Saudi Aramco Marketing Management & Strategy - Masters Level

VerifiedAdded on 2023/06/12

|19

|4916

|121

Report

AI Summary

This report provides a detailed analysis of Saudi Aramco's marketing and business activities in the UAE and the international market. It evaluates current marketing approaches, highlighting customers, suppliers, distributors, marketing positions, and branding strategies. The report assesses the 5C's marketing strategy, SWOT, and PESTLE analysis. It identifies the strengths and weaknesses of the organization and provides marketing suggestions based on the analysis. The report discusses Saudi Aramco's vision, mission, and core values, along with its product offerings and the dynamics of the oil and gas industry, including future development initiatives and challenges. The analysis covers political, economic, socio-cultural, and technological factors impacting Saudi Aramco's operations and competitive landscape.

Running head: MARKETING MANAGEMENT - MASTERS LEVEL

Marketing Management - Masters level

Name of the Student

Name of the University

Author Note

Marketing Management - Masters level

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1MARKETING MANAGEMENT - MASTERS LEVEL

Table of Content

Introduction................................................................................................................................2

Issue 1:.......................................................................................................................................2

Overview of the organization.................................................................................................2

Products of the organization...................................................................................................4

Overview of the industry........................................................................................................4

Issue 2:.......................................................................................................................................5

Analysing each of 5C’s for this organization.........................................................................5

SWOT analysis...........................................................................................................................6

PESTLE..................................................................................................................................8

Porter’s five forces.................................................................................................................9

Issue 3:.....................................................................................................................................11

Issue 4:.....................................................................................................................................12

Choice of target market:.......................................................................................................12

Value proposition for the target market...............................................................................12

Issue 5:.....................................................................................................................................13

Marketing Mix:....................................................................................................................13

Conclusion................................................................................................................................14

References................................................................................................................................15

Table of Content

Introduction................................................................................................................................2

Issue 1:.......................................................................................................................................2

Overview of the organization.................................................................................................2

Products of the organization...................................................................................................4

Overview of the industry........................................................................................................4

Issue 2:.......................................................................................................................................5

Analysing each of 5C’s for this organization.........................................................................5

SWOT analysis...........................................................................................................................6

PESTLE..................................................................................................................................8

Porter’s five forces.................................................................................................................9

Issue 3:.....................................................................................................................................11

Issue 4:.....................................................................................................................................12

Choice of target market:.......................................................................................................12

Value proposition for the target market...............................................................................12

Issue 5:.....................................................................................................................................13

Marketing Mix:....................................................................................................................13

Conclusion................................................................................................................................14

References................................................................................................................................15

2MARKETING MANAGEMENT - MASTERS LEVEL

Introduction

The following report provides a detailed analysis of the marketing and business

activities of the organization Saudi Aramco- is running the operation in UAE and in the

international market. The Purpose of the report is to evaluate the current marketing

approaches and activities which helps the company to run the operation achieving growth and

competitive advantages. The report particularly highlights the customers, suppliers,

distributors, current marketing positions and promotion as well as branding strategies. In

addition to all these areas, the report particularly assess the 5’C marketing strategy of the

organization. In order to make the analysis critical and reliable, the strength and weakness of

the organization and the approaches used by the organization have also been considered in

the discussion. Based on the findings of the analysis, suitable marketing suggestions have

also been provided to the organization.

Issue 1:

Overview of the organization

Saudi Aramco is a state owned oil and company of the Saud Arabia and it is fully

integrated global as well as global petroleum enterprise. Moreover, the organization is a

world leader with respect to exploration, distribution, marketing, refining and manufacturing

of petrochemical products. It is identified that the organization deals with world’s largest

proven traditional crude oil. In addition, the organization is known as world’s fourth-largest

natural gas reserves of 288.4 trillion. Among other oil and gas organizations, Saud Aramco

holds the top position with respect to producer of natural resource such as and forth position

with respect to natural gas. The headquarter of the organization is located in Dahran in Saudi

Arabia and with its extending operation, the organization employs more than 65,000 staff

worldwide (Saudi Aramco 2018).

Introduction

The following report provides a detailed analysis of the marketing and business

activities of the organization Saudi Aramco- is running the operation in UAE and in the

international market. The Purpose of the report is to evaluate the current marketing

approaches and activities which helps the company to run the operation achieving growth and

competitive advantages. The report particularly highlights the customers, suppliers,

distributors, current marketing positions and promotion as well as branding strategies. In

addition to all these areas, the report particularly assess the 5’C marketing strategy of the

organization. In order to make the analysis critical and reliable, the strength and weakness of

the organization and the approaches used by the organization have also been considered in

the discussion. Based on the findings of the analysis, suitable marketing suggestions have

also been provided to the organization.

Issue 1:

Overview of the organization

Saudi Aramco is a state owned oil and company of the Saud Arabia and it is fully

integrated global as well as global petroleum enterprise. Moreover, the organization is a

world leader with respect to exploration, distribution, marketing, refining and manufacturing

of petrochemical products. It is identified that the organization deals with world’s largest

proven traditional crude oil. In addition, the organization is known as world’s fourth-largest

natural gas reserves of 288.4 trillion. Among other oil and gas organizations, Saud Aramco

holds the top position with respect to producer of natural resource such as and forth position

with respect to natural gas. The headquarter of the organization is located in Dahran in Saudi

Arabia and with its extending operation, the organization employs more than 65,000 staff

worldwide (Saudi Aramco 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3MARKETING MANAGEMENT - MASTERS LEVEL

Vision- The major vision of the company is to become world’s leading integrated

energy and Chemicals Company and strengthening its fouls on the long-term future.

Mission- The mission of the organization is to diversify the national economy

beyond oil and establish a thriving private sector which could minimize market reliance on

oil and gas. Tis mission will help the organisation to enable Saudi Aramco to develop the

operation to the next level.

Value Statement: The organization has five different core values such as Excellence,

Safety, integrity, accountability, Citizenship as well as accountability which guides

Aramco’s business conduct and integrate all it operation.

The values contribute to the development of success and control of marketing positions as

one of the most respected organizations in the world.

As put forward by Mearns and Yule (2009), because the global population is

increasing, the economies increase, it is true that standard of living is also increasing and

hence, the energy could continue to become a significant opportunity. Therefore, the

organization is seeking to carry out a large range of strategy to make sure that they are at the

forefront of providing the essential energy now and in the coming figure. When it comes to

marketing, Kim and Mauborgne (2014) mentioned that marketing remains as the art and

science of selecting customers, target market and increasing the consumer base by creating

and delivering an excellent customer value. On the other side, Gronroos (2016) also

mentioned that marketing management relies on the size of the business and the sector in

which the organization is running the operation. Hence, Saudi Aramco believes in the fact

that professional marketing remains as the trademark of its commitment to customers. The

organization achieves its marketing objectives through efficient and innovative techniques

that helps to conduct the market research. The mission and vision statement of the company

Vision- The major vision of the company is to become world’s leading integrated

energy and Chemicals Company and strengthening its fouls on the long-term future.

Mission- The mission of the organization is to diversify the national economy

beyond oil and establish a thriving private sector which could minimize market reliance on

oil and gas. Tis mission will help the organisation to enable Saudi Aramco to develop the

operation to the next level.

Value Statement: The organization has five different core values such as Excellence,

Safety, integrity, accountability, Citizenship as well as accountability which guides

Aramco’s business conduct and integrate all it operation.

The values contribute to the development of success and control of marketing positions as

one of the most respected organizations in the world.

As put forward by Mearns and Yule (2009), because the global population is

increasing, the economies increase, it is true that standard of living is also increasing and

hence, the energy could continue to become a significant opportunity. Therefore, the

organization is seeking to carry out a large range of strategy to make sure that they are at the

forefront of providing the essential energy now and in the coming figure. When it comes to

marketing, Kim and Mauborgne (2014) mentioned that marketing remains as the art and

science of selecting customers, target market and increasing the consumer base by creating

and delivering an excellent customer value. On the other side, Gronroos (2016) also

mentioned that marketing management relies on the size of the business and the sector in

which the organization is running the operation. Hence, Saudi Aramco believes in the fact

that professional marketing remains as the trademark of its commitment to customers. The

organization achieves its marketing objectives through efficient and innovative techniques

that helps to conduct the market research. The mission and vision statement of the company

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4MARKETING MANAGEMENT - MASTERS LEVEL

stated to achieve its success in the coming future in the international market. The

organization is currently exporting its quality products to several nations. In addition to this,

the organisation is also following the B2B strategy. It is a certain fact that petroleum products

are the essential communities which can hardly be branded. Therefore, the price is strictly

regulated by the industry; however, Saudi Aramco is perfectly serving the customers.

Products of the organization

The organization’s network of refineries around the regions manufactures the products which

the customers highly need and the industry which is driving the nation’s economy. The

following are some of major products that company produces to the market

Gasoline

Diesel

Crude oil

Sulphur

LPG

Propane

Butane

Natural Gasoline (NG)

Sales Gas

Fuel oil

Overview of the industry

It is observed that oil and industry has observed a dynamic scenario, where economy and

political factors plays a great. According to Harhara, Singh and Hussain (2015), much of the

oil and gas industry survived a stiff few years with the weak as well as low price; thereby, the

organizations find it difficult to make effective strategic marketing decision and plan for the

stated to achieve its success in the coming future in the international market. The

organization is currently exporting its quality products to several nations. In addition to this,

the organisation is also following the B2B strategy. It is a certain fact that petroleum products

are the essential communities which can hardly be branded. Therefore, the price is strictly

regulated by the industry; however, Saudi Aramco is perfectly serving the customers.

Products of the organization

The organization’s network of refineries around the regions manufactures the products which

the customers highly need and the industry which is driving the nation’s economy. The

following are some of major products that company produces to the market

Gasoline

Diesel

Crude oil

Sulphur

LPG

Propane

Butane

Natural Gasoline (NG)

Sales Gas

Fuel oil

Overview of the industry

It is observed that oil and industry has observed a dynamic scenario, where economy and

political factors plays a great. According to Harhara, Singh and Hussain (2015), much of the

oil and gas industry survived a stiff few years with the weak as well as low price; thereby, the

organizations find it difficult to make effective strategic marketing decision and plan for the

5MARKETING MANAGEMENT - MASTERS LEVEL

future. However, in the present time, the sector has started to emerge from its upheaval.

When digging into industry’s current scenario, it has been found out that even though the

price seems to be recovering, the crude was up nearly 90% ii 2016, which is over US$50 for

each barrel (Calixto 2016). On the other side Mitchell and Mitchell (2014) provided a fact

that “post-recession” high water is reached in 2011 and as the consequence, the organization

started to consider to new investment in the development of resource and making it more

attractive. The continuous enhancement in the price could perhaps be slow and the supply

could be restrained by the cutbacks in reserve development project over the last few years.

The major players in the industry are now Abu Dhabi National Oil and Gas Company, Royal

Dutch Shell and British Petroleum (Cordes et al. 2016).

The following are some of the major future development initiatives for oil and gas

organizations.

The largest oil explore Saud Aramco is determined to invest in the refineries as well

as petrochemicals in the Asian nations because it is planning to make a strategic

partnerships with then nations in Asia such as India

The foreign investors have the opportunity to invest in oil and gas project which

worth US$300 billion in India because the nation is supposed to cut reliance on the

import of gas and oil (Ruqaishi. and Bashir 2013)

State-run oil and gas firms are planning to make the investment worth US$111.30

million) in UAE (Mitchell and Mitchell 2014).

Issue 2:

Analysing each of 5C’s for this organization

It has been identified that the strength of Saudi Aramco’s lies in its growing edge of science

and creativity, which helps to make energy that could further be more beneficial; and

future. However, in the present time, the sector has started to emerge from its upheaval.

When digging into industry’s current scenario, it has been found out that even though the

price seems to be recovering, the crude was up nearly 90% ii 2016, which is over US$50 for

each barrel (Calixto 2016). On the other side Mitchell and Mitchell (2014) provided a fact

that “post-recession” high water is reached in 2011 and as the consequence, the organization

started to consider to new investment in the development of resource and making it more

attractive. The continuous enhancement in the price could perhaps be slow and the supply

could be restrained by the cutbacks in reserve development project over the last few years.

The major players in the industry are now Abu Dhabi National Oil and Gas Company, Royal

Dutch Shell and British Petroleum (Cordes et al. 2016).

The following are some of the major future development initiatives for oil and gas

organizations.

The largest oil explore Saud Aramco is determined to invest in the refineries as well

as petrochemicals in the Asian nations because it is planning to make a strategic

partnerships with then nations in Asia such as India

The foreign investors have the opportunity to invest in oil and gas project which

worth US$300 billion in India because the nation is supposed to cut reliance on the

import of gas and oil (Ruqaishi. and Bashir 2013)

State-run oil and gas firms are planning to make the investment worth US$111.30

million) in UAE (Mitchell and Mitchell 2014).

Issue 2:

Analysing each of 5C’s for this organization

It has been identified that the strength of Saudi Aramco’s lies in its growing edge of science

and creativity, which helps to make energy that could further be more beneficial; and

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6MARKETING MANAGEMENT - MASTERS LEVEL

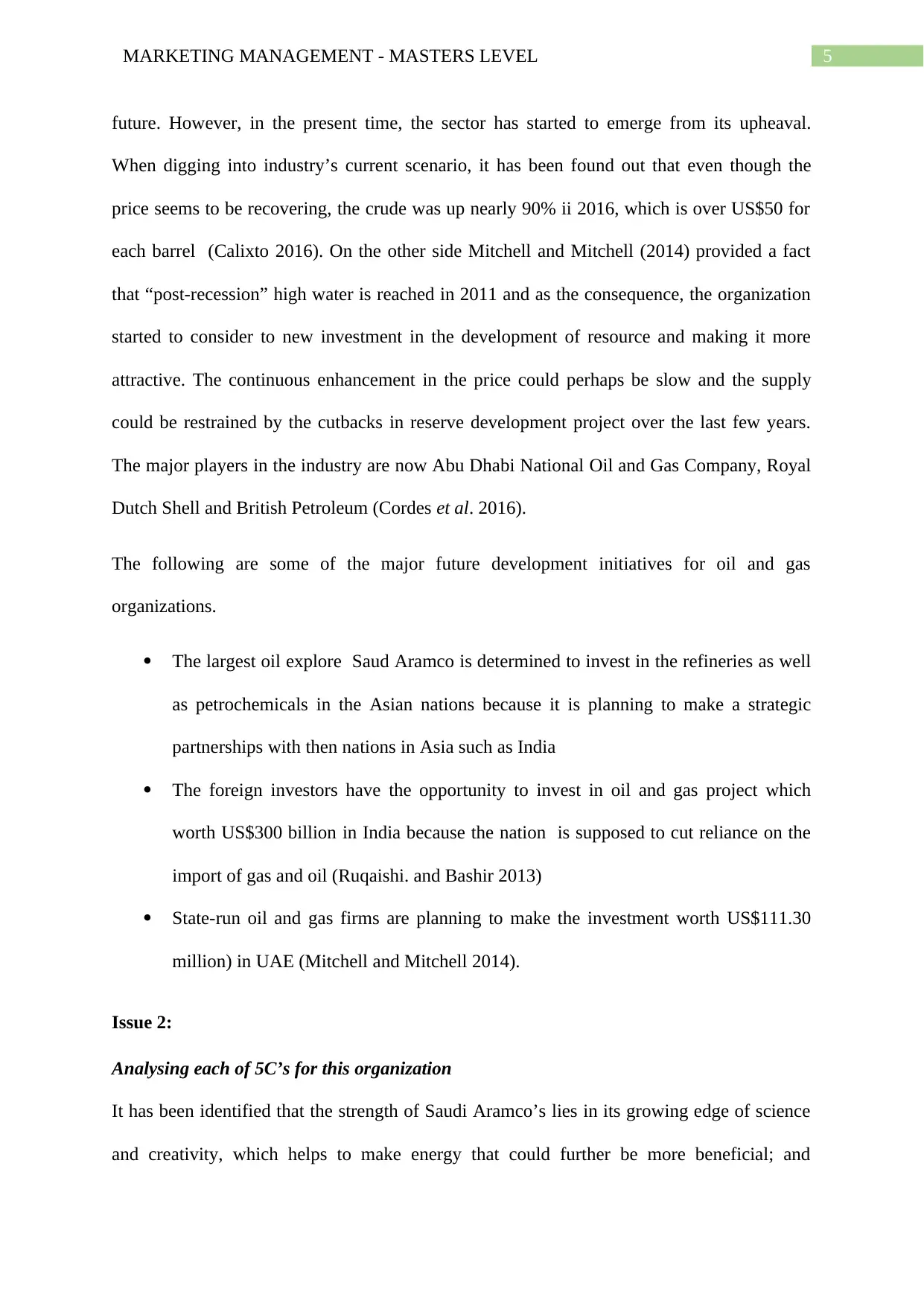

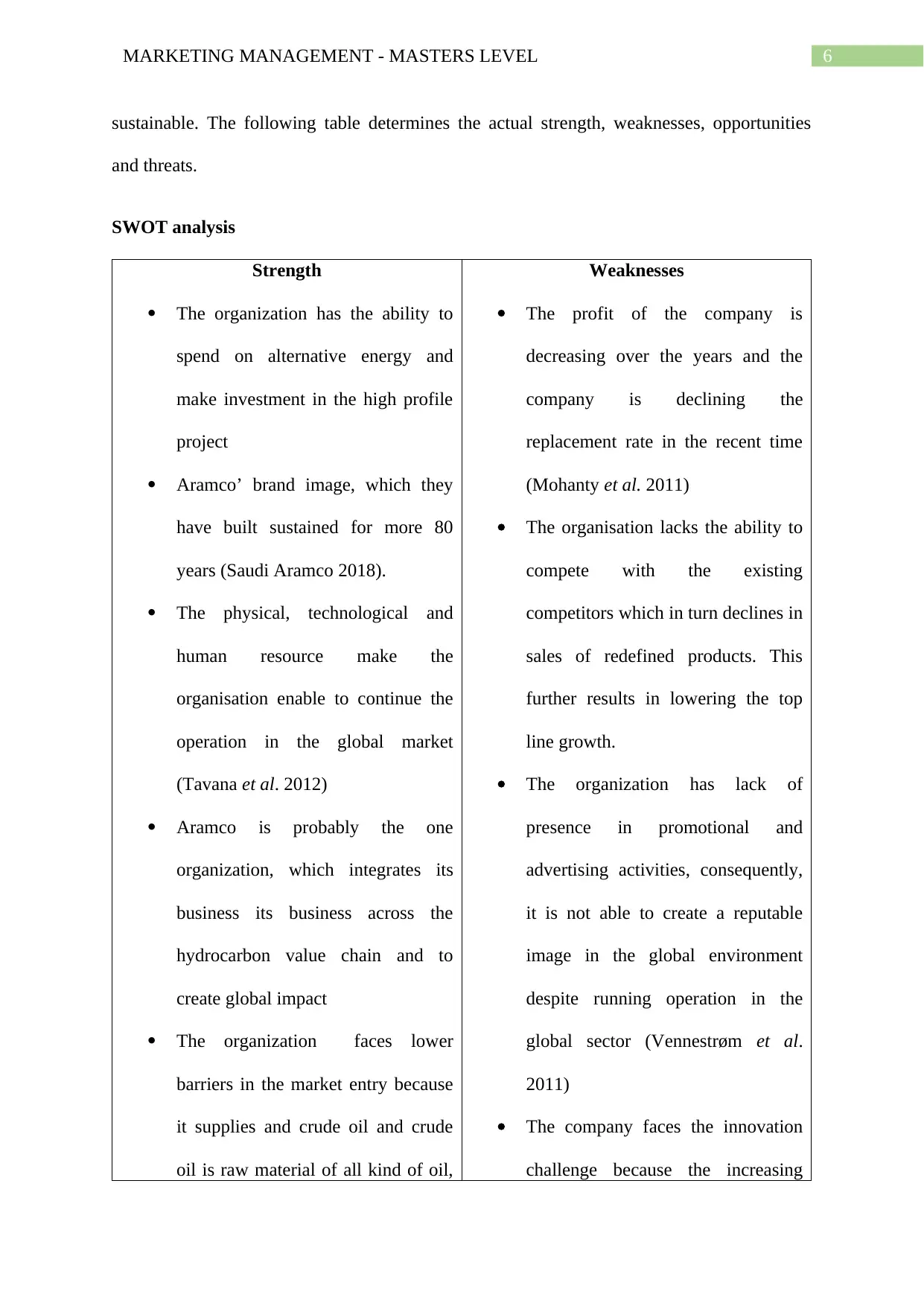

sustainable. The following table determines the actual strength, weaknesses, opportunities

and threats.

SWOT analysis

Strength

The organization has the ability to

spend on alternative energy and

make investment in the high profile

project

Aramco’ brand image, which they

have built sustained for more 80

years (Saudi Aramco 2018).

The physical, technological and

human resource make the

organisation enable to continue the

operation in the global market

(Tavana et al. 2012)

Aramco is probably the one

organization, which integrates its

business its business across the

hydrocarbon value chain and to

create global impact

The organization faces lower

barriers in the market entry because

it supplies and crude oil and crude

oil is raw material of all kind of oil,

Weaknesses

The profit of the company is

decreasing over the years and the

company is declining the

replacement rate in the recent time

(Mohanty et al. 2011)

The organisation lacks the ability to

compete with the existing

competitors which in turn declines in

sales of redefined products. This

further results in lowering the top

line growth.

The organization has lack of

presence in promotional and

advertising activities, consequently,

it is not able to create a reputable

image in the global environment

despite running operation in the

global sector (Vennestrøm et al.

2011)

The company faces the innovation

challenge because the increasing

sustainable. The following table determines the actual strength, weaknesses, opportunities

and threats.

SWOT analysis

Strength

The organization has the ability to

spend on alternative energy and

make investment in the high profile

project

Aramco’ brand image, which they

have built sustained for more 80

years (Saudi Aramco 2018).

The physical, technological and

human resource make the

organisation enable to continue the

operation in the global market

(Tavana et al. 2012)

Aramco is probably the one

organization, which integrates its

business its business across the

hydrocarbon value chain and to

create global impact

The organization faces lower

barriers in the market entry because

it supplies and crude oil and crude

oil is raw material of all kind of oil,

Weaknesses

The profit of the company is

decreasing over the years and the

company is declining the

replacement rate in the recent time

(Mohanty et al. 2011)

The organisation lacks the ability to

compete with the existing

competitors which in turn declines in

sales of redefined products. This

further results in lowering the top

line growth.

The organization has lack of

presence in promotional and

advertising activities, consequently,

it is not able to create a reputable

image in the global environment

despite running operation in the

global sector (Vennestrøm et al.

2011)

The company faces the innovation

challenge because the increasing

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7MARKETING MANAGEMENT - MASTERS LEVEL

petroleum expense of skilled manpower and the

cost of mining and refining crude oil

tends to push up the expense of

innovation

Opportunities

The increasing state of Asian-pacific

population as well as the expansion

to their economy could lead to larger

demand for energy

The organization can use the bio-

fuels as well as alternative energy

method

Emerging market for oil and gas in

different nation or cities

There is growing demand for crude

oil ; thereby, it can be mentioned

that the growth rate and profitability

can be maximized if Saudi Aramco

could meet the increasing demand

After the occurrence of Brexit the

economic situation in UK has been

stable and the organization is

welcoming the foreign investors and

likewise, in some Asian nations such

as India is welcoming the foreign

Threats

The continuous global recession is

making it difficult for the oil and gas

organizations to run the operation in

a smoother way

The cost of mining and refining is

also increasing and the labour cost is

always a separate concern

The competition is increasing among

the existing organizations. BP and

Shell have already increased their

market share.

petroleum expense of skilled manpower and the

cost of mining and refining crude oil

tends to push up the expense of

innovation

Opportunities

The increasing state of Asian-pacific

population as well as the expansion

to their economy could lead to larger

demand for energy

The organization can use the bio-

fuels as well as alternative energy

method

Emerging market for oil and gas in

different nation or cities

There is growing demand for crude

oil ; thereby, it can be mentioned

that the growth rate and profitability

can be maximized if Saudi Aramco

could meet the increasing demand

After the occurrence of Brexit the

economic situation in UK has been

stable and the organization is

welcoming the foreign investors and

likewise, in some Asian nations such

as India is welcoming the foreign

Threats

The continuous global recession is

making it difficult for the oil and gas

organizations to run the operation in

a smoother way

The cost of mining and refining is

also increasing and the labour cost is

always a separate concern

The competition is increasing among

the existing organizations. BP and

Shell have already increased their

market share.

8MARKETING MANAGEMENT - MASTERS LEVEL

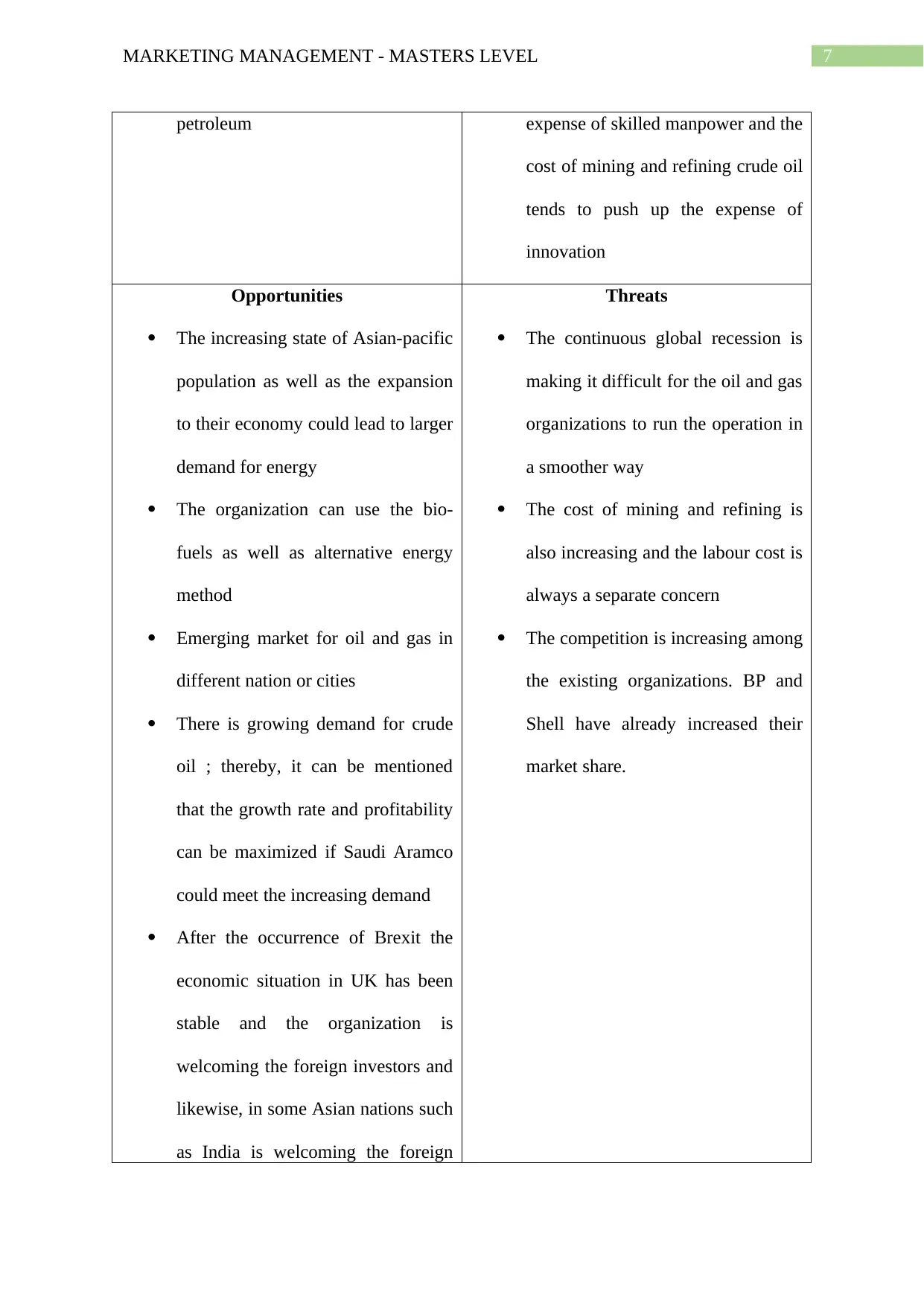

investors (Ramiah, Pham and Moosa

2017).

Table 1: SWOT analysis of Saudi Aramco

(Source: Ramiah, Pham and Moosa 2017)

PESTLE

Political factor- As out forward by Mohanty et al. (2011), governments have a strong

control over the operation of oil and gas and the reserve of hydrocarbon which has a

significant impact on OPEC which controls almost 76.4% of world reserves. On the other

side, it is also identified that instability, exploration, nationalization of terrorisms, civil

conflicts, strikes and wars have a solid adverse impact on the operation (Ruqaishi and Bashir

2013). The government in UK increased the tariff cost of exporting oil and gas products to

UK (Sovacool 2010). Likewise, the recent demonetization under NDA government in India

has a strong impact on the global economy. Consequently, many Indian distributors refused

to import the products from the foreign nations. The entire scenario has a strong impact on

the oil and gas industry.

Economic factor- Downfall of World Bank, Brexit and demonization in India have

broadly affected the world economy, which has a strong influence on Saudi Aramco’s

operation and even in the entire oil and gas industry (Mohanty et al. 2011). Due to this

constant economic inflation, the supply and distribution of oil and gas products were entirely

messed up.

Socio-cultural impact: People in each nation have become increasingly concerned

about the environmental degradation. Therefore, besides the oil and gas operation, the

organization will also have to implement some social responsibility. The organizations in the

sector will have to support sustainable natural and human development. Observing the

investors (Ramiah, Pham and Moosa

2017).

Table 1: SWOT analysis of Saudi Aramco

(Source: Ramiah, Pham and Moosa 2017)

PESTLE

Political factor- As out forward by Mohanty et al. (2011), governments have a strong

control over the operation of oil and gas and the reserve of hydrocarbon which has a

significant impact on OPEC which controls almost 76.4% of world reserves. On the other

side, it is also identified that instability, exploration, nationalization of terrorisms, civil

conflicts, strikes and wars have a solid adverse impact on the operation (Ruqaishi and Bashir

2013). The government in UK increased the tariff cost of exporting oil and gas products to

UK (Sovacool 2010). Likewise, the recent demonetization under NDA government in India

has a strong impact on the global economy. Consequently, many Indian distributors refused

to import the products from the foreign nations. The entire scenario has a strong impact on

the oil and gas industry.

Economic factor- Downfall of World Bank, Brexit and demonization in India have

broadly affected the world economy, which has a strong influence on Saudi Aramco’s

operation and even in the entire oil and gas industry (Mohanty et al. 2011). Due to this

constant economic inflation, the supply and distribution of oil and gas products were entirely

messed up.

Socio-cultural impact: People in each nation have become increasingly concerned

about the environmental degradation. Therefore, besides the oil and gas operation, the

organization will also have to implement some social responsibility. The organizations in the

sector will have to support sustainable natural and human development. Observing the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9MARKETING MANAGEMENT - MASTERS LEVEL

response of the citizens, the governments of UK, UAE and Australia have started pushing the

organizations to show their CSR roles (Ford, Steen and Verreynne 2014).

Figure 1: PESTLE analysis

(Source: Made by Student)

Technology: The oil and gas operation is entirely based on technology, which means

the technology drives the entire operation both in upstream and downstream operations. The

organizations are thinking of more effective recovery of hydrocarbons from the reserves. On

the other side, Kong and Ohadi (2010) mentioned that technology is rapidly developing, and

thereby, the organizations in the sector might not have to face the challenge of refineries and

distribution or nay other operation. Nonetheless, the industry requires more advanced

technology for deep impact on the long-term responsibility.

Porter’s five forces

Competitive rivalry – Moderate: It has been identified that Saudi Aramco does not have to

face any high state of competitive rivalry because the organization is state owned player and

Political

Environmental

Social

Technological

response of the citizens, the governments of UK, UAE and Australia have started pushing the

organizations to show their CSR roles (Ford, Steen and Verreynne 2014).

Figure 1: PESTLE analysis

(Source: Made by Student)

Technology: The oil and gas operation is entirely based on technology, which means

the technology drives the entire operation both in upstream and downstream operations. The

organizations are thinking of more effective recovery of hydrocarbons from the reserves. On

the other side, Kong and Ohadi (2010) mentioned that technology is rapidly developing, and

thereby, the organizations in the sector might not have to face the challenge of refineries and

distribution or nay other operation. Nonetheless, the industry requires more advanced

technology for deep impact on the long-term responsibility.

Porter’s five forces

Competitive rivalry – Moderate: It has been identified that Saudi Aramco does not have to

face any high state of competitive rivalry because the organization is state owned player and

Political

Environmental

Social

Technological

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10MARKETING MANAGEMENT - MASTERS LEVEL

they will get the preference when making a major deal in the area of expansion and refining.

However, for the finished goods such as hydrocarbon products, the organization will

probably have to deal with a significant competition because there are large domestic players

such as SABIC, ADNOC, Shell and British Petroleum (Shuen, Feiler and Teece 2014).

Nonetheless, it can mentioned that the organization acquires a broad oil reserve in the

domestic market which further provides a series of competitive advantages.

Threats of new entrants: Low- The operation of oil and gas requires broad initiatives.

Digging in the oil fields, establishing production and distribution network require time and

huge amount of effort, which further requires large investment (Mitchell, Marcel and

Mitchell 2012). Moreover, to run operation in the oil and gas industry, the organization it

have support of the government or any other regulatory bodies, Therefore, it can be

mentioned that Saudi Aramco may not have to deal with the threats of new entrants presently

in the sector. In this context, Hatakenaka et al. (2011) mentioned that multinational oil

organization may enter the market in future if the government of the nation welcome the

foreign investors but there is no threat from the small and medium size organizations.

Competitiverivalry–ModerateThreatsofnewentrants:LowThreatsofsubstituteproducts:LowBargainingpowerofthecustomers:ModerateBargainingpowerofcustomersBargainingpowerofcustomers

they will get the preference when making a major deal in the area of expansion and refining.

However, for the finished goods such as hydrocarbon products, the organization will

probably have to deal with a significant competition because there are large domestic players

such as SABIC, ADNOC, Shell and British Petroleum (Shuen, Feiler and Teece 2014).

Nonetheless, it can mentioned that the organization acquires a broad oil reserve in the

domestic market which further provides a series of competitive advantages.

Threats of new entrants: Low- The operation of oil and gas requires broad initiatives.

Digging in the oil fields, establishing production and distribution network require time and

huge amount of effort, which further requires large investment (Mitchell, Marcel and

Mitchell 2012). Moreover, to run operation in the oil and gas industry, the organization it

have support of the government or any other regulatory bodies, Therefore, it can be

mentioned that Saudi Aramco may not have to deal with the threats of new entrants presently

in the sector. In this context, Hatakenaka et al. (2011) mentioned that multinational oil

organization may enter the market in future if the government of the nation welcome the

foreign investors but there is no threat from the small and medium size organizations.

Competitiverivalry–ModerateThreatsofnewentrants:LowThreatsofsubstituteproducts:LowBargainingpowerofthecustomers:ModerateBargainingpowerofcustomersBargainingpowerofcustomers

11MARKETING MANAGEMENT - MASTERS LEVEL

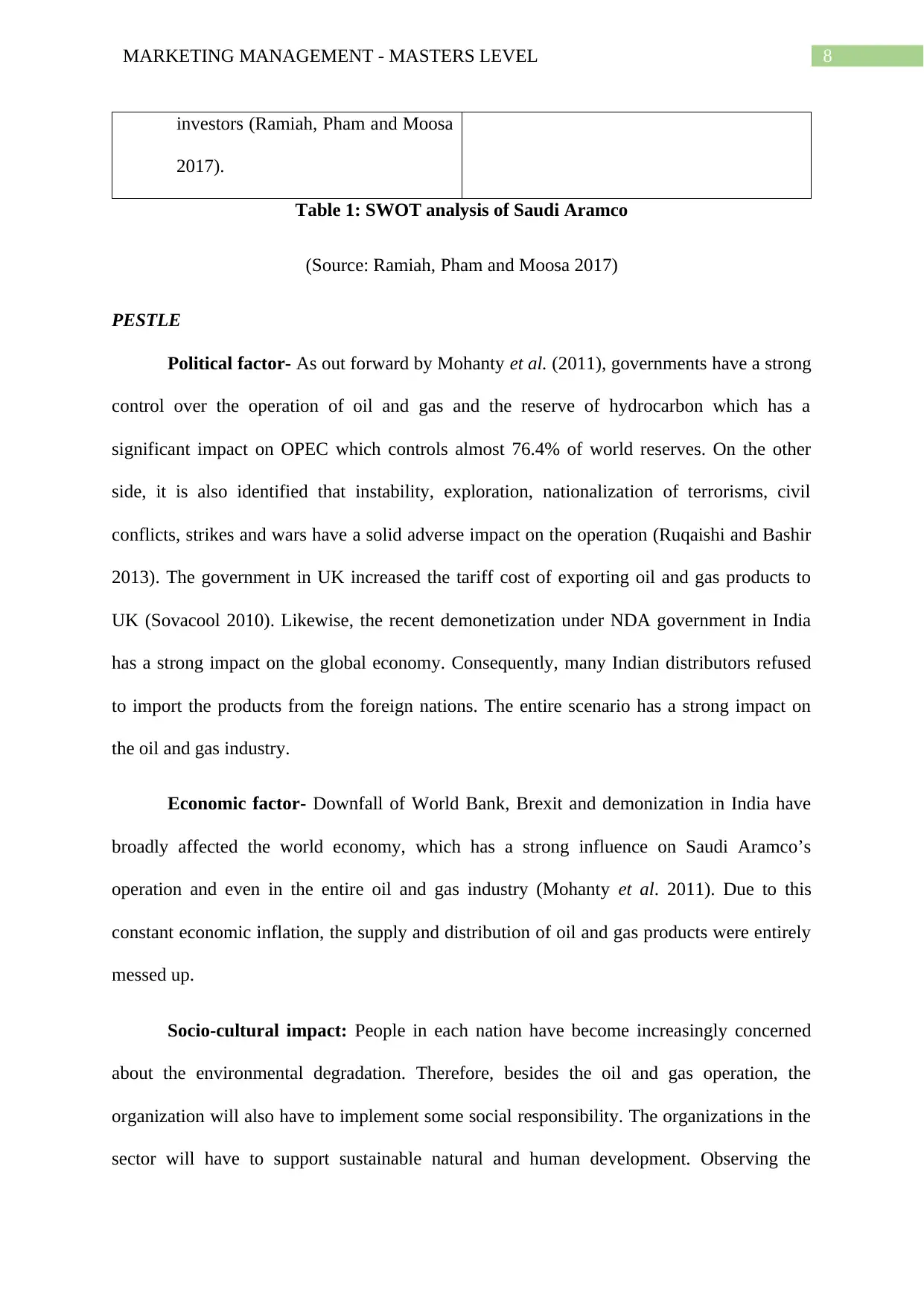

Figure 2: Porter’s five forces

(Source: Made by Student)

Threats of substitute products: Low- As put forward by Yusuf et al. (2014), the depletion of

the oil research created the urge for using the substitutes such as bio fuels, solar power, and

nuclear power. El-Diasty and Ragab (2013) argued and mentioned the fact that the

technology is not developed properly to a level where these sources could be utilized to use

the substitute the petro products. In future, the organization must have to use substantial

products.

Bargaining power of the customers: Moderate-it is identified that as Saudi Aramco is the

one single organization supported by government, it takes advantage of the monopolistic

acquisition. Saudi Aramco controls the market and gains a significant hold over the

customers. On the other side, Saudi Aramco is the member of OPEC’ thereby, it can control

the oil and the global price. However, Hatakenaka et al. (2011) argued that the customers also

have other options such as BP, Shell, and ABNOC.

Bargaining power of customers: Saudi Aramco does not have to deal with any supplier

because the organization is its own supplier.

Issue 3:

In order to identify the customer needs, a detailed market analysis has been performed by

conducting a survey. The survey has been conducted involving a particular area of the market

By Collecting the email address of the customers, a set of 10 questions about the quality of

products and services have been sent to the customers and then the responses have been

gathered and analysed. Likewise, to learn about the competitors’ threats such as BP’s

aggressive marketing strategy, data has been collected from the industry benchmarking report

produced by the third party organisation such as PWC and Deloitte. In addition, the

Figure 2: Porter’s five forces

(Source: Made by Student)

Threats of substitute products: Low- As put forward by Yusuf et al. (2014), the depletion of

the oil research created the urge for using the substitutes such as bio fuels, solar power, and

nuclear power. El-Diasty and Ragab (2013) argued and mentioned the fact that the

technology is not developed properly to a level where these sources could be utilized to use

the substitute the petro products. In future, the organization must have to use substantial

products.

Bargaining power of the customers: Moderate-it is identified that as Saudi Aramco is the

one single organization supported by government, it takes advantage of the monopolistic

acquisition. Saudi Aramco controls the market and gains a significant hold over the

customers. On the other side, Saudi Aramco is the member of OPEC’ thereby, it can control

the oil and the global price. However, Hatakenaka et al. (2011) argued that the customers also

have other options such as BP, Shell, and ABNOC.

Bargaining power of customers: Saudi Aramco does not have to deal with any supplier

because the organization is its own supplier.

Issue 3:

In order to identify the customer needs, a detailed market analysis has been performed by

conducting a survey. The survey has been conducted involving a particular area of the market

By Collecting the email address of the customers, a set of 10 questions about the quality of

products and services have been sent to the customers and then the responses have been

gathered and analysed. Likewise, to learn about the competitors’ threats such as BP’s

aggressive marketing strategy, data has been collected from the industry benchmarking report

produced by the third party organisation such as PWC and Deloitte. In addition, the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.