FIN 601 - Principles of Finance: Financial Analysis of GlaxoSmithKline

VerifiedAdded on 2022/09/01

|21

|3499

|17

Report

AI Summary

This report provides a comprehensive financial analysis of GlaxoSmithKline (GSK), a major multinational pharmaceutical company. It utilizes ratio analysis, including gross profit margin, net profit margin, current ratio, quick ratio, inventory turnover, accounts receivable turnover, and debt-to-equity ratio, to evaluate GSK's performance over a four-year period (2015-2018). The report compares GSK's financial health with its competitor AstraZeneca (AZN), highlighting key differences in profitability, liquidity, and debt management. Furthermore, trend analysis is employed to assess revenue, cost of sales, operating income, and net profit trends. The analysis reveals GSK's strengths and weaknesses, offering an investor's perspective and concluding with recommendations to enhance future financial performance, such as improving liquidity and managing debt. The report also acknowledges the limitations of ratio and trend analysis, considering factors like inflation and the aggregation of financial data.

Running head: PRINCIPLES OF FINANCE

Principles of Finance

Name of the Student

Name of the University

Author’s Note

Principles of Finance

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1PRINCIPLES OF FINANCE

Table of Contents

Section A.........................................................................................................................................2

Introduction..................................................................................................................................3

Company Introduction and Overview of Financial Performance and Position...........................3

Ratio Analysis..............................................................................................................................4

i) Comparison of Financial Performance over the Past Four Years............................................4

ii) Comparison with the Competitor............................................................................................7

Trend Analysis...........................................................................................................................10

Comment on Business from Investors’ Perspective..................................................................11

Conclusion and Recommendation to Enhance Financial Performance in Future.....................12

Limitation of Analysis and Any Reservation............................................................................13

Conclusion.................................................................................................................................13

Section B........................................................................................................................................15

Problem 2...................................................................................................................................15

References......................................................................................................................................16

Appendix........................................................................................................................................18

Table of Contents

Section A.........................................................................................................................................2

Introduction..................................................................................................................................3

Company Introduction and Overview of Financial Performance and Position...........................3

Ratio Analysis..............................................................................................................................4

i) Comparison of Financial Performance over the Past Four Years............................................4

ii) Comparison with the Competitor............................................................................................7

Trend Analysis...........................................................................................................................10

Comment on Business from Investors’ Perspective..................................................................11

Conclusion and Recommendation to Enhance Financial Performance in Future.....................12

Limitation of Analysis and Any Reservation............................................................................13

Conclusion.................................................................................................................................13

Section B........................................................................................................................................15

Problem 2...................................................................................................................................15

References......................................................................................................................................16

Appendix........................................................................................................................................18

2PRINCIPLES OF FINANCE

Section A

Executive Summary

Investors all over the world adopt different method, techniques and tools for analyzing the

financial statements of the business organizations so that they can assess the financial

performance and position of the firms. This helps in making investment decisions. This report

involves in applying ratio analysis and trend analysis for measuring the financial performance of

GlaxoSmithKline Plc. Findings of the report show that the company is a well-performing

company that is suitable for investing in.

Section A

Executive Summary

Investors all over the world adopt different method, techniques and tools for analyzing the

financial statements of the business organizations so that they can assess the financial

performance and position of the firms. This helps in making investment decisions. This report

involves in applying ratio analysis and trend analysis for measuring the financial performance of

GlaxoSmithKline Plc. Findings of the report show that the company is a well-performing

company that is suitable for investing in.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3PRINCIPLES OF FINANCE

Introduction

Assessment of the financial performance of the business organizations is a key technique

for analyzing the financial performance and financial position of those companies. Under this

technique, the key financial statements of the firms along with the notes to the financial

statements are taken into account by the investors and other stakeholders for the purpose of

analysis. Some major methods under this are the analysis of ratios, analysis of trends and others

since these methods help in assessing and comparing the companies’ performance with other

competitors and different timeline of the same companies. The aim of this report is the analysis

of the financial performance and position of GlaxoSmithKline Plc (GSK) through the analysis of

relevant ratios and trends. This also compared the financial performance of GSK with one of its

main competitors named AstraZeneca (AZN).

Company Introduction and Overview of Financial Performance and Position

GSK is one of the major multinational pharmaceutical companies of Britain that is

headquartered in Brentford, London. GSK operates in the pharmaceutical biotechnology

consumer goods industry; and the main products of the company are pharmaceuticals, vaccines,

nutritional products, oral healthcare and over the counter medicines. GSK is known as a science-

led global healthcare corporation with the purpose of helping people to do more, feel better and

live longer (gsk.com 2020).

GSK has performed well in terms of revenue as it has continuously increased from 2015

to 2018. Both operating profit and profit after taxation has decreased from 2015 to 2016; but

these have continuously increased from 2016 to 2018. EPS has improved from 2016 to 2018.

Major improvements can be seen in return on capital employed from 2016 to 2018. Total assets

Introduction

Assessment of the financial performance of the business organizations is a key technique

for analyzing the financial performance and financial position of those companies. Under this

technique, the key financial statements of the firms along with the notes to the financial

statements are taken into account by the investors and other stakeholders for the purpose of

analysis. Some major methods under this are the analysis of ratios, analysis of trends and others

since these methods help in assessing and comparing the companies’ performance with other

competitors and different timeline of the same companies. The aim of this report is the analysis

of the financial performance and position of GlaxoSmithKline Plc (GSK) through the analysis of

relevant ratios and trends. This also compared the financial performance of GSK with one of its

main competitors named AstraZeneca (AZN).

Company Introduction and Overview of Financial Performance and Position

GSK is one of the major multinational pharmaceutical companies of Britain that is

headquartered in Brentford, London. GSK operates in the pharmaceutical biotechnology

consumer goods industry; and the main products of the company are pharmaceuticals, vaccines,

nutritional products, oral healthcare and over the counter medicines. GSK is known as a science-

led global healthcare corporation with the purpose of helping people to do more, feel better and

live longer (gsk.com 2020).

GSK has performed well in terms of revenue as it has continuously increased from 2015

to 2018. Both operating profit and profit after taxation has decreased from 2015 to 2016; but

these have continuously increased from 2016 to 2018. EPS has improved from 2016 to 2018.

Major improvements can be seen in return on capital employed from 2016 to 2018. Total assets

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4PRINCIPLES OF FINANCE

have increased from 2015 to 2016, the decreased in 2017 and finally increased in 2018. Total

liabilities have increased from 2015 to 2018. Total equity has decreased from 2015 to 2018

(gsk.com 2020).

Ratio Analysis

i) Comparison of Financial Performance over the Past Four Years

2018 2017 2016 2015 2018

66.77% 65.74% 66.69% 62.99%

13.13%

7.19% 3.81%

35.00%

Profitability Ratios

Gross Profit Margin Net Profit Margin

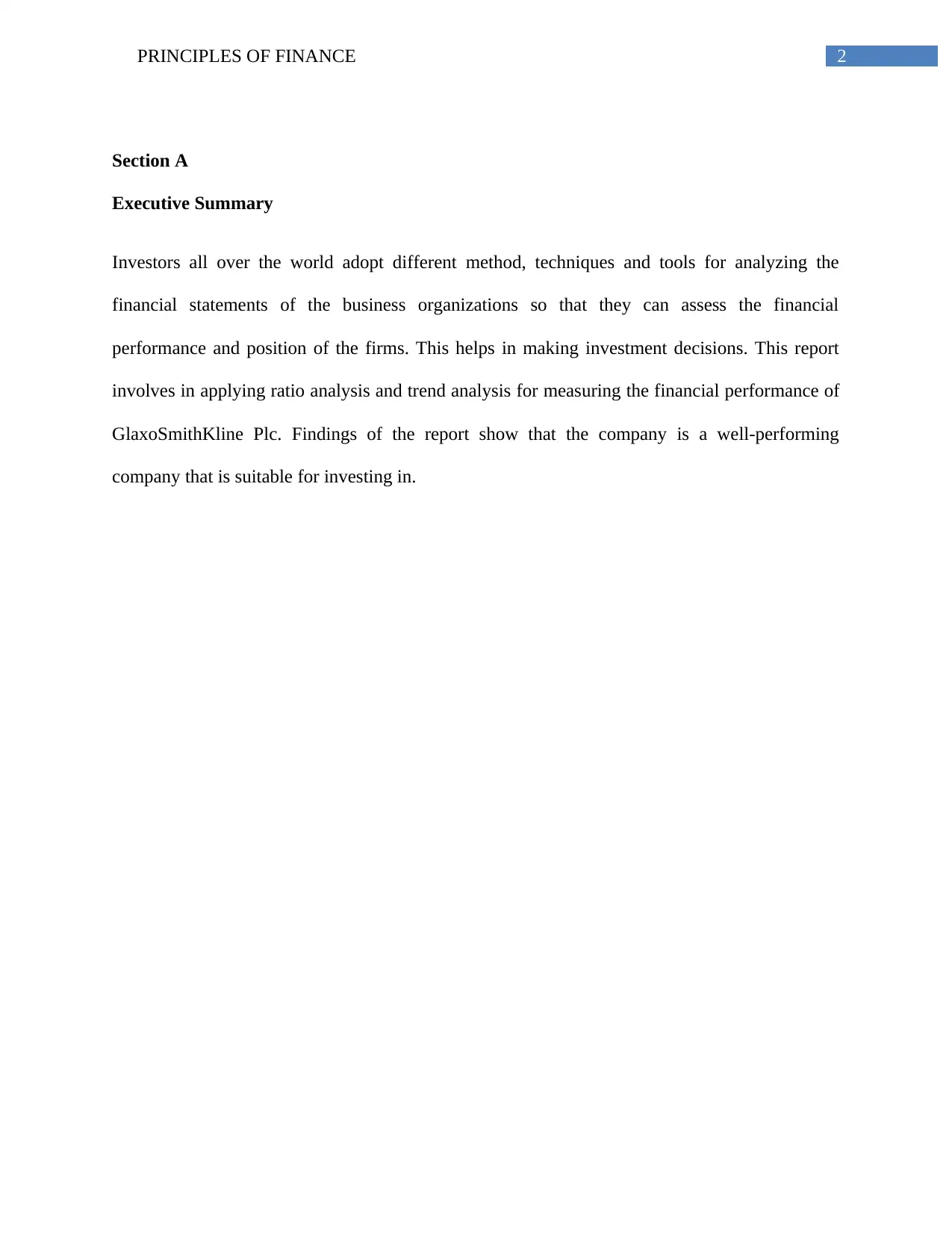

Gross profit margin of GSK has continuously increased from 2015 to 2016. This is a sign

of improvement for the company. However, net profit margin of GSK had a massive fall from

2015 to 2016; and this keeps improving from 2016 to 2018 in a slow pace (Innocent, Mary and

Matthew 2013).

have increased from 2015 to 2016, the decreased in 2017 and finally increased in 2018. Total

liabilities have increased from 2015 to 2018. Total equity has decreased from 2015 to 2018

(gsk.com 2020).

Ratio Analysis

i) Comparison of Financial Performance over the Past Four Years

2018 2017 2016 2015 2018

66.77% 65.74% 66.69% 62.99%

13.13%

7.19% 3.81%

35.00%

Profitability Ratios

Gross Profit Margin Net Profit Margin

Gross profit margin of GSK has continuously increased from 2015 to 2016. This is a sign

of improvement for the company. However, net profit margin of GSK had a massive fall from

2015 to 2016; and this keeps improving from 2016 to 2018 in a slow pace (Innocent, Mary and

Matthew 2013).

5PRINCIPLES OF FINANCE

2018 2017 2016 2015

0.75

0.60

0.88

1.24

0.51

0.39

0.61

0.88

Liquidity Ratios

Current Ratio Quick Ratio

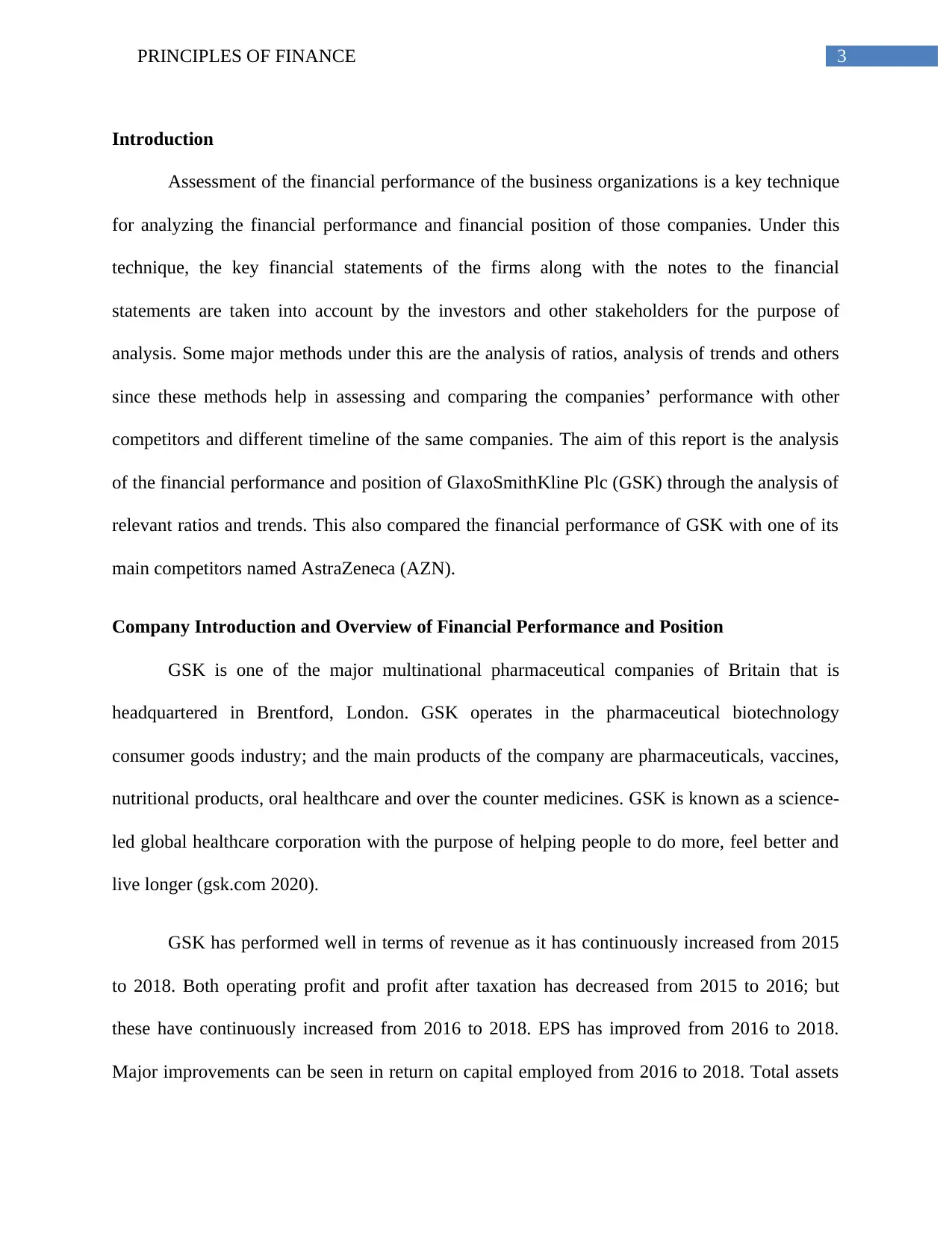

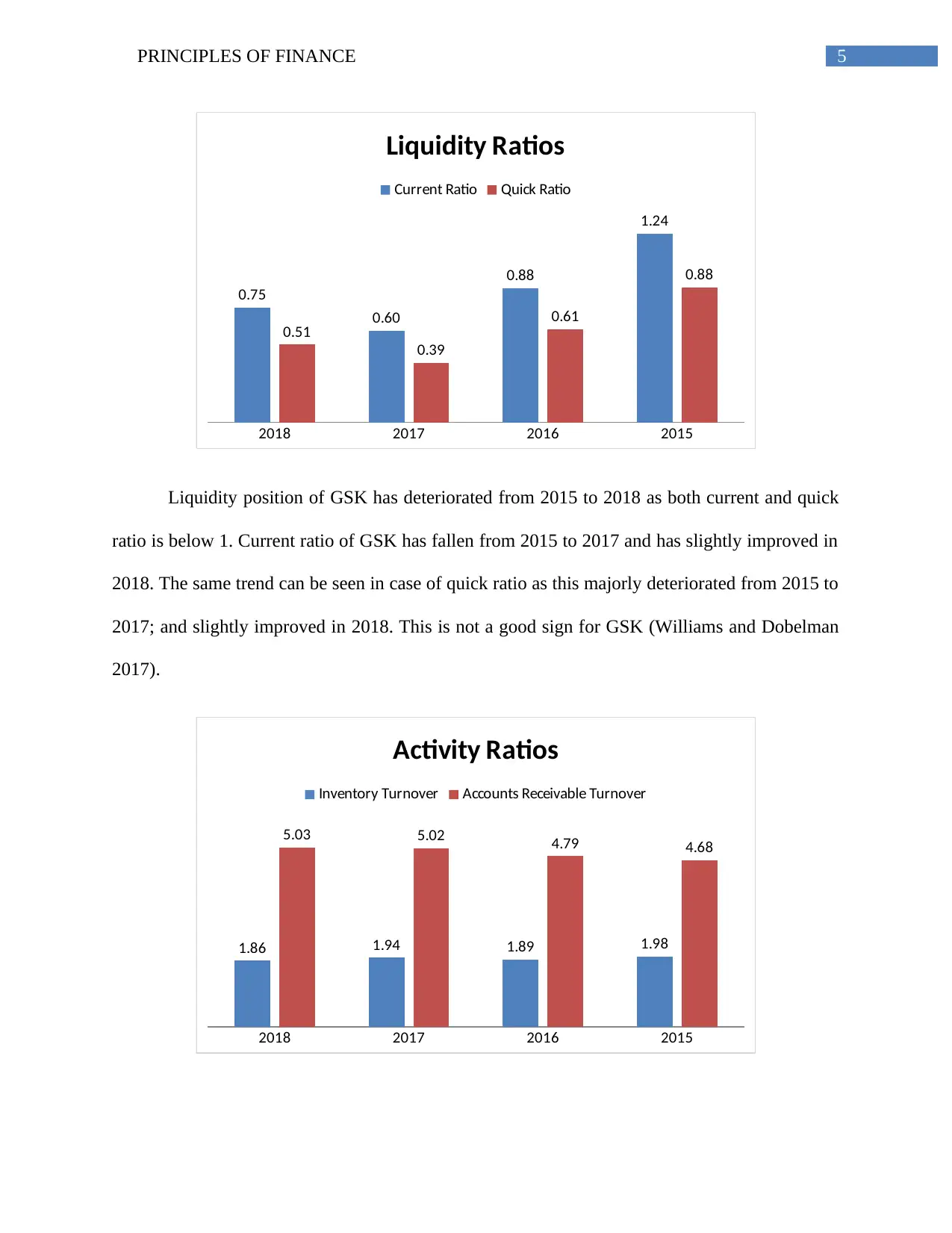

Liquidity position of GSK has deteriorated from 2015 to 2018 as both current and quick

ratio is below 1. Current ratio of GSK has fallen from 2015 to 2017 and has slightly improved in

2018. The same trend can be seen in case of quick ratio as this majorly deteriorated from 2015 to

2017; and slightly improved in 2018. This is not a good sign for GSK (Williams and Dobelman

2017).

2018 2017 2016 2015

1.86 1.94 1.89 1.98

5.03 5.02 4.79 4.68

Activity Ratios

Inventory Turnover Accounts Receivable Turnover

2018 2017 2016 2015

0.75

0.60

0.88

1.24

0.51

0.39

0.61

0.88

Liquidity Ratios

Current Ratio Quick Ratio

Liquidity position of GSK has deteriorated from 2015 to 2018 as both current and quick

ratio is below 1. Current ratio of GSK has fallen from 2015 to 2017 and has slightly improved in

2018. The same trend can be seen in case of quick ratio as this majorly deteriorated from 2015 to

2017; and slightly improved in 2018. This is not a good sign for GSK (Williams and Dobelman

2017).

2018 2017 2016 2015

1.86 1.94 1.89 1.98

5.03 5.02 4.79 4.68

Activity Ratios

Inventory Turnover Accounts Receivable Turnover

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6PRINCIPLES OF FINANCE

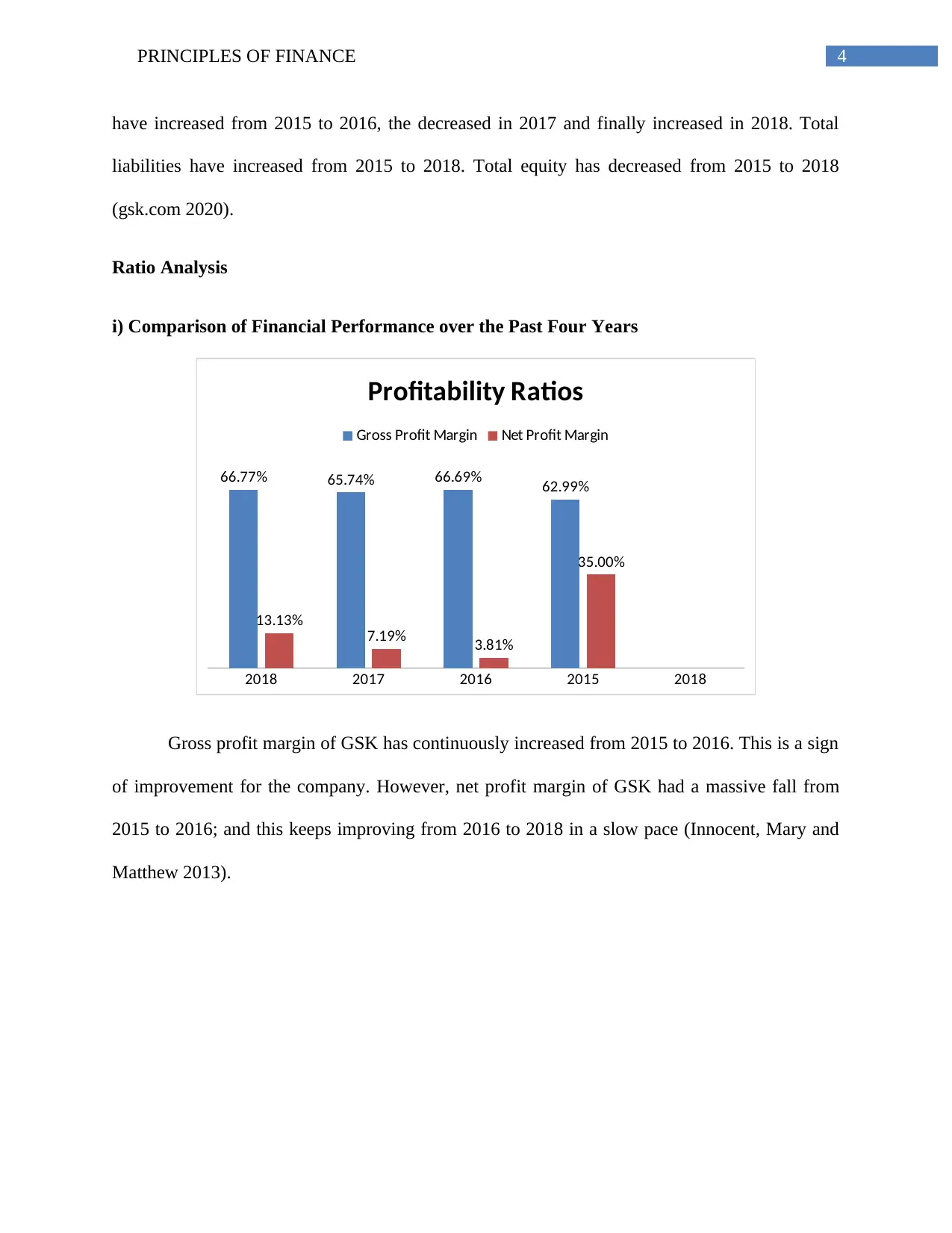

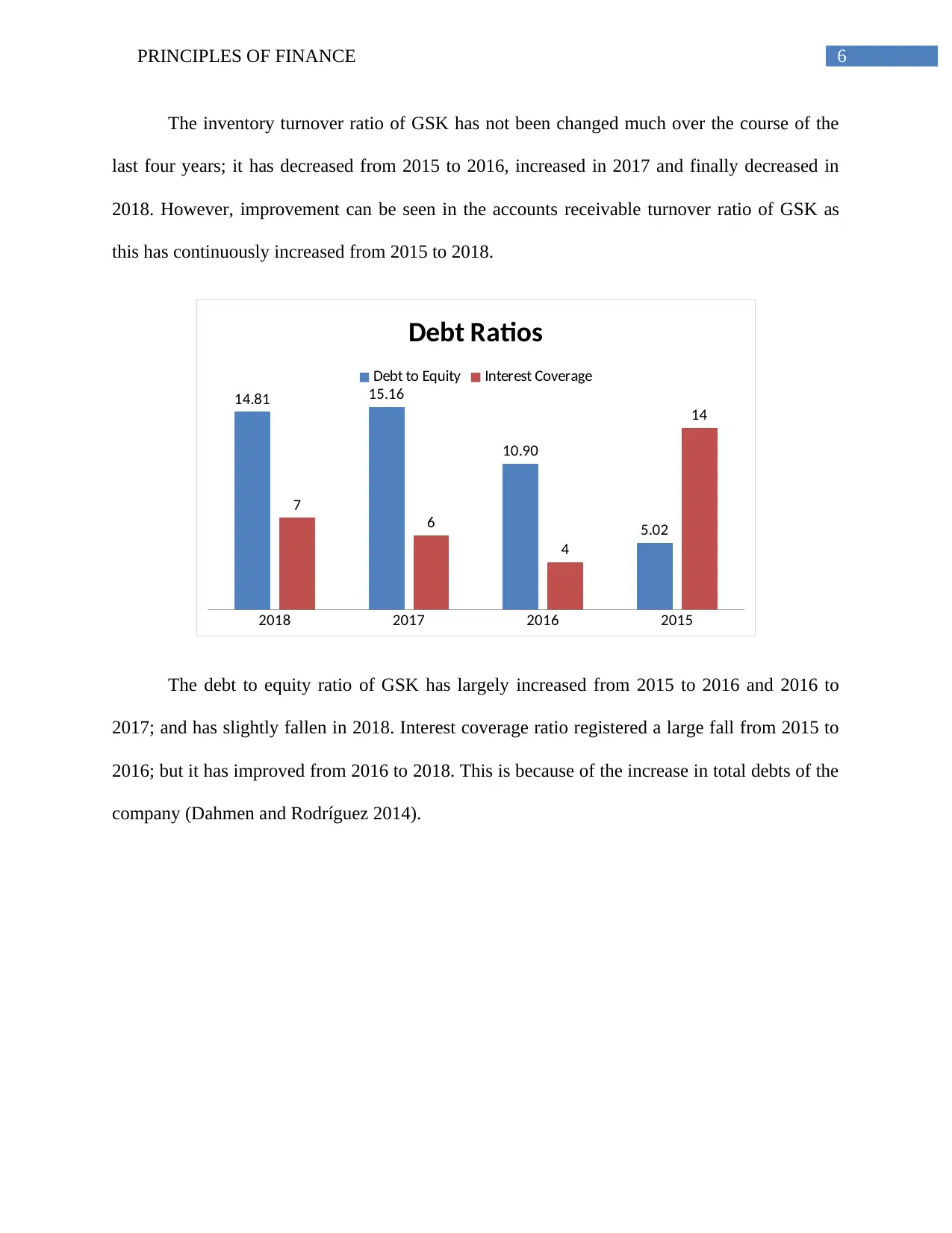

The inventory turnover ratio of GSK has not been changed much over the course of the

last four years; it has decreased from 2015 to 2016, increased in 2017 and finally decreased in

2018. However, improvement can be seen in the accounts receivable turnover ratio of GSK as

this has continuously increased from 2015 to 2018.

2018 2017 2016 2015

14.81 15.16

10.90

5.02

7

6

4

14

Debt Ratios

Debt to Equity Interest Coverage

The debt to equity ratio of GSK has largely increased from 2015 to 2016 and 2016 to

2017; and has slightly fallen in 2018. Interest coverage ratio registered a large fall from 2015 to

2016; but it has improved from 2016 to 2018. This is because of the increase in total debts of the

company (Dahmen and Rodríguez 2014).

The inventory turnover ratio of GSK has not been changed much over the course of the

last four years; it has decreased from 2015 to 2016, increased in 2017 and finally decreased in

2018. However, improvement can be seen in the accounts receivable turnover ratio of GSK as

this has continuously increased from 2015 to 2018.

2018 2017 2016 2015

14.81 15.16

10.90

5.02

7

6

4

14

Debt Ratios

Debt to Equity Interest Coverage

The debt to equity ratio of GSK has largely increased from 2015 to 2016 and 2016 to

2017; and has slightly fallen in 2018. Interest coverage ratio registered a large fall from 2015 to

2016; but it has improved from 2016 to 2018. This is because of the increase in total debts of the

company (Dahmen and Rodríguez 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7PRINCIPLES OF FINANCE

2018 2017 2016 2015

97% 181% 367% 46%

73.7

31.4 18.8

174.3

Market Ratios

Dividend Payout Ratio Earnings Per Share (EPS)

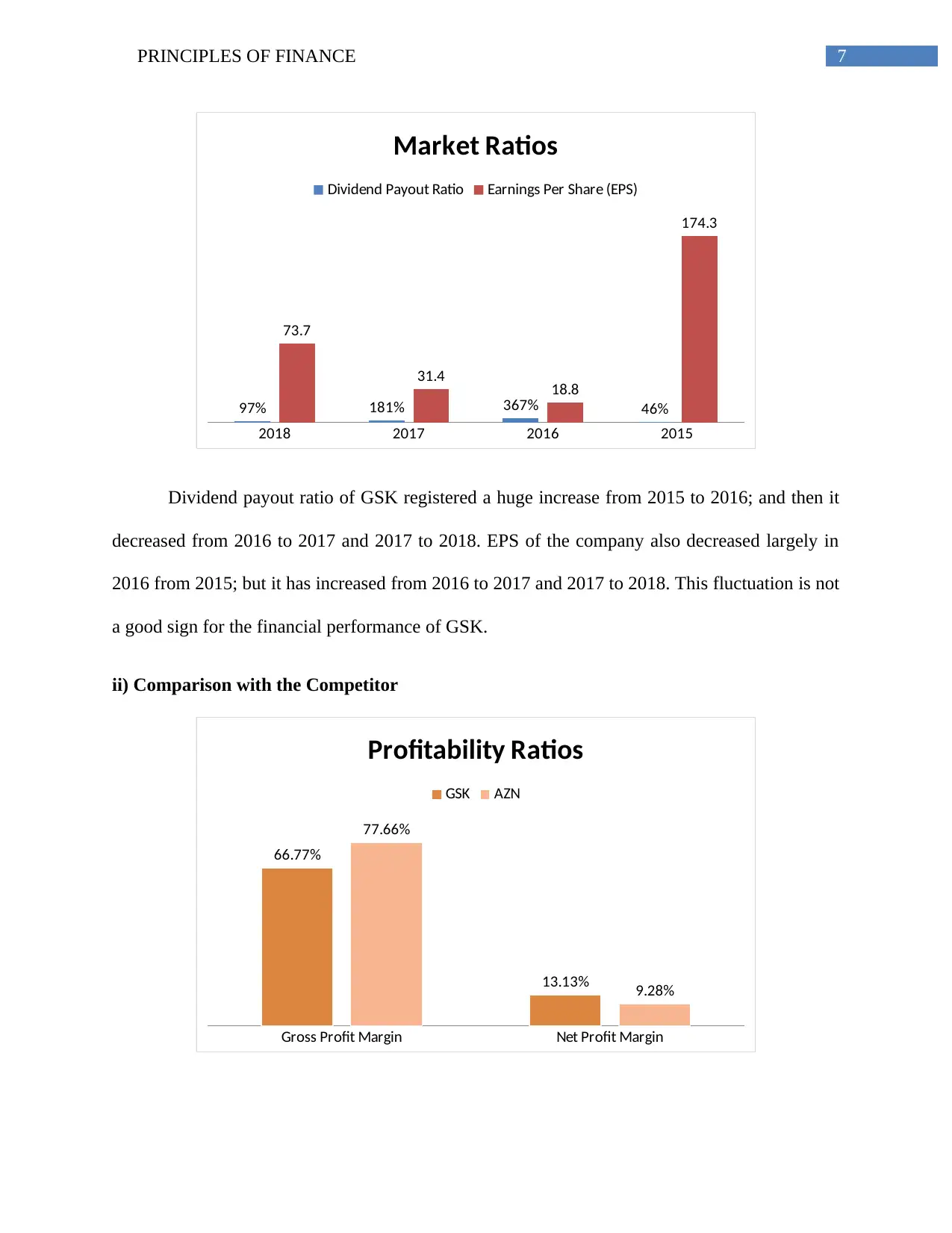

Dividend payout ratio of GSK registered a huge increase from 2015 to 2016; and then it

decreased from 2016 to 2017 and 2017 to 2018. EPS of the company also decreased largely in

2016 from 2015; but it has increased from 2016 to 2017 and 2017 to 2018. This fluctuation is not

a good sign for the financial performance of GSK.

ii) Comparison with the Competitor

Gross Profit Margin Net Profit Margin

66.77%

13.13%

77.66%

9.28%

Profitability Ratios

GSK AZN

2018 2017 2016 2015

97% 181% 367% 46%

73.7

31.4 18.8

174.3

Market Ratios

Dividend Payout Ratio Earnings Per Share (EPS)

Dividend payout ratio of GSK registered a huge increase from 2015 to 2016; and then it

decreased from 2016 to 2017 and 2017 to 2018. EPS of the company also decreased largely in

2016 from 2015; but it has increased from 2016 to 2017 and 2017 to 2018. This fluctuation is not

a good sign for the financial performance of GSK.

ii) Comparison with the Competitor

Gross Profit Margin Net Profit Margin

66.77%

13.13%

77.66%

9.28%

Profitability Ratios

GSK AZN

8PRINCIPLES OF FINANCE

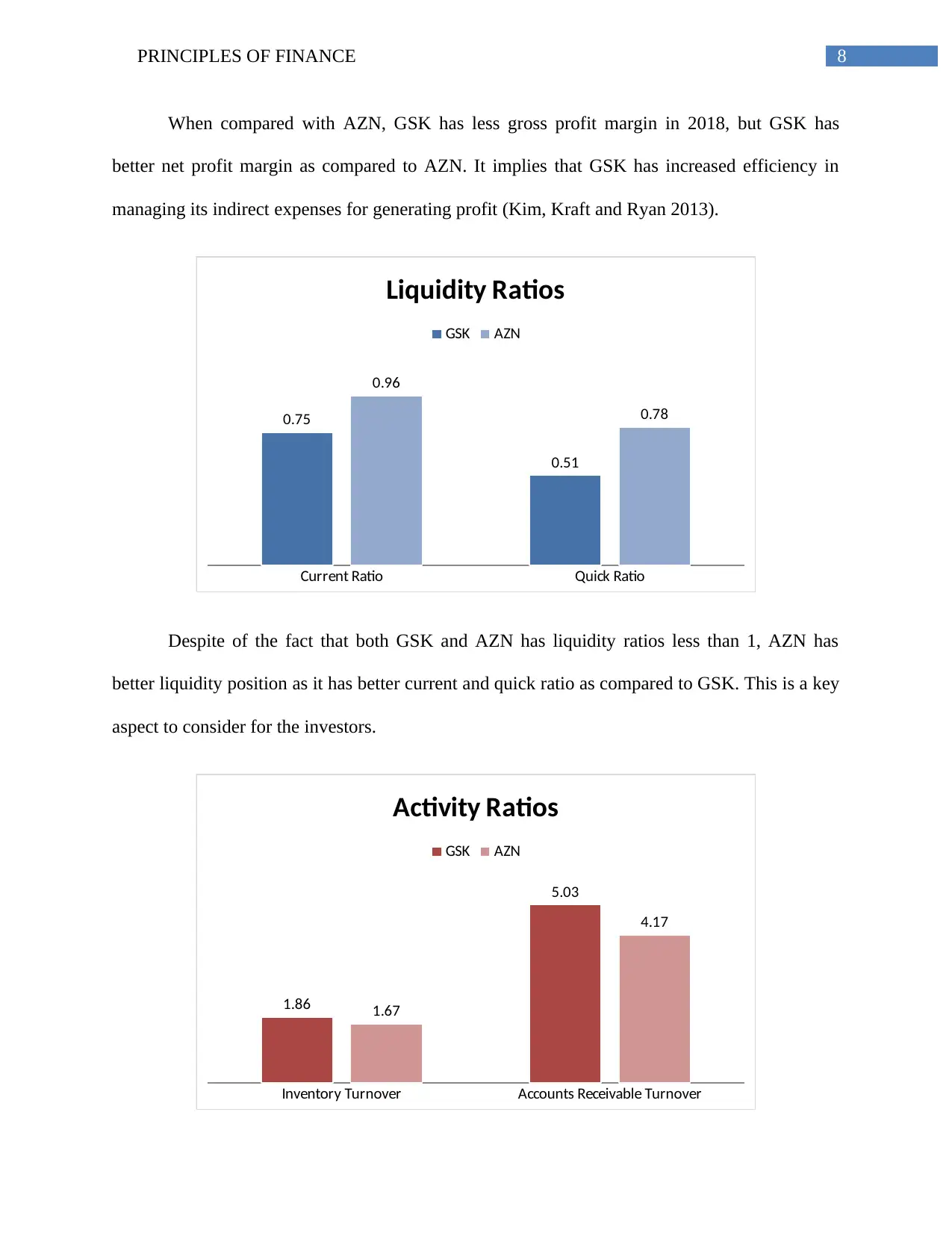

When compared with AZN, GSK has less gross profit margin in 2018, but GSK has

better net profit margin as compared to AZN. It implies that GSK has increased efficiency in

managing its indirect expenses for generating profit (Kim, Kraft and Ryan 2013).

Current Ratio Quick Ratio

0.75

0.51

0.96

0.78

Liquidity Ratios

GSK AZN

Despite of the fact that both GSK and AZN has liquidity ratios less than 1, AZN has

better liquidity position as it has better current and quick ratio as compared to GSK. This is a key

aspect to consider for the investors.

Inventory Turnover Accounts Receivable Turnover

1.86

5.03

1.67

4.17

Activity Ratios

GSK AZN

When compared with AZN, GSK has less gross profit margin in 2018, but GSK has

better net profit margin as compared to AZN. It implies that GSK has increased efficiency in

managing its indirect expenses for generating profit (Kim, Kraft and Ryan 2013).

Current Ratio Quick Ratio

0.75

0.51

0.96

0.78

Liquidity Ratios

GSK AZN

Despite of the fact that both GSK and AZN has liquidity ratios less than 1, AZN has

better liquidity position as it has better current and quick ratio as compared to GSK. This is a key

aspect to consider for the investors.

Inventory Turnover Accounts Receivable Turnover

1.86

5.03

1.67

4.17

Activity Ratios

GSK AZN

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9PRINCIPLES OF FINANCE

GSK has turned over its inventory more time than AZN as the inventory which indicate

efficient management of inventory by GSK as compared to AZN. Since GSK has better accounts

receivable turnover ratio that AZN, this means GSK has been able in collecting the dues from the

debtors more time than AZN (Delen, Kuzey and Uyar 2013).

Debt to Equity Interest Coverage

15

7

3 2

Debt Ratios

GSK AZN

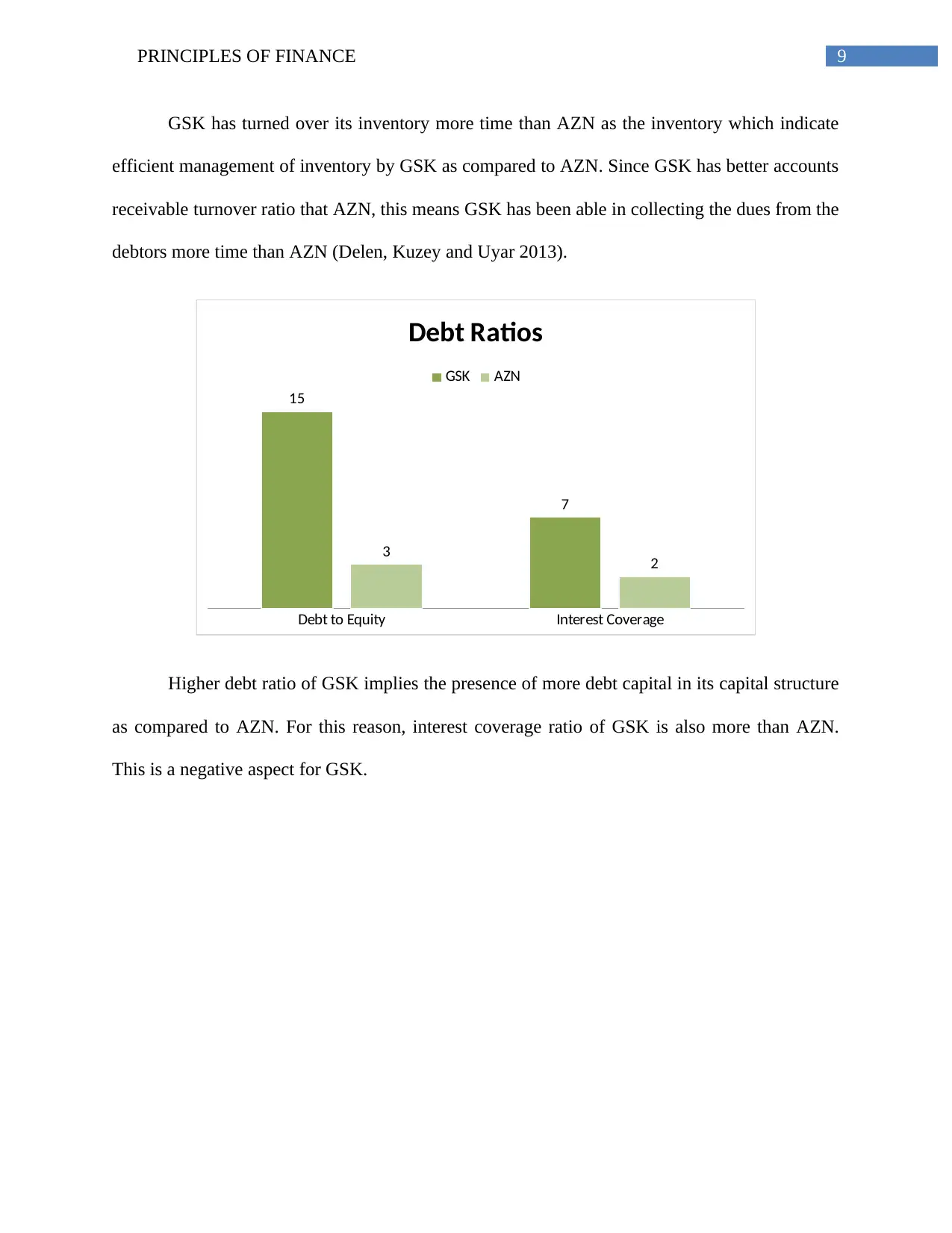

Higher debt ratio of GSK implies the presence of more debt capital in its capital structure

as compared to AZN. For this reason, interest coverage ratio of GSK is also more than AZN.

This is a negative aspect for GSK.

GSK has turned over its inventory more time than AZN as the inventory which indicate

efficient management of inventory by GSK as compared to AZN. Since GSK has better accounts

receivable turnover ratio that AZN, this means GSK has been able in collecting the dues from the

debtors more time than AZN (Delen, Kuzey and Uyar 2013).

Debt to Equity Interest Coverage

15

7

3 2

Debt Ratios

GSK AZN

Higher debt ratio of GSK implies the presence of more debt capital in its capital structure

as compared to AZN. For this reason, interest coverage ratio of GSK is also more than AZN.

This is a negative aspect for GSK.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10PRINCIPLES OF FINANCE

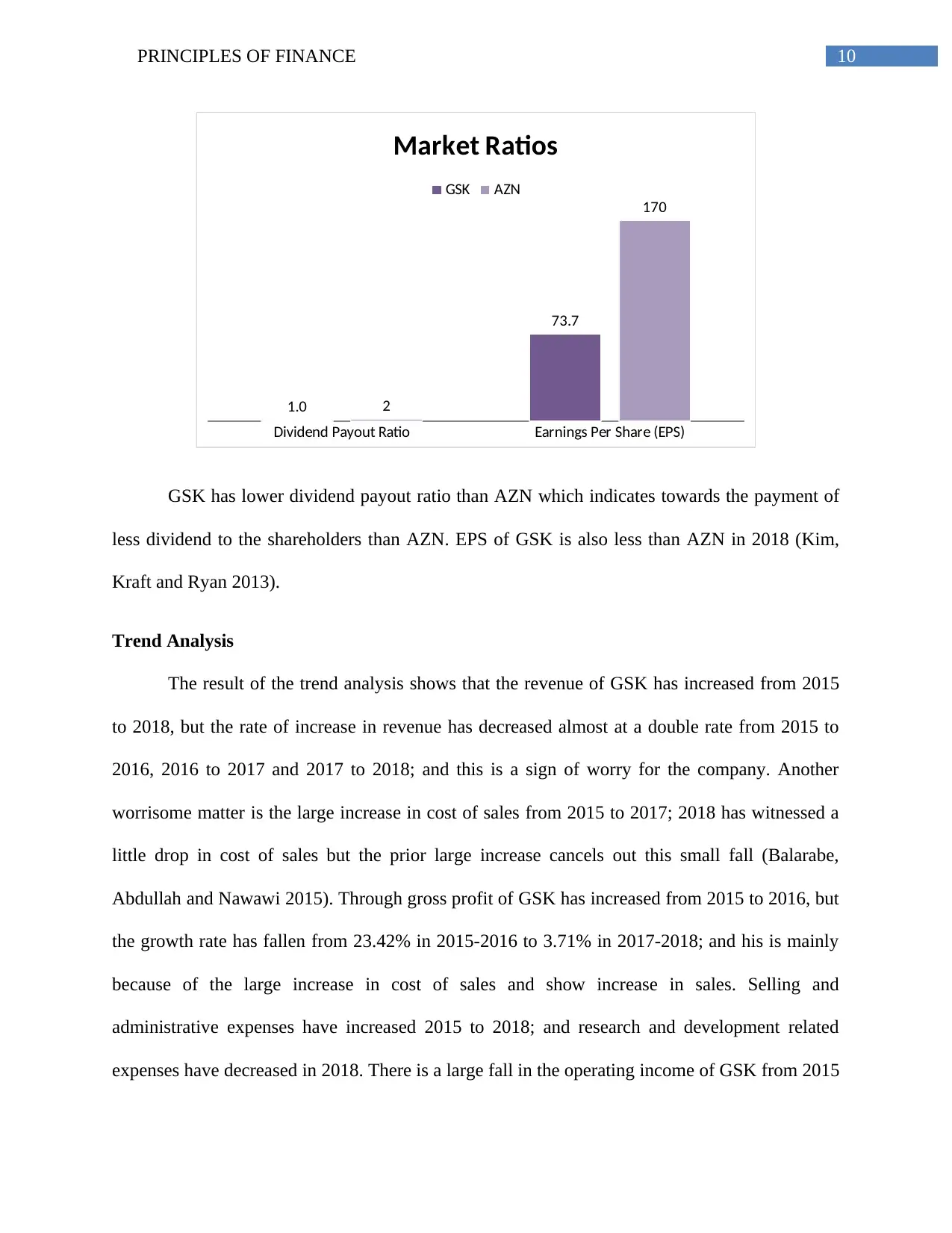

Dividend Payout Ratio Earnings Per Share (EPS)

1.0

73.7

2

170

Market Ratios

GSK AZN

GSK has lower dividend payout ratio than AZN which indicates towards the payment of

less dividend to the shareholders than AZN. EPS of GSK is also less than AZN in 2018 (Kim,

Kraft and Ryan 2013).

Trend Analysis

The result of the trend analysis shows that the revenue of GSK has increased from 2015

to 2018, but the rate of increase in revenue has decreased almost at a double rate from 2015 to

2016, 2016 to 2017 and 2017 to 2018; and this is a sign of worry for the company. Another

worrisome matter is the large increase in cost of sales from 2015 to 2017; 2018 has witnessed a

little drop in cost of sales but the prior large increase cancels out this small fall (Balarabe,

Abdullah and Nawawi 2015). Through gross profit of GSK has increased from 2015 to 2016, but

the growth rate has fallen from 23.42% in 2015-2016 to 3.71% in 2017-2018; and his is mainly

because of the large increase in cost of sales and show increase in sales. Selling and

administrative expenses have increased 2015 to 2018; and research and development related

expenses have decreased in 2018. There is a large fall in the operating income of GSK from 2015

Dividend Payout Ratio Earnings Per Share (EPS)

1.0

73.7

2

170

Market Ratios

GSK AZN

GSK has lower dividend payout ratio than AZN which indicates towards the payment of

less dividend to the shareholders than AZN. EPS of GSK is also less than AZN in 2018 (Kim,

Kraft and Ryan 2013).

Trend Analysis

The result of the trend analysis shows that the revenue of GSK has increased from 2015

to 2018, but the rate of increase in revenue has decreased almost at a double rate from 2015 to

2016, 2016 to 2017 and 2017 to 2018; and this is a sign of worry for the company. Another

worrisome matter is the large increase in cost of sales from 2015 to 2017; 2018 has witnessed a

little drop in cost of sales but the prior large increase cancels out this small fall (Balarabe,

Abdullah and Nawawi 2015). Through gross profit of GSK has increased from 2015 to 2016, but

the growth rate has fallen from 23.42% in 2015-2016 to 3.71% in 2017-2018; and his is mainly

because of the large increase in cost of sales and show increase in sales. Selling and

administrative expenses have increased 2015 to 2018; and research and development related

expenses have decreased in 2018. There is a large fall in the operating income of GSK from 2015

11PRINCIPLES OF FINANCE

to 2018; and the growth rate has also decreased from 2016-2017 to 2017-2018. Finance expenses

have increased from 2015 to 2018. Profit before taxation of GSK has largely decreased from

2015 to 2016, but it has improved from 2016 to 2018. There is a decrease in tax payments

because of the decrease in net income before tax. Most importantly, net profit of GSK has largely

decreased from 2015 to 2018. Trend shows a decrease from 2015 to 2016 and then gradual

improvement in 2017 and 2018 (Harvey 2014).

Comment on Business from Investors’ Perspective

Increase in gross profit margin of GSK means increase in sales and effective

managements of materials and labors. Net profit ratio trend also shows that this ratio of GSK is

improving in the current years and it is a positive sign; and it implies effective management of

direct and indirect costs for increasing profit. Increase in profitability always attracts the

investors. However, GSK has poor liquidity position in the recent years. As per the movements

in current and quick ratio, GSK does not have adequate current and quick assets for paying off

the current business obligations. This is a key negative aspect for investing in GSK. This affects

the company’s ability to pay the short-term loans (Penman 2013).

Inventory turnover of GSK has been stable over the last four years and the result of AZN

shows that this is the average industry standard for GSK. One positive aspect is that accounts

receivable turnover has improved in 2018 that depicts the enhanced efficiency of GSK in

extending credit and collecting the dues from the debtors. However, recent trend in debt to equity

ratio of GSK shows the use of huge debt capital by the company to raise the required capital for

business. This increases the payment of interest which can be seen from the increase in interest

coverage ratio in current years. However, this also indicates the need for more capital of GSK to

to 2018; and the growth rate has also decreased from 2016-2017 to 2017-2018. Finance expenses

have increased from 2015 to 2018. Profit before taxation of GSK has largely decreased from

2015 to 2016, but it has improved from 2016 to 2018. There is a decrease in tax payments

because of the decrease in net income before tax. Most importantly, net profit of GSK has largely

decreased from 2015 to 2018. Trend shows a decrease from 2015 to 2016 and then gradual

improvement in 2017 and 2018 (Harvey 2014).

Comment on Business from Investors’ Perspective

Increase in gross profit margin of GSK means increase in sales and effective

managements of materials and labors. Net profit ratio trend also shows that this ratio of GSK is

improving in the current years and it is a positive sign; and it implies effective management of

direct and indirect costs for increasing profit. Increase in profitability always attracts the

investors. However, GSK has poor liquidity position in the recent years. As per the movements

in current and quick ratio, GSK does not have adequate current and quick assets for paying off

the current business obligations. This is a key negative aspect for investing in GSK. This affects

the company’s ability to pay the short-term loans (Penman 2013).

Inventory turnover of GSK has been stable over the last four years and the result of AZN

shows that this is the average industry standard for GSK. One positive aspect is that accounts

receivable turnover has improved in 2018 that depicts the enhanced efficiency of GSK in

extending credit and collecting the dues from the debtors. However, recent trend in debt to equity

ratio of GSK shows the use of huge debt capital by the company to raise the required capital for

business. This increases the payment of interest which can be seen from the increase in interest

coverage ratio in current years. However, this also indicates the need for more capital of GSK to

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.