Recording Business Transactions: Ledger Accounts and Income Statement

VerifiedAdded on 2023/01/03

|26

|4178

|42

Homework Assignment

AI Summary

This student assignment delves into the core principles of recording business transactions, encompassing a range of accounting practices. The assignment begins with an introduction to accounting, defining its role in monitoring and categorizing financial transactions. It then proceeds with an in-depth analysis of the decision-making process and the need for accounting information, highlighting the advantages and disadvantages of accounting for a business. The core of the assignment involves practical application, including journal entries for various transactions, the creation of general ledger accounts, and the preparation of a trial balance. Furthermore, it extends to the creation of an income statement and a discussion on the potential impact of external factors, such as Covid-19, on financial statements. The assignment covers a range of accounting concepts, providing a comprehensive overview of financial recording and reporting.

Recording Business Transactions

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

Introduction.................................................................................................................................................3

Assessment 1...........................................................................................................................................3

Part 1.......................................................................................................................................................3

Part 2.......................................................................................................................................................5

Part 3.......................................................................................................................................................6

Part 4.....................................................................................................................................................10

ASSESSEMENT 2.....................................................................................................................................12

PART A...................................................................................................................................................12

PART B...................................................................................................................................................20

CONCLUSION.............................................................................................................................................22

References.................................................................................................................................................24

Introduction.................................................................................................................................................3

Assessment 1...........................................................................................................................................3

Part 1.......................................................................................................................................................3

Part 2.......................................................................................................................................................5

Part 3.......................................................................................................................................................6

Part 4.....................................................................................................................................................10

ASSESSEMENT 2.....................................................................................................................................12

PART A...................................................................................................................................................12

PART B...................................................................................................................................................20

CONCLUSION.............................................................................................................................................22

References.................................................................................................................................................24

Introduction

Accounting includes monitoring, categorizing, updating and outlining the cash transactions of

the person (Cai, 2019). The framework for the completion of the acquisition and the

corporation's status is established by these records and the analyses extracted from it. It technical

supports the collection by various entities of financial documents and the preparation of trial

accounts and revenue reports. Merits and demerits are addressed in the context of companies.

Covid-19's effect on business income is also discussed.

Assessment 1

Part 1

A. Decision-makers and need for accounting information

The descriptions and review of all statistical details require financial reports in such a way that it

could be recorded in the journal. Such effects are very useful for predictive analytics. Efficient

choices from purchasing to service quality determine the potential opportunity (Viriyasitavat and

Hoonsopon, 2019). The multiple company executives take all actions on the recruitment and

firing of employees, the creation of the benefit target, the preparation of current events and

expenditures, the use of technologies for separate production activities, etc. A corporation's

choice leadership is based on its management mechanisms, which are controlled by the advisory

board or the chairmen. These tasks are then assigned to the management team, together with the

approval needed for them to be executed.

In analytical words, financial statements get the necessary business statistics, making it easier for

leadership and analysts to make critical choices. Capabilities are defined are prepared in

compliance with specific frameworks and procedures that are common from across sector

(Hamilton, 2020). It allows them equivalent to many other rivals who by strategic objectives

realize their market standing. Annual statements also offer a framework for executives to

determine whether or not it should variety a strength distribution achievable and monetarily

feasible. In actual market conditions, forecasts and estimates also rely on positive business

financial information. Only is traditional monetary applicable because it enables association on

its own but it also procedures the foundation for the removing of valued information from non-

financial records.

Accounting includes monitoring, categorizing, updating and outlining the cash transactions of

the person (Cai, 2019). The framework for the completion of the acquisition and the

corporation's status is established by these records and the analyses extracted from it. It technical

supports the collection by various entities of financial documents and the preparation of trial

accounts and revenue reports. Merits and demerits are addressed in the context of companies.

Covid-19's effect on business income is also discussed.

Assessment 1

Part 1

A. Decision-makers and need for accounting information

The descriptions and review of all statistical details require financial reports in such a way that it

could be recorded in the journal. Such effects are very useful for predictive analytics. Efficient

choices from purchasing to service quality determine the potential opportunity (Viriyasitavat and

Hoonsopon, 2019). The multiple company executives take all actions on the recruitment and

firing of employees, the creation of the benefit target, the preparation of current events and

expenditures, the use of technologies for separate production activities, etc. A corporation's

choice leadership is based on its management mechanisms, which are controlled by the advisory

board or the chairmen. These tasks are then assigned to the management team, together with the

approval needed for them to be executed.

In analytical words, financial statements get the necessary business statistics, making it easier for

leadership and analysts to make critical choices. Capabilities are defined are prepared in

compliance with specific frameworks and procedures that are common from across sector

(Hamilton, 2020). It allows them equivalent to many other rivals who by strategic objectives

realize their market standing. Annual statements also offer a framework for executives to

determine whether or not it should variety a strength distribution achievable and monetarily

feasible. In actual market conditions, forecasts and estimates also rely on positive business

financial information. Only is traditional monetary applicable because it enables association on

its own but it also procedures the foundation for the removing of valued information from non-

financial records.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

B. Advantages and disadvantages of accounting for a business

Accounting monitors and reviews the financial reports of a major company on the grounds of the

essence of the regulation. Benefits and risks related to the handling of financial records are as

shown in:

Advantages:

Decision-making - The executive committee wants statistics and business decision-

making. Account books have a role to play in the company (Zhang, Wang and Zhu,

2019). It delivers intelligences on the business's cash streams as well as many other

expenditure and transactions, allowing forecasting operating deficits or deficits in a

reasonable time. It also purposes to deliver mistake and accountability that can

discourage and recognize fraud.

Proof in legal proceedings - Bookkeeping archives help as an operative background for

the main monetary contract specified confidential. After any difference happens, it will

then performance as lawful resistant beforehand the judgements. Enterprises must have

archives in the arrangement agreed in the Rule but after consuming been studied by

autonomous auditors, send them to the Recordkeeping.

Disadvantages:

Records just financial factors - among the effective important limitations of revenue

recognition is that this implements to managing of money transfers, like consumer

conditions, political environment, legal and controlling rubrics, etc., have significant

analysis for business practices. They are not recorded in financial accounts and have an

erroneous picture during effective decision making.

Historical nature - Amounts are listed in individual spending accounts and price shifts

are not taken into consideration. This helps financial documents of historical value in the

books of accounts (Mola, Microsoft Technology Licensing LLC, 2019). These

documents are then regarded as a prerequisite for predicting future outcomes. It loses the

period value of resources and the changes that come with that as well; making projections

Accounting monitors and reviews the financial reports of a major company on the grounds of the

essence of the regulation. Benefits and risks related to the handling of financial records are as

shown in:

Advantages:

Decision-making - The executive committee wants statistics and business decision-

making. Account books have a role to play in the company (Zhang, Wang and Zhu,

2019). It delivers intelligences on the business's cash streams as well as many other

expenditure and transactions, allowing forecasting operating deficits or deficits in a

reasonable time. It also purposes to deliver mistake and accountability that can

discourage and recognize fraud.

Proof in legal proceedings - Bookkeeping archives help as an operative background for

the main monetary contract specified confidential. After any difference happens, it will

then performance as lawful resistant beforehand the judgements. Enterprises must have

archives in the arrangement agreed in the Rule but after consuming been studied by

autonomous auditors, send them to the Recordkeeping.

Disadvantages:

Records just financial factors - among the effective important limitations of revenue

recognition is that this implements to managing of money transfers, like consumer

conditions, political environment, legal and controlling rubrics, etc., have significant

analysis for business practices. They are not recorded in financial accounts and have an

erroneous picture during effective decision making.

Historical nature - Amounts are listed in individual spending accounts and price shifts

are not taken into consideration. This helps financial documents of historical value in the

books of accounts (Mola, Microsoft Technology Licensing LLC, 2019). These

documents are then regarded as a prerequisite for predicting future outcomes. It loses the

period value of resources and the changes that come with that as well; making projections

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

dependent on historical costs do not necessarily have the best basis for predicting events

in the future.

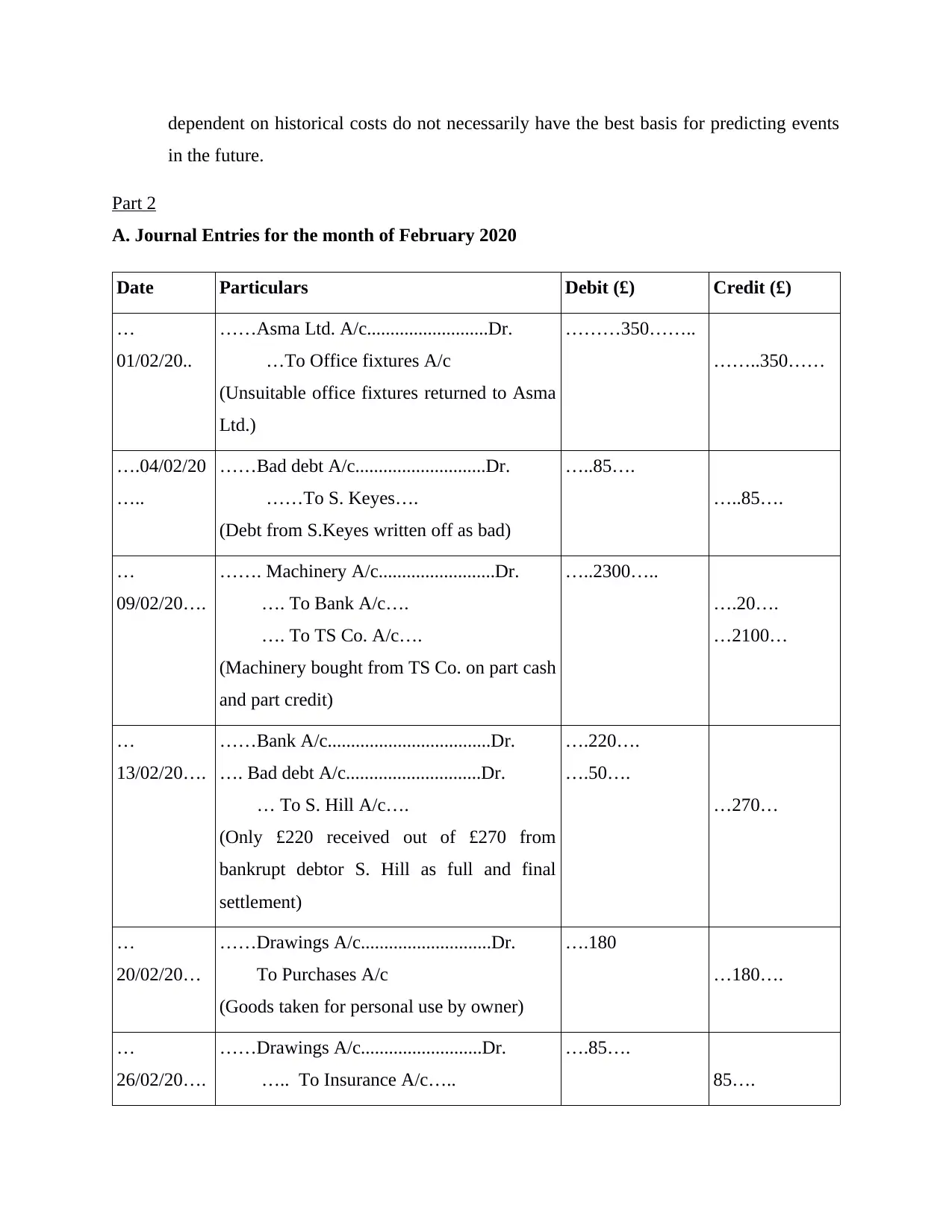

Part 2

A. Journal Entries for the month of February 2020

Date Particulars Debit (£) Credit (£)

…

01/02/20..

……Asma Ltd. A/c..........................Dr.

…To Office fixtures A/c

(Unsuitable office fixtures returned to Asma

Ltd.)

………350……..

……..350……

….04/02/20

…..

……Bad debt A/c............................Dr.

……To S. Keyes….

(Debt from S.Keyes written off as bad)

…..85….

…..85….

…

09/02/20….

……. Machinery A/c.........................Dr.

…. To Bank A/c….

…. To TS Co. A/c….

(Machinery bought from TS Co. on part cash

and part credit)

…..2300…..

….20….

…2100…

…

13/02/20….

……Bank A/c...................................Dr.

…. Bad debt A/c.............................Dr.

… To S. Hill A/c….

(Only £220 received out of £270 from

bankrupt debtor S. Hill as full and final

settlement)

….220….

….50….

…270…

…

20/02/20…

……Drawings A/c............................Dr.

To Purchases A/c

(Goods taken for personal use by owner)

….180

…180….

…

26/02/20….

……Drawings A/c..........................Dr.

….. To Insurance A/c…..

….85….

85….

in the future.

Part 2

A. Journal Entries for the month of February 2020

Date Particulars Debit (£) Credit (£)

…

01/02/20..

……Asma Ltd. A/c..........................Dr.

…To Office fixtures A/c

(Unsuitable office fixtures returned to Asma

Ltd.)

………350……..

……..350……

….04/02/20

…..

……Bad debt A/c............................Dr.

……To S. Keyes….

(Debt from S.Keyes written off as bad)

…..85….

…..85….

…

09/02/20….

……. Machinery A/c.........................Dr.

…. To Bank A/c….

…. To TS Co. A/c….

(Machinery bought from TS Co. on part cash

and part credit)

…..2300…..

….20….

…2100…

…

13/02/20….

……Bank A/c...................................Dr.

…. Bad debt A/c.............................Dr.

… To S. Hill A/c….

(Only £220 received out of £270 from

bankrupt debtor S. Hill as full and final

settlement)

….220….

….50….

…270…

…

20/02/20…

……Drawings A/c............................Dr.

To Purchases A/c

(Goods taken for personal use by owner)

….180

…180….

…

26/02/20….

……Drawings A/c..........................Dr.

….. To Insurance A/c…..

….85….

85….

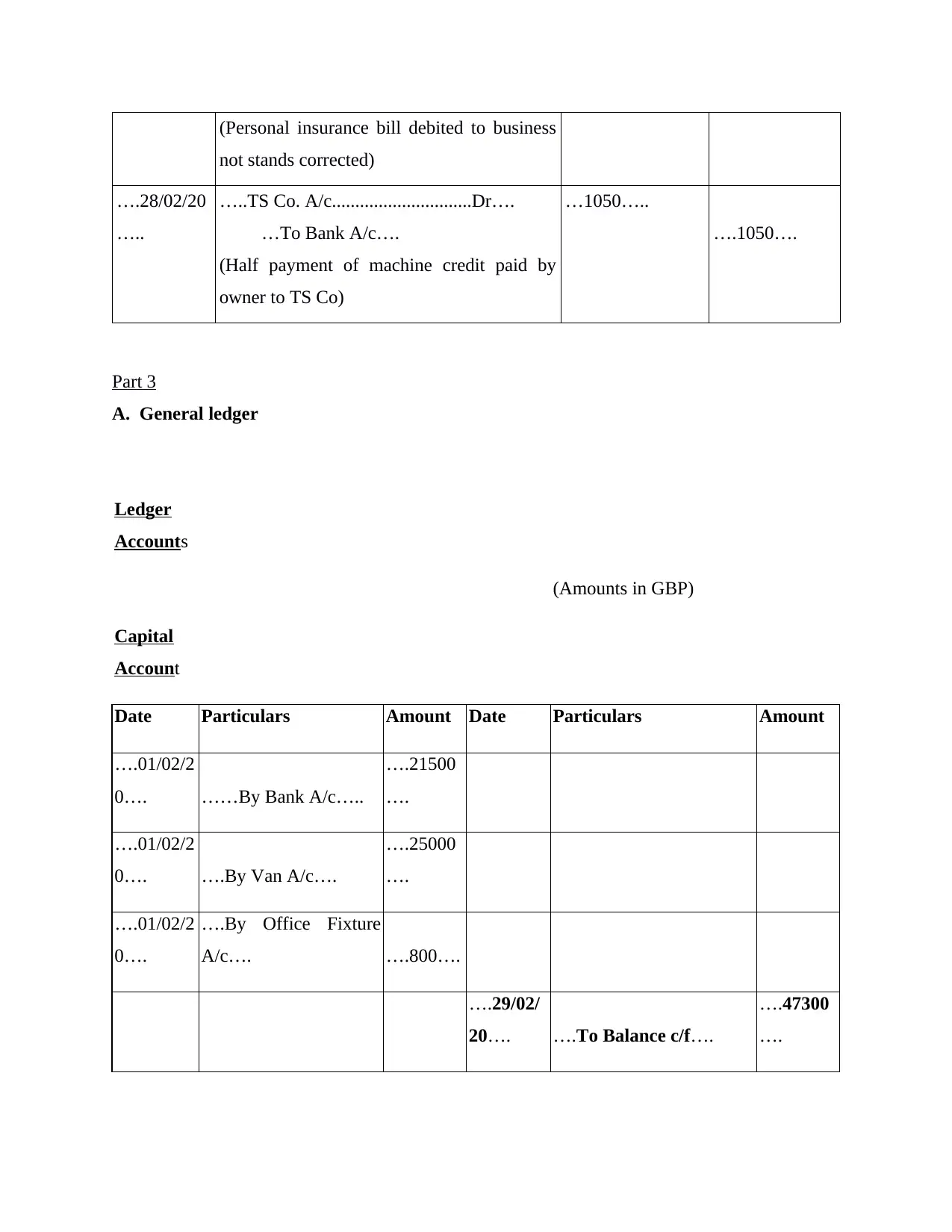

(Personal insurance bill debited to business

not stands corrected)

….28/02/20

…..

…..TS Co. A/c..............................Dr….

…To Bank A/c….

(Half payment of machine credit paid by

owner to TS Co)

…1050…..

….1050….

Part 3

A. General ledger

Ledger

Accounts

(Amounts in GBP)

Capital

Account

Date Particulars Amount Date Particulars Amount

….01/02/2

0…. ……By Bank A/c…..

….21500

….

….01/02/2

0…. ….By Van A/c….

….25000

….

….01/02/2

0….

….By Office Fixture

A/c…. ….800….

….29/02/

20…. ….To Balance c/f….

….47300

….

not stands corrected)

….28/02/20

…..

…..TS Co. A/c..............................Dr….

…To Bank A/c….

(Half payment of machine credit paid by

owner to TS Co)

…1050…..

….1050….

Part 3

A. General ledger

Ledger

Accounts

(Amounts in GBP)

Capital

Account

Date Particulars Amount Date Particulars Amount

….01/02/2

0…. ……By Bank A/c…..

….21500

….

….01/02/2

0…. ….By Van A/c….

….25000

….

….01/02/2

0….

….By Office Fixture

A/c…. ….800….

….29/02/

20…. ….To Balance c/f….

….47300

….

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

….Total….

….47300

…. ….Total….

….47300

….

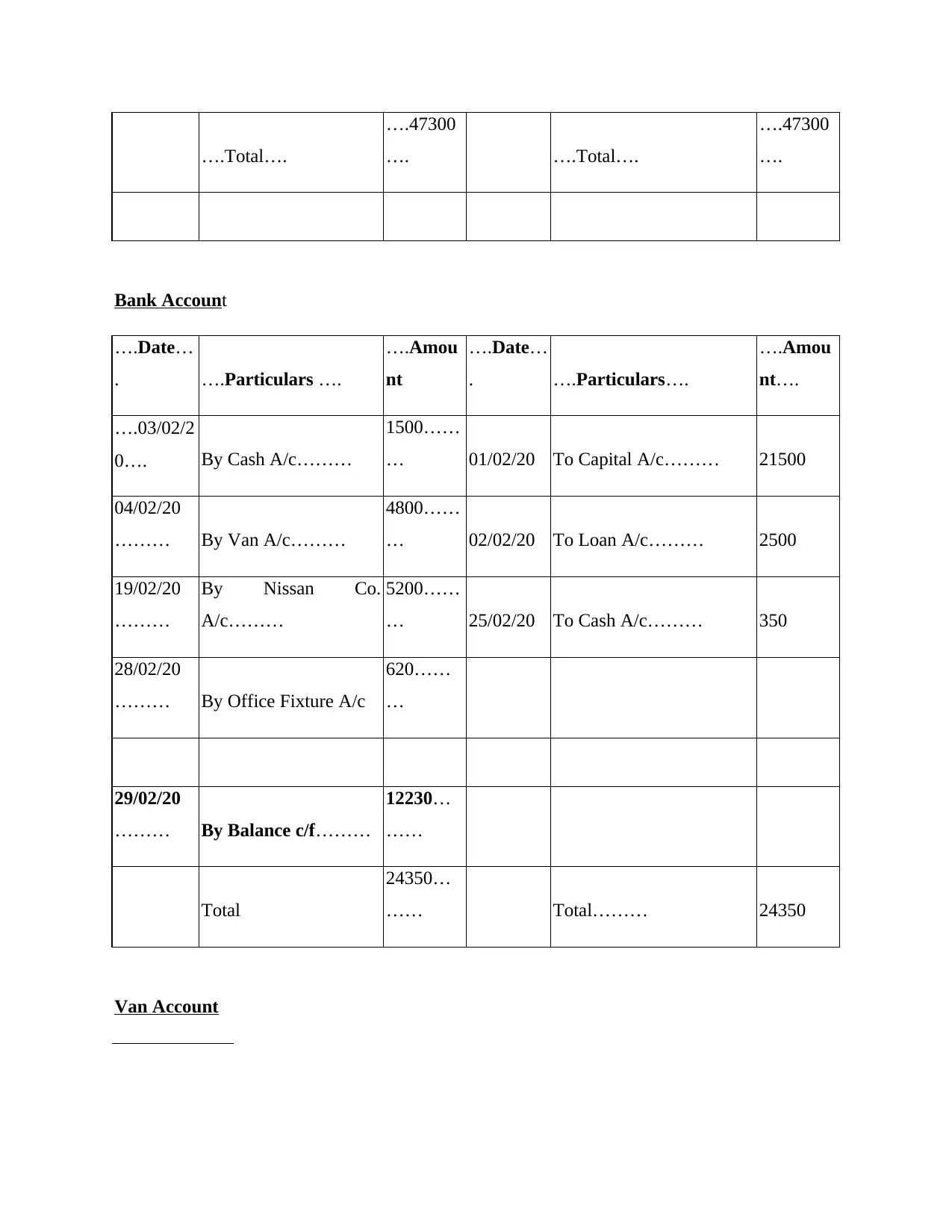

Bank Account

….Date…

. ….Particulars ….

….Amou

nt

….Date…

. ….Particulars….

….Amou

nt….

….03/02/2

0…. By Cash A/c………

1500……

… 01/02/20 To Capital A/c……… 21500

04/02/20

……… By Van A/c………

4800……

… 02/02/20 To Loan A/c……… 2500

19/02/20

………

By Nissan Co.

A/c………

5200……

… 25/02/20 To Cash A/c……… 350

28/02/20

……… By Office Fixture A/c

620……

…

29/02/20

……… By Balance c/f………

12230…

……

Total

24350…

…… Total……… 24350

Van Account

….47300

…. ….Total….

….47300

….

Bank Account

….Date…

. ….Particulars ….

….Amou

nt

….Date…

. ….Particulars….

….Amou

nt….

….03/02/2

0…. By Cash A/c………

1500……

… 01/02/20 To Capital A/c……… 21500

04/02/20

……… By Van A/c………

4800……

… 02/02/20 To Loan A/c……… 2500

19/02/20

………

By Nissan Co.

A/c………

5200……

… 25/02/20 To Cash A/c……… 350

28/02/20

……… By Office Fixture A/c

620……

…

29/02/20

……… By Balance c/f………

12230…

……

Total

24350…

…… Total……… 24350

Van Account

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Date……

… Particulars ………

Amount

………

Date……

… Particulars………

Amount

………

01/02/20

……… To Capital A/c………

………

25000

04/02/20

……… To Bank A/c………

4800……

…

08/02/20

……… To Nissan Co. A/c………

5200……

…

29/02/20

……… By Balance c/f………

35000…

……

Total………

35000…

…… Total………

………

35000…

……

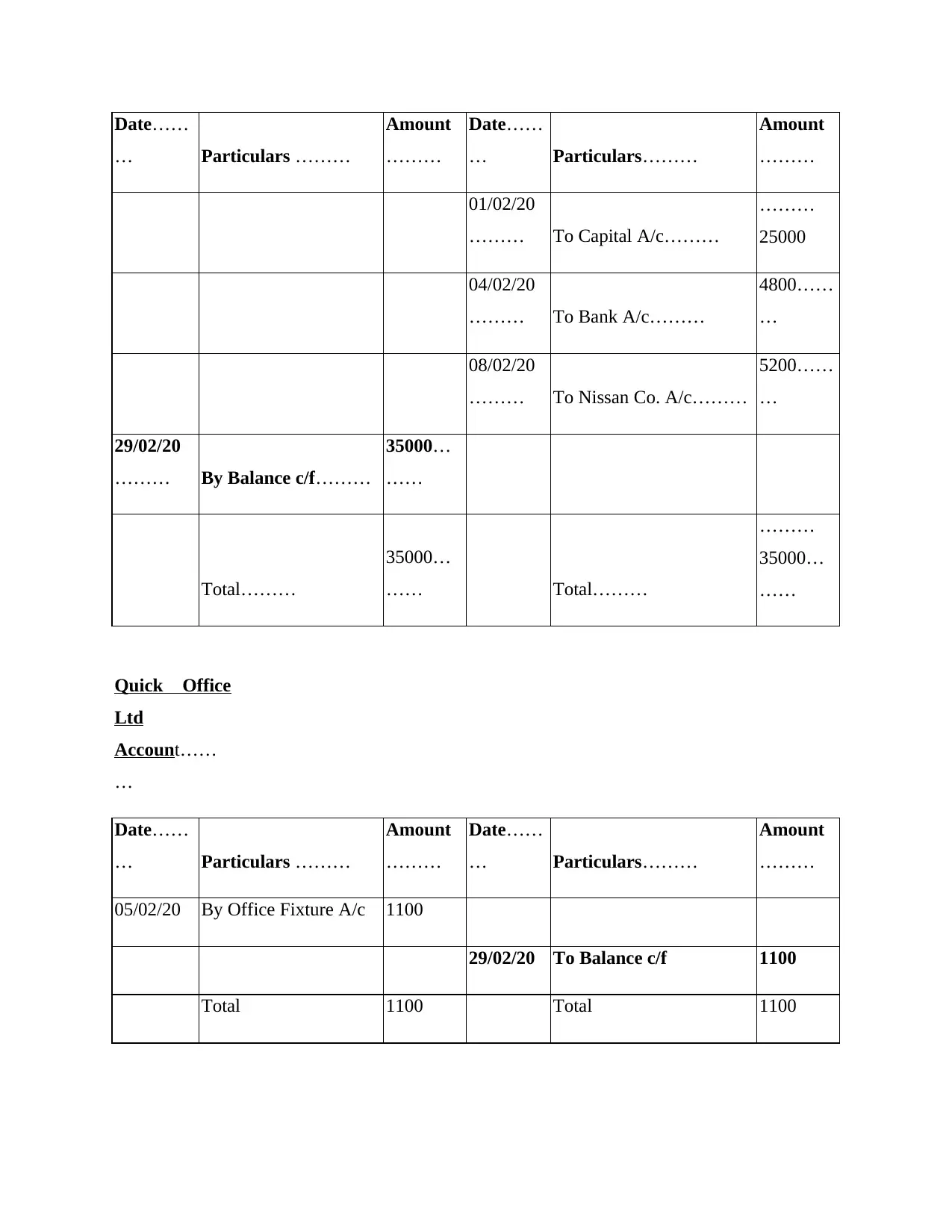

Quick Office

Ltd

Account……

…

Date……

… Particulars ………

Amount

………

Date……

… Particulars………

Amount

………

05/02/20 By Office Fixture A/c 1100

29/02/20 To Balance c/f 1100

Total 1100 Total 1100

… Particulars ………

Amount

………

Date……

… Particulars………

Amount

………

01/02/20

……… To Capital A/c………

………

25000

04/02/20

……… To Bank A/c………

4800……

…

08/02/20

……… To Nissan Co. A/c………

5200……

…

29/02/20

……… By Balance c/f………

35000…

……

Total………

35000…

…… Total………

………

35000…

……

Quick Office

Ltd

Account……

…

Date……

… Particulars ………

Amount

………

Date……

… Particulars………

Amount

………

05/02/20 By Office Fixture A/c 1100

29/02/20 To Balance c/f 1100

Total 1100 Total 1100

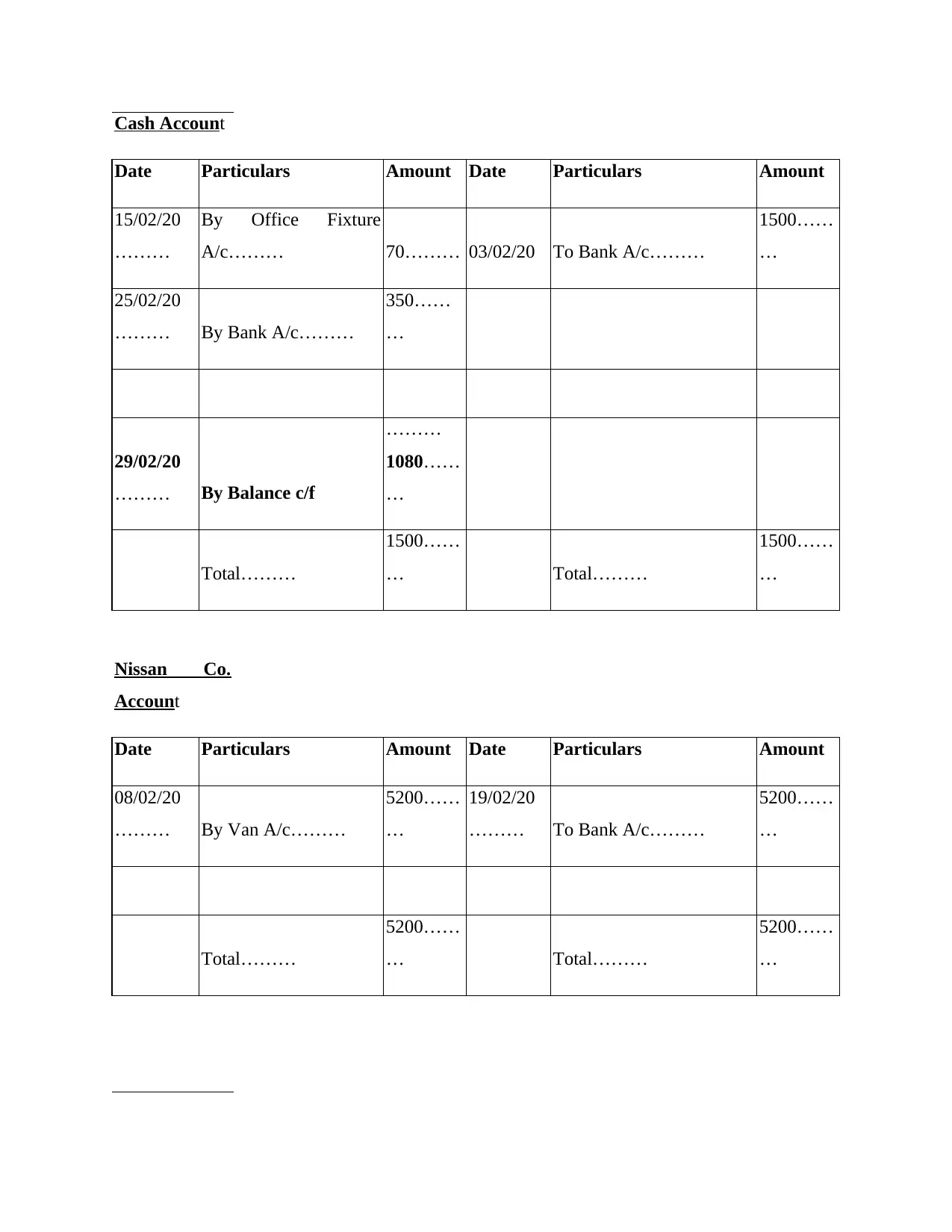

Cash Account

Date Particulars Amount Date Particulars Amount

15/02/20

………

By Office Fixture

A/c……… 70……… 03/02/20 To Bank A/c………

1500……

…

25/02/20

……… By Bank A/c………

350……

…

29/02/20

……… By Balance c/f

………

1080……

…

Total………

1500……

… Total………

1500……

…

Nissan Co.

Account

Date Particulars Amount Date Particulars Amount

08/02/20

……… By Van A/c………

5200……

…

19/02/20

……… To Bank A/c………

5200……

…

Total………

5200……

… Total………

5200……

…

Date Particulars Amount Date Particulars Amount

15/02/20

………

By Office Fixture

A/c……… 70……… 03/02/20 To Bank A/c………

1500……

…

25/02/20

……… By Bank A/c………

350……

…

29/02/20

……… By Balance c/f

………

1080……

…

Total………

1500……

… Total………

1500……

…

Nissan Co.

Account

Date Particulars Amount Date Particulars Amount

08/02/20

……… By Van A/c………

5200……

…

19/02/20

……… To Bank A/c………

5200……

…

Total………

5200……

… Total………

5200……

…

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

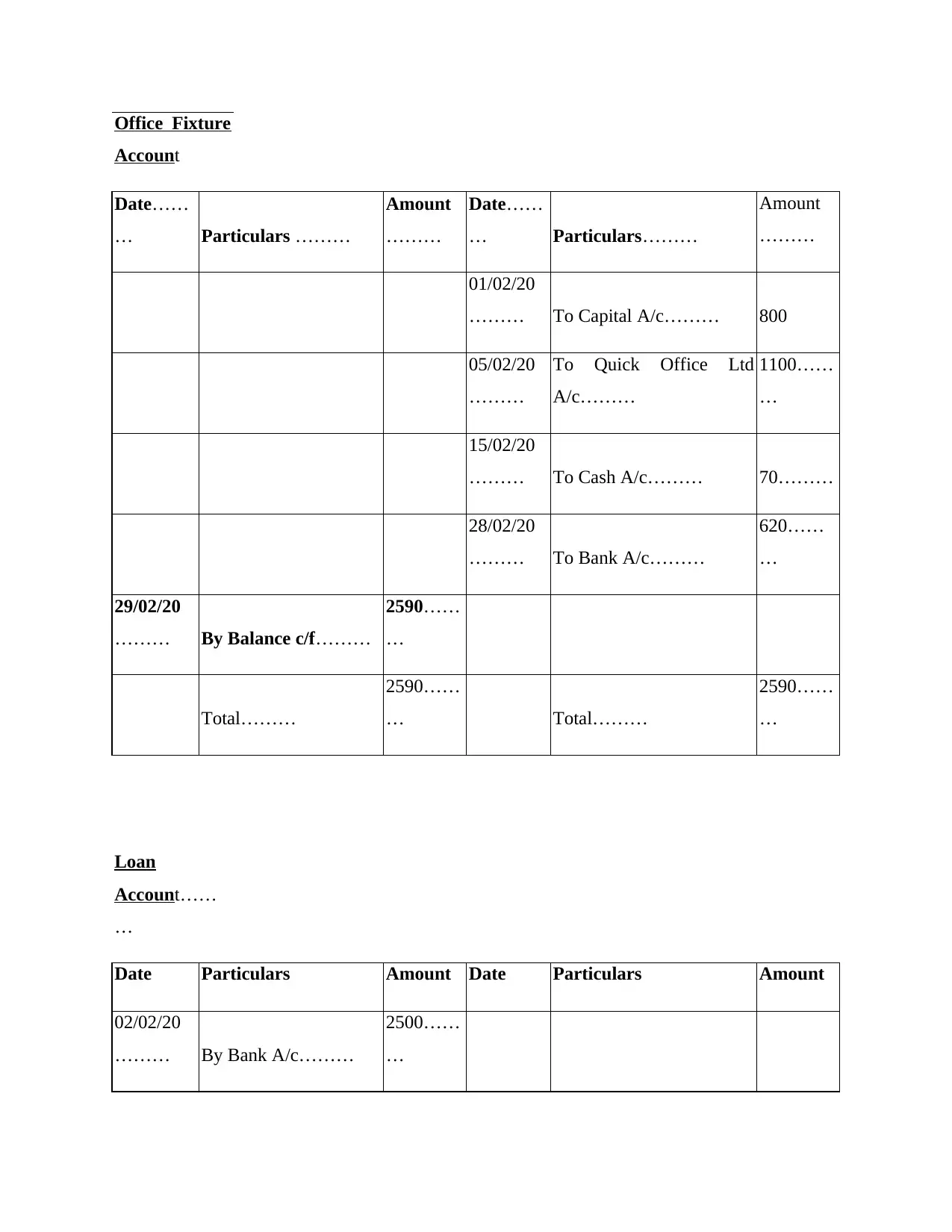

Office Fixture

Account

Date……

… Particulars ………

Amount

………

Date……

… Particulars………

Amount

………

01/02/20

……… To Capital A/c……… 800

05/02/20

………

To Quick Office Ltd

A/c………

1100……

…

15/02/20

……… To Cash A/c……… 70………

28/02/20

……… To Bank A/c………

620……

…

29/02/20

……… By Balance c/f………

2590……

…

Total………

2590……

… Total………

2590……

…

Loan

Account……

…

Date Particulars Amount Date Particulars Amount

02/02/20

……… By Bank A/c………

2500……

…

Account

Date……

… Particulars ………

Amount

………

Date……

… Particulars………

Amount

………

01/02/20

……… To Capital A/c……… 800

05/02/20

………

To Quick Office Ltd

A/c………

1100……

…

15/02/20

……… To Cash A/c……… 70………

28/02/20

……… To Bank A/c………

620……

…

29/02/20

……… By Balance c/f………

2590……

…

Total………

2590……

… Total………

2590……

…

Loan

Account……

…

Date Particulars Amount Date Particulars Amount

02/02/20

……… By Bank A/c………

2500……

…

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

29/02/20

……… By Balance c/f………

2500……

…

Total………

2500……

… Total………

2500……

…

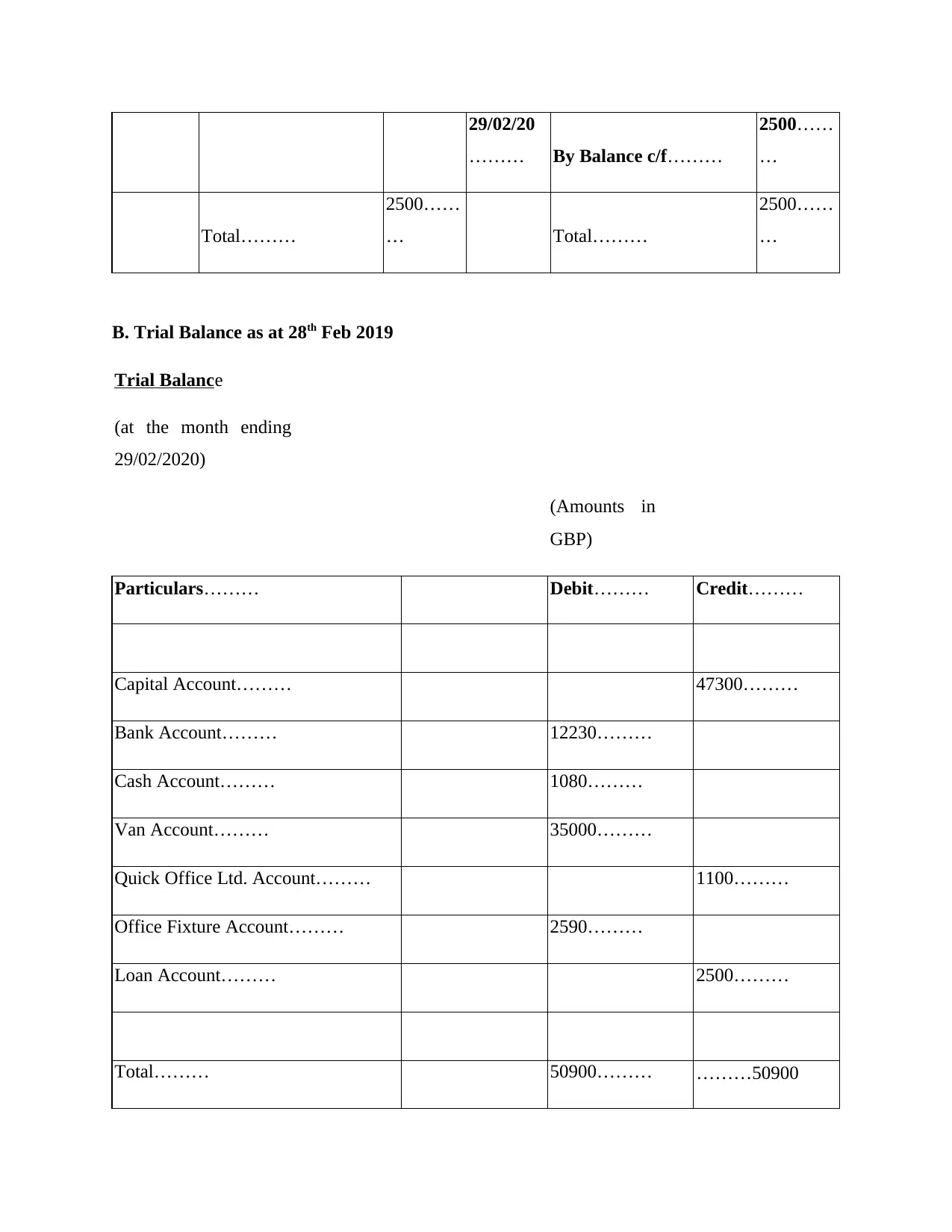

B. Trial Balance as at 28th Feb 2019

Trial Balance

(at the month ending

29/02/2020)

(Amounts in

GBP)

Particulars……… Debit……… Credit………

Capital Account……… 47300………

Bank Account……… 12230………

Cash Account……… 1080………

Van Account……… 35000………

Quick Office Ltd. Account……… 1100………

Office Fixture Account……… 2590………

Loan Account……… 2500………

Total……… 50900……… ………50900

……… By Balance c/f………

2500……

…

Total………

2500……

… Total………

2500……

…

B. Trial Balance as at 28th Feb 2019

Trial Balance

(at the month ending

29/02/2020)

(Amounts in

GBP)

Particulars……… Debit……… Credit………

Capital Account……… 47300………

Bank Account……… 12230………

Cash Account……… 1080………

Van Account……… 35000………

Quick Office Ltd. Account……… 1100………

Office Fixture Account……… 2590………

Loan Account……… 2500………

Total……… 50900……… ………50900

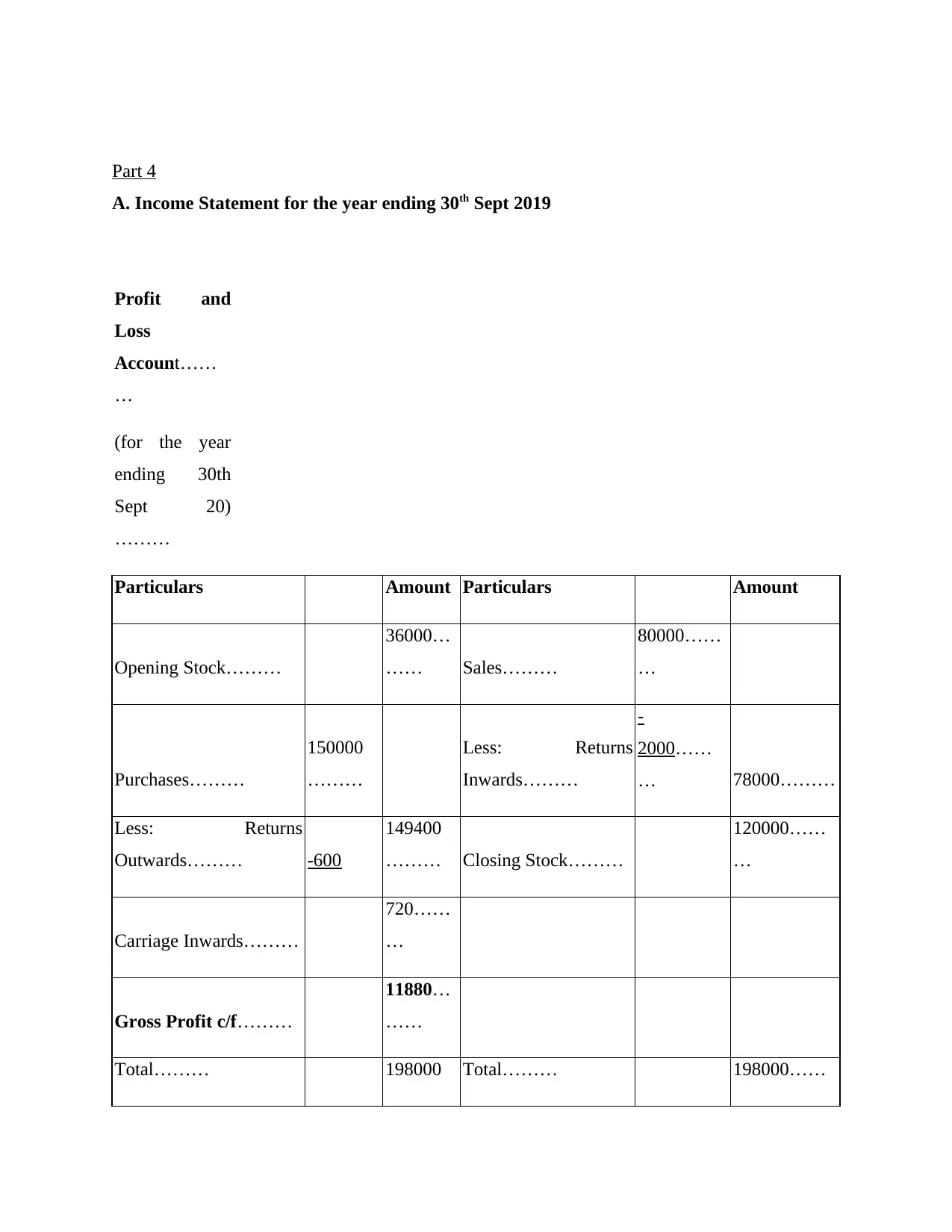

Part 4

A. Income Statement for the year ending 30th Sept 2019

Profit and

Loss

Account……

…

(for the year

ending 30th

Sept 20)

………

Particulars Amount Particulars Amount

Opening Stock………

36000…

…… Sales………

80000……

…

Purchases………

150000

………

Less: Returns

Inwards………

-

2000……

… 78000………

Less: Returns

Outwards……… -600

149400

……… Closing Stock………

120000……

…

Carriage Inwards………

720……

…

Gross Profit c/f………

11880…

……

Total……… 198000 Total……… 198000……

A. Income Statement for the year ending 30th Sept 2019

Profit and

Loss

Account……

…

(for the year

ending 30th

Sept 20)

………

Particulars Amount Particulars Amount

Opening Stock………

36000…

…… Sales………

80000……

…

Purchases………

150000

………

Less: Returns

Inwards………

-

2000……

… 78000………

Less: Returns

Outwards……… -600

149400

……… Closing Stock………

120000……

…

Carriage Inwards………

720……

…

Gross Profit c/f………

11880…

……

Total……… 198000 Total……… 198000……

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 26

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.