The Role of Management Accounts Department: A Comprehensive Analysis

VerifiedAdded on 2021/01/01

|21

|5696

|343

Report

AI Summary

This report provides a comprehensive analysis of management accounting, focusing on its role in business operations and financial decision-making. It explores various management accounting systems, including cost accounting, inventory management, and job costing, detailing their functions and advantages within the context of Jupiter Plc. The report examines different reporting methods such as accounts receivable aging and budget reports, highlighting their importance in financial analysis and control. Furthermore, it evaluates the benefits and limitations of planning tools like budgetary control and their application in forecasting and budget preparation. The analysis extends to comparing organizational approaches to adapting management accounting systems for addressing financial problems and achieving sustainable success. The report also assesses the integration of management accounting with organizational processes and offers a critical evaluation of the entire system, emphasizing its impact on efficiency, accuracy, and decision-making within Jupiter Plc.

The Role of Management

Accounts Department

Accounts Department

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Management accounting and different type of management accounting system..................1

1.2 Representing methods of management accounting reporting................................................4

1.3 Representing advantages of above management accounting system with its use.................6

1.4 Representing critical evaluation of system of management accounting along with its

integration by reporting with organizational process...................................................................7

TASK 2............................................................................................................................................8

Income statement as per absorption costing................................................................................8

Income statement on basis of marginal costing...........................................................................9

TASK 3............................................................................................................................................9

3.1 Representing benefits and limitations of planning tool with use of budgetary control.........9

3.2 Representing application of various planning tool for forecasting and preparing budget...12

TASK 4..........................................................................................................................................13

4.1 Representing comparison of organization for purpose of adapting system of management

accounting to respond on financial problems............................................................................13

4.2 Representing analysis to respond to financial problems, management accounting could

lead organization for sustainable success..................................................................................15

4.3 Representing evaluation of planning tools of account for solving financial problems for

leading sustainable success........................................................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION...........................................................................................................................1

TASK 1............................................................................................................................................1

1.1 Management accounting and different type of management accounting system..................1

1.2 Representing methods of management accounting reporting................................................4

1.3 Representing advantages of above management accounting system with its use.................6

1.4 Representing critical evaluation of system of management accounting along with its

integration by reporting with organizational process...................................................................7

TASK 2............................................................................................................................................8

Income statement as per absorption costing................................................................................8

Income statement on basis of marginal costing...........................................................................9

TASK 3............................................................................................................................................9

3.1 Representing benefits and limitations of planning tool with use of budgetary control.........9

3.2 Representing application of various planning tool for forecasting and preparing budget...12

TASK 4..........................................................................................................................................13

4.1 Representing comparison of organization for purpose of adapting system of management

accounting to respond on financial problems............................................................................13

4.2 Representing analysis to respond to financial problems, management accounting could

lead organization for sustainable success..................................................................................15

4.3 Representing evaluation of planning tools of account for solving financial problems for

leading sustainable success........................................................................................................16

CONCLUSION..............................................................................................................................17

REFERENCES..............................................................................................................................18

INTRODUCTION

Accounting is referred as process of measuring, identifying and communicating

economic data for purpose of allowing different judgements along with informed decision

amount users of data. The present report will give brief discussion about concept of management

accounting with its requirements and essentials. Further it will reflect various planning tools

which will be used for responding to financial problems. With context of planning tool, it will

represent merits and their demerits with their organization. In the similar aspect, it will show

managerial accounting reports with their importance in Jupiter Plc.

TASK 1

1.1 Management accounting and different type of management accounting system.

Management accounting implies for the internal financial business activities analysis

which assists manager in developing competent strategies and policies for day to day operations.

Management accounting is the process of preparing management reports that includes the

accounting information to the management of the organisation so that they make effective

strategies and policies for the long term and short-term objectives of Jupiter Plc. It helps the

management of the company to perform their basic function of managing, controlling, planning

and directing (Fullerton, Kennedy and Widener, 2014).

Management accounting system is crucial for the effective operations of Jupiter Plc. It is

a process which helps in formatting a managerial report with the company's financial information

for the managers so that they identify different ways and decision making to run the company

more efficiently. Management accounting system helps all the department of the Jupiter plc.

Management accounting system focuses on the expenses that are incurred to the Jupiter plc in the

production of the goods and services. There are different types of management accounting

system that are required by Jupiter Plc in their management system:

Cost accounting system:

it is process that helps in determine the company cost in producing a single product by

evaluating its overhead cods and fixed cost. It is very important to evaluate the cost of the

product in order to analyse the profitability of the products, inventory valuation and controlling

of the expenses. By ascertaining the profitability of the product, the management can determine

the actual cost of the product. Cost accounting system is of two types:

1

Accounting is referred as process of measuring, identifying and communicating

economic data for purpose of allowing different judgements along with informed decision

amount users of data. The present report will give brief discussion about concept of management

accounting with its requirements and essentials. Further it will reflect various planning tools

which will be used for responding to financial problems. With context of planning tool, it will

represent merits and their demerits with their organization. In the similar aspect, it will show

managerial accounting reports with their importance in Jupiter Plc.

TASK 1

1.1 Management accounting and different type of management accounting system.

Management accounting implies for the internal financial business activities analysis

which assists manager in developing competent strategies and policies for day to day operations.

Management accounting is the process of preparing management reports that includes the

accounting information to the management of the organisation so that they make effective

strategies and policies for the long term and short-term objectives of Jupiter Plc. It helps the

management of the company to perform their basic function of managing, controlling, planning

and directing (Fullerton, Kennedy and Widener, 2014).

Management accounting system is crucial for the effective operations of Jupiter Plc. It is

a process which helps in formatting a managerial report with the company's financial information

for the managers so that they identify different ways and decision making to run the company

more efficiently. Management accounting system helps all the department of the Jupiter plc.

Management accounting system focuses on the expenses that are incurred to the Jupiter plc in the

production of the goods and services. There are different types of management accounting

system that are required by Jupiter Plc in their management system:

Cost accounting system:

it is process that helps in determine the company cost in producing a single product by

evaluating its overhead cods and fixed cost. It is very important to evaluate the cost of the

product in order to analyse the profitability of the products, inventory valuation and controlling

of the expenses. By ascertaining the profitability of the product, the management can determine

the actual cost of the product. Cost accounting system is of two types:

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Standard costing: it is the techniques which are used to evaluate the variances of actual

cost of production and the cost that should be incurred in the production.

Direct Cost: It is the cost or expenses that are assigned in the production of certain goods

and services. Direct cost is helpful to the manager in the process of making decisions

regarding the cost control.

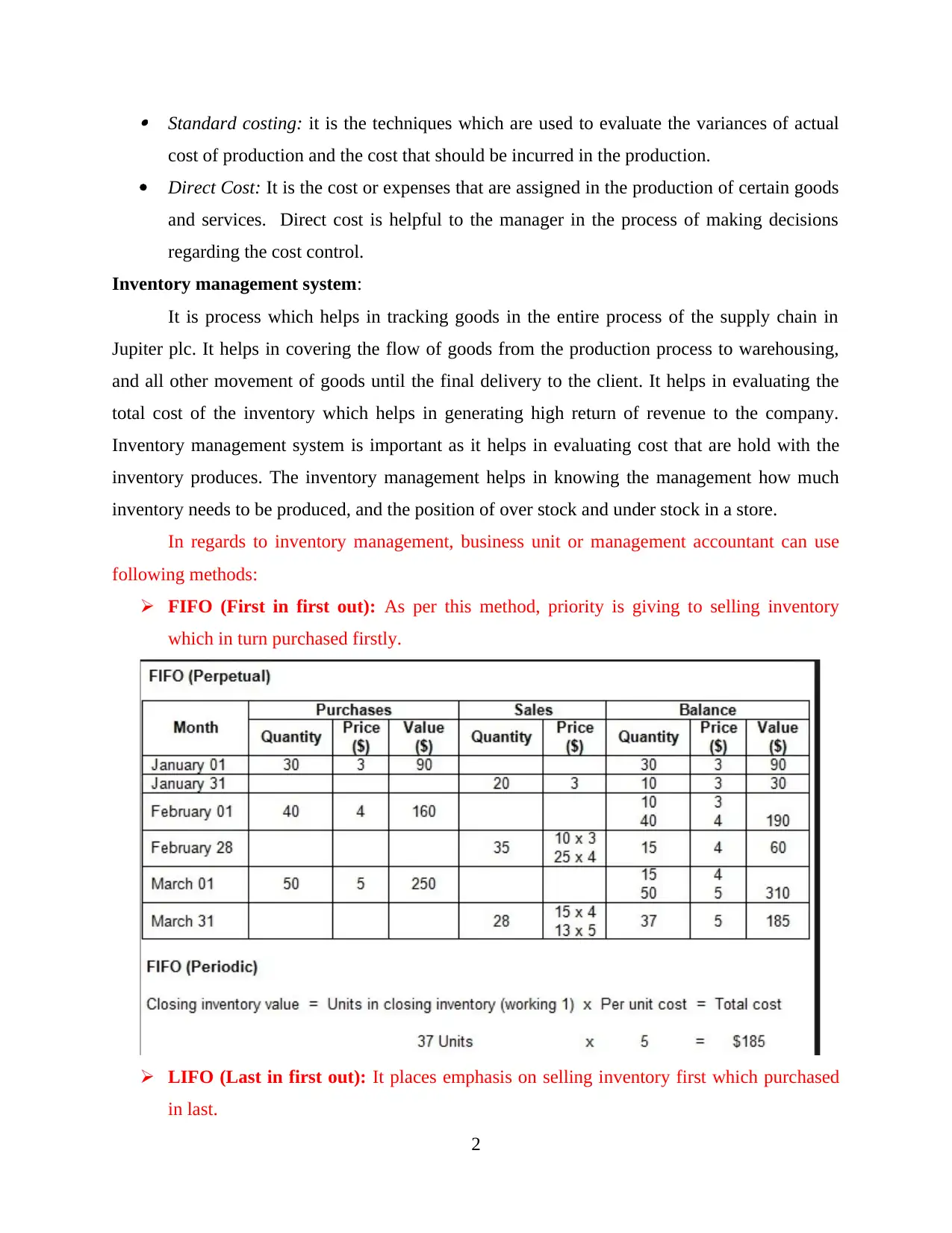

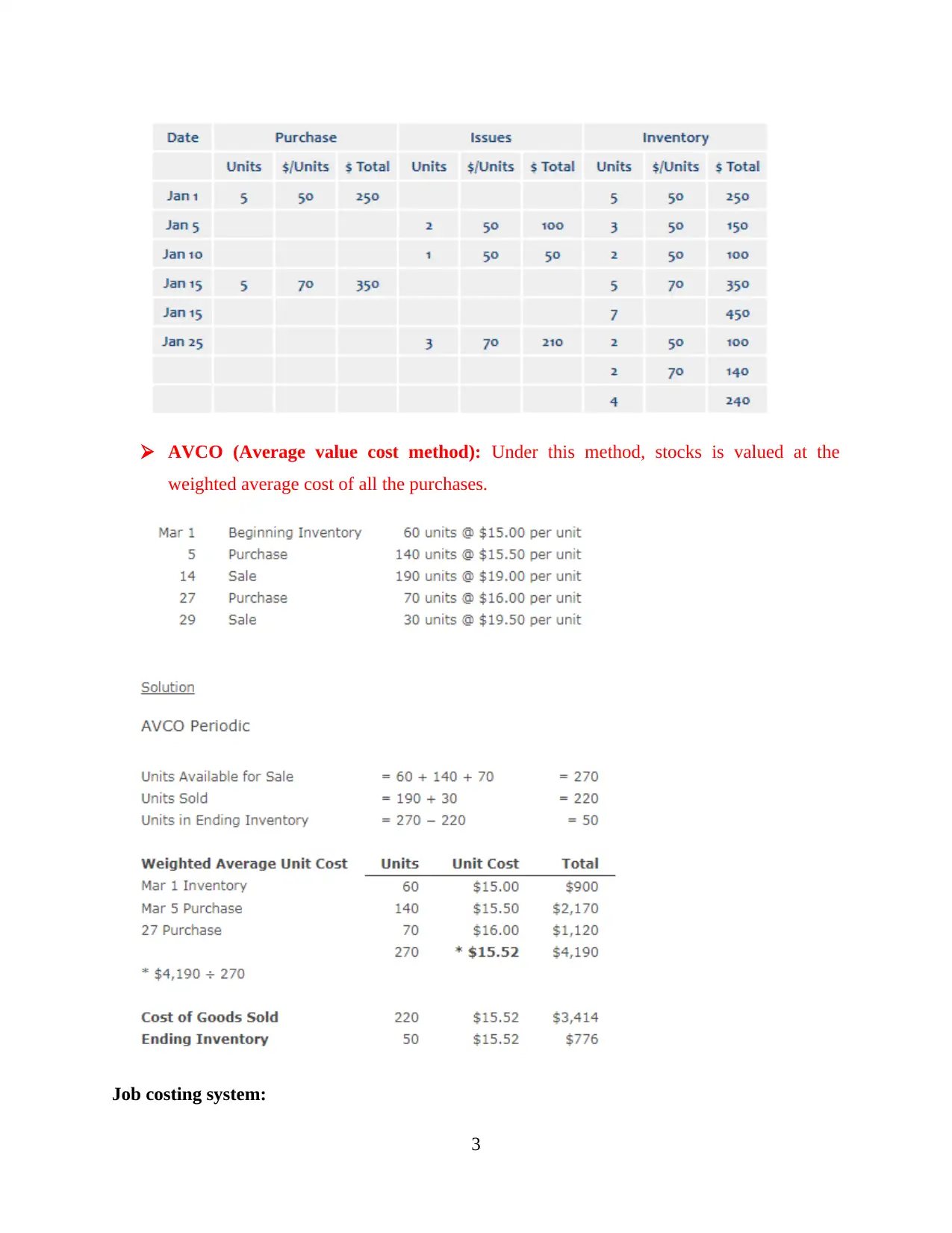

Inventory management system:

It is process which helps in tracking goods in the entire process of the supply chain in

Jupiter plc. It helps in covering the flow of goods from the production process to warehousing,

and all other movement of goods until the final delivery to the client. It helps in evaluating the

total cost of the inventory which helps in generating high return of revenue to the company.

Inventory management system is important as it helps in evaluating cost that are hold with the

inventory produces. The inventory management helps in knowing the management how much

inventory needs to be produced, and the position of over stock and under stock in a store.

In regards to inventory management, business unit or management accountant can use

following methods:

FIFO (First in first out): As per this method, priority is giving to selling inventory

which in turn purchased firstly.

LIFO (Last in first out): It places emphasis on selling inventory first which purchased

in last.

2

cost of production and the cost that should be incurred in the production.

Direct Cost: It is the cost or expenses that are assigned in the production of certain goods

and services. Direct cost is helpful to the manager in the process of making decisions

regarding the cost control.

Inventory management system:

It is process which helps in tracking goods in the entire process of the supply chain in

Jupiter plc. It helps in covering the flow of goods from the production process to warehousing,

and all other movement of goods until the final delivery to the client. It helps in evaluating the

total cost of the inventory which helps in generating high return of revenue to the company.

Inventory management system is important as it helps in evaluating cost that are hold with the

inventory produces. The inventory management helps in knowing the management how much

inventory needs to be produced, and the position of over stock and under stock in a store.

In regards to inventory management, business unit or management accountant can use

following methods:

FIFO (First in first out): As per this method, priority is giving to selling inventory

which in turn purchased firstly.

LIFO (Last in first out): It places emphasis on selling inventory first which purchased

in last.

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

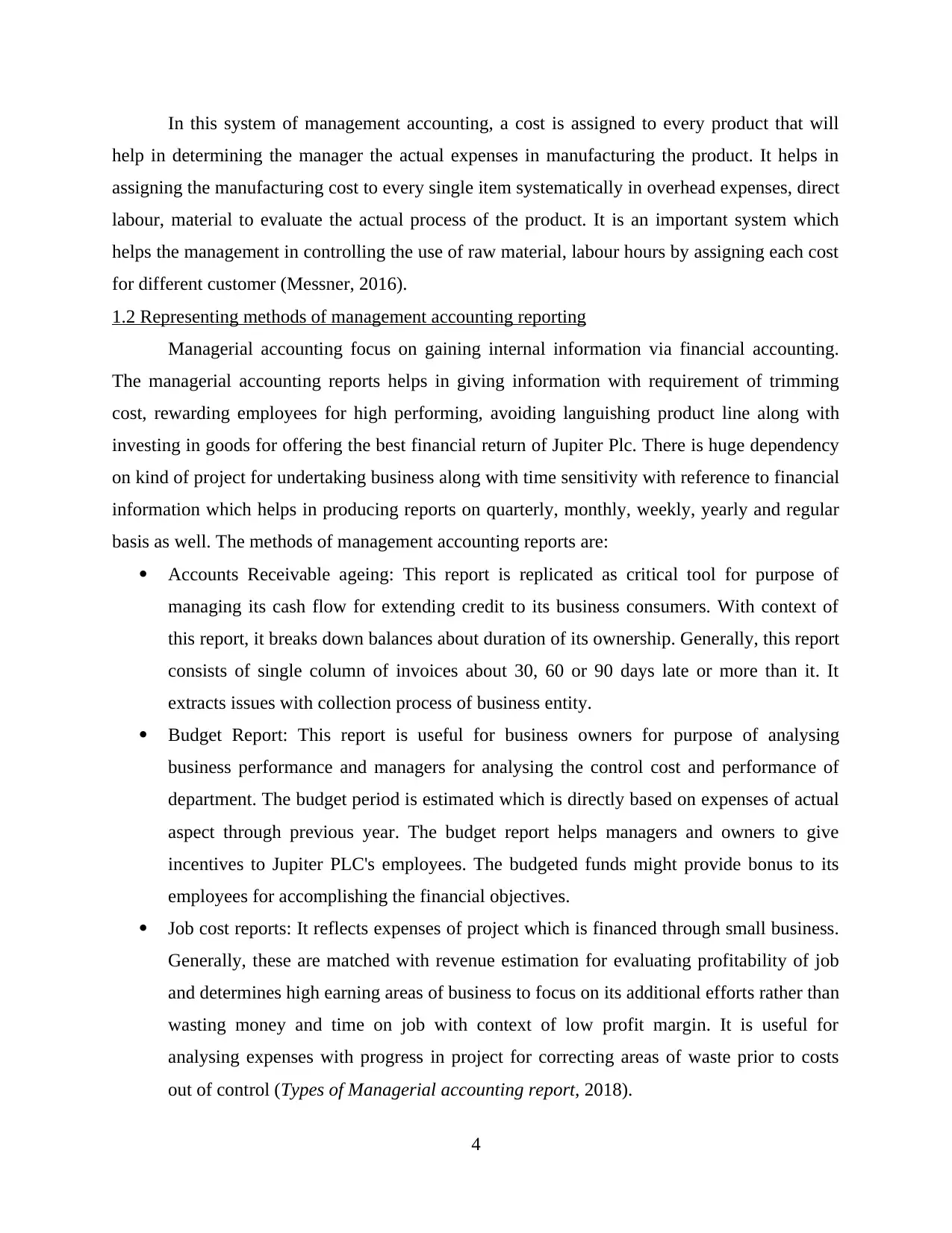

AVCO (Average value cost method): Under this method, stocks is valued at the

weighted average cost of all the purchases.

Job costing system:

3

weighted average cost of all the purchases.

Job costing system:

3

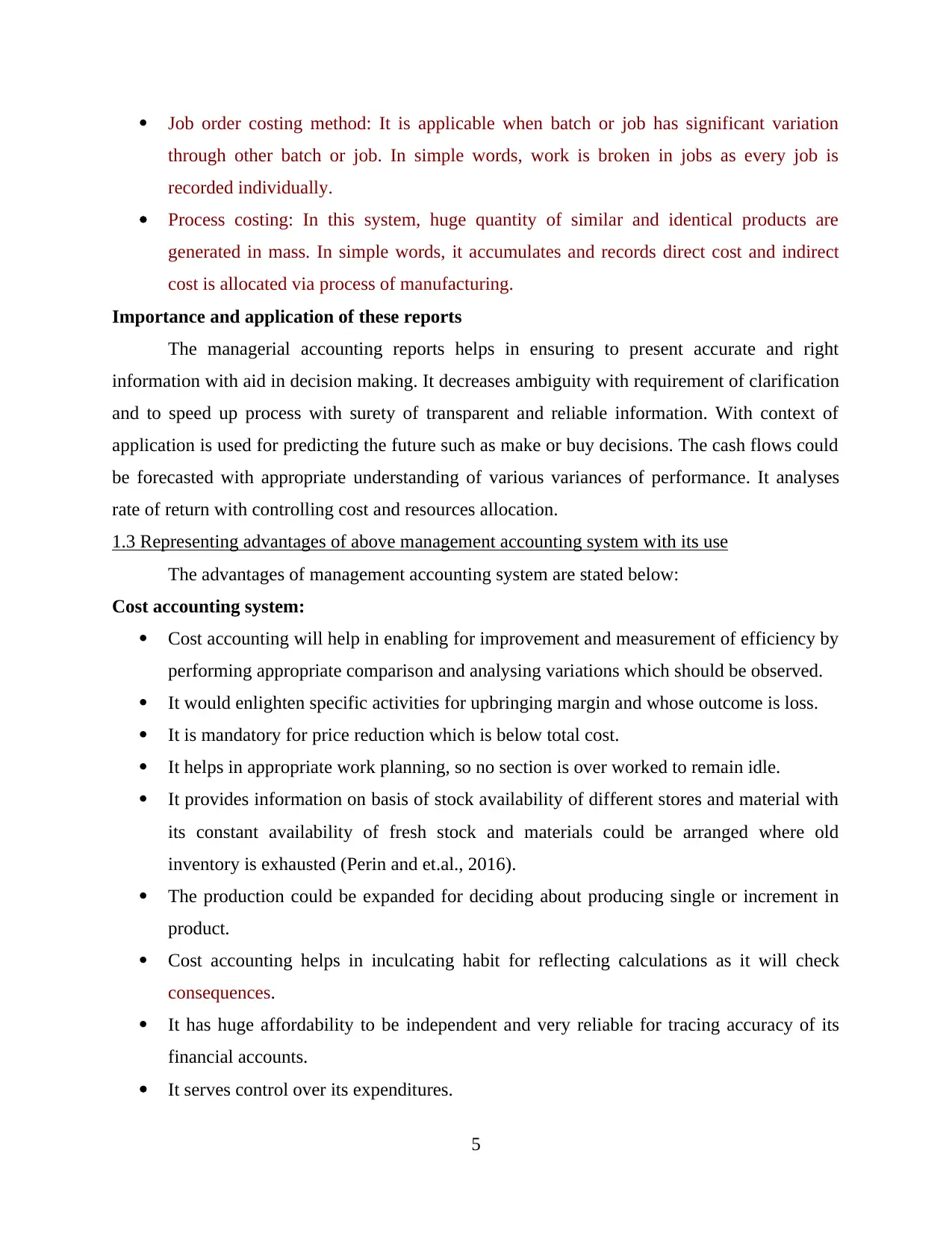

In this system of management accounting, a cost is assigned to every product that will

help in determining the manager the actual expenses in manufacturing the product. It helps in

assigning the manufacturing cost to every single item systematically in overhead expenses, direct

labour, material to evaluate the actual process of the product. It is an important system which

helps the management in controlling the use of raw material, labour hours by assigning each cost

for different customer (Messner, 2016).

1.2 Representing methods of management accounting reporting

Managerial accounting focus on gaining internal information via financial accounting.

The managerial accounting reports helps in giving information with requirement of trimming

cost, rewarding employees for high performing, avoiding languishing product line along with

investing in goods for offering the best financial return of Jupiter Plc. There is huge dependency

on kind of project for undertaking business along with time sensitivity with reference to financial

information which helps in producing reports on quarterly, monthly, weekly, yearly and regular

basis as well. The methods of management accounting reports are:

Accounts Receivable ageing: This report is replicated as critical tool for purpose of

managing its cash flow for extending credit to its business consumers. With context of

this report, it breaks down balances about duration of its ownership. Generally, this report

consists of single column of invoices about 30, 60 or 90 days late or more than it. It

extracts issues with collection process of business entity.

Budget Report: This report is useful for business owners for purpose of analysing

business performance and managers for analysing the control cost and performance of

department. The budget period is estimated which is directly based on expenses of actual

aspect through previous year. The budget report helps managers and owners to give

incentives to Jupiter PLC's employees. The budgeted funds might provide bonus to its

employees for accomplishing the financial objectives.

Job cost reports: It reflects expenses of project which is financed through small business.

Generally, these are matched with revenue estimation for evaluating profitability of job

and determines high earning areas of business to focus on its additional efforts rather than

wasting money and time on job with context of low profit margin. It is useful for

analysing expenses with progress in project for correcting areas of waste prior to costs

out of control (Types of Managerial accounting report, 2018).

4

help in determining the manager the actual expenses in manufacturing the product. It helps in

assigning the manufacturing cost to every single item systematically in overhead expenses, direct

labour, material to evaluate the actual process of the product. It is an important system which

helps the management in controlling the use of raw material, labour hours by assigning each cost

for different customer (Messner, 2016).

1.2 Representing methods of management accounting reporting

Managerial accounting focus on gaining internal information via financial accounting.

The managerial accounting reports helps in giving information with requirement of trimming

cost, rewarding employees for high performing, avoiding languishing product line along with

investing in goods for offering the best financial return of Jupiter Plc. There is huge dependency

on kind of project for undertaking business along with time sensitivity with reference to financial

information which helps in producing reports on quarterly, monthly, weekly, yearly and regular

basis as well. The methods of management accounting reports are:

Accounts Receivable ageing: This report is replicated as critical tool for purpose of

managing its cash flow for extending credit to its business consumers. With context of

this report, it breaks down balances about duration of its ownership. Generally, this report

consists of single column of invoices about 30, 60 or 90 days late or more than it. It

extracts issues with collection process of business entity.

Budget Report: This report is useful for business owners for purpose of analysing

business performance and managers for analysing the control cost and performance of

department. The budget period is estimated which is directly based on expenses of actual

aspect through previous year. The budget report helps managers and owners to give

incentives to Jupiter PLC's employees. The budgeted funds might provide bonus to its

employees for accomplishing the financial objectives.

Job cost reports: It reflects expenses of project which is financed through small business.

Generally, these are matched with revenue estimation for evaluating profitability of job

and determines high earning areas of business to focus on its additional efforts rather than

wasting money and time on job with context of low profit margin. It is useful for

analysing expenses with progress in project for correcting areas of waste prior to costs

out of control (Types of Managerial accounting report, 2018).

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Job order costing method: It is applicable when batch or job has significant variation

through other batch or job. In simple words, work is broken in jobs as every job is

recorded individually.

Process costing: In this system, huge quantity of similar and identical products are

generated in mass. In simple words, it accumulates and records direct cost and indirect

cost is allocated via process of manufacturing.

Importance and application of these reports

The managerial accounting reports helps in ensuring to present accurate and right

information with aid in decision making. It decreases ambiguity with requirement of clarification

and to speed up process with surety of transparent and reliable information. With context of

application is used for predicting the future such as make or buy decisions. The cash flows could

be forecasted with appropriate understanding of various variances of performance. It analyses

rate of return with controlling cost and resources allocation.

1.3 Representing advantages of above management accounting system with its use

The advantages of management accounting system are stated below:

Cost accounting system:

Cost accounting will help in enabling for improvement and measurement of efficiency by

performing appropriate comparison and analysing variations which should be observed.

It would enlighten specific activities for upbringing margin and whose outcome is loss.

It is mandatory for price reduction which is below total cost.

It helps in appropriate work planning, so no section is over worked to remain idle.

It provides information on basis of stock availability of different stores and material with

its constant availability of fresh stock and materials could be arranged where old

inventory is exhausted (Perin and et.al., 2016).

The production could be expanded for deciding about producing single or increment in

product.

Cost accounting helps in inculcating habit for reflecting calculations as it will check

consequences.

It has huge affordability to be independent and very reliable for tracing accuracy of its

financial accounts.

It serves control over its expenditures.

5

through other batch or job. In simple words, work is broken in jobs as every job is

recorded individually.

Process costing: In this system, huge quantity of similar and identical products are

generated in mass. In simple words, it accumulates and records direct cost and indirect

cost is allocated via process of manufacturing.

Importance and application of these reports

The managerial accounting reports helps in ensuring to present accurate and right

information with aid in decision making. It decreases ambiguity with requirement of clarification

and to speed up process with surety of transparent and reliable information. With context of

application is used for predicting the future such as make or buy decisions. The cash flows could

be forecasted with appropriate understanding of various variances of performance. It analyses

rate of return with controlling cost and resources allocation.

1.3 Representing advantages of above management accounting system with its use

The advantages of management accounting system are stated below:

Cost accounting system:

Cost accounting will help in enabling for improvement and measurement of efficiency by

performing appropriate comparison and analysing variations which should be observed.

It would enlighten specific activities for upbringing margin and whose outcome is loss.

It is mandatory for price reduction which is below total cost.

It helps in appropriate work planning, so no section is over worked to remain idle.

It provides information on basis of stock availability of different stores and material with

its constant availability of fresh stock and materials could be arranged where old

inventory is exhausted (Perin and et.al., 2016).

The production could be expanded for deciding about producing single or increment in

product.

Cost accounting helps in inculcating habit for reflecting calculations as it will check

consequences.

It has huge affordability to be independent and very reliable for tracing accuracy of its

financial accounts.

It serves control over its expenditures.

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Inventory management system:

This system helps in extracting exact amount of required inventory.

There must be high inventory turnover ratio for ensuring that products are not disposed or

obsoleting its working capital.

It will lead for repetition of consumers as it fulfils need on time.

The good inventory management system accurate planning.

This system optimizes warehouse for setup through putting its products which are close

together and could be accessed easily at each place. In simple words it speeds up

shipping, picking and packing process.

This will help in empowering employees for managing inventory with barcode scanners

and other tools for utilising time and helps business for better application of resources

such as technological and human.

It is great time saving tool as it tracks every product and proper coordination by suppliers

at every location with dependency on variations in demand and other factor as well.

It helps in cost cutting or avoiding waste money on slow moving products (Suomala,

Lyly-Yrjänäinen and Lukka, 2014).

Job costing system:

It gives proper basis for cost estimation of similar roles which are undertaken in the

future.

Detailed analysis had been provided with context of cost of labour, material and

overheads of every job.

Efficiency had been planned with control of confirming attention to its cost on basis of

individual jobs.

It helps in determining spoilage and defective work with determination of responsibility

and job which might be fixed on its individuals.

The pre-determined rate of overhead in job costing has been adopted as it will extract

budgetary control's advantages.

It is mandatory for cost-plus contract with identification of cost price with reference to

cost.

6

This system helps in extracting exact amount of required inventory.

There must be high inventory turnover ratio for ensuring that products are not disposed or

obsoleting its working capital.

It will lead for repetition of consumers as it fulfils need on time.

The good inventory management system accurate planning.

This system optimizes warehouse for setup through putting its products which are close

together and could be accessed easily at each place. In simple words it speeds up

shipping, picking and packing process.

This will help in empowering employees for managing inventory with barcode scanners

and other tools for utilising time and helps business for better application of resources

such as technological and human.

It is great time saving tool as it tracks every product and proper coordination by suppliers

at every location with dependency on variations in demand and other factor as well.

It helps in cost cutting or avoiding waste money on slow moving products (Suomala,

Lyly-Yrjänäinen and Lukka, 2014).

Job costing system:

It gives proper basis for cost estimation of similar roles which are undertaken in the

future.

Detailed analysis had been provided with context of cost of labour, material and

overheads of every job.

Efficiency had been planned with control of confirming attention to its cost on basis of

individual jobs.

It helps in determining spoilage and defective work with determination of responsibility

and job which might be fixed on its individuals.

The pre-determined rate of overhead in job costing has been adopted as it will extract

budgetary control's advantages.

It is mandatory for cost-plus contract with identification of cost price with reference to

cost.

6

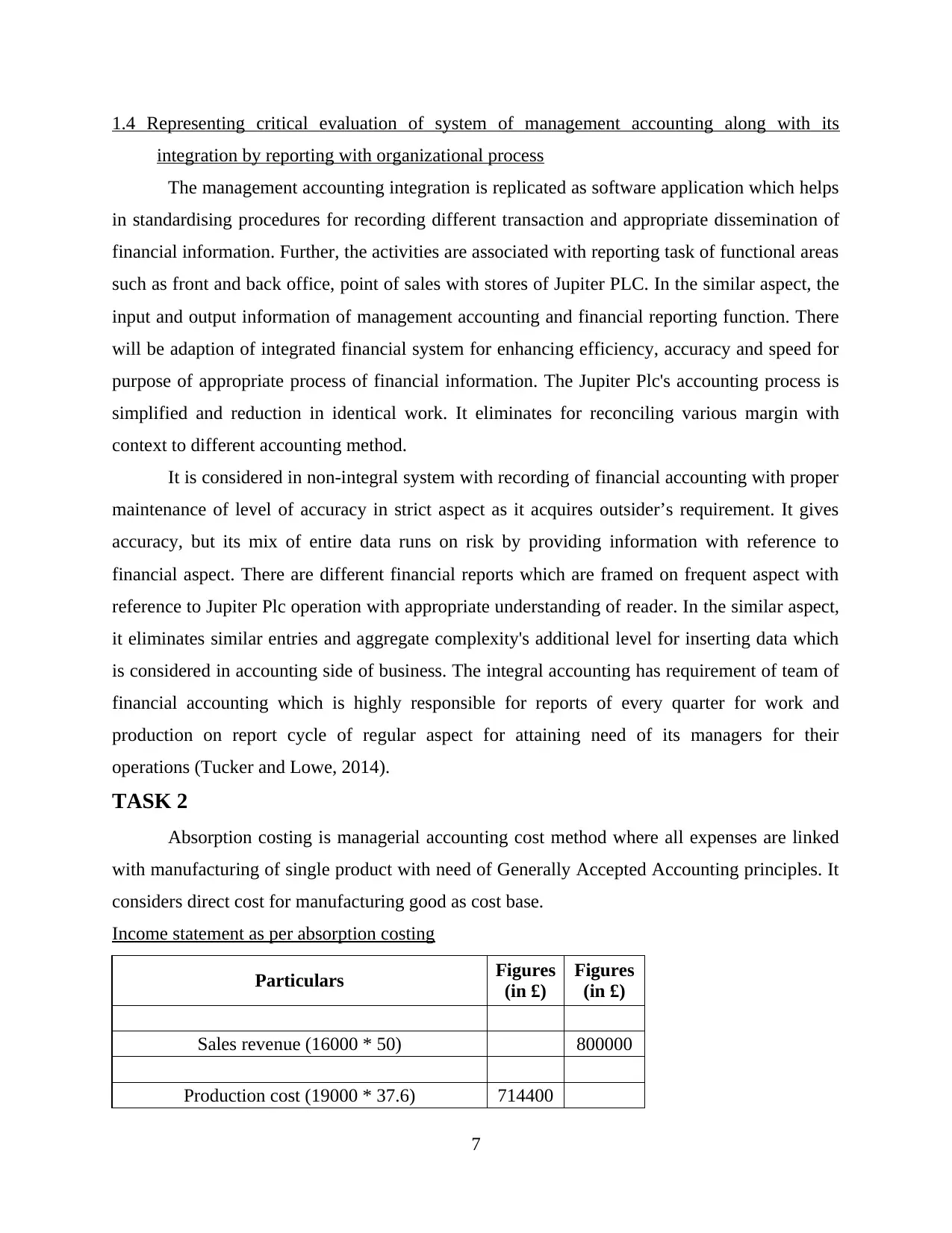

1.4 Representing critical evaluation of system of management accounting along with its

integration by reporting with organizational process

The management accounting integration is replicated as software application which helps

in standardising procedures for recording different transaction and appropriate dissemination of

financial information. Further, the activities are associated with reporting task of functional areas

such as front and back office, point of sales with stores of Jupiter PLC. In the similar aspect, the

input and output information of management accounting and financial reporting function. There

will be adaption of integrated financial system for enhancing efficiency, accuracy and speed for

purpose of appropriate process of financial information. The Jupiter Plc's accounting process is

simplified and reduction in identical work. It eliminates for reconciling various margin with

context to different accounting method.

It is considered in non-integral system with recording of financial accounting with proper

maintenance of level of accuracy in strict aspect as it acquires outsider’s requirement. It gives

accuracy, but its mix of entire data runs on risk by providing information with reference to

financial aspect. There are different financial reports which are framed on frequent aspect with

reference to Jupiter Plc operation with appropriate understanding of reader. In the similar aspect,

it eliminates similar entries and aggregate complexity's additional level for inserting data which

is considered in accounting side of business. The integral accounting has requirement of team of

financial accounting which is highly responsible for reports of every quarter for work and

production on report cycle of regular aspect for attaining need of its managers for their

operations (Tucker and Lowe, 2014).

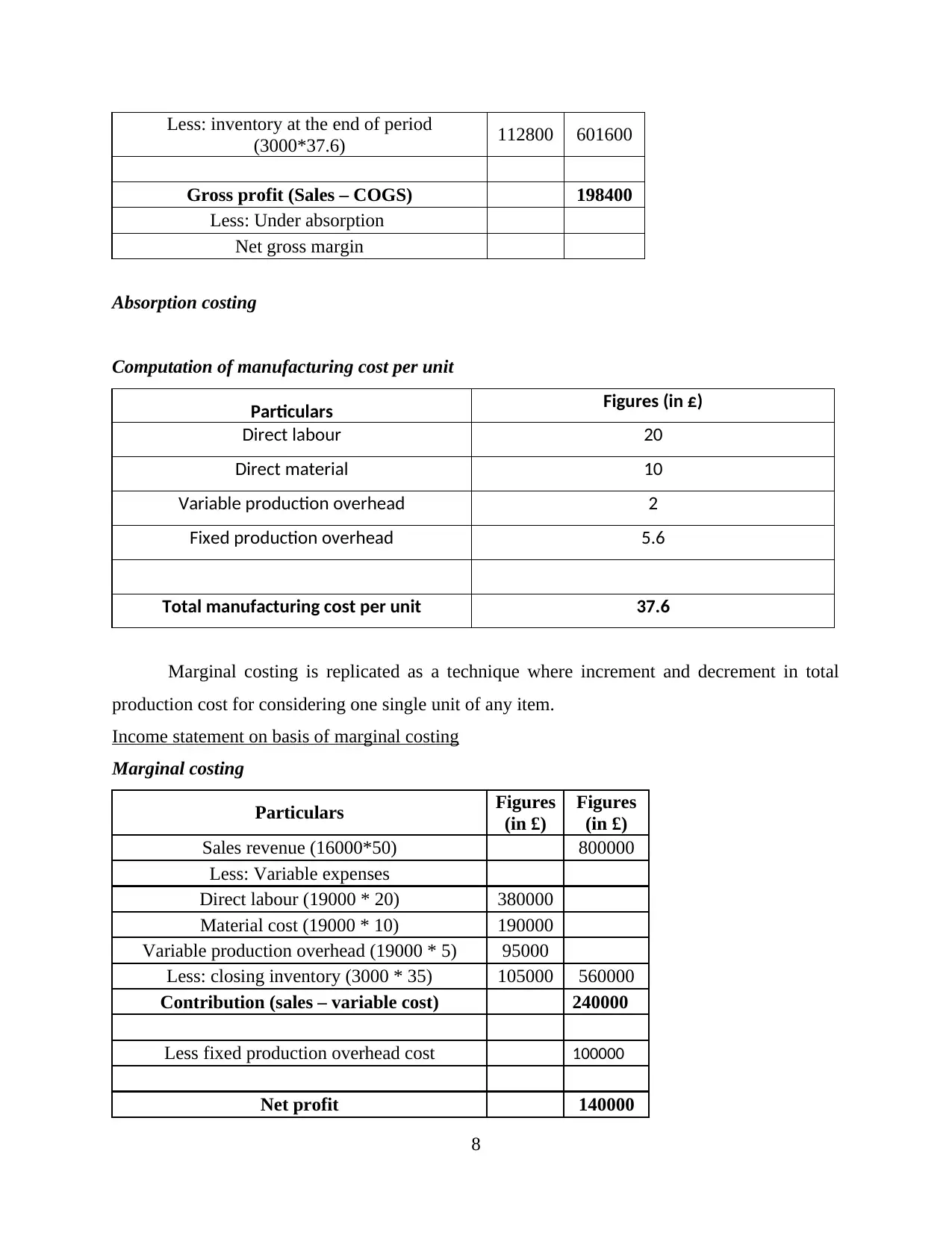

TASK 2

Absorption costing is managerial accounting cost method where all expenses are linked

with manufacturing of single product with need of Generally Accepted Accounting principles. It

considers direct cost for manufacturing good as cost base.

Income statement as per absorption costing

Particulars Figures

(in £)

Figures

(in £)

Sales revenue (16000 * 50) 800000

Production cost (19000 * 37.6) 714400

7

integration by reporting with organizational process

The management accounting integration is replicated as software application which helps

in standardising procedures for recording different transaction and appropriate dissemination of

financial information. Further, the activities are associated with reporting task of functional areas

such as front and back office, point of sales with stores of Jupiter PLC. In the similar aspect, the

input and output information of management accounting and financial reporting function. There

will be adaption of integrated financial system for enhancing efficiency, accuracy and speed for

purpose of appropriate process of financial information. The Jupiter Plc's accounting process is

simplified and reduction in identical work. It eliminates for reconciling various margin with

context to different accounting method.

It is considered in non-integral system with recording of financial accounting with proper

maintenance of level of accuracy in strict aspect as it acquires outsider’s requirement. It gives

accuracy, but its mix of entire data runs on risk by providing information with reference to

financial aspect. There are different financial reports which are framed on frequent aspect with

reference to Jupiter Plc operation with appropriate understanding of reader. In the similar aspect,

it eliminates similar entries and aggregate complexity's additional level for inserting data which

is considered in accounting side of business. The integral accounting has requirement of team of

financial accounting which is highly responsible for reports of every quarter for work and

production on report cycle of regular aspect for attaining need of its managers for their

operations (Tucker and Lowe, 2014).

TASK 2

Absorption costing is managerial accounting cost method where all expenses are linked

with manufacturing of single product with need of Generally Accepted Accounting principles. It

considers direct cost for manufacturing good as cost base.

Income statement as per absorption costing

Particulars Figures

(in £)

Figures

(in £)

Sales revenue (16000 * 50) 800000

Production cost (19000 * 37.6) 714400

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Less: inventory at the end of period

(3000*37.6) 112800 601600

Gross profit (Sales – COGS) 198400

Less: Under absorption

Net gross margin

Absorption costing

Computation of manufacturing cost per unit

Particulars Figures (in £)

Direct labour 20

Direct material 10

Variable production overhead 2

Fixed production overhead 5.6

Total manufacturing cost per unit 37.6

Marginal costing is replicated as a technique where increment and decrement in total

production cost for considering one single unit of any item.

Income statement on basis of marginal costing

Marginal costing

Particulars Figures

(in £)

Figures

(in £)

Sales revenue (16000*50) 800000

Less: Variable expenses

Direct labour (19000 * 20) 380000

Material cost (19000 * 10) 190000

Variable production overhead (19000 * 5) 95000

Less: closing inventory (3000 * 35) 105000 560000

Contribution (sales – variable cost) 240000

Less fixed production overhead cost 100000

Net profit 140000

8

(3000*37.6) 112800 601600

Gross profit (Sales – COGS) 198400

Less: Under absorption

Net gross margin

Absorption costing

Computation of manufacturing cost per unit

Particulars Figures (in £)

Direct labour 20

Direct material 10

Variable production overhead 2

Fixed production overhead 5.6

Total manufacturing cost per unit 37.6

Marginal costing is replicated as a technique where increment and decrement in total

production cost for considering one single unit of any item.

Income statement on basis of marginal costing

Marginal costing

Particulars Figures

(in £)

Figures

(in £)

Sales revenue (16000*50) 800000

Less: Variable expenses

Direct labour (19000 * 20) 380000

Material cost (19000 * 10) 190000

Variable production overhead (19000 * 5) 95000

Less: closing inventory (3000 * 35) 105000 560000

Contribution (sales – variable cost) 240000

Less fixed production overhead cost 100000

Net profit 140000

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Computation of variable cost per unit

Variable cost per unit: 10 + 20 + 5

= £35

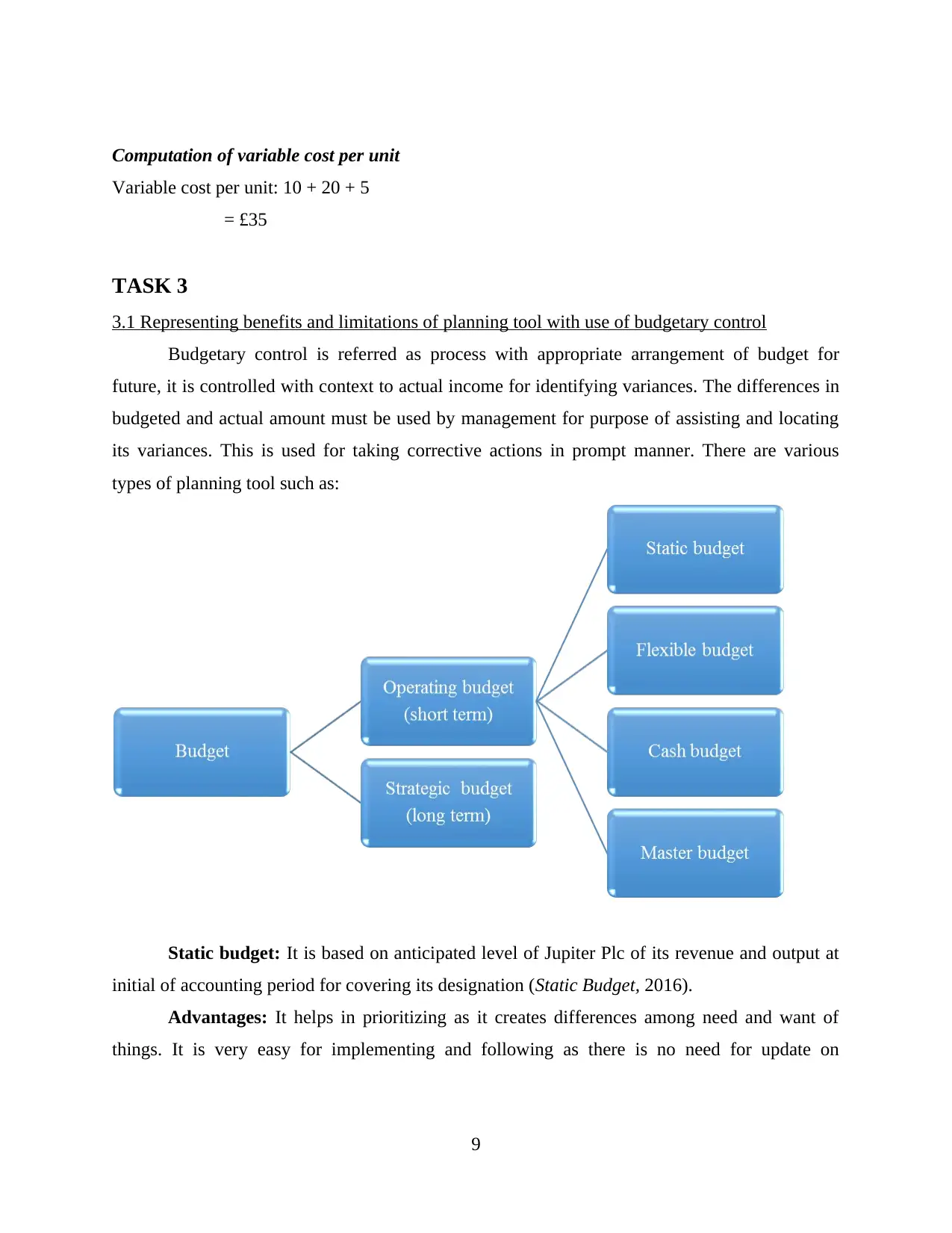

TASK 3

3.1 Representing benefits and limitations of planning tool with use of budgetary control

Budgetary control is referred as process with appropriate arrangement of budget for

future, it is controlled with context to actual income for identifying variances. The differences in

budgeted and actual amount must be used by management for purpose of assisting and locating

its variances. This is used for taking corrective actions in prompt manner. There are various

types of planning tool such as:

Static budget: It is based on anticipated level of Jupiter Plc of its revenue and output at

initial of accounting period for covering its designation (Static Budget, 2016).

Advantages: It helps in prioritizing as it creates differences among need and want of

things. It is very easy for implementing and following as there is no need for update on

9

Variable cost per unit: 10 + 20 + 5

= £35

TASK 3

3.1 Representing benefits and limitations of planning tool with use of budgetary control

Budgetary control is referred as process with appropriate arrangement of budget for

future, it is controlled with context to actual income for identifying variances. The differences in

budgeted and actual amount must be used by management for purpose of assisting and locating

its variances. This is used for taking corrective actions in prompt manner. There are various

types of planning tool such as:

Static budget: It is based on anticipated level of Jupiter Plc of its revenue and output at

initial of accounting period for covering its designation (Static Budget, 2016).

Advantages: It helps in prioritizing as it creates differences among need and want of

things. It is very easy for implementing and following as there is no need for update on

9

continuous aspect in whole accounting period. It offers insight of cost and profit of company

with performance of variance analysis (Cooper, Ezzamel and Qu, 2017).

Disadvantages: There is lack of flexibility as it establishes budget on basis of specific

level of volume of sales and with this increment, it does not perform resource allocation to keep

it up. It could impact revenue stream of Jupiter Plc in negative aspect as it is based on previous

data as in new business it might be difficult for implementing and establishing it.

Flexible budget: It extracts various level of expenditure for variable cost which directly

depends on alteration in actual revenue. It accounts different range of volume possibilities.

Advantages: It helps in enabling accurate assessment of performance of management

and organization. It also predicts income and performance level at specified range of sales and

activity level.

Disadvantages: It has assumption of cost linearity as it rely on continuous aspect where

cost might actually behave in discontinuous or stepped manner. It could not compare actual and

budgeted revenue when two numbers are same as well.

Master budget: It is functional division of Jupiter Plc as it forms budget for division. In

simple words, aggregate of all divisional budget formed through all divisions.

Advantages: This budget helps in motivating staff of Jupiter Plc where budgeted and

actual performance could be compared. It summarizes the budget for getting overview of

business owners along with its management. It also indicates about its earning along with its

expenses. It determines unusual issues in advance and resolves as well. The main advantage is

that it is useful for attaining objectives of Jupiter Plc for long term perspective. The resources are

directly channelized and controlled for utilising its profit. It is a continuous process as it

performs as analytics tools. The differences are determined and worked for better outcome on

continuous aspect.

Disadvantages: With context of cons, Jupiter Plc's divisional staff is directly forced for

accomplishing its target along with practical difficulties because of high pressure via top level

management. In the similar aspect, it is very difficult for modifying and updating lengthy

description along with charts.

Operational budget: It is a financial plan which is framed for accomplishing various

debt obligations of Jupiter plc for sustaining growth over time.

10

with performance of variance analysis (Cooper, Ezzamel and Qu, 2017).

Disadvantages: There is lack of flexibility as it establishes budget on basis of specific

level of volume of sales and with this increment, it does not perform resource allocation to keep

it up. It could impact revenue stream of Jupiter Plc in negative aspect as it is based on previous

data as in new business it might be difficult for implementing and establishing it.

Flexible budget: It extracts various level of expenditure for variable cost which directly

depends on alteration in actual revenue. It accounts different range of volume possibilities.

Advantages: It helps in enabling accurate assessment of performance of management

and organization. It also predicts income and performance level at specified range of sales and

activity level.

Disadvantages: It has assumption of cost linearity as it rely on continuous aspect where

cost might actually behave in discontinuous or stepped manner. It could not compare actual and

budgeted revenue when two numbers are same as well.

Master budget: It is functional division of Jupiter Plc as it forms budget for division. In

simple words, aggregate of all divisional budget formed through all divisions.

Advantages: This budget helps in motivating staff of Jupiter Plc where budgeted and

actual performance could be compared. It summarizes the budget for getting overview of

business owners along with its management. It also indicates about its earning along with its

expenses. It determines unusual issues in advance and resolves as well. The main advantage is

that it is useful for attaining objectives of Jupiter Plc for long term perspective. The resources are

directly channelized and controlled for utilising its profit. It is a continuous process as it

performs as analytics tools. The differences are determined and worked for better outcome on

continuous aspect.

Disadvantages: With context of cons, Jupiter Plc's divisional staff is directly forced for

accomplishing its target along with practical difficulties because of high pressure via top level

management. In the similar aspect, it is very difficult for modifying and updating lengthy

description along with charts.

Operational budget: It is a financial plan which is framed for accomplishing various

debt obligations of Jupiter plc for sustaining growth over time.

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.