Sainsbury's Financial Health: A Comparative Analysis with Morrisons

VerifiedAdded on 2023/06/17

|13

|1177

|138

Report

AI Summary

This report provides a comprehensive financial analysis of J. Sainsbury plc, a leading UK supermarket, comparing its performance against its major competitor, Morrisons. The analysis includes a brief history of Sainsbury's, an examination of its financial performance using profitability, liquidity, gearing, and efficiency ratios, and a comparative analysis with Morrisons. The report highlights Sainsbury's operational inefficiencies compared to Morrisons and offers recommendations for improvement. It also delves into investment appraisal techniques, including payback period, accounting rate of return (ARR), and net present value (NPV), with a critical analysis of their advantages and shortcomings. The conclusion emphasizes the importance of financial management in strategic decision-making for businesses like Sainsbury's.

Financial

Management

Management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

• Introduction

• A Brief history of J Sainsbury

• Sainsbury's Financial Performance

• Competitor of Sainsbury

• Comparative Analysis of Sainsbury with its competitor Morrisons

• Recommendation

• Usage of Investment Appraisal technique

• Calculation of Ratios

• Advantages and Shortcomings of the different techniques of Investment appraisal

• Conclusion

• References

• Introduction

• A Brief history of J Sainsbury

• Sainsbury's Financial Performance

• Competitor of Sainsbury

• Comparative Analysis of Sainsbury with its competitor Morrisons

• Recommendation

• Usage of Investment Appraisal technique

• Calculation of Ratios

• Advantages and Shortcomings of the different techniques of Investment appraisal

• Conclusion

• References

INTRODUCTION

Financial management is the management theory and practices which focuses on strategically

planning, organising, directing and controlling of different financial issues and requirements of an

organisation. In simple words, it is a practice of handling finances of a company while focusing

on the organisation's success. Planning, budgeting, managing and accessing risks related to

finance is the main scope of financial management. In this report the main focus is given to the

financial information of a plc. The company taken for this report is J. Sainsbury plc. It is a retail

food supermarket in the United Kingdom (Heo, Lee, and Rabbani, 2021).

Financial management is the management theory and practices which focuses on strategically

planning, organising, directing and controlling of different financial issues and requirements of an

organisation. In simple words, it is a practice of handling finances of a company while focusing

on the organisation's success. Planning, budgeting, managing and accessing risks related to

finance is the main scope of financial management. In this report the main focus is given to the

financial information of a plc. The company taken for this report is J. Sainsbury plc. It is a retail

food supermarket in the United Kingdom (Heo, Lee, and Rabbani, 2021).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

A Brief history of J Sainsbury

J. Sainsbury is one the leading supermarket chain in the United Kingdom. It currently holds market

share of 16% in the the supermarket sector. It was founded in the year 1869 by John J Sainsbury. He

started the business as partnership between him and his wife Mary Ann with a single shop in Drury

Lane, London. They began trading with fresh foods and later expanded into packaged consumable

items and groceries like tea, sugar, chips. The mission of the business in the 19th century was Quality

perfect, Prices lower. The business grew stronger and wider. The management offered extra

convenience to the public to hold the competitive edge in the market and it was in the year 1922 that

the business was incorporated as a private company and became one of the UK's largest grocery

group.

J. Sainsbury is one the leading supermarket chain in the United Kingdom. It currently holds market

share of 16% in the the supermarket sector. It was founded in the year 1869 by John J Sainsbury. He

started the business as partnership between him and his wife Mary Ann with a single shop in Drury

Lane, London. They began trading with fresh foods and later expanded into packaged consumable

items and groceries like tea, sugar, chips. The mission of the business in the 19th century was Quality

perfect, Prices lower. The business grew stronger and wider. The management offered extra

convenience to the public to hold the competitive edge in the market and it was in the year 1922 that

the business was incorporated as a private company and became one of the UK's largest grocery

group.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Sainsbury's Financial Performance

• Profitability Ratios

• Liquidity Ratios

• Gearing Ratios (leverage ratio)

• Efficiency Ratios

• Profitability Ratios

• Liquidity Ratios

• Gearing Ratios (leverage ratio)

• Efficiency Ratios

Competitor of Sainsbury

The major competitor for the Sainsbury is Morrisons. So now the ratios of Morrisons will be

calculated below of the five years from 2016 to 2021.

• Profitability Ratios

• Liquidity Ratios

• Gearing Ratios (leverage ratio)

• Efficiency Ratios

The major competitor for the Sainsbury is Morrisons. So now the ratios of Morrisons will be

calculated below of the five years from 2016 to 2021.

• Profitability Ratios

• Liquidity Ratios

• Gearing Ratios (leverage ratio)

• Efficiency Ratios

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Comparative Analysis of Sainsbury with its competitor

Morrisons

The operating profit margin of Sainsbury is less compare to that of the Morrisons. The sales of both

the companies is not so stable, which results in the fluctuation of the operating profit. Good

profitability is generated by the good revenue (Cheak-Zamora, Teti, Peters, and Maurer-Batjer,

2017). The operating profit of Morrisons is more it means that it operates at low costs compared to

Sainsbury. The cost of sales represents expense for the retail market, a change in the return on

investment is caused due to the decrease or increase in the net profit. The efficiency ratio shows the

turnover of the inventory and assets over the whole year.

Morrisons

The operating profit margin of Sainsbury is less compare to that of the Morrisons. The sales of both

the companies is not so stable, which results in the fluctuation of the operating profit. Good

profitability is generated by the good revenue (Cheak-Zamora, Teti, Peters, and Maurer-Batjer,

2017). The operating profit of Morrisons is more it means that it operates at low costs compared to

Sainsbury. The cost of sales represents expense for the retail market, a change in the return on

investment is caused due to the decrease or increase in the net profit. The efficiency ratio shows the

turnover of the inventory and assets over the whole year.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Recommendation

From the above analysis it is clear that Sainsbury

is not doing great in comparison to its competitor,

Morrisons. The financial condition of Sainsbury is

well but the operational efficiency of the business

is not up to the mark. The comparison shows how

Morrisons is earning profits, their revenue is

sufficient to meet the costs and make a high level

of profit (Osoolian, Hoseyni Esfidavajani, and

Bagheri, 2019).

From the above analysis it is clear that Sainsbury

is not doing great in comparison to its competitor,

Morrisons. The financial condition of Sainsbury is

well but the operational efficiency of the business

is not up to the mark. The comparison shows how

Morrisons is earning profits, their revenue is

sufficient to meet the costs and make a high level

of profit (Osoolian, Hoseyni Esfidavajani, and

Bagheri, 2019).

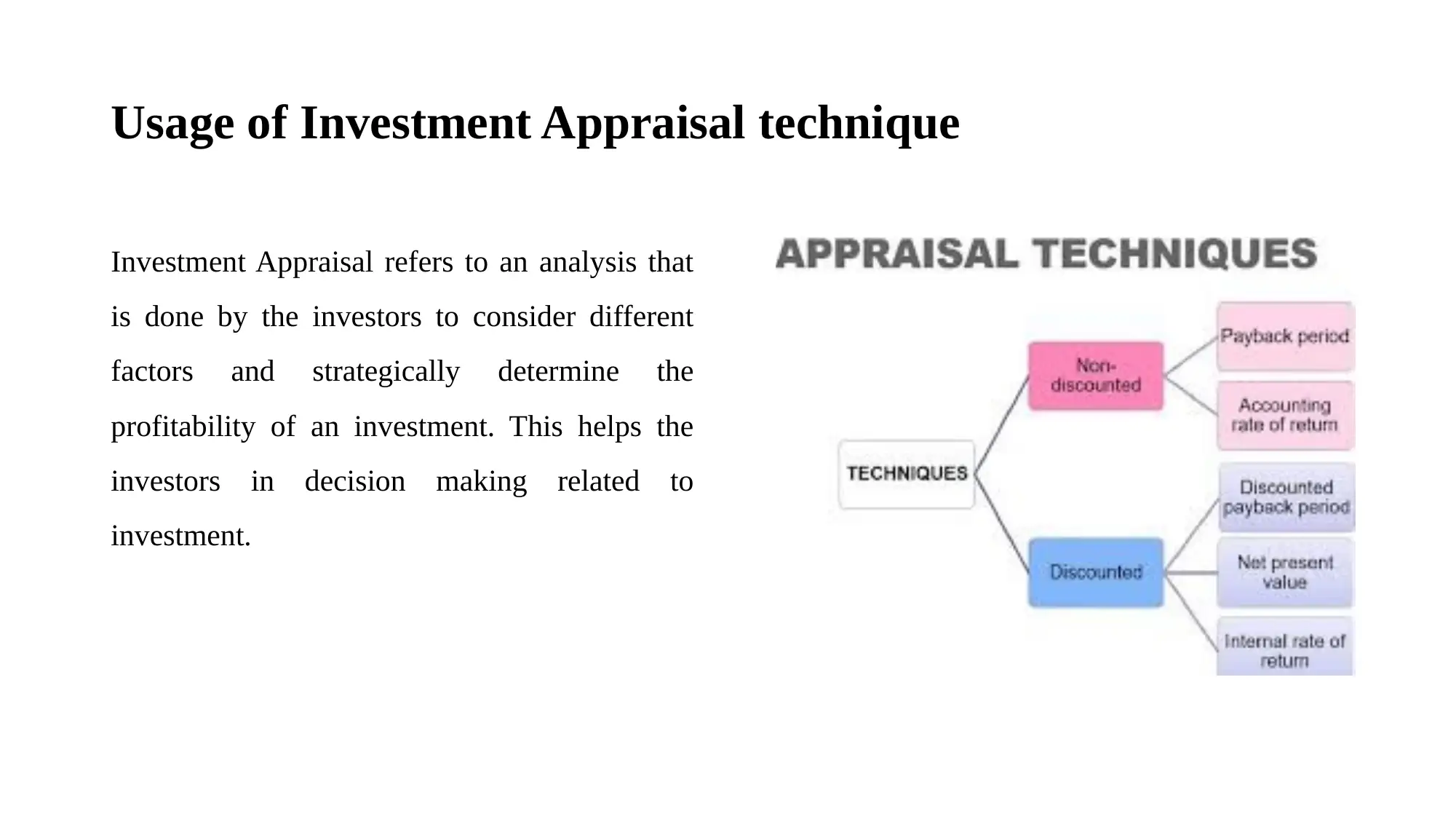

Usage of Investment Appraisal technique

Investment Appraisal refers to an analysis that

is done by the investors to consider different

factors and strategically determine the

profitability of an investment. This helps the

investors in decision making related to

investment.

Investment Appraisal refers to an analysis that

is done by the investors to consider different

factors and strategically determine the

profitability of an investment. This helps the

investors in decision making related to

investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Calculation of Payback period, Accounting rate of return

and net present value with critical analysis of the results

following recommendations.

• Payback Period: This is a capital budgeting technique which ascertains the time period required to recuperate

the initial value of investment. Following are the calculations of payback period of the two projects.

• Accounting rate of return (ARR) : It refers to the percentage of return which is forecasted from an

investment plan or assets compared to the initial cost of investment. Following are the calculation of ARR of

the two projects (Tey, and et.al., 2021).

• Net Present Value (NPV) : It is another investment appraisal technique which helps the investors decide the

future cash flows at the current value of investment. Following are the calculation of NPV for the two projects.

and net present value with critical analysis of the results

following recommendations.

• Payback Period: This is a capital budgeting technique which ascertains the time period required to recuperate

the initial value of investment. Following are the calculations of payback period of the two projects.

• Accounting rate of return (ARR) : It refers to the percentage of return which is forecasted from an

investment plan or assets compared to the initial cost of investment. Following are the calculation of ARR of

the two projects (Tey, and et.al., 2021).

• Net Present Value (NPV) : It is another investment appraisal technique which helps the investors decide the

future cash flows at the current value of investment. Following are the calculation of NPV for the two projects.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

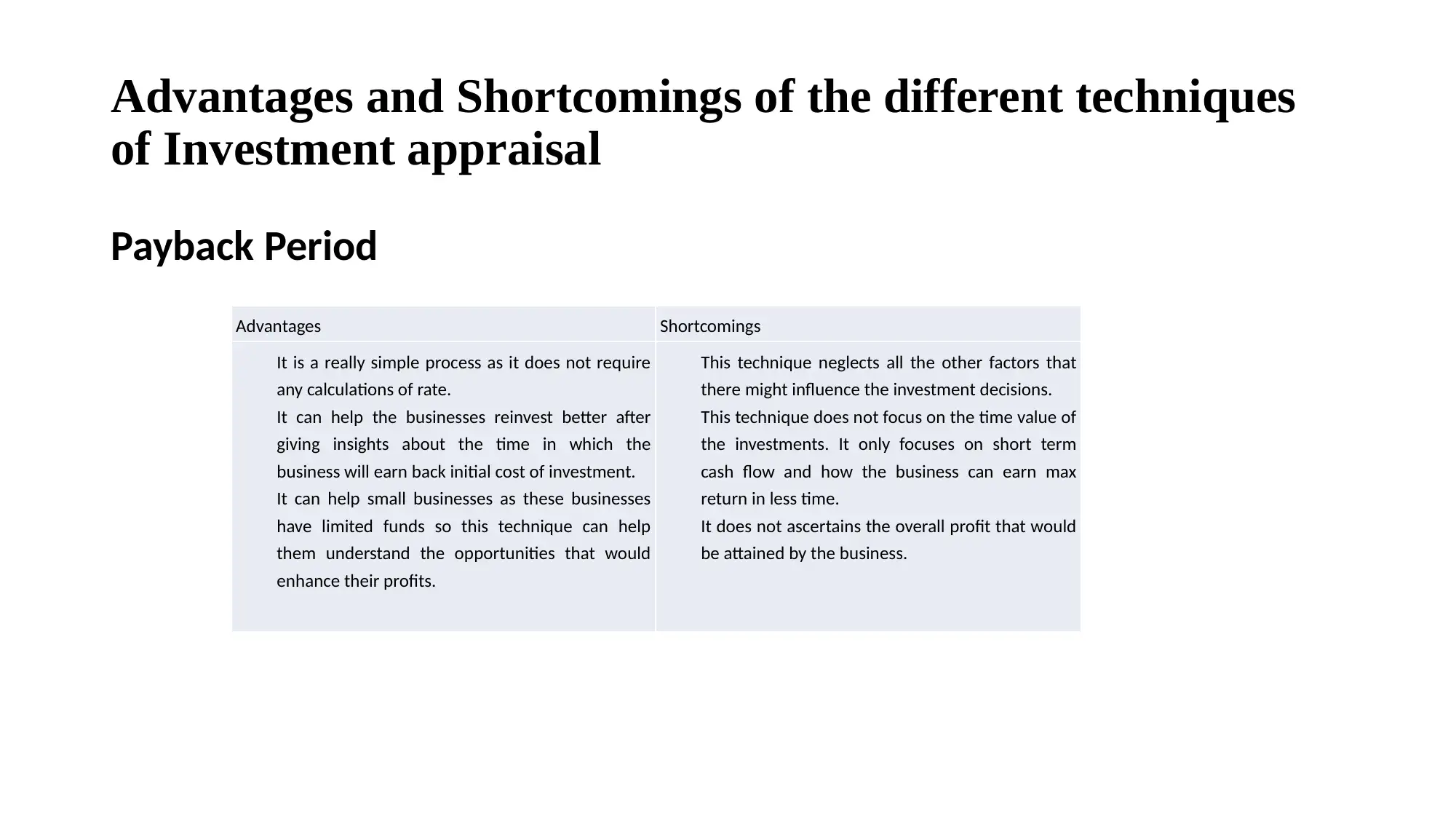

Advantages and Shortcomings of the different techniques

of Investment appraisal

Payback Period

Advantages Shortcomings

It is a really simple process as it does not require

any calculations of rate.

It can help the businesses reinvest better after

giving insights about the time in which the

business will earn back initial cost of investment.

It can help small businesses as these businesses

have limited funds so this technique can help

them understand the opportunities that would

enhance their profits.

This technique neglects all the other factors that

there might influence the investment decisions.

This technique does not focus on the time value of

the investments. It only focuses on short term

cash flow and how the business can earn max

return in less time.

It does not ascertains the overall profit that would

be attained by the business.

of Investment appraisal

Payback Period

Advantages Shortcomings

It is a really simple process as it does not require

any calculations of rate.

It can help the businesses reinvest better after

giving insights about the time in which the

business will earn back initial cost of investment.

It can help small businesses as these businesses

have limited funds so this technique can help

them understand the opportunities that would

enhance their profits.

This technique neglects all the other factors that

there might influence the investment decisions.

This technique does not focus on the time value of

the investments. It only focuses on short term

cash flow and how the business can earn max

return in less time.

It does not ascertains the overall profit that would

be attained by the business.

CONCLUSION

From the above mentioned detailed report it can be concluded that financial management is an

important management tool which is used by the strategic managers of the business to influence the

financial position and fiscal needs that the business requires for its operations. The report revolves

around Sainsbury, a food retail business listed in the London Stock Exchange. Sainsbury was

incorporated in the year 1869 as a partnership firm. The business was later converted into a private

limited company and later in 1973 the company went public attracting great amount for its shares.

From the above mentioned detailed report it can be concluded that financial management is an

important management tool which is used by the strategic managers of the business to influence the

financial position and fiscal needs that the business requires for its operations. The report revolves

around Sainsbury, a food retail business listed in the London Stock Exchange. Sainsbury was

incorporated in the year 1869 as a partnership firm. The business was later converted into a private

limited company and later in 1973 the company went public attracting great amount for its shares.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.