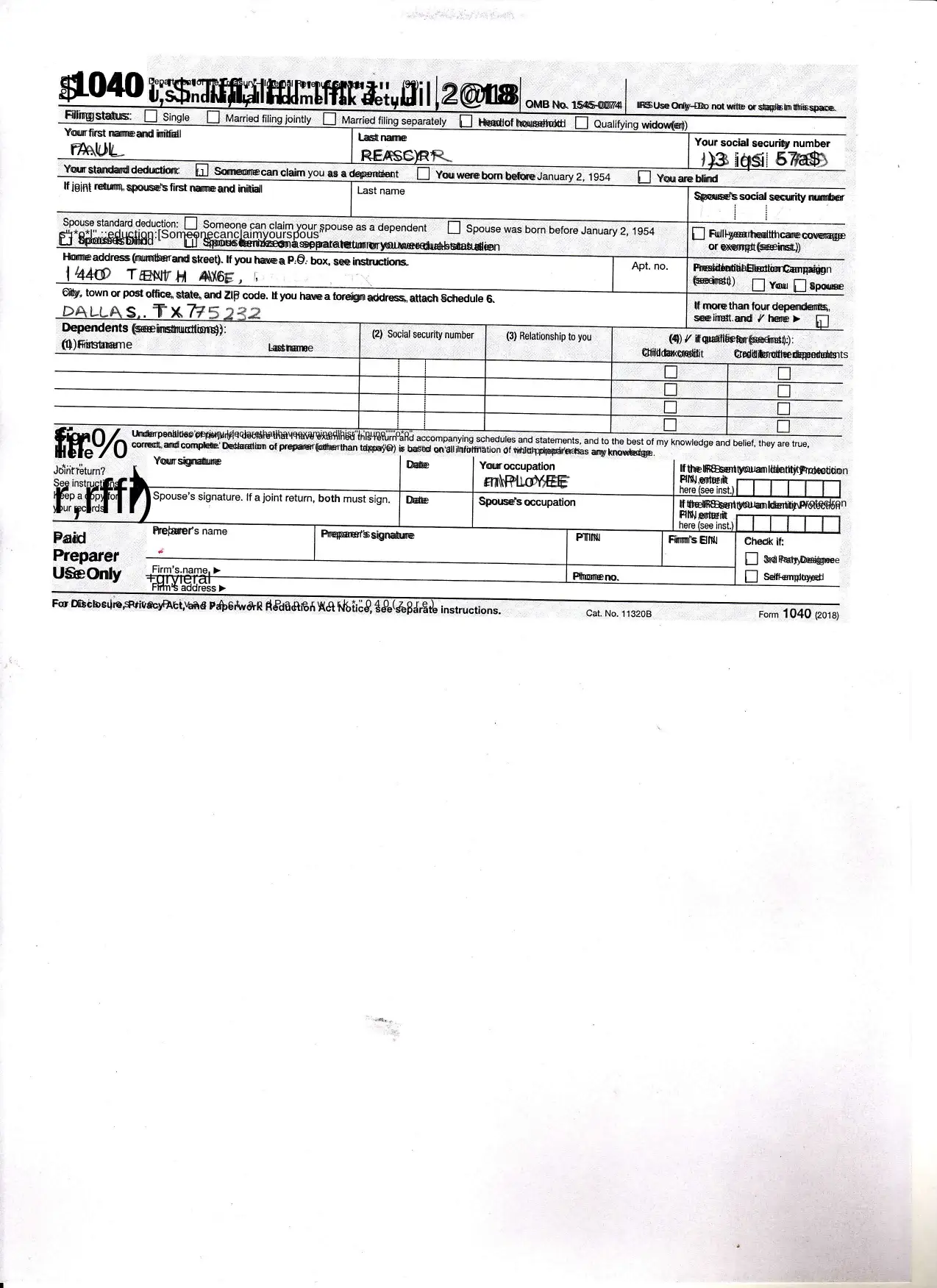

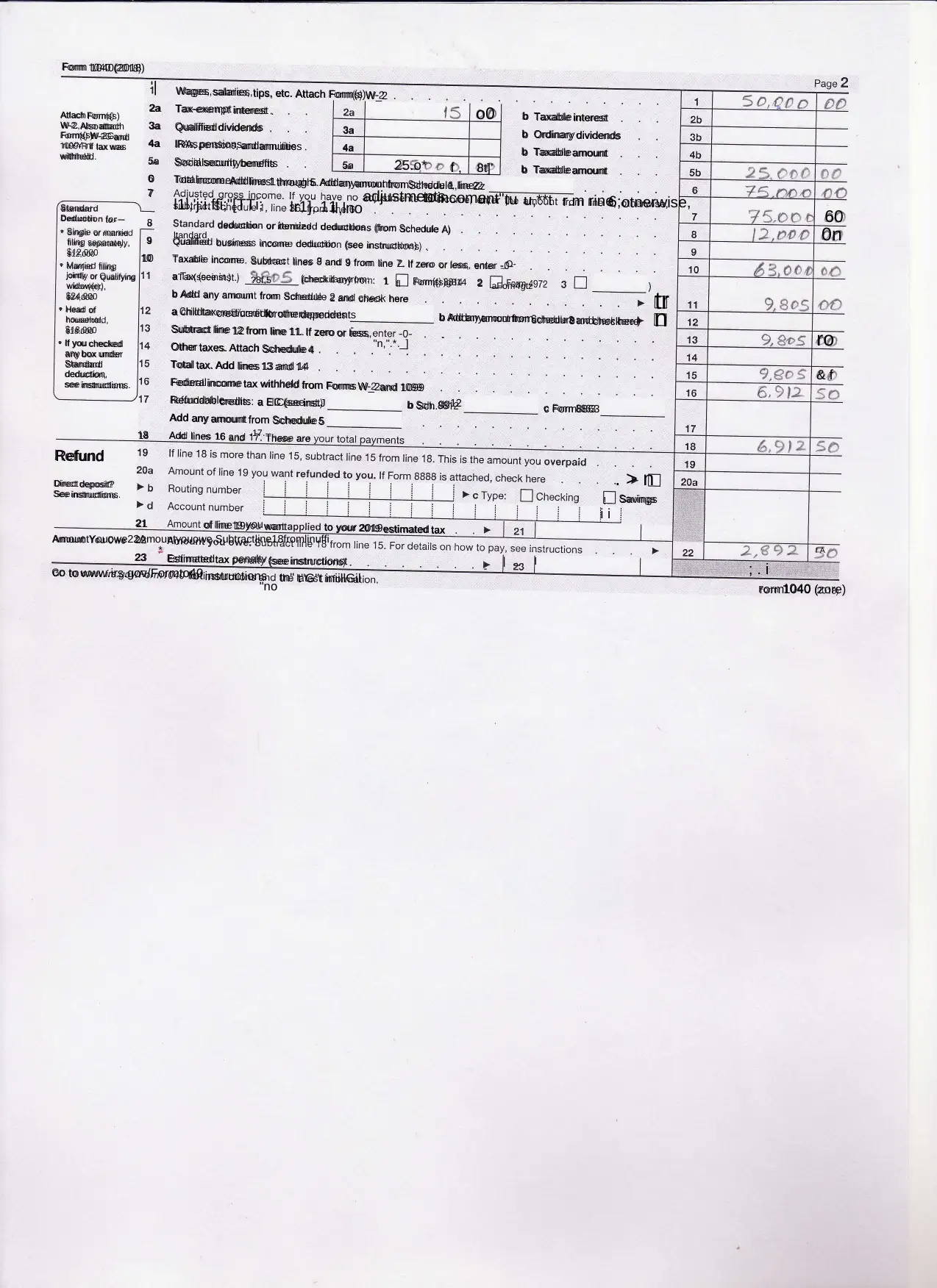

Comprehensive Preparation of Form 1040: Paul Reasor's Tax Return

VerifiedAdded on 2023/01/17

|2

|732

|38

Homework Assignment

AI Summary

This assignment involves the preparation of Form 1040, the U.S. Individual Income Tax Return, for Paul Reasor. The task requires using the provided information, including Paul's name, address, social security number, date of birth, and employment details, to accurately complete the form. Paul was employed by Best Comic Books, Inc., and received a W-2 and a K-1 from his S corporation. The assignment specifically states that Paul had no deductions, either itemized or above-the-line, for the tax year 2017. The solution requires calculating taxable income, determining tax liability, and completing all relevant sections of Form 1040 based on the information provided, without the use of tax software. The solution demonstrates the process of tax preparation and the application of tax laws.

1 out of 2

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)