University Finance: Retirement and Estate Planning Report for Clients

VerifiedAdded on 2023/03/17

|20

|4784

|52

Report

AI Summary

This report presents a detailed financial analysis and planning strategy for Mark and Susan Saunders, focusing on retirement and estate planning. It begins with a covering letter and table of contents, followed by a comprehensive cash flow statement for the year ending June 30, 2017, detailing income, expenses, and taxable income. The report then models investment accumulation for shares, rental income, and superannuation accounts for both Mark and Susan, projecting their financial growth over time. The core of the report provides a breakdown of their asset allocation and recommends various financial strategies, including superannuation optimization, non-superannuation investment strategies, and estate planning. The report also includes personal insurance considerations and a detailed projection of post-retirement cash flows, offering insights into how the couple can maintain their desired standard of living. The recommendations include adjustments to their investment portfolio, savings plans, and the importance of maintaining a cash buffer, along with suggestions for periodic reviews of their investment portfolio and insurance coverage. Finally, the report concludes with a projected statement of cash flow after retirement, illustrating the impact of the recommended strategies. The report is well-structured, incorporating financial modeling, assumptions, and projections to provide a clear and concise analysis of the couple's financial situation and provides recommendations.

Running head: PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Principles of Retirement and Estate Planning

Name of the Student:

Name of the University:

Author’s Note:

Principles of Retirement and Estate Planning

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Covering Letter

To: Mark and Susan Saunders

41 Super Street Diamond Creek 3089

Melbourne

Sub: Covering Letter for the Report

Date: 14 May 2019

Respected Mr and Mrs Saunders,

In view of the conversation we had earlier during our appointment, we had gone through

interactions regarding the various aspects with respect to the financial resources and information

in order to build up an effective retirement planning and investment portfolio. According to our

discussions we had previously, the following paper consists of the report in which every question

has been answered in view to the answers desired. Please have a go through it thoroughly and

feel free to revert back in case any doubt arises and in need of any clarification.

The report has been prepared to cover every aspect in lieu of the retirement planning.

Regards

Malcolm Johnson

Financial Consultant

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Covering Letter

To: Mark and Susan Saunders

41 Super Street Diamond Creek 3089

Melbourne

Sub: Covering Letter for the Report

Date: 14 May 2019

Respected Mr and Mrs Saunders,

In view of the conversation we had earlier during our appointment, we had gone through

interactions regarding the various aspects with respect to the financial resources and information

in order to build up an effective retirement planning and investment portfolio. According to our

discussions we had previously, the following paper consists of the report in which every question

has been answered in view to the answers desired. Please have a go through it thoroughly and

feel free to revert back in case any doubt arises and in need of any clarification.

The report has been prepared to cover every aspect in lieu of the retirement planning.

Regards

Malcolm Johnson

Financial Consultant

2

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Table of Contents

Answer to question 1:......................................................................................................................3

Sub part (i):..................................................................................................................................3

Sub part (ii):.................................................................................................................................3

Sub part (iii):................................................................................................................................6

Sub part (iv):................................................................................................................................7

Sub part (v):...............................................................................................................................10

Answer to question 2:....................................................................................................................11

Bibliography:.................................................................................................................................16

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Table of Contents

Answer to question 1:......................................................................................................................3

Sub part (i):..................................................................................................................................3

Sub part (ii):.................................................................................................................................3

Sub part (iii):................................................................................................................................6

Sub part (iv):................................................................................................................................7

Sub part (v):...............................................................................................................................10

Answer to question 2:....................................................................................................................11

Bibliography:.................................................................................................................................16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Answer to question 1:

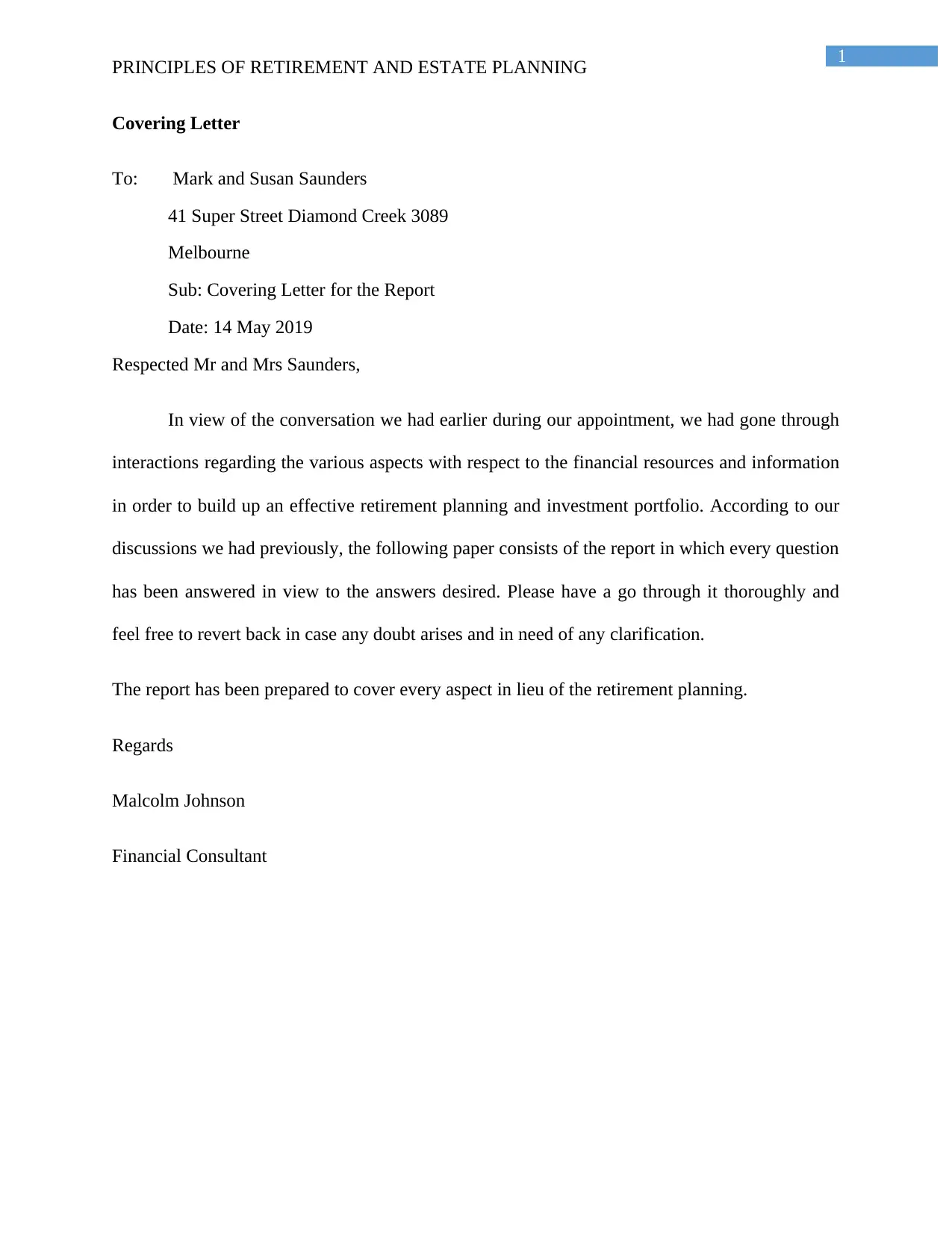

Sub part (i):

Statement of Cash flow for the Year 30 June 2017

Particulars Mark Susan Total

Income

Salary $ 32,000.00 $ 32,000.00

Superannuation contribution $ 3,200.00 $ 3,200.00

Net Income from Business $ 125,000.00 $ 125,000.00

Income from term deposit $ 1,000.00 $ 1,000.00

Dividend Income $ 4,000.00 $ 4,000.00

Total Income $ 125,000.00 $ 40,200.00 $ 165,200.00

Expenses $ -

Work related expenses $ 700.00 $ 700.00

Donation $ 100.00 $ 120.00 $ 220.00

Total Expenses $ 100.00 $ 820.00 $ 920.00

Net Income/ Taxable

income $ 124,900.00 $ 39,380.00 $ 164,280.00

Tax Payable $ 33,845.00 $ 4,024.20 $ 37,869.20

Medicare Levy $ 2,498.00 $ 787.60 $ 3,285.60

Gross Tax Payable $ 36,343.00 $ 4,811.80 $ 41,154.80

Franking credit $ 1,200.00 $ 1,200.00

Net income after tax $ 88,557.00 $ 33,368.20 $ 121,925.20

Adjustments $ -

Living Expenses $ 45,400.00 $ 14,600.00 $ 60,000.00

Mortgage and loan repayment $ 29,888.00 $ 9,612.00 $ 39,500.00

Expected Cash Surplus $ 13,269.00 $ 9,156.20 $ 22,425.20

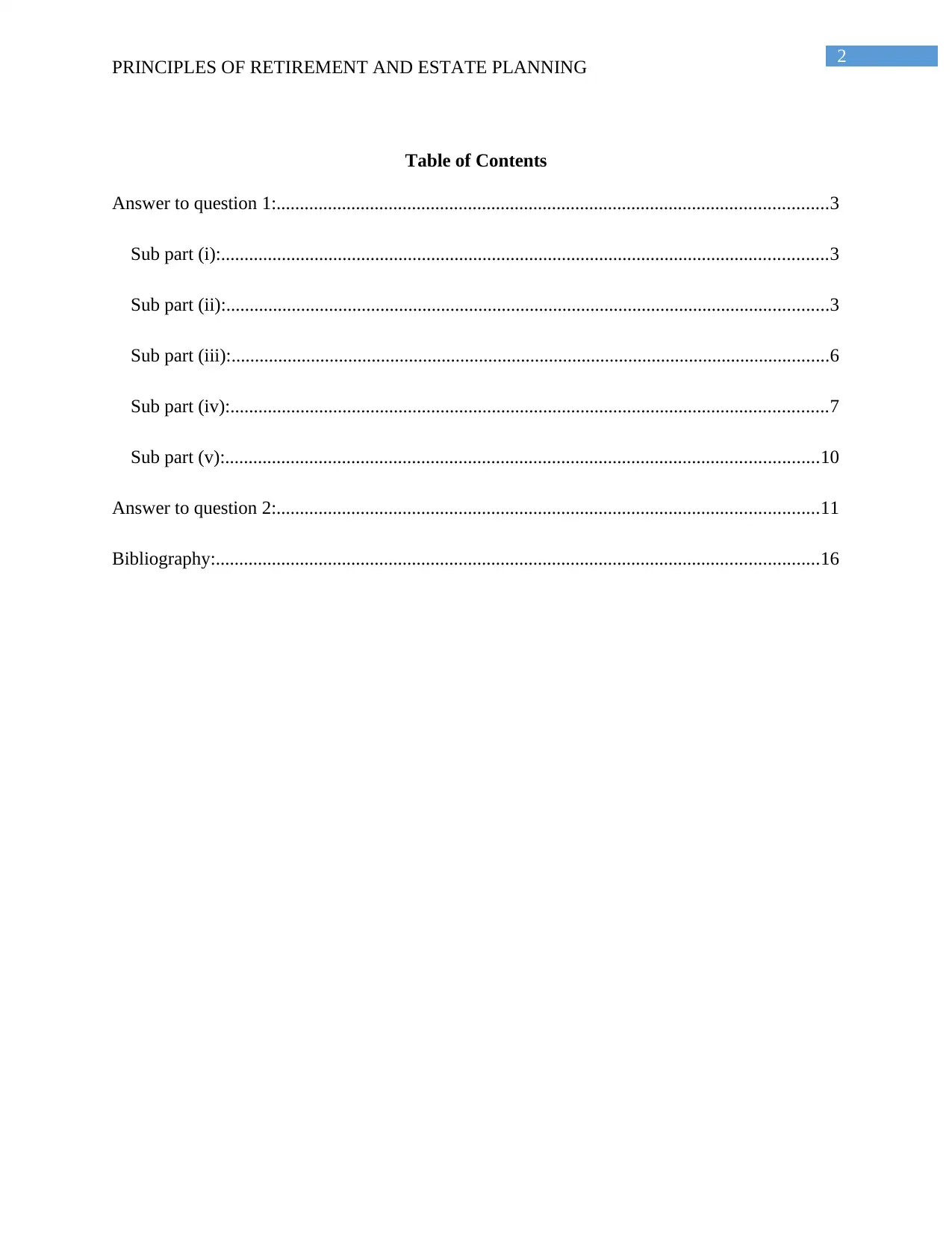

Sub part (ii):

Statement Showing Accumulation of Income from shares

Yea

r Opening Balance Growth Accumulated

closing Value

2017 $ 1,00,000.00 $ 6,000.00 $ 1,06,000.00

2018 $ 1,06,000.00 $ 6,360.00 $ 1,12,360.00

2019 $ 1,12,360.00 $ 6,741.60 $ 1,19,101.60

2020 $ 1,19,101.60 $ 7,146.10 $ 1,26,247.70

2021 $ 1,26,247.70 $ 7,574.86 $ 1,33,822.56

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Answer to question 1:

Sub part (i):

Statement of Cash flow for the Year 30 June 2017

Particulars Mark Susan Total

Income

Salary $ 32,000.00 $ 32,000.00

Superannuation contribution $ 3,200.00 $ 3,200.00

Net Income from Business $ 125,000.00 $ 125,000.00

Income from term deposit $ 1,000.00 $ 1,000.00

Dividend Income $ 4,000.00 $ 4,000.00

Total Income $ 125,000.00 $ 40,200.00 $ 165,200.00

Expenses $ -

Work related expenses $ 700.00 $ 700.00

Donation $ 100.00 $ 120.00 $ 220.00

Total Expenses $ 100.00 $ 820.00 $ 920.00

Net Income/ Taxable

income $ 124,900.00 $ 39,380.00 $ 164,280.00

Tax Payable $ 33,845.00 $ 4,024.20 $ 37,869.20

Medicare Levy $ 2,498.00 $ 787.60 $ 3,285.60

Gross Tax Payable $ 36,343.00 $ 4,811.80 $ 41,154.80

Franking credit $ 1,200.00 $ 1,200.00

Net income after tax $ 88,557.00 $ 33,368.20 $ 121,925.20

Adjustments $ -

Living Expenses $ 45,400.00 $ 14,600.00 $ 60,000.00

Mortgage and loan repayment $ 29,888.00 $ 9,612.00 $ 39,500.00

Expected Cash Surplus $ 13,269.00 $ 9,156.20 $ 22,425.20

Sub part (ii):

Statement Showing Accumulation of Income from shares

Yea

r Opening Balance Growth Accumulated

closing Value

2017 $ 1,00,000.00 $ 6,000.00 $ 1,06,000.00

2018 $ 1,06,000.00 $ 6,360.00 $ 1,12,360.00

2019 $ 1,12,360.00 $ 6,741.60 $ 1,19,101.60

2020 $ 1,19,101.60 $ 7,146.10 $ 1,26,247.70

2021 $ 1,26,247.70 $ 7,574.86 $ 1,33,822.56

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

2022 $ 1,33,822.56 $ 8,029.35 $ 1,41,851.91

2023 $ 1,41,851.91 $ 8,511.11 $ 1,50,363.03

2024 $ 1,50,363.03 $ 9,021.78 $ 1,59,384.81

2025 $ 1,59,384.81 $ 9,563.09 $ 1,68,947.90

2026 $ 1,68,947.90 $ 10,136.87 $ 1,79,084.77

2027 $ 1,79,084.77 $ 10,745.09 $ 1,89,829.86

2028 $ 1,89,829.86 $ 11,389.79 $ 2,01,219.65

2029 $ 2,01,219.65 $ 12,073.18 $ 2,13,292.83

2030 $ 2,13,292.83 $ 12,797.57 $ 2,26,090.40

Statement showing accumulated Income From rent

Yea

r value of Property Rental Income

2017 $ 3,20,000.00 $ 16,000.00

2018 $ 3,32,800.00 $ 16,640.00

2019 $ 3,46,112.00 $ 17,305.60

2020 $ 3,59,956.48 $ 17,997.82

2021 $ 3,74,354.74 $ 18,717.74

2022 $ 3,89,328.93 $ 19,466.45

2023 $ 4,04,902.09 $ 20,245.10

2024 $ 4,21,098.17 $ 21,054.91

2025 $ 4,37,942.10 $ 21,897.10

2026 $ 4,55,459.78 $ 22,772.99

2027 $ 4,73,678.17 $ 23,683.91

Mark

Statement showing Accumulation and income in Superannuation

Account

Yea

r S&M SMSF AMP Super Fund Return

2017 $ 40,000.00 $ 20,000.00 $ 3,520.00

2018 $ 41,200.00 $ 20,600.00 $ 3,625.60

2019 $ 42,436.00 $ 21,218.00 $ 3,734.37

2020 $ 43,709.08 $ 21,854.54 $ 3,846.40

2021 $ 45,020.35 $ 22,510.18 $ 3,961.79

2022 $ 46,370.96 $ 23,185.48 $ 4,080.64

2023 $ 47,762.09 $ 23,881.05 $ 4,203.06

2024 $ 49,194.95 $ 24,597.48 $ 4,329.16

2025 $ 50,670.80 $ 25,335.40 $ 4,459.03

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

2022 $ 1,33,822.56 $ 8,029.35 $ 1,41,851.91

2023 $ 1,41,851.91 $ 8,511.11 $ 1,50,363.03

2024 $ 1,50,363.03 $ 9,021.78 $ 1,59,384.81

2025 $ 1,59,384.81 $ 9,563.09 $ 1,68,947.90

2026 $ 1,68,947.90 $ 10,136.87 $ 1,79,084.77

2027 $ 1,79,084.77 $ 10,745.09 $ 1,89,829.86

2028 $ 1,89,829.86 $ 11,389.79 $ 2,01,219.65

2029 $ 2,01,219.65 $ 12,073.18 $ 2,13,292.83

2030 $ 2,13,292.83 $ 12,797.57 $ 2,26,090.40

Statement showing accumulated Income From rent

Yea

r value of Property Rental Income

2017 $ 3,20,000.00 $ 16,000.00

2018 $ 3,32,800.00 $ 16,640.00

2019 $ 3,46,112.00 $ 17,305.60

2020 $ 3,59,956.48 $ 17,997.82

2021 $ 3,74,354.74 $ 18,717.74

2022 $ 3,89,328.93 $ 19,466.45

2023 $ 4,04,902.09 $ 20,245.10

2024 $ 4,21,098.17 $ 21,054.91

2025 $ 4,37,942.10 $ 21,897.10

2026 $ 4,55,459.78 $ 22,772.99

2027 $ 4,73,678.17 $ 23,683.91

Mark

Statement showing Accumulation and income in Superannuation

Account

Yea

r S&M SMSF AMP Super Fund Return

2017 $ 40,000.00 $ 20,000.00 $ 3,520.00

2018 $ 41,200.00 $ 20,600.00 $ 3,625.60

2019 $ 42,436.00 $ 21,218.00 $ 3,734.37

2020 $ 43,709.08 $ 21,854.54 $ 3,846.40

2021 $ 45,020.35 $ 22,510.18 $ 3,961.79

2022 $ 46,370.96 $ 23,185.48 $ 4,080.64

2023 $ 47,762.09 $ 23,881.05 $ 4,203.06

2024 $ 49,194.95 $ 24,597.48 $ 4,329.16

2025 $ 50,670.80 $ 25,335.40 $ 4,459.03

5

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

2026 $ 52,190.93 $ 26,095.46 $ 4,592.80

2027 $ 53,756.66 $ 26,878.33 $ 4,730.59

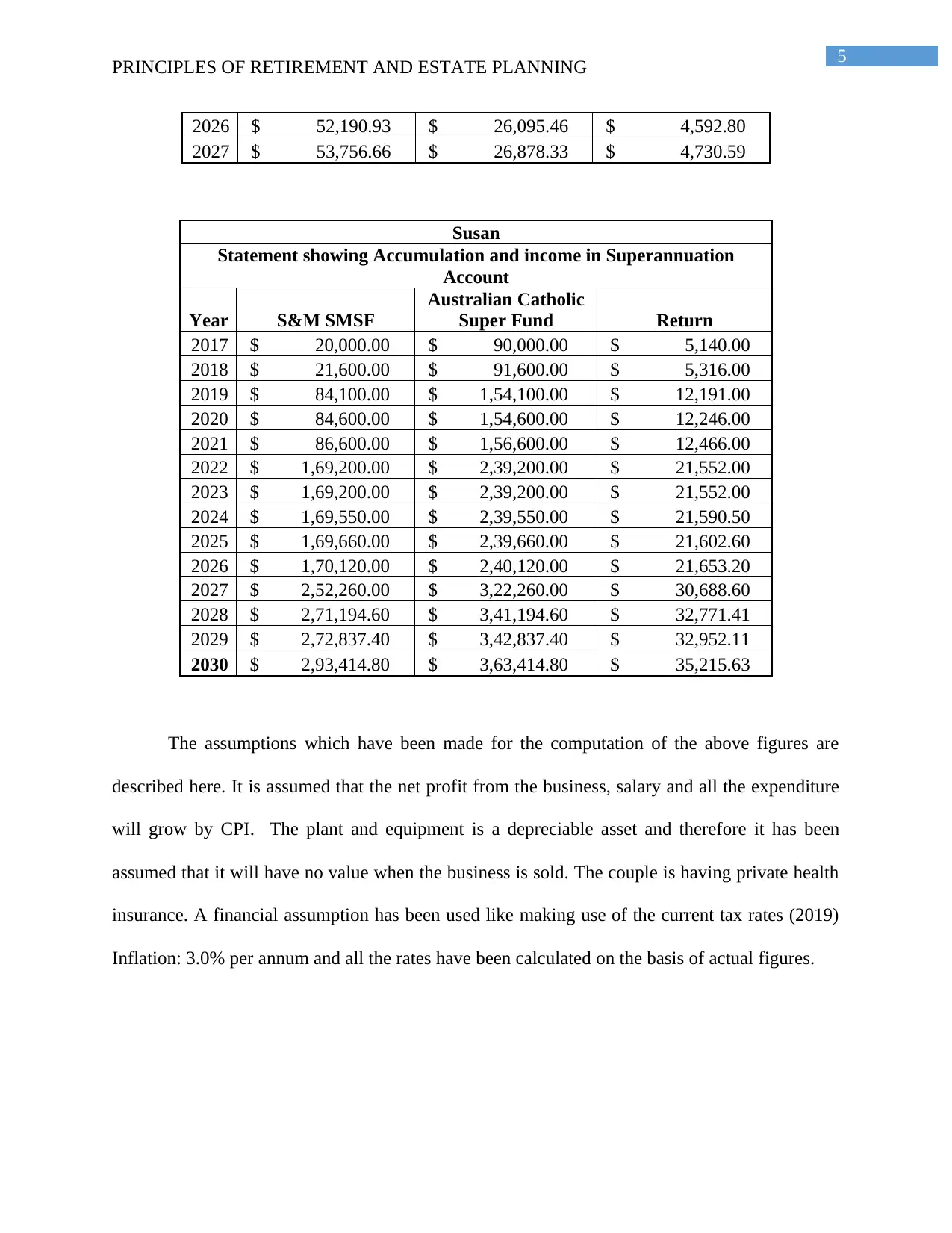

Susan

Statement showing Accumulation and income in Superannuation

Account

Year S&M SMSF

Australian Catholic

Super Fund Return

2017 $ 20,000.00 $ 90,000.00 $ 5,140.00

2018 $ 21,600.00 $ 91,600.00 $ 5,316.00

2019 $ 84,100.00 $ 1,54,100.00 $ 12,191.00

2020 $ 84,600.00 $ 1,54,600.00 $ 12,246.00

2021 $ 86,600.00 $ 1,56,600.00 $ 12,466.00

2022 $ 1,69,200.00 $ 2,39,200.00 $ 21,552.00

2023 $ 1,69,200.00 $ 2,39,200.00 $ 21,552.00

2024 $ 1,69,550.00 $ 2,39,550.00 $ 21,590.50

2025 $ 1,69,660.00 $ 2,39,660.00 $ 21,602.60

2026 $ 1,70,120.00 $ 2,40,120.00 $ 21,653.20

2027 $ 2,52,260.00 $ 3,22,260.00 $ 30,688.60

2028 $ 2,71,194.60 $ 3,41,194.60 $ 32,771.41

2029 $ 2,72,837.40 $ 3,42,837.40 $ 32,952.11

2030 $ 2,93,414.80 $ 3,63,414.80 $ 35,215.63

The assumptions which have been made for the computation of the above figures are

described here. It is assumed that the net profit from the business, salary and all the expenditure

will grow by CPI. The plant and equipment is a depreciable asset and therefore it has been

assumed that it will have no value when the business is sold. The couple is having private health

insurance. A financial assumption has been used like making use of the current tax rates (2019)

Inflation: 3.0% per annum and all the rates have been calculated on the basis of actual figures.

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

2026 $ 52,190.93 $ 26,095.46 $ 4,592.80

2027 $ 53,756.66 $ 26,878.33 $ 4,730.59

Susan

Statement showing Accumulation and income in Superannuation

Account

Year S&M SMSF

Australian Catholic

Super Fund Return

2017 $ 20,000.00 $ 90,000.00 $ 5,140.00

2018 $ 21,600.00 $ 91,600.00 $ 5,316.00

2019 $ 84,100.00 $ 1,54,100.00 $ 12,191.00

2020 $ 84,600.00 $ 1,54,600.00 $ 12,246.00

2021 $ 86,600.00 $ 1,56,600.00 $ 12,466.00

2022 $ 1,69,200.00 $ 2,39,200.00 $ 21,552.00

2023 $ 1,69,200.00 $ 2,39,200.00 $ 21,552.00

2024 $ 1,69,550.00 $ 2,39,550.00 $ 21,590.50

2025 $ 1,69,660.00 $ 2,39,660.00 $ 21,602.60

2026 $ 1,70,120.00 $ 2,40,120.00 $ 21,653.20

2027 $ 2,52,260.00 $ 3,22,260.00 $ 30,688.60

2028 $ 2,71,194.60 $ 3,41,194.60 $ 32,771.41

2029 $ 2,72,837.40 $ 3,42,837.40 $ 32,952.11

2030 $ 2,93,414.80 $ 3,63,414.80 $ 35,215.63

The assumptions which have been made for the computation of the above figures are

described here. It is assumed that the net profit from the business, salary and all the expenditure

will grow by CPI. The plant and equipment is a depreciable asset and therefore it has been

assumed that it will have no value when the business is sold. The couple is having private health

insurance. A financial assumption has been used like making use of the current tax rates (2019)

Inflation: 3.0% per annum and all the rates have been calculated on the basis of actual figures.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

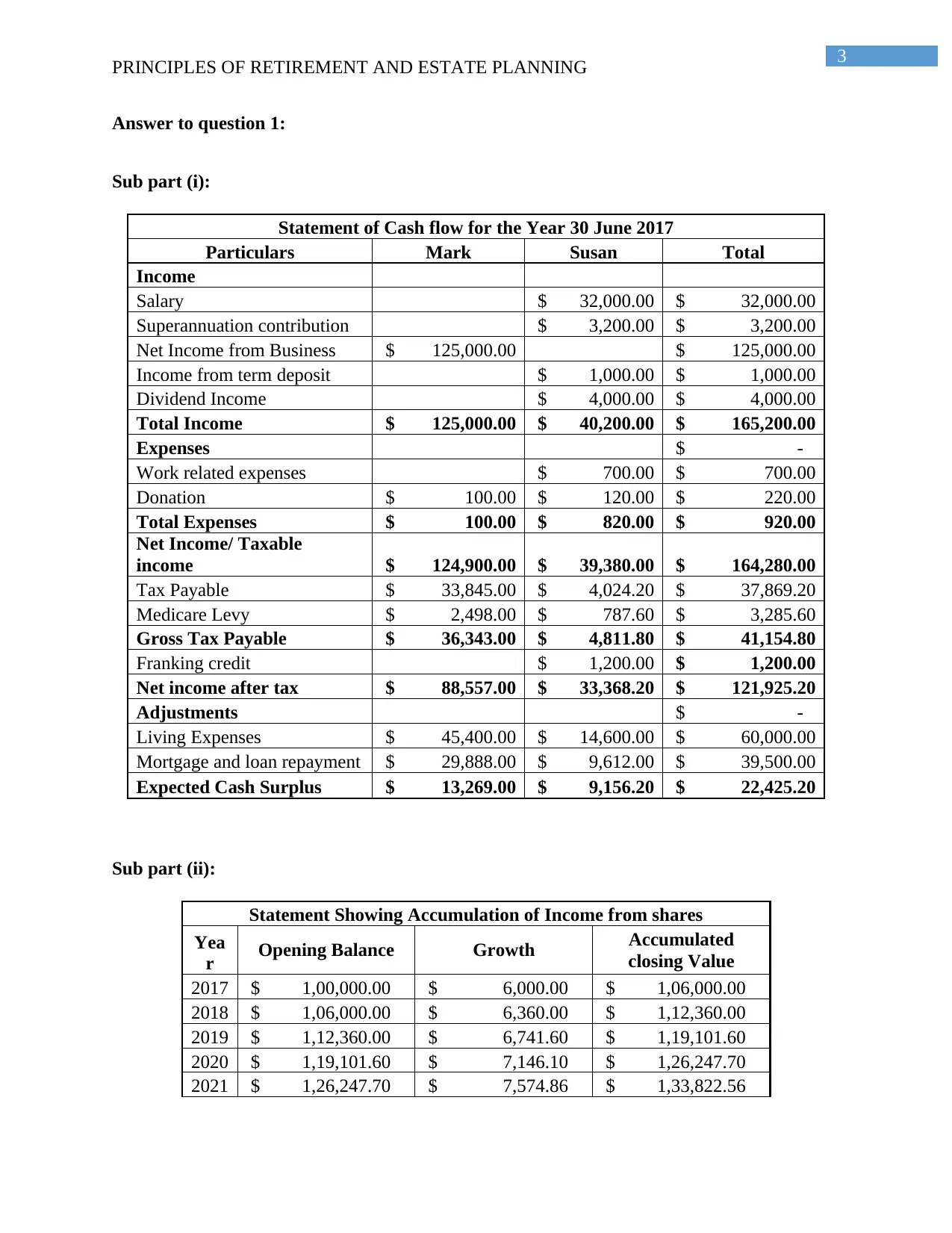

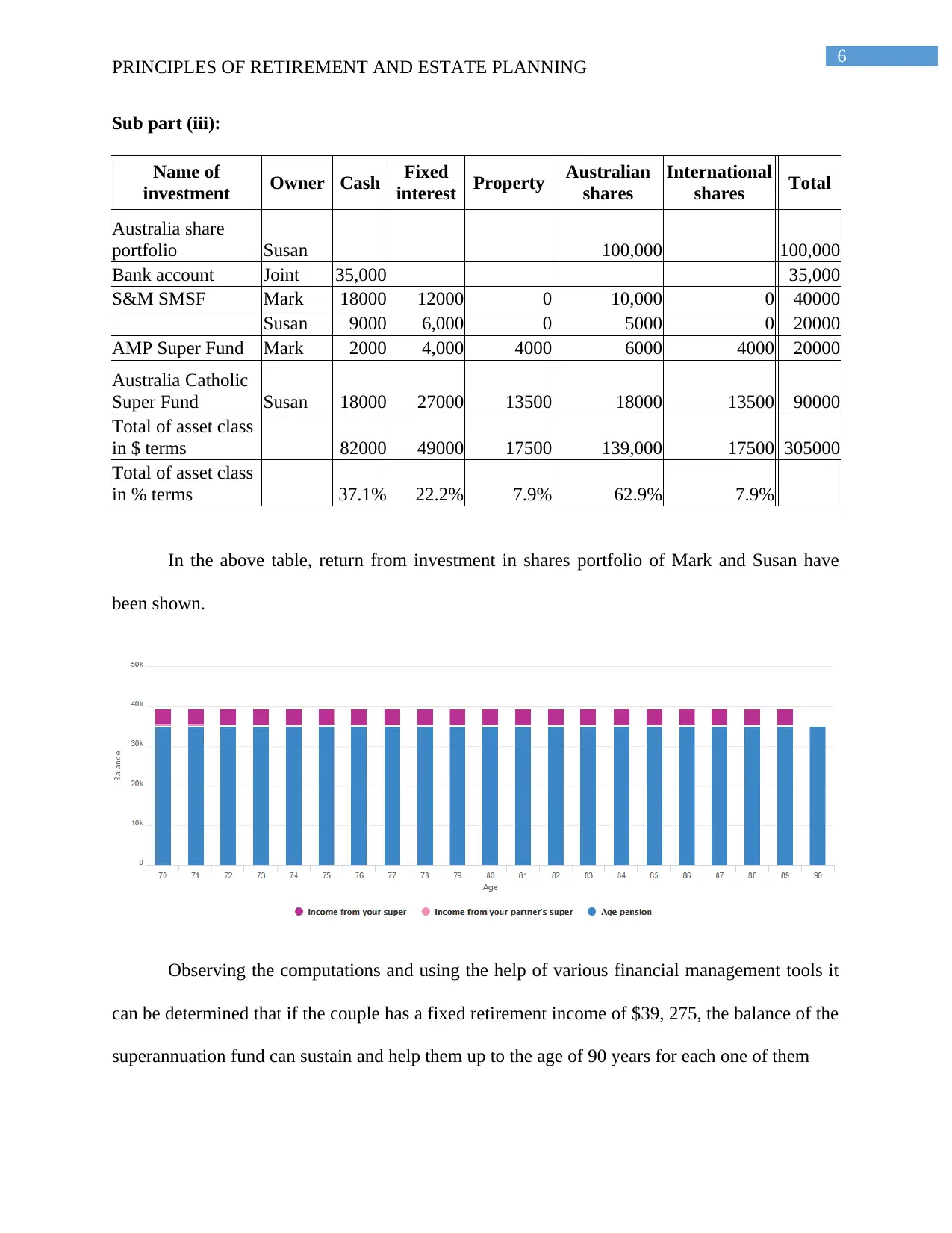

Sub part (iii):

Name of

investment Owner Cash Fixed

interest Property Australian

shares

International

shares Total

Australia share

portfolio Susan 100,000 100,000

Bank account Joint 35,000 35,000

S&M SMSF Mark 18000 12000 0 10,000 0 40000

Susan 9000 6,000 0 5000 0 20000

AMP Super Fund Mark 2000 4,000 4000 6000 4000 20000

Australia Catholic

Super Fund Susan 18000 27000 13500 18000 13500 90000

Total of asset class

in $ terms 82000 49000 17500 139,000 17500 305000

Total of asset class

in % terms 37.1% 22.2% 7.9% 62.9% 7.9%

In the above table, return from investment in shares portfolio of Mark and Susan have

been shown.

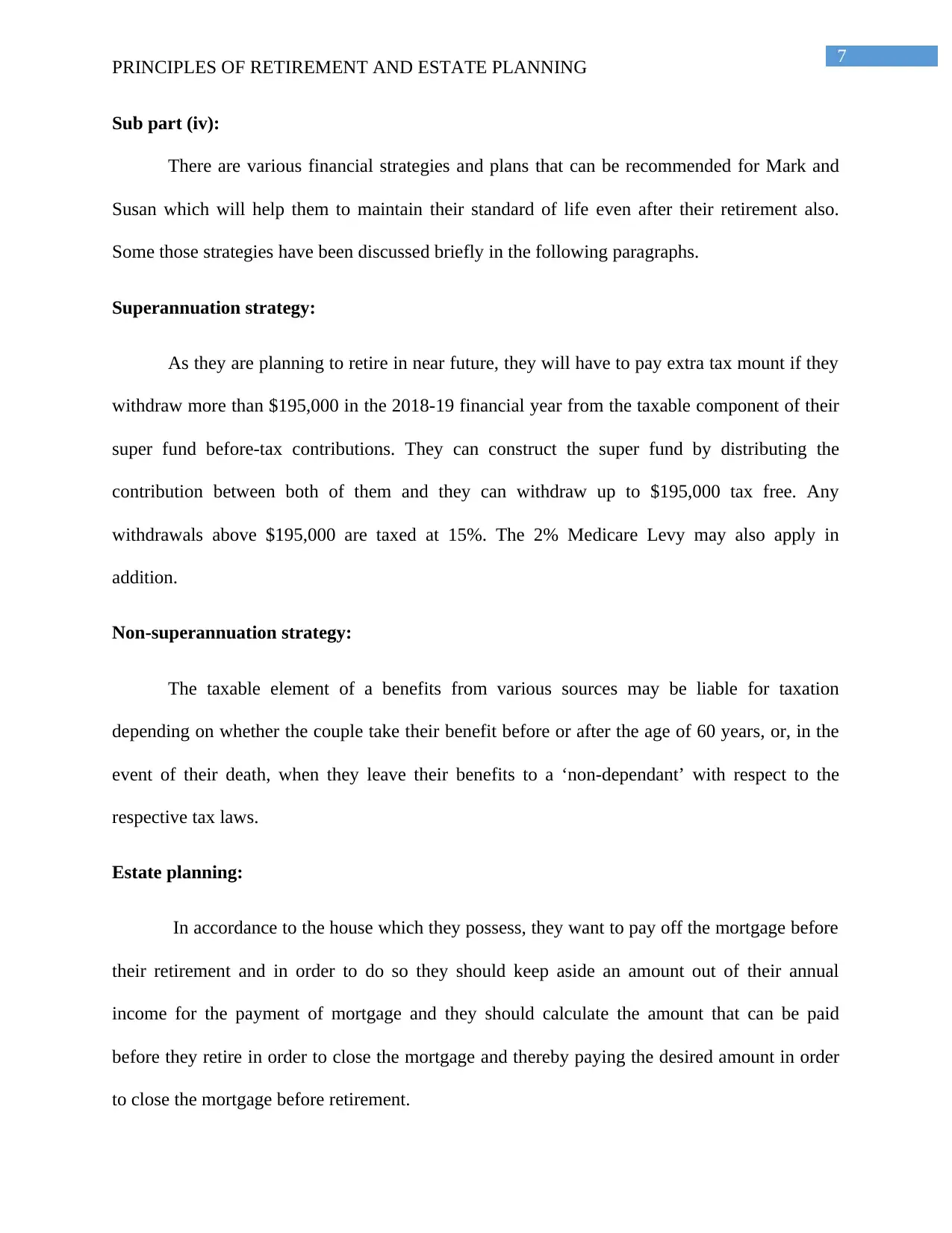

Observing the computations and using the help of various financial management tools it

can be determined that if the couple has a fixed retirement income of $39, 275, the balance of the

superannuation fund can sustain and help them up to the age of 90 years for each one of them

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Sub part (iii):

Name of

investment Owner Cash Fixed

interest Property Australian

shares

International

shares Total

Australia share

portfolio Susan 100,000 100,000

Bank account Joint 35,000 35,000

S&M SMSF Mark 18000 12000 0 10,000 0 40000

Susan 9000 6,000 0 5000 0 20000

AMP Super Fund Mark 2000 4,000 4000 6000 4000 20000

Australia Catholic

Super Fund Susan 18000 27000 13500 18000 13500 90000

Total of asset class

in $ terms 82000 49000 17500 139,000 17500 305000

Total of asset class

in % terms 37.1% 22.2% 7.9% 62.9% 7.9%

In the above table, return from investment in shares portfolio of Mark and Susan have

been shown.

Observing the computations and using the help of various financial management tools it

can be determined that if the couple has a fixed retirement income of $39, 275, the balance of the

superannuation fund can sustain and help them up to the age of 90 years for each one of them

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

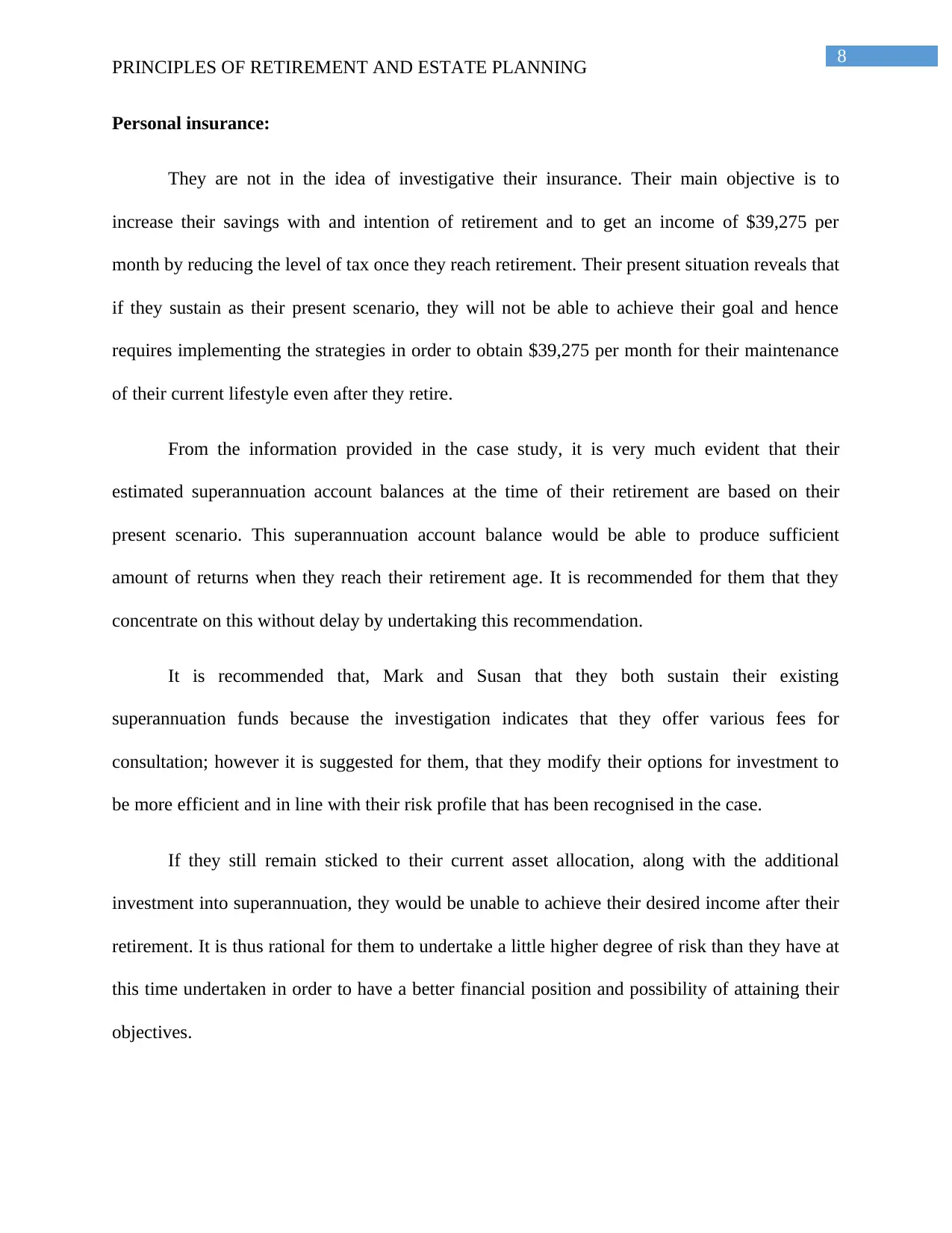

Sub part (iv):

There are various financial strategies and plans that can be recommended for Mark and

Susan which will help them to maintain their standard of life even after their retirement also.

Some those strategies have been discussed briefly in the following paragraphs.

Superannuation strategy:

As they are planning to retire in near future, they will have to pay extra tax mount if they

withdraw more than $195,000 in the 2018-19 financial year from the taxable component of their

super fund before-tax contributions. They can construct the super fund by distributing the

contribution between both of them and they can withdraw up to $195,000 tax free. Any

withdrawals above $195,000 are taxed at 15%. The 2% Medicare Levy may also apply in

addition.

Non-superannuation strategy:

The taxable element of a benefits from various sources may be liable for taxation

depending on whether the couple take their benefit before or after the age of 60 years, or, in the

event of their death, when they leave their benefits to a ‘non-dependant’ with respect to the

respective tax laws.

Estate planning:

In accordance to the house which they possess, they want to pay off the mortgage before

their retirement and in order to do so they should keep aside an amount out of their annual

income for the payment of mortgage and they should calculate the amount that can be paid

before they retire in order to close the mortgage and thereby paying the desired amount in order

to close the mortgage before retirement.

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Sub part (iv):

There are various financial strategies and plans that can be recommended for Mark and

Susan which will help them to maintain their standard of life even after their retirement also.

Some those strategies have been discussed briefly in the following paragraphs.

Superannuation strategy:

As they are planning to retire in near future, they will have to pay extra tax mount if they

withdraw more than $195,000 in the 2018-19 financial year from the taxable component of their

super fund before-tax contributions. They can construct the super fund by distributing the

contribution between both of them and they can withdraw up to $195,000 tax free. Any

withdrawals above $195,000 are taxed at 15%. The 2% Medicare Levy may also apply in

addition.

Non-superannuation strategy:

The taxable element of a benefits from various sources may be liable for taxation

depending on whether the couple take their benefit before or after the age of 60 years, or, in the

event of their death, when they leave their benefits to a ‘non-dependant’ with respect to the

respective tax laws.

Estate planning:

In accordance to the house which they possess, they want to pay off the mortgage before

their retirement and in order to do so they should keep aside an amount out of their annual

income for the payment of mortgage and they should calculate the amount that can be paid

before they retire in order to close the mortgage and thereby paying the desired amount in order

to close the mortgage before retirement.

8

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Personal insurance:

They are not in the idea of investigative their insurance. Their main objective is to

increase their savings with and intention of retirement and to get an income of $39,275 per

month by reducing the level of tax once they reach retirement. Their present situation reveals that

if they sustain as their present scenario, they will not be able to achieve their goal and hence

requires implementing the strategies in order to obtain $39,275 per month for their maintenance

of their current lifestyle even after they retire.

From the information provided in the case study, it is very much evident that their

estimated superannuation account balances at the time of their retirement are based on their

present scenario. This superannuation account balance would be able to produce sufficient

amount of returns when they reach their retirement age. It is recommended for them that they

concentrate on this without delay by undertaking this recommendation.

It is recommended that, Mark and Susan that they both sustain their existing

superannuation funds because the investigation indicates that they offer various fees for

consultation; however it is suggested for them, that they modify their options for investment to

be more efficient and in line with their risk profile that has been recognised in the case.

If they still remain sticked to their current asset allocation, along with the additional

investment into superannuation, they would be unable to achieve their desired income after their

retirement. It is thus rational for them to undertake a little higher degree of risk than they have at

this time undertaken in order to have a better financial position and possibility of attaining their

objectives.

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Personal insurance:

They are not in the idea of investigative their insurance. Their main objective is to

increase their savings with and intention of retirement and to get an income of $39,275 per

month by reducing the level of tax once they reach retirement. Their present situation reveals that

if they sustain as their present scenario, they will not be able to achieve their goal and hence

requires implementing the strategies in order to obtain $39,275 per month for their maintenance

of their current lifestyle even after they retire.

From the information provided in the case study, it is very much evident that their

estimated superannuation account balances at the time of their retirement are based on their

present scenario. This superannuation account balance would be able to produce sufficient

amount of returns when they reach their retirement age. It is recommended for them that they

concentrate on this without delay by undertaking this recommendation.

It is recommended that, Mark and Susan that they both sustain their existing

superannuation funds because the investigation indicates that they offer various fees for

consultation; however it is suggested for them, that they modify their options for investment to

be more efficient and in line with their risk profile that has been recognised in the case.

If they still remain sticked to their current asset allocation, along with the additional

investment into superannuation, they would be unable to achieve their desired income after their

retirement. It is thus rational for them to undertake a little higher degree of risk than they have at

this time undertaken in order to have a better financial position and possibility of attaining their

objectives.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

As they will still have an increased surplus income in future, it is suggested for them that

they should undertake various savings plan into a high income earning cash account to form up a

buffer for unprecedented events in future. It is recommended for them to keep a cash buffer and

it is recommended as a strategy that the couple with debt and investment property maintain a

buffer in case of unexpected operating expenses that may arise in future, or rising interest rates

on loans. It has been estimated that that they will need $39,275 per month for maintaining their

standard of living up to the age of 90 years and an earnings of 3% per annum net of inflation.

It is suggested for them to build a strategy to review their insurances once they have

built-in the strategies within their investment portfolio. Without considering this, assessment of

the risk of being over or under insured and probably unable to meet their demanded long-term

objectives and goals if something happens in future to anyone of them increases. It is further

suggested that assessment of the investment portfolio should be undertake periodically in order

to compare their return with respect to the market and undertake changes if it is necessary with

respect to the market in order to maintain their stable income. The couple should even maintain

sufficient balances for their children especially the one who is still undertaking education in

order to financially stabilise them in case anything happens to the couple in future.

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

As they will still have an increased surplus income in future, it is suggested for them that

they should undertake various savings plan into a high income earning cash account to form up a

buffer for unprecedented events in future. It is recommended for them to keep a cash buffer and

it is recommended as a strategy that the couple with debt and investment property maintain a

buffer in case of unexpected operating expenses that may arise in future, or rising interest rates

on loans. It has been estimated that that they will need $39,275 per month for maintaining their

standard of living up to the age of 90 years and an earnings of 3% per annum net of inflation.

It is suggested for them to build a strategy to review their insurances once they have

built-in the strategies within their investment portfolio. Without considering this, assessment of

the risk of being over or under insured and probably unable to meet their demanded long-term

objectives and goals if something happens in future to anyone of them increases. It is further

suggested that assessment of the investment portfolio should be undertake periodically in order

to compare their return with respect to the market and undertake changes if it is necessary with

respect to the market in order to maintain their stable income. The couple should even maintain

sufficient balances for their children especially the one who is still undertaking education in

order to financially stabilise them in case anything happens to the couple in future.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

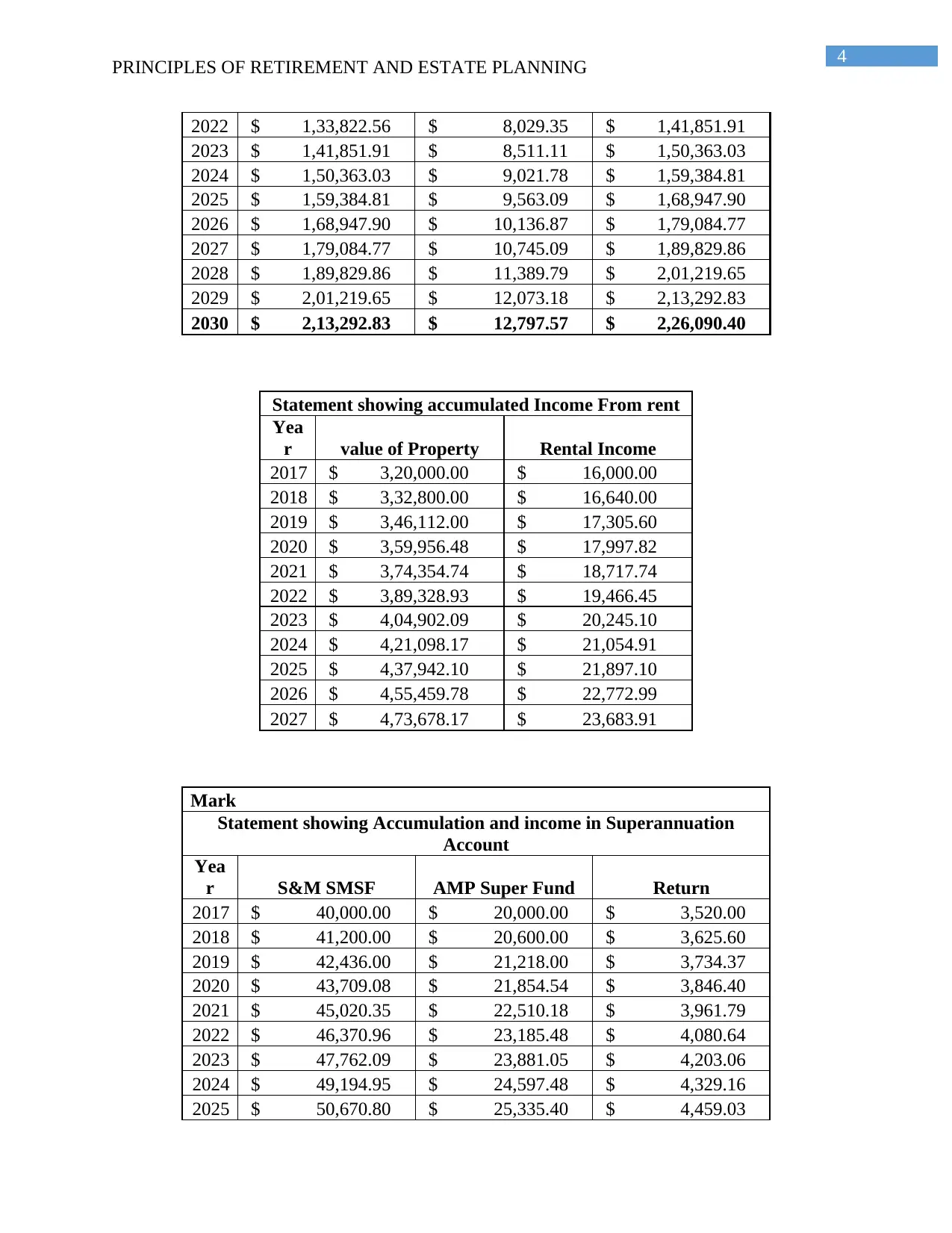

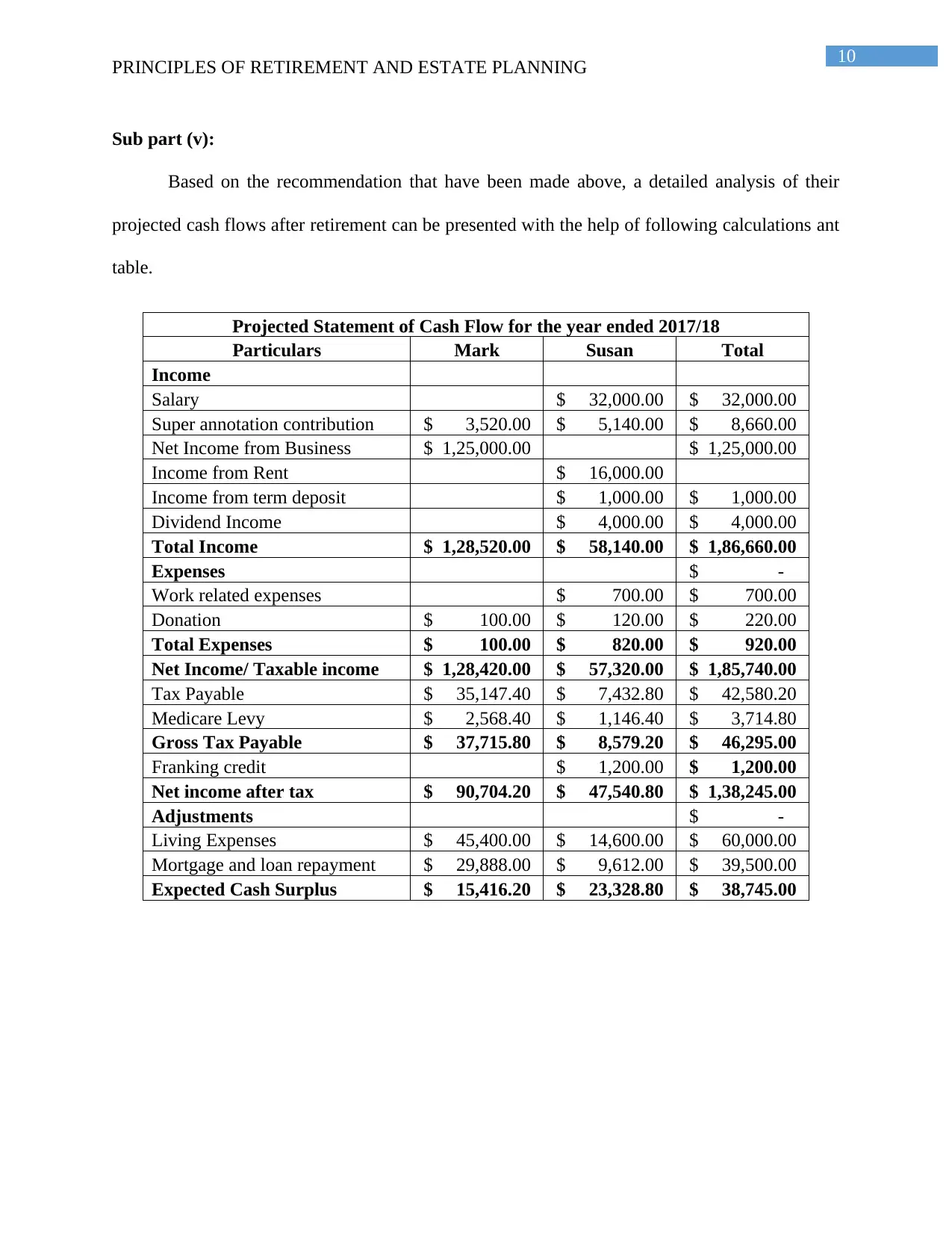

Sub part (v):

Based on the recommendation that have been made above, a detailed analysis of their

projected cash flows after retirement can be presented with the help of following calculations ant

table.

Projected Statement of Cash Flow for the year ended 2017/18

Particulars Mark Susan Total

Income

Salary $ 32,000.00 $ 32,000.00

Super annotation contribution $ 3,520.00 $ 5,140.00 $ 8,660.00

Net Income from Business $ 1,25,000.00 $ 1,25,000.00

Income from Rent $ 16,000.00

Income from term deposit $ 1,000.00 $ 1,000.00

Dividend Income $ 4,000.00 $ 4,000.00

Total Income $ 1,28,520.00 $ 58,140.00 $ 1,86,660.00

Expenses $ -

Work related expenses $ 700.00 $ 700.00

Donation $ 100.00 $ 120.00 $ 220.00

Total Expenses $ 100.00 $ 820.00 $ 920.00

Net Income/ Taxable income $ 1,28,420.00 $ 57,320.00 $ 1,85,740.00

Tax Payable $ 35,147.40 $ 7,432.80 $ 42,580.20

Medicare Levy $ 2,568.40 $ 1,146.40 $ 3,714.80

Gross Tax Payable $ 37,715.80 $ 8,579.20 $ 46,295.00

Franking credit $ 1,200.00 $ 1,200.00

Net income after tax $ 90,704.20 $ 47,540.80 $ 1,38,245.00

Adjustments $ -

Living Expenses $ 45,400.00 $ 14,600.00 $ 60,000.00

Mortgage and loan repayment $ 29,888.00 $ 9,612.00 $ 39,500.00

Expected Cash Surplus $ 15,416.20 $ 23,328.80 $ 38,745.00

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Sub part (v):

Based on the recommendation that have been made above, a detailed analysis of their

projected cash flows after retirement can be presented with the help of following calculations ant

table.

Projected Statement of Cash Flow for the year ended 2017/18

Particulars Mark Susan Total

Income

Salary $ 32,000.00 $ 32,000.00

Super annotation contribution $ 3,520.00 $ 5,140.00 $ 8,660.00

Net Income from Business $ 1,25,000.00 $ 1,25,000.00

Income from Rent $ 16,000.00

Income from term deposit $ 1,000.00 $ 1,000.00

Dividend Income $ 4,000.00 $ 4,000.00

Total Income $ 1,28,520.00 $ 58,140.00 $ 1,86,660.00

Expenses $ -

Work related expenses $ 700.00 $ 700.00

Donation $ 100.00 $ 120.00 $ 220.00

Total Expenses $ 100.00 $ 820.00 $ 920.00

Net Income/ Taxable income $ 1,28,420.00 $ 57,320.00 $ 1,85,740.00

Tax Payable $ 35,147.40 $ 7,432.80 $ 42,580.20

Medicare Levy $ 2,568.40 $ 1,146.40 $ 3,714.80

Gross Tax Payable $ 37,715.80 $ 8,579.20 $ 46,295.00

Franking credit $ 1,200.00 $ 1,200.00

Net income after tax $ 90,704.20 $ 47,540.80 $ 1,38,245.00

Adjustments $ -

Living Expenses $ 45,400.00 $ 14,600.00 $ 60,000.00

Mortgage and loan repayment $ 29,888.00 $ 9,612.00 $ 39,500.00

Expected Cash Surplus $ 15,416.20 $ 23,328.80 $ 38,745.00

11

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Answer to question 2:

It can be observed that Mark and Susan have an intention of maximising their income

before they reach their retirement age. They are having sufficient amount of superannuation fund

as well as salary and other income in the current period of time and therefore they have the

intention and able to undertake an investment plan that would reap considerable amount of

revenue in a socially responsible manner. The couple hence has a strong willpower to make sure

that they undertaken investments in a communally responsible manner. They are even having the

idea of ensuring that they abstain from investing in organizations that have a negative impact on

the society and the environment. There are certain business organizations like the tobacco, liquor

and chemical industries that have an adverse impact on the society and the environment and

hence they look to stay away from investing in such businesses.

On the other hand, they are even concerned about undertaking investments in a socially

responsible way might create revenue or return that may be relatively be lower in value than

other investments opportunities. Hence, it has become necessary to establish the couple about the

meaning of investing in a socially responsible approach. An investment would be considered as

socially responsible by the nature of the operations undertaken by the organization where the

investment is made. The general situation for communally responsible investment includes not

taking investments in organizations which associated with gambling tobacco and liquoring

industries and undertaking investments in firms who are engaged in efforts for cleaner

environment friendly technology, environmental sustainability and communal justice in the

society. Such investments can be undertaken with the help of investments in individual

PRINCIPLES OF RETIREMENT AND ESTATE PLANNING

Answer to question 2:

It can be observed that Mark and Susan have an intention of maximising their income

before they reach their retirement age. They are having sufficient amount of superannuation fund

as well as salary and other income in the current period of time and therefore they have the

intention and able to undertake an investment plan that would reap considerable amount of

revenue in a socially responsible manner. The couple hence has a strong willpower to make sure

that they undertaken investments in a communally responsible manner. They are even having the

idea of ensuring that they abstain from investing in organizations that have a negative impact on

the society and the environment. There are certain business organizations like the tobacco, liquor

and chemical industries that have an adverse impact on the society and the environment and

hence they look to stay away from investing in such businesses.

On the other hand, they are even concerned about undertaking investments in a socially

responsible way might create revenue or return that may be relatively be lower in value than

other investments opportunities. Hence, it has become necessary to establish the couple about the

meaning of investing in a socially responsible approach. An investment would be considered as

socially responsible by the nature of the operations undertaken by the organization where the

investment is made. The general situation for communally responsible investment includes not

taking investments in organizations which associated with gambling tobacco and liquoring

industries and undertaking investments in firms who are engaged in efforts for cleaner

environment friendly technology, environmental sustainability and communal justice in the

society. Such investments can be undertaken with the help of investments in individual

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.