SOE11444: Financial Report on Scylace plc Investment Decisions

VerifiedAdded on 2023/01/11

|17

|3240

|45

Report

AI Summary

This financial report analyzes Scylace plc's investment strategies, focusing on evaluating two potential superstore locations and the prospective acquisition of Helibeb plc. The report employs various financial methods, including annual profit calculations, average investment analysis, accounting rate of return, and ratio analysis (return on shareholders’ equity, capital employed turnover, net profit margin, operating margin, and book gearing ratio), to assess the viability of each option. The analysis reveals that location B is more suitable than location A for the superstore, and that acquiring Helibeb plc is recommended based on favorable financial ratios, despite its average performance. The report emphasizes the importance of thorough financial analysis before making key decisions to mitigate potential financial risks. The report also includes the evaluation of available finance options, such as yield to redemption on bonds and cost of equity capital, to determine the best financial strategy. The report concludes with recommendations based on the financial analysis, highlighting the importance of data-driven decision-making in financial planning.

FINANCIAL REPORT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Contents

EXECUTIVE SUMMARY.........................................................................................................................3

INTRODUCTION......................................................................................................................................3

MAIN BODY..............................................................................................................................................4

A methodology for evaluating the proposed new superstore locations and prospective

acquisition, in the light of available finance.......................................................................................4

An evaluation of the proposed new superstore locations and prospective acquisition...............6

CONCLUSION........................................................................................................................................12

RECOMMENDATIONS..........................................................................................................................13

REFERENCES........................................................................................................................................14

EXECUTIVE SUMMARY.........................................................................................................................3

INTRODUCTION......................................................................................................................................3

MAIN BODY..............................................................................................................................................4

A methodology for evaluating the proposed new superstore locations and prospective

acquisition, in the light of available finance.......................................................................................4

An evaluation of the proposed new superstore locations and prospective acquisition...............6

CONCLUSION........................................................................................................................................12

RECOMMENDATIONS..........................................................................................................................13

REFERENCES........................................................................................................................................14

EXECUTIVE SUMMARY

The project report summarize about evaluation of different types of financial

options and aspects available to mentioned company. In the first part of report methods

which are going to be used for making evaluation of location alternatives, business

finance and acquisition are mentioned. These methods are annual profitability

calculation, accounting rate of return, ratio analysis and many more. The further part of

report summarize about proper evaluation of above mentioned alternatives on the

behalf of discussed methods. It abstracts that from two available options of location A

and B, location B is suitable. As well as they should acquire Helibeb plc because

different types ratios such as net profit margin, operating margin, book gearing ratio etc.

are showing that Scylace plc can acquire. Though, performance is average of this

company but expected to grow in upcoming time frame. In addition, the report

summarizes that companies need to make proper analysis before taking any major

decisions such as selecting any locations or acquiring any company. This is so because

these are some key aspects and any wrong decision may lead to huge financial and

non financial lose of company. Same as in this report proper analysis of available

alternatives have been done in an effective manner.

INTRODUCTION

The term financial report can be defined as a form of written document that

contains detailed information regards to each financial transactions and total profitability

from operations. These reports are too essential for business entities in order to take

corrective actions (Authority, 2018). The project report is based on a company that is

Scylace plc. This company is involved in the grocery retail chain. Company is planning

to build a new store as well as want to make acquisition of another company which is

Helibeb plc. The report covers detailed information regards analysis of available two

options for building a new superstore. In order to make proper evaluation of these two

proposals various kinds of techniques have been implemented. Basically these

techniques and methods are too crucial for business entities in order to take corrective

The project report summarize about evaluation of different types of financial

options and aspects available to mentioned company. In the first part of report methods

which are going to be used for making evaluation of location alternatives, business

finance and acquisition are mentioned. These methods are annual profitability

calculation, accounting rate of return, ratio analysis and many more. The further part of

report summarize about proper evaluation of above mentioned alternatives on the

behalf of discussed methods. It abstracts that from two available options of location A

and B, location B is suitable. As well as they should acquire Helibeb plc because

different types ratios such as net profit margin, operating margin, book gearing ratio etc.

are showing that Scylace plc can acquire. Though, performance is average of this

company but expected to grow in upcoming time frame. In addition, the report

summarizes that companies need to make proper analysis before taking any major

decisions such as selecting any locations or acquiring any company. This is so because

these are some key aspects and any wrong decision may lead to huge financial and

non financial lose of company. Same as in this report proper analysis of available

alternatives have been done in an effective manner.

INTRODUCTION

The term financial report can be defined as a form of written document that

contains detailed information regards to each financial transactions and total profitability

from operations. These reports are too essential for business entities in order to take

corrective actions (Authority, 2018). The project report is based on a company that is

Scylace plc. This company is involved in the grocery retail chain. Company is planning

to build a new store as well as want to make acquisition of another company which is

Helibeb plc. The report covers detailed information regards analysis of available two

options for building a new superstore. In order to make proper evaluation of these two

proposals various kinds of techniques have been implemented. Basically these

techniques and methods are too crucial for business entities in order to take corrective

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

steps for taking further financial decisions. Any error in this aspect may lead to huge

loss of companies. In addition, report also covers information related to acquisition of a

company and for that analysis of that company’s profitability, their debts, and assets is

done. So overall report includes vital range of techniques, methods for making suitable

and valuable decisions in regards with financial aspects.

MAIN BODY

A methodology for evaluating the proposed new superstore locations and prospective

acquisition, in the light of available finance.

There are various kinds of methods for making evaluation of different aspects

regards to finance (Muda, Harahap, Maksum and Abubakar, 2018). It depends on

companies that which method they apply. In the context of above mentioned company,

this can be find out that they want to open new store as well as they also decide to do

acquisition. For this purpose below mentioned methods can be applied by them which

are as follows:

For proposed new superstore locations- There are two locations which are A and B. The

efficiency of these locations can be evaluated by below mentioned methods:

By calculating annual profit- The annual benefit is the company's net profits due

to taxes, interest costs, asset sales gains (loss), investment gains (losses),

property disposal gains, depreciation, amortization, income tax, extraordinary

products, and award expenses, as calculated by the accounting firm in

compliance with commonly agreed accounting rules that representing the

expenses imposed by the event's allocation. This is computed by below

mentioned formula:

Annual Sales Revenue – Annual Cost of Sales – Annual Staff Costs –

Depreciation Other Annual Costs.

By calculating average investment- Average investment is the capital cost

required to start a project, plus the final scrap value of any equipment, divided by

two (Nogueira and Jorge, 2016). This is a type of method which can be used in

loss of companies. In addition, report also covers information related to acquisition of a

company and for that analysis of that company’s profitability, their debts, and assets is

done. So overall report includes vital range of techniques, methods for making suitable

and valuable decisions in regards with financial aspects.

MAIN BODY

A methodology for evaluating the proposed new superstore locations and prospective

acquisition, in the light of available finance.

There are various kinds of methods for making evaluation of different aspects

regards to finance (Muda, Harahap, Maksum and Abubakar, 2018). It depends on

companies that which method they apply. In the context of above mentioned company,

this can be find out that they want to open new store as well as they also decide to do

acquisition. For this purpose below mentioned methods can be applied by them which

are as follows:

For proposed new superstore locations- There are two locations which are A and B. The

efficiency of these locations can be evaluated by below mentioned methods:

By calculating annual profit- The annual benefit is the company's net profits due

to taxes, interest costs, asset sales gains (loss), investment gains (losses),

property disposal gains, depreciation, amortization, income tax, extraordinary

products, and award expenses, as calculated by the accounting firm in

compliance with commonly agreed accounting rules that representing the

expenses imposed by the event's allocation. This is computed by below

mentioned formula:

Annual Sales Revenue – Annual Cost of Sales – Annual Staff Costs –

Depreciation Other Annual Costs.

By calculating average investment- Average investment is the capital cost

required to start a project, plus the final scrap value of any equipment, divided by

two (Nogueira and Jorge, 2016). This is a type of method which can be used in

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

order to measure efficiency of various kinds of projects. In the above company’s

two options evaluation this is applied by using below mentioned formula:

Cost of New Superstore + Residual Value) / 2

Accounting rate of return- ARR is the financial formula for capital budgeting. This

is often referred to as the annual return rate, or ARR. The calculation does not

take the term value of capital into account (Onchong’a, Muturi and Atambo,

2016). The value provided by ARR from the capital investment's net profit is

estimated. The ARR returns a percentage. In the above company’s two options

evaluation this is applied by using below mentioned formula:

Annual Profit / Average Investment

For prospective acquisition- In order to evaluate about efficiency of Helibeb plc, ratio

analysis is done which are as follows:

Ratio analysis- Ratio analysis is a systematic approach of analyzing the financial results

of an entity, and offers an overview into efficiency, business efficacy, and productivity.

Analysis of percentages is an integral part in the analysis in securities (Agustiningsih,

Murni and Putri, 2017). In the aspect of above company, they have calculated below

mentioned ratios to evaluate efficiency of Helibeb plc which are as follows:

Return on shareholders’ equity ratio

Capital employed turnover ratio

Net profit margin

Operating margin

Book gearing ratio

For available finance- In order to find out efficiency of available finance options below

mentioned methods have been used by above company:

Yield to redemption on bonds- This is the intrinsic return rate (IRR) of an

shareholder in a debt because, before the maturity of the bond, the lender retains

the debt at the same pace for all contributions made over time and reinvested

(Bosi and Joy, 2017). It is calculated by below mentioned formula:

two options evaluation this is applied by using below mentioned formula:

Cost of New Superstore + Residual Value) / 2

Accounting rate of return- ARR is the financial formula for capital budgeting. This

is often referred to as the annual return rate, or ARR. The calculation does not

take the term value of capital into account (Onchong’a, Muturi and Atambo,

2016). The value provided by ARR from the capital investment's net profit is

estimated. The ARR returns a percentage. In the above company’s two options

evaluation this is applied by using below mentioned formula:

Annual Profit / Average Investment

For prospective acquisition- In order to evaluate about efficiency of Helibeb plc, ratio

analysis is done which are as follows:

Ratio analysis- Ratio analysis is a systematic approach of analyzing the financial results

of an entity, and offers an overview into efficiency, business efficacy, and productivity.

Analysis of percentages is an integral part in the analysis in securities (Agustiningsih,

Murni and Putri, 2017). In the aspect of above company, they have calculated below

mentioned ratios to evaluate efficiency of Helibeb plc which are as follows:

Return on shareholders’ equity ratio

Capital employed turnover ratio

Net profit margin

Operating margin

Book gearing ratio

For available finance- In order to find out efficiency of available finance options below

mentioned methods have been used by above company:

Yield to redemption on bonds- This is the intrinsic return rate (IRR) of an

shareholder in a debt because, before the maturity of the bond, the lender retains

the debt at the same pace for all contributions made over time and reinvested

(Bosi and Joy, 2017). It is calculated by below mentioned formula:

Cost of equity capital- In finance, equity costs are the benefit a corporation pays

its creditors, i.e. shareholders, by borrowing through their resources to reduce

the risk they face (Song, Wang and Zhu, 2018). Corporations must acquire

resources from others in order to expand and operate. It is calculated by below

mentioned formula:

(Dividend / Share Price) + Dividend Growth

An evaluation of the proposed new superstore locations and prospective acquisition

On the basis of above mentioned methods, evaluation of proposed new

superstore locations and prospective acquisition is done in such manner:

Evaluation of Proposed new superstore locations-

Annual profit- On the basis of calculated values of annual profit of both locations

A and B, this can be find out that location A has annual profit of 1 while B has

profit of 0.66. It shows that location A is better as compared to location B due to

higher value of annual profit.

Location A Location B

Annual profit 1 0.66

its creditors, i.e. shareholders, by borrowing through their resources to reduce

the risk they face (Song, Wang and Zhu, 2018). Corporations must acquire

resources from others in order to expand and operate. It is calculated by below

mentioned formula:

(Dividend / Share Price) + Dividend Growth

An evaluation of the proposed new superstore locations and prospective acquisition

On the basis of above mentioned methods, evaluation of proposed new

superstore locations and prospective acquisition is done in such manner:

Evaluation of Proposed new superstore locations-

Annual profit- On the basis of calculated values of annual profit of both locations

A and B, this can be find out that location A has annual profit of 1 while B has

profit of 0.66. It shows that location A is better as compared to location B due to

higher value of annual profit.

Location A Location B

Annual profit 1 0.66

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Location A Location B

0

0.2

0.4

0.6

0.8

1

1.2

1

0.66

Annual profit

Annual profit

Average investment- The value of average investment of location A is of 25 while

B has average investment of 14. It shows that location B will be less expensive

for above mentioned Plc but higher expensive investment will have higher risk.

Thus above company should consider location B.

Location A Location B

Average investment 25 14

0

0.2

0.4

0.6

0.8

1

1.2

1

0.66

Annual profit

Annual profit

Average investment- The value of average investment of location A is of 25 while

B has average investment of 14. It shows that location B will be less expensive

for above mentioned Plc but higher expensive investment will have higher risk.

Thus above company should consider location B.

Location A Location B

Average investment 25 14

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Location A Location B

0

5

10

15

20

25

30

25

14

Average investment

Average investment

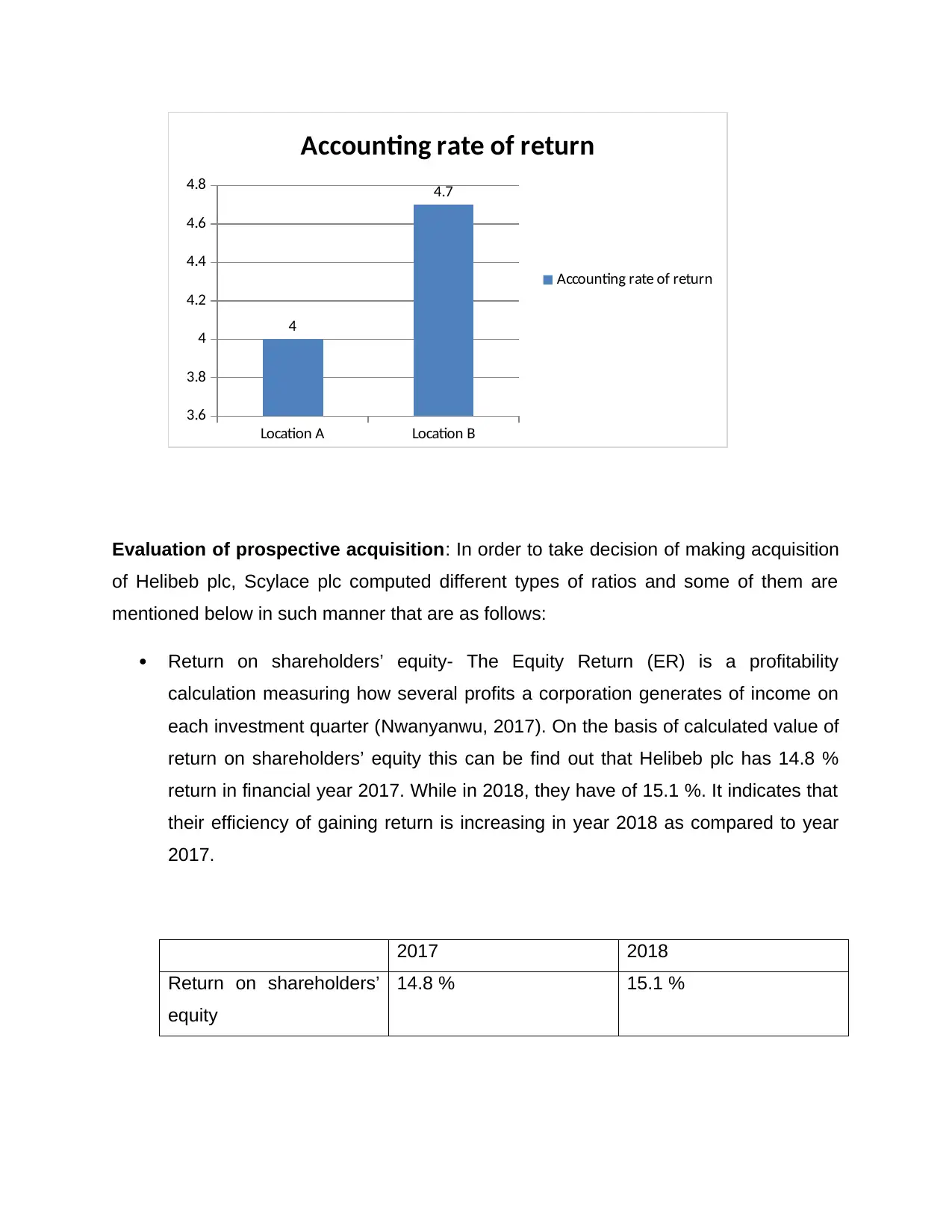

Accounting rate of return- The value of accounting rate of return of location A is

of 4. On the other hand, location B has accounting rate of return of 4.7. Hence,

above company should consider location B because it will produce higher

amount of return in future.

Location A Location B

Accounting rate of return 4 4.7

0

5

10

15

20

25

30

25

14

Average investment

Average investment

Accounting rate of return- The value of accounting rate of return of location A is

of 4. On the other hand, location B has accounting rate of return of 4.7. Hence,

above company should consider location B because it will produce higher

amount of return in future.

Location A Location B

Accounting rate of return 4 4.7

Location A Location B

3.6

3.8

4

4.2

4.4

4.6

4.8

4

4.7

Accounting rate of return

Accounting rate of return

Evaluation of prospective acquisition: In order to take decision of making acquisition

of Helibeb plc, Scylace plc computed different types of ratios and some of them are

mentioned below in such manner that are as follows:

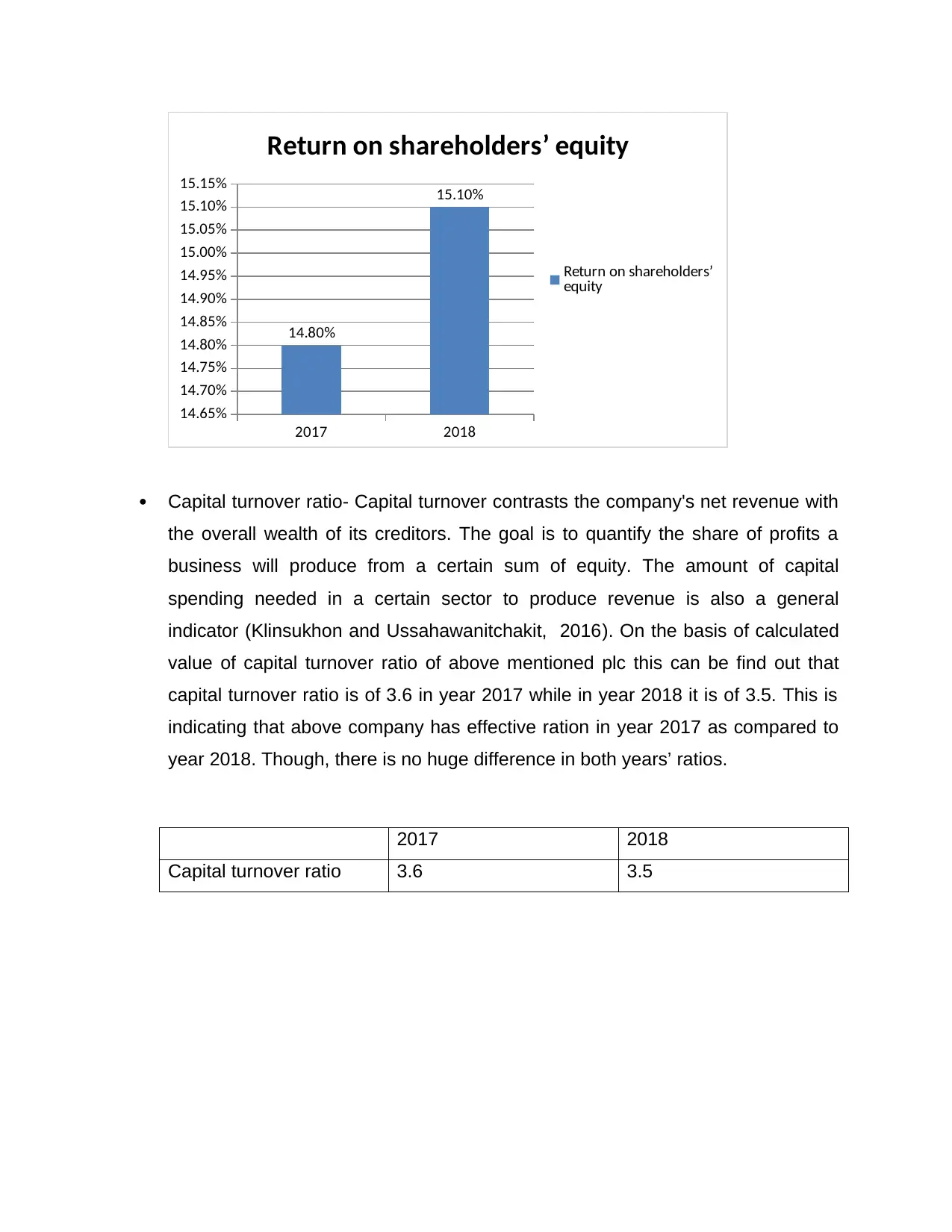

Return on shareholders’ equity- The Equity Return (ER) is a profitability

calculation measuring how several profits a corporation generates of income on

each investment quarter (Nwanyanwu, 2017). On the basis of calculated value of

return on shareholders’ equity this can be find out that Helibeb plc has 14.8 %

return in financial year 2017. While in 2018, they have of 15.1 %. It indicates that

their efficiency of gaining return is increasing in year 2018 as compared to year

2017.

2017 2018

Return on shareholders’

equity

14.8 % 15.1 %

3.6

3.8

4

4.2

4.4

4.6

4.8

4

4.7

Accounting rate of return

Accounting rate of return

Evaluation of prospective acquisition: In order to take decision of making acquisition

of Helibeb plc, Scylace plc computed different types of ratios and some of them are

mentioned below in such manner that are as follows:

Return on shareholders’ equity- The Equity Return (ER) is a profitability

calculation measuring how several profits a corporation generates of income on

each investment quarter (Nwanyanwu, 2017). On the basis of calculated value of

return on shareholders’ equity this can be find out that Helibeb plc has 14.8 %

return in financial year 2017. While in 2018, they have of 15.1 %. It indicates that

their efficiency of gaining return is increasing in year 2018 as compared to year

2017.

2017 2018

Return on shareholders’

equity

14.8 % 15.1 %

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2017 2018

14.65%

14.70%

14.75%

14.80%

14.85%

14.90%

14.95%

15.00%

15.05%

15.10%

15.15%

14.80%

15.10%

Return on shareholders’ equity

Return on shareholders’

equity

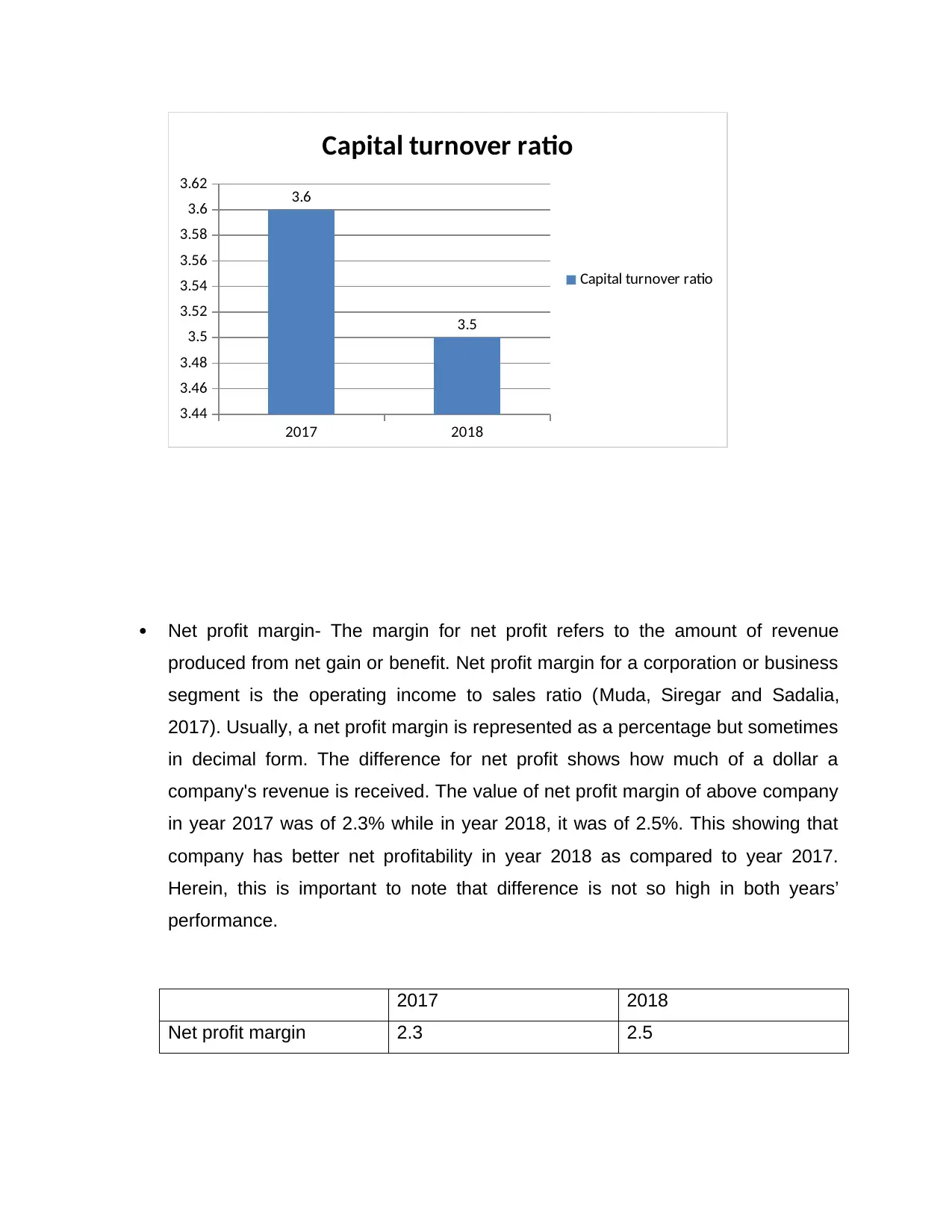

Capital turnover ratio- Capital turnover contrasts the company's net revenue with

the overall wealth of its creditors. The goal is to quantify the share of profits a

business will produce from a certain sum of equity. The amount of capital

spending needed in a certain sector to produce revenue is also a general

indicator (Klinsukhon and Ussahawanitchakit, 2016). On the basis of calculated

value of capital turnover ratio of above mentioned plc this can be find out that

capital turnover ratio is of 3.6 in year 2017 while in year 2018 it is of 3.5. This is

indicating that above company has effective ration in year 2017 as compared to

year 2018. Though, there is no huge difference in both years’ ratios.

2017 2018

Capital turnover ratio 3.6 3.5

14.65%

14.70%

14.75%

14.80%

14.85%

14.90%

14.95%

15.00%

15.05%

15.10%

15.15%

14.80%

15.10%

Return on shareholders’ equity

Return on shareholders’

equity

Capital turnover ratio- Capital turnover contrasts the company's net revenue with

the overall wealth of its creditors. The goal is to quantify the share of profits a

business will produce from a certain sum of equity. The amount of capital

spending needed in a certain sector to produce revenue is also a general

indicator (Klinsukhon and Ussahawanitchakit, 2016). On the basis of calculated

value of capital turnover ratio of above mentioned plc this can be find out that

capital turnover ratio is of 3.6 in year 2017 while in year 2018 it is of 3.5. This is

indicating that above company has effective ration in year 2017 as compared to

year 2018. Though, there is no huge difference in both years’ ratios.

2017 2018

Capital turnover ratio 3.6 3.5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

2017 2018

3.44

3.46

3.48

3.5

3.52

3.54

3.56

3.58

3.6

3.62 3.6

3.5

Capital turnover ratio

Capital turnover ratio

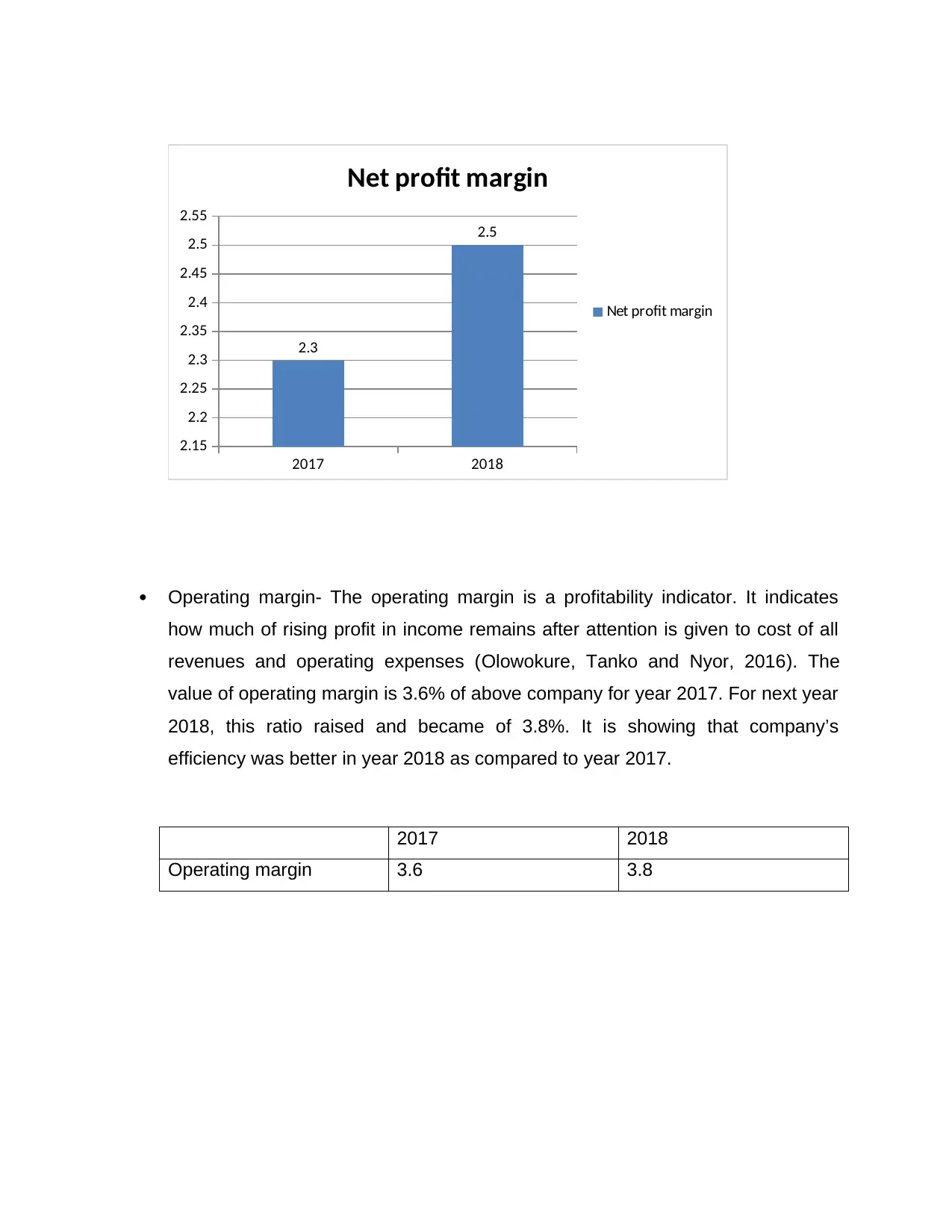

Net profit margin- The margin for net profit refers to the amount of revenue

produced from net gain or benefit. Net profit margin for a corporation or business

segment is the operating income to sales ratio (Muda, Siregar and Sadalia,

2017). Usually, a net profit margin is represented as a percentage but sometimes

in decimal form. The difference for net profit shows how much of a dollar a

company's revenue is received. The value of net profit margin of above company

in year 2017 was of 2.3% while in year 2018, it was of 2.5%. This showing that

company has better net profitability in year 2018 as compared to year 2017.

Herein, this is important to note that difference is not so high in both years’

performance.

2017 2018

Net profit margin 2.3 2.5

3.44

3.46

3.48

3.5

3.52

3.54

3.56

3.58

3.6

3.62 3.6

3.5

Capital turnover ratio

Capital turnover ratio

Net profit margin- The margin for net profit refers to the amount of revenue

produced from net gain or benefit. Net profit margin for a corporation or business

segment is the operating income to sales ratio (Muda, Siregar and Sadalia,

2017). Usually, a net profit margin is represented as a percentage but sometimes

in decimal form. The difference for net profit shows how much of a dollar a

company's revenue is received. The value of net profit margin of above company

in year 2017 was of 2.3% while in year 2018, it was of 2.5%. This showing that

company has better net profitability in year 2018 as compared to year 2017.

Herein, this is important to note that difference is not so high in both years’

performance.

2017 2018

Net profit margin 2.3 2.5

2017 2018

2.15

2.2

2.25

2.3

2.35

2.4

2.45

2.5

2.55

2.3

2.5

Net profit margin

Net profit margin

Operating margin- The operating margin is a profitability indicator. It indicates

how much of rising profit in income remains after attention is given to cost of all

revenues and operating expenses (Olowokure, Tanko and Nyor, 2016). The

value of operating margin is 3.6% of above company for year 2017. For next year

2018, this ratio raised and became of 3.8%. It is showing that company’s

efficiency was better in year 2018 as compared to year 2017.

2017 2018

Operating margin 3.6 3.8

2.15

2.2

2.25

2.3

2.35

2.4

2.45

2.5

2.55

2.3

2.5

Net profit margin

Net profit margin

Operating margin- The operating margin is a profitability indicator. It indicates

how much of rising profit in income remains after attention is given to cost of all

revenues and operating expenses (Olowokure, Tanko and Nyor, 2016). The

value of operating margin is 3.6% of above company for year 2017. For next year

2018, this ratio raised and became of 3.8%. It is showing that company’s

efficiency was better in year 2018 as compared to year 2017.

2017 2018

Operating margin 3.6 3.8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.