Financial Markets Analysis: Commonwealth and Westpac Report

VerifiedAdded on 2019/11/20

|24

|4544

|216

Report

AI Summary

This report undertakes a fundamental evaluation of Commonwealth Bank and Westpac Bank, two prominent organizations listed on the Australian Stock Exchange, within the context of the Australian banking sector. The analysis employs both bottom-up and top-down approaches, incorporating an examination of the banks' mission statements and the broader economic landscape, including GDP growth, inflation, and unemployment rates. The top-down analysis utilizes the EIC (Economy, Industry, Company) approach to assess the impact of macroeconomic factors on the banking industry. The bottom-up analysis involves the evaluation of the financial ratios of the organizations. The report also provides an overview of the Australian banking industry, its evolution, and key developments such as the Banking Act 1959 and the significance of LCR (Liquidity Coverage Ratio). Finally, the report offers recommendations based on the findings, providing investors with valuable insights into the financial health and potential of Commonwealth Bank and Westpac.

Running head: PRINCIPLES OF FINANCIAL MARKETS

Principles of Financial Markets

Name of the Student:

Name of the University:

Author’s Note:

Principles of Financial Markets

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

PRINCIPLES OF FINANCIAL MARKETS

Executive Summary

This paper has been constructed in order to explain about the organizations

Commonwealth Bank and Westpac Bank. The vision and mission statement of the companies are

even explained in this paper. The background of the Australian banking sector is even explained.

The fundamental evaluation has been undertaken by taking help of the bottom up and top down

analysis. The top down analysis is possible with the help of the rate of inflation, unemployment

and GDP growth of the country. Furthermore, the impact on the Australian economy on the

concerned organizations is even explained. The bottom up analysis is possible by undertaking the

evaluation of the financial ratios of the organizations.

PRINCIPLES OF FINANCIAL MARKETS

Executive Summary

This paper has been constructed in order to explain about the organizations

Commonwealth Bank and Westpac Bank. The vision and mission statement of the companies are

even explained in this paper. The background of the Australian banking sector is even explained.

The fundamental evaluation has been undertaken by taking help of the bottom up and top down

analysis. The top down analysis is possible with the help of the rate of inflation, unemployment

and GDP growth of the country. Furthermore, the impact on the Australian economy on the

concerned organizations is even explained. The bottom up analysis is possible by undertaking the

evaluation of the financial ratios of the organizations.

2

PRINCIPLES OF FINANCIAL MARKETS

Table of Contents

Introduction......................................................................................................................................3

Banking Industry background of Australia......................................................................................3

Mission Statement of the organizations...........................................................................................4

Top-down Analysis..........................................................................................................................5

Bottom-up Analysis.......................................................................................................................10

Recommendations and Summary..................................................................................................19

Reference List................................................................................................................................21

PRINCIPLES OF FINANCIAL MARKETS

Table of Contents

Introduction......................................................................................................................................3

Banking Industry background of Australia......................................................................................3

Mission Statement of the organizations...........................................................................................4

Top-down Analysis..........................................................................................................................5

Bottom-up Analysis.......................................................................................................................10

Recommendations and Summary..................................................................................................19

Reference List................................................................................................................................21

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

PRINCIPLES OF FINANCIAL MARKETS

Introduction

In the current terms of the business, it has been of countless spirit for an investor to

undertake an effective evaluation of the organization or the industrial sector before undertaking

an investment. This evaluation can be undertaken by taking assistance of the bottom-up and the

top-down evaluation. Along with this, it can be cited that top down assessment aids the investors

to disclose a bigger picture of the economy that is to be represented and even the industry itself.

Conversely, the approach of bottom up discloses an image that is micro-economic with respect to

the organization that has been taken into consideration (Bodie 2013). The concerned report will

be helpful for undertaking a fundamental evaluation on two organizations that are listed in the

Australian Stock Exchange. The organizations that have been taken into consideration are

Westpac and Common Wealth Bank of Australia (CWB). This research will be done on the basis

of the bottom-up and top-down evaluation of the financial figures that are available for both the

organizations. By depending on the outcomes, appropriate suggestions can be attained from the

mindset of the investors.

Banking Industry background of Australia

It has been observed that the establishment of the Banking Act 1959 has been one of the

influential factors that have aided Australia in enhancing their banking sector. There has been a

stable evolution in the performance of the asset in the banking sector, which in a way has

assisted in the overall growth of the Australian economy. There have been numerous banks that

have been licence and are therefore within the banking sector of Australia. The constancy of the

banking sector has been developed by the enhancement in the capital in the current quarters of

the financial year (PwC 2017). The other significant step that has been uncovered by the banking

sector of Australia is inclusive of concentrating on the Liquidity Coverage Ratio (LCR).

PRINCIPLES OF FINANCIAL MARKETS

Introduction

In the current terms of the business, it has been of countless spirit for an investor to

undertake an effective evaluation of the organization or the industrial sector before undertaking

an investment. This evaluation can be undertaken by taking assistance of the bottom-up and the

top-down evaluation. Along with this, it can be cited that top down assessment aids the investors

to disclose a bigger picture of the economy that is to be represented and even the industry itself.

Conversely, the approach of bottom up discloses an image that is micro-economic with respect to

the organization that has been taken into consideration (Bodie 2013). The concerned report will

be helpful for undertaking a fundamental evaluation on two organizations that are listed in the

Australian Stock Exchange. The organizations that have been taken into consideration are

Westpac and Common Wealth Bank of Australia (CWB). This research will be done on the basis

of the bottom-up and top-down evaluation of the financial figures that are available for both the

organizations. By depending on the outcomes, appropriate suggestions can be attained from the

mindset of the investors.

Banking Industry background of Australia

It has been observed that the establishment of the Banking Act 1959 has been one of the

influential factors that have aided Australia in enhancing their banking sector. There has been a

stable evolution in the performance of the asset in the banking sector, which in a way has

assisted in the overall growth of the Australian economy. There have been numerous banks that

have been licence and are therefore within the banking sector of Australia. The constancy of the

banking sector has been developed by the enhancement in the capital in the current quarters of

the financial year (PwC 2017). The other significant step that has been uncovered by the banking

sector of Australia is inclusive of concentrating on the Liquidity Coverage Ratio (LCR).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

PRINCIPLES OF FINANCIAL MARKETS

The evaluation of financial stability of Australia discloses that significance has been

stressed on the performance of the assets of the banks in Australia. During the year 2016, a key

step has been creating loans for the organizations. The significant decisions and the competitive

pressures that are undertaken by the country have been done with the help of assessing the

development and the growth of numerous cities. The pattern of the banking sector in Australia is

inclusive of evaluating critically the valuations of the commercial property. The extent of the

competition in the banking sector has been consistent. This is the significant factor that the sector

has developed over the past few years. The democracy of the free market of Australia has even

assisted in reaching the present condition of the sector (Delen, Kuzey and Uyar 2013). The

enhancement of the banking sector has been inclusive of the significance of the banks that are

present and the even their securitization. Furthermore, the third transformation has been in the

sharing of the assets. Lastly, the development has been dependent on the fall in the existence of

the financial organisations, constructing societies and the credit unions.

Mission Statement of the organizations

Commonwealth Bank of Australia and Westpac has been two significant banks that are

functioning in Australia.

The mission statement of the Commonwealth Bank of Australia has been to promote the

capital of their priceless customers. This is to make sure that the desires of their customers are

fulfilled. The vision of the bank has been to develop the financial wellness of their customers.

This is inclusive of the trust and the loyalty of the customers by safeguarding their communities

and their business (Commbank.com.au. 2017).

PRINCIPLES OF FINANCIAL MARKETS

The evaluation of financial stability of Australia discloses that significance has been

stressed on the performance of the assets of the banks in Australia. During the year 2016, a key

step has been creating loans for the organizations. The significant decisions and the competitive

pressures that are undertaken by the country have been done with the help of assessing the

development and the growth of numerous cities. The pattern of the banking sector in Australia is

inclusive of evaluating critically the valuations of the commercial property. The extent of the

competition in the banking sector has been consistent. This is the significant factor that the sector

has developed over the past few years. The democracy of the free market of Australia has even

assisted in reaching the present condition of the sector (Delen, Kuzey and Uyar 2013). The

enhancement of the banking sector has been inclusive of the significance of the banks that are

present and the even their securitization. Furthermore, the third transformation has been in the

sharing of the assets. Lastly, the development has been dependent on the fall in the existence of

the financial organisations, constructing societies and the credit unions.

Mission Statement of the organizations

Commonwealth Bank of Australia and Westpac has been two significant banks that are

functioning in Australia.

The mission statement of the Commonwealth Bank of Australia has been to promote the

capital of their priceless customers. This is to make sure that the desires of their customers are

fulfilled. The vision of the bank has been to develop the financial wellness of their customers.

This is inclusive of the trust and the loyalty of the customers by safeguarding their communities

and their business (Commbank.com.au. 2017).

5

PRINCIPLES OF FINANCIAL MARKETS

The vision of Westpac has been to assist the customers who are present all over the globe

in prospering and growing. They want to provide extensive service to their customers by

assisting them in their development. The mission of the organization has been to provide greater

returns to their customers, professional businessmen and other stakeholders. They even want the

relationship with their customers to be trustworthy and strong. The company wants themselves to

be the most effective place for their employees. They want to flourish on the style of leadership

and construct a company that is efficient in creating long term bonding (Westpac.com.au. 2017).

Top-down Analysis

Top-down analysis can be assessed by taking help of the EIC approach that is even

known as the Economy, Industry and Company process.

Bryce (2017) has cited that industry assessment comes on top during the process of top-

down analysis. It has been viewed that the economy of Australia is a prospering one. In the

present situation, the development of the GDP has been observed to be pretty good. This can be

analysed by looking at the present rate of growth of the GDP by around 4.40%.

PRINCIPLES OF FINANCIAL MARKETS

The vision of Westpac has been to assist the customers who are present all over the globe

in prospering and growing. They want to provide extensive service to their customers by

assisting them in their development. The mission of the organization has been to provide greater

returns to their customers, professional businessmen and other stakeholders. They even want the

relationship with their customers to be trustworthy and strong. The company wants themselves to

be the most effective place for their employees. They want to flourish on the style of leadership

and construct a company that is efficient in creating long term bonding (Westpac.com.au. 2017).

Top-down Analysis

Top-down analysis can be assessed by taking help of the EIC approach that is even

known as the Economy, Industry and Company process.

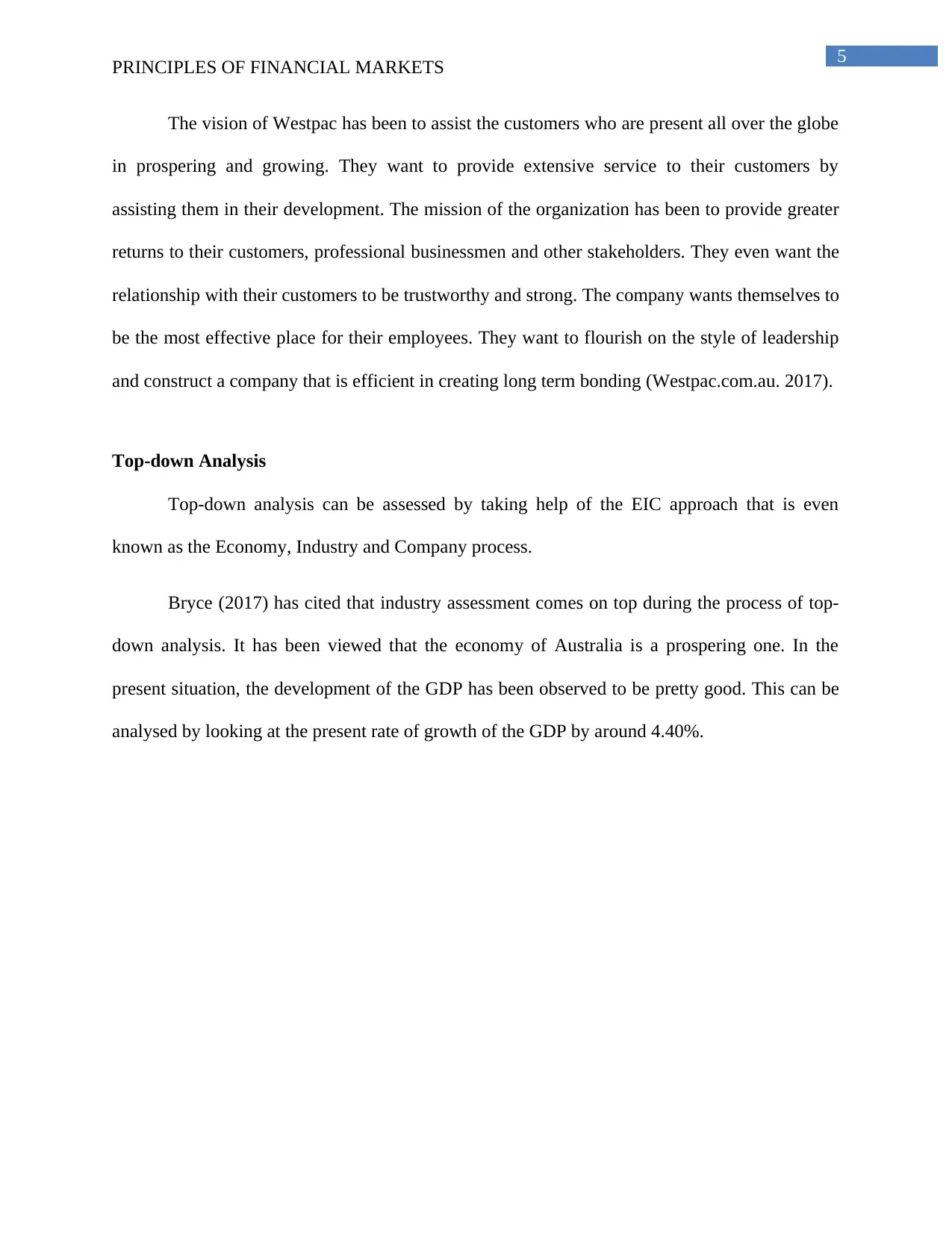

Bryce (2017) has cited that industry assessment comes on top during the process of top-

down analysis. It has been viewed that the economy of Australia is a prospering one. In the

present situation, the development of the GDP has been observed to be pretty good. This can be

analysed by looking at the present rate of growth of the GDP by around 4.40%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

PRINCIPLES OF FINANCIAL MARKETS

Figure 1: Australian Economy Overview

(Source: Brooks 2015)

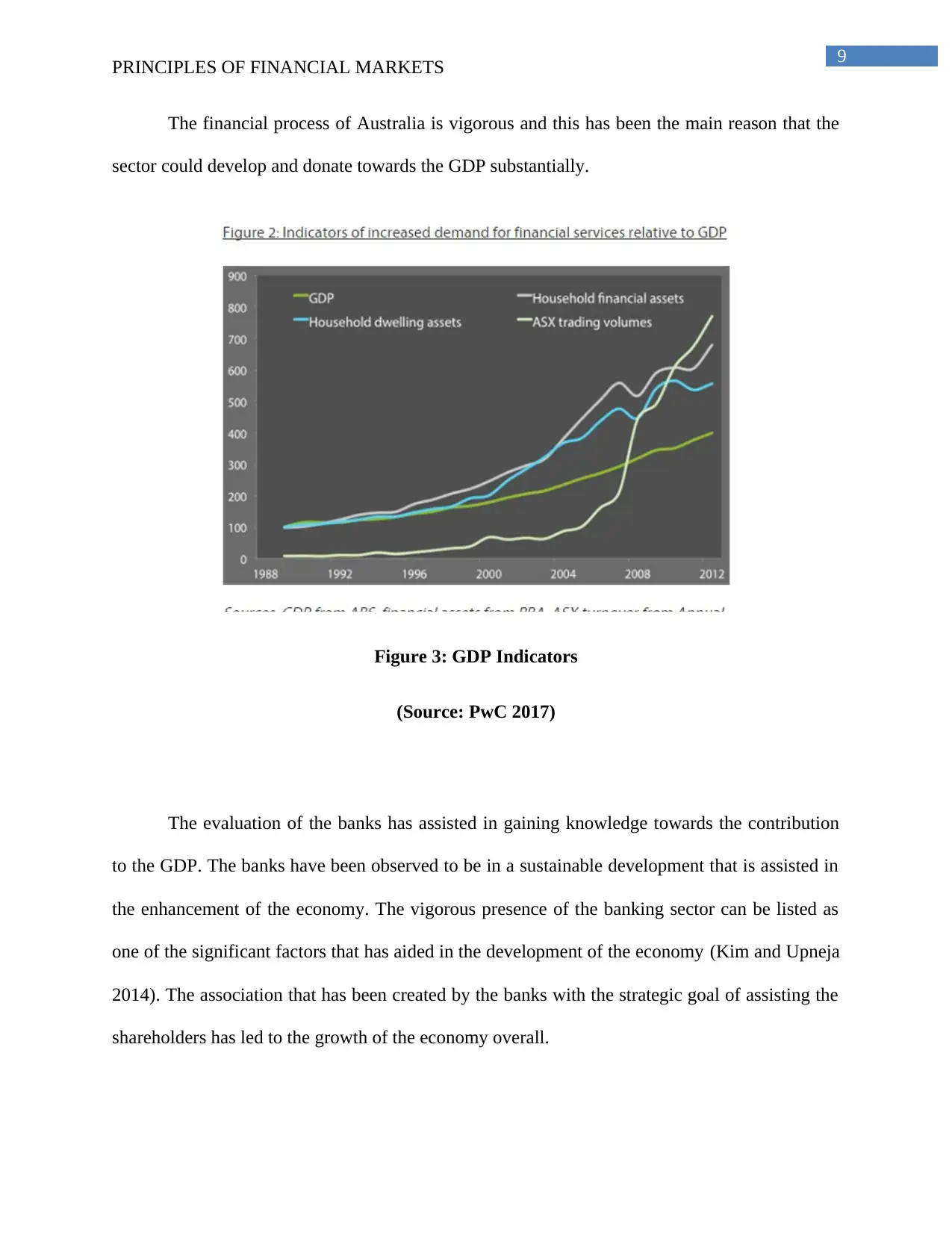

By looking at the above table, it can be cited that the rate of growth in Australia has been

on the higher level and the rate of unemployment has decreased over the past few years.

Furthermore, the rate of inflation in the country has grown and the present account deficit has

been enhanced. This can be regarded as a sign that is negative for the economy of the country

and hence numerous steps are essential from the side of the government in order to reduce the

rate of growth in the country (Chikoto and Neely 2014).

The second level of the top-down assessment is the industry that has been highlighted.

The banking industry has been one of the primary contributors for the development of the

Australian GDP. There has been a transformation in the percentage rate of the GDP during the

year 2015, which has grown by 1% from the quarter in the month of June in the year 2012.

PRINCIPLES OF FINANCIAL MARKETS

Figure 1: Australian Economy Overview

(Source: Brooks 2015)

By looking at the above table, it can be cited that the rate of growth in Australia has been

on the higher level and the rate of unemployment has decreased over the past few years.

Furthermore, the rate of inflation in the country has grown and the present account deficit has

been enhanced. This can be regarded as a sign that is negative for the economy of the country

and hence numerous steps are essential from the side of the government in order to reduce the

rate of growth in the country (Chikoto and Neely 2014).

The second level of the top-down assessment is the industry that has been highlighted.

The banking industry has been one of the primary contributors for the development of the

Australian GDP. There has been a transformation in the percentage rate of the GDP during the

year 2015, which has grown by 1% from the quarter in the month of June in the year 2012.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

PRINCIPLES OF FINANCIAL MARKETS

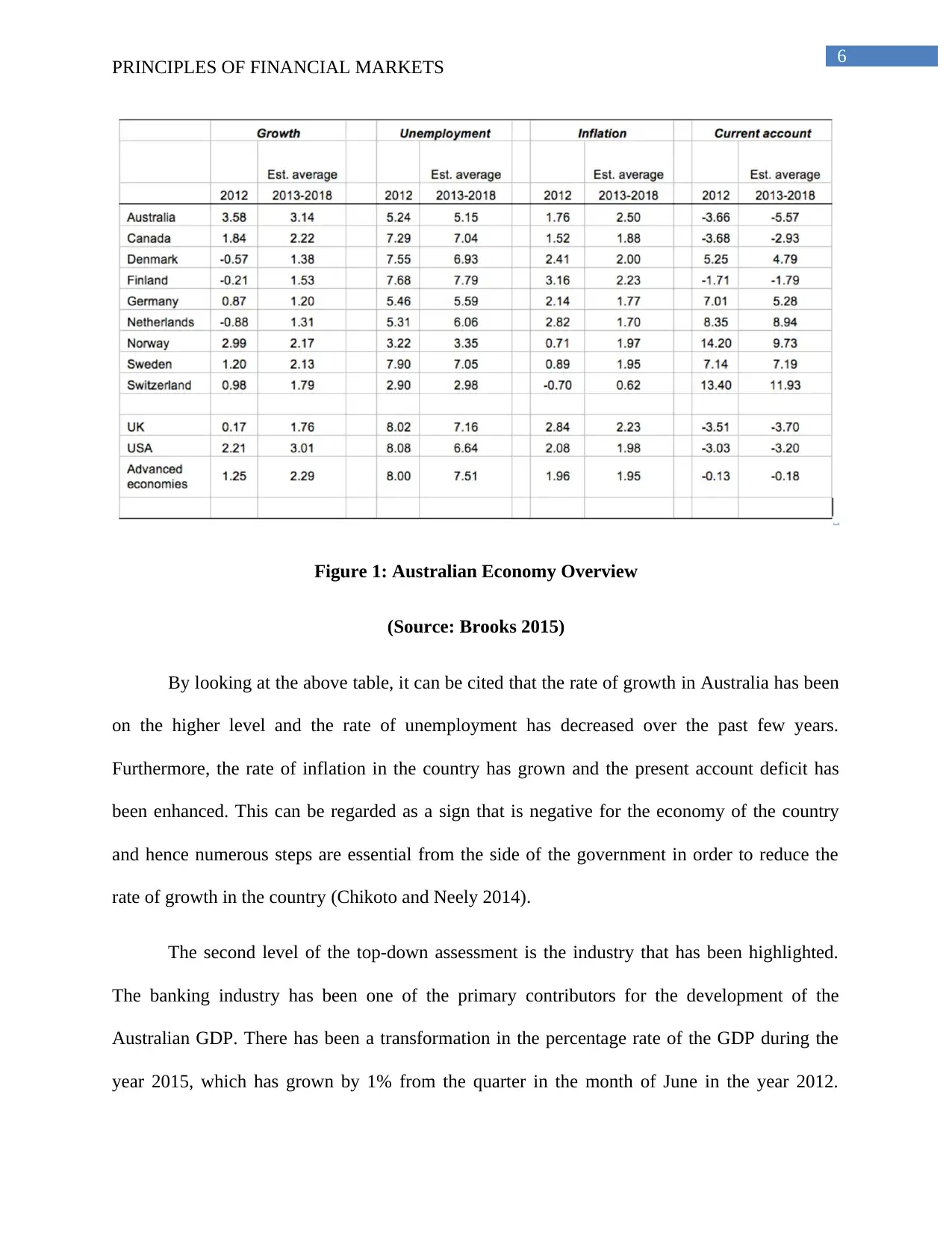

Leaving aside the service sector, which has been the banking industry in this case, the significant

amount of development in the GDP of Australia has been contributed by the mineral sources and

the agricultural sector. The expenses have grown by 2% during the enhanced economic situation.

During the quarter of March 2016, it has been discovered that the expanded development of the

GDP of the country has been 1.1% (PwC 2017). This extent of contribution from the service

industry of the country has been crucial. Conversely, it has been cited by many well known

economists that the rise in the currency value of the Australian dollar in the international market

would be remarkable. This would even be inclusive of the stability that has been given out by the

capitalization of the market.

Figure 2: Growth of GDP in Australia

(Source: David. 2017)

The banking industry has been harassed in order to offer the outmost to the country’s

economy. In this respect, it can be opined that the GDP growth has been 3.1% over the past few

PRINCIPLES OF FINANCIAL MARKETS

Leaving aside the service sector, which has been the banking industry in this case, the significant

amount of development in the GDP of Australia has been contributed by the mineral sources and

the agricultural sector. The expenses have grown by 2% during the enhanced economic situation.

During the quarter of March 2016, it has been discovered that the expanded development of the

GDP of the country has been 1.1% (PwC 2017). This extent of contribution from the service

industry of the country has been crucial. Conversely, it has been cited by many well known

economists that the rise in the currency value of the Australian dollar in the international market

would be remarkable. This would even be inclusive of the stability that has been given out by the

capitalization of the market.

Figure 2: Growth of GDP in Australia

(Source: David. 2017)

The banking industry has been harassed in order to offer the outmost to the country’s

economy. In this respect, it can be opined that the GDP growth has been 3.1% over the past few

8

PRINCIPLES OF FINANCIAL MARKETS

years. The banking sector has been one of the significant contributors for the development. This

has been one of the key factors that the development of the economy has been essential. The

insurance and the financial services of Australia have been developing with a percentage of 1.8%

contribution to the GDP. Conversely, the other side of the banking industry and development of

the GDP has been inclusive of the inflation. It has been discovered that inflation may have been

the key factor that can undertake repayment of the debt more complex for the customers. This is

even inclusive of having an impact on the development of the GDP by not recognising the lower

level of rate of interest. The rivalry among the banks within the country is fundamental in

evaluating the essential indicators of performance. The banking industrial sector has been one of

the primary needs of the customers in order to construct a plan for their future (Marshall 2016).

There are several economists of the country who orate to the fact that the banking industry plays

a role of a bridge in between the economy and the stakeholders.

The economists have explained that the financial services of Australia have been the key

contributor to the domestic economy. The value that is anticipated has been $140 billion within

the GDP. The specific sector of the country has made use of around 450,000 employees. The

most renowned banks of Australia like Westpac and Commonwealth Bank of Australia has been

found to be the most secured banks in the overall list of the secured banks that are functioning all

over the globe. According to the World Economic Forum Financial development Index of the

year 2013, Australia has been highlighted to be one of the most effective countries with respect

to the performance of their financial centres. The financial stableness that has been given out by

the banks like Westpac and Commonwealth Bank of Australia has performed a key role in the

same.

PRINCIPLES OF FINANCIAL MARKETS

years. The banking sector has been one of the significant contributors for the development. This

has been one of the key factors that the development of the economy has been essential. The

insurance and the financial services of Australia have been developing with a percentage of 1.8%

contribution to the GDP. Conversely, the other side of the banking industry and development of

the GDP has been inclusive of the inflation. It has been discovered that inflation may have been

the key factor that can undertake repayment of the debt more complex for the customers. This is

even inclusive of having an impact on the development of the GDP by not recognising the lower

level of rate of interest. The rivalry among the banks within the country is fundamental in

evaluating the essential indicators of performance. The banking industrial sector has been one of

the primary needs of the customers in order to construct a plan for their future (Marshall 2016).

There are several economists of the country who orate to the fact that the banking industry plays

a role of a bridge in between the economy and the stakeholders.

The economists have explained that the financial services of Australia have been the key

contributor to the domestic economy. The value that is anticipated has been $140 billion within

the GDP. The specific sector of the country has made use of around 450,000 employees. The

most renowned banks of Australia like Westpac and Commonwealth Bank of Australia has been

found to be the most secured banks in the overall list of the secured banks that are functioning all

over the globe. According to the World Economic Forum Financial development Index of the

year 2013, Australia has been highlighted to be one of the most effective countries with respect

to the performance of their financial centres. The financial stableness that has been given out by

the banks like Westpac and Commonwealth Bank of Australia has performed a key role in the

same.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

PRINCIPLES OF FINANCIAL MARKETS

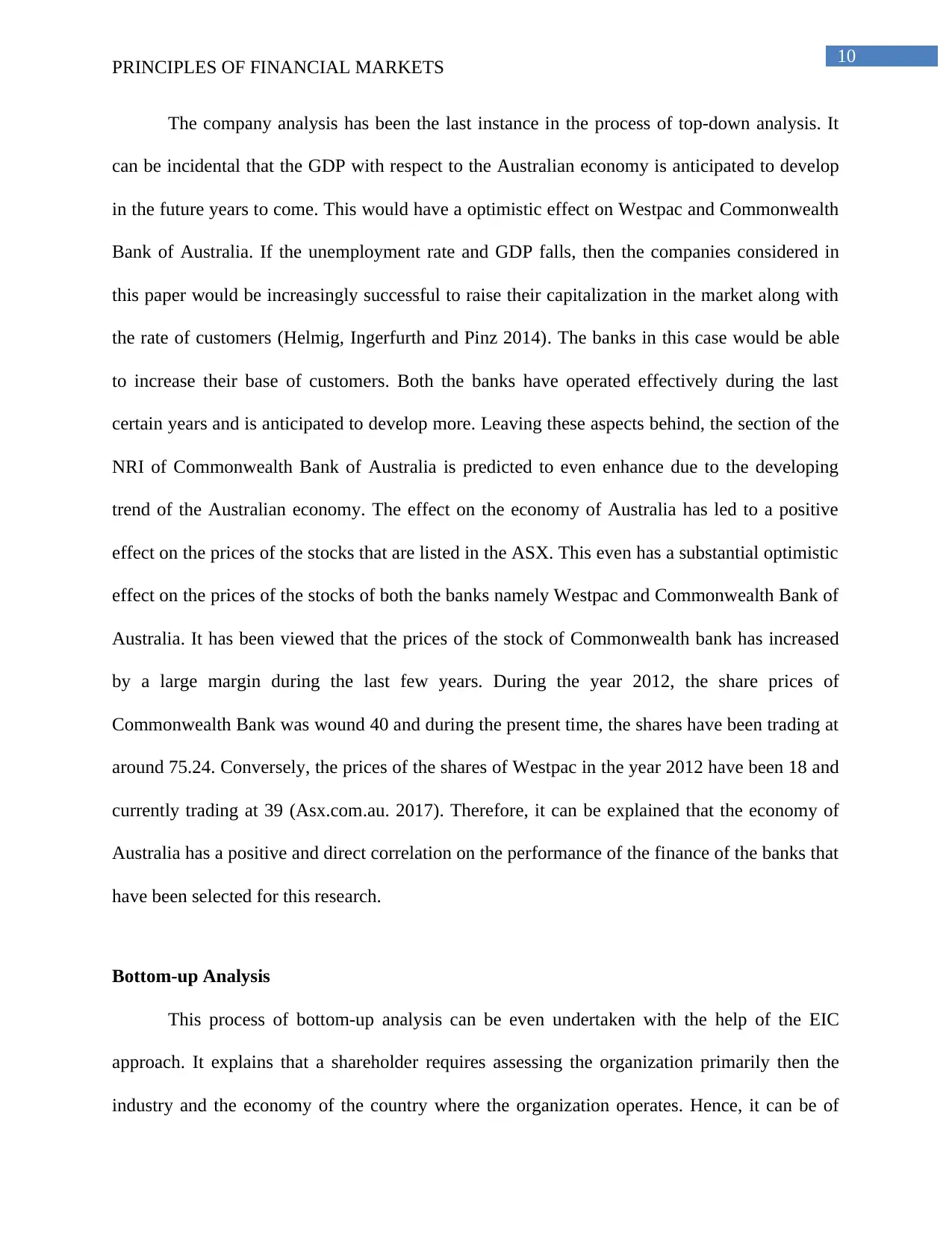

The financial process of Australia is vigorous and this has been the main reason that the

sector could develop and donate towards the GDP substantially.

Figure 3: GDP Indicators

(Source: PwC 2017)

The evaluation of the banks has assisted in gaining knowledge towards the contribution

to the GDP. The banks have been observed to be in a sustainable development that is assisted in

the enhancement of the economy. The vigorous presence of the banking sector can be listed as

one of the significant factors that has aided in the development of the economy (Kim and Upneja

2014). The association that has been created by the banks with the strategic goal of assisting the

shareholders has led to the growth of the economy overall.

PRINCIPLES OF FINANCIAL MARKETS

The financial process of Australia is vigorous and this has been the main reason that the

sector could develop and donate towards the GDP substantially.

Figure 3: GDP Indicators

(Source: PwC 2017)

The evaluation of the banks has assisted in gaining knowledge towards the contribution

to the GDP. The banks have been observed to be in a sustainable development that is assisted in

the enhancement of the economy. The vigorous presence of the banking sector can be listed as

one of the significant factors that has aided in the development of the economy (Kim and Upneja

2014). The association that has been created by the banks with the strategic goal of assisting the

shareholders has led to the growth of the economy overall.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

PRINCIPLES OF FINANCIAL MARKETS

The company analysis has been the last instance in the process of top-down analysis. It

can be incidental that the GDP with respect to the Australian economy is anticipated to develop

in the future years to come. This would have a optimistic effect on Westpac and Commonwealth

Bank of Australia. If the unemployment rate and GDP falls, then the companies considered in

this paper would be increasingly successful to raise their capitalization in the market along with

the rate of customers (Helmig, Ingerfurth and Pinz 2014). The banks in this case would be able

to increase their base of customers. Both the banks have operated effectively during the last

certain years and is anticipated to develop more. Leaving these aspects behind, the section of the

NRI of Commonwealth Bank of Australia is predicted to even enhance due to the developing

trend of the Australian economy. The effect on the economy of Australia has led to a positive

effect on the prices of the stocks that are listed in the ASX. This even has a substantial optimistic

effect on the prices of the stocks of both the banks namely Westpac and Commonwealth Bank of

Australia. It has been viewed that the prices of the stock of Commonwealth bank has increased

by a large margin during the last few years. During the year 2012, the share prices of

Commonwealth Bank was wound 40 and during the present time, the shares have been trading at

around 75.24. Conversely, the prices of the shares of Westpac in the year 2012 have been 18 and

currently trading at 39 (Asx.com.au. 2017). Therefore, it can be explained that the economy of

Australia has a positive and direct correlation on the performance of the finance of the banks that

have been selected for this research.

Bottom-up Analysis

This process of bottom-up analysis can be even undertaken with the help of the EIC

approach. It explains that a shareholder requires assessing the organization primarily then the

industry and the economy of the country where the organization operates. Hence, it can be of

PRINCIPLES OF FINANCIAL MARKETS

The company analysis has been the last instance in the process of top-down analysis. It

can be incidental that the GDP with respect to the Australian economy is anticipated to develop

in the future years to come. This would have a optimistic effect on Westpac and Commonwealth

Bank of Australia. If the unemployment rate and GDP falls, then the companies considered in

this paper would be increasingly successful to raise their capitalization in the market along with

the rate of customers (Helmig, Ingerfurth and Pinz 2014). The banks in this case would be able

to increase their base of customers. Both the banks have operated effectively during the last

certain years and is anticipated to develop more. Leaving these aspects behind, the section of the

NRI of Commonwealth Bank of Australia is predicted to even enhance due to the developing

trend of the Australian economy. The effect on the economy of Australia has led to a positive

effect on the prices of the stocks that are listed in the ASX. This even has a substantial optimistic

effect on the prices of the stocks of both the banks namely Westpac and Commonwealth Bank of

Australia. It has been viewed that the prices of the stock of Commonwealth bank has increased

by a large margin during the last few years. During the year 2012, the share prices of

Commonwealth Bank was wound 40 and during the present time, the shares have been trading at

around 75.24. Conversely, the prices of the shares of Westpac in the year 2012 have been 18 and

currently trading at 39 (Asx.com.au. 2017). Therefore, it can be explained that the economy of

Australia has a positive and direct correlation on the performance of the finance of the banks that

have been selected for this research.

Bottom-up Analysis

This process of bottom-up analysis can be even undertaken with the help of the EIC

approach. It explains that a shareholder requires assessing the organization primarily then the

industry and the economy of the country where the organization operates. Hence, it can be of

11

PRINCIPLES OF FINANCIAL MARKETS

effective essence to gain knowledge about the financial scenario of the organizations that have

been chosen, which in this case has been Westpac and Commonwealth Bank of Australia.

The financial standing can be assessed by taking assistance of the financial ratios. The

financial ratio evaluation can be undertaken with the help of numerous processes. They include

the efficiency ratios, growth ratios, liquidity ratio, profitability ratios etc. The ratios that have

been named would assist an investor to undertake a comparison among the organizations with

respect to their financial performance (Vogel 2014).

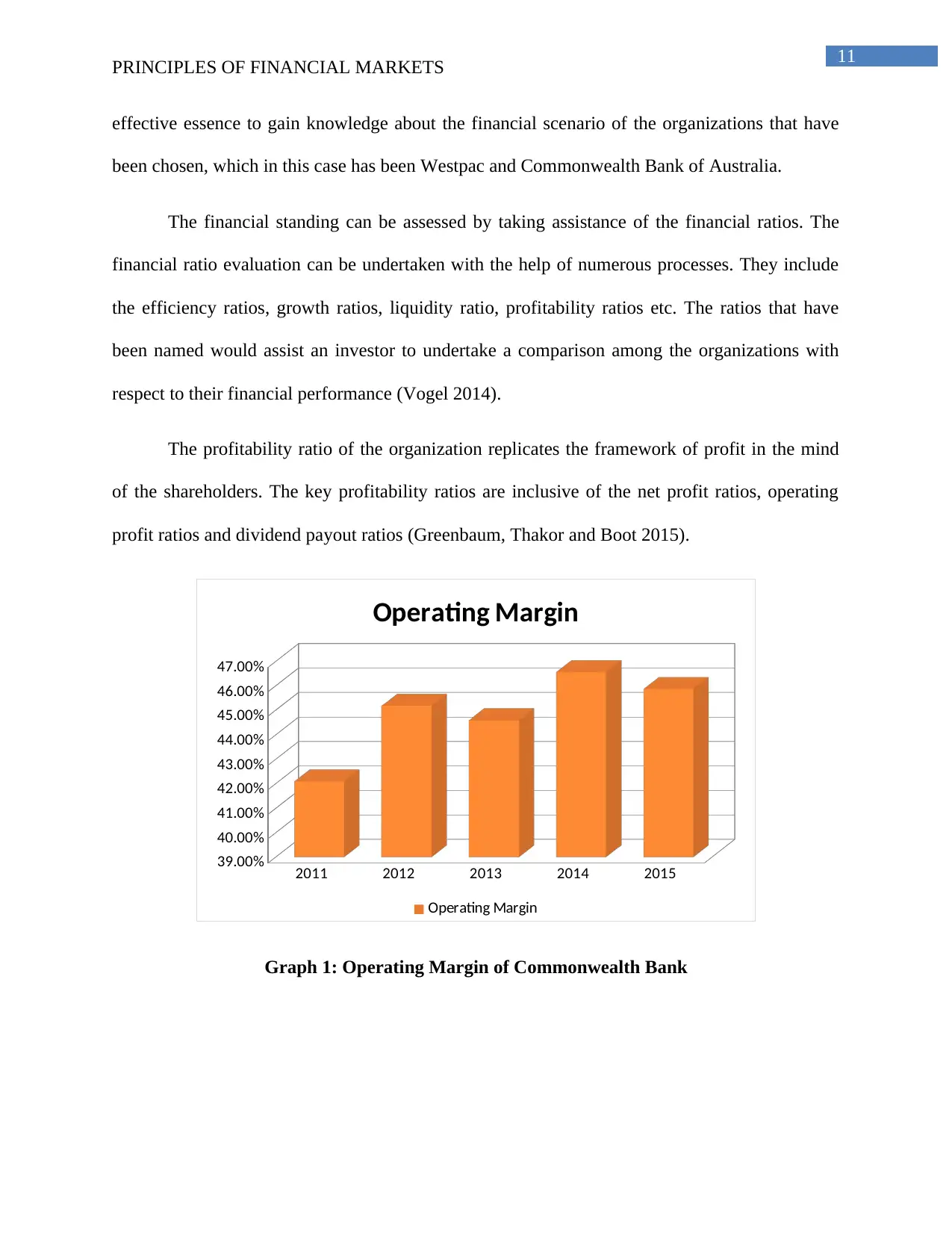

The profitability ratio of the organization replicates the framework of profit in the mind

of the shareholders. The key profitability ratios are inclusive of the net profit ratios, operating

profit ratios and dividend payout ratios (Greenbaum, Thakor and Boot 2015).

2011 2012 2013 2014 2015

39.00%

40.00%

41.00%

42.00%

43.00%

44.00%

45.00%

46.00%

47.00%

Operating Margin

Operating Margin

Graph 1: Operating Margin of Commonwealth Bank

PRINCIPLES OF FINANCIAL MARKETS

effective essence to gain knowledge about the financial scenario of the organizations that have

been chosen, which in this case has been Westpac and Commonwealth Bank of Australia.

The financial standing can be assessed by taking assistance of the financial ratios. The

financial ratio evaluation can be undertaken with the help of numerous processes. They include

the efficiency ratios, growth ratios, liquidity ratio, profitability ratios etc. The ratios that have

been named would assist an investor to undertake a comparison among the organizations with

respect to their financial performance (Vogel 2014).

The profitability ratio of the organization replicates the framework of profit in the mind

of the shareholders. The key profitability ratios are inclusive of the net profit ratios, operating

profit ratios and dividend payout ratios (Greenbaum, Thakor and Boot 2015).

2011 2012 2013 2014 2015

39.00%

40.00%

41.00%

42.00%

43.00%

44.00%

45.00%

46.00%

47.00%

Operating Margin

Operating Margin

Graph 1: Operating Margin of Commonwealth Bank

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.