Portfolio Management Using Fundamental & Technical Analysis

VerifiedAdded on 2023/06/15

|18

|3787

|97

Report

AI Summary

This report explores portfolio management through fundamental and technical analysis, comparing the Efficient Market Hypothesis (EMH) with behavioral finance. Two portfolios, each containing 10 stocks, were constructed, one based on fundamental analysis and the other on technical analysis. The fundamental analysis employed methods like the Gordon Dividend Discount Model and PB Multiple Model, while the technical analysis utilized line charts and moving averages. The report details the stock selection process, trading activities within each portfolio, and a comparative analysis of their performance against the FTSE ST All Share Index. Results indicated that both portfolios outperformed the market, with the fundamentally analyzed portfolio showing a slightly better return. The report concludes that while both methods have value, markets often deviate from rational behavior due to investor psychology and information asymmetry. Desklib provides access to this and other solved assignments for student learning.

Running Head: PORTFOLIO MANAGEMENT 1

Portfolio Management using Fundamental and Technical Analysis

Portfolio Management using Fundamental and Technical Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 2

Table of Contents

Introduction...........................................................................................................................................3

Literature Review..................................................................................................................................3

Rational and Methodology....................................................................................................................5

Result and Analysis................................................................................................................................9

Conclusion...........................................................................................................................................10

References...........................................................................................................................................12

Appendix 1 Fundamental Portfolio......................................................................................................14

Appendix 2 Technical Portfolio............................................................................................................14

Appendix 3 Portfolio 1 Valuation.........................................................................................................15

Appendix 4 Portfolio 2 Valuation.........................................................................................................15

Appendix 5 Stock Profits 1...................................................................................................................16

Appendix 6 Stock Profits 2...................................................................................................................16

Appendix 7 Final Return......................................................................................................................17

Appendix 8 Market Return..................................................................................................................17

Table of Contents

Introduction...........................................................................................................................................3

Literature Review..................................................................................................................................3

Rational and Methodology....................................................................................................................5

Result and Analysis................................................................................................................................9

Conclusion...........................................................................................................................................10

References...........................................................................................................................................12

Appendix 1 Fundamental Portfolio......................................................................................................14

Appendix 2 Technical Portfolio............................................................................................................14

Appendix 3 Portfolio 1 Valuation.........................................................................................................15

Appendix 4 Portfolio 2 Valuation.........................................................................................................15

Appendix 5 Stock Profits 1...................................................................................................................16

Appendix 6 Stock Profits 2...................................................................................................................16

Appendix 7 Final Return......................................................................................................................17

Appendix 8 Market Return..................................................................................................................17

PORTFOLIO MANAGEMENT 3

Introduction

Investment in stocks and portfolio management involves analysing different

parameters using various techniques. Fundamental analysis and technical analysis are two

most commonly employed methods for stock selection. The study of macro-economic data

and financial performance of an organization for evaluating the intrinsic value of a stock is

referred to as fundamental analysis (Krantz, 2016). On the other hand, technical analysis

involves examination of historical trends in stock movements and prediction of future prices

on the basis of past trends (Grimes, 2012). This report involves construction of two portfolios

of 10 stocks each. First portfolio is constructed on the basis on fundamental analysis and

other one is based on technical analysis. Apart from this report also discusses about the

efficient market hypothesis and behavioural finance. The report also gives view about the

conflict between the EMH and behavioural finance.

Literature Review

Stock selection and evaluation is commonly carried using various methods of

fundamental and technical analysis. This consists of analysis of past financial position of a

company and studying movements of price fluctuations of its stock. On the other hand,

efficient market hypothesis and behavioural finance add another dimension to stock selection

and their performance evaluation According to Efficient market hypothesis, stock prices

always reflect all the information that is available in the market and trade at their intrinsic

value. New information is transferred to all the investors without any cost and is randomly

distributed. Therefore passive investment strategy will be more effective than active

management. Behaviour finance believes that investors do not behave rationally and their

emotional biases affect their choices. Overconfidence, conservatism and risk aversion are

some of many such behavioural influences which affect market sentiments (Forbes, 2009).

Introduction

Investment in stocks and portfolio management involves analysing different

parameters using various techniques. Fundamental analysis and technical analysis are two

most commonly employed methods for stock selection. The study of macro-economic data

and financial performance of an organization for evaluating the intrinsic value of a stock is

referred to as fundamental analysis (Krantz, 2016). On the other hand, technical analysis

involves examination of historical trends in stock movements and prediction of future prices

on the basis of past trends (Grimes, 2012). This report involves construction of two portfolios

of 10 stocks each. First portfolio is constructed on the basis on fundamental analysis and

other one is based on technical analysis. Apart from this report also discusses about the

efficient market hypothesis and behavioural finance. The report also gives view about the

conflict between the EMH and behavioural finance.

Literature Review

Stock selection and evaluation is commonly carried using various methods of

fundamental and technical analysis. This consists of analysis of past financial position of a

company and studying movements of price fluctuations of its stock. On the other hand,

efficient market hypothesis and behavioural finance add another dimension to stock selection

and their performance evaluation According to Efficient market hypothesis, stock prices

always reflect all the information that is available in the market and trade at their intrinsic

value. New information is transferred to all the investors without any cost and is randomly

distributed. Therefore passive investment strategy will be more effective than active

management. Behaviour finance believes that investors do not behave rationally and their

emotional biases affect their choices. Overconfidence, conservatism and risk aversion are

some of many such behavioural influences which affect market sentiments (Forbes, 2009).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT 4

Overconfidence in markets leads excessive buying during market rally. Another

empirical evidence of irrationality of investors is that low price to earnings ratio companies

react more positively to good news than high P/E ratio companies (Byrne, 2008). Stock

market crashes in one part of the world affect investor sentiments in other regions. This was

particularly evident during global financial crisis of 2008 and dot com bubble, when market

crash in USA not only had an effect on neighbouring markets but also in markets of China,

Australia and other regions of the world. This was due to selling pressure which had built due

to negative news from USA. However, macro-economic conditions in these countries were

better than USA. This is purely because of irrational investor behaviour (Baker and

Nofsinger, 2010).

Various theories of finance lay their foundation on the basis of efficient market

hypothesis. Capital asset pricing model (CAPM) and modern portfolio theory which form the

basis of most of the investments are based on efficient market hypothesis. Efficient market

hypothesis has been useful in securities pricing. This is particularly true in the case of

shareholder appraisal cases and benefit plans for employees. According to EMH, investors

are assumed to rational and it is believed that markets are self-correcting. EMH also is

contrary to technical analysis and believes that it cannot be used to outperform the market.

Proponents of EMH argue that past prices and data cannot be used to predict future returns.

So a portfolio can outperform a market only by chance and past information is already

reflected in market (Harder, 2010).

There seems to be a conflict in ideologies of believers of EMH and behavioural

finance. EMH believes in superiority of market and rationality of investors. EMH also causes

no random price movements in the markets. Apart from stock market, EMH is also used in

other fields of finance such as construction of portfolio, dividends and efficiency of funding.

On the other hand, behaviour finance argues that prices of securities in markets are not the

Overconfidence in markets leads excessive buying during market rally. Another

empirical evidence of irrationality of investors is that low price to earnings ratio companies

react more positively to good news than high P/E ratio companies (Byrne, 2008). Stock

market crashes in one part of the world affect investor sentiments in other regions. This was

particularly evident during global financial crisis of 2008 and dot com bubble, when market

crash in USA not only had an effect on neighbouring markets but also in markets of China,

Australia and other regions of the world. This was due to selling pressure which had built due

to negative news from USA. However, macro-economic conditions in these countries were

better than USA. This is purely because of irrational investor behaviour (Baker and

Nofsinger, 2010).

Various theories of finance lay their foundation on the basis of efficient market

hypothesis. Capital asset pricing model (CAPM) and modern portfolio theory which form the

basis of most of the investments are based on efficient market hypothesis. Efficient market

hypothesis has been useful in securities pricing. This is particularly true in the case of

shareholder appraisal cases and benefit plans for employees. According to EMH, investors

are assumed to rational and it is believed that markets are self-correcting. EMH also is

contrary to technical analysis and believes that it cannot be used to outperform the market.

Proponents of EMH argue that past prices and data cannot be used to predict future returns.

So a portfolio can outperform a market only by chance and past information is already

reflected in market (Harder, 2010).

There seems to be a conflict in ideologies of believers of EMH and behavioural

finance. EMH believes in superiority of market and rationality of investors. EMH also causes

no random price movements in the markets. Apart from stock market, EMH is also used in

other fields of finance such as construction of portfolio, dividends and efficiency of funding.

On the other hand, behaviour finance argues that prices of securities in markets are not the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 5

reflection of their intrinsic value. In many cases, human psychology is real force behind

market movements. The research in the field of behavioural finance not only involves study

of human emotions but also cultural trends and expectations of investors. In real world

efficient market hypothesis rarely holds, primarily due to information asymmetry and

psychological biases present in investors. Securities in markets are mostly not trading at their

intrinsic values and it requires various financial techniques to take advantage of such

mispricing (Akintoye, 2008). Various methods of technical analysis such as moving average,

trend analysis and candle stick chart have been developed to determine real values of

securities. Fundamental analysis also uses many methods such as Gordon dividend discount

model and valuation on the basis of price multiples. Therefore, both EMH and behavioural

finance have important role in play in markets. However, markets primarily do not behave

rationally.

Rational and Methodology

The methodology of portfolio management and stock selection consists of gathering

of quantitative financial data for analysis to draw suitable conclusions. The crux of efficient

financial management lies in adoption of right methods and their effective implementation

(Phillips and Stawarski, 2016). In this report, two portfolios have been constructed by use

various methods with the intention to beat the market. Various methods of technical and

fundamental analysis have been used successfully for active management of portfolio. Both

the methods are based different principles. Technical analysis does not rely on the analysing

the financial performance of a company, it attempts to draw conclusions from price

movements and changes in volume of stock traded. On the other hand, fundamental analysis

believes in analysing the financial performance of the company and does not give much of

reflection of their intrinsic value. In many cases, human psychology is real force behind

market movements. The research in the field of behavioural finance not only involves study

of human emotions but also cultural trends and expectations of investors. In real world

efficient market hypothesis rarely holds, primarily due to information asymmetry and

psychological biases present in investors. Securities in markets are mostly not trading at their

intrinsic values and it requires various financial techniques to take advantage of such

mispricing (Akintoye, 2008). Various methods of technical analysis such as moving average,

trend analysis and candle stick chart have been developed to determine real values of

securities. Fundamental analysis also uses many methods such as Gordon dividend discount

model and valuation on the basis of price multiples. Therefore, both EMH and behavioural

finance have important role in play in markets. However, markets primarily do not behave

rationally.

Rational and Methodology

The methodology of portfolio management and stock selection consists of gathering

of quantitative financial data for analysis to draw suitable conclusions. The crux of efficient

financial management lies in adoption of right methods and their effective implementation

(Phillips and Stawarski, 2016). In this report, two portfolios have been constructed by use

various methods with the intention to beat the market. Various methods of technical and

fundamental analysis have been used successfully for active management of portfolio. Both

the methods are based different principles. Technical analysis does not rely on the analysing

the financial performance of a company, it attempts to draw conclusions from price

movements and changes in volume of stock traded. On the other hand, fundamental analysis

believes in analysing the financial performance of the company and does not give much of

PORTFOLIO MANAGEMENT 6

the importance to price trends. None of the methods is superior to other and both are

complimentary to each other (Stanfield, 2005).

In this report, company Jardine Cycle and Carriage Limited has been chosen on the

basis of fundamental analysis because of it has generated a return on equity of 14.42%

(Yahoo finance, 2018). On the other hand, stock of DBS Group Holdings has been selected

because of exceptional profit margin of 40.74% and operating profit margin of 51.49%.

(Yahoo finance, 2018). Thus using various parameters of financial performance and

techniques of fundamental analysis one portfolio of 10 has been constructed. Another

portfolio comprising of 10 stocks has also been constructed on basis of technical analysis.

Both the methods will result rational choices and prudent judgments.

Analysis of a Stock using Fundamental Analysis

Dividend Discount Model

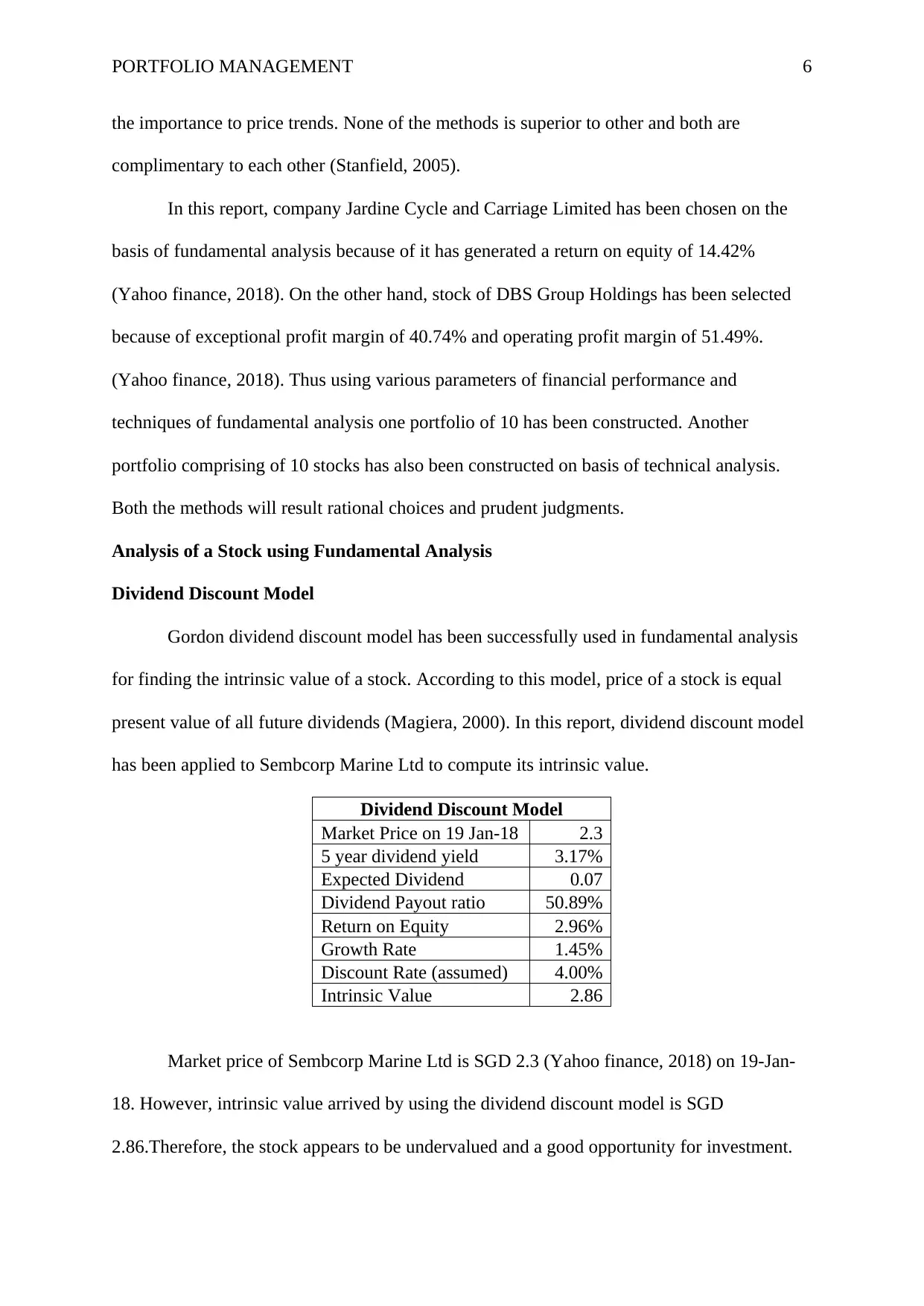

Gordon dividend discount model has been successfully used in fundamental analysis

for finding the intrinsic value of a stock. According to this model, price of a stock is equal

present value of all future dividends (Magiera, 2000). In this report, dividend discount model

has been applied to Sembcorp Marine Ltd to compute its intrinsic value.

Dividend Discount Model

Market Price on 19 Jan-18 2.3

5 year dividend yield 3.17%

Expected Dividend 0.07

Dividend Payout ratio 50.89%

Return on Equity 2.96%

Growth Rate 1.45%

Discount Rate (assumed) 4.00%

Intrinsic Value 2.86

Market price of Sembcorp Marine Ltd is SGD 2.3 (Yahoo finance, 2018) on 19-Jan-

18. However, intrinsic value arrived by using the dividend discount model is SGD

2.86.Therefore, the stock appears to be undervalued and a good opportunity for investment.

the importance to price trends. None of the methods is superior to other and both are

complimentary to each other (Stanfield, 2005).

In this report, company Jardine Cycle and Carriage Limited has been chosen on the

basis of fundamental analysis because of it has generated a return on equity of 14.42%

(Yahoo finance, 2018). On the other hand, stock of DBS Group Holdings has been selected

because of exceptional profit margin of 40.74% and operating profit margin of 51.49%.

(Yahoo finance, 2018). Thus using various parameters of financial performance and

techniques of fundamental analysis one portfolio of 10 has been constructed. Another

portfolio comprising of 10 stocks has also been constructed on basis of technical analysis.

Both the methods will result rational choices and prudent judgments.

Analysis of a Stock using Fundamental Analysis

Dividend Discount Model

Gordon dividend discount model has been successfully used in fundamental analysis

for finding the intrinsic value of a stock. According to this model, price of a stock is equal

present value of all future dividends (Magiera, 2000). In this report, dividend discount model

has been applied to Sembcorp Marine Ltd to compute its intrinsic value.

Dividend Discount Model

Market Price on 19 Jan-18 2.3

5 year dividend yield 3.17%

Expected Dividend 0.07

Dividend Payout ratio 50.89%

Return on Equity 2.96%

Growth Rate 1.45%

Discount Rate (assumed) 4.00%

Intrinsic Value 2.86

Market price of Sembcorp Marine Ltd is SGD 2.3 (Yahoo finance, 2018) on 19-Jan-

18. However, intrinsic value arrived by using the dividend discount model is SGD

2.86.Therefore, the stock appears to be undervalued and a good opportunity for investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT 7

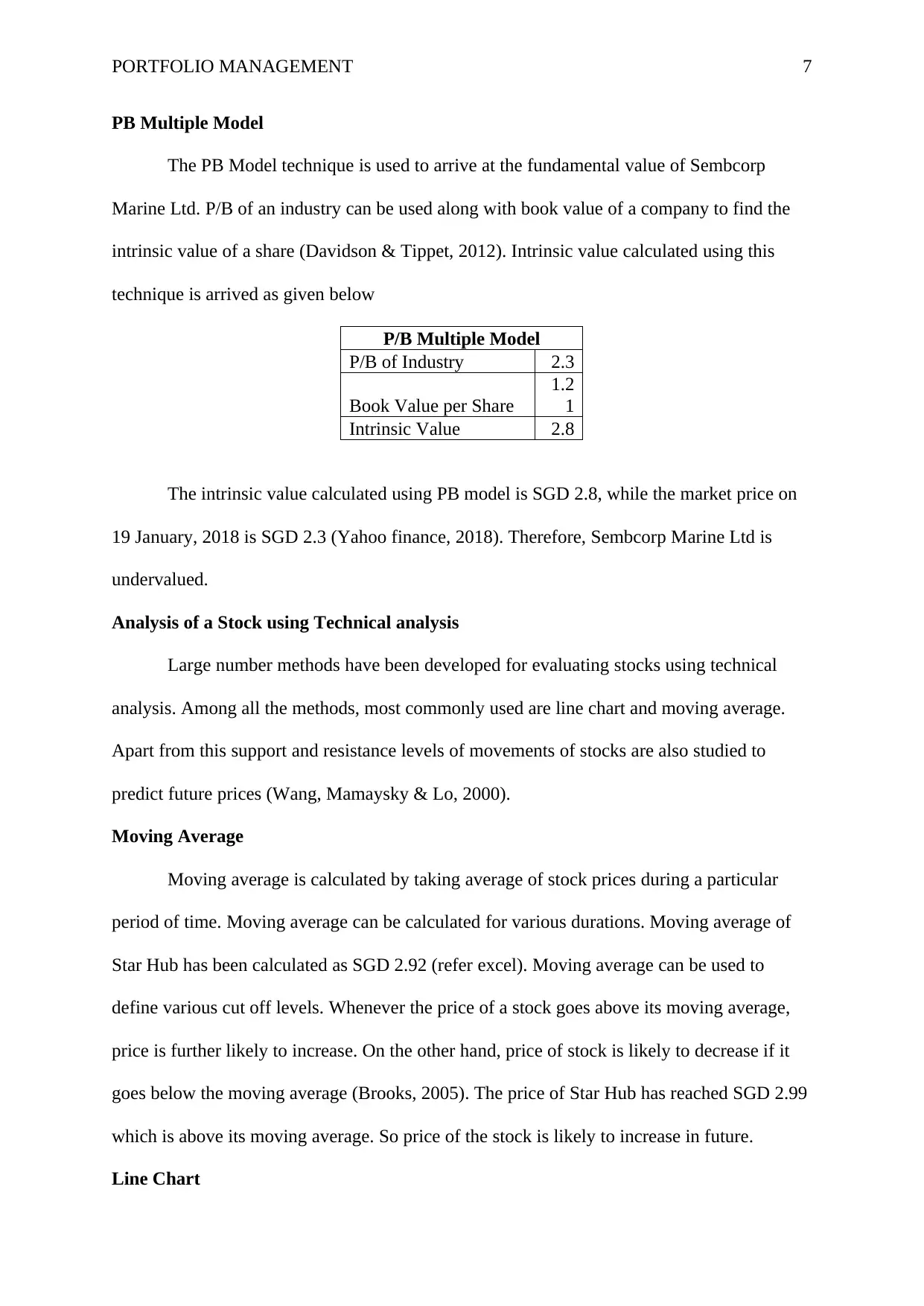

PB Multiple Model

The PB Model technique is used to arrive at the fundamental value of Sembcorp

Marine Ltd. P/B of an industry can be used along with book value of a company to find the

intrinsic value of a share (Davidson & Tippet, 2012). Intrinsic value calculated using this

technique is arrived as given below

P/B Multiple Model

P/B of Industry 2.3

Book Value per Share

1.2

1

Intrinsic Value 2.8

The intrinsic value calculated using PB model is SGD 2.8, while the market price on

19 January, 2018 is SGD 2.3 (Yahoo finance, 2018). Therefore, Sembcorp Marine Ltd is

undervalued.

Analysis of a Stock using Technical analysis

Large number methods have been developed for evaluating stocks using technical

analysis. Among all the methods, most commonly used are line chart and moving average.

Apart from this support and resistance levels of movements of stocks are also studied to

predict future prices (Wang, Mamaysky & Lo, 2000).

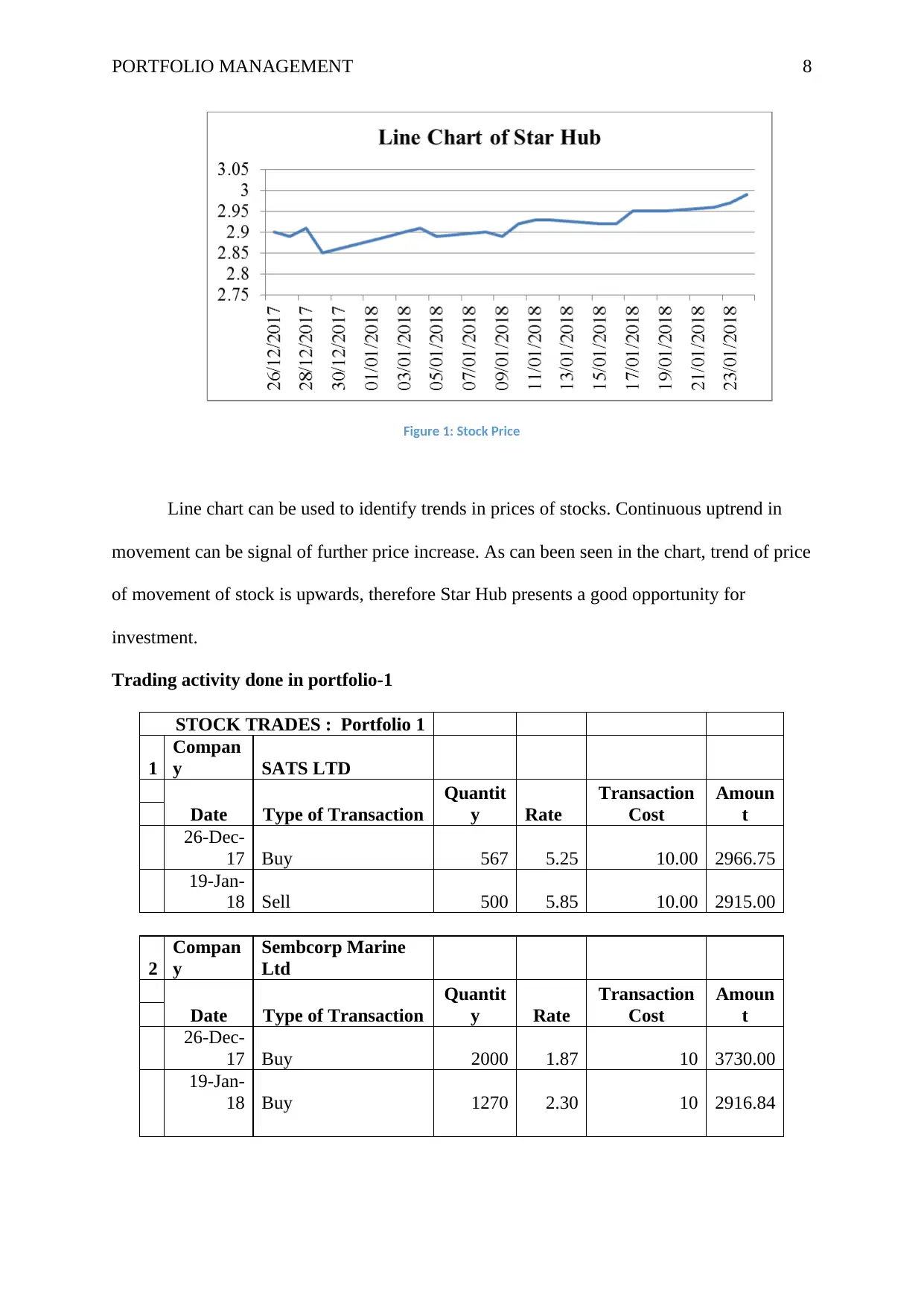

Moving Average

Moving average is calculated by taking average of stock prices during a particular

period of time. Moving average can be calculated for various durations. Moving average of

Star Hub has been calculated as SGD 2.92 (refer excel). Moving average can be used to

define various cut off levels. Whenever the price of a stock goes above its moving average,

price is further likely to increase. On the other hand, price of stock is likely to decrease if it

goes below the moving average (Brooks, 2005). The price of Star Hub has reached SGD 2.99

which is above its moving average. So price of the stock is likely to increase in future.

Line Chart

PB Multiple Model

The PB Model technique is used to arrive at the fundamental value of Sembcorp

Marine Ltd. P/B of an industry can be used along with book value of a company to find the

intrinsic value of a share (Davidson & Tippet, 2012). Intrinsic value calculated using this

technique is arrived as given below

P/B Multiple Model

P/B of Industry 2.3

Book Value per Share

1.2

1

Intrinsic Value 2.8

The intrinsic value calculated using PB model is SGD 2.8, while the market price on

19 January, 2018 is SGD 2.3 (Yahoo finance, 2018). Therefore, Sembcorp Marine Ltd is

undervalued.

Analysis of a Stock using Technical analysis

Large number methods have been developed for evaluating stocks using technical

analysis. Among all the methods, most commonly used are line chart and moving average.

Apart from this support and resistance levels of movements of stocks are also studied to

predict future prices (Wang, Mamaysky & Lo, 2000).

Moving Average

Moving average is calculated by taking average of stock prices during a particular

period of time. Moving average can be calculated for various durations. Moving average of

Star Hub has been calculated as SGD 2.92 (refer excel). Moving average can be used to

define various cut off levels. Whenever the price of a stock goes above its moving average,

price is further likely to increase. On the other hand, price of stock is likely to decrease if it

goes below the moving average (Brooks, 2005). The price of Star Hub has reached SGD 2.99

which is above its moving average. So price of the stock is likely to increase in future.

Line Chart

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 8

Figure 1: Stock Price

Line chart can be used to identify trends in prices of stocks. Continuous uptrend in

movement can be signal of further price increase. As can been seen in the chart, trend of price

of movement of stock is upwards, therefore Star Hub presents a good opportunity for

investment.

Trading activity done in portfolio-1

STOCK TRADES : Portfolio 1

1

Compan

y SATS LTD

Date Type of Transaction

Quantit

y Rate

Transaction

Cost

Amoun

t

26-Dec-

17 Buy 567 5.25 10.00 2966.75

19-Jan-

18 Sell 500 5.85 10.00 2915.00

2

Compan

y

Sembcorp Marine

Ltd

Date Type of Transaction

Quantit

y Rate

Transaction

Cost

Amoun

t

26-Dec-

17 Buy 2000 1.87 10 3730.00

19-Jan-

18 Buy 1270 2.30 10 2916.84

Figure 1: Stock Price

Line chart can be used to identify trends in prices of stocks. Continuous uptrend in

movement can be signal of further price increase. As can been seen in the chart, trend of price

of movement of stock is upwards, therefore Star Hub presents a good opportunity for

investment.

Trading activity done in portfolio-1

STOCK TRADES : Portfolio 1

1

Compan

y SATS LTD

Date Type of Transaction

Quantit

y Rate

Transaction

Cost

Amoun

t

26-Dec-

17 Buy 567 5.25 10.00 2966.75

19-Jan-

18 Sell 500 5.85 10.00 2915.00

2

Compan

y

Sembcorp Marine

Ltd

Date Type of Transaction

Quantit

y Rate

Transaction

Cost

Amoun

t

26-Dec-

17 Buy 2000 1.87 10 3730.00

19-Jan-

18 Buy 1270 2.30 10 2916.84

PORTFOLIO MANAGEMENT 9

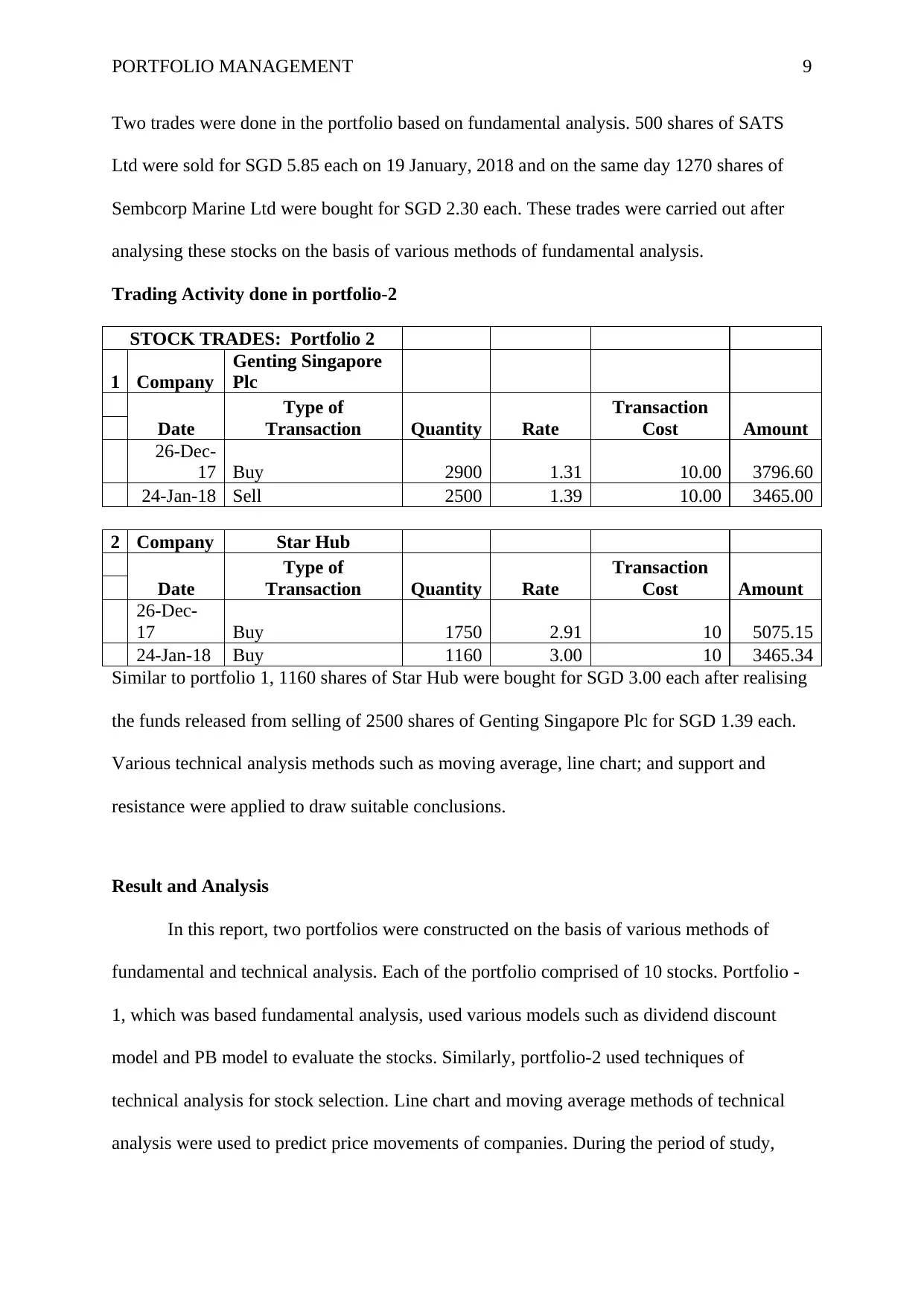

Two trades were done in the portfolio based on fundamental analysis. 500 shares of SATS

Ltd were sold for SGD 5.85 each on 19 January, 2018 and on the same day 1270 shares of

Sembcorp Marine Ltd were bought for SGD 2.30 each. These trades were carried out after

analysing these stocks on the basis of various methods of fundamental analysis.

Trading Activity done in portfolio-2

STOCK TRADES: Portfolio 2

1 Company

Genting Singapore

Plc

Date

Type of

Transaction Quantity Rate

Transaction

Cost Amount

26-Dec-

17 Buy 2900 1.31 10.00 3796.60

24-Jan-18 Sell 2500 1.39 10.00 3465.00

2 Company Star Hub

Date

Type of

Transaction Quantity Rate

Transaction

Cost Amount

26-Dec-

17 Buy 1750 2.91 10 5075.15

24-Jan-18 Buy 1160 3.00 10 3465.34

Similar to portfolio 1, 1160 shares of Star Hub were bought for SGD 3.00 each after realising

the funds released from selling of 2500 shares of Genting Singapore Plc for SGD 1.39 each.

Various technical analysis methods such as moving average, line chart; and support and

resistance were applied to draw suitable conclusions.

Result and Analysis

In this report, two portfolios were constructed on the basis of various methods of

fundamental and technical analysis. Each of the portfolio comprised of 10 stocks. Portfolio -

1, which was based fundamental analysis, used various models such as dividend discount

model and PB model to evaluate the stocks. Similarly, portfolio-2 used techniques of

technical analysis for stock selection. Line chart and moving average methods of technical

analysis were used to predict price movements of companies. During the period of study,

Two trades were done in the portfolio based on fundamental analysis. 500 shares of SATS

Ltd were sold for SGD 5.85 each on 19 January, 2018 and on the same day 1270 shares of

Sembcorp Marine Ltd were bought for SGD 2.30 each. These trades were carried out after

analysing these stocks on the basis of various methods of fundamental analysis.

Trading Activity done in portfolio-2

STOCK TRADES: Portfolio 2

1 Company

Genting Singapore

Plc

Date

Type of

Transaction Quantity Rate

Transaction

Cost Amount

26-Dec-

17 Buy 2900 1.31 10.00 3796.60

24-Jan-18 Sell 2500 1.39 10.00 3465.00

2 Company Star Hub

Date

Type of

Transaction Quantity Rate

Transaction

Cost Amount

26-Dec-

17 Buy 1750 2.91 10 5075.15

24-Jan-18 Buy 1160 3.00 10 3465.34

Similar to portfolio 1, 1160 shares of Star Hub were bought for SGD 3.00 each after realising

the funds released from selling of 2500 shares of Genting Singapore Plc for SGD 1.39 each.

Various technical analysis methods such as moving average, line chart; and support and

resistance were applied to draw suitable conclusions.

Result and Analysis

In this report, two portfolios were constructed on the basis of various methods of

fundamental and technical analysis. Each of the portfolio comprised of 10 stocks. Portfolio -

1, which was based fundamental analysis, used various models such as dividend discount

model and PB model to evaluate the stocks. Similarly, portfolio-2 used techniques of

technical analysis for stock selection. Line chart and moving average methods of technical

analysis were used to predict price movements of companies. During the period of study,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PORTFOLIO MANAGEMENT 10

both the portfolios were able to outperform the market. FTSE ST all share index generated a

holding period return of 1.44% (Appendix 8). Portfolio-1 gave a return of 8.90% (Appendix

7), while portfolio-2 generated a return of 6.97% (Appendix 7). In portfolio-1, seven out of

ten stocks gave positive holding period returns (Appendix 5). On the other hand, in portfolio-

2, only two stocks gave negative returns over the period of study (Appendix 6). Overall, it

was observed the portfolio-1 based on fundamental analysis was better performing than

portfolio-2.

By analysing the results, it can be inferred that market can be beaten using various

techniques of portfolio management. It also shows us the markets are not efficient in realty

and are affected by behavioural biases. So, prices of stocks rarely trade at their intrinsic

values. By using various techniques of fundamental and technical analysis, mispricing in

stock values can be exploited. Efficient market hypothesis which was earlier discussed in this

report does not hold in real world conditions. Markets and stocks also do not reflect all the

information. Here various methods which were used for stock selection, were able to identity

mispricing in markets and generate better return than market. That is why, in this report

stocks not trading at their intrinsic value were identified and such opportunities were

exploited to generate excess return over the market. In this study, both portfolio-1 and

portfolio-2 were able take advantages of inefficiencies and psychological biases in markets.

Overall it was observed that portfolio-1 was better performing than portfolio-2.

Conclusion

This report presents construction of two portfolios of companies and discusses various

methods of stock selection. Various methods discussed in this report fall under the category

of fundamental and technical analysis. Different valuation models and trend finding

techniques such as dividend discount model, moving average and line chart were used for

portfolio evaluation. Apart from this, this report also discusses efficient market hypothesis

both the portfolios were able to outperform the market. FTSE ST all share index generated a

holding period return of 1.44% (Appendix 8). Portfolio-1 gave a return of 8.90% (Appendix

7), while portfolio-2 generated a return of 6.97% (Appendix 7). In portfolio-1, seven out of

ten stocks gave positive holding period returns (Appendix 5). On the other hand, in portfolio-

2, only two stocks gave negative returns over the period of study (Appendix 6). Overall, it

was observed the portfolio-1 based on fundamental analysis was better performing than

portfolio-2.

By analysing the results, it can be inferred that market can be beaten using various

techniques of portfolio management. It also shows us the markets are not efficient in realty

and are affected by behavioural biases. So, prices of stocks rarely trade at their intrinsic

values. By using various techniques of fundamental and technical analysis, mispricing in

stock values can be exploited. Efficient market hypothesis which was earlier discussed in this

report does not hold in real world conditions. Markets and stocks also do not reflect all the

information. Here various methods which were used for stock selection, were able to identity

mispricing in markets and generate better return than market. That is why, in this report

stocks not trading at their intrinsic value were identified and such opportunities were

exploited to generate excess return over the market. In this study, both portfolio-1 and

portfolio-2 were able take advantages of inefficiencies and psychological biases in markets.

Overall it was observed that portfolio-1 was better performing than portfolio-2.

Conclusion

This report presents construction of two portfolios of companies and discusses various

methods of stock selection. Various methods discussed in this report fall under the category

of fundamental and technical analysis. Different valuation models and trend finding

techniques such as dividend discount model, moving average and line chart were used for

portfolio evaluation. Apart from this, this report also discusses efficient market hypothesis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

PORTFOLIO MANAGEMENT 11

and concepts behavioural finance. A view of conflict between EMH and behavioural finance

has also been provided in this with reference many global events such as financial crisis of

2008. It is rarely seen that markets are efficient and personal choices affect market behaviour.

Further, both the portfolios constructed on the basis of technical and fundamental analysis

were able be beat the market and generate a holding period return in excess of 5%. For the

period of study of 26 December, 2017 to 16 February, 2018 FTSE ST all share index

generated a return of 1.44% (Appendix 8). On the other hand portfolio-1 based on

fundamental analysis generated a return of 8.90% (Appendix 7) and portfolio-2 (Appendix 7)

gave a return of 6.97%. Portfolio-1 outperformed the market as well as portfolio-2.

and concepts behavioural finance. A view of conflict between EMH and behavioural finance

has also been provided in this with reference many global events such as financial crisis of

2008. It is rarely seen that markets are efficient and personal choices affect market behaviour.

Further, both the portfolios constructed on the basis of technical and fundamental analysis

were able be beat the market and generate a holding period return in excess of 5%. For the

period of study of 26 December, 2017 to 16 February, 2018 FTSE ST all share index

generated a return of 1.44% (Appendix 8). On the other hand portfolio-1 based on

fundamental analysis generated a return of 8.90% (Appendix 7) and portfolio-2 (Appendix 7)

gave a return of 6.97%. Portfolio-1 outperformed the market as well as portfolio-2.

PORTFOLIO MANAGEMENT 12

References

Akintoye, I. R. (2008). Efficient Market Hypothesis and Behavioural Finance: A Review of

Literature. European Journal of Social Sciences. 7(2), 7-17.

Baker, H.K. and Nofsinger, J.R. (2010). Behavioral Finance: Investors, Corporations, and

Markets. New Jersey, USA: John Wiley & Sons.

Brooks, J. C. (2005). Mastering technical analysis. Pennsylvania, USA :McGraw Hill

Professional.

Byrne, A. (2008). Behavioural finance: theories and evidence. The Research Foundation of

CFA Institute Literature Review. Retrieved from

https://www.cfapubs.org/doi/pdf/10.2470/rflr.v3.n1.1

Davidson, I. & Tippet, M. (2012). Principles of equity valuation. Abingdon, Oxon:

Routledge.

Forbes, W. (2009). Behavioral finance. Sussex, UK:John Wiley & Sons.

Grimes, A. (2012). The art and science of technical Analysis: Market Structure, price action

and trading strategies. New Jersey, USA: John Wiley & Sons.

Harder, S. (2010). The efficient market hypothesis and its applications to stock markets.

Norderstedt, Germany: GRIN Verlag.

Krantz, M. (2016). Fundamental analysis for dummies. New Jersey, USA: John Wiley &

Sons.

References

Akintoye, I. R. (2008). Efficient Market Hypothesis and Behavioural Finance: A Review of

Literature. European Journal of Social Sciences. 7(2), 7-17.

Baker, H.K. and Nofsinger, J.R. (2010). Behavioral Finance: Investors, Corporations, and

Markets. New Jersey, USA: John Wiley & Sons.

Brooks, J. C. (2005). Mastering technical analysis. Pennsylvania, USA :McGraw Hill

Professional.

Byrne, A. (2008). Behavioural finance: theories and evidence. The Research Foundation of

CFA Institute Literature Review. Retrieved from

https://www.cfapubs.org/doi/pdf/10.2470/rflr.v3.n1.1

Davidson, I. & Tippet, M. (2012). Principles of equity valuation. Abingdon, Oxon:

Routledge.

Forbes, W. (2009). Behavioral finance. Sussex, UK:John Wiley & Sons.

Grimes, A. (2012). The art and science of technical Analysis: Market Structure, price action

and trading strategies. New Jersey, USA: John Wiley & Sons.

Harder, S. (2010). The efficient market hypothesis and its applications to stock markets.

Norderstedt, Germany: GRIN Verlag.

Krantz, M. (2016). Fundamental analysis for dummies. New Jersey, USA: John Wiley &

Sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.