Decision Analysis for Restaurant Operation and Digital Company - 2018

VerifiedAdded on 2023/06/04

|9

|1134

|475

Homework Assignment

AI Summary

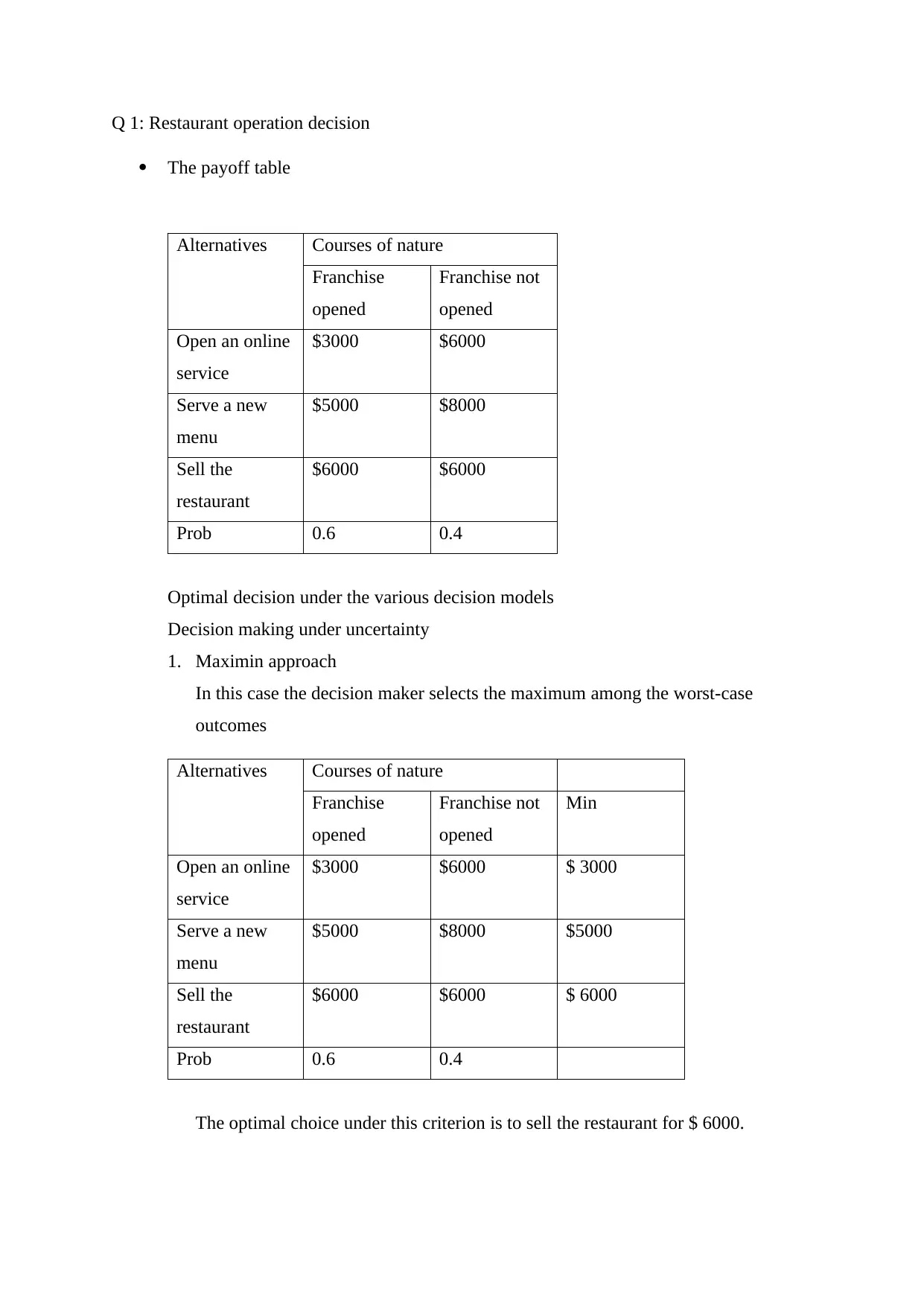

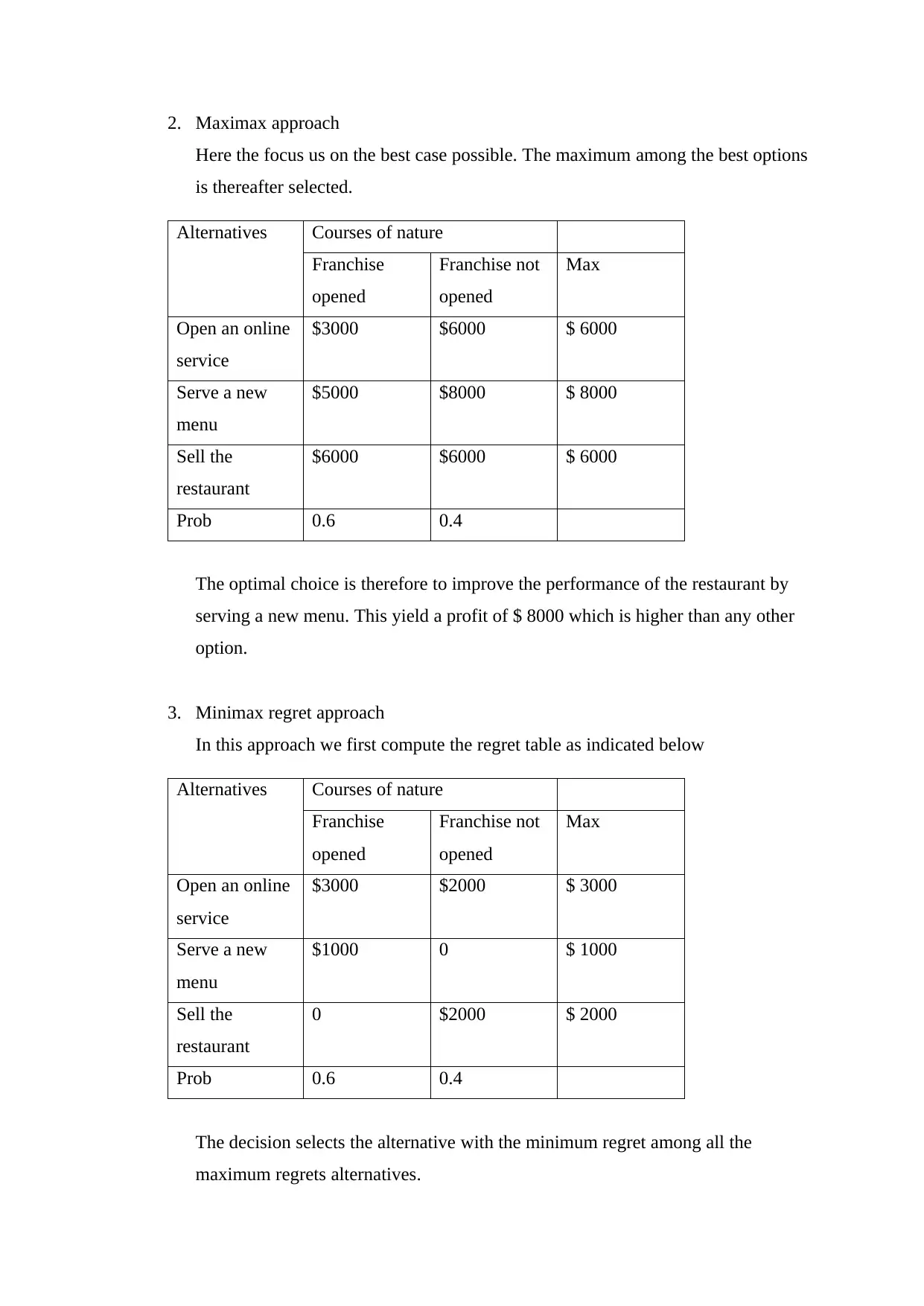

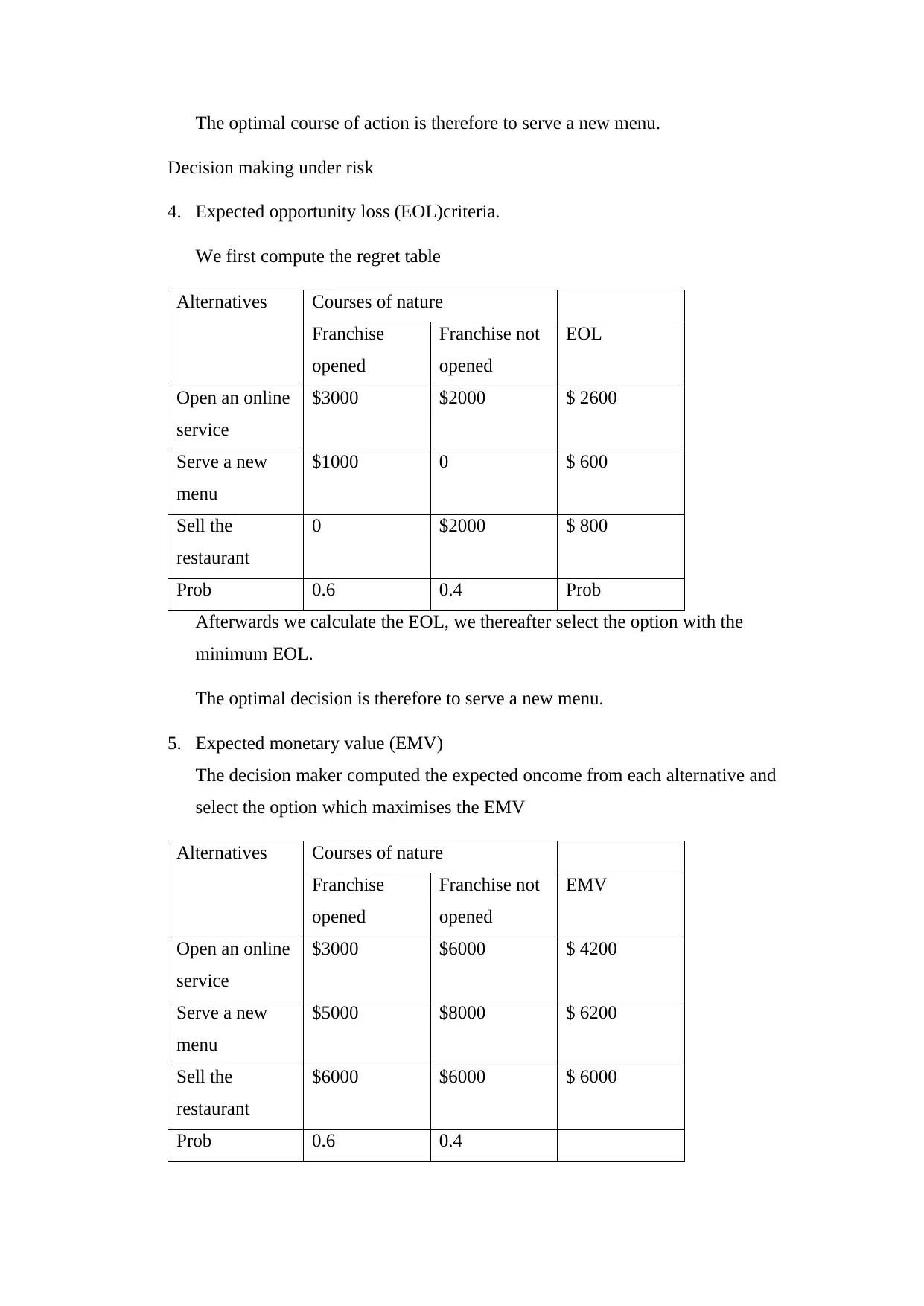

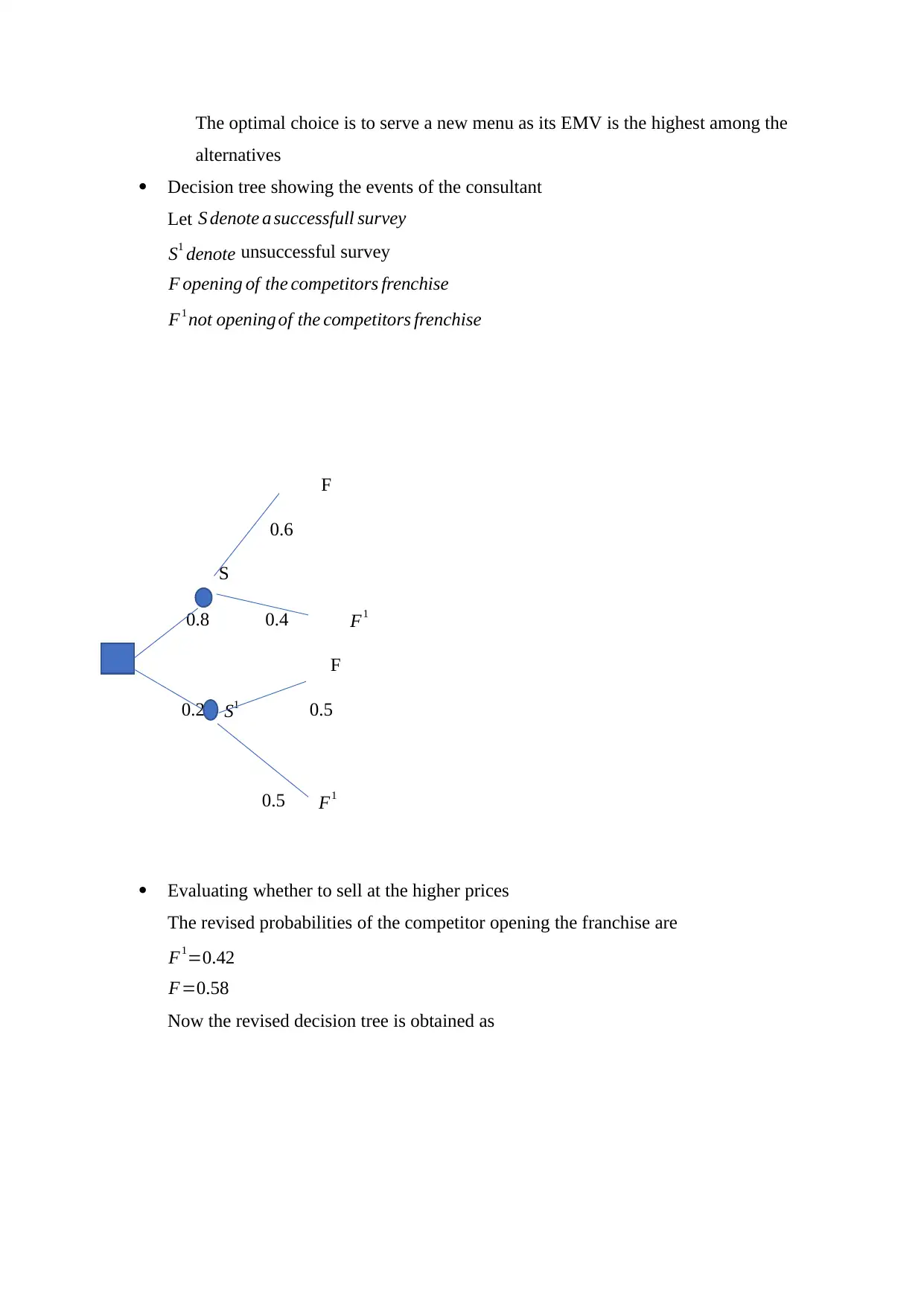

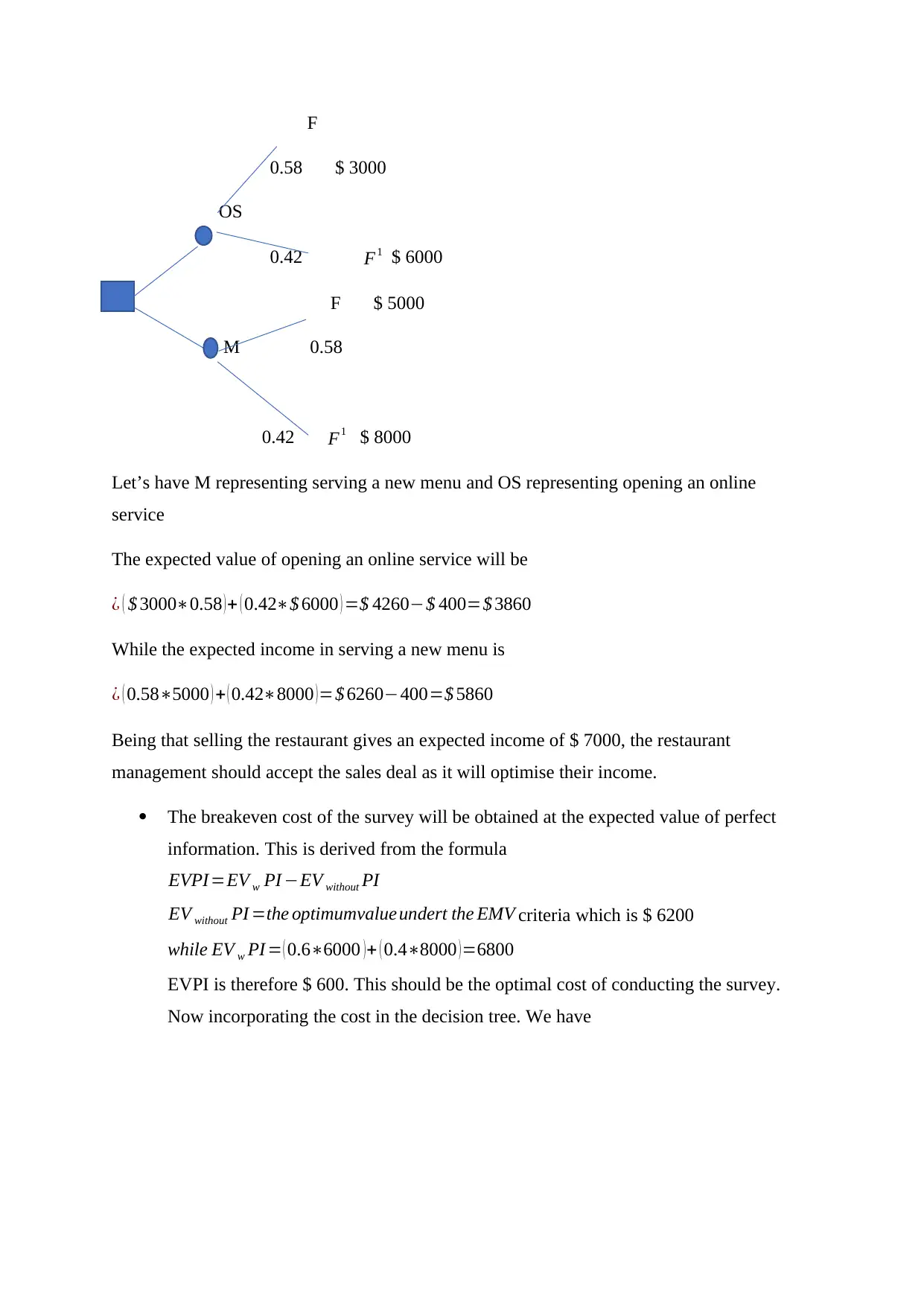

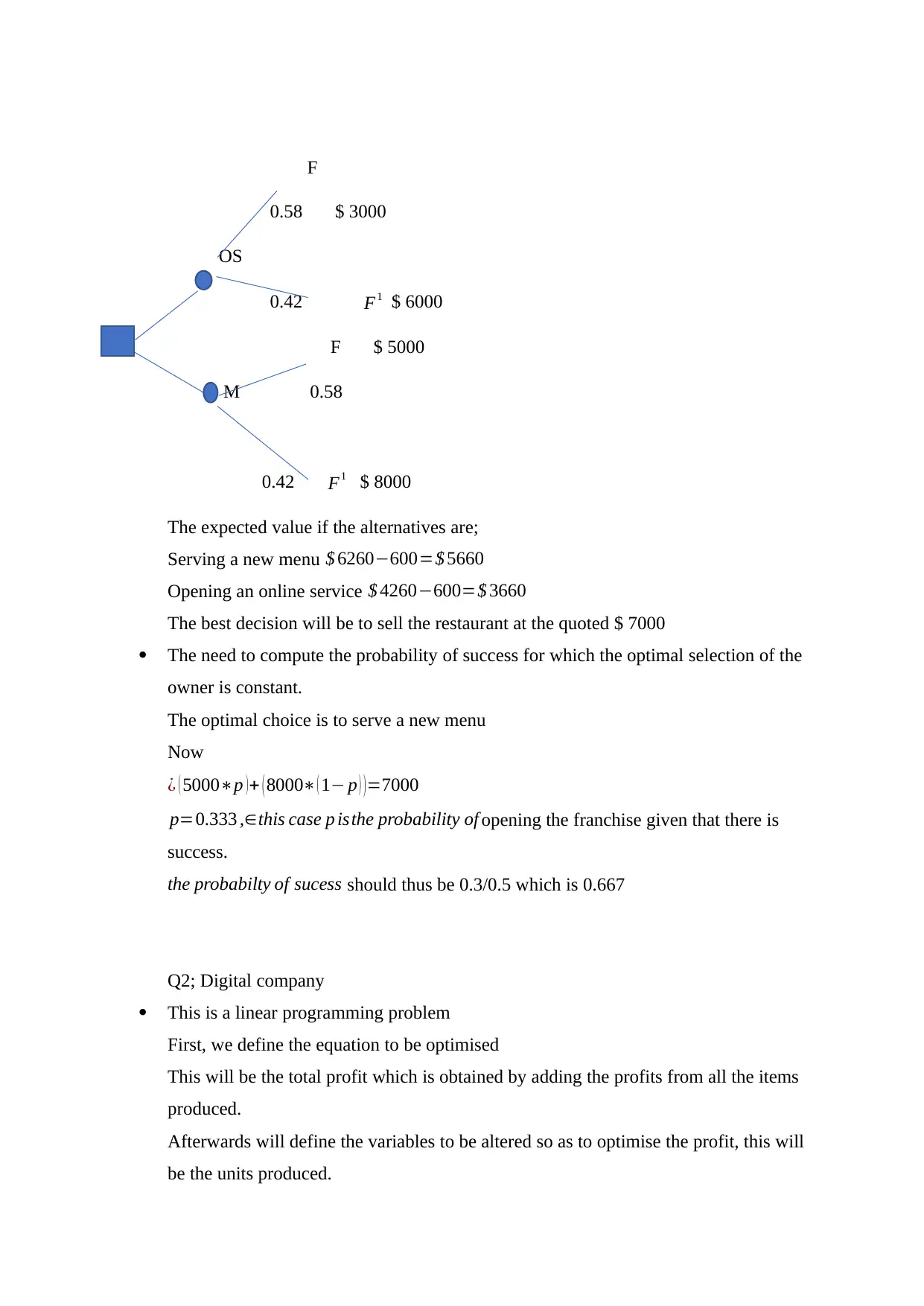

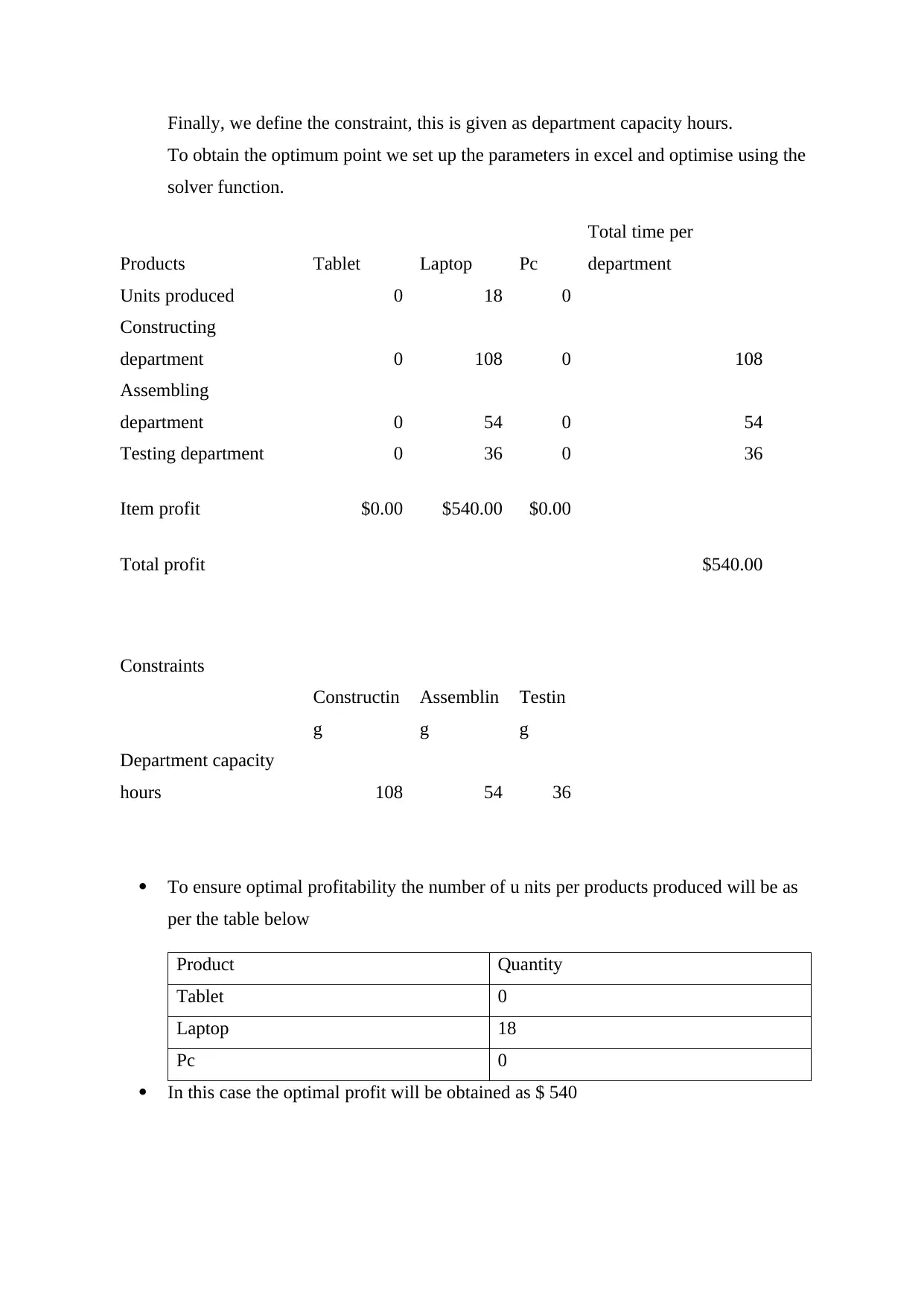

This assignment provides a detailed analysis of decision-making processes for a restaurant operation and a digital company. For the restaurant, it explores various decision models under uncertainty and risk, including maximin, maximax, minimax regret, expected opportunity loss (EOL), and expected monetary value (EMV). It also incorporates decision tree analysis to evaluate the impact of a competitor's franchise opening and the value of conducting a survey. Furthermore, it determines the breakeven cost of the survey and the probability of success required for a constant optimal selection. For the digital company, the assignment formulates a linear programming problem to optimize profit by determining the optimal production quantities of tablets, laptops, and PCs, subject to departmental capacity constraints. The solution utilizes Excel's solver function to find the optimal production plan and maximize profitability. Desklib provides past papers and solved assignments for students.

1 out of 9

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)