ACC30010 Audit Plan: Accounts Payable for Reliable Printers Ltd (RPL)

VerifiedAdded on 2023/01/12

|11

|1746

|66

Report

AI Summary

This report presents an audit plan for Reliable Printers Ltd (RPL), a printing company, focusing specifically on the accounts payable section for the year ended June 30, 2019. The plan, developed by an imaginary audit team from Luccia and Jansen (L&J), addresses the specific requirements outlined in the ACC30010 assignment. It details audit procedures, including the nature, extent, and timing of tests, designed to ensure the accuracy and reliability of accounts payable balances. The plan includes an examination of invoices, confirmation of balances with creditors, and inspection of outstanding dues. The report also addresses relevant assertions, the audit strategy, the use of test controls, and the substantive approach. Furthermore, the report outlines the composition of the audit team, including their roles, education, and experience, and culminates in a conclusion summarizing the key aspects of the audit plan and its importance in ensuring the integrity of financial statements. References to relevant books and journals are provided.

AUDITING

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

TABLE OF CONTENTS................................................................................................................2

INTRODUTION..............................................................................................................................1

AUDIT REPORT.............................................................................................................................1

Audit Programs............................................................................................................................1

Relevant assertions for the balance sheet items...........................................................................4

Audit Strategy..............................................................................................................................5

Test Controls................................................................................................................................5

Substantive approach...................................................................................................................6

Audit Team..................................................................................................................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

TABLE OF CONTENTS................................................................................................................2

INTRODUTION..............................................................................................................................1

AUDIT REPORT.............................................................................................................................1

Audit Programs............................................................................................................................1

Relevant assertions for the balance sheet items...........................................................................4

Audit Strategy..............................................................................................................................5

Test Controls................................................................................................................................5

Substantive approach...................................................................................................................6

Audit Team..................................................................................................................................6

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

INTRODUTION

Audit refers to the process of examining the business transactions and records for ensuring

that the all the records are made according to the requirements of accounting standards and

reporting frameworks provided by the statutory authorities. Audit is conducted for increasing the

confidence of users of financial statements that all the information given about the financial

performance and position of the company is true and is free from errors and material

misstatements. Present report based over the Reliable Printers ltd which is a printer of books,

magazines and the advertising materials and many more such things. It wants its accounts to be

audited for the year 2015 for identifying the errors or mistakes in recording the transactions.

Research will involve audit of the financial statements in proper structured format laying a audit

program and work schedule.

AUDIT REPORT

Audit Programs

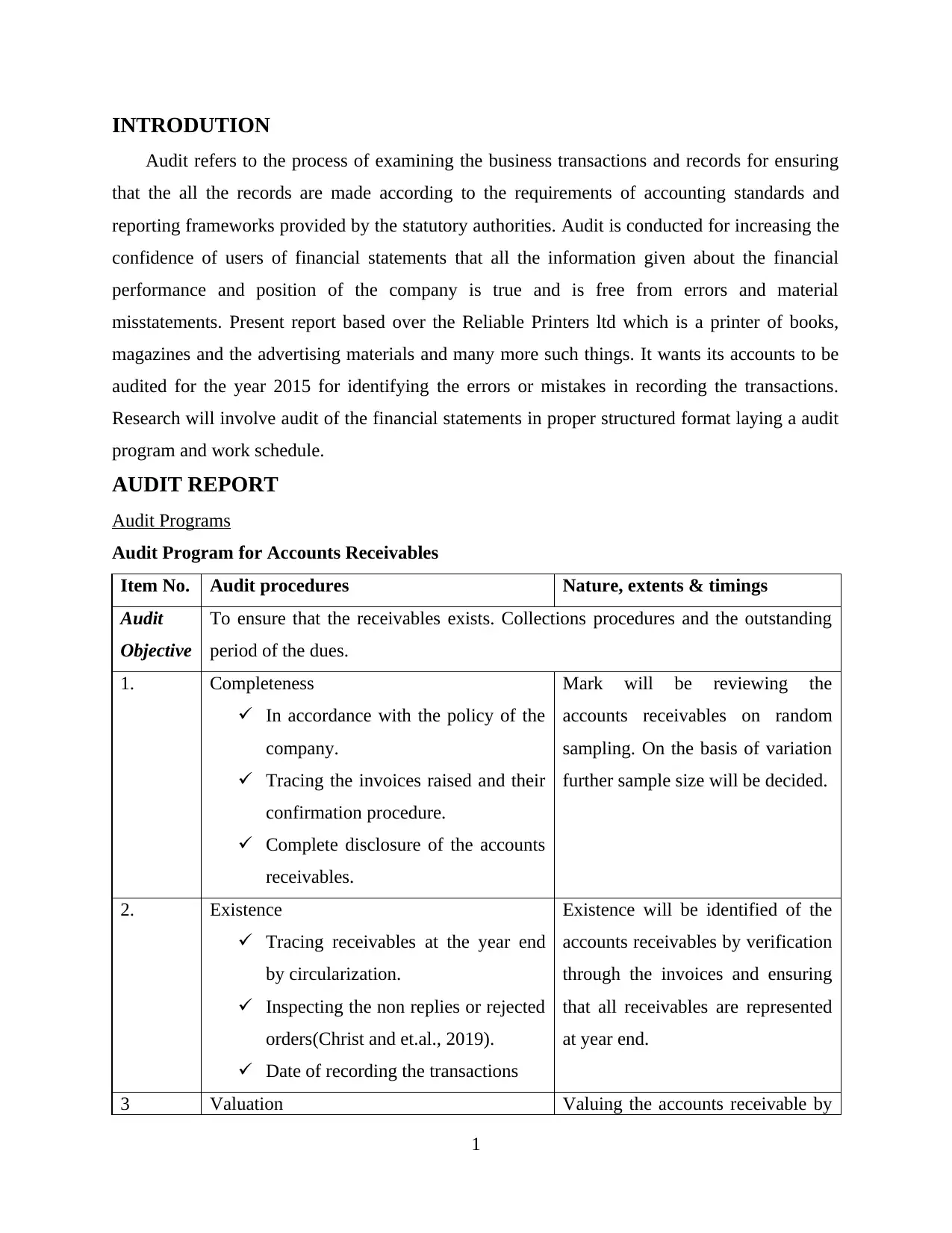

Audit Program for Accounts Receivables

Item No. Audit procedures Nature, extents & timings

Audit

Objective

To ensure that the receivables exists. Collections procedures and the outstanding

period of the dues.

1. Completeness

In accordance with the policy of the

company.

Tracing the invoices raised and their

confirmation procedure.

Complete disclosure of the accounts

receivables.

Mark will be reviewing the

accounts receivables on random

sampling. On the basis of variation

further sample size will be decided.

2. Existence

Tracing receivables at the year end

by circularization.

Inspecting the non replies or rejected

orders(Christ and et.al., 2019).

Date of recording the transactions

Existence will be identified of the

accounts receivables by verification

through the invoices and ensuring

that all receivables are represented

at year end.

3 Valuation Valuing the accounts receivable by

1

Audit refers to the process of examining the business transactions and records for ensuring

that the all the records are made according to the requirements of accounting standards and

reporting frameworks provided by the statutory authorities. Audit is conducted for increasing the

confidence of users of financial statements that all the information given about the financial

performance and position of the company is true and is free from errors and material

misstatements. Present report based over the Reliable Printers ltd which is a printer of books,

magazines and the advertising materials and many more such things. It wants its accounts to be

audited for the year 2015 for identifying the errors or mistakes in recording the transactions.

Research will involve audit of the financial statements in proper structured format laying a audit

program and work schedule.

AUDIT REPORT

Audit Programs

Audit Program for Accounts Receivables

Item No. Audit procedures Nature, extents & timings

Audit

Objective

To ensure that the receivables exists. Collections procedures and the outstanding

period of the dues.

1. Completeness

In accordance with the policy of the

company.

Tracing the invoices raised and their

confirmation procedure.

Complete disclosure of the accounts

receivables.

Mark will be reviewing the

accounts receivables on random

sampling. On the basis of variation

further sample size will be decided.

2. Existence

Tracing receivables at the year end

by circularization.

Inspecting the non replies or rejected

orders(Christ and et.al., 2019).

Date of recording the transactions

Existence will be identified of the

accounts receivables by verification

through the invoices and ensuring

that all receivables are represented

at year end.

3 Valuation Valuing the accounts receivable by

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Comparing the turnover of

receivables with the previous year.

Reviewing the adequacy of the

allowances for the uncollectable.

Examining large customer accounts

and their pending durations.

making comparisons with the

figures of last year. Adequate

inspection of bigger dues of the

parties from long time.

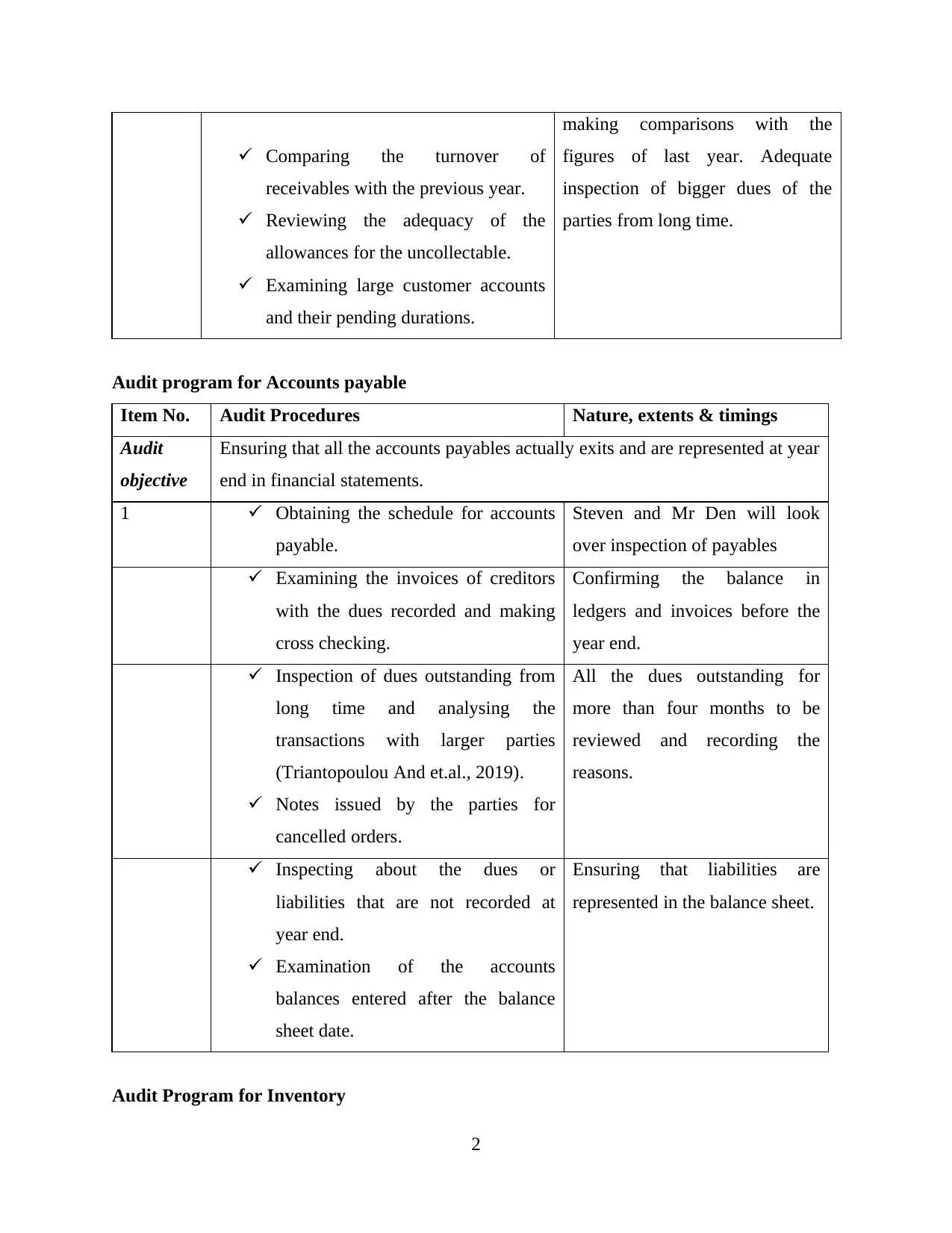

Audit program for Accounts payable

Item No. Audit Procedures Nature, extents & timings

Audit

objective

Ensuring that all the accounts payables actually exits and are represented at year

end in financial statements.

1 Obtaining the schedule for accounts

payable.

Steven and Mr Den will look

over inspection of payables

Examining the invoices of creditors

with the dues recorded and making

cross checking.

Confirming the balance in

ledgers and invoices before the

year end.

Inspection of dues outstanding from

long time and analysing the

transactions with larger parties

(Triantopoulou And et.al., 2019).

Notes issued by the parties for

cancelled orders.

All the dues outstanding for

more than four months to be

reviewed and recording the

reasons.

Inspecting about the dues or

liabilities that are not recorded at

year end.

Examination of the accounts

balances entered after the balance

sheet date.

Ensuring that liabilities are

represented in the balance sheet.

Audit Program for Inventory

2

receivables with the previous year.

Reviewing the adequacy of the

allowances for the uncollectable.

Examining large customer accounts

and their pending durations.

making comparisons with the

figures of last year. Adequate

inspection of bigger dues of the

parties from long time.

Audit program for Accounts payable

Item No. Audit Procedures Nature, extents & timings

Audit

objective

Ensuring that all the accounts payables actually exits and are represented at year

end in financial statements.

1 Obtaining the schedule for accounts

payable.

Steven and Mr Den will look

over inspection of payables

Examining the invoices of creditors

with the dues recorded and making

cross checking.

Confirming the balance in

ledgers and invoices before the

year end.

Inspection of dues outstanding from

long time and analysing the

transactions with larger parties

(Triantopoulou And et.al., 2019).

Notes issued by the parties for

cancelled orders.

All the dues outstanding for

more than four months to be

reviewed and recording the

reasons.

Inspecting about the dues or

liabilities that are not recorded at

year end.

Examination of the accounts

balances entered after the balance

sheet date.

Ensuring that liabilities are

represented in the balance sheet.

Audit Program for Inventory

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

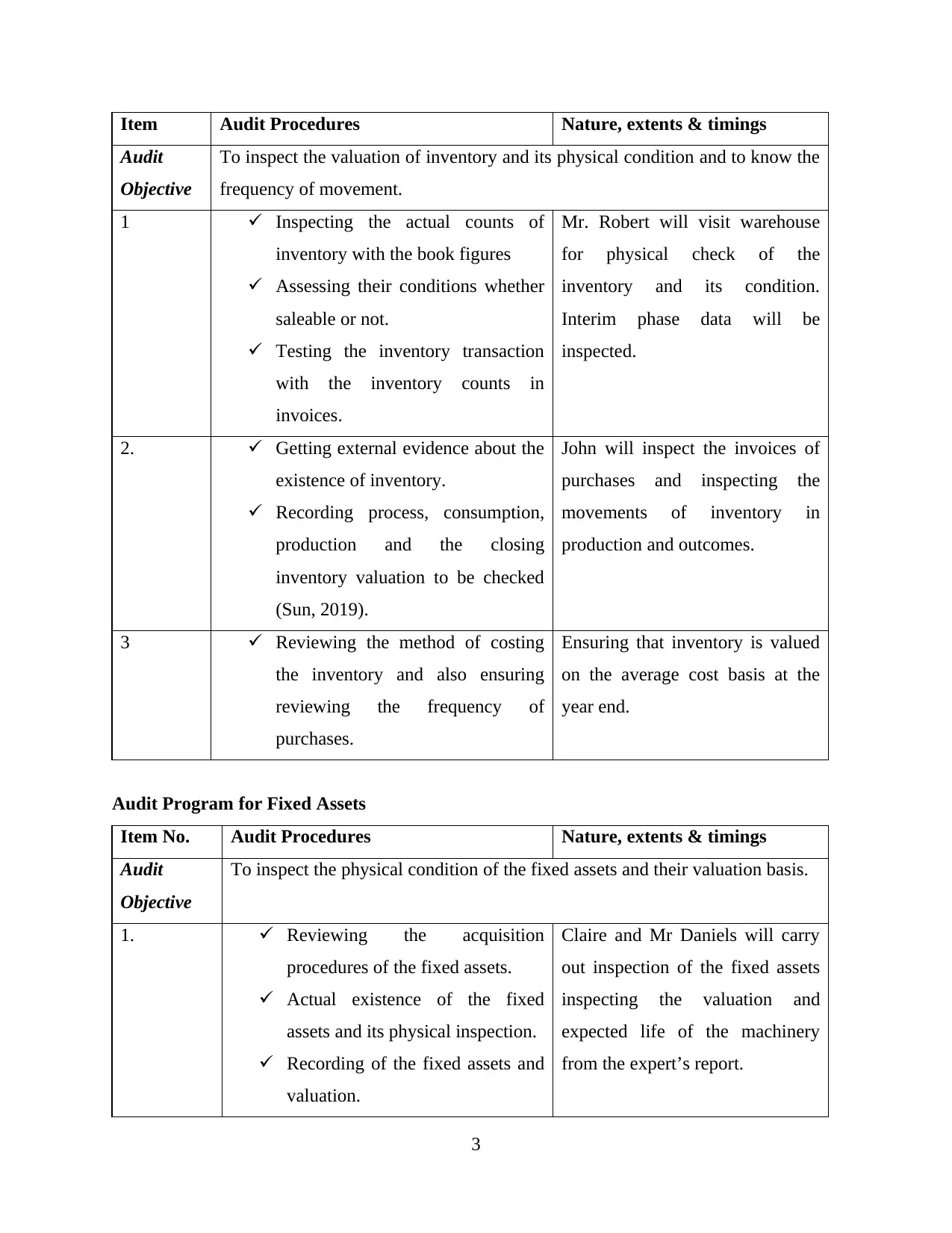

Item Audit Procedures Nature, extents & timings

Audit

Objective

To inspect the valuation of inventory and its physical condition and to know the

frequency of movement.

1 Inspecting the actual counts of

inventory with the book figures

Assessing their conditions whether

saleable or not.

Testing the inventory transaction

with the inventory counts in

invoices.

Mr. Robert will visit warehouse

for physical check of the

inventory and its condition.

Interim phase data will be

inspected.

2. Getting external evidence about the

existence of inventory.

Recording process, consumption,

production and the closing

inventory valuation to be checked

(Sun, 2019).

John will inspect the invoices of

purchases and inspecting the

movements of inventory in

production and outcomes.

3 Reviewing the method of costing

the inventory and also ensuring

reviewing the frequency of

purchases.

Ensuring that inventory is valued

on the average cost basis at the

year end.

Audit Program for Fixed Assets

Item No. Audit Procedures Nature, extents & timings

Audit

Objective

To inspect the physical condition of the fixed assets and their valuation basis.

1. Reviewing the acquisition

procedures of the fixed assets.

Actual existence of the fixed

assets and its physical inspection.

Recording of the fixed assets and

valuation.

Claire and Mr Daniels will carry

out inspection of the fixed assets

inspecting the valuation and

expected life of the machinery

from the expert’s report.

3

Audit

Objective

To inspect the valuation of inventory and its physical condition and to know the

frequency of movement.

1 Inspecting the actual counts of

inventory with the book figures

Assessing their conditions whether

saleable or not.

Testing the inventory transaction

with the inventory counts in

invoices.

Mr. Robert will visit warehouse

for physical check of the

inventory and its condition.

Interim phase data will be

inspected.

2. Getting external evidence about the

existence of inventory.

Recording process, consumption,

production and the closing

inventory valuation to be checked

(Sun, 2019).

John will inspect the invoices of

purchases and inspecting the

movements of inventory in

production and outcomes.

3 Reviewing the method of costing

the inventory and also ensuring

reviewing the frequency of

purchases.

Ensuring that inventory is valued

on the average cost basis at the

year end.

Audit Program for Fixed Assets

Item No. Audit Procedures Nature, extents & timings

Audit

Objective

To inspect the physical condition of the fixed assets and their valuation basis.

1. Reviewing the acquisition

procedures of the fixed assets.

Actual existence of the fixed

assets and its physical inspection.

Recording of the fixed assets and

valuation.

Claire and Mr Daniels will carry

out inspection of the fixed assets

inspecting the valuation and

expected life of the machinery

from the expert’s report.

3

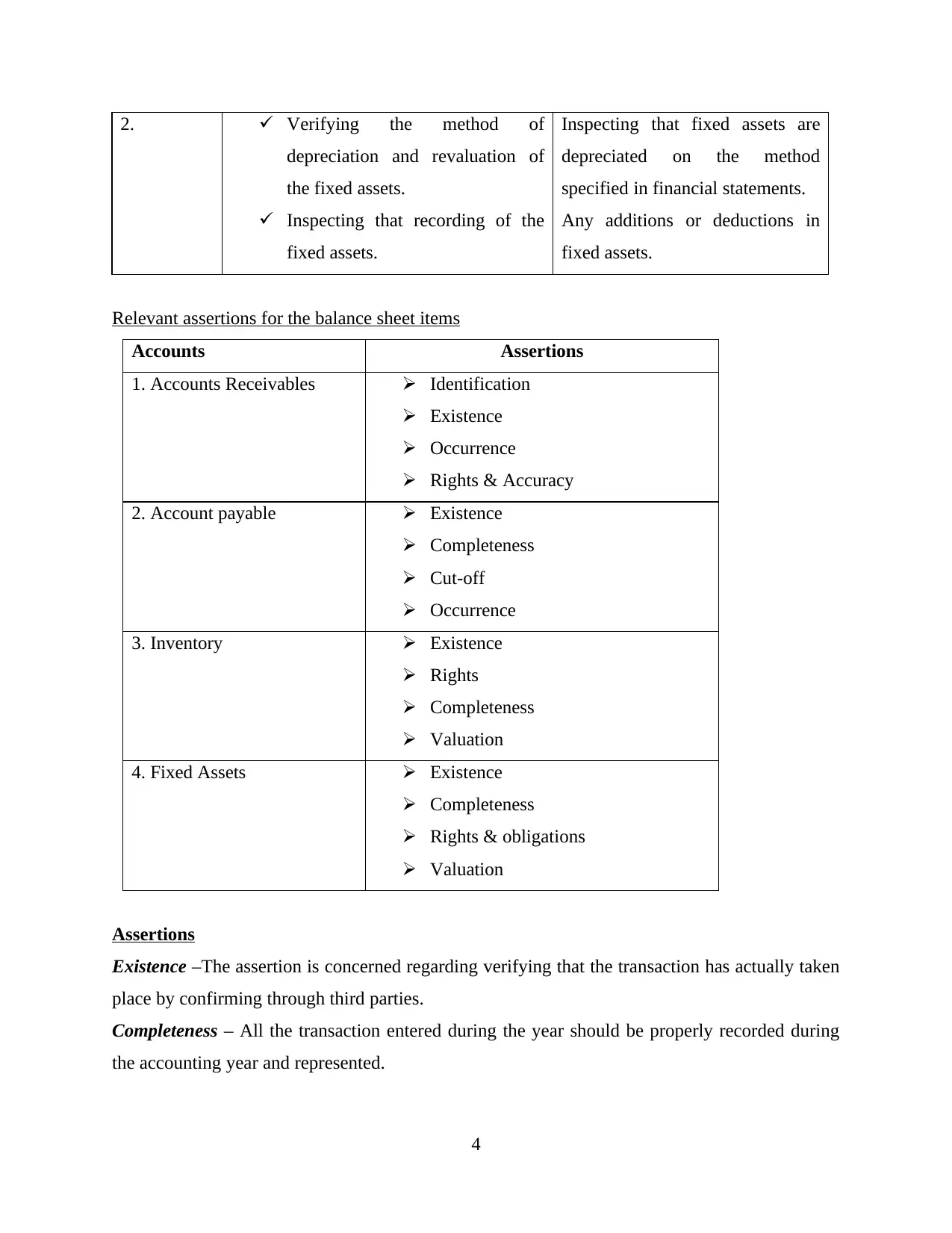

2. Verifying the method of

depreciation and revaluation of

the fixed assets.

Inspecting that recording of the

fixed assets.

Inspecting that fixed assets are

depreciated on the method

specified in financial statements.

Any additions or deductions in

fixed assets.

Relevant assertions for the balance sheet items

Accounts Assertions

1. Accounts Receivables Identification

Existence

Occurrence

Rights & Accuracy

2. Account payable Existence

Completeness

Cut-off

Occurrence

3. Inventory Existence

Rights

Completeness

Valuation

4. Fixed Assets Existence

Completeness

Rights & obligations

Valuation

Assertions

Existence –The assertion is concerned regarding verifying that the transaction has actually taken

place by confirming through third parties.

Completeness – All the transaction entered during the year should be properly recorded during

the accounting year and represented.

4

depreciation and revaluation of

the fixed assets.

Inspecting that recording of the

fixed assets.

Inspecting that fixed assets are

depreciated on the method

specified in financial statements.

Any additions or deductions in

fixed assets.

Relevant assertions for the balance sheet items

Accounts Assertions

1. Accounts Receivables Identification

Existence

Occurrence

Rights & Accuracy

2. Account payable Existence

Completeness

Cut-off

Occurrence

3. Inventory Existence

Rights

Completeness

Valuation

4. Fixed Assets Existence

Completeness

Rights & obligations

Valuation

Assertions

Existence –The assertion is concerned regarding verifying that the transaction has actually taken

place by confirming through third parties.

Completeness – All the transaction entered during the year should be properly recorded during

the accounting year and represented.

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

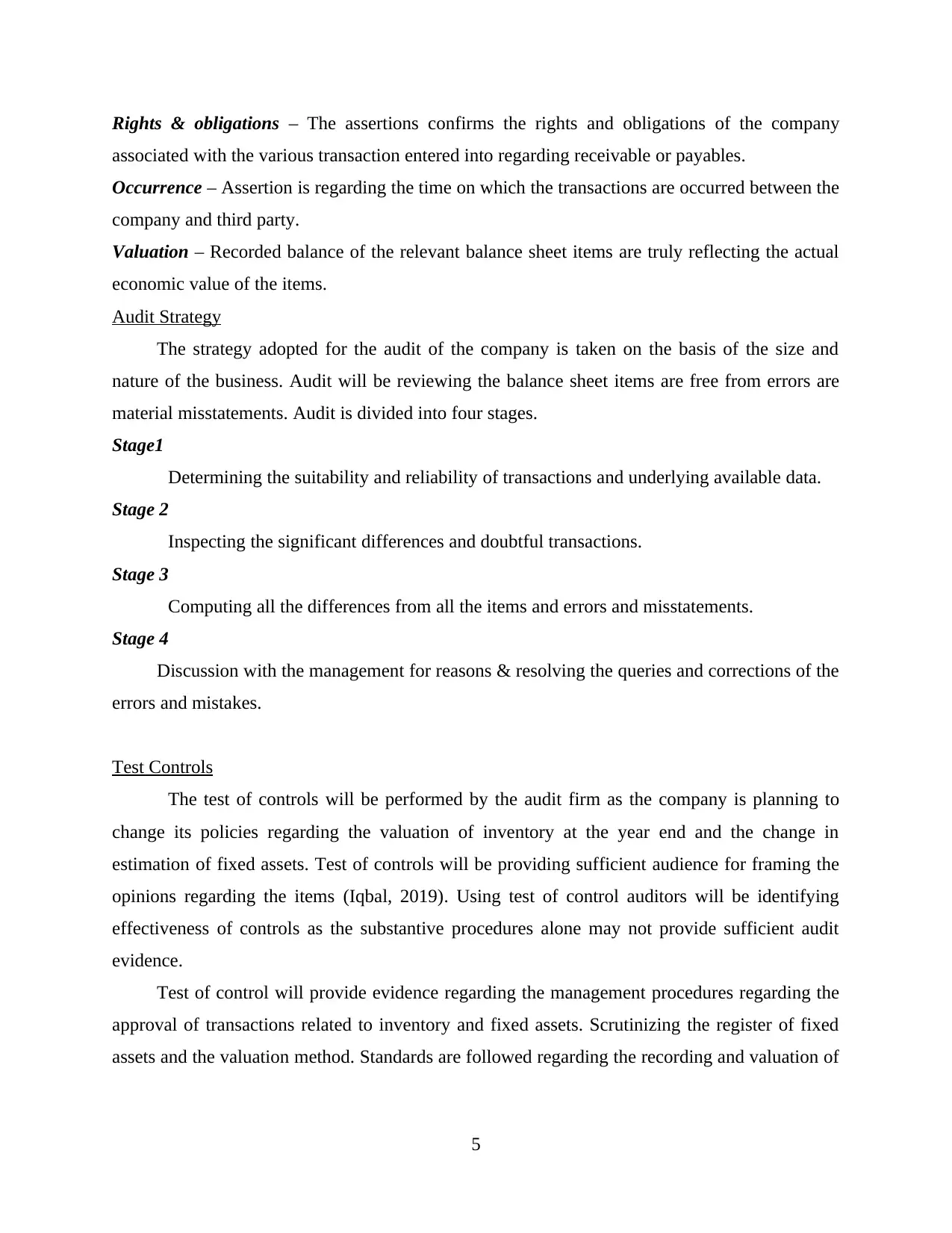

Rights & obligations – The assertions confirms the rights and obligations of the company

associated with the various transaction entered into regarding receivable or payables.

Occurrence – Assertion is regarding the time on which the transactions are occurred between the

company and third party.

Valuation – Recorded balance of the relevant balance sheet items are truly reflecting the actual

economic value of the items.

Audit Strategy

The strategy adopted for the audit of the company is taken on the basis of the size and

nature of the business. Audit will be reviewing the balance sheet items are free from errors are

material misstatements. Audit is divided into four stages.

Stage1

Determining the suitability and reliability of transactions and underlying available data.

Stage 2

Inspecting the significant differences and doubtful transactions.

Stage 3

Computing all the differences from all the items and errors and misstatements.

Stage 4

Discussion with the management for reasons & resolving the queries and corrections of the

errors and mistakes.

Test Controls

The test of controls will be performed by the audit firm as the company is planning to

change its policies regarding the valuation of inventory at the year end and the change in

estimation of fixed assets. Test of controls will be providing sufficient audience for framing the

opinions regarding the items (Iqbal, 2019). Using test of control auditors will be identifying

effectiveness of controls as the substantive procedures alone may not provide sufficient audit

evidence.

Test of control will provide evidence regarding the management procedures regarding the

approval of transactions related to inventory and fixed assets. Scrutinizing the register of fixed

assets and the valuation method. Standards are followed regarding the recording and valuation of

5

associated with the various transaction entered into regarding receivable or payables.

Occurrence – Assertion is regarding the time on which the transactions are occurred between the

company and third party.

Valuation – Recorded balance of the relevant balance sheet items are truly reflecting the actual

economic value of the items.

Audit Strategy

The strategy adopted for the audit of the company is taken on the basis of the size and

nature of the business. Audit will be reviewing the balance sheet items are free from errors are

material misstatements. Audit is divided into four stages.

Stage1

Determining the suitability and reliability of transactions and underlying available data.

Stage 2

Inspecting the significant differences and doubtful transactions.

Stage 3

Computing all the differences from all the items and errors and misstatements.

Stage 4

Discussion with the management for reasons & resolving the queries and corrections of the

errors and mistakes.

Test Controls

The test of controls will be performed by the audit firm as the company is planning to

change its policies regarding the valuation of inventory at the year end and the change in

estimation of fixed assets. Test of controls will be providing sufficient audience for framing the

opinions regarding the items (Iqbal, 2019). Using test of control auditors will be identifying

effectiveness of controls as the substantive procedures alone may not provide sufficient audit

evidence.

Test of control will provide evidence regarding the management procedures regarding the

approval of transactions related to inventory and fixed assets. Scrutinizing the register of fixed

assets and the valuation method. Standards are followed regarding the recording and valuation of

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

the fixed assets and misstatements. That change will result in better presentation of the

accounting statements

Substantive approach

Substantive will be used for auditing the balance sheet items of the company. However in

depth substantive approach is not required as the internal control system of the company is

strong.

Substantive approach will be followed in verification of the accounts receivable and

accounts payable. This will be confirming transactions in the bank statement and the third party

confirmation random basis. Matching the orders with invoices and cash collections are made

timely. Substantive approach will provide accuracy of various transactions and balances.

Sufficient appropriate audit evidence will be obtained for confirming the balances of accounts

payable.

Substantive testing refers to the audit procedures for examining financial statements for

supporting the documentations. For auditors to frame their opinion it is essential that they obtain

sufficient audit evidence (Rahman, 2019). They are essential for ensuring that the records and the

statements are free from errors and material misstatements.

Audit Team

Auditors Name Audit Education Experience

Lead Auditor Mr Daniels Fixed Assets CPA, Bachelor of

Accounting & Business

18 years

Senior Auditor Mr Robert Inventory CPA, Bachelor of

Accounting

12 years

Senior Auditor Mr Den Accounts Payable CPA, Bachelor of

Business

9 years

Auditor Steven Accounts Payable CPA, Bachelor of

Accounting

3 years

Auditor John Inventory CPA 3 years

Auditor Mark Accounts

Receivables

CPA 4 years

6

accounting statements

Substantive approach

Substantive will be used for auditing the balance sheet items of the company. However in

depth substantive approach is not required as the internal control system of the company is

strong.

Substantive approach will be followed in verification of the accounts receivable and

accounts payable. This will be confirming transactions in the bank statement and the third party

confirmation random basis. Matching the orders with invoices and cash collections are made

timely. Substantive approach will provide accuracy of various transactions and balances.

Sufficient appropriate audit evidence will be obtained for confirming the balances of accounts

payable.

Substantive testing refers to the audit procedures for examining financial statements for

supporting the documentations. For auditors to frame their opinion it is essential that they obtain

sufficient audit evidence (Rahman, 2019). They are essential for ensuring that the records and the

statements are free from errors and material misstatements.

Audit Team

Auditors Name Audit Education Experience

Lead Auditor Mr Daniels Fixed Assets CPA, Bachelor of

Accounting & Business

18 years

Senior Auditor Mr Robert Inventory CPA, Bachelor of

Accounting

12 years

Senior Auditor Mr Den Accounts Payable CPA, Bachelor of

Business

9 years

Auditor Steven Accounts Payable CPA, Bachelor of

Accounting

3 years

Auditor John Inventory CPA 3 years

Auditor Mark Accounts

Receivables

CPA 4 years

6

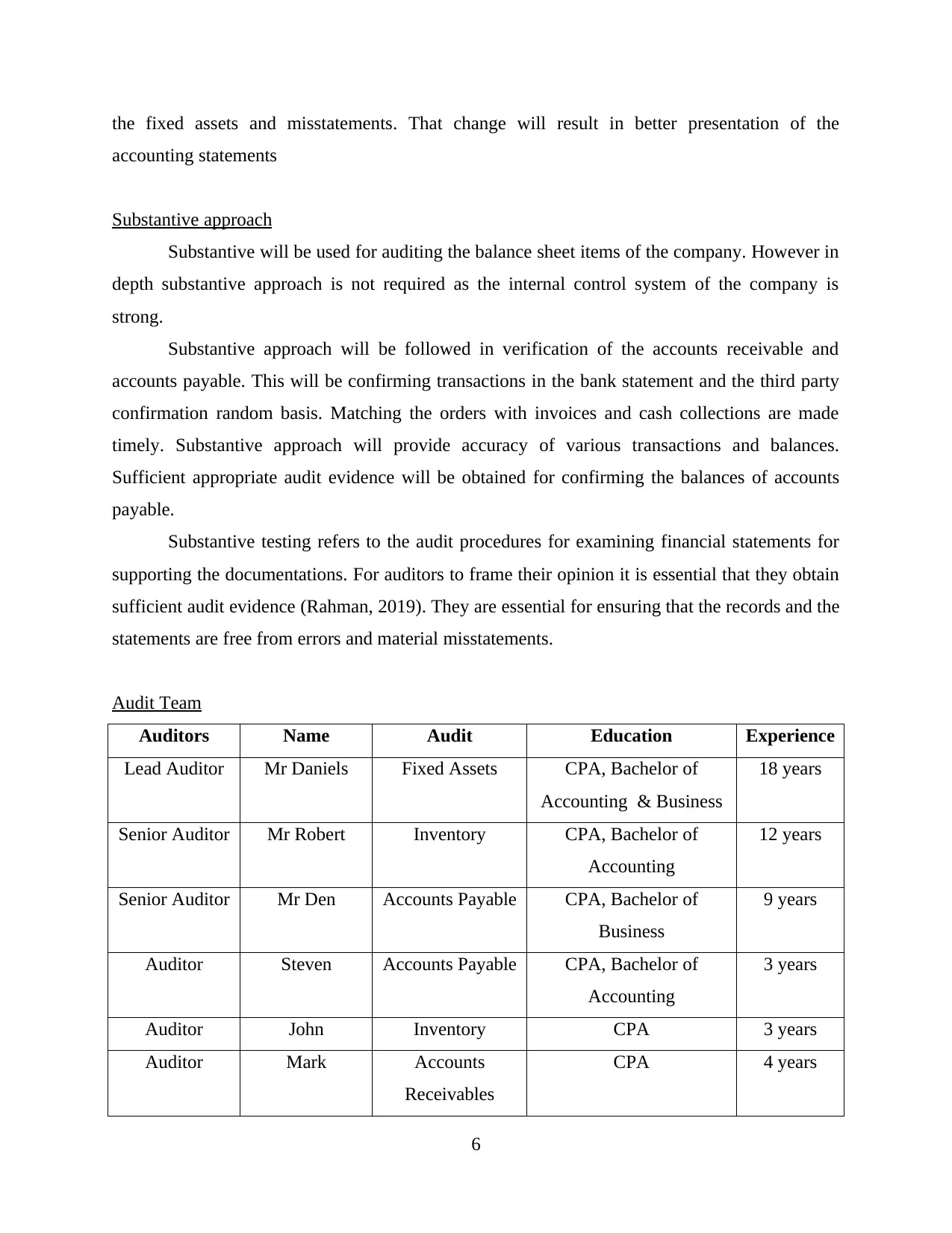

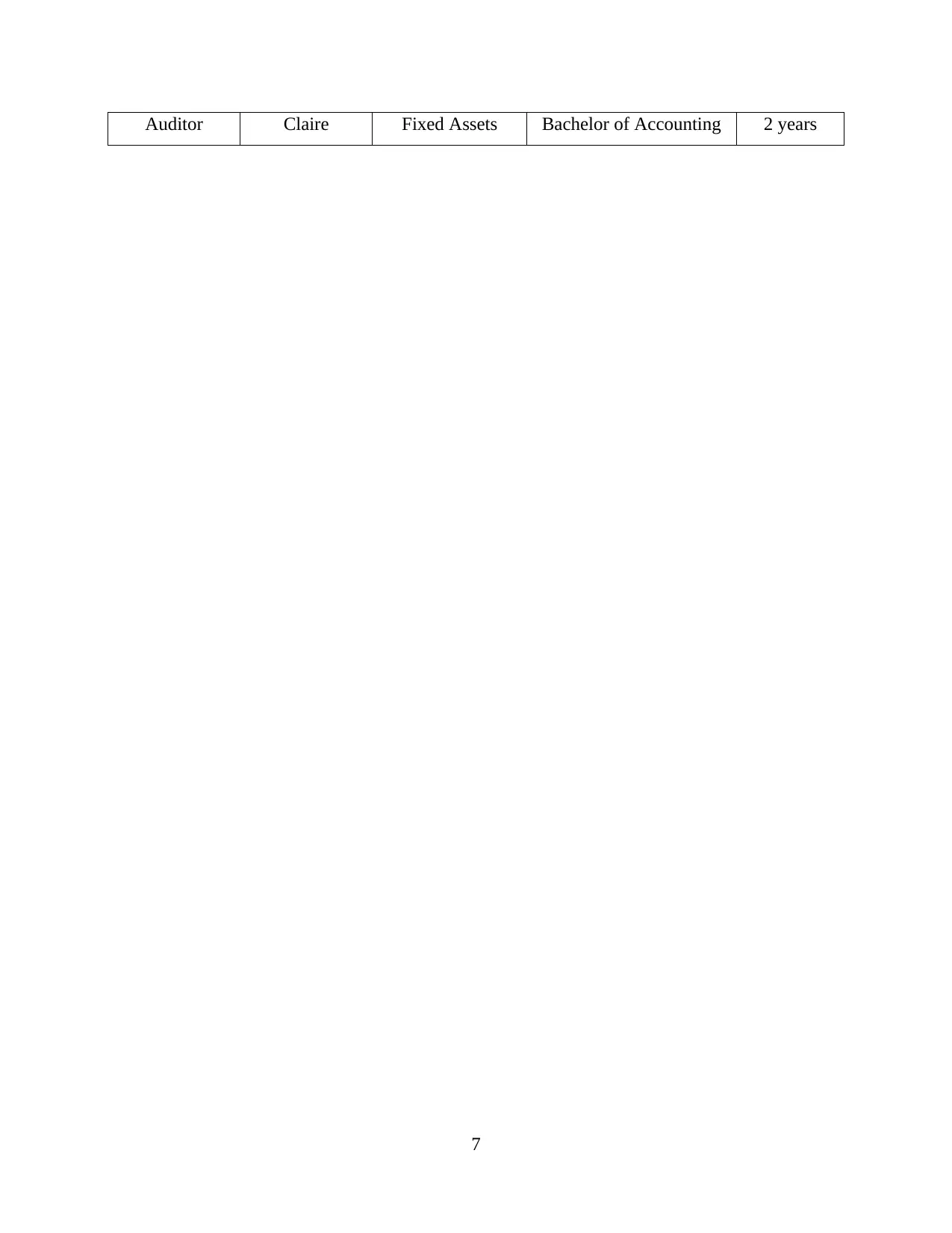

Auditor Claire Fixed Assets Bachelor of Accounting 2 years

7

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CONCLUSION

Conclusion are framed that for initiating the audit of any company it is very essential for

planning the audit. Audit is to be framed according to the various items that will be inspecting.

Framing proper auditing strategy, audit programs with relevant assertions are required for the

balance sheet items. Substantive audit procedures are conducted for supporting the

documentation of the records and for getting substantive audit evidence for framing the audit

opinion.

8

Conclusion are framed that for initiating the audit of any company it is very essential for

planning the audit. Audit is to be framed according to the various items that will be inspecting.

Framing proper auditing strategy, audit programs with relevant assertions are required for the

balance sheet items. Substantive audit procedures are conducted for supporting the

documentation of the records and for getting substantive audit evidence for framing the audit

opinion.

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Sun, T., 2019. Applying deep learning to audit procedures: An illustrative

framework. Accounting Horizons.33(3). pp.89-109.

Christ, M.H. and et.al., 2019. Prepare for Takeoff: Improving Audit Efficiency and Effectiveness

with Drone-enabled Inventory Audit Procedures. Available at SSRN 3335204.

Triantopoulou, C. And et.al., 2019. Imaging department accreditation: audit procedures and

implementation.

Rahman, A., 2019. Audit Procedures of a Chartered Accountant Firm: A Study on Habib Sarwar

Bhuiyan& Co.

Iqbal, M., 2019. Audit Procedures of a Chartered Accountant Firm: A Study on Mahfel Huq &

Co.

9

Books and Journals

Sun, T., 2019. Applying deep learning to audit procedures: An illustrative

framework. Accounting Horizons.33(3). pp.89-109.

Christ, M.H. and et.al., 2019. Prepare for Takeoff: Improving Audit Efficiency and Effectiveness

with Drone-enabled Inventory Audit Procedures. Available at SSRN 3335204.

Triantopoulou, C. And et.al., 2019. Imaging department accreditation: audit procedures and

implementation.

Rahman, A., 2019. Audit Procedures of a Chartered Accountant Firm: A Study on Habib Sarwar

Bhuiyan& Co.

Iqbal, M., 2019. Audit Procedures of a Chartered Accountant Firm: A Study on Mahfel Huq &

Co.

9

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.