be applicable for holidays for regional events wherein the dates differ every year.

Last Minute Pricing

A general means for accommodation supplies to satisfy the gaps of last minute in the

availability of booking, the prices based on last-minute which means discounting day-today

prices under ahead booking and supported on the websites of last minute.

By considering above described P & O Cruises is required to make use of Markup pricing

strategy as it will assure covering entire prices along with getting desired returns. Mark down

strategy is not suitable because expansion is for premium class customers however factor of

discount is essential to consider in offseason.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CONCLUSION

In accordance with the present study, it can be concluded that financial decision making is a

crucial task as it has a direct impact on sales and profitability of the business. Due to this

aspect, companies are required to make use suitable tools and techniques. The present study

shows that P & O Cruises generate funds from both debt and equity sources to minimise the

overall financial cost. Further by selection of appropriate pricing strategies and using Cost

Volume and Profit (CVP) analysis managers can optimise the cost as well as maximise their

revenues.

In accordance with the present study, it can be concluded that financial decision making is a

crucial task as it has a direct impact on sales and profitability of the business. Due to this

aspect, companies are required to make use suitable tools and techniques. The present study

shows that P & O Cruises generate funds from both debt and equity sources to minimise the

overall financial cost. Further by selection of appropriate pricing strategies and using Cost

Volume and Profit (CVP) analysis managers can optimise the cost as well as maximise their

revenues.

REFERENCES

Becker, E., 2016. Overbooked: The exploding business of travel and tourism. Simon and

Schuster.

Boardman, A.E., Greenberg, D.H., Vining, A.R. and Weimer, D.L., 2017. Cost-benefit

analysis: concepts and practice. Cambridge University Press.

Cerqueiro, G., Ongena, S. and Roszbach, K., 2016. Collateralization, bank loan rates, and

monitoring. The Journal of Finance, 71(3), pp.1295-1322.

da Silva Etges, A.P.B., Calegari, R., dos Santos Rhoden, M.I. and Cortimiglia, M.N., 2016.

USING COST-VOLUME-PROFIT TO ANALYSE THE VIABILITY OF

IMPLEMENTING A NEW DISTRIBUTION CENTER. Brazilian Journal of Operations & Production

Management, 13(1), pp.44-50.

De Visscher, F.M., 2016. Financing transitions: Managing capital and liquidity in the family

business. Springer.

Derudder, B. and Witlox, F., 2016. International business travel in the global economy.

Routledge.

Dixit, D. and Mathews, A., 2017. International assistance for developing countries to

participate fully in the trade system. Handbook of International Food and Agricultural

Policies, 3.

Horner, S. and Swarbrooke, J., 2016. Consumer behaviour in tourism. Routledge.

Morningstar Carnival Corp CCL, 2018. [Online]. Available through

<http://financials.morningstar.com/ratios/r.html?t=CCL>. [Accessed on 25th April 2018].

P & O Cruises, 2018. [Online]. Available through <http://www.pocruises.com/>. [Accessed

on 25th April 2018].

Said, H.A., 2016. Using Different Probability Distributions for Managerial Accounting

Technique: The Cost-Volume-Profit Analysis. Journal of Business and Accounting, 9(1), p.3.

Vogel, H.L., 2016. Travel industry economics: A guide for financial analysis. Springer.

Wild, J., 2015. Research in International Business and Finance.

Becker, E., 2016. Overbooked: The exploding business of travel and tourism. Simon and

Schuster.

Boardman, A.E., Greenberg, D.H., Vining, A.R. and Weimer, D.L., 2017. Cost-benefit

analysis: concepts and practice. Cambridge University Press.

Cerqueiro, G., Ongena, S. and Roszbach, K., 2016. Collateralization, bank loan rates, and

monitoring. The Journal of Finance, 71(3), pp.1295-1322.

da Silva Etges, A.P.B., Calegari, R., dos Santos Rhoden, M.I. and Cortimiglia, M.N., 2016.

USING COST-VOLUME-PROFIT TO ANALYSE THE VIABILITY OF

IMPLEMENTING A NEW DISTRIBUTION CENTER. Brazilian Journal of Operations & Production

Management, 13(1), pp.44-50.

De Visscher, F.M., 2016. Financing transitions: Managing capital and liquidity in the family

business. Springer.

Derudder, B. and Witlox, F., 2016. International business travel in the global economy.

Routledge.

Dixit, D. and Mathews, A., 2017. International assistance for developing countries to

participate fully in the trade system. Handbook of International Food and Agricultural

Policies, 3.

Horner, S. and Swarbrooke, J., 2016. Consumer behaviour in tourism. Routledge.

Morningstar Carnival Corp CCL, 2018. [Online]. Available through

<http://financials.morningstar.com/ratios/r.html?t=CCL>. [Accessed on 25th April 2018].

P & O Cruises, 2018. [Online]. Available through <http://www.pocruises.com/>. [Accessed

on 25th April 2018].

Said, H.A., 2016. Using Different Probability Distributions for Managerial Accounting

Technique: The Cost-Volume-Profit Analysis. Journal of Business and Accounting, 9(1), p.3.

Vogel, H.L., 2016. Travel industry economics: A guide for financial analysis. Springer.

Wild, J., 2015. Research in International Business and Finance.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.