Strategic Marketing Management and Analysis of POSB Bank, 2018

VerifiedAdded on 2023/06/04

|17

|4769

|420

Report

AI Summary

This report provides a comprehensive analysis of POSB Bank's strategic marketing management in 2018. It includes a PESTLE analysis, evaluating the political, economic, social, technological, environmental, and legal factors affecting the bank. A competitor analysis focuses on HSBC, comparing its objectives, strategies, resources, and potential future actions with those of POSB. The report also outlines POSB's current and future objectives, community marketing, and premium services strategies. It further discusses the development and selection of marketing strategies, including marketing mix, diversification, and digital and big data analytics. The conclusion summarizes the key findings and their implications for POSB Bank's success in the global market. Desklib offers a wide range of study resources, including past papers and solved assignments, to support students in their academic endeavors.

Running head: Strategic marketing management

Strategic marketing

management

2018

Strategic marketing

management

2018

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic marketing management

Table of Contents

Introduction.................................................................................................................................................3

Pestle analysis.............................................................................................................................................3

Competitor analysis.....................................................................................................................................8

A. Identify one competitor, compare to firm...........................................................................................8

B.Current and future objectives...............................................................................................................8

C.Current strategies.................................................................................................................................9

D.Compeitior resource profile.................................................................................................................9

E.Competitior future strategies................................................................................................................9

Firm analysis.............................................................................................................................................10

Marketing strategies development.............................................................................................................10

Strategies selection....................................................................................................................................12

3 Strategies and justification behind the selection of strategies.............................................................12

Marketing mix strategy......................................................................................................................12

Diversification strategy......................................................................................................................14

Digital and big data analytics strategy...............................................................................................14

Conclusion.................................................................................................................................................14

References.................................................................................................................................................15

2

Table of Contents

Introduction.................................................................................................................................................3

Pestle analysis.............................................................................................................................................3

Competitor analysis.....................................................................................................................................8

A. Identify one competitor, compare to firm...........................................................................................8

B.Current and future objectives...............................................................................................................8

C.Current strategies.................................................................................................................................9

D.Compeitior resource profile.................................................................................................................9

E.Competitior future strategies................................................................................................................9

Firm analysis.............................................................................................................................................10

Marketing strategies development.............................................................................................................10

Strategies selection....................................................................................................................................12

3 Strategies and justification behind the selection of strategies.............................................................12

Marketing mix strategy......................................................................................................................12

Diversification strategy......................................................................................................................14

Digital and big data analytics strategy...............................................................................................14

Conclusion.................................................................................................................................................14

References.................................................................................................................................................15

2

Strategic marketing management

Introduction

The major purpose of this study is to discuss about the business activities and operations

of POSB bank which is one of the growing banks in Singapore. It provides innovative and

attractive banking services to the key target audience across the globe. The bank further provides

online banking and mobile banking services to the customers. Pestle analysis, TOWS matrix and

marketing strategies have been drawn in the task to flourish and explore the banking operations

internationally. The current objectives of POSB, resources and strategies of competitors like

HSBC are explained in the task briefly. At the end, the paper discusses three strategies that are

used by POSB to make a strong financial position and goodwill in the international market.

POSB bank is a Singaporean bank rendering consumer banking services to the customers

across the globe. It is one of the oldest banks that continuously operating business activities and

operations in Singapore. The bank was formed in 1st January 1877 as the post office savings

bank. In today’s era, the bank operates and manages as part of DBS, which obtained the

institution and its subsidiaries on 16 November 1998 (Deposits, 2018). POSB is one of the

biggest local banks in Singapore as it has approx 53 branches in the country. POSB is a part of

the DBS bank and it works together with DBS banks to attain competitive benefits in the

international market. The bank has more than 1,100 ATMs around Singapore. It is stated that the

bank offers traditional banking products that include current account products, Singaporean

dollar denominated savings bank account, and foreign currency fixed deposit accounts. The bank

provides personal banking and individual investments services to the customers across the globe

(Deposits, 2018).

Pestle analysis

Pestle analysis is a framework used by investors and marketers to evaluate and identify the

external environment factors influencing the business activities and operations. Pestle stands for

political, economic, social, technological, environmental and legal factors. The main motive of

the Pestle analysis is to have a foresight of the macro environment that can impact the internal

3

Introduction

The major purpose of this study is to discuss about the business activities and operations

of POSB bank which is one of the growing banks in Singapore. It provides innovative and

attractive banking services to the key target audience across the globe. The bank further provides

online banking and mobile banking services to the customers. Pestle analysis, TOWS matrix and

marketing strategies have been drawn in the task to flourish and explore the banking operations

internationally. The current objectives of POSB, resources and strategies of competitors like

HSBC are explained in the task briefly. At the end, the paper discusses three strategies that are

used by POSB to make a strong financial position and goodwill in the international market.

POSB bank is a Singaporean bank rendering consumer banking services to the customers

across the globe. It is one of the oldest banks that continuously operating business activities and

operations in Singapore. The bank was formed in 1st January 1877 as the post office savings

bank. In today’s era, the bank operates and manages as part of DBS, which obtained the

institution and its subsidiaries on 16 November 1998 (Deposits, 2018). POSB is one of the

biggest local banks in Singapore as it has approx 53 branches in the country. POSB is a part of

the DBS bank and it works together with DBS banks to attain competitive benefits in the

international market. The bank has more than 1,100 ATMs around Singapore. It is stated that the

bank offers traditional banking products that include current account products, Singaporean

dollar denominated savings bank account, and foreign currency fixed deposit accounts. The bank

provides personal banking and individual investments services to the customers across the globe

(Deposits, 2018).

Pestle analysis

Pestle analysis is a framework used by investors and marketers to evaluate and identify the

external environment factors influencing the business activities and operations. Pestle stands for

political, economic, social, technological, environmental and legal factors. The main motive of

the Pestle analysis is to have a foresight of the macro environment that can impact the internal

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic marketing management

business environment and initiate essential measures. The pestle analysis for POSB has been

drawn below.

Political factors: It has been found that various political factors such as economy tariffs, labor

laws, trade restrictions, tax policy and environment law affect the growth and success of POSB

bank. All these political factors initiated by the government influence the banking industry

directly and indirectly and POSB has to adhere to the legislations, standards and rules set by the

government whether if it is for bad or good consequences. Singapore follows a territorial basis of

taxation. POSB bank enjoys a headline corporate tax rate of 17% on their chargeable income

(Gudiemesingapore, 2018

Opportunity

The political stability has created an atmosphere in Singapore of a quite low political risk.

Maximize in business operations and activities are promoting the development and

expansion of POSB bank.

POSB is a major leader in the banking industry enjoys the growth, expansion and

development of the bank.

It is noted that political risk is low in Singapore as compared to other countries.

Threat

The tax rates is high in the market this it can affect the success of POSB bank.

Globalization further impacts on the progress and targets of the firm.

Limited dissemination of content is a significant and largest threat for the company.

Economic factors: An overwhelming study shows that Singapore is experiencing maximizing

worker cost. This may influence the firm by gaining the cost benefit. Singapore dollar is

strengthening in the currency market. The economic factors include government policy, taxes,

exchange rate, interest rate, labor costs, and management. The GDP per capital (USD) was

57,495(2017) and inflation rate was 0.4% in the country that can affect the profitability of POSB

bank (Focuseconomics, 2018).

Opportunities

4

business environment and initiate essential measures. The pestle analysis for POSB has been

drawn below.

Political factors: It has been found that various political factors such as economy tariffs, labor

laws, trade restrictions, tax policy and environment law affect the growth and success of POSB

bank. All these political factors initiated by the government influence the banking industry

directly and indirectly and POSB has to adhere to the legislations, standards and rules set by the

government whether if it is for bad or good consequences. Singapore follows a territorial basis of

taxation. POSB bank enjoys a headline corporate tax rate of 17% on their chargeable income

(Gudiemesingapore, 2018

Opportunity

The political stability has created an atmosphere in Singapore of a quite low political risk.

Maximize in business operations and activities are promoting the development and

expansion of POSB bank.

POSB is a major leader in the banking industry enjoys the growth, expansion and

development of the bank.

It is noted that political risk is low in Singapore as compared to other countries.

Threat

The tax rates is high in the market this it can affect the success of POSB bank.

Globalization further impacts on the progress and targets of the firm.

Limited dissemination of content is a significant and largest threat for the company.

Economic factors: An overwhelming study shows that Singapore is experiencing maximizing

worker cost. This may influence the firm by gaining the cost benefit. Singapore dollar is

strengthening in the currency market. The economic factors include government policy, taxes,

exchange rate, interest rate, labor costs, and management. The GDP per capital (USD) was

57,495(2017) and inflation rate was 0.4% in the country that can affect the profitability of POSB

bank (Focuseconomics, 2018).

Opportunities

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic marketing management

There is an open economy in the country thus, POSB can flourish the business globally.

Threat

There is a labor shortage in Singapore market.

Along with this, labor cost is high in the Singaporean market.

Singaporean’s economy is weak and slower than US and China economy.

Decline in productivity.

Social factors: It is portrayed that various socio-cultural factors may put direct impact on the

efficiency and effectiveness of POSB bank in the country. The socio-cultural factors include

culture, values, norms, aspects, attitudes, behaviors and nature of customers. The sale and

revenue of the bank is dependent on behavior and attributes of people in the marketplace

(Studymore, 2018).

Opportunities

Maximizing living standards and norms in the country can promote the business activities

and operations of POSB bank in Singapore.

High level of education in the country is likely to generate a pull of skilled and talented

workforce for the business companies like POSB bank.

Threats

Constant changing in trends is major threat for POSB bank that can affect the products

and services in the marketplace.

Technological factors: One of the significant factors that can affect the outcomes and returns of

POSB bank is technology factor. POSB is a leading and growing business organization to

effectively and efficiently initiate use of information technology that has maximized ATM

network effectiveness and customer satisfaction in general (Studymore, 2018).

Opportunities

Open and strong communication system.

5

There is an open economy in the country thus, POSB can flourish the business globally.

Threat

There is a labor shortage in Singapore market.

Along with this, labor cost is high in the Singaporean market.

Singaporean’s economy is weak and slower than US and China economy.

Decline in productivity.

Social factors: It is portrayed that various socio-cultural factors may put direct impact on the

efficiency and effectiveness of POSB bank in the country. The socio-cultural factors include

culture, values, norms, aspects, attitudes, behaviors and nature of customers. The sale and

revenue of the bank is dependent on behavior and attributes of people in the marketplace

(Studymore, 2018).

Opportunities

Maximizing living standards and norms in the country can promote the business activities

and operations of POSB bank in Singapore.

High level of education in the country is likely to generate a pull of skilled and talented

workforce for the business companies like POSB bank.

Threats

Constant changing in trends is major threat for POSB bank that can affect the products

and services in the marketplace.

Technological factors: One of the significant factors that can affect the outcomes and returns of

POSB bank is technology factor. POSB is a leading and growing business organization to

effectively and efficiently initiate use of information technology that has maximized ATM

network effectiveness and customer satisfaction in general (Studymore, 2018).

Opportunities

Open and strong communication system.

5

Strategic marketing management

The country has strong and widespread IT infrastructure which help in growing and

expanding the business internationally.

With strong and advanced technology, the company can attain ample of benefits both

externally and internally as well.

Both external and internal advantages enjoyed by POSB bank derived from advanced and

innovative technological infrastructure rendered in Singapore (Koh &Tan, 2014).

Threats

Advanced technology becomes a major threat for the employees and company in the

country because it needs huge investment and resources.

Legal factors: POSB bank is in a highly and effectively regulated and governed sector. There

are various rules, standards and legislations that need to be followed by the company while

performing and functioning in the country. It is elucidated that Singaporean government has

various business regulations and laws which aim to protecting and saving the rights and interests

of the leaders in the banking sector (Studytigger, 2018).

Opportunities

Rapid and constant growth in the economy helps in gaining various competitive

advantages in the international market.

In today’s era, the Singaporean government is likely to maximize the level if litigation

and regulations to both the financial and public sectors.

By planning and organizing the field of operation beyond the boundaries of the nations,

POSB bank wants to explore business internationally.

POSB bank has to adhere to standards, rules and legislations set by the MAS(Monetary

authority of Singapore) and they do not have the free would to act on their own harmony.

That means the bank cannot work on specific criteria which can influence the economy in

a bad way, this is significant way to protect the interest of the economy.

Threat

Sometimes, the company is unable to follow and understand the rules, legislations and

norms which are made by the Singaporean government.

6

The country has strong and widespread IT infrastructure which help in growing and

expanding the business internationally.

With strong and advanced technology, the company can attain ample of benefits both

externally and internally as well.

Both external and internal advantages enjoyed by POSB bank derived from advanced and

innovative technological infrastructure rendered in Singapore (Koh &Tan, 2014).

Threats

Advanced technology becomes a major threat for the employees and company in the

country because it needs huge investment and resources.

Legal factors: POSB bank is in a highly and effectively regulated and governed sector. There

are various rules, standards and legislations that need to be followed by the company while

performing and functioning in the country. It is elucidated that Singaporean government has

various business regulations and laws which aim to protecting and saving the rights and interests

of the leaders in the banking sector (Studytigger, 2018).

Opportunities

Rapid and constant growth in the economy helps in gaining various competitive

advantages in the international market.

In today’s era, the Singaporean government is likely to maximize the level if litigation

and regulations to both the financial and public sectors.

By planning and organizing the field of operation beyond the boundaries of the nations,

POSB bank wants to explore business internationally.

POSB bank has to adhere to standards, rules and legislations set by the MAS(Monetary

authority of Singapore) and they do not have the free would to act on their own harmony.

That means the bank cannot work on specific criteria which can influence the economy in

a bad way, this is significant way to protect the interest of the economy.

Threat

Sometimes, the company is unable to follow and understand the rules, legislations and

norms which are made by the Singaporean government.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic marketing management

Constantly changing rules and regulations are another threat for the firm.

Environmental factors: It has been found from the various studies that the activities and

operations in the banking industry have relatively the lowest adverse impact on the natural

environment and culture (Kauškale and Geipele, 2017). However, as a big institution that is

ethically needed to promote and improve environmental responsibility within the society where it

is functioning and operating. POSB bank conducts green initiatives or steps in their offices to

promote its workers to save energy and recycle used materials. Various programs and sessions

are being held by the company to reduce and prevent the environment related issues and

challenges (Studytigger, 2018).

Opportunities

POSB bank with proper and adequate corporate responsibility and ethics will care about

their environment. It further helps in making a dynamic and strong brand image in the

minds of the customers.

Threats

Recently, Singapore is under a serious and bad issue of environmental pollution due to

industrialization which is undergoing. The country mangrove forest is under a wide threat

as 30% of it has been depleted.

Weather, climate change and pollution are another biggest threat for POSB bank in the

Singapore.

There is a lack of water resources; the country is dependent on Malaysian supplied water

which is a major issue in the country.

It can be stated that pestle analysis is one of the biggest tools that is used by POSB bank to

analyze and identify the risks, challenges and threats of the market in the Singapore. It is further

analyzed that the bank needs to focus on these issues and threats to overcome the competitors

globally (Studytigger, 2018).

7

Constantly changing rules and regulations are another threat for the firm.

Environmental factors: It has been found from the various studies that the activities and

operations in the banking industry have relatively the lowest adverse impact on the natural

environment and culture (Kauškale and Geipele, 2017). However, as a big institution that is

ethically needed to promote and improve environmental responsibility within the society where it

is functioning and operating. POSB bank conducts green initiatives or steps in their offices to

promote its workers to save energy and recycle used materials. Various programs and sessions

are being held by the company to reduce and prevent the environment related issues and

challenges (Studytigger, 2018).

Opportunities

POSB bank with proper and adequate corporate responsibility and ethics will care about

their environment. It further helps in making a dynamic and strong brand image in the

minds of the customers.

Threats

Recently, Singapore is under a serious and bad issue of environmental pollution due to

industrialization which is undergoing. The country mangrove forest is under a wide threat

as 30% of it has been depleted.

Weather, climate change and pollution are another biggest threat for POSB bank in the

Singapore.

There is a lack of water resources; the country is dependent on Malaysian supplied water

which is a major issue in the country.

It can be stated that pestle analysis is one of the biggest tools that is used by POSB bank to

analyze and identify the risks, challenges and threats of the market in the Singapore. It is further

analyzed that the bank needs to focus on these issues and threats to overcome the competitors

globally (Studytigger, 2018).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic marketing management

Competitor analysis

It is stated that competitors may affect the growth and targets of POSB bank adversely.

The competitors of the firm include HSBC, standard charted bank, and Chinese banking

corporation limited.

A. Identify one competitor, compare to firm

One of the major and biggest competitors for POSB is HSBC. It is noted that HSBC

holding plc is a British multinational financial and banking services holding company that may

affect the sustainability and growth of POSB internationally. If POSB wants to grow and survive

business globally then it needs to focus on the strengths, policies, approaches and strategies of

the competitors. POSB further needs to keep an eye on the products and services that are being

rendered by the competitive company globally. They must differentiate the products and services

from the rivals to beat the competitors. It is stated that POSB is a Singaporean whereas HSBC is

situated in United Kingdom (Lovelock and Patterson, 2015). It has been portrayed that POSB

bank can take ample of growth opportunities while expanding and exploring the business

activities and actions in developing countries such as Indian as compared to HSBC. On the other

hand, retail banking in HSBC bank is in the context of POSB bank. There is high and stiff

competition in both the banks that could directly put various impact on the returns, profitability

and efficiency of the workers (Belkhir, 2009).

B.Current and future objectives

The current and future objectives of POSB bank have been discussed below.

Current objectives

To provide innovative and excellent services to the customers and clients as well.

To maintain price stability

To reduce social gaps for maximizing profitability and returns

Future objectives

To help the stability of the strong and unique financial system

To be a leader in the banking industry

8

Competitor analysis

It is stated that competitors may affect the growth and targets of POSB bank adversely.

The competitors of the firm include HSBC, standard charted bank, and Chinese banking

corporation limited.

A. Identify one competitor, compare to firm

One of the major and biggest competitors for POSB is HSBC. It is noted that HSBC

holding plc is a British multinational financial and banking services holding company that may

affect the sustainability and growth of POSB internationally. If POSB wants to grow and survive

business globally then it needs to focus on the strengths, policies, approaches and strategies of

the competitors. POSB further needs to keep an eye on the products and services that are being

rendered by the competitive company globally. They must differentiate the products and services

from the rivals to beat the competitors. It is stated that POSB is a Singaporean whereas HSBC is

situated in United Kingdom (Lovelock and Patterson, 2015). It has been portrayed that POSB

bank can take ample of growth opportunities while expanding and exploring the business

activities and actions in developing countries such as Indian as compared to HSBC. On the other

hand, retail banking in HSBC bank is in the context of POSB bank. There is high and stiff

competition in both the banks that could directly put various impact on the returns, profitability

and efficiency of the workers (Belkhir, 2009).

B.Current and future objectives

The current and future objectives of POSB bank have been discussed below.

Current objectives

To provide innovative and excellent services to the customers and clients as well.

To maintain price stability

To reduce social gaps for maximizing profitability and returns

Future objectives

To help the stability of the strong and unique financial system

To be a leader in the banking industry

8

Strategic marketing management

To fulfill the needs and expectations of the customers related to money

C.Current strategies

After the various studies, it is reveals that POSB bank uses tremendous strategies to explore the

business activities globally (Singleton and Verhoef, 2010). Some of the strategies that are being

used by the company have been detailed below.

Community marketing strategy: Bank ranges in capabilities and size. POSB bank may have

thousands of branches across the globe. Regardless of the size and nature of the bank, POSB

needs to tailor local or domestic marketing strategies to serve the society in the global market.

The consumer bank is a place where they feel comfortable, secure and happy that means banking

executives and managers who speak in English as well as any prominent language in the society

to provide various services to the customers around the globe (Leonard, 2018).

Premium services strategy: It is stated that POSB bank uses currently premium services

strategy. The premium services are created to attract high net worth in the competitive market.

Service is better for this bank to understand and focus on the findings the best solutions to fit

complete financial scenario (Leonard, 2018).

Social media strategy: It is stated that POSB bank uses social media strategy to promote and

improve the services in the global market. The company uses this strategy to attract and retain

majority of people in the market towards the services (Synthesion, 2017). The bank uses social

media strategy to communicate with clients, launch new products and build credibility in the

global market (Nayak, 2012).

D.Compeitior resource profile

It is observed that HSBC uses ample of resources including derivatives, human resources,

financial resources, risk management, survey reports, economic resources, benchmarking

programs, liquidity toolbox, ABA communication guide, data breach communication kit,

insurance sales, wealth management, compliance.

E.Competitior future strategies

The company will uses innovative strategies to gain competitive benefits and to serve

effectively to the customers around the globe. The company will constantly use the digital

9

To fulfill the needs and expectations of the customers related to money

C.Current strategies

After the various studies, it is reveals that POSB bank uses tremendous strategies to explore the

business activities globally (Singleton and Verhoef, 2010). Some of the strategies that are being

used by the company have been detailed below.

Community marketing strategy: Bank ranges in capabilities and size. POSB bank may have

thousands of branches across the globe. Regardless of the size and nature of the bank, POSB

needs to tailor local or domestic marketing strategies to serve the society in the global market.

The consumer bank is a place where they feel comfortable, secure and happy that means banking

executives and managers who speak in English as well as any prominent language in the society

to provide various services to the customers around the globe (Leonard, 2018).

Premium services strategy: It is stated that POSB bank uses currently premium services

strategy. The premium services are created to attract high net worth in the competitive market.

Service is better for this bank to understand and focus on the findings the best solutions to fit

complete financial scenario (Leonard, 2018).

Social media strategy: It is stated that POSB bank uses social media strategy to promote and

improve the services in the global market. The company uses this strategy to attract and retain

majority of people in the market towards the services (Synthesion, 2017). The bank uses social

media strategy to communicate with clients, launch new products and build credibility in the

global market (Nayak, 2012).

D.Compeitior resource profile

It is observed that HSBC uses ample of resources including derivatives, human resources,

financial resources, risk management, survey reports, economic resources, benchmarking

programs, liquidity toolbox, ABA communication guide, data breach communication kit,

insurance sales, wealth management, compliance.

E.Competitior future strategies

The company will uses innovative strategies to gain competitive benefits and to serve

effectively to the customers around the globe. The company will constantly use the digital

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Strategic marketing management

strategy to protect the business in the international market (Thefinancialbrand, 2018). It is a

mandatory strategy that would be initiated by the firm in near future. It is emphasizes that that

digital strategy will not only be safer, but also better equipped to leverage innovative and unique

technologies to accomplish the desired goals and objectives. Along with this, HSBC will use

corporate level and business level strategies to stand over the rivals in the marketplace. It will

further help in increasing and boosting revenue and returns in the competitive market

(Thefinancialbrand, 2018).

Firm analysis

After the various studies, it has been found that POSB bank identifies and analyzes its

strengths and weaknesses to cope up with competitors globally (Brunnermeier, Crockett,

Goodhart, Persaud and Shin, 2009). The strengths and weaknesses of POSB banks are drawn

below.

Strengths

Strong and unique position in Singapore market.

The bank offers diversify and unique products and services to the customers across the

globe. It is one of the effective and unique strengths for POSB.

Close to 20,000 workers work for DBS bank.

Divided yield is remarkably high as compared to the other banks.

Weaknesses

There is high and stiff competition in the market.

Major chunk of the revenue comes from consumer banking, asset management, treasury

and less revenue may come from the other offerings.

Low penetration in the Americas and Europe.

Marketing strategies development

There are several strategies used by the bank to identify and analyze the threats and

challenges of the market. TOWS is one of the fundamental strategies that initiated by POSB that

has been discussed below.

10

strategy to protect the business in the international market (Thefinancialbrand, 2018). It is a

mandatory strategy that would be initiated by the firm in near future. It is emphasizes that that

digital strategy will not only be safer, but also better equipped to leverage innovative and unique

technologies to accomplish the desired goals and objectives. Along with this, HSBC will use

corporate level and business level strategies to stand over the rivals in the marketplace. It will

further help in increasing and boosting revenue and returns in the competitive market

(Thefinancialbrand, 2018).

Firm analysis

After the various studies, it has been found that POSB bank identifies and analyzes its

strengths and weaknesses to cope up with competitors globally (Brunnermeier, Crockett,

Goodhart, Persaud and Shin, 2009). The strengths and weaknesses of POSB banks are drawn

below.

Strengths

Strong and unique position in Singapore market.

The bank offers diversify and unique products and services to the customers across the

globe. It is one of the effective and unique strengths for POSB.

Close to 20,000 workers work for DBS bank.

Divided yield is remarkably high as compared to the other banks.

Weaknesses

There is high and stiff competition in the market.

Major chunk of the revenue comes from consumer banking, asset management, treasury

and less revenue may come from the other offerings.

Low penetration in the Americas and Europe.

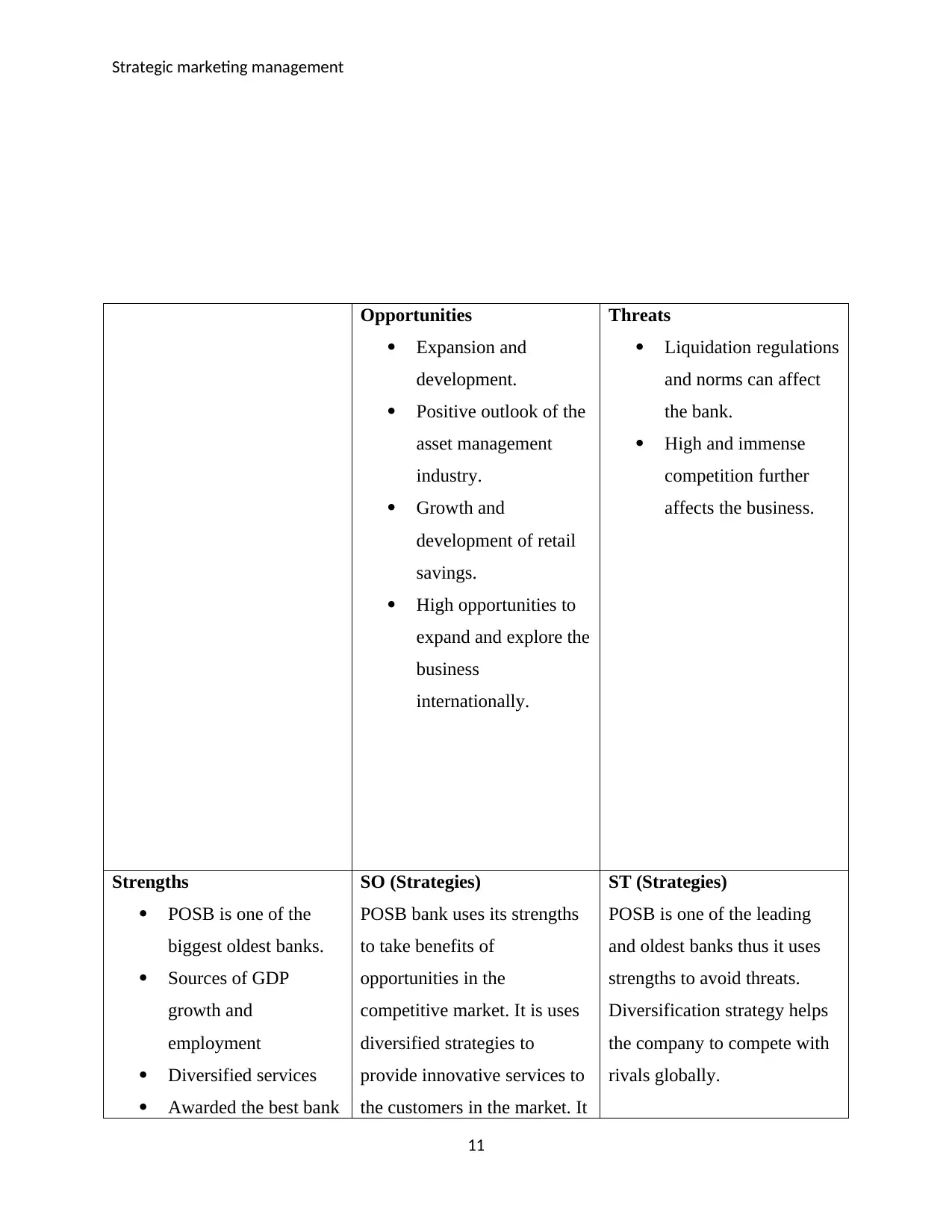

Marketing strategies development

There are several strategies used by the bank to identify and analyze the threats and

challenges of the market. TOWS is one of the fundamental strategies that initiated by POSB that

has been discussed below.

10

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategic marketing management

Opportunities

Expansion and

development.

Positive outlook of the

asset management

industry.

Growth and

development of retail

savings.

High opportunities to

expand and explore the

business

internationally.

Threats

Liquidation regulations

and norms can affect

the bank.

High and immense

competition further

affects the business.

Strengths

POSB is one of the

biggest oldest banks.

Sources of GDP

growth and

employment

Diversified services

Awarded the best bank

SO (Strategies)

POSB bank uses its strengths

to take benefits of

opportunities in the

competitive market. It is uses

diversified strategies to

provide innovative services to

the customers in the market. It

ST (Strategies)

POSB is one of the leading

and oldest banks thus it uses

strengths to avoid threats.

Diversification strategy helps

the company to compete with

rivals globally.

11

Opportunities

Expansion and

development.

Positive outlook of the

asset management

industry.

Growth and

development of retail

savings.

High opportunities to

expand and explore the

business

internationally.

Threats

Liquidation regulations

and norms can affect

the bank.

High and immense

competition further

affects the business.

Strengths

POSB is one of the

biggest oldest banks.

Sources of GDP

growth and

employment

Diversified services

Awarded the best bank

SO (Strategies)

POSB bank uses its strengths

to take benefits of

opportunities in the

competitive market. It is uses

diversified strategies to

provide innovative services to

the customers in the market. It

ST (Strategies)

POSB is one of the leading

and oldest banks thus it uses

strengths to avoid threats.

Diversification strategy helps

the company to compete with

rivals globally.

11

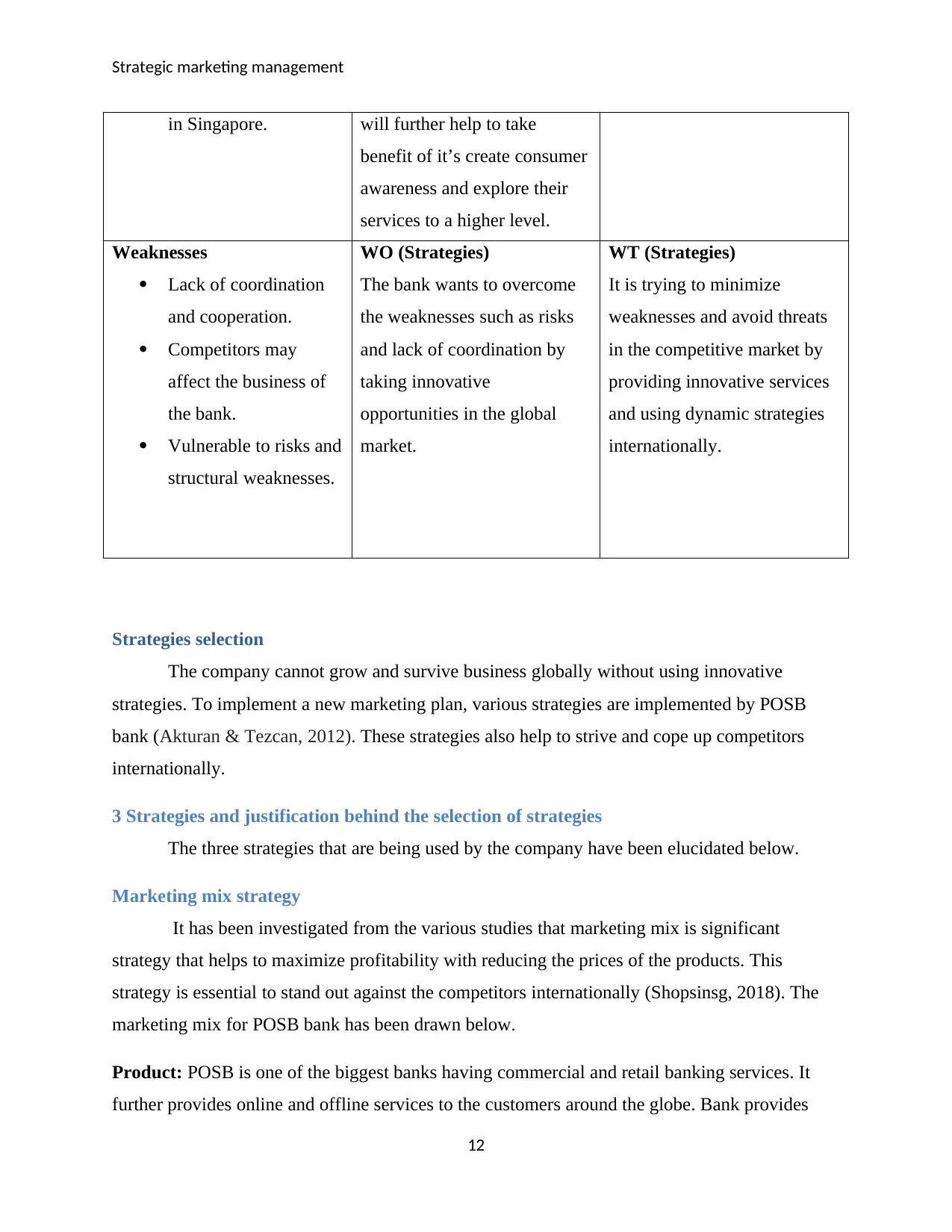

Strategic marketing management

in Singapore. will further help to take

benefit of it’s create consumer

awareness and explore their

services to a higher level.

Weaknesses

Lack of coordination

and cooperation.

Competitors may

affect the business of

the bank.

Vulnerable to risks and

structural weaknesses.

WO (Strategies)

The bank wants to overcome

the weaknesses such as risks

and lack of coordination by

taking innovative

opportunities in the global

market.

WT (Strategies)

It is trying to minimize

weaknesses and avoid threats

in the competitive market by

providing innovative services

and using dynamic strategies

internationally.

Strategies selection

The company cannot grow and survive business globally without using innovative

strategies. To implement a new marketing plan, various strategies are implemented by POSB

bank (Akturan & Tezcan, 2012). These strategies also help to strive and cope up competitors

internationally.

3 Strategies and justification behind the selection of strategies

The three strategies that are being used by the company have been elucidated below.

Marketing mix strategy

It has been investigated from the various studies that marketing mix is significant

strategy that helps to maximize profitability with reducing the prices of the products. This

strategy is essential to stand out against the competitors internationally (Shopsinsg, 2018). The

marketing mix for POSB bank has been drawn below.

Product: POSB is one of the biggest banks having commercial and retail banking services. It

further provides online and offline services to the customers around the globe. Bank provides

12

in Singapore. will further help to take

benefit of it’s create consumer

awareness and explore their

services to a higher level.

Weaknesses

Lack of coordination

and cooperation.

Competitors may

affect the business of

the bank.

Vulnerable to risks and

structural weaknesses.

WO (Strategies)

The bank wants to overcome

the weaknesses such as risks

and lack of coordination by

taking innovative

opportunities in the global

market.

WT (Strategies)

It is trying to minimize

weaknesses and avoid threats

in the competitive market by

providing innovative services

and using dynamic strategies

internationally.

Strategies selection

The company cannot grow and survive business globally without using innovative

strategies. To implement a new marketing plan, various strategies are implemented by POSB

bank (Akturan & Tezcan, 2012). These strategies also help to strive and cope up competitors

internationally.

3 Strategies and justification behind the selection of strategies

The three strategies that are being used by the company have been elucidated below.

Marketing mix strategy

It has been investigated from the various studies that marketing mix is significant

strategy that helps to maximize profitability with reducing the prices of the products. This

strategy is essential to stand out against the competitors internationally (Shopsinsg, 2018). The

marketing mix for POSB bank has been drawn below.

Product: POSB is one of the biggest banks having commercial and retail banking services. It

further provides online and offline services to the customers around the globe. Bank provides

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.