Real Estate Finance Assignment: Detailed Analysis of Bond and Mortgage

VerifiedAdded on 2023/05/31

|20

|2599

|229

Homework Assignment

AI Summary

This real estate finance assignment delves into various aspects of bond valuation and mortgage analysis. It begins by calculating net gross interest rates for bonds with different time periods, comparing market values and face values, and determining market interest rates. The assignment then moves on to pricing securities, analyzing the impact of different discount rates, and calculating potential losses or profits from bond transactions. Furthermore, the document analyzes the market interest rates for different securities, considering factors like time periods, coupon rates, and present values. Finally, the assignment provides a detailed amortization schedule for a mortgage, outlining the interest portion, principal portion, and remaining principal over a 249-month period, showcasing the gradual reduction of the mortgage principal.

Running head: REAL ESTATE FINANCE

Real Estate Finance

Name of the Student:

Name of the University:

Author’s Note:

Real Estate Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1REAL ESTATE FINANCE

Table of Contents

In Response to Question 1..........................................................................................................2

In Response to Question 2..........................................................................................................3

In Response to Question 3..........................................................................................................4

In Response to Question 4..........................................................................................................6

Bibliography.............................................................................................................................19

Table of Contents

In Response to Question 1..........................................................................................................2

In Response to Question 2..........................................................................................................3

In Response to Question 3..........................................................................................................4

In Response to Question 4..........................................................................................................6

Bibliography.............................................................................................................................19

2REAL ESTATE FINANCE

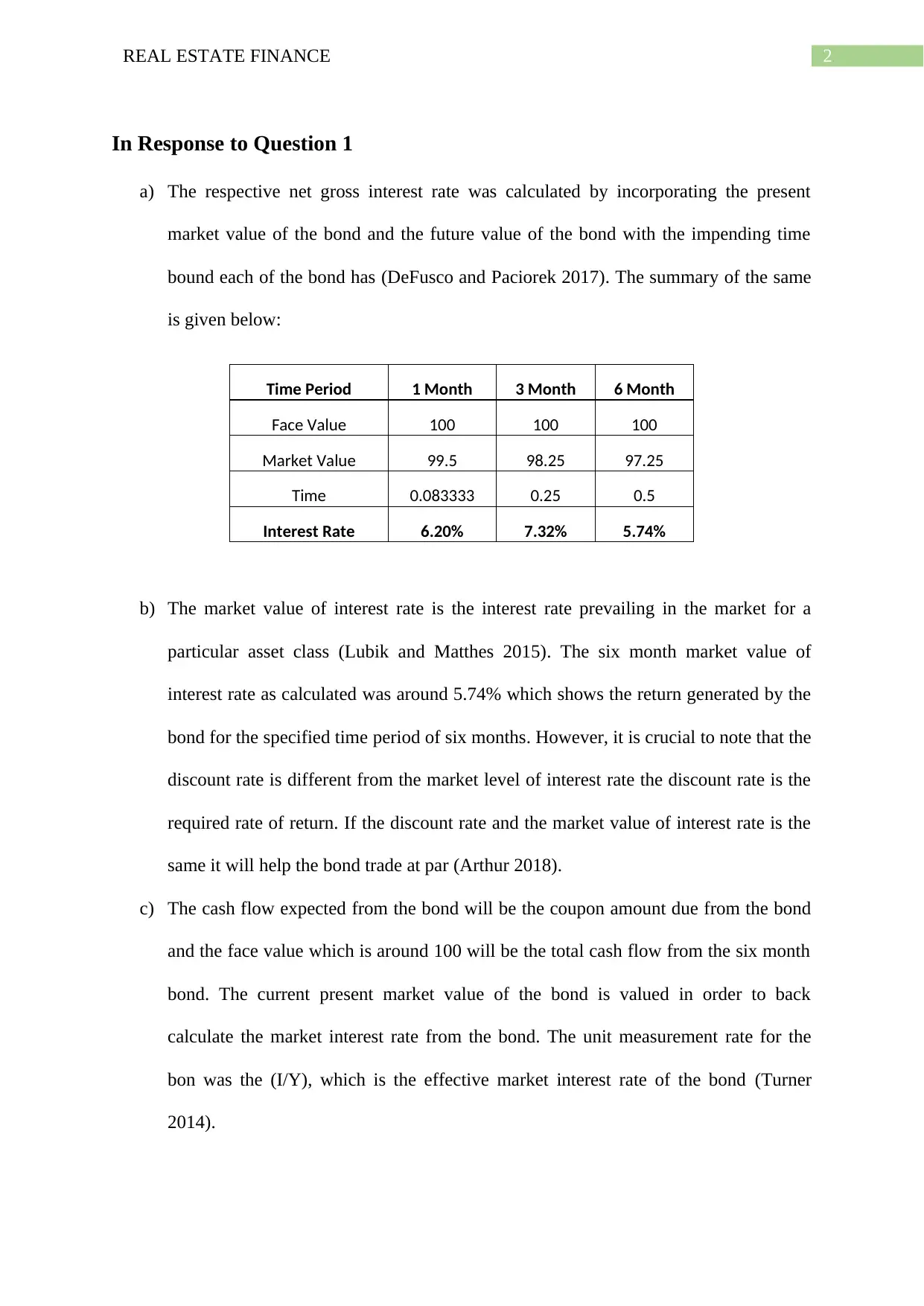

In Response to Question 1

a) The respective net gross interest rate was calculated by incorporating the present

market value of the bond and the future value of the bond with the impending time

bound each of the bond has (DeFusco and Paciorek 2017). The summary of the same

is given below:

Time Period 1 Month 3 Month 6 Month

Face Value 100 100 100

Market Value 99.5 98.25 97.25

Time 0.083333 0.25 0.5

Interest Rate 6.20% 7.32% 5.74%

b) The market value of interest rate is the interest rate prevailing in the market for a

particular asset class (Lubik and Matthes 2015). The six month market value of

interest rate as calculated was around 5.74% which shows the return generated by the

bond for the specified time period of six months. However, it is crucial to note that the

discount rate is different from the market level of interest rate the discount rate is the

required rate of return. If the discount rate and the market value of interest rate is the

same it will help the bond trade at par (Arthur 2018).

c) The cash flow expected from the bond will be the coupon amount due from the bond

and the face value which is around 100 will be the total cash flow from the six month

bond. The current present market value of the bond is valued in order to back

calculate the market interest rate from the bond. The unit measurement rate for the

bon was the (I/Y), which is the effective market interest rate of the bond (Turner

2014).

In Response to Question 1

a) The respective net gross interest rate was calculated by incorporating the present

market value of the bond and the future value of the bond with the impending time

bound each of the bond has (DeFusco and Paciorek 2017). The summary of the same

is given below:

Time Period 1 Month 3 Month 6 Month

Face Value 100 100 100

Market Value 99.5 98.25 97.25

Time 0.083333 0.25 0.5

Interest Rate 6.20% 7.32% 5.74%

b) The market value of interest rate is the interest rate prevailing in the market for a

particular asset class (Lubik and Matthes 2015). The six month market value of

interest rate as calculated was around 5.74% which shows the return generated by the

bond for the specified time period of six months. However, it is crucial to note that the

discount rate is different from the market level of interest rate the discount rate is the

required rate of return. If the discount rate and the market value of interest rate is the

same it will help the bond trade at par (Arthur 2018).

c) The cash flow expected from the bond will be the coupon amount due from the bond

and the face value which is around 100 will be the total cash flow from the six month

bond. The current present market value of the bond is valued in order to back

calculate the market interest rate from the bond. The unit measurement rate for the

bon was the (I/Y), which is the effective market interest rate of the bond (Turner

2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3REAL ESTATE FINANCE

d) The market interest rate determined for the bond in the part C was around 5.74%.

However, the required return from the bond will be more than 5.74% so as to make

the bond value trade at par.

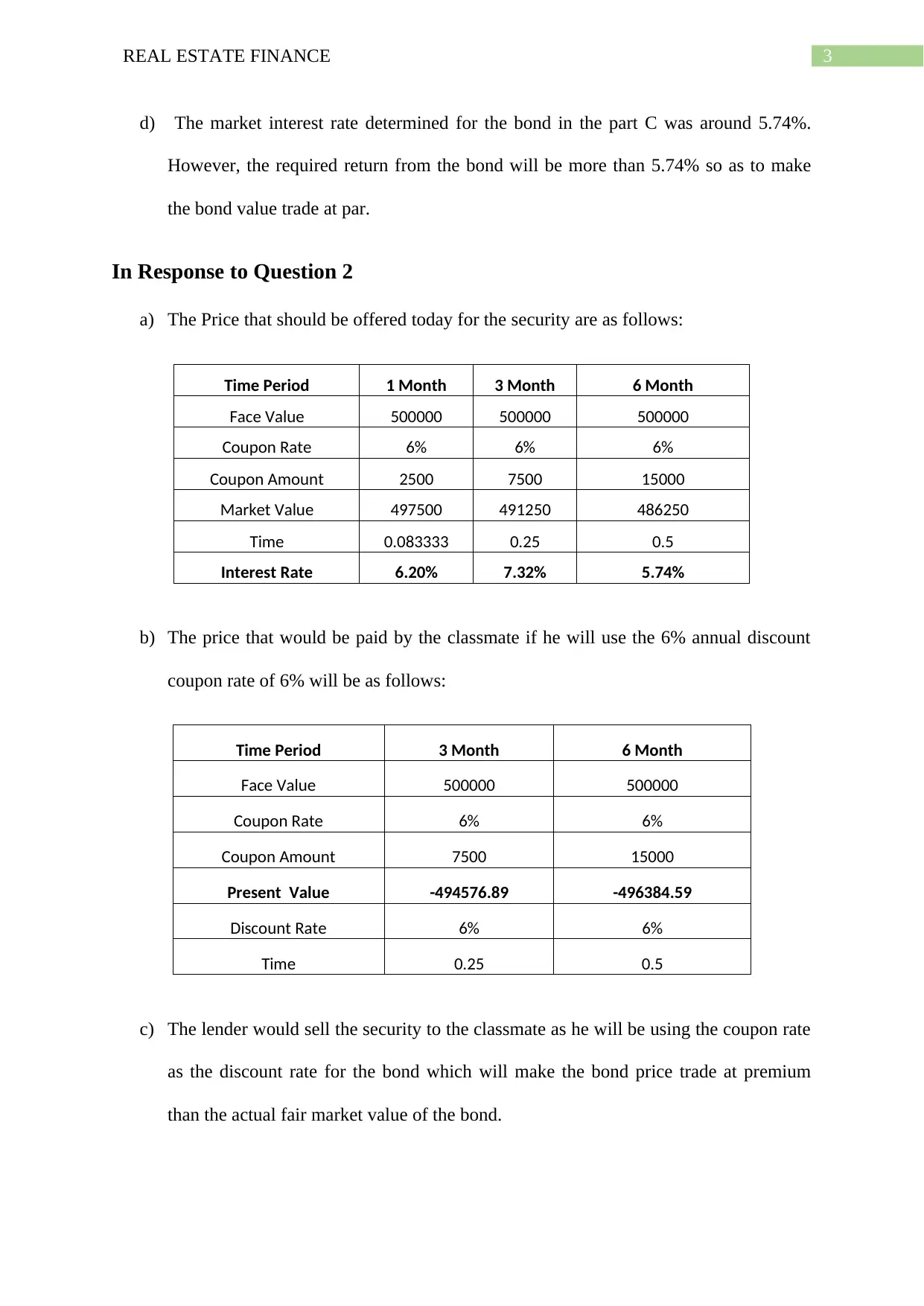

In Response to Question 2

a) The Price that should be offered today for the security are as follows:

Time Period 1 Month 3 Month 6 Month

Face Value 500000 500000 500000

Coupon Rate 6% 6% 6%

Coupon Amount 2500 7500 15000

Market Value 497500 491250 486250

Time 0.083333 0.25 0.5

Interest Rate 6.20% 7.32% 5.74%

b) The price that would be paid by the classmate if he will use the 6% annual discount

coupon rate of 6% will be as follows:

Time Period 3 Month 6 Month

Face Value 500000 500000

Coupon Rate 6% 6%

Coupon Amount 7500 15000

Present Value -494576.89 -496384.59

Discount Rate 6% 6%

Time 0.25 0.5

c) The lender would sell the security to the classmate as he will be using the coupon rate

as the discount rate for the bond which will make the bond price trade at premium

than the actual fair market value of the bond.

d) The market interest rate determined for the bond in the part C was around 5.74%.

However, the required return from the bond will be more than 5.74% so as to make

the bond value trade at par.

In Response to Question 2

a) The Price that should be offered today for the security are as follows:

Time Period 1 Month 3 Month 6 Month

Face Value 500000 500000 500000

Coupon Rate 6% 6% 6%

Coupon Amount 2500 7500 15000

Market Value 497500 491250 486250

Time 0.083333 0.25 0.5

Interest Rate 6.20% 7.32% 5.74%

b) The price that would be paid by the classmate if he will use the 6% annual discount

coupon rate of 6% will be as follows:

Time Period 3 Month 6 Month

Face Value 500000 500000

Coupon Rate 6% 6%

Coupon Amount 7500 15000

Present Value -494576.89 -496384.59

Discount Rate 6% 6%

Time 0.25 0.5

c) The lender would sell the security to the classmate as he will be using the coupon rate

as the discount rate for the bond which will make the bond price trade at premium

than the actual fair market value of the bond.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4REAL ESTATE FINANCE

d) The actual loss suffered by the classmate was calculated with the help of the extra

price paid over and above the fair market value of the bond. The Loss suffered by the

classmate was as follows:

Time Period 3 Month 6 Month

Fair Market Price 491250 486250

Price offered by Classmate 494576.89 496384.59

Actual Loss suffered by Classmate -3326.89 -10134.59

e) 1) the actual profit to be made from the classmate will be around 3,326 from the three

month bond and 10134 from the six month bond.

2) Both the bonds should be sold to the classmate the three month and the six month

respectively.

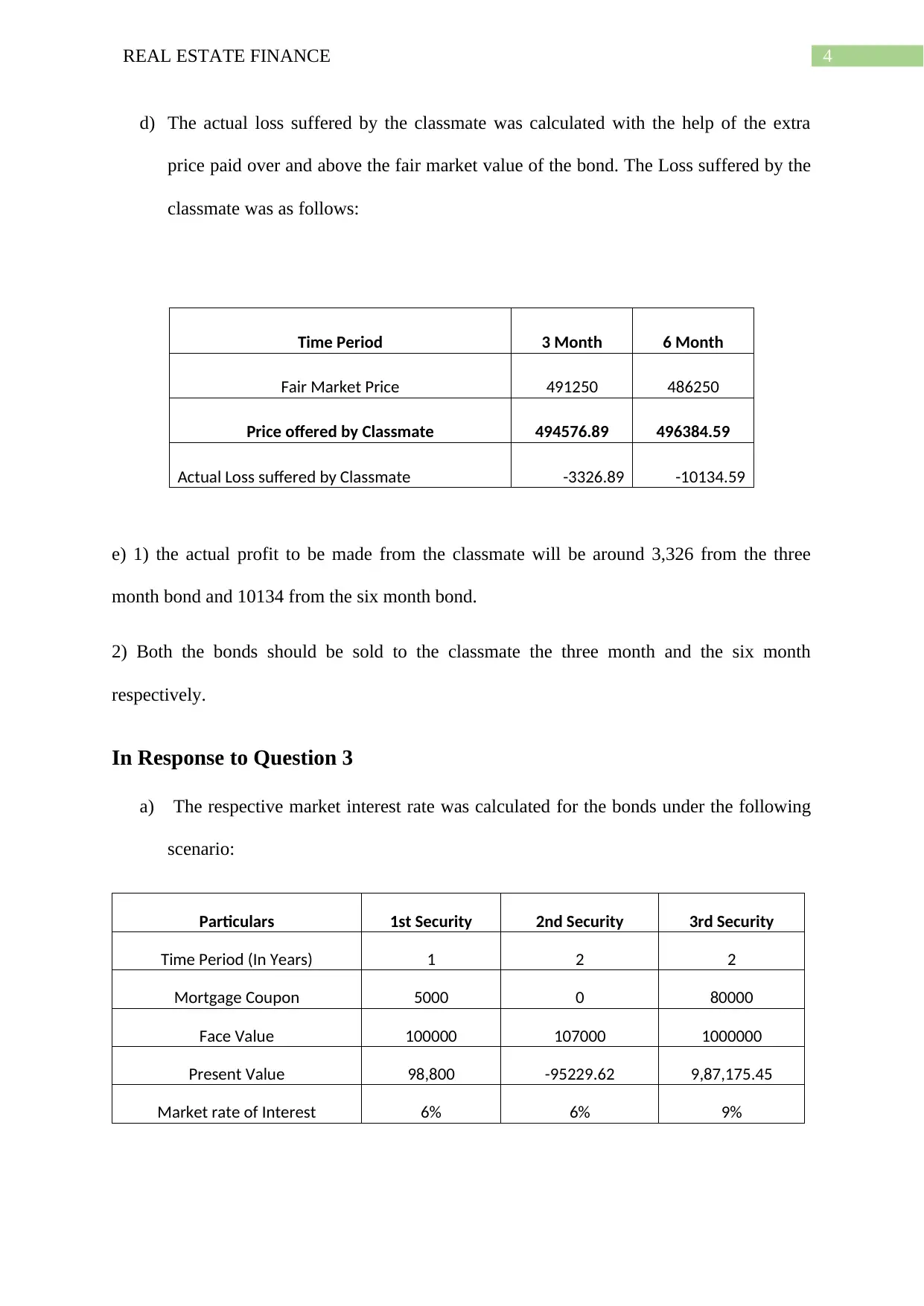

In Response to Question 3

a) The respective market interest rate was calculated for the bonds under the following

scenario:

Particulars 1st Security 2nd Security 3rd Security

Time Period (In Years) 1 2 2

Mortgage Coupon 5000 0 80000

Face Value 100000 107000 1000000

Present Value 98,800 -95229.62 9,87,175.45

Market rate of Interest 6% 6% 9%

d) The actual loss suffered by the classmate was calculated with the help of the extra

price paid over and above the fair market value of the bond. The Loss suffered by the

classmate was as follows:

Time Period 3 Month 6 Month

Fair Market Price 491250 486250

Price offered by Classmate 494576.89 496384.59

Actual Loss suffered by Classmate -3326.89 -10134.59

e) 1) the actual profit to be made from the classmate will be around 3,326 from the three

month bond and 10134 from the six month bond.

2) Both the bonds should be sold to the classmate the three month and the six month

respectively.

In Response to Question 3

a) The respective market interest rate was calculated for the bonds under the following

scenario:

Particulars 1st Security 2nd Security 3rd Security

Time Period (In Years) 1 2 2

Mortgage Coupon 5000 0 80000

Face Value 100000 107000 1000000

Present Value 98,800 -95229.62 9,87,175.45

Market rate of Interest 6% 6% 9%

5REAL ESTATE FINANCE

b) The current market price of the second security was around 95,229.62 which is the no

arbitrage price determined.

b) The current market price of the second security was around 95,229.62 which is the no

arbitrage price determined.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6REAL ESTATE FINANCE

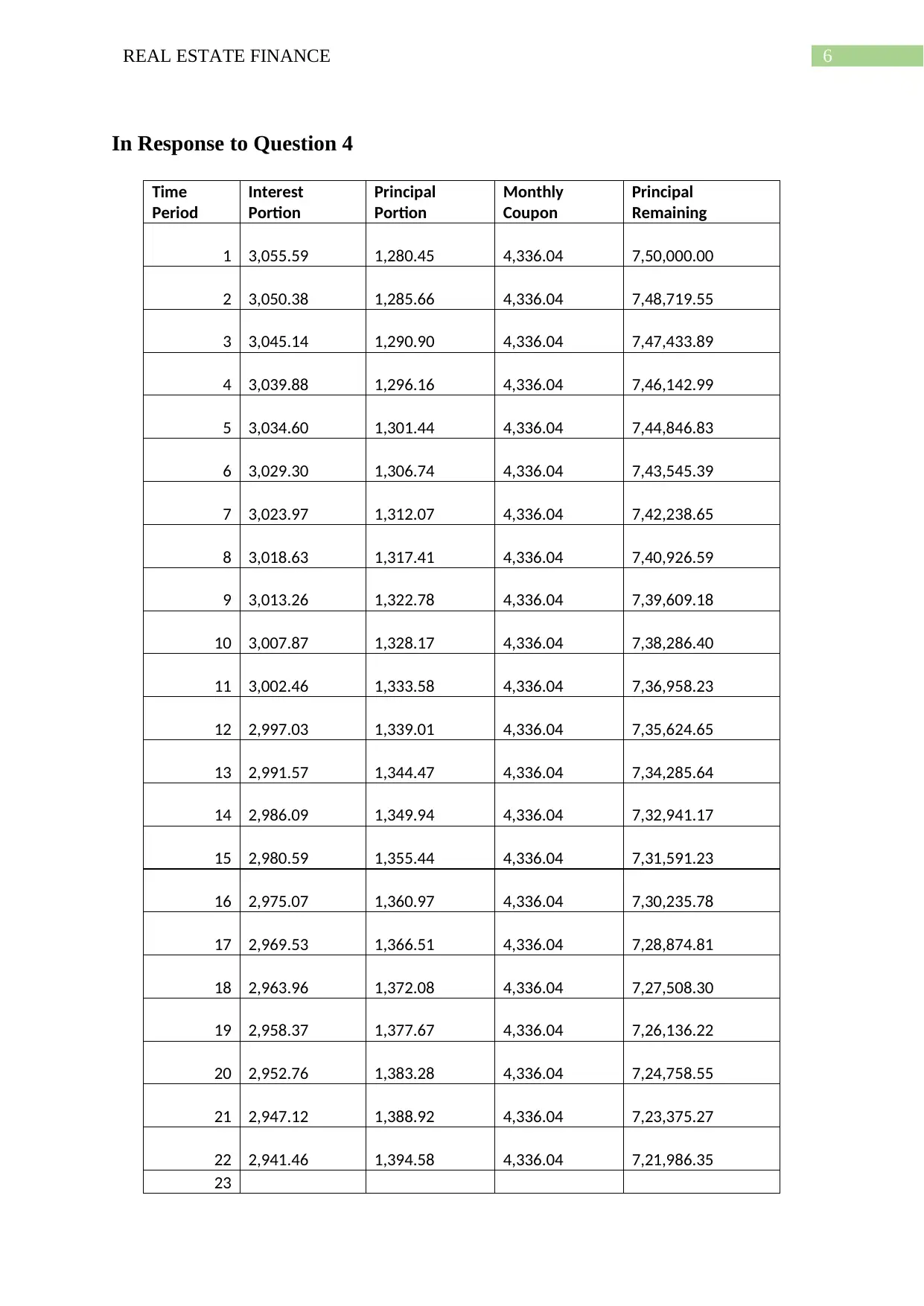

In Response to Question 4

Time

Period

Interest

Portion

Principal

Portion

Monthly

Coupon

Principal

Remaining

1 3,055.59 1,280.45 4,336.04 7,50,000.00

2 3,050.38 1,285.66 4,336.04 7,48,719.55

3 3,045.14 1,290.90 4,336.04 7,47,433.89

4 3,039.88 1,296.16 4,336.04 7,46,142.99

5 3,034.60 1,301.44 4,336.04 7,44,846.83

6 3,029.30 1,306.74 4,336.04 7,43,545.39

7 3,023.97 1,312.07 4,336.04 7,42,238.65

8 3,018.63 1,317.41 4,336.04 7,40,926.59

9 3,013.26 1,322.78 4,336.04 7,39,609.18

10 3,007.87 1,328.17 4,336.04 7,38,286.40

11 3,002.46 1,333.58 4,336.04 7,36,958.23

12 2,997.03 1,339.01 4,336.04 7,35,624.65

13 2,991.57 1,344.47 4,336.04 7,34,285.64

14 2,986.09 1,349.94 4,336.04 7,32,941.17

15 2,980.59 1,355.44 4,336.04 7,31,591.23

16 2,975.07 1,360.97 4,336.04 7,30,235.78

17 2,969.53 1,366.51 4,336.04 7,28,874.81

18 2,963.96 1,372.08 4,336.04 7,27,508.30

19 2,958.37 1,377.67 4,336.04 7,26,136.22

20 2,952.76 1,383.28 4,336.04 7,24,758.55

21 2,947.12 1,388.92 4,336.04 7,23,375.27

22 2,941.46 1,394.58 4,336.04 7,21,986.35

23

In Response to Question 4

Time

Period

Interest

Portion

Principal

Portion

Monthly

Coupon

Principal

Remaining

1 3,055.59 1,280.45 4,336.04 7,50,000.00

2 3,050.38 1,285.66 4,336.04 7,48,719.55

3 3,045.14 1,290.90 4,336.04 7,47,433.89

4 3,039.88 1,296.16 4,336.04 7,46,142.99

5 3,034.60 1,301.44 4,336.04 7,44,846.83

6 3,029.30 1,306.74 4,336.04 7,43,545.39

7 3,023.97 1,312.07 4,336.04 7,42,238.65

8 3,018.63 1,317.41 4,336.04 7,40,926.59

9 3,013.26 1,322.78 4,336.04 7,39,609.18

10 3,007.87 1,328.17 4,336.04 7,38,286.40

11 3,002.46 1,333.58 4,336.04 7,36,958.23

12 2,997.03 1,339.01 4,336.04 7,35,624.65

13 2,991.57 1,344.47 4,336.04 7,34,285.64

14 2,986.09 1,349.94 4,336.04 7,32,941.17

15 2,980.59 1,355.44 4,336.04 7,31,591.23

16 2,975.07 1,360.97 4,336.04 7,30,235.78

17 2,969.53 1,366.51 4,336.04 7,28,874.81

18 2,963.96 1,372.08 4,336.04 7,27,508.30

19 2,958.37 1,377.67 4,336.04 7,26,136.22

20 2,952.76 1,383.28 4,336.04 7,24,758.55

21 2,947.12 1,388.92 4,336.04 7,23,375.27

22 2,941.46 1,394.58 4,336.04 7,21,986.35

23

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7REAL ESTATE FINANCE

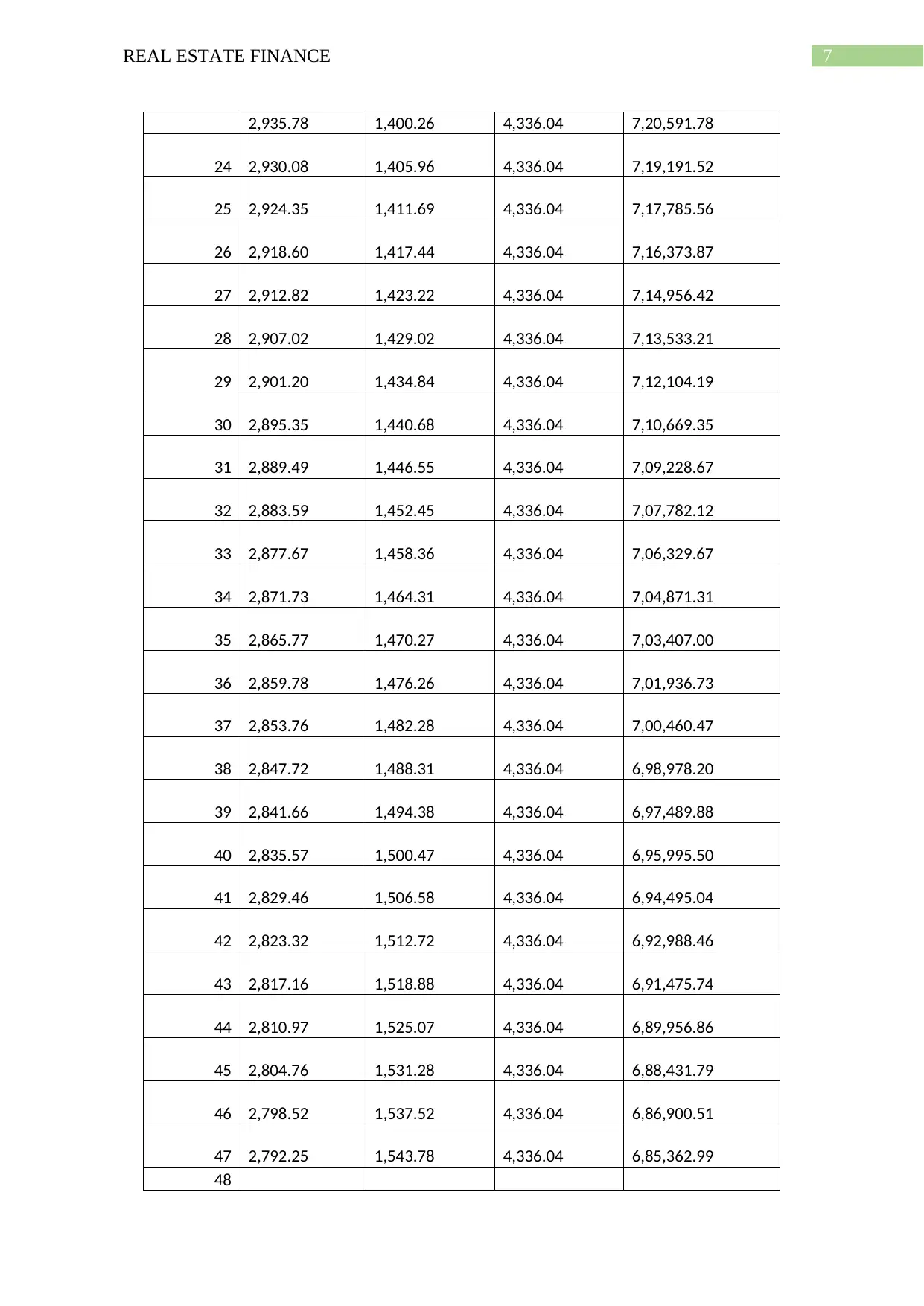

2,935.78 1,400.26 4,336.04 7,20,591.78

24 2,930.08 1,405.96 4,336.04 7,19,191.52

25 2,924.35 1,411.69 4,336.04 7,17,785.56

26 2,918.60 1,417.44 4,336.04 7,16,373.87

27 2,912.82 1,423.22 4,336.04 7,14,956.42

28 2,907.02 1,429.02 4,336.04 7,13,533.21

29 2,901.20 1,434.84 4,336.04 7,12,104.19

30 2,895.35 1,440.68 4,336.04 7,10,669.35

31 2,889.49 1,446.55 4,336.04 7,09,228.67

32 2,883.59 1,452.45 4,336.04 7,07,782.12

33 2,877.67 1,458.36 4,336.04 7,06,329.67

34 2,871.73 1,464.31 4,336.04 7,04,871.31

35 2,865.77 1,470.27 4,336.04 7,03,407.00

36 2,859.78 1,476.26 4,336.04 7,01,936.73

37 2,853.76 1,482.28 4,336.04 7,00,460.47

38 2,847.72 1,488.31 4,336.04 6,98,978.20

39 2,841.66 1,494.38 4,336.04 6,97,489.88

40 2,835.57 1,500.47 4,336.04 6,95,995.50

41 2,829.46 1,506.58 4,336.04 6,94,495.04

42 2,823.32 1,512.72 4,336.04 6,92,988.46

43 2,817.16 1,518.88 4,336.04 6,91,475.74

44 2,810.97 1,525.07 4,336.04 6,89,956.86

45 2,804.76 1,531.28 4,336.04 6,88,431.79

46 2,798.52 1,537.52 4,336.04 6,86,900.51

47 2,792.25 1,543.78 4,336.04 6,85,362.99

48

2,935.78 1,400.26 4,336.04 7,20,591.78

24 2,930.08 1,405.96 4,336.04 7,19,191.52

25 2,924.35 1,411.69 4,336.04 7,17,785.56

26 2,918.60 1,417.44 4,336.04 7,16,373.87

27 2,912.82 1,423.22 4,336.04 7,14,956.42

28 2,907.02 1,429.02 4,336.04 7,13,533.21

29 2,901.20 1,434.84 4,336.04 7,12,104.19

30 2,895.35 1,440.68 4,336.04 7,10,669.35

31 2,889.49 1,446.55 4,336.04 7,09,228.67

32 2,883.59 1,452.45 4,336.04 7,07,782.12

33 2,877.67 1,458.36 4,336.04 7,06,329.67

34 2,871.73 1,464.31 4,336.04 7,04,871.31

35 2,865.77 1,470.27 4,336.04 7,03,407.00

36 2,859.78 1,476.26 4,336.04 7,01,936.73

37 2,853.76 1,482.28 4,336.04 7,00,460.47

38 2,847.72 1,488.31 4,336.04 6,98,978.20

39 2,841.66 1,494.38 4,336.04 6,97,489.88

40 2,835.57 1,500.47 4,336.04 6,95,995.50

41 2,829.46 1,506.58 4,336.04 6,94,495.04

42 2,823.32 1,512.72 4,336.04 6,92,988.46

43 2,817.16 1,518.88 4,336.04 6,91,475.74

44 2,810.97 1,525.07 4,336.04 6,89,956.86

45 2,804.76 1,531.28 4,336.04 6,88,431.79

46 2,798.52 1,537.52 4,336.04 6,86,900.51

47 2,792.25 1,543.78 4,336.04 6,85,362.99

48

8REAL ESTATE FINANCE

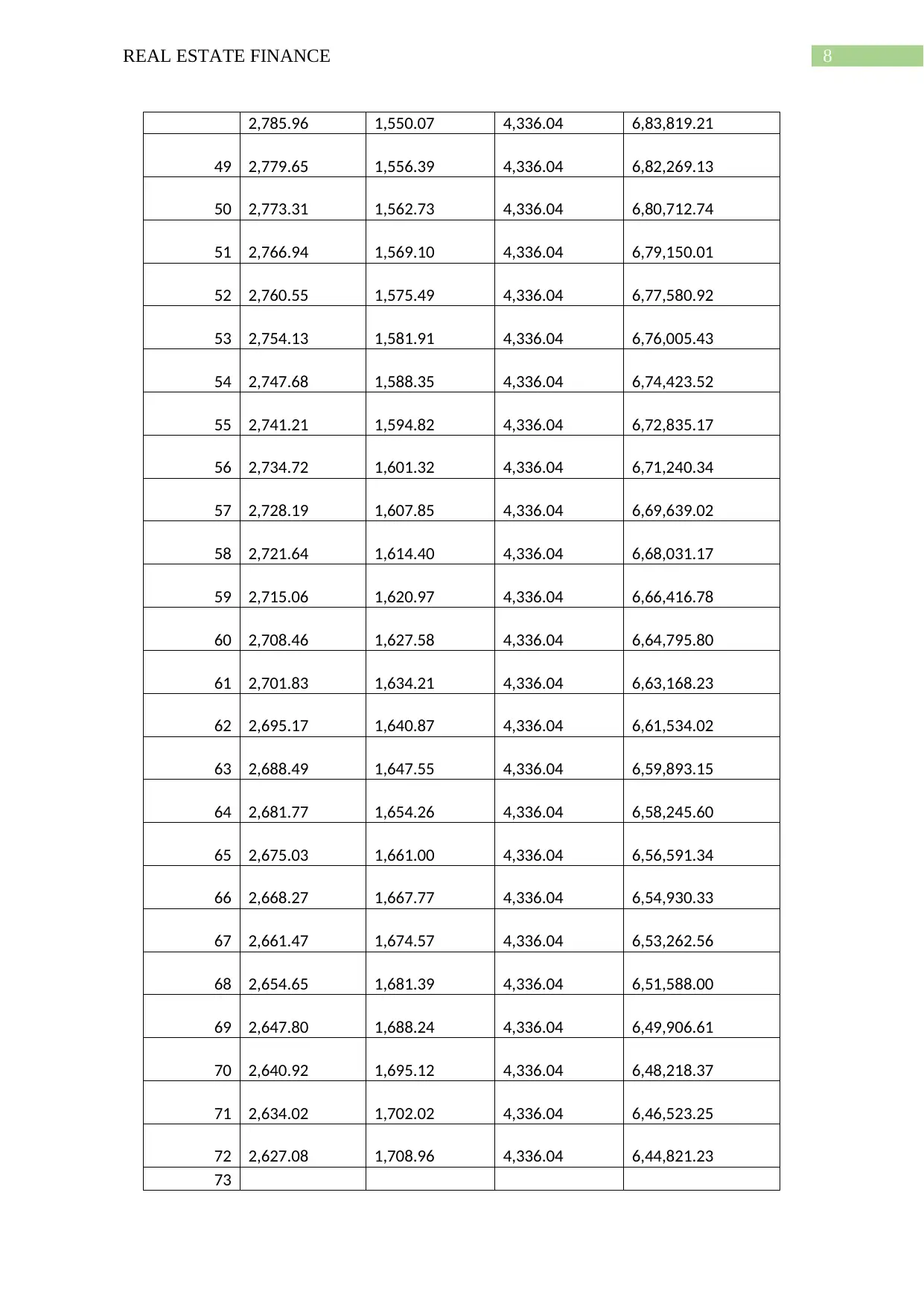

2,785.96 1,550.07 4,336.04 6,83,819.21

49 2,779.65 1,556.39 4,336.04 6,82,269.13

50 2,773.31 1,562.73 4,336.04 6,80,712.74

51 2,766.94 1,569.10 4,336.04 6,79,150.01

52 2,760.55 1,575.49 4,336.04 6,77,580.92

53 2,754.13 1,581.91 4,336.04 6,76,005.43

54 2,747.68 1,588.35 4,336.04 6,74,423.52

55 2,741.21 1,594.82 4,336.04 6,72,835.17

56 2,734.72 1,601.32 4,336.04 6,71,240.34

57 2,728.19 1,607.85 4,336.04 6,69,639.02

58 2,721.64 1,614.40 4,336.04 6,68,031.17

59 2,715.06 1,620.97 4,336.04 6,66,416.78

60 2,708.46 1,627.58 4,336.04 6,64,795.80

61 2,701.83 1,634.21 4,336.04 6,63,168.23

62 2,695.17 1,640.87 4,336.04 6,61,534.02

63 2,688.49 1,647.55 4,336.04 6,59,893.15

64 2,681.77 1,654.26 4,336.04 6,58,245.60

65 2,675.03 1,661.00 4,336.04 6,56,591.34

66 2,668.27 1,667.77 4,336.04 6,54,930.33

67 2,661.47 1,674.57 4,336.04 6,53,262.56

68 2,654.65 1,681.39 4,336.04 6,51,588.00

69 2,647.80 1,688.24 4,336.04 6,49,906.61

70 2,640.92 1,695.12 4,336.04 6,48,218.37

71 2,634.02 1,702.02 4,336.04 6,46,523.25

72 2,627.08 1,708.96 4,336.04 6,44,821.23

73

2,785.96 1,550.07 4,336.04 6,83,819.21

49 2,779.65 1,556.39 4,336.04 6,82,269.13

50 2,773.31 1,562.73 4,336.04 6,80,712.74

51 2,766.94 1,569.10 4,336.04 6,79,150.01

52 2,760.55 1,575.49 4,336.04 6,77,580.92

53 2,754.13 1,581.91 4,336.04 6,76,005.43

54 2,747.68 1,588.35 4,336.04 6,74,423.52

55 2,741.21 1,594.82 4,336.04 6,72,835.17

56 2,734.72 1,601.32 4,336.04 6,71,240.34

57 2,728.19 1,607.85 4,336.04 6,69,639.02

58 2,721.64 1,614.40 4,336.04 6,68,031.17

59 2,715.06 1,620.97 4,336.04 6,66,416.78

60 2,708.46 1,627.58 4,336.04 6,64,795.80

61 2,701.83 1,634.21 4,336.04 6,63,168.23

62 2,695.17 1,640.87 4,336.04 6,61,534.02

63 2,688.49 1,647.55 4,336.04 6,59,893.15

64 2,681.77 1,654.26 4,336.04 6,58,245.60

65 2,675.03 1,661.00 4,336.04 6,56,591.34

66 2,668.27 1,667.77 4,336.04 6,54,930.33

67 2,661.47 1,674.57 4,336.04 6,53,262.56

68 2,654.65 1,681.39 4,336.04 6,51,588.00

69 2,647.80 1,688.24 4,336.04 6,49,906.61

70 2,640.92 1,695.12 4,336.04 6,48,218.37

71 2,634.02 1,702.02 4,336.04 6,46,523.25

72 2,627.08 1,708.96 4,336.04 6,44,821.23

73

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9REAL ESTATE FINANCE

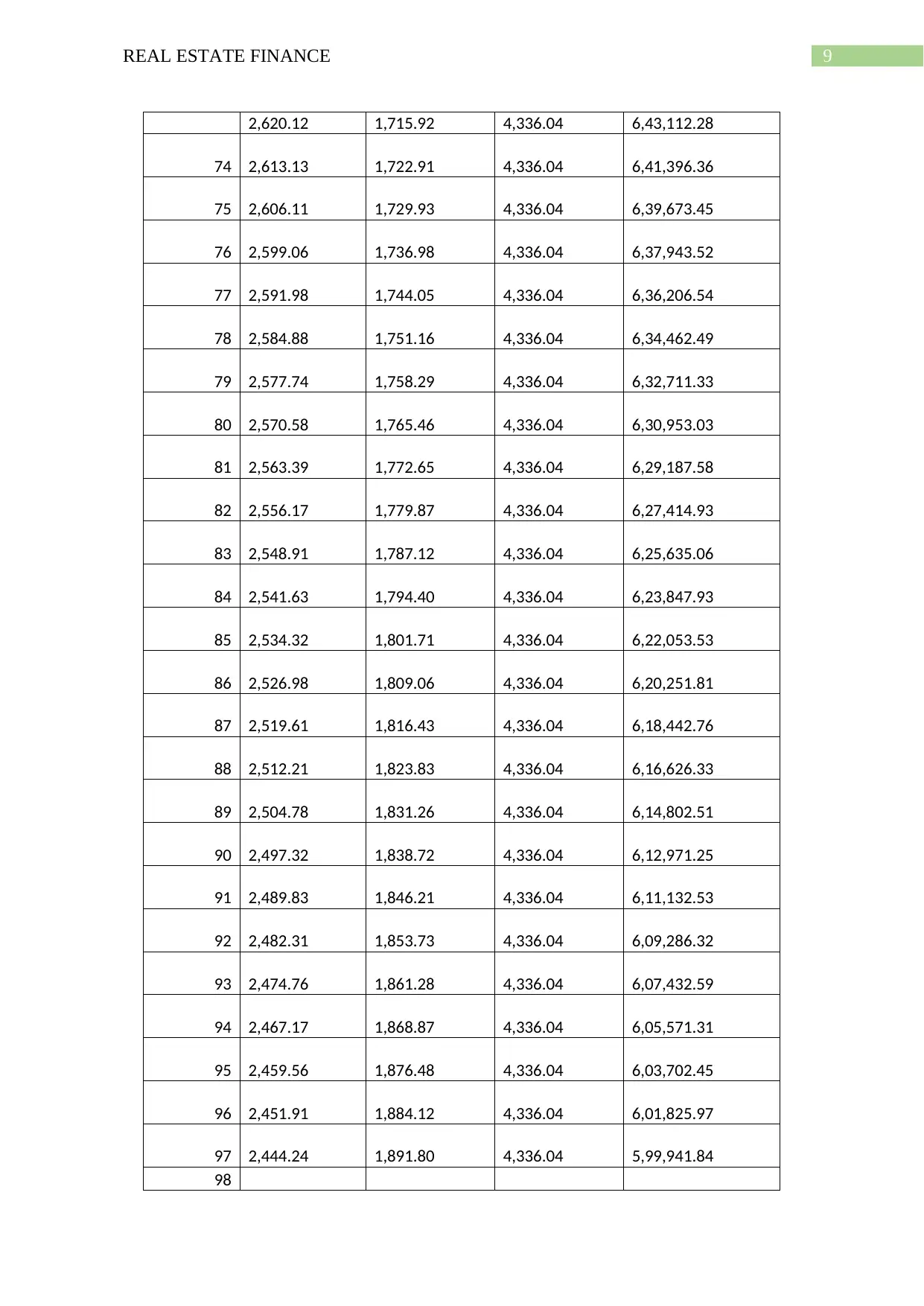

2,620.12 1,715.92 4,336.04 6,43,112.28

74 2,613.13 1,722.91 4,336.04 6,41,396.36

75 2,606.11 1,729.93 4,336.04 6,39,673.45

76 2,599.06 1,736.98 4,336.04 6,37,943.52

77 2,591.98 1,744.05 4,336.04 6,36,206.54

78 2,584.88 1,751.16 4,336.04 6,34,462.49

79 2,577.74 1,758.29 4,336.04 6,32,711.33

80 2,570.58 1,765.46 4,336.04 6,30,953.03

81 2,563.39 1,772.65 4,336.04 6,29,187.58

82 2,556.17 1,779.87 4,336.04 6,27,414.93

83 2,548.91 1,787.12 4,336.04 6,25,635.06

84 2,541.63 1,794.40 4,336.04 6,23,847.93

85 2,534.32 1,801.71 4,336.04 6,22,053.53

86 2,526.98 1,809.06 4,336.04 6,20,251.81

87 2,519.61 1,816.43 4,336.04 6,18,442.76

88 2,512.21 1,823.83 4,336.04 6,16,626.33

89 2,504.78 1,831.26 4,336.04 6,14,802.51

90 2,497.32 1,838.72 4,336.04 6,12,971.25

91 2,489.83 1,846.21 4,336.04 6,11,132.53

92 2,482.31 1,853.73 4,336.04 6,09,286.32

93 2,474.76 1,861.28 4,336.04 6,07,432.59

94 2,467.17 1,868.87 4,336.04 6,05,571.31

95 2,459.56 1,876.48 4,336.04 6,03,702.45

96 2,451.91 1,884.12 4,336.04 6,01,825.97

97 2,444.24 1,891.80 4,336.04 5,99,941.84

98

2,620.12 1,715.92 4,336.04 6,43,112.28

74 2,613.13 1,722.91 4,336.04 6,41,396.36

75 2,606.11 1,729.93 4,336.04 6,39,673.45

76 2,599.06 1,736.98 4,336.04 6,37,943.52

77 2,591.98 1,744.05 4,336.04 6,36,206.54

78 2,584.88 1,751.16 4,336.04 6,34,462.49

79 2,577.74 1,758.29 4,336.04 6,32,711.33

80 2,570.58 1,765.46 4,336.04 6,30,953.03

81 2,563.39 1,772.65 4,336.04 6,29,187.58

82 2,556.17 1,779.87 4,336.04 6,27,414.93

83 2,548.91 1,787.12 4,336.04 6,25,635.06

84 2,541.63 1,794.40 4,336.04 6,23,847.93

85 2,534.32 1,801.71 4,336.04 6,22,053.53

86 2,526.98 1,809.06 4,336.04 6,20,251.81

87 2,519.61 1,816.43 4,336.04 6,18,442.76

88 2,512.21 1,823.83 4,336.04 6,16,626.33

89 2,504.78 1,831.26 4,336.04 6,14,802.51

90 2,497.32 1,838.72 4,336.04 6,12,971.25

91 2,489.83 1,846.21 4,336.04 6,11,132.53

92 2,482.31 1,853.73 4,336.04 6,09,286.32

93 2,474.76 1,861.28 4,336.04 6,07,432.59

94 2,467.17 1,868.87 4,336.04 6,05,571.31

95 2,459.56 1,876.48 4,336.04 6,03,702.45

96 2,451.91 1,884.12 4,336.04 6,01,825.97

97 2,444.24 1,891.80 4,336.04 5,99,941.84

98

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10REAL ESTATE FINANCE

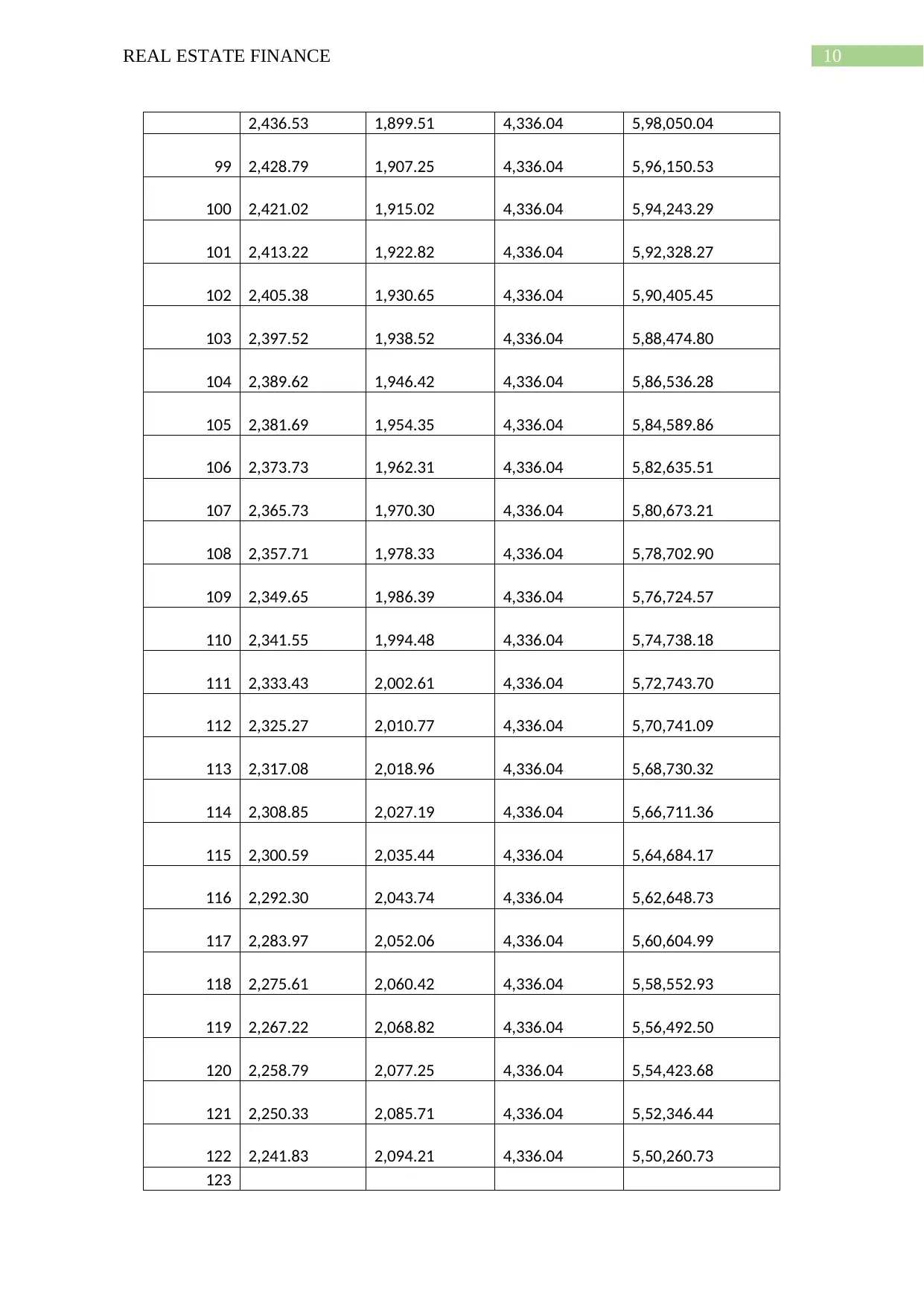

2,436.53 1,899.51 4,336.04 5,98,050.04

99 2,428.79 1,907.25 4,336.04 5,96,150.53

100 2,421.02 1,915.02 4,336.04 5,94,243.29

101 2,413.22 1,922.82 4,336.04 5,92,328.27

102 2,405.38 1,930.65 4,336.04 5,90,405.45

103 2,397.52 1,938.52 4,336.04 5,88,474.80

104 2,389.62 1,946.42 4,336.04 5,86,536.28

105 2,381.69 1,954.35 4,336.04 5,84,589.86

106 2,373.73 1,962.31 4,336.04 5,82,635.51

107 2,365.73 1,970.30 4,336.04 5,80,673.21

108 2,357.71 1,978.33 4,336.04 5,78,702.90

109 2,349.65 1,986.39 4,336.04 5,76,724.57

110 2,341.55 1,994.48 4,336.04 5,74,738.18

111 2,333.43 2,002.61 4,336.04 5,72,743.70

112 2,325.27 2,010.77 4,336.04 5,70,741.09

113 2,317.08 2,018.96 4,336.04 5,68,730.32

114 2,308.85 2,027.19 4,336.04 5,66,711.36

115 2,300.59 2,035.44 4,336.04 5,64,684.17

116 2,292.30 2,043.74 4,336.04 5,62,648.73

117 2,283.97 2,052.06 4,336.04 5,60,604.99

118 2,275.61 2,060.42 4,336.04 5,58,552.93

119 2,267.22 2,068.82 4,336.04 5,56,492.50

120 2,258.79 2,077.25 4,336.04 5,54,423.68

121 2,250.33 2,085.71 4,336.04 5,52,346.44

122 2,241.83 2,094.21 4,336.04 5,50,260.73

123

2,436.53 1,899.51 4,336.04 5,98,050.04

99 2,428.79 1,907.25 4,336.04 5,96,150.53

100 2,421.02 1,915.02 4,336.04 5,94,243.29

101 2,413.22 1,922.82 4,336.04 5,92,328.27

102 2,405.38 1,930.65 4,336.04 5,90,405.45

103 2,397.52 1,938.52 4,336.04 5,88,474.80

104 2,389.62 1,946.42 4,336.04 5,86,536.28

105 2,381.69 1,954.35 4,336.04 5,84,589.86

106 2,373.73 1,962.31 4,336.04 5,82,635.51

107 2,365.73 1,970.30 4,336.04 5,80,673.21

108 2,357.71 1,978.33 4,336.04 5,78,702.90

109 2,349.65 1,986.39 4,336.04 5,76,724.57

110 2,341.55 1,994.48 4,336.04 5,74,738.18

111 2,333.43 2,002.61 4,336.04 5,72,743.70

112 2,325.27 2,010.77 4,336.04 5,70,741.09

113 2,317.08 2,018.96 4,336.04 5,68,730.32

114 2,308.85 2,027.19 4,336.04 5,66,711.36

115 2,300.59 2,035.44 4,336.04 5,64,684.17

116 2,292.30 2,043.74 4,336.04 5,62,648.73

117 2,283.97 2,052.06 4,336.04 5,60,604.99

118 2,275.61 2,060.42 4,336.04 5,58,552.93

119 2,267.22 2,068.82 4,336.04 5,56,492.50

120 2,258.79 2,077.25 4,336.04 5,54,423.68

121 2,250.33 2,085.71 4,336.04 5,52,346.44

122 2,241.83 2,094.21 4,336.04 5,50,260.73

123

11REAL ESTATE FINANCE

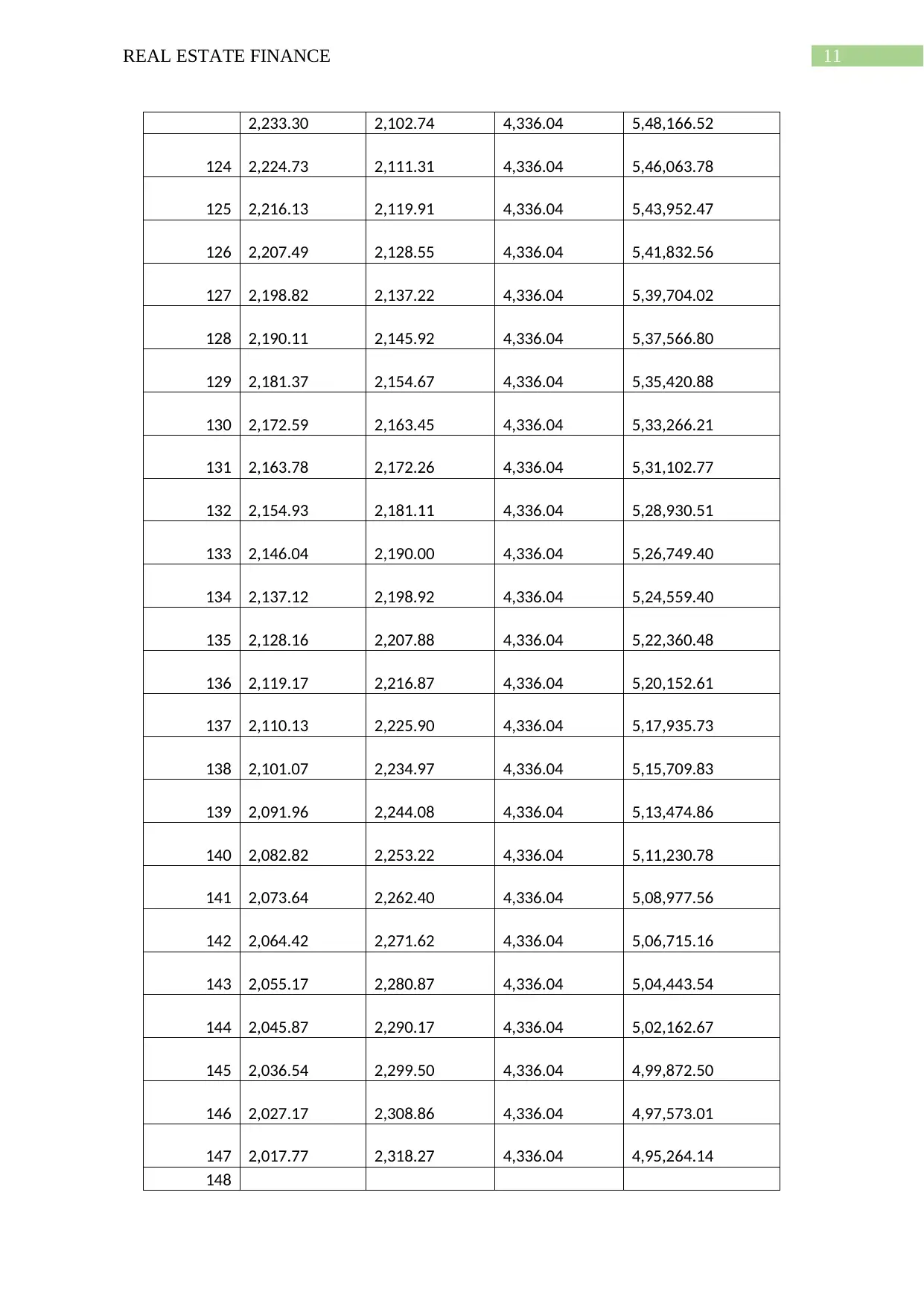

2,233.30 2,102.74 4,336.04 5,48,166.52

124 2,224.73 2,111.31 4,336.04 5,46,063.78

125 2,216.13 2,119.91 4,336.04 5,43,952.47

126 2,207.49 2,128.55 4,336.04 5,41,832.56

127 2,198.82 2,137.22 4,336.04 5,39,704.02

128 2,190.11 2,145.92 4,336.04 5,37,566.80

129 2,181.37 2,154.67 4,336.04 5,35,420.88

130 2,172.59 2,163.45 4,336.04 5,33,266.21

131 2,163.78 2,172.26 4,336.04 5,31,102.77

132 2,154.93 2,181.11 4,336.04 5,28,930.51

133 2,146.04 2,190.00 4,336.04 5,26,749.40

134 2,137.12 2,198.92 4,336.04 5,24,559.40

135 2,128.16 2,207.88 4,336.04 5,22,360.48

136 2,119.17 2,216.87 4,336.04 5,20,152.61

137 2,110.13 2,225.90 4,336.04 5,17,935.73

138 2,101.07 2,234.97 4,336.04 5,15,709.83

139 2,091.96 2,244.08 4,336.04 5,13,474.86

140 2,082.82 2,253.22 4,336.04 5,11,230.78

141 2,073.64 2,262.40 4,336.04 5,08,977.56

142 2,064.42 2,271.62 4,336.04 5,06,715.16

143 2,055.17 2,280.87 4,336.04 5,04,443.54

144 2,045.87 2,290.17 4,336.04 5,02,162.67

145 2,036.54 2,299.50 4,336.04 4,99,872.50

146 2,027.17 2,308.86 4,336.04 4,97,573.01

147 2,017.77 2,318.27 4,336.04 4,95,264.14

148

2,233.30 2,102.74 4,336.04 5,48,166.52

124 2,224.73 2,111.31 4,336.04 5,46,063.78

125 2,216.13 2,119.91 4,336.04 5,43,952.47

126 2,207.49 2,128.55 4,336.04 5,41,832.56

127 2,198.82 2,137.22 4,336.04 5,39,704.02

128 2,190.11 2,145.92 4,336.04 5,37,566.80

129 2,181.37 2,154.67 4,336.04 5,35,420.88

130 2,172.59 2,163.45 4,336.04 5,33,266.21

131 2,163.78 2,172.26 4,336.04 5,31,102.77

132 2,154.93 2,181.11 4,336.04 5,28,930.51

133 2,146.04 2,190.00 4,336.04 5,26,749.40

134 2,137.12 2,198.92 4,336.04 5,24,559.40

135 2,128.16 2,207.88 4,336.04 5,22,360.48

136 2,119.17 2,216.87 4,336.04 5,20,152.61

137 2,110.13 2,225.90 4,336.04 5,17,935.73

138 2,101.07 2,234.97 4,336.04 5,15,709.83

139 2,091.96 2,244.08 4,336.04 5,13,474.86

140 2,082.82 2,253.22 4,336.04 5,11,230.78

141 2,073.64 2,262.40 4,336.04 5,08,977.56

142 2,064.42 2,271.62 4,336.04 5,06,715.16

143 2,055.17 2,280.87 4,336.04 5,04,443.54

144 2,045.87 2,290.17 4,336.04 5,02,162.67

145 2,036.54 2,299.50 4,336.04 4,99,872.50

146 2,027.17 2,308.86 4,336.04 4,97,573.01

147 2,017.77 2,318.27 4,336.04 4,95,264.14

148

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.