Business Management and Strategic Analysis of Ryanair Airlines

VerifiedAdded on 2023/04/11

|19

|3847

|413

Report

AI Summary

This report provides a comprehensive analysis of Ryanair Airlines' business and strategic management. It begins with a VRIO analysis to assess the company's internal resources and capabilities, followed by a SWOT analysis to identify its strengths, weaknesses, opportunities, and threats. A TOWS analysis is then conducted to formulate strategic options based on the SWOT findings. The report also applies McKinsey's 7S framework to evaluate the alignment of key organizational elements within Ryanair. Strategic recommendations are presented, derived from the VRIO, SWOT, and TOWS analyses, and these recommendations are further evaluated for suitability, feasibility, and acceptability. The report concludes by addressing Ryanair's key challenges, such as currency fluctuations, rising oil prices, regulatory changes, customer service issues, and human resources management, emphasizing the need for the airline to leverage its resources and capabilities while aligning its mission, vision, and objectives.

Running Head: BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Name of the Student

Name of the University

Student ID

Author Note

BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Name of the Student

Name of the University

Student ID

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Executive Summary

The aim of this report is the analysis and management of business strategy of the Ryanair

Airlines. It is one the largest low cost Irish airline in Ireland which was founded in the year

1984. Under this report discussion will be based on VRIO, SWOT and TOWS analysis. In

addition, Mc Kinsey’s 7S framework analysis will be done. Moreover, the strategic

recommendations based on the analysis of VRIO, SWOT and TOWS will be presented in the

report. Lastly, analysis of the overall suitability, feasibility and acceptability through

evaluation of the recommendations will be presented in the report. Hence, it is concluded that

Ryanair airlines is facing some key issues such as fluctuations in the currency, increase in the

oil price, changes in the government regulations, poor customer services, poor human

resources management. Therefore, the airline needs to identify, analyze and implement the

strategies through utilizing their resources and capabilities with aligning the mission, vision

and objectives of the organization.

Executive Summary

The aim of this report is the analysis and management of business strategy of the Ryanair

Airlines. It is one the largest low cost Irish airline in Ireland which was founded in the year

1984. Under this report discussion will be based on VRIO, SWOT and TOWS analysis. In

addition, Mc Kinsey’s 7S framework analysis will be done. Moreover, the strategic

recommendations based on the analysis of VRIO, SWOT and TOWS will be presented in the

report. Lastly, analysis of the overall suitability, feasibility and acceptability through

evaluation of the recommendations will be presented in the report. Hence, it is concluded that

Ryanair airlines is facing some key issues such as fluctuations in the currency, increase in the

oil price, changes in the government regulations, poor customer services, poor human

resources management. Therefore, the airline needs to identify, analyze and implement the

strategies through utilizing their resources and capabilities with aligning the mission, vision

and objectives of the organization.

2BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Table of Contents

Introduction................................................................................................................................3

Section 1- VRIO Analysis..........................................................................................................3

Section 2.....................................................................................................................................6

SWOT Analysis.....................................................................................................................6

TOWS Analysis.....................................................................................................................8

Section 3- Mc Kinsey 7S Framework of Ryanair Models.......................................................10

Section 4...................................................................................................................................12

(a) Recommendations.....................................................................................................12

(b) Evaluation of SFA on Recommendations.................................................................13

Conclusion................................................................................................................................14

References................................................................................................................................15

Table of Contents

Introduction................................................................................................................................3

Section 1- VRIO Analysis..........................................................................................................3

Section 2.....................................................................................................................................6

SWOT Analysis.....................................................................................................................6

TOWS Analysis.....................................................................................................................8

Section 3- Mc Kinsey 7S Framework of Ryanair Models.......................................................10

Section 4...................................................................................................................................12

(a) Recommendations.....................................................................................................12

(b) Evaluation of SFA on Recommendations.................................................................13

Conclusion................................................................................................................................14

References................................................................................................................................15

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Introduction

The aim of this report is the business management and the strategic management of

the Ryanair Airlines. There are so many low cost airlines which operates in Europe.

However, the most popular airline is Ryanair Airlines. It commenced its operations on 8th

July 1985 and is considered as one of the oldest and largest budgeted European airline

headquartered in Ireland. The operations of Ryanair include 400 aircraft of Boeing 737-800

and one charter aircraft of 737-700. The success and rapid expansion of this airline is resulted

from its low cost model of the business and due to the deregulation of the European

aviation’s industry (Ryanair.com 2019). The discussion of this report will include VRIO

Analysis which includes internal strategic capabilities as well as any limitations in terms of

strategic capabilities. In addition, SWOT and TOWS Analysis will be presented in the report.

SWOT Analysis will include strength, weakness, opportunities and threat of the company

whereas TOWS Analysis will include identification of the options of SO, ST, WO and WT

for the company. Moreover, the models of change management will be discussed. Lastly,

strategic recommendations based on the analysis of VRIO, SWOT and TOWS will be done

and based on the recommendations overall evaluation of the suitability, feasibility and

acceptability will be done. It will followed by summary of the findings and conclusions based

on the strategic recommendations.

Section 1- VRIO Analysis

The resources of the organization include physical, organization, reputation,

intellectual, financial and technological. On the basis of these resources, the core

competencies can be developed by Ryanair. Hence, VRIO analysis is performed for finding

out whether the internal resources helps in competitive advantage or not (Slavik and Bednár

2014).

Introduction

The aim of this report is the business management and the strategic management of

the Ryanair Airlines. There are so many low cost airlines which operates in Europe.

However, the most popular airline is Ryanair Airlines. It commenced its operations on 8th

July 1985 and is considered as one of the oldest and largest budgeted European airline

headquartered in Ireland. The operations of Ryanair include 400 aircraft of Boeing 737-800

and one charter aircraft of 737-700. The success and rapid expansion of this airline is resulted

from its low cost model of the business and due to the deregulation of the European

aviation’s industry (Ryanair.com 2019). The discussion of this report will include VRIO

Analysis which includes internal strategic capabilities as well as any limitations in terms of

strategic capabilities. In addition, SWOT and TOWS Analysis will be presented in the report.

SWOT Analysis will include strength, weakness, opportunities and threat of the company

whereas TOWS Analysis will include identification of the options of SO, ST, WO and WT

for the company. Moreover, the models of change management will be discussed. Lastly,

strategic recommendations based on the analysis of VRIO, SWOT and TOWS will be done

and based on the recommendations overall evaluation of the suitability, feasibility and

acceptability will be done. It will followed by summary of the findings and conclusions based

on the strategic recommendations.

Section 1- VRIO Analysis

The resources of the organization include physical, organization, reputation,

intellectual, financial and technological. On the basis of these resources, the core

competencies can be developed by Ryanair. Hence, VRIO analysis is performed for finding

out whether the internal resources helps in competitive advantage or not (Slavik and Bednár

2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Value analysis is done to ensure that whether the company is able to deploy the

resources in such a way that it meets the expectations and needs of the customers. Ryanair

airline is able to achieve the distinct value in the minds of the customers through reducing

airport charges, model of their low price structure, subsidies of the government. It becomes

one of the low fare airlines by combining these aspects.

Rareness analysis of Ryanair helps in identifying the resources and capabilities it is

having as compared to other airlines. Resources, such as reduction in the airport charges and

subsidies of the government makes the company valuable and rare as compare to other direct

competitors such as EasyJet which do not have this resources. The company has gained in

terms of these resources due to its ability for attracting customers and access to secondary

routes. Therefore, the government helps in developing secondary airports which increases

tourism and consumption for the local government.

Limitability analysis of Ryanair helps in finding out the limitless of the company in its

resource. The resources such as reduction of the airport charges and subsidies of the

government is hardly imitated and transferred. Hence, it is the biggest advantage for the

company in comparison of the other airlines.

Organization analysis of the Ryanair helps in finding out the fact that it provides

lowest cost and price by utilizing effectively all the internal resources and capabilities. The

effective strategy of the organization and the strong team of management help in making

good strategy of operations and strategies of marketing for the best possible use of the

resources and capabilities which leads to competitive advantage for the company.

Financial analysis of the company helps in identifying that the company is

continuously growing in terms of excess in the earning by 20%. The operating revenue of the

company from year 2010-2011 has grown to 21% and from 2011- 2012 has grown to 20%

Value analysis is done to ensure that whether the company is able to deploy the

resources in such a way that it meets the expectations and needs of the customers. Ryanair

airline is able to achieve the distinct value in the minds of the customers through reducing

airport charges, model of their low price structure, subsidies of the government. It becomes

one of the low fare airlines by combining these aspects.

Rareness analysis of Ryanair helps in identifying the resources and capabilities it is

having as compared to other airlines. Resources, such as reduction in the airport charges and

subsidies of the government makes the company valuable and rare as compare to other direct

competitors such as EasyJet which do not have this resources. The company has gained in

terms of these resources due to its ability for attracting customers and access to secondary

routes. Therefore, the government helps in developing secondary airports which increases

tourism and consumption for the local government.

Limitability analysis of Ryanair helps in finding out the limitless of the company in its

resource. The resources such as reduction of the airport charges and subsidies of the

government is hardly imitated and transferred. Hence, it is the biggest advantage for the

company in comparison of the other airlines.

Organization analysis of the Ryanair helps in finding out the fact that it provides

lowest cost and price by utilizing effectively all the internal resources and capabilities. The

effective strategy of the organization and the strong team of management help in making

good strategy of operations and strategies of marketing for the best possible use of the

resources and capabilities which leads to competitive advantage for the company.

Financial analysis of the company helps in identifying that the company is

continuously growing in terms of excess in the earning by 20%. The operating revenue of the

company from year 2010-2011 has grown to 21% and from 2011- 2012 has grown to 20%

5BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

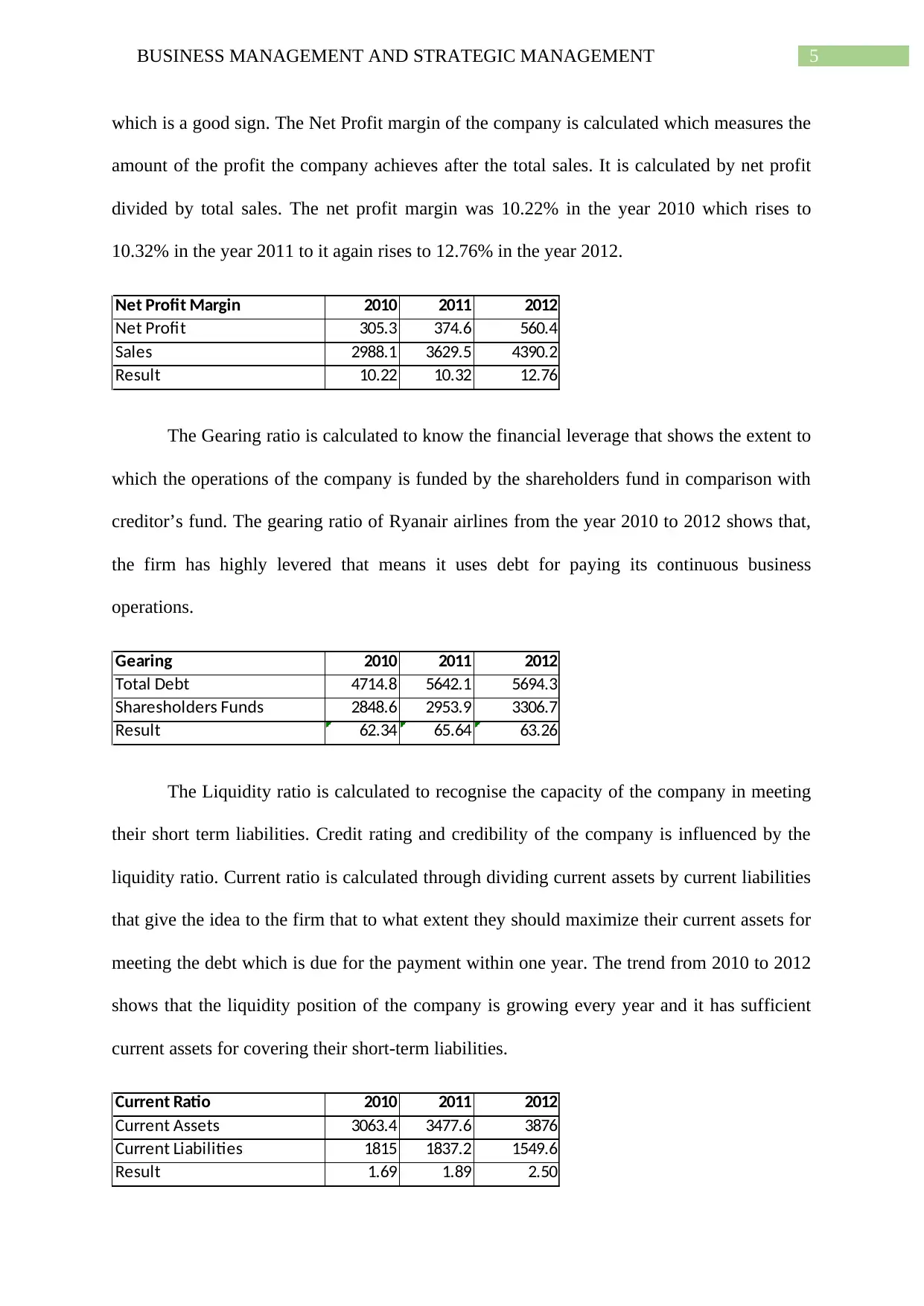

which is a good sign. The Net Profit margin of the company is calculated which measures the

amount of the profit the company achieves after the total sales. It is calculated by net profit

divided by total sales. The net profit margin was 10.22% in the year 2010 which rises to

10.32% in the year 2011 to it again rises to 12.76% in the year 2012.

Net Profit Margin 2010 2011 2012

Net Profit 305.3 374.6 560.4

Sales 2988.1 3629.5 4390.2

Result 10.22 10.32 12.76

The Gearing ratio is calculated to know the financial leverage that shows the extent to

which the operations of the company is funded by the shareholders fund in comparison with

creditor’s fund. The gearing ratio of Ryanair airlines from the year 2010 to 2012 shows that,

the firm has highly levered that means it uses debt for paying its continuous business

operations.

Gearing 2010 2011 2012

Total Debt 4714.8 5642.1 5694.3

Sharesholders Funds 2848.6 2953.9 3306.7

Result 62.34 65.64 63.26

The Liquidity ratio is calculated to recognise the capacity of the company in meeting

their short term liabilities. Credit rating and credibility of the company is influenced by the

liquidity ratio. Current ratio is calculated through dividing current assets by current liabilities

that give the idea to the firm that to what extent they should maximize their current assets for

meeting the debt which is due for the payment within one year. The trend from 2010 to 2012

shows that the liquidity position of the company is growing every year and it has sufficient

current assets for covering their short-term liabilities.

Current Ratio 2010 2011 2012

Current Assets 3063.4 3477.6 3876

Current Liabilities 1815 1837.2 1549.6

Result 1.69 1.89 2.50

which is a good sign. The Net Profit margin of the company is calculated which measures the

amount of the profit the company achieves after the total sales. It is calculated by net profit

divided by total sales. The net profit margin was 10.22% in the year 2010 which rises to

10.32% in the year 2011 to it again rises to 12.76% in the year 2012.

Net Profit Margin 2010 2011 2012

Net Profit 305.3 374.6 560.4

Sales 2988.1 3629.5 4390.2

Result 10.22 10.32 12.76

The Gearing ratio is calculated to know the financial leverage that shows the extent to

which the operations of the company is funded by the shareholders fund in comparison with

creditor’s fund. The gearing ratio of Ryanair airlines from the year 2010 to 2012 shows that,

the firm has highly levered that means it uses debt for paying its continuous business

operations.

Gearing 2010 2011 2012

Total Debt 4714.8 5642.1 5694.3

Sharesholders Funds 2848.6 2953.9 3306.7

Result 62.34 65.64 63.26

The Liquidity ratio is calculated to recognise the capacity of the company in meeting

their short term liabilities. Credit rating and credibility of the company is influenced by the

liquidity ratio. Current ratio is calculated through dividing current assets by current liabilities

that give the idea to the firm that to what extent they should maximize their current assets for

meeting the debt which is due for the payment within one year. The trend from 2010 to 2012

shows that the liquidity position of the company is growing every year and it has sufficient

current assets for covering their short-term liabilities.

Current Ratio 2010 2011 2012

Current Assets 3063.4 3477.6 3876

Current Liabilities 1815 1837.2 1549.6

Result 1.69 1.89 2.50

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

Hence, the financial position of Ryanair airlines shows that the firm has grown in

respect of financial resources and it is the greatest competitive advantage for the company in

terms of profitability, liquidity and solvency position.

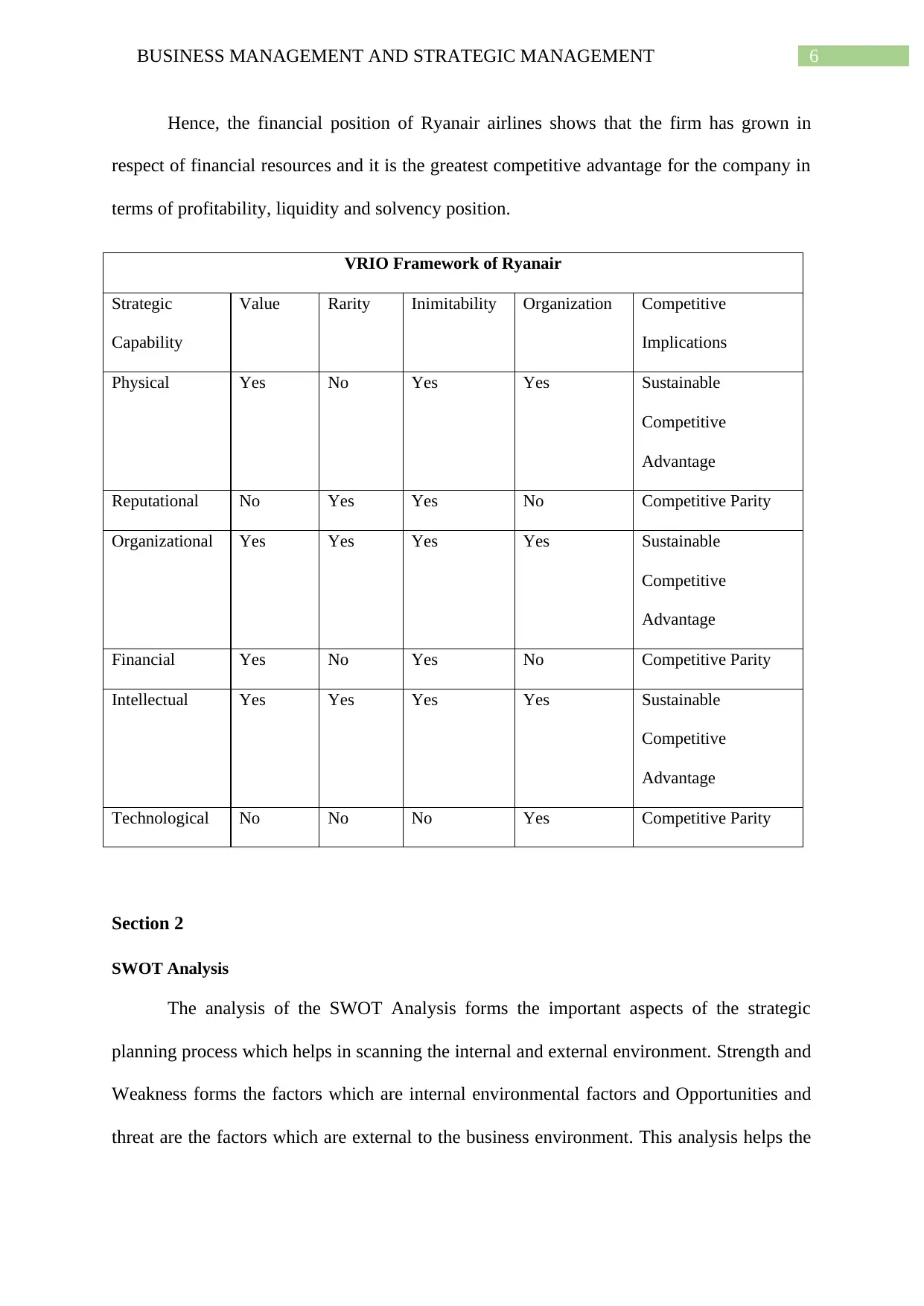

VRIO Framework of Ryanair

Strategic

Capability

Value Rarity Inimitability Organization Competitive

Implications

Physical Yes No Yes Yes Sustainable

Competitive

Advantage

Reputational No Yes Yes No Competitive Parity

Organizational Yes Yes Yes Yes Sustainable

Competitive

Advantage

Financial Yes No Yes No Competitive Parity

Intellectual Yes Yes Yes Yes Sustainable

Competitive

Advantage

Technological No No No Yes Competitive Parity

Section 2

SWOT Analysis

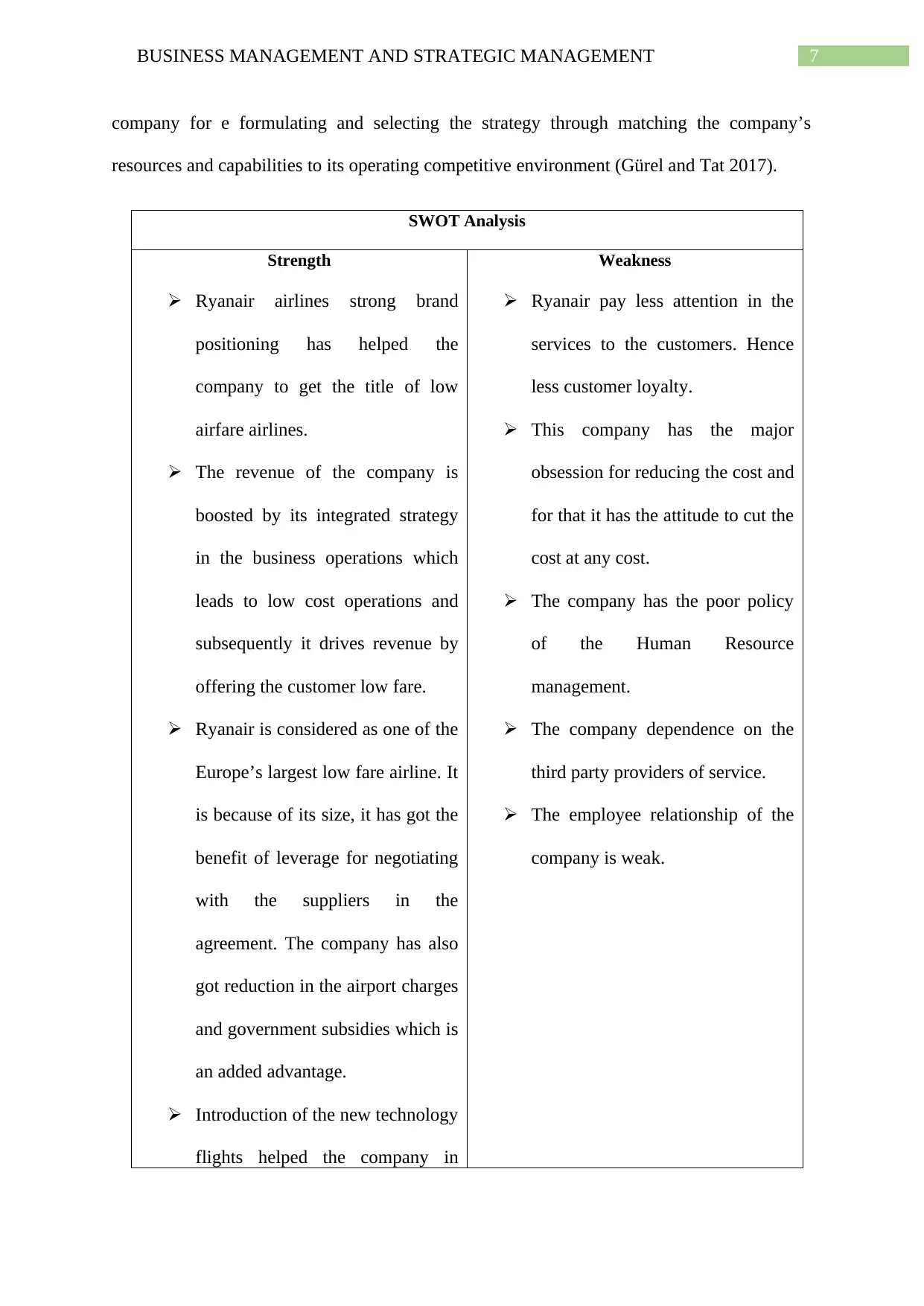

The analysis of the SWOT Analysis forms the important aspects of the strategic

planning process which helps in scanning the internal and external environment. Strength and

Weakness forms the factors which are internal environmental factors and Opportunities and

threat are the factors which are external to the business environment. This analysis helps the

Hence, the financial position of Ryanair airlines shows that the firm has grown in

respect of financial resources and it is the greatest competitive advantage for the company in

terms of profitability, liquidity and solvency position.

VRIO Framework of Ryanair

Strategic

Capability

Value Rarity Inimitability Organization Competitive

Implications

Physical Yes No Yes Yes Sustainable

Competitive

Advantage

Reputational No Yes Yes No Competitive Parity

Organizational Yes Yes Yes Yes Sustainable

Competitive

Advantage

Financial Yes No Yes No Competitive Parity

Intellectual Yes Yes Yes Yes Sustainable

Competitive

Advantage

Technological No No No Yes Competitive Parity

Section 2

SWOT Analysis

The analysis of the SWOT Analysis forms the important aspects of the strategic

planning process which helps in scanning the internal and external environment. Strength and

Weakness forms the factors which are internal environmental factors and Opportunities and

threat are the factors which are external to the business environment. This analysis helps the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

company for e formulating and selecting the strategy through matching the company’s

resources and capabilities to its operating competitive environment (Gürel and Tat 2017).

SWOT Analysis

Strength

Ryanair airlines strong brand

positioning has helped the

company to get the title of low

airfare airlines.

The revenue of the company is

boosted by its integrated strategy

in the business operations which

leads to low cost operations and

subsequently it drives revenue by

offering the customer low fare.

Ryanair is considered as one of the

Europe’s largest low fare airline. It

is because of its size, it has got the

benefit of leverage for negotiating

with the suppliers in the

agreement. The company has also

got reduction in the airport charges

and government subsidies which is

an added advantage.

Introduction of the new technology

flights helped the company in

Weakness

Ryanair pay less attention in the

services to the customers. Hence

less customer loyalty.

This company has the major

obsession for reducing the cost and

for that it has the attitude to cut the

cost at any cost.

The company has the poor policy

of the Human Resource

management.

The company dependence on the

third party providers of service.

The employee relationship of the

company is weak.

company for e formulating and selecting the strategy through matching the company’s

resources and capabilities to its operating competitive environment (Gürel and Tat 2017).

SWOT Analysis

Strength

Ryanair airlines strong brand

positioning has helped the

company to get the title of low

airfare airlines.

The revenue of the company is

boosted by its integrated strategy

in the business operations which

leads to low cost operations and

subsequently it drives revenue by

offering the customer low fare.

Ryanair is considered as one of the

Europe’s largest low fare airline. It

is because of its size, it has got the

benefit of leverage for negotiating

with the suppliers in the

agreement. The company has also

got reduction in the airport charges

and government subsidies which is

an added advantage.

Introduction of the new technology

flights helped the company in

Weakness

Ryanair pay less attention in the

services to the customers. Hence

less customer loyalty.

This company has the major

obsession for reducing the cost and

for that it has the attitude to cut the

cost at any cost.

The company has the poor policy

of the Human Resource

management.

The company dependence on the

third party providers of service.

The employee relationship of the

company is weak.

8BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

achieving efficiency in the fuel and

less maintenance cost

Ryanair has sufficient amount of

the cash in their books which is the

added strength of the company as

compared to the creditors.

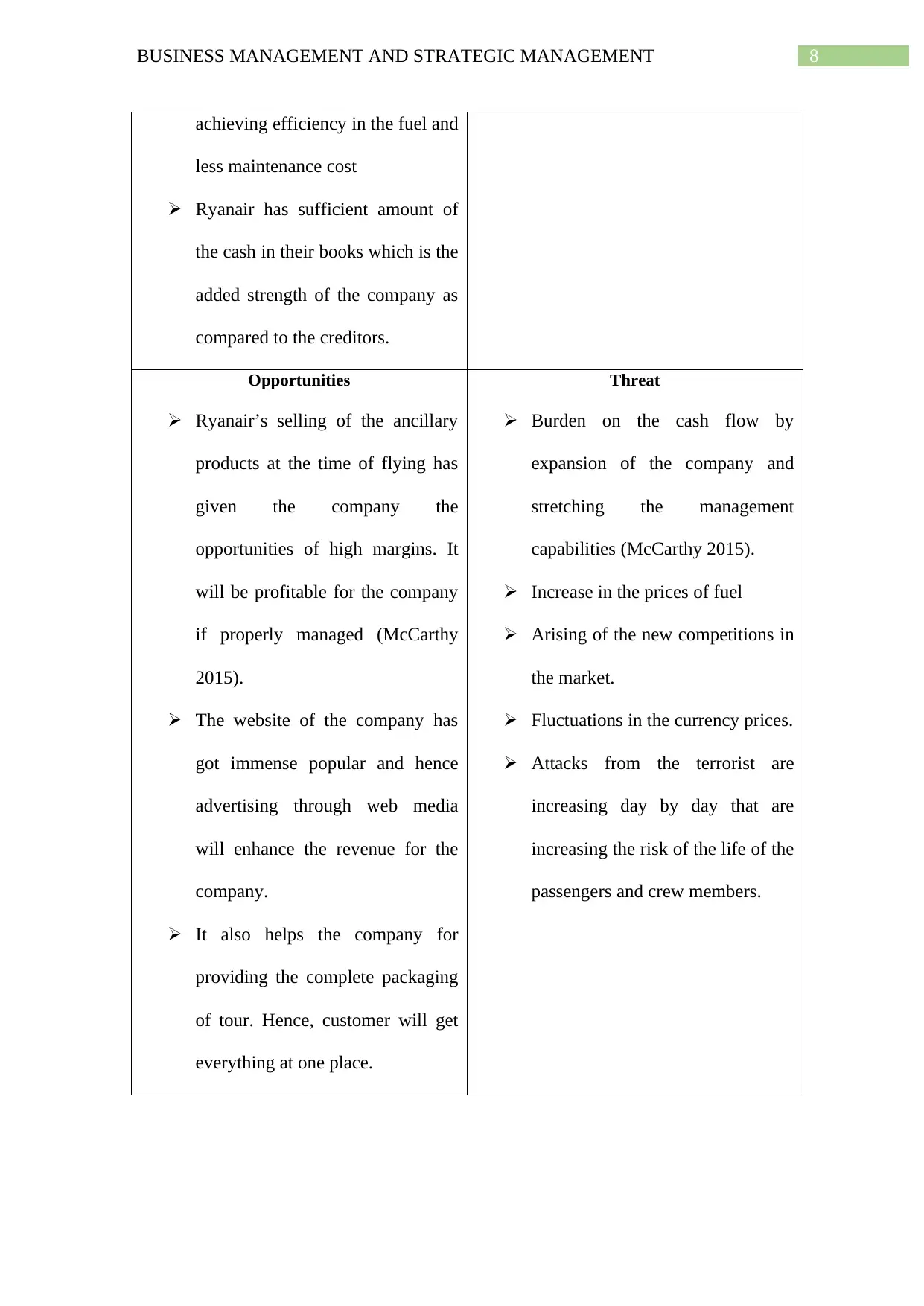

Opportunities

Ryanair’s selling of the ancillary

products at the time of flying has

given the company the

opportunities of high margins. It

will be profitable for the company

if properly managed (McCarthy

2015).

The website of the company has

got immense popular and hence

advertising through web media

will enhance the revenue for the

company.

It also helps the company for

providing the complete packaging

of tour. Hence, customer will get

everything at one place.

Threat

Burden on the cash flow by

expansion of the company and

stretching the management

capabilities (McCarthy 2015).

Increase in the prices of fuel

Arising of the new competitions in

the market.

Fluctuations in the currency prices.

Attacks from the terrorist are

increasing day by day that are

increasing the risk of the life of the

passengers and crew members.

achieving efficiency in the fuel and

less maintenance cost

Ryanair has sufficient amount of

the cash in their books which is the

added strength of the company as

compared to the creditors.

Opportunities

Ryanair’s selling of the ancillary

products at the time of flying has

given the company the

opportunities of high margins. It

will be profitable for the company

if properly managed (McCarthy

2015).

The website of the company has

got immense popular and hence

advertising through web media

will enhance the revenue for the

company.

It also helps the company for

providing the complete packaging

of tour. Hence, customer will get

everything at one place.

Threat

Burden on the cash flow by

expansion of the company and

stretching the management

capabilities (McCarthy 2015).

Increase in the prices of fuel

Arising of the new competitions in

the market.

Fluctuations in the currency prices.

Attacks from the terrorist are

increasing day by day that are

increasing the risk of the life of the

passengers and crew members.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

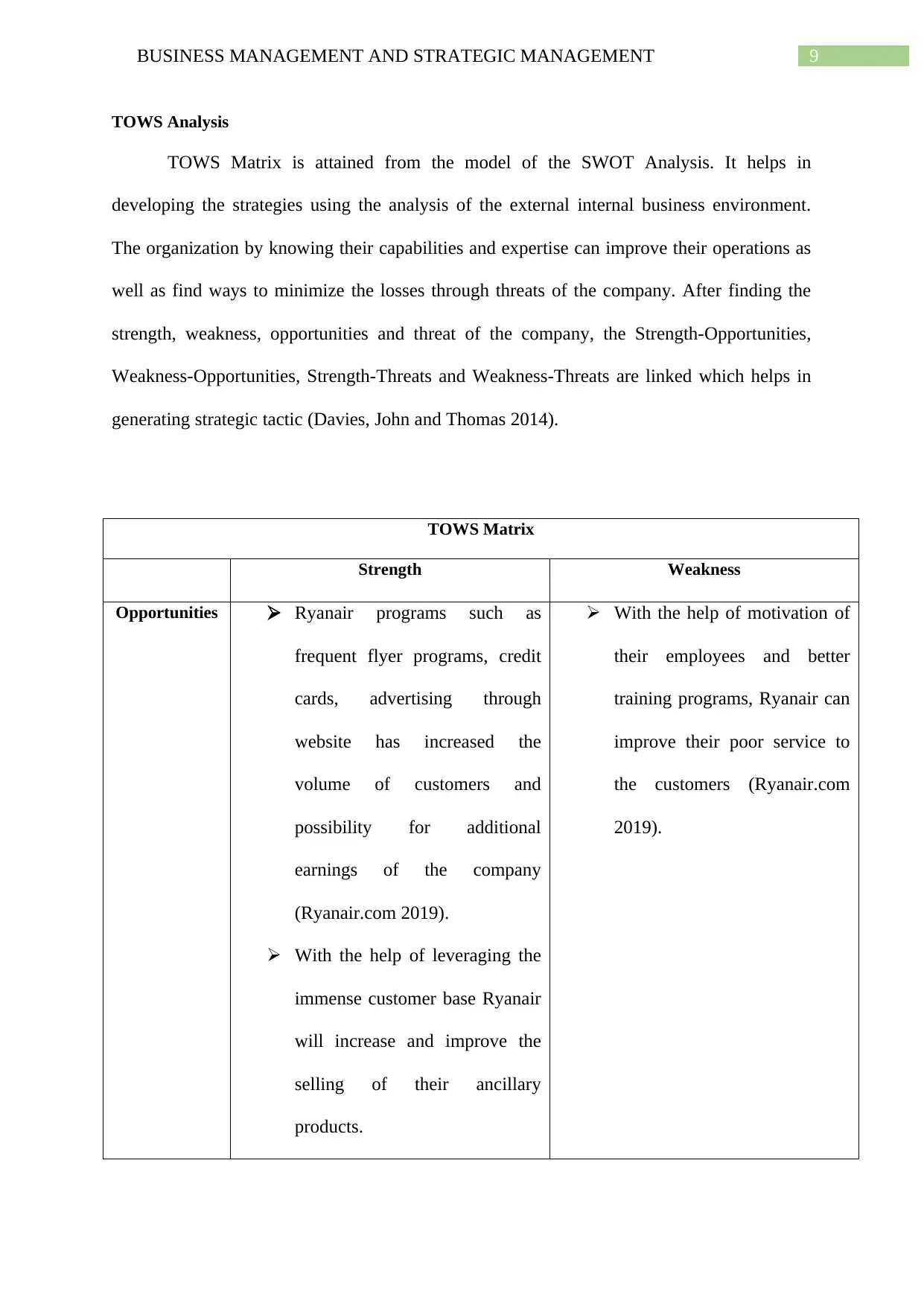

TOWS Analysis

TOWS Matrix is attained from the model of the SWOT Analysis. It helps in

developing the strategies using the analysis of the external internal business environment.

The organization by knowing their capabilities and expertise can improve their operations as

well as find ways to minimize the losses through threats of the company. After finding the

strength, weakness, opportunities and threat of the company, the Strength-Opportunities,

Weakness-Opportunities, Strength-Threats and Weakness-Threats are linked which helps in

generating strategic tactic (Davies, John and Thomas 2014).

TOWS Matrix

Strength Weakness

Opportunities Ryanair programs such as

frequent flyer programs, credit

cards, advertising through

website has increased the

volume of customers and

possibility for additional

earnings of the company

(Ryanair.com 2019).

With the help of leveraging the

immense customer base Ryanair

will increase and improve the

selling of their ancillary

products.

With the help of motivation of

their employees and better

training programs, Ryanair can

improve their poor service to

the customers (Ryanair.com

2019).

TOWS Analysis

TOWS Matrix is attained from the model of the SWOT Analysis. It helps in

developing the strategies using the analysis of the external internal business environment.

The organization by knowing their capabilities and expertise can improve their operations as

well as find ways to minimize the losses through threats of the company. After finding the

strength, weakness, opportunities and threat of the company, the Strength-Opportunities,

Weakness-Opportunities, Strength-Threats and Weakness-Threats are linked which helps in

generating strategic tactic (Davies, John and Thomas 2014).

TOWS Matrix

Strength Weakness

Opportunities Ryanair programs such as

frequent flyer programs, credit

cards, advertising through

website has increased the

volume of customers and

possibility for additional

earnings of the company

(Ryanair.com 2019).

With the help of leveraging the

immense customer base Ryanair

will increase and improve the

selling of their ancillary

products.

With the help of motivation of

their employees and better

training programs, Ryanair can

improve their poor service to

the customers (Ryanair.com

2019).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

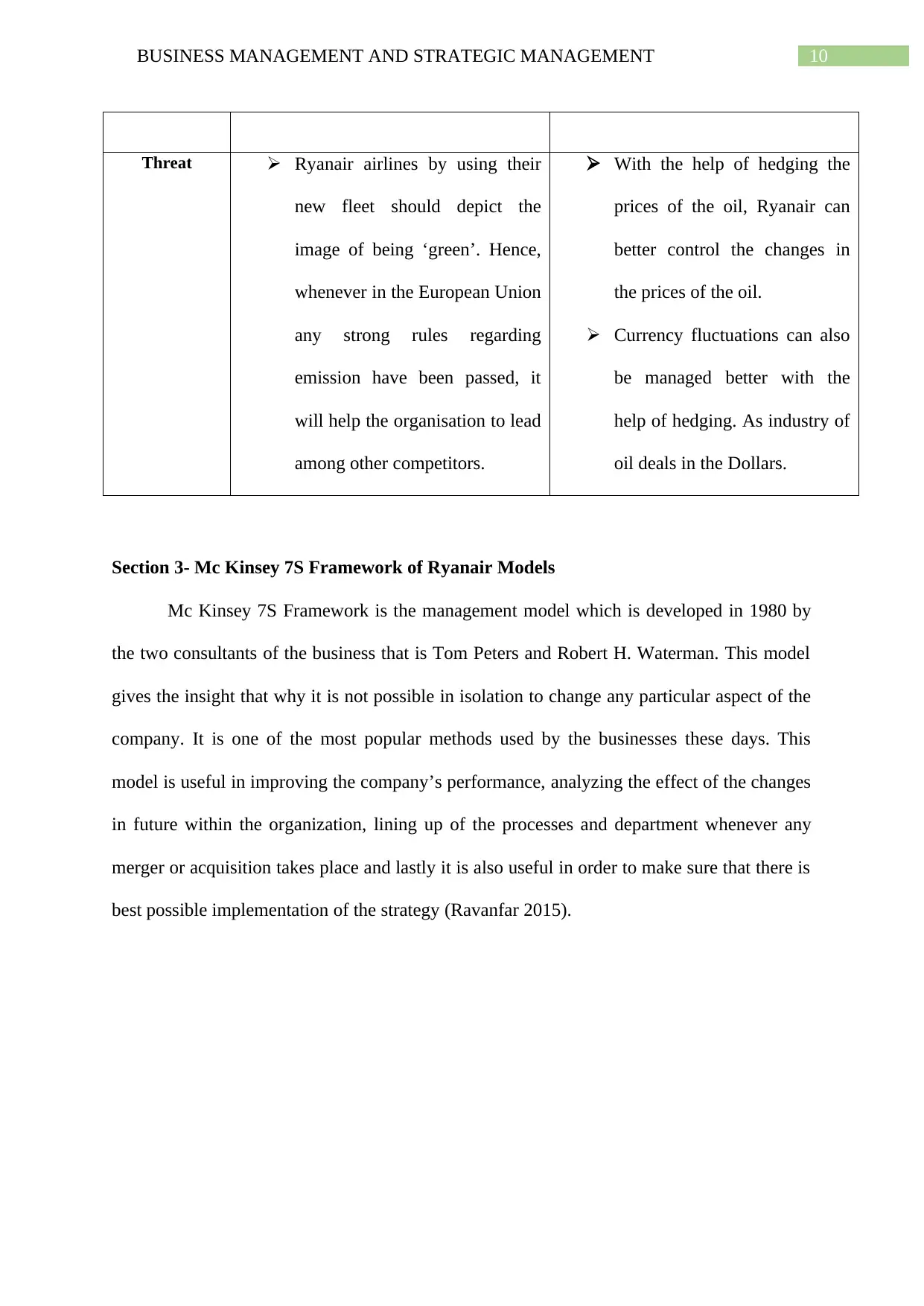

Threat Ryanair airlines by using their

new fleet should depict the

image of being ‘green’. Hence,

whenever in the European Union

any strong rules regarding

emission have been passed, it

will help the organisation to lead

among other competitors.

With the help of hedging the

prices of the oil, Ryanair can

better control the changes in

the prices of the oil.

Currency fluctuations can also

be managed better with the

help of hedging. As industry of

oil deals in the Dollars.

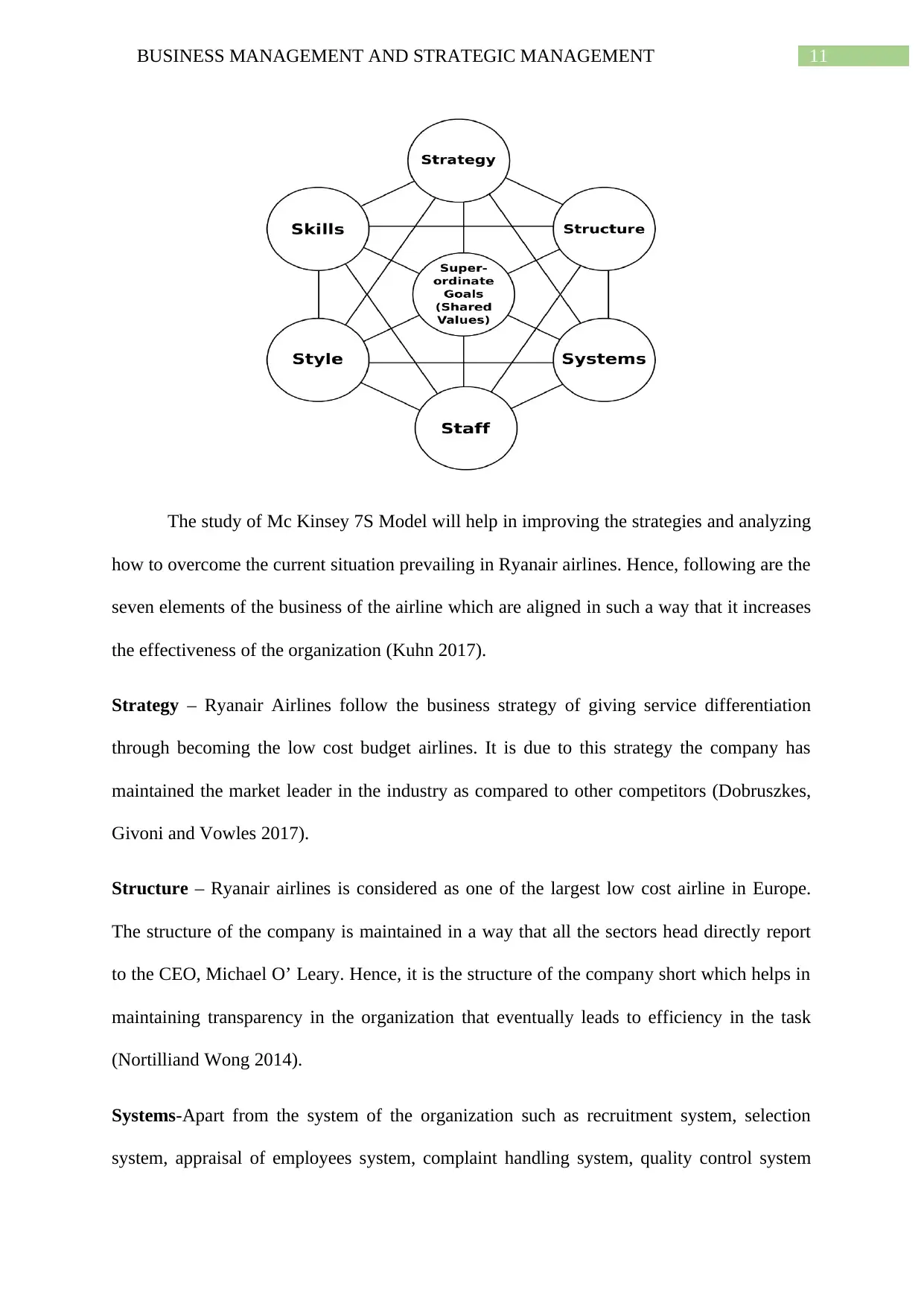

Section 3- Mc Kinsey 7S Framework of Ryanair Models

Mc Kinsey 7S Framework is the management model which is developed in 1980 by

the two consultants of the business that is Tom Peters and Robert H. Waterman. This model

gives the insight that why it is not possible in isolation to change any particular aspect of the

company. It is one of the most popular methods used by the businesses these days. This

model is useful in improving the company’s performance, analyzing the effect of the changes

in future within the organization, lining up of the processes and department whenever any

merger or acquisition takes place and lastly it is also useful in order to make sure that there is

best possible implementation of the strategy (Ravanfar 2015).

Threat Ryanair airlines by using their

new fleet should depict the

image of being ‘green’. Hence,

whenever in the European Union

any strong rules regarding

emission have been passed, it

will help the organisation to lead

among other competitors.

With the help of hedging the

prices of the oil, Ryanair can

better control the changes in

the prices of the oil.

Currency fluctuations can also

be managed better with the

help of hedging. As industry of

oil deals in the Dollars.

Section 3- Mc Kinsey 7S Framework of Ryanair Models

Mc Kinsey 7S Framework is the management model which is developed in 1980 by

the two consultants of the business that is Tom Peters and Robert H. Waterman. This model

gives the insight that why it is not possible in isolation to change any particular aspect of the

company. It is one of the most popular methods used by the businesses these days. This

model is useful in improving the company’s performance, analyzing the effect of the changes

in future within the organization, lining up of the processes and department whenever any

merger or acquisition takes place and lastly it is also useful in order to make sure that there is

best possible implementation of the strategy (Ravanfar 2015).

11BUSINESS MANAGEMENT AND STRATEGIC MANAGEMENT

The study of Mc Kinsey 7S Model will help in improving the strategies and analyzing

how to overcome the current situation prevailing in Ryanair airlines. Hence, following are the

seven elements of the business of the airline which are aligned in such a way that it increases

the effectiveness of the organization (Kuhn 2017).

Strategy – Ryanair Airlines follow the business strategy of giving service differentiation

through becoming the low cost budget airlines. It is due to this strategy the company has

maintained the market leader in the industry as compared to other competitors (Dobruszkes,

Givoni and Vowles 2017).

Structure – Ryanair airlines is considered as one of the largest low cost airline in Europe.

The structure of the company is maintained in a way that all the sectors head directly report

to the CEO, Michael O’ Leary. Hence, it is the structure of the company short which helps in

maintaining transparency in the organization that eventually leads to efficiency in the task

(Nortilliand Wong 2014).

Systems-Apart from the system of the organization such as recruitment system, selection

system, appraisal of employees system, complaint handling system, quality control system

The study of Mc Kinsey 7S Model will help in improving the strategies and analyzing

how to overcome the current situation prevailing in Ryanair airlines. Hence, following are the

seven elements of the business of the airline which are aligned in such a way that it increases

the effectiveness of the organization (Kuhn 2017).

Strategy – Ryanair Airlines follow the business strategy of giving service differentiation

through becoming the low cost budget airlines. It is due to this strategy the company has

maintained the market leader in the industry as compared to other competitors (Dobruszkes,

Givoni and Vowles 2017).

Structure – Ryanair airlines is considered as one of the largest low cost airline in Europe.

The structure of the company is maintained in a way that all the sectors head directly report

to the CEO, Michael O’ Leary. Hence, it is the structure of the company short which helps in

maintaining transparency in the organization that eventually leads to efficiency in the task

(Nortilliand Wong 2014).

Systems-Apart from the system of the organization such as recruitment system, selection

system, appraisal of employees system, complaint handling system, quality control system

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.