MBA403: Financial Analysis of Rio Tinto - Investor Report

VerifiedAdded on 2022/12/29

|3

|1154

|56

Report

AI Summary

This report presents an investor analysis of Rio Tinto, evaluating its financial performance based on its annual report and market data. The executive summary highlights profitability ratios, revealing a decrease in gross profit but an increase in net income and profit margin, indicating revenue generation. Liquidity ratios show a decrease in current assets but an increase in the current ratio due to decreased liabilities. The report also examines cash flow management, economic crises, and market analysis, including earning per share. Non-financial information covers Rio Tinto's international operations, market trends, and competitive landscape. The report concludes with recommendations for maintaining shareholder relations and expanding business. The analysis considers factors like the 4 P's strategy, management structure, and competitor analysis, providing a comprehensive overview of Rio Tinto's financial health and market position.

Executive Summary

The main aim of this report is to evaluate the financial position of the company. The company financial and non-financial

information has been evaluated in this report to evaluate its position in the market. Rio Tinto has been taken into

consideration to evaluate the financial report of the company. Rio Tinto is the multinational mining company in Australia.

The liquidity, cash management, profitability and market analysis has been evaluated to analyse the financial position with

the financial information data. At the end of the report, the non-financial information of the organisation has been analysed

to identify the market position of Rio Tinto.

Profitability Ratio

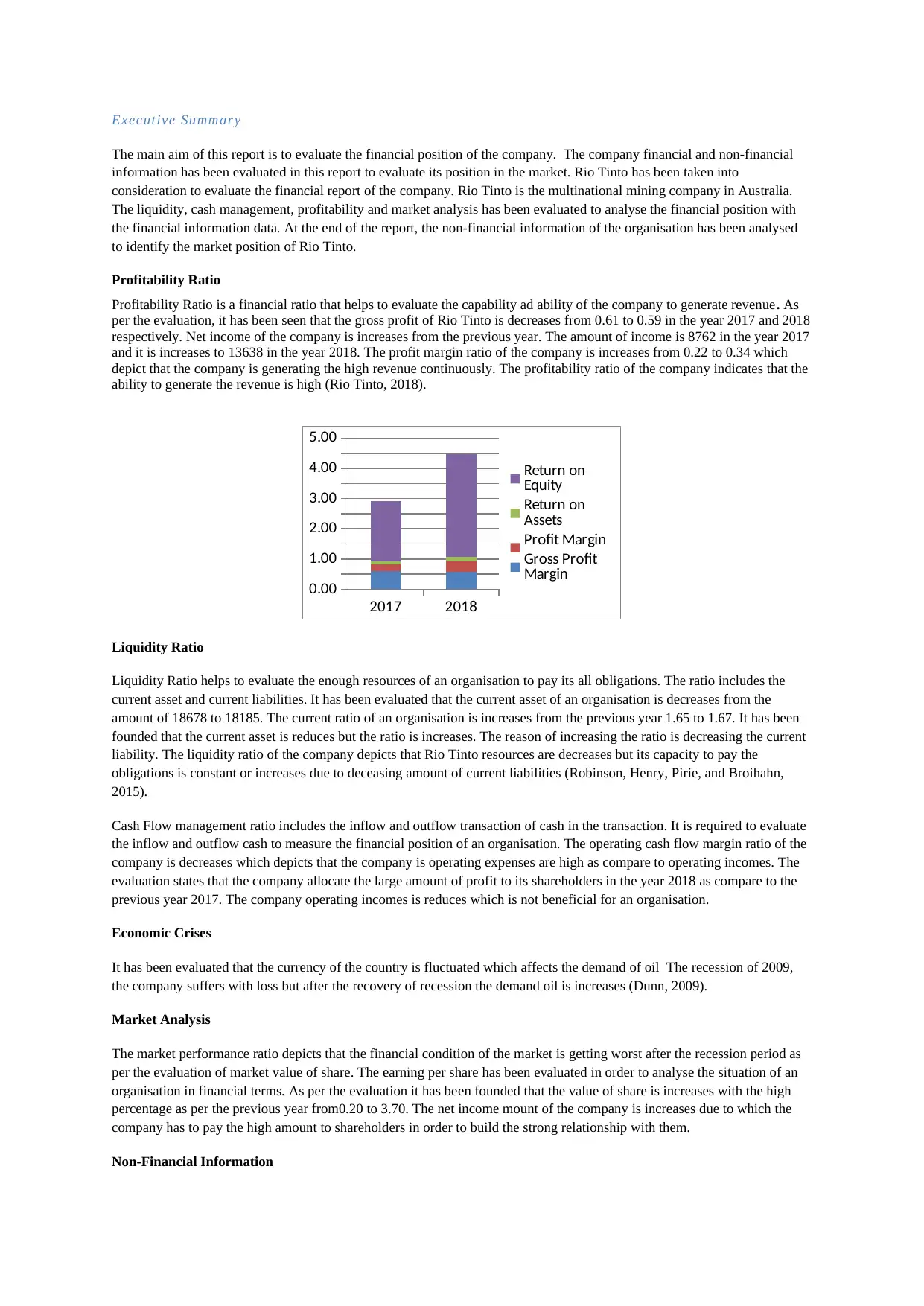

Profitability Ratio is a financial ratio that helps to evaluate the capability ad ability of the company to generate revenue. As

per the evaluation, it has been seen that the gross profit of Rio Tinto is decreases from 0.61 to 0.59 in the year 2017 and 2018

respectively. Net income of the company is increases from the previous year. The amount of income is 8762 in the year 2017

and it is increases to 13638 in the year 2018. The profit margin ratio of the company is increases from 0.22 to 0.34 which

depict that the company is generating the high revenue continuously. The profitability ratio of the company indicates that the

ability to generate the revenue is high (Rio Tinto, 2018).

2017 2018

0.00

1.00

2.00

3.00

4.00

5.00

Return on

Equity

Return on

Assets

Profit Margin

Gross Profit

Margin

Liquidity Ratio

Liquidity Ratio helps to evaluate the enough resources of an organisation to pay its all obligations. The ratio includes the

current asset and current liabilities. It has been evaluated that the current asset of an organisation is decreases from the

amount of 18678 to 18185. The current ratio of an organisation is increases from the previous year 1.65 to 1.67. It has been

founded that the current asset is reduces but the ratio is increases. The reason of increasing the ratio is decreasing the current

liability. The liquidity ratio of the company depicts that Rio Tinto resources are decreases but its capacity to pay the

obligations is constant or increases due to deceasing amount of current liabilities (Robinson, Henry, Pirie, and Broihahn,

2015).

Cash Flow management ratio includes the inflow and outflow transaction of cash in the transaction. It is required to evaluate

the inflow and outflow cash to measure the financial position of an organisation. The operating cash flow margin ratio of the

company is decreases which depicts that the company is operating expenses are high as compare to operating incomes. The

evaluation states that the company allocate the large amount of profit to its shareholders in the year 2018 as compare to the

previous year 2017. The company operating incomes is reduces which is not beneficial for an organisation.

Economic Crises

It has been evaluated that the currency of the country is fluctuated which affects the demand of oil The recession of 2009,

the company suffers with loss but after the recovery of recession the demand oil is increases (Dunn, 2009).

Market Analysis

The market performance ratio depicts that the financial condition of the market is getting worst after the recession period as

per the evaluation of market value of share. The earning per share has been evaluated in order to analyse the situation of an

organisation in financial terms. As per the evaluation it has been founded that the value of share is increases with the high

percentage as per the previous year from0.20 to 3.70. The net income mount of the company is increases due to which the

company has to pay the high amount to shareholders in order to build the strong relationship with them.

Non-Financial Information

The main aim of this report is to evaluate the financial position of the company. The company financial and non-financial

information has been evaluated in this report to evaluate its position in the market. Rio Tinto has been taken into

consideration to evaluate the financial report of the company. Rio Tinto is the multinational mining company in Australia.

The liquidity, cash management, profitability and market analysis has been evaluated to analyse the financial position with

the financial information data. At the end of the report, the non-financial information of the organisation has been analysed

to identify the market position of Rio Tinto.

Profitability Ratio

Profitability Ratio is a financial ratio that helps to evaluate the capability ad ability of the company to generate revenue. As

per the evaluation, it has been seen that the gross profit of Rio Tinto is decreases from 0.61 to 0.59 in the year 2017 and 2018

respectively. Net income of the company is increases from the previous year. The amount of income is 8762 in the year 2017

and it is increases to 13638 in the year 2018. The profit margin ratio of the company is increases from 0.22 to 0.34 which

depict that the company is generating the high revenue continuously. The profitability ratio of the company indicates that the

ability to generate the revenue is high (Rio Tinto, 2018).

2017 2018

0.00

1.00

2.00

3.00

4.00

5.00

Return on

Equity

Return on

Assets

Profit Margin

Gross Profit

Margin

Liquidity Ratio

Liquidity Ratio helps to evaluate the enough resources of an organisation to pay its all obligations. The ratio includes the

current asset and current liabilities. It has been evaluated that the current asset of an organisation is decreases from the

amount of 18678 to 18185. The current ratio of an organisation is increases from the previous year 1.65 to 1.67. It has been

founded that the current asset is reduces but the ratio is increases. The reason of increasing the ratio is decreasing the current

liability. The liquidity ratio of the company depicts that Rio Tinto resources are decreases but its capacity to pay the

obligations is constant or increases due to deceasing amount of current liabilities (Robinson, Henry, Pirie, and Broihahn,

2015).

Cash Flow management ratio includes the inflow and outflow transaction of cash in the transaction. It is required to evaluate

the inflow and outflow cash to measure the financial position of an organisation. The operating cash flow margin ratio of the

company is decreases which depicts that the company is operating expenses are high as compare to operating incomes. The

evaluation states that the company allocate the large amount of profit to its shareholders in the year 2018 as compare to the

previous year 2017. The company operating incomes is reduces which is not beneficial for an organisation.

Economic Crises

It has been evaluated that the currency of the country is fluctuated which affects the demand of oil The recession of 2009,

the company suffers with loss but after the recovery of recession the demand oil is increases (Dunn, 2009).

Market Analysis

The market performance ratio depicts that the financial condition of the market is getting worst after the recession period as

per the evaluation of market value of share. The earning per share has been evaluated in order to analyse the situation of an

organisation in financial terms. As per the evaluation it has been founded that the value of share is increases with the high

percentage as per the previous year from0.20 to 3.70. The net income mount of the company is increases due to which the

company has to pay the high amount to shareholders in order to build the strong relationship with them.

Non-Financial Information

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Rio Tinto operates at the international level because its business is expanded in various countries. The main headquarters of

the organisation is in Australia which is registered under the ASX Australia exchange board.

It is recommended that the company has to reduce the operating expenses in order to encourage the shareholders to purchase

there share and increase the value of shares.

Market trends

The company operates in Australia that is considered as the largest supplier of mining resources such as hydrocarbon, non-

mineral reserves and mineral. It has been evaluated that market will grow with 2.4% and it is expected that the market will

grow with the high rate in the near future as per the current economy situation (IBIS World, 2019).The company follows the

fours P’s Strategy such as portfolio, performance, people, and partners. The main strategy of the company is to deliver the

superior value for our shareholders. The employee’s should be qualified as per the responsibilities to perform appropriately.

The employee should require to think differently so that they target the market differently. Reviewing the management of

the organisation, they cooperate and work with the government in order to take the permission while expanding the business.

The activity which is done by the management team is beneficial for the organisation in terms of profit as they influence the

investors to invest in it. There are many competitors of the Rio Tinto such as BHP Billiton. BHP Billiton is the main

competitor that compete company in terms of remuneration. The current management structure includes four products such

as Aluminum, Copper & Diamonds, Energy & Minerals, and Iron Ore. The group will be complemented by newly shaped

growth & innovation group that focuses on the future assets and technical support.

Conclusion

At the end, it is concluded that the organisation is growing with the high percentage as per its market value of share. It is

recommended that the organisation has to maintain the relation with the shareholders so that they can purchase the share

with the large amount. Raising the share value helps the organisation to expand the business at the international level.

the organisation is in Australia which is registered under the ASX Australia exchange board.

It is recommended that the company has to reduce the operating expenses in order to encourage the shareholders to purchase

there share and increase the value of shares.

Market trends

The company operates in Australia that is considered as the largest supplier of mining resources such as hydrocarbon, non-

mineral reserves and mineral. It has been evaluated that market will grow with 2.4% and it is expected that the market will

grow with the high rate in the near future as per the current economy situation (IBIS World, 2019).The company follows the

fours P’s Strategy such as portfolio, performance, people, and partners. The main strategy of the company is to deliver the

superior value for our shareholders. The employee’s should be qualified as per the responsibilities to perform appropriately.

The employee should require to think differently so that they target the market differently. Reviewing the management of

the organisation, they cooperate and work with the government in order to take the permission while expanding the business.

The activity which is done by the management team is beneficial for the organisation in terms of profit as they influence the

investors to invest in it. There are many competitors of the Rio Tinto such as BHP Billiton. BHP Billiton is the main

competitor that compete company in terms of remuneration. The current management structure includes four products such

as Aluminum, Copper & Diamonds, Energy & Minerals, and Iron Ore. The group will be complemented by newly shaped

growth & innovation group that focuses on the future assets and technical support.

Conclusion

At the end, it is concluded that the organisation is growing with the high percentage as per its market value of share. It is

recommended that the organisation has to maintain the relation with the shareholders so that they can purchase the share

with the large amount. Raising the share value helps the organisation to expand the business at the international level.

References

Dunn, M. (2009) Recession fears as economy hits lowest level since 2009 global financial crisis. [online] Available from:

https://finance.nine.com.au/personal-finance/australian-recession-2019-economy-slowed-to-weakest-level-since-2009-

global-financial-crisis/9282fe6c-b394-40d2-ab83-39add2e099d5 [Accessed 15/4/19].

IBIS World. (2019) Mining - Australia Market Research Report. [online] Available from:

https://www.ibisworld.com.au/industry-trends/market-research-reports/mining/mining.html [Accessed 15/4/19].

Rio Tinto. (2018) 2018 Annual Report. [online] Available from:

http://www.riotinto.com/documents/RT_2018_annual_report.pdf [Accessed 15/4/19].

Robinson, T. R., Henry, E., Pirie, W. L., and Broihahn, M. A. (2015) International financial statement analysis. John Wiley

& Sons.

Dunn, M. (2009) Recession fears as economy hits lowest level since 2009 global financial crisis. [online] Available from:

https://finance.nine.com.au/personal-finance/australian-recession-2019-economy-slowed-to-weakest-level-since-2009-

global-financial-crisis/9282fe6c-b394-40d2-ab83-39add2e099d5 [Accessed 15/4/19].

IBIS World. (2019) Mining - Australia Market Research Report. [online] Available from:

https://www.ibisworld.com.au/industry-trends/market-research-reports/mining/mining.html [Accessed 15/4/19].

Rio Tinto. (2018) 2018 Annual Report. [online] Available from:

http://www.riotinto.com/documents/RT_2018_annual_report.pdf [Accessed 15/4/19].

Robinson, T. R., Henry, E., Pirie, W. L., and Broihahn, M. A. (2015) International financial statement analysis. John Wiley

& Sons.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 3

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.