Finance Management in Public Sector: Case Studies and Analysis

VerifiedAdded on 2019/12/03

|18

|5840

|153

Report

AI Summary

This report provides a comprehensive analysis of financial management within the public sector, focusing on organizations like the NHS and the UK Atomic Energy Authority. It begins by examining the structure of public sector organizations, differentiating them from private entities, and highlighting the role of the NHS in providing healthcare services. The report delves into the analysis of financial information, including revenue, expenses, and performance indicators, as reported by these organizations. It further explores the accountability of public sector managers, emphasizing their responsibilities to various stakeholders and the tools used to ensure financial transparency. The report includes detailed analyses of financial statements, such as income statements and balance sheets, to evaluate financial performance. Additionally, it covers project evaluation techniques, the tendering process, and the selection of suitable suppliers, providing a thorough overview of financial practices in the public sector.

MANAGING FINANCE IN

PUBLIC SECTOR

PUBLIC SECTOR

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Analysis of different organizations in the public sector...................................................1

1.2 Accountability of public sector managers in relation to finance......................................2

1.3 Analysis of financial information reported for different public sector organizations......4

TASK 2............................................................................................................................................5

2.1 Analysis of available financial information and evaluation of the same for decision

making....................................................................................................................................5

2.2 Areas to be monitored and way to do this........................................................................7

2.3 Financial decisions and techniques to support them........................................................8

TASK 3..........................................................................................................................................11

3.1 Process by which project are put out to tender...............................................................11

3.2 Ways in which tenders are evaluated and suitable suppliers are selected......................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Analysis of different organizations in the public sector...................................................1

1.2 Accountability of public sector managers in relation to finance......................................2

1.3 Analysis of financial information reported for different public sector organizations......4

TASK 2............................................................................................................................................5

2.1 Analysis of available financial information and evaluation of the same for decision

making....................................................................................................................................5

2.2 Areas to be monitored and way to do this........................................................................7

2.3 Financial decisions and techniques to support them........................................................8

TASK 3..........................................................................................................................................11

3.1 Process by which project are put out to tender...............................................................11

3.2 Ways in which tenders are evaluated and suitable suppliers are selected......................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

NHS is a government organization which is providing medical services to the sick

people. This organization is playing a vital role in the elimination of diseases in UK. This report

is prepared on managing finance in public sector. In this report, government organizations are

analyzed and structure of NHS is discussed in detail. Further, in this report, accountability of

managers in public sector firms is discussed in detail. With respect to finance, budgets and

project evaluation techniques are discussed in detail in this report. Further, ways are proposed

that can be used for identifying appropriate discount rate for computing present value of the

project. At the end of the report, ways that are used for applying for tender are discussed in

detail. Furthermore, some of the factors are discussed that must be followed in order to select

right supplier for passing the tender.

TASK 1

1.1 Analysis of different organizations in the public sector

Public sectors refer to an organization that is owned by the government and entire

investment is made by the regulatory bodies itself. Usually, these firms are government

departments and they have their own system of accounting. Government also runs some of the

companies specifically in those areas in which entry of private firms are prohibited. These areas

may be atomic energy etc. Organizations operating in such industry are fully owned by the

regulatory bodies. There is a great difference between public and private sector organizations.

The main difference comes in case of ownership. Public companies are owned by government

whereas private firms are owned by an individual or group of people. The second difference

comes on profit. In case of public organizations, main aim is to do welfare of general public. But

in case of private companies, major objective is to earn profit (Flynn, 2007). Private firms are

focusing on growing their business at a rapid rate and their efficiency is also very high. On the

other hand, public organization’s efficiency level is very low and they follow a detailed

procedure to perform any activity. NHS is one of the UK’s largest and most popular service

providers in health care sector. In order to understand the working of NHS, it is necessary to

understand its structure (Bovaird and Löffler, 2009). Main components of its organizational

structure are primary care, specialized services, offender health care, armed forces health care

and immunization screening of young children. Through these components, it is providing varied

1

NHS is a government organization which is providing medical services to the sick

people. This organization is playing a vital role in the elimination of diseases in UK. This report

is prepared on managing finance in public sector. In this report, government organizations are

analyzed and structure of NHS is discussed in detail. Further, in this report, accountability of

managers in public sector firms is discussed in detail. With respect to finance, budgets and

project evaluation techniques are discussed in detail in this report. Further, ways are proposed

that can be used for identifying appropriate discount rate for computing present value of the

project. At the end of the report, ways that are used for applying for tender are discussed in

detail. Furthermore, some of the factors are discussed that must be followed in order to select

right supplier for passing the tender.

TASK 1

1.1 Analysis of different organizations in the public sector

Public sectors refer to an organization that is owned by the government and entire

investment is made by the regulatory bodies itself. Usually, these firms are government

departments and they have their own system of accounting. Government also runs some of the

companies specifically in those areas in which entry of private firms are prohibited. These areas

may be atomic energy etc. Organizations operating in such industry are fully owned by the

regulatory bodies. There is a great difference between public and private sector organizations.

The main difference comes in case of ownership. Public companies are owned by government

whereas private firms are owned by an individual or group of people. The second difference

comes on profit. In case of public organizations, main aim is to do welfare of general public. But

in case of private companies, major objective is to earn profit (Flynn, 2007). Private firms are

focusing on growing their business at a rapid rate and their efficiency is also very high. On the

other hand, public organization’s efficiency level is very low and they follow a detailed

procedure to perform any activity. NHS is one of the UK’s largest and most popular service

providers in health care sector. In order to understand the working of NHS, it is necessary to

understand its structure (Bovaird and Löffler, 2009). Main components of its organizational

structure are primary care, specialized services, offender health care, armed forces health care

and immunization screening of young children. Through these components, it is providing varied

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

services to its customers. Through immunization services, it identifies that whether young

children are capable to fight with their diseases or not. On the other hand, it also looks after the

health of army personnel and ensures that they remain healthy forever. Under specialized

services, it is providing unique services to the patients that are suffering from specific disease.

Primary care is another segment in which NHS is operating and under this segment, firm is

providing primary care services to the patients. Hence, NHS as a government organization is

playing a prominent role in keeping people of UK healthy.

1.3 Analysis of financial information reported for different public sector organizations

In many nations, corruption has a strong grip on the public sector organizations. In these

nations, every year, many cases regarding corruption in government departments are identified.

Thus, government in these nations is using each and every measure that helps them in the

identification of manipulation in money if it has happened in any public sector firm. In financial

information, plenty of data about public sector organization is made available and along with

this, its revenue receipt is also shown in the financial statements. In these financial reports,

financial and non financial information is also disclosed (Farneti and Guthrie, 2009). After

preparation of report, it is communicated to the top authorities which may be single or multiple

in their nature. These financial information snapshots are also printed in reports from the house

of parliament and audit commission. Hence, in this way, fully fledged control is maintained on

the government organization by parliament and regulatory authorities. Further, information

provided in financial reporting is also audited by some specific authority in order to ensure that

money is not manipulated by the employees that are working in the specific department. Hence,

these measures certainly help in ensuring that in an organization, operations are performed fairly

without any manipulation (Finkler, 2005). With the passage of time, government requires to

introduce some new things in order to ensure that if any corruption will be done in the

government department, it will be identified and strong actions will be taken against culprit as

soon as possible.

NHS

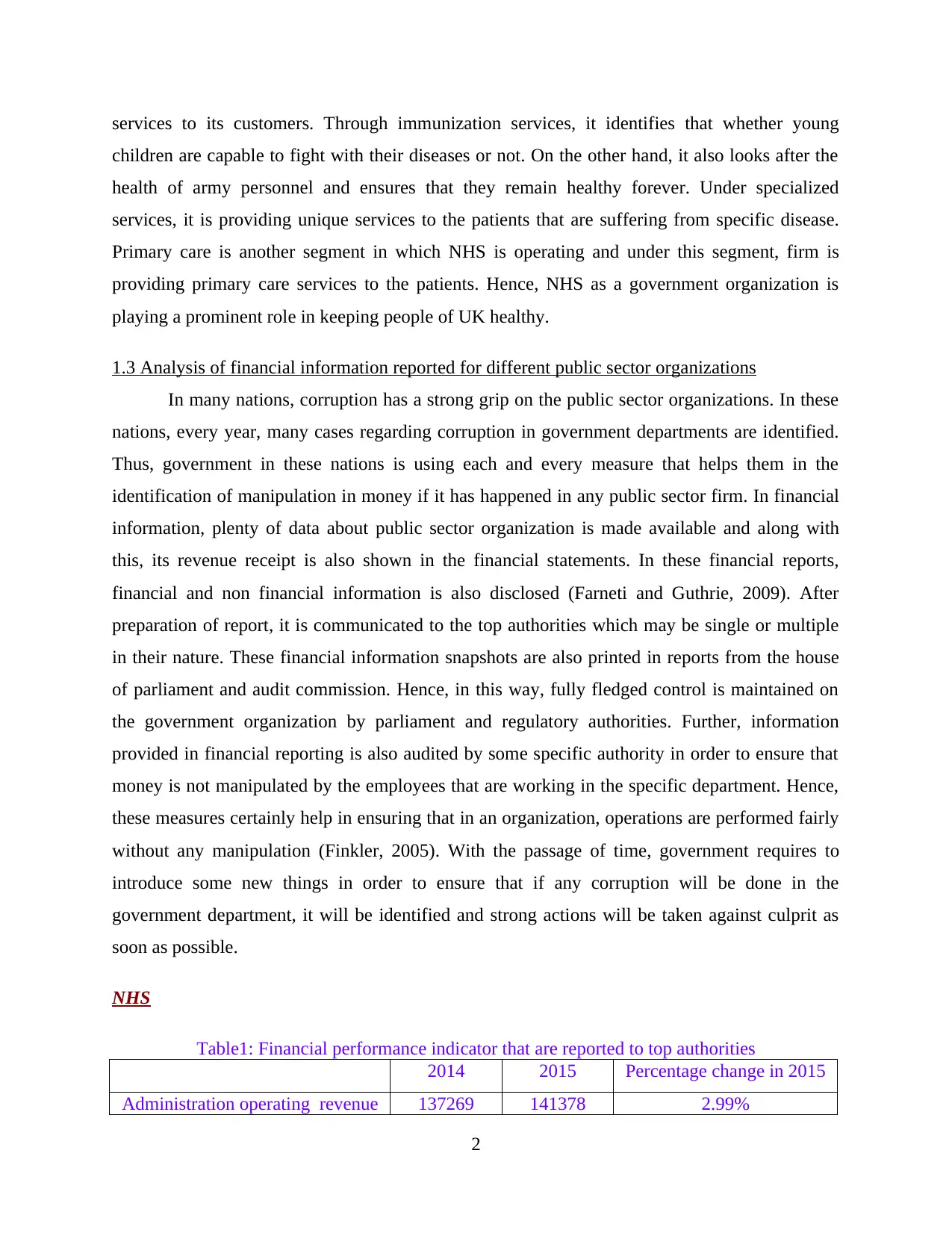

Table1: Financial performance indicator that are reported to top authorities

2014 2015 Percentage change in 2015

Administration operating revenue 137269 141378 2.99%

2

children are capable to fight with their diseases or not. On the other hand, it also looks after the

health of army personnel and ensures that they remain healthy forever. Under specialized

services, it is providing unique services to the patients that are suffering from specific disease.

Primary care is another segment in which NHS is operating and under this segment, firm is

providing primary care services to the patients. Hence, NHS as a government organization is

playing a prominent role in keeping people of UK healthy.

1.3 Analysis of financial information reported for different public sector organizations

In many nations, corruption has a strong grip on the public sector organizations. In these

nations, every year, many cases regarding corruption in government departments are identified.

Thus, government in these nations is using each and every measure that helps them in the

identification of manipulation in money if it has happened in any public sector firm. In financial

information, plenty of data about public sector organization is made available and along with

this, its revenue receipt is also shown in the financial statements. In these financial reports,

financial and non financial information is also disclosed (Farneti and Guthrie, 2009). After

preparation of report, it is communicated to the top authorities which may be single or multiple

in their nature. These financial information snapshots are also printed in reports from the house

of parliament and audit commission. Hence, in this way, fully fledged control is maintained on

the government organization by parliament and regulatory authorities. Further, information

provided in financial reporting is also audited by some specific authority in order to ensure that

money is not manipulated by the employees that are working in the specific department. Hence,

these measures certainly help in ensuring that in an organization, operations are performed fairly

without any manipulation (Finkler, 2005). With the passage of time, government requires to

introduce some new things in order to ensure that if any corruption will be done in the

government department, it will be identified and strong actions will be taken against culprit as

soon as possible.

NHS

Table1: Financial performance indicator that are reported to top authorities

2014 2015 Percentage change in 2015

Administration operating revenue 137269 141378 2.99%

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

(Source of income )

Administration employee benefits 1271301 1289438 1.43%

Administration operating expenses 938860 689469 -26.56%

Administration finance cost 6150 4263 -30.68%

Program operating income (Source

of income ) 1706099 2014531 18.08%

Program employee benefits 257767 437590 69.76%

Program operating expenses 93887559 97321163 3.66%

Interpretation

On analysis of financial indicator it can be said that NHS income is greater then cost.

Moreover, stiff control is kept on cost and due to this reason cost fall sharply in administration.

But same not happened in case of operating program activities. This happens because attention is

not paid on this front.

Annual report related to NHS is published on regular basis and send to relevant

authorities and parliament. Other external agencies also prepare and published a report related to

NHS. PHE is an executive agency sponsored by the department of health and it prepared a report

on NHS and other government services time to time. These reports indicate the activities that

health organizations perform in the UK. UK House of Commons also prepared a report related to

NHS under head “Investigating clinical incidents in the NHS”. Hence, it can be said that internal

and external reports related to NHS are released time to time on various sources of secondary

information.

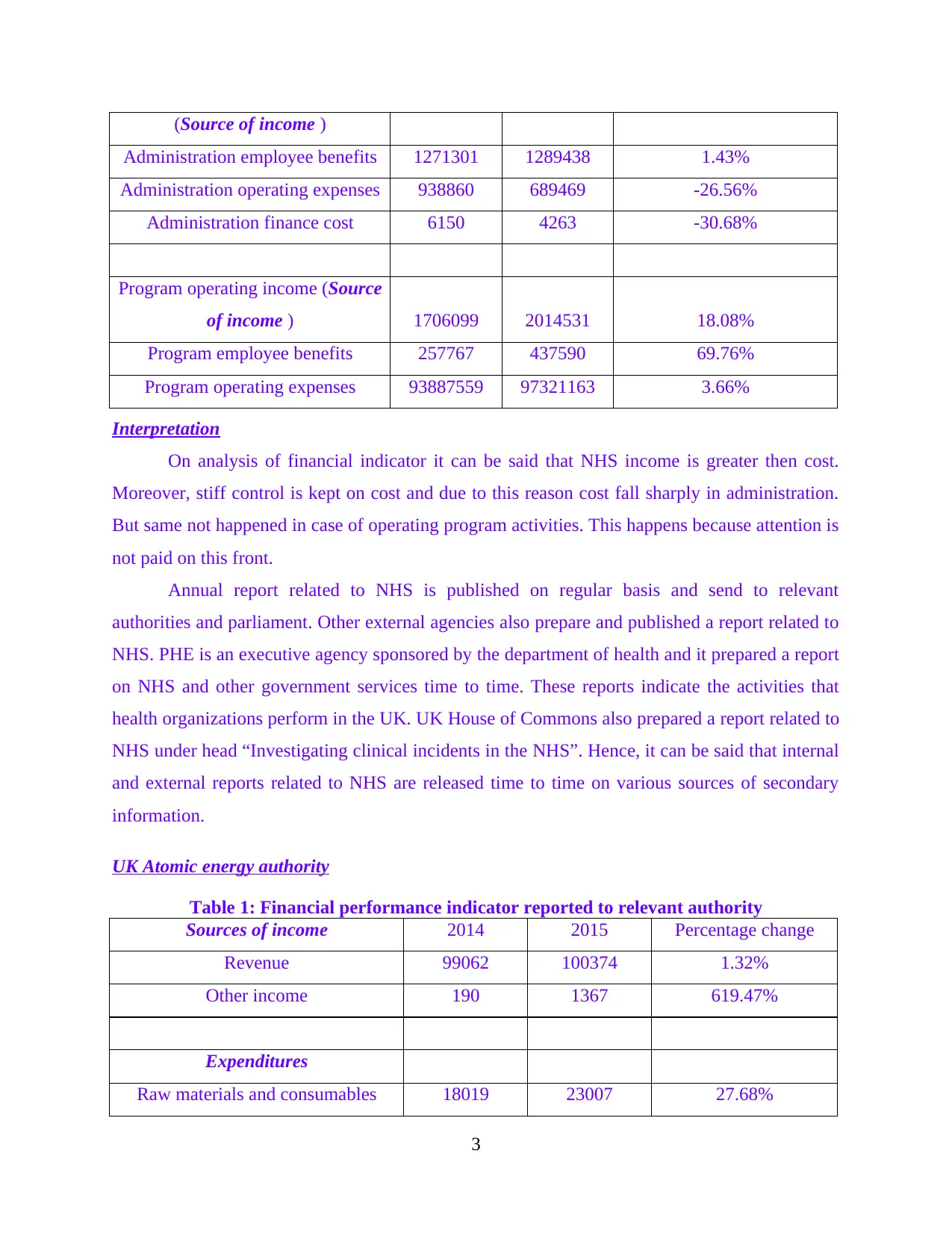

UK Atomic energy authority

Table 1: Financial performance indicator reported to relevant authority

Sources of income 2014 2015 Percentage change

Revenue 99062 100374 1.32%

Other income 190 1367 619.47%

Expenditures

Raw materials and consumables 18019 23007 27.68%

3

Administration employee benefits 1271301 1289438 1.43%

Administration operating expenses 938860 689469 -26.56%

Administration finance cost 6150 4263 -30.68%

Program operating income (Source

of income ) 1706099 2014531 18.08%

Program employee benefits 257767 437590 69.76%

Program operating expenses 93887559 97321163 3.66%

Interpretation

On analysis of financial indicator it can be said that NHS income is greater then cost.

Moreover, stiff control is kept on cost and due to this reason cost fall sharply in administration.

But same not happened in case of operating program activities. This happens because attention is

not paid on this front.

Annual report related to NHS is published on regular basis and send to relevant

authorities and parliament. Other external agencies also prepare and published a report related to

NHS. PHE is an executive agency sponsored by the department of health and it prepared a report

on NHS and other government services time to time. These reports indicate the activities that

health organizations perform in the UK. UK House of Commons also prepared a report related to

NHS under head “Investigating clinical incidents in the NHS”. Hence, it can be said that internal

and external reports related to NHS are released time to time on various sources of secondary

information.

UK Atomic energy authority

Table 1: Financial performance indicator reported to relevant authority

Sources of income 2014 2015 Percentage change

Revenue 99062 100374 1.32%

Other income 190 1367 619.47%

Expenditures

Raw materials and consumables 18019 23007 27.68%

3

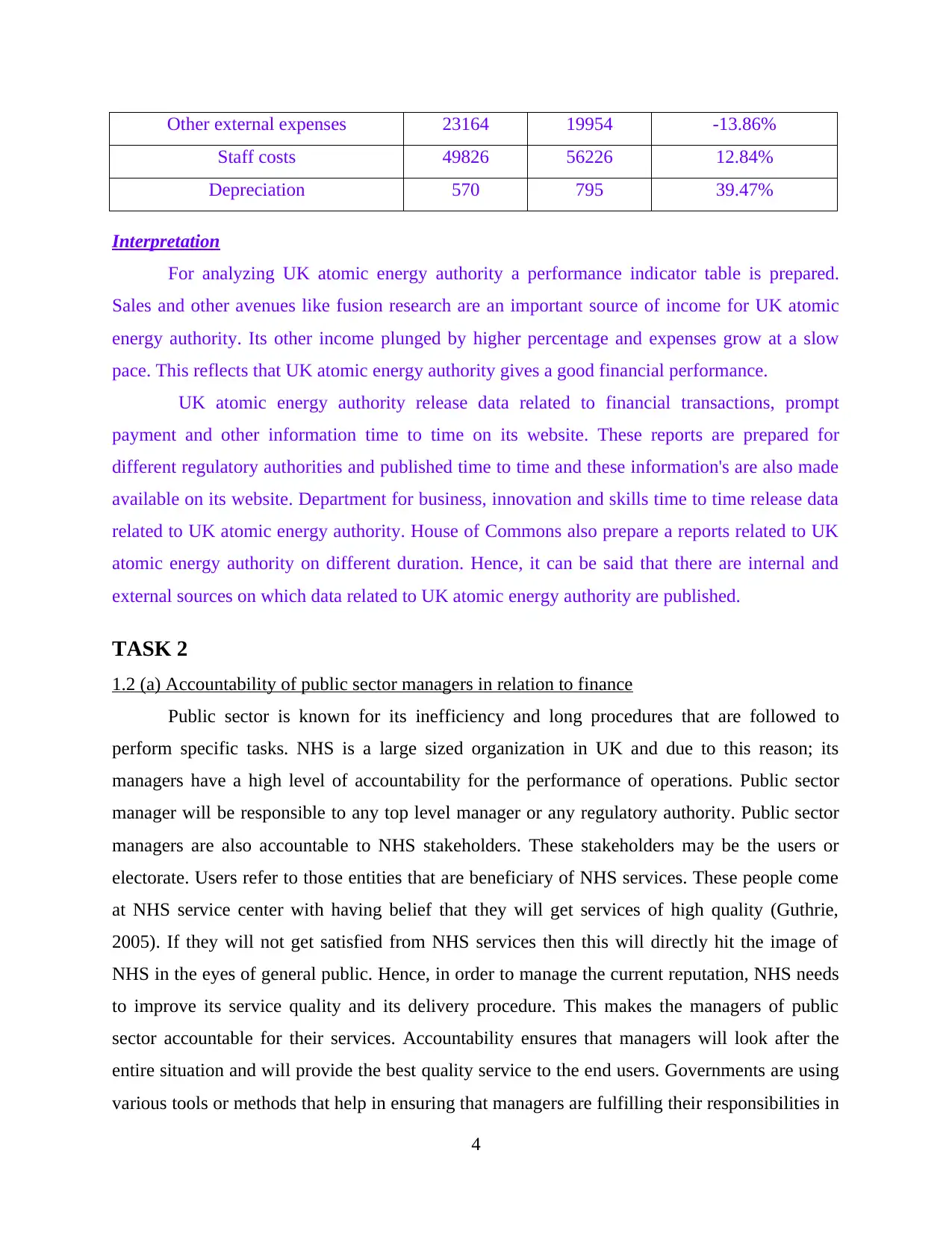

Other external expenses 23164 19954 -13.86%

Staff costs 49826 56226 12.84%

Depreciation 570 795 39.47%

Interpretation

For analyzing UK atomic energy authority a performance indicator table is prepared.

Sales and other avenues like fusion research are an important source of income for UK atomic

energy authority. Its other income plunged by higher percentage and expenses grow at a slow

pace. This reflects that UK atomic energy authority gives a good financial performance.

UK atomic energy authority release data related to financial transactions, prompt

payment and other information time to time on its website. These reports are prepared for

different regulatory authorities and published time to time and these information's are also made

available on its website. Department for business, innovation and skills time to time release data

related to UK atomic energy authority. House of Commons also prepare a reports related to UK

atomic energy authority on different duration. Hence, it can be said that there are internal and

external sources on which data related to UK atomic energy authority are published.

TASK 2

1.2 (a) Accountability of public sector managers in relation to finance

Public sector is known for its inefficiency and long procedures that are followed to

perform specific tasks. NHS is a large sized organization in UK and due to this reason; its

managers have a high level of accountability for the performance of operations. Public sector

manager will be responsible to any top level manager or any regulatory authority. Public sector

managers are also accountable to NHS stakeholders. These stakeholders may be the users or

electorate. Users refer to those entities that are beneficiary of NHS services. These people come

at NHS service center with having belief that they will get services of high quality (Guthrie,

2005). If they will not get satisfied from NHS services then this will directly hit the image of

NHS in the eyes of general public. Hence, in order to manage the current reputation, NHS needs

to improve its service quality and its delivery procedure. This makes the managers of public

sector accountable for their services. Accountability ensures that managers will look after the

entire situation and will provide the best quality service to the end users. Governments are using

various tools or methods that help in ensuring that managers are fulfilling their responsibilities in

4

Staff costs 49826 56226 12.84%

Depreciation 570 795 39.47%

Interpretation

For analyzing UK atomic energy authority a performance indicator table is prepared.

Sales and other avenues like fusion research are an important source of income for UK atomic

energy authority. Its other income plunged by higher percentage and expenses grow at a slow

pace. This reflects that UK atomic energy authority gives a good financial performance.

UK atomic energy authority release data related to financial transactions, prompt

payment and other information time to time on its website. These reports are prepared for

different regulatory authorities and published time to time and these information's are also made

available on its website. Department for business, innovation and skills time to time release data

related to UK atomic energy authority. House of Commons also prepare a reports related to UK

atomic energy authority on different duration. Hence, it can be said that there are internal and

external sources on which data related to UK atomic energy authority are published.

TASK 2

1.2 (a) Accountability of public sector managers in relation to finance

Public sector is known for its inefficiency and long procedures that are followed to

perform specific tasks. NHS is a large sized organization in UK and due to this reason; its

managers have a high level of accountability for the performance of operations. Public sector

manager will be responsible to any top level manager or any regulatory authority. Public sector

managers are also accountable to NHS stakeholders. These stakeholders may be the users or

electorate. Users refer to those entities that are beneficiary of NHS services. These people come

at NHS service center with having belief that they will get services of high quality (Guthrie,

2005). If they will not get satisfied from NHS services then this will directly hit the image of

NHS in the eyes of general public. Hence, in order to manage the current reputation, NHS needs

to improve its service quality and its delivery procedure. This makes the managers of public

sector accountable for their services. Accountability ensures that managers will look after the

entire situation and will provide the best quality service to the end users. Governments are using

various tools or methods that help in ensuring that managers are fulfilling their responsibilities in

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

a proper manner. These tools may be audit, financial reporting, legislation and policies etc. Audit

is commonly used in the public sector organizations in which accounts of specific public firm are

audited by auditors or auditor in general. On the basis of accounts, it is ensured that money is not

manipulated in an organization (De Bruijn, 2007). Along with this, in audit, way of working by a

specific government company is also analyzed. This helps auditors in measuring the extent to

which an organization is performing its operations efficiently. If any discrepancy is observed at

the time of auditing then strict actions may be taken against manager or employees that are

working under him. Financial reporting is another tool that is used in this regard. In this method,

entire financial data of an organization is presented in the report format to recognize the

governing authority or board. These authorities or board on evaluation of received report makes

a decision about the performance of company. If evaluation is negative then they can made some

of the recommendations in order to improve the efficiency level of an enterprise.

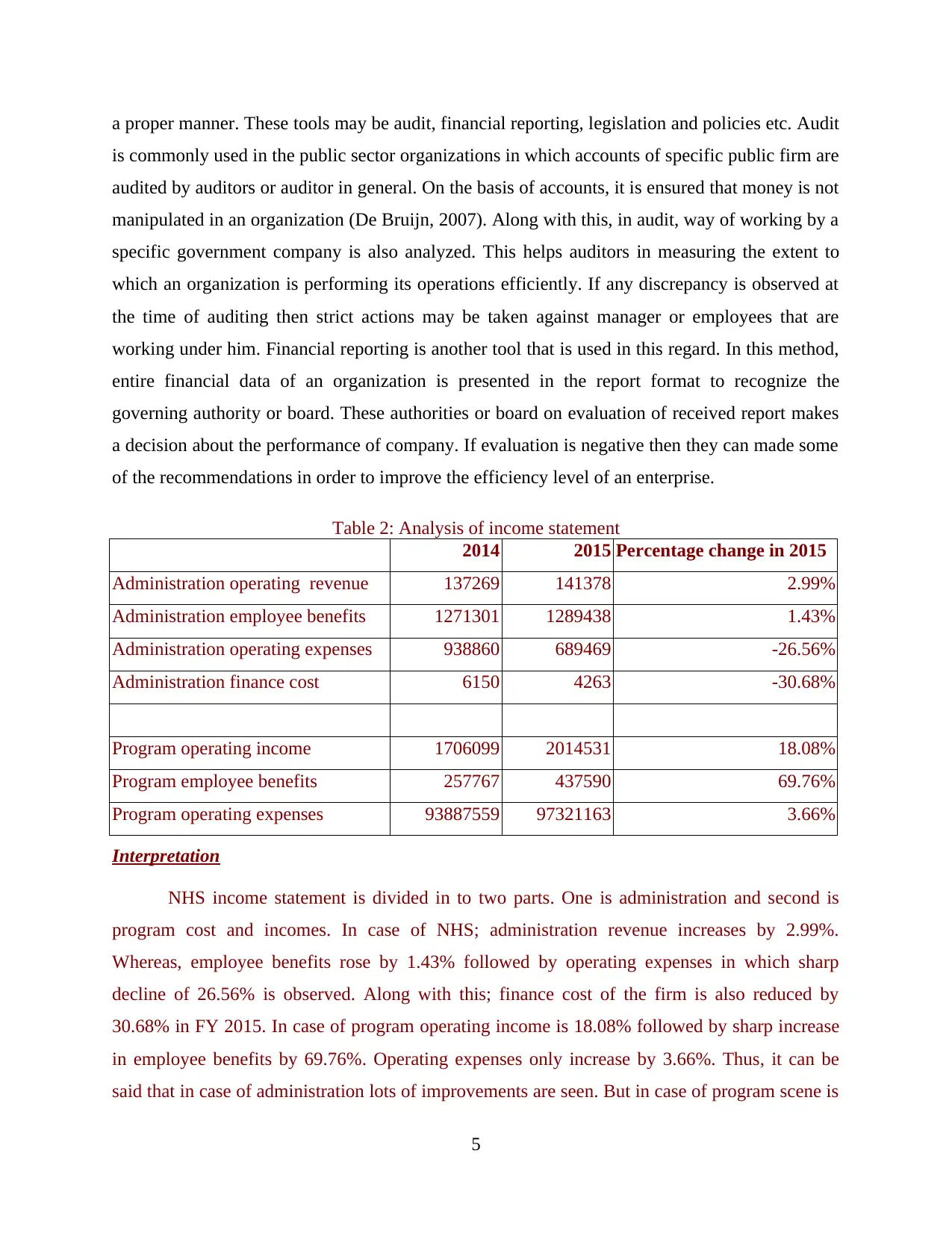

Table 2: Analysis of income statement

2014 2015 Percentage change in 2015

Administration operating revenue 137269 141378 2.99%

Administration employee benefits 1271301 1289438 1.43%

Administration operating expenses 938860 689469 -26.56%

Administration finance cost 6150 4263 -30.68%

Program operating income 1706099 2014531 18.08%

Program employee benefits 257767 437590 69.76%

Program operating expenses 93887559 97321163 3.66%

Interpretation

NHS income statement is divided in to two parts. One is administration and second is

program cost and incomes. In case of NHS; administration revenue increases by 2.99%.

Whereas, employee benefits rose by 1.43% followed by operating expenses in which sharp

decline of 26.56% is observed. Along with this; finance cost of the firm is also reduced by

30.68% in FY 2015. In case of program operating income is 18.08% followed by sharp increase

in employee benefits by 69.76%. Operating expenses only increase by 3.66%. Thus, it can be

said that in case of administration lots of improvements are seen. But in case of program scene is

5

is commonly used in the public sector organizations in which accounts of specific public firm are

audited by auditors or auditor in general. On the basis of accounts, it is ensured that money is not

manipulated in an organization (De Bruijn, 2007). Along with this, in audit, way of working by a

specific government company is also analyzed. This helps auditors in measuring the extent to

which an organization is performing its operations efficiently. If any discrepancy is observed at

the time of auditing then strict actions may be taken against manager or employees that are

working under him. Financial reporting is another tool that is used in this regard. In this method,

entire financial data of an organization is presented in the report format to recognize the

governing authority or board. These authorities or board on evaluation of received report makes

a decision about the performance of company. If evaluation is negative then they can made some

of the recommendations in order to improve the efficiency level of an enterprise.

Table 2: Analysis of income statement

2014 2015 Percentage change in 2015

Administration operating revenue 137269 141378 2.99%

Administration employee benefits 1271301 1289438 1.43%

Administration operating expenses 938860 689469 -26.56%

Administration finance cost 6150 4263 -30.68%

Program operating income 1706099 2014531 18.08%

Program employee benefits 257767 437590 69.76%

Program operating expenses 93887559 97321163 3.66%

Interpretation

NHS income statement is divided in to two parts. One is administration and second is

program cost and incomes. In case of NHS; administration revenue increases by 2.99%.

Whereas, employee benefits rose by 1.43% followed by operating expenses in which sharp

decline of 26.56% is observed. Along with this; finance cost of the firm is also reduced by

30.68% in FY 2015. In case of program operating income is 18.08% followed by sharp increase

in employee benefits by 69.76%. Operating expenses only increase by 3.66%. Thus, it can be

said that in case of administration lots of improvements are seen. But in case of program scene is

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

inverse and economies of scale generated in administration offset by elevation in expenses in

case of program.

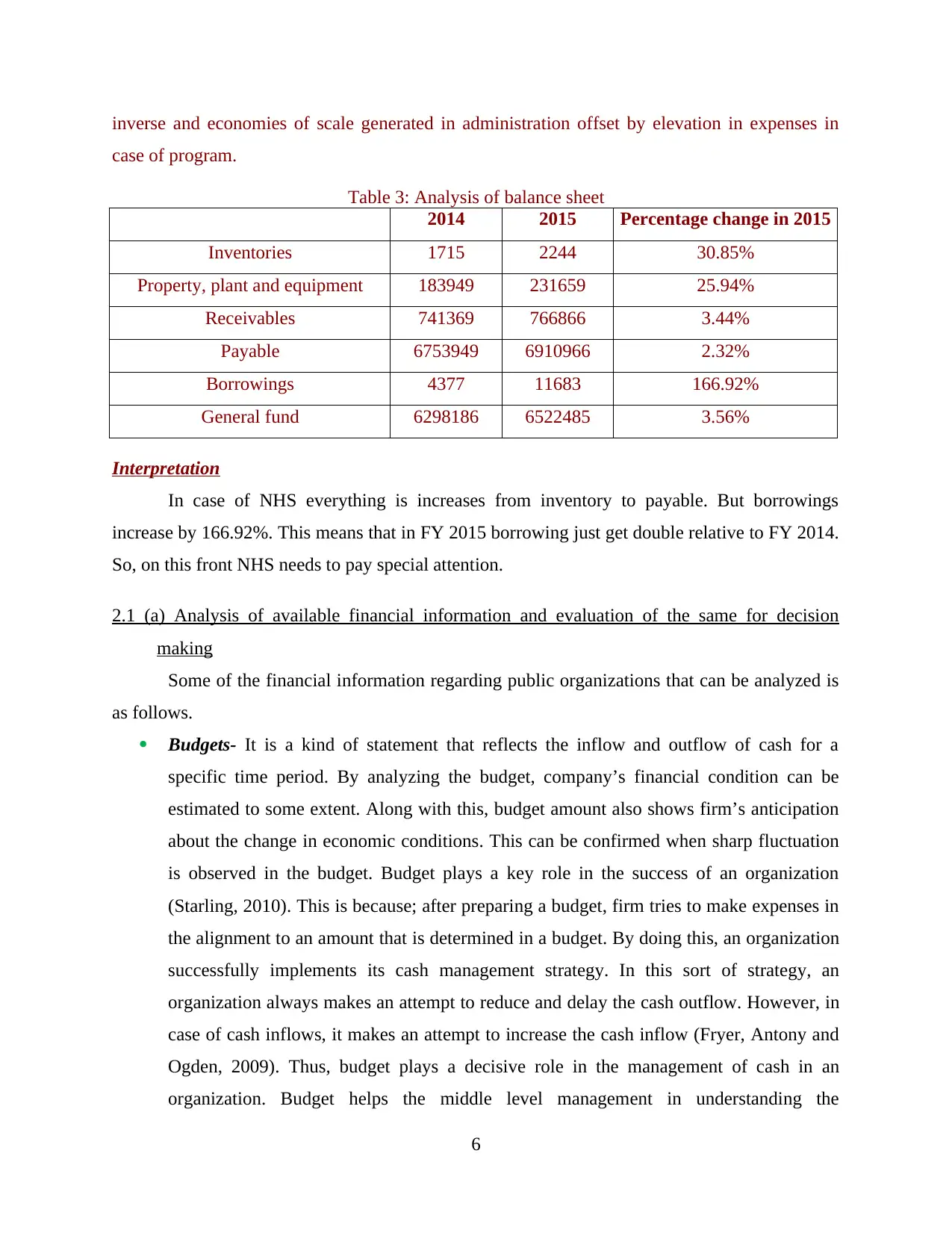

Table 3: Analysis of balance sheet

2014 2015 Percentage change in 2015

Inventories 1715 2244 30.85%

Property, plant and equipment 183949 231659 25.94%

Receivables 741369 766866 3.44%

Payable 6753949 6910966 2.32%

Borrowings 4377 11683 166.92%

General fund 6298186 6522485 3.56%

Interpretation

In case of NHS everything is increases from inventory to payable. But borrowings

increase by 166.92%. This means that in FY 2015 borrowing just get double relative to FY 2014.

So, on this front NHS needs to pay special attention.

2.1 (a) Analysis of available financial information and evaluation of the same for decision

making

Some of the financial information regarding public organizations that can be analyzed is

as follows.

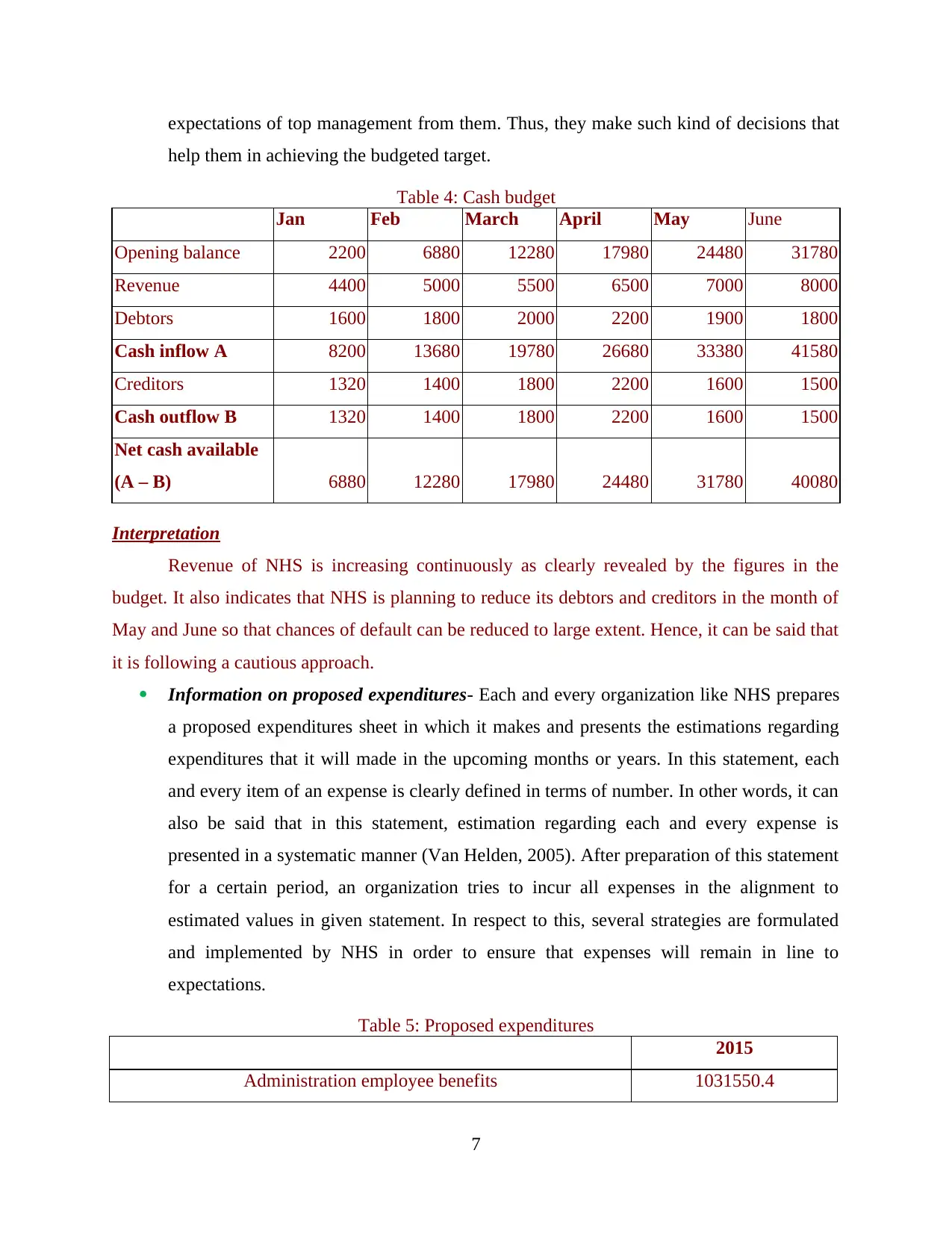

Budgets- It is a kind of statement that reflects the inflow and outflow of cash for a

specific time period. By analyzing the budget, company’s financial condition can be

estimated to some extent. Along with this, budget amount also shows firm’s anticipation

about the change in economic conditions. This can be confirmed when sharp fluctuation

is observed in the budget. Budget plays a key role in the success of an organization

(Starling, 2010). This is because; after preparing a budget, firm tries to make expenses in

the alignment to an amount that is determined in a budget. By doing this, an organization

successfully implements its cash management strategy. In this sort of strategy, an

organization always makes an attempt to reduce and delay the cash outflow. However, in

case of cash inflows, it makes an attempt to increase the cash inflow (Fryer, Antony and

Ogden, 2009). Thus, budget plays a decisive role in the management of cash in an

organization. Budget helps the middle level management in understanding the

6

case of program.

Table 3: Analysis of balance sheet

2014 2015 Percentage change in 2015

Inventories 1715 2244 30.85%

Property, plant and equipment 183949 231659 25.94%

Receivables 741369 766866 3.44%

Payable 6753949 6910966 2.32%

Borrowings 4377 11683 166.92%

General fund 6298186 6522485 3.56%

Interpretation

In case of NHS everything is increases from inventory to payable. But borrowings

increase by 166.92%. This means that in FY 2015 borrowing just get double relative to FY 2014.

So, on this front NHS needs to pay special attention.

2.1 (a) Analysis of available financial information and evaluation of the same for decision

making

Some of the financial information regarding public organizations that can be analyzed is

as follows.

Budgets- It is a kind of statement that reflects the inflow and outflow of cash for a

specific time period. By analyzing the budget, company’s financial condition can be

estimated to some extent. Along with this, budget amount also shows firm’s anticipation

about the change in economic conditions. This can be confirmed when sharp fluctuation

is observed in the budget. Budget plays a key role in the success of an organization

(Starling, 2010). This is because; after preparing a budget, firm tries to make expenses in

the alignment to an amount that is determined in a budget. By doing this, an organization

successfully implements its cash management strategy. In this sort of strategy, an

organization always makes an attempt to reduce and delay the cash outflow. However, in

case of cash inflows, it makes an attempt to increase the cash inflow (Fryer, Antony and

Ogden, 2009). Thus, budget plays a decisive role in the management of cash in an

organization. Budget helps the middle level management in understanding the

6

expectations of top management from them. Thus, they make such kind of decisions that

help them in achieving the budgeted target.

Table 4: Cash budget

Jan Feb March April May June

Opening balance 2200 6880 12280 17980 24480 31780

Revenue 4400 5000 5500 6500 7000 8000

Debtors 1600 1800 2000 2200 1900 1800

Cash inflow A 8200 13680 19780 26680 33380 41580

Creditors 1320 1400 1800 2200 1600 1500

Cash outflow B 1320 1400 1800 2200 1600 1500

Net cash available

(A – B) 6880 12280 17980 24480 31780 40080

Interpretation

Revenue of NHS is increasing continuously as clearly revealed by the figures in the

budget. It also indicates that NHS is planning to reduce its debtors and creditors in the month of

May and June so that chances of default can be reduced to large extent. Hence, it can be said that

it is following a cautious approach.

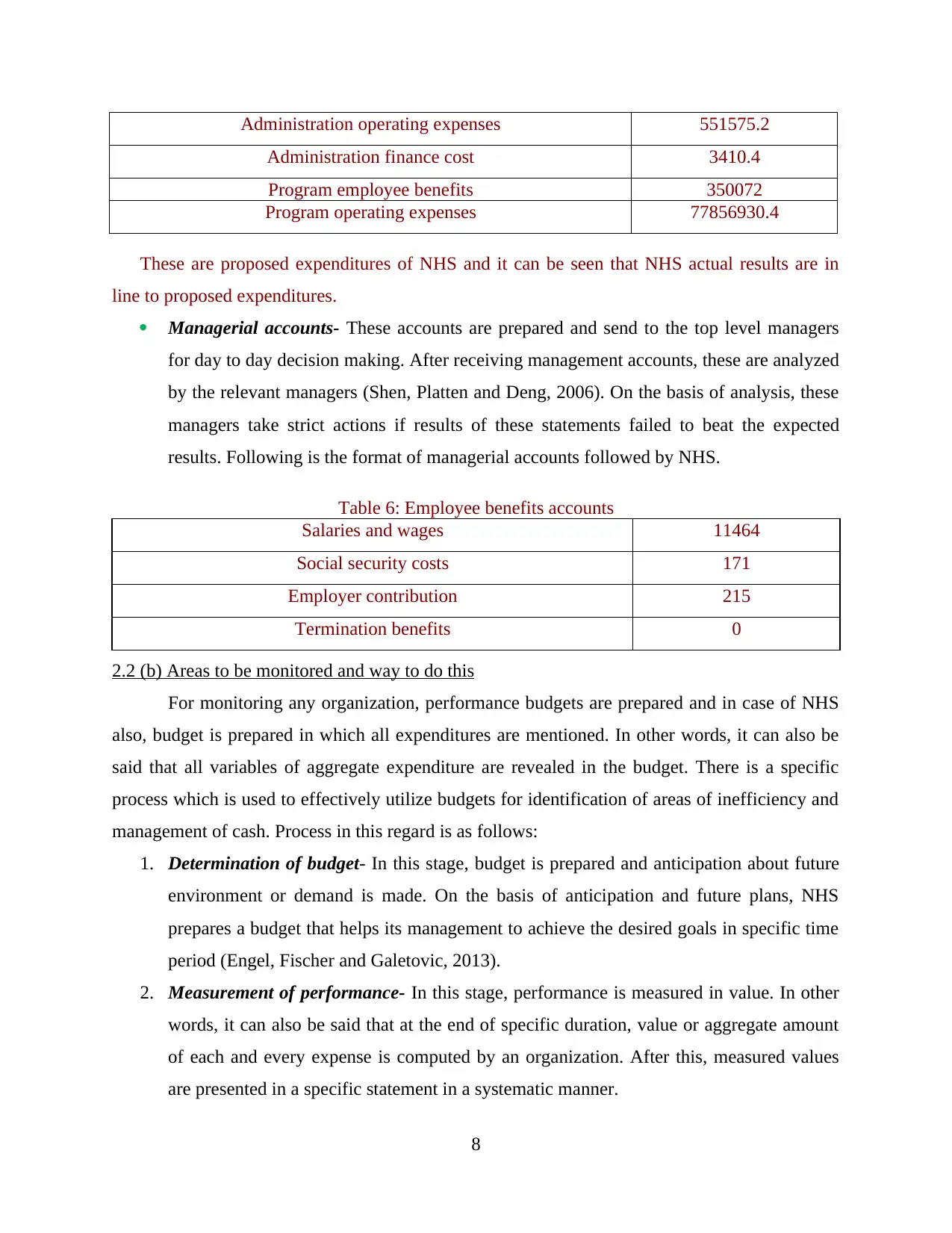

Information on proposed expenditures- Each and every organization like NHS prepares

a proposed expenditures sheet in which it makes and presents the estimations regarding

expenditures that it will made in the upcoming months or years. In this statement, each

and every item of an expense is clearly defined in terms of number. In other words, it can

also be said that in this statement, estimation regarding each and every expense is

presented in a systematic manner (Van Helden, 2005). After preparation of this statement

for a certain period, an organization tries to incur all expenses in the alignment to

estimated values in given statement. In respect to this, several strategies are formulated

and implemented by NHS in order to ensure that expenses will remain in line to

expectations.

Table 5: Proposed expenditures

2015

Administration employee benefits 1031550.4

7

help them in achieving the budgeted target.

Table 4: Cash budget

Jan Feb March April May June

Opening balance 2200 6880 12280 17980 24480 31780

Revenue 4400 5000 5500 6500 7000 8000

Debtors 1600 1800 2000 2200 1900 1800

Cash inflow A 8200 13680 19780 26680 33380 41580

Creditors 1320 1400 1800 2200 1600 1500

Cash outflow B 1320 1400 1800 2200 1600 1500

Net cash available

(A – B) 6880 12280 17980 24480 31780 40080

Interpretation

Revenue of NHS is increasing continuously as clearly revealed by the figures in the

budget. It also indicates that NHS is planning to reduce its debtors and creditors in the month of

May and June so that chances of default can be reduced to large extent. Hence, it can be said that

it is following a cautious approach.

Information on proposed expenditures- Each and every organization like NHS prepares

a proposed expenditures sheet in which it makes and presents the estimations regarding

expenditures that it will made in the upcoming months or years. In this statement, each

and every item of an expense is clearly defined in terms of number. In other words, it can

also be said that in this statement, estimation regarding each and every expense is

presented in a systematic manner (Van Helden, 2005). After preparation of this statement

for a certain period, an organization tries to incur all expenses in the alignment to

estimated values in given statement. In respect to this, several strategies are formulated

and implemented by NHS in order to ensure that expenses will remain in line to

expectations.

Table 5: Proposed expenditures

2015

Administration employee benefits 1031550.4

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Administration operating expenses 551575.2

Administration finance cost 3410.4

Program employee benefits 350072

Program operating expenses 77856930.4

These are proposed expenditures of NHS and it can be seen that NHS actual results are in

line to proposed expenditures.

Managerial accounts- These accounts are prepared and send to the top level managers

for day to day decision making. After receiving management accounts, these are analyzed

by the relevant managers (Shen, Platten and Deng, 2006). On the basis of analysis, these

managers take strict actions if results of these statements failed to beat the expected

results. Following is the format of managerial accounts followed by NHS.

Table 6: Employee benefits accounts

Salaries and wages 11464

Social security costs 171

Employer contribution 215

Termination benefits 0

2.2 (b) Areas to be monitored and way to do this

For monitoring any organization, performance budgets are prepared and in case of NHS

also, budget is prepared in which all expenditures are mentioned. In other words, it can also be

said that all variables of aggregate expenditure are revealed in the budget. There is a specific

process which is used to effectively utilize budgets for identification of areas of inefficiency and

management of cash. Process in this regard is as follows:

1. Determination of budget- In this stage, budget is prepared and anticipation about future

environment or demand is made. On the basis of anticipation and future plans, NHS

prepares a budget that helps its management to achieve the desired goals in specific time

period (Engel, Fischer and Galetovic, 2013).

2. Measurement of performance- In this stage, performance is measured in value. In other

words, it can also be said that at the end of specific duration, value or aggregate amount

of each and every expense is computed by an organization. After this, measured values

are presented in a specific statement in a systematic manner.

8

Administration finance cost 3410.4

Program employee benefits 350072

Program operating expenses 77856930.4

These are proposed expenditures of NHS and it can be seen that NHS actual results are in

line to proposed expenditures.

Managerial accounts- These accounts are prepared and send to the top level managers

for day to day decision making. After receiving management accounts, these are analyzed

by the relevant managers (Shen, Platten and Deng, 2006). On the basis of analysis, these

managers take strict actions if results of these statements failed to beat the expected

results. Following is the format of managerial accounts followed by NHS.

Table 6: Employee benefits accounts

Salaries and wages 11464

Social security costs 171

Employer contribution 215

Termination benefits 0

2.2 (b) Areas to be monitored and way to do this

For monitoring any organization, performance budgets are prepared and in case of NHS

also, budget is prepared in which all expenditures are mentioned. In other words, it can also be

said that all variables of aggregate expenditure are revealed in the budget. There is a specific

process which is used to effectively utilize budgets for identification of areas of inefficiency and

management of cash. Process in this regard is as follows:

1. Determination of budget- In this stage, budget is prepared and anticipation about future

environment or demand is made. On the basis of anticipation and future plans, NHS

prepares a budget that helps its management to achieve the desired goals in specific time

period (Engel, Fischer and Galetovic, 2013).

2. Measurement of performance- In this stage, performance is measured in value. In other

words, it can also be said that at the end of specific duration, value or aggregate amount

of each and every expense is computed by an organization. After this, measured values

are presented in a specific statement in a systematic manner.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

3. Comparison of actual with budgeted performance- In this stage, actual performance is

compared with the budgeted performance in order to identify deviation in performance

(Grimsey and Lewis, 2007). In this regard, a sheet is prepared in which actual and

budgeted figures are placed vertically parallel to each other. After this, sheet is used for

comparison.

4. Identification of deviation- At this stage, a deviation is identified and it may be positive

or negative in nature. Positive deviation means that actual results beat the estimated

figures. On the other hand, negative deviation indicates the excess of estimated figures

that are relative to actual results (Kongstvedt, 2012). If negative deviation is identified

then management takes an action to ensure that such a negative deviation will not occur

in the future.

Review by politicians (local or national)

Sometimes, accounts of NHS are also audited by any local or national authority in order

to ensure that everything is going well in an organization. This also helps in ensuring that in an

enterprise, all operations are performed in an efficient and effective manner. Moreover, positive

response of these authorities also reflects that accounts of NHS are perfect and there is no

corruption in the mentioned organization.

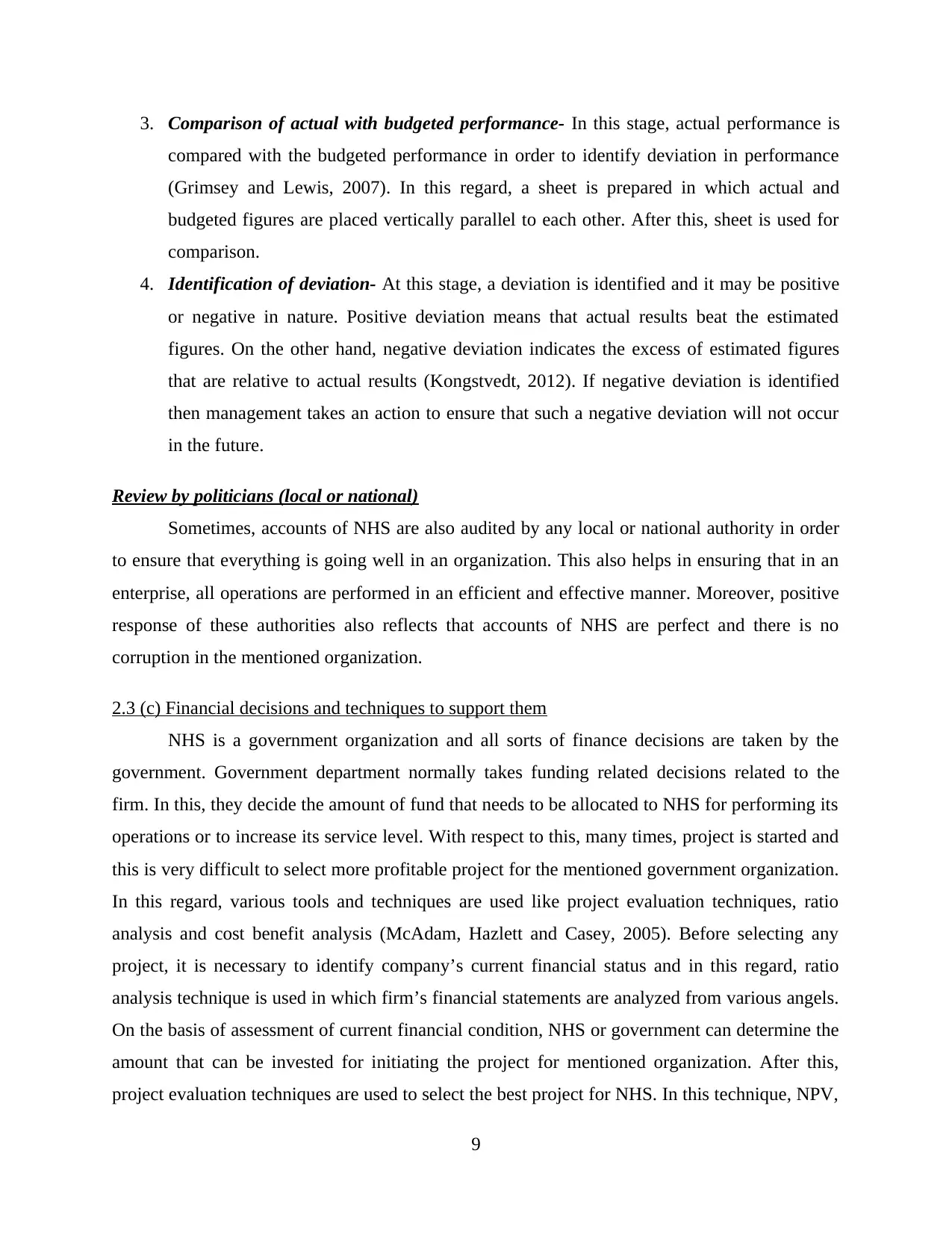

2.3 (c) Financial decisions and techniques to support them

NHS is a government organization and all sorts of finance decisions are taken by the

government. Government department normally takes funding related decisions related to the

firm. In this, they decide the amount of fund that needs to be allocated to NHS for performing its

operations or to increase its service level. With respect to this, many times, project is started and

this is very difficult to select more profitable project for the mentioned government organization.

In this regard, various tools and techniques are used like project evaluation techniques, ratio

analysis and cost benefit analysis (McAdam, Hazlett and Casey, 2005). Before selecting any

project, it is necessary to identify company’s current financial status and in this regard, ratio

analysis technique is used in which firm’s financial statements are analyzed from various angels.

On the basis of assessment of current financial condition, NHS or government can determine the

amount that can be invested for initiating the project for mentioned organization. After this,

project evaluation techniques are used to select the best project for NHS. In this technique, NPV,

9

compared with the budgeted performance in order to identify deviation in performance

(Grimsey and Lewis, 2007). In this regard, a sheet is prepared in which actual and

budgeted figures are placed vertically parallel to each other. After this, sheet is used for

comparison.

4. Identification of deviation- At this stage, a deviation is identified and it may be positive

or negative in nature. Positive deviation means that actual results beat the estimated

figures. On the other hand, negative deviation indicates the excess of estimated figures

that are relative to actual results (Kongstvedt, 2012). If negative deviation is identified

then management takes an action to ensure that such a negative deviation will not occur

in the future.

Review by politicians (local or national)

Sometimes, accounts of NHS are also audited by any local or national authority in order

to ensure that everything is going well in an organization. This also helps in ensuring that in an

enterprise, all operations are performed in an efficient and effective manner. Moreover, positive

response of these authorities also reflects that accounts of NHS are perfect and there is no

corruption in the mentioned organization.

2.3 (c) Financial decisions and techniques to support them

NHS is a government organization and all sorts of finance decisions are taken by the

government. Government department normally takes funding related decisions related to the

firm. In this, they decide the amount of fund that needs to be allocated to NHS for performing its

operations or to increase its service level. With respect to this, many times, project is started and

this is very difficult to select more profitable project for the mentioned government organization.

In this regard, various tools and techniques are used like project evaluation techniques, ratio

analysis and cost benefit analysis (McAdam, Hazlett and Casey, 2005). Before selecting any

project, it is necessary to identify company’s current financial status and in this regard, ratio

analysis technique is used in which firm’s financial statements are analyzed from various angels.

On the basis of assessment of current financial condition, NHS or government can determine the

amount that can be invested for initiating the project for mentioned organization. After this,

project evaluation techniques are used to select the best project for NHS. In this technique, NPV,

9

ARR, IRR and payback period techniques are used for selecting appropriate project for NHS

(Verbeeten, 2008). These techniques will be applied on each and every project in order to select

the most viable project for NHS. In order to apply these techniques, discount rate will be

required. It is a very difficult task to determine this rate. Determination of wrong discount rate

leads to selection of wrong project. Hence, instead of earning profit, NHS may face loss in its

project. In order to ascertain appropriate discount rate, NHS can use WACC or weighted average

cost of capital concept in order to ascertain the most appropriate discount rate for the project

(Heinrich and Marschke, 2010). By using this technique, NHS can identify appropriate discount

rate and can select the most appropriate project for itself.

Table 7: Payback period method

Project A Project B

Initial investment -1200 -1900

1 1000 -200 1000 -900

2 800 600 1200 300

3 600 1200 1500 1800

4 400 1600 1600 3400

5 100 1700 2000 5400

Interpretation

This method indicates the time period with in which project can recover investment

amount. As per data both projects will cover initial investment in one year. Hence, none of them

can be considered viable on the basis of this parameter.

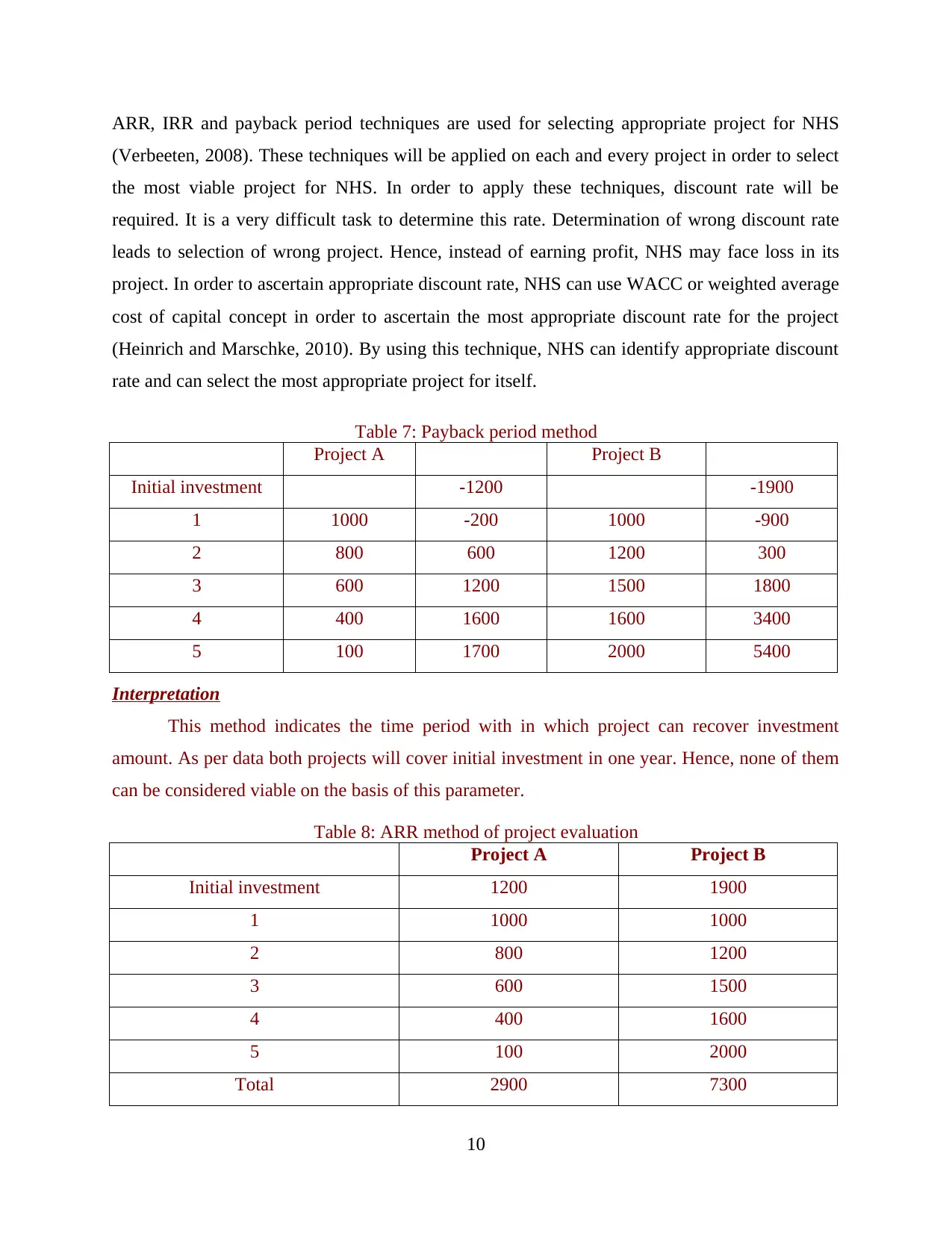

Table 8: ARR method of project evaluation

Project A Project B

Initial investment 1200 1900

1 1000 1000

2 800 1200

3 600 1500

4 400 1600

5 100 2000

Total 2900 7300

10

(Verbeeten, 2008). These techniques will be applied on each and every project in order to select

the most viable project for NHS. In order to apply these techniques, discount rate will be

required. It is a very difficult task to determine this rate. Determination of wrong discount rate

leads to selection of wrong project. Hence, instead of earning profit, NHS may face loss in its

project. In order to ascertain appropriate discount rate, NHS can use WACC or weighted average

cost of capital concept in order to ascertain the most appropriate discount rate for the project

(Heinrich and Marschke, 2010). By using this technique, NHS can identify appropriate discount

rate and can select the most appropriate project for itself.

Table 7: Payback period method

Project A Project B

Initial investment -1200 -1900

1 1000 -200 1000 -900

2 800 600 1200 300

3 600 1200 1500 1800

4 400 1600 1600 3400

5 100 1700 2000 5400

Interpretation

This method indicates the time period with in which project can recover investment

amount. As per data both projects will cover initial investment in one year. Hence, none of them

can be considered viable on the basis of this parameter.

Table 8: ARR method of project evaluation

Project A Project B

Initial investment 1200 1900

1 1000 1000

2 800 1200

3 600 1500

4 400 1600

5 100 2000

Total 2900 7300

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 18

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.