Monetary Policy and the Reserve Bank of Australia: A Detailed Analysis

VerifiedAdded on 2023/06/03

|5

|704

|158

Report

AI Summary

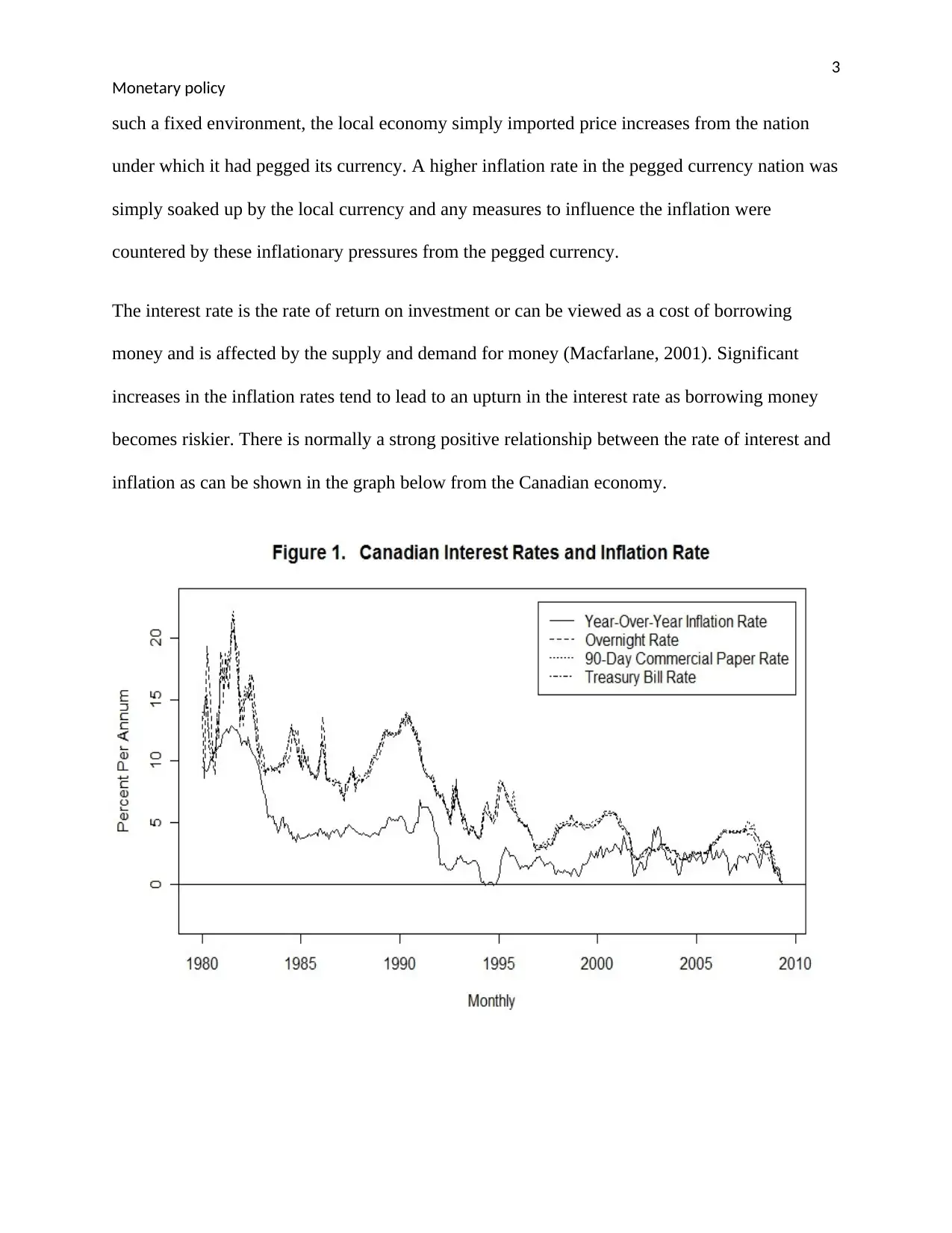

This report examines the core principles of monetary policy, with a specific focus on the Reserve Bank of Australia (RBA). It delves into the primary objective of monetary policy, which is maintaining price stability, and explores the various instruments employed to achieve this goal. The report investigates the relationships between key economic variables such as interest rates, inflation, and exchange rates, highlighting the challenges the RBA faces in simultaneously controlling these variables. It explains why the RBA prioritizes inflation targeting and uses the exchange rate as a buffer rather than a direct control mechanism. The report further discusses the impact of exchange rates on the prices of goods, the influence of interest rates on inflation, and the historical context of exchange rate regimes. Through this analysis, the report demonstrates the complexities and interdependencies inherent in monetary policy decision-making, emphasizing the need for a well-considered approach to achieve desired economic outcomes.

1 out of 5

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)