MSc Project Management: Risk Management Report and Analysis, 2024

VerifiedAdded on 2022/10/15

|28

|2756

|473

Report

AI Summary

This report presents a detailed exploration of risk management techniques within the context of project management. It begins with an analysis of decision trees and Expected Monetary Value (EMV) to aid in bidding decisions for a computer systems contract. The report then delves into the application of Bayes' Rule for evaluating probabilities, specifically in the context of drug testing. Following this, the report investigates optimization problems using Excel, focusing on production scheduling and cost minimization for a manufacturing company. It examines various scenarios and alterations to production schedules to meet customer demands and minimize costs. The report also covers linear programming, graphical illustrations of constraints, and optimization using Solver. Finally, the report applies these concepts to project scheduling, including network diagrams, critical path analysis, and calculating probabilities related to project completion times. The report uses Excel models extensively and provides a comprehensive analysis of project risk exposure and mitigation strategies.

1 | P a g e

Windows User

Windows User

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Risk management

Table of Contents

List of figures................................................................................................................2

Question 1....................................................................................................................3

1.1 Introduction......................................................................................................3

1.2 Decision Tree......................................................................................................5

1.3 Decision Tree with EVM......................................................................................6

1.4 Discussion and calculation..................................................................................7

61.5 Bayes Rule Problem..........................................................................................9

1.6 Bayes Rule Outcomes......................................................................................10

2.0 Question 2............................................................................................................11

2.1 Objective............................................................................................................11

2.2 Original Data.....................................................................................................11

2.3 First Alteration with Discussion.........................................................................12

2.4 Second Alteration and Discussion....................................................................13

2.5 Final Alteration and Discussion.........................................................................14

3.0 Question 3............................................................................................................16

3.1 Problem statement............................................................................................16

3.2 Constraints........................................................................................................16

3.3 Objectives..........................................................................................................16

3.4 Equations..........................................................................................................16

Table of Contents

List of figures................................................................................................................2

Question 1....................................................................................................................3

1.1 Introduction......................................................................................................3

1.2 Decision Tree......................................................................................................5

1.3 Decision Tree with EVM......................................................................................6

1.4 Discussion and calculation..................................................................................7

61.5 Bayes Rule Problem..........................................................................................9

1.6 Bayes Rule Outcomes......................................................................................10

2.0 Question 2............................................................................................................11

2.1 Objective............................................................................................................11

2.2 Original Data.....................................................................................................11

2.3 First Alteration with Discussion.........................................................................12

2.4 Second Alteration and Discussion....................................................................13

2.5 Final Alteration and Discussion.........................................................................14

3.0 Question 3............................................................................................................16

3.1 Problem statement............................................................................................16

3.2 Constraints........................................................................................................16

3.3 Objectives..........................................................................................................16

3.4 Equations..........................................................................................................16

3.5 Coordinates.......................................................................................................18

3.6 Graphical Illustration..........................................................................................19

3.6 Final number.....................................................................................................19

3.7 Spreadsheet solution........................................................................................20

4.0 Question 4...........................................................................................................21

4.1 Expected Activity...............................................................................................21

4.2 Excel model.......................................................................................................22

4.3 Network Diagram...............................................................................................23

4.4 Z value/ project finishing before 46 weeks........................................................23

4.5 Project lasting longer than 46 weeks................................................................24

4.6 Completion of project time where 85% of the project is complete....................24

4.7 Project Risk Exposure.......................................................................................24

Question 5..................................................................................................................26

Network project.......................................................................................................26

Appendices.................................................................................................................27

3.6 Graphical Illustration..........................................................................................19

3.6 Final number.....................................................................................................19

3.7 Spreadsheet solution........................................................................................20

4.0 Question 4...........................................................................................................21

4.1 Expected Activity...............................................................................................21

4.2 Excel model.......................................................................................................22

4.3 Network Diagram...............................................................................................23

4.4 Z value/ project finishing before 46 weeks........................................................23

4.5 Project lasting longer than 46 weeks................................................................24

4.6 Completion of project time where 85% of the project is complete....................24

4.7 Project Risk Exposure.......................................................................................24

Question 5..................................................................................................................26

Network project.......................................................................................................26

Appendices.................................................................................................................27

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

List of figures

Figure 1: Decision tree produced in Visio.....................................................................2

Figure 2: Decision Tree with EVM................................................................................3

Figure 3: Original excel model......................................................................................8

Figure 4: shows the excel model 2 with alteration.......................................................9

Figure 5: Shows excel 3 model with alteration...........................................................10

Figure 6: Shows the final excel model with alterations..............................................11

Figure 7 shows the illustration of Constraints.............................................................16

Figure 8 shows the spreadsheet solution with solver.................................................17

Figure 9 shows the Excel Model and PERT analysis.................................................19

Figure 10 Network diagram with critical path.............................................................20

Figure 11 shows the critical path for the project.........................................................20

Figure 12 Network Project..........................................................................................23

Figure 1: Decision tree produced in Visio.....................................................................2

Figure 2: Decision Tree with EVM................................................................................3

Figure 3: Original excel model......................................................................................8

Figure 4: shows the excel model 2 with alteration.......................................................9

Figure 5: Shows excel 3 model with alteration...........................................................10

Figure 6: Shows the final excel model with alterations..............................................11

Figure 7 shows the illustration of Constraints.............................................................16

Figure 8 shows the spreadsheet solution with solver.................................................17

Figure 9 shows the Excel Model and PERT analysis.................................................19

Figure 10 Network diagram with critical path.............................................................20

Figure 11 shows the critical path for the project.........................................................20

Figure 12 Network Project..........................................................................................23

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Question 1

1.1 Introduction

The main motive of this report is to build an EMV and a decision tree for

determining if the organization ABC submit a bid to give computer systems to

win contract. The main points in establishment of the decision tree is to reduce

the cost of manufacturing laptops and also to provide a competitive advantage

over the competitor Complex computer bid.

1.1 Introduction

The main motive of this report is to build an EMV and a decision tree for

determining if the organization ABC submit a bid to give computer systems to

win contract. The main points in establishment of the decision tree is to reduce

the cost of manufacturing laptops and also to provide a competitive advantage

over the competitor Complex computer bid.

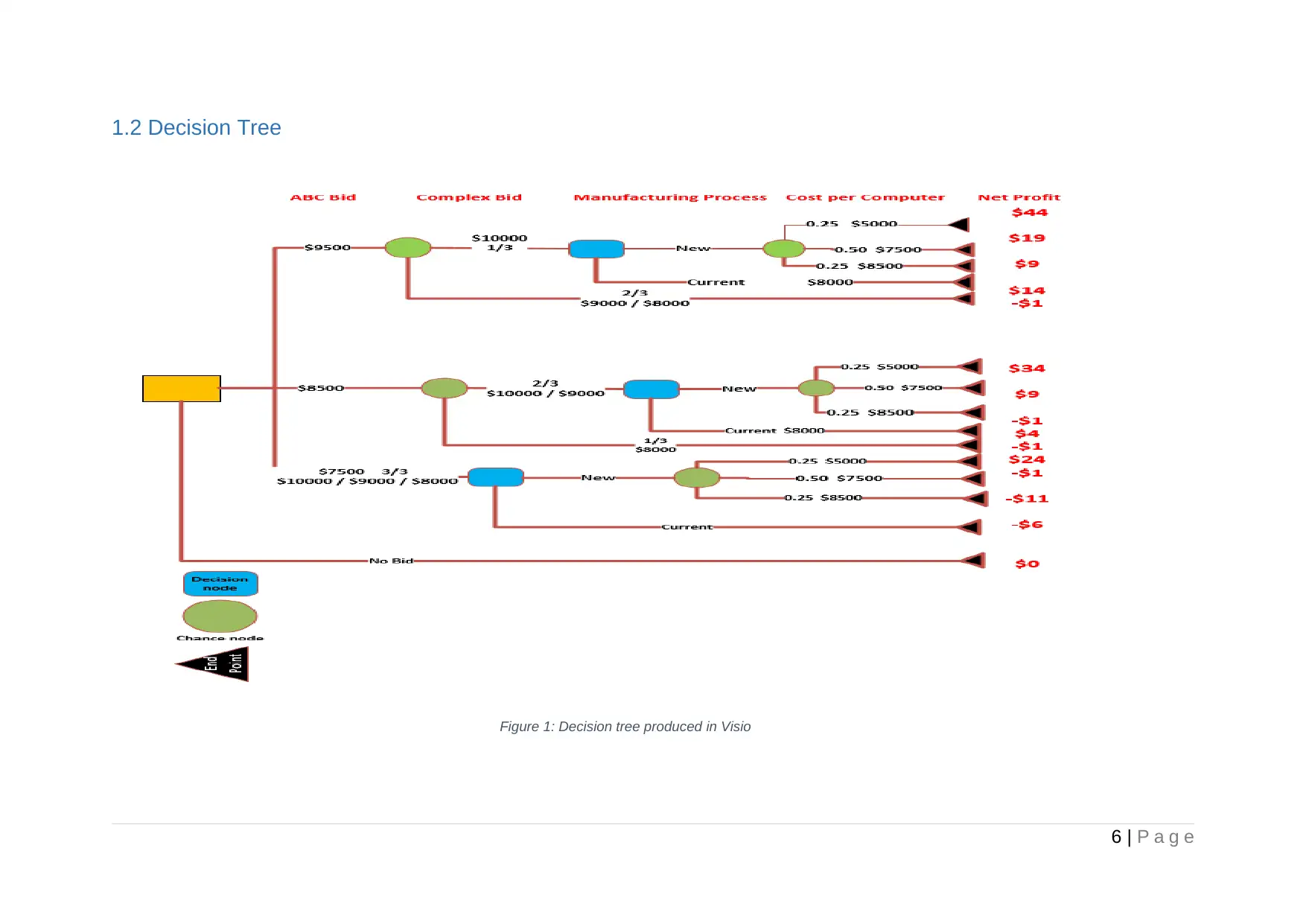

1.2 Decision Tree

6 | P a g e

Figure 1: Decision tree produced in Visio

6 | P a g e

Figure 1: Decision tree produced in Visio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

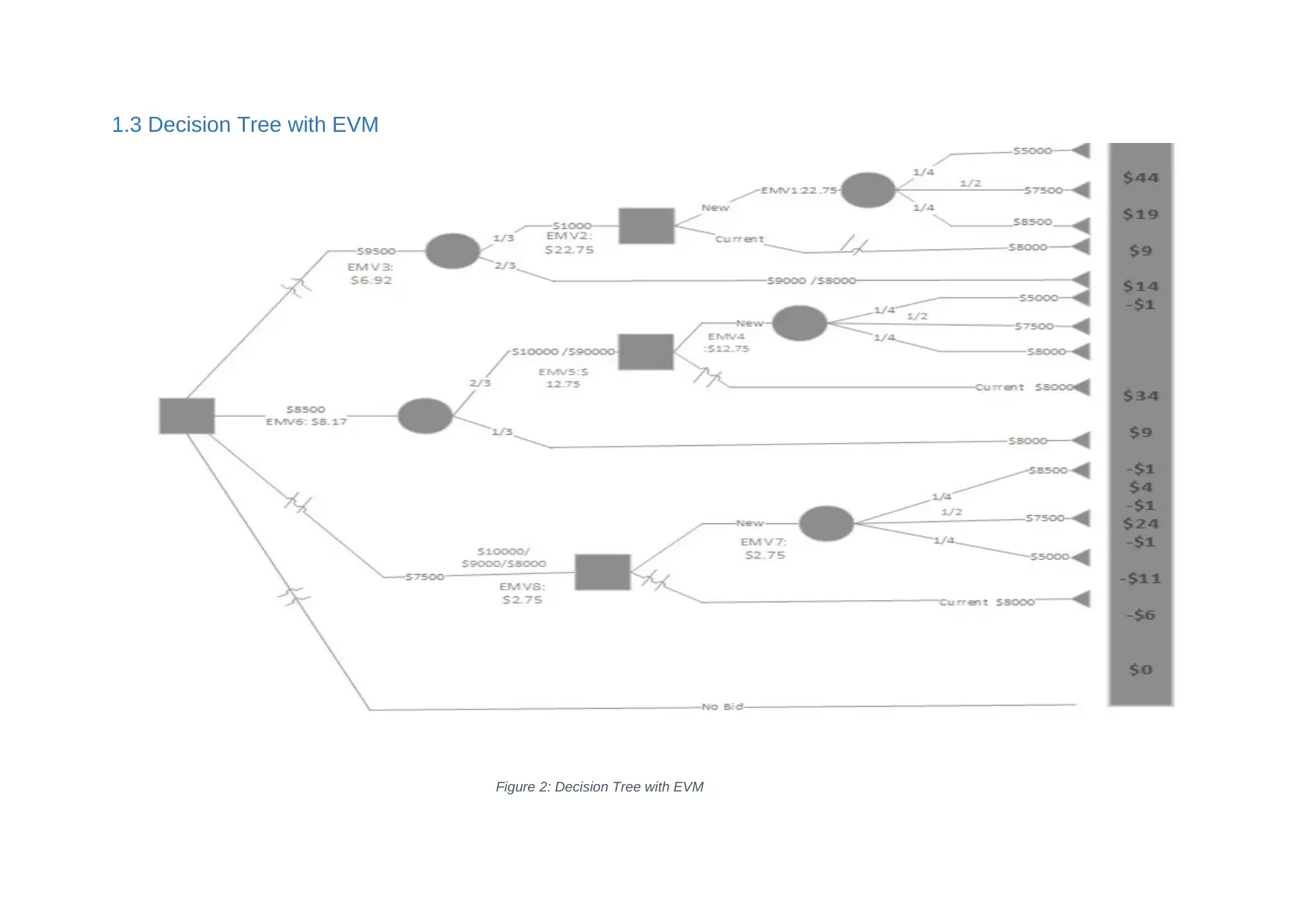

1.3 Decision Tree with EVM

Figure 2: Decision Tree with EVM

Figure 2: Decision Tree with EVM

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

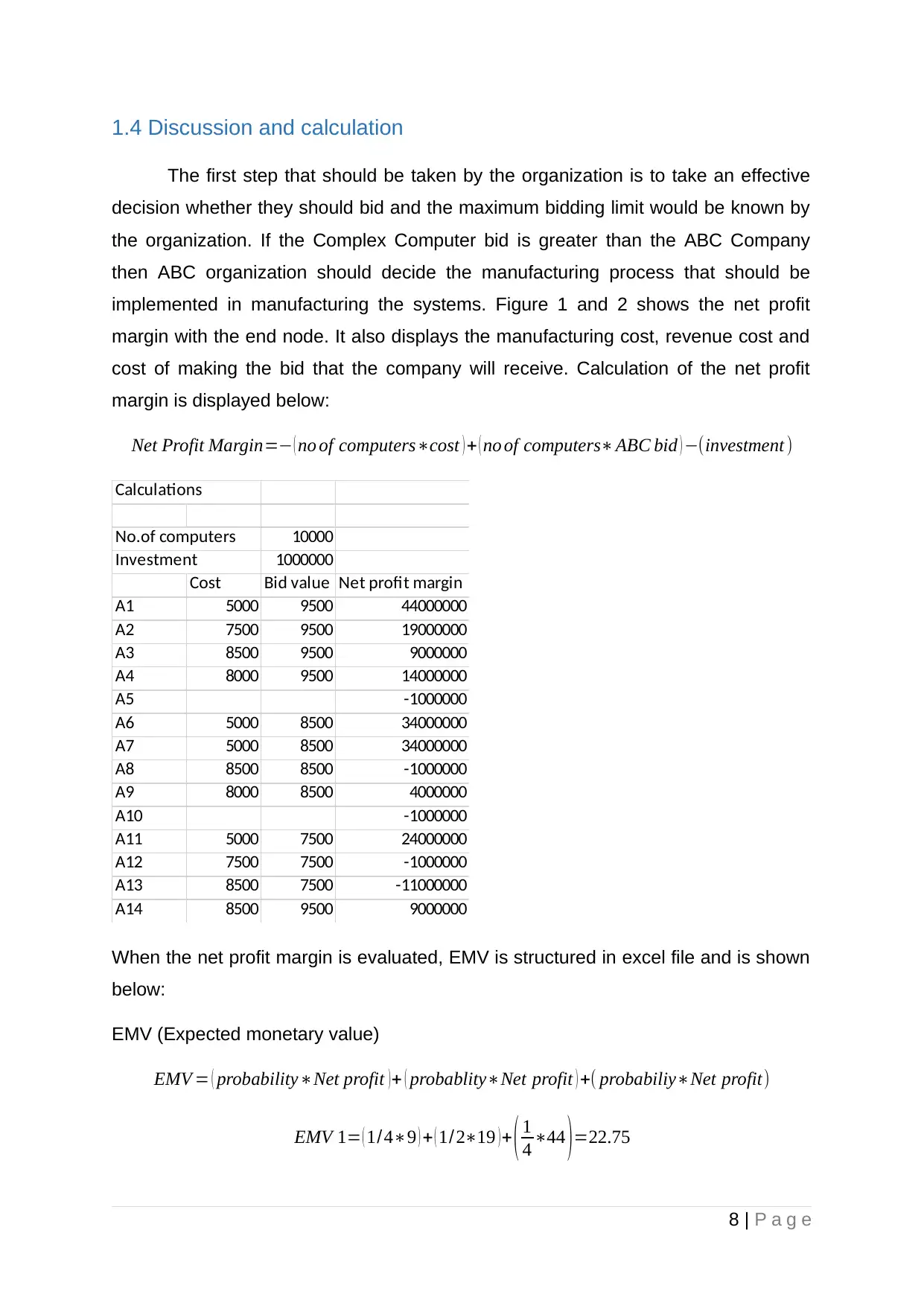

1.4 Discussion and calculation

The first step that should be taken by the organization is to take an effective

decision whether they should bid and the maximum bidding limit would be known by

the organization. If the Complex Computer bid is greater than the ABC Company

then ABC organization should decide the manufacturing process that should be

implemented in manufacturing the systems. Figure 1 and 2 shows the net profit

margin with the end node. It also displays the manufacturing cost, revenue cost and

cost of making the bid that the company will receive. Calculation of the net profit

margin is displayed below:

Net Profit Margin=− ( no of computers∗cost ) + ( no of computers∗ABC bid ) −(investment )

Calculations

No.of computers 10000

Investment 1000000

Cost Bid value Net profit margin

A1 5000 9500 44000000

A2 7500 9500 19000000

A3 8500 9500 9000000

A4 8000 9500 14000000

A5 -1000000

A6 5000 8500 34000000

A7 5000 8500 34000000

A8 8500 8500 -1000000

A9 8000 8500 4000000

A10 -1000000

A11 5000 7500 24000000

A12 7500 7500 -1000000

A13 8500 7500 -11000000

A14 8500 9500 9000000

When the net profit margin is evaluated, EMV is structured in excel file and is shown

below:

EMV (Expected monetary value)

EMV = ( probability∗Net profit ) + ( probablity∗Net profit ) +( probabiliy∗Net profit)

EMV 1= ( 1/4∗9 ) + ( 1/2∗19 )+ ( 1

4 ∗44 )=22.75

8 | P a g e

The first step that should be taken by the organization is to take an effective

decision whether they should bid and the maximum bidding limit would be known by

the organization. If the Complex Computer bid is greater than the ABC Company

then ABC organization should decide the manufacturing process that should be

implemented in manufacturing the systems. Figure 1 and 2 shows the net profit

margin with the end node. It also displays the manufacturing cost, revenue cost and

cost of making the bid that the company will receive. Calculation of the net profit

margin is displayed below:

Net Profit Margin=− ( no of computers∗cost ) + ( no of computers∗ABC bid ) −(investment )

Calculations

No.of computers 10000

Investment 1000000

Cost Bid value Net profit margin

A1 5000 9500 44000000

A2 7500 9500 19000000

A3 8500 9500 9000000

A4 8000 9500 14000000

A5 -1000000

A6 5000 8500 34000000

A7 5000 8500 34000000

A8 8500 8500 -1000000

A9 8000 8500 4000000

A10 -1000000

A11 5000 7500 24000000

A12 7500 7500 -1000000

A13 8500 7500 -11000000

A14 8500 9500 9000000

When the net profit margin is evaluated, EMV is structured in excel file and is shown

below:

EMV (Expected monetary value)

EMV = ( probability∗Net profit ) + ( probablity∗Net profit ) +( probabiliy∗Net profit)

EMV 1= ( 1/4∗9 ) + ( 1/2∗19 )+ ( 1

4 ∗44 )=22.75

8 | P a g e

EMV 2=22.75

EMV 3= ( 1

3∗22.75 )+ ( 2

3∗−1 )=6.92

EMV 4= ( 1/ 4∗34 ) + ( 1/2∗9 ) +( 1

4∗−1 )=12.75

EMV 5=12.75

EMV 6= ( 2/3∗12.75 ) + ( 1

3 ∗−1)=8.17

EMV 7= ( 1

4 ∗−11 )+ ( 1

2∗−1 )+ ( 1

4 ∗24 )=2.75

EMV =2.75

Thus, from the above evaluation it defines that $8500 bid contains the maximum

expected value of $8.17 million. If the ABC organization go with the decision tree

then they should bid $8500. The organization should also employ a new method of

manufacturing the laptops or computer systems. The decision tree contains the

cross hatch which defines the less prioritized branches of a decision node. Thus,

form the above evaluation it can be concluded that the probability of ABC company

in winning the bid in 2/3.

61.5 Bayes Rule Problem

The Bayes rule also known as Bayes theorem is a concept of statistics and

probability. It is utilized to find conditional probability of the events.

Bayes theorem formula

P ( A |B )= P ( B|A ) P( A)

P( B)

The above equation can also be written as:

P ( A |B )= P ( B|A ) P( A)

P ( B|A ) P ( A ) +P(B∨notA) P(notA )

EMV 3= ( 1

3∗22.75 )+ ( 2

3∗−1 )=6.92

EMV 4= ( 1/ 4∗34 ) + ( 1/2∗9 ) +( 1

4∗−1 )=12.75

EMV 5=12.75

EMV 6= ( 2/3∗12.75 ) + ( 1

3 ∗−1)=8.17

EMV 7= ( 1

4 ∗−11 )+ ( 1

2∗−1 )+ ( 1

4 ∗24 )=2.75

EMV =2.75

Thus, from the above evaluation it defines that $8500 bid contains the maximum

expected value of $8.17 million. If the ABC organization go with the decision tree

then they should bid $8500. The organization should also employ a new method of

manufacturing the laptops or computer systems. The decision tree contains the

cross hatch which defines the less prioritized branches of a decision node. Thus,

form the above evaluation it can be concluded that the probability of ABC company

in winning the bid in 2/3.

61.5 Bayes Rule Problem

The Bayes rule also known as Bayes theorem is a concept of statistics and

probability. It is utilized to find conditional probability of the events.

Bayes theorem formula

P ( A |B )= P ( B|A ) P( A)

P( B)

The above equation can also be written as:

P ( A |B )= P ( B|A ) P( A)

P ( B|A ) P ( A ) +P(B∨notA) P(notA )

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

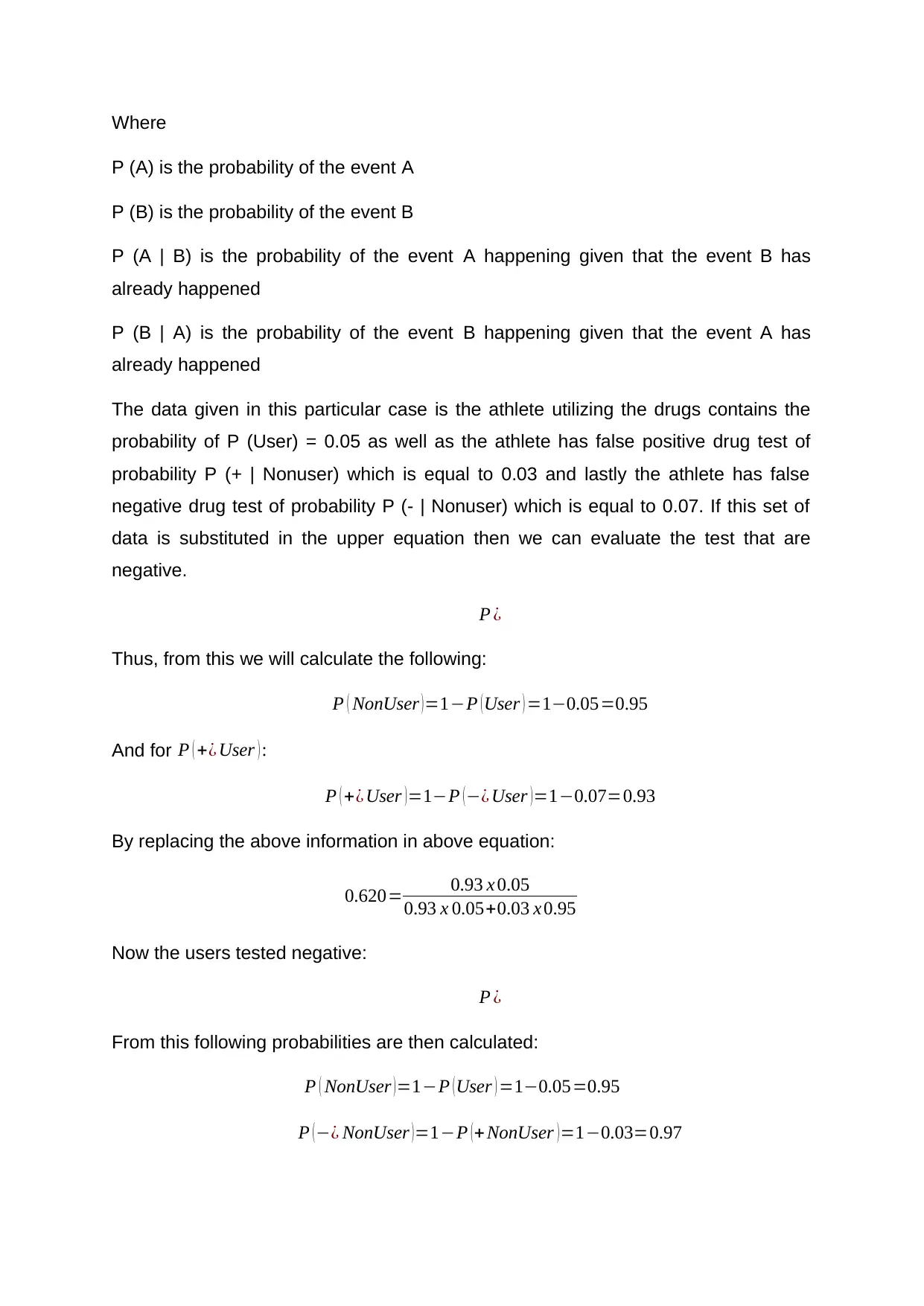

Where

P (A) is the probability of the event A

P (B) is the probability of the event B

P (A | B) is the probability of the event A happening given that the event B has

already happened

P (B | A) is the probability of the event B happening given that the event A has

already happened

The data given in this particular case is the athlete utilizing the drugs contains the

probability of P (User) = 0.05 as well as the athlete has false positive drug test of

probability P (+ | Nonuser) which is equal to 0.03 and lastly the athlete has false

negative drug test of probability P (- | Nonuser) which is equal to 0.07. If this set of

data is substituted in the upper equation then we can evaluate the test that are

negative.

P ¿

Thus, from this we will calculate the following:

P ( NonUser )=1−P (User ) =1−0.05=0.95

And for P ( +¿ User ) :

P ( +¿ User )=1−P (−¿ User )=1−0.07=0.93

By replacing the above information in above equation:

0.620= 0.93 x 0.05

0.93 x 0.05+0.03 x 0.95

Now the users tested negative:

P ¿

From this following probabilities are then calculated:

P ( NonUser )=1−P (User ) =1−0.05=0.95

P (−¿ NonUser )=1−P (+ NonUser )=1−0.03=0.97

P (A) is the probability of the event A

P (B) is the probability of the event B

P (A | B) is the probability of the event A happening given that the event B has

already happened

P (B | A) is the probability of the event B happening given that the event A has

already happened

The data given in this particular case is the athlete utilizing the drugs contains the

probability of P (User) = 0.05 as well as the athlete has false positive drug test of

probability P (+ | Nonuser) which is equal to 0.03 and lastly the athlete has false

negative drug test of probability P (- | Nonuser) which is equal to 0.07. If this set of

data is substituted in the upper equation then we can evaluate the test that are

negative.

P ¿

Thus, from this we will calculate the following:

P ( NonUser )=1−P (User ) =1−0.05=0.95

And for P ( +¿ User ) :

P ( +¿ User )=1−P (−¿ User )=1−0.07=0.93

By replacing the above information in above equation:

0.620= 0.93 x 0.05

0.93 x 0.05+0.03 x 0.95

Now the users tested negative:

P ¿

From this following probabilities are then calculated:

P ( NonUser )=1−P (User ) =1−0.05=0.95

P (−¿ NonUser )=1−P (+ NonUser )=1−0.03=0.97

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

0.996= 0.97 x 0.95

0.0035+ 0.97 x 0.95

1.6 Bayes Rule Outcomes

After completion of the calculations, we can determine that whether an athlete utilize

the drugs or not. The calculation shows that there is thirty eight percent chance that

the test is false positive that defines that the athletes do not utilize drugs.

Part 1-Outcomes Page Number

Introduction to the problems 1

Decisions Tree without the EMV 2

EMV with Decision Tree with Discussion 3

Final Decision with justification 4

Bayes Rule problem 6

Bayes Rule two outputs and their

discussions

7

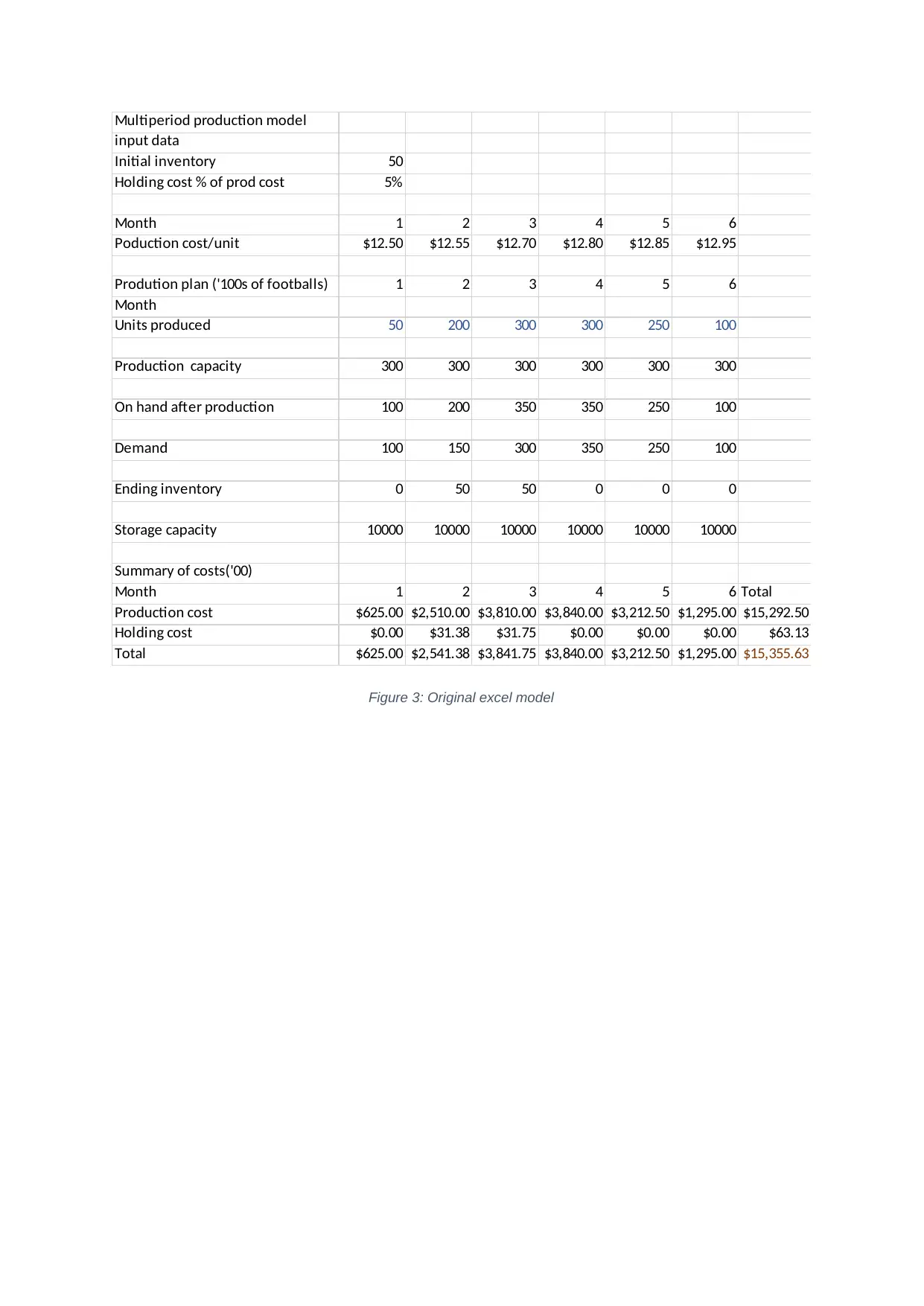

2.0 Question 2

2.1 Objective

In this case there is an organization namely Pigskin Company that manufactures

football and also utilizes the six-month production schedule for determination of

optimum work schedule which decreases the production as well as holding cost and

also helps the organization to meet the customer demands in time. In this case an

excel structure was generated and modified with respect to problem statement.

0.0035+ 0.97 x 0.95

1.6 Bayes Rule Outcomes

After completion of the calculations, we can determine that whether an athlete utilize

the drugs or not. The calculation shows that there is thirty eight percent chance that

the test is false positive that defines that the athletes do not utilize drugs.

Part 1-Outcomes Page Number

Introduction to the problems 1

Decisions Tree without the EMV 2

EMV with Decision Tree with Discussion 3

Final Decision with justification 4

Bayes Rule problem 6

Bayes Rule two outputs and their

discussions

7

2.0 Question 2

2.1 Objective

In this case there is an organization namely Pigskin Company that manufactures

football and also utilizes the six-month production schedule for determination of

optimum work schedule which decreases the production as well as holding cost and

also helps the organization to meet the customer demands in time. In this case an

excel structure was generated and modified with respect to problem statement.

Multiperiod production model

input data

Initial inventory 50

Holding cost % of prod cost 5%

Month 1 2 3 4 5 6

Poduction cost/unit $12.50 $12.55 $12.70 $12.80 $12.85 $12.95

Prodution plan ('100s of footballs) 1 2 3 4 5 6

Month

Units produced 50 200 300 300 250 100

Production capacity 300 300 300 300 300 300

On hand after production 100 200 350 350 250 100

Demand 100 150 300 350 250 100

Ending inventory 0 50 50 0 0 0

Storage capacity 10000 10000 10000 10000 10000 10000

Summary of costs('00)

Month 1 2 3 4 5 6 Total

Production cost $625.00 $2,510.00 $3,810.00 $3,840.00 $3,212.50 $1,295.00 $15,292.50

Holding cost $0.00 $31.38 $31.75 $0.00 $0.00 $0.00 $63.13

Total $625.00 $2,541.38 $3,841.75 $3,840.00 $3,212.50 $1,295.00 $15,355.63

Figure 3: Original excel model

input data

Initial inventory 50

Holding cost % of prod cost 5%

Month 1 2 3 4 5 6

Poduction cost/unit $12.50 $12.55 $12.70 $12.80 $12.85 $12.95

Prodution plan ('100s of footballs) 1 2 3 4 5 6

Month

Units produced 50 200 300 300 250 100

Production capacity 300 300 300 300 300 300

On hand after production 100 200 350 350 250 100

Demand 100 150 300 350 250 100

Ending inventory 0 50 50 0 0 0

Storage capacity 10000 10000 10000 10000 10000 10000

Summary of costs('00)

Month 1 2 3 4 5 6 Total

Production cost $625.00 $2,510.00 $3,810.00 $3,840.00 $3,212.50 $1,295.00 $15,292.50

Holding cost $0.00 $31.38 $31.75 $0.00 $0.00 $0.00 $63.13

Total $625.00 $2,541.38 $3,841.75 $3,840.00 $3,212.50 $1,295.00 $15,355.63

Figure 3: Original excel model

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 28

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.

![Risk Management Report: Project and Risk Analysis, [University]](/_next/image/?url=https%3A%2F%2Fdesklib.com%2Fmedia%2Fimages%2Fhr%2F5b452424732244a8af988a91c6655f2d.jpg&w=256&q=75)