Comprehensive Review: Contract of Sale of Business and Legal Aspects

VerifiedAdded on 2022/08/19

|26

|12782

|25

Practical Assignment

AI Summary

This assignment presents a comprehensive contract for the sale of a business, detailing the operative parts, particulars of sale, special and general conditions, and schedules. It covers aspects such as payments, settlement, stock valuation, apportionment of outgoings, vendor's debts, finance, lease agreements, GST, running the business, inspection rights, employee matters, warranties, restraint of trade, and confidential information. The contract also addresses breach of contract scenarios, service of notices, non-merger, severance, guarantee, indemnity, and interpretation. Schedules include assets included in the price, equipment hire contracts, other material contracts, terms of current or new leases, permitted encumbrances, and warranties. The document includes warnings and disclaimers for legal practitioners, copyright information, and instructions for signing. The particulars of sale outline vendor, purchaser, business, and premises details, including price, deposit, and settlement terms. Special conditions address rental reductions and takings conditions. The assignment also includes related documents like email communications, duties forms, and property details related to a real estate transaction, providing a holistic view of legal and business practices.

Page 1

Contract of

Sale of Business

[Ref: ]

Contract of

Sale of Business

[Ref: ]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 2

Contents

Operative Part______________________________________3

Signing Page_______________________________________4

Particulars of sale___________________________________5

Special conditions__________________________________8

General Conditions_________________________________9

MONEY__________________________________________9

1. Payments_____________________________________9

2. Settlement____________________________________9

3. Valuing stock________________________________10

4. Apportionment of outgoings and entitlements_____10

5. Vendor’s debts_______________________________11

6. Finance______________________________________11

7. Lease _______________________________________11

8. GST________________________________________12

TRANSACTIONAL_______________________________12

9. Running the business__________________________12

10. Inspection___________________________________12

11. Employees___________________________________12

12. Warranties___________________________________13

13. Restraint of trade_____________________________13

14. Confidential information_______________________14

BREACH OF CONTRACT________________________14

15. Default______________________________________14

LEGAL AND GENERAL__________________________15

16. Service of notices_____________________________15

17. Non merger__________________________________15

18. Severance____________________________________15

19. Guarantee, indemnity and promise_______________15

20. Interpretation_________________________________16

Schedule 1: Assets included in the price_______________17

Schedule 2: Equipment hire contracts_________________18

Schedule 3: Other material contracts__________________19

Schedule 4: Terms of current or new lease_____________20

Schedule 5: Permitted encumbrances__________________22

Schedule 6: Warranties_____________________________23

Warning and Disclaimer

This document is prepared from a precedent intended solely for use by legal practitioners. The parts of the document prepared by the Law

Institute of Victoria are intended for use only by legal practitioners with the knowledge, skill and qualifications required to use the precedent

to create a document suitable for the transaction. This precedent is not a guide and it does not attempt to include all relevant issues or include

all aspects of law or changes to the law.

Legal practitioners using this document should check for any change in the law and ensure that the facts and circumstances for its intended

use are appropriately included.

The Law Institute of Victoria, its contractors and agents are not liable in any way, including, without limitation, negligence, for the use to

which the document may be put, for any errors or omissions in the precedent document, or any other changes or understanding of the law

arising from any legislative instruments or the decision of any court or tribunal, whether before or after this precedent was prepared, first

published, sold or used.

Copyright

The document is copyright. The document may only be reproduced in accordance with an agreement with the Law Institute of Victoria Limited

(ABN 32 075 475 731) for each specific transaction that is authorised. Any person who has purchased a physical copy of this precedent

document may only copy it for the purpose of providing legal services for the specific transaction or documenting the specific transaction.

“Specific transaction” means common parties entering into a legal relationship for the sale and purchase of the same subject matter.

Operative part

The vendor agrees to sell and the purchaser agrees to buy:

1. The Business for the price; and

Contents

Operative Part______________________________________3

Signing Page_______________________________________4

Particulars of sale___________________________________5

Special conditions__________________________________8

General Conditions_________________________________9

MONEY__________________________________________9

1. Payments_____________________________________9

2. Settlement____________________________________9

3. Valuing stock________________________________10

4. Apportionment of outgoings and entitlements_____10

5. Vendor’s debts_______________________________11

6. Finance______________________________________11

7. Lease _______________________________________11

8. GST________________________________________12

TRANSACTIONAL_______________________________12

9. Running the business__________________________12

10. Inspection___________________________________12

11. Employees___________________________________12

12. Warranties___________________________________13

13. Restraint of trade_____________________________13

14. Confidential information_______________________14

BREACH OF CONTRACT________________________14

15. Default______________________________________14

LEGAL AND GENERAL__________________________15

16. Service of notices_____________________________15

17. Non merger__________________________________15

18. Severance____________________________________15

19. Guarantee, indemnity and promise_______________15

20. Interpretation_________________________________16

Schedule 1: Assets included in the price_______________17

Schedule 2: Equipment hire contracts_________________18

Schedule 3: Other material contracts__________________19

Schedule 4: Terms of current or new lease_____________20

Schedule 5: Permitted encumbrances__________________22

Schedule 6: Warranties_____________________________23

Warning and Disclaimer

This document is prepared from a precedent intended solely for use by legal practitioners. The parts of the document prepared by the Law

Institute of Victoria are intended for use only by legal practitioners with the knowledge, skill and qualifications required to use the precedent

to create a document suitable for the transaction. This precedent is not a guide and it does not attempt to include all relevant issues or include

all aspects of law or changes to the law.

Legal practitioners using this document should check for any change in the law and ensure that the facts and circumstances for its intended

use are appropriately included.

The Law Institute of Victoria, its contractors and agents are not liable in any way, including, without limitation, negligence, for the use to

which the document may be put, for any errors or omissions in the precedent document, or any other changes or understanding of the law

arising from any legislative instruments or the decision of any court or tribunal, whether before or after this precedent was prepared, first

published, sold or used.

Copyright

The document is copyright. The document may only be reproduced in accordance with an agreement with the Law Institute of Victoria Limited

(ABN 32 075 475 731) for each specific transaction that is authorised. Any person who has purchased a physical copy of this precedent

document may only copy it for the purpose of providing legal services for the specific transaction or documenting the specific transaction.

“Specific transaction” means common parties entering into a legal relationship for the sale and purchase of the same subject matter.

Operative part

The vendor agrees to sell and the purchaser agrees to buy:

1. The Business for the price; and

Page 3

2. The Stock of the Business for the value of the Stock calculated under this contract;

as a going concern on the terms set out in this contract.

Each party agrees to promptly perform that party’s obligations contained in this contract.

The guarantor guarantees, indemnifies and promises as described in general condition 19.

All the terms of the sale and purchase are contained in this contract. This contract includes:

the particulars of sale;

any special conditions;

the general conditions; and

the schedules attached to this contract.

The particulars of sale, any special conditions and the general conditions are to be interpreted in that order of priority in the absence of

any provision to the contrary.

Each party represents and warrants to the other parties and the guarantors that the party has not altered the general conditions in this

contract from the form published by the Law Institute of Victoria dated May 2014, except to the extent that they are amended expressly

by a special condition (if any).

The authority of a person signing:

under a power of attorney;

as director of a corporation; or

as agent authorised in writing by one or more of the parties;

must be noted beneath their signature. That person represents and warrants to the other parties that the person has the power and

authority of that party to enter that party into this contract.

The vendor must provide a statement in writing to the purchaser in the prescribed form containing the prescribed particulars under

section 52 of the Estate Agents Act 1980 (Vic) if the Business is a “small business” as defined in that legislation.

2. The Stock of the Business for the value of the Stock calculated under this contract;

as a going concern on the terms set out in this contract.

Each party agrees to promptly perform that party’s obligations contained in this contract.

The guarantor guarantees, indemnifies and promises as described in general condition 19.

All the terms of the sale and purchase are contained in this contract. This contract includes:

the particulars of sale;

any special conditions;

the general conditions; and

the schedules attached to this contract.

The particulars of sale, any special conditions and the general conditions are to be interpreted in that order of priority in the absence of

any provision to the contrary.

Each party represents and warrants to the other parties and the guarantors that the party has not altered the general conditions in this

contract from the form published by the Law Institute of Victoria dated May 2014, except to the extent that they are amended expressly

by a special condition (if any).

The authority of a person signing:

under a power of attorney;

as director of a corporation; or

as agent authorised in writing by one or more of the parties;

must be noted beneath their signature. That person represents and warrants to the other parties that the person has the power and

authority of that party to enter that party into this contract.

The vendor must provide a statement in writing to the purchaser in the prescribed form containing the prescribed particulars under

section 52 of the Estate Agents Act 1980 (Vic) if the Business is a “small business” as defined in that legislation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page 4

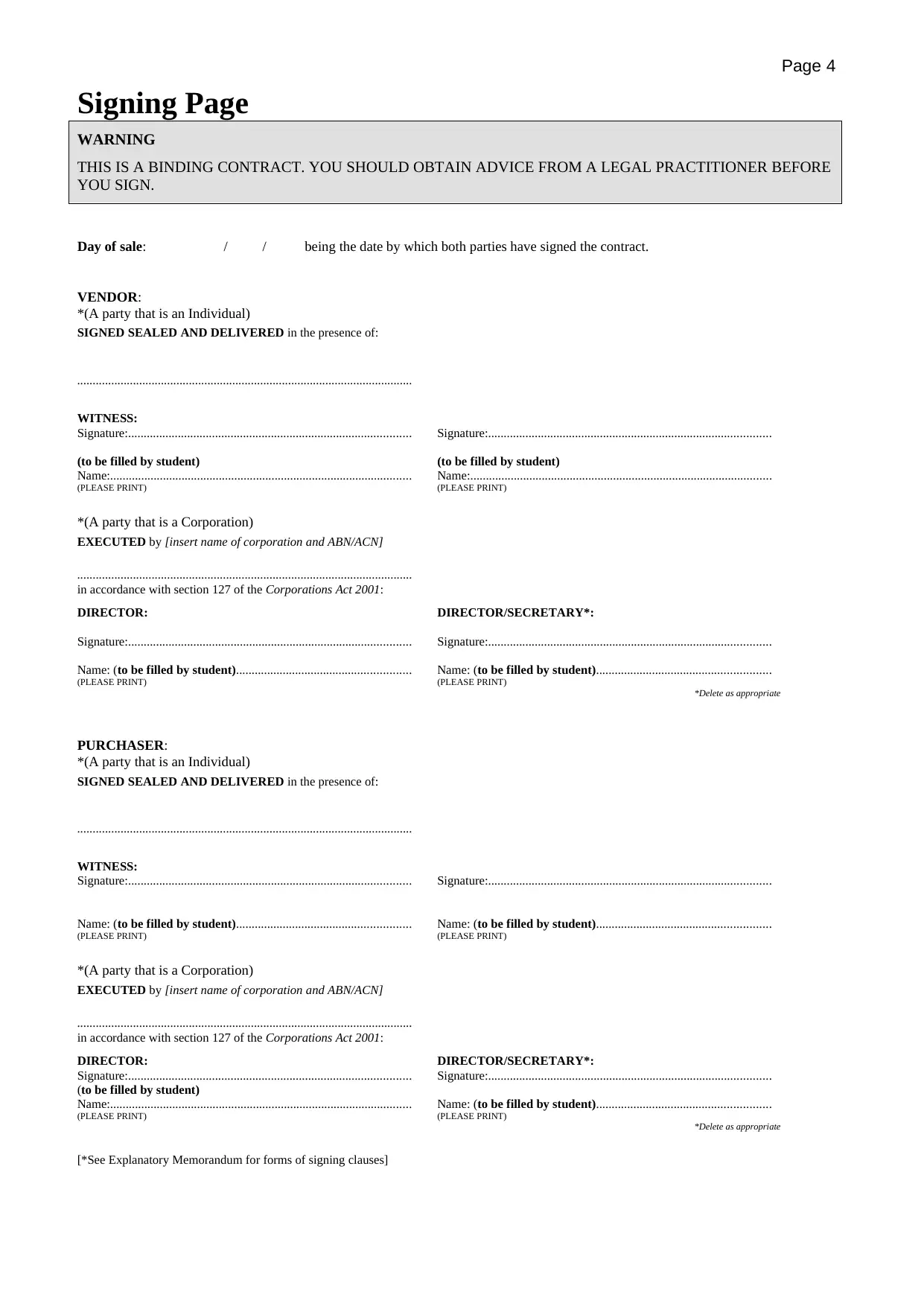

Signing Page

WARNING

THIS IS A BINDING CONTRACT. YOU SHOULD OBTAIN ADVICE FROM A LEGAL PRACTITIONER BEFORE

YOU SIGN.

Day of sale: / / being the date by which both parties have signed the contract.

VENDOR:

*(A party that is an Individual)

SIGNED SEALED AND DELIVERED in the presence of:

............................................................................................................

WITNESS:

Signature:...........................................................................................

(to be filled by student)

Name:.................................................................................................

(PLEASE PRINT)

Signature:...........................................................................................

(to be filled by student)

Name:.................................................................................................

(PLEASE PRINT)

*(A party that is a Corporation)

EXECUTED by [insert name of corporation and ABN/ACN]

............................................................................................................

in accordance with section 127 of the Corporations Act 2001:

DIRECTOR:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

DIRECTOR/SECRETARY*:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

*Delete as appropriate

PURCHASER:

*(A party that is an Individual)

SIGNED SEALED AND DELIVERED in the presence of:

............................................................................................................

WITNESS:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

*(A party that is a Corporation)

EXECUTED by [insert name of corporation and ABN/ACN]

............................................................................................................

in accordance with section 127 of the Corporations Act 2001:

DIRECTOR:

Signature:...........................................................................................

(to be filled by student)

Name:.................................................................................................

(PLEASE PRINT)

DIRECTOR/SECRETARY*:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

*Delete as appropriate

[*See Explanatory Memorandum for forms of signing clauses]

Signing Page

WARNING

THIS IS A BINDING CONTRACT. YOU SHOULD OBTAIN ADVICE FROM A LEGAL PRACTITIONER BEFORE

YOU SIGN.

Day of sale: / / being the date by which both parties have signed the contract.

VENDOR:

*(A party that is an Individual)

SIGNED SEALED AND DELIVERED in the presence of:

............................................................................................................

WITNESS:

Signature:...........................................................................................

(to be filled by student)

Name:.................................................................................................

(PLEASE PRINT)

Signature:...........................................................................................

(to be filled by student)

Name:.................................................................................................

(PLEASE PRINT)

*(A party that is a Corporation)

EXECUTED by [insert name of corporation and ABN/ACN]

............................................................................................................

in accordance with section 127 of the Corporations Act 2001:

DIRECTOR:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

DIRECTOR/SECRETARY*:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

*Delete as appropriate

PURCHASER:

*(A party that is an Individual)

SIGNED SEALED AND DELIVERED in the presence of:

............................................................................................................

WITNESS:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

*(A party that is a Corporation)

EXECUTED by [insert name of corporation and ABN/ACN]

............................................................................................................

in accordance with section 127 of the Corporations Act 2001:

DIRECTOR:

Signature:...........................................................................................

(to be filled by student)

Name:.................................................................................................

(PLEASE PRINT)

DIRECTOR/SECRETARY*:

Signature:...........................................................................................

Name: (to be filled by student)........................................................

(PLEASE PRINT)

*Delete as appropriate

[*See Explanatory Memorandum for forms of signing clauses]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 5

Particulars of sale

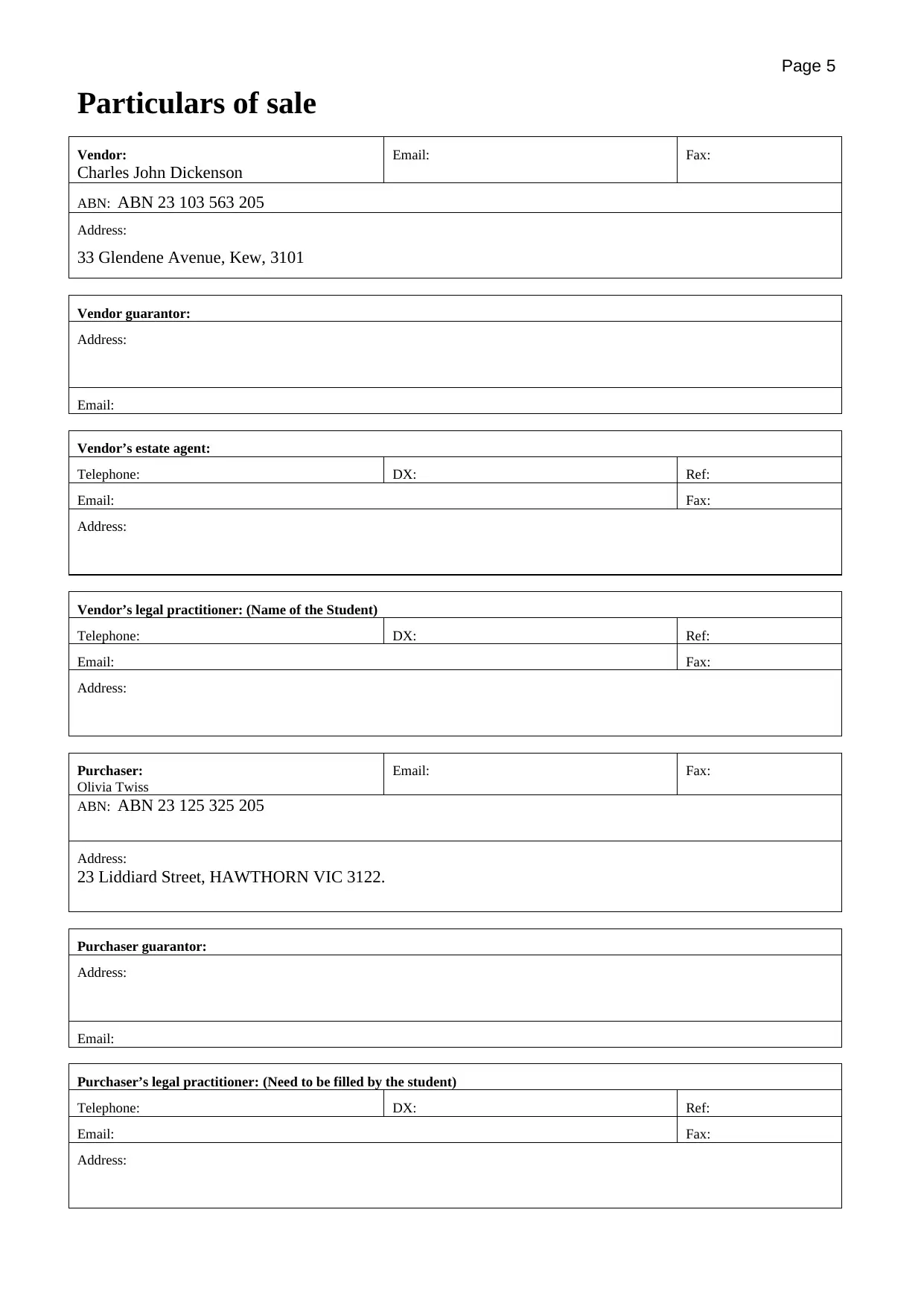

Vendor:

Charles John Dickenson

Email: Fax:

ABN: ABN 23 103 563 205

Address:

33 Glendene Avenue, Kew, 3101

Vendor guarantor:

Address:

Email:

Vendor’s estate agent:

Telephone: DX: Ref:

Email: Fax:

Address:

Vendor’s legal practitioner: (Name of the Student)

Telephone: DX: Ref:

Email: Fax:

Address:

Purchaser:

Olivia Twiss

Email: Fax:

ABN: ABN 23 125 325 205

Address:

23 Liddiard Street, HAWTHORN VIC 3122.

Purchaser guarantor:

Address:

Email:

Purchaser’s legal practitioner: (Need to be filled by the student)

Telephone: DX: Ref:

Email: Fax:

Address:

Particulars of sale

Vendor:

Charles John Dickenson

Email: Fax:

ABN: ABN 23 103 563 205

Address:

33 Glendene Avenue, Kew, 3101

Vendor guarantor:

Address:

Email:

Vendor’s estate agent:

Telephone: DX: Ref:

Email: Fax:

Address:

Vendor’s legal practitioner: (Name of the Student)

Telephone: DX: Ref:

Email: Fax:

Address:

Purchaser:

Olivia Twiss

Email: Fax:

ABN: ABN 23 125 325 205

Address:

23 Liddiard Street, HAWTHORN VIC 3122.

Purchaser guarantor:

Address:

Email:

Purchaser’s legal practitioner: (Need to be filled by the student)

Telephone: DX: Ref:

Email: Fax:

Address:

Page 6

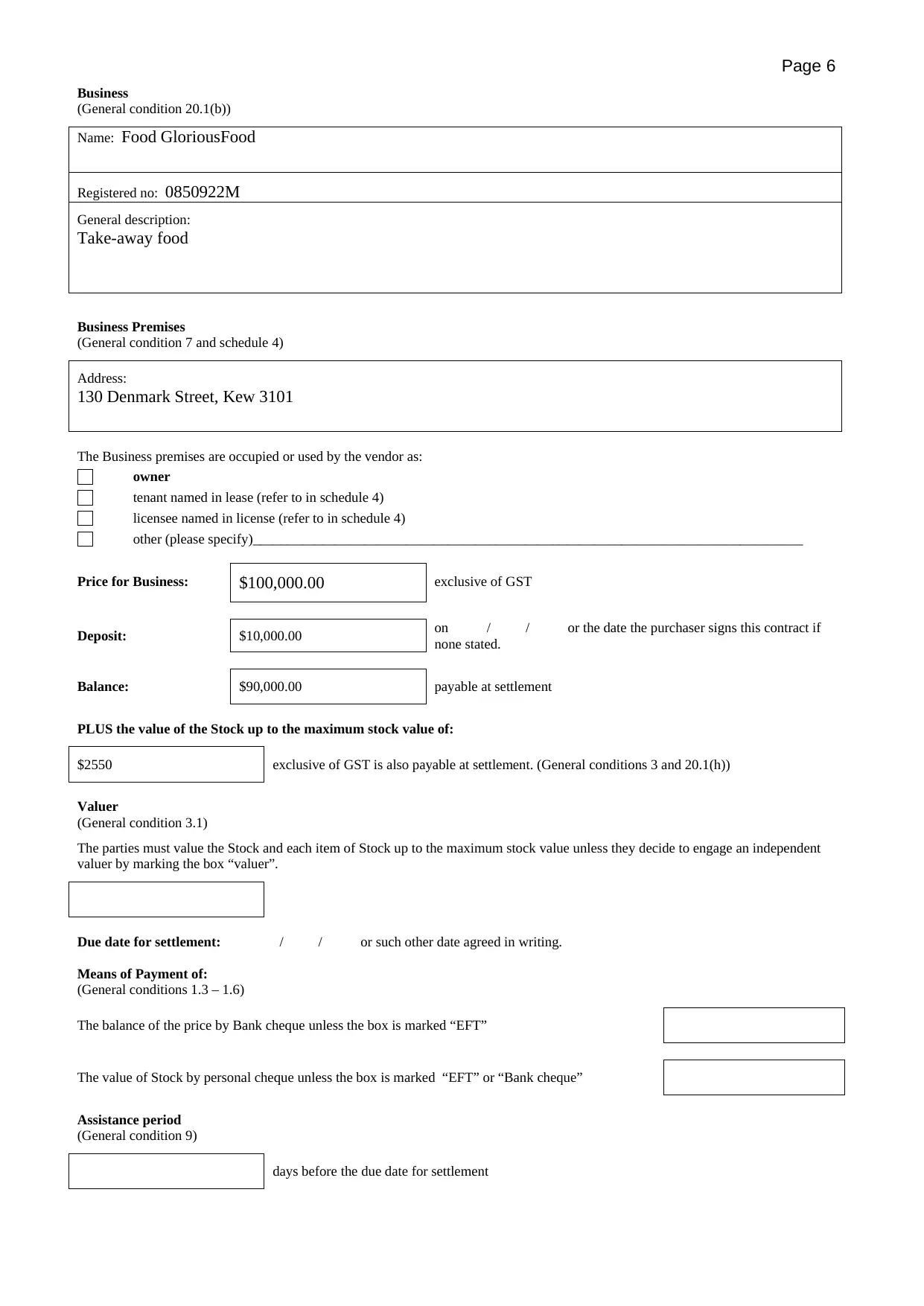

Business

(General condition 20.1(b))

Name: Food GloriousFood

Registered no: 0850922M

General description:

Take-away food

Business Premises

(General condition 7 and schedule 4)

Address:

130 Denmark Street, Kew 3101

The Business premises are occupied or used by the vendor as:

owner

tenant named in lease (refer to in schedule 4)

licensee named in license (refer to in schedule 4)

other (please specify)_______________________________________________________________________________

Price for Business: $100,000.00 exclusive of GST

Deposit: $10,000.00 on / / or the date the purchaser signs this contract if

none stated.

Balance: $90,000.00 payable at settlement

PLUS the value of the Stock up to the maximum stock value of:

$2550 exclusive of GST is also payable at settlement. (General conditions 3 and 20.1(h))

Valuer

(General condition 3.1)

The parties must value the Stock and each item of Stock up to the maximum stock value unless they decide to engage an independent

valuer by marking the box “valuer”.

Due date for settlement: / / or such other date agreed in writing.

Means of Payment of:

(General conditions 1.3 – 1.6)

The balance of the price by Bank cheque unless the box is marked “EFT”

The value of Stock by personal cheque unless the box is marked “EFT” or “Bank cheque”

Assistance period

(General condition 9)

days before the due date for settlement

Business

(General condition 20.1(b))

Name: Food GloriousFood

Registered no: 0850922M

General description:

Take-away food

Business Premises

(General condition 7 and schedule 4)

Address:

130 Denmark Street, Kew 3101

The Business premises are occupied or used by the vendor as:

owner

tenant named in lease (refer to in schedule 4)

licensee named in license (refer to in schedule 4)

other (please specify)_______________________________________________________________________________

Price for Business: $100,000.00 exclusive of GST

Deposit: $10,000.00 on / / or the date the purchaser signs this contract if

none stated.

Balance: $90,000.00 payable at settlement

PLUS the value of the Stock up to the maximum stock value of:

$2550 exclusive of GST is also payable at settlement. (General conditions 3 and 20.1(h))

Valuer

(General condition 3.1)

The parties must value the Stock and each item of Stock up to the maximum stock value unless they decide to engage an independent

valuer by marking the box “valuer”.

Due date for settlement: / / or such other date agreed in writing.

Means of Payment of:

(General conditions 1.3 – 1.6)

The balance of the price by Bank cheque unless the box is marked “EFT”

The value of Stock by personal cheque unless the box is marked “EFT” or “Bank cheque”

Assistance period

(General condition 9)

days before the due date for settlement

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page 7

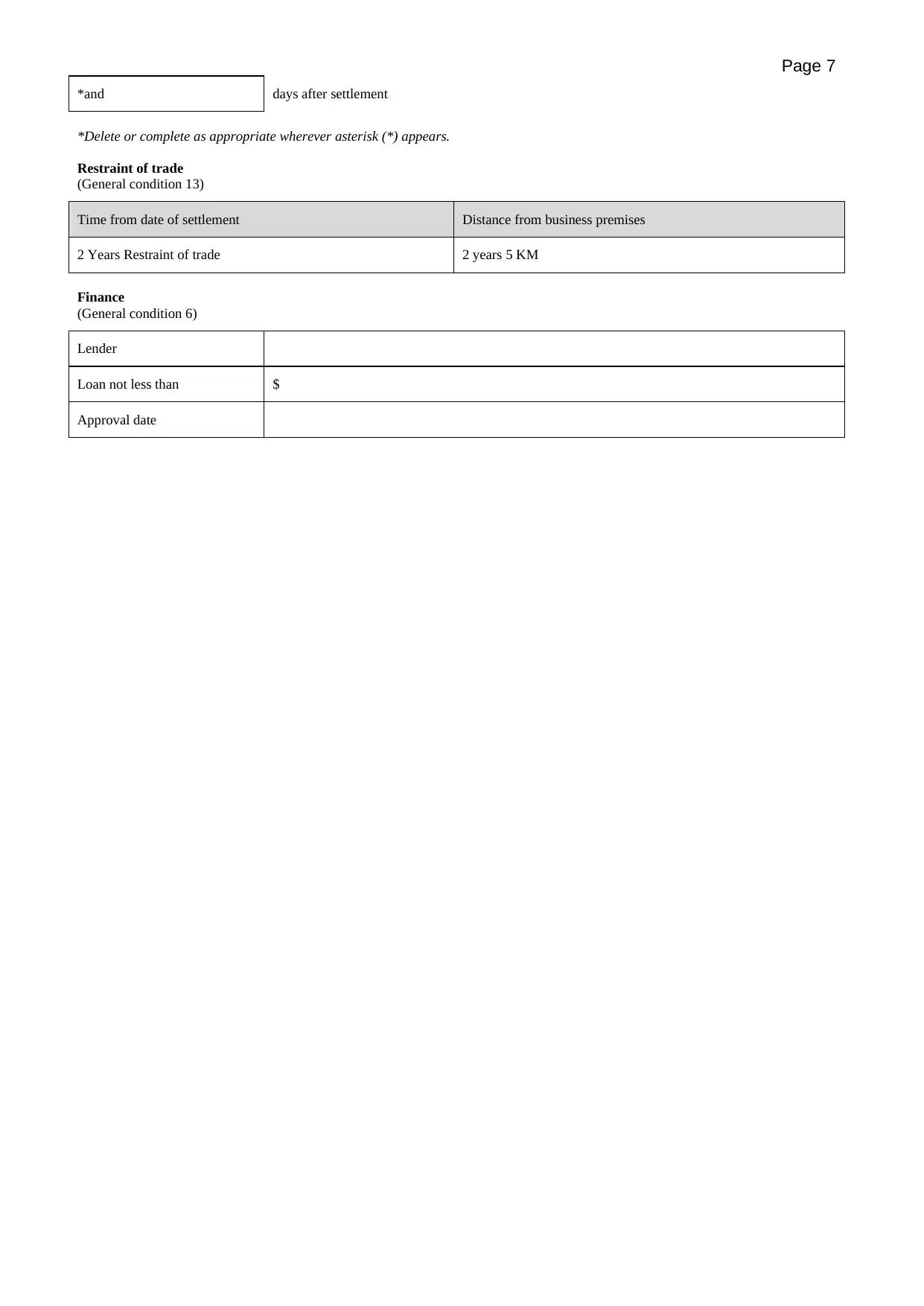

*and days after settlement

*Delete or complete as appropriate wherever asterisk (*) appears.

Restraint of trade

(General condition 13)

Time from date of settlement Distance from business premises

2 Years Restraint of trade 2 years 5 KM

Finance

(General condition 6)

Lender

Loan not less than $

Approval date

*and days after settlement

*Delete or complete as appropriate wherever asterisk (*) appears.

Restraint of trade

(General condition 13)

Time from date of settlement Distance from business premises

2 Years Restraint of trade 2 years 5 KM

Finance

(General condition 6)

Lender

Loan not less than $

Approval date

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 8

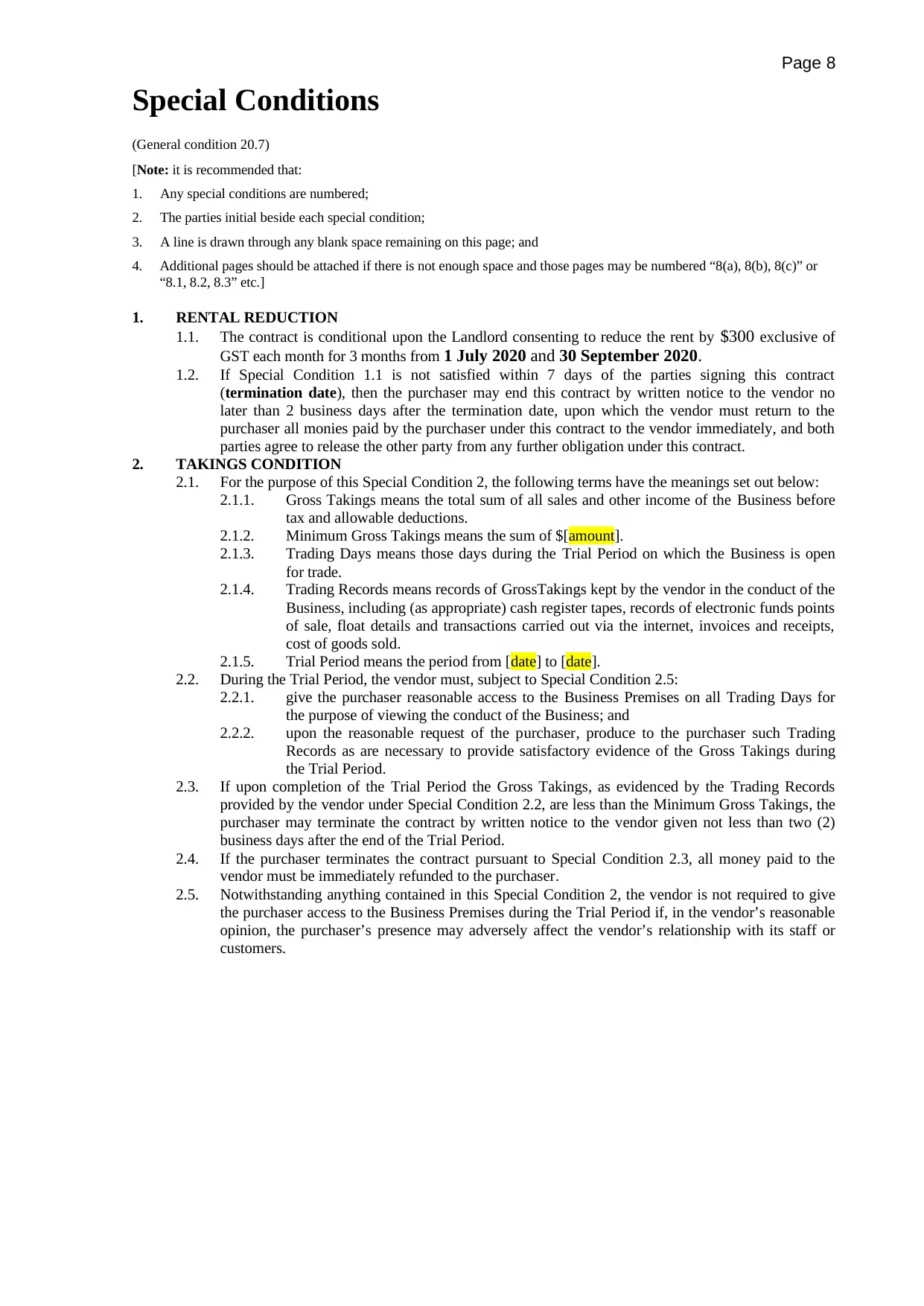

Special Conditions

(General condition 20.7)

[Note: it is recommended that:

1. Any special conditions are numbered;

2. The parties initial beside each special condition;

3. A line is drawn through any blank space remaining on this page; and

4. Additional pages should be attached if there is not enough space and those pages may be numbered “8(a), 8(b), 8(c)” or

“8.1, 8.2, 8.3” etc.]

1. RENTAL REDUCTION

1.1. The contract is conditional upon the Landlord consenting to reduce the rent by $300 exclusive of

GST each month for 3 months from 1 July 2020 and 30 September 2020.

1.2. If Special Condition 1.1 is not satisfied within 7 days of the parties signing this contract

(termination date), then the purchaser may end this contract by written notice to the vendor no

later than 2 business days after the termination date, upon which the vendor must return to the

purchaser all monies paid by the purchaser under this contract to the vendor immediately, and both

parties agree to release the other party from any further obligation under this contract.

2. TAKINGS CONDITION

2.1. For the purpose of this Special Condition 2, the following terms have the meanings set out below:

2.1.1. Gross Takings means the total sum of all sales and other income of the Business before

tax and allowable deductions.

2.1.2. Minimum Gross Takings means the sum of $[amount].

2.1.3. Trading Days means those days during the Trial Period on which the Business is open

for trade.

2.1.4. Trading Records means records of GrossTakings kept by the vendor in the conduct of the

Business, including (as appropriate) cash register tapes, records of electronic funds points

of sale, float details and transactions carried out via the internet, invoices and receipts,

cost of goods sold.

2.1.5. Trial Period means the period from [date] to [date].

2.2. During the Trial Period, the vendor must, subject to Special Condition 2.5:

2.2.1. give the purchaser reasonable access to the Business Premises on all Trading Days for

the purpose of viewing the conduct of the Business; and

2.2.2. upon the reasonable request of the purchaser, produce to the purchaser such Trading

Records as are necessary to provide satisfactory evidence of the Gross Takings during

the Trial Period.

2.3. If upon completion of the Trial Period the Gross Takings, as evidenced by the Trading Records

provided by the vendor under Special Condition 2.2, are less than the Minimum Gross Takings, the

purchaser may terminate the contract by written notice to the vendor given not less than two (2)

business days after the end of the Trial Period.

2.4. If the purchaser terminates the contract pursuant to Special Condition 2.3, all money paid to the

vendor must be immediately refunded to the purchaser.

2.5. Notwithstanding anything contained in this Special Condition 2, the vendor is not required to give

the purchaser access to the Business Premises during the Trial Period if, in the vendor’s reasonable

opinion, the purchaser’s presence may adversely affect the vendor’s relationship with its staff or

customers.

Special Conditions

(General condition 20.7)

[Note: it is recommended that:

1. Any special conditions are numbered;

2. The parties initial beside each special condition;

3. A line is drawn through any blank space remaining on this page; and

4. Additional pages should be attached if there is not enough space and those pages may be numbered “8(a), 8(b), 8(c)” or

“8.1, 8.2, 8.3” etc.]

1. RENTAL REDUCTION

1.1. The contract is conditional upon the Landlord consenting to reduce the rent by $300 exclusive of

GST each month for 3 months from 1 July 2020 and 30 September 2020.

1.2. If Special Condition 1.1 is not satisfied within 7 days of the parties signing this contract

(termination date), then the purchaser may end this contract by written notice to the vendor no

later than 2 business days after the termination date, upon which the vendor must return to the

purchaser all monies paid by the purchaser under this contract to the vendor immediately, and both

parties agree to release the other party from any further obligation under this contract.

2. TAKINGS CONDITION

2.1. For the purpose of this Special Condition 2, the following terms have the meanings set out below:

2.1.1. Gross Takings means the total sum of all sales and other income of the Business before

tax and allowable deductions.

2.1.2. Minimum Gross Takings means the sum of $[amount].

2.1.3. Trading Days means those days during the Trial Period on which the Business is open

for trade.

2.1.4. Trading Records means records of GrossTakings kept by the vendor in the conduct of the

Business, including (as appropriate) cash register tapes, records of electronic funds points

of sale, float details and transactions carried out via the internet, invoices and receipts,

cost of goods sold.

2.1.5. Trial Period means the period from [date] to [date].

2.2. During the Trial Period, the vendor must, subject to Special Condition 2.5:

2.2.1. give the purchaser reasonable access to the Business Premises on all Trading Days for

the purpose of viewing the conduct of the Business; and

2.2.2. upon the reasonable request of the purchaser, produce to the purchaser such Trading

Records as are necessary to provide satisfactory evidence of the Gross Takings during

the Trial Period.

2.3. If upon completion of the Trial Period the Gross Takings, as evidenced by the Trading Records

provided by the vendor under Special Condition 2.2, are less than the Minimum Gross Takings, the

purchaser may terminate the contract by written notice to the vendor given not less than two (2)

business days after the end of the Trial Period.

2.4. If the purchaser terminates the contract pursuant to Special Condition 2.3, all money paid to the

vendor must be immediately refunded to the purchaser.

2.5. Notwithstanding anything contained in this Special Condition 2, the vendor is not required to give

the purchaser access to the Business Premises during the Trial Period if, in the vendor’s reasonable

opinion, the purchaser’s presence may adversely affect the vendor’s relationship with its staff or

customers.

Page 9

General conditions

MONEY

1. PAYMENTS

1.1 The purchaser must pay the deposit to the vendor’s

legal practitioner or the vendor’s estate agent as

stakeholder at the time and on the day specified in

the particulars. The deposit may be paid by personal

cheque.

1.2 The stakeholder:

(a) must hold the deposit and any interest derived

on it, in their trust account as stakeholder, until

the contract is settled or ended. The stakeholder

must then pay the deposit and any interest to

the party entitled. The party entitled to the

deposit is entitled to the interest;

(b) being the vendor’s estate agent, must transfer

the deposit from the vendor’s estate agent to the

vendor’s legal practitioner as stakeholder if

directed by the vendor or vendor’s legal

practitioner;

(c) is authorised, but is not obliged, to pay the

deposit and any interest into an interest bearing

account with an authorised deposit-taking

institution. The investment with the authorised

deposit- taking institution is at the risk of the

party entitled;

(d) may pay the deposit and any interest into court

if it is reasonable to do so; and

(e) is entitled to deduct from the deposit any

authorised deposit-taking institution fees and

any reasonable professional fees for dealing

with the deposit.

1.3 The purchaser must make all other payments by

delivery of a Bank cheque payable as directed by the

vendor unless the particulars of sale specify payment

by electronic funds transfer by the box being marked

“EFT”, in which case payment must be made by

electronic funds transfer unless a special condition

authorises another form of payment.

1.4 This general condition 1.4 applies if any payments

are required to be made by electronic funds transfer:

(a) all electronic funds transfers must be paid to the

vendor’s legal practitioner’s trust account;

(b) the vendor must ensure that the vendor’s legal

practitioner notifies the purchaser of the

vendor’s legal practitioner’s trust account

particulars at least 7 days before the due date

for settlement if the particulars of sale specify

payment by electronic funds transfer. The

purchaser must advise the vendor’s legal

practitioner of the reference details recorded

against the money electronically transferred and

notify the vendor’s legal practitioner, as soon as

the money has been transferred;

(c) the purchaser must ensure that the payment of

the balance of the price by electronic funds

transfer into the vendor’s legal practitioner’s

trust account, is designated by the remitting

authorised deposit-taking institution as cleared

funds, or those payments received into the

recipient’s trust account have become cleared

funds, by 10.00 am on the due date for

settlement.

1.5 Payment for any Stock may be made by personal

cheque unless the particulars of sale specify that

payment of the Stock is to be made by electronic

funds transfer or Bank cheque.

1.6 The party making payment by cheque or electronic

funds transfer represents and warrants to the other

party that the cheque or electronic funds transfer will

be honoured and payment irrevocably made by the

payer’s authorised deposit taking institution when

the cheque or electronic funds transfer is presented

by the recipient’s authorised deposit taking

institution.

2. SETTLEMENT

2.1 The parties must perform the obligations in this

contract by the due date for settlement unless

indicated otherwise.

2.2 Settlement is effected when the vendor transfers to

the purchaser the full title, benefit and quiet

possession of the Business, the Stock and all

documents of title free from all Encumbrances other

than the Permitted Encumbrances, in exchange for

the whole of the price and the value of the Stock up

to the maximum stock value as set out in the

particulars of sale.

2.3 Ownership of the Business and Stock passes when

the whole of the price and the value of the Stock up

to the maximum stock value are paid.

2.4 The vendor must deliver the assets of the Business

described in Schedule 1 to the purchaser at

settlement in the same state of repair (fair wear and

tear excepted) as at the day of sale and in proper

working order unless otherwise agreed. The quality

and quantity of the Stock must remain materially the

same other than in the ordinary course of the

Business.

2.5 The vendor must sign all documents prepared by the

purchaser and do whatever else is necessary for the

vendor to do to enable the transfer to the purchaser

on settlement of the right, title and benefit in the

Business, including the Stock; as a going concern.

2.6 The purchaser indemnifies the vendor against any

cost, loss or damage arising from a breach of a

contract described in schedules 2, 3 or 4 which

occurs after settlement.

2.7 The vendor must by the due date for settlement:

(a) ensure that the business premises can be

lawfully used for the Business; and

(b) comply with any order or notice affecting the

Business or the business premises served before

settlement.

2.8 This general condition 2.8 applies if any part of the

assets of the Business, including the Stock, is subject

to a security interest to which the Personal Property

Securities Act 2009 (Cth) applies.

(a) The vendor must advise the purchaser of the

vendor’s date of birth solely for the purpose of

enabling the purchaser to search the Personal

Properties Securities Register for any security

interests affecting any personal property for

which the purchaser is entitled to a release,

statement, approval or correction under general

condition 2.8(c). The purchaser must keep the

vendor’s date of birth secure and confidential.

General conditions

MONEY

1. PAYMENTS

1.1 The purchaser must pay the deposit to the vendor’s

legal practitioner or the vendor’s estate agent as

stakeholder at the time and on the day specified in

the particulars. The deposit may be paid by personal

cheque.

1.2 The stakeholder:

(a) must hold the deposit and any interest derived

on it, in their trust account as stakeholder, until

the contract is settled or ended. The stakeholder

must then pay the deposit and any interest to

the party entitled. The party entitled to the

deposit is entitled to the interest;

(b) being the vendor’s estate agent, must transfer

the deposit from the vendor’s estate agent to the

vendor’s legal practitioner as stakeholder if

directed by the vendor or vendor’s legal

practitioner;

(c) is authorised, but is not obliged, to pay the

deposit and any interest into an interest bearing

account with an authorised deposit-taking

institution. The investment with the authorised

deposit- taking institution is at the risk of the

party entitled;

(d) may pay the deposit and any interest into court

if it is reasonable to do so; and

(e) is entitled to deduct from the deposit any

authorised deposit-taking institution fees and

any reasonable professional fees for dealing

with the deposit.

1.3 The purchaser must make all other payments by

delivery of a Bank cheque payable as directed by the

vendor unless the particulars of sale specify payment

by electronic funds transfer by the box being marked

“EFT”, in which case payment must be made by

electronic funds transfer unless a special condition

authorises another form of payment.

1.4 This general condition 1.4 applies if any payments

are required to be made by electronic funds transfer:

(a) all electronic funds transfers must be paid to the

vendor’s legal practitioner’s trust account;

(b) the vendor must ensure that the vendor’s legal

practitioner notifies the purchaser of the

vendor’s legal practitioner’s trust account

particulars at least 7 days before the due date

for settlement if the particulars of sale specify

payment by electronic funds transfer. The

purchaser must advise the vendor’s legal

practitioner of the reference details recorded

against the money electronically transferred and

notify the vendor’s legal practitioner, as soon as

the money has been transferred;

(c) the purchaser must ensure that the payment of

the balance of the price by electronic funds

transfer into the vendor’s legal practitioner’s

trust account, is designated by the remitting

authorised deposit-taking institution as cleared

funds, or those payments received into the

recipient’s trust account have become cleared

funds, by 10.00 am on the due date for

settlement.

1.5 Payment for any Stock may be made by personal

cheque unless the particulars of sale specify that

payment of the Stock is to be made by electronic

funds transfer or Bank cheque.

1.6 The party making payment by cheque or electronic

funds transfer represents and warrants to the other

party that the cheque or electronic funds transfer will

be honoured and payment irrevocably made by the

payer’s authorised deposit taking institution when

the cheque or electronic funds transfer is presented

by the recipient’s authorised deposit taking

institution.

2. SETTLEMENT

2.1 The parties must perform the obligations in this

contract by the due date for settlement unless

indicated otherwise.

2.2 Settlement is effected when the vendor transfers to

the purchaser the full title, benefit and quiet

possession of the Business, the Stock and all

documents of title free from all Encumbrances other

than the Permitted Encumbrances, in exchange for

the whole of the price and the value of the Stock up

to the maximum stock value as set out in the

particulars of sale.

2.3 Ownership of the Business and Stock passes when

the whole of the price and the value of the Stock up

to the maximum stock value are paid.

2.4 The vendor must deliver the assets of the Business

described in Schedule 1 to the purchaser at

settlement in the same state of repair (fair wear and

tear excepted) as at the day of sale and in proper

working order unless otherwise agreed. The quality

and quantity of the Stock must remain materially the

same other than in the ordinary course of the

Business.

2.5 The vendor must sign all documents prepared by the

purchaser and do whatever else is necessary for the

vendor to do to enable the transfer to the purchaser

on settlement of the right, title and benefit in the

Business, including the Stock; as a going concern.

2.6 The purchaser indemnifies the vendor against any

cost, loss or damage arising from a breach of a

contract described in schedules 2, 3 or 4 which

occurs after settlement.

2.7 The vendor must by the due date for settlement:

(a) ensure that the business premises can be

lawfully used for the Business; and

(b) comply with any order or notice affecting the

Business or the business premises served before

settlement.

2.8 This general condition 2.8 applies if any part of the

assets of the Business, including the Stock, is subject

to a security interest to which the Personal Property

Securities Act 2009 (Cth) applies.

(a) The vendor must advise the purchaser of the

vendor’s date of birth solely for the purpose of

enabling the purchaser to search the Personal

Properties Securities Register for any security

interests affecting any personal property for

which the purchaser is entitled to a release,

statement, approval or correction under general

condition 2.8(c). The purchaser must keep the

vendor’s date of birth secure and confidential.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page 10

(b) However, the vendor is only required to so

advise of the vendor’s date of birth if the

purchaser makes the request at least 21 days

before the due date for settlement.

(c) The vendor must ensure that at or before

settlement, the purchaser receives:

(i) a release from the secured party releasing

the security interest in personal property;

or

(ii) a statement in writing under section

275(1)(b) of the Personal Property

Securities Act 2009 (Cth) setting out that

the amount or obligation that is secured is

nil at settlement; or

(iii) a written approval or correction under

section 275(1)(c) of the Personal Property

Securities Act 2009 (Cth) indicating that,

on settlement, the personal property

included in the contract is not or will not

be property in which the security interest

is granted.

(d) A release for the purposes of general condition

2.8(c) (1) must be in writing. The release must

be effective in releasing the personal property

from the security interest and be in a form that

allows the purchaser to take title to the personal

property free of that security interest.

(e) The purchaser must provide the vendor with a

copy of the release at or as soon as practicable

after settlement if the purchaser receives a

release under general condition 2.8(c)(1) at

settlement.

(f) The purchaser must advise the vendor at least

21 days before the due date for settlement of

any security interest that is registered on or

before the day of sale on the Personal Property

Securities Register, that the purchaser requires

a statement, approval or correction in

accordance with general condition 2.8(c).

(g) The vendor may delay settlement until 21 days

after the purchaser advises the vendor of the

security interests that the purchaser reasonably

requires to be released under general condition

2.8(f).

(h) The purchaser must pay the vendor:

(i) interest from the due date for settlement

until the date on which settlement occurs

or 21 days after the vendor receives the

advice, whichever is the earlier; and

(ii) any reasonable cost, loss or damage

incurred by the vendor as a result of the

delay; and

(iii) as though the purchaser was in default,

if settlement is delayed under general condition

2.8(g).

2.9 The vendor gives the purchaser the full benefit of

and quiet possession of the Business and the Stock at

settlement, except as provided in this contract.

2.10 Settlement must be effected:

(a) on the due date for settlement between 10.00

a.m. and 3.00 p.m. as specified by the vendor;

and

(b) at the place or places in Victoria reasonably

specified by the vendor.

Different parts of the settlement may occur

simultaneously at different places.

3. VALUING STOCK

3.1 A stocktake will be jointly conducted by the parties

and the value of each Stock item mutually agreed

unless there is a dispute as to value or items in which

case Clause 3.3 will apply.

3.2 The purchaser must pay the vendor the value of the

Stock up to the maximum stock value. The purchaser

must buy all Stock if there is no maximum stock

value specified in the particulars of sale.

3.3 The value of the Stock and each Stock item must be

decided by an independent valuer mutually

nominated by the parties, or failing their mutual

nomination by 15 days before the due date for

settlement, nominated by the president or acting

president of the Law Institute of Victoria on

application by either party if the valuer item in the

particulars of sale is completed with the word

“valuer”, or the parties fail to mutually agree on the

value of the Stock, any item of Stock or any other

matters described in general condition 3.1.

3.4 The purchaser can decide which Stock the purchaser

will not purchase if the Stock exceeds the maximum

stock value specified in the particulars of sale.

3.5 The valuer acts as an expert and the valuer’s

decisions are binding on the parties. Each party must

pay or reimburse the other an equal share of the

valuer’s fees.

4. APPORTIONMENT OF OUTGOINGS AND

ENTITLEMENTS

4.1 All Outgoings of the Business and any revenue and

income of the Business must be apportioned and

adjusted between the parties at settlement; including

the following employee expenses:

(a) wages; and

(b) superannuation payments, charges and levies.

4.2 The vendor is entitled to the revenue and income and

is liable for the Outgoings, of the Business before

and for the day of settlement except:

(a) sales of the Stock made which is included in

this sale;

(b) any new Stock acquired by the purchaser after

settlement; and

(c) employee expenses that accrue after settlement.

The purchaser is entitled to that revenue and income

and is liable for the Outgoings, referred to in this

general condition 4.2(a), (b) and (c) after the date of

settlement.

4.3 Transferring employee entitlements will be

apportioned and adjusted in the following manner

(whether within the meaning of the Fair Work Act

2009 (Cth) or not):

(a) 70% of the value of accrued annual leave and

any annual leave loading, where this is not paid

out on settlement under general condition 11.7,

is adjusted against the vendor;

(b) 70% of the value of long service entitlements

accrued but not taken, is adjusted against the

vendor;

(c) 70% of the value of long service entitlements of

employees with greater than 5 but fewer than 7

years of service, as if a statutory entitlement

(b) However, the vendor is only required to so

advise of the vendor’s date of birth if the

purchaser makes the request at least 21 days

before the due date for settlement.

(c) The vendor must ensure that at or before

settlement, the purchaser receives:

(i) a release from the secured party releasing

the security interest in personal property;

or

(ii) a statement in writing under section

275(1)(b) of the Personal Property

Securities Act 2009 (Cth) setting out that

the amount or obligation that is secured is

nil at settlement; or

(iii) a written approval or correction under

section 275(1)(c) of the Personal Property

Securities Act 2009 (Cth) indicating that,

on settlement, the personal property

included in the contract is not or will not

be property in which the security interest

is granted.

(d) A release for the purposes of general condition

2.8(c) (1) must be in writing. The release must

be effective in releasing the personal property

from the security interest and be in a form that

allows the purchaser to take title to the personal

property free of that security interest.

(e) The purchaser must provide the vendor with a

copy of the release at or as soon as practicable

after settlement if the purchaser receives a

release under general condition 2.8(c)(1) at

settlement.

(f) The purchaser must advise the vendor at least

21 days before the due date for settlement of

any security interest that is registered on or

before the day of sale on the Personal Property

Securities Register, that the purchaser requires

a statement, approval or correction in

accordance with general condition 2.8(c).

(g) The vendor may delay settlement until 21 days

after the purchaser advises the vendor of the

security interests that the purchaser reasonably

requires to be released under general condition

2.8(f).

(h) The purchaser must pay the vendor:

(i) interest from the due date for settlement

until the date on which settlement occurs

or 21 days after the vendor receives the

advice, whichever is the earlier; and

(ii) any reasonable cost, loss or damage

incurred by the vendor as a result of the

delay; and

(iii) as though the purchaser was in default,

if settlement is delayed under general condition

2.8(g).

2.9 The vendor gives the purchaser the full benefit of

and quiet possession of the Business and the Stock at

settlement, except as provided in this contract.

2.10 Settlement must be effected:

(a) on the due date for settlement between 10.00

a.m. and 3.00 p.m. as specified by the vendor;

and

(b) at the place or places in Victoria reasonably

specified by the vendor.

Different parts of the settlement may occur

simultaneously at different places.

3. VALUING STOCK

3.1 A stocktake will be jointly conducted by the parties

and the value of each Stock item mutually agreed

unless there is a dispute as to value or items in which

case Clause 3.3 will apply.

3.2 The purchaser must pay the vendor the value of the

Stock up to the maximum stock value. The purchaser

must buy all Stock if there is no maximum stock

value specified in the particulars of sale.

3.3 The value of the Stock and each Stock item must be

decided by an independent valuer mutually

nominated by the parties, or failing their mutual

nomination by 15 days before the due date for

settlement, nominated by the president or acting

president of the Law Institute of Victoria on

application by either party if the valuer item in the

particulars of sale is completed with the word

“valuer”, or the parties fail to mutually agree on the

value of the Stock, any item of Stock or any other

matters described in general condition 3.1.

3.4 The purchaser can decide which Stock the purchaser

will not purchase if the Stock exceeds the maximum

stock value specified in the particulars of sale.

3.5 The valuer acts as an expert and the valuer’s

decisions are binding on the parties. Each party must

pay or reimburse the other an equal share of the

valuer’s fees.

4. APPORTIONMENT OF OUTGOINGS AND

ENTITLEMENTS

4.1 All Outgoings of the Business and any revenue and

income of the Business must be apportioned and

adjusted between the parties at settlement; including

the following employee expenses:

(a) wages; and

(b) superannuation payments, charges and levies.

4.2 The vendor is entitled to the revenue and income and

is liable for the Outgoings, of the Business before

and for the day of settlement except:

(a) sales of the Stock made which is included in

this sale;

(b) any new Stock acquired by the purchaser after

settlement; and

(c) employee expenses that accrue after settlement.

The purchaser is entitled to that revenue and income

and is liable for the Outgoings, referred to in this

general condition 4.2(a), (b) and (c) after the date of

settlement.

4.3 Transferring employee entitlements will be

apportioned and adjusted in the following manner

(whether within the meaning of the Fair Work Act

2009 (Cth) or not):

(a) 70% of the value of accrued annual leave and

any annual leave loading, where this is not paid

out on settlement under general condition 11.7,

is adjusted against the vendor;

(b) 70% of the value of long service entitlements

accrued but not taken, is adjusted against the

vendor;

(c) 70% of the value of long service entitlements of

employees with greater than 5 but fewer than 7

years of service, as if a statutory entitlement

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page 11

accrues after 5 years of service, is adjusted

against the vendor; and

(d) 35% of the value of accrued personal leave is

adjusted against the vendor.

4.4 Amounts representing employee expenses payable

by the vendor or adjusted against the vendor at

settlement must be paid in full by the purchaser to

the employee when the employee becomes entitled

to those employee entitlements. The purchaser

indemnifies the vendor against any cost, loss,

damage or other liability arising from or incurred by

the vendor to an employee for which any amount

was adjusted against the vendor.

4.5 The parties must not apportion the following

Outgoings of the Business which remain the

responsibility of the vendor:

(a) advertising contracts;

(b) business promotion prizes;

(c) business, professional or trade subscriptions;

and

(d) telephone or trade directory subscriptions and

similar entries.

5. VENDOR’S DEBTS

5.1 The debts of the Business owed to the vendor before

settlement are not included in this contract. The

vendor must not cause any unreasonable damage or

risk to the goodwill of the Business when collecting

those debts after settlement.

5.2 The debts of the Business incurred by the vendor

before settlement remain the liability of the vendor.

The vendor must meet those liabilities as and when

they become due and payable or are required to be

performed.

5.3 The purchaser must immediately pay to the vendor

any money that represents the vendor’s debts that the

purchaser receives after settlement.

6. FINANCE

6.1 This contract is subject to the lender approving the

finance for the purchase of the Business by the

approval date if the finance items of the particulars

of sale are filled in. Either party may end the contract

if the finance is not approved by the approval date or

any later date agreed by the parties. However, the

purchaser may only end the contract under this

general condition 6.1 if the purchaser:

(a) has made immediate application for the

finance;

(b) has done everything reasonably required to

obtain approval of the finance;

(c) serves written notice ending the contract on the

vendor on or before 2 Business days after the

approval date or later agreed date; and

(d) is not in default under any other condition of

this contract when the notice is served.

6.2 The purchaser must immediately notify the vendor in

writing when the purchaser’s finance is approved or

refused.

6.3 All money paid by the purchaser must be

immediately refunded to the purchaser if the contract

is ended under this general condition 6.

7. LEASE

7.1 The vendor must attach a copy of the lease and the

other relevant lease related documents and provide

the other information referred to in schedule 4.

7.2 The vendor must obtain for the purchaser by the due

date for settlement, a lease of the business premises

either:

(a) by transfer of the current lease with the

landlord’s written consent; or

(b) by a new lease as described in item 3 of

schedule 4.

7.3 (a) Both parties must take all reasonable steps to

obtain the transfer and the landlord’s consent or

the new lease of the business premises. In

particular, the purchaser must promptly provide

the vendor with the following to assist the

vendor to obtain the landlord’s consent:

(i) evidence that the purchaser does not

intend to use the business premises in a

way not permitted under the lease;

(ii) information that a landlord could or does

reasonably require about the financial

resources and business experience of the

purchaser and to enable the landlord to

make a decision; and

(iii) a statement that the purchaser has been

provided with the business records of the

Business for the previous 3 years or such

shorter period as the vendor has carried on

business at the business premises.

(b) The purchaser must prepare the transfer unless

the lease provides otherwise.

(c) The vendor must provide the purchaser with the

business records of the Business (or a copy of

them) at settlement except for those business

records that relate to employees who are not

offered and accept employment with the

purchaser from settlement. The purchaser must

allow the vendor to inspect the business records

for the time up to settlement to enable the

vendor to compile a tax return for a period

which includes the time up to settlement.

(d) The vendor must perform all the tenant’s

obligations under any lease up to settlement and

the purchaser must perform all the tenant’s

obligations after settlement.

7.4 The vendor must provide written evidence of consent

of any mortgagee or chargee of the freehold of the

business premises to any existing lease, or the new

lease if one is proposed, to enable the purchaser to

obtain priority against the mortgagee or chargee.

7.5 The purchaser may end this contract by service of an

unsatisfied 5 business day notice which specifies one

of the following:

(a) the landlord has not consented in writing to the

transfer;

(b) the landlord has not granted a new lease; or

(c) any mortgagee or chargee has not consented to

the transfer or grant of the new lease (as the

case may be),

by the due date for settlement in which case the

vendor must repay any monies paid by the purchaser.

7.6 (a) The purchaser must pay:

(i) any duty payable on the transfer or new

lease, and

accrues after 5 years of service, is adjusted

against the vendor; and

(d) 35% of the value of accrued personal leave is

adjusted against the vendor.

4.4 Amounts representing employee expenses payable

by the vendor or adjusted against the vendor at

settlement must be paid in full by the purchaser to

the employee when the employee becomes entitled

to those employee entitlements. The purchaser

indemnifies the vendor against any cost, loss,

damage or other liability arising from or incurred by

the vendor to an employee for which any amount

was adjusted against the vendor.

4.5 The parties must not apportion the following

Outgoings of the Business which remain the

responsibility of the vendor:

(a) advertising contracts;

(b) business promotion prizes;

(c) business, professional or trade subscriptions;

and

(d) telephone or trade directory subscriptions and

similar entries.

5. VENDOR’S DEBTS

5.1 The debts of the Business owed to the vendor before

settlement are not included in this contract. The

vendor must not cause any unreasonable damage or

risk to the goodwill of the Business when collecting

those debts after settlement.

5.2 The debts of the Business incurred by the vendor

before settlement remain the liability of the vendor.

The vendor must meet those liabilities as and when

they become due and payable or are required to be

performed.

5.3 The purchaser must immediately pay to the vendor

any money that represents the vendor’s debts that the

purchaser receives after settlement.

6. FINANCE

6.1 This contract is subject to the lender approving the

finance for the purchase of the Business by the

approval date if the finance items of the particulars

of sale are filled in. Either party may end the contract

if the finance is not approved by the approval date or

any later date agreed by the parties. However, the

purchaser may only end the contract under this

general condition 6.1 if the purchaser:

(a) has made immediate application for the

finance;

(b) has done everything reasonably required to

obtain approval of the finance;

(c) serves written notice ending the contract on the

vendor on or before 2 Business days after the

approval date or later agreed date; and

(d) is not in default under any other condition of

this contract when the notice is served.

6.2 The purchaser must immediately notify the vendor in

writing when the purchaser’s finance is approved or

refused.

6.3 All money paid by the purchaser must be

immediately refunded to the purchaser if the contract

is ended under this general condition 6.

7. LEASE

7.1 The vendor must attach a copy of the lease and the

other relevant lease related documents and provide

the other information referred to in schedule 4.

7.2 The vendor must obtain for the purchaser by the due

date for settlement, a lease of the business premises

either:

(a) by transfer of the current lease with the

landlord’s written consent; or

(b) by a new lease as described in item 3 of

schedule 4.

7.3 (a) Both parties must take all reasonable steps to

obtain the transfer and the landlord’s consent or

the new lease of the business premises. In

particular, the purchaser must promptly provide

the vendor with the following to assist the

vendor to obtain the landlord’s consent:

(i) evidence that the purchaser does not

intend to use the business premises in a

way not permitted under the lease;

(ii) information that a landlord could or does

reasonably require about the financial

resources and business experience of the

purchaser and to enable the landlord to

make a decision; and

(iii) a statement that the purchaser has been

provided with the business records of the

Business for the previous 3 years or such

shorter period as the vendor has carried on

business at the business premises.

(b) The purchaser must prepare the transfer unless

the lease provides otherwise.

(c) The vendor must provide the purchaser with the

business records of the Business (or a copy of

them) at settlement except for those business

records that relate to employees who are not

offered and accept employment with the

purchaser from settlement. The purchaser must

allow the vendor to inspect the business records

for the time up to settlement to enable the

vendor to compile a tax return for a period

which includes the time up to settlement.

(d) The vendor must perform all the tenant’s

obligations under any lease up to settlement and

the purchaser must perform all the tenant’s

obligations after settlement.

7.4 The vendor must provide written evidence of consent

of any mortgagee or chargee of the freehold of the

business premises to any existing lease, or the new

lease if one is proposed, to enable the purchaser to

obtain priority against the mortgagee or chargee.

7.5 The purchaser may end this contract by service of an

unsatisfied 5 business day notice which specifies one

of the following:

(a) the landlord has not consented in writing to the

transfer;

(b) the landlord has not granted a new lease; or

(c) any mortgagee or chargee has not consented to

the transfer or grant of the new lease (as the

case may be),

by the due date for settlement in which case the

vendor must repay any monies paid by the purchaser.

7.6 (a) The purchaser must pay:

(i) any duty payable on the transfer or new

lease, and

Page 12

(ii) the landlord’s reasonable legal costs for

the preparation of the new lease but not if

the lease is subject to the Retail Leases

Act 2003 (Vic).

(b) The vendor must pay all other lawful expenses

including expenses related to obtaining the

written consent of:

(i) the landlord;

(ii) any mortgagee or chargee;

to the transfer or the new lease.

8. GST

8.1 The parties agree that this contract is for the supply

of a going concern.

8.2 The vendor warrants that the vendor will carry on the

Business as a going concern until settlement. The

purchaser warrants that the purchaser is, or before

settlement will be, registered for GST and that the

purchaser will carry on the Business after settlement.

8.3 The purchaser must pay the vendor any GST payable

by the vendor:

(a) solely as a result of any action taken or

intended to be taken by the purchaser after the

day of sale, including a change of use;

(b) where the supply does not does not satisfy the

requirements of section 38-325 of the GST Act

for a ”going concern”; or

(c) the amount payable by a party for a taxable

supply is expressed as a GST exclusive amount

if a party makes a taxable supply which is not

part of the consideration for a going concern.

This general condition 8.3 is subject to any other

provisions of this contract.

8.4 The party liable to pay for a taxable supply to which

this general condition 8 applies must also pay the

amount of any GST payable for the taxable supply

on the date on which payment for the taxable supply

is due.

8.5 A party is not obliged under this general condition to

pay GST on a taxable supply to the other party, until

the party is given a tax invoice for the supply.

TRANSACTIONAL

9. RUNNING THE BUSINESS

9.1 The vendor must maintain the goodwill of the

Business and carry on the Business in the ordinary

course and in a proper and businesslike manner until

settlement.

9.2 The vendor must do whatever is reasonably

necessary to introduce the purchaser to customers

and suppliers of the Business and give the purchaser

reasonable assistance and advice about running the

Business during the assistance period set out in the

particulars of sale.

9.3 The Business, including the Stock, is at the risk of

the vendor until settlement.

10. INSPECTION

10.1 The purchaser may inspect the Business and the

business premises at all reasonable times within 3

Business days before the due date of settlement.

10.2 The vendor must allow inspection of the business

premises by officers of the local government or

officers authorised by any government department if

requested by the purchaser.

11. EMPLOYEES

11.1 The vendor must provide the following information

to the purchaser in respect of each employee. The

information is to be provided within 5 Business days

if requested in writing by the purchaser:

(a) the employees’ names;

(b) date of commencement:

(c) job title;

(d) remuneration and other employee benefits;

(e) employment status (i.e. permanent fulltime,

permanent part-time or casual);

(f) accrued annual, personal and long-service leave

entitlements and any other entitlements to time

off (such as rostered days off/time off in lieu);

(g) any employee complaints, applications or

proceedings in a tribunal or court;

(h) any applicable industrial instrument for the

employee (i.e. award/enterprise agreement);

and

(i) any sample letter of offer/employment contract

used by the vendor for each class of employee

engaged.

11.2 The purchaser must also be given a reasonable

opportunity (if requested) to inspect:

(a) the vendor’s employment policies and

procedures; and

(b) the contracts of employment of all employees

to whom the purchaser offers, or may offer,

employment from settlement and who accept,

or may accept, that offer, in accordance with

this contract; and

(c) the employment files of each employee.

However, this general condition 11.2 (c) only

applies if or when this contract is or becomes

unconditional by way of a financial condition

or contract subject to finance being satisfied.

11.3 The purchaser must only use any information

obtained in accordance with general conditions 11.1

and 11.2 for the purpose of the Business. The

purchaser must not disclose that information to any

other person.

11.4 The purchaser must:

(a) at least 35 Business days before the due date for

settlement, notify the vendor of the names of

the vendor’s employees to whom the purchaser

wishes to offer employment from settlement;

(b) then, within a further 2 Business days, make an

offer of employment to those employees from

and conditional on settlement taking place;

(c) ensure that the terms and conditions of the offer

made to a prospective transferring employee

are substantially similar to and, overall, no less

favourable than the existing terms and

conditions of employment with the vendor; and

(d) ensure that the offers made by the purchaser

under any relevant transferable industrial

instrument (award, enterprise agreement or

other relevant industrial instrument notified by

the vendor under general condition 11.1 (h))

include a statement whether:

(i) the employee’s service is to be, or is not to

be, recognised by the purchaser; and

(ii) the landlord’s reasonable legal costs for

the preparation of the new lease but not if

the lease is subject to the Retail Leases

Act 2003 (Vic).

(b) The vendor must pay all other lawful expenses

including expenses related to obtaining the

written consent of:

(i) the landlord;

(ii) any mortgagee or chargee;

to the transfer or the new lease.

8. GST

8.1 The parties agree that this contract is for the supply

of a going concern.

8.2 The vendor warrants that the vendor will carry on the

Business as a going concern until settlement. The

purchaser warrants that the purchaser is, or before

settlement will be, registered for GST and that the

purchaser will carry on the Business after settlement.

8.3 The purchaser must pay the vendor any GST payable

by the vendor:

(a) solely as a result of any action taken or

intended to be taken by the purchaser after the

day of sale, including a change of use;

(b) where the supply does not does not satisfy the

requirements of section 38-325 of the GST Act

for a ”going concern”; or

(c) the amount payable by a party for a taxable

supply is expressed as a GST exclusive amount

if a party makes a taxable supply which is not

part of the consideration for a going concern.

This general condition 8.3 is subject to any other

provisions of this contract.

8.4 The party liable to pay for a taxable supply to which

this general condition 8 applies must also pay the

amount of any GST payable for the taxable supply

on the date on which payment for the taxable supply

is due.

8.5 A party is not obliged under this general condition to

pay GST on a taxable supply to the other party, until

the party is given a tax invoice for the supply.

TRANSACTIONAL

9. RUNNING THE BUSINESS

9.1 The vendor must maintain the goodwill of the

Business and carry on the Business in the ordinary

course and in a proper and businesslike manner until

settlement.

9.2 The vendor must do whatever is reasonably

necessary to introduce the purchaser to customers

and suppliers of the Business and give the purchaser

reasonable assistance and advice about running the

Business during the assistance period set out in the

particulars of sale.

9.3 The Business, including the Stock, is at the risk of

the vendor until settlement.

10. INSPECTION

10.1 The purchaser may inspect the Business and the

business premises at all reasonable times within 3

Business days before the due date of settlement.

10.2 The vendor must allow inspection of the business

premises by officers of the local government or

officers authorised by any government department if

requested by the purchaser.

11. EMPLOYEES

11.1 The vendor must provide the following information

to the purchaser in respect of each employee. The

information is to be provided within 5 Business days

if requested in writing by the purchaser:

(a) the employees’ names;

(b) date of commencement:

(c) job title;

(d) remuneration and other employee benefits;

(e) employment status (i.e. permanent fulltime,

permanent part-time or casual);

(f) accrued annual, personal and long-service leave

entitlements and any other entitlements to time

off (such as rostered days off/time off in lieu);

(g) any employee complaints, applications or

proceedings in a tribunal or court;

(h) any applicable industrial instrument for the

employee (i.e. award/enterprise agreement);

and

(i) any sample letter of offer/employment contract

used by the vendor for each class of employee

engaged.

11.2 The purchaser must also be given a reasonable