Singapore Airlines: Business Environment Analysis and Recommendations

VerifiedAdded on 2020/05/28

|19

|4118

|54

Report

AI Summary

This report provides an in-depth analysis of Singapore Airlines' external business environment. It begins with an executive summary outlining the airline's establishment and global presence. The report then conducts an external environmental analysis using PESTLE and Porter's Five Forces models to identify opportunities and threats. The PESTLE analysis examines the political, economic, socio-cultural, technological, legal, and environmental factors impacting the airline. Porter's Five Forces analysis assesses the threat of new entrants, industry rivalry, the bargaining power of suppliers and buyers, and the threat of substitutes. The analysis highlights key issues faced by the airline and concludes with recommendations. Supporting data, including graphs and tables, is included to illustrate key points and support the findings.

Running head: SINGAPORE AIRLINES

SINGAPORE AIRLINES

Name of the Student

Name of the University

Author Note

SINGAPORE AIRLINES

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1SINGAPORE AIRLINES

Executive Summary

Singapore Airlines was established in the year 1972 and is one of the largest and the most

popular carriers around the globe. This report aims to throw light on the external business

environment of the business domain of Singapore Airlines. For this purpose, an external

environmental analysis has been conducted. The analysis has been conducted by using

two strategic management tools named PESTLE Analysis and Porter’s Five Forces

Analysis. After the analysis, the situation and the issue for the business has been

identified and followed by recommendations and conclusion. Some graphs and tables

have been provided to support the content.

Executive Summary

Singapore Airlines was established in the year 1972 and is one of the largest and the most

popular carriers around the globe. This report aims to throw light on the external business

environment of the business domain of Singapore Airlines. For this purpose, an external

environmental analysis has been conducted. The analysis has been conducted by using

two strategic management tools named PESTLE Analysis and Porter’s Five Forces

Analysis. After the analysis, the situation and the issue for the business has been

identified and followed by recommendations and conclusion. Some graphs and tables

have been provided to support the content.

2SINGAPORE AIRLINES

Table of Contents

Introduction..................................................................................................................3

External Environmental Analysis................................................................................4

PESTLE Analysis........................................................................................................4

Porter`s 5 forces Analysis............................................................................................8

Issue Analysis............................................................................................................10

Recommendations and Conclusion............................................................................10

References..................................................................................................................12

Table of Contents

Introduction..................................................................................................................3

External Environmental Analysis................................................................................4

PESTLE Analysis........................................................................................................4

Porter`s 5 forces Analysis............................................................................................8

Issue Analysis............................................................................................................10

Recommendations and Conclusion............................................................................10

References..................................................................................................................12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3SINGAPORE AIRLINES

Introduction

Singapore Airlines limited is one of the largest airlines present around the globe.

The airline is a transportation-based company with its origins in Singapore. Incorporated

in the year 1972, the Singapore airlines during its early years concentrated on becoming

the leader in the airline business. It aimed to extend its operations internationally

(Alagarasan et al., 2015). The airline was successful in doing so by increasing its

operations and bringing in more aircrafts to its company like the Boeing 777 and the

Airbus A380. Singapore Airlines is known for its reputable business and services in the

market. The company has provided a brilliant service since a long period of time for

which it has been appraised and awarded. The primary business focus of the airlines is to

maintain its position as a leader in the airline market of Singapore and overpower its

competitors by providing good quality services to its customers.

As Singapore Airlines is one of the oldest brands in the airline industry with

respect to Singapore, the customer seem to trust its service. Trust by customer is an

outcome of an excellent brand. The company needs to make sure that it abides by the trust

that has been invested in them by the consumers. As the society of Singapore is extremely

trust conscious, the only way out for the airlines to keep the trust factor high by providing

optimum service.

This report aims to throw light on the business environment of Singapore

airlines. The business environment of a business is complex and dynamic, which can lead

to tremendous changes within the business. Although these factors lie outside the domain

of the business, they tend to affect the performance of the company tremendously

(Anderson et al., 2015). It is for this purpose, that external environment analysis becomes

Introduction

Singapore Airlines limited is one of the largest airlines present around the globe.

The airline is a transportation-based company with its origins in Singapore. Incorporated

in the year 1972, the Singapore airlines during its early years concentrated on becoming

the leader in the airline business. It aimed to extend its operations internationally

(Alagarasan et al., 2015). The airline was successful in doing so by increasing its

operations and bringing in more aircrafts to its company like the Boeing 777 and the

Airbus A380. Singapore Airlines is known for its reputable business and services in the

market. The company has provided a brilliant service since a long period of time for

which it has been appraised and awarded. The primary business focus of the airlines is to

maintain its position as a leader in the airline market of Singapore and overpower its

competitors by providing good quality services to its customers.

As Singapore Airlines is one of the oldest brands in the airline industry with

respect to Singapore, the customer seem to trust its service. Trust by customer is an

outcome of an excellent brand. The company needs to make sure that it abides by the trust

that has been invested in them by the consumers. As the society of Singapore is extremely

trust conscious, the only way out for the airlines to keep the trust factor high by providing

optimum service.

This report aims to throw light on the business environment of Singapore

airlines. The business environment of a business is complex and dynamic, which can lead

to tremendous changes within the business. Although these factors lie outside the domain

of the business, they tend to affect the performance of the company tremendously

(Anderson et al., 2015). It is for this purpose, that external environment analysis becomes

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4SINGAPORE AIRLINES

extremely crucial. The external analysis will be done using two methods, the PESTLE

and the Porter`s Five Forces Model Method.

Figure 1: Highlights of the Group’s Performance

Source: (Singstat.gov.sg, 2018)

External Environmental Analysis

PESTLE Analysis

Figure 2: Pollution causes by transportation

Source: (Singstat.gov.sg, 2018)

extremely crucial. The external analysis will be done using two methods, the PESTLE

and the Porter`s Five Forces Model Method.

Figure 1: Highlights of the Group’s Performance

Source: (Singstat.gov.sg, 2018)

External Environmental Analysis

PESTLE Analysis

Figure 2: Pollution causes by transportation

Source: (Singstat.gov.sg, 2018)

5SINGAPORE AIRLINES

The PESTLE Analysis tool is a strategic management tool, which is used by

many business enterprises to analyze their environment and identify the threats as well as

the weaknesses. This analysis will be done on the Singapore airlines in order to

understand the threats and opportunities for its growth.

Political- The political scenario of the country tends to have a huge impact on the

Operations of the Airlines. Since the airline is one of the primary carriers present

in Singapore, any relevant change in the government policy of the country can affect its

performance. However, the political stability of the country is extremely good and that is

why the Singapore airlines have been successful in becoming one of the most promising

airlines in the world (Buono, 2015). The political stability of the country was considered

good. The transparent and structured system of the leader tended to result in low

corruption and low risk, which allowed easy investments, which encouraged the investors

to invest in the company and thereby increasing its resources (Heracleous & Wirtz, 2014).

Corruption seems to be an extremely big problem for any country. Bureaucracy and

bribery are a part of corruption. The officials themselves keep the sanctioned amount

projects, which lead to fewer amounts being sanctioned for the ones who are actually in

need or for the projects that actually require those funds (Heracleous & Wirtz, 2013).

Corruptions tend to indicate problems in the system of government and for this reason;

the investors do not want to invest in the country (Alagöz & Ekici, 2014). The investors

get a feeling that their money would be wasted and they avoid the investment.

Singapore has greatly improved in its ranking of countries, which have been

deemed the least corrupt ones. In 2016, it was given the seventh rank with respect to the

graft watchdog Transparency International`s (TI) Corruption Perceptions Index. It scored

The PESTLE Analysis tool is a strategic management tool, which is used by

many business enterprises to analyze their environment and identify the threats as well as

the weaknesses. This analysis will be done on the Singapore airlines in order to

understand the threats and opportunities for its growth.

Political- The political scenario of the country tends to have a huge impact on the

Operations of the Airlines. Since the airline is one of the primary carriers present

in Singapore, any relevant change in the government policy of the country can affect its

performance. However, the political stability of the country is extremely good and that is

why the Singapore airlines have been successful in becoming one of the most promising

airlines in the world (Buono, 2015). The political stability of the country was considered

good. The transparent and structured system of the leader tended to result in low

corruption and low risk, which allowed easy investments, which encouraged the investors

to invest in the company and thereby increasing its resources (Heracleous & Wirtz, 2014).

Corruption seems to be an extremely big problem for any country. Bureaucracy and

bribery are a part of corruption. The officials themselves keep the sanctioned amount

projects, which lead to fewer amounts being sanctioned for the ones who are actually in

need or for the projects that actually require those funds (Heracleous & Wirtz, 2013).

Corruptions tend to indicate problems in the system of government and for this reason;

the investors do not want to invest in the country (Alagöz & Ekici, 2014). The investors

get a feeling that their money would be wasted and they avoid the investment.

Singapore has greatly improved in its ranking of countries, which have been

deemed the least corrupt ones. In 2016, it was given the seventh rank with respect to the

graft watchdog Transparency International`s (TI) Corruption Perceptions Index. It scored

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6SINGAPORE AIRLINES

84 points on this index. However, as compared to Switzerland, Norway and Denmark, the

country still has still certain amount of corruption, which often tends to shoo away

investors. Singapore is the only Asian country to make the cut.

Investors seem to face certain problems with respect to Singapore`s high value

added investment policy which is suitable for only those companies with a high

technology and larger background (Heracleous & Wirtz, 2014). Small and medium sized

companies may face difficulties while adhering to these philosophies.

Economical- According to Heracleous (2014), an international airline is subject to a

variety of economies. Not only are they affected by the national economy but are also

affected by the global economy as well. A particular change in the fiscal policy of a

country, which may result in the change of the prices of fuel, may affect the costs of

the airlines and then they will need to re-invent their whole model. High costs

associated with fuel tend to have an impact on the profitability of the airline company.

Fuel prices have increased considerably which then tend to increase the prices of the

tickets. When the price of the ticket increases, the customers are very often tend to go

to another airlines and this reduces the profitability of the company. As the economy

has been performing well, the standard of living has also increased; this has led the

people to travel more often to international places thereby increasing the sales of the

company.

84 points on this index. However, as compared to Switzerland, Norway and Denmark, the

country still has still certain amount of corruption, which often tends to shoo away

investors. Singapore is the only Asian country to make the cut.

Investors seem to face certain problems with respect to Singapore`s high value

added investment policy which is suitable for only those companies with a high

technology and larger background (Heracleous & Wirtz, 2014). Small and medium sized

companies may face difficulties while adhering to these philosophies.

Economical- According to Heracleous (2014), an international airline is subject to a

variety of economies. Not only are they affected by the national economy but are also

affected by the global economy as well. A particular change in the fiscal policy of a

country, which may result in the change of the prices of fuel, may affect the costs of

the airlines and then they will need to re-invent their whole model. High costs

associated with fuel tend to have an impact on the profitability of the airline company.

Fuel prices have increased considerably which then tend to increase the prices of the

tickets. When the price of the ticket increases, the customers are very often tend to go

to another airlines and this reduces the profitability of the company. As the economy

has been performing well, the standard of living has also increased; this has led the

people to travel more often to international places thereby increasing the sales of the

company.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7SINGAPORE AIRLINES

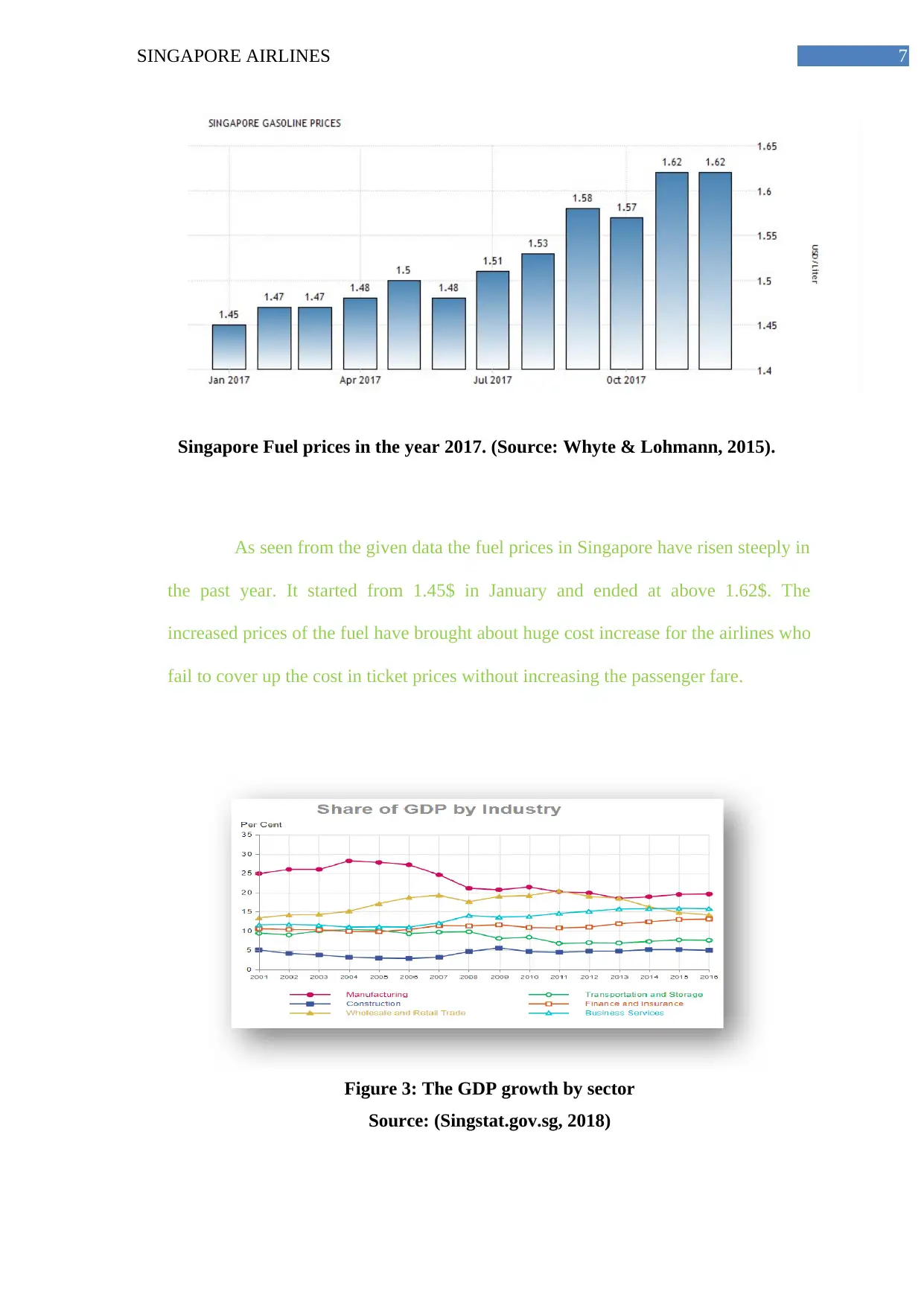

Singapore Fuel prices in the year 2017. (Source: Whyte & Lohmann, 2015).

As seen from the given data the fuel prices in Singapore have risen steeply in

the past year. It started from 1.45$ in January and ended at above 1.62$. The

increased prices of the fuel have brought about huge cost increase for the airlines who

fail to cover up the cost in ticket prices without increasing the passenger fare.

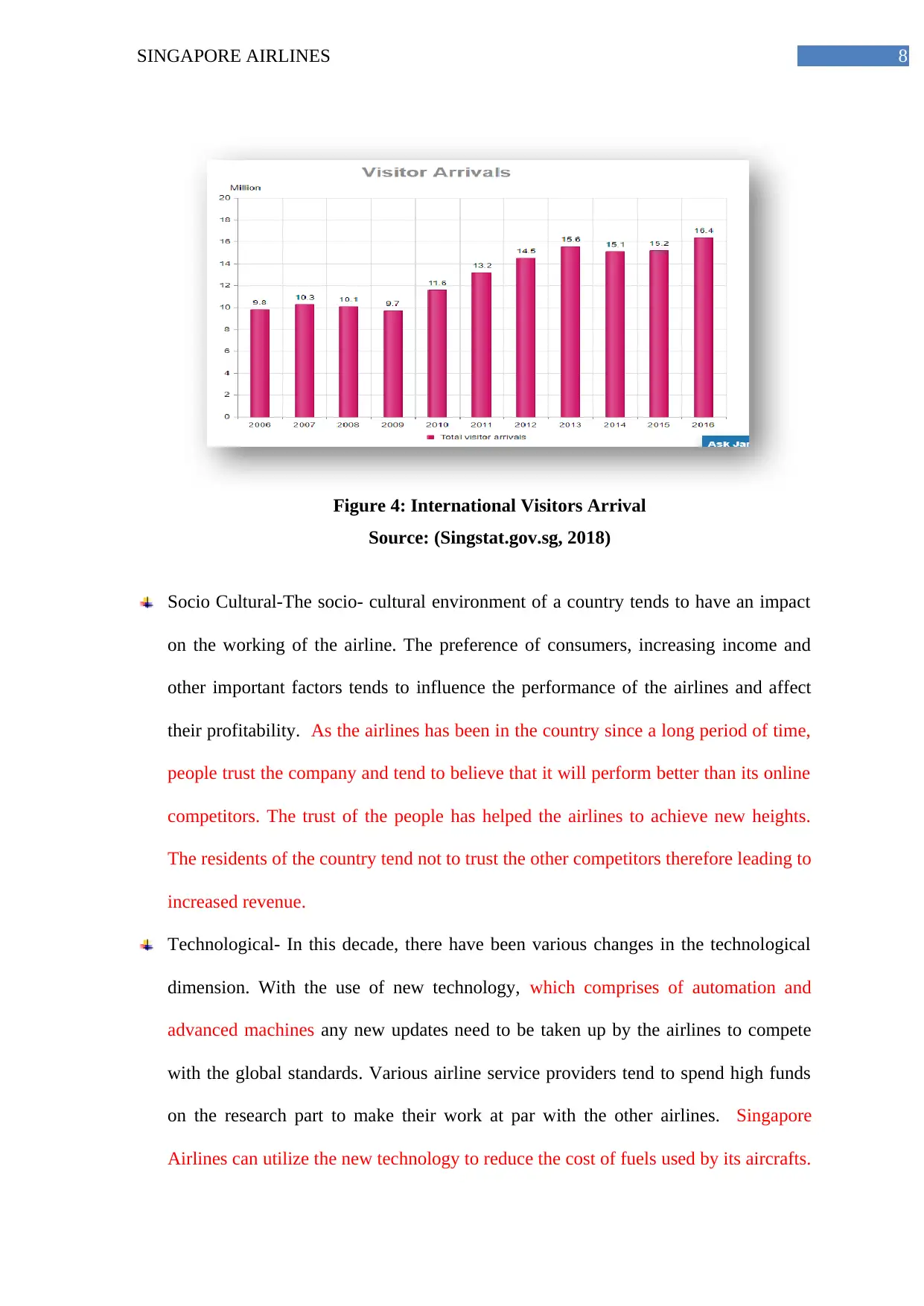

Figure 3: The GDP growth by sector

Source: (Singstat.gov.sg, 2018)

Singapore Fuel prices in the year 2017. (Source: Whyte & Lohmann, 2015).

As seen from the given data the fuel prices in Singapore have risen steeply in

the past year. It started from 1.45$ in January and ended at above 1.62$. The

increased prices of the fuel have brought about huge cost increase for the airlines who

fail to cover up the cost in ticket prices without increasing the passenger fare.

Figure 3: The GDP growth by sector

Source: (Singstat.gov.sg, 2018)

8SINGAPORE AIRLINES

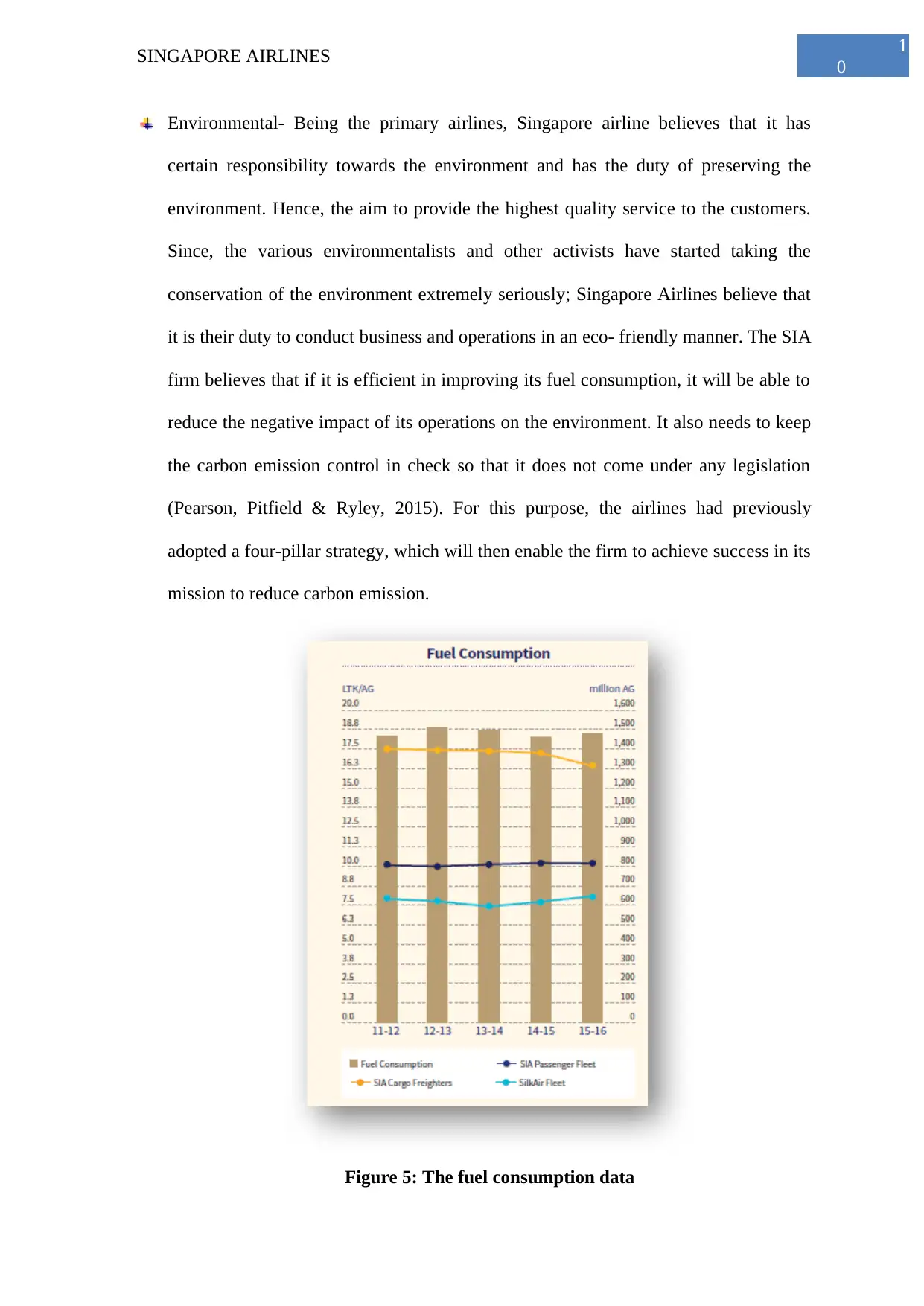

Figure 4: International Visitors Arrival

Source: (Singstat.gov.sg, 2018)

Socio Cultural-The socio- cultural environment of a country tends to have an impact

on the working of the airline. The preference of consumers, increasing income and

other important factors tends to influence the performance of the airlines and affect

their profitability. As the airlines has been in the country since a long period of time,

people trust the company and tend to believe that it will perform better than its online

competitors. The trust of the people has helped the airlines to achieve new heights.

The residents of the country tend not to trust the other competitors therefore leading to

increased revenue.

Technological- In this decade, there have been various changes in the technological

dimension. With the use of new technology, which comprises of automation and

advanced machines any new updates need to be taken up by the airlines to compete

with the global standards. Various airline service providers tend to spend high funds

on the research part to make their work at par with the other airlines. Singapore

Airlines can utilize the new technology to reduce the cost of fuels used by its aircrafts.

Figure 4: International Visitors Arrival

Source: (Singstat.gov.sg, 2018)

Socio Cultural-The socio- cultural environment of a country tends to have an impact

on the working of the airline. The preference of consumers, increasing income and

other important factors tends to influence the performance of the airlines and affect

their profitability. As the airlines has been in the country since a long period of time,

people trust the company and tend to believe that it will perform better than its online

competitors. The trust of the people has helped the airlines to achieve new heights.

The residents of the country tend not to trust the other competitors therefore leading to

increased revenue.

Technological- In this decade, there have been various changes in the technological

dimension. With the use of new technology, which comprises of automation and

advanced machines any new updates need to be taken up by the airlines to compete

with the global standards. Various airline service providers tend to spend high funds

on the research part to make their work at par with the other airlines. Singapore

Airlines can utilize the new technology to reduce the cost of fuels used by its aircrafts.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9SINGAPORE AIRLINES

This shall help the business in increasing the profit in its operations. Some

technologies have the power to reduce fuel usage, which can be useful for the airlines.

Use of technology to reduce operations cost:

o Using automation

Singapore Airlines has invested in automation, which has lead to reducing work force

costs of the company. Although it received backslash from various communities for

causing unemployment.

o Transferring IT infrastructure to Cloud

It has also adopted cloud technology, which has lead to integrated operations and

omission of redundancy.

o Investing in green technology

As a part of its CSR activities, the company has invested in green technology, which

uses technologies in an eco-friendly manner thereby reducing harm to the

environment.

Legal- The legal environment comprises of various legal and regulatory policies that a

business needs to abide by when they are operating in the airline industry. The airline

industry is particularly strict in this domain and it tends to operate with various rules

and regulations (Hillier, 2015). Since the development of the airline industry is

extremely important for the growth of a nation, the rules are generally relaxed for the

industry. However, there are certain restrictions related to the emission of carbon

dioxide, which need to be followed by the airline industry. Related to the

environmental policy, the Singapore airlines have a certain limit up to which the

organization can emit pollutants into the air.

This shall help the business in increasing the profit in its operations. Some

technologies have the power to reduce fuel usage, which can be useful for the airlines.

Use of technology to reduce operations cost:

o Using automation

Singapore Airlines has invested in automation, which has lead to reducing work force

costs of the company. Although it received backslash from various communities for

causing unemployment.

o Transferring IT infrastructure to Cloud

It has also adopted cloud technology, which has lead to integrated operations and

omission of redundancy.

o Investing in green technology

As a part of its CSR activities, the company has invested in green technology, which

uses technologies in an eco-friendly manner thereby reducing harm to the

environment.

Legal- The legal environment comprises of various legal and regulatory policies that a

business needs to abide by when they are operating in the airline industry. The airline

industry is particularly strict in this domain and it tends to operate with various rules

and regulations (Hillier, 2015). Since the development of the airline industry is

extremely important for the growth of a nation, the rules are generally relaxed for the

industry. However, there are certain restrictions related to the emission of carbon

dioxide, which need to be followed by the airline industry. Related to the

environmental policy, the Singapore airlines have a certain limit up to which the

organization can emit pollutants into the air.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

0

SINGAPORE AIRLINES

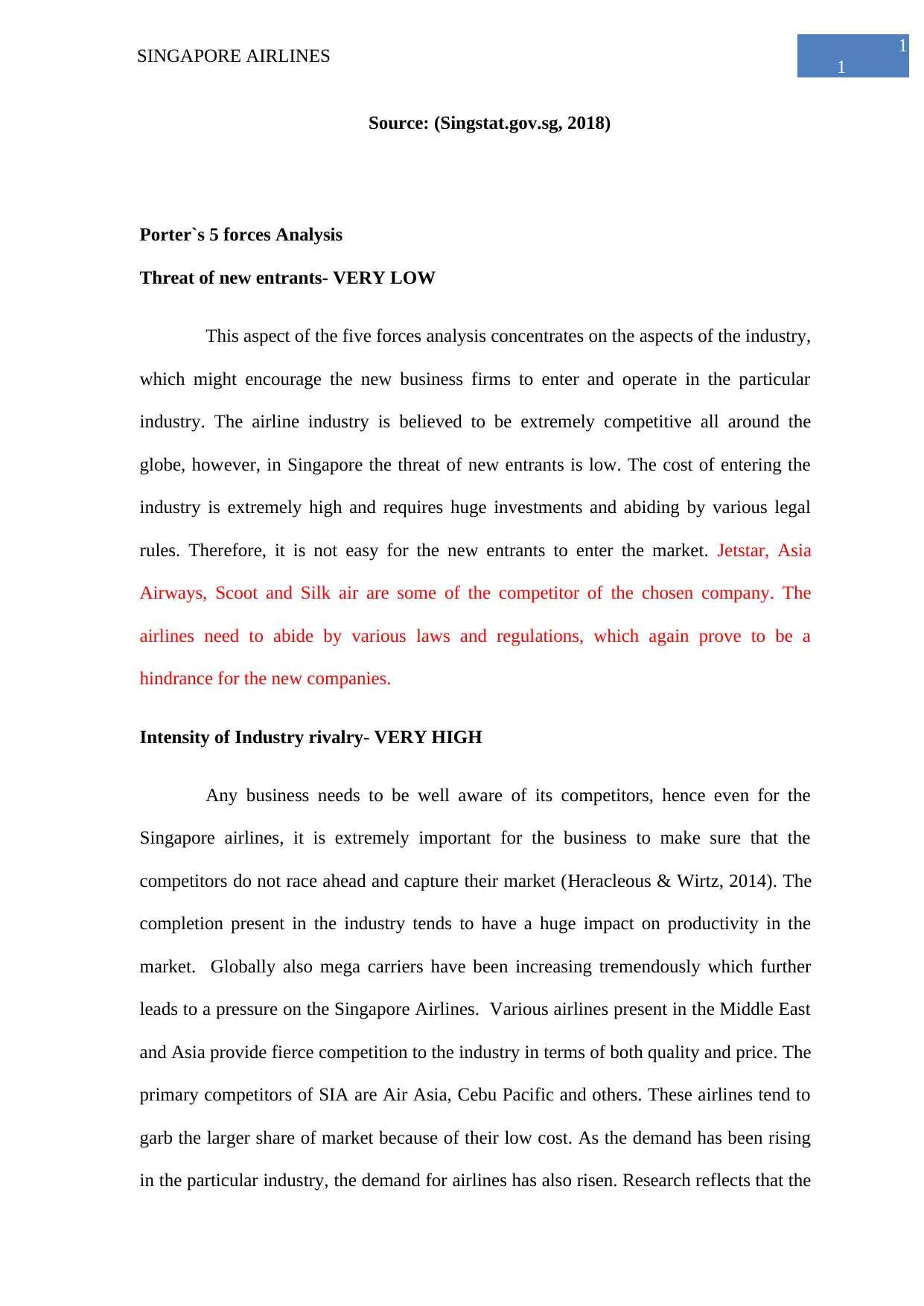

Environmental- Being the primary airlines, Singapore airline believes that it has

certain responsibility towards the environment and has the duty of preserving the

environment. Hence, the aim to provide the highest quality service to the customers.

Since, the various environmentalists and other activists have started taking the

conservation of the environment extremely seriously; Singapore Airlines believe that

it is their duty to conduct business and operations in an eco- friendly manner. The SIA

firm believes that if it is efficient in improving its fuel consumption, it will be able to

reduce the negative impact of its operations on the environment. It also needs to keep

the carbon emission control in check so that it does not come under any legislation

(Pearson, Pitfield & Ryley, 2015). For this purpose, the airlines had previously

adopted a four-pillar strategy, which will then enable the firm to achieve success in its

mission to reduce carbon emission.

Figure 5: The fuel consumption data

0

SINGAPORE AIRLINES

Environmental- Being the primary airlines, Singapore airline believes that it has

certain responsibility towards the environment and has the duty of preserving the

environment. Hence, the aim to provide the highest quality service to the customers.

Since, the various environmentalists and other activists have started taking the

conservation of the environment extremely seriously; Singapore Airlines believe that

it is their duty to conduct business and operations in an eco- friendly manner. The SIA

firm believes that if it is efficient in improving its fuel consumption, it will be able to

reduce the negative impact of its operations on the environment. It also needs to keep

the carbon emission control in check so that it does not come under any legislation

(Pearson, Pitfield & Ryley, 2015). For this purpose, the airlines had previously

adopted a four-pillar strategy, which will then enable the firm to achieve success in its

mission to reduce carbon emission.

Figure 5: The fuel consumption data

1

1

SINGAPORE AIRLINES

Source: (Singstat.gov.sg, 2018)

Porter`s 5 forces Analysis

Threat of new entrants- VERY LOW

This aspect of the five forces analysis concentrates on the aspects of the industry,

which might encourage the new business firms to enter and operate in the particular

industry. The airline industry is believed to be extremely competitive all around the

globe, however, in Singapore the threat of new entrants is low. The cost of entering the

industry is extremely high and requires huge investments and abiding by various legal

rules. Therefore, it is not easy for the new entrants to enter the market. Jetstar, Asia

Airways, Scoot and Silk air are some of the competitor of the chosen company. The

airlines need to abide by various laws and regulations, which again prove to be a

hindrance for the new companies.

Intensity of Industry rivalry- VERY HIGH

Any business needs to be well aware of its competitors, hence even for the

Singapore airlines, it is extremely important for the business to make sure that the

competitors do not race ahead and capture their market (Heracleous & Wirtz, 2014). The

completion present in the industry tends to have a huge impact on productivity in the

market. Globally also mega carriers have been increasing tremendously which further

leads to a pressure on the Singapore Airlines. Various airlines present in the Middle East

and Asia provide fierce competition to the industry in terms of both quality and price. The

primary competitors of SIA are Air Asia, Cebu Pacific and others. These airlines tend to

garb the larger share of market because of their low cost. As the demand has been rising

in the particular industry, the demand for airlines has also risen. Research reflects that the

1

SINGAPORE AIRLINES

Source: (Singstat.gov.sg, 2018)

Porter`s 5 forces Analysis

Threat of new entrants- VERY LOW

This aspect of the five forces analysis concentrates on the aspects of the industry,

which might encourage the new business firms to enter and operate in the particular

industry. The airline industry is believed to be extremely competitive all around the

globe, however, in Singapore the threat of new entrants is low. The cost of entering the

industry is extremely high and requires huge investments and abiding by various legal

rules. Therefore, it is not easy for the new entrants to enter the market. Jetstar, Asia

Airways, Scoot and Silk air are some of the competitor of the chosen company. The

airlines need to abide by various laws and regulations, which again prove to be a

hindrance for the new companies.

Intensity of Industry rivalry- VERY HIGH

Any business needs to be well aware of its competitors, hence even for the

Singapore airlines, it is extremely important for the business to make sure that the

competitors do not race ahead and capture their market (Heracleous & Wirtz, 2014). The

completion present in the industry tends to have a huge impact on productivity in the

market. Globally also mega carriers have been increasing tremendously which further

leads to a pressure on the Singapore Airlines. Various airlines present in the Middle East

and Asia provide fierce competition to the industry in terms of both quality and price. The

primary competitors of SIA are Air Asia, Cebu Pacific and others. These airlines tend to

garb the larger share of market because of their low cost. As the demand has been rising

in the particular industry, the demand for airlines has also risen. Research reflects that the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 19

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.