Strategic Analysis Report: Sainsbury's Corporate Strategy Evaluation

VerifiedAdded on 2023/01/12

|12

|3705

|2

Report

AI Summary

This report offers a comprehensive strategic analysis of Sainsbury's, a major UK supermarket chain. It begins with an external analysis utilizing PESTLE and Porter's Five Forces models to identify opportunities, threats, and industry attractiveness. The internal analysis employs SWOT and VRIO frameworks to assess Sainsbury's resources, capabilities, and competitive advantages, particularly in light of its acquisition of Argos. The report then evaluates Sainsbury's strategy, specifically the acquisition of Argos, using the SAFe criteria to determine its suitability, acceptability, and feasibility. The analysis covers the impact of Brexit, changing consumer preferences, technological advancements, and competitive pressures from rivals like Tesco and Morrison's, providing insights into Sainsbury's strategic positioning and future prospects.

Corporate Strategy

INTRODUCTION.......................................................................................................................................3

External analysis to identify a set of opportunities and threats and assess industry attractiveness...............3

INTRODUCTION.......................................................................................................................................3

External analysis to identify a set of opportunities and threats and assess industry attractiveness...............3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Internal analysis to identify the organization resources and unique capabilities and demonstrate this to

link to competitive advantages....................................................................................................................5

Strategy evaluation......................................................................................................................................8

CONCLUSION.........................................................................................................................................10

REFERENCES..........................................................................................................................................11

link to competitive advantages....................................................................................................................5

Strategy evaluation......................................................................................................................................8

CONCLUSION.........................................................................................................................................10

REFERENCES..........................................................................................................................................11

INTRODUCTION

Corporate strategy refers to a highest strategically plan that is used to identify the overall

goals and directions and the path on the basis of which a company achieve its activities related to

strategic management. It is based on the long term vision direction that is related to overall

success of the organization. Sainsbury’s is one of the largest chain supermarkets in the United

Kingdom, established in 1869. It deals in superstore, hyper store, supermarket, convenience shop

and forecourt shop. This individual report is based on the analyses of external and internal factor

of the company so that they easily identify the opportunities, threats, strength and weaknesses

which present in the organization at the time of accomplishing the goal for the longer

sustainability and increasing the sales and profits in the market place. At last it includes the SAFs

analysis which is very significant to know the overall suitability, accessibility and feasibility that

was present at the time of making strategies. To identify this is very important because is the

core method of making any strategic plan for the success of any business (Rugman and Verbeke,

2017).

External analysis to identify a set of opportunities and threats and assess

industry attractiveness

Macro environment

It refers to a analysis of external factor that affects the overall activities that is performed

in the business enterprises. It is depended on the economy as a whole which includes

employment, gross domestic product, inflation monetary policy and the spending. In Sainsbury’s

manager use to examine it to produce a products and earns more profits.

PESTLE Analysis

It refers to that condition in which company can analyzing the various circumstances like

opportunities and threats that will impact on the sales and profits of the Sainsbury’s. in this

manager need to identify the PESTLE that are as follows(Mazzei and Noble, 2017). Political factor- This factor affect the business activities in the UK, as there is Brexit

occur in the country which affect the whole economy of the country. In context of

Sainsbury’s, this will impact the overall sales as they declines the consumer spending

because of inflation occur in the nation this will create a threat in the company as they

negatively affect the sales and profits. It will also create opportunities as many consumers

lost to competitors that provide same products because of Brexit(Thompson, Strickland

and Gamble, 2015).

Economical factor- This factor affects the Sainsbury’s business in a way that the

employees are expecting to increase their salary because of inflation in the country. And

there are large number of workers present in the supermarket increment in the salary

affect the total revenues of the firms this will leads to the occurring of threat. But at the

Corporate strategy refers to a highest strategically plan that is used to identify the overall

goals and directions and the path on the basis of which a company achieve its activities related to

strategic management. It is based on the long term vision direction that is related to overall

success of the organization. Sainsbury’s is one of the largest chain supermarkets in the United

Kingdom, established in 1869. It deals in superstore, hyper store, supermarket, convenience shop

and forecourt shop. This individual report is based on the analyses of external and internal factor

of the company so that they easily identify the opportunities, threats, strength and weaknesses

which present in the organization at the time of accomplishing the goal for the longer

sustainability and increasing the sales and profits in the market place. At last it includes the SAFs

analysis which is very significant to know the overall suitability, accessibility and feasibility that

was present at the time of making strategies. To identify this is very important because is the

core method of making any strategic plan for the success of any business (Rugman and Verbeke,

2017).

External analysis to identify a set of opportunities and threats and assess

industry attractiveness

Macro environment

It refers to a analysis of external factor that affects the overall activities that is performed

in the business enterprises. It is depended on the economy as a whole which includes

employment, gross domestic product, inflation monetary policy and the spending. In Sainsbury’s

manager use to examine it to produce a products and earns more profits.

PESTLE Analysis

It refers to that condition in which company can analyzing the various circumstances like

opportunities and threats that will impact on the sales and profits of the Sainsbury’s. in this

manager need to identify the PESTLE that are as follows(Mazzei and Noble, 2017). Political factor- This factor affect the business activities in the UK, as there is Brexit

occur in the country which affect the whole economy of the country. In context of

Sainsbury’s, this will impact the overall sales as they declines the consumer spending

because of inflation occur in the nation this will create a threat in the company as they

negatively affect the sales and profits. It will also create opportunities as many consumers

lost to competitors that provide same products because of Brexit(Thompson, Strickland

and Gamble, 2015).

Economical factor- This factor affects the Sainsbury’s business in a way that the

employees are expecting to increase their salary because of inflation in the country. And

there are large number of workers present in the supermarket increment in the salary

affect the total revenues of the firms this will leads to the occurring of threat. But at the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

same time because of increase in the salary of workers they work very productively as

they earn higher profits with high sales.

Social factor- In UK, people are more conscious about their health and they prefer to

purchase organic and healthy food and drinks. To became successful and for longer

stability in the market they provide healthy food and beverages to their customers that is

body-conscious. Supply the food as per the demand of the customers is the basic motto of

the social factor. Is is the great opportunity for the company to produce healthy and

organic food so that it will increase its sales and profits and longer survival in the market.

Technological factor- Today’s current environment is based on the use of advance

technology and they spend most of the time on the digital technology. In context of

Sainsbury’s they provide online shopping and click and collect services for the people

who place orders online which is very convenient for the consumers to collects it. It

create the opportunities as they attracts more customers and increase the sales and profit.

Legal factor - It is related to the government legislation and policies that affect the

performance of the organization. They introduces a law related to the new tax on

advertising highly fatty foods. In context of Sainsbury’s they take as a opportunity as

they adapted the tax policy and modifying its goods that fulfills the legal requirements. It

also create threats for the company as sugar tax in the UK as they suggest to reduce the

content of sugar in the drink that will impact the profits of the firm.

Environmental factor- In context of Sainsbury’s they produce a environmental friendly

products and use of recycled materials. It will create a major challenge in front of them to

use the zero waste products that is not harm the environment resources. And it will helps

in increasing the sales and profit of the firm. As they also helps in longer susvival of the

firm.

Porter’s five forces model

This model helps in analyzing the business and helps in examine the industries

attractiveness to sustain different levels of profitability. In Sainsbury it is used to assess the

attractiveness, sustainability in the market place as it is food retailing industry in UK. It explains

porter’s five forces model that is explained below( Adamides, 2015).

Power of suppliers- Suppliers in the supermarket have contains low bargaining power

as there are many suppliers are present in the market that provides raw material at low

cost. In context of Sainsbury’s, they but raw material from the suppliers at low cost. If

the suppliers are not provides the inputs at low cost then firm switch them and buy from

another one. Purchase a inputs from lower rates helps the company to earn more profit

margins and sales.

Power of buyers- In context of Sainsbury, customers and buyers have high degree of

bargaining power as there are many other retail supermarkets that present in the market

like Tesco, Morrison etc. and they also provide same type of goods offerings to their

customers. This makes the consumers to switch the other brands on the basis of price.

they earn higher profits with high sales.

Social factor- In UK, people are more conscious about their health and they prefer to

purchase organic and healthy food and drinks. To became successful and for longer

stability in the market they provide healthy food and beverages to their customers that is

body-conscious. Supply the food as per the demand of the customers is the basic motto of

the social factor. Is is the great opportunity for the company to produce healthy and

organic food so that it will increase its sales and profits and longer survival in the market.

Technological factor- Today’s current environment is based on the use of advance

technology and they spend most of the time on the digital technology. In context of

Sainsbury’s they provide online shopping and click and collect services for the people

who place orders online which is very convenient for the consumers to collects it. It

create the opportunities as they attracts more customers and increase the sales and profit.

Legal factor - It is related to the government legislation and policies that affect the

performance of the organization. They introduces a law related to the new tax on

advertising highly fatty foods. In context of Sainsbury’s they take as a opportunity as

they adapted the tax policy and modifying its goods that fulfills the legal requirements. It

also create threats for the company as sugar tax in the UK as they suggest to reduce the

content of sugar in the drink that will impact the profits of the firm.

Environmental factor- In context of Sainsbury’s they produce a environmental friendly

products and use of recycled materials. It will create a major challenge in front of them to

use the zero waste products that is not harm the environment resources. And it will helps

in increasing the sales and profit of the firm. As they also helps in longer susvival of the

firm.

Porter’s five forces model

This model helps in analyzing the business and helps in examine the industries

attractiveness to sustain different levels of profitability. In Sainsbury it is used to assess the

attractiveness, sustainability in the market place as it is food retailing industry in UK. It explains

porter’s five forces model that is explained below( Adamides, 2015).

Power of suppliers- Suppliers in the supermarket have contains low bargaining power

as there are many suppliers are present in the market that provides raw material at low

cost. In context of Sainsbury’s, they but raw material from the suppliers at low cost. If

the suppliers are not provides the inputs at low cost then firm switch them and buy from

another one. Purchase a inputs from lower rates helps the company to earn more profit

margins and sales.

Power of buyers- In context of Sainsbury, customers and buyers have high degree of

bargaining power as there are many other retail supermarkets that present in the market

like Tesco, Morrison etc. and they also provide same type of goods offerings to their

customers. This makes the consumers to switch the other brands on the basis of price.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

This is because the business firm selects and decides the price on the basis of the

competitors pricing strategy. Otherwise they need to differentiate their products to make

their own price.

Threat of substitutes- It is very high degree in the supermarket context. In Sainsbury’s

manager must focus on the substitutes that was present in the market so that they

differentiate it and make a product for which no substitute is available. As they deals in

the food market and also in clothing, furniture and electronic so that customers we easily

buy different types of offering from one market(Rugman and Verbeke, 2017).

Competitive rivalry- In the context of Sainsbury’s they have many competitors in the

market who sales same types of product range to the customers on almost on a same price

this will reducing the sales of the company and profit margins of the company. In this to

increase the sales and profits they need to do is innovation in product advertisements so

that they attract more peoples.

Threat of new-entry- This model contains low degree of force in the context of

supermarkets. Mainly there are some supermarkets who covers the whole market and the

customers in UK are very loyal about the brand and its price so they do not easily switch

their shop to buying the products (Mollan and Tennent, 2015).

Internal analysis to identify the organization resources and unique capabilities

and demonstrate this to link to competitive advantages

In Sainsbury manager need to identify the company resources as it is very

important to achieve the targets on time and earns high profit margins. By using this they need to

identify the unique and innovative capabilities that help in gaining the competitive advantages in

this they use SWOT Analysis and VRIO analysis that are explained below(Rastogi and Trivedi,

2016).

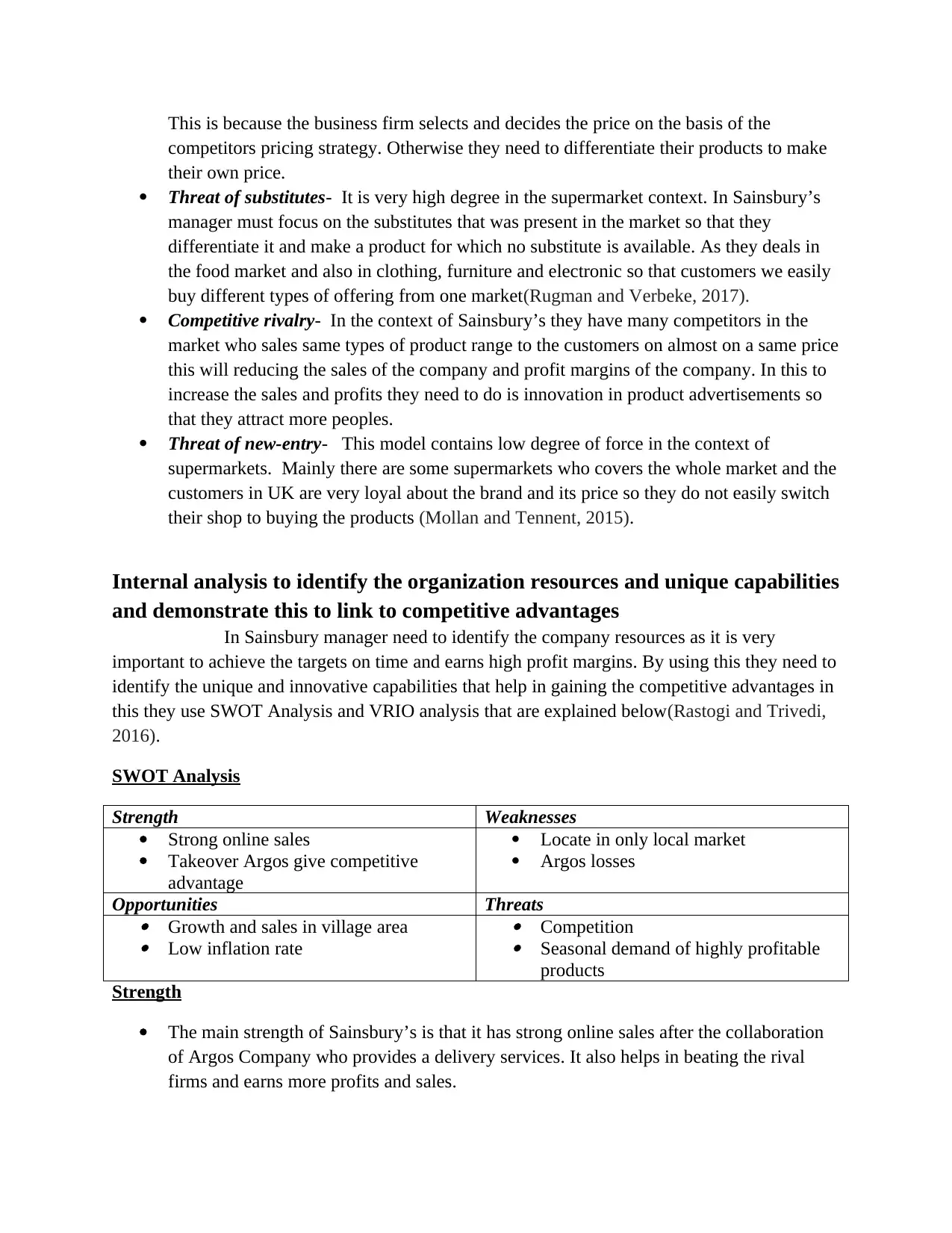

SWOT Analysis

Strength Weaknesses

Strong online sales

Takeover Argos give competitive

advantage

Locate in only local market

Argos losses

Opportunities Threats

Growth and sales in village area

Low inflation rate

Competition

Seasonal demand of highly profitable

products

Strength

The main strength of Sainsbury’s is that it has strong online sales after the collaboration

of Argos Company who provides a delivery services. It also helps in beating the rival

firms and earns more profits and sales.

competitors pricing strategy. Otherwise they need to differentiate their products to make

their own price.

Threat of substitutes- It is very high degree in the supermarket context. In Sainsbury’s

manager must focus on the substitutes that was present in the market so that they

differentiate it and make a product for which no substitute is available. As they deals in

the food market and also in clothing, furniture and electronic so that customers we easily

buy different types of offering from one market(Rugman and Verbeke, 2017).

Competitive rivalry- In the context of Sainsbury’s they have many competitors in the

market who sales same types of product range to the customers on almost on a same price

this will reducing the sales of the company and profit margins of the company. In this to

increase the sales and profits they need to do is innovation in product advertisements so

that they attract more peoples.

Threat of new-entry- This model contains low degree of force in the context of

supermarkets. Mainly there are some supermarkets who covers the whole market and the

customers in UK are very loyal about the brand and its price so they do not easily switch

their shop to buying the products (Mollan and Tennent, 2015).

Internal analysis to identify the organization resources and unique capabilities

and demonstrate this to link to competitive advantages

In Sainsbury manager need to identify the company resources as it is very

important to achieve the targets on time and earns high profit margins. By using this they need to

identify the unique and innovative capabilities that help in gaining the competitive advantages in

this they use SWOT Analysis and VRIO analysis that are explained below(Rastogi and Trivedi,

2016).

SWOT Analysis

Strength Weaknesses

Strong online sales

Takeover Argos give competitive

advantage

Locate in only local market

Argos losses

Opportunities Threats

Growth and sales in village area

Low inflation rate

Competition

Seasonal demand of highly profitable

products

Strength

The main strength of Sainsbury’s is that it has strong online sales after the collaboration

of Argos Company who provides a delivery services. It also helps in beating the rival

firms and earns more profits and sales.

After getting and acquisition with the Argos, Sainsbury’s have taking the advantages in

non-food market. It helps in increasing the online sales with the use of digital

technologies and delivery services which is provided by the Argos in a unique way. It

give benefits in changing market(Song and Sung, 2015).

Weaknesses

Major weakness of the company Sainsbury’s is that it operates its business only in UK, so

this will attracts only the local people that limits the growth of the business in the

market.

Due to major loss face by the Argos company it create a weakness to the Sainsbury’s firm

as it reduces the profits margins and market share in the country. In this organisation

acquire the business to earn more revenues but because of facing loss by Argos they earn

only loss in profits and brand image.

Opportunities

The major opportunities that was taken by the company Sainsbury’s is that increments

the sales of the products and profit margins because of villagers are now aware about the

brand and they prefer to buy the products from the supermarkets. This will increase the

capability of working more in the employees to achieve the target on time with high

profits and growth in the market place.

Because of low inflation rate in the country and more stable economy of the country heps

in earning more profits at lower interest rates by the customers. This is the great

opportunity of the Sainsbury.

Threats

The major threats that was present in front of the Sainsbury is that there are many

competitors are present in the market place who deals in same type of product range at

similar pricing strategy this will reducing the sales and profits of the firm in the current

market growth.

It is another threat that was faced by the company is that the demand of the products

which are highly profitable is based on the seasons. As the sales are high on the peak load

which helps in earning more profits but when the season is gone it faces the losses in the

revenues and growth of the company.

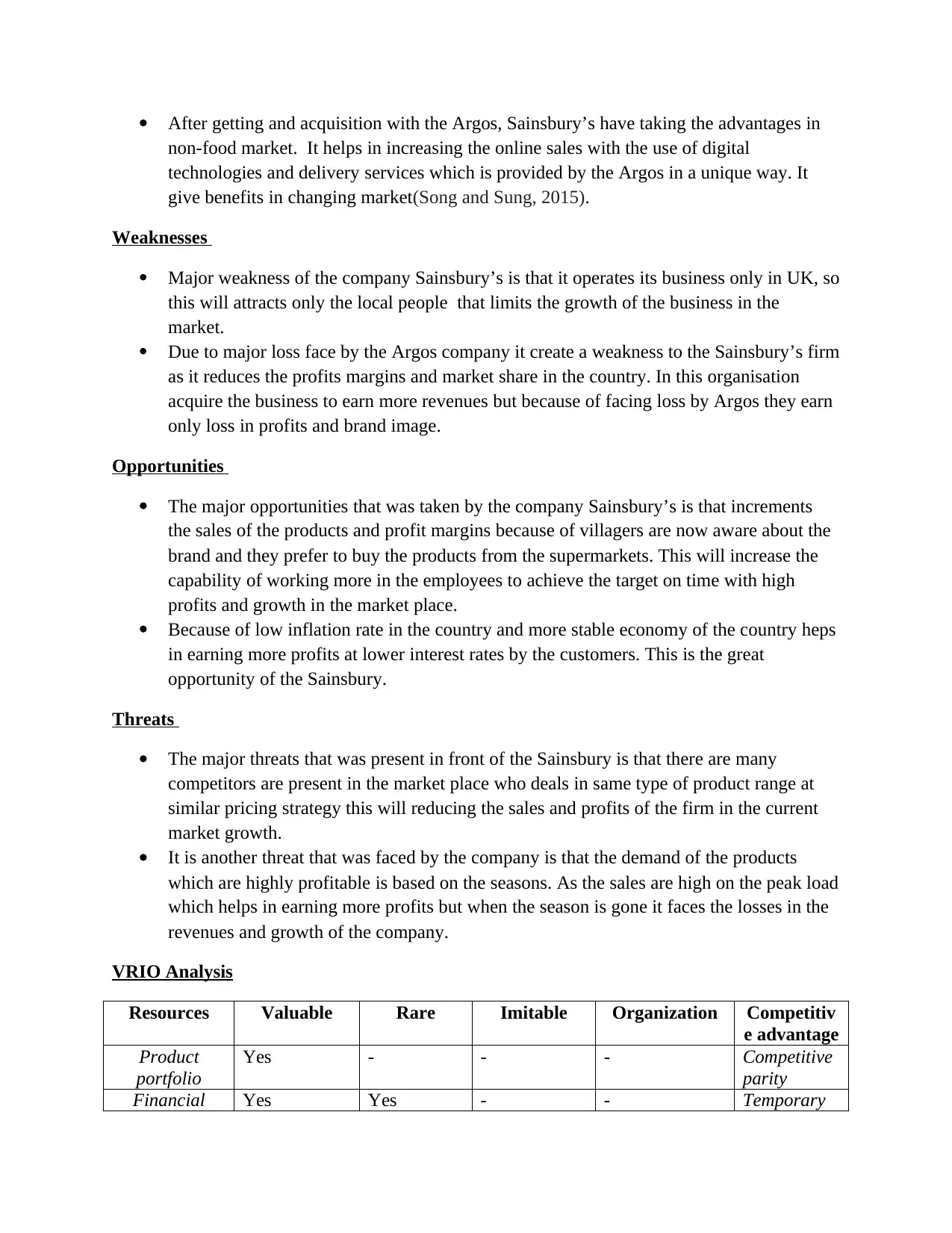

VRIO Analysis

Resources Valuable Rare Imitable Organization Competitiv

e advantage

Product

portfolio

Yes - - - Competitive

parity

Financial Yes Yes - - Temporary

non-food market. It helps in increasing the online sales with the use of digital

technologies and delivery services which is provided by the Argos in a unique way. It

give benefits in changing market(Song and Sung, 2015).

Weaknesses

Major weakness of the company Sainsbury’s is that it operates its business only in UK, so

this will attracts only the local people that limits the growth of the business in the

market.

Due to major loss face by the Argos company it create a weakness to the Sainsbury’s firm

as it reduces the profits margins and market share in the country. In this organisation

acquire the business to earn more revenues but because of facing loss by Argos they earn

only loss in profits and brand image.

Opportunities

The major opportunities that was taken by the company Sainsbury’s is that increments

the sales of the products and profit margins because of villagers are now aware about the

brand and they prefer to buy the products from the supermarkets. This will increase the

capability of working more in the employees to achieve the target on time with high

profits and growth in the market place.

Because of low inflation rate in the country and more stable economy of the country heps

in earning more profits at lower interest rates by the customers. This is the great

opportunity of the Sainsbury.

Threats

The major threats that was present in front of the Sainsbury is that there are many

competitors are present in the market place who deals in same type of product range at

similar pricing strategy this will reducing the sales and profits of the firm in the current

market growth.

It is another threat that was faced by the company is that the demand of the products

which are highly profitable is based on the seasons. As the sales are high on the peak load

which helps in earning more profits but when the season is gone it faces the losses in the

revenues and growth of the company.

VRIO Analysis

Resources Valuable Rare Imitable Organization Competitiv

e advantage

Product

portfolio

Yes - - - Competitive

parity

Financial Yes Yes - - Temporary

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

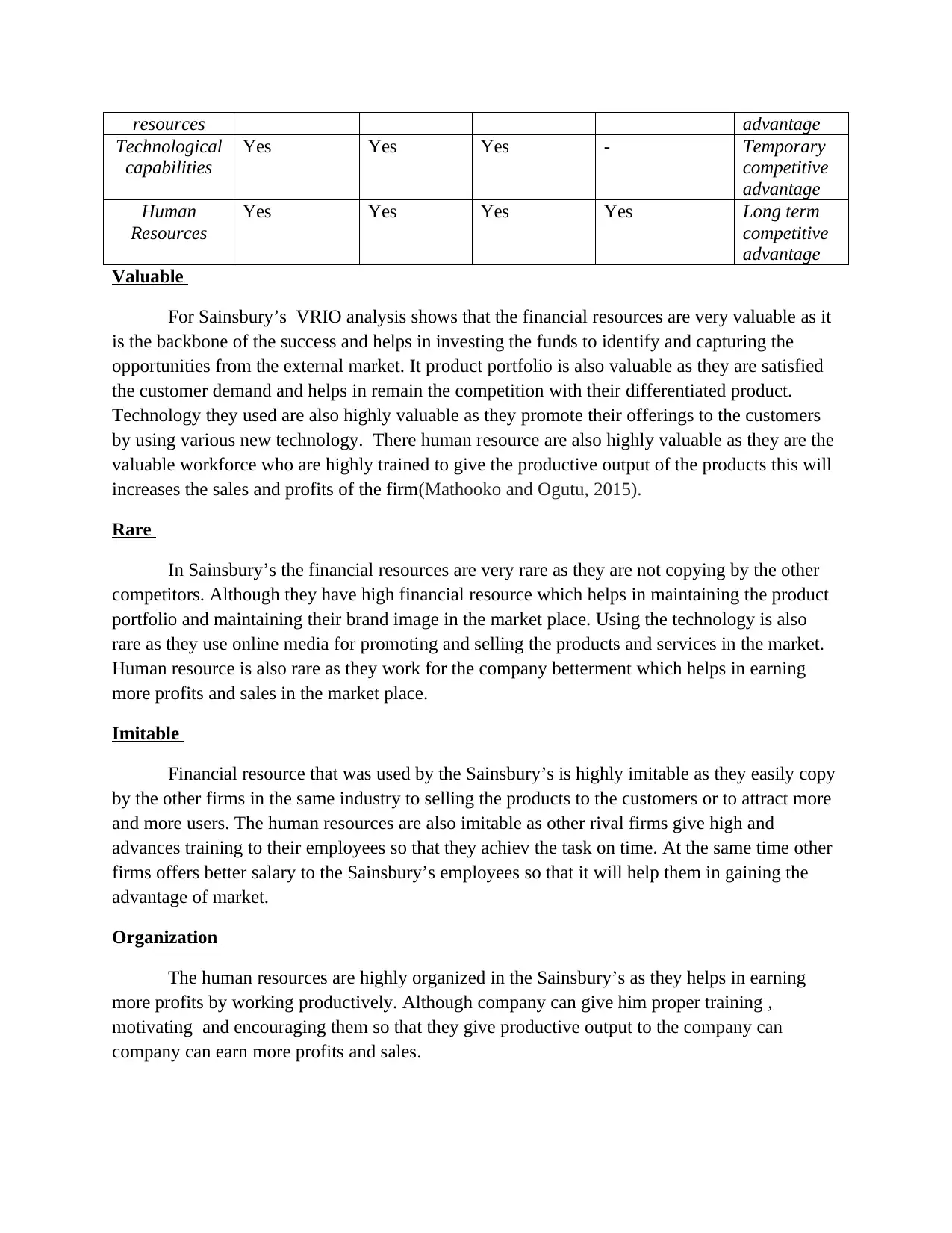

resources advantage

Technological

capabilities

Yes Yes Yes - Temporary

competitive

advantage

Human

Resources

Yes Yes Yes Yes Long term

competitive

advantage

Valuable

For Sainsbury’s VRIO analysis shows that the financial resources are very valuable as it

is the backbone of the success and helps in investing the funds to identify and capturing the

opportunities from the external market. It product portfolio is also valuable as they are satisfied

the customer demand and helps in remain the competition with their differentiated product.

Technology they used are also highly valuable as they promote their offerings to the customers

by using various new technology. There human resource are also highly valuable as they are the

valuable workforce who are highly trained to give the productive output of the products this will

increases the sales and profits of the firm(Mathooko and Ogutu, 2015).

Rare

In Sainsbury’s the financial resources are very rare as they are not copying by the other

competitors. Although they have high financial resource which helps in maintaining the product

portfolio and maintaining their brand image in the market place. Using the technology is also

rare as they use online media for promoting and selling the products and services in the market.

Human resource is also rare as they work for the company betterment which helps in earning

more profits and sales in the market place.

Imitable

Financial resource that was used by the Sainsbury’s is highly imitable as they easily copy

by the other firms in the same industry to selling the products to the customers or to attract more

and more users. The human resources are also imitable as other rival firms give high and

advances training to their employees so that they achiev the task on time. At the same time other

firms offers better salary to the Sainsbury’s employees so that it will help them in gaining the

advantage of market.

Organization

The human resources are highly organized in the Sainsbury’s as they helps in earning

more profits by working productively. Although company can give him proper training ,

motivating and encouraging them so that they give productive output to the company can

company can earn more profits and sales.

Technological

capabilities

Yes Yes Yes - Temporary

competitive

advantage

Human

Resources

Yes Yes Yes Yes Long term

competitive

advantage

Valuable

For Sainsbury’s VRIO analysis shows that the financial resources are very valuable as it

is the backbone of the success and helps in investing the funds to identify and capturing the

opportunities from the external market. It product portfolio is also valuable as they are satisfied

the customer demand and helps in remain the competition with their differentiated product.

Technology they used are also highly valuable as they promote their offerings to the customers

by using various new technology. There human resource are also highly valuable as they are the

valuable workforce who are highly trained to give the productive output of the products this will

increases the sales and profits of the firm(Mathooko and Ogutu, 2015).

Rare

In Sainsbury’s the financial resources are very rare as they are not copying by the other

competitors. Although they have high financial resource which helps in maintaining the product

portfolio and maintaining their brand image in the market place. Using the technology is also

rare as they use online media for promoting and selling the products and services in the market.

Human resource is also rare as they work for the company betterment which helps in earning

more profits and sales in the market place.

Imitable

Financial resource that was used by the Sainsbury’s is highly imitable as they easily copy

by the other firms in the same industry to selling the products to the customers or to attract more

and more users. The human resources are also imitable as other rival firms give high and

advances training to their employees so that they achiev the task on time. At the same time other

firms offers better salary to the Sainsbury’s employees so that it will help them in gaining the

advantage of market.

Organization

The human resources are highly organized in the Sainsbury’s as they helps in earning

more profits by working productively. Although company can give him proper training ,

motivating and encouraging them so that they give productive output to the company can

company can earn more profits and sales.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Strategy evaluation

For any business it is very beneficial to make a strategic analysis. In context of

Sainsbury’s manager take a strategy of Acquisition as they acquire the Argos Company to

increase the profits and sales in the company and increase the brand image of the firm. For this

company can make a strategy analysis plan in which it includes suitability, acceptability and

feasibility because it is a great way to fairly weigh up all the options and helps the supermarket

to increase its growth in the market place(FATRICIA, 2016).

SAFs

It is related to the key issues that was present in the company and analyze the resources

and capabilities to deliver its strategy for earning the revenues and sales in the company. In

context of Sainsbury’s, it will take a strategy related to Acquisition with Argos Company that are

as follows.

Suitability - It is the first step of the strategy planning which helps in gaining the

understanding of the firm and its environment in which its established, in this it includes

the major opportunities and threats that was face by the business in its external terms and

strength and weaknesses that is very important to encourage and influence on strategic

choice. In context of Sainsbury’s manager need to identify its opportunities that is helpful

in acquisition with Argos.

o According to the technological factor is consider it is very helpful in generating

more cash and sales because of acquisition firm enabled the increment in sales

target and opening across 250 digital Argos outlet within their branches since

three years. Because of this they also deals in the non-grocery brand in their

stores.

o This acquisitions gives the customer choice, flexibility in dealing like when,

where and how to buy and sale the products, convenience and speed.

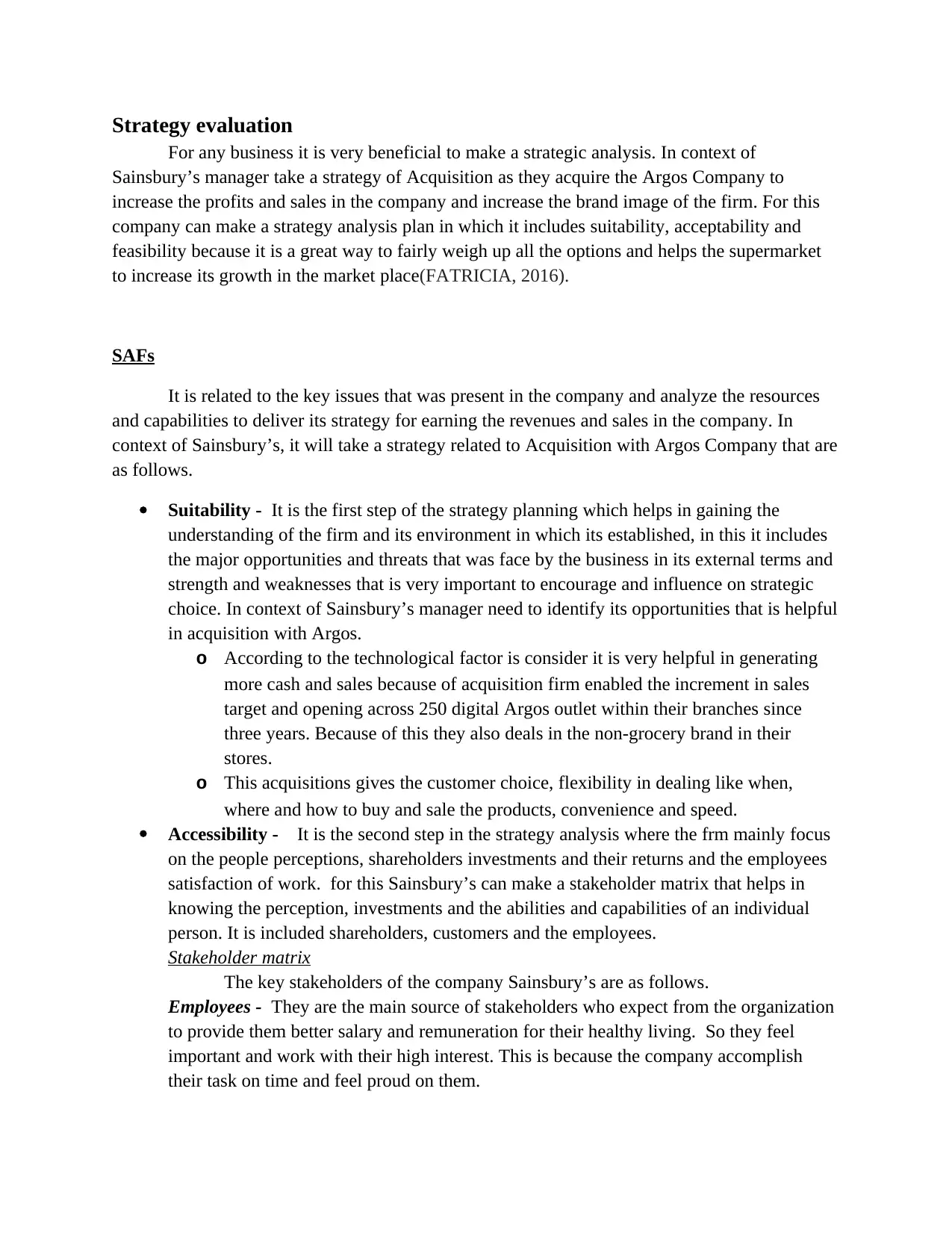

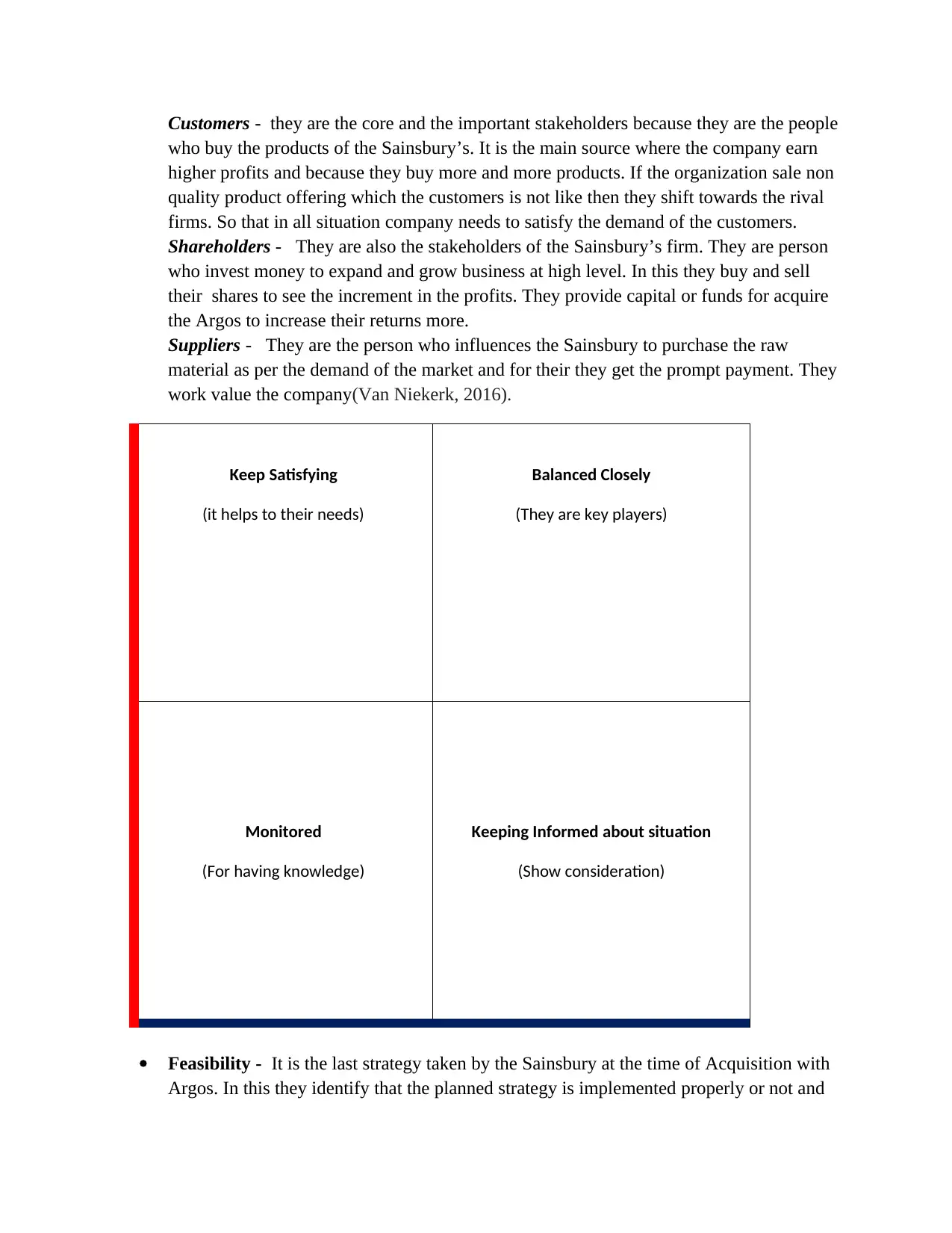

Accessibility - It is the second step in the strategy analysis where the frm mainly focus

on the people perceptions, shareholders investments and their returns and the employees

satisfaction of work. for this Sainsbury’s can make a stakeholder matrix that helps in

knowing the perception, investments and the abilities and capabilities of an individual

person. It is included shareholders, customers and the employees.

Stakeholder matrix

The key stakeholders of the company Sainsbury’s are as follows.

Employees - They are the main source of stakeholders who expect from the organization

to provide them better salary and remuneration for their healthy living. So they feel

important and work with their high interest. This is because the company accomplish

their task on time and feel proud on them.

For any business it is very beneficial to make a strategic analysis. In context of

Sainsbury’s manager take a strategy of Acquisition as they acquire the Argos Company to

increase the profits and sales in the company and increase the brand image of the firm. For this

company can make a strategy analysis plan in which it includes suitability, acceptability and

feasibility because it is a great way to fairly weigh up all the options and helps the supermarket

to increase its growth in the market place(FATRICIA, 2016).

SAFs

It is related to the key issues that was present in the company and analyze the resources

and capabilities to deliver its strategy for earning the revenues and sales in the company. In

context of Sainsbury’s, it will take a strategy related to Acquisition with Argos Company that are

as follows.

Suitability - It is the first step of the strategy planning which helps in gaining the

understanding of the firm and its environment in which its established, in this it includes

the major opportunities and threats that was face by the business in its external terms and

strength and weaknesses that is very important to encourage and influence on strategic

choice. In context of Sainsbury’s manager need to identify its opportunities that is helpful

in acquisition with Argos.

o According to the technological factor is consider it is very helpful in generating

more cash and sales because of acquisition firm enabled the increment in sales

target and opening across 250 digital Argos outlet within their branches since

three years. Because of this they also deals in the non-grocery brand in their

stores.

o This acquisitions gives the customer choice, flexibility in dealing like when,

where and how to buy and sale the products, convenience and speed.

Accessibility - It is the second step in the strategy analysis where the frm mainly focus

on the people perceptions, shareholders investments and their returns and the employees

satisfaction of work. for this Sainsbury’s can make a stakeholder matrix that helps in

knowing the perception, investments and the abilities and capabilities of an individual

person. It is included shareholders, customers and the employees.

Stakeholder matrix

The key stakeholders of the company Sainsbury’s are as follows.

Employees - They are the main source of stakeholders who expect from the organization

to provide them better salary and remuneration for their healthy living. So they feel

important and work with their high interest. This is because the company accomplish

their task on time and feel proud on them.

Customers - they are the core and the important stakeholders because they are the people

who buy the products of the Sainsbury’s. It is the main source where the company earn

higher profits and because they buy more and more products. If the organization sale non

quality product offering which the customers is not like then they shift towards the rival

firms. So that in all situation company needs to satisfy the demand of the customers.

Shareholders - They are also the stakeholders of the Sainsbury’s firm. They are person

who invest money to expand and grow business at high level. In this they buy and sell

their shares to see the increment in the profits. They provide capital or funds for acquire

the Argos to increase their returns more.

Suppliers - They are the person who influences the Sainsbury to purchase the raw

material as per the demand of the market and for their they get the prompt payment. They

work value the company(Van Niekerk, 2016).

Keep Satisfying

(it helps to their needs)

Balanced Closely

(They are key players)

Monitored

(For having knowledge)

Keeping Informed about situation

(Show consideration)

Feasibility - It is the last strategy taken by the Sainsbury at the time of Acquisition with

Argos. In this they identify that the planned strategy is implemented properly or not and

who buy the products of the Sainsbury’s. It is the main source where the company earn

higher profits and because they buy more and more products. If the organization sale non

quality product offering which the customers is not like then they shift towards the rival

firms. So that in all situation company needs to satisfy the demand of the customers.

Shareholders - They are also the stakeholders of the Sainsbury’s firm. They are person

who invest money to expand and grow business at high level. In this they buy and sell

their shares to see the increment in the profits. They provide capital or funds for acquire

the Argos to increase their returns more.

Suppliers - They are the person who influences the Sainsbury to purchase the raw

material as per the demand of the market and for their they get the prompt payment. They

work value the company(Van Niekerk, 2016).

Keep Satisfying

(it helps to their needs)

Balanced Closely

(They are key players)

Monitored

(For having knowledge)

Keeping Informed about situation

(Show consideration)

Feasibility - It is the last strategy taken by the Sainsbury at the time of Acquisition with

Argos. In this they identify that the planned strategy is implemented properly or not and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

from where they raise funds to acquire other firm and make a large organization in the

country. In this they take a opportunity i.e. zero waste in a feasibility sector. In which if

they acquire with the Argos they make foods and beverages and other non-grocery items

with a zero waste and which is also cost effective and easily available by the customers

by the use of Argos technological delivering process, this will helps in increasing the

sales and profits of the firm for the long term. By taking and acquire the Argos they used

to open a store in other city so they will attract more other customers from the wide range

of locations(Anwar, Shah and Hasnu, 2016 ).

CONCLUSION

It is to be concluded from the above mentioned report that corporate strategy is the

method to identifying the goals that helps in achieving the target and make profits. This report

provides the external ( PESTLE & Porter’s five forces model) and internal factors that create

opportunities and threats for the company. And further finds the abilities and capabilities that

help in gaining the competitive advantage by using VRIO analysis and SWOT analysis this both

factors helps in identifying the internal factors that affects the business profits and sales in the

long run. At last its uses to analyze the strategic factor to analyze and a make a plan for acquire

the company which is related to the non-food sector to make their delivery part strong by using

new technologies.

country. In this they take a opportunity i.e. zero waste in a feasibility sector. In which if

they acquire with the Argos they make foods and beverages and other non-grocery items

with a zero waste and which is also cost effective and easily available by the customers

by the use of Argos technological delivering process, this will helps in increasing the

sales and profits of the firm for the long term. By taking and acquire the Argos they used

to open a store in other city so they will attract more other customers from the wide range

of locations(Anwar, Shah and Hasnu, 2016 ).

CONCLUSION

It is to be concluded from the above mentioned report that corporate strategy is the

method to identifying the goals that helps in achieving the target and make profits. This report

provides the external ( PESTLE & Porter’s five forces model) and internal factors that create

opportunities and threats for the company. And further finds the abilities and capabilities that

help in gaining the competitive advantage by using VRIO analysis and SWOT analysis this both

factors helps in identifying the internal factors that affects the business profits and sales in the

long run. At last its uses to analyze the strategic factor to analyze and a make a plan for acquire

the company which is related to the non-food sector to make their delivery part strong by using

new technologies.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and journal

Adamides, E.D., 2015. Linking operations strategy to the corporate strategy process: a practice

perspective. Business Process Management Journal.

Anwar, J., Shah, S. and Hasnu, S., 2016. BUSINESS STRATEGY AND ORGANIZATIONAL

PERFORMANCE. Pakistan Economic and Social Review. 54(1). pp.97-122.

FATRICIA, R.S., 2016. SWOT ANALYSIS OF SAINSBURY’S SUPERMARKET. Jurnal

Manajemen Terapan dan Keuangan. 5(1).

Mathooko, F.M. and Ogutu, M., 2015. Porter’s five competitive forces framework and other

factors that influence the choice of response strategies adopted by public universities in

Kenya. International Journal of Educational Management.

Mazzei, M.J. and Noble, D., 2017. Big data dreams: A framework for corporate strategy. Business

Horizons. 60(3). pp.405-414.

Mollan, S. and Tennent, K.D., 2015. International taxation and corporate strategy: evidence from

British overseas business, circa 1900–1965. Business History. 57(7). pp.1054-1081.

Rastogi, N.I.T.A.N.K. and Trivedi, M.K., 2016. PESTLE technique–a tool to identify external

risks in construction projects. International Research Journal of Engineering and

Technology (IRJET). 3(1). pp.384-388.

Rugman, A.M. and Verbeke, A., 2017. Global corporate strategy and trade policy (Vol. 12).

Routledge.

Song, J.J. and Sung, H., 2015. A study on relation between strategic attributes of technological

resources and competitive advantage: Empirical analysis of VRIO framework by using

technology evaluation results of technology based SMEs. Journal of Korea Technology

Innovation Society. 18(3). pp.416-443.

Thompson, A., Strickland, A.J. and Gamble, J., 2015. Crafting and executing strategy: Concepts

and readings. McGraw-Hill Education.

Van Niekerk, M., 2016. The applicability and usefulness of the stakeholder strategy matrix for

festival management. Event Management. 20(2). pp.165-179.

Books and journal

Adamides, E.D., 2015. Linking operations strategy to the corporate strategy process: a practice

perspective. Business Process Management Journal.

Anwar, J., Shah, S. and Hasnu, S., 2016. BUSINESS STRATEGY AND ORGANIZATIONAL

PERFORMANCE. Pakistan Economic and Social Review. 54(1). pp.97-122.

FATRICIA, R.S., 2016. SWOT ANALYSIS OF SAINSBURY’S SUPERMARKET. Jurnal

Manajemen Terapan dan Keuangan. 5(1).

Mathooko, F.M. and Ogutu, M., 2015. Porter’s five competitive forces framework and other

factors that influence the choice of response strategies adopted by public universities in

Kenya. International Journal of Educational Management.

Mazzei, M.J. and Noble, D., 2017. Big data dreams: A framework for corporate strategy. Business

Horizons. 60(3). pp.405-414.

Mollan, S. and Tennent, K.D., 2015. International taxation and corporate strategy: evidence from

British overseas business, circa 1900–1965. Business History. 57(7). pp.1054-1081.

Rastogi, N.I.T.A.N.K. and Trivedi, M.K., 2016. PESTLE technique–a tool to identify external

risks in construction projects. International Research Journal of Engineering and

Technology (IRJET). 3(1). pp.384-388.

Rugman, A.M. and Verbeke, A., 2017. Global corporate strategy and trade policy (Vol. 12).

Routledge.

Song, J.J. and Sung, H., 2015. A study on relation between strategic attributes of technological

resources and competitive advantage: Empirical analysis of VRIO framework by using

technology evaluation results of technology based SMEs. Journal of Korea Technology

Innovation Society. 18(3). pp.416-443.

Thompson, A., Strickland, A.J. and Gamble, J., 2015. Crafting and executing strategy: Concepts

and readings. McGraw-Hill Education.

Van Niekerk, M., 2016. The applicability and usefulness of the stakeholder strategy matrix for

festival management. Event Management. 20(2). pp.165-179.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.