RSK80003 Risk Perception and Analysis Report - Swinburne

VerifiedAdded on 2023/06/12

|15

|3512

|61

Report

AI Summary

This report provides a detailed analysis of risk perception and management, covering reactive and proactive risk management, the risk management process, sources of risk, and the use of risk registers. It discusses the differences between general and operational risks, the importance of risk governance, and the role of a risk management committee in achieving desired outcomes and efficient resource utilization. The report also explores the measurement of risk, including the total cost of risk and its constituents, such as insurance premiums, employee protection costs, and retained losses. Furthermore, it examines market risk as a systemic risk, comparing it to interest rate risk and discussing its potential consequences, particularly in scenarios involving political instability. The risk matrix is presented as a tool for evaluating and ranking risks based on their impact and probability of occurrence. This student-contributed document is available on Desklib, a platform offering a wide range of study tools and resources for students.

RISK PERCEPTION AND ANALYSIS

By [Name]

Course

Professor’s Name

Institution

Location of Institution

Date

By [Name]

Course

Professor’s Name

Institution

Location of Institution

Date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Risk Perception and Analysis

Part A Elements of Risk Management

Question One

a) Reactive risk management involves the identification of risks and measures to curb or

reduce them way after they have already occurred based on the audit and evaluation

findings after its occurrence. On the hand, proactive risk management involves

identification of a probably risk way before an incident occurs after relevant observations

and measurements have already been obtained (Norrman and Jansson, 2004, p. 434-456).

b) Risk management process has various aspects in a logical manner. First, we start by

assessing the risk faced and this involves identification, measurement, and financing of

the risk (Jorion, 2001).Once that is in order, control measures are adopted and then the

risk portfolio is monitored.

c) The main type of sources of risk in an organization includes systematic and diversifiable

risk, liquidity risk, credit risk, business risk and market risk (Jüttner, Peck, and

Christopher, 2003, 197-210).

d) Risk register which is also known as risk log is a tool used to document risks and the

relevant actions to be taken so as to manage them. Its contents include a brief description

of each risk, risk category, risk rating, the probability of occurrence of a risk and common

mitigation steps in case of occurrence (Cassar, G., 2004, p. 265).

e) This is because general risks arise from external events that the organization has no

control over such as fire whereas the operational risk can be controlled as they arise from

Part A Elements of Risk Management

Question One

a) Reactive risk management involves the identification of risks and measures to curb or

reduce them way after they have already occurred based on the audit and evaluation

findings after its occurrence. On the hand, proactive risk management involves

identification of a probably risk way before an incident occurs after relevant observations

and measurements have already been obtained (Norrman and Jansson, 2004, p. 434-456).

b) Risk management process has various aspects in a logical manner. First, we start by

assessing the risk faced and this involves identification, measurement, and financing of

the risk (Jorion, 2001).Once that is in order, control measures are adopted and then the

risk portfolio is monitored.

c) The main type of sources of risk in an organization includes systematic and diversifiable

risk, liquidity risk, credit risk, business risk and market risk (Jüttner, Peck, and

Christopher, 2003, 197-210).

d) Risk register which is also known as risk log is a tool used to document risks and the

relevant actions to be taken so as to manage them. Its contents include a brief description

of each risk, risk category, risk rating, the probability of occurrence of a risk and common

mitigation steps in case of occurrence (Cassar, G., 2004, p. 265).

e) This is because general risks arise from external events that the organization has no

control over such as fire whereas the operational risk can be controlled as they arise from

the failure of internal processes, individuals, and scheme or even outside events

(Wipplinger, 2007, p. 397).

f) The achievement of desired outcomes, efficient use of resources in the organization,

presence of transparency and clear accountability in the organization (Tao, 2010, p. 1-4).

g) Risk management system involves the identification, quantification, and management of

risks that a firm is facing. On the other hand, systematic approach to risk management

mainly involves being ready with contingency plans just in case any type of risk faces the

organization at any time(Stewart and Roth, 2001, p. 145).

h) The outcome of events in an organization is always uncertain because various levels of

risk are involved. This, therefore, calls for proper risk governance through a proper risk

management system. The system should be in a position to identify, measure, finance,

control and monitor risk efficiently.

Question Two

Exercise Two

Risk can be of high consequence or low consequence depending on the amount of uncertainty

involved. One has to consider the amount of risk he is able to take and the amount he is

comfortable taking in regards to his financial level. Various types of risk have different levels of

consequences to an organization

Lost time injury is that amount of time lost when an employee is not able to perform his duties

for a day or a shift because of an injury he sustained during work. This puts the organization at a

risk of low labor turn out which might decline the levels of production and hence putting the

organization at a risk of lesser profits or even loss. The amount of lost time injuries that arise

(Wipplinger, 2007, p. 397).

f) The achievement of desired outcomes, efficient use of resources in the organization,

presence of transparency and clear accountability in the organization (Tao, 2010, p. 1-4).

g) Risk management system involves the identification, quantification, and management of

risks that a firm is facing. On the other hand, systematic approach to risk management

mainly involves being ready with contingency plans just in case any type of risk faces the

organization at any time(Stewart and Roth, 2001, p. 145).

h) The outcome of events in an organization is always uncertain because various levels of

risk are involved. This, therefore, calls for proper risk governance through a proper risk

management system. The system should be in a position to identify, measure, finance,

control and monitor risk efficiently.

Question Two

Exercise Two

Risk can be of high consequence or low consequence depending on the amount of uncertainty

involved. One has to consider the amount of risk he is able to take and the amount he is

comfortable taking in regards to his financial level. Various types of risk have different levels of

consequences to an organization

Lost time injury is that amount of time lost when an employee is not able to perform his duties

for a day or a shift because of an injury he sustained during work. This puts the organization at a

risk of low labor turn out which might decline the levels of production and hence putting the

organization at a risk of lesser profits or even loss. The amount of lost time injuries that arise

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

during the reporting period is what levels up to the lost time injury frequency rate. However this

does not create much of a risk as the company could easily maintain a good safety culture, train

the employees on how to keep safe from any types of injuries and also the organization could

conduct a regular hazard assessment system (Blewett, 1994, p. 1-55). Moreover, another

employee could be called upon to perform the duties of the injured employee. This, therefore,

shows that lost time injury frequency rate is not a high consequence value risk to an organization

as measures can be put to control its consequences. As long as the organization has an effective

risk management system, LTIFR will not be much of a problem in the risk measurement and

control.

Exercise Three

Every organization requires a proper risk management committee for its risks governance. A

high-quality risk governance will be full of transparency and clear accountability as well as

efficiency in the use of resources and achievement of desired outcomes.

A competent management team prefers to put the organization in face of lower losses as it is the

main aim of the organization to make profits. It also has to ensure that the cost involved in

identification, initiation, transfer of the risk and enforcement are low as possible as this form the

transaction costs(Stevenson and Hojati, 2007). These include the financial distress costs, the cost

required for issuing external financing, cost of implementing risk management and costs of

ensuring a strong risk profile.

In order for the company to avoid high losses resulting from various types of risk, the

organization has to ensure that proper risk management measures are put in place. The higher the

cost invested in this process of risk governance the higher the probability of the organization

does not create much of a risk as the company could easily maintain a good safety culture, train

the employees on how to keep safe from any types of injuries and also the organization could

conduct a regular hazard assessment system (Blewett, 1994, p. 1-55). Moreover, another

employee could be called upon to perform the duties of the injured employee. This, therefore,

shows that lost time injury frequency rate is not a high consequence value risk to an organization

as measures can be put to control its consequences. As long as the organization has an effective

risk management system, LTIFR will not be much of a problem in the risk measurement and

control.

Exercise Three

Every organization requires a proper risk management committee for its risks governance. A

high-quality risk governance will be full of transparency and clear accountability as well as

efficiency in the use of resources and achievement of desired outcomes.

A competent management team prefers to put the organization in face of lower losses as it is the

main aim of the organization to make profits. It also has to ensure that the cost involved in

identification, initiation, transfer of the risk and enforcement are low as possible as this form the

transaction costs(Stevenson and Hojati, 2007). These include the financial distress costs, the cost

required for issuing external financing, cost of implementing risk management and costs of

ensuring a strong risk profile.

In order for the company to avoid high losses resulting from various types of risk, the

organization has to ensure that proper risk management measures are put in place. The higher the

cost invested in this process of risk governance the higher the probability of the organization

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

being safe from losses (Stevenson, W.J. and Hojati, M., 2007). These are because a proper

management team will be made which will enable the organization to control and monitor the

risks that it may be facing and therefore reducing the consequence values of those risks.

Operating with lower loss and risk costs and with higher risk control costs also improves the

organization's public image and therefore making it attractive for making investments and they

can also easily get financial support which is really good for the business. Last but not least, the

organization's resources gains much protection.

Exercise Four

Risk can be measured making it have various ways by which it can be controlled. The total cost

of risk greatly depends on this argument. It is considered to be the costs incurred by insurance

companies as premium, administrative costs and indirect costs in the process of performing

safety and risk management programs (Stevenson and Hojati, 2007). All these costs are

controllable as they can be tracked and monitored. Moreover, there are operational tactics that

can be implemented so as to manage and reduce these costs.

The total cost of risk is made up of different constituents the first being insurance premiums. It is

the most easily tracked component of total cost of risk. Another constituent of TCOR is the costs

needed to protect the employees or even customers from injury during operations. These costs

are not easy to track and they include costs for safety equipment, training and warning signs,

e.t.c. However, they could be tracked as part of the total cost of risk for the business internally.

Retained losses is also a constituent of a total cost of risk. This is the amount of money an

organization spends to fix an issue but it is not deducted from there account as they are below the

organization's deductibles. The next element of TCOR is the costs needed to engage firms for

management team will be made which will enable the organization to control and monitor the

risks that it may be facing and therefore reducing the consequence values of those risks.

Operating with lower loss and risk costs and with higher risk control costs also improves the

organization's public image and therefore making it attractive for making investments and they

can also easily get financial support which is really good for the business. Last but not least, the

organization's resources gains much protection.

Exercise Four

Risk can be measured making it have various ways by which it can be controlled. The total cost

of risk greatly depends on this argument. It is considered to be the costs incurred by insurance

companies as premium, administrative costs and indirect costs in the process of performing

safety and risk management programs (Stevenson and Hojati, 2007). All these costs are

controllable as they can be tracked and monitored. Moreover, there are operational tactics that

can be implemented so as to manage and reduce these costs.

The total cost of risk is made up of different constituents the first being insurance premiums. It is

the most easily tracked component of total cost of risk. Another constituent of TCOR is the costs

needed to protect the employees or even customers from injury during operations. These costs

are not easy to track and they include costs for safety equipment, training and warning signs,

e.t.c. However, they could be tracked as part of the total cost of risk for the business internally.

Retained losses is also a constituent of a total cost of risk. This is the amount of money an

organization spends to fix an issue but it is not deducted from there account as they are below the

organization's deductibles. The next element of TCOR is the costs needed to engage firms for

assistance with their risk and insurance issues. An organization could hire an attorney to help

them with this issues. This element is seen as an external risk control cost. Lastly, TCOR is

constituted of productivity loss. This could arise due to losses or even injury and the time and

resources taken to fix them.

Part B Relevance Significance of Risk

Question One

a) Types of risk are the different classes or various forms of risk. The risk is the possibility

or the uncertainty of loss or injury. Market risk being a type of risk is a risk that is related

to the changes in investment market values or any other features that are related to

investment markets. These features could be interest and inflation rates (Diamond and

Rajan, 2001, p. 288). Market risk is divided into the consequences of changes in asset

values, consequences of investment market value change on liabilities and the

consequences of a provider not matching asset and liability cash flow. Market risk is

mainly associated with regular fluctuations observed in the trading price of any particular

shares or securities. That is to mean that it arises because of the rise or fall in the trading

price of listed shares or securities in the stock market.

b) Market risk is a systemic type of risk. It affects the entire market and not only specific

participants of the market. It is an un-diversifiable risk and cannot be controlled through

diversification. It can, however, be compared to diversifiable risks such as business risk

despite being of a different nature through various parameters. These include risk

likelihood, risk consequence and the thresholds to trigger management activities. Risk

likelihood is the probability of the risk occurring and market risk as an un-diversifiable

them with this issues. This element is seen as an external risk control cost. Lastly, TCOR is

constituted of productivity loss. This could arise due to losses or even injury and the time and

resources taken to fix them.

Part B Relevance Significance of Risk

Question One

a) Types of risk are the different classes or various forms of risk. The risk is the possibility

or the uncertainty of loss or injury. Market risk being a type of risk is a risk that is related

to the changes in investment market values or any other features that are related to

investment markets. These features could be interest and inflation rates (Diamond and

Rajan, 2001, p. 288). Market risk is divided into the consequences of changes in asset

values, consequences of investment market value change on liabilities and the

consequences of a provider not matching asset and liability cash flow. Market risk is

mainly associated with regular fluctuations observed in the trading price of any particular

shares or securities. That is to mean that it arises because of the rise or fall in the trading

price of listed shares or securities in the stock market.

b) Market risk is a systemic type of risk. It affects the entire market and not only specific

participants of the market. It is an un-diversifiable risk and cannot be controlled through

diversification. It can, however, be compared to diversifiable risks such as business risk

despite being of a different nature through various parameters. These include risk

likelihood, risk consequence and the thresholds to trigger management activities. Risk

likelihood is the probability of the risk occurring and market risk as an un-diversifiable

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

risk is more likely to occur as there is less control over them. Risk consequences or

impact turns out to be greater due to lack of measures to control them.

c) The market risk could be compared to interest rate risk as they are both systemic risks

and therefore un-diversifiable. They could be compared through various parameters such

as the risk likelihood of occurrence, the intensity of the risk consequences and the

threshold to trigger management activities (Müller and Stoyan, 2002). Market risk has a

higher probability of occurring as compared to interest rate risk which might only occur

in the case whereby there has been a change in monetary policy by the Central Bank. Its

risk consequences are also higher as it affects even the customers. Moreover, it has a

stronger threshold to the risk management or governance committee because of its great

impact.

Question Two

a) The country might have conducted elections which might have resulted in post-

election violence and majorly political instability. This event will result in the

organization facing market risk.

The main event, in this case, is political instability that may be accompanied by chaos.

These would give the organization poor working conditions that would see its

performance going down and therefore most probably incurring losses. The aftermath of

this event will result in a decrease in demand, loss of license of the business due to loss of

control and decrease in supply which all have consequences. A decrease in demand will

be as a result of poor working conditions which might lead the customer into losing

confidence in the organization((Ni, H., Chen and Chen, 2010, p. 1269). Other

impact turns out to be greater due to lack of measures to control them.

c) The market risk could be compared to interest rate risk as they are both systemic risks

and therefore un-diversifiable. They could be compared through various parameters such

as the risk likelihood of occurrence, the intensity of the risk consequences and the

threshold to trigger management activities (Müller and Stoyan, 2002). Market risk has a

higher probability of occurring as compared to interest rate risk which might only occur

in the case whereby there has been a change in monetary policy by the Central Bank. Its

risk consequences are also higher as it affects even the customers. Moreover, it has a

stronger threshold to the risk management or governance committee because of its great

impact.

Question Two

a) The country might have conducted elections which might have resulted in post-

election violence and majorly political instability. This event will result in the

organization facing market risk.

The main event, in this case, is political instability that may be accompanied by chaos.

These would give the organization poor working conditions that would see its

performance going down and therefore most probably incurring losses. The aftermath of

this event will result in a decrease in demand, loss of license of the business due to loss of

control and decrease in supply which all have consequences. A decrease in demand will

be as a result of poor working conditions which might lead the customer into losing

confidence in the organization((Ni, H., Chen and Chen, 2010, p. 1269). Other

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

competitive companies might also take advantage of the current situation and therefore be

handing them a tough competition to deal with.

The organization may also lose its operating license due to not being able to meet their

dues such as paying taxes and running bankrupt. The organization might also lose its

supply due to the various conditions surrounding it. These would see the downfall of the

organization as the laborers will likely withdraw their labor. The suppliers will also

terminate their contracts due to financial failure and therefore be leaving the company

without resources or raw materials to work with.

b) The risk matrix is also known as impact or probability matrix. It is a software that is

used in capturing identified risks, estimating their impact and the occurrence probability

and then ranking the risks as per this information (Pickering and Cowley, 2010,

p.11). Risk matrix can be used in the critical evaluation of risk and it depends on various

processes to be carried out. The first step towards the evaluation is the planning for the

activity to be conducted. A risk evaluation team with a facilitator is selected and the

ground rules are set for the application in the risk matrix.

Secondly, the team identifies key program requirements or objectives. This will help in

the identification of risks. After that, the team facilitator helps in the process of

identifying program risks and arranging them in an affinity diagram. After that, the team

concurs on grouping titles to be used for every group and then identifies full risk

statements neede in the affinity diagram. These are then entered in the risk entry

worksheet of the risk matrix. The team then assigns various attributes, proper time frame,

handing them a tough competition to deal with.

The organization may also lose its operating license due to not being able to meet their

dues such as paying taxes and running bankrupt. The organization might also lose its

supply due to the various conditions surrounding it. These would see the downfall of the

organization as the laborers will likely withdraw their labor. The suppliers will also

terminate their contracts due to financial failure and therefore be leaving the company

without resources or raw materials to work with.

b) The risk matrix is also known as impact or probability matrix. It is a software that is

used in capturing identified risks, estimating their impact and the occurrence probability

and then ranking the risks as per this information (Pickering and Cowley, 2010,

p.11). Risk matrix can be used in the critical evaluation of risk and it depends on various

processes to be carried out. The first step towards the evaluation is the planning for the

activity to be conducted. A risk evaluation team with a facilitator is selected and the

ground rules are set for the application in the risk matrix.

Secondly, the team identifies key program requirements or objectives. This will help in

the identification of risks. After that, the team facilitator helps in the process of

identifying program risks and arranging them in an affinity diagram. After that, the team

concurs on grouping titles to be used for every group and then identifies full risk

statements neede in the affinity diagram. These are then entered in the risk entry

worksheet of the risk matrix. The team then assigns various attributes, proper time frame,

impact and chances of occurrence of each risk. After that, risk matrix impact

classifications are set;

C (Critical); in case the risk event occurs, the program will fail and minimum

acceptable requirements will not be met.

S (Serious); in case the risk event occurs, the program will encounter a major

increase in costs but the acceptable requirements will be met. However secondary

requirements might not be met.

Mo (Moderate); in case the risk event occurs, the program will encounter a

moderate increase in costs and minimum requirements will be met. However,

some secondary requirements might not be met.

Mi (Minor); in case the risk event occurs, the program will encounter minor

increases in cost. The minimum requirement and most of the second requirement

will be met.

N (Negligible); in case the risk event occurs, it will have no effect on the program

and all the requirements will be met.

The probability of occurrence in the risk matrix is estimated using the relative scale of

occurrence as follows;

0-10%; very unlikely for the risk to occur

11-40%; unlikely for the risk to occur

41-60%; even probability that the risk will occur

61-90%; likely the risk will occur

91-100%; very likely that the risk will occur

classifications are set;

C (Critical); in case the risk event occurs, the program will fail and minimum

acceptable requirements will not be met.

S (Serious); in case the risk event occurs, the program will encounter a major

increase in costs but the acceptable requirements will be met. However secondary

requirements might not be met.

Mo (Moderate); in case the risk event occurs, the program will encounter a

moderate increase in costs and minimum requirements will be met. However,

some secondary requirements might not be met.

Mi (Minor); in case the risk event occurs, the program will encounter minor

increases in cost. The minimum requirement and most of the second requirement

will be met.

N (Negligible); in case the risk event occurs, it will have no effect on the program

and all the requirements will be met.

The probability of occurrence in the risk matrix is estimated using the relative scale of

occurrence as follows;

0-10%; very unlikely for the risk to occur

11-40%; unlikely for the risk to occur

41-60%; even probability that the risk will occur

61-90%; likely the risk will occur

91-100%; very likely that the risk will occur

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

At this point, the team has all the required information needed to rank the risks. Therefore we

move to the step of ranking program risks. Risk ranking is calculated using the Borda method

which ranks the risks in descending order on the basis of multiple evaluation criteria. After

ranking the risks from the most critical to the least critical, they are then managed by a good risk

management committee. This committee will eliminate some risks in case the requirements

changes, some will need a transfer in the case of inadequate resources to handle them while

others will need mitigation strategies. After managing the risks, the management team will then

manage the action plan as the risk matrix provide an execution plan in the superior mode. This is

used for tracing risk execution plans and in the adjustment rankings of the risk on the basis of

action plan status. The management team should continue monitoring and evaluating risks at a

periodical interval. Through this process, it will be evident whether the level of importance of the

risk has changed or even if new risks that need management have come up. The advanced mode

used in risk matrix is able to support a continuous evaluation process (Goerlandt and Reniers,

2016, P. 67-77).

move to the step of ranking program risks. Risk ranking is calculated using the Borda method

which ranks the risks in descending order on the basis of multiple evaluation criteria. After

ranking the risks from the most critical to the least critical, they are then managed by a good risk

management committee. This committee will eliminate some risks in case the requirements

changes, some will need a transfer in the case of inadequate resources to handle them while

others will need mitigation strategies. After managing the risks, the management team will then

manage the action plan as the risk matrix provide an execution plan in the superior mode. This is

used for tracing risk execution plans and in the adjustment rankings of the risk on the basis of

action plan status. The management team should continue monitoring and evaluating risks at a

periodical interval. Through this process, it will be evident whether the level of importance of the

risk has changed or even if new risks that need management have come up. The advanced mode

used in risk matrix is able to support a continuous evaluation process (Goerlandt and Reniers,

2016, P. 67-77).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Part C

a)

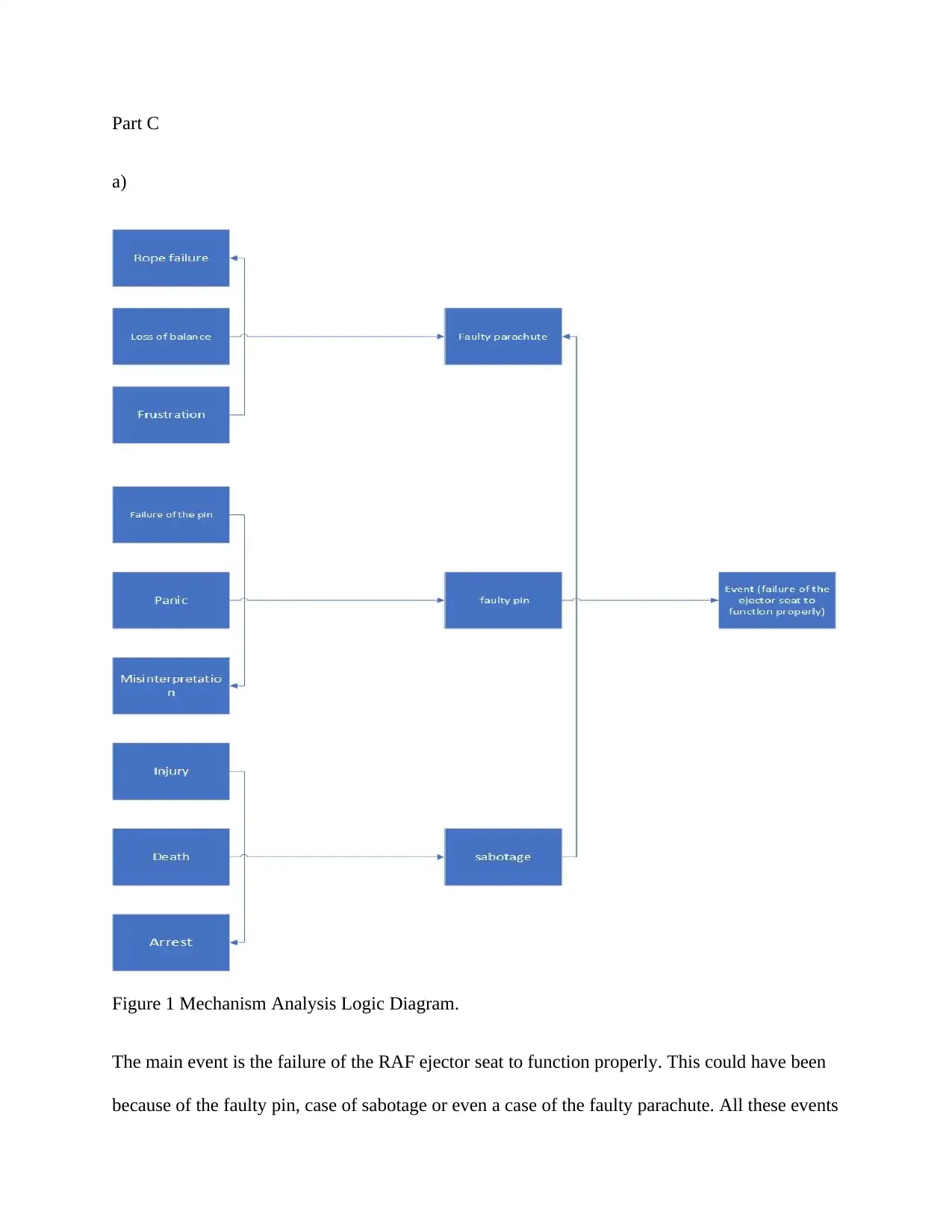

Figure 1 Mechanism Analysis Logic Diagram.

The main event is the failure of the RAF ejector seat to function properly. This could have been

because of the faulty pin, case of sabotage or even a case of the faulty parachute. All these events

a)

Figure 1 Mechanism Analysis Logic Diagram.

The main event is the failure of the RAF ejector seat to function properly. This could have been

because of the faulty pin, case of sabotage or even a case of the faulty parachute. All these events

result in consequences which are as a result of them as it is seen in Figure 1 above (Ball and

Watt, 2013).

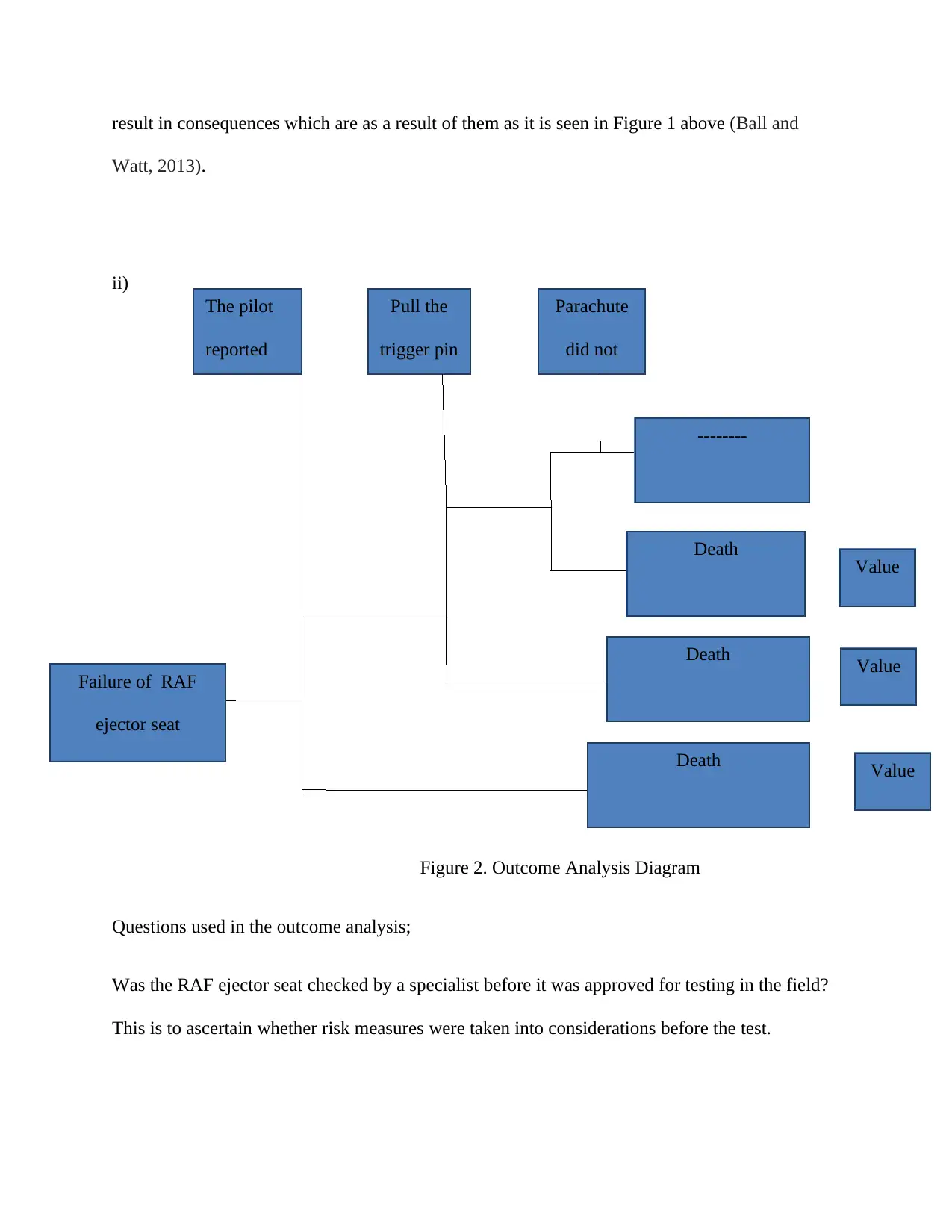

ii)

Figure 2. Outcome Analysis Diagram

Questions used in the outcome analysis;

Was the RAF ejector seat checked by a specialist before it was approved for testing in the field?

This is to ascertain whether risk measures were taken into considerations before the test.

The pilot

reported

the event

Pull the

trigger pin

Parachute

did not

open

--------

Death

Death

Death

Failure of RAF

ejector seat

Value

$

Value

$

Value

$

Watt, 2013).

ii)

Figure 2. Outcome Analysis Diagram

Questions used in the outcome analysis;

Was the RAF ejector seat checked by a specialist before it was approved for testing in the field?

This is to ascertain whether risk measures were taken into considerations before the test.

The pilot

reported

the event

Pull the

trigger pin

Parachute

did not

open

--------

Death

Death

Death

Failure of RAF

ejector seat

Value

$

Value

$

Value

$

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.