Finance in SMEs: A Comprehensive Analysis of Brompton Bicycle Ltd.

VerifiedAdded on 2021/02/20

|17

|4519

|62

Report

AI Summary

This report delves into the realm of finance within Small and Medium Enterprises (SMEs), utilizing Brompton Bicycle Ltd., a UK-based bicycle manufacturer, as a case study. The report meticulously explores various facets of SME finance, beginning with an examination of diverse sources of finance, including internal and external options like retained earnings, debentures, and loans. It then proceeds to a detailed ratio analysis, encompassing profitability, liquidity, and efficiency ratios to assess the financial performance of Brompton. The report further discusses investment appraisal techniques, particularly the Net Present Value (NPV) method, and explores different approaches to business valuation. Moreover, it addresses the significance of ethical values in decision-making within SMEs and concludes with a module learning log. The analysis provides a comprehensive overview of financial management in the context of SMEs, offering valuable insights into financial strategies and performance evaluation.

Finance in an SME

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

Sources of finance........................................................................................................................3

TASK 2............................................................................................................................................4

Ratio analysis...............................................................................................................................4

TASK 3............................................................................................................................................6

Discussing investment appraisal techniques................................................................................6

TASK 4 ...........................................................................................................................................8

Approaches of business valuation................................................................................................8

TASK 5............................................................................................................................................9

Concept of ethics and its potential impact on decision making in SME’s...................................9

TASK 6..........................................................................................................................................10

Module learning log...................................................................................................................10

SUMMARY ..................................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

Sources of finance........................................................................................................................3

TASK 2............................................................................................................................................4

Ratio analysis...............................................................................................................................4

TASK 3............................................................................................................................................6

Discussing investment appraisal techniques................................................................................6

TASK 4 ...........................................................................................................................................8

Approaches of business valuation................................................................................................8

TASK 5............................................................................................................................................9

Concept of ethics and its potential impact on decision making in SME’s...................................9

TASK 6..........................................................................................................................................10

Module learning log...................................................................................................................10

SUMMARY ..................................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Finance can be defined as the activities which are concerned with the debt, credit,

banking, capital markets, investments and money. Finance in small and medium enterprises is

considered as the funding of SMEs which is related with the areas such as how the activities and

operations of such enterprises are backed up by the money, what kind of source of finance is

used for running the business etc. The present report will focus on Brompton Bicycle Ltd., a

bicycle manufacturing company based in United Kingdom and is the largest manufacturer of

bicucyloe in the country whose annual production is 36000 units out of which 80 % of

production is exported. The report will highlight different sources of finance, ratio analysis of the

company, application of investment techniques for evaluating a investment of company,

approaches of business valuation. Further, it will also cover impact of ethical values on decision

making of SMEs and a learning module log.

TASK 1

Sources of finance

Sources of finance implies the channels through which an enterprise obtains its funds.

They are classified on the basis of following basis of Time period, ownership, control and source

of creation of funds.

Internal sources:

Retained earnings:

These are the profits which are ploughed back in the business. Sometimes for growth and

expansion purpose, enterprises does not distribute all of its profits into its members or investors,

rather holds it back. Such ploughed back profits are known as retained earning which is an

internal source of finance (Classification of Sources of Funds, 2019).

External sources :

Debentures:

It is an external source of finance in which company borrows money by offering long

term security at a fixed rate. Such debt is backed up by the assets of business.

Loans :

Enterprise finance its operations by borrowing money from public financial institutions

and commercial banks by mortgaging of company's assets and at a charge of fixed interest.

Time period

Finance can be defined as the activities which are concerned with the debt, credit,

banking, capital markets, investments and money. Finance in small and medium enterprises is

considered as the funding of SMEs which is related with the areas such as how the activities and

operations of such enterprises are backed up by the money, what kind of source of finance is

used for running the business etc. The present report will focus on Brompton Bicycle Ltd., a

bicycle manufacturing company based in United Kingdom and is the largest manufacturer of

bicucyloe in the country whose annual production is 36000 units out of which 80 % of

production is exported. The report will highlight different sources of finance, ratio analysis of the

company, application of investment techniques for evaluating a investment of company,

approaches of business valuation. Further, it will also cover impact of ethical values on decision

making of SMEs and a learning module log.

TASK 1

Sources of finance

Sources of finance implies the channels through which an enterprise obtains its funds.

They are classified on the basis of following basis of Time period, ownership, control and source

of creation of funds.

Internal sources:

Retained earnings:

These are the profits which are ploughed back in the business. Sometimes for growth and

expansion purpose, enterprises does not distribute all of its profits into its members or investors,

rather holds it back. Such ploughed back profits are known as retained earning which is an

internal source of finance (Classification of Sources of Funds, 2019).

External sources :

Debentures:

It is an external source of finance in which company borrows money by offering long

term security at a fixed rate. Such debt is backed up by the assets of business.

Loans :

Enterprise finance its operations by borrowing money from public financial institutions

and commercial banks by mortgaging of company's assets and at a charge of fixed interest.

Time period

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Long term sources :

Funds which is required for a period of more than 1 year are considered as long term

sources of finance (Han, Zhang and Greene, 2017). Fixed capital requirements of company are

financed through these sources. Examples are :

Equity : Funds are obtained by selling the share of company to people in capital markets.

The money is does not create any fixed charge on assets and it does not have to be paid back to

investors during the normal course of business.

Other examples are preference shares, debentures, venture capital etc.

Medium term :

Funds when are needed for expenses or operations whose benefit will last for more than

one accounting year such as advertisement expenses, are financed through these sources.

Example are : Loans from commercial banks, lease financing etc.

Short term :

Funds when are required for meeting daily expenses of business such as working capital

requirements are financed through this sources (Cole, 2018).

Examples : trade credit, commercial paper, factoring, bank loan etc.

Owned & Borrowed capital :

Financing trough equity, preference share, retained earnings are considered as owned

capital. Equity capital is not required to repaid during the lifetime of company. However, these

sources dilutes the control of business in the hands of shareholders.

Borrowed capital includes loans, debentures, public deposited which creates a charge on

company's assets and possess contractual nature. Fixed rate of interest has to be paid at specified

time mentioned in document and the principal amount has to be repaid at specified date (Cole

and Mehran, 2018).

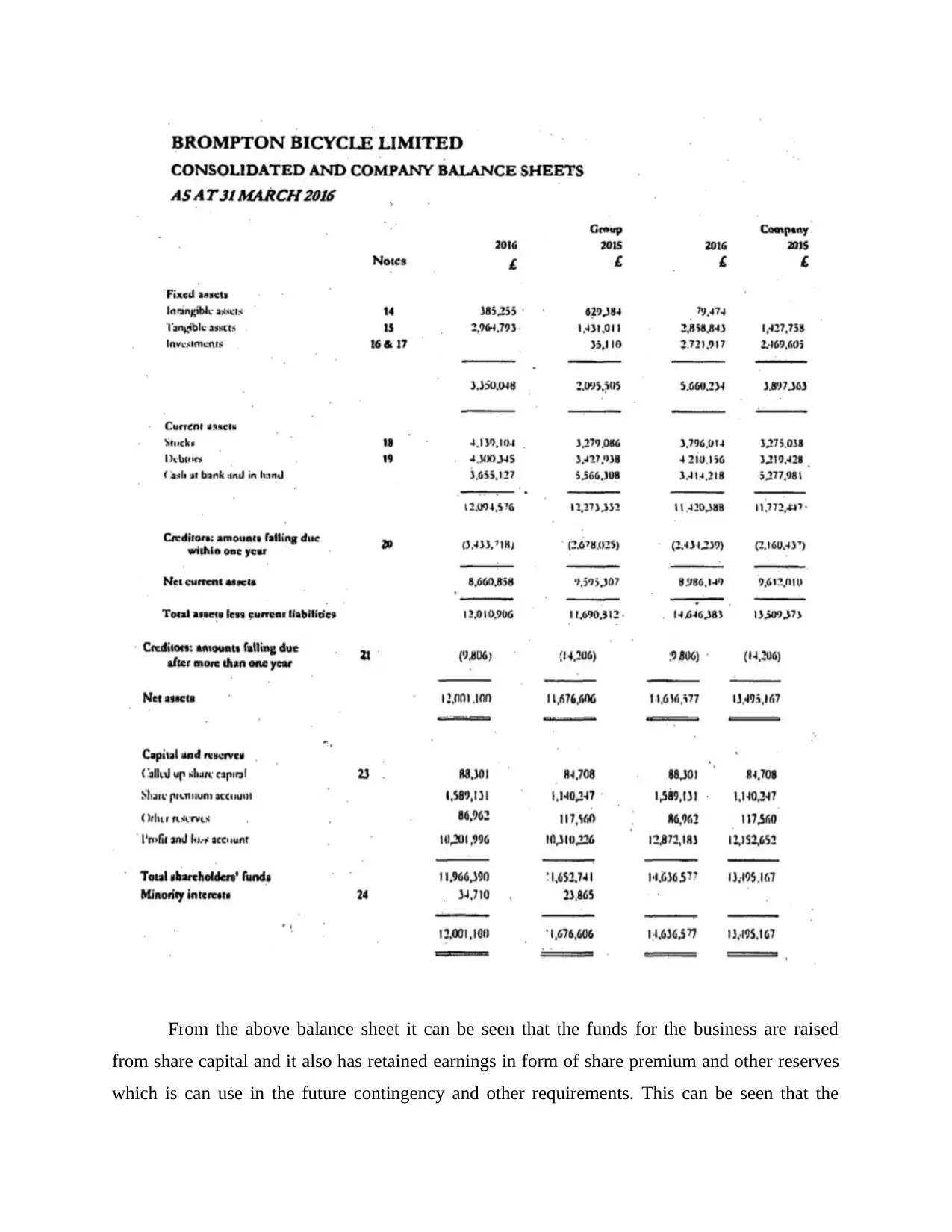

Sources of finance of Brompton:

Funds which is required for a period of more than 1 year are considered as long term

sources of finance (Han, Zhang and Greene, 2017). Fixed capital requirements of company are

financed through these sources. Examples are :

Equity : Funds are obtained by selling the share of company to people in capital markets.

The money is does not create any fixed charge on assets and it does not have to be paid back to

investors during the normal course of business.

Other examples are preference shares, debentures, venture capital etc.

Medium term :

Funds when are needed for expenses or operations whose benefit will last for more than

one accounting year such as advertisement expenses, are financed through these sources.

Example are : Loans from commercial banks, lease financing etc.

Short term :

Funds when are required for meeting daily expenses of business such as working capital

requirements are financed through this sources (Cole, 2018).

Examples : trade credit, commercial paper, factoring, bank loan etc.

Owned & Borrowed capital :

Financing trough equity, preference share, retained earnings are considered as owned

capital. Equity capital is not required to repaid during the lifetime of company. However, these

sources dilutes the control of business in the hands of shareholders.

Borrowed capital includes loans, debentures, public deposited which creates a charge on

company's assets and possess contractual nature. Fixed rate of interest has to be paid at specified

time mentioned in document and the principal amount has to be repaid at specified date (Cole

and Mehran, 2018).

Sources of finance of Brompton:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

From the above balance sheet it can be seen that the funds for the business are raised

from share capital and it also has retained earnings in form of share premium and other reserves

which is can use in the future contingency and other requirements. This can be seen that the

from share capital and it also has retained earnings in form of share premium and other reserves

which is can use in the future contingency and other requirements. This can be seen that the

company do not have any outside borrowed funds and hence there is no interest burden on the

company Brompton.

TASK 2

Ratio analysis

Gross profit margin :

This refers to the profitability ratio which is concerned with measuring the revenue which

is left deducting the cost of sales.

Formula : Gross profit /sales*100

Operating margin :

It is another profitability ratio which measures the profit which is left after paying all the

operational expenses of the business such as salaries, office expenses, general expenses,

stationary etc.

Formula : Operating profit /sales*100

Return on Equity:

This is a ratio which is concerned with assessing the financial performance of the

company which shows the efficiency of company's management regarding how effectively it is

utilising the assets for generating profit (Uechi and et.al., 2015) .

Formula : Net income / shareholders' equity

Return on capital employed:

It is a financial ratio which is concerned with profitability and the effectiveness

with which the capital of company is employed.

Formula : Earning before interest and tax (EBIT) / Capital employed

Current ratio:

It is the ratio which measures the liquidity of the organisation regarding company's

ability of repaying its short term liabilities with its available short term assets. Ideal current ratio

is 2:1 which means that company has 2 times of assets of repaying each of its short term

liabilities (Gabric, 2018.).

Formula : Current assets / current liabilities

Quick ratio:

company Brompton.

TASK 2

Ratio analysis

Gross profit margin :

This refers to the profitability ratio which is concerned with measuring the revenue which

is left deducting the cost of sales.

Formula : Gross profit /sales*100

Operating margin :

It is another profitability ratio which measures the profit which is left after paying all the

operational expenses of the business such as salaries, office expenses, general expenses,

stationary etc.

Formula : Operating profit /sales*100

Return on Equity:

This is a ratio which is concerned with assessing the financial performance of the

company which shows the efficiency of company's management regarding how effectively it is

utilising the assets for generating profit (Uechi and et.al., 2015) .

Formula : Net income / shareholders' equity

Return on capital employed:

It is a financial ratio which is concerned with profitability and the effectiveness

with which the capital of company is employed.

Formula : Earning before interest and tax (EBIT) / Capital employed

Current ratio:

It is the ratio which measures the liquidity of the organisation regarding company's

ability of repaying its short term liabilities with its available short term assets. Ideal current ratio

is 2:1 which means that company has 2 times of assets of repaying each of its short term

liabilities (Gabric, 2018.).

Formula : Current assets / current liabilities

Quick ratio:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

It is one of the indicator of organisation's liquidity. It measures the capability of business

concern to repay its short term liabilities with its highly liquid assets. The ideal acid test ratio is

1:1.

Formula : Current assets- prepaid expenses- stock / current liabilities

Inventory turnover period:

This ratio measures the frequency of sales. It means number of times inventory has been

sold or consumed in a year.

Formula : Sales / average inventory

Debtors' collection period:

This refers to the length of duration for recovering the dues from debtors. Credit period is

allowed to customers for increasing the sales (Muritala, 2018).

Formula: Average debtors / net sales

Creditors payable period:

It is a financial ratio which is concerned with measuring the number of days which the

company takes for paying its liabilities – trade payables.

Formula : Average Accounts payable / COGS* Number of days

Gearing ratio:

This ratio measures the financial leverage of the company which assists in evaluating the

financial health of the organisation.

Formula : Long term debt + short term debt + bank overdrafts / shareholder's

equity

Interest coverage:

This ratio is related with measuring the ability of company to tackle its outstanding debt.

Market analysts says that a company cannot grow until it has the capability of paying interest on

its existing liabilities (Robinson and et.al., 2015).

Formula : EBIT / Interest expense

Ratio analysis

Ratios 2015 2016 change

Profitability ratios

Gross profit

margin

10.29/27.48

=0 .37 11.26/28.42

=.39

0.02

concern to repay its short term liabilities with its highly liquid assets. The ideal acid test ratio is

1:1.

Formula : Current assets- prepaid expenses- stock / current liabilities

Inventory turnover period:

This ratio measures the frequency of sales. It means number of times inventory has been

sold or consumed in a year.

Formula : Sales / average inventory

Debtors' collection period:

This refers to the length of duration for recovering the dues from debtors. Credit period is

allowed to customers for increasing the sales (Muritala, 2018).

Formula: Average debtors / net sales

Creditors payable period:

It is a financial ratio which is concerned with measuring the number of days which the

company takes for paying its liabilities – trade payables.

Formula : Average Accounts payable / COGS* Number of days

Gearing ratio:

This ratio measures the financial leverage of the company which assists in evaluating the

financial health of the organisation.

Formula : Long term debt + short term debt + bank overdrafts / shareholder's

equity

Interest coverage:

This ratio is related with measuring the ability of company to tackle its outstanding debt.

Market analysts says that a company cannot grow until it has the capability of paying interest on

its existing liabilities (Robinson and et.al., 2015).

Formula : EBIT / Interest expense

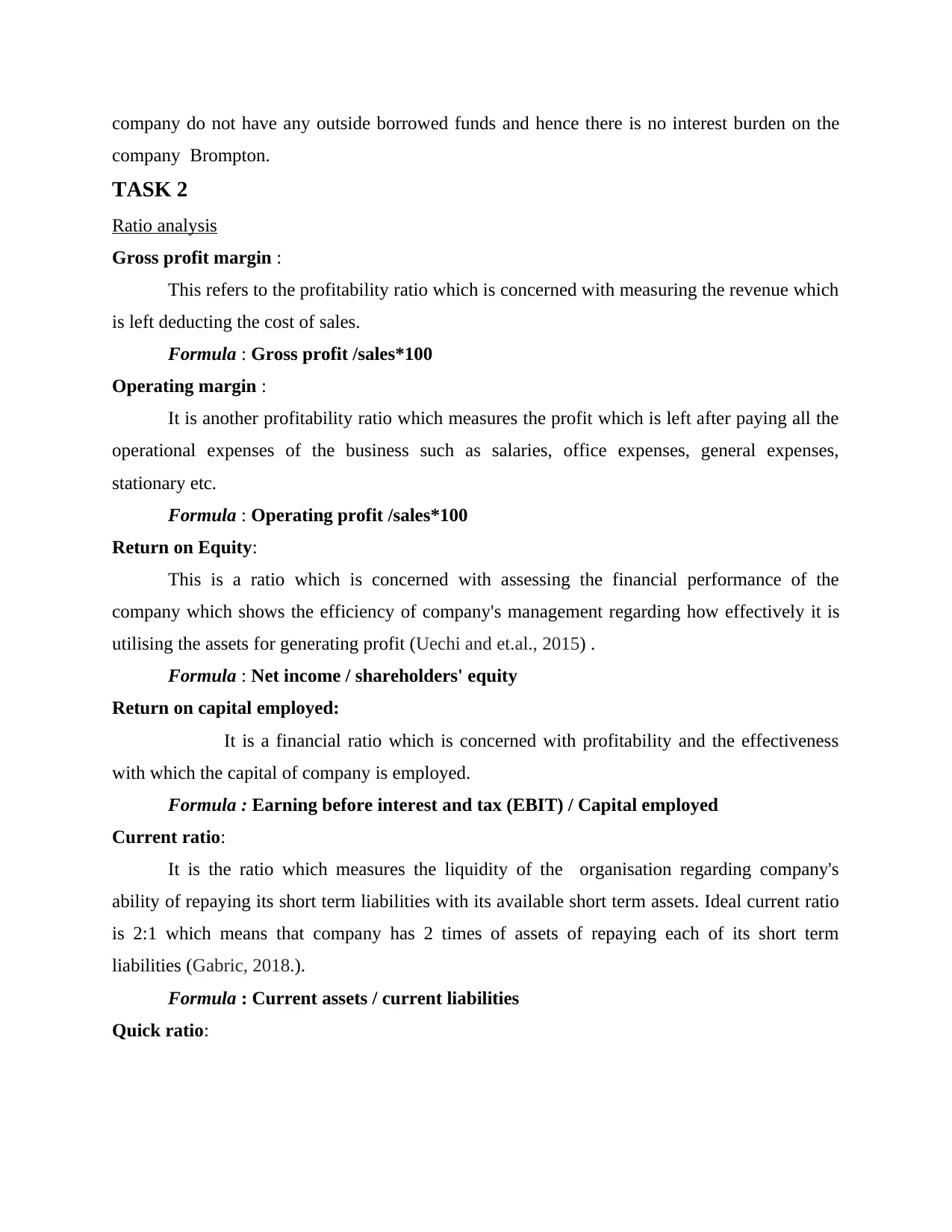

Ratio analysis

Ratios 2015 2016 change

Profitability ratios

Gross profit

margin

10.29/27.48

=0 .37 11.26/28.42

=.39

0.02

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Operating margin

2.15/27.48

= 0.07

1.76/28.42

=0.06 0.01

ROE

1.81/13.49

= 0.13

0.29/14.63

= 0.019

0.111

ROCE

2.15/13.49

= 0.16 1.76/ 14.63

= 0.12 0.04

Liquidity ratios

Current ratio

12.27/26.92

=0.45

12.09/34.43

=0.35

0.10

Quick ratio

8.99/26.92

=0.33

7.95/34.43

=0.23 0.10

Efficiency ratios

Inventories

turnover period

27.48/ (.38+0.32)/2

= 19.62

28.42/

(0.32+0.41)/2

=19.46 0.17

settlement period

for receivables.

(3.3+3.4)/27.48

=0.24

(3.4+4.3)/28.42

=0.27 0.03

settlement period

for payables

2.7/17.18* 365

=57.36

3.4/17.15*365

72.36 15

Gearing ratios

Gearing ratio - - -

Interest coverage - - -

Profitability ratios

Company is having GP ration of 39% in 2016 as compared with previous year 2015 of

37 % company is manufacturing company so it will not high GP ratio but it should be above 50%

so that it can efficiently meet its operational expenses. All its direct cost are covered in

production of products. But comp[any still have to focus on managing its cost of manufacturing

so that it can raise its profits. Company has shown growth of 2% which shows it is improving its

costs. The net profits of company is not high which means it is not efficiently managing its

operations. Return on capital employed of company is 12% in 2016 and it has fallen from 16% in

2015. The fall shows that performance of company is going down and company is not making

effective use of its capital employed. Whereas return on equity of company has increased by

11.1% from previous year. Increase in return shows that company have increased its

performance by taking new strategies. Company has to take considerable steps for improving its

profitability ratios.

2.15/27.48

= 0.07

1.76/28.42

=0.06 0.01

ROE

1.81/13.49

= 0.13

0.29/14.63

= 0.019

0.111

ROCE

2.15/13.49

= 0.16 1.76/ 14.63

= 0.12 0.04

Liquidity ratios

Current ratio

12.27/26.92

=0.45

12.09/34.43

=0.35

0.10

Quick ratio

8.99/26.92

=0.33

7.95/34.43

=0.23 0.10

Efficiency ratios

Inventories

turnover period

27.48/ (.38+0.32)/2

= 19.62

28.42/

(0.32+0.41)/2

=19.46 0.17

settlement period

for receivables.

(3.3+3.4)/27.48

=0.24

(3.4+4.3)/28.42

=0.27 0.03

settlement period

for payables

2.7/17.18* 365

=57.36

3.4/17.15*365

72.36 15

Gearing ratios

Gearing ratio - - -

Interest coverage - - -

Profitability ratios

Company is having GP ration of 39% in 2016 as compared with previous year 2015 of

37 % company is manufacturing company so it will not high GP ratio but it should be above 50%

so that it can efficiently meet its operational expenses. All its direct cost are covered in

production of products. But comp[any still have to focus on managing its cost of manufacturing

so that it can raise its profits. Company has shown growth of 2% which shows it is improving its

costs. The net profits of company is not high which means it is not efficiently managing its

operations. Return on capital employed of company is 12% in 2016 and it has fallen from 16% in

2015. The fall shows that performance of company is going down and company is not making

effective use of its capital employed. Whereas return on equity of company has increased by

11.1% from previous year. Increase in return shows that company have increased its

performance by taking new strategies. Company has to take considerable steps for improving its

profitability ratios.

Liquidity ratios

Liquidity ratios of company shows that it is not having strong liquidity position. Standard

current ratio is 2:1 whereas it has ratio of 0.35 in 2016. the current assets of company are not

sufficient to meet its current liabilities. The rise may be because the companies are not having

pending collection for its sales. Quick ratio is 0.23 as against standard of 1:1 which shows that

even after excluding inventory its liquidity is not rising. Ratios shows that company's liquidity

position of has gone down from previous year. Company is not able to raise its liquidity.

Company has to implement new plans so that its liquidity is increased. It is important for

company to improve its liquidity position otherwise it may affect operations of company.

Efficiency ratios

From above efficiency ratios it can be identified that inventory ratio for 2015 is 19.62 and

for 2016 it is 19.46. from the inventory ratio it can be figured out that company is having good

cash flows for running its operations. Settlement period of receivables have increased which

shows that company is becoming flexible in its cash collections. Company have to stop at this

level as rising above this level may affect cash flows of company. Settlement period of payables

has gone high in 2016 from 2015 by 15 points. High settlement period shows that company is

having problems to meet its debt over short time. High ratio will give time to utilise the money

over other operations for raising returns.

The above table depict the changes in the various ratios of the company Brompton for

two consecutive years, 2015 and 2016 and the variance or changes in the ratios of two years. For

the profitability ratios no major changes can be seen means the profitability level of company

cannot change from 2015 to 2016. A shift of 10% in both current and quick ratio can be seen

which means the liquidity position of the company is not good at all. The company do not have

any outside debts so there is no interest burden on the business.

TASK 3

Discussing investment appraisal techniques

Investments needs to be evaluated and analysed in terms of benefits its is going to

provide is worthy enough or not. Following are the investment appraisal techniques :

Net present value method (NPV):

The profitability of a project or investment is assessed by ascertaining the variation

between cash inflows that will generated by investment in future and initial cash outflow.

Liquidity ratios of company shows that it is not having strong liquidity position. Standard

current ratio is 2:1 whereas it has ratio of 0.35 in 2016. the current assets of company are not

sufficient to meet its current liabilities. The rise may be because the companies are not having

pending collection for its sales. Quick ratio is 0.23 as against standard of 1:1 which shows that

even after excluding inventory its liquidity is not rising. Ratios shows that company's liquidity

position of has gone down from previous year. Company is not able to raise its liquidity.

Company has to implement new plans so that its liquidity is increased. It is important for

company to improve its liquidity position otherwise it may affect operations of company.

Efficiency ratios

From above efficiency ratios it can be identified that inventory ratio for 2015 is 19.62 and

for 2016 it is 19.46. from the inventory ratio it can be figured out that company is having good

cash flows for running its operations. Settlement period of receivables have increased which

shows that company is becoming flexible in its cash collections. Company have to stop at this

level as rising above this level may affect cash flows of company. Settlement period of payables

has gone high in 2016 from 2015 by 15 points. High settlement period shows that company is

having problems to meet its debt over short time. High ratio will give time to utilise the money

over other operations for raising returns.

The above table depict the changes in the various ratios of the company Brompton for

two consecutive years, 2015 and 2016 and the variance or changes in the ratios of two years. For

the profitability ratios no major changes can be seen means the profitability level of company

cannot change from 2015 to 2016. A shift of 10% in both current and quick ratio can be seen

which means the liquidity position of the company is not good at all. The company do not have

any outside debts so there is no interest burden on the business.

TASK 3

Discussing investment appraisal techniques

Investments needs to be evaluated and analysed in terms of benefits its is going to

provide is worthy enough or not. Following are the investment appraisal techniques :

Net present value method (NPV):

The profitability of a project or investment is assessed by ascertaining the variation

between cash inflows that will generated by investment in future and initial cash outflow.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

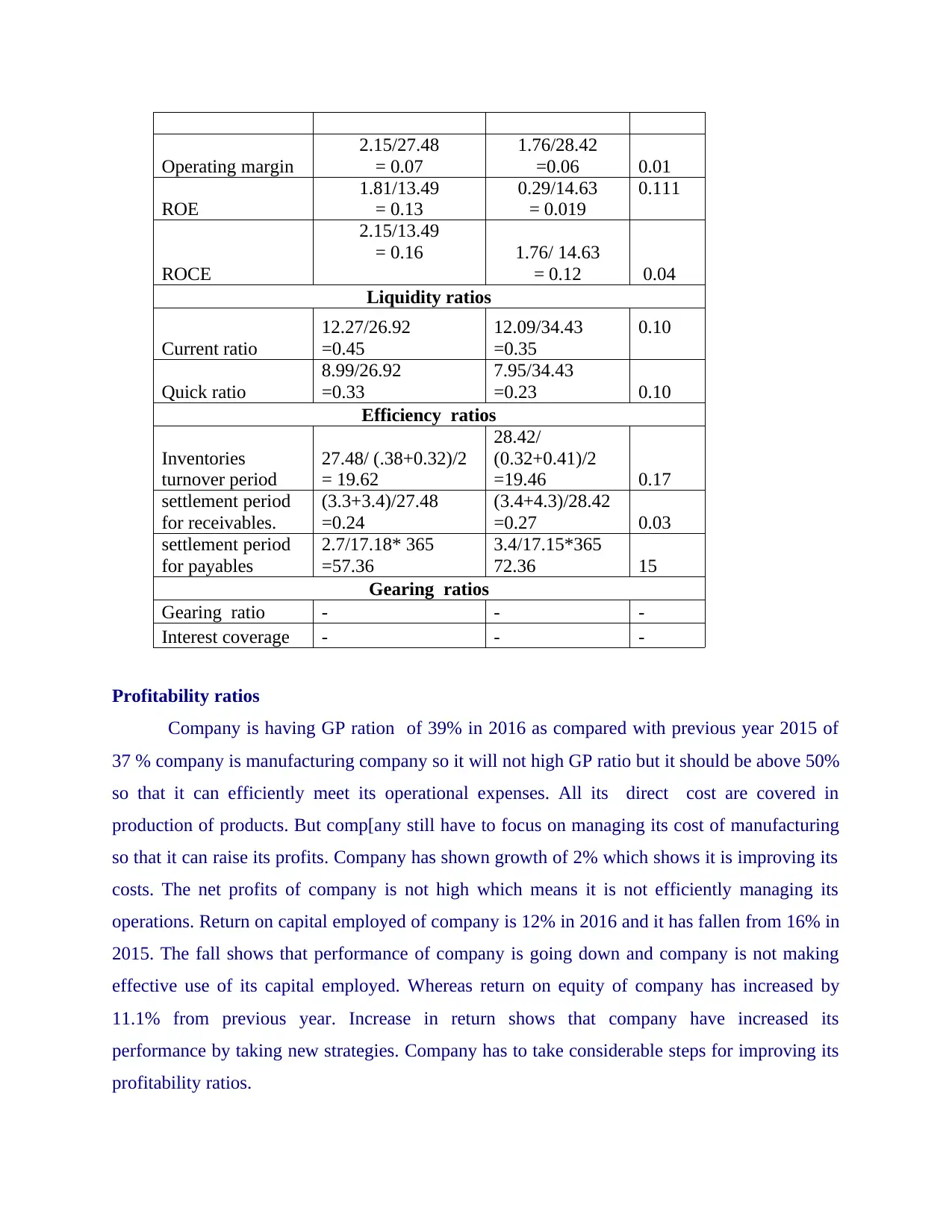

Positive NPV means investment is profitable and should be accepted and if negative , then

should be left out.

Year Cash inflows

Discounting

factor @ 12% Discounted cash inflows

1 10000 0.893 8928.57

2 22000 0.797 17538.27

3 36000 0.712 25624.09

4 48000 0.636 30504.87

5 60000 0.567 34045.61

Total cash inflows 116641.40

Initial cash outlay 100000

NPV 16641.40

The NPV of the investment is 16641.40 which is positive & profitable. Thus, it can be

said that it should be accepted by the Brompton Bicycle Ltd.

Internal rate of return :

It means the rate which represents the NPV of all cash inflows generating from an

investment equals to 0. It is basically applied for assessing the attractiveness of the proposed

investment. An investment having a greater IRR than cost of capital of investment, then it must

be accepted. The IRR calculated to be 17.03% which is higher than the cost of capital and thus,

investment should be accepted.

Payback period:

This refers to the period in which the proposed investment will cover its costs. Lower the

payback period, higher is the attractiveness of the investment and vice-versa (Back to basics:

Investment Appraisal Techniques, 2018).

Pay back period : 3.67 years is acceptable because the time taken for recovering the cost

is lower than life of investment.

Discounted pay back period :

It refers to the time taken by an investment for recovering its costs by considering the

discounted present values of cash inflows and initial cash outflow.

Discounted payback period is 5.15 years which higher the number of cash inflows years,

thus it should not be accepted.

Year Cash

inflows

Discounting

factor @

Discounted

cash inflows

Cumulative

cash inflows

Cumulative

cash inflows

should be left out.

Year Cash inflows

Discounting

factor @ 12% Discounted cash inflows

1 10000 0.893 8928.57

2 22000 0.797 17538.27

3 36000 0.712 25624.09

4 48000 0.636 30504.87

5 60000 0.567 34045.61

Total cash inflows 116641.40

Initial cash outlay 100000

NPV 16641.40

The NPV of the investment is 16641.40 which is positive & profitable. Thus, it can be

said that it should be accepted by the Brompton Bicycle Ltd.

Internal rate of return :

It means the rate which represents the NPV of all cash inflows generating from an

investment equals to 0. It is basically applied for assessing the attractiveness of the proposed

investment. An investment having a greater IRR than cost of capital of investment, then it must

be accepted. The IRR calculated to be 17.03% which is higher than the cost of capital and thus,

investment should be accepted.

Payback period:

This refers to the period in which the proposed investment will cover its costs. Lower the

payback period, higher is the attractiveness of the investment and vice-versa (Back to basics:

Investment Appraisal Techniques, 2018).

Pay back period : 3.67 years is acceptable because the time taken for recovering the cost

is lower than life of investment.

Discounted pay back period :

It refers to the time taken by an investment for recovering its costs by considering the

discounted present values of cash inflows and initial cash outflow.

Discounted payback period is 5.15 years which higher the number of cash inflows years,

thus it should not be accepted.

Year Cash

inflows

Discounting

factor @

Discounted

cash inflows

Cumulative

cash inflows

Cumulative

cash inflows

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

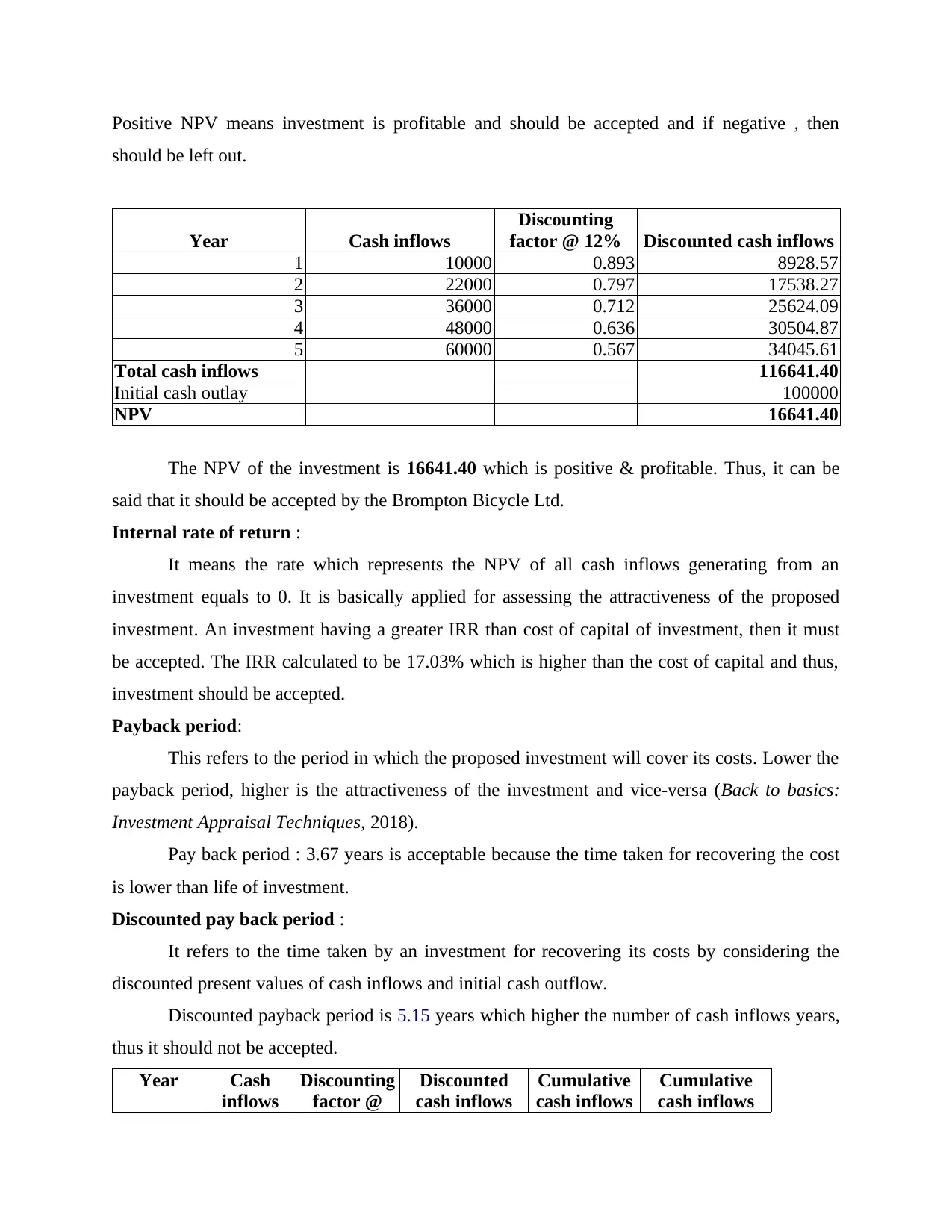

12%

1 10000 0.893 8928.57 8928.57 10000

2 22000 0.797 17538.27 26466.84 32000

3 36000 0.712 25624.09 52090.23 68000

4 48000 0.636 30504.87 82595.8 116000

5 60000 0.567 34045.61 116641.41 176000

Discounte

d pay back

period 5.15

Pay back

period

recovered in

3 & 4 year

In 3 year 68000

balance in

4th year 32000

recovery in

5th year 0.67

Pay back

period 3.41

NPV and discounted pay back period methods are considered as best method for

evaluating the profitability of an investment or project because both of the methods takes into

consideration the future value of money from which more accurate decision making regarding

the purchase of fixed asset or other investment is facilitated.

TASK 4

Approaches of business valuation

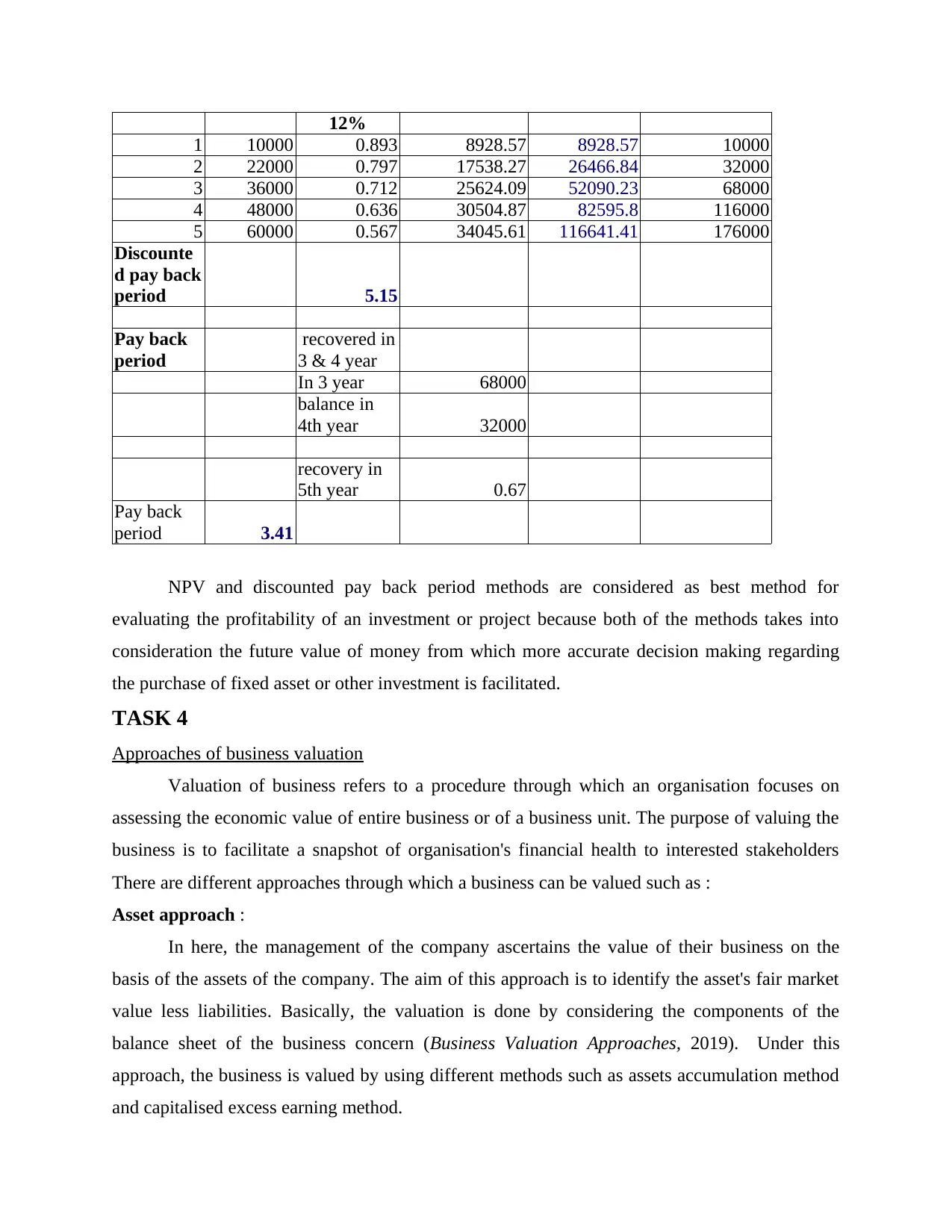

Valuation of business refers to a procedure through which an organisation focuses on

assessing the economic value of entire business or of a business unit. The purpose of valuing the

business is to facilitate a snapshot of organisation's financial health to interested stakeholders

There are different approaches through which a business can be valued such as :

Asset approach :

In here, the management of the company ascertains the value of their business on the

basis of the assets of the company. The aim of this approach is to identify the asset's fair market

value less liabilities. Basically, the valuation is done by considering the components of the

balance sheet of the business concern (Business Valuation Approaches, 2019). Under this

approach, the business is valued by using different methods such as assets accumulation method

and capitalised excess earning method.

1 10000 0.893 8928.57 8928.57 10000

2 22000 0.797 17538.27 26466.84 32000

3 36000 0.712 25624.09 52090.23 68000

4 48000 0.636 30504.87 82595.8 116000

5 60000 0.567 34045.61 116641.41 176000

Discounte

d pay back

period 5.15

Pay back

period

recovered in

3 & 4 year

In 3 year 68000

balance in

4th year 32000

recovery in

5th year 0.67

Pay back

period 3.41

NPV and discounted pay back period methods are considered as best method for

evaluating the profitability of an investment or project because both of the methods takes into

consideration the future value of money from which more accurate decision making regarding

the purchase of fixed asset or other investment is facilitated.

TASK 4

Approaches of business valuation

Valuation of business refers to a procedure through which an organisation focuses on

assessing the economic value of entire business or of a business unit. The purpose of valuing the

business is to facilitate a snapshot of organisation's financial health to interested stakeholders

There are different approaches through which a business can be valued such as :

Asset approach :

In here, the management of the company ascertains the value of their business on the

basis of the assets of the company. The aim of this approach is to identify the asset's fair market

value less liabilities. Basically, the valuation is done by considering the components of the

balance sheet of the business concern (Business Valuation Approaches, 2019). Under this

approach, the business is valued by using different methods such as assets accumulation method

and capitalised excess earning method.

For example, through asset accumulation method, company can determine the value of

its assets as it is the increase in the assets of financial nature through savings, investments or

earnings. It can be measured as the change in the value of investments in monetary terms,

amount which is reinvested or the change in the assets' value owned by the company.

Market approach :

In this approach, management focus on determining the value of business by comparing

the historic sales of similar businesses in the industry. Real market conditions are used for

figuring the worth of the business of an organisation. In this approach company uses

transactional data for determining the value of the company. The method includes the

transactions of public, private companies along with the measures of valuation of public

companies by using market data relating to current stock (Bowe and Van der Horst, 2016).

For example, in the business of Brampton, the management can value its business by

looking at the bases for comparisons such as sales of bicycles of similar business enterprise in

terms of size and nature located within UK.

Income approach :

Under this approach, the business is valued on the basis of the capability of company's to

yield the desired economic result for its owners. The main objective of this approach is to

ascertain the business value as a function of economic outcomes. Discounted cash flow and cap

rates are its methods which the manager uses for assessing the worth of the business.

TASK 5

Concept of ethics and its potential impact on decision making in SME’s

Ethics is a terms which signifies the beliefs or values which differentiates between right

or wrong about a phenomenon or a thing. Conducting business operation within the framework

of corporate governance and ethics aids Brompton in establishing and creating a good working

conditions. Basic ethics which the enterprises must have are integrity and trust. Business ethics

involves all the obligations which the SMEs have towards customers, employees, suppliers,

neighbours and even competitors.

Ethics greatly impacts the decision making of SMEs. For example, people desires to

work for the organisation which is high on its ethical practises. This way, ethics plays great role

in Brompton in deciding the policies and procedures relating recruiting & selection. Because

reputation of brand plays a great role in the success of the SMEs, the top management has started

its assets as it is the increase in the assets of financial nature through savings, investments or

earnings. It can be measured as the change in the value of investments in monetary terms,

amount which is reinvested or the change in the assets' value owned by the company.

Market approach :

In this approach, management focus on determining the value of business by comparing

the historic sales of similar businesses in the industry. Real market conditions are used for

figuring the worth of the business of an organisation. In this approach company uses

transactional data for determining the value of the company. The method includes the

transactions of public, private companies along with the measures of valuation of public

companies by using market data relating to current stock (Bowe and Van der Horst, 2016).

For example, in the business of Brampton, the management can value its business by

looking at the bases for comparisons such as sales of bicycles of similar business enterprise in

terms of size and nature located within UK.

Income approach :

Under this approach, the business is valued on the basis of the capability of company's to

yield the desired economic result for its owners. The main objective of this approach is to

ascertain the business value as a function of economic outcomes. Discounted cash flow and cap

rates are its methods which the manager uses for assessing the worth of the business.

TASK 5

Concept of ethics and its potential impact on decision making in SME’s

Ethics is a terms which signifies the beliefs or values which differentiates between right

or wrong about a phenomenon or a thing. Conducting business operation within the framework

of corporate governance and ethics aids Brompton in establishing and creating a good working

conditions. Basic ethics which the enterprises must have are integrity and trust. Business ethics

involves all the obligations which the SMEs have towards customers, employees, suppliers,

neighbours and even competitors.

Ethics greatly impacts the decision making of SMEs. For example, people desires to

work for the organisation which is high on its ethical practises. This way, ethics plays great role

in Brompton in deciding the policies and procedures relating recruiting & selection. Because

reputation of brand plays a great role in the success of the SMEs, the top management has started

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.