Ratio Analysis & Balanced Scorecard: Financial Performance Report

VerifiedAdded on 2023/06/09

|17

|4902

|400

Report

AI Summary

This report provides an overview of financial performance management, examining company performance through financial measures. It includes a computation of financial ratios for Walmart and Tesco, assessing their financial positions and working capital. The report also evaluates the balanced scorecard approach as a strategic management system, discussing its benefits and implementation challenges. Furthermore, it touches upon the advantages and issues of integrated reporting, offering insights into corporate financial analysis and strategic decision-making. Desklib offers a variety of solved assignments and study resources for students.

FINANCIAL

PERFORMANCE

MANAGEMENT

PERFORMANCE

MANAGEMENT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION.......................................................................................................................3

TASK........................................................................................................................................3

1. Compute ratios and assess the financial performance of the business enterprise..........................3

2. Assess Balanced scorecard and develop proposed balanced scorecard of the business as a

Strategic management system...........................................................................................................7

3. Advantages and issues in adopting integrated reporting which is based on the company............11

CONCLUSION.........................................................................................................................15

REFERENCES..........................................................................................................................16

INTRODUCTION.......................................................................................................................3

TASK........................................................................................................................................3

1. Compute ratios and assess the financial performance of the business enterprise..........................3

2. Assess Balanced scorecard and develop proposed balanced scorecard of the business as a

Strategic management system...........................................................................................................7

3. Advantages and issues in adopting integrated reporting which is based on the company............11

CONCLUSION.........................................................................................................................15

REFERENCES..........................................................................................................................16

INTRODUCTION

The report prepared as under helps to have an overview about financial management which

is useful in examining the performance with the help of several financial measures in the

working and functioning of a company. It is also explained as corporate performance

management. The foremost goal related to financial performance being rendered in a business is

compilation of actual performance with the forecasted performance of the organisation and for

making adjustments accordingly (Aastvedt, Behmiri and Lu, 2021). Currency performance in a

wider sense explains to what extent currency target has been achieved, and has proved to be an

essential and necessary aspect of monetary risk. This is considered as of the mutual way of

predicting the result of an organisation’s approaches as well as undertaking of monetary

relations. This is utilized to compute a business enterprise's overall financially position which is

based on performance over a certain period of time span along with this equivalent should be

adapted for viewing similar businesses in parallel industries or for analysing the business

activities or collection fields. Financial executive examines, memorizes, investigations, and

translates the financial statement for a comprehensive view of efficiency and adequate funds in

monetary aspects. It is the capability and ability of the management to provide assistance in the

performance being rendered for the business being carried and which would also indicate the

plans being forecasted and handling the reporting and rising the financial efficiency and

acquisition over the world. In the following report it helps in computation of financial

positioning of the enterprise and determine results. Moreover, it explains the record of both the

organisation Walmart and Tesco. In addition to it would state the merged report of the business

by examining challenges and benefits being recognised by the company.

TASK

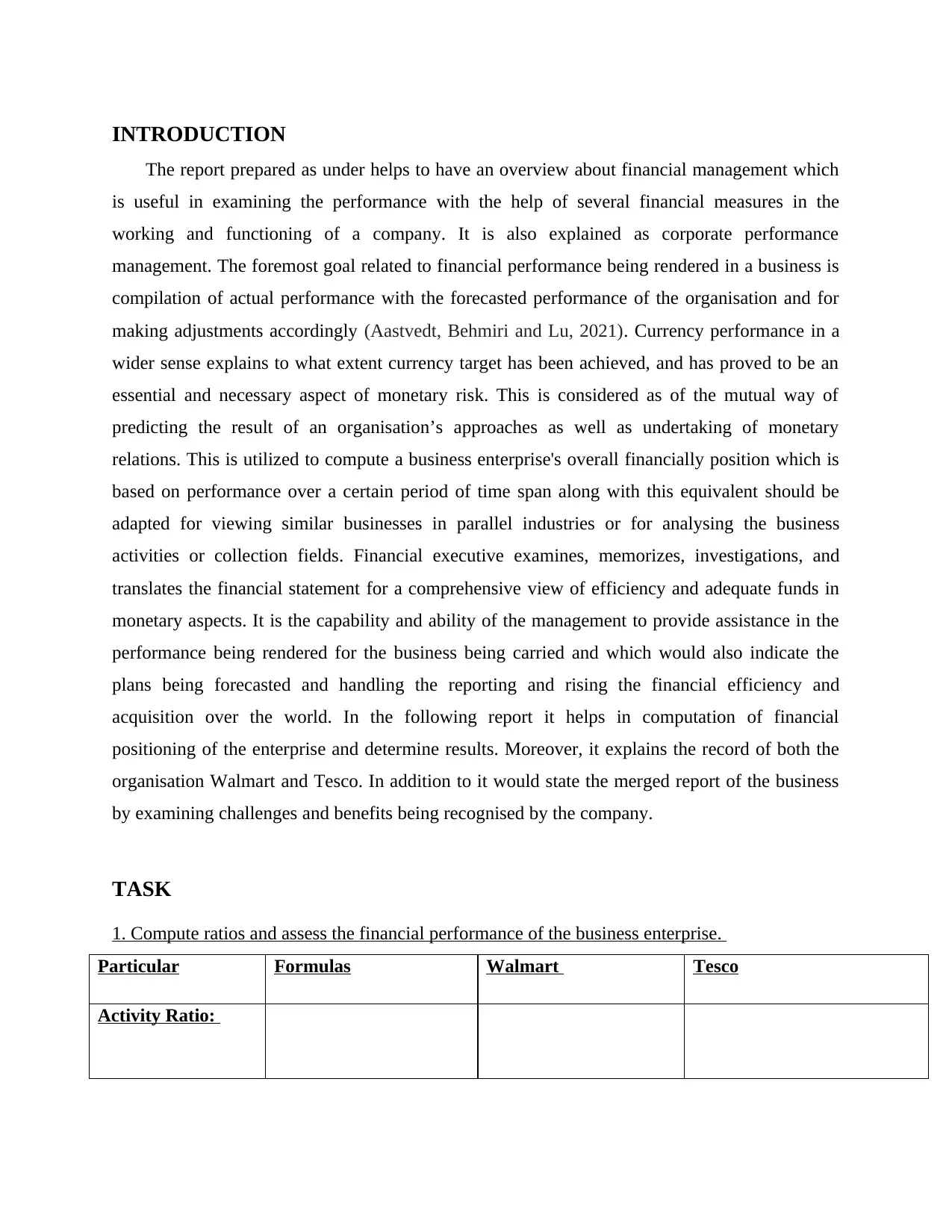

1. Compute ratios and assess the financial performance of the business enterprise.

Particular Formulas Walmart Tesco

Activity Ratio:

The report prepared as under helps to have an overview about financial management which

is useful in examining the performance with the help of several financial measures in the

working and functioning of a company. It is also explained as corporate performance

management. The foremost goal related to financial performance being rendered in a business is

compilation of actual performance with the forecasted performance of the organisation and for

making adjustments accordingly (Aastvedt, Behmiri and Lu, 2021). Currency performance in a

wider sense explains to what extent currency target has been achieved, and has proved to be an

essential and necessary aspect of monetary risk. This is considered as of the mutual way of

predicting the result of an organisation’s approaches as well as undertaking of monetary

relations. This is utilized to compute a business enterprise's overall financially position which is

based on performance over a certain period of time span along with this equivalent should be

adapted for viewing similar businesses in parallel industries or for analysing the business

activities or collection fields. Financial executive examines, memorizes, investigations, and

translates the financial statement for a comprehensive view of efficiency and adequate funds in

monetary aspects. It is the capability and ability of the management to provide assistance in the

performance being rendered for the business being carried and which would also indicate the

plans being forecasted and handling the reporting and rising the financial efficiency and

acquisition over the world. In the following report it helps in computation of financial

positioning of the enterprise and determine results. Moreover, it explains the record of both the

organisation Walmart and Tesco. In addition to it would state the merged report of the business

by examining challenges and benefits being recognised by the company.

TASK

1. Compute ratios and assess the financial performance of the business enterprise.

Particular Formulas Walmart Tesco

Activity Ratio:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Inventory turnover

ratio:

(Average inventory / Cost

of goods sold) * 365

6065+6038 / 96476 *

365 = 46 Days

Total Asset Turnover

ratio

Net sales / Average total

assets

108324 / 57888 + 51774

= 1.98 Times

2020 = (58091 / 53147 * 100)

= 109.30 %

2021 = (57887 / 45778 * 100)

= 126.45 %

Working capital

turnover ratio

Net revenue / working

capital

108324 / (15844 – 9283)

= 16.51 Times

2020 = (13893 / 18656) =

0.74 times

2021 = (10807 / 15997) =

0.68 times

Liquidity ratio:

Current ratio Current assets / current

liabilities

15844 / 9283 = 1.71

times

2020 = (13893/18656) = .74

times

2021 = (10807/15997) = .68

times

Liquid ratio Liquid assets / current

liabilities

(15844 – 6038) / 9283 =

1.06 times

2020 = (13893 - 2433 /

18656) = 0.61 times

2021 = (10807 - 2069 /

15997) = 0.55 times

Cash ratio (Cash + marketable

Securities) / Current

Liabilities

(3313 / 9283) = .36

Times

2020 = (4137 + 1076 / 18656)

= 0.28 times

2021 = (2510 + 1011 / 15997)

= 0.22 times

Solvency ratio:

Debt- to- assets ratio Total Debt / Total Assets 3620 / 51774 = .07 times 2020 = (13369 / 53147) =

0.25 times

2021 = (12325 / 45778) =

0.27 times

ratio:

(Average inventory / Cost

of goods sold) * 365

6065+6038 / 96476 *

365 = 46 Days

Total Asset Turnover

ratio

Net sales / Average total

assets

108324 / 57888 + 51774

= 1.98 Times

2020 = (58091 / 53147 * 100)

= 109.30 %

2021 = (57887 / 45778 * 100)

= 126.45 %

Working capital

turnover ratio

Net revenue / working

capital

108324 / (15844 – 9283)

= 16.51 Times

2020 = (13893 / 18656) =

0.74 times

2021 = (10807 / 15997) =

0.68 times

Liquidity ratio:

Current ratio Current assets / current

liabilities

15844 / 9283 = 1.71

times

2020 = (13893/18656) = .74

times

2021 = (10807/15997) = .68

times

Liquid ratio Liquid assets / current

liabilities

(15844 – 6038) / 9283 =

1.06 times

2020 = (13893 - 2433 /

18656) = 0.61 times

2021 = (10807 - 2069 /

15997) = 0.55 times

Cash ratio (Cash + marketable

Securities) / Current

Liabilities

(3313 / 9283) = .36

Times

2020 = (4137 + 1076 / 18656)

= 0.28 times

2021 = (2510 + 1011 / 15997)

= 0.22 times

Solvency ratio:

Debt- to- assets ratio Total Debt / Total Assets 3620 / 51774 = .07 times 2020 = (13369 / 53147) =

0.25 times

2021 = (12325 / 45778) =

0.27 times

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

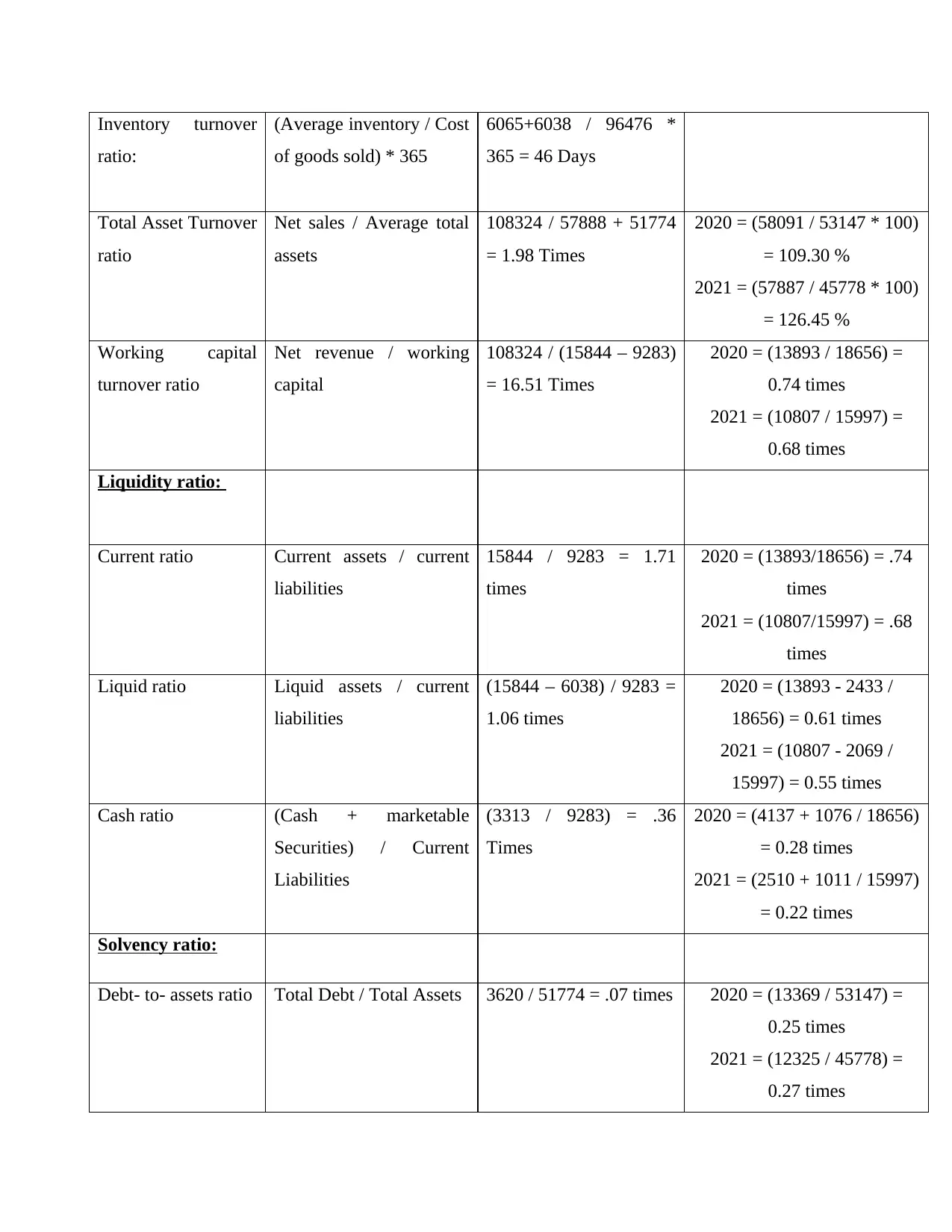

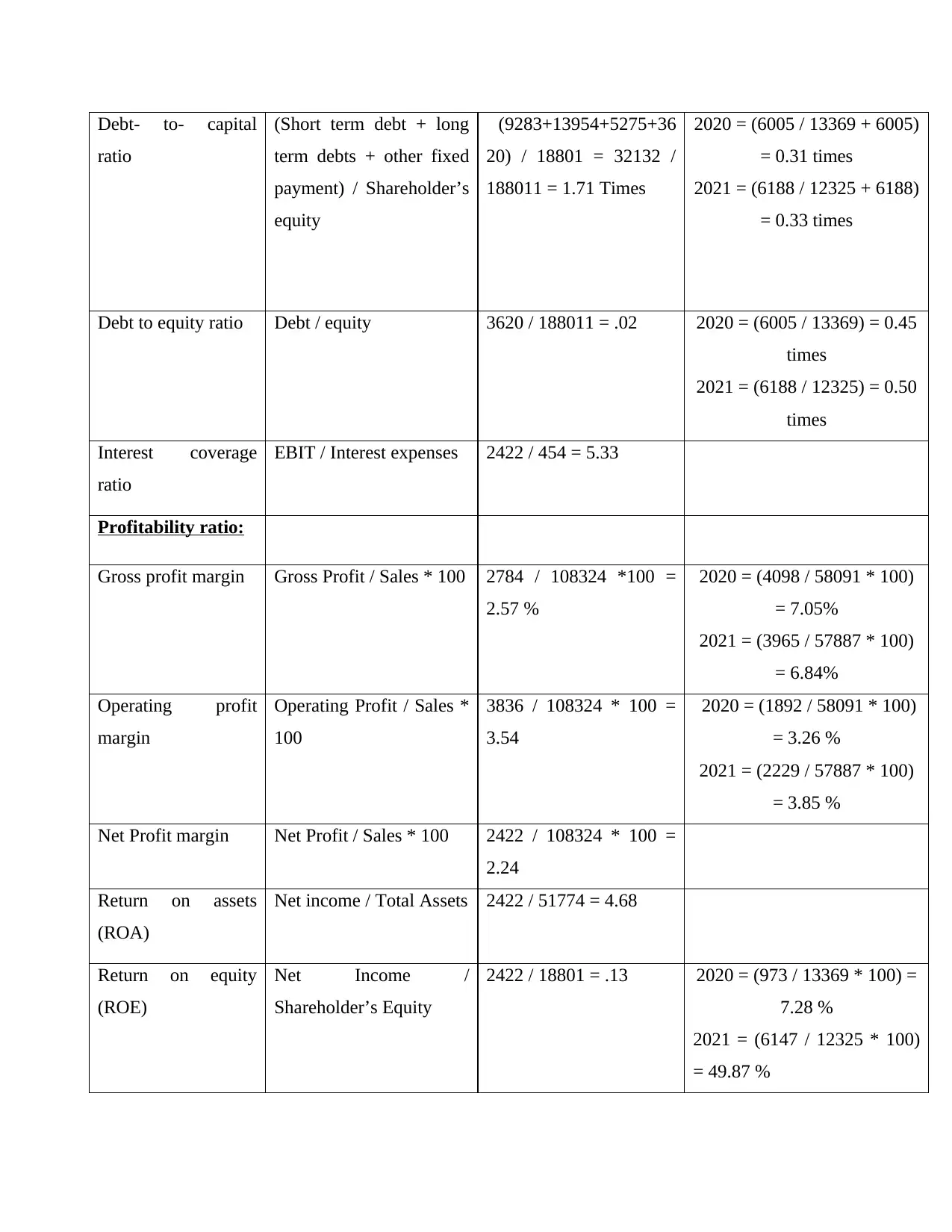

Debt- to- capital

ratio

(Short term debt + long

term debts + other fixed

payment) / Shareholder’s

equity

(9283+13954+5275+36

20) / 18801 = 32132 /

188011 = 1.71 Times

2020 = (6005 / 13369 + 6005)

= 0.31 times

2021 = (6188 / 12325 + 6188)

= 0.33 times

Debt to equity ratio Debt / equity 3620 / 188011 = .02 2020 = (6005 / 13369) = 0.45

times

2021 = (6188 / 12325) = 0.50

times

Interest coverage

ratio

EBIT / Interest expenses 2422 / 454 = 5.33

Profitability ratio:

Gross profit margin Gross Profit / Sales * 100 2784 / 108324 *100 =

2.57 %

2020 = (4098 / 58091 * 100)

= 7.05%

2021 = (3965 / 57887 * 100)

= 6.84%

Operating profit

margin

Operating Profit / Sales *

100

3836 / 108324 * 100 =

3.54

2020 = (1892 / 58091 * 100)

= 3.26 %

2021 = (2229 / 57887 * 100)

= 3.85 %

Net Profit margin Net Profit / Sales * 100 2422 / 108324 * 100 =

2.24

Return on assets

(ROA)

Net income / Total Assets 2422 / 51774 = 4.68

Return on equity

(ROE)

Net Income /

Shareholder’s Equity

2422 / 18801 = .13 2020 = (973 / 13369 * 100) =

7.28 %

2021 = (6147 / 12325 * 100)

= 49.87 %

ratio

(Short term debt + long

term debts + other fixed

payment) / Shareholder’s

equity

(9283+13954+5275+36

20) / 18801 = 32132 /

188011 = 1.71 Times

2020 = (6005 / 13369 + 6005)

= 0.31 times

2021 = (6188 / 12325 + 6188)

= 0.33 times

Debt to equity ratio Debt / equity 3620 / 188011 = .02 2020 = (6005 / 13369) = 0.45

times

2021 = (6188 / 12325) = 0.50

times

Interest coverage

ratio

EBIT / Interest expenses 2422 / 454 = 5.33

Profitability ratio:

Gross profit margin Gross Profit / Sales * 100 2784 / 108324 *100 =

2.57 %

2020 = (4098 / 58091 * 100)

= 7.05%

2021 = (3965 / 57887 * 100)

= 6.84%

Operating profit

margin

Operating Profit / Sales *

100

3836 / 108324 * 100 =

3.54

2020 = (1892 / 58091 * 100)

= 3.26 %

2021 = (2229 / 57887 * 100)

= 3.85 %

Net Profit margin Net Profit / Sales * 100 2422 / 108324 * 100 =

2.24

Return on assets

(ROA)

Net income / Total Assets 2422 / 51774 = 4.68

Return on equity

(ROE)

Net Income /

Shareholder’s Equity

2422 / 18801 = .13 2020 = (973 / 13369 * 100) =

7.28 %

2021 = (6147 / 12325 * 100)

= 49.87 %

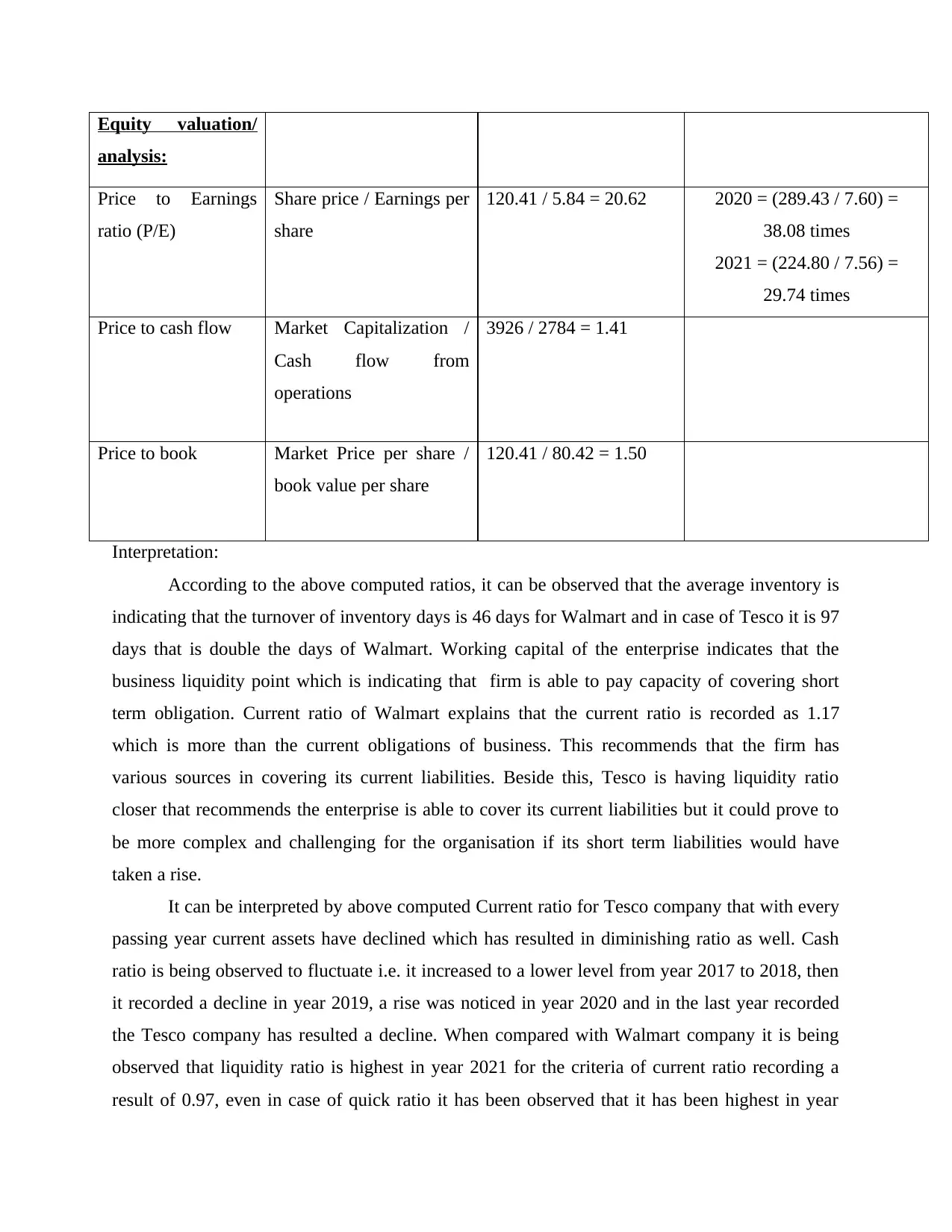

Equity valuation/

analysis:

Price to Earnings

ratio (P/E)

Share price / Earnings per

share

120.41 / 5.84 = 20.62 2020 = (289.43 / 7.60) =

38.08 times

2021 = (224.80 / 7.56) =

29.74 times

Price to cash flow Market Capitalization /

Cash flow from

operations

3926 / 2784 = 1.41

Price to book Market Price per share /

book value per share

120.41 / 80.42 = 1.50

Interpretation:

According to the above computed ratios, it can be observed that the average inventory is

indicating that the turnover of inventory days is 46 days for Walmart and in case of Tesco it is 97

days that is double the days of Walmart. Working capital of the enterprise indicates that the

business liquidity point which is indicating that firm is able to pay capacity of covering short

term obligation. Current ratio of Walmart explains that the current ratio is recorded as 1.17

which is more than the current obligations of business. This recommends that the firm has

various sources in covering its current liabilities. Beside this, Tesco is having liquidity ratio

closer that recommends the enterprise is able to cover its current liabilities but it could prove to

be more complex and challenging for the organisation if its short term liabilities would have

taken a rise.

It can be interpreted by above computed Current ratio for Tesco company that with every

passing year current assets have declined which has resulted in diminishing ratio as well. Cash

ratio is being observed to fluctuate i.e. it increased to a lower level from year 2017 to 2018, then

it recorded a decline in year 2019, a rise was noticed in year 2020 and in the last year recorded

the Tesco company has resulted a decline. When compared with Walmart company it is being

observed that liquidity ratio is highest in year 2021 for the criteria of current ratio recording a

result of 0.97, even in case of quick ratio it has been observed that it has been highest in year

analysis:

Price to Earnings

ratio (P/E)

Share price / Earnings per

share

120.41 / 5.84 = 20.62 2020 = (289.43 / 7.60) =

38.08 times

2021 = (224.80 / 7.56) =

29.74 times

Price to cash flow Market Capitalization /

Cash flow from

operations

3926 / 2784 = 1.41

Price to book Market Price per share /

book value per share

120.41 / 80.42 = 1.50

Interpretation:

According to the above computed ratios, it can be observed that the average inventory is

indicating that the turnover of inventory days is 46 days for Walmart and in case of Tesco it is 97

days that is double the days of Walmart. Working capital of the enterprise indicates that the

business liquidity point which is indicating that firm is able to pay capacity of covering short

term obligation. Current ratio of Walmart explains that the current ratio is recorded as 1.17

which is more than the current obligations of business. This recommends that the firm has

various sources in covering its current liabilities. Beside this, Tesco is having liquidity ratio

closer that recommends the enterprise is able to cover its current liabilities but it could prove to

be more complex and challenging for the organisation if its short term liabilities would have

taken a rise.

It can be interpreted by above computed Current ratio for Tesco company that with every

passing year current assets have declined which has resulted in diminishing ratio as well. Cash

ratio is being observed to fluctuate i.e. it increased to a lower level from year 2017 to 2018, then

it recorded a decline in year 2019, a rise was noticed in year 2020 and in the last year recorded

the Tesco company has resulted a decline. When compared with Walmart company it is being

observed that liquidity ratio is highest in year 2021 for the criteria of current ratio recording a

result of 0.97, even in case of quick ratio it has been observed that it has been highest in year

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2021 which indicates and depicts that the company is working on managing and improving the

working life cycle of company and business in long run.

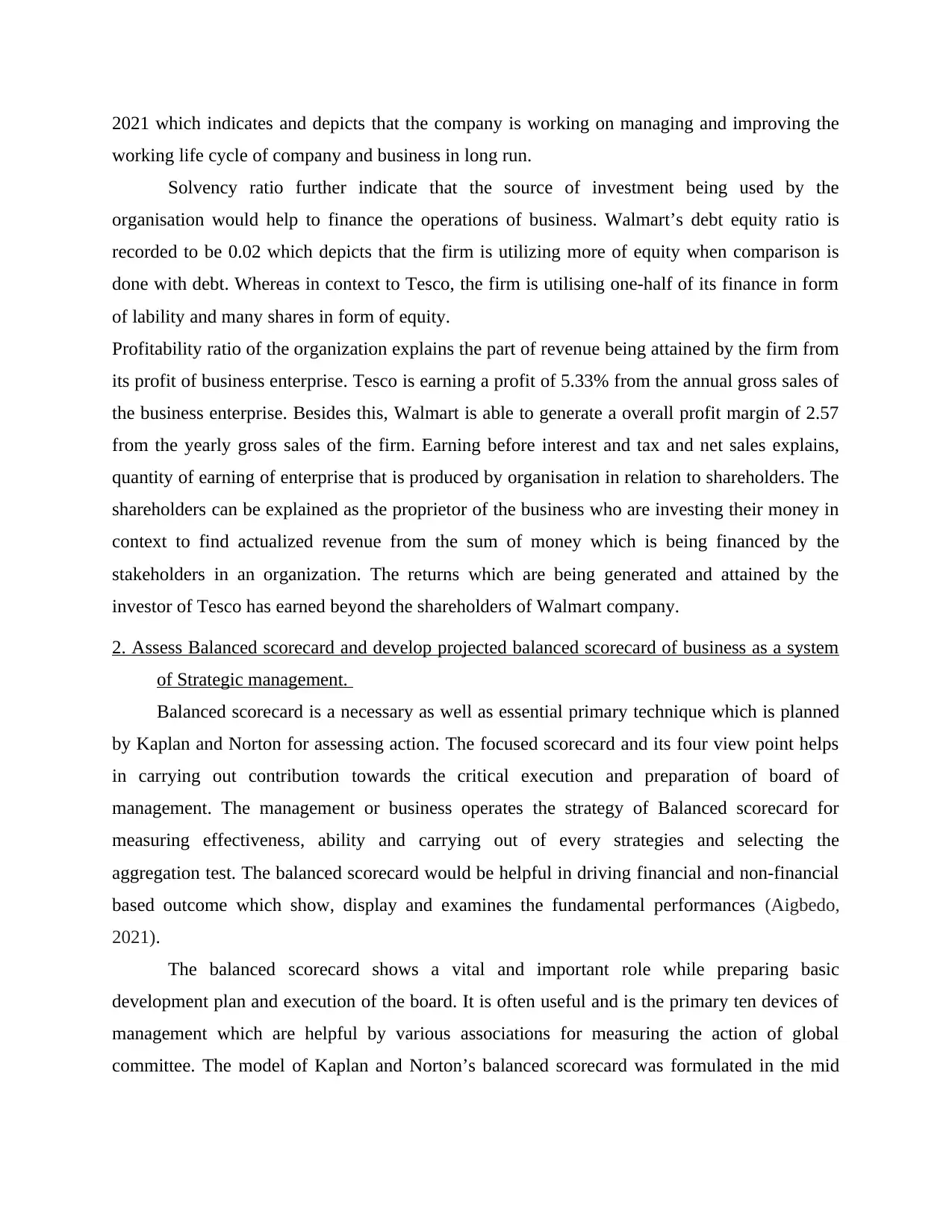

Solvency ratio further indicate that the source of investment being used by the

organisation would help to finance the operations of business. Walmart’s debt equity ratio is

recorded to be 0.02 which depicts that the firm is utilizing more of equity when comparison is

done with debt. Whereas in context to Tesco, the firm is utilising one-half of its finance in form

of lability and many shares in form of equity.

Profitability ratio of the organization explains the part of revenue being attained by the firm from

its profit of business enterprise. Tesco is earning a profit of 5.33% from the annual gross sales of

the business enterprise. Besides this, Walmart is able to generate a overall profit margin of 2.57

from the yearly gross sales of the firm. Earning before interest and tax and net sales explains,

quantity of earning of enterprise that is produced by organisation in relation to shareholders. The

shareholders can be explained as the proprietor of the business who are investing their money in

context to find actualized revenue from the sum of money which is being financed by the

stakeholders in an organization. The returns which are being generated and attained by the

investor of Tesco has earned beyond the shareholders of Walmart company.

2. Assess Balanced scorecard and develop projected balanced scorecard of business as a system

of Strategic management.

Balanced scorecard is a necessary as well as essential primary technique which is planned

by Kaplan and Norton for assessing action. The focused scorecard and its four view point helps

in carrying out contribution towards the critical execution and preparation of board of

management. The management or business operates the strategy of Balanced scorecard for

measuring effectiveness, ability and carrying out of every strategies and selecting the

aggregation test. The balanced scorecard would be helpful in driving financial and non-financial

based outcome which show, display and examines the fundamental performances (Aigbedo,

2021).

The balanced scorecard shows a vital and important role while preparing basic

development plan and execution of the board. It is often useful and is the primary ten devices of

management which are helpful by various associations for measuring the action of global

committee. The model of Kaplan and Norton’s balanced scorecard was formulated in the mid

working life cycle of company and business in long run.

Solvency ratio further indicate that the source of investment being used by the

organisation would help to finance the operations of business. Walmart’s debt equity ratio is

recorded to be 0.02 which depicts that the firm is utilizing more of equity when comparison is

done with debt. Whereas in context to Tesco, the firm is utilising one-half of its finance in form

of lability and many shares in form of equity.

Profitability ratio of the organization explains the part of revenue being attained by the firm from

its profit of business enterprise. Tesco is earning a profit of 5.33% from the annual gross sales of

the business enterprise. Besides this, Walmart is able to generate a overall profit margin of 2.57

from the yearly gross sales of the firm. Earning before interest and tax and net sales explains,

quantity of earning of enterprise that is produced by organisation in relation to shareholders. The

shareholders can be explained as the proprietor of the business who are investing their money in

context to find actualized revenue from the sum of money which is being financed by the

stakeholders in an organization. The returns which are being generated and attained by the

investor of Tesco has earned beyond the shareholders of Walmart company.

2. Assess Balanced scorecard and develop projected balanced scorecard of business as a system

of Strategic management.

Balanced scorecard is a necessary as well as essential primary technique which is planned

by Kaplan and Norton for assessing action. The focused scorecard and its four view point helps

in carrying out contribution towards the critical execution and preparation of board of

management. The management or business operates the strategy of Balanced scorecard for

measuring effectiveness, ability and carrying out of every strategies and selecting the

aggregation test. The balanced scorecard would be helpful in driving financial and non-financial

based outcome which show, display and examines the fundamental performances (Aigbedo,

2021).

The balanced scorecard shows a vital and important role while preparing basic

development plan and execution of the board. It is often useful and is the primary ten devices of

management which are helpful by various associations for measuring the action of global

committee. The model of Kaplan and Norton’s balanced scorecard was formulated in the mid

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

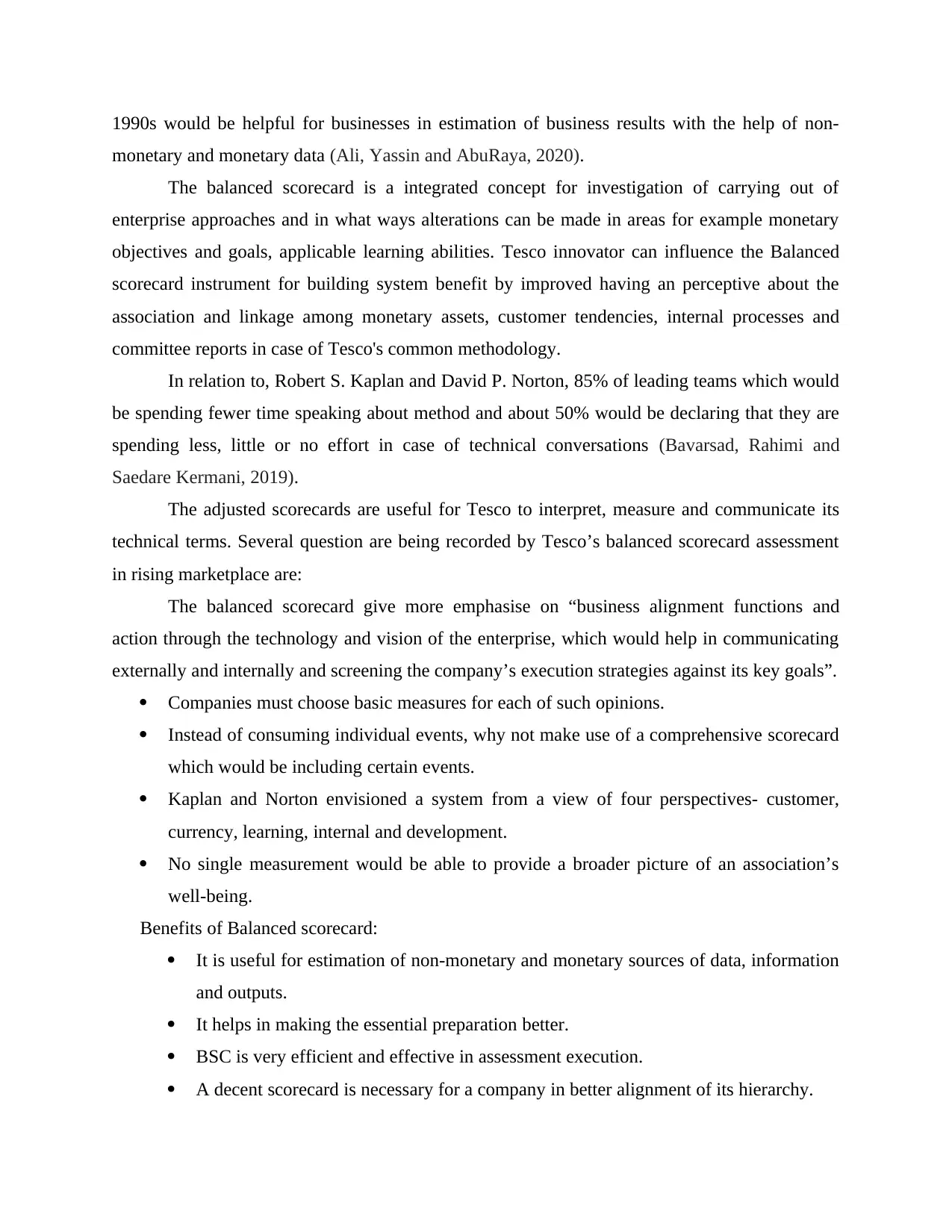

1990s would be helpful for businesses in estimation of business results with the help of non-

monetary and monetary data (Ali, Yassin and AbuRaya, 2020).

The balanced scorecard is a integrated concept for investigation of carrying out of

enterprise approaches and in what ways alterations can be made in areas for example monetary

objectives and goals, applicable learning abilities. Tesco innovator can influence the Balanced

scorecard instrument for building system benefit by improved having an perceptive about the

association and linkage among monetary assets, customer tendencies, internal processes and

committee reports in case of Tesco's common methodology.

In relation to, Robert S. Kaplan and David P. Norton, 85% of leading teams which would

be spending fewer time speaking about method and about 50% would be declaring that they are

spending less, little or no effort in case of technical conversations (Bavarsad, Rahimi and

Saedare Kermani, 2019).

The adjusted scorecards are useful for Tesco to interpret, measure and communicate its

technical terms. Several question are being recorded by Tesco’s balanced scorecard assessment

in rising marketplace are:

The balanced scorecard give more emphasise on “business alignment functions and

action through the technology and vision of the enterprise, which would help in communicating

externally and internally and screening the company’s execution strategies against its key goals”.

Companies must choose basic measures for each of such opinions.

Instead of consuming individual events, why not make use of a comprehensive scorecard

which would be including certain events.

Kaplan and Norton envisioned a system from a view of four perspectives- customer,

currency, learning, internal and development.

No single measurement would be able to provide a broader picture of an association’s

well-being.

Benefits of Balanced scorecard:

It is useful for estimation of non-monetary and monetary sources of data, information

and outputs.

It helps in making the essential preparation better.

BSC is very efficient and effective in assessment execution.

A decent scorecard is necessary for a company in better alignment of its hierarchy.

monetary and monetary data (Ali, Yassin and AbuRaya, 2020).

The balanced scorecard is a integrated concept for investigation of carrying out of

enterprise approaches and in what ways alterations can be made in areas for example monetary

objectives and goals, applicable learning abilities. Tesco innovator can influence the Balanced

scorecard instrument for building system benefit by improved having an perceptive about the

association and linkage among monetary assets, customer tendencies, internal processes and

committee reports in case of Tesco's common methodology.

In relation to, Robert S. Kaplan and David P. Norton, 85% of leading teams which would

be spending fewer time speaking about method and about 50% would be declaring that they are

spending less, little or no effort in case of technical conversations (Bavarsad, Rahimi and

Saedare Kermani, 2019).

The adjusted scorecards are useful for Tesco to interpret, measure and communicate its

technical terms. Several question are being recorded by Tesco’s balanced scorecard assessment

in rising marketplace are:

The balanced scorecard give more emphasise on “business alignment functions and

action through the technology and vision of the enterprise, which would help in communicating

externally and internally and screening the company’s execution strategies against its key goals”.

Companies must choose basic measures for each of such opinions.

Instead of consuming individual events, why not make use of a comprehensive scorecard

which would be including certain events.

Kaplan and Norton envisioned a system from a view of four perspectives- customer,

currency, learning, internal and development.

No single measurement would be able to provide a broader picture of an association’s

well-being.

Benefits of Balanced scorecard:

It is useful for estimation of non-monetary and monetary sources of data, information

and outputs.

It helps in making the essential preparation better.

BSC is very efficient and effective in assessment execution.

A decent scorecard is necessary for a company in better alignment of its hierarchy.

It helps in rendering a powerful structure for developing communication systems.

It is also useful in differentiating between various issue focuses/defects where

developments are expected to be achieved in improving the results as well as

outcomes.

The 4 factor of Kaplan and Norton’s balanced scorecard would be providing a clearer as

well as broader view or image of what is needed to be promptly reasoned, where and in what

manner companies must choose execution. Such perspectives and points can be made transparent

and clear on individual basis.

The financial perspectives of Balanced scorecard

Investment capital

Company’s turnover

Fixed cost, variable cost and other costs

Working capital of business and organisation

Market share

Gross and net profit

Profit and loss margin

Yearly revenue

Customer perspective – Parameters being taken by the organisations are:

Providing customer services

offering of product and services

Internal business perspectives – The concentration areas are:

Innovation process

Operation management process

Regulatory and environmental procedure

Consumer relation procedure

Learning and development position – Breaking down into leading element

The organisational capital

The human capital

The information capital

It is also useful in differentiating between various issue focuses/defects where

developments are expected to be achieved in improving the results as well as

outcomes.

The 4 factor of Kaplan and Norton’s balanced scorecard would be providing a clearer as

well as broader view or image of what is needed to be promptly reasoned, where and in what

manner companies must choose execution. Such perspectives and points can be made transparent

and clear on individual basis.

The financial perspectives of Balanced scorecard

Investment capital

Company’s turnover

Fixed cost, variable cost and other costs

Working capital of business and organisation

Market share

Gross and net profit

Profit and loss margin

Yearly revenue

Customer perspective – Parameters being taken by the organisations are:

Providing customer services

offering of product and services

Internal business perspectives – The concentration areas are:

Innovation process

Operation management process

Regulatory and environmental procedure

Consumer relation procedure

Learning and development position – Breaking down into leading element

The organisational capital

The human capital

The information capital

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The advantage of Tesco’s Balanced scorecard method is rising in marketplaces. Such that

it would be providing top administrator and innovator with a method such that they can adopt it

to set up a broad tool instead of just enhancing one portion of the enterprise. The scorecard

would allow in charging for examining company against varied point of view.

Besides this, respective person let down in the companies are essentially assessed by non-

financial measuring, such that the scorecard method renders a method for remembering the

strengths in generic processes and informing them in what ways they shall do efforts for

increasing in general the technique and Tesco’s outcomes (Gambo, Bello and Rimamshung,

2018).

For better discussing a decent scorecard and how it would work, a simple example of

Walmart is being taken into account as a productive company which has been running for a

longer time period. Walmart stores Inc. is perhaps one of the most visible as well as best

individual distributor existing on the globe. What form it even much more than obvious and

efficient that it is affecting in infinite debates, considering a evidence of claims regarding it,

media outrages over portions of plan of action, governing groups viewing aspects of its plan of

action and strategies on various discussions.

it would be providing top administrator and innovator with a method such that they can adopt it

to set up a broad tool instead of just enhancing one portion of the enterprise. The scorecard

would allow in charging for examining company against varied point of view.

Besides this, respective person let down in the companies are essentially assessed by non-

financial measuring, such that the scorecard method renders a method for remembering the

strengths in generic processes and informing them in what ways they shall do efforts for

increasing in general the technique and Tesco’s outcomes (Gambo, Bello and Rimamshung,

2018).

For better discussing a decent scorecard and how it would work, a simple example of

Walmart is being taken into account as a productive company which has been running for a

longer time period. Walmart stores Inc. is perhaps one of the most visible as well as best

individual distributor existing on the globe. What form it even much more than obvious and

efficient that it is affecting in infinite debates, considering a evidence of claims regarding it,

media outrages over portions of plan of action, governing groups viewing aspects of its plan of

action and strategies on various discussions.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

The unit came into existence below unusual situations in year 1945 when both relative (Sam

Walton and sibling) joined hands and established the franchise Ben Franklin’s Classifieds, and

the group then instantly became favourite and observable as well. Its supports further production

about the company’s capability and business process.

The company is having many 4150 retailing business office globally and is a leading distributor

in Canada, Mexico and the United Kingdom as well (Ghosh and Ansari, 2018).

It is also in the effective medicinal enterprise, tire and courier business of lubricator, photo

processing business as well. The organizers behind the company, till date the three systematic

objectives of the business work, such as: “excellent assistance given to purchaser, regard for the

respective person operating in company and their customer, pursuant follower of quality as

well”. Its management of business tools is for selling the top-grade goods and brands at the lower

price. It is this method which, with minimum name of brand and undertaking expense is having

wide firms to invariant assessment and assertion as it leveraging measurements for understanding

controversial processes.

3. Advantages and issues in following merged reporting which is founded on company.

The composed reveal is a consolidated agreement of the administrating system, possibilities

and execution of a factor is connected with the external climatic conditions, which prompts the

development of measures for non-monetary and monetary values over a period of time span.

Corporate disclosure is dangerous towards the compelling functioning of a marketable

economy which would enable financial backers and investors for investigating in what ways a

business must be carrying out its performance in every view, demonstrating its amount and

exercising oversights. For businesses which is private is to be more prospering, our business

firm's framework must be basically as durable and powerful as the monetary sector of the

business itself. Most significantly, it would tend to adopt the planned assignments which are

being capable to understand the actual abilities and capableness of such assignments.

(Kengkathran, 2018).

Besides this, the business information are being fastened towards yearly based assignments

for introducing as well as revealing company of recording towards the generic population. The

business statements are basically developed on capitalist, banks and contributory web as well.

Whereas the main concentration of organisation details on fiscal information, it somehow

undertakes integrated result.

Walton and sibling) joined hands and established the franchise Ben Franklin’s Classifieds, and

the group then instantly became favourite and observable as well. Its supports further production

about the company’s capability and business process.

The company is having many 4150 retailing business office globally and is a leading distributor

in Canada, Mexico and the United Kingdom as well (Ghosh and Ansari, 2018).

It is also in the effective medicinal enterprise, tire and courier business of lubricator, photo

processing business as well. The organizers behind the company, till date the three systematic

objectives of the business work, such as: “excellent assistance given to purchaser, regard for the

respective person operating in company and their customer, pursuant follower of quality as

well”. Its management of business tools is for selling the top-grade goods and brands at the lower

price. It is this method which, with minimum name of brand and undertaking expense is having

wide firms to invariant assessment and assertion as it leveraging measurements for understanding

controversial processes.

3. Advantages and issues in following merged reporting which is founded on company.

The composed reveal is a consolidated agreement of the administrating system, possibilities

and execution of a factor is connected with the external climatic conditions, which prompts the

development of measures for non-monetary and monetary values over a period of time span.

Corporate disclosure is dangerous towards the compelling functioning of a marketable

economy which would enable financial backers and investors for investigating in what ways a

business must be carrying out its performance in every view, demonstrating its amount and

exercising oversights. For businesses which is private is to be more prospering, our business

firm's framework must be basically as durable and powerful as the monetary sector of the

business itself. Most significantly, it would tend to adopt the planned assignments which are

being capable to understand the actual abilities and capableness of such assignments.

(Kengkathran, 2018).

Besides this, the business information are being fastened towards yearly based assignments

for introducing as well as revealing company of recording towards the generic population. The

business statements are basically developed on capitalist, banks and contributory web as well.

Whereas the main concentration of organisation details on fiscal information, it somehow

undertakes integrated result.

Human capital: Individual’s capabilities, ability, education of the capital of human and

skills as well.

Intellectual capital: It considers software system, intellectual property and knowledge as

well.

Natural capital: Renewable as well as Non-renewable are incorporating the

environmental sources.

Fiscal capital: This is a mixture which organisation use the debt and equity or generates

income from operational activities of a business.

Social and relation: It is a linkage of business with stakeholders, provider and other

gathering as well.

Advantages of incorporated reporting

It assist in knowing the strategies as well as goals of company for attaining the aims and

objectives of business enterprise.

It helps in connecting between the non-financial performance and business growth of the

company.

It boost the culture which is incorporated by manner of believing.

By analysing the action and result of the business enterprise it would help in deciding the

measure of enterprise.

It is helpful in processing linkage between the non-financial performance and business

growth of the business enterprise.

It is useful in preparing business strategies and policies and ways in which resources

would be allocated.

It assists in forming better in the enterprise by making decision approach and have a

improved statement in case of organisation.

Problem and issues faced by the business

There are different levels of artificial hypothesis: presenting detail in an associated

surroundings, articulating how strategies are being understood and illustrated in case of

impacting the working environment, differentiating activity which are essential in relation to

creation, collecting solid data, inferred and investigate experiences, reflecting the interconnection

of tools and techniques aims. Motivation, Execution and Danger; and differentiating in what

ways empowerment coordinated thinking could be promoted and independent orientation as

skills as well.

Intellectual capital: It considers software system, intellectual property and knowledge as

well.

Natural capital: Renewable as well as Non-renewable are incorporating the

environmental sources.

Fiscal capital: This is a mixture which organisation use the debt and equity or generates

income from operational activities of a business.

Social and relation: It is a linkage of business with stakeholders, provider and other

gathering as well.

Advantages of incorporated reporting

It assist in knowing the strategies as well as goals of company for attaining the aims and

objectives of business enterprise.

It helps in connecting between the non-financial performance and business growth of the

company.

It boost the culture which is incorporated by manner of believing.

By analysing the action and result of the business enterprise it would help in deciding the

measure of enterprise.

It is helpful in processing linkage between the non-financial performance and business

growth of the business enterprise.

It is useful in preparing business strategies and policies and ways in which resources

would be allocated.

It assists in forming better in the enterprise by making decision approach and have a

improved statement in case of organisation.

Problem and issues faced by the business

There are different levels of artificial hypothesis: presenting detail in an associated

surroundings, articulating how strategies are being understood and illustrated in case of

impacting the working environment, differentiating activity which are essential in relation to

creation, collecting solid data, inferred and investigate experiences, reflecting the interconnection

of tools and techniques aims. Motivation, Execution and Danger; and differentiating in what

ways empowerment coordinated thinking could be promoted and independent orientation as

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.