Real Estate Market Analysis Report for State A Residential Properties

VerifiedAdded on 2022/11/17

|8

|1847

|1

Report

AI Summary

This report presents an analysis of the real estate market in non-capital cities and towns within State A, focusing on predicting residential property prices. The study employs descriptive statistics to understand the characteristics of properties across regional cities, coastal cities, and coastal towns. A multiple regression model is developed to estimate house prices, considering variables such as internal area, number of bathrooms, and garages. The findings reveal that internal area, bathrooms, and garages have a positive impact on property prices. However, the model's R-squared value indicates that there is still a significant amount of variation in property prices not explained by the included variables, suggesting that the model can be improved by including additional variables. The report recommends incorporating factors such as the distance to public transport and CBD. The report also notes that the type of property (house or unit) does not significantly influence the price. The analysis is based on data provided by Safe-As-House Real Estate and adheres to the guidelines of the Business Analytics and Big Data (ACC73002) assignment.

DATA ANALYTICS

STUDENT ID:

[Pick the date]

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Introduction and Background

During the last decade or so, property prices in Australia have soared which is particularly

true for certain cities such as Sydney and Melbourne. As a result, the investment in real

estate has seen a significant increase in the last two decades or so. It is essential to determine

a intrinsic value of various residential properties so that the clients can be advised with

regards to a fair price for a given property. In this backdrop, the objective of the given report

is to predict the fair value of the residential property prices in non-capital cities and towns

corresponding to State A. In this regards, data has been provided from the relevant cities and

towns which corresponds to data about the houses which have been recently sold.

Data and Empirical Strategy

Sample data has been presented in order to facilitate the summary of data and also estimation

of best multiple regression model to estimate the prices for the various residential properties

(i.e. house and unit) based on their relevant attributes. The starting point is the data which

has been segregated for the coastal city, coastal town along with regional city. The underlying

objective is to produce the best possible multiple regression model for the estimation of

residential property. The data sample includes information about various variables such as

price, internal area, number of bedrooms, number of garages, number of bathrooms. Further,

there are certain variables such as Land area for which data is available only in particular

cities and not available for all properties. Most of the variables are quantitative in nature and

measures based on ratio scale since there is an absolute zero which can be defined as

variables such as price, number of bedrooms, bathrooms, garages cannot assume negative

values. A key example of categorical variable is type which has been measured using

nominal scale since two possible labels namely unit and house are possible (Flick, 2015).

The first step in data analysis is to compute the descriptive statistics for the various

quantitative variables which provides a summary of these based on regional city, coastal city

and town. In order to understand any differences in the sample with regard to price of other

attributes, a comparison of the descriptive statistics in accordance with the location has been

carried. With regards to the estimation of the regression model, the cumulative data for state

A has been considered. Some variables are available for only properties located in a

particular city or town. These variables have not been taken into consideration for the

multiple regression thereby limiting the participation of only those variables which are

available for all properties included in the sample.

2

During the last decade or so, property prices in Australia have soared which is particularly

true for certain cities such as Sydney and Melbourne. As a result, the investment in real

estate has seen a significant increase in the last two decades or so. It is essential to determine

a intrinsic value of various residential properties so that the clients can be advised with

regards to a fair price for a given property. In this backdrop, the objective of the given report

is to predict the fair value of the residential property prices in non-capital cities and towns

corresponding to State A. In this regards, data has been provided from the relevant cities and

towns which corresponds to data about the houses which have been recently sold.

Data and Empirical Strategy

Sample data has been presented in order to facilitate the summary of data and also estimation

of best multiple regression model to estimate the prices for the various residential properties

(i.e. house and unit) based on their relevant attributes. The starting point is the data which

has been segregated for the coastal city, coastal town along with regional city. The underlying

objective is to produce the best possible multiple regression model for the estimation of

residential property. The data sample includes information about various variables such as

price, internal area, number of bedrooms, number of garages, number of bathrooms. Further,

there are certain variables such as Land area for which data is available only in particular

cities and not available for all properties. Most of the variables are quantitative in nature and

measures based on ratio scale since there is an absolute zero which can be defined as

variables such as price, number of bedrooms, bathrooms, garages cannot assume negative

values. A key example of categorical variable is type which has been measured using

nominal scale since two possible labels namely unit and house are possible (Flick, 2015).

The first step in data analysis is to compute the descriptive statistics for the various

quantitative variables which provides a summary of these based on regional city, coastal city

and town. In order to understand any differences in the sample with regard to price of other

attributes, a comparison of the descriptive statistics in accordance with the location has been

carried. With regards to the estimation of the regression model, the cumulative data for state

A has been considered. Some variables are available for only properties located in a

particular city or town. These variables have not been taken into consideration for the

multiple regression thereby limiting the participation of only those variables which are

available for all properties included in the sample.

2

The first step is to run the multiple regression model with the aid of MS-Excel where price

would act as the dependent variable and all the various variables for which data on all

properties is available would serve as independent variables. The tweaking of this model

would be performed based on the statistical significance of the respective slopes of the

independent variables used for the regression model. The independent variables which are

found to be statistically insignificant would be ignored and the multiple regression would be

run without these variables so as to enhance the statistical significance of the regression

model (Hair et. al., 2015).

Results and Discussion

The descriptive statistics for the residential properties to regional city in state A are

summarised below.

The descriptive statistics for the residential properties to coastal city in state A are

summarised below.

3

would act as the dependent variable and all the various variables for which data on all

properties is available would serve as independent variables. The tweaking of this model

would be performed based on the statistical significance of the respective slopes of the

independent variables used for the regression model. The independent variables which are

found to be statistically insignificant would be ignored and the multiple regression would be

run without these variables so as to enhance the statistical significance of the regression

model (Hair et. al., 2015).

Results and Discussion

The descriptive statistics for the residential properties to regional city in state A are

summarised below.

The descriptive statistics for the residential properties to coastal city in state A are

summarised below.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

The descriptive statistics for the residential properties to coastal town in state A are

summarised below.

The objective is to draw a comparison between the descriptive statistics in three different

locations in state A. This is carried below.

Price: A common feature for price across the three locations is the existence of high skew

owing to which the average price would be best captured by median rather than mean

(Eriksson and Kovalainen, 2015). Comparing the median prices across the three locations, it

is evident that the prices are lowest for regional city while maximum for coastal town.

Further, the extent of dispersion in the price also seems to be influenced by the median prices

as more volatility is observed in locations exhibiting higher median prices.

Internal Area: Owing to presence of skew, it would be preferable to compare the median

value. There does not seem to be any significant difference in the median internal area across

the three types of locations in State A. The median area is marginally lower for coastal city.

Also, the extent of dispersion in this variables does not significant differ across the three

locations in state A (Hair et. al., 2015).

Bedrooms: The median value of bedrooms for the sample data across the three locations in

state A is the same at 3 bedrooms. This implies that for all the three locations, there ar e 50%

properties in the sample data where the bedrooms do not exceed 3. The extent of dispersion

in the number of bedrooms for the three locations also does not show any meaning difference

to be of any statistical significance.

Bathrooms: The median bathrooms for properties located in coastal city and town is 2 while

that for properties located in regional city, it is 1. This suggests that in regional city, half of

the sample properties would not have more than 1 bathrooms (Hillier, 2016). In terms of

4

summarised below.

The objective is to draw a comparison between the descriptive statistics in three different

locations in state A. This is carried below.

Price: A common feature for price across the three locations is the existence of high skew

owing to which the average price would be best captured by median rather than mean

(Eriksson and Kovalainen, 2015). Comparing the median prices across the three locations, it

is evident that the prices are lowest for regional city while maximum for coastal town.

Further, the extent of dispersion in the price also seems to be influenced by the median prices

as more volatility is observed in locations exhibiting higher median prices.

Internal Area: Owing to presence of skew, it would be preferable to compare the median

value. There does not seem to be any significant difference in the median internal area across

the three types of locations in State A. The median area is marginally lower for coastal city.

Also, the extent of dispersion in this variables does not significant differ across the three

locations in state A (Hair et. al., 2015).

Bedrooms: The median value of bedrooms for the sample data across the three locations in

state A is the same at 3 bedrooms. This implies that for all the three locations, there ar e 50%

properties in the sample data where the bedrooms do not exceed 3. The extent of dispersion

in the number of bedrooms for the three locations also does not show any meaning difference

to be of any statistical significance.

Bathrooms: The median bathrooms for properties located in coastal city and town is 2 while

that for properties located in regional city, it is 1. This suggests that in regional city, half of

the sample properties would not have more than 1 bathrooms (Hillier, 2016). In terms of

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

variation, lesser variation is observed for this variable in the regional city as compared to the

coastal city and town.

Garages: Owing to highly skewed nature of this variable, the median is compared across

locations in state A. it has been seen that median garages is 1 for sample properties in coastal

city while the corresponding value is 2 for sample properties at other two locations namely

coastal town and regional city. The extent of dispersion in the given variable does not differ

significantly across the three locations.

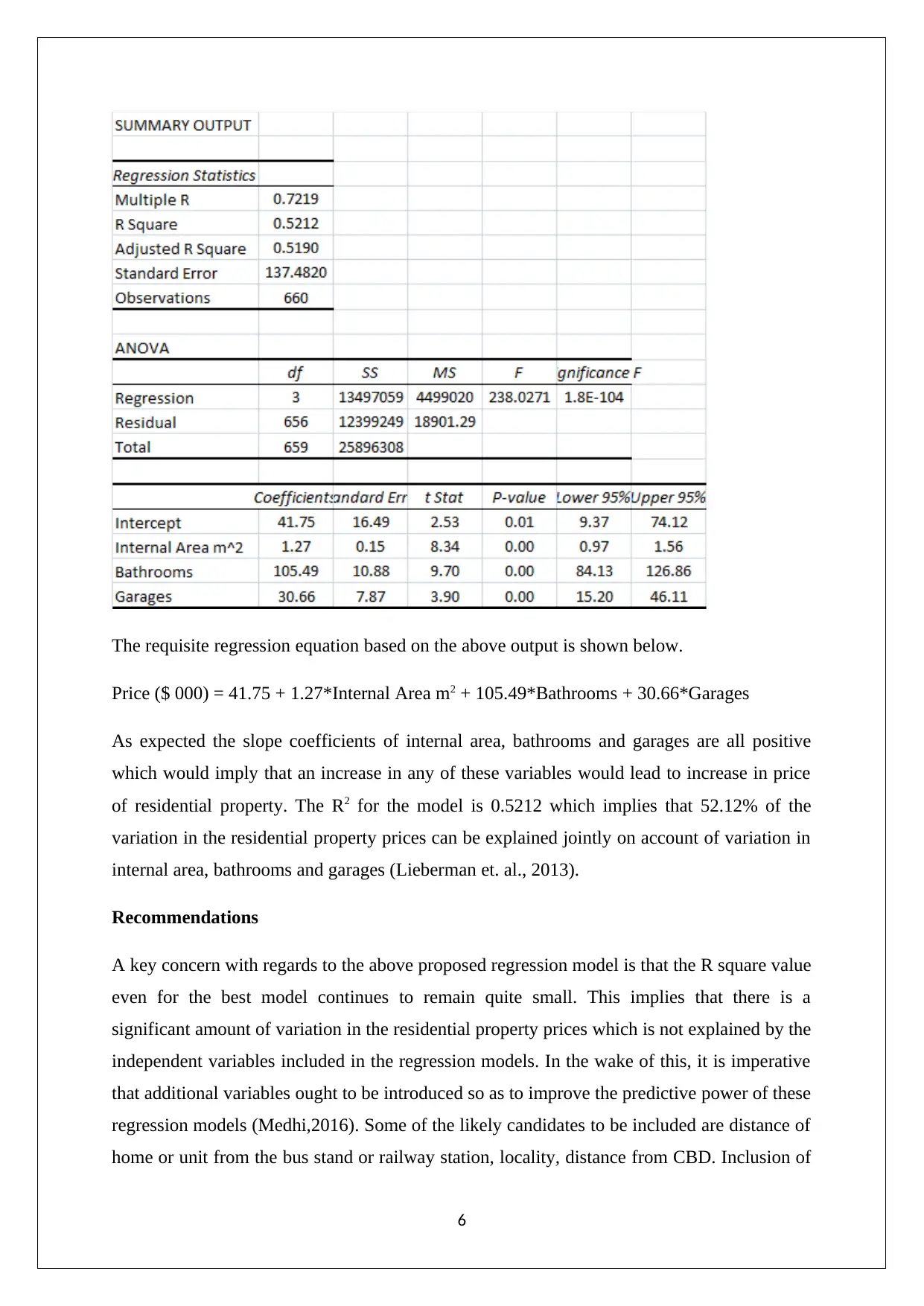

Estimation of multiple regression

In order to frame a multiple linear regression model for the estimation for the residential

properties, the dependent variable has been taken as price while the independent variables to

begin with were internal area, bedroom, garage, bathroom along with type of unit. In order to

capture the potential influence of type of residential property on the price, a 0/1 notation has

been used whereby unit has been represented by 0 and a house by 1. The initial multiple

regression with all the above variables as independent variables indicated that the influence

of type on price was not statistically significant and hence this independent variables was

removed from the regression model. Also, the slope corresponding to number of bedrooms

was also not significant thereby implying that the bedroom count did not materially influence

the price (Taylor and Cihon, 2017). As a result, the final multiple regression model has been

proposed with three independent variables namely the internal area, bathroom and garages.

The requisite output obtained from the regression analysis using MS-Excel is indicated as

follows.

5

coastal city and town.

Garages: Owing to highly skewed nature of this variable, the median is compared across

locations in state A. it has been seen that median garages is 1 for sample properties in coastal

city while the corresponding value is 2 for sample properties at other two locations namely

coastal town and regional city. The extent of dispersion in the given variable does not differ

significantly across the three locations.

Estimation of multiple regression

In order to frame a multiple linear regression model for the estimation for the residential

properties, the dependent variable has been taken as price while the independent variables to

begin with were internal area, bedroom, garage, bathroom along with type of unit. In order to

capture the potential influence of type of residential property on the price, a 0/1 notation has

been used whereby unit has been represented by 0 and a house by 1. The initial multiple

regression with all the above variables as independent variables indicated that the influence

of type on price was not statistically significant and hence this independent variables was

removed from the regression model. Also, the slope corresponding to number of bedrooms

was also not significant thereby implying that the bedroom count did not materially influence

the price (Taylor and Cihon, 2017). As a result, the final multiple regression model has been

proposed with three independent variables namely the internal area, bathroom and garages.

The requisite output obtained from the regression analysis using MS-Excel is indicated as

follows.

5

The requisite regression equation based on the above output is shown below.

Price ($ 000) = 41.75 + 1.27*Internal Area m2 + 105.49*Bathrooms + 30.66*Garages

As expected the slope coefficients of internal area, bathrooms and garages are all positive

which would imply that an increase in any of these variables would lead to increase in price

of residential property. The R2 for the model is 0.5212 which implies that 52.12% of the

variation in the residential property prices can be explained jointly on account of variation in

internal area, bathrooms and garages (Lieberman et. al., 2013).

Recommendations

A key concern with regards to the above proposed regression model is that the R square value

even for the best model continues to remain quite small. This implies that there is a

significant amount of variation in the residential property prices which is not explained by the

independent variables included in the regression models. In the wake of this, it is imperative

that additional variables ought to be introduced so as to improve the predictive power of these

regression models (Medhi,2016). Some of the likely candidates to be included are distance of

home or unit from the bus stand or railway station, locality, distance from CBD. Inclusion of

6

Price ($ 000) = 41.75 + 1.27*Internal Area m2 + 105.49*Bathrooms + 30.66*Garages

As expected the slope coefficients of internal area, bathrooms and garages are all positive

which would imply that an increase in any of these variables would lead to increase in price

of residential property. The R2 for the model is 0.5212 which implies that 52.12% of the

variation in the residential property prices can be explained jointly on account of variation in

internal area, bathrooms and garages (Lieberman et. al., 2013).

Recommendations

A key concern with regards to the above proposed regression model is that the R square value

even for the best model continues to remain quite small. This implies that there is a

significant amount of variation in the residential property prices which is not explained by the

independent variables included in the regression models. In the wake of this, it is imperative

that additional variables ought to be introduced so as to improve the predictive power of these

regression models (Medhi,2016). Some of the likely candidates to be included are distance of

home or unit from the bus stand or railway station, locality, distance from CBD. Inclusion of

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

more independent variables could improve the results. Also, it is seen that price of the preprty

is independent of the underlying type (i.e. house and unit) and thereby the same may be

ignored. More research ought to be performed regarding the same so as to enhance the

understanding of property market in state A (Lind, Marchal and Wathen, 2014).

7

is independent of the underlying type (i.e. house and unit) and thereby the same may be

ignored. More research ought to be performed regarding the same so as to enhance the

understanding of property market in state A (Lind, Marchal and Wathen, 2014).

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

References

Eriksson, P. and Kovalainen, A. (2015) Quantitative methods in business research. 3rd ed.

London: Sage Publications.

Flick, U. (2015) Introducing research methodology: A beginner's guide to doing a research

project. 4th ed. New York: Sage Publications.

Hair, J. F., Wolfinbarger, M., Money, A. H., Samouel, P., and Page, M. J. (2015) Essentials

of business research methods. 2nd ed. New York: Routledge.

Hastie, T., Tibshirani, R. and Friedman, J. (2014) The Elements of Statistical Learning. 4th

ed. New York: Springer Publications.

Hillier, F. (2016) Introduction to Operations Research.6th ed.New York: McGraw Hill

Publications.

Lieberman, F. J., Nag, B., Hiller, F.S. and Basu, P. (2013) Introduction To Operations

Research. 5th ed.New Delhi: Tata McGraw Hill Publishers.

Lind, A.D., Marchal, G.W. and Wathen, A.S. (2014) Statistical Techniques in Business and

Economics. 15th ed. New York : McGraw-Hill/Irwin.

Medhi, J. (2016) Statistical Methods: An Introductory Text. 4th ed. Sydney: New Age

International.

Taylor, K. J. and Cihon, C. (2017) Statistical Techniques for Data Analysis. 2nd ed.

Melbourne: CRC Press.

8

Eriksson, P. and Kovalainen, A. (2015) Quantitative methods in business research. 3rd ed.

London: Sage Publications.

Flick, U. (2015) Introducing research methodology: A beginner's guide to doing a research

project. 4th ed. New York: Sage Publications.

Hair, J. F., Wolfinbarger, M., Money, A. H., Samouel, P., and Page, M. J. (2015) Essentials

of business research methods. 2nd ed. New York: Routledge.

Hastie, T., Tibshirani, R. and Friedman, J. (2014) The Elements of Statistical Learning. 4th

ed. New York: Springer Publications.

Hillier, F. (2016) Introduction to Operations Research.6th ed.New York: McGraw Hill

Publications.

Lieberman, F. J., Nag, B., Hiller, F.S. and Basu, P. (2013) Introduction To Operations

Research. 5th ed.New Delhi: Tata McGraw Hill Publishers.

Lind, A.D., Marchal, G.W. and Wathen, A.S. (2014) Statistical Techniques in Business and

Economics. 15th ed. New York : McGraw-Hill/Irwin.

Medhi, J. (2016) Statistical Methods: An Introductory Text. 4th ed. Sydney: New Age

International.

Taylor, K. J. and Cihon, C. (2017) Statistical Techniques for Data Analysis. 2nd ed.

Melbourne: CRC Press.

8

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.