Business Analysis and Valuation Report: Qantas Airways (B01BAVA320)

VerifiedAdded on 2023/04/23

|17

|1887

|484

Report

AI Summary

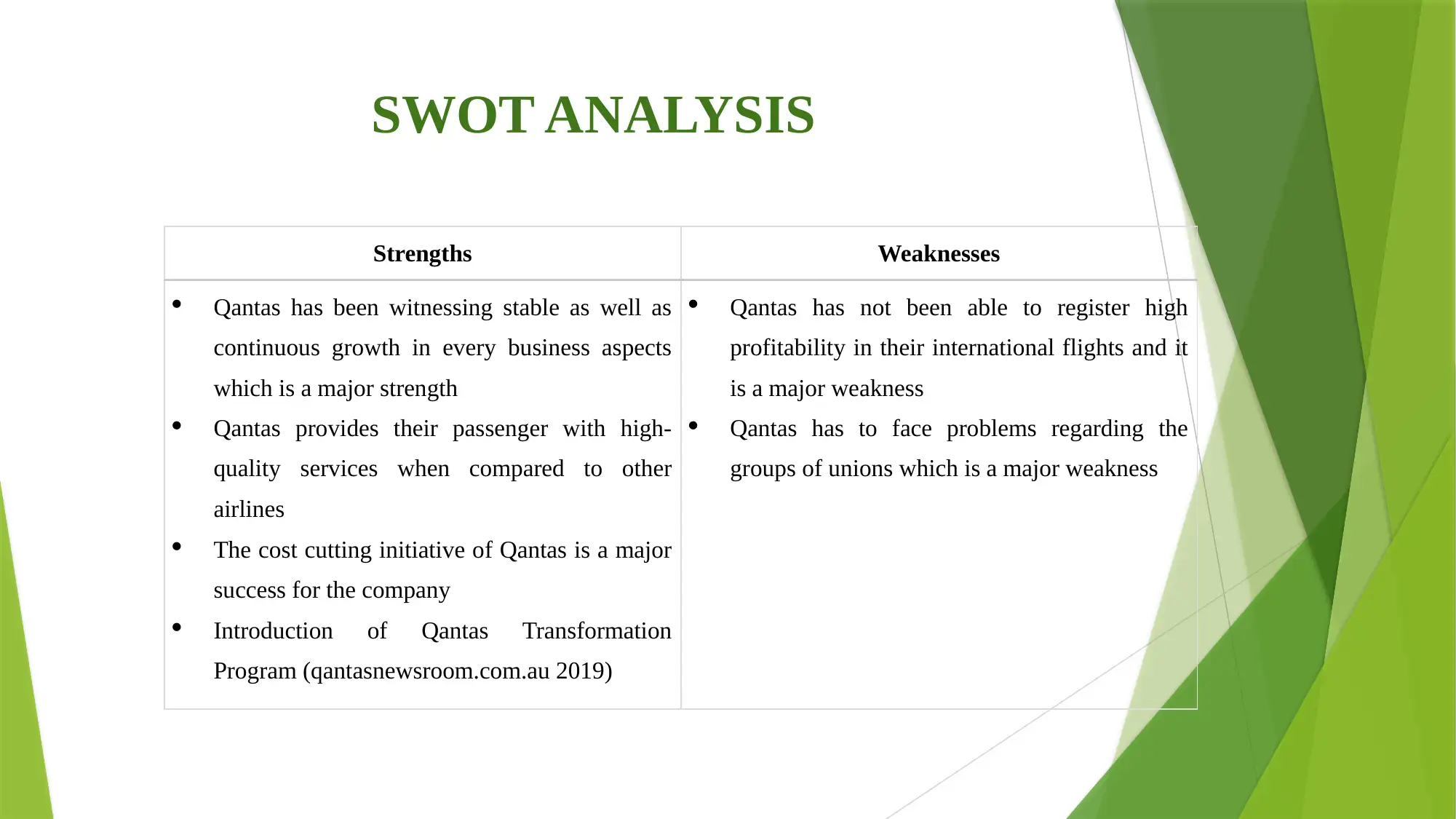

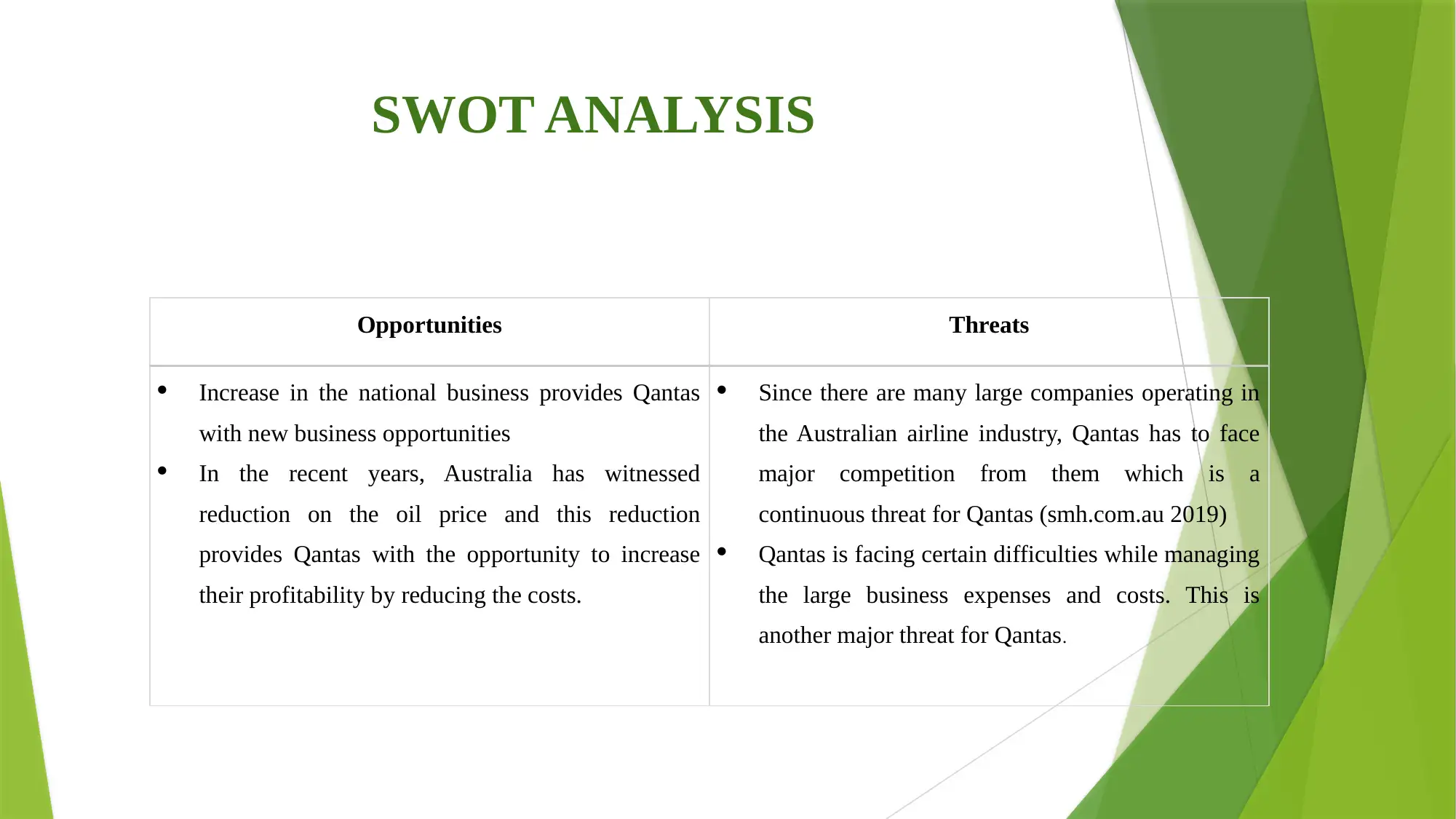

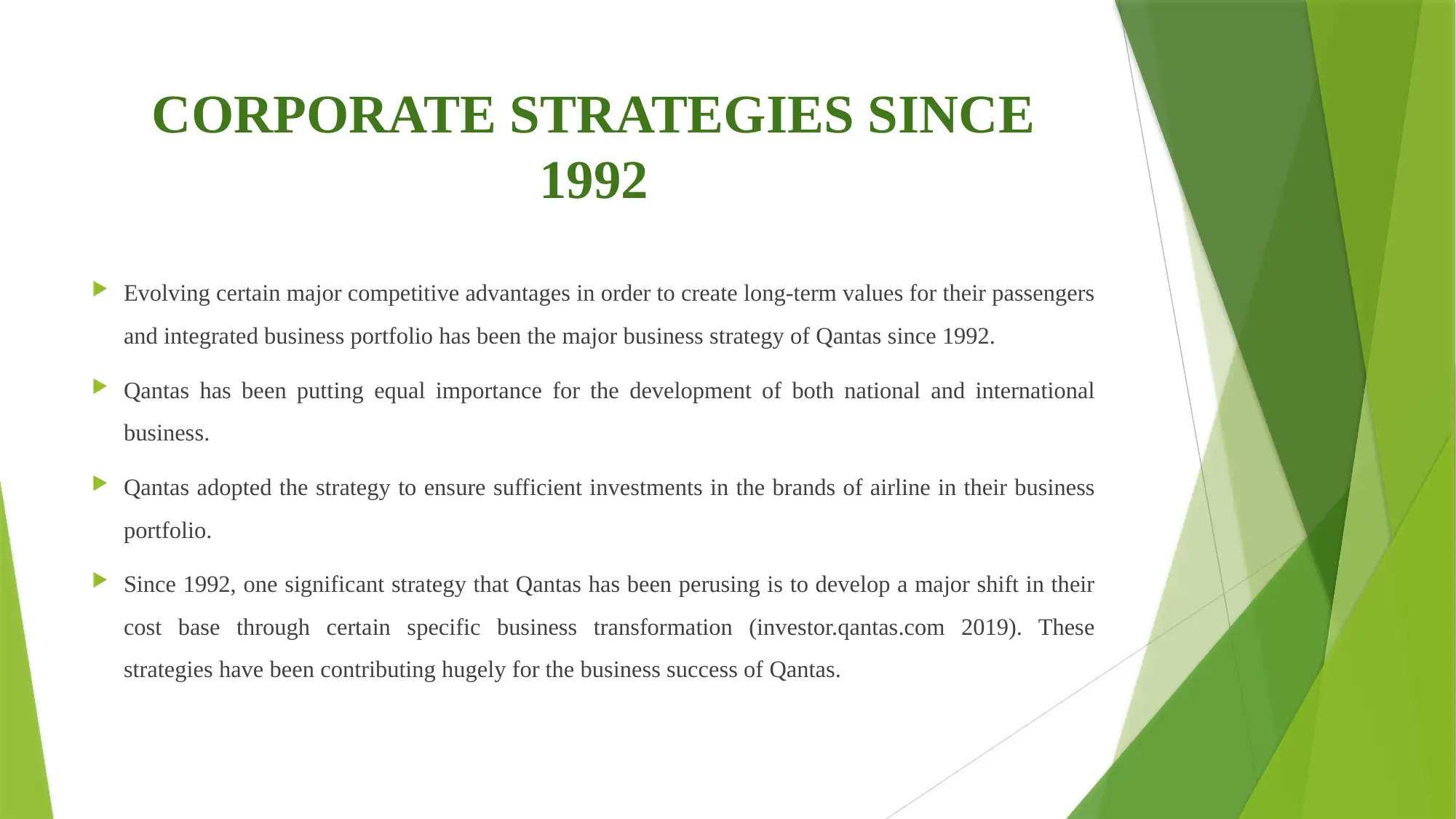

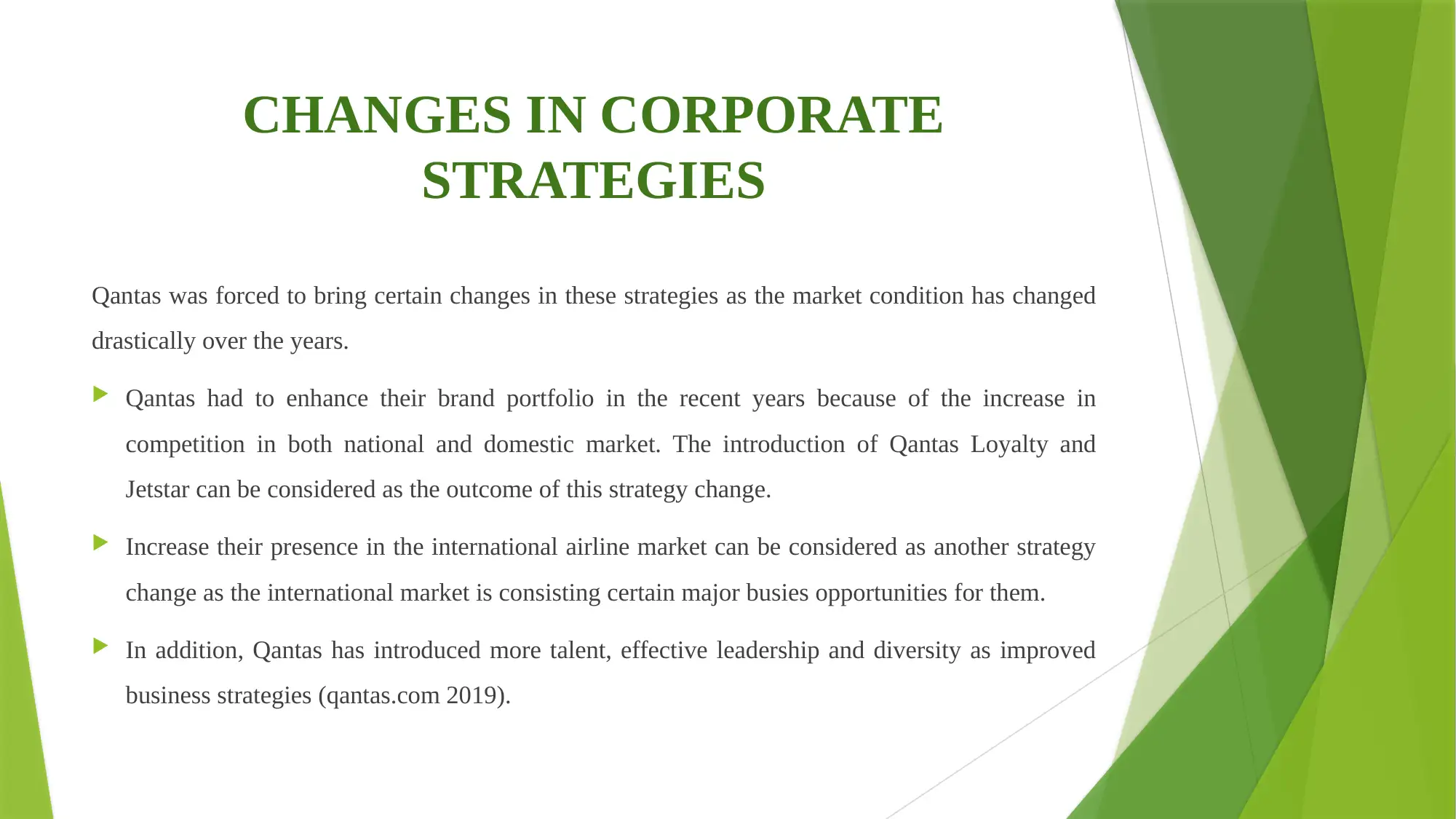

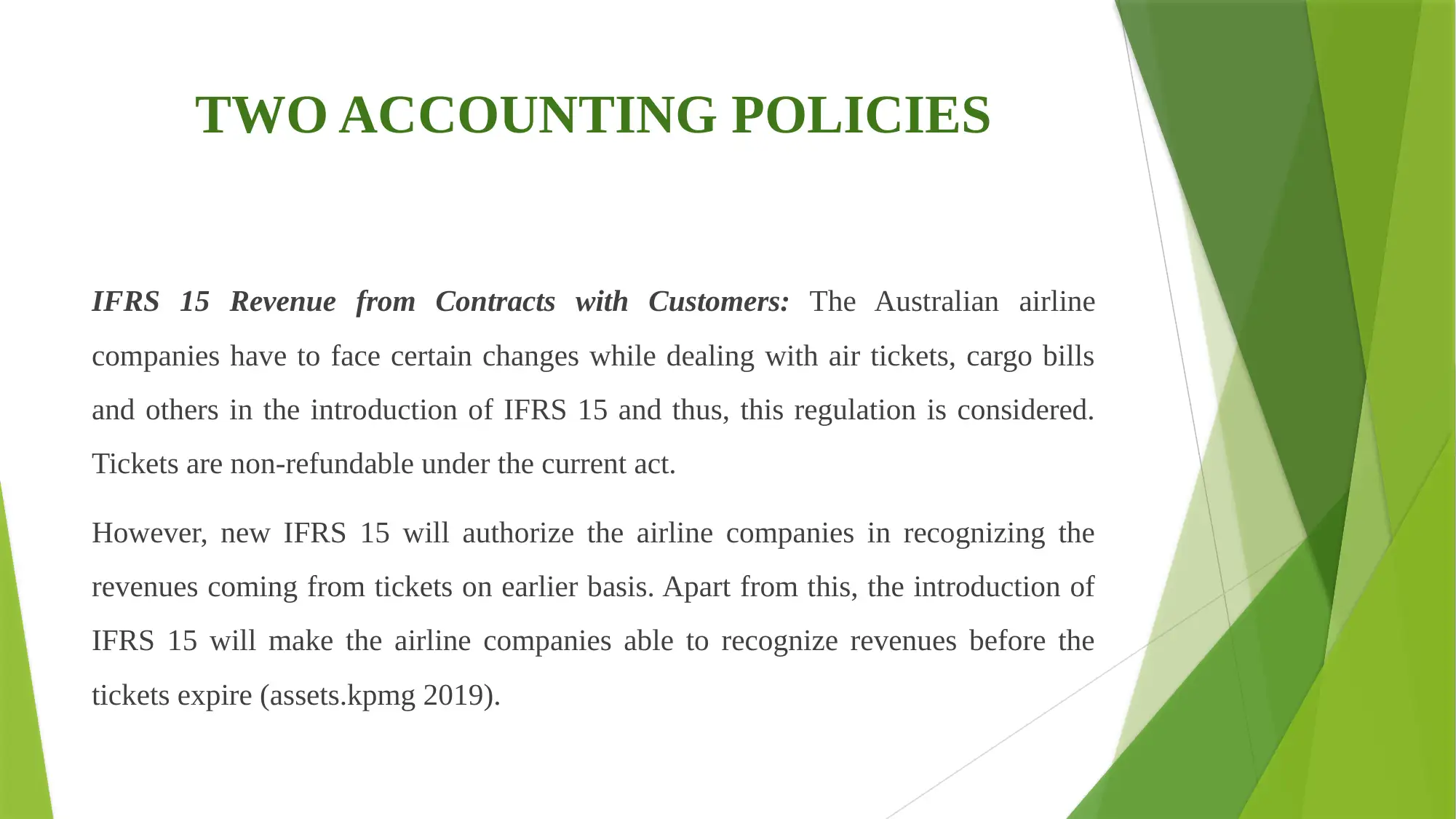

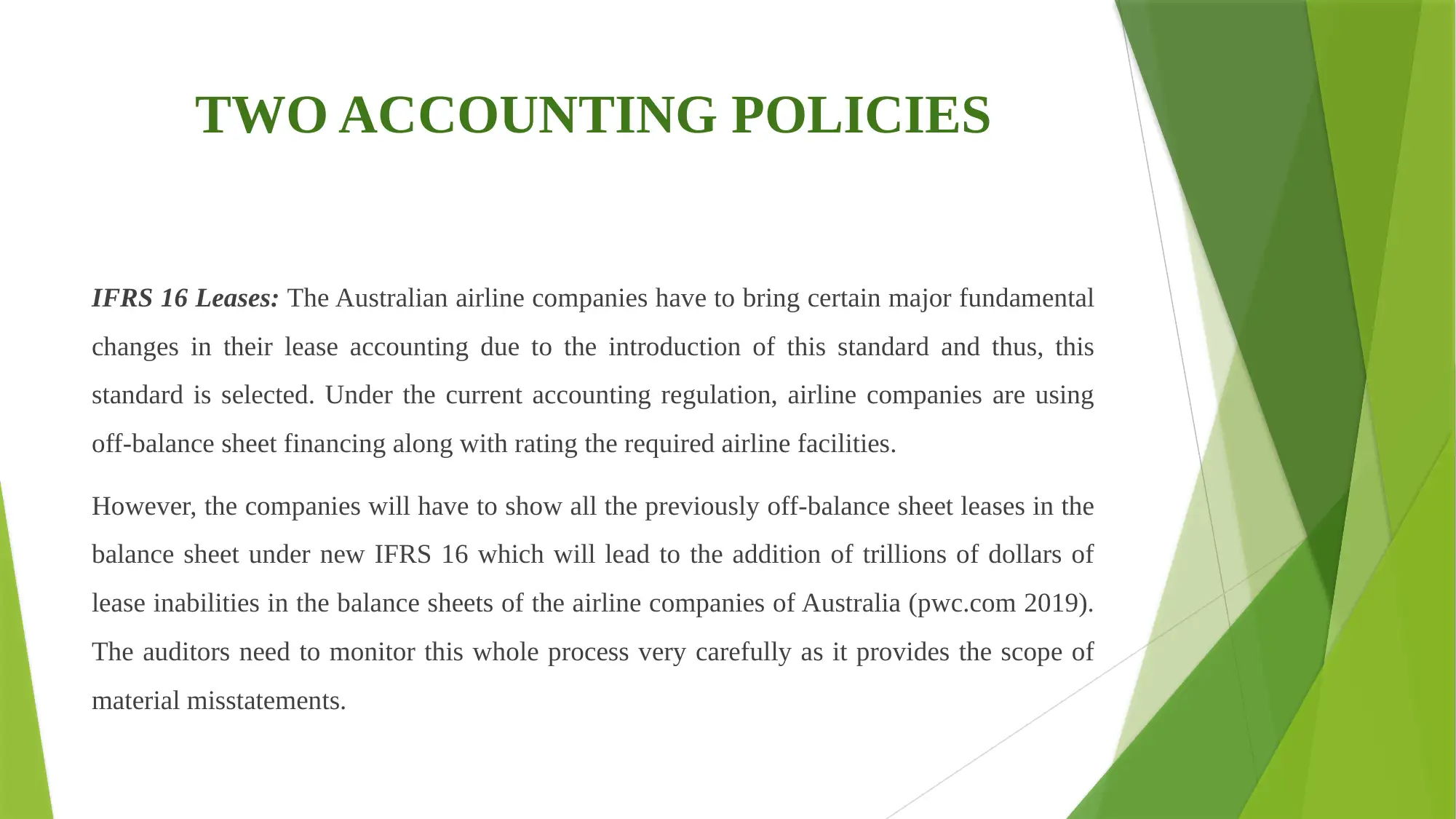

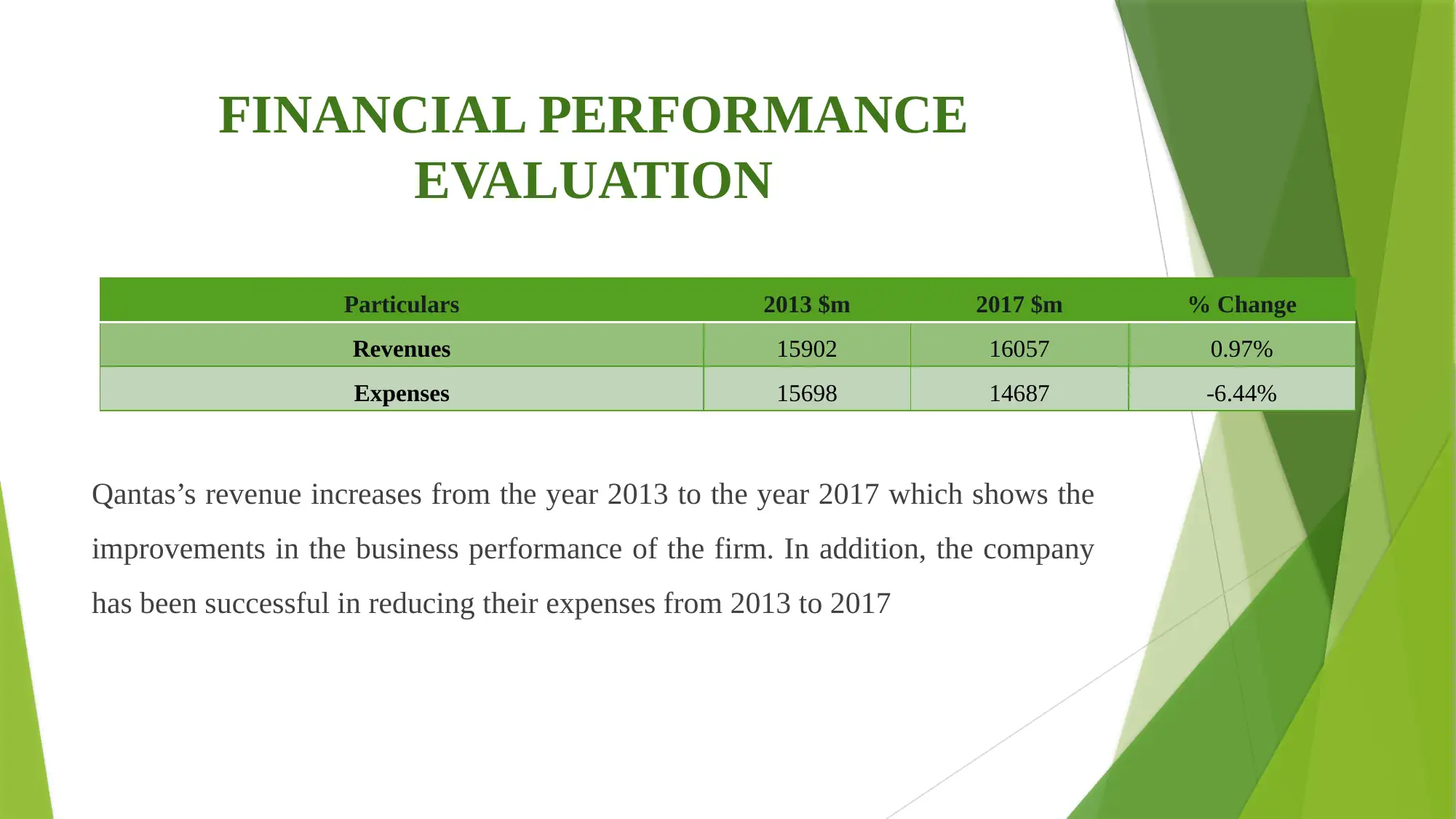

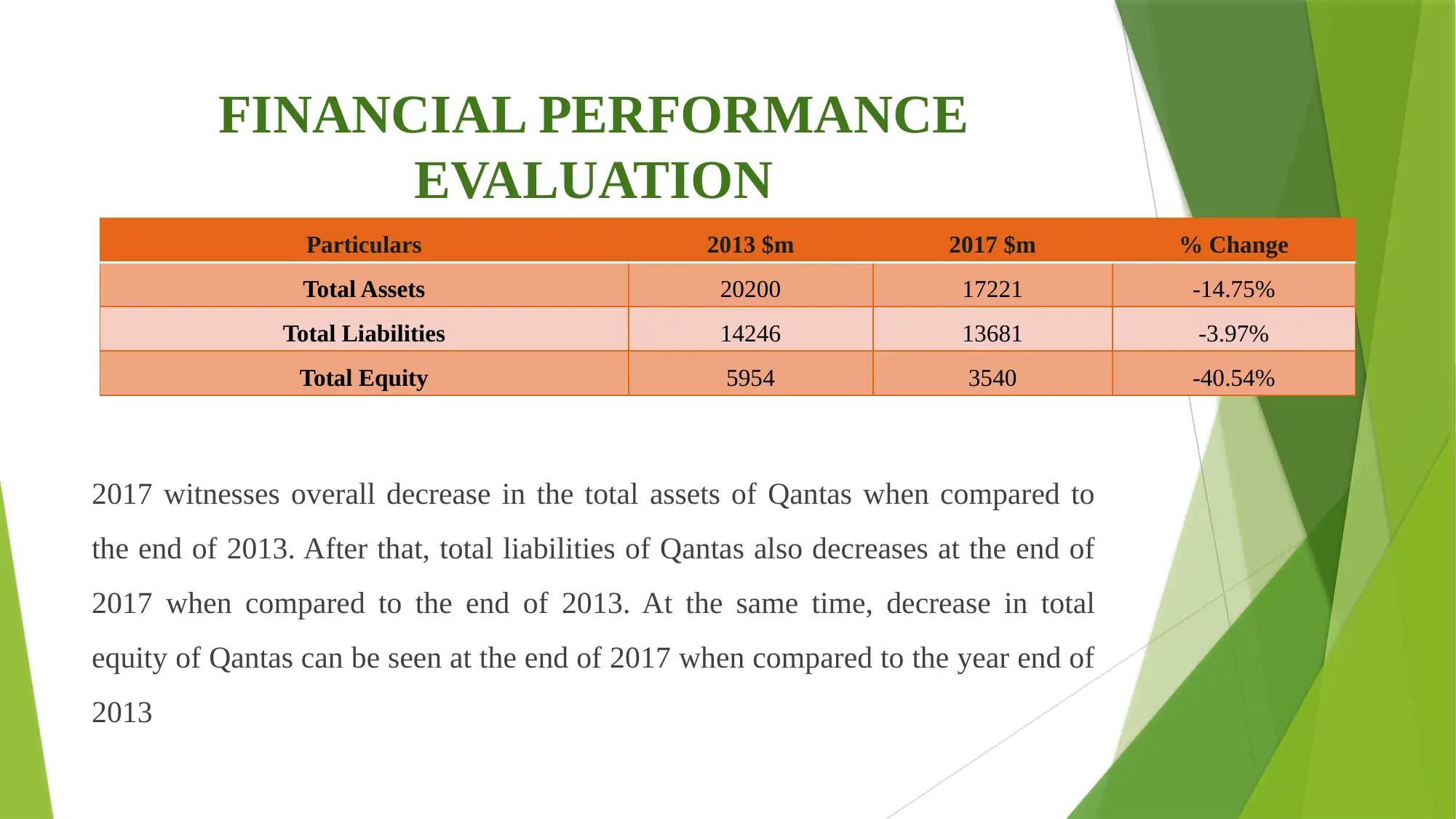

This report provides a comprehensive business analysis and valuation of Qantas Airways. It begins with an introduction outlining the report's objectives, which include examining the airline's business through Five Forces and SWOT analyses, evaluating its corporate strategy and relevant financial regulations, and assessing its financial performance to offer recommendations. The Five Forces analysis reveals high customer bargaining power, low supplier bargaining power, a low threat of new entrants, high competition among existing competitors, and a low threat of substitutes. The SWOT analysis highlights Qantas's strengths, such as stable growth and high-quality services, and weaknesses, including challenges with international flight profitability and union relations. Opportunities include increased national business and cost reduction through lower oil prices, while threats involve intense competition and high business expenses. Corporate strategies since 1992 are discussed, including competitive advantages, national and international business development, brand investments, and cost base shifts. The report also examines changes in corporate strategies, such as brand portfolio enhancements and increased international presence, and discusses the impact of IFRS 15 and 16 on the airline. Financial performance is evaluated using revenue, expense, asset, liability, and equity data from 2013 and 2017. The analysis indicates improved financial performance with increased revenue and decreased expenses, but also a decrease in total assets, liabilities, and equity. Based on these findings, recommendations are made for investors to buy or retain Qantas shares. The conclusion emphasizes the importance of considering competitive forces and strategic development, as well as the implications of accounting standards.

1 out of 17

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)