Unit 42: Planning for Growth Report - Strategies for R Robson (Guinot)

VerifiedAdded on 2020/10/05

|15

|3690

|368

Report

AI Summary

This report delves into the crucial aspects of growth planning for small and medium-sized enterprises (SMEs), using R Robson (Guinot) as a case study. It begins by analyzing key considerations for evaluating growth opportunities, emphasizing the impact of digital technology. The report then applies Ansoff's Growth Vector Matrix to evaluate growth opportunities, recommending a product development strategy. A comprehensive assessment of potential funding sources, including internal and external options, is provided, along with their respective benefits and drawbacks. Furthermore, the report outlines the design of a business plan for growth, encompassing financial information and strategic objectives for scaling up the chosen business. Finally, it assesses exit and succession options for the SME, explaining the benefits and drawbacks of each. The report leverages frameworks such as PESTLE analysis, Porter's Five Forces Model, and the Boston Matrix to provide a holistic view of the subject.

UNIT 42 PLANNING FOR

GROWTH

GROWTH

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................1

1. Analyse key considerations for evaluating growth opportunities and justify these

considerations within an organisational context with special reference to the chosen SME

organisation and its impact on digital technology.......................................................................1

2. Evaluate the opportunities for growth applying Ansoff’s growth vector matrix for the

chosen SME organisation............................................................................................................4

3. Assess the potential sources of funding available to businesses and discuss benefits and

drawbacks of each source............................................................................................................5

4. Design a business plan for growth that includes financial information and strategic

objectives for scaling up your chosen business...........................................................................7

5. Assess exit or succession options for the small business chosen for the purpose, explaining

the benefits and drawbacks of each option...............................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION...........................................................................................................................1

1. Analyse key considerations for evaluating growth opportunities and justify these

considerations within an organisational context with special reference to the chosen SME

organisation and its impact on digital technology.......................................................................1

2. Evaluate the opportunities for growth applying Ansoff’s growth vector matrix for the

chosen SME organisation............................................................................................................4

3. Assess the potential sources of funding available to businesses and discuss benefits and

drawbacks of each source............................................................................................................5

4. Design a business plan for growth that includes financial information and strategic

objectives for scaling up your chosen business...........................................................................7

5. Assess exit or succession options for the small business chosen for the purpose, explaining

the benefits and drawbacks of each option...............................................................................10

CONCLUSION..............................................................................................................................11

REFERENCES..............................................................................................................................13

INTRODUCTION

Growth is essential for firm by which profits may be attained quite effectually. Present

report deals with R Robson (Guinot) which is an SME engaged in beauty treatment commodities

in UK. For evaluating growth opportunities, PESTLE analysis, Product Life Cycle, Boston

Matrix, Porter's Five Forces Model and Ansoff's Growth Vector Matrix will be discussed.

Furthermore, sources of funding will be assessed along with the same, business plan will be

made. Succession or exit options will be discussed in report. Thus, firm will be able to attain

more growth by introducing new product and more profits will be achieved along with customer

satisfaction.

1. Analyse key considerations for evaluating growth opportunities and justify these

considerations within an organisational context with special reference to the chosen SME

organisation and its impact on digital technology.

Growth is required to be attained by firm so that it may be able to attain profits. R

Robson (Guinot) which is an SME in UK is planning for initiating new product for protection

from harmful UV-rays i.e. sun cream product option in order to attain profits quite effectively.

For this, PESTLE analysis, Porter five forces model, Boston Matrix and Product life cycle are

provided below-

PESTLE Analysis

Political (P)-

The political factors such as taxation policy, rules and regulations etc. are basic factors

which might affect operations of company. Moreover, it has direct effect on company as it has

limited operations in UK and sudden change in such factors will its sales (Kim, 2017).

Economical (E)-

Economic factors such as interest rate fluctuation, change in policy and rate of exchange

rate are crucial ones affecting R Robson (Guinot). Thus, in order to sell its beauty products, all

such factors have to be kept in mind.

Social (S)-

Cultural, social, beliefs are required to be assessed so that firm may provide items with

ease. Customers are sensitive for their skin and as such, beauty products should be of quality so

that sales may be accelerated.

1

Growth is essential for firm by which profits may be attained quite effectually. Present

report deals with R Robson (Guinot) which is an SME engaged in beauty treatment commodities

in UK. For evaluating growth opportunities, PESTLE analysis, Product Life Cycle, Boston

Matrix, Porter's Five Forces Model and Ansoff's Growth Vector Matrix will be discussed.

Furthermore, sources of funding will be assessed along with the same, business plan will be

made. Succession or exit options will be discussed in report. Thus, firm will be able to attain

more growth by introducing new product and more profits will be achieved along with customer

satisfaction.

1. Analyse key considerations for evaluating growth opportunities and justify these

considerations within an organisational context with special reference to the chosen SME

organisation and its impact on digital technology.

Growth is required to be attained by firm so that it may be able to attain profits. R

Robson (Guinot) which is an SME in UK is planning for initiating new product for protection

from harmful UV-rays i.e. sun cream product option in order to attain profits quite effectively.

For this, PESTLE analysis, Porter five forces model, Boston Matrix and Product life cycle are

provided below-

PESTLE Analysis

Political (P)-

The political factors such as taxation policy, rules and regulations etc. are basic factors

which might affect operations of company. Moreover, it has direct effect on company as it has

limited operations in UK and sudden change in such factors will its sales (Kim, 2017).

Economical (E)-

Economic factors such as interest rate fluctuation, change in policy and rate of exchange

rate are crucial ones affecting R Robson (Guinot). Thus, in order to sell its beauty products, all

such factors have to be kept in mind.

Social (S)-

Cultural, social, beliefs are required to be assessed so that firm may provide items with

ease. Customers are sensitive for their skin and as such, beauty products should be of quality so

that sales may be accelerated.

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Technological (T)-

Technological advancement is changing quite rapidly (Wynn, 2017). It is required that

promotional tactics should be applied for marketing products in a better way. This will help

organisation to accomplish goals by relying on modern marketing through digital media.

Legal (L)-

Legal factors such equal opportunities at workplace, advertising standards and related

legal rules should be followed by R Robson (Guinot) so that it may easily offer products for sale

with ease.

Environmental (E)-

The resources are scarce and as such, company needs to be follow all such environmental

rules and regulations for effectively attaining operational activities with ease. Sustainability is

one of key opportunity for R Robson (Guinot) for accomplishing desired sales.

Product Life Cycle

Introduction-

It is the stage in which item is just launched in the market and no profits are achieved at

initial stage. Modifications are required to be done, failure rate is high as well (Denton, Forsyth

and MacLennan, 2017).

Growth-

Introductory stage is survived by company, then it effectively attains growth in this stage.

It means that customers come to know about offerings of firm and sales start rising which attracts

many rival businesses. R Robson (Guinot) falls under this stage as company is focusing on

reaching for online sales of beauty products.

Maturity-

Goods are present for very long in the market. This means that at maturity stage, sales

increases but at diminishing rate. It requires adopting well-defined strategies by company for

injecting sales (Pred, 2017).

Decline-

This is the stage where goods are not demanded by people due to availability of better

substitutes, change in tastes etc. Thus, new offerings are required for gaining market share.

2

Technological advancement is changing quite rapidly (Wynn, 2017). It is required that

promotional tactics should be applied for marketing products in a better way. This will help

organisation to accomplish goals by relying on modern marketing through digital media.

Legal (L)-

Legal factors such equal opportunities at workplace, advertising standards and related

legal rules should be followed by R Robson (Guinot) so that it may easily offer products for sale

with ease.

Environmental (E)-

The resources are scarce and as such, company needs to be follow all such environmental

rules and regulations for effectively attaining operational activities with ease. Sustainability is

one of key opportunity for R Robson (Guinot) for accomplishing desired sales.

Product Life Cycle

Introduction-

It is the stage in which item is just launched in the market and no profits are achieved at

initial stage. Modifications are required to be done, failure rate is high as well (Denton, Forsyth

and MacLennan, 2017).

Growth-

Introductory stage is survived by company, then it effectively attains growth in this stage.

It means that customers come to know about offerings of firm and sales start rising which attracts

many rival businesses. R Robson (Guinot) falls under this stage as company is focusing on

reaching for online sales of beauty products.

Maturity-

Goods are present for very long in the market. This means that at maturity stage, sales

increases but at diminishing rate. It requires adopting well-defined strategies by company for

injecting sales (Pred, 2017).

Decline-

This is the stage where goods are not demanded by people due to availability of better

substitutes, change in tastes etc. Thus, new offerings are required for gaining market share.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Boston Matrix

Stars-

The stars' category finds place for high growth products which are dominating market by

increasing sales. For attaining this, heavy amount of investment is to be made.

Cash cows-

In this category of Boston Matrix, items having low-growth are found but have good

market share. In relation to this, successful products fall under this requiring less investment as

product has good share in the market.

Question marks -

This means that products operating in higher growth markets but have low market share

due to good position of competitor's commodities. Investment is needed for maximising cash

balance (Boserup, 2017).

Dogs-

It refers to low-growth market which is unattractive and firm has low share in it. Usually,

under this matrix, operational activities of firm comes to an end or sold to other businesses.

Porter's Five Forces Model

New entrants' threats-

SME are integral part of UK which provides economic growth up to a major extent.

Threat of new entrants is high as competencies are more. Furthermore, R Robson (Guinot) is

under growth stage which will attract more competition.

Power of customers-

The bargaining power of customers' is high as there are plenty of products available. This

can drive customers to rivals leading to loss of customer base. It requires that lower prices must

be quoted for increasing sales else they will be attracted to other businesses (Bridge and Dodds,

2018.).

Power of suppliers-

3

Stars-

The stars' category finds place for high growth products which are dominating market by

increasing sales. For attaining this, heavy amount of investment is to be made.

Cash cows-

In this category of Boston Matrix, items having low-growth are found but have good

market share. In relation to this, successful products fall under this requiring less investment as

product has good share in the market.

Question marks -

This means that products operating in higher growth markets but have low market share

due to good position of competitor's commodities. Investment is needed for maximising cash

balance (Boserup, 2017).

Dogs-

It refers to low-growth market which is unattractive and firm has low share in it. Usually,

under this matrix, operational activities of firm comes to an end or sold to other businesses.

Porter's Five Forces Model

New entrants' threats-

SME are integral part of UK which provides economic growth up to a major extent.

Threat of new entrants is high as competencies are more. Furthermore, R Robson (Guinot) is

under growth stage which will attract more competition.

Power of customers-

The bargaining power of customers' is high as there are plenty of products available. This

can drive customers to rivals leading to loss of customer base. It requires that lower prices must

be quoted for increasing sales else they will be attracted to other businesses (Bridge and Dodds,

2018.).

Power of suppliers-

3

The power of suppliers is required to be analysed so that firm may be able to purchase

raw materials in effective manner. In beauty industry, bargaining power is more of suppliers

which will affect company's production up to a high extent.

Substitute threats-

The substitute threat is however low in company as beauty products are to be made with

proper ingredients which suits skin of all type. Thus, it is low.

Competitive rivalry-

Competencies are major part of businesses. R Robson (Guinot) has also competitors

offering products at competitive prices. Thus, it is required to set well-defined strategies for

increasing profits and outreach competitors.

2. Evaluate the opportunities for growth applying Ansoff’s growth vector matrix for the chosen

SME organisation

The Ansoff's Growth Vector Matrix is useful for assessing growth opportunities for the

company so that it may enlarge its operational activities for achieving maximum sales. The

matrix consists of four elements listed below-

Market Penetration-

In this, in present market only, organisation aims for increasing market share in order to

satisfy customers in the best way possible (Pelham, 2017). It is desired because company sells

existing products to the present or existing market leading to accomplishment of goals with ease.

It is required for maximising sales and also to expand share in market by offering better quality

products to consumers. Thus, in current market segment, firm achieves more market share.

Product Development-

The new commodities are being developed by firm for increasing customer's satisfaction

in existing markets only. Firm provides new products for providing something different which

increases loyalty of customers in the best manner possible (Ansoff Matrix. 2018). Thus, existing

market is developed by imparting products in a better manner.

Market development-

4

raw materials in effective manner. In beauty industry, bargaining power is more of suppliers

which will affect company's production up to a high extent.

Substitute threats-

The substitute threat is however low in company as beauty products are to be made with

proper ingredients which suits skin of all type. Thus, it is low.

Competitive rivalry-

Competencies are major part of businesses. R Robson (Guinot) has also competitors

offering products at competitive prices. Thus, it is required to set well-defined strategies for

increasing profits and outreach competitors.

2. Evaluate the opportunities for growth applying Ansoff’s growth vector matrix for the chosen

SME organisation

The Ansoff's Growth Vector Matrix is useful for assessing growth opportunities for the

company so that it may enlarge its operational activities for achieving maximum sales. The

matrix consists of four elements listed below-

Market Penetration-

In this, in present market only, organisation aims for increasing market share in order to

satisfy customers in the best way possible (Pelham, 2017). It is desired because company sells

existing products to the present or existing market leading to accomplishment of goals with ease.

It is required for maximising sales and also to expand share in market by offering better quality

products to consumers. Thus, in current market segment, firm achieves more market share.

Product Development-

The new commodities are being developed by firm for increasing customer's satisfaction

in existing markets only. Firm provides new products for providing something different which

increases loyalty of customers in the best manner possible (Ansoff Matrix. 2018). Thus, existing

market is developed by imparting products in a better manner.

Market development-

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The market development is a strategy which is just opposite to market penetration. Firm

aims to sell its commodities in newer segments of market which is not yet tapped by it. The

potential in the market is analysed and taking it as a feasible market, existing products which are

sold by customers are offered to completely new customers. This strategy is used for expanding

or elevating share in new market for higher profits.

Diversification strategy-

As the name suggests, diversification is the strategy in which company aims to offer new

products to newer markets. The products so offered are not of regular offerings made by it but an

effort is made for diversifying range of products by starting different business operational

activities. The risk is high as experience of company is low and thus, proper and in-depth market

research is required for accelerating business toward growth.

From the Ansoff's Growth Vector Matrix, it can be assessed that R Robson (Guinot) will

adopt product development strategy for increasing customer's base and satisfaction up to a high

extent (Sager, 2017). It is required that new products will be developed and sold in existing

market of UK for expanding growth and revenue with ease. Thus, product development is

recommended as per the growth opportunity for firm.

3. Assess the potential sources of funding available to businesses and discuss benefits and

drawbacks of each source.

There are different Sources of funds available for R Robson (Guinot) which includes

internal and external through which firm can raise fund to perform various activities of

organisation.

Internal sources of funding is also known as owners funds which includes retained earning, sale

of fixed assets, equity shares etc.

Internal sources of funding

Retained earning : Retained earnings are the profits which is left after distributing

dividends to the shareholders (Gold And et.al., 2015). This profits are reinvested in the

business to perform various activities of organisation. Retained earning is an internal

source of fund which is generated internally to invest in business to perform operation of

firm.

Benefits

5

aims to sell its commodities in newer segments of market which is not yet tapped by it. The

potential in the market is analysed and taking it as a feasible market, existing products which are

sold by customers are offered to completely new customers. This strategy is used for expanding

or elevating share in new market for higher profits.

Diversification strategy-

As the name suggests, diversification is the strategy in which company aims to offer new

products to newer markets. The products so offered are not of regular offerings made by it but an

effort is made for diversifying range of products by starting different business operational

activities. The risk is high as experience of company is low and thus, proper and in-depth market

research is required for accelerating business toward growth.

From the Ansoff's Growth Vector Matrix, it can be assessed that R Robson (Guinot) will

adopt product development strategy for increasing customer's base and satisfaction up to a high

extent (Sager, 2017). It is required that new products will be developed and sold in existing

market of UK for expanding growth and revenue with ease. Thus, product development is

recommended as per the growth opportunity for firm.

3. Assess the potential sources of funding available to businesses and discuss benefits and

drawbacks of each source.

There are different Sources of funds available for R Robson (Guinot) which includes

internal and external through which firm can raise fund to perform various activities of

organisation.

Internal sources of funding is also known as owners funds which includes retained earning, sale

of fixed assets, equity shares etc.

Internal sources of funding

Retained earning : Retained earnings are the profits which is left after distributing

dividends to the shareholders (Gold And et.al., 2015). This profits are reinvested in the

business to perform various activities of organisation. Retained earning is an internal

source of fund which is generated internally to invest in business to perform operation of

firm.

Benefits

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1. This source of funding is easily available and it is a cheap source than external.

2. Retained earnings do not dilute the ownership of organisation.

Drawbacks

1. Retained earning do not allow shareholders with actual profits earned by organisation and this

creates dissatisfaction among shareholders regarding less payment of dividends.

2. Retained earning are profits of organisation and if this profits are not utilised properly it may

leads to losses for a firm.

Sale of fixed assets : ale of fixed assets is an internal source of fund which company

raise by selling its assets in the open market. Fixed assets includes plant and machinery,

furniture, building etc. Fixed assets sold in the market attract value of the assets in the

market which the company invest in the business to grow its market. The fixed assets

sold in the market includes those assets which are not needed by the organisation.

Benefits

1. It is a good source of finance as it does not require any cost and create space for the

organisation by selling the old assets of company (Birley and Stockley, 2017).

2. It helps in increasing profitability by selling those assets which are not required by company

such as spare land etc.

Drawbacks

1. Sale of fixed assets is a slow method of financing as it require various formalities to sell the

assets of organisation.

2. It is possible some organisation does not have surplus assets which are not required by firm .

External sources of funding

It is also known as borrowed capital which the organisation borrow from the open market

such as bank loan, debentures etc. to operate different activities of firm.

Bank loan : The bank is a key source for the organisation by which it can attain funds in

effective manner. In relation to this, principal amount is to be paid along with interest. It

means that company may be able to attain funds from the bank in effective manner.

Bank loan is a main source of external funding through which organisation perform

different functions. Banks provides loan to organisation which firm have to return after

certain period along with interest of the period (Ruan And et.al., 2018).

Benefits

6

2. Retained earnings do not dilute the ownership of organisation.

Drawbacks

1. Retained earning do not allow shareholders with actual profits earned by organisation and this

creates dissatisfaction among shareholders regarding less payment of dividends.

2. Retained earning are profits of organisation and if this profits are not utilised properly it may

leads to losses for a firm.

Sale of fixed assets : ale of fixed assets is an internal source of fund which company

raise by selling its assets in the open market. Fixed assets includes plant and machinery,

furniture, building etc. Fixed assets sold in the market attract value of the assets in the

market which the company invest in the business to grow its market. The fixed assets

sold in the market includes those assets which are not needed by the organisation.

Benefits

1. It is a good source of finance as it does not require any cost and create space for the

organisation by selling the old assets of company (Birley and Stockley, 2017).

2. It helps in increasing profitability by selling those assets which are not required by company

such as spare land etc.

Drawbacks

1. Sale of fixed assets is a slow method of financing as it require various formalities to sell the

assets of organisation.

2. It is possible some organisation does not have surplus assets which are not required by firm .

External sources of funding

It is also known as borrowed capital which the organisation borrow from the open market

such as bank loan, debentures etc. to operate different activities of firm.

Bank loan : The bank is a key source for the organisation by which it can attain funds in

effective manner. In relation to this, principal amount is to be paid along with interest. It

means that company may be able to attain funds from the bank in effective manner.

Bank loan is a main source of external funding through which organisation perform

different functions. Banks provides loan to organisation which firm have to return after

certain period along with interest of the period (Ruan And et.al., 2018).

Benefits

6

1. Banks provides loans easily.

2. Banks charge interest which is fixed for the periods that is beneficial for organisation as

interest amount is already known.

Drawback

1. Bank loans are borrowed by giving security of assets to banks to provide loans.

2. Bank loans are not flexible as it charges interest.

Debentures : It is a long term sources of finance which are raised by firm in order to attract

funding for organisation to perform various activities of enterprise.

Benefits

1. Interest paid on debentures in a tax deductible expense as it provide tax benefit to the

company.

2. Debentures attract fixed rate of interest.

Drawbacks

1. Payment of debenture interest is mandatory as it is a burden for the organisation in low profit

situations.

2. Debenture are borrowed at high interest taxes.

R Robson (Guinot) will use bank loan as a source of finance in order to perform various

activities of organisation. Bank loans are easily available and have low interest rate.

4. Design a business plan for growth that includes financial information and strategic objectives

for scaling up your chosen business.

Company Background

R Robson (Guinot) is engaged in professional beauty treatment for men and women in

UK. It provides beauty products such as facial beauty, hair removal products, men's care and sun

beauty products which suits skin of all customers. It will provide new sun cream product for

protection from UV-rays, thus, customers will be benefited by it.

Vision and Mission

The vision is to provide product suitable for all skin types and at affordable price range.

Protecting skin from harmful sun rays in effective manner.

Objectives

To offer quality commodities for enriching skins of customers

7

2. Banks charge interest which is fixed for the periods that is beneficial for organisation as

interest amount is already known.

Drawback

1. Bank loans are borrowed by giving security of assets to banks to provide loans.

2. Bank loans are not flexible as it charges interest.

Debentures : It is a long term sources of finance which are raised by firm in order to attract

funding for organisation to perform various activities of enterprise.

Benefits

1. Interest paid on debentures in a tax deductible expense as it provide tax benefit to the

company.

2. Debentures attract fixed rate of interest.

Drawbacks

1. Payment of debenture interest is mandatory as it is a burden for the organisation in low profit

situations.

2. Debenture are borrowed at high interest taxes.

R Robson (Guinot) will use bank loan as a source of finance in order to perform various

activities of organisation. Bank loans are easily available and have low interest rate.

4. Design a business plan for growth that includes financial information and strategic objectives

for scaling up your chosen business.

Company Background

R Robson (Guinot) is engaged in professional beauty treatment for men and women in

UK. It provides beauty products such as facial beauty, hair removal products, men's care and sun

beauty products which suits skin of all customers. It will provide new sun cream product for

protection from UV-rays, thus, customers will be benefited by it.

Vision and Mission

The vision is to provide product suitable for all skin types and at affordable price range.

Protecting skin from harmful sun rays in effective manner.

Objectives

To offer quality commodities for enriching skins of customers

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

To attain mark of 10 % gross profit in forthcoming year

To maximise financial performance by maximising sales

Marketing Mix of R Robson (Guinot)

Product

There are various variety of products being offered by company for maximising

satisfaction level of customers. The new product sun cream will be offered to customers by

which their skins may be protected with ease.

Price-

The price is key component of marketing mix. The goods will be sold by implementing

market penetrating strategy as it is new in the market and customers will get attracted to purchase

the same at lower price.

Place-

The place is another important mix for providing products with a higher pace. There are

various brand salons of firm by which it may be able to earn good amount of profits with ease.

Bulk orders can also be fulfilled as it has good distribution network.

Promotion-

It is required for enhancing sales in a better manner by selling products to target

customers. For promotion of good, R Robson (Guinot) will use social media marketing for

increasing sales through Facebook, Instagram and related channels.

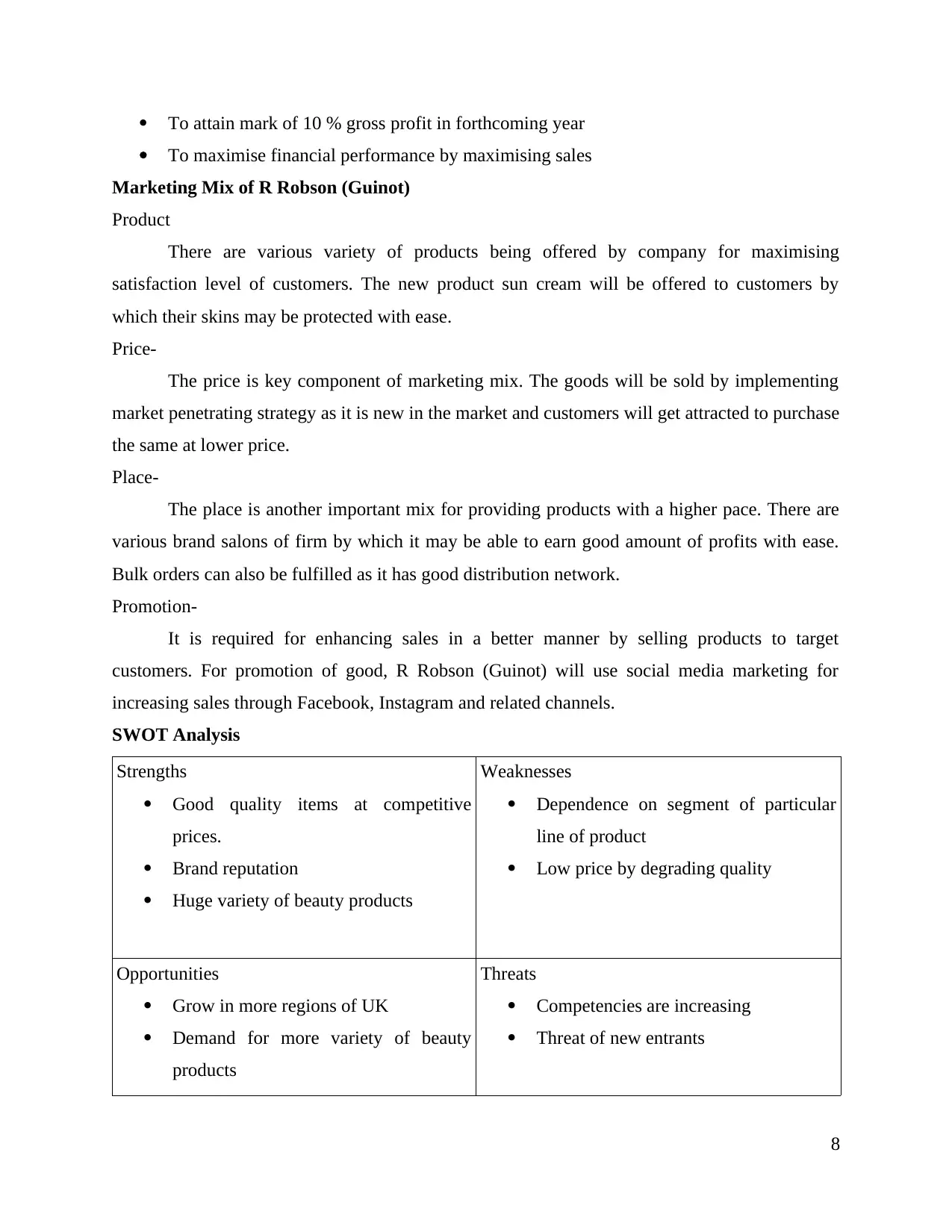

SWOT Analysis

Strengths

Good quality items at competitive

prices.

Brand reputation

Huge variety of beauty products

Weaknesses

Dependence on segment of particular

line of product

Low price by degrading quality

Opportunities

Grow in more regions of UK

Demand for more variety of beauty

products

Threats

Competencies are increasing

Threat of new entrants

8

To maximise financial performance by maximising sales

Marketing Mix of R Robson (Guinot)

Product

There are various variety of products being offered by company for maximising

satisfaction level of customers. The new product sun cream will be offered to customers by

which their skins may be protected with ease.

Price-

The price is key component of marketing mix. The goods will be sold by implementing

market penetrating strategy as it is new in the market and customers will get attracted to purchase

the same at lower price.

Place-

The place is another important mix for providing products with a higher pace. There are

various brand salons of firm by which it may be able to earn good amount of profits with ease.

Bulk orders can also be fulfilled as it has good distribution network.

Promotion-

It is required for enhancing sales in a better manner by selling products to target

customers. For promotion of good, R Robson (Guinot) will use social media marketing for

increasing sales through Facebook, Instagram and related channels.

SWOT Analysis

Strengths

Good quality items at competitive

prices.

Brand reputation

Huge variety of beauty products

Weaknesses

Dependence on segment of particular

line of product

Low price by degrading quality

Opportunities

Grow in more regions of UK

Demand for more variety of beauty

products

Threats

Competencies are increasing

Threat of new entrants

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Competitor's Analysis

The rivals are required to be assessed so that well-structured strategies may be

implemented by company in effective manner. Moreover, company should analyse the market by

which new product may be launched in a better way. For achieving increased sales of new

product, market penetration strategy will be implemented so that more amount of sales may be

accomplished leading to higher revenue with ease.

Investment-

Securing investment is essentially needed so that firm may be able to attain profits by

incorporating sources of funds helpful for preparation of products and launch product in a better

manner. There are various sources such as bank loan, equity shares, raising funds through

debentures and other options. Particularly, with good financial standing in market, bank loan will

be taken for initiating funds.

Operations Management

The operations are to be handled effectively by which products may be delivered to

customers within stipulated time. This means that redesigning of products will be done in

effective manner and products will be offered to consumers.

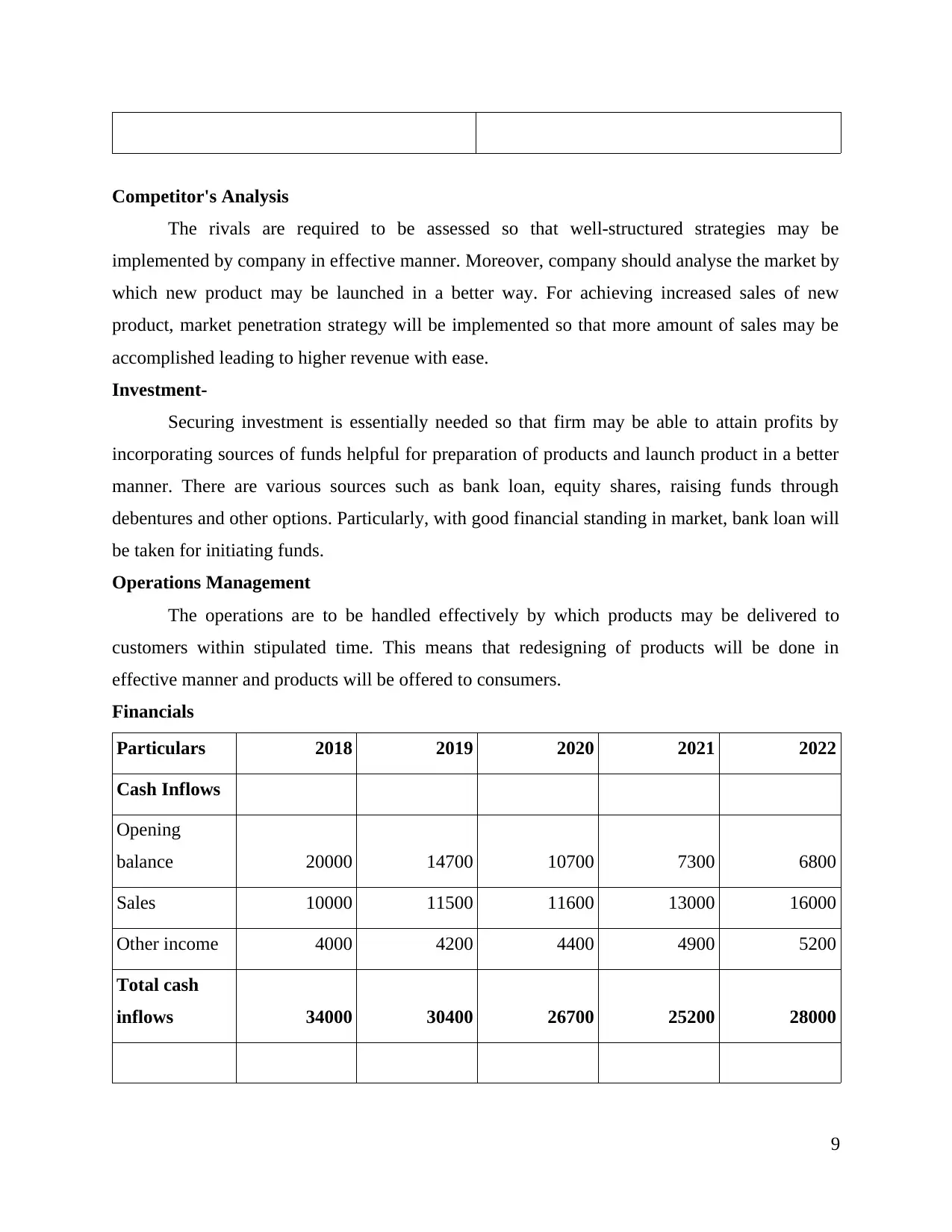

Financials

Particulars 2018 2019 2020 2021 2022

Cash Inflows

Opening

balance 20000 14700 10700 7300 6800

Sales 10000 11500 11600 13000 16000

Other income 4000 4200 4400 4900 5200

Total cash

inflows 34000 30400 26700 25200 28000

9

The rivals are required to be assessed so that well-structured strategies may be

implemented by company in effective manner. Moreover, company should analyse the market by

which new product may be launched in a better way. For achieving increased sales of new

product, market penetration strategy will be implemented so that more amount of sales may be

accomplished leading to higher revenue with ease.

Investment-

Securing investment is essentially needed so that firm may be able to attain profits by

incorporating sources of funds helpful for preparation of products and launch product in a better

manner. There are various sources such as bank loan, equity shares, raising funds through

debentures and other options. Particularly, with good financial standing in market, bank loan will

be taken for initiating funds.

Operations Management

The operations are to be handled effectively by which products may be delivered to

customers within stipulated time. This means that redesigning of products will be done in

effective manner and products will be offered to consumers.

Financials

Particulars 2018 2019 2020 2021 2022

Cash Inflows

Opening

balance 20000 14700 10700 7300 6800

Sales 10000 11500 11600 13000 16000

Other income 4000 4200 4400 4900 5200

Total cash

inflows 34000 30400 26700 25200 28000

9

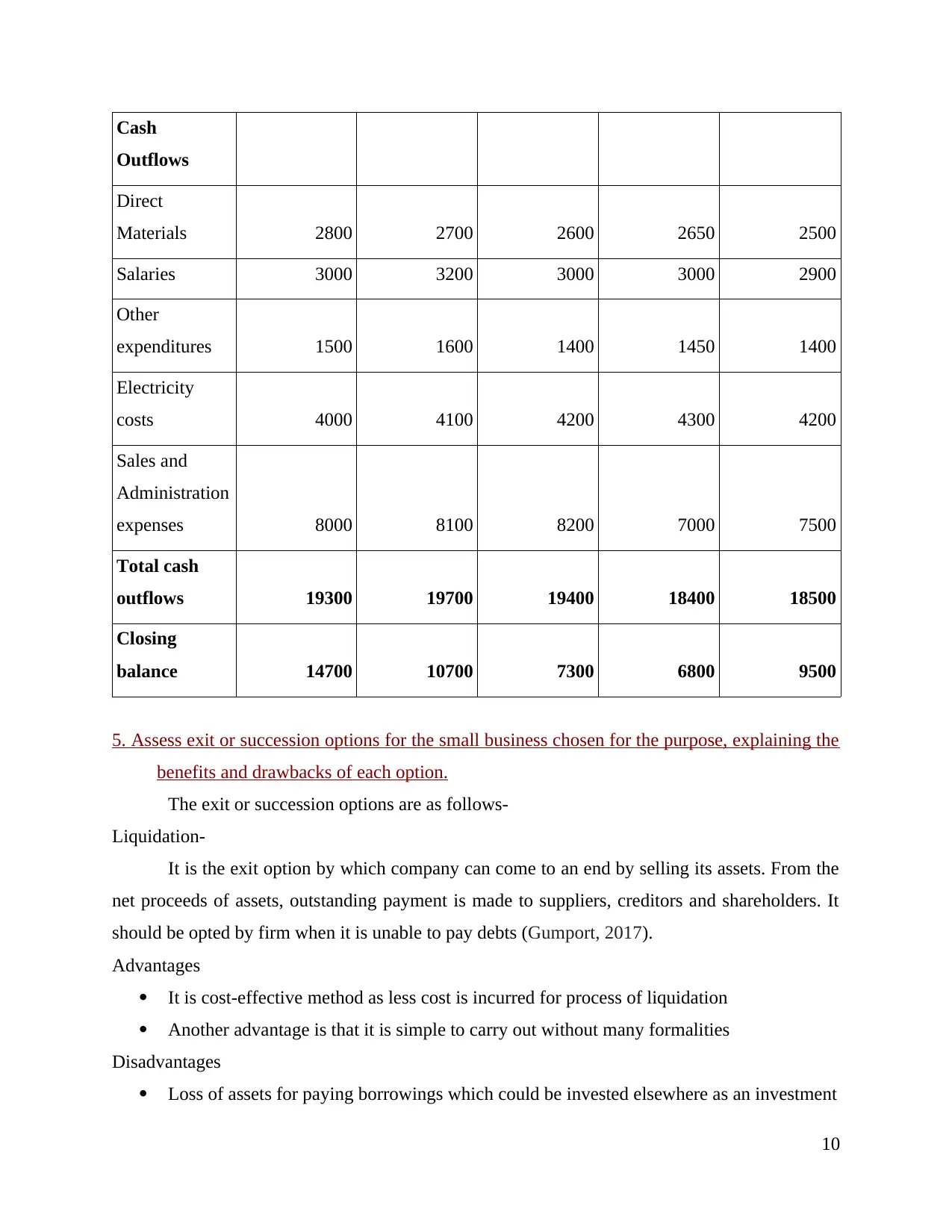

Cash

Outflows

Direct

Materials 2800 2700 2600 2650 2500

Salaries 3000 3200 3000 3000 2900

Other

expenditures 1500 1600 1400 1450 1400

Electricity

costs 4000 4100 4200 4300 4200

Sales and

Administration

expenses 8000 8100 8200 7000 7500

Total cash

outflows 19300 19700 19400 18400 18500

Closing

balance 14700 10700 7300 6800 9500

5. Assess exit or succession options for the small business chosen for the purpose, explaining the

benefits and drawbacks of each option.

The exit or succession options are as follows-

Liquidation-

It is the exit option by which company can come to an end by selling its assets. From the

net proceeds of assets, outstanding payment is made to suppliers, creditors and shareholders. It

should be opted by firm when it is unable to pay debts (Gumport, 2017).

Advantages

It is cost-effective method as less cost is incurred for process of liquidation

Another advantage is that it is simple to carry out without many formalities

Disadvantages

Loss of assets for paying borrowings which could be invested elsewhere as an investment

10

Outflows

Direct

Materials 2800 2700 2600 2650 2500

Salaries 3000 3200 3000 3000 2900

Other

expenditures 1500 1600 1400 1450 1400

Electricity

costs 4000 4100 4200 4300 4200

Sales and

Administration

expenses 8000 8100 8200 7000 7500

Total cash

outflows 19300 19700 19400 18400 18500

Closing

balance 14700 10700 7300 6800 9500

5. Assess exit or succession options for the small business chosen for the purpose, explaining the

benefits and drawbacks of each option.

The exit or succession options are as follows-

Liquidation-

It is the exit option by which company can come to an end by selling its assets. From the

net proceeds of assets, outstanding payment is made to suppliers, creditors and shareholders. It

should be opted by firm when it is unable to pay debts (Gumport, 2017).

Advantages

It is cost-effective method as less cost is incurred for process of liquidation

Another advantage is that it is simple to carry out without many formalities

Disadvantages

Loss of assets for paying borrowings which could be invested elsewhere as an investment

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.