Business Valuation and Analysis of Qantas Airline: 2017 Report

VerifiedAdded on 2020/05/16

|13

|2643

|82

Report

AI Summary

This report provides a comprehensive business valuation and analysis of Qantas Airline, focusing on its financial performance and strategic decisions. It begins with a Porter's Five Forces analysis to assess the competitive landscape, followed by a SWOT analysis to evaluate the company's strengths, weaknesses, opportunities, and threats. The report then examines Qantas's core competitive strategy, highlighting its evolution and effectiveness. It also delves into critical accounting policies, particularly revenue recognition and property, plant, and equipment valuation, emphasizing their significance in the airline industry. A quantitative analysis compares Qantas's financial performance in 2013 and 2017, evaluating key ratios such as return on assets, return on equity, and debt-equity ratio. The analysis concludes with a comparative assessment of the airline's performance over the specified period, offering insights into its growth and investment potential.

2017

Business

Valutaion and

Analysis

Business

Valutaion and

Analysis

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

By student name

Professor

University

Date: Januray 23 , 2018.

1 | P a g e

By student name

Professor

University

Date: Januray 23 , 2018.

1 | P a g e

2

Contents

Question a…………………………………………………………………....3

Question b…………………………………………………………………....4

Question c…………………………………………………………………....4

Question d…………………………………………………………………....5

Question e…………………………………………………………………....9

Question f…………………………………………………………………....9

Question g…………………………………………………………………....9

Refrences.....……………………………………………………………....11

2 | P a g e

Contents

Question a…………………………………………………………………....3

Question b…………………………………………………………………....4

Question c…………………………………………………………………....4

Question d…………………………………………………………………....5

Question e…………………………………………………………………....9

Question f…………………………………………………………………....9

Question g…………………………………………………………………....9

Refrences.....……………………………………………………………....11

2 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

Qantas airline is one of the largest airline companies in Australia and has also grown

internationally in the recent times. It started its operations in 1920, and today it operates more then

5000 flights. It is one of the strongest trade names in Australia and in times to come it will grow and

expand overseas also. A brief analysis on the financials of the company and the overall strategy

evaluation is given below.

a.The Porter five forces analysis of the Qantas airlines is as follow-

• Bargaining Power of the Suppliers- The suppliers have the highest bargaining power because

they have the option to choose from a variety of airlines that is operating in the market. They can go for

any premium services that are offered at low prices. Hence this puts a lot of pressure on the profitability

of Qantas. It makes it more prone to consumer discretion (Abbott & Kantor, 2017).

• Bargaining Power of the Suppliers- There are large number of supplier in the airline industry that

offer raw material to these companies. The suppliers are often in a dominant position because the

companies depend on them for the raw material that they offer. The bargaining power of the suppliers

have a negative impact on the profitability of the company in the form of increased prices and low

revenues.

• Threat of substitute- The threat of substitute is lower in air form of transport. People mostly

prefer travelling from air as it takes less time and helps in travelling longer distance. Thus, for Qantas the

threat of substitute is very low (Alexander, 2016).But with large scale development, other modes of

transport have also developed and people are often choosing the same because they are relatively

cheaper. This is a factor that the company needs to consider.

• Rivalry among existing firm- In the international air transport market, the company is having

rivals in the form of Emirates, Virgin Australia and Air Asia. The competition is so severe that it

sometimes causes the company loss of operations. In the domestic front also the company faces severe

competition from many renowned airlines and needs to be actively functioning to curb the same.

• Threat of new entry- In case of airline industry, there is a lower threat of new entrants, given to

the fast that it requires huge amount of investment to start operations in this field. So smaller

3 | P a g e

Qantas airline is one of the largest airline companies in Australia and has also grown

internationally in the recent times. It started its operations in 1920, and today it operates more then

5000 flights. It is one of the strongest trade names in Australia and in times to come it will grow and

expand overseas also. A brief analysis on the financials of the company and the overall strategy

evaluation is given below.

a.The Porter five forces analysis of the Qantas airlines is as follow-

• Bargaining Power of the Suppliers- The suppliers have the highest bargaining power because

they have the option to choose from a variety of airlines that is operating in the market. They can go for

any premium services that are offered at low prices. Hence this puts a lot of pressure on the profitability

of Qantas. It makes it more prone to consumer discretion (Abbott & Kantor, 2017).

• Bargaining Power of the Suppliers- There are large number of supplier in the airline industry that

offer raw material to these companies. The suppliers are often in a dominant position because the

companies depend on them for the raw material that they offer. The bargaining power of the suppliers

have a negative impact on the profitability of the company in the form of increased prices and low

revenues.

• Threat of substitute- The threat of substitute is lower in air form of transport. People mostly

prefer travelling from air as it takes less time and helps in travelling longer distance. Thus, for Qantas the

threat of substitute is very low (Alexander, 2016).But with large scale development, other modes of

transport have also developed and people are often choosing the same because they are relatively

cheaper. This is a factor that the company needs to consider.

• Rivalry among existing firm- In the international air transport market, the company is having

rivals in the form of Emirates, Virgin Australia and Air Asia. The competition is so severe that it

sometimes causes the company loss of operations. In the domestic front also the company faces severe

competition from many renowned airlines and needs to be actively functioning to curb the same.

• Threat of new entry- In case of airline industry, there is a lower threat of new entrants, given to

the fast that it requires huge amount of investment to start operations in this field. So smaller

3 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

companies are unable to afford the same (Birt, et al., 2017). There are high barriers exsisting to enter

this industry and thus the new entrants need to financially very strong to prevail in the market.

b. SWOT Analysis

Strengths- The Qantas airline is one of the largest operating airlines that has operations in many

countries. The major strengths of the company are-

• It is present in many international and domestic sector.

• It is one of the largest and the oldest operating airline sector.

• It has one of the largest brand building exercise through advertising and sponsoring.

• It offers variety of services like lounge, low cost flying programs etc.

Weakness – The major weakness includes incidences like price fixing and sabotage that have destroyed

the brand value of the company affecting its public image. The overall presence of the company

internationally is limited in comparison to other companies. The company has to develop its network to

make sure that it is delivering services in the international front also.

Opportunities – The company has great opportunity is widen its network by acquiring other small

companies that operate in this sector. The company can also have international tie-ups for wide

coverage and better growth. This will help in the overall growth and development of the company and

help it in getting an upper hand in comparison to other companies (Burke & Clark, 2016).

Threats – The major threats are from the suppliers in the form of increased fuel prices. The overall labor

charges have also increased. The presence of other international airlines is also affecting the growth of

the company. The customers are always looking for such companies that can provide them premium

services at cheaper prices. Thus the company needs to deal both with the suppliers and satisfy the

deamnds of the consumers.

c.The core competitive strategy for Qantas since 1992, across its domestic and international

market was to grow and expand its network. The company merged with the Australian Airlines in 1992,

that helped it bringing down its economies of scale and improving its overall revenue and business. The

company also aimed at eliminating competition by acquiring smaller units that operated in remote

4 | P a g e

companies are unable to afford the same (Birt, et al., 2017). There are high barriers exsisting to enter

this industry and thus the new entrants need to financially very strong to prevail in the market.

b. SWOT Analysis

Strengths- The Qantas airline is one of the largest operating airlines that has operations in many

countries. The major strengths of the company are-

• It is present in many international and domestic sector.

• It is one of the largest and the oldest operating airline sector.

• It has one of the largest brand building exercise through advertising and sponsoring.

• It offers variety of services like lounge, low cost flying programs etc.

Weakness – The major weakness includes incidences like price fixing and sabotage that have destroyed

the brand value of the company affecting its public image. The overall presence of the company

internationally is limited in comparison to other companies. The company has to develop its network to

make sure that it is delivering services in the international front also.

Opportunities – The company has great opportunity is widen its network by acquiring other small

companies that operate in this sector. The company can also have international tie-ups for wide

coverage and better growth. This will help in the overall growth and development of the company and

help it in getting an upper hand in comparison to other companies (Burke & Clark, 2016).

Threats – The major threats are from the suppliers in the form of increased fuel prices. The overall labor

charges have also increased. The presence of other international airlines is also affecting the growth of

the company. The customers are always looking for such companies that can provide them premium

services at cheaper prices. Thus the company needs to deal both with the suppliers and satisfy the

deamnds of the consumers.

c.The core competitive strategy for Qantas since 1992, across its domestic and international

market was to grow and expand its network. The company merged with the Australian Airlines in 1992,

that helped it bringing down its economies of scale and improving its overall revenue and business. The

company also aimed at eliminating competition by acquiring smaller units that operated in remote

4 | P a g e

5

places. This helped the company in improving its position and recovering its losses (Chariri, 2017).

Qantas aimed at the domestic end in improving its brand value by using the tools of advertising and

promotion. It aimed at providing premium services at lower cost and making use of the economies of

scale. It also tried to effectively improve its suppliers position by renovating its cost cutting model, and

getting the raw material at cheaper prices (Dichev, 2017). This is how the company aimed at improving

its business position both internationally and on the domestic front.

In response to the current market changes and the one that had occurred over the year, the

company is now aiming at delivering quality services even if they should charge higher prices. This is

because competition has become fierce and more and more companies are entering the market. The

suppliers are also making use of the dominant position as companies depend on them for supply of fuel

(Chiapello, 2017). Thus, this is a bad position for the company on a financial front, as it must deal with

excessive competition and make sure to deliver economically. Thus, the competitive strategy of the

company is marginally successful but it is not sustainable because on the international front the

company has no hold. It needs to revamp its model to grow internationally where the competition is

even more fierce (Crosby & Henneberry, 2016).

d.Two of the most critical accounting policies in case of airline companies that auditors must see

closely are –

Revenue recognition

The most important accounting policy is of revenue recognition. The airline revenue recognition

extends from calculating fare for the core passengers to the frequent flyers. The most common

accounting method for revenue recognition is that revenue that is received is deferred and is classified

as a liability on the balance sheet of the company, until the time the passenger or the freight is uplifted

and the revenue is then recognized on the balance sheet. The revenue recognition policy is used to

determine when to recognize unavailed revenue that occurs when the tickets are not used. It can have

huge impact on the results of the company. Hence the auditors must closely scrutinize the same.

Property, Plant and Equipment

Another important accounting policy that the auditor must check is the valuation of property,

plant and equipment. The airline companies take most of the aircrafts on leases, and hence valuation of

the same becomes difficult. It is important that companies must focus on the same, and make sure that

5 | P a g e

places. This helped the company in improving its position and recovering its losses (Chariri, 2017).

Qantas aimed at the domestic end in improving its brand value by using the tools of advertising and

promotion. It aimed at providing premium services at lower cost and making use of the economies of

scale. It also tried to effectively improve its suppliers position by renovating its cost cutting model, and

getting the raw material at cheaper prices (Dichev, 2017). This is how the company aimed at improving

its business position both internationally and on the domestic front.

In response to the current market changes and the one that had occurred over the year, the

company is now aiming at delivering quality services even if they should charge higher prices. This is

because competition has become fierce and more and more companies are entering the market. The

suppliers are also making use of the dominant position as companies depend on them for supply of fuel

(Chiapello, 2017). Thus, this is a bad position for the company on a financial front, as it must deal with

excessive competition and make sure to deliver economically. Thus, the competitive strategy of the

company is marginally successful but it is not sustainable because on the international front the

company has no hold. It needs to revamp its model to grow internationally where the competition is

even more fierce (Crosby & Henneberry, 2016).

d.Two of the most critical accounting policies in case of airline companies that auditors must see

closely are –

Revenue recognition

The most important accounting policy is of revenue recognition. The airline revenue recognition

extends from calculating fare for the core passengers to the frequent flyers. The most common

accounting method for revenue recognition is that revenue that is received is deferred and is classified

as a liability on the balance sheet of the company, until the time the passenger or the freight is uplifted

and the revenue is then recognized on the balance sheet. The revenue recognition policy is used to

determine when to recognize unavailed revenue that occurs when the tickets are not used. It can have

huge impact on the results of the company. Hence the auditors must closely scrutinize the same.

Property, Plant and Equipment

Another important accounting policy that the auditor must check is the valuation of property,

plant and equipment. The airline companies take most of the aircrafts on leases, and hence valuation of

the same becomes difficult. It is important that companies must focus on the same, and make sure that

5 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

impairment of the assets is recorded accordingly and accurate amount is reflected on the balance sheet.

Thus, it is important that correct amount estimation of the assets is done, considering the overall

impairment cost and cost of the leases and same should be shown on the financial reports of the

company.

The reason that these policies can be considered important is because they have significant effect on the

financial reports of the company and thus it is important that same must be considered for audit

process. The auditors must evaluate the accurate position of the financials of the company and consider

these accounting policies briefly. They play an important role in the overall profitability of the company

and the return that the shareholders earn.

Quantative Analysis

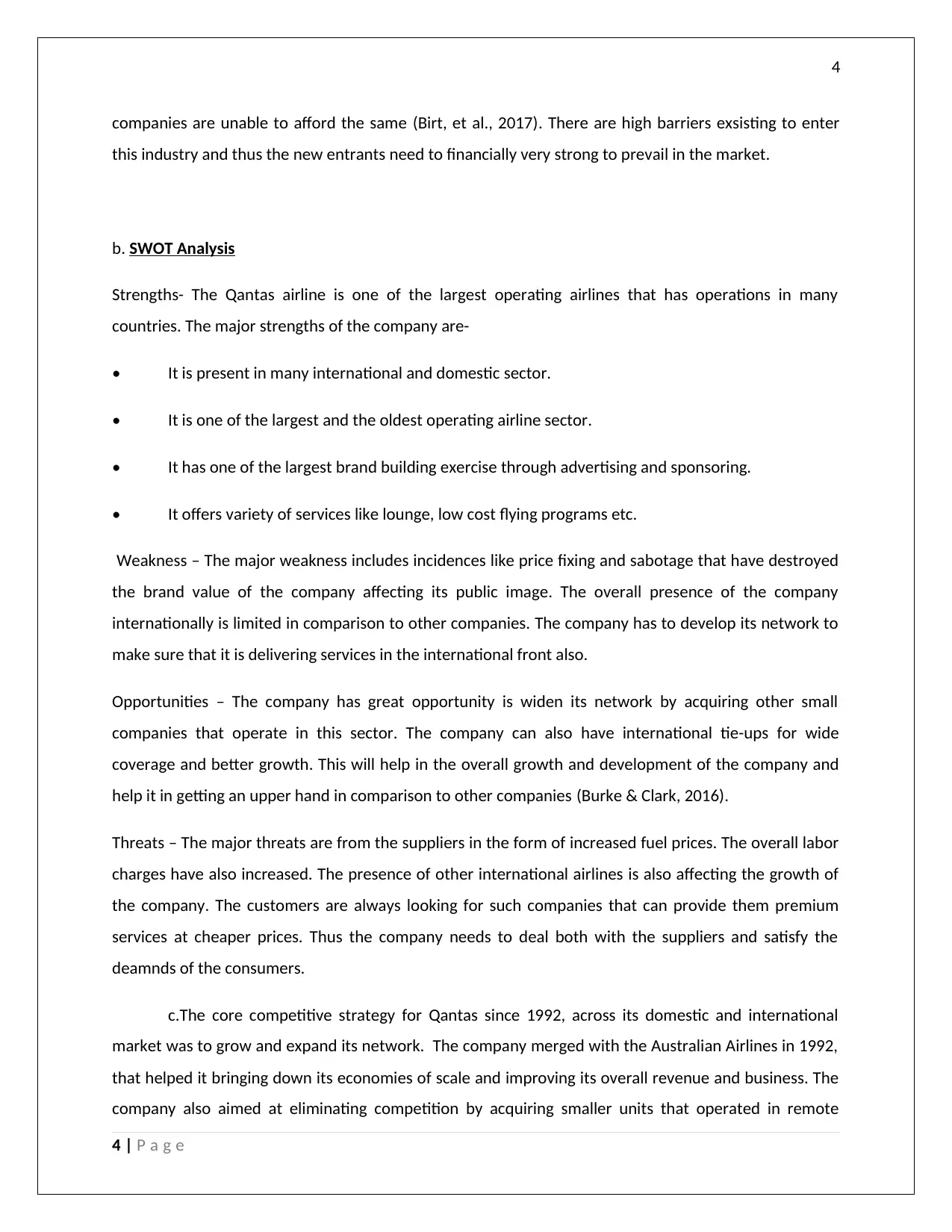

Ratios

For the Fiscal Period Ending 12 months

Jun-30-2013

12 months

Jun-30-2017

Profitability

Return on Assets % 0.8% 5.1%

Return on Capital % 1.4% 10.4%

Return on Equity % 0.0% 25.1%

Return on Common Equity % 0.0% 25.1%

Margin Analysis

Gross Margin % 26.5% 32.1%

EBIT Margin % 1.8% 8.6%

Net Income Margin % 0.0% 5.3%

Asset Turnover

Total Asset Turnover 0.8x 0.9x

Fixed Asset Turnover 1.2x 1.4x

Accounts Receivable Turnover 17.3x 22.2x

Inventory Turnover 31.4x 31.7x

Short Term Liquidity

Current Ratio 0.7x 0.4x

Quick Ratio 0.6x 0.4x

Long Term Solvency

Total Debt/Equity 104.1% 136.7%

Total Debt/Capital 51.0% 57.7%

LT Debt/Equity 89.8% 124.4%

LT Debt/Capital 44.0% 52.6%

Total Liabilities/Total Assets 70.8% 79.4%

Qantas Airways Limited > Ratios

6 | P a g e

impairment of the assets is recorded accordingly and accurate amount is reflected on the balance sheet.

Thus, it is important that correct amount estimation of the assets is done, considering the overall

impairment cost and cost of the leases and same should be shown on the financial reports of the

company.

The reason that these policies can be considered important is because they have significant effect on the

financial reports of the company and thus it is important that same must be considered for audit

process. The auditors must evaluate the accurate position of the financials of the company and consider

these accounting policies briefly. They play an important role in the overall profitability of the company

and the return that the shareholders earn.

Quantative Analysis

Ratios

For the Fiscal Period Ending 12 months

Jun-30-2013

12 months

Jun-30-2017

Profitability

Return on Assets % 0.8% 5.1%

Return on Capital % 1.4% 10.4%

Return on Equity % 0.0% 25.1%

Return on Common Equity % 0.0% 25.1%

Margin Analysis

Gross Margin % 26.5% 32.1%

EBIT Margin % 1.8% 8.6%

Net Income Margin % 0.0% 5.3%

Asset Turnover

Total Asset Turnover 0.8x 0.9x

Fixed Asset Turnover 1.2x 1.4x

Accounts Receivable Turnover 17.3x 22.2x

Inventory Turnover 31.4x 31.7x

Short Term Liquidity

Current Ratio 0.7x 0.4x

Quick Ratio 0.6x 0.4x

Long Term Solvency

Total Debt/Equity 104.1% 136.7%

Total Debt/Capital 51.0% 57.7%

LT Debt/Equity 89.8% 124.4%

LT Debt/Capital 44.0% 52.6%

Total Liabilities/Total Assets 70.8% 79.4%

Qantas Airways Limited > Ratios

6 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

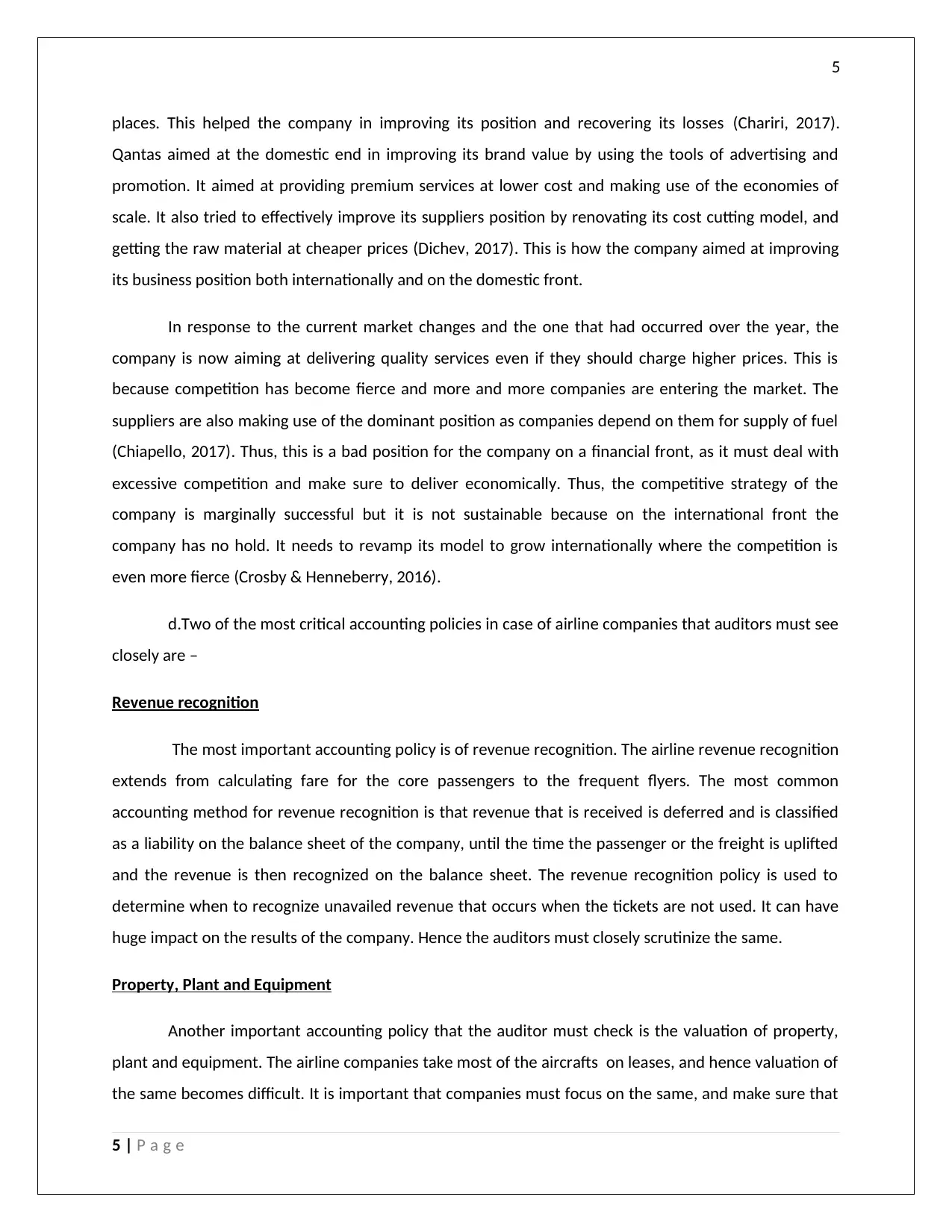

I ncome Statement

For the Fiscal Period Ending

Restated

12 months

Jun-30-2013

12 months

Jun-30-2017

Currency AUD AUD

Revenue 14,608.0 14,665.0

Other Revenue 1,169.0 1,392.0

Total Revenue 15,777.0 16,057.0

Cost Of Goods Sold 11,603.0 10,897.0

Gross Profit 4,174.0 5,160.0

Selling General & Admin Exp. 540.0 509.0

R & D Exp. - -

Depreciation & Amort. 1,450.0 1,382.0

Other Operating Expense/(Income) 1,907.0 1,892.0

Other Operating Exp., Total 3,897.0 3,783.0

Operating Income 277.0 1,377.0

Interest Expense (265.0) (198.0)

Interest and Invest. Income 104.0 39.0

Net Interest Exp. (161.0) (159.0)

Income/(Loss) from Affiliates (39.0) (7.0)

Other Non-Operating Inc. (Exp.) (9.0) (11.0)

EBT Excl. Unusual Items 68.0 1,200.0

Restructuring Charges (97.0) (48.0)

Impairment of Goodwill - -

Gain (Loss) On Sale Of Invest. 30.0 22.0

Gain (Loss) On Sale Of Assets - 11.0

Asset Writedown (115.0) (4.0)

Other Unusual Items 125.0 -

EBT Incl. Unusual Items 11.0 1,181.0

Income Tax Expense 9.0 328.0

Earnings from Cont. Ops. 2.0 853.0

Earnings of Discontinued Ops. - -

Extraord. Item & Account. Change - -

Net Income to Company 2.0 853.0

Minority Int. in Earnings (1.0) (1.0)

Net Income 1.0 852.0

7 | P a g e

I ncome Statement

For the Fiscal Period Ending

Restated

12 months

Jun-30-2013

12 months

Jun-30-2017

Currency AUD AUD

Revenue 14,608.0 14,665.0

Other Revenue 1,169.0 1,392.0

Total Revenue 15,777.0 16,057.0

Cost Of Goods Sold 11,603.0 10,897.0

Gross Profit 4,174.0 5,160.0

Selling General & Admin Exp. 540.0 509.0

R & D Exp. - -

Depreciation & Amort. 1,450.0 1,382.0

Other Operating Expense/(Income) 1,907.0 1,892.0

Other Operating Exp., Total 3,897.0 3,783.0

Operating Income 277.0 1,377.0

Interest Expense (265.0) (198.0)

Interest and Invest. Income 104.0 39.0

Net Interest Exp. (161.0) (159.0)

Income/(Loss) from Affiliates (39.0) (7.0)

Other Non-Operating Inc. (Exp.) (9.0) (11.0)

EBT Excl. Unusual Items 68.0 1,200.0

Restructuring Charges (97.0) (48.0)

Impairment of Goodwill - -

Gain (Loss) On Sale Of Invest. 30.0 22.0

Gain (Loss) On Sale Of Assets - 11.0

Asset Writedown (115.0) (4.0)

Other Unusual Items 125.0 -

EBT Incl. Unusual Items 11.0 1,181.0

Income Tax Expense 9.0 328.0

Earnings from Cont. Ops. 2.0 853.0

Earnings of Discontinued Ops. - -

Extraord. Item & Account. Change - -

Net Income to Company 2.0 853.0

Minority Int. in Earnings (1.0) (1.0)

Net Income 1.0 852.0

7 | P a g e

8

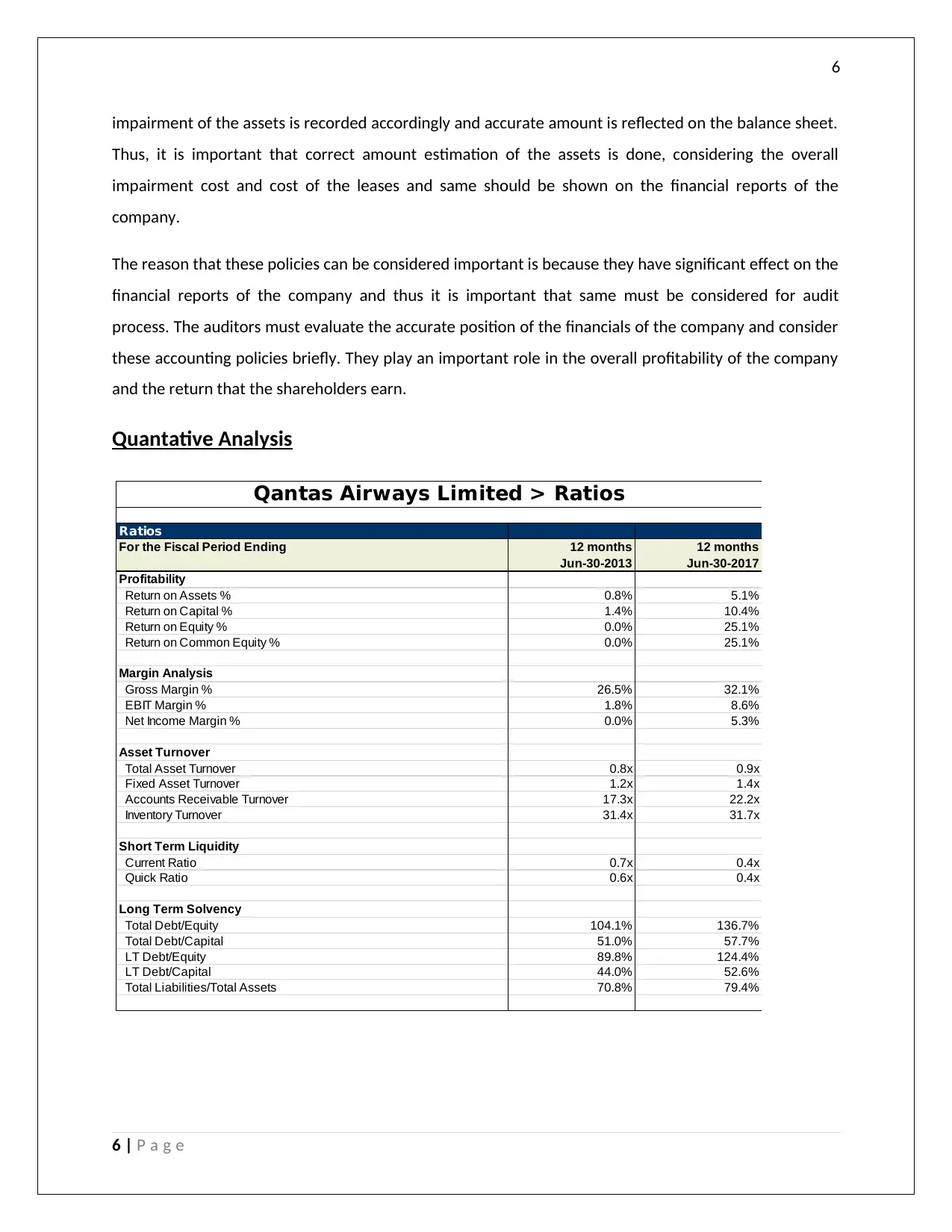

Balance Sheet

Balance Sheet as of: Restated

Jun-30-2013 Jun-30-2017

Currency AUD AUD

ASSETS

Cash And Equivalents 2,829.0 1,775.0

Total Cash & ST Investments 2,829.0 1,775.0

Accounts Receivable 898.0 664.0

Other Receivables 538.0 120.0

Total Receivables 1,436.0 784.0

Inventory 364.0 351.0

Prepaid Exp. - -

Other Current Assets 332.0 209.0

Total Current Assets 4,961.0 3,119.0

Gross Property, Plant & Equipment 22,929.0 25,188.0

Accumulated Depreciation (10,117.0) (13,687.0)

Net Property, Plant & Equipment 12,812.0 11,501.0

Long-term Investments 190.0 214.0

Goodwill 197.0 207.0

Other Intangibles 517.0 818.0

Deferred Tax Assets, LT - -

Other Long-Term Assets 1,355.0 1,362.0

Total Assets 20,032.0 17,221.0

LIABILITIES

Accounts Payable 640.0 -

Accrued Exp. 796.0 834.0

Curr. Port. of LT Debt 592.0 330.0

Curr. Port. of Cap. Leases 243.0 103.0

Unearned Revenue, Current 3,047.0 3,685.0

Other Current Liabilities 1,329.0 2,143.0

Total Current Liabilities 6,647.0 7,095.0

Long-Term Debt 4,612.0 3,144.0

Capital Leases 633.0 1,261.0

Unearned Revenue, Non-Current 1,186.0 1,424.0

Pension & Other Post-Retire. Benefits 59.0 -

Def. Tax Liability, Non-Curr. 625.0 353.0

Other Non-Current Liabilities 430.0 404.0

Total Liabilities 14,192.0 13,681.0

Common Stock 4,693.0 3,259.0

Additional Paid In Capital - -

Retained Earnings 1,057.0 472.0

Treasury Stock (43.0) (206.0)

Comprehensive Inc. and Other 128.0 12.0

Total Common Equity 5,835.0 3,537.0

Minority Interest 5.0 3.0

Total Equity 5,840.0 3,540.0

Total Liabilities And Equity 20,032.0 17,221.0

8 | P a g e

Balance Sheet

Balance Sheet as of: Restated

Jun-30-2013 Jun-30-2017

Currency AUD AUD

ASSETS

Cash And Equivalents 2,829.0 1,775.0

Total Cash & ST Investments 2,829.0 1,775.0

Accounts Receivable 898.0 664.0

Other Receivables 538.0 120.0

Total Receivables 1,436.0 784.0

Inventory 364.0 351.0

Prepaid Exp. - -

Other Current Assets 332.0 209.0

Total Current Assets 4,961.0 3,119.0

Gross Property, Plant & Equipment 22,929.0 25,188.0

Accumulated Depreciation (10,117.0) (13,687.0)

Net Property, Plant & Equipment 12,812.0 11,501.0

Long-term Investments 190.0 214.0

Goodwill 197.0 207.0

Other Intangibles 517.0 818.0

Deferred Tax Assets, LT - -

Other Long-Term Assets 1,355.0 1,362.0

Total Assets 20,032.0 17,221.0

LIABILITIES

Accounts Payable 640.0 -

Accrued Exp. 796.0 834.0

Curr. Port. of LT Debt 592.0 330.0

Curr. Port. of Cap. Leases 243.0 103.0

Unearned Revenue, Current 3,047.0 3,685.0

Other Current Liabilities 1,329.0 2,143.0

Total Current Liabilities 6,647.0 7,095.0

Long-Term Debt 4,612.0 3,144.0

Capital Leases 633.0 1,261.0

Unearned Revenue, Non-Current 1,186.0 1,424.0

Pension & Other Post-Retire. Benefits 59.0 -

Def. Tax Liability, Non-Curr. 625.0 353.0

Other Non-Current Liabilities 430.0 404.0

Total Liabilities 14,192.0 13,681.0

Common Stock 4,693.0 3,259.0

Additional Paid In Capital - -

Retained Earnings 1,057.0 472.0

Treasury Stock (43.0) (206.0)

Comprehensive Inc. and Other 128.0 12.0

Total Common Equity 5,835.0 3,537.0

Minority Interest 5.0 3.0

Total Equity 5,840.0 3,540.0

Total Liabilities And Equity 20,032.0 17,221.0

8 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

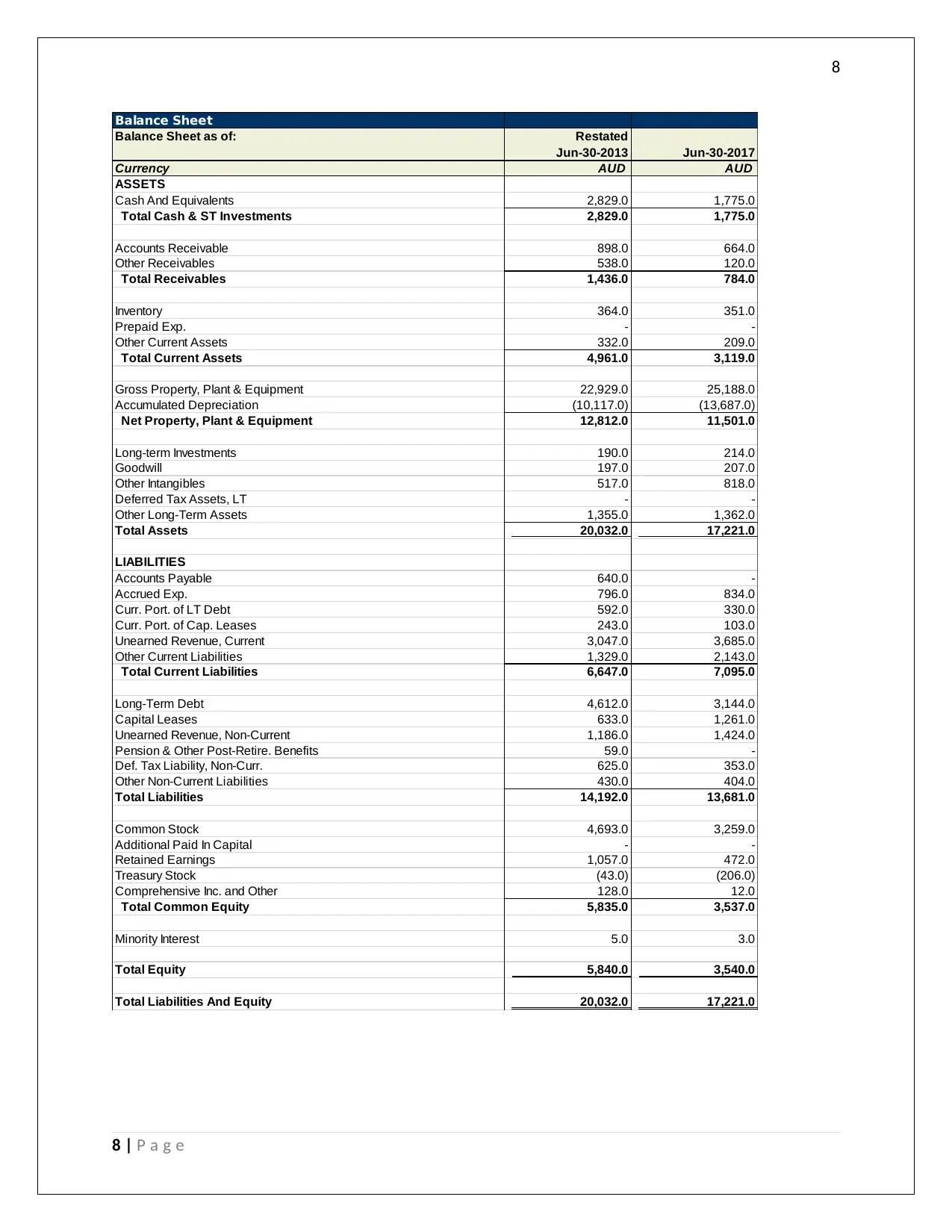

e) At the end of 2013, it can be seen that the overall revenue of the company is very less, given

to its huge operating expenses that have affected the preofitability of the company. The total assets and

liabilities are at a good position, with company having good amount of cash which reflects the liquidity

position of the company.If we see the overall ratios, the return on assets are very low, and the return on

equity is negligible, given the low profitability of the company. The debt equity ratio ideally should by

2.1 but in this case it is very high which reflects that the company needs to improve the same. But the

overall position of the company is not great given that the company is earning nil income and that

makes it vulnerable and given that the company is having huge cash balance it must invest the same for

further growth and development. The company needs to make more investment and improve the

position of its stakeholders by providing them with better returns.

f) At the end of 2017, the latest financial year, it can be seen that net income of the company

have improved tremendously, and that has also in turn improved the net earning ratios and the return

on equity for the shareholders. The operating income has also increased and is responsible for the

growth of the company. As for the net assets and liabilities, there has been a decrease from the prior

years, and that is because of the reduction in the overall cash balance of the company. This reflects low

liquidity position and the company needs to improve the same. Overall there has been growth in the

financial position of the company with respect to its overall asset position and the return that it is

providing to the shareholders. The company just needs to work on its liquidity position and provide

security to the invetsors (Chariri, 2017).

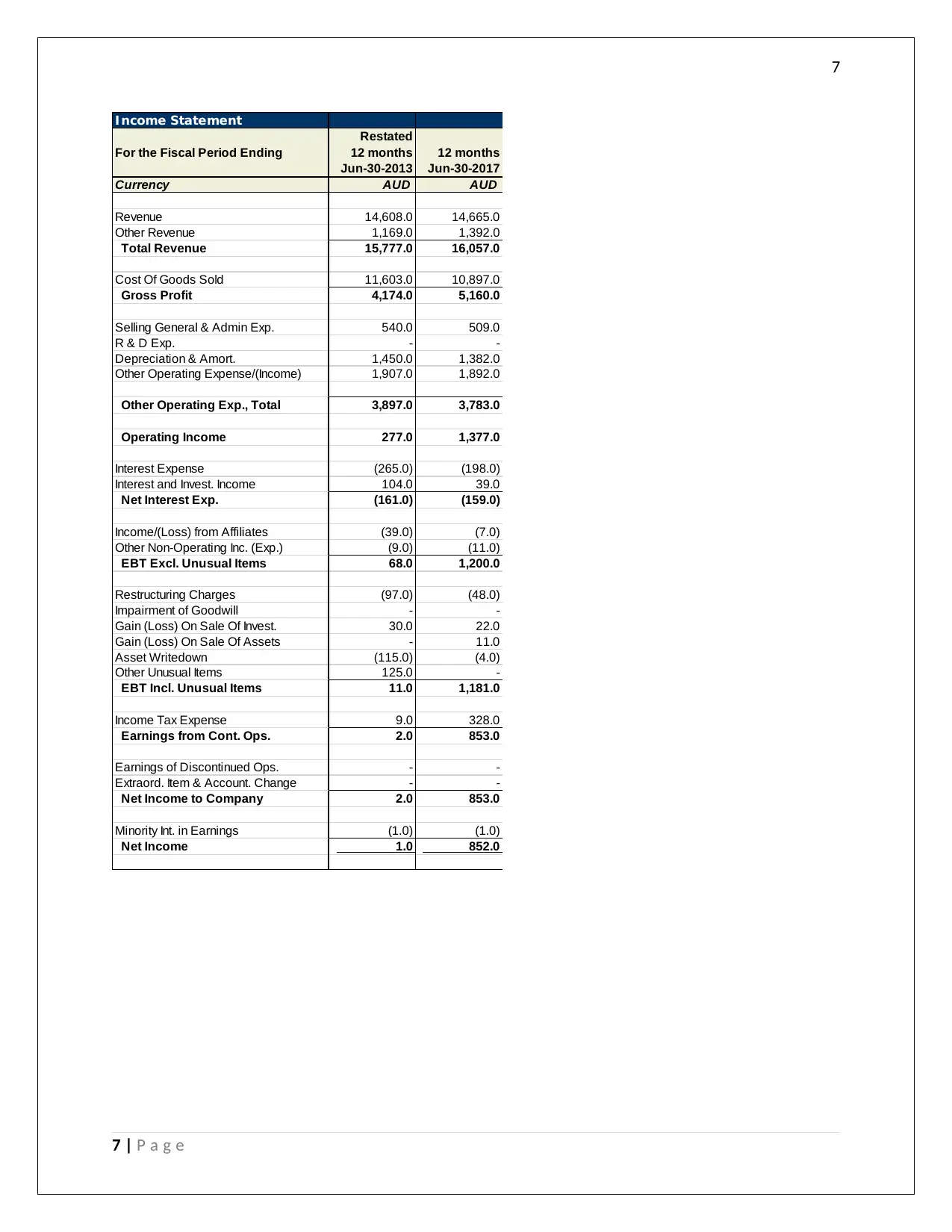

g) On comparing both the years, it can be seen that there has been huge growth in the overall

profit of the company, and this is mainly because the operating income in 2017 is much more in

comparison to that in 2013. This has increased the overall return to the shareholders and has improved

the return on equity. If we analyse the other ratios it can be said that is improvement in all aspects as it

can be seen, the return on assets have grown from 0.8% in 2013 to 5.1% in 2017. Also the return on

equity have increased from 0.05 to 25.1%. This shows that the shareholders are getting good returns on

their investments and in times to come the company will develop further. This also makes it a good

decision to invest in the shares of the company as for now. The only point of concern is that the

company is having a low debt equity ratios, which means that the company is funding its growth

through debt sources and needs to improve the same. Other ratios like current ratio, assets turnover,

accounts receivable ratio etc shows a good picture for the investors and reflects a good position where

they can get return for their investments. Since 2013, to 2017 the company has showcase great results

9 | P a g e

e) At the end of 2013, it can be seen that the overall revenue of the company is very less, given

to its huge operating expenses that have affected the preofitability of the company. The total assets and

liabilities are at a good position, with company having good amount of cash which reflects the liquidity

position of the company.If we see the overall ratios, the return on assets are very low, and the return on

equity is negligible, given the low profitability of the company. The debt equity ratio ideally should by

2.1 but in this case it is very high which reflects that the company needs to improve the same. But the

overall position of the company is not great given that the company is earning nil income and that

makes it vulnerable and given that the company is having huge cash balance it must invest the same for

further growth and development. The company needs to make more investment and improve the

position of its stakeholders by providing them with better returns.

f) At the end of 2017, the latest financial year, it can be seen that net income of the company

have improved tremendously, and that has also in turn improved the net earning ratios and the return

on equity for the shareholders. The operating income has also increased and is responsible for the

growth of the company. As for the net assets and liabilities, there has been a decrease from the prior

years, and that is because of the reduction in the overall cash balance of the company. This reflects low

liquidity position and the company needs to improve the same. Overall there has been growth in the

financial position of the company with respect to its overall asset position and the return that it is

providing to the shareholders. The company just needs to work on its liquidity position and provide

security to the invetsors (Chariri, 2017).

g) On comparing both the years, it can be seen that there has been huge growth in the overall

profit of the company, and this is mainly because the operating income in 2017 is much more in

comparison to that in 2013. This has increased the overall return to the shareholders and has improved

the return on equity. If we analyse the other ratios it can be said that is improvement in all aspects as it

can be seen, the return on assets have grown from 0.8% in 2013 to 5.1% in 2017. Also the return on

equity have increased from 0.05 to 25.1%. This shows that the shareholders are getting good returns on

their investments and in times to come the company will develop further. This also makes it a good

decision to invest in the shares of the company as for now. The only point of concern is that the

company is having a low debt equity ratios, which means that the company is funding its growth

through debt sources and needs to improve the same. Other ratios like current ratio, assets turnover,

accounts receivable ratio etc shows a good picture for the investors and reflects a good position where

they can get return for their investments. Since 2013, to 2017 the company has showcase great results

9 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

with 25 times increase in the overall profit ratio and high returns for the potential investors (Burke &

Clark, 2016). Thus it can be said that in times to come, the position of the company will further improve

and thus it will be great for the invetsors to buy the shares of the company, and for the potential

shareholders they must hold the shares of the company and invest more as there are good possibilities

of the profit increasing in the times to come.

10 | P a g e

with 25 times increase in the overall profit ratio and high returns for the potential investors (Burke &

Clark, 2016). Thus it can be said that in times to come, the position of the company will further improve

and thus it will be great for the invetsors to buy the shares of the company, and for the potential

shareholders they must hold the shares of the company and invest more as there are good possibilities

of the profit increasing in the times to come.

10 | P a g e

11

References

Abbott, M. & Kantor, A., 2017. Fair Value Measurement and Mandated Accounting Changes: The Case of

the Victorian Rail Track Corporation. Australian accounting Review.

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

Birt, J., Muthusamy, K. & Bir, P., 2017. "XBRL and the qualitative characteristics of useful financial

information". Accounting Research Journal, 30(1), pp. 107-126.

Burke, J. & Clark, C., 2016. The business case for integrated reporting: Insights from leading

practitioners, regulators, and academics. Business Horizons, 59(3), pp. 273-283.

Chariri, A., 2017. FINANCIAL REPORTING PRACTICE AS A RITUAL: UNDERSTANDING ACCOUNTING

WITHIN INSTITUTIONAL FRAMEWORK. Journal of Economics, Business and Accountancy, 14(1).

Chiapello, E., 2017. Critical accounting research and neoliberalism. Critical Perspectives on Accounting,

Volume 43, pp. 47-64.

Crosby, N. & Henneberry, J., 2016. Financialisation, the valuation of investment property and the urban

built environment in the UK. Urban Studies, 53(7).

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Fay, R. & Negangard, E., 2017. Manual journal entry testing : Data analytics and the risk of fraud. Journal

of Accounting Education, Volume 38, pp. 37-49.

Given, L., 2016. 100 questions (and answers) about qualitative research. s.l.:Sage.

Guragai, B., Hunt, N., Neri, M. & Taylor, E., 2017. Accounting Information Systems and Ethics Research:

Review, Synthesis, and the Future. Journal of Information Systems: Summer 2017, 31(2), pp. 65-81.

Han, B., Subrahmanyam, A. & Zhou, Y., 2017. The term structure of credit spreads, firm fundamentals,

and expected stock returns. Journal of Financial Economics, 24(1), pp. 147-171.

Maynard, J., 2017. Financial accounting reporting and analysis. second ed. United Kingdom: Oxford

University Press.

Prasad, P. & Chand, P., 2017. The Changing Face of the Auditor's Report: Implications for Suppliers and

Users of Financial Statements. Australian Accounting Review.

11 | P a g e

References

Abbott, M. & Kantor, A., 2017. Fair Value Measurement and Mandated Accounting Changes: The Case of

the Victorian Rail Track Corporation. Australian accounting Review.

Alexander, F., 2016. The Changing Face of Accountability. The Journal of Higher Education, 71(4), pp.

411-431.

Birt, J., Muthusamy, K. & Bir, P., 2017. "XBRL and the qualitative characteristics of useful financial

information". Accounting Research Journal, 30(1), pp. 107-126.

Burke, J. & Clark, C., 2016. The business case for integrated reporting: Insights from leading

practitioners, regulators, and academics. Business Horizons, 59(3), pp. 273-283.

Chariri, A., 2017. FINANCIAL REPORTING PRACTICE AS A RITUAL: UNDERSTANDING ACCOUNTING

WITHIN INSTITUTIONAL FRAMEWORK. Journal of Economics, Business and Accountancy, 14(1).

Chiapello, E., 2017. Critical accounting research and neoliberalism. Critical Perspectives on Accounting,

Volume 43, pp. 47-64.

Crosby, N. & Henneberry, J., 2016. Financialisation, the valuation of investment property and the urban

built environment in the UK. Urban Studies, 53(7).

Dichev, I., 2017. On the conceptual foundations of financial reporting. Accounting and Business

Research, 47(6), pp. 617-632.

Fay, R. & Negangard, E., 2017. Manual journal entry testing : Data analytics and the risk of fraud. Journal

of Accounting Education, Volume 38, pp. 37-49.

Given, L., 2016. 100 questions (and answers) about qualitative research. s.l.:Sage.

Guragai, B., Hunt, N., Neri, M. & Taylor, E., 2017. Accounting Information Systems and Ethics Research:

Review, Synthesis, and the Future. Journal of Information Systems: Summer 2017, 31(2), pp. 65-81.

Han, B., Subrahmanyam, A. & Zhou, Y., 2017. The term structure of credit spreads, firm fundamentals,

and expected stock returns. Journal of Financial Economics, 24(1), pp. 147-171.

Maynard, J., 2017. Financial accounting reporting and analysis. second ed. United Kingdom: Oxford

University Press.

Prasad, P. & Chand, P., 2017. The Changing Face of the Auditor's Report: Implications for Suppliers and

Users of Financial Statements. Australian Accounting Review.

11 | P a g e

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.